UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-6589 | |||||||

| ||||||||

FIRST FUNDS | ||||||||

(Exact name of registrant as specified in charter) | ||||||||

| ||||||||

1625 Broadway, Suite 2200, Denver, Colorado |

| 80202 | ||||||

(Address of principal executive offices) |

| (Zip code) | ||||||

| ||||||||

Erin E. Douglas | ||||||||

(Name and address of agent for service) | ||||||||

| ||||||||

Registrant’s telephone number, including area code: | (303) 623-2577 |

| ||||||

| ||||||||

Date of fiscal year end: | June 30 |

| ||||||

| ||||||||

Date of reporting period: | June 30, 2005 |

| ||||||

Item 1 - Reports to Stockholders

The following is a copy of the report to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

Annual Report • June 30, 2005

Letter from the Chairman

Dear Shareholders:

During the previous 12 months, escalating oil prices and rising interest rates kept the stock and bond markets fluctuating between periods of positive and negative performance.

Crude oil prices surged throughout the period and eventually broke the $60 per barrel all-time high. Record oil prices caused inflationary concerns and fears of restricted economic growth among investors, as rising fuel costs can have a downward influence on most companies’ profits and on consumer spending. Throughout the period, however, corporate profits and consumer spending generally remained robust.

Likewise, the economy has maintained strong growth with gross domestic product increasing 4.4% for calendar 2004. In the first quarter of 2005, GDP slowed slightly but still gained at a 3.8% annual rate. Even in the midst of this growth, inflation was well contained, as the Consumer Price Index only increased by 3.3% for 2004, and 3.1% for the first six months of 2005.

In the 12-month period, the Federal Reserve (the “Fed”) continued its tightening cycle and raised the federal funds rate from 1.25% to 3.25%. The Fed has indicated that further rate increases are likely. Despite the interest rate environment, bond funds delivered positive returns across the board for the first six months of the period. According to investment research firm Morningstar, Inc., the long-term bond category was up 6%, and the intermediate-term group gained nearly 4% for the year through December 30, 2004.

Although most bond funds suffered declines during the first quarter of 2005, many returned to positive territory by the end of June 2005. Morningstar reported that long-term U.S. government bond funds added 5.2% on average, while their intermediate-term peers gained 2.7% for the second calendar quarter of 2005.

Meanwhile, the stock market posted strong gains at the end of 2004 but slowed in 2005. By year-end 2004, Morningstar’s U.S. Market Index, which tracks the performance of the broad U.S. equity market, gained 12.35%. However, for the first six months of 2005, the index only posted a 0.15% increase.

Comparatively, Morningstar’s U.S. Core Index, which tracks the performance of stocks where neither growth nor value characteristics predominate, posted a 15.62% return for year-end 2004, but posted a 1.21% loss for the first six months of 2005.

Results of the past year demonstrate how difficult it is to predict market movements or the popularity of fund styles. Because no one knows where the fixed-income or equity markets are headed over the short-term, attempting to time the market can be hazardous to an investor’s longer-term financial goals.

i

This is why at First Funds we continue to believe in the three tenets of sound investing: consistency to maintain a repeatable investment strategy, discipline to respect the markets and the inherent risks of investing, and patience to take a long-term view of the markets. To help investors achieve their goals through consistency, discipline and patience, First Funds offers an array of investments, including equity, fixed-income and money market portfolios. Additionally, we provide tax-advantaged accounts such as Coverdell Education Savings Accounts and individual retirement accounts.

The following report includes commentary from our portfolio management teams as well as full financial information on the funds. To answer your questions or for access to your account, feel free to contact First Funds at 800.442.1941. You may also access up-to-date Portfolio information at www.firstfunds.com.

Thank you for your investment in First Funds. As always, we appreciate the opportunity to serve your financial needs.

Sincerely, |

|

|

Richard C. Rantzow |

Chairman, Board of Trustees |

First Funds

• Are NOT insured by the FDIC or any other governmental agency.

• Are NOT bank deposits or other obligations of or guaranteed by First Tennessee Bank National Association or any of its affiliates.

• Involve investment risks, including the possible loss of the principal amount invested.

• Although the Money Market Portfolios seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the portfolios.

ii

First Funds Core Equity Portfolio

Core Equity Portfolio Managers

David Thompson and Mark Cronin

Mr. Thompson is senior vice president with Highland Capital Management Corp. and is a Chartered Financial Analyst. After graduating from the University of Mississippi in 1981, he worked as an analyst for Gulf Oil for three years, then went on to receive a M.B.A. from the University of North Carolina in 1986. Mr. Thompson has 16 years of investment experience including nine years of experience managing both individual and institutional investment portfolios at major regional banks. He joined Highland Capital’s equity team in 1995.

Mr. Cronin is vice president with Highland Capital Management Corp. and is a Chartered Financial Analyst. He has two decades of investment experience and earned a B.A. from the University of Washington. Former employers include Merrill Lynch and Paine Webber. Prior to joining Highland Capital in 1999, Mr. Cronin was senior portfolio manager and vice president with First Chicago NBD.

Fiscal Year Review

Market Review and Portfolio Update

The stock market produced a positive rate of return during the past 12 months. Most of the gain was recorded in the October-December 2004 quarter when the election uncertainty was erased and concerns relative to the Iraq war dissipated. The economy continued to strengthen with a gross domestic product (GDP) annual growth rate of 4.4% for calendar 2004 compared to 3.0% for calendar 2003. In the first quarter of 2005 GDP slowed slightly to 3.8%. In the midst of this growth, inflation remained well contained.

During the period, the Portfolio was overweighted in the financials, consumer discretionary and information technology sectors. The Portfolio’s financial holdings fared well despite higher interest rates from the Federal Reserve. The information technology sector outperformed the S&P 500 Index in the last quarter and we believe this group may continue to perform well in 2005. We also anticipate that the consumer discretionary sector may benefit from the strong economy and from the potential of falling crude oil prices. Lower energy prices could provide additional discretionary income for consumers.

Although the Federal Reserve has indicated that it is not finished raising interest rates, we feel the end of this series of rate hikes may be near. If true, this could be a positive for the overweighting that the Portfolio has in financial stocks, as this sector historically performs well at the end of a cycle of rate increases.

Our overall outlook for the market is predicated on crude oil prices. A continued upward movement of crude prices or a sustained high price level could have detrimental impacts on the economy and corporate earnings. However, a sustained drop in crude prices could offer a positive boost to the economy, consumer confidence and earnings.

iii

Industry Breakdown and Performance

Showing Percentage of Total Net Assets | as of June 30, 2005 |

Financials |

|

|

| 27.6 | % |

Insurance |

| 17.3 | % |

|

|

Diversified Financials |

| 7.2 | % |

|

|

Banks |

| 3.1 | % |

|

|

Consumer Discretionary |

|

|

| 18.1 | % |

Information Technology |

|

|

| 17.3 | % |

Consumer Staples |

|

|

| 10.7 | % |

Industrials |

|

|

| 6.6 | % |

Money Market Mutual Funds |

|

|

| 5.9 | % |

Healthcare |

|

|

| 5.6 | % |

Telecommunications |

|

|

| 3.7 | % |

Energy |

|

|

| 3.0 | % |

**Other Assets in Excess of Liabilities - 1.5%

|

| Cumulative |

| Average Annual |

| ||||||

|

| Since |

| 1 Year |

| 5 Year |

| 10 Year |

| Since |

|

Class I |

| 254.49 | % | (0.45 | )% | (1.51 | )% | 10.26 | % | 11.20 | % |

Class A |

| 225.92 | % | (11.71 | )% | (2.90 | )% | 9.33 | % | 10.42 | % |

Class B |

| 213.06 | % | (6.23 | )% | (2.85 | )% | 9.11 | % | 10.05 | % |

Class C |

| 213.90 | % | (2.18 | )% | (2.44 | )% | 9.14 | % | 10.07 | % |

S&P 500 |

| 229.52 | % | 6.29 | % | (2.38 | )% | 9.93 | % | 10.52 | % |

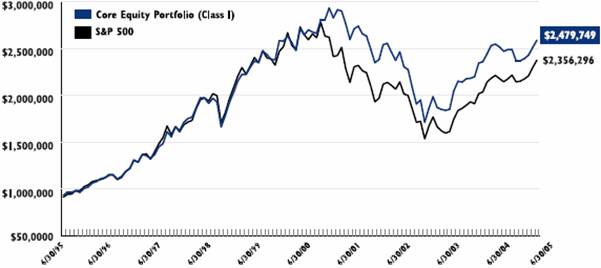

Comparison of 10 Year Change in Value of a $750,000 Investment in the First Funds Core Equity Portfolio (Class I) and the S&P 500.

Please note: Class I inception is August 2, 1993. Minimum investment for Class I is $750,000. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance data quoted represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the performance quoted. Call First Funds at 800.442.1941 to obtain performance data current to the most recent month end.

*Total Returns are for the period ended 6/30/2005 and reflect reinvestment of all dividends, capital gains distributions, all fee waivers in effect, and any expense reimbursements. Without the fee waivers and expense reimbursements, the Total Return figures would have been lower. Class I inception date is 8/2/1993. On 12/9/1993, the Portfolio commenced sales of Class C shares, which include a .75% distribution fee and a .25% shareholder services fee. Performance information prior to 12/9/1993 for Class C shares is based on the performance of Class I shares and does not reflect the effects of these fees, which, if included, would lower Class C performance. Quotation of Class C performance reflects a 1% Deferred Sales Load applied to redemptions made during the first year after purchase. Without this load, the figures quoted would have been (1.19)% for 1 Year. The Portfolio commenced sales of Class A shares on 12/20/1995, which include a .25% shareholder services fee. Class A performance shown is based on a maximum 5.75% initial sales charge. Performance information for Class A shares prior to their inception date is based on the performance of Class I shares and does not reflect the effects of these fees which, if included, would lower Class A performance. The Portfolio commenced sales of Class B shares on 8/3/1999. These shares include a 1.00% distribution fee. Performance information for Class B shares prior to their inception reflect applicable Class C and Class I performance data. Class B performance shown is net of CDSC. Class B shares of the Portfolio are subject to a 5.00% CDSC which declines to 0.00% for shares held up to six years.

iv

First Funds Capital Appreciation Portfolio

Capital Appreciation Portfolio Managers

Portfolio Management Team

A team of portfolio managers and analysts is responsible for the day-to-day operations of the Portfolio. The team is led by Marshall Bassett, chief investment officer, growth equities of Delaware Investments. Mr. Bassett serves as senior portfolio manager for the consumer and retail sectors. He has over 20 years of professional investment exprience.

Other Team Members

Matthew Todorow, portfolio manager, healthcare sector

Steven Lampe, portfolio manager, financial sector

Lori Wachs, portfolio manager, consumer and retail sector

Fiscal Year Review

Market Review and Portfolio Update

The last 12 months saw the equity market move in fits and starts. The market was down in July 2004 brought on by concerns about the economy and rising fuel costs. But soon after that, stocks rallied. The strength of the October-December quarter pulled most stock indices into double-digit territory for the 2004 calendar year, even though many entered the quarter flat or negative. This optimism was dashed in the following quarter as rising energy prices spread fear of a decelerating economy. By June 2005, however, the market rallied again, as energy prices and inflation fears eased. This rally lifted many stock indices into positive territory for the previous 12 months.

Stock selection in the consumer non-durable sector, particularly retailers, produced the most significant positive impact on the Portfolio. Urban Outfitters, Inc. was a top contributor to performance, as it posted strong sales and earnings growth. Carter’s, Inc. also performed well based in part on improved growth prospects with its acquisition of OshKosh B’Gosh Co., which helped send the stock up 46% in the last quarter and 114% for the previous 12 months.

Hindering performance was healthcare in aggregate, due to the severe battering that biotech stocks took, particularly in the January-March quarter. Individually, Inspire Pharmaceuticals, Inc. was one detractor from performance, falling by half upon announcing disappointing results regarding its experimental drug for chronic dry-eye syndrome. We exited from the stock as a result of this news.

Entering the next period, we continue to maintain an overweighted position in the biotech sector (a sub-sector within healthcare), as we believe the negative sentiment toward this sector has been overly severe. We have also reduced our underweighted position in technology to the smallest margin since 2001 because we feel the negative sentiment regarding many companies’ future growth prospects has become too pessimistic.

v

Industry Breakdown and Performance

Showing Percentage of Total Net Assets | as of June 30, 2005 |

Healthcare |

| 21.6 | % |

Technology |

| 18.4 | % |

Consumer Non-Durables |

| 16.1 | % |

Consumer Services |

| 13.4 | % |

Financials |

| 9.6 | % |

Business Services |

| 8.0 | % |

U.S. Government & Agency Obligations |

| 6.9 | % |

Capital Goods |

| 4.7 | % |

Transportation |

| 3.0 | % |

Money Market Mutual Funds |

| 1.0 | % |

** Liabilities in Excess of Other Assets - (2.7)%

|

| Cumulative |

| Average Annual |

| ||||

|

| Since |

| 1 Year |

| 5 Year |

| Since |

|

Class I |

| 51.46 | % | 1.15 | % | 0.42 | % | 5.44 | % |

Class A |

| 32.57 | % | (4.88 | )% | (1.03 | )% | 3.71 | % |

Class B |

| 33.71 | % | (4.82 | )% | (1.06 | )% | 3.82 | % |

Class C |

| 32.32 | % | (0.90 | )% | (0.66 | )% | 3.68 | % |

Russell 2000 Growth Index |

| 13.80 | % | 4.02 | % | (4.78 | )% | 1.67 | % |

Comparison of Since Inception Change in Value of a $750,000 Investment in the First Funds Capital Appreciation Portfolio (Class I) and the Russell 2000 Growth Index.

Please note: Class I inception is September 2, 1997. Minimum investment for Class I is $750,000. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance data quoted represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the performance quoted. Call First Funds at 800.442.1941 to obtain performance data current to the most recent month end.

*Total Returns are for the period ended 6/30/2005 and reflect reinvestment of all dividends, capital gains distributions, all fee waivers in effect and any expense reimbursements. Without the fee waivers and expense reimbursements, the Total Return figures would have been lower. Class I inception date is 9/2/1997. The Portfolio commenced sales of Class A shares on 10/2/1997. These shares include a .25% shareholder services fee. Class A performance shown is based on a maximum 5.75% initial sales charge. On 10/2/1997, the Portfolio commenced sales of Class C shares, which include a .75% distribution fee and a .25% shareholder services fee. Quotation of Class C performance reflects a 1% Deferred Sales Load applied to redemptions made during the first year after purchase. Without this load, the figures quoted would have been 0.10% for 1 Year. The Portfolio commenced sales of Class B shares on 8/3/1999. These shares include a 1.00% distribution fee. Class B shares of Capital Appreciation prior to their inception reflect applicable Class C performance data. Class B performance shown is net of CDSC. Class B shares of the Portfolio are subject to a 5.00% CDSC which declines to 0.00% for shares held up to six years.

vi

First Funds Intermediate Bond Portfolio

Intermediate Bond Portfolio Managers

Ralph W. Herbert, Ted L. Flickinger, Jr. and Michael W. Holt

Mr. Herbert is vice president for Martin & Company, the sub-adviser to the Portfolio. He is a graduate of the University of Tennessee and in 1979 he began his career with First American Bank. In 1987 he joined Culver Securities as a municipal debt underwriter and two years later became portfolio manager for Valley Fidelity Bank which merged with First Tennessee Bank in 1991. Mr. Herbert joined Martin & Company in 1998 when the firm became a subsidiary of First Horizon National Corporation.

Mr. Flickinger is executive vice president for Martin & Company and is a Chartered Financial Analyst. Prior to joining the firm in 1990, he was an assistant manager of the investment department of Home Federal Bank of Tennessee for six years. His 25-year career includes management positions in the investment departments of the Park National Bank and Fidelity Federal Savings and Loan of Knoxville.

Mr. Holt is a Chartered Financial Analyst, holds a M.B.A. and is senior vice president for Martin & Company. Prior to joining the firm in 2002, he was senior vice president, fixed income portfolio manager, and head of fixed income research for Wachovia Asset Management. Mr. Holt’s 18-year investment career also includes being a fixed income portfolio manager with Third National Bank (now SunTrust) and a fixed income account representative with Morgan Keegan & Company.

Fiscal Year Review

Market Review and Portfolio Update

During the 12-month period, the Federal Reserve (the “Fed”) raised the federal funds rate from 1.25% to 3.25%. During the July-September 2004 quarter, investors who assumed more interest rate and credit quality risks were rewarded as long-term securities gained more in value than short-term securities, and lower quality bonds outperformed higher quality bonds of similar maturity. In the following quarter, BBB-rated bonds again outpaced their higher quality counterparts.

From January through March 2005, the yield curve flattened. Long-term Treasury rates declined and BBB-rated bonds became the worst performers in the investment-grade sector. During the April-June quarter, bond prices generally rose, the interest rate curve flattened and high credit quality bonds continued to outshine lower quality bonds.

During the previous 12 months, we reduced the Portfolio’s allocation to the corporate market by cutting back exposure to the auto sector and selling GMAC and Daimler Chrysler Corp. bonds. For the period, we maintained a shorter duration with Portfolio than the benchmark Lehman Brothers Intermediate Government/Credit Index. The Portfolio began 2005 with a targeted duration of 81% of the benchmark. In June 2005, the duration target was cut to 76% of the benchmark, which equates to a 2.8-year duration. The benchmark duration is 3.7 years.

Going forward, we remain cautious about inflation and its resulting negative impact on bond values.

Given our sense of the elevated risk of rising inflation rates and the historically low level of real rates, we believe it remains prudent for the Portfolio to keep a lower duration than the benchmark. The Portfolio also continues to hold a greater allocation of agency securities and high quality corporate bonds than the benchmark.

vii

Industry Breakdown and Performance

Showing Percentage of Total Net Assets | as of June 30, 2005 |

U.S. Government & Agency Obligations |

|

|

| 47.4 | % |

Financials |

|

|

| 29.4 | % |

Banks |

| 11.5 | % |

|

|

Broker/Dealers |

| 9.6 | % |

|

|

Insurance |

| 4.2 | % |

|

|

Financial Services |

| 3.5 | % |

|

|

Leasing Company |

| 0.6 | % |

|

|

Industrials |

|

|

| 17.1 | % |

Money Market Mutual Funds |

|

|

| 2.6 | % |

Utilities |

|

|

| 2.5 | % |

Morgage-Backed Obligations |

|

|

| 0.0 | %** |

**Less than 0.05% of Net Assets

*** Other Assets in Excess of Liabilities - 1.0%

|

| Cumulative |

| Average Annual |

| ||||

|

| Since |

| 1 Year |

| 5 Year |

| Since |

|

Class I |

| 50.17 | % | 3.72 | % | 6.41 | % | 5.70 | % |

Class A |

| 42.23 | % | (0.15 | )% | 5.39 | % | 4.93 | % |

Class B |

| 40.42 | % | (1.02 | )% | 5.30 | % | 4.88 | % |

Class C |

| 40.33 | % | 1.94 | % | 5.61 | % | 4.87 | % |

Lehman Bros. Intermediate Gov’t/Credit Index |

| 54.67 | % | 4.77 | % | 6.86 | % | 6.13 | % |

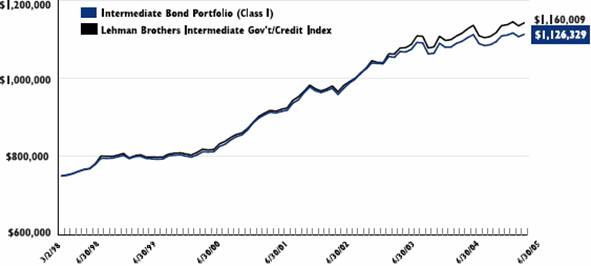

Comparison of Since Inception Change in Value of a $750,000 Investment in the First Funds Intermediate Bond Portfolio (Class I) and the Lehman Brothers Intermediate Government/Credit Index.

Please note: Class I inception is March 2, 1998. Minimum investment for Class I is $750,000. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance data quoted represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the performance quoted. Call First Funds at 800.442.1941 to obtain performance data current to the most recent month end.

*Total Returns are for the period ended 6/30/2005 and reflect reinvestment of all dividends, capital gains distributions, all fee waivers in effect and any expense reimbursements. Without the fee waivers and expense reimbursements, the Total Return figures would have been lower. Class I inception date is 3/2/1998. The Portfolio commenced sales of Class A shares on 3/9/1998. These shares include a .25% shareholder services fee. Class A performance shown is based on a maximum 3.50% initial sales charge. On 5/19/1998, the Portfolio commenced sales of Class C shares, which include a .50% distribution fee and a .25% shareholder services fee. Quotation of Class C performance reflects a 1% Deferred Sales Load applied to redemptions made during the sixteen months after purchase. Without this load, the figures quoted would have been 2.94% for 1 Year. The Portfolio commenced sales of Class B shares on 10/28/2002. These shares include a 0.70% distribution fee. Class B shares prior to their inception reflect applicable Class C performance data. Class B shares of the Intermediate Bond Portfolio are subject to a 4.00% CDSC which declines to 0.00% for shares held up to six years. Treasury bonds are guaranteed as to the timely payment of interest and repayment of principal if held to maturity.

viii

First Funds Tennessee Tax-Free Portfolio

Tennessee Tax-Free Portfolio Managers

Ralph W. Herbert and Ted L. Flickinger, Jr.

Mr. Herbert is vice president for Martin & Company, the sub-adviser to the Portfolio. He is a graduate of the University of Tennessee and in 1979 he began his career with First American Bank. In 1987 he joined Culver Securities as a municipal debt underwriter and two years later became portfolio manager for Valley Fidelity Bank which merged with First Tennessee Bank in 1991. Mr. Herbert joined Martin & Company in 1998 when the firm became a subsidiary of First Horizon National Corporation.

Mr. Flickinger is executive vice president for Martin & Company and is a Chartered Financial Analyst. Prior to joining the firm in 1990, he was an assistant manager of the investment department of Home Federal Bank of Tennessee for six years. His 25-year career includes management positions in the investment departments of the Park National Bank and Fidelity Federal Savings and Loan of Knoxville.

Fiscal Year Review

Market Review and Portfolio Update

During the July-September 2004 quarter, municipal bond yields dropped and the yield curve flattened as the result of Federal Reserve (the “Fed”) tightening. As rates dropped, we shortened the Portfolio’s duration to 4.9 years from 5 years because we felt there was not enough yield to warrant a longer duration and the implied risk. In the following quarter, municipal bonds finished with positive returns and we extended the Portfolio’s duration back to 5 years as rates began to rise. Ten-year municipal yields ended 2004 at 3.64%, up from 3.60% at year-end 2003.

In the January-March quarter, the Fed pushed the federal funds rate to 2.75%, causing the yield curve to continue to flatten. We extended the Portfolio’s duration to 5.1 years. During the next quarter, the Fed raised the federal funds rate to 3.25%. We then extended the Portfolio’s duration to 5.2 years to capture higher yields.

For the first six months of 2005, nationwide new municipal bond issuance reached $205 billion, marking an increase of almost 9% over the same period in 2004. In Tennessee, new issue volume for the six-month period totaled more than $2.2 billion, a 57% increase from last year for the same period.

During the past 12 months, municipal yields in the Portfolio’s area of interest – 10 to 15 years – have dropped nearly 0.50% and are close to their three-year lows. Because we think real rates are too low, our goal is to limit interest rate risk in the Portfolio going forward. We also remain cautious about inflation and its resulting negative impact on bond values.

ix

Industry Breakdown and Performance

Showing Percentage of Total Net Assets | as of June 30, 2005 |

General Obligation Bonds |

|

|

| 53.6 | % |

Health & Education |

|

|

| 26.5 | % |

Health |

| 18.0 | % |

|

|

Education |

| 8.5 | % |

|

|

Utilities |

|

|

| 11.4 | % |

Other |

|

|

| 4.7 | % |

Housing |

|

|

| 2.8 | % |

Money Market Mutual Funds |

|

|

| 0.0 | %** |

** Less than 0.05% of Net Assets

***Other Assets in Excess of Liabilities - 1.0%

|

| Cumulative |

| Average Annual |

| ||||

|

| Since |

| 1 Year |

| 5 Year |

| Since |

|

Class I |

| 58.56 | % | 5.05 | % | 5.26 | % | 4.95 | % |

Class A |

| 49.49 | % | 0.85 | % | 4.17 | % | 4.32 | % |

Class B |

| 50.46 | % | 0.31 | % | 4.16 | % | 4.37 | % |

Class C |

| 52.35 | % | 3.52 | % | 4.73 | % | 4.51 | % |

Lehman Bros. 10-Year Municipal Bond Index |

| 74.53 | % | 7.67 | % | 6.74 | % | 6.01 | % |

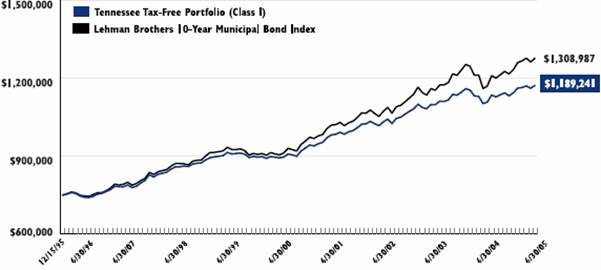

Comparison of Since Inception Change in Value of a $750,000 Investment in the First Funds Tennessee Tax-Free Portfolio (Class I) and the Lehman Brothers 10-Year Municipal Bond Index.

Please note: Class I inception is December 15, 1995. Minimum investment for Class I is $750,000. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance data quoted represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the performance quoted. Call First Funds at 800.442.1941 to obtain performance data current to the most recent month end.

*Total Returns are for the period ended 6/30/2005 and reflect reinvestment of all dividends, capital gains distributions, all fee waivers in effect and any expense reimbursements. Without the fee waivers and expense reimbursements, the Total Return figures would have been lower. Class I inception date is 12/15/1995. On 12/15/1995, the Portfolio also commenced sales of Class C shares, which include a .50% distribution fee. On 12/29/1995, the Portfolio commenced sales of Class A shares, which include a .25% shareholder services fee. Class A performance shown is based on a maximum 3.75% initial sales charge. Quotation of Class C performance reflects a 1% Deferred Sales Load applied to redemptions made during the first two years after purchase. Without this load, the figures quoted would have been 4.52% for 1 Year. The Portfolio commenced sales of Class B shares on 8/3/1999. These shares include a 0.70% distribution fee. Class B shares prior to their inception reflect applicable Class C performance data. Class B performance shown is net of CDSC. Class B shares of the Tennessee Tax-Free Portfolio are subject to a 4.00% CDSC which declines to 0.00% for shares held up to six years.

x

Definitions

Common Terms

Basis Point

Smallest measure of quoting yields on bonds and notes. One basis point is 0.01% of yield.

Bond Ratings

The quality of bonds can, to some degree, be determined from the ratings of the two most prominent rating services: Moody’s and Standard & Poor’s. The ratings are used by the government and industry regulatory agencies, the investing public, and portfolio managers as a guide to the relative security and value of each bond. The ratings are not used as an absolute factor in determining the strength of the pledge securing a particular issue. However, since Moody’s and Standard & Poor’s rate bonds on a fee basis, some issuers choose not to be rated. Many non-rated (NR) issues are sound investments. The rating symbols of the two services are shown in the accompanying table. Moody’s ratings may be modified by the addition of 1, 2 and 3 to show relative standing within the major rating categories in which 1 indicates a ranking in the higher end of the category, 2 in a mid-range and 3 in the lower end of the category. Standard & Poor’s ratings may be modified by the addition of a plus or minus to show relative standing within the major rating categories.

|

| Moody’s Investors |

| Standard & Poor’s Corp. |

|

|

|

|

|

|

|

Prime |

| Aaa |

| AAA |

|

Excellent |

| Aa |

| AA |

|

Good |

| A |

| A |

|

Average |

| Baa |

| BBB |

|

Fair |

| Ba |

| BB |

|

Poor |

| B |

| B |

|

Marginal |

| Caa |

| C |

|

Dividend

Net income distributed to shareholders generated by securities in a portfolio. The Intermediate Bond, Tennessee Tax-Free, and all the Money Market Portfolios pay dividends monthly. The Core Equity Portfolio and the Capital Appreciation Portfolios pay dividends annually.

Gain (or Loss)

If a stock or bond appreciates in price, there is an unrealized gain; if it depreciates there is an unrealized loss. A gain or loss is “realized” upon the sale of a security; if a Portfolio’s net gains exceed net losses, there may be a capital gain distribution to shareholders. There could also be an ordinary income distribution if the net gain is short term or no distribution if there is a capital loss carryover.

General Obligation Bonds

General Obligation Bonds (GOs) are debt-backed by the general taxing power of the issuer. Payment of the obligation may be backed by a specific tax or the issuer’s general tax fund. Examples of GOs include sidewalk bonds, sewer bonds and street bonds. These bonds are also known as full faith and credit bonds because the debt is a general obligation of the issuer.

Insured Bonds

Insured Bonds refer to municipal obligations which are covered by an insurance policy issued by independent insurance companies. The policies insure the payment of principal and/or interest of the issuer. Examples of such companies are MBIA (Municipal Bond Investors Assurance Corporation), and AMBAC (American Municipal Bond Assurance Corporation).

Net Asset Value (NAV)

NAV is the total value of all securities and other assets held by a portfolio, minus liabilities, divided by the number of shares outstanding. It is the value of a single share of a mutual fund on a given day. The total value of your investment would be the NAV multiplied by the number of shares you own.

Revenue Bonds

Revenue Bonds are issued to provide capital for the construction of a revenue-producing facility. The interest and principal payments are backed to the extent that the facility produces revenue to pay. Examples of revenue bonds include toll bridges, roads, parking lots and ports. The municipality is not obligated to cover debt payments on revenue bonds in default.

xi

SEC Yield

The SEC Yield was mandated by the Securities and Exchange Commission in 1988 as a standardized yield calculation intended to put performance presentations for all bond and money market funds on a level playing field. The SEC Yield does not take into account income derived from capital gains, option writing, futures, or return of capital. The formula also adjusts the income from premium or discounted bonds to reflect the amortization of that bond.

Total Return

Total return measures a portfolio’s performance over a stated period of time, taking into account the combination of dividends paid and the gain or loss in the value of the securities held in the Portfolio. It may be expressed on an average annual basis or a cumulative basis (total change over a given period).

Indices

Standard & Poor’s 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely-held common stocks.

Lehman Brothers Intermediate Government/Credit Index, an unmanaged index, is a broad measure of bond performance, and includes reinvestment of dividends and capital gains. This index includes only investment-grade bonds with maturities of up to 10 years.

Lehman Brothers Government/Credit Index is composed of all bonds that are of investment grade with at least one year until maturity.

Lehman Brothers 10-Year Municipal Bond Index, an unmanaged index, is a broad measure of shorter-term municipal bond performance and includes reinvestment of dividends and capital gains.

The Russell 2000® Growth Index, measures the performance of those Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values.

xii

Fund Expenses

As a shareholder of the Funds, you incur two potential types of costs. You incur transaction costs including sales charges, you also incur ongoing costs, including management fees, 12b-1 fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on January 3, 2005 and held until June 30, 2005.

Actual Return. The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expense Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical 5% Return. The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The expenses shown in the table are meant to highlight ongoing Fund costs only and do not reflect transaction fees, such as redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and may not help you determine the relative total costs of owning different funds. In addition, if these transaction fees were included, your costs would have been higher.

Core Equity Portfolio

|

|

|

| Beginning Account Value |

| Ending Account Value |

| Expense Paid During Period * |

| |||

Class I |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 958.00 |

| $ | 4.56 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,019.89 |

| $ | 4.71 |

|

Class A |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 956.30 |

| $ | 5.76 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,018.64 |

| $ | 5.94 |

|

Class B |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 952.90 |

| $ | 9.34 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,014.96 |

| $ | 9.63 |

|

Class C |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 953.40 |

| $ | 9.34 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,014.96 |

| $ | 9.63 |

|

Capital Appreciation Portfolio

|

|

|

| Beginning Account Value |

| Ending Account Value |

| Expense Paid During Period * |

| |||

Class I |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 951.00 |

| $ | 5.98 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,018.39 |

| $ | 6.19 |

|

Class A |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 949.60 |

| $ | 7.17 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,017.16 |

| $ | 7.42 |

|

Class B |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 946.70 |

| $ | 10.74 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,013.49 |

| $ | 11.11 |

|

Class C |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 946.20 |

| $ | 10.74 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,013.49 |

| $ | 11.11 |

|

Intermediate Bond Portfolio

|

|

|

| Beginning Account Value |

| Ending Account Value |

| Expense Paid During Period * |

| |||

Class I |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 1,012.40 |

| $ | 3.21 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,021.33 |

| $ | 3.22 |

|

Class A |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 1,011.10 |

| $ | 4.44 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,020.11 |

| $ | 4.46 |

|

Class B |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 1,008.80 |

| $ | 6.70 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,017.85 |

| $ | 6.73 |

|

Class C |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 1,008.60 |

| $ | 6.90 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,017.65 |

| $ | 6.93 |

|

xiii

Tennessee Tax-Free Portfolio

|

|

|

| Beginning Account Value |

| Ending Account Value |

| Expense Paid During Period * |

| |||

Class I |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 1,014.80 |

| $ | 3.41 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,021.14 |

| $ | 3.42 |

|

Class A |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 1,013.50 |

| $ | 4.64 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,019.91 |

| $ | 4.66 |

|

Class B |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 1,011.30 |

| $ | 6.86 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,017.70 |

| $ | 6.88 |

|

Class C |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 1,013.30 |

| $ | 5.87 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,018.68 |

| $ | 5.89 |

|

U.S. Government Money Market Portfolio

|

|

|

| Beginning Account Value |

| Ending Account Value |

| Expense Paid During Period * |

| |||

Class I |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 1,012.30 |

| $ | 1.23 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,023.29 |

| $ | 1.24 |

|

Class C |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 1,011.00 |

| $ | 2.47 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,022.07 |

| $ | 2.48 |

|

Municipal Money Market Portfolio

|

|

|

| Beginning Account Value |

| Ending Account Value |

| Expense Paid During Period * |

| |||

Class I |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 1,009.60 |

| $ | 1.48 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,023.05 |

| $ | 1.49 |

|

Class C |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 1,008.30 |

| $ | 2.71 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,021.82 |

| $ | 2.73 |

|

Cash Reserve Portfolio

|

|

|

| Beginning Account Value |

| Ending Account Value |

| Expense Paid During Period * |

| |||

Class I |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 1,012.30 |

| $ | 1.48 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,023.05 |

| $ | 1.49 |

|

Class B |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 1,007.30 |

| $ | 6.40 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,018.15 |

| $ | 6.43 |

|

Class C |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 1,011.00 |

| $ | 2.71 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,021.82 |

| $ | 2.73 |

|

*Expenses are equal to the Core Equity Portfolio annualized expense ratios of 0.95%, 1.20%, 1.95% and 1.95% for classes I, A, B & C, respectively; Capital Appreciation Portfolio annualized expense ratios of 1.25%, 1.50%, 2.25% and 2.25% for classes I, A, B & C, respectively; Intermediate Bond Portfolio annualized expense ratios of 0.65%, 0.90%, 1.36% and 1.40% for classes I, A, B & C, respectively; Tennessee Tax-Free Portfolio annualized expense ratios of 0.69%, 0.94%, 1.39% and 1.19% for classes I, A, B & C, respectively; U.S. Government Money Market Portfolio annualized expense ratio of 0.25% and 0.50% for classes I & C, respectively; Municipal Money Market Portfolio annualized expense ratios of 0.30% and 0.55% for classes I & C, respectively and Cash Reserve Portfolio annualized expense ratios of 0.30%, 1.30% and 0.55% for classes I, B & C, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year/365 (to reflect the half-year period).

xiv

Report of Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of First Funds

We have audited the accompanying statements of assets and liabilities, including the portfolios of investments, of First Funds (the “Trust”) comprising the Core Equity, Capital Appreciation, Intermediate Bond, Tennessee Tax-Free, U.S. Government Money Market, Municipal Money Market and Cash Reserve Portfolios as of June 30, 2005, and the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights the periods presented. These financial statements and financial highlights are the responsibility of the Trust’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Trust is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Trust’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of June 30, 2005, by correspondence with the custodian and brokers; where replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of each of the portfolios constituting First Funds as of June 30, 2005, the results of their operations and for the year then ended, the changes in their net assets for each of the two years in the period then ended, and the financial highlights for the periods presented, in conformity with accounting principles generally accepted in the United States of America.

|

Deloitte & Touche L.L.P. |

Denver, Colorado |

August 16, 2005 |

xv

THIS PAGE INTENTIONALLY LEFT BLANK

Portfolio of Investments

As of June 30, 2005 - Showing Percentage of Total Net Assets

Core Equity Portfolio

|

| Shares |

| Value |

| |

COMMON STOCKS - 92.6% |

|

|

|

|

| |

CONSUMER DISCRETIONARY - 18.1% |

|

|

|

|

| |

Media - 11.6% |

|

|

|

|

| |

Comcast Corp., Class A* |

| 352,518 |

| $ | 10,557,914 |

|

McGraw-Hill Co., Inc. |

| 247,160 |

| 10,936,830 |

| |

Omnicom Group, Inc. |

| 176,915 |

| 14,128,432 |

| |

Walt Disney Co. |

| 496,000 |

| 12,489,280 |

| |

|

|

|

|

|

| |

TOTAL MEDIA |

|

|

| 48,112,456 |

| |

|

|

|

|

|

| |

Motorcycle Manufacturers - 2.0% |

|

|

|

|

| |

Harley Davidson, Inc. |

| 166,050 |

| 8,236,080 |

| |

|

|

|

|

|

| |

Retailing - 4.5% |

|

|

|

|

| |

Home Depot, Inc. |

| 485,290 |

| 18,877,781 |

| |

|

|

|

|

|

| |

TOTAL CONSUMER DISCRETIONARY |

|

|

| 75,226,317 |

| |

|

|

|

|

|

| |

CONSUMER STAPLES - 10.7% |

|

|

|

|

| |

Discount Stores - 1.2% |

|

|

|

|

| |

Wal-Mart Stores, Inc. |

| 102,600 |

| 4,945,320 |

| |

|

|

|

|

|

| |

Food, Beverage & Tobacco - 7.3% |

|

|

|

|

| |

Costco Wholesale Corp. |

| 324,050 |

| 14,523,921 |

| |

Pepsico, Inc. |

| 289,500 |

| 15,612,735 |

| |

|

|

|

|

|

| |

TOTAL FOOD, BEVERAGE & TOBACCO |

|

|

| 30,136,656 |

| |

|

|

|

|

|

| |

Household & Personal Products - 2.2% |

|

|

|

|

| |

Colgate-Palmolive Co. |

| 187,425 |

| 9,354,382 |

| |

|

|

|

|

|

| |

TOTAL CONSUMER STAPLES |

|

|

| 44,436,358 |

| |

|

|

|

|

|

| |

ENERGY - 3.0% |

|

|

|

|

| |

Energy - 3.0% |

|

|

|

|

| |

Exxon Mobil Corp. |

| 215,600 |

| 12,390,532 |

| |

|

|

|

|

|

| |

TOTAL ENERGY |

|

|

| 12,390,532 |

| |

|

|

|

|

|

| |

FINANCIALS - 27.6% |

|

|

|

|

| |

Banks - 3.1% |

|

|

|

|

| |

Wells Fargo & Co. |

| 206,906 |

| 12,741,271 |

| |

|

|

|

|

|

| |

Diversified Financials - 7.2% |

|

|

|

|

| |

Capital One Financial Corp. |

| 281,425 |

| 22,516,814 |

| |

Federal National Mortgage Association |

| 129,600 |

| 7,568,640 |

| |

|

|

|

|

|

| |

TOTAL DIVERSIFIED FINANCIALS |

|

|

| 30,085,454 |

| |

|

|

|

|

|

| |

Insurance - 17.3% |

|

|

|

|

| |

AFLAC, Inc. |

| 360,400 |

| 15,598,112 |

| |

American International Group, Inc. |

| 262,970 |

| 15,278,558 |

| |

Fidelity National Financial, Inc. |

| 206,720 |

| 7,377,837 |

| |

Willis Group Holdings, Ltd. |

| 409,965 |

| 13,414,055 |

| |

XL Capital, Ltd., Class A |

| 269,600 |

| 20,063,632 |

| |

|

|

|

|

|

| |

TOTAL INSURANCE |

|

|

| 71,732,194 |

| |

|

|

|

|

|

| |

TOTAL FINANCIALS |

|

|

| 114,558,919 |

| |

|

|

|

|

|

| |

HEALTHCARE - 5.6% |

|

|

|

|

| |

Healthcare Equipment & Supplies - 2.7% |

|

|

|

|

| |

Medtronic, Inc. |

| 218,750 |

| 11,329,062 |

| |

|

|

|

|

|

| |

Pharmaceuticals & Biotechnology - 2.9% |

|

|

|

|

| |

Pfizer, Inc. |

| 427,915 |

| 11,801,896 |

| |

|

|

|

|

|

| |

TOTAL HEALTHCARE |

|

|

| 23,130,958 |

| |

|

|

|

|

|

| |

INDUSTRIALS - 6.6% |

|

|

|

|

| |

Capital Goods - 3.4% |

|

|

|

|

| |

General Electric Co. |

| 413,400 |

| $ | 14,324,310 |

|

|

|

|

|

|

| |

Industrial Machinery - 3.2% |

|

|

|

|

| |

Ingersoll-Rand Co., Ltd. |

| 187,350 |

| 13,367,423 |

| |

|

|

|

|

|

| |

TOTAL INDUSTRIALS |

|

|

| 27,691,733 |

| |

|

|

|

|

|

| |

INFORMATION TECHNOLOGY - 17.3% |

|

|

|

|

| |

Semiconductors - 4.3% |

|

|

|

|

| |

Analog Devices, Inc. |

| 167,250 |

| 6,240,097 |

| |

Intel Corp. |

| 446,650 |

| 11,639,699 |

| |

|

|

|

|

|

| |

TOTAL SEMICONDUCTORS |

|

|

| 17,879,796 |

| |

|

|

|

|

|

| |

Software - 3.8% |

|

|

|

|

| |

Microsoft Corp. |

| 637,500 |

| 15,835,500 |

| |

|

|

|

|

|

| |

Technology Hardware & Equipment - 9.2% |

|

|

|

|

| |

Cisco Systems, Inc. * |

| 536,400 |

| 10,250,604 |

| |

Flextronics International, Ltd.* |

| 959,876 |

| 12,679,962 |

| |

Jabil Circuit, Inc.* |

| 167,450 |

| 5,145,738 |

| |

Lexmark International, Inc.* |

| 153,825 |

| 9,972,475 |

| |

|

|

|

|

|

| |

TOTAL TECHNOLOGY HARDWARE & EQUIPMENT |

|

|

| 38,048,779 |

| |

|

|

|

|

|

| |

TOTAL INFORMATION TECHNOLOGY |

|

|

| 71,764,075 |

| |

|

|

|

|

|

| |

TELECOMMUNICATIONS - 3.7% |

|

|

|

|

| |

Telecommunication Services - 3.7% |

|

|

|

|

| |

Vodafone Group, plc ADR |

| 633,475 |

| 15,406,112 |

| |

|

|

|

|

|

| |

TOTAL TELECOMMUNICATIONS |

|

|

| 15,406,112 |

| |

|

|

|

|

|

| |

TOTAL COMMON STOCKS |

|

|

| 384,605,004 |

| |

|

|

|

|

|

| |

MONEY MARKET MUTUAL FUNDS - 5.9% |

|

|

|

|

| |

SSgA Prime Money Market Fund |

| 12,324,860 |

| 12,324,860 |

| |

SSgA U.S. Treasury Money Market Fund |

| 12,134,152 |

| 12,134,152 |

| |

|

|

|

|

|

| |

TOTAL MONEY MARKET MUTUAL FUNDS |

|

|

| 24,459,012 |

| |

|

|

|

|

|

| |

TOTAL INVESTMENTS |

| 98.5 | % | 409,064,016 |

| |

Other Assets in Excess of Liabilities |

| 1.5 | % | 6,167,060 |

| |

NET ASSETS |

| 100.0 | % | $ | 415,231,076 |

|

* Non-income producing security

ADR - - American Depositary Receipt

See accompanying Notes to Financial Statements.

1

Income Tax Information:

At June 30, 2005, the net unrealized appreciation based on cost for income tax purposes of $365,747,629 was as follows:

Aggregate gross unrealized appreciation for all investments in which there was an excess of value over tax cost |

| $ | 57,470,572 |

|

|

|

|

| |

Aggregate gross unrealized depreciation for all investments in which there was an excess of tax cost over value |

| (14,154,185 | ) | |

|

|

|

| |

Net unrealized appreciation |

| $ | 43,316,387 |

|

The difference between book and tax net unrealized appreciation is wash sale loss deferrals.

Other Information:

Purchases and sales of securities, other than short-term securities, for the year ended June 30, 2005, aggregated $114,857,647 and $289,861,904, respectively.

Capital Appreciation Portfolio

Due |

| Coupon |

| Principal |

| Value |

| ||

|

|

|

|

|

|

|

| ||

U.S. GOVERNMENT & AGENCY OBLIGATIONS - 6.9% |

|

|

|

|

|

|

| ||

Federal National Mortgage Association |

|

|

|

|

|

|

| ||

Discount Notes - 6.9% |

|

|

|

|

|

|

| ||

07/01/05 |

| 2.97% |

| $ | 7,020,000 |

| $ | 7,020,000 |

|

07/05/05 |

| 3.09% |

| 400,000 |

| 399,863 |

| ||

07/06/05 |

| 3.15% |

| 520,000 |

| 519,773 |

| ||

07/13/05 |

| 3.15% |

| 80,000 |

| 79,916 |

| ||

07/13/05 |

| 3.13% |

| 270,000 |

| 269,718 |

| ||

|

|

|

|

|

|

|

| ||

TOTAL U.S. GOVERNMENT & AGENCY OBLIGATIONS |

|

|

|

|

| 8,289,270 |

| ||

|

|

|

| Shares |

|

|

|

COMMON STOCKS - 94.8% |

|

|

|

|

|

|

|

Business Services - 8.0% |

|

|

|

|

|

|

|

Advisory Board Co.* |

|

|

| 45,200 |

| 2,203,048 |

|

aQuantive, Inc.* |

|

|

| 69,400 |

| 1,229,768 |

|

Ivillage, Inc.* |

|

|

| 234,900 |

| 1,404,702 |

|

Jupitermedia Corp.* |

|

|

| 116,100 |

| 1,988,793 |

|

Portfolio Recovery Associates, Inc.* |

|

|

| 4,300 |

| 180,686 |

|

Resources Connection, Inc.* |

|

|

| 77,800 |

| 1,807,294 |

|

SupportSoft, Inc.* |

|

|

| 166,600 |

| 864,654 |

|

|

|

|

|

|

|

|

|

TOTAL BUSINESS SERVICES |

|

|

|

|

| 9,678,945 |

|

|

|

|

|

|

|

|

|

Capital Goods - 4.7% |

|

|

|

|

|

|

|

Engineered Support Systems, Inc. |

|

|

| 42,050 |

| 1,506,651 |

|

Lincoln Electric Holdings, Inc. |

|

|

| 53,800 |

| 1,783,470 |

|

NCI Building Systems, Inc.* |

|

|

| 51,100 |

| 1,676,080 |

|

Trex Company, Inc.* |

|

|

| 29,800 |

| 765,860 |

|

|

|

|

|

|

|

|

|

TOTAL CAPITAL GOODS |

|

|

|

|

| 5,732,061 |

|

|

|

|

|

|

|

|

|

Consumer Non-Durables - 16.1% |

|

|

|

|

|

|

|

America’s Car Mart, Inc.* |

|

|

| 44,650 |

| 1,005,072 |

|

Build-A-Bear-Workshop, Inc.* |

|

|

| 42,000 |

| 984,900 |

|

Carter’s, Inc.* |

|

|

| 30,500 |

| 1,780,590 |

|

Coach, Inc.* |

|

|

| 87,800 |

| 2,947,446 |

|

Guitar Center, Inc.* |

|

|

| 37,900 |

| 2,212,223 |

|

Hibbett Sporting Goods, Inc.* |

|

|

| 95,587 |

| 3,617,012 |

|

Tractor Supply Co.* |

|

|

| 23,200 |

| 1,139,120 |

|

Urban Outfitters, Inc.* |

|

|

| 66,600 |

| 3,775,554 |

|

Warnaco Group, Inc.* |

|

|

| 84,000 |

| 1,953,000 |

|

|

|

|

|

|

|

|

|

TOTAL CONSUMER NON-DURABLES |

|

|

|

|

| 19,414,917 |

|

|

|

|

|

|

|

|

|

Consumer Services - 13.4% |

|

|

|

|

|

|

|

BJ’s Restaurants, Inc.* |

|

|

| 270,700 |

| 5,506,038 |

|

Cheesecake Factory, Inc.* |

|

|

| 50,700 |

| 1,760,811 |

|

Collectors Universe, Inc.* |

|

|

| 80,000 |

| 1,401,600 |

|

First Cash Financial Services, Inc.* |

|

|

| 55,950 |

| 1,195,651 |

|

Four Seasons Hotel, Inc. |

|

|

| 21,900 |

| 1,447,590 |

|

InPhonic, Inc.* |

|

|

| 47,400 |

| 729,012 |

|

Rare Hospitality International, Inc.* |

|

|

| 46,850 |

| 1,427,520 |

|

Sonic Corp.* |

|

|

| 66,762 |

| 2,038,244 |

|

TRM Corp.* |

|

|

| 41,400 |

| 696,348 |

|

|

|

|

|

|

|

|

|

TOTAL CONSUMER SERVICES |

|

|

|

|

| 16,202,814 |

|

|

|

|

|

|

|

|

|

Financials - 9.6% |

|

|

|

|

|

|

|

Brookline Bancorp, Inc. |

|

|

| 81,000 |

| 1,317,060 |

|

Delphi Financial Group, Inc. |

|

|

| 60,200 |

| 2,657,830 |

|

Downey Financial Corp. |

|

|

| 21,200 |

| 1,551,840 |

|

Hub International, Ltd. |

|

|

| 41,000 |

| 799,090 |

|

RAIT Investment Trust |

|

|

| 37,100 |

| 1,111,145 |

|

Signature Bank* |

|

|

| 66,700 |

| 1,627,480 |

|

Westcorp |

|

|

| 48,100 |

| 2,521,402 |

|

|

|

|

|

|

|

|

|

TOTAL FINANCIALS |

|

|

|

|

| 11,585,847 |

|

See accompanying Notes to Financial Statements.

2

|

|

|

| Shares |

| Value |

| |

Healthcare - 21.6% |

|

|

|

|

|

|

| |

Align Technology, Inc. * |

|

|

| 150,600 |

| $ | 1,109,922 |

|

Amylin Pharmaceuticals, Inc.* |

|

|

| 94,000 |

| 1,967,420 |

| |

Animas Corp.* |

|

|

| 99,300 |

| 2,000,895 |

| |

Conceptus, Inc.* |

|

|

| 124,000 |

| 700,600 |

| |

Conor Medsystems, Inc.* |

|

|

| 45,100 |

| 692,285 |

| |

CV Therapeutics, Inc.* |

|

|

| 117,100 |

| 2,625,382 |

| |

Digene Corp.* |

|

|

| 50,800 |

| 1,406,144 |

| |

Dyax Corp.* |

|

|

| 130,600 |

| 616,432 |

| |

Encysive Pharmaceuticals, Inc.* |

|

|

| 111,800 |

| 1,208,558 |

| |

Immucor, Inc.* |

|

|

| 54,350 |

| 1,573,432 |

| |

Isolagen, Inc.* |

|

|

| 167,900 |

| 688,390 |

| |

Medicis Pharmaceutical Corp. |

|

|

| 41,100 |

| 1,304,103 |

| |

MGI PHARMA, Inc.* |

|

|

| 66,000 |

| 1,436,160 |

| |

Nektar Therapeutics* |

|

|

| 125,900 |

| 2,120,156 |

| |

POZEN, Inc.* |

|

|

| 91,900 |

| 753,580 |

| |

Protein Design Labs, Inc.* |

|

|

| 83,000 |

| 1,677,430 |

| |

Rigel Pharmaceuticals, Inc.* |

|

|

| 58,400 |

| 1,163,328 |

| |

SeraCare Life Sciences, Inc.* |

|

|

| 38,700 |

| 541,413 |

| |

United Therapeutics Corp.* |

|

|

| 52,400 |

| 2,525,680 |

| |

|

|

|

|

|

|

|

| |

TOTAL HEALTHCARE |

|

|

|

|

| 26,111,310 |

| |

|

|

|

|

|

|

|

| |

Technology - 18.4% |

|

|

|

|

|

|

| |

Agile Software Corp.* |

|

|

| 129,300 |

| 814,590 |

| |

Akamai Technologies, Inc.* |

|

|

| 134,600 |

| 1,767,298 |

| |

Cymer, Inc.* |

|

|

| 55,400 |

| 1,459,790 |

| |

Integrated Device Technology, Inc.* |

|

|

| 84,900 |

| 912,675 |

| |

Interwoven, Inc.* |

|

|

| 154,500 |

| 1,163,385 |

| |

Manhattan Associates, Inc.* |

|

|

| 44,000 |

| 845,240 |

| |

Marchex, Inc.* |

|

|

| 121,600 |

| 1,828,864 |

| |

MatrixOne, Inc.* |

|

|

| 223,600 |

| 1,118,000 |

| |

Mattson Technology, Inc.* |

|

|

| 159,200 |

| 1,139,872 |

| |

Merix Corp.* |

|

|

| 92,100 |

| 538,785 |

| |

NMS Communications Corp.* |

|

|

| 156,300 |

| 447,018 |

| |

O2Micro International, Ltd.* |

|

|

| 178,600 |

| 2,509,330 |

| |

Power Integrations, Inc.* |

|

|

| 64,500 |

| 1,391,265 |

| |

SiRF Technology Holdings, Inc.* |

|

|

| 95,500 |

| 1,688,440 |

| |

Skyworks Solutions, Inc.* |

|

|

| 85,300 |

| 628,661 |

| |

Tessera Technologies, Inc.* |

|

|

| 82,300 |

| 2,749,643 |

| |

TIBCO Software, Inc.* |

|

|

| 188,700 |

| 1,234,098 |

| |

|

|

|

|

|

|

|

| |

TOTAL TECHNOLOGY |

|

|

|

|

| 22,236,954 |

| |

|

|

|

|

|

|

|

| |

Transportation - 3.0% |

|

|

|

|

|

|

| |

Knight Transportation, Inc. |

|

|

| 63,350 |

| 1,541,305 |

| |

Old Dominion Freight Line, Inc.* |

|

|

| 40,500 |

| 1,086,615 |

| |

Universal Truckload Services, Inc.* |

|

|

| 63,000 |

| 1,064,070 |

| |

|

|

|

|

|

|

|

| |

TOAL TRANSPORTATION |

|

|

|

|

| 3,691,990 |

| |

|

|

|

|

|

|

|

| |

TOTAL COMMON STOCKS |

|

|

|

|

| 114,654,838 |

| |

|

|

|

|

|

|

|

| |

MONEY MARKET MUTUAL FUNDS - 1.0% |

|

|

|

|

|

|

| |

SSGA Prime Money Market Fund |

|

|

| 597,413 |

| 597,413 |

| |

SSGA U.S. Treasury Money Market Fund |

|

|

| 597,371 |

| 597,371 |

| |

|

|

|

|

|

|

|

| |

TOTAL MONEY MARKET MUTUAL FUNDS |

|

|

|

|

| 1,194,784 |

| |

|

|

|

|

|

|

|

| |

TOTAL INVESTMENTS |

|

|

| 102.7 | % | 124,138,892 |

| |

|

|

|

|

|

|

|

| |

Liabilities in Excess of Other Assets |

|

|

| -2.7 | % | (3,261,714 | ) | |

NET ASSETS |

|

|

| 100.0 | % | $ | 120,877,178 |

|

*Non-income producing security

Income Tax Information:

At June 30, 2005, the net unrealized appreciation based on cost for income tax purposes of $111,676,201 was as follows:

Aggregate gross unrealized appreciation for all investments in which there was an excess of value over tax cost |

| $ | 21,414,227 |

|

|

|

|

| |

Aggregate gross unrealized depreciation for all investments in which there was an excess of tax cost over value |

| (8,951,536 | ) | |

|

|

|

| |

Net unrealized appreciation |

| $ | 12,462,691 |

|

The difference between book and tax net unrealized appreciation is wash sale loss deferrals

At June 30, 2005, the Capital Appreciation Portfolio had a capital loss carryover of $1,496,878 available to offset capital gains to the extent provided in regulations, which will expire on June 30, 2011. During the year ended June 30, 2005, the Capital Appreciation Portfolio used capital loss carryovers of $5,028,202.

Other Information:

Purchases and sales of securities, other than short-term securities, for the year ended June 30, 2005, aggregated $95,759,245 and $86,968,331, respectively.

See accompanying Notes to Financial Statements.

3

Intermediate Bond Portfolio

Due |

| Coupon |

| Principal |

| Value |

| ||

|

|

|

|

|

|

|

| ||

U.S. GOVERNMENT & AGENCY OBLIGATIONS - 47.4% |

|

|

|

|

|

|

| ||

U.S. Treasury Notes - 8.2% |

|

|

|

|

|

|

| ||

09/15/05 |

| 3.125% |

| $ | 14,175,000 |

| $ | 13,934,691 |

|

02/15/09 |

| 3.000% |

| 14,000,000 |

| 13,672,974 |

| ||

|

|

|

|

|

|

|

| ||

TOTAL U.S. TREASURY NOTES |

|

|

|

|

| 27,607,665 |

| ||

|

|

|

|

|

|

|

| ||

Federal Farm Credit Bank - 1.6% |

|

|

|

|

|

|

| ||

06/15/07 |

| 3.250% |

| 2,500,000 |

| 2,472,090 |

| ||

07/21/08 |

| 3.150% |

| 3,000,000 |

| 2,933,874 |

| ||

|

|

|

|

|

|

|

| ||

TOTAL FEDERAL FARM CREDIT BANK |

|

|

|

|

| 5,405,964 |

| ||

|

|

|

|

|

|

|

| ||

Federal Home Loan Bank - 13.3% |

|

|

|

|

|

|

| ||

11/15/06 |

| 4.125% |

| 20,000,000 |

| 20,077,360 |

| ||

11/15/06 |

| 4.875% |

| 14,000,000 |

| 14,183,764 |

| ||

10/05/07 |

| 3.375% |

| 11,000,000 |

| 10,899,075 |

| ||

|

|

|

|

|

|

|

| ||

TOTAL FEDERAL HOME LOAN BANK |

|

|

|

|

| 45,160,199 |

| ||

|

|

|

|

|

|

|

| ||

Federal Home Loan Mortgage Corporation - 14.1% |

|

|

|

|

|

|

| ||

01/15/06 |

| 5.250% |

| 6,500,000 |

| 6,549,160 |

| ||

06/16/06 |

| 2.910% |

| 14,500,000 |

| 14,383,463 |

| ||

01/05/07 |

| 6.700% |

| 5,000,000 |

| 5,210,965 |

| ||

01/19/07 |

| 3.050% |

| 2,500,000 |

| 2,472,003 |

| ||

09/15/07 |

| 3.500% |

| 1,950,000 |

| 1,938,025 |

| ||

01/23/08 |

| 3.650% |

| 10,540,000 |

| 10,480,955 |

| ||

03/15/09 |

| 5.750% |

| 4,510,000 |

| 4,788,867 |

| ||

07/15/12 |

| 5.125% |

| 1,810,000 |

| 1,918,624 |

| ||

|

|

|

|

|

|

|

| ||

TOTAL FEDERAL HOME LOAN MORTGAGE CORPORATION |

|

|

|

|

| 47,742,062 |

| ||

|

|

|

|

|

|

|

| ||

Federal National Mortgage Association - 7.2% |

|

|

|

|

|

|

| ||

02/15/08 |

| 5.750% |

| 2,850,000 |

| 2,983,676 |

| ||

02/01/11 |

| 6.250% |

| 5,000,000 |

| 5,478,830 |

| ||

02/28/12 |

| 5.625% |

| 11,000,000 |

| 11,272,998 |

| ||

08/01/12 |

| 5.250% |

| 4,500,000 |

| 4,743,212 |

| ||

|

|

|

|

|

|

|

| ||

TOTAL FEDERAL NATIONAL MORTGAGE ASSOCIATION |

|

|

|

|

| 24,478,716 |

| ||

|

|

|

|

|

|

|

| ||

Other - 3.0% |

|

|

|

|

|

|

| ||

Private Export Funding Corp. |

|

|

|

|

|

|

| ||

03/15/06 |

| 5.340% |

| 10,000,000 |

| 10,110,530 |

| ||

|

|

|

|

|

|

|

| ||

TOTAL U.S. GOVERNMENT & AGENCY OBLIGATIONS |

|

|

|

|

| 160,505,136 |

| ||

|

|

|

|

|

|

|

| ||

CORPORATE BONDS & NOTES - 49.0% |

|

|

|

|

|

|

| ||

FINANCIALS - 29.4% |

|

|

|

|

|

|

| ||

Banks 11.5% |

|

|

|

|

|

|

| ||

AmSouth Bank* |

|

|

|

|

|

|

| ||

02/01/08 |

| 6.450% |

| 5,100,000 |

| 5,380,107 |

| ||

Bank of America Corp. |

|

|

|

|

|

|

| ||

01/15/13 |

| 4.875% |

| 4,940,000 |

| 5,067,467 |

| ||

First Union National Bank |

|

|

|

|

|

|

| ||

02/15/10 |

| 7.875% |

| 5,000,000 |

| 5,750,915 |

| ||

Key Bank |

|

|

|

|

|

|

| ||

07/17/07 |

| 5.000% |

| 5,500,000 |

| 5,589,787 |

| ||

Regions Bank |

|

|

|

|

|

|

| ||

12/15/06 |

| 2.900% |

| 2,530,000 |

| 2,486,679 |

| ||

Regions Financial Corp. |

|

|

|

|

|

|

| ||

03/01/11 |

| 7.000% |

| 4,500,000 |

| 5,063,571 |

| ||

Synovus Financial Corp. |

|

|

|

|

|

|

| ||

02/15/13 |

| 4.875% |

| 1,775,000 |

| 1,802,440 |

| ||

US Bank |

|

|

|

|

|

|

| ||

02/04/14 |

| 6.300% |

| $ | 7,000,000 |

| $ | 7,904,085 |

|

|

|

|

|

|

|

|

| ||

TOTAL BANKS |

|

|

|

|

| 39,045,051 |

| ||

|

|

|

|

|

|

|

| ||