UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-6589 | |||||||

| ||||||||

FIRST FUNDS | ||||||||

(Exact name of registrant as specified in charter) | ||||||||

| ||||||||

1625 Broadway, Suite 2200, Denver, Colorado |

| 80202 | ||||||

(Address of principal executive offices) |

| (Zip code) | ||||||

| ||||||||

Erin E. Douglas First Funds 1625 Broadway, Suite 2200 Denver, Colorado 80202 | ||||||||

(Name and address of agent for service) | ||||||||

| ||||||||

Registrant’s telephone number, including area code: | (303) 623-2577 |

| ||||||

| ||||||||

Date of fiscal year end: | June 30 |

| ||||||

| ||||||||

Date of reporting period: | December 31, 2005 |

| ||||||

Item 1 — Reports to Stockholders

The following is a copy of the report to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

First Funds

• Are NOT insured by the FDIC or any other governmental agency.

• Are NOT bank deposits or other obligations of or guaranteed by First Tennessee Bank National Association or any of its affiliates.

• Involve investment risks, including the possible loss of the principal amount invested.

• Although the Money Market Portfolios seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the portfolios.

|

| First Funds Core Equity Portfolio |

Core Equity Portfolio Managers

David Thompson and Mark Cronin

Mr. Thompson is senior vice president with Highland Capital Management Corp. and is a Chartered Financial Analyst. After graduating from the University of Mississippi in 1981, he worked as an analyst for Gulf Oil for three years, then went on to receive a M.B.A. from the University of North Carolina in 1986. Mr. Thompson has 17 years of investment experience including nine years of experience managing both individual and institutional investment portfolios at major regional banks. He joined Highland Capital’s equity team in 1995.

Mr. Cronin is vice president with Highland Capital Management Corp. and is a Chartered Financial Analyst. He has two decades of investment experience and earned a B.A. from the University of Washington. Former employers include Merrill Lynch and Paine Webber. Prior to joining Highland Capital in 1999, Mr. Cronin was senior portfolio manager and vice president with First Chicago NBD.

Fiscal Year Review

Market Review and Portfolio Update

During the second half of 2005, the Core Equity Class I Portfolio gained 1.49%, underperforming the S&P 500 Index return of 5.77%. The portfolio return was 0.85% in the third calendar quarter and 0.63% in the fourth calendar quarter.

Portfolio performance was negatively impacted by our under weighting of the energy sector. This was a major drag to relative performance in the third calendar quarter as crude prices ran up due to the active hurricane season, and a slight benefit in the fourth calendar quarter as crude prices fell. However, energy sector price appreciation in the third quarter more than offset the weakness in the group in the fourth quarter.

The consumer discretionary sector of our portfolio was also weak in the third calendar quarter as higher energy prices had a negative impact on the market’s perception of how companies dependent on consumer spending would perform. Energy prices did impact a number of retailers, particularly those whose customers are at lower income levels.

The information technology sector of the portfolio performed poorly in the fourth calendar quarter. Part of the concern impacting the technology group was the inversion of the yield curve (when short term interest rates exceed longer term rates). This sometimes precedes an economic recession, which would, in turn, hurt spending on new technology investments. Flextronics International, Ltd. and Lexmark International, Inc. (portfolio exited position on November 1, 2005) were both particularly weak in the quarter.

We are optimistic on the outlook for 2006. The economy continues to be strong with consensus expectations for GDP to grow 3.5% in the first half of the year, and slow slightly in the second half to 3.1%. Moderation in energy prices should continue to contain inflation, and the Federal Reserve should be through raising rates by mid-year. Earnings growth for the market should cool slightly in 2006, with S&P 500 Index operating earnings growing approximately 7%. With industrial capacity nearing 80%, corporations that are flush with cash should begin to spend more on capital investments designed to increase productivity, which would bode well for a number of the technology holdings in our portfolio. Consumer spending has been the strength of the U.S. economy for the past few years. Declining energy prices coupled with strong employment numbers should allow consumer spending to remain strong, which would be positive for retailers such as Wal-Mart Stores, Inc., Home Depot, Inc., Costco Wholesale Corp. and Kohl’s Corp. The market’s price earnings ratio is approximately 16 times estimated 2006 earnings, which is a reasonable valuation level given the prevailing low level of interest rates.

i

Industry Breakdown and Performance

Showing Percentage of Total Net Assets |

| as of December 31, 2005 |

Financials |

|

|

| 27.4 | % |

Insurance |

| 18.2 | % |

|

|

Diversified Financials |

| 5.8 | % |

|

|

Banks |

| 3.4 | % |

|

|

Consumer Discretionary |

|

|

| 16.8 | % |

Information Technology |

|

|

| 16.1 | % |

Consumer Staples |

|

|

| 11.9 | % |

Industrials |

|

|

| 9.6 | % |

Healthcare |

|

|

| 6.6 | % |

Energy |

|

|

| 4.9 | % |

Money Market Mutual Funds |

|

|

| 4.2 | % |

Telecommunications |

|

|

| 2.5 | % |

|

| Cumulative |

| Average Annual |

| ||||||

|

| Since |

|

|

|

|

|

|

| Since |

|

|

| Inception |

| 1 Year |

| 5 Year |

| 10 Year |

| Inception |

|

Class I |

| 259.78 | % | (2.77 | )% | (2.89 | )% | 9.42 | % | 10.86 | % |

Class A |

| 230.42 | % | (8.65 | )% | (4.25 | )% | 8.48 | % | 10.10 | % |

Class B |

| 216.65 | % | (8.44 | )% | (4.19 | )% | 8.30 | % | 9.72 | % |

Class C |

| 217.54 | % | (4.52 | )% | (3.78 | )% | 8.33 | % | 9.75 | % |

S&P 500 |

| 248.54 | % | 4.90 | % | 0.54 | % | 9.07 | % | 10.57 | % |

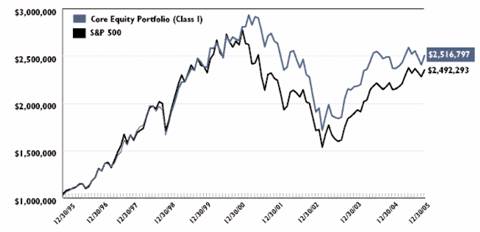

Comparison of 10 Year Change in Value of a $750,000 Investment in the First Funds Core Equity Portfolio (Class I) and the S&P 500.

Please note: Class I inception is August 2, 1993. Minimum investment for Class I is $750,000. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance data quoted represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the performance quoted. Call First Funds at 800.442.1941 to obtain performance data current to the most recent month end.

*Total Returns are for the period ended 12/31/2005 and reflect reinvestment of all dividends, capital gains distributions, all fee waivers in effect, and any expense reimbursements. Without the fee waivers and expense reimbursements, the Total Return figures would have been lower. Class I inception date is 8/2/1993. On 12/9/1993, the Portfolio commenced sales of Class C shares, which include a .75% distribution fee and a .25% shareholder services fee. Performance information prior to 12/9/1993 for Class C shares is based on the performance of Class I shares and does not reflect the effects of these fees, which, if included, would lower Class C performance. Quotation of Class C performance reflects a 1% Deferred Sales Load applied to redemptions made during the first year after purchase. Without this load, the figures quoted would have been (3.56)% for 1 Year. The Portfolio commenced sales of Class A shares on 12/20/1995, which include a ..25% shareholder services fee. Class A performance shown is based on a maximum 5.75% initial sales charge. Performance information for Class A shares prior to their inception date is based on the performance of Class I shares and does not reflect the effects of these fees which, if included, would lower Class A performance. The Portfolio commenced sales of Class B shares on 8/3/1999. These shares include a 1.00% distribution fee. Performance information for Class B shares prior to their inception reflect applicable Class C and Class I performance data. Class B performance shown is net of CDSC. Class B shares of the Portfolio are subject to a 5.00% CDSC which declines to 0.00% for shares held up to six years.

ii

|

| First Funds Capital Appreciation Portfolio |

Capital Appreciation Portfolio Managers

Portfolio Management Team

A team of portfolio managers and analysts is responsible for the day-to-day operations of the Portfolio. The team is led by Marshall Bassett, chief investment officer, growth equities of Delaware Investments. Mr. Bassett serves as senior portfolio manager for the consumer and retail sectors. He has over 20 years of professional investment experience.

Other Team Members

Matthew Todorow, portfolio manager, healthcare sector

Steven Lampe, portfolio manager, financial sector

Lori Wachs, portfolio manager, consumer and retail sector

Fiscal Year Review

Market Review and Portfolio Update

Despite the effects of rising energy prices, continued interest rate hikes by the Federal Reserve, and the largest natural disaster in U.S. history, stocks rose across capitalization and style spectrums during the second half of 2005. July saw a continuation of a market rally that began in May but was followed by a weak August. Then, even in the wake of Hurricanes Katrina and Rita, markets rose in September. The fourth calendar quarter saw a solid rally in November, flanked by down months, but the strength of July and November were sufficient to take most indices to mid to high single-digit gains for the period. Midcaps led the way, as they did in the first half of the year (they were, in fact, the only portion of the cap spectrum in territory by June 30). Over the last six months, the Russell 2000 Index rose 5.88%, the Russell Top 200 Index gained 5.24%, while the Russell Midcap Index posted an 8.24% return. In a reversal of the first half of 2005, growth strongly outperformed value across all capitalizations. Within the Russell 2000 Growth Index, the energy sector returned 26%, and in inverse relation due to the effects of rising energy prices, the consumer-related sectors were the worst performers, dropping to low single digits.

The Capital Appreciation Class I portfolio returned 7.86% for the last six months. Overall stock selection was positive, driven primarily by technology and, to a lesser extent, the financial sector. In a departure from the norm, the top 10 contributors came from only three sectors, nine of them from technology and healthcare alone.

Amylin Pharmaceuticals, Inc. was the top contributor, jumping 91%, largely in response to positive results regarding its diabetes drug. Conceptus, Inc. was the leading performer, with a gain of 123%, as its permanent contraception product won increased support from health insurers. Global Positioning System (GPS) chip manufacturer SiRF Technology Holdings, Inc. was the portfolio’s second-best contributor, with a return of 68%. It acquired Motorola, Inc.’s GPS chipset line and is providing its technology for some of Garmin, Ltd.’s GPS products.

Hindering performance was overall sector selection, driven primarily by an underweight in energy and an overweight in consumer-related sectors. We were proven correct in the fourth calendar quarter that energy stocks had gotten ahead of themselves in September and that consumer stocks had been oversold. But we continued to believe that a secular demand-driven shift created opportunities for select energy-related companies to sustain growth independent of short-term oil price volatility. Accordingly, we took advantage of the decline in energy stocks in the fourth calendar quarter to reduce our under weight in the sector.

Despite the success of several healthcare stocks, the sector suffered two setbacks late in the period. Encysive Pharmaceuticals, Inc. fell 27%, largely as a result of positive developments regarding a competing drug. Since Encysive’s own drug should reach market 18 months ahead of its competitor, and the competitor still has approval hurdles, we believe the market overreacted and continue to hold the stock. Rigel Pharmaceuticals, Inc. was the portfolio’s worst performer, falling more than 50% after its allergy-related drug failed in a clinical study. Given the quality of Rigel’s drug discovery platform and its partnerships with major pharmaceutical firms, we believe the market strongly overreacted and bought more of the stock at extremely depressed levels.

We enter 2006 fairly optimistic about the overall economy and the potential for positive stock performance. An end to Federal Reserve rate increases and a leveling in energy prices could establish a solid operating environment for many businesses, leading to continued sales and profit growth. We are comfortable with our current portfolio weights and believe that we will be able to participate in a strong market environment. While changes in portfolio positioning throughout the past year have reduced the portfolio’s sensitivity to the over- or under-performance of any particular sector, we continue to focus on stock selection—finding and holding individual companies that have delivered and will be able to continue to deliver strong sales and profit growth.

iii

Industry Breakdown and Performance

Showing Percentage of Total Net Assets |

| as of December 31, 2005 |

Technology |

| 26.4 | % |

Healthcare |

| 19.5 | % |

Consumer Non-Durables |

| 14.3 | % |

Financials |

| 8.1 | % |

Consumer Services |

| 7.8 | % |

Business Services |

| 7.5 | % |

Energy |

| 3.9 | % |

Transportation |

| 3.9 | % |

Capital Goods |

| 3.7 | % |

U.S. Government & Agency Obligations |

| 2.8 | % |

Money Market Mutual Funds |

| 1.9 | % |

** Other Assets in Excess of Liabilities - 0.2%

|

| Cumulative |

| Average Annual |

| ||||

|

| Since |

|

|

|

|

| Since |

|

|

| Inception |

| 1 Year |

| 5 Year |

| Inception |

|

Class I |

| 63.36 | % | 2.57 | % | 2.95 | % | 6.07 | % |

Class A |

| 42.81 | % | (3.55 | )% | 1.48 | % | 4.41 | % |

Class B |

| 43.56 | % | (3.35 | )% | 1.51 | % | 4.48 | % |

Class C |

| 42.25 | % | 0.72 | % | 1.93 | % | 4.36 | % |

Russell 2000 Growth Index |

| 22.95 | % | 4.12 | % | 1.99 | % | 2.51 | % |

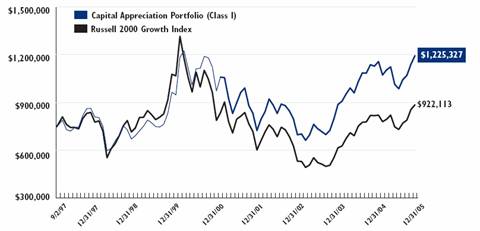

Comparison of Since Inception Change in Value of a $750,000 Investment in the First Funds Capital Appreciation Portfolio (Class I) and the Russell 2000 Growth Index.

Please note: Class I inception is September 2, 1997. Minimum investment for Class I is $750,000. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance data quoted represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the performance quoted. Call First Funds at 800.442.1941 to obtain performance data current to the most recent month end.

*Total Returns are for the period ended 12/31/2005 and reflect reinvestment of all dividends, capital gains distributions, all fee waivers in effect and any expense reimbursements. Without the fee waivers and expense reimbursements, the Total Return figures would have been lower. Class I inception date is 9/2/1997. The Portfolio commenced sales of Class A shares on 10/2/1997. These shares include a .25% shareholder services fee. Class A performance shown is based on a maximum 5.75% initial sales charge. On 10/2/1997, the Portfolio commenced sales of Class C shares, which include a .75% distribution fee and a .25% shareholder services fee. Quotation of Class C performance reflects a 1% Deferred Sales Load applied to redemptions made during the first year after purchase. Without this load, the figures quoted would have been 1.72% for 1 Year. The Portfolio commenced sales of Class B shares on 8/3/1999. These shares include a 1.00% distribution fee. Class B shares of Capital Appreciation prior to their inception reflect applicable Class C performance data. Class B performance shown is net of CDSC. Class B shares of the Portfolio are subject to a 5.00% CDSC which declines to 0.00% for shares held up to six years.

iv

|

| First Funds Intermediate Bond Portfolio |

Intermediate Bond Portfolio Managers

Ted L. Flickinger, Jr. and Michael W. Holt

Mr. Flickinger is executive vice president for Martin & Company and is a Chartered Financial Analyst. Prior to joining the firm in 1990, he was an assistant manager of the investment department of Home Federal Bank of Tennessee for six years. His 25-year career includes management positions in the investment departments of the Park National Bank and Fidelity Federal Savings and Loan of Knoxville.

Mr. Holt is a Chartered Financial Analyst, holds a M.B.A. and is senior vice president for Martin & Company. Prior to joining the firm in 2002, he was senior vice president, fixed income portfolio manager, and head of fixed income research for Wachovia Asset Management. Mr. Holt’s 19-year investment career also includes being a fixed income portfolio manager with Third National Bank (now SunTrust) and a fixed income account representative with Morgan Keegan & Company.

Fiscal Year Review

Market Review and Portfolio Update

The Intermediate Bond Portfolio Class I finished 2005 with a return of 1.35%, just below the comparable Lehman Intermediate Government/Credit Index return of 1.57%.

The Federal Reserve Open Market Committee met four times over the last two quarters, raising the benchmark Fed Funds rate by 0.25% at each of the meetings, to 4.25%. But in its policy statement accompanying the last move, the Federal Reserve appeared to indicate a limit to additional tightening, assuming data regarding inflation and inflation expectations remains in check and the economy continues to grow at a reasonable rate.

In the third quarter of 2005, following two quarters of relative under performance, the credit sector of the bond market posted a good quarter as corporate yield spreads tightened. Within the quality sectors of the investment grade credit market, bonds rated BBB logged their best quarterly performance of 2005. The AAA, AA and A rated quality sectors of the market performed well as all three generated positive excess returns on a quarterly basis. The biggest news in the credit markets has been continued financial strains on the U.S. auto industry and the unrelenting credit pressures on the U.S. airline industry.

In the fourth quarter of 2005, the interest rate curve continued the flattening trend from the previous quarter, with short-term rates increasing more than long-term rates, in line with the Federal Reserve policy tightening. With the exception of longer-term securities, bond prices declined during the quarter. However, the drop in market prices was more than offset by coupon income, resulting in generally positive total returns across the bond market.

Treasuries, which are considered the safest and most liquid securities in the bond market, generated the highest return of the major sectors during the fourth calendar quarter. The Lehman Brothers Intermediate Credit Index posted a duration adjusted return that was ..25% below a comparable Treasury as credit spreads were generally wider across the entire corporate bond market.

The portfolio consistently maintained a target duration that was shorter than the benchmark Lehman Brothers Intermediate Government/Credit Index, beginning the third quarter at 76% of the benchmark’s duration and ending the fourth quarter at of 85% of the benchmark. The portfolio had a lower than benchmark allocation to Treasury securities and maintained an emphasis on corporate and agency investments during the period. As rates moved higher over the time period, the shorter than benchmark duration improved performance relative to the benchmark.

v

Industry Breakdown and Performance

Showing Percentage of Total Net Assets |

| as of December 31, 2005 |

U.S. Government & Agency Obligations |

|

|

| 52.0 | % |

Financials |

|

|

| 30.8 | % |

Banks |

| 11.8 | % |

|

|

Broker/Dealers |

| 8.4 | % |

|

|

Insurance |

| 6.4 | % |

|

|

Financial Services |

| 3.6 | % |

|

|

Leasing Company |

| 0.6 | % |

|

|

Industrials |

|

|

| 12.4 | % |

Money Market Mutual Funds |

|

|

| 1.9 | % |

Utilities |

|

|

| 1.6 | % |

Morgage-Backed Obligations |

|

|

| 0.0 | %* |

**Less than 0.05% of Net Assets

*** Other Assets in Excess of Liabilities - 1.3%

|

| Cumulative |

| Average Annual |

| ||||

|

| Since |

|

|

|

|

| Since |

|

|

| Inception |

| 1 Year |

| 5 Year |

| Inception |

|

Class I |

| 50.33 | % | 1.35 | % | 4.93 | % | 5.34 | % |

Class A |

| 42.06 | % | (2.52 | )% | 3.94 | % | 4.59 | % |

Class B |

| 40.07 | % | (3.37 | )% | 3.84 | % | 4.52 | % |

Class C |

| 39.95 | % | (0.41 | )% | 4.17 | % | 4.51 | % |

Lehman Bros. Intermediate Gov’t/Credit Index |

| 54.65 | % | 1.57 | % | 5.49 | % | 5.72 | % |

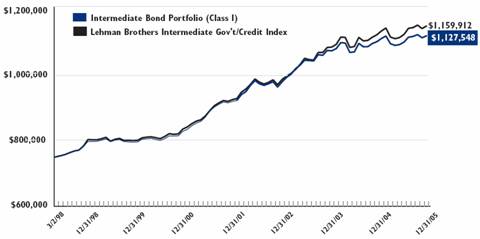

Comparison of Since Inception Change in Value of a $750,000 Investment in the First Funds Intermediate Bond Portfolio (Class I) and the Lehman Brothers Intermediate Government/Credit Index.

Please note: Class I inception is March 2, 1998. Minimum investment for Class I is $750,000. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance data quoted represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the performance quoted. Call First Funds at 800.442.1941 to obtain performance data current to the most recent month end.

*Total Returns are for the period ended 12/31/2005 and reflect reinvestment of all dividends, capital gains distributions, all fee waivers in effect and any expense reimbursements. Without the fee waivers and expense reimbursements, the Total Return figures would have been lower. Class I inception date is 3/2/1998. The Portfolio commenced sales of Class A shares on 3/9/1998. These shares include a .25% shareholder services fee. Class A performance shown is based on a maximum 3.50% initial sales charge. On 5/19/1998, the Portfolio commenced sales of Class C shares, which include a .50% distribution fee and a .25% shareholder services fee. Quotation of Class C performance reflects a 1% Deferred Sales Load applied to redemptions made during the sixteen months after purchase. Without this load, the figures quoted would have been 0.59% for 1 Year. The Portfolio commenced sales of Class B shares on 10/28/2002. These shares include a 0.70% distribution fee. Class B shares prior to their inception reflect applicable Class C performance data. Class B shares of the Intermediate Bond Portfolio are subject to a 4.00% CDSC which declines to 0.00% for shares held up to six years. Treasury bonds are guaranteed as to the timely payment of interest and repayment of principal if held to maturity.

vi

|

| First Funds Tennessee Tax-Free Portfolio |

Tennessee Tax-Free Portfolio Managers

Ted L. Flickinger, Jr.

Mr. Flickinger is executive vice president for Martin & Company and is a Chartered Financial Analyst. Prior to joining the firm in 1990, he was an assistant manager of the investment department of Home Federal Bank of Tennessee for six years. His 25-year career includes management positions in the investment departments of the Park National Bank and Fidelity Federal Savings and Loan of Knoxville.

Fiscal Year Review

Market Review and Portfolio Update

The Tennessee Tax-Free Portfolio Class I finished the 2005 calendar year with a full-year return of 1.44% after a fairly flat six months to close the year.

Municipal rates rose significantly in the third calendar quarter, with 7- to 15-year rates rising .20% to .30%. As a result, portfolios and funds which target indexes in the middle of the curve suffered. Municipal relative values dropped from 94% at the beginning of the quarter to 89% at quarter end as measured by the percentage of the 10-year AA rated General Obligation (GO) yield relative to the yield of a 10-year Treasury note. At the end of the quarter, municipals were trading at very close to their 1-year average value relative to Treasury rates.

The primary credit events of the quarter were Hurricanes Katrina and Rita, which created specific concerns for the municipal market. The hurricanes had an impact on issuers directly affected by the storms (primarily in Mississippi and Louisiana), bond insurers, and property and casualty insurers (buyers of municipal bonds). The net amount of exposure of the insurers, after reinsurance, is roughly $16 billion. But even if municipalities go into default, the bond insurers only pay the interest and principal currently due and very rarely is there an acceleration of the entire debt, minimizing the impact on insurer ratings.

As interest rates rose during the quarter, we extended the average maturity of the portfolio from 8.4 to 8.5 years.

The fourth calendar quarter of 2005 was the sixth consecutive quarter in which the yield curve from 1 to 10 years has flattened.

At the end of the fourth quarter a 10-year AA rated GO yielded around 4.0%, or 91% of a comparable Treasury. Ten-year AA municipals are more attractive relative to Treasuries than at the beginning of the quarter, when the yield of an AA GO was 89% of a Treasury.

The fourth quarter was another quarter of strong issuance in the Tennessee market, as issuers priced $571 million in debt, bringing the total for 2005 to $2.8 billion. Tennessee issuance was up from 2004, but still below the record total of $3.3 billion in 2003. The largest Tennessee deals in the fourth quarter were a $214 million deal by the Metropolitan Government of Nashville and Davidson County and a $145 million Tennessee State deal.

vii

Industry Breakdown and Performance

Showing Percentage of Total Net Assets |

| as of December 31, 2005 |

General Obligation Bonds |

| 53.1 | % |

Health & Education |

| 22.6 | % |

Utilities |

| 15.2 | % |

Other |

| 5.3 | % |

Housing |

| 2.3 | % |

Money Market Mutual Funds |

| 0.4 | % |

**Other Assets in Excess of Liabilities - 1.1%

|

| Cumulative |

| Average Annual |

| ||||||

|

| Since |

|

|

|

|

|

|

| Since |

|

|

| Inception |

| 1 Year |

| 5 Year |

| 10 Year |

| Inception |

|

Class I |

| 58.50% |

| 1.44 | % | 4.14 | % | 4.64 | % | 4.69 | % |

Class A |

| 49.25% |

| (2.64 | )% | 3.08 | % | 4.08 | % | 4.08 | % |

Class B |

| 49.87% |

| (3.27 | )% | 3.05 | % | 4.05 | % | 4.11 | % |

Class C |

| 51.91% |

| 0.03 | % | 3.62 | % | 4.19 | % | 4.25 | % |

Lehman Bros. 10-Year Municipal Bond Index |

| 74.91% |

| 2.75 | % | 5.44 | % | 5.68 | % | 5.72 | % |

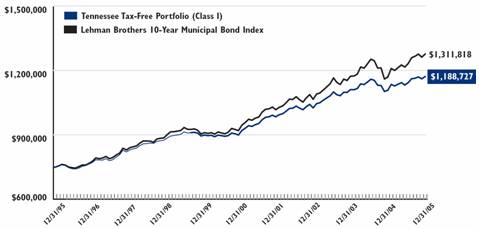

Comparison of Since Inception Change in Value of a $750,000 Investment in the First Funds

Tennessee Tax-Free Portfolio (Class I) and the Lehman Brothers 10-Year Municipal Bond Index.

Please note: Class I inception is December 15, 1995. Minimum investment for Class I is $750,000. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance data quoted represents past performance. Past performance does not guarantee future results and current performance may be lower or higher than the performance quoted. Call First Funds at 800.442.1941 to obtain performance data current to the most recent month end.

*Total Returns are for the period ended 12/31/2005 and reflect reinvestment of all dividends, capital gains distributions, all fee waivers in effect and any expense reimbursements. Without the fee waivers and expense reimbursements, the Total Return figures would have been lower. Class I inception date is 12/15/1995. On 12/15/1995, the Portfolio also commenced sales of Class C shares, which include a .50% distribution fee. On 12/29/1995, the Portfolio commenced sales of Class A shares, which include a .25% shareholder services fee. Class A performance shown is based on a maximum 3.75% initial sales charge. Quotation of Class C performance reflects a 1% Deferred Sales Load applied to redemptions made during the first two years after purchase. Without this load, the figures quoted would have been 1.03% for 1 Year. The Portfolio commenced sales of Class B shares on 8/3/1999. These shares include a 0.70% distribution fee. Class B shares prior to their inception reflect applicable Class C performance data. Class B performance shown is net of CDSC. Class B shares of the Tennessee Tax-Free Portfolio are subject to a 4.00% CDSC which declines to 0.00% for shares held up to six years.

viii

|

| Definitions |

Common Terms

|

| Moody’s Investors |

| Standard & Poor’s Corp. |

|

|

| Services, Inc. |

| (Plus (+) or minus (-)) |

|

Prime |

| Aaa |

| AAA |

|

Excellent |

| Aa |

| AA |

|

Good |

| A |

| A |

|

Average |

| Baa |

| BBB |

|

Fair |

| Ba |

| BB |

|

Poor |

| B |

| B |

|

Marginal |

| Caa |

| C |

|

Basis Point

Smallest measure of quoting yields on bonds and notes. One basis point is 0.01% of yield.

Bond Ratings

The quality of bonds can, to some degree, be determined from the ratings of the two most prominent rating services: Moody’s and Standard & Poor’s. The ratings are used by thegovernment and industry regulatory agencies, the investing public, and portfolio managers as a guide to the relative security and value of each bond. The ratings are not used as an absolute factor in determining the strength of the pledge securing a particular issue. However, since Moody’s and Standard & Poor’s rate bonds on a fee basis, some issuers choose not to be rated. Many non-rated (NR) issues are sound investments. The rating symbols of the two services are shown in the accompanying table. Moody’s ratings may be modified by the addition of 1, 2 and 3 to show relative standing within the major rating categories in which 1 indicates a ranking in the higher end of the category, 2 in a mid-range and 3 in the lower end of the category. Standard & Poor’s ratings may be modified by the addition of a plus or minus to show relative standing within the major rating categories.

Dividend

Net income distributed to shareholders generated by securities in a portfolio. The Intermediate Bond, Tennessee Tax-Free, and all the Money Market Portfolios pay dividends monthly. The Core Equity and Capital Appreciation Portfolios pay dividends annually.

Gain (or Loss)

If a stock or bond appreciates in price, there is an unrealized gain; if it depreciates there is an unrealized loss. A gain or loss is “realized” upon the sale of a security; if a Portfolio’s net gains exceed net losses, there may be a capital gain distribution to shareholders. There could also be an ordinary income distribution if the net gain is short term or no distribution if there is a capital loss carryover.

General Obligation Bonds

General Obligation Bonds (GOs) are debt-backed by the general taxing power of the issuer. Payment of the obligation may be backed by a specific tax or the issuer’s general tax fund. Examples of GOs include sidewalk bonds, sewer bonds and street bonds. These bonds are also known as full faith and credit bonds because the debt is a general obligation of the issuer.

Insured Bonds

Insured Bonds refer to municipal obligations which are covered by an insurance policy issued by independent insurance companies. The policies insure the payment of principal and/or interest of the issuer. Examples of such companies are MBIA(Municipal Bond Investors Assurance Corporation), and AMBAC (American Municipal Bond Assurance Corporation).

Net Asset Value (NAV)

NAV is the total value of all securities and other assets held by a portfolio, minus liabilities, divided by the number of shares outstanding. It is the value of a single share of a mutual fund on a given day. The total value of your investment would be the NAV multiplied by the number of shares you own.

Revenue Bonds

Revenue Bonds are issued to provide capital for the construction of a revenue-producing facility. The interest and principal payments are backed to the extent that the facility produces revenue to pay. Examples of revenue bonds include toll bridges, roads, parking lots and ports. The municipality is not obligated to cover debt payments on revenue bonds in default.

ix

SEC Yield

The SEC Yield was mandated by the Securities and Exchange Commission in 1988 as a standardized yield calculation intended to put performance presentations for all bond and money market funds on a level playing field. The SEC Yield does not take into account income derived from capital gains, option writing, futures, or return of capital. The formula also adjusts the income from premium or discounted bonds to reflect the amortization of that bond.

Total Return

Total return measures a portfolio’s performance over a stated period of time, taking into account the combination of dividends paid and the gain or loss in the value of the securities held in the Portfolio. It may be expressed on an average annual basis or a cumulative basis (total change over a given period).

Indices

Standard & Poor’s 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely-held common stocks.

Lehman Brothers Intermediate Government/Credit Index, an unmanaged index, is a broad measure of bond performance, and includes reinvestment of dividends and capital gains. This index includes only investment-grade bonds with maturities of up to 10 years.

Lehman Brothers Intermediate Credit Index is designed to represent all investment grade corporate bonds with maturities between one and 10 years.

Russell 2000® Growth Index, measures the performance of those Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values.

Russell 2000® Index, is constructed to provide a comprehensive and unbiased small-cap barometer. The Russell 2000 includes the smallest 2000 securities in the Russell 3000.

Russell Top 200® Index, measures the largest 200 securities by market cap and approximately 68% of the U.S. market. This index constructed to provide a comprehensive and unbiased barometer for this very large cap segment. The Russell Top 200 includes the largest 200 securities in the Russell 3000.

Russell Midcap® Index, is constructed to provide a comprehensive and unbiased barometer for the mid-cap segment. The Russell Midcap Index includes the smallest 800 securities in the Russell 1000.

x

|

| Fund Expenses |

As a shareholder of the Portfolios, you incur two potential types of costs. You incur transaction costs including sales charges, you also incur ongoing costs, including management fees, 12b-1 fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on July 1, 2005 and held until January 2, 2006.

Actual Return. The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expense Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical 5% Return. The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The expenses shown in the table are meant to highlight ongoing Fund costs only and do not reflect transaction fees, such as redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and may not help you determine the relative total costs of owning different funds. In addition, if these transaction fees were included, your costs would have been higher.

Core Equity Portfolio

|

|

|

| Beginning Account Value |

| Ending Account Value |

| Expense Paid During Period * |

| |||

|

|

|

| 7/1/05 |

| 1/2/06 |

| (7/1/05-1/2/06) |

| |||

Class I |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 1,014.92 |

| $ | 4.06 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,021.45 |

| $ | 4.07 |

|

Class A |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 1,013.83 |

| $ | 5.34 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,020.18 |

| $ | 5.35 |

|

Class B |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 1,011.46 |

| $ | 9.17 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,016.36 |

| $ | 9.20 |

|

Class C |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 1,011.61 |

| $ | 9.17 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,016.36 |

| $ | 9.20 |

|

Capital Appreciation Portfolio

|

|

|

| Beginning Account Value |

| Ending Account Value |

| Expense Paid During Period * |

| |||

|

|

|

| 7/1/05 |

| 1/2/06 |

| (7/1/05-1/2/06) |

| |||

Class I |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 1,078.56 |

| $ | 5.67 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,020.03 |

| $ | 5.51 |

|

Class A |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 1,077.22 |

| $ | 6.99 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,018.75 |

| $ | 6.79 |

|

Class B |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 1,073.67 |

| $ | 10.94 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,014.93 |

| $ | 10.63 |

|

Class C |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 1,075.02 |

| $ | 10.94 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,014.93 |

| $ | 10.63 |

|

Intermediate Bond Portfolio

|

|

|

| Beginning Account Value |

| Ending Account Value |

| Expense Paid During Period * |

| |||

|

|

|

| 7/1/05 |

| 1/2/06 |

| (7/1/05-1/2/06) |

| |||

Class I |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 1,001.07 |

| $ | 3.16 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,022.32 |

| $ | 3.19 |

|

Class A |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 998.84 |

| $ | 4.43 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,021.05 |

| $ | 4.48 |

|

Class B |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 997.55 |

| $ | 6.72 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,018.75 |

| $ | 6.79 |

|

Class C |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 997.30 |

| $ | 6.97 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,018.50 |

| $ | 7.05 |

|

xi

Tennessee Tax-Free Portfolio

|

|

|

| Beginning Account Value |

| Ending Account Value |

| Expense Paid During Period * |

| |||

|

|

|

| 7/1/05 |

| 1/2/06 |

| (7/1/05-1/2/06) |

| |||

Class I |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 999.64 |

| $ | 3.36 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,022.12 |

| $ | 3.40 |

|

Class A |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 998.38 |

| $ | 4.63 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,020.84 |

| $ | 4.69 |

|

Class B |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 996.11 |

| $ | 6.92 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,018.55 |

| $ | 6.99 |

|

Class C |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 997.11 |

| $ | 5.90 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,019.57 |

| $ | 5.97 |

|

U.S. Government Money Market Portfolio

|

|

|

| Beginning Account Value |

| Ending Account Value |

| Expense Paid During Period * |

| |||

|

|

|

| 7/1/05 |

| 1/2/06 |

| (7/1/05-1/2/06) |

| |||

Class I |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 1,017.42 |

| $ | 1.29 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,024.21 |

| $ | 1.29 |

|

Class C |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 1,016.15 |

| $ | 2.57 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,022.93 |

| $ | 2.58 |

|

Municipal Money Market Portfolio

|

|

|

| Beginning Account Value |

| Ending Account Value |

| Expense Paid During Period * |

| |||

|

|

|

| 7/1/05 |

| 1/2/06 |

| (7/1/05-1/2/06) |

| |||

Class I |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 1,011.72 |

| $ | 1.54 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,023.95 |

| $ | 1.55 |

|

Class C |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 1,010.47 |

| $ | 2.82 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,022.68 |

| $ | 2.83 |

|

Cash Reserve Portfolio

|

|

|

| Beginning Account Value |

| Ending Account Value |

| Expense Paid During Period * |

| |||

|

|

|

| 7/1/05 |

| 1/2/06 |

| (7/1/05-1/2/06) |

| |||

Class I |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 1,017.51 |

| $ | 1.54 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,023.95 |

| $ | 1.55 |

|

Class B |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 1,012.47 |

| $ | 6.67 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,018.85 |

| $ | 6.69 |

|

Class C |

| Actual Fund Return |

| $ | 1,000.00 |

| $ | 1,016.25 |

| $ | 2.83 |

|

|

| Hypothetical Fund Return |

| $ | 1,000.00 |

| $ | 1,022.68 |

| $ | 2.83 |

|

*Expenses are equal to the Core Equity Portfolio annualized expense ratios of 0.79%, 1.04%, 1.79% and 1.79% for classes I, A, B & C, respectively; Capital Appreciation Portfolio annualized expense ratios of 1.07%, 1.32%, 2.07% and 2.07% for classes I, A, B & C, respectively; Intermediate Bond Portfolio annualized expense ratios of 0.62%, 0.87%, 1.32% and 1.37% for classes I, A, B & C, respectively; Tennessee Tax-Free Portfolio annualized expense ratios of 0.66%, 0.91%, 1.36% and 1.16% for classes I, A, B & C, respectively; U.S. Government Money Market Portfolio annualized expense ratio of 0.25% and 0.50% for classes I & C, respectively; Municipal Money Market Portfolio annualized expense ratios of 0.30% and 0.55% for classes I & C, respectively and Cash Reserve Portfolio annualized expense ratios of 0.30%, 1.30% and 0.55% for classes I, B & C, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year/365 (to reflect the half year period).

xii

|

| Portfolio of Investments |

As of December 31, 2005 (Unaudited) - Showing Percentage of Total Net Assets

Core Equity Portfolio

|

| Shares |

| Value |

| |

COMMON STOCKS - 95.8% |

|

|

|

|

| |

CONSUMER DISCRETIONARY - 16.8% |

|

|

|

|

| |

Media - 8.6% |

|

|

|

|

| |

Comcast Corp., Class A* |

| 296,018 |

| $ | 7,604,702 |

|

McGraw-Hill Co., Inc. |

| 212,860 |

| 10,989,962 |

| |

Walt Disney Co. |

| 496,000 |

| 11,889,120 |

| |

|

|

|

|

|

| |

TOTAL MEDIA |

|

|

| 30,483,784 |

| |

|

|

|

|

|

| |

Motorcycle Manufacturers - 2.1% |

|

|

|

|

| |

Harley Davidson, Inc. |

| 144,050 |

| 7,417,135 |

| |

|

|

|

|

|

| |

Retailing - 6.1% |

|

|

|

|

| |

Home Depot, Inc. |

| 400,290 |

| 16,203,739 |

| |

Kohl’s Corp.* |

| 106,900 |

| 5,195,340 |

| |

|

|

|

|

|

| |

TOTAL RETAILING |

|

|

| 21,399,079 |

| |

|

|

|

|

|

| |

TOTAL CONSUMER DISCRETIONARY |

|

|

| 59,299,998 |

| |

|

|

|

|

|

| |

CONSUMER STAPLES - 11.9% |

|

|

|

|

| |

Discount Stores - 2.2% |

|

|

|

|

| |

Wal-Mart Stores, Inc. |

| 166,200 |

| 7,778,160 |

| |

|

|

|

|

|

| |

Food, Beverage & Tobacco - 7.0% |

|

|

|

|

| |

Costco Wholesale Corp. |

| 226,050 |

| 11,182,693 |

| |

Pepsico, Inc. |

| 228,300 |

| 13,487,964 |

| |

|

|

|

|

|

| |

TOTAL FOOD, BEVERAGE & TOBACCO |

|

|

| 24,670,657 |

| |

|

|

|

|

|

| |

Household & Personal Products - 2.7% |

|

|

|

|

| |

Colgate-Palmolive Co. |

| 172,425 |

| 9,457,511 |

| |

|

|

|

|

|

| |

TOTAL CONSUMER STAPLES |

|

|

| 41,906,328 |

| |

|

|

|

|

|

| |

ENERGY - 4.9% |

|

|

|

|

| |

Energy - 4.9% |

|

|

|

|

| |

Exxon Mobil Corp. |

| 208,100 |

| 11,688,977 |

| |

GlobalSantaFe Corp. |

| 118,100 |

| 5,686,515 |

| |

|

|

|

|

|

| |

TOTAL ENERGY |

|

|

| 17,375,492 |

| |

|

|

|

|

|

| |

FINANCIALS - 27.4% |

|

|

|

|

| |

Banks - 3.4% |

|

|

|

|

| |

Wells Fargo & Co. |

| 190,906 |

| 11,994,624 |

| |

|

|

|

|

|

| |

Diversified Financials - 5.8% |

|

|

|

|

| |

Capital One Financial Corp. |

| 183,725 |

| 15,873,840 |

| |

Federal Home Loan Mortgage |

| 66,675 |

| 4,357,211 |

| |

|

|

|

|

|

| |

TOTAL DIVERSIFIED FINANCIALS |

|

|

| 20,231,051 |

| |

|

|

|

|

|

| |

Insurance - 18.2% |

|

|

|

|

| |

AFLAC, Inc. |

| 255,000 |

| 11,837,100 |

| |

American International Group, Inc. |

| 226,970 |

| 15,486,164 |

| |

Fidelity National Financial, Inc. |

| 202,720 |

| 7,458,069 |

| |

Fidelity National Title Class A |

| 90,476 |

| 2,203,091 |

| |

Willis Group Holdings, Ltd. |

| 351,715 |

| 12,992,352 |

| |

XL Capital, Ltd., Class A |

| 209,600 |

| 14,122,848 |

| |

|

|

|

|

|

| |

TOTAL INSURANCE |

|

|

| 64,099,624 |

| |

|

|

|

|

|

| |

TOTAL FINANCIALS |

|

|

| 96,325,299 |

| |

|

|

|

|

|

| |

HEALTHCARE - 6.6% |

|

|

|

|

| |

Healthcare Equipment & Supplies - 3.8% |

|

|

|

|

| |

Fisher Scientific International, Inc.* |

| 51,500 |

| $ | 3,185,790 |

|

Medtronic, Inc. |

| 177,750 |

| 10,233,068 |

| |

|

|

|

|

|

| |

TOTAL HEALTHCARE EQUIPMENT & SUPPLIES |

|

|

| 13,418,858 |

| |

|

|

|

|

|

| |

Pharmaceuticals & Biotechnology - 2.8% |

|

|

|

|

| |

Pfizer, Inc. |

| 427,915 |

| 9,978,978 |

| |

|

|

|

|

|

| |

TOTAL HEALTHCARE |

|

|

| 23,397,836 |

| |

|

|

|

|

|

| |

INDUSTRIALS - 9.6% |

|

|

|

|

| |

Capital Goods - 4.0% |

|

|

|

|

| |

General Electric Co. |

| 395,400 |

| 13,858,770 |

| |

|

|

|

|

|

| |

Industrial Machinery - 5.6% |

|

|

|

|

| |

Illinois Tool Works, Inc. |

| 70,190 |

| 6,176,018 |

| |

Ingersoll-Rand Co., Ltd. |

| 339,700 |

| 13,713,689 |

| |

|

|

|

|

|

| |

TOTAL INDUSTRIAL MACHINERY |

|

|

| 19,889,707 |

| |

|

|

|

|

|

| |

TOTAL INDUSTRIALS |

|

|

| 33,748,477 |

| |

|

|

|

|

|

| |

INFORMATION TECHNOLOGY - 16.1% |

|

|

|

|

| |

Semiconductors - 4.0% |

|

|

|

|

| |

Analog Devices, Inc. |

| 157,250 |

| 5,640,558 |

| |

Intel Corp. |

| 338,650 |

| 8,452,704 |

| |

|

|

|

|

|

| |

TOTAL SEMICONDUCTORS |

|

|

| 14,093,262 |

| |

|

|

|

|

|

| |

Software - 4.8% |

|

|

|

|

| |

Microsoft Corp. |

| 637,500 |

| 16,670,625 |

| |

|

|

|

|

|

| |

Technology Hardware & Equipment - 7.3% |

|

|

|

|

| |

Cisco Systems, Inc.* |

| 536,400 |

| 9,183,168 |

| |

Flextronics International, Ltd.* |

| 954,876 |

| 9,968,905 |

| |

Qualcomm, Inc. |

| 153,800 |

| 6,625,704 |

| |

|

|

|

|

|

| |

TOTAL TECHNOLOGY HARDWARE & EQUIPMENT |

|

|

| 25,777,777 |

| |

|

|

|

|

|

| |

TOTAL INFORMATION TECHNOLOGY |

|

|

| 56,541,664 |

| |

|

|

|

|

|

| |

TELECOMMUNICATIONS - 2.5% |

|

|

|

|

| |

Telecommunication Services - 2.5% |

|

|

|

|

| |

Vodafone Group, plc ADR |

| 411,075 |

| 8,825,780 |

| |

|

|

|

|

|

| |

TOTAL TELECOMMUNICATIONS |

|

|

| 8,825,780 |

| |

|

|

|

|

|

| |

TOTAL COMMON STOCKS |

|

|

| 337,420,874 |

| |

|

|

|

|

|

| |

MONEY MARKET MUTUAL FUNDS - 4.2% |

|

|

|

|

| |

SSgA Prime Money Market Fund |

| 7,522,072 |

| 7,522,072 |

| |

SSgA U.S. Treasury Money Market Fund |

| 7,324,877 |

| 7,324,877 |

| |

|

|

|

|

|

| |

TOTAL MONEY MARKET MUTUAL FUNDS |

|

|

| 14,846,949 |

| |

|

|

|

|

|

| |

TOTAL INVESTMENTS |

| 100.0 | % | 352,267,823 |

| |

Other Assets in Excess of Liabilities |

| 0.0 | %** | 29,994 |

| |

NET ASSETS |

| 100.0 | % | $ | 352,297,817 |

|

* Non-income producing security

**Less than 0.05% of net assets

ADR - American Depositary Receipt

See accompanying Notes to Financial Statements.

1

Income Tax Information:

At December 31, 2005, the net unrealized appreciation based on cost for income tax purposes of $315,816,407 was as follows:

Aggregate gross unrealized appreciation for all investments in which there was an excess of value over tax cost |

| $ | 49,832,616 |

|

|

|

|

| |

Aggregate gross unrealized depreciation for all investments in which there was an excess of tax cost over value |

| (13,381,200 | ) | |

|

|

|

| |

Net unrealized appreciation |

| $ | 36,451,416 |

|

The primary difference between book & tax net unrealized appreciation is wash sale loss deferrals.

Other Information:

Purchases and sales of securities other than short-term securities, for the six-months ended December 31, 2005, aggregated $34,356,003 and $85,193,376 respectively.

Capital Appreciation Portfolio

Due |

|

|

| Principal |

|

|

| ||

Date |

| Coupon |

| Amount |

| Value |

| ||

|

|

|

|

|

|

|

| ||

U.S. GOVERNMENT & AGENCY OBLIGATIONS - 2.8% |

|

|

|

|

|

|

| ||

Federal Home Loan Mortgage Corporation |

|

|

|

|

|

|

| ||

Discount Notes - 1.3% |

|

|

|

|

|

|

| ||

01/23/06 |

| 4.19 | % | $ | 355,000 |

| $ | 354,176 |

|

01/30/06 |

| 4.20 | % | 1,330,000 |

| 1,325,810 |

| ||

|

|

|

|

|

|

|

| ||

TOTAL HOME LOAN MORTGAGE CORPORATION |

|

|

|

|

| 1,679,986 |

| ||

|

|

|

|

|

|

|

| ||

Federal National Mortgage Association |

|

|

|

|

|

|

| ||

Discount Note -1.5% |

|

|

|

|

|

|

| ||

01/05/06 |

| 1.22 | % | 1,810,000 |

| 1,809,633 |

| ||

|

|

|

|

|

|

|

| ||

TOTAL NATIONAL MORTGAGE ASSOCIATION |

|

|

|

|

| 1,809,633 |

| ||

|

|

|

|

|

|

|

| ||

TOTAL U.S. GOVERNMENT & AGENCY OBLIGATIONS |

|

|

|

|

| 3,489,619 |

| ||

|

| Shares |

|

|

|

COMMON STOCKS - 95.1% |

|

|

|

|

|

Business Services - 7.5% |

|

|

|

|

|

Advisory Board Co.* |

| 39,900 |

| 1,902,033 |

|

Euronet Worldwide, Inc.* |

| 75,700 |

| 2,104,460 |

|

HouseValues, Inc.* |

| 88,300 |

| 1,150,549 |

|

Portfolio Recovery Associates, Inc.* |

| 48,600 |

| 2,256,984 |

|

Resources Connection, Inc.* |

| 77,800 |

| 2,027,468 |

|

|

|

|

|

|

|

TOTAL BUSINESS SERVICES |

|

|

| 9,441,494 |

|

|

|

|

|

|

|

Capital Goods - 3.7% |

|

|

|

|

|

Lincoln Electric Holdings, Inc. |

| 43,500 |

| 1,725,210 |

|

Mine Safety Appliances Co. |

| 31,700 |

| 1,147,857 |

|

NCI Building Systems, Inc.* |

| 41,400 |

| 1,758,672 |

|

|

|

|

|

|

|

TOTAL CAPITAL GOODS |

|

|

| 4,631,739 |

|

|

|

|

|

|

|

Consumer Non-Durables - 14.3% |

|

|

|

|

|

America’s Car Mart, Inc.* |

| 28,750 |

| 474,950 |

|

Carter’s, Inc.* |

| 37,400 |

| 2,200,990 |

|

Coach, Inc.* |

| 87,800 |

| 2,927,252 |

|

Guitar Center, Inc.* |

| 46,100 |

| 2,305,461 |

|

Hibbett Sporting Goods, Inc.* |

| 132,030 |

| 3,760,215 |

|

Tractor Supply Co.* |

| 25,600 |

| 1,355,264 |

|

Urban Outfitters, Inc.* |

| 126,200 |

| 3,194,122 |

|

Warnaco Group, Inc.* |

| 65,700 |

| 1,755,504 |

|

|

|

|

|

|

|

TOTAL CONSUMER NON-DURABLES |

|

|

| 17,973,758 |

|

|

|

|

|

|

|

Consumer Services - 7.8% |

|

|

|

|

|

BJ’s Restaurants, Inc.* |

| 105,000 |

| 2,400,300 |

|

Cheesecake Factory, Inc.* |

| 48,000 |

| 1,794,720 |

|

First Cash Financial Services, Inc.* |

| 64,850 |

| 1,891,026 |

|

InPhonic, Inc.* |

| 23,600 |

| 205,084 |

|

Sonic Corp.* |

| 66,762 |

| 1,969,479 |

|

Strategic Hotel Capital, Inc. |

| 78,700 |

| 1,619,646 |

|

|

|

|

|

|

|

TOTAL CONSUMER SERVICES |

|

|

| 9,880,255 |

|

See accompanying Notes to Financial Statements.

2

|

| Shares |

| Value |

| |

Energy - 3.9% |

|

|

|

|

| |

Basic Energy Services, Inc.* |

| 64,100 |

| $ | 1,278,795 |

|

Input/Output, Inc.* |

| 173,000 |

| 1,216,190 |

| |

SEACOR Holdings, Inc.* |

| 20,100 |

| 1,368,810 |

| |

Wh Energy Services, Llp* |

| 32,200 |

| 1,065,176 |

| |

|

|

|

|

|

| |

TOTAL ENERGY |

|

|

| 4,928,971 |

| |

|

|

|

|

|

| |

Financials - 8.1% |

|

|

|

|

| |

American Equity Investment Life Insurance Co. |

| 114,700 |

| 1,496,835 |

| |

Amerisafe, Inc.* |

| 82,200 |

| 828,576 |

| |

Brookline Bancorp, Inc. |

| 72,200 |

| 1,023,074 |

| |

Delphi Financial Group, Inc. |

| 60,200 |

| 2,769,802 |

| |

Midwest Banc Holdings, Inc. |

| 53,100 |

| 1,181,475 |

| |

RAIT Investment Trust |

| 40,900 |

| 1,060,128 |

| |

Signature Bank* |

| 66,700 |

| 1,872,269 |

| |

|

|

|

|

|

| |

TOTAL FINANCIALS |

|

|

| 10,232,159 |

| |

|

|

|

|

|

| |

Healthcare - 19.5% |

|

|

|

|

| |

Align Technology, Inc.* |

| 150,600 |

| 974,382 |

| |

Amylin Pharmaceuticals, Inc.* |

| 34,500 |

| 1,377,240 |

| |

CombinatoRx, Inc.* |

| 43,200 |

| 353,376 |

| |

Conceptus, Inc.* |

| 93,800 |

| 1,183,756 |

| |

Conor Medsystems, Inc.* |

| 45,100 |

| 872,685 |

| |

CV Therapeutics, Inc.* |

| 91,000 |

| 2,250,430 |

| |

Digene Corp.* |

| 41,800 |

| 1,219,306 |

| |

Encysive Pharmaceuticals, Inc.* |

| 133,500 |

| 1,053,315 |

| |

Immucor, Inc.* |

| 53,650 |

| 1,253,264 |

| |

Keryx Biopharmaceuticals, Inc.* |

| 93,900 |

| 1,374,696 |

| |

MGI PHARMA, Inc.* |

| 109,300 |

| 1,875,588 |

| |

Micrus Endovascular Corp.* |

| 88,500 |

| 769,950 |

| |

Nastech Pharmaceutical Co., Inc.* |

| 112,400 |

| 1,654,528 |

| |

Nektar Therapeutics* |

| 97,100 |

| 1,598,266 |

| |

Protein Design Labs, Inc.* |

| 71,200 |

| 2,023,504 |

| |

Rigel Pharmaceuticals, Inc.* |

| 101,400 |

| 847,704 |

| |

SeraCare Life Sciences, Inc.* |

| 59,300 |

| 536,665 |

| |

Telik, Inc.* |

| 84,100 |

| 1,428,859 |

| |

United Therapeutics Corp.* |

| 27,600 |

| 1,907,712 |

| |

|

|

|

|

|

| |

TOTAL HEALTHCARE |

|

|

| 24,555,226 |

| |

|

|

|

|

|

| |

Technology - 26.4% |

|

|

|

|

| |

Akamai Technologies, Inc.* |

| 81,100 |

| 1,616,323 |

| |

Cymer, Inc.* |

| 32,700 |

| 1,161,177 |

| |

ESCO Technologies, Inc.* |

| 37,900 |

| 1,686,171 |

| |

F5 Networks, Inc.* |

| 29,400 |

| 1,681,386 |

| |

FormFactor, Inc.* |

| 9,100 |

| 222,313 |

| |

Hutchinson Technology, Inc.* |

| 29,000 |

| 825,050 |

| |

Informatica Corp.* |

| 115,900 |

| 1,390,800 |

| |

iRobot Corp.* |

| 19,000 |

| 633,270 |

| |

Ixia* |

| 87,100 |

| 1,287,338 |

| |

Marchex, Inc.* |

| 54,700 |

| 1,230,203 |

| |

Micromuse, Inc.* |

| 98,700 |

| 976,143 |

| |

Microsemi Corp.* |

| 54,100 |

| 1,496,406 |

| |

NMS Communications Corp.* |

| 106,800 |

| 372,732 |

| |

O2Micro International, Ltd.* |

| 143,900 |

| 1,464,902 |

| |

Polycom, Inc.* |

| 104,000 |

| 1,591,200 |

| |

Rackable Systems, Inc.* |

| 21,600 |

| 615,168 |

| |

Redback Networks, Inc.* |

| 128,500 |

| 1,806,710 |

| |

SafeNet, Inc.* |

| 21,700 |

| 699,174 |

| |

Secure Computing Corp.* |

| 107,900 |

| 1,322,854 |

| |

Semtech Corp.* |

| 82,900 |

| 1,513,754 |

| |

SiRF Technology Holdings, Inc.* |

| 45,900 |

| 1,367,820 |

| |

Symmetricom, Inc.* |

| 137,700 |

| 1,166,319 |

| |

Tekelec* |

| 119,500 |

| 1,661,050 |

| |

Tessera Technologies, Inc.* |

| 39,200 |

| 1,013,320 |

| |

TIBCO Software, Inc.* |

| 188,700 |

| 1,409,589 |

| |

Websense, Inc.* |

| 37,300 |

| 2,448,372 |

| |

Witness Systems, Inc.* |

| 30,100 |

| 592,067 |

| |

|

|

|

|

|

| |

TOTAL TECHNOLOGY |

|

|

| 33,251,611 |

| |

|

|

|

|

|

| |

Transportation - 3.9% |

|

|

|

|

| |

Knight Transportation, Inc. |

| 72,225 |

| $ | 1,497,224 |

|

Old Dominion Freight Line, Inc.* |

| 60,750 |

| 1,639,035 |

| |

Universal Truckload Services, Inc.* |

| 75,400 |

| 1,734,200 |

| |

|

|

|

|

|

| |

TOTAL TRANSPORTATION |

|

|

| 4,870,459 |

| |

|

|

|

|

|

| |

TOTAL COMMON STOCKS |

|

|

| 119,765,672 |

| |

|

|

|

|

|

| |

MONEY MARKET MUTUAL FUNDS - 1.9% |

|

|

|

|

| |

SSGA Prime Money Market Fund |

| 1,202,842 |

| 1,202,841 |

| |

SSGA U.S. Treasury Money Market Fund |

| 1,202,457 |

| 1,202,457 |

| |

|

|

|

|

|

| |

TOTAL MONEY MARKET MUTUAL FUNDS |

|

|

| 2,405,298 |

| |

|

|

|

|

|

| |

TOTAL INVESTMENTS |

| 99.8 | % | 125,660,589 |

| |

Other Assets in Excess of Liabilities |

| 0.2 | % | 225,907 |

| |

NET ASSETS |

| 100.0 | % | $ | 125,886,496 |

|

*Non-income producing security

Income Tax Information:

At December 31, 2005, the net unrealized appreciation based on cost for income tax purposes of $107,050,462 was as follows:

Aggregate gross unrealized appreciation for all investments in which there was an excess of value over tax cost |

| $ | 24,132,788 |

|

|

|

|

| |

Aggregate gross unrealized depreciation for all investments in which there was an excess of tax cost over value |

| (5,522,661 | ) | |

|

|

|

| |

Net unrealized appreciation |

| $ | 18,610,127 |

|

The primary difference between book & tax net unrealized appreciation is wash sale loss deferrals.

Other Information:

Purchases and sales of securities, other than short-term securities, for the six months ended December 31, 2005, aggregated $54,111,449 and $58,685,731 respectively.

See accompanying Notes to Financial Statements.

3

Intermediate Bond Portfolio

Due |

|

|

| Principal |

|

|

| ||

Date |

| Coupon |

| Amount |

| Value |

| ||

|

|

|

|

|

|

|

| ||

U.S. GOVERNMENT & AGENCY OBLIGATIONS - 52.0% |

|

|

|

|

|

|

| ||

U.S. Treasury Notes - 13.9% |

|

|

|

|

|

|

| ||

02/15/09 |

| 3.000% |

| $ | 14,000,000 |

| $ | 13,436,724 |

|

08/15/10 |

| 4.125% |

| 4,200,000 |

| 4,158,655 |

| ||

08/15/12 |

| 4.375% |

| 14,175,000 |

| 14,173,342 |

| ||

02/15/15 |

| 4.000% |

| 13,500,000 |

| 13,088,669 |

| ||

|

|

|

|

|

|

|

| ||

TOTAL U.S. TREASURY NOTES |

|

|

|

|

| 44,857,390 |

| ||

|

|

|

|

|

|

|

| ||

Federal Farm Credit Bank - 1.7% |

|

|

|

|

|

|

| ||

06/15/07 |

| 3.250% |

| 2,500,000 |

| 2,447,918 |

| ||

07/21/08 |

| 3.150% |

| 3,000,000 |

| 2,887,755 |

| ||

|

|

|

|

|

|

|

| ||

TOTAL FEDERAL FARM CREDIT BANK |

|

|

|

|

| 5,335,673 |

| ||

|

|

|

|

|

|

|

| ||

Federal Home Loan Bank - 13.6% |

|

|

|

|

|

|

| ||

11/15/06 |

| 4.125% |

| 20,000,000 |

| 19,896,580 |

| ||

11/15/06 |

| 4.875% |

| 13,000,000 |

| 13,012,324 |

| ||

10/05/07 |

| 3.375% |

| 11,000,000 |

| 10,750,443 |

| ||

|

|

|

|

|

|

|

| ||

TOTAL FEDERAL HOME LOAN BANK |

|

|

|

|

| 43,659,347 |

| ||

|

|

|

|

|

|

|

| ||

Federal Home Loan Mortgage Corporation - 15.4% |

|

|

|

|

|

|

| ||

06/16/06 |

| 2.910% |

| 14,500,000 |

| 14,390,568 |

| ||

01/05/07 |

| 6.700% |

| 5,000,000 |

| 5,078,935 |

| ||

01/19/07 |

| 3.050% |

| 2,500,000 |

| 2,456,460 |

| ||

09/15/07 |

| 3.500% |

| 1,950,000 |

| 1,912,357 |

| ||

01/23/08 |

| 3.650% |

| 10,540,000 |

| 10,317,353 |

| ||

03/15/09 |

| 5.750% |

| 4,510,000 |

| 4,643,099 |

| ||

07/15/12 |

| 5.125% |

| 1,810,000 |

| 1,843,089 |

| ||

01/30/14 |

| 5.000% |

| 9,000,000 |

| 8,870,535 |

| ||

|

|

|

|

|

|

|

| ||

TOTAL FEDERAL HOME LOAN MORTGAGE CORPORATION |

|

|

|

|

| 49,512,396 |

| ||

|

|

|

|

|

|

|

| ||

Federal National Mortgage Association - 7.4% |

|

|

|

|

|

|

| ||

02/15/08 |

| 5.750% |

| 2,850,000 |

| 2,907,302 |

| ||

02/01/11 |

| 6.250% |

| 5,000,000 |

| 5,280,550 |

| ||

02/28/12 |

| 5.625% |

| 11,000,000 |

| 11,019,800 |

| ||

08/01/12 |

| 5.250% |

| 4,500,000 |

| 4,543,164 |

| ||

|

|

|

|

|

|

|

| ||

TOTAL FEDERAL NATIONAL MORTGAGE ASSOCIATION |

|

|

|

|

| 23,750,816 |

| ||

|

|

|

|

|

|

|

| ||

TOTAL U.S. GOVERNMENT & AGENCY OBLIGATIONS |

|

|

|

|

|

|

| ||

(Cost $168,422,727) |

|

|

|

|

| 167,115,622 |

| ||

|

|

|

|

|

|

|

| ||

CORPORATE BONDS & NOTES - 44.8% |

|

|

|

|

|

|

| ||

FINANCIALS - 30.8% |

|

|

|

|

|

|

| ||

Banks - 11.8% |

|

|

|

|

|

|

| ||

AmSouth Bank* |

|

|

|

|

|

|

| ||

02/01/08 |

| 6.450% |

| 5,100,000 |

| 5,261,140 |

| ||

Bank of America Corp. |

|

|

|

|

|

|

| ||

01/15/13 |

| 4.875% |

| 4,940,000 |

| 4,885,477 |

| ||

First Union National Bank |

|

|

|

|

|

|

| ||

02/15/10 |

| 7.875% |

| 5,000,000 |

| 5,557,185 |

| ||

Key Bank |

|

|

|

|

|

|

| ||

07/17/07 |

| 5.000% |

| 5,500,000 |

| 5,499,329 |

| ||

Regions Bank |

|

|

|

|

|

|

| ||

12/15/06 |

| 2.900% |

| 2,530,000 |

| 2,475,974 |

| ||

Regions Financial Corp. |

|

|

|

|

|

|

| ||

03/01/11 |

| 7.000% |

| $ | 4,500,000 |

| $ | 4,918,432 |

|

Synovus Financial Corp. |

|

|

|

|

|

|

| ||

02/15/13 |

| 4.875% |

| 1,775,000 |

| 1,743,405 |

| ||

US Bank |

|

|

|

|

|

|

| ||

02/04/14 |

| 6.300% |

| 7,000,000 |

| 7,552,629 |

| ||

|

|

|

|

|

|

|

| ||

TOTAL BANKS |

|

|

|

|

| 37,893,571 |

| ||

|

|

|

|

|

|

|

| ||

Broker/Dealers - 8.4% |

|

|

|

|

|

|

| ||

Bear Stearns Co. |

|

|

|

|

|

|

| ||

01/15/07 |

| 5.700% |

| 6,330,000 |

| 6,380,178 |

| ||

Goldman Sachs Group, Inc. |

|

|

|

|

|

|

| ||

01/15/11 |

| 6.875% |

| 3,500,000 |

| 3,770,452 |

| ||

J.P. Morgan Chase & Co. |

|

|

|

|

|

|

| ||

05/30/07 |

| 5.250% |

| 4,065,000 |

| 4,083,419 |

| ||

Lehman Brothers, Inc. |

|

|

|

|

|

|

| ||

01/18/12 |

| 6.625% |

| 4,500,000 |

| 4,858,506 |

| ||

Merrill Lynch & Co., Inc. |

|

|

|

|

|

|

| ||

01/30/06 |

| 2.940% |

| 5,400,000 |

| 5,394,098 |

| ||

01/15/07 |

| 7.000% |

| 2,580,000 |

| 2,637,250 |

| ||

|

|

|

|

|

|

|

| ||

TOTAL BROKER/DEALERS |

|

|

|

|

| 27,123,903 |

| ||

|

|

|

|

|

|

|

| ||

Financial Services - 3.6% |

|

|

|

|

|

|

| ||

General Electric Corp. |

|

|

|

|

|

|

| ||

11/21/11 |

| 4.375% |

| 6,710,000 |

| 6,514,518 |

| ||

Washington Mutual Bank |

|

|

|

|

|

|