SECURITY EQUITY FUND

SEPTEMBER 30, 2003

ANNUAL REPORT

TABLE OF CONTENTS

Security Equity Fund

Alpha Opportunity Series .............................................3

Enhanced Index Series ................................................6

Equity Series .......................................................16

Global Series .......................................................20

International Series ................................................25

Large Cap Growth Series .............................................29

Mid Cap Value Series ................................................33

Select 25(R)Series ..................................................38

Small Cap Growth Series .............................................41

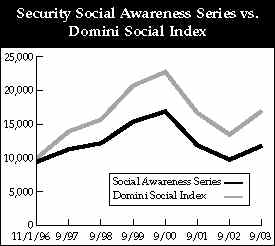

Social Awareness Series .............................................46

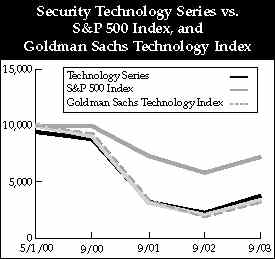

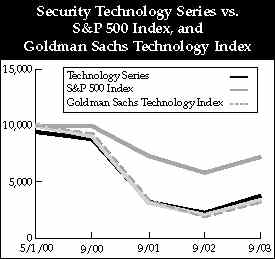

Technology Series ...................................................50

Security Large Cap Value Fund .........................................53

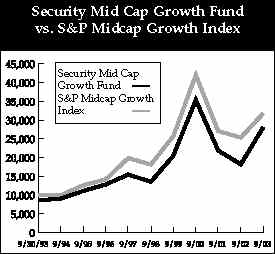

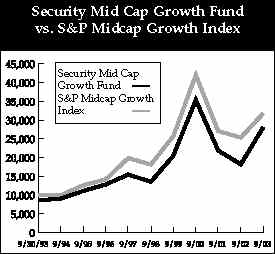

Security Mid Cap Growth Fund ..........................................57

Statements of Assets and Liabilities ..................................61

Statements of Operations ..............................................64

Statements of Changes in Net Assets ...................................67

Financial Highlights ..................................................73

Notes to Financial Statements ........................................100

Report of Independent Auditors .......................................111

Special Shareholder Meeting ..........................................112

Director Disclosure ..................................................113

- --------------------------------------------------------------------------------

2

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2003

- --------------------------------------------------------------------------------

SECURITY EQUITY FUND -

ALPHA OPPORTUNITY SERIES

- --------------------------------------------------------------------------------

NUMBER MARKET

COMMON STOCKS OF SHARES VALUE

- --------------------------------------------------------------------------------

AGRICULTURAL PRODUCTS - 0.9%

Bunge, Ltd. .......................... 300 $ 8,250

Delta & Pine Land Company ............ 2,100 48,321

----------

56,571

ALUMINUM - 1.7%

Alcoa, Inc. .......................... 2,700 70,632

Imco Recycling, Inc.* ................ 6,000 36,900

----------

107,532

APPAREL, ACCESSORIES & LUXURY GOODS - 1.3%

Columbia Sportswear Company* ......... 1,100 58,025

Kellwood Company ..................... 700 23,415

----------

81,440

CATALOG RETAIL - 0.6%

InterActiveCorp* ..................... 1,200 39,660

COMMODITY CHEMICALS - 0.4%

NL Industries, Inc. .................. 1,700 27,659

COMMUNICATIONS EQUIPMENT - 0.1%

3Com Corporation* .................... 700 4,130

ADC Telecommunications, Inc. ......... 700 1,631

----------

5,761

CONSTRUCTION & ENGINEERING - 2.3%

Chicago Bridge & Iron

Company N.V. ...................... 1,200 32,592

Fluor Corporation .................... 3,100 115,723

----------

148,315

CONSTRUCTION & FARM MACHINERY & HEAVY TRUCKS - 5.8%

Agco Corporation* .................... 100 1,714

Caterpillar, Inc. .................... 2,000 137,680

CNH Global N.V. ...................... 1,500 19,230

Cummins, Inc. ........................ 1,000 44,430

Deere & Company ...................... 1,400 74,634

Lindsay Manufacturing Company ........ 1,300 26,130

Navistar International Corporation* .. 1,200 44,736

Volvo AB ADR ......................... 1,000 23,280

----------

371,834

CONSTRUCTION MATERIALS - 0.6%

LaFarge S.A. ADR ..................... 2,200 35,970

DIVERSIFIED CAPITAL MARKETS - 0.8%

J.P. Morgan Chase & Company .......... 1,500 51,495

DIVERSIFIED CHEMICALS - 0.7%

Eastman Chemical Company ............. 1,200 40,200

Engelhard Corporation ................ 200 5,534

----------

45,734

NUMBER MARKET

COMMON STOCKS (CONTINUED) OF SHARES VALUE

- --------------------------------------------------------------------------------

DIVERSIFIED METALS & MINING - 2.6%

Anglo American plc ADR ............... 400 $ 7,260

Arch Coal, Inc. ...................... 1,200 26,652

Consol Energy, Inc. .................. 600 11,148

Massey Energy Company ................ 400 5,320

Noranda, Inc. ........................ 9,000 92,340

Peabody Energy Corporation ........... 300 9,411

Penn Virginia Resource Partners,

L.P. .............................. 100 2,989

Rio Tinto plc ADR .................... 100 8,775

----------

163,895

ELECTRICAL COMPONENTS & EQUIPMENT - 1.7%

Emerson Electric Company ............. 600 31,590

Rockwell Automation, Inc. ............ 3,000 78,750

----------

110,340

ELECTRONIC EQUIPMENT MANUFACTURERS - 0.1%

Thermo Electron Corporation* ......... 400 8,680

ELECTRONIC MANUFACTURING SERVICES - 0.6%

Molex, Inc. .......................... 1,300 37,167

FERTILIZERS & AGRICULTURAL CHEMICALS - 1.2%

Monsanto Company ..................... 3,200 76,608

FOOD RETAIL - 0.1%

Wild Oats Markets, Inc.* ............. 600 6,558

FOREST PRODUCTS - 2.5%

Louisiana-Pacific Corporation* ....... 3,800 52,364

Rayonier, Inc. ....................... 400 16,240

Weyerhaeuser Company ................. 1,500 87,675

----------

156,279

GOLD - 1.4%

Placer Dome, Inc. .................... 6,400 88,000

HOME FURNISHINGS - 1.5%

Furniture Brands International,

Inc.* ............................. 1,100 26,510

Kimball International, Inc. (Cl. B) .. 4,800 70,368

----------

96,878

HOTELS, RESORTS & CRUISE LINES - 0.4%

Fairmont Hotels & Resorts, Inc. ...... 900 23,175

HOUSEHOLD APPLIANCES - 0.6%

Snap-On Inc. ......................... 1,300 35,945

INDUSTRIAL CONGLOMERATES - 1.0%

Carlisle Companies, Inc. ............. 1,500 65,430

INDUSTRIAL GASES - 0.9%

Praxair, Inc. ........................ 900 55,755

- --------------------------------------------------------------------------------

3 SEE ACCOMPANYING NOTES.

SCHEDULE OF INVESTMENTS (CONTINUED)

SEPTEMBER 30, 2003

- --------------------------------------------------------------------------------

SECURITY EQUITY FUND -

ALPHA OPPORTUNITY SERIES (CONTINUED)

- --------------------------------------------------------------------------------

NUMBER MARKET

COMMON STOCKS (CONTINUED) OF SHARES VALUE

- --------------------------------------------------------------------------------

INDUSTRIAL MACHINERY - 5.6%

Flowserve Corporation* ............... 300 $ 6,090

Gardner Denver, Inc.* ................ 400 8,404

Harsco Corporation ................... 600 23,082

Idex Corporation ..................... 900 32,796

Ingersoll-Rand Company ............... 1,400 74,816

Joy Global, Inc.* .................... 2,000 31,400

Kennametal, Inc. ..................... 1,300 48,620

Lincoln Electric Holdings, Inc. ...... 1,400 31,094

Manitowoc Company, Inc. .............. 900 19,521

Metso Corporation ADR ................ 800 8,112

SPX Corporation* ..................... 900 40,752

Watts Industries, Inc. ............... 1,700 29,954

----------

354,641

INTEGRATED OIL & GAS - 1.4%

Norsk Hydro ASA ADR .................. 1,532 78,684

Tesoro Petroleum Corporation* ........ 1,200 10,152

----------

88,836

INTERNET SOFTWARE & SERVICES - 0.3%

Covad Communications Group,

Inc.* ............................. 3,700 20,461

LEISURE FACILITIES - 0.1%

Vail Resorts, Inc.* .................. 600 8,580

LEISURE PRODUCTS - 0.4%

Brunswick Corporation ................ 900 23,112

MARINE - 2.1%

Alexander & Baldwin, Inc. ............ 4,756 133,548

OIL & GAS DRILLING - 1.1%

Pride International, Inc.* ........... 600 10,170

Rowan Companies, Inc.* ............... 2,400 58,992

----------

69,162

OIL & GAS EQUIPMENT & SERVICES - 0.7%

Halliburton Company .................. 1,800 43,650

OIL & GAS REFINING, MARKETING & TRANSPORTATION - 1.9%

Premcor, Inc.* ....................... 500 11,585

Sunoco, Inc. ......................... 1,000 40,220

Valero Energy Corporation ............ 1,900 72,713

----------

124,518

OTHER DIVERSIFIED FINANCIAL SERVICES - 0.8%

Brascan Corporation .................. 1,700 42,857

St. Joe Company ...................... 300 9,624

----------

52,481

NUMBER MARKET

COMMON STOCKS (CONTINUED) OF SHARES VALUE

- --------------------------------------------------------------------------------

PACKAGED FOODS & MEATS - 0.4%

Cresud S.A. ADR* ..................... 2,400 $ 21,624

Pilgrims Pride Corporation (Cl. B) ... 500 6,250

----------

27,874

PAPER PACKAGING - 0.9%

Longview Fibre Company ............... 1,600 15,632

Smurfit-Stone Container

Corporation* ...................... 2,800 41,944

----------

57,576

PAPER PRODUCTS - 2.2%

International Paper Company .......... 3,600 140,472

RAILROADS - 2.6%

CSX Corporation ...................... 1,500 43,875

Kansas City Southern* ................ 600 6,642

Union Pacific Corporation ............ 2,000 116,340

----------

166,857

REAL ESTATE INVESTMENT TRUSTS - 0.3%

Plum Creek Timber Company, Inc. ...... 800 20,352

SEMICONDUCTOR EQUIPMENT - 0.1%

Mykrolis Corporation* ................ 600 7,284

SPECIALTY CHEMICALS - 0.8%

Minerals Technologies, Inc. .......... 801 40,771

RPM International, Inc. .............. 1,000 13,060

----------

53,831

SPECIALTY STORES - 0.3%

Barnes & Noble, Inc.* ............ 700 17,787

STEEL - 1.6%

AK Steel Holding Corporation* ........ 1,100 2,200

Metal Management, Inc.* .............. 2,100 40,950

NN, Inc. ............................. 4,704 60,493

----------

103,643

TRADING COMPANIES & DISTRIBUTORS - 0.7%

Applied Industrial Technology, Inc. .. 500 9,935

W.W. Grainger, Inc. .................. 700 33,285

----------

43,220

TRUCKING - 1.3%

Heartland Express, Inc. .............. 1,700 40,834

Knight Transportation, Inc. .......... 1,600 40,112

----------

80,946

----------

Total common stocks - 55.4% ........................... 3,535,512

- --------------------------------------------------------------------------------

4 SEE ACCOMPANYING NOTES.

SCHEDULE OF INVESTMENTS (CONTINUED)

SEPTEMBER 30, 2003

- --------------------------------------------------------------------------------

SECURITY EQUITY FUND -

ALPHA OPPORTUNITY SERIES (CONTINUED)

- --------------------------------------------------------------------------------

PRINCIPAL

AMOUNT OR

NUMBER MARKET

U.S. GOVERNMENT & AGENCIES OF SHARES VALUE

- --------------------------------------------------------------------------------

Federal Home Loan Bank,

1.017%, 11-05-03 .................. $375,000 $ 374,639

Federal Home Loan Mortgage Corporation:

0.98%, 10-02-03 ................... $150,000 149,996

1.098%, 12-04-03 .................. $250,000 249,538

----------

399,534

Federal National Mortgage Association:

1.00%, 10-15-03 ................... $275,000 274,890

1.07%, 11-13-03 ................... $125,000 124,846

1.06%, 12-10-03 ................... $450,000 449,090

----------

848,826

----------

Total U.S. government & agencies - 25.4% .............. 1,622,999

ASSET BACKED SECURITIES

- -----------------------

AUTO - 6.3%

Ford Credit Auto Owner Trust,

1.24% - 2006(1) ................... $400,000 400,570

CREDIT CARDS - 6.2%

First USA Credit Card Master Trust,

1.25% - 2007(1) ................... $400,000 400,213

----------

Total asset backed securities -12.5% .................. 800,783

REPURCHASE AGREEMENT - 3.4%

- ---------------------------

State Street, 10-01-03

(Collateralized by FHLMC, 1.25%,

08-27-04 with a value of $225,430

and a repurchase amount

of $219,501) ...................... $219,499 219,499

----------

Total investments - 96.7% ............................. 6,178,793

SHORT POSITIONS

- ---------------

BREWERS - (0.8%)

Anheuser-Busch Companies, Inc. ....... (1,100) (54,274)

DISTILLERS & VINTERS - (0.2%)

Brown-Forman Corporation (CI. B) ..... (200) (15,824)

DIVERSIFIED COMMERCIAL SERVICES -(0.2%)

DeVry, Inc.* ......................... (500) (11,830)

HEALTH CARE DISTRIBUTORS - (0.2%)

Cardinal Health, Inc. ................ (200) (11,678)

HEALTH CARE SERVICES - (0.2%)

Express Scripts, Inc.* ............... (200) (12,230)

INTEGRATED TELECOMMUNICATION SERVICES - (0.3%)

Alltel Corporation ................... (400) (18,536)

LIFE & HEALTH INSURANCE - (0.3%)

Aflac, Inc. .......................... (200) (6,460)

MetLife, Inc. ........................ (400) (11,220)

----------

(17,680)

MULTI-UTILITIES & UNREGULATED POWER - (0.1%)

Questar Corporation .................. (200) (6,162)

PRINCIPAL

AMOUNT OR

NUMBER MARKET

SHORT POSITIONS (CONTINUED) OF SHARES VALUE

- --------------------------------------------------------------------------------

PERSONAL PRODUCTS - (0.1%)

Chattem, Inc. ........................ (300) $ (4,164)

UNIT INVESTMENT TRUST - (0.1%)

iShares Lehman 20+ Year Treasury

Bond Fund ......................... (100) (8,822)

----------

Total short positions - (2.5%) ........................ (161,200)

Cash & other assets, less liabilities - 5.8% .......... 371,618

----------

Total net assets - 100.0% ............................. $6,389,211

==========

For federal income tax purposes, the identified cost of investments owned at

September 30, 2003 was $6,262,835.

* Non-income producing security

(1) Variable rate security. Rate indicated is rate effective at September 30,

2003.

ADR (American Depositary Receipt)

plc (public limited company)

The Alpha Opportunity Fund's hybrid structure combines an actively managed

long/short component with a passively managed Standard & Poor's 500 Composite

Stock Price Index component. Approximately 50 percent of the portfolio is

invested in a long/short strategy managed by Mainstream Investment Advisers,

LLC; the remainder is independently invested in an index strategy managed by

Security Management Company, LLC.

- --------------------------------------------------------------------------------

5 SEE ACCOMPANYING NOTES.

MANAGER'S COMMENTARY

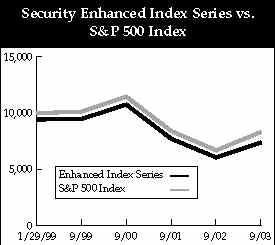

SECURITY EQUITY FUND - ENHANCED INDEX SERIES

NOVEMBER 15, 2003

SUBADVISOR, NORTHERN TRUST

TO OUR SHAREHOLDERS:

The Enhanced Index Series of Security Equity Fund began operations January 29,

1999. The core portfolio is designed to outperform the S&P 500 Index while

retaining similar risk characteristics as the Index. Through the use of a

proprietary multi-factor model, stocks which in our view have above-average

potential for appreciation are overweighted, while stocks that have less than

average potential are underweighted. During the one year period ended September

30, 2003, the portfolio was up 22.06% versus 24.40% for the benchmark, the

Standard and Poor's 500 Stock Index. Since the inception of the series on

January 29, 1999, the fund is down 5.08% versus a negative 3.87% for the

benchmark.1

OPERATION OF THE PROPRIETARY SCREENS

The Northern Trust Investments Quantitative Management group uses a proprietary

model to overweight or underweight stocks relative to the index. Based on our

model, stocks are overweighted when: the company reports a positive earnings

surprise, the company becomes an acquisition target, it is announced that the

company will be added to the S&P Index, the stock has a high dividend yield or a

zero dividend yield (if further research shows that the company uses the funds

for internal investment).

Conversely, stocks are underweighted if there is a negative earnings surprise,

negative financial statement trends, negative price downward price momentum, or

it is announced that the company will be deleted from the S&P 500 Index. If none

of these positive or negative factors apply, we will hold a neutral position in

the stock.

The Fund underperformed its benchmark during the 12 months ended September 30,

2003. The performance of most of the model's quantitative factors was weak this

past year. Factors based on valuation and earnings characteristics tended to

underperform this year as the market rewarded higher priced, smaller companies

with weaker historical fundamentals. Earnings announcements did not elicit much

market reaction for either positive or negative news as skepticism of earnings

estimates continued to affect investor behavior. Indeed, companies with higher

expected, but not necessarily realized growth, outperformed more value oriented

stocks; a sharp contrast to prior years and most longer-term periods.

Quickly changing market conditions resulted in mid- and long-term momentum

strategies' weaker performance through most of the year. Effective trading of

index changes, though, boosted performance in the past year; however, this

year's changes were few and small relative to the index capitalization.

Similarly, the relative scarcity of companies engaging in merger and acquisition

activity resulted in few opportunities to benefit from trading in these stocks,

although some benefit was captured through the year.

MARKET OUTLOOK

While as index fund managers we don't manage the portfolio according to a given

outlook for the equity markets or the economy, we do monitor economic conditions

and how they affect the financial markets.

Global equity markets performed well in the third quarter, building on their

strong gains of the previous three months. While the rally has been fueled in

part by an improvement in investor sentiment, it also appears to have a sound

basis in fundamentals.

First, economic growth may be gathering momentum now that the concerns over

corporate governance abuses, geopolitical tensions and the aftereffects of the

bubble in technology stocks may be dissipating. Additionally, the benefits of

low interest rates, tax reductions and increased government spending are being

felt. A positive trend has become visible in some key measurements of the

economy, and indicators of future activity may be pointing to a strong second

half.

Second, there appears to be an improvement in corporate profits, with the S&P

500 operating earnings growing by about 10 percent in the second quarter and

beating analysts' reduced expectations. Third quarter and full-year estimates

are now generally holding, and in some instances, increasing. Cost-cutting

initiatives could produce strong profits if the economy accelerates.

Sincerely,

Enhanced Index Team

(1)Performance figures are based on Class A shares and do not reflect deduction

of the sales charges or taxes that a shareholder would pay on distributions or

the redemption of shares. Fee waivers and/or reimbursements reduced Fund

expenses and in the absence of such waivers, the performance quoted would be

reduced.

- --------------------------------------------------------------------------------

6

MANAGER'S COMMENTARY (CONTINUED)

SECURITY EQUITY FUND - ENHANCED INDEX SERIES

NOVEMBER 15, 2003

================================= PERFORMANCE ==================================

$10,000 SINCE INCEPTION

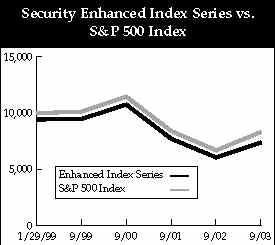

This chart assumes a $10,000 investment in Class A shares of Enhanced Index

Series on January 29, 1999, and reflects deduction of the 5.75% sales load. On

September30, 2003, the value of your investment in Class A shares of the Series

(with dividends reinvested) would have been $7,388. By comparison, the same

$10,000 investment would have been $8,319, based on the S&P 500 Index

performance. The chart does not reflect the deduction of taxes that a

shareholder would pay on distributions or the redemption of fund shares.

- --------------------------------------------------------------------------------

TOP 5 EQUITY HOLDINGS*

% OF

NET ASSETS

----------

Microsoft Corporation 3.1%

General Electric Company 3.1%

Wal-Mart Stores, Inc. 2.6%

Exxon Mobil Corporation 2.6%

Pfizer, Inc. 2.5%

*At September 30, 2003

- --------------------------------------------------------------------------------

- --------------------------------------------------------------------------------

AVERAGE ANNUAL RETURNS

AS OF SEPTEMBER 30, 2003

1 YEAR SINCE INCEPTION

------ ---------------

A Shares 22.06% (5.08%) (1-29-99)

A Shares with sales charge 15.12% (6.28%) (1-29-99)

B Shares 21.11% (5.85%) (1-29-99)

B Shares with CDSC 16.11% (6.26%) (1-29-99)

C Shares 21.24% (5.80%) (1-29-99)

C Shares with CDSC 20.24% (5.80%) (1-29-99)

- --------------------------------------------------------------------------------

The performance data above represents past performance that is not predictive of

future results. The investment return and principal value of an investment in

the fund will fluctuate so that an investor's shares, when redeemed, may be

worth more or less than their original cost. The figures above do not reflect

deduction of the maximum front-end sales charge of 5.75% for Class A shares or

the contingent deferred sales charge of 5% for Class B shares and 1% for Class C

shares, as applicable, except where noted. The figures do not reflect the

deduction of taxes that a shareholder would pay on distributions or redemption

of fund shares. Such figures would be lower if the maximum sales charge and any

applicable taxes were deducted. Fee waivers reduced expenses of the Fund and in

the absence of such waiver, the performance quoted would be reduced.

- --------------------------------------------------------------------------------

7

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2003

- --------------------------------------------------------------------------------

SECURITY EQUITY FUND -

ENHANCED INDEX SERIES

- --------------------------------------------------------------------------------

NUMBER MARKET

COMMON STOCKS OF SHARES VALUE

- --------------------------------------------------------------------------------

ADVERTISING - 0.2%

Interpublic Group of Companies,

Inc. .............................. 557 $ 7,865

Omnicom Group, Inc. .................. 279 20,046

----------

27,911

AEROSPACE & DEFENSE - 1.6%

Boeing Company ....................... 1,475 50,637

General Dynamics Corporation ......... 282 22,013

Goodrich Corporation ................. 138 3,345

Honeywell International, Inc. ........ 1,242 32,727

Lockheed Martin Corporation .......... 651 30,044

Northrop Grumman Corporation ......... 88 7,587

Raytheon Company ..................... 605 16,940

Rockwell Collins ..................... 264 6,666

United Technologies Corporation ...... 715 55,255

----------

225,214

AGRICULTURAL PRODUCTS - 0.1%

Archer-Daniels-Midland Company ....... 1,030 13,503

AIR FREIGHT & LOGISTICS - 1.0%

FedEx Corporation .................... 467 30,089

Ryder System, Inc. ................... 75 2,199

United Parcel Service, Inc. .......... 1,700 108,460

----------

140,748

AIRLINES - 0.2%

Delta Air Lines, Inc. ................ 148 1,968

Southwest Airlines Company ........... 1,099 19,452

----------

21,420

ALUMINUM - 0.2%

Alcoa, Inc. .......................... 1,233 32,255

APPAREL RETAIL - 0.3%

Gap, Inc. ............................ 1,348 23,078

Limited Brands ....................... 1,300 19,604

TJX Companies, Inc. .................. 157 3,049

----------

45,731

APPAREL, ACCESSORIES & LUXURY GOODS - 0.3%

Jones Apparel Group, Inc. ............ 474 14,187

Liz Claiborne, Inc. .................. 168 5,720

V.F. Corporation ..................... 390 15,175

----------

35,082

NUMBER MARKET

COMMON STOCKS (CONTINUED) OF SHARES VALUE

- --------------------------------------------------------------------------------

APPLICATION SOFTWARE - 0.4%

AutoDesk, Inc. ....................... 52 $ 885

Citrix Systems, Inc.* ................ 247 5,454

Compuware Corporation* ............... 516 2,766

Intuit, Inc.* ........................ 528 25,470

Mercury Interactive Corporation* ..... 134 6,085

Parametric Technology

Corporation* ...................... 315 983

PeopleSoft, Inc.* .................... 547 9,950

Siebel Systems, Inc.* ................ 724 7,037

----------

58,630

ASSET MANAGEMENT & CUSTODY BANKS - 0.8%

Bank of New York Company, Inc. ....... 1,126 32,778

Federated Investors, Inc. (Cl. B) .... 144 3,989

Franklin Resources, Inc. ............. 366 16,181

Janus Capital Group, Inc. ............ 322 4,498

Mellon Financial Corporation ......... 622 18,747

T. Rowe Price Group, Inc. ............ 168 6,932

State Street Corporation ............. 710 31,950

----------

115,075

AUTO PARTS & EQUIPMENT - 0.2%

Dana Corporation ..................... 195 3,009

Delphi Corporation ................... 807 7,303

Johnson Controls, Inc. ............... 236 22,326

Visteon Corporation .................. 200 1,320

----------

33,958

AUTOMOBILE MANUFACTURERS - 0.4%

Ford Motor Company ................... 2,716 29,251

General Motors Corporation ........... 833 34,095

----------

63,346

BIOTECHNOLOGY - 1.2%

Amgen, Inc.* ......................... 1,901 122,747

Biogen, Inc.* ........................ 221 8,449

Chiron Corporation* .................. 282 14,577

Genzyme Corporation* ................. 317 14,661

MedImmune, Inc.* ..................... 383 12,643

----------

173,077

BREWERS - 0.5%

Anheuser-Busch Companies, Inc. ....... 1,265 62,415

Adolph Coors Company ................. 65 3,494

----------

65,909

BROADCASTING & CABLE TV - 1.0%

Clear Channel Communications,

Inc. .............................. 906 34,700

Comcast Corporation* ................. 3,366 103,942

Univision Communications,

Inc.* ............................. 334 10,665

----------

149,307

- --------------------------------------------------------------------------------

8 SEE ACCOMPANYING NOTES.

SCHEDULE OF INVESTMENTS (CONTINUED)

SEPTEMBER 30, 2003

- --------------------------------------------------------------------------------

SECURITY EQUITY FUND -

ENHANCED INDEX SERIES (CONTINUED)

- --------------------------------------------------------------------------------

NUMBER MARKET

COMMON STOCKS (CONTINUED OF SHARES VALUE

- --------------------------------------------------------------------------------

BUILDING PRODUCTS - 0.3%

American Standard Companies,

Inc.* ............................. 238 $ 20,051

Masco Corporation .................... 708 17,332

----------

37,383

CASINOS & GAMING - 0.2%

Harrah's Entertainment, Inc. ......... 156 6,569

International Game Technology ........ 873 24,575

----------

31,144

COMMERCIAL PRINTING - 0.0%

R. R. Donnelley & Sons Company ....... 191 4,750

COMMUNICATIONS EQUIPMENT - 2.5%

ADC Telecommunications,

Inc.* ............................. 1,093 2,547

Andrew Corporation* .................. 182 2,237

Avaya, Inc.* ......................... 454 4,949

Ciena Corporation* ................... 700 4,137

Cisco Systems, Inc.* ................. 10,550 206,147

Comverse Technology, Inc.* ........... 856 12,806

Corning, Inc.* ....................... 1,840 17,333

JDS Uniphase Corporation* ............ 2,047 7,369

Lucent Technologies, Inc.* ........... 6,067 13,105

Motorola, Inc. ....................... 1,891 22,635

Qlogic Corporation* .................. 146 6,863

Qualcomm, Inc. ....................... 1,190 49,552

Scientific-Atlanta, Inc. ............. 236 7,351

Tellabs, Inc.* ....................... 618 4,196

----------

361,227

COMPUTER & ELECTRONICS RETAIL - 0.3%

Best Buy Company, Inc.* .............. 474 22,524

Circuit City Stores, Inc. ............ 1,182 11,264

RadioShack Corporation ............... 250 7,103

----------

40,891

COMPUTER HARDWARE - 3.3%

Apple Computer, Inc.* ................ 531 10,954

Dell, Inc.* .......................... 3,854 128,685

Gateway, Inc.* ....................... 400 2,264

Hewlett-Packard Company .............. 4,555 88,185

International Business Machines

Corporation ....................... 2,575 227,450

NCR Corporation* 131 4,151

Sun Microsystems, Inc.* .............. 4,764 15,769

----------

477,458

COMPUTER STORAGE & PERIPHERALS - 0.5%

EMC Corporation* ..................... 3,300 41,679

Lexmark International, Inc.* ......... 194 12,224

Network Appliance, Inc.* ............. 506 10,388

----------

64,291

NUMBER MARKET

COMMON STOCKS (CONTINUED) OF SHARES VALUE

- --------------------------------------------------------------------------------

CONSTRUCTION & ENGINEERING - 0.0%

Fluor Corporation .................... 53 $ 1,978

CONSTRUCTION & FARM MACHINERY - 0.5%

Caterpillar, Inc. .................... 665 45,779

Cummins, Inc. ........................ 49 2,177

Deere & Company ...................... 94 5,011

Navistar International Corporation* .. 80 2,982

Paccar, Inc. ......................... 191 14,266

----------

70,215

CONSTRUCTION MATERIALS - 0.0%

Vulcan Materials Company ............. 138 5,508

CONSUMER FINANCE - 1.3%

American Express Company ............. 1,964 88,498

Capital One Financial Corporation .... 327 18,652

MBNA Corporation ..................... 2,271 51,779

Providian Financial Corporation* ..... 484 5,706

SLM Corporation ...................... 692 26,960

----------

191,595

DATA PROCESSING & OUTSOURCED SERVICE - 1.1%

Automatic Data Processing, Inc. ...... 887 31,799

Computer Sciences Corporation* ....... 274 10,294

Concord EFS, Inc.* ................... 718 9,815

Convergys Corporation* ............... 712 13,058

Electronic Data Systems

Corporation ....................... 129 2,606

First Data Corporation ............... 1,114 44,515

Fiserv, Inc.* ........................ 281 10,181

Paychex, Inc. ........................ 121 4,105

Sabre Holdings Corporation ........... 202 4,341

Sungard Data Systems, Inc.* .......... 731 19,233

----------

149,947

DEPARTMENT STORES - 0.6%

Federated Department Stores, Inc. .... 274 11,481

J.C. Penney Company, Inc. ............ 383 8,185

Kohl's Corporation* .................. 501 26,804

May Department Stores Company ........ 73 1,798

Nordstrom, Inc. ...................... 544 13,497

Sears, Roebuck & Company ............. 462 20,203

----------

81,968

DISTILLERS & VINTNERS - 0.1%

Brown-Forman Corporation (Cl. B) 82 .. 6,488

DISTRIBUTORS - 0.0%

Genuine Parts Company ................ 60 1,919

- --------------------------------------------------------------------------------

9 SEE ACCOMPANYING NOTES.

SCHEDULE OF INVESTMENTS (CONTINUED)

SEPTEMBER 30, 2003

- --------------------------------------------------------------------------------

SECURITY EQUITY FUND -

ENHANCED INDEX SERIES (CONTINUED)

- --------------------------------------------------------------------------------

NUMBER MARKET

COMMON STOCKS (CONTINUED) OF SHARES VALUE

- --------------------------------------------------------------------------------

DIVERSIFIED BANKS - 4.2%

Bank of America Corporation .......... 2,368 $ 184,799

Bank One Corporation ................. 1,736 67,096

Comerica, Inc. ....................... 251 11,697

Fleetboston Financial

Corporation ....................... 1,556 46,913

U.S. Bancorp ......................... 2,894 69,427

Wachovia Corporation ................. 2,029 83,574

Wells Fargo & Company ................ 2,523 129,935

----------

593,441

DIVERSIFIED CAPITAL MARKETS - 0.7%

J.P. Morgan Chase & Company .......... 3,015 103,505

DIVERSIFIED CHEMICALS - 0.9%

Dow Chemical Company ................. 1,394 45,361

E.I. du Pont de Nemours &

Company ........................... 1,136 45,451

Eastman Chemical Company ............. 100 3,350

Engelhard Corporation ................ 211 5,838

Hercules, Inc.* ...................... 129 1,462

PPG Industries, Inc. ................. 424 22,141

----------

123,603

DIVERSIFIED COMMERCIAL SERVICES - 0.6%

Apollo Group, Inc.* .................. 411 27,138

Cendant Corporation* ................. 2,022 37,791

Cintas Corporation ................... 43 1,584

Deluxe Corporation ................... 73 2,930

Equifax, Inc. ........................ 220 4,899

H&R Block, Inc. ...................... 260 11,219

----------

85,561

DIVERSIFIED METALS & MINING - 0.1%

Freeport-McMoran Copper &

Gold, Inc. (Cl. B) ................ 239 7,911

Phelps Dodge Corporation* ............ 148 6,926

----------

14,837

DRUG RETAIL - 0.2%

CVS Corporation ...................... 97 3,013

Walgreen Company ..................... 824 25,247

----------

28,260

ELECTRIC UTILITIES - 2.3%

Allegheny Energy, Inc.* .............. 50 457

Ameren Corporation ................... 238 10,213

American Electric Power

Company, Inc. ..................... 590 17,700

CMS Energy Corporation ............... 214 1,577

CenterPoint Energy, Inc. ............. 1,527 14,003

Cinergy Corporation .................. 259 9,505

Consolidated Edison, Inc. ............ 329 13,410

DTE Energy Company ................... 248 9,149

Dominion Resources, Inc. ............. 465 28,784

NUMBER MARKET

COMMON STOCKS (CONTINUED) OF SHARES VALUE

- --------------------------------------------------------------------------------

ELECTRIC UTILITIES (CONTINUED)

Edison International* ................ 963 $ 18,393

Entergy Corporation .................. 336 18,194

Exelon Corporation ................... 635 40,323

FPL Group, Inc. ...................... 274 17,317

FirstEnergy Corporation .............. 446 14,227

PG&E Corporation* .................... 607 14,507

PPL Corporation ...................... 252 10,319

Pinnacle West Capital Corporation .... 134 4,757

Progress Energy, Inc. ................ 359 15,961

Progress Energy, Inc. - Contingent

Value Obligation* ................. 400 64

Public Service Enterprise

Group, Inc ........................ 547 22,974

Southern Company ..................... 1,078 31,607

Teco Energy, Inc. .................... 261 3,607

TXU Corporation ...................... 485 11,427

Xcel Energy, Inc. .................... 118 1,825

----------

330,300

ELECTRICAL COMPONENTS & EQUIPMENT - 0.4%

American Power Conversion

Corporation ....................... 355 6,085

Cooper Industries, Inc. .............. 167 8,021

Emerson Electric Company ............. 811 42,699

Power-One, Inc.* ..................... 100 1,029

Rockwell Automation, Inc. ............ 100 2,625

Thomas & Betts Corporation* .......... 71 1,125

----------

61,584

ELECTRONIC EQUIPMENT MANUFACTURERS - 0.3%

Agilent Technologies, Inc.* .......... 1,059 23,414

PerkinElmer, Inc. .................... 167 2,557

Symbol Technologies, Inc. ............ 424 5,067

Tektronix, Inc.* ..................... 126 3,119

Thermo Electron Corporation* ......... 290 6,293

Waters Corporation* .................. 186 5,102

----------

45,552

ELECTRONIC MANUFACTURING SERVICES - 0.1%

Jabil Circuit, Inc.* ................. 249 6,486

Sanmina-Sci Corporation* ............. 607 5,888

Solectron Corporation* ............... 985 5,762

----------

18,136

EMPLOYMENT SERVICES - 0.1%

Monster Worldwide, Inc.* ............. 166 4,180

Robert Half International, Inc.* ..... 241 4,700

----------

8,880

ENVIRONMENTAL SERVICES - 0.2%

Allied Waste Industries, Inc.* ....... 248 2,678

Waste Management, Inc. ............... 843 22,061

----------

24,739

- --------------------------------------------------------------------------------

10 SEE ACCOMPANYING NOTES.

SCHEDULE OF INVESTMENTS (CONTINUED)

SEPTEMBER 30, 2003

- --------------------------------------------------------------------------------

SECURITY EQUITY FUND -

ENHANCED INDEX SERIES (CONTINUED)

- --------------------------------------------------------------------------------

NUMBER MARKET

COMMON STOCKS (CONTINUED) OF SHARES VALUE

- --------------------------------------------------------------------------------

FERTILIZERS & AGRICULTURAL CHEMICALS - 0.1%

Monsanto Company ..................... 742 $ 17,763

FOOD DISTRIBUTORS - 0.2%

Sysco Corporation .................... 965 31,565

FOOD RETAIL - 0.3%

Albertson's, Inc. .................... 87 1,790

Kroger Company* ...................... 1,114 19,907

Safeway, Inc.* ....................... 647 14,842

Supervalu, Inc. ...................... 53 1,265

----------

37,804

FOOTWEAR - 0.2%

Nike, Inc. (Cl. B) ................... 400 24,328

Reebok International, Ltd. ........... 90 3,009

----------

27,337

FOREST PRODUCTS - 0.2%

Louisiana-Pacific Corporation* ....... 211 2,908

Weyerhaeuser Company ................. 470 27,472

----------

30,380

GAS UTILITIES - 0.3%

KeySpan Corporation .................. 234 8,209

Kinder Morgan, Inc. .................. 223 12,044

Nicor, Inc. .......................... 53 1,862

NiSource, Inc. ....................... 385 7,692

Peoples Energy Corporation ........... 73 3,021

Sempra Energy ........................ 307 9,014

----------

41,842

GENERAL MERCHANDISE STORES - 0.5%

Big Lots, Inc.* ...................... 156 2,466

Dollar General Corporation ........... 480 9,600

Family Dollar Stores, Inc. ........... 262 10,451

Target Corporation ................... 1,362 51,252

----------

73,769

GOLD - 0.2%

Newmont Mining Corporation

Holding Company ................... 618 24,158

HEALTH CARE DISTRIBUTORS - 0.4%

AmerisourceBergen Corporation ........ 174 9,405

Cardinal Health, Inc. ................ 661 38,596

McKesson Corporation ................. 426 14,182

----------

62,183

HEALTH CARE EQUIPMENT - 1.8%

Applera Corporation - Applied

Biosystems Group .................. 338 7,541

Baxter International, Inc. ........... 281 8,166

Becton, Dickinson & Company .......... 384 13,870

Biomet, Inc. ......................... 392 13,175

Boston Scientific Corporation* ....... 617 39,365

C.R. Bard, Inc. ...................... 85 6,035

NUMBER MARKET

COMMON STOCKS (CONTINUED) OF SHARES VALUE

- --------------------------------------------------------------------------------

HEALTH CARE EQUIPMENT (CONTINUED)

Guidant Corporation .................. 468 $ 21,926

Medtronic, Inc. ...................... 1,831 85,911

St. Jude Medical, Inc.* .............. 262 14,088

Stryker Corporation .................. 323 24,325

Zimmer Holdings, Inc.* ............... 294 16,199

----------

250,601

HEALTH CARE FACILITIES - 0.2%

HCA, Inc. ............................ 312 11,500

Health Management

Association, Inc. ................. 373 8,135

Manor Care, Inc. ..................... 143 4,290

Tenet Healthcare Corporation* ........ 683 9,890

----------

33,815

HEALTH CARE SERVICES - 0.3%

Express Scripts, Inc.* ............... 100 6,115

IMS Health, Inc. ..................... 377 7,955

Medco Health Solutions, Inc.* ........ 401 10,398

Quest Diagnostics, Inc. .............. 304 18,435

----------

42,903

HEALTH CARE SUPPLIES - 0.1%

Bausch & Lomb, Inc. .............. 86 3,797

Millipore Corporation* ............... 59 2,718

----------

6,515

HOME ENTERTAINMENT SOFTWARE - 0.1%

Electonic Arts, Inc.* ................ 222 20,475

HOME FURNISHINGS - 0.0%

Leggett & Platt, Inc. ............ 275 5,948

HOME IMPROVEMENT RETAIL - 1.3%

Home Depot, Inc. ..................... 3,439 109,532

Lowe's Companies, Inc. ............... 1,328 68,923

Sherwin-Williams Company ............. 221 6,500

----------

184,955

HOMEBUILDING - 0.2%

Centex Corporation ................... 96 7,476

KB Home .............................. 231 13,781

Pulte Homes, Inc. .................... 92 6,257

----------

27,514

HOTELS, RESORTS & CRUISE LINES - 0.3%

Carnival Corporation ................. 316 10,393

Hilton Hotels Corporation ............ 538 8,726

Marriott International, Inc. ......... 340 14,630

Starwood Hotels & Resorts

Worldwide, Inc. ................... 300 10,440

----------

44,189

- --------------------------------------------------------------------------------

11 SEE ACCOMPANYING NOTES.

SCHEDULE OF INVESTMENTS (CONTINUED)

SEPTEMBER 30, 2003

- --------------------------------------------------------------------------------

SECURITY EQUITY FUND -

ENHANCED INDEX SERIES (CONTINUED)

- --------------------------------------------------------------------------------

NUMBER MARKET

COMMON STOCKS (CONTINUED OF SHARES VALUE

- --------------------------------------------------------------------------------

HOUSEHOLD APPLIANCES - 0.1%

Black & Decker Corporation ........... 112 $ 4,542

Snap-On, Inc. ........................ 86 2,378

Whirlpool Corporation ................ 104 7,048

----------

13,968

HOUSEHOLD PRODUCTS - 1.8%

Clorox Company ....................... 337 15,458

Colgate-Palmolive Company ............ 816 45,606

Kimberly-Clark Corporation ........... 423 21,708

Procter & Gamble Company ............. 1,934 179,514

----------

262,286

HOUSEWARES & SPECIALTIES - 0.1%

American Greetings Corporation* ...... 113 2,196

Fortune Brands, Inc. ................. 207 11,747

Newell Rubbermaid, Inc. .............. 71 1,539

Tupperware Corporation ............... 100 1,338

----------

16,820

HYPERMARKETS & SUPERCENTERS - 2.7%

Costco Wholesale Corporation* ........ 674 20,948

Wal-Mart Stores, Inc. ................ 6562 366,488

----------

387,436

INDUSTRIAL CONGLOMERATES - 4.2%

General Electric Company ............. 14,944 445,481

3M Company ........................... 1,190 82,193

Textron, Inc. ........................ 200 7,890

Tyco International, Ltd. ............. 2,987 61,024

----------

596,588

INDUSTRIAL GASES - 0.2%

Air Products & Chemicals, Inc. ....... 359 16,191

Praxair, Inc. ........................ 252 15,611

----------

31,802

INDUSTRIAL MACHINERY - 0.8%

Crane Company ........................ 69 1,615

Danaher Corporation .................. 244 18,022

Dover Corporation .................... 267 9,444

Eaton Corporation .................... 124 10,989

Illinois Tool Works, Inc. ............ 477 31,606

Ingersoll-Rand Company ............... 228 12,184

ITT Industries, Inc. ................. 121 7,241

Pall Corporation ..................... 515 11,557

Parker-Hannifin Corporation .......... 200 8,940

----------

111,598

INSURANCE BROKERS - 0.3%

Aon Corporation ...................... 435 9,070

Marsh & McLennan

Companies, Inc. ................... 812 38,659

----------

47,729

NUMBER MARKET

COMMON STOCKS (CONTINUED) OF SHARES VALUE

- --------------------------------------------------------------------------------

INTEGRATED OIL & GAS - 3.9%

ChevronTexaco Corporation ............ 1,585 $113,248

ConocoPhillips ....................... 1,022 55,955

Exxon Mobil Corporation .............. 9,982 365,341

Marathon Oil Corporation ............. 51 1,454

Occidental Petroleum Corporation 598 21,068

----------

557,066

INTEGRATED TELECOMMUNICATION SERVICES - 2.8%

Alltel Corporation ................... 488 22,614

AT&T Corporation ..................... 1,118 24,093

BellSouth Corporation ................ 2,728 64,599

CenturyTel, Inc. ..................... 496 16,809

Citizens Communications Company* ..... 337 3,778

Qwest Communications

International, Inc.* .............. 2,370 8,058

SBC Communications, Inc. ............. 4,940 109,915

Sprint Corporation (FON Group) ....... 1,286 19,419

Verizon Communications, Inc. ......... 4,091 132,712

----------

401,997

INTERNET RETAIL - 0.4%

Ebay, Inc.* .......................... 1,096 58,417

INTERNET SOFTWARE & SERVICES - 0.2%

Yahoo!, Inc.* ........................ 898 31,771

INVESTMENT BANKING & BROKERAGE - 2.0%

Bear Stearns Companies, Inc. ......... 282 21,094

Charles Schwab Corporation ........... 1965 23,403

Goldman Sachs Group, Inc. ............ 812 68,127

Lehman Brothers Holdings, Inc. ....... 505 34,885

Merrill Lynch & Company, Inc. ........ 1573 84,203

Morgan Stanley ....................... 1178 59,442

----------

291,154

IT CONSULTING & OTHER SERVICES - 0.1%

Unisys Corporation* .................. 492 6,657

LEISURE PRODUCTS - 0.1%

Brunswick Corporation ................ 122 3,133

Hasbro, Inc. ......................... 68 1,270

Mattel, Inc. ......................... 142 2,692

----------

7,095

LIFE & HEALTH INSURANCE - 1.0%

Aflac, Inc. .......................... 794 25,646

Jefferson-Pilot Corporation .......... 225 9,986

John Hancock Financial

Services, Inc. .................... 414 13,993

Lincoln National Corporation ......... 250 8,845

MetLife, Inc. ........................ 1,561 43,786

Prudential Financial, Inc. ........... 828 30,934

Torchmark Corporation ................ 190 7,722

UNUMProvident Corporation ............ 125 1,846

----------

142,758

- --------------------------------------------------------------------------------

12 SEE ACCOMPANYING NOTES.

SCHEDULE OF INVESTMENTS (CONTINUED)

SEPTEMBER 30, 2003

- --------------------------------------------------------------------------------

SECURITY EQUITY FUND -

ENHANCED INDEX SERIES (CONTINUED)

- --------------------------------------------------------------------------------

NUMBER MARKET

COMMON STOCKS (CONTINUED) OF SHARES VALUE

- --------------------------------------------------------------------------------

MANAGED HEALTH CARE - 0.9%

Aetna, Inc. .......................... 237 $ 14,464

Anthem, Inc.* ........................ 206 14,694

Humana, Inc.* ........................ 774 13,971

UnitedHealth Group, Inc. 1,078 54,245

WellPoint Health Networks,

Inc.* ............................. 338 26,053

----------

123,427

METAL & GLASS CONTAINERS - 0.2%

Ball Corporation ..................... 289 15,606

Pactiv Corporation* .................. 741 15,027

----------

30,633

MOTORCYCLE MANUFACTURERS - 0.2%

Harley-Davidson, Inc. ................ 459 22,124

MOVIES & ENTERTAINMENT - 1.9%

AOL Time Warner, Inc.* ............... 7,259 109,683

Viacom, Inc. (Cl. B) ................. 2,623 100,461

Walt Disney Company .................. 3,032 61,155

----------

271,299

MULTI-LINE INSURANCE - 1.7%

American International Group, Inc. ... 3,890 224,453

Hartford Financial Group, Inc. ....... 71 3,737

Loews Corporation .................... 287 11,586

----------

239,776

MULTI-UTILITIES & UNREGULATED POWER - 0.4%

AES Corporation* ..................... 735 5,454

Calpine Corporation* ................. 452 2,210

Constellation Energy Group,

Inc. .............................. 496 17,747

Duke Energy Corporation .............. 1,345 23,954

Dynegy, Inc.* ........................ 443 1,595

Williams Companies, Inc. ............. 614 5,784

----------

56,744

OFFICE ELECTRONICS - 0.1%

Xerox Corporation .................... 1,146 11,758

OFFICE SERVICES & SUPPLIES - 0.1%

Avery Dennison Corporation ........... 52 2,627

Pitney Bowes, Inc. ................... 381 14,600

----------

17,227

OIL & GAS DRILLING - 0.2%

Nabors Industries, Inc.* ............. 241 8,980

Noble Corporation* ................... 229 7,784

Rowan Companies, Inc.* ............... 172 4,228

Transocean, Inc. ..................... 441 8,820

----------

29,812

NUMBER MARKET

COMMON STOCKS (CONTINUED) OF SHARES VALUE

- --------------------------------------------------------------------------------

OIL & GAS EQUIPMENT & SERVICES - 0.5%

Baker Hughes, Inc. ................... 536 $ 15,860

BJ Services Company* ................. 264 9,021

Halliburton Company .................. 174 4,220

Schlumberger, Ltd. ................... 853 41,285

----------

70,386

OIL & GAS EXPLORATION & PRODUCTION - 0.8%

Anadarko Petroleum Corporation ....... 398 16,620

Apache Corporation ................... 258 17,890

Burlington Resources, Inc. ........... 318 15,328

Devon Energy Corporation ............. 365 17,589

EOG Resources, Inc. .................. 409 17,072

Kerr-McGee Group ..................... 335 14,954

Unocal Corporation ................... 356 11,221

----------

110,674

OIL & GAS REFINING,MARKETING & TRANSPORTATION - 0.0%

Ashland, Inc. ........................ 45 1,478

Sunoco, Inc. ......................... 45 1,810

----------

3,288

OTHER DIVERSIFIED FINANCIAL SERVICES - 2.6%

Citigroup, Inc. ...................... 7,714 351,064

Principal Financial Group, Inc. ...... 486 15,061

----------

366,125

PACKAGED FOODS & MEATS - 1.0%

Campbell Soup Company ................ 588 15,582

ConAgra Foods, Inc. .................. 780 16,567

General Mills, Inc. .................. 564 26,547

H.J. Heinz Company ................... 510 17,483

Hershey Foods Corporation ............ 48 3,489

Kellogg Company ...................... 594 19,810

McCormick & Company, Inc. ............ 199 5,457

Sara Lee Corporation ................. 1,178 21,628

Wm. Wrigley Jr. Company .............. 341 18,857

----------

145,420

PAPER PACKAGING - 0.1%

Sealed Air Corporation* .............. 149 7,037

Temple-Inland, Inc. .................. 68 3,301

----------

10,338

PAPER PRODUCTS - 0.3%

Boise Cascade Corporation ............ 69 1,904

Georgia-Pacific Corporation .......... 341 8,266

International Paper Company .......... 715 27,899

----------

38,069

PERSONAL PRODUCTS - 0.5%

Alberto-Culver Company (Cl. B) ....... 97 5,706

Avon Products, Inc. .................. 360 23,242

Gillette Company ..................... 1,518 48,546

----------

77,494

- --------------------------------------------------------------------------------

13 SEE ACCOMPANYING NOTES.

SCHEDULE OF INVESTMENTS (CONTINUED)

SEPTEMBER 30, 2003

- --------------------------------------------------------------------------------

SECURITY EQUITY FUND -

ENHANCED INDEX SERIES (CONTINUED)

- --------------------------------------------------------------------------------

NUMBER MARKET

COMMON STOCKS (CONTINUED) OF SHARES VALUE

- --------------------------------------------------------------------------------

PHARMACEUTICALS - 8.3%

Abbott Laboratories .................. 2,324 $ 98,886

Allergan, Inc. ....................... 200 15,746

Bristol-Myers Squibb Company ......... 2,889 74,132

Eli Lilly & Company .................. 1,685 100,089

Forest Laboratories, Inc.* ........... 548 28,195

Johnson & Johnson .................... 4,116 203,824

King Pharmaceuticals, Inc.* .......... 339 5,136

Merck & Company, Inc. ................ 3,363 170,235

Pfizer, Inc. ......................... 11,847 359,912

Schering-Plough Corporation .......... 1,089 16,596

Watson Pharmaceuticals, Inc.* ........ 166 6,921

Wyeth ................................ 2,187 100,821

----------

1,180,493

PHOTOGRAPHIC PRODUCTS - 0.1%

Eastman Kodak Company ................ 756 15,831

PROPERTY & CASUALTY INSURANCE - 1.4%

Ace, Ltd. ............................ 397 13,133

Allstate Corporation ................. 1,074 39,233

Ambac Financial Group, Inc. .......... 171 10,944

Chubb Corporation .................... 393 25,498

Cincinnati Financial Corporation ..... 256 10,230

MBIA, Inc. ........................... 225 12,368

Progressive Corporation .............. 334 23,083

Safeco Corporation ................... 220 7,757

St. Paul Companies, Inc. ............. 322 11,924

Travelers Property Casualty

Corporation (Cl. B) ............... 1,504 23,884

XL Capital, Ltd. ..................... 202 15,643

----------

193,697

PUBLISHING & PRINTING - 0.6%

Dow Jones & Company, Inc. ............ 126 5,966

Gannett Company, Inc. ................ 406 31,489

Knight-Ridder, Inc. .................. 126 8,404

McGraw-Hill Companies, Inc. .......... 279 17,334

Meredith Corporation ................. 67 3,093

Tribune Company ...................... 461 21,160

----------

87,446

RAILROADS - 0.5%

Burlington Northern Santa Fe Corporation 604 17,437

CSX Corporation ...................... 358 10,472

Norfolk Southern Corporation ......... 645 11,933

Union Pacific Corporation ............ 544 31,644

----------

71,486

NUMBER MARKET

COMMON STOCKS (CONTINUED) OF SHARES VALUE

- --------------------------------------------------------------------------------

REAL ESTATE INVESTMENT TRUSTS - 0.4%

Apartment Investment & Management

Company ........................... 117 $ 4,605

Equity Office Properties Trust ....... 635 17,482

Equity Residential ................... 427 12,503

Plum Creek Timber Company, Inc. ...... 251 6,385

Prologis ............................. 267 8,077

Simon Property Group, Inc. ........... 292 12,725

----------

61,777

REGIONAL BANKS - 1.7%

Amsouth Bancorporation ............... 562 11,926

BB&T Corporation ..................... 832 29,877

Charter One Financial, Inc. .......... 600 18,360

Fifth Third Bancorp .................. 569 31,449

First Tennessee National

Corporation ....................... 201 8,534

Huntington Bancshares, Inc. .......... 366 7,243

Keycorp .............................. 654 16,723

Marshall & Ilsley Corporation ........ 319 10,055

National City Corporation ............ 930 27,398

PNC Financial Services ............... 412 19,603

Regions Financial Corporation ........ 348 11,919

Southtrust Corporation ............... 529 15,547

Suntrust Banks, Inc. ................. 142 8,573

Synovus Financial Corporation ........ 434 10,846

Union Planters Corporation ........... 312 9,872

Zions Bancorporation ................. 124 6,925

----------

244,850

RESTAURANTS - 0.4%

Darden Restaurants, Inc. ............. 226 4,294

McDonald's Corporation ............... 1,147 27,000

Starbucks Corporation* ............... 595 17,136

Wendy's International, Inc. .......... 43 1,389

Yum! Brands, Inc.* ................... 430 12,737

----------

62,556

SEMICONDUCTOR EQUIPMENT - 0.5%

Applied Materials, Inc.* ............. 2,461 44,643

KLA-Tencor Corporation* .............. 291 14,957

Novellus Systems, Inc.* .............. 217 7,324

Teradyne, Inc.* ...................... 273 5,078

----------

72,002

- --------------------------------------------------------------------------------

14 SEE ACCOMPANYING NOTES.

SCHEDULE OF INVESTMENTS (CONTINUED)

SEPTEMBER 30, 2003

- --------------------------------------------------------------------------------

SECURITY EQUITY FUND -

ENHANCED INDEX SERIES (CONTINUED)

- --------------------------------------------------------------------------------

NUMBER MARKET

COMMON STOCKS (CONTINUED) OF SHARES VALUE

- --------------------------------------------------------------------------------

SEMICONDUCTORS - 3.3%

Advanced Micro Devices, Inc.* ........ 475 $ 5,277

Altera Corporation* .................. 559 10,565

Analog Devices, Inc.* ................ 540 20,531

Applied Micro Circuits Corporation* .. 400 1,948

Broadcom Corporation* ................ 756 20,125

Intel Corporation .................... 9,793 269,405

LSI Logic Corporation* ............... 1,322 11,885

Linear Technology Corporation ........ 461 16,508

Maxim Integrated Products, Inc. ...... 479 18,921

Micron Technology, Inc.* ............. 1,536 20,613

National Semiconductor Corporation* .. 259 8,363

Nvidia Corporation* .................. 224 3,564

PMC-Sierra, Inc.* .................... 227 2,994

Texas Instruments, Inc. .............. 1,860 42,408

Xilinx, Inc.* ........................ 504 14,369

----------

467,476

SOFT DRINKS - 2.0%

Coca-Cola Company .................... 3,305 141,983

Coca-Cola Enterprises, Inc. .......... 707 13,475

Pepsi Bottling Group, Inc. ........... 435 8,952

PepsiCo, Inc. ........................ 2,581 118,287

----------

282,697

SPECIALIZED FINANCE - 0.1%

Moody's Corporation .................. 388 21,328

SPECIALTY CHEMICALS - 0.2%

Ecolab, Inc. ......................... 409 10,327

International Flavors &

Fragrances, Inc. .................. 45 1,489

Rohm & Haas Company .................. 348 11,641

Sigma-Aldrich Corporation ............ 115 5,973

----------

29,430

SPECIALTY STORES - 0.7%

AutoNation, Inc.* .................... 880 15,435

AutoZone, Inc.* ...................... 138 12,355

Bed Bath & Beyond, Inc.* ............. 449 17,143

Office Depot, Inc.* .................. 949 13,333

Staples, Inc.* ....................... 1,101 26,149

Tiffany & Company .................... 446 16,649

Toys 'R' Us, Inc.* ................... 316 3,801

----------

104,865

STEEL - 0.0%

Allegheny Technologies, Inc. ......... 97 635

Worthington Industries, Inc. ......... 162 2,035

----------

2,670

SYSTEMS SOFTWARE - 4.4%

Adobe Systems, Inc. .................. 355 13,937

BMC Software, Inc.* .................. 365 5,084

Computer Associates

International, Inc. ............... 855 22,324

NUMBER MARKET

COMMON STOCKS (CONTINUED) OF SHARES VALUE

- --------------------------------------------------------------------------------

SYSTEMS SOFTWARE (CONTINUED)

Microsoft Corporation ................ 16,066 $ 446,474

Novell, Inc.* ........................ 470 2,505

Oracle Corporation* .................. 7,874 88,346

Symantec Corporation* ................ 385 24,263

Veritas Software Corporation* ........ 888 27,883

----------

630,816

THIRFTS & MORTGAGE FINANCE - 1.7%

Countrywide Financial Corporation .... 201 15,734

Freddie Mac .......................... 1,022 53,502

Fannie Mae ........................... 1,463 102,703

Golden West Financial Corporation .... 234 20,945

Washington Mutual, Inc. .............. 1,411 55,551

----------

248,435

TIRES & RUBBER - 0.0%

Cooper Tire & Rubber Company ......... 93 1,476

Goodyear Tire & Rubber Company ....... 221 1,452

----------

2,928

TOBACCO - 1.1%

Alteria Group, Inc. .................. 3251 142,394

UST, Inc. ............................ 530 18,645

----------

161,039

TRADING COMPANIES & DISTRIBUTORS - 0.1%

W.W. Grainger, Inc. .................. 142 6,752

UNIT INVESTMENT TRUST - 1.0%

S&P Depositary Receipts .............. 1460 145,883

WIRELESS TELECOMMUNICATION SERVICES - 0.5%

AT&T Wireless Services* .............. 3,920 32,066

Nextel Communications, Inc.* ......... 1,591 31,327

Sprint Corporation (PCS Group)* ...... 1,344 7,701

----------

71,094

-----------

Total common stocks - 97.1% ........................... 13,885,329

U.S. GOVERNMENT SECURITIES - 0.4%

- ---------------------------------

U.S. Treasury Bill, 1.175%, 10-16-03(1) $50,000 49,984

REPURCHASE AGREEMENT - 3.6%

- ---------------------------

United Missouri Bank, 0.65%,

10-01-03 (Collateralized by FNMA,

10-01-03 with a value

of $529,000 and a repurchase

amount of $518,010) ............... $518,000 518,000

----------

Total investments - 101.1% ............................ 14,453,313

Liabilities, less cash & other assets - (1.1%) ........ (155,934)

-----------

Total net assets - 100.0% ............................. $14,297,379

===========

For federal income tax purposes, the identified cost of investments owned at

September 30, 2003 was $15,511,420.

*Non-income producing security

(1) Security is segregated as collateral for futures, options or forward

exchange contracts.

- --------------------------------------------------------------------------------

15 SEE ACCOMPANYING NOTES.

MANAGER'S COMMENTARY

SECURITY EQUITY FUND - EQUITY SERIES

NOVEMBER 15, 2003

Terry Milberger

Senior Portfolio Manager |

Advisor, Security

Management Company, LLC |

TO OUR SHAREHOLDERS:

Following the most severe bear market since the early 1970s, equity investors

were finally rewarded with positive returns for the one-year period ended

September 30, 2003. Security Equity Fund returned a positive 17.49% for the

period, lagging the benchmark S&P 500 index's return of 24.40% and the Fund's

peer group median return of 20.72% for the period.1

Our strategy for Equity Fund continues to be one of owning a mixture of growth

and value stocks, skewing the mix based upon the relative value of growth and

value categories. When this fiscal year began, the Fund emphasized consistent

growth names with visibility given our view that the economy would be slow to

recover. With the majority of the market falling into this line of thinking, the

valuation gap between quality names with consistent growth prospects and

cyclical names with earnings leverage became stretched to extremes, especially

around the start of the Iraqi war. While in hindsight this created an

opportunity to skew the portfolio to more cyclical and value names, we kept the

Fund focused on growth given our views that the economic recovery would be

muted. This is the main reason the Fund underperformed versus its benchmark

during the period.

INDUSTRIALS AND ENERGY STOCKS BOOST PERFORMANCE

Despite a slightly underweighted position to its benchmark, the industrials

sector returned 23% for the Fund compared to a 21% return for the benchmark.

United Technologies, a diversified industrial company that makes Otis elevators,

helicopters and aircraft engines among other products, benefited from the

economic recovery. The stock returned 38% for the period. General Electric,

another good performer, gained 24%.

Stock selection in energy helped the Fund return 20% compared to a 16% return

for the benchmark. Apache, an exploration and production company, returned 23%.

Halliburton, an energy equipment and service firm, advanced 57%.

HEALTH CARE AND TECHNOLOGY DAMPEN TOTAL RETURN

An overweighted position in health care hurt the Fund's performance with the

exception of a strong performance by Amgen, a leading biotech company with

important new drugs to treat rheumatoid arthritis and cancer. The stock gained

54% for the period. Expectations were that health care stocks would grow

earnings between 10% and 15% during 2003. However, with a muted economic

recovery and political uncertainty surrounding the health care industry, the

health care sector did not look as interesting to investors.

An underweight position in the information technology sector relative to the

index also dampened overall performance. The technology sector returned 59% for

the benchmark compared to 48% for the Fund. Technology stocks are typically

cyclical by nature and tend to outperform as investors perceive the economy is

recovering. In reality, the economic recovery has been moderate due to a lack of

corporate spending.

GREAT COMPANIES MAKE GREAT STOCKS OVER TIME

Looking forward, we expect cyclical stocks to cool down and the economic

recovery to moderate. Driven primarily by the mortgage refinancing boom and

federal tax cuts, we anticipate that for a strong economic recovery to continue,

it will require corporate capital spending to drive job growth and manufacturing

orders.

With this outlook and the performance of cyclicals during the last six months,

we are holding our course by continuing our ownership of consistent growth

names. While this approach underperformed over the last six months, we believe

it will offer outperformance in the future.

As always, we remain convinced that long-term investing in equities is the best

way for investors to meet their financial goals. We believe that patience will

be rewarded.

Sincerely,

Terry Milberger

Senior Portfolio Manager

(1)Performance figures are based on Class A shares and do not reflect deduction

of the sales charges or taxes that a shareholder would pay on distributions or

redemptions of shares.

- --------------------------------------------------------------------------------

16

MANAGER'S COMMENTARY (CONTINUED)

SECURITY EQUITY FUND - EQUITY SERIES

NOVEMBER 15, 2003

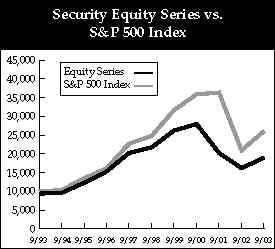

================================= PERFORMANCE ==================================

$10,000 OVER TEN YEARS

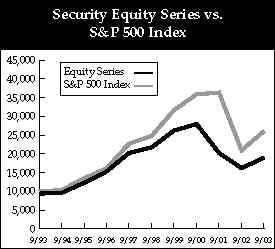

This chart assumes a $10,000 investment in Class A shares of Equity Series on

September 30, 1993, and reflects deduction of the 5.75% sales load. On September

30, 2003, the value of your investment in Class A shares of the Series (with

dividends reinvested) would have grown to $19,035. By comparison, the same

$10,000 investment would have grown to $26,072 based on the S&P 500 Index's

performance. The chart does not reflect the deduction of taxes that a

shareholder would pay on distributions or the redemption of fund shares.

- --------------------------------------------------------------------------------

TOP 5 EQUITY HOLDINGS*

% OF

NET ASSETS

----------

Microsoft Corporation 4.5%

General Electric Company 4.2%

Pfizer, Inc. 4.1%

S&P Depositary Receipts 3.9%

Citigroup, Inc. 3.7%

*At September 30, 2003

- --------------------------------------------------------------------------------

- --------------------------------------------------------------------------------

AVERAGE ANNUAL RETURNS

AS OF SEPTEMBER 30, 2003

SINCE

1 YEAR 5 YEARS 10 YEARS INCEPTION

---------------------------------------

A Shares 17.49% (2.63%) 7.28% N/A

A Shares with

sales charge 10.74% (3.78%) 6.65% N/A

B Shares 16.59% (3.57%) N/A 6.34%

(10-19-93)

B Shares

with CDSC 11.59% (3.96%) N/A 6.34%

(10-19-93)

C Shares 16.60% N/A N/A (7.89%)

(1-29-99)

C Shares

with CDSC 15.60% N/A N/A (7.89%)

(1-29-99)

- --------------------------------------------------------------------------------

The performance data above represents past performance that is not predictive of

future results. The investment return and principal value of an investment in

the fund will fluctuate so that an investor's shares, when redeemed, may be

worth more or less than their original cost. The figures above do not reflect

deduction of the maximum front-end sales charge of 5.75% for Class A shares or

the contingent deferred sales charge of 5% for Class B shares and 1% for Class C

shares, as applicable, except where noted. The figures do not reflect the

deduction of taxes that a shareholder would pay on distributions or redemption

of fund shares. Such figures would be lower if the maximum sales charge and any

applicable taxes were deducted.

- --------------------------------------------------------------------------------

17

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2003

- --------------------------------------------------------------------------------

SECURITY EQUITY FUND -

EQUITY SERIES

- --------------------------------------------------------------------------------

NUMBER MARKET

COMMON STOCKS OF SHARES VALUE

- --------------------------------------------------------------------------------

ADVERTISING - 1.1%

Omnicom Group, Inc. .................. 80,000 $ 5,748,000

AEROSPACE & DEFENSE - 2.3%

General Dynamics Corporation ......... 60,000 4,683,600

United Technologies Corporation ...... 90,400 6,986,112

-----------

11,669,712

ALUMINUM - 0.8%

Alcoa, Inc. .......................... 145,000 3,793,200

APPLICATIONS SOFTWARE - 1.4%

Intuit, Inc.* ........................ 140,000 6,753,600

ASSET MANAGEMENT & CUSTODY BANKS - 0.9%

Bank of New York Company, Inc. ....... 150,000 4,366,500

BIOTECHNOLOGY - 1.3%

Amgen, Inc.* ......................... 100,000 6,457,000

BREWERS - 1.2%

Anheuser-Busch Companies, Inc. ....... 120,000 5,920,800

BROADCASTING & CABLE TV - 2.2%

Comcast Corporation* ................. 350,000 10,808,000

COMMUNICATIONS EQUIPMENT - 2.7%

Cisco Systems, Inc.* ................. 500,000 9,770,000

Nokia OYJ ADR ........................ 225,000 3,510,000

-----------

13,280,000

COMPUTER HARDWARE - 3.5%

Dell, Inc.* .......................... 200,900 6,708,051

International Business Machines

Corporation ....................... 120,000 10,599,600

-----------

17,307,651

CONSUMER FINANCE - 0.8%

MBNA Corporation ..................... 180,900 4,124,520

DATA PROCESSING & OUTSOURCED SERVICE - 1.3%

First Data Corporation 165,000 6,593,400

DIVERSIFIED BANKS - 2.7%

Bank of America Corporation .......... 70,000 5,462,800

Wells Fargo & Company ................ 160,000 8,240,000

-----------

13,702,800

DRUG RETAIL - 0.4%

Walgreen Company ..................... 65,000 1,991,600

ELECTRONIC MANUFACTURING SERVICES - 0.6%

Molex, Inc. .......................... 100,000 2,859,000

GENERAL MERCHANDISE STORES - 1.1%

Target Corporation ................... 150,000 5,644,500

HEALTH CARE DISTRIBUTORS - 1.9%

Cardinal Health, Inc. ................ 160,000 9,342,400

HEALTH CARE EQUIPMENT - 1.7%

Medtronic, Inc. ...................... 175,800 8,248,536

NUMBER MARKET

COMMON STOCKS (CONTINUED) OF SHARES VALUE

- --------------------------------------------------------------------------------

HOME IMPROVEMENT RETAIL - 2.1%

Home Depot, Inc. ..................... 240,000 $ 7,644,000

Lowe's Companies, Inc. ............... 50,000 2,595,000

-----------

10,239,000

HOTELS, RESORTS & CRUISE LINES - 0.8%

Carnival Corporation ................. 120,000 3,946,800

HOUSEHOLD PRODUCTS - 3.2%

Colgate-Palmolive Company ............ 100,000 5,589,000

Procter & Gamble Company ............. 110,000 10,210,200

-----------

15,799,200

HYPERMARKETS & SUPERCENTERS - 2.5%

Wal-Mart Store, Inc. ................. 220,000 12,287,000

INDUSTRIAL CONGLOMERATES - 5.6%

3M Company ........................... 100,000 6,907,000

General Electric Company ............. 700,000 20,867,000

-----------

27,774,000

INDUSTRIAL GASES - 1.0%

Praxair, Inc. ........................ 80,000 4,956,000

INSURANCE BROKERS - 0.7%

Marsh & McLennan Companies,

Inc. .............................. 70,000 3,332,700

INTEGRATED OIL & GAS - 3.6%

ChevronTexaco Corporation ............ 70,000 5,001,500

Exxon Mobil Corporation .............. 350,000 12,810,000

-----------

17,811,500

INTEGRATED TELECOMMUNICATIONS SERVICES - 1.5%

SBC Communications, Inc. ............. 200,000 4,450,000

Verizon Communications, Inc. ......... 100,000 3,244,000

-----------

7,694,000

INVESTMENT BANKING & BROKERAGE - 2.7%

Goldman Sachs Group, Inc. ............ 50,000 4,195,000

Merrill Lynch & Company, Inc. ........ 90,500 4,844,465

Morgan Stanley ....................... 90,000 4,541,400

-----------

13,580,865

LEISURE PRODUCTS - 0.8%

Mattel, Inc. ......................... 200,000 3,792,000

LIFE & HEALTH INSURANCE - 1.9%

Aflac, Inc. .......................... 160,000 5,168,000

MetLife, Inc. ........................ 160,000 4,488,000

-----------

9,656,000

MANAGED HEALTH CARE - 0.7%

UnitedHealth Group, Inc. ............. 70,000 3,522,400

MOTORCYCLE MANUFACTURERS - 1.9%

Harley-Davidson, Inc. ................ 198,000 9,543,600

- --------------------------------------------------------------------------------

18 SEE ACCOMPANYING NOTES.

SCHEDULE OF INVESTMENTS (CONTINUED)

SEPTEMBER 30, 2003

- --------------------------------------------------------------------------------

SECURITY EQUITY FUND -

EQUITY SERIES (CONTINUED)

- --------------------------------------------------------------------------------

NUMBER MARKET

COMMON STOCKS (CONTINUED) OF SHARES VALUE

- --------------------------------------------------------------------------------

MOVIES & ENTERTAINMENT - 2.9%

Time Warner, Inc* .................... 440,000 $6,648,400

Viacom, Inc. (Cl. B) ................. 200,000 7,660,000

-----------

14,308,400

MULTI-LINE INSURANCE - 2.5%

American International

Group, Inc. ....................... 220,000 12,694,000

OIL & GAS EQUIPMENT & SERVICES - 1.3%

BJ Services Company* ................. 50,000 1,708,500

Halliburton Company .................. 200,000 4,850,000

-----------

6,558,500

OIL & GAS EXPLORATION & PRODUCTION - 1.8%

Apache Corporation ................... 70,000 4,853,800

Devon Energy Corporation ............. 90,000 4,337,100

-----------

9,190,900

OTHER DIVERSIFIED FINANCIAL SERVICES - 3.7%

Citigroup, Inc. ...................... 401,766 18,284,371

PHARMACEUTICALS - 10.4%

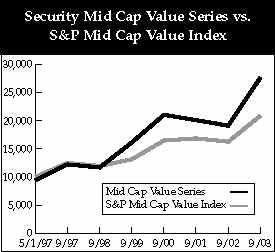

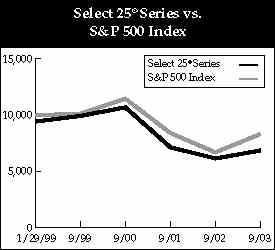

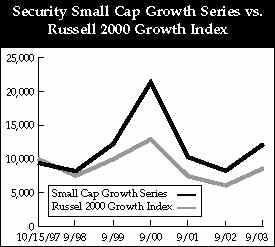

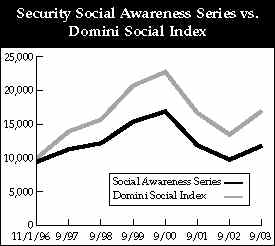

Abbott Laboratories .................. 140,000 5,957,000