UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-01136

SECURITY EQUITY FUND

(Exact name of registrant as specified in charter)

ONE SECURITY BENEFIT PLACE, TOPEKA, KANSAS 66636-0001

(Address of principal executive offices) (Zip code)

THOMAS A. SWANK, PRESIDENT

SECURITY EQUITY FUND

ONE SECURITY BENEFIT PLACE

TOPEKA, KANSAS 66636-0001

(Name and address of agent for service)

Registrant’s telephone number, including area code: (785) 438-3000

Date of fiscal year end: September 30

Date of reporting period: September 30, 2007

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. §3507.

| Item 1. | Reports to Stockholders. |

Security Equity Fund®

Security Large Cap Value Fund

Security Mid Cap Growth Fund

September 30, 2007

Annual Report

Table of Contents

Security Global Investors refers to the asset management arm of Security Benefit Corporation (“Security Benefit”) that consists of Security Investors, LLC, and for global investing, Security Global Investors, LLC. Security Distributors, Inc., Security Investors, LLC and Security Global Investors, LLC are subsidiaries of Security Benefit.

1

This page left blank intentionally.

2

| | |

| | Security Equity Fund |

| Managers’ Commentary | | Alpha Opportunity Series |

| November 15, 2007 | | (unaudited) |

| | | | | | | | |

Advised by: | |  | | and | |  | | Subadviser, Mainstream |

| | | | | | | | Investment Advisers |

| | | | |

| |  | |  |

Bill Jenkins Co-Portfolio Manager | | Mark Lamb Co-Portfolio Manager | | Steve Bowser Co-Portfolio Manager |

To Our Shareholders:

Performance

The performance of the Security Equity Fund Alpha Opportunity Series was very strong in the 12 months ended September 30, 2007, returning 26.10% compared to 16.44% for the S&P 500 Index. Since inception on July 7, 2003, the Series has outperformed the benchmark by more than 300 basis points, 16.21% to 13.18% on an annualized basis. The performance of the portfolio more than doubled that of other long/short equity managers when using the Credit Suisse/Tremont Long/Short Equity Index for the same period. The favorable comparisons to the S&P 500 index can be principally attributed to the portfolio’s emphasis on the energy, materials and industrial sectors of the market. Results were enhanced versus other long/short managers due to the relatively low level of short positions in the portfolio.

Investment Philosophy

We are active managers, as that style and approach plays well to our strengths of portfolio management experience and discipline. Our fundamental philosophy rests first upon the belief that it is critical to identify the long-term investment theme governing the equity markets. These themes may persist for 15 to 20 years. Second, while we also believe that valuation adds important perspective to investment decisions, it is not an efficient means of timing purchase and sale decisions. Those decisions are best made using technical analysis, a practice that uses the movement of security prices to indicate possible future price behavior. The third tenet of our philosophy is that changes in stock prices can lead changes in fundamental corporate developments. A proactive asset management approach helps to keep our investment themes fresh and our risk levels moderate.

Sector Performance

Our current theme can best be described as a global infrastructure one. When using the performance of the S&P 500 sectors as an indicator, our theme sectors performed very well. Energy (+41%), materials (+33%) and industrials (+22%) all handily outperformed the S&P 500 Index. In the energy sector, one of the better performing companies was Schlumberger, Ltd., which rose 71% in the last year. In the materials sector, Freeport-McMoRan contributed strongly to our results with the stock rising 106% in the last 12 months. Within industrials, Deere’s common equity returned approximately 80% in the last year. Technology was a good sector for us with the stock of Cisco Systems rising 44% over the last twelve months, thereby contributing to our theme of global infrastructure build out. By the same token, those sectors that we have traditionally viewed as short candidates were weak. Financials (-0.1%), consumer durables (+5%) and consumer staples (+11) all underperformed the S&P 500 Index.

Market Outlook

We continue to be positive in our outlook for the equity markets over the long term. We view overall valuation to be fair and the fundamentals for global economies and markets to be positive. As such, we do not expect that shorting will become a significant part of our strategy in the near future. In addition to the principal theme sectors mentioned above, we are increasingly more optimistic toward technology stocks, which were up 22% in the trailing twelve months that ended in September. Many of the companies in this sector are well positioned to benefit from our global infrastructure investment theme.

Sincerely,

Bill Jenkins, Portfolio Manager (Mainstream Investment Advisers)

Mark Lamb, Portfolio Manager (Security Investors)

Steve Bowser, Portfolio Manager (Security Investors)

1 | Performance figures are based on Class A shares and do not reflect deduction of the sales charges or taxes that a shareholder would pay on distributions or the redemption of shares. Fee waivers and/or reimbursements reduce Fund expenses and in the absence of such waivers, the performance quoted would be reduced. |

3

| | |

| | Security Equity Fund |

| Performance Summary | | Alpha Opportunity Series |

| September 30, 2007 | | (unaudited) |

PERFORMANCE

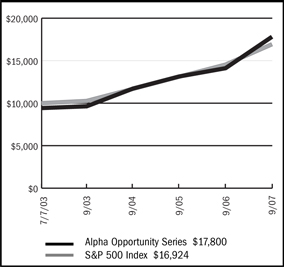

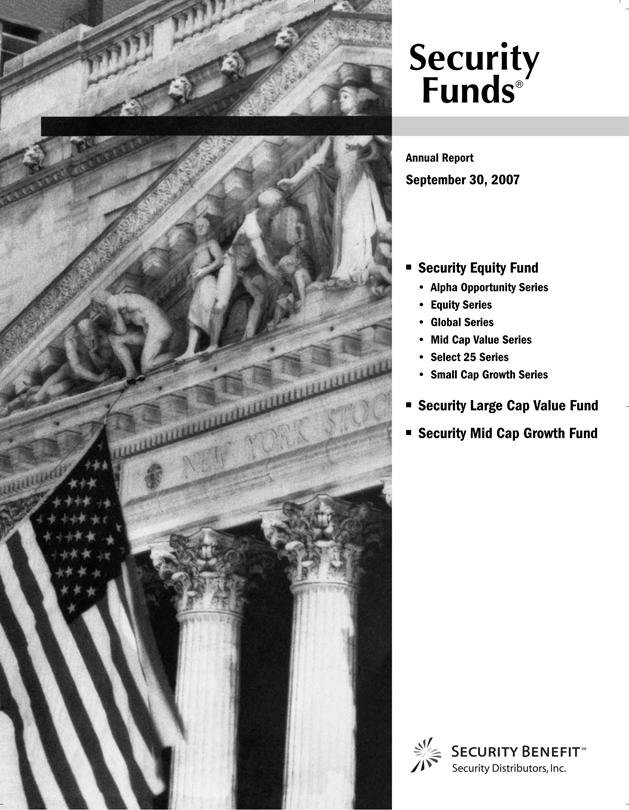

Security Alpha Opportunity Series vs. S&P 500 Index

$10,000 Since Inception

This chart assumes a $10,000 investment in Class A shares of Alpha Opportunity Series on July 7, 2003 (date of inception), reflects deduction of the 5.75% sales load and assumes all dividends reinvested. The chart does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of fund shares. The S&P 500 Index is a capitalization weighted index composed of 500 selected common stocks that represent the broad domestic economy and is a widely recognized unmanaged index of market performance.

Average Annual Returns

| | | | | | |

Periods Ended 9-30-07 | | 1 Year | | | Since Inception

(7-07-03) | |

A Shares | | 26.10 | % | | 16.21 | % |

| | |

A Shares with sales charge | | 18.81 | % | | 14.59 | % |

| | |

B Shares | | 25.14 | % | | 15.32 | % |

| | |

B Shares with CDSC | | 20.14 | % | | 15.02 | % |

| | |

C Shares | | 25.24 | % | | 15.34 | % |

| | |

C Shares with CDSC | | 24.24 | % | | 15.34 | % |

The performance data above represents past performance that is not predictive of future results. The investment return and principal value of an investment in the Series will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The figures above do not reflect deduction of the maximum front-end sales charge of 5.75% for Class A shares or the contingent deferred sales charge of 5% for Class B shares and 1% for Class C shares, as applicable, except where noted. The figures do not reflect the deduction of taxes that a shareholder would pay on distributions or redemption of shares. Such figures would be lower if the maximum sales charge and any applicable taxes were deducted. Fee waivers and/or reimbursements reduced expenses of the Series and in the absence of such waiver, the performance quoted would be reduced.

Portfolio Composition by Sector as of 9-30-07*

| | | |

Consumer Discretionary | | 0.33 | % |

| |

Consumer Staples | | 0.73 | |

| |

Energy | | 9.30 | |

| |

Financials | | 1.13 | |

| |

Health Care | | 0.09 | |

| |

Industrials | | 25.42 | |

| |

Information Technology | | 12.67 | |

| |

Materials | | 6.87 | |

| |

Telecommunication Services | | 0.27 | |

| |

Utilities | | 0.14 | |

| |

Exchange Traded Funds | | (0.80 | ) |

| |

U.S. Government Sponsored Agencies | | 39.55 | |

| |

Other assets in excess of liabilities | | 4.30 | |

| |

Total net assets | | 100.00 | % |

| | | |

| * | Securities sold short are netted with long positions in common stocks in the appropriate sectors. |

The accompanying notes are an integral part of the financial statements

4

| | |

| | Security Equity Fund |

| Performance Summary | | Alpha Opportunity Series |

| September 30, 2007 | | (unaudited) |

PERFORMANCE

Information About Your Series Expenses

Calculating your ongoing Series expenses

Example

As a shareholder of the Series, you incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; contingent deferred sales charges on redemptions; and redemption fees, if any; and (2) ongoing costs, including management fees; distribution and/or service fees (12b-1); and other Series expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Series and to compare these costs with ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, April 1, 2007 – September 30, 2007.

Actual Expenses

The first line for each class of shares in the table provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each class of shares in the table provides information about hypothetical account values and hypothetical expenses based on the Series actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Series actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Series and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) on purchase payments, contingent deferred sales charges on redemptions, and redemption fees, if any. Therefore, the second line for each class of shares is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Series Expenses

| | | | | | | | | |

| | | Beginning

Account Value

04-01-07 | | Ending

Account Value

09-30-071 | | Expenses Paid

During

Period2 |

Alpha Opportunity | | | | | | | | | |

Series—Class A | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,130.60 | | $ | 14.74 |

Hypothetical | | | 1,000.00 | | | 1,011.17 | | | 13.92 |

| | | |

Alpha Opportunity | | | | | | | | | |

Series—Class B | | | | | | | | | |

Actual | | | 1,000.00 | | | 1,125.80 | | | 18.28 |

Hypothetical | | | 1,000.00 | | | 1,007.83 | | | 17.26 |

| | | |

Alpha Opportunity | | | | | | | | | |

Series—Class C | | | | | | | | | |

Actual | | | 1,000.00 | | | 1,126.70 | | | 18.39 |

Hypothetical | | | 1,000.00 | | | 1,007.73 | | | 17.36 |

1 | The actual ending account value is based on the actual total return of the Series for the period from April 1, 2007 to September 30, 2007 after actual expenses and will differ from the hypothetical ending account value which is based on the Series expense ratio and a hypothetical annual return of 5% before expenses. The actual cumulative return at net asset value for the period from April 1, 2007 to September 30, 2007 was 13.06%, 12.58% and 12.67%, for Class A, B and C shares, respectively. |

2 | Expenses are equal to the Series annualized expense ratio (2.76%, 3.43% and 3.45% for Class A, B and C shares, respectively), net of any applicable fee waivers or earnings credits, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). |

5

| | |

| Schedule of Investments | | Security Equity Fund - Alpha Opportunity Series |

| September 30, 2007 | | |

|

| | | | | |

| | | Shares | | Value |

COMMON STOCK - 57.2% | | | | | |

Agricultural Products - 0.2% | | | | | |

Cresud S.A. ADR | | 3,103 | | $ | 70,500 |

| | | | | |

Airlines - 1.3% | | | | | |

UAL Corporation * | | 8,686 | | | 404,160 |

| | | | | |

Aluminum - 0.5% | | | | | |

Aluminum Corporation of China, Ltd. ADR | | 569 | | | 39,847 |

Century Aluminum Company * | | 2,555 | | | 134,521 |

| | | | | |

| | | | | 174,368 |

| | | | | |

Application Software - 1.3% | | | | | |

Ado be Systems, Inc. * | | 1,533 | | | 66,931 |

Autodesk, Inc. * | | 6,642 | | | 331,901 |

Business Objects S.A. ADR* | | 511 | | | 22,928 |

| | | | | |

| | | | | 421,760 |

| | | | | |

Coal & Consumable Fuels - 0.6% | | | | | |

Consol Energy, Inc. | | 1,533 | | | 71,438 |

International Coal Group, Inc. * | | 23,776 | | | 105,565 |

| | | | | |

| | | | | 177,003 |

| | | | | |

Commodity Chemicals - 0.3% | | | | | |

Braskem S.A. ADR | | 5,109 | | | 96,202 |

| | | | | |

Communications Equipment - 3.3% | | | | | |

Black Box Corporation | | 12,111 | | | 517,867 |

CommScope Inc. * | | 6,642 | | | 333,694 |

Telefonaktiebolaget LM Ericsson ADR * | | 5,474 | | | 217,865 |

| | | | | |

| | | | | 1,069,426 |

| | | | | |

Computer Hardware - 2.7% | | | | | |

Hewlett-Packard Company | | 8,176 | | | 407,083 |

International Business Machines Corporation | | 4,087 | | | 481,449 |

| | | | | |

| | | | | 888,532 |

| | | | | |

Computer Storage & Peripherals - 0.5% | | | | | |

Seagate Technology | | 6,496 | | | 166,168 |

| | | | | |

Construction & Engineering - 5.1% | | | | | |

Chicago Bridge & Iron Company N.V. | | 9,314 | | | 401,061 |

KHD Humboldt Wedag International, Ltd. * | | 1,284 | | | 39,162 |

Quanta Services, Inc. * (1) | | 32,798 | | | 867,507 |

URS Corporation * | | 6,131 | | | 346,095 |

| | | | | |

| | | | | 1,653,825 |

| | | | | |

Construction & Farm Machinery & Heavy Trucks - 1.4% | | | | | |

Caterpillar, Inc. | | 1,533 | | | 120,233 |

Cummins, Inc. | | 511 | | | 65,352 |

Lindsay Corporation | | 1,431 | | | 62,649 |

Toro Company | | 3,577 | | | 210,435 |

| | | | | |

| | | | | 458,669 |

| | | | | |

Diversified Banks - 0.6% | | | | | |

Banco Santander Chile S.A. ADR | | 781 | | | 39,495 |

Wells Fargo & Company | | 4,598 | | | 163,781 |

| | | | | |

| | | | | 203,276 |

| | | | | |

Diversified Commercial & Professional Services - 0.7% | | | | | |

Pike Electric Corporation * | | 9,510 | | | 178,407 |

Ritchie Bros Auctioneers, Inc. | | 967 | | | 62,952 |

| | | | | |

| | | | | 241,359 |

| | | | | |

Diversified Metals & Mining - 0.6% | | | | | |

AMCOL International Corporation | | 4,110 | | | 136,000 |

Idaho General Mines, Inc. * | | 8,532 | | | 56,652 |

| | | | | |

| | | | | 192,652 |

| | | | | |

Electric Utilities - 0.1% | | | | | |

Korea Electric Power Corporation ADR | | 1,825 | | | 42,249 |

| | | | | |

Electrical Components & Equipment - 7.4% | | | | | |

American Superconductor Corporation * | | 4,087 | | | 83,702 |

Belden, Inc. | | 2,044 | | | 95,884 |

Cooper Industries, Ltd. | | 1,022 | | | 52,214 |

Evergreen Solar, Inc. * | | 2,846 | | | 25,415 |

General Cable Corporation * | | 3,577 | | | 240,088 |

GrafTech International, Ltd. * | | 8,781 | | | 156,653 |

Hubbell, Inc. (CI.B) | | 744 | | | 42,497 |

Powell Industries, Inc. * | | 6,519 | | | 247,005 |

Rockwell Automation, Inc. | | 6,642 | | | 461,685 |

Roper Industries, Inc. | | 6,627 | | | 434,069 |

Suntech Power Holdings Company, Ltd. ADR * | | 1,460 | | | 58,254 |

Thomas & Betts Corporation * | | 8,438 | | | 494,804 |

| | | | | |

| | | | | 2,392,270 |

| | | | | |

Electronic Equipment Manufacturers - 0.5% | | | | | |

Agilent Technologies, Inc. * | | 2,044 | | | 75,383 |

Itron, Inc. * | | 511 | | | 47,559 |

TDK Corporation ADR | | 511 | | | 44,712 |

| | | | | |

| | | | | 167,654 |

| | | | | |

Electronic Manufacturing Services - 0.4% | | | | | |

Flextronics International, Ltd. * | | 11,751 | | | 131,376 |

| | | | | |

Environmental & Facilities Services - 0.1% | | | | | |

Waste Management, Inc. | | 1,022 | | | 38,570 |

| | | | | |

Fertilizers & Agricultural Chemicals - 0.8% | | | | | |

Terra Nitrogen Company, LP | | 2,044 | | | 259,241 |

| | | | | |

The accompanying notes are an integral part of the financial statements

6

| | |

| Schedule of Investments | | Security Equity Fund - Alpha Opportunity Series |

September 30, 2007 - continued | | |

| | | | | |

| | | Shares | | Value |

COMMON STOCK (continued) | | | | | |

Food Distributors - 0.2% | | | | | |

Andersons, Inc. | | 1,022 | | $ | 49,076 |

| | | | | |

Food Retail - 0.4% | | | | | |

Kroger Company | | 4,087 | | | 116,561 |

| | | | | |

Gold - 1.0% | | | | | |

Newmont Mining Corporation | | 7,153 | | | 319,954 |

| | | | | |

Independent Power Producers & Energy Traders - 0.0% | | | | | |

Ormat Technologies, Inc. | | 59 | | | 2,734 |

| | | | | |

Industrial Conglomerates - 2.5% | | | | | |

Carlisle Companies, Inc. | | 4,161 | | | 202,225 |

General Electric Company | | 7,153 | | | 296,134 |

Teleflex, Inc. | | 1,715 | | | 133,633 |

Textron, Inc. | | 182 | | | 11,322 |

Walter Industries, Inc. | | 6,131 | | | 164,924 |

| | | | | |

| | | | | 808,238 |

| | | | | |

Industrial Machinery - 6.9% | | | | | |

Donaldson Company, Inc. | | 4,445 | | | 185,623 |

Dover Corporation | | 2,664 | | | 135,731 |

Dynamic Materials Corporation | | 4,824 | | | 231,022 |

Hardinge, Inc. | | 1,022 | | | 35,596 |

Harsco Corporation | | 3,493 | | | 207,030 |

IDEX Corporation | | 3,065 | | | 111,535 |

Ingersoll-Rand Company, Ltd. | | 511 | | | 27,834 |

ITT Corporation | | 153 | | | 10,393 |

Kennametal, Inc. | | 3,540 | | | 297,289 |

Lincoln Electric Holdings, Inc. | | 2,170 | | | 168,414 |

Parker Hannifin Corporation | | 2,044 | | | 228,581 |

Timken Company | | 4,161 | | | 154,581 |

Valmont Industries, Inc. | | 5,365 | | | 455,220 |

| | | | | |

| | | | | 2,248,849 |

| | | | | |

Integrated Oil & Gas - 0.8% | | | | | |

InterOil Corporation * | | 7,153 | | | 226,035 |

Sasol, Ltd. ADR | | 511 | | | 21,968 |

| | | | | |

| | | | | 248,003 |

| | | | | |

Internet Software & Services - 0.7% | | | | | |

Vignette Corporation * | | 11,401 | | | 228,818 |

| | | | | |

Metal & Glass Containers - 2.0% | | | | | |

Owens-Illinois, Inc. * (1) | | 15,627 | | | 647,739 |

| | | | | |

Oil &Gas Equipment & Services - 4.1% | | | | | |

Dril-Quip, Inc. * | | 5,620 | | | 277,347 |

Grant Prideco, Inc.* | | 5,620 | | | 306,402 |

Mitcham Industries, Inc. * | | 4,888 | | | 94,241 |

Schlumberger, Ltd. | | 6,131 | | | 643,755 |

| | | | | |

| | | | | 1,321,745 |

| | | | | |

Oil & Gas Exploration & Production - 2.1% | | | | | |

Denbury Resources, Inc. * | | 4,357 | | | 194,714 |

Forest Oil Corporation * | | 1,562 | | | 67,229 |

Harvest Natural Resources, Inc. * | | 14,744 | | | 176,043 |

Newfield Exploration Company * | | 1,022 | | | 49,220 |

PetroHawk Energy Corporation * | | 11,751 | | | 192,951 |

| | | | | |

| | | | | 680,157 |

| | | | | |

Oil & Gas Refining & Marketing - 1.0% | | | | | |

Valero Energy Corporation | | 4,598 | | | 308,894 |

| | | | | |

Oil & Gas Storage & Transportation - 0.9% | | | | | |

El Paso Corporation | | 14,306 | | | 242,773 |

Knightsbridge Tankers, Ltd. | | 1,448 | | | 38,951 |

| | | | | |

| | | | | 281,724 |

| | | | | |

Pharmaceuticals - 0.1% | | | | | |

Dr Reddys Laboratories, Ltd. ADR | | 1,825 | | | 29,857 |

| | | | | |

Semiconductor Equipment - 0.9% | | | | | |

ASM International N.V. | | 1,364 | | | 38,983 |

MEMC Electronic Materials, Inc. * | | 4,087 | | | 240,561 |

| | | | | |

| | | | | 279,544 |

| | | | | |

Semiconductors - 2.3% | | | | | |

Intel Corporation | | 11,167 | | | 288,779 |

ON Semiconductor Corporation * | | 37,297 | | | 468,450 |

| | | | | |

| | | | | 757,229 |

| | | | | |

Specialized REIT’s - 0.7% | | | | | |

Plum Creek Timber Company, Inc. | | 5,109 | | | 228,679 |

| | | | | |

Specialty Chemicals - 0.4% | | | | | |

Cytec Industries, Inc. | | 2,044 | | | 139,789 |

| | | | | |

Specialty Stores - 0.3% | | | | | |

Cabela’s, Inc. * | | 4,598 | | | 108,743 |

| | | | | |

Steel - 1.2% | | | | | |

Commercial Metals Company | | 2,533 | | | 80,169 |

Haynes International, Inc. * | | 1,533 | | | 130,872 |

Metal Management, Inc. | | 3,478 | | | 188,508 |

| | | | | |

| | | | | 399,549 |

| | | | | |

Wireless Telecommunication Services - 0.3% | | | | | |

Rogers Communications, Inc. (CI.B) | | 1,825 | | | 83,092 |

Telemig Celular Participacoes S.A. ADR | | 73 | | | 4,278 |

| | | | | |

| | | | | 87,370 |

| | | | | |

TOTAL COMMON STOCK (Cost $18,436,661) | | | | $ | 18,542,512 |

| | | | | |

The accompanying notes are an integral part of the financial statements

| | |

| Schedule of Investments | | Security Equity Fund - Alpha Opportunity Series |

September 30, 2007 - continued | | |

| | | | | | |

| | | Principal

Amount | | Value |

U.S. GOVERNMENT SPONSORED AGENCY BONDS & NOTES - 39.5% | | | | | | |

Federal Farm Credit Discount Note | | | | | | |

5.13% - 2007 (1) | | $ | 275,000 | | $ | 274,412 |

Federal Home Loan Bank | | | | | | |

4.705% - 2007 (1) | | | 1,050,000 | | | 1,044,225 |

4.84% - 2007 (1) | | | 1,050,000 | | | 1,043,306 |

4.93% - 2007 (1) | | | 750,000 | | | 744,469 |

5.11% - 2007 (1) | | | 950,000 | | | 946,414 |

5.13% - 2007 (1) | | | 200,000 | | | 199,723 |

Federal Home Loan Mortgage Corporation | | | | | | |

4.52% - 2007 (1) | | | 650,000 | | | 644,338 |

4.52% - 2007 (1) | | | 1,000,000 | | | 989,547 |

4.72% - 2007 (1) | | | 500,000 | | | 500,000 |

5.09% - 2007 (1) | | | 750,000 | | | 745,406 |

5.12% - 2007 (2) | | | 1,175,000 | | | 1,171,894 |

5.14% - 2007 (1) | | | 700,000 | | | 699,295 |

Federal National Mortgage Association | | | | | | |

4.52% - 2007 (1) | | | 1,000,000 | | | 991,040 |

4.53% - 2007 (1) | | | 1,000,000 | | | 990,169 |

4.59% - 2007 (1) | | | 350,000 | | | 349,643 |

4.72% - 2007 (1) | | | 250,000 | | | 249,937 |

4.77% - 2007 (1) | | | 225,000 | | | 224,100 |

5.11% - 2007 (1) | | | 725,000 | | | 722,902 |

5.115% - 2007 (1) | | | 300,000 | | | 298,613 |

| | | | | | |

TOTAL U.S. GOVERNMENT SPONSORED AGENCY BONDS & NOTES (Cost $12,825,566) | | | | | $ | 12,829,433 |

| | | | | | |

Total Investments (Security Equity Fund - Alpha Opportunity Series) | | | | | $ | 31,371,945 |

(Cost $31,262,227) - 96.7% | | | | | | |

Other Assets in Excess of Liabilities - 3.3% | | | | | | 1,069,668 |

| | | | | | |

TOTAL NET ASSETS - 100.0% | | | | | $ | 32,441,613 |

| | | | | | |

Schedule of Securities Sold Short

September 30, 2007

Security Equity Fund - Alpha Opportunity Series

| | | | | | | |

| | | Shares | | | Value | |

COMMON STOCK - (1.0)% | | (2,017 | ) | | $ | (179,110 | ) |

Exchange Traded Funds - (0.8)% | | | | | | | |

iShares Lehman 20+ Year Treasury | | | | | | | |

Retail HOLDRs Trust * | | (807 | ) | | | (80,829 | ) |

| | | | | | | |

| | | | | | (259,939 | ) |

| | | | | | | |

Life & Health Insurance - (0.1)% | | | | | | | |

Nationwide Financial Services | | (403 | ) | | | (21,689 | ) |

| | | | | | | |

Thrifts & Mortgage Finance - (0.1)% | | | | | | | |

Washington Mutual, Inc. | | (1,210 | ) | | | (42,725 | ) |

| | | | | | | |

TOTAL COMMON STOCK (Proceeds $326,738) | | | | | $ | (324,353 | ) |

| | | | | | | |

Total Securities Sold Short (Security Equity Fund - Alpha Opportunity Series) (Proceeds $326,738) | | | | | $ | (324,353 | ) |

| | | | | | | |

Footnotes

Percentages are stated as a percent of net assets.

For federal income tax purposes the identified cost of investments owned at 9/30/2007 was $31,357,765.

| | |

| * | | - Non-income producing security |

| 1 | | - Security is segregated as collateral for open futures contracts. |

| 2 | | - Security is segregated as collateral for short positions. |

|

| Glossary: |

| ADR | | - American Depositary Receipt |

See notes to financial statements.

The accompanying notes are an integral part of the financial statements

8

Security Equity Fund

Alpha Opportunity Series

Statement of Assets and Liabilities

September 30, 2007

| | | |

Assets: | | | |

Investments, at value* | | $ | 31,371,945 |

Cash | | | 4,085,343 |

Receivables: | | | |

Fund shares sold | | | 39,911 |

Securities sold | | | 5,526,687 |

Dividends | | | 7,417 |

Prepaid expenses | | | 13,796 |

| | | |

Total assets | | | 41,045,099 |

| | | |

Liabilities: | | | |

Common stock sold short, at value** | | | 324,353 |

Payable for: | | | |

Securities purchased | | | 7,891,828 |

Fund shares redeemed | | | 232,918 |

Variation margin | | | 55,250 |

Dividends on short sales | | | 266 |

Management fees | | | 56,179 |

Custodian fees | | | 2,771 |

Transfer agent/maintenance fees | | | 2,444 |

Administration fees | | | 4,549 |

Professional fees | | | 17,390 |

12b-1 distribution plan fees | | | 10,835 |

Directors’ fees | | | 632 |

Other | | | 4,071 |

| | | |

Total liabilities | | | 8,603,486 |

| | | |

Net assets | | $ | 32,441,613 |

| | | |

Net assets consist of: | | | |

Paid in capital | | $ | 26,303,979 |

Undistributed net realized gain on sale of investments | | | 5,486,189 |

Net unrealized appreciation in value of investments | | | 651,445 |

| | | |

Net assets | | $ | 32,441,613 |

| | | |

Class A: | | | |

Capital shares outstanding (unlimited number of shares authorized) | | | 1,798,732 |

Net assets | | $ | 25,071,508 |

Net asset value and redemption price per share | | $ | 13.94 |

| | | |

Maximum offering price per share (net asset value divided by 94.25%) | | $ | 14.79 |

| | | |

Class B: | | | |

Capital shares outstanding (unlimited number of shares authorized) | | | 235,002 |

Net assets | | $ | 3,154,103 |

Net asset value, offering and redemption price per share (excluding any applicable contingent deferred sales charge) | | $ | 13.42 |

| | | |

Class C: | | | |

Capital shares outstanding (unlimited number of shares authorized) | | | 314,027 |

Net assets | | $ | 4,216,002 |

Net asset value, offering and redemption price per share (excluding any applicable contingent deferred sales charge) | | $ | 13.43 |

| | | |

| | | |

* Investments, at cost | | $ | 31,262,227 |

** Common stock sold short, at proceeds | | | 326,738 |

Statement of Operations

For the Year Ended September 30, 2007

| | | | |

Investment Income: | | | | |

Dividends (net of foreign withholding tax of $166) | | $ | 134,761 | |

Interest | | | 732,597 | |

| | | | |

Total investment income | | | 867,358 | |

| | | | |

Expenses: | | | | |

Management fees | | | 631,487 | |

Transfer agent/maintenance fees | | | 33,875 | |

Administration fees | | | 53,900 | |

Custodian fees | | | 69,711 | |

Directors’ fees | | | 2,160 | |

Professional fees | | | 18,759 | |

Reports to shareholders | | | 4,605 | |

Registration fees | | | 31,933 | |

Other expenses | | | 3,110 | |

Dividends on short sales | | | 20,518 | |

12b-1 distribution fees - Class A | | | 56,852 | |

12b-1 distribution fees - Class B | | | 48,780 | |

12b-1 distribution fees - Class C | | | 55,922 | |

| | | | |

Total expenses | | | 1,031,612 | |

Less: | | | | |

Earnings credits applied | | | (65,972 | ) |

| | | | |

Net expenses | | | 965,640 | |

| | | | |

Net investment loss | | | (98,282 | ) |

| | | | |

Net Realized and Unrealized Gain (Loss): | | | | |

Net realized gain (loss) during the year on: | | | | |

Investments | | | 6,298,596 | |

Securities sold short | | | (375,652 | ) |

Futures | | | 950,617 | |

| | | | |

Net realized gain | | | 6,873,561 | |

| | | | |

Net unrealized appreciation (depreciation) during the year on: | | | | |

Investments | | | 445,928 | |

Securities sold short | | | 96,394 | |

Futures | | | 355,739 | |

| | | | |

Net unrealized appreciation | | | 898,061 | |

| | | | |

Net realized and unrealized gain | | | 7,771,622 | |

| | | | |

Net increase in net assets resulting from operations | | $ | 7,673,340 | |

| | | | |

The accompanying notes are an integral part of the financial statements

9

| | |

| | | Security Equity Fund |

| Statement of Changes in Net Assets | | Alpha Opportunity Series |

| | | | | | | | |

| | | Year Ended

September 30, 2007 | | | Year Ended

September 30, 2006 | |

Increase (decrease) in net assets from operations: | | | | | | | | |

Net investment loss | | $ | (98,282 | ) | | $ | (212,445 | ) |

Net realized gain during the year on investments | | | 6,873,561 | | | | 2,290,275 | |

Net unrealized appreciation (depreciation) during the year on investments | | | 898,061 | | | | (514,291 | ) |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 7,673,340 | | | | 1,563,539 | |

| | | | | | | | |

Distributions to shareholders from: | | | | | | | | |

Net realized gain | | | | | | | | |

Class A | | | (2,136,563 | ) | | | (1,193,077 | ) |

Class B | | | (523,991 | ) | | | (346,675 | ) |

Class C | | | (617,311 | ) | | | (438,798 | ) |

| | | | | | | | |

Total distributions to shareholders | | | (3,277,865 | ) | | | (1,978,550 | ) |

| | | | | | | | |

Capital share transactions: | | | | | | | | |

Proceeds from sale of shares | | | | | | | | |

Class A | | | 10,352,391 | | | | 7,974,133 | |

Class B | | | 1,279,776 | | | | 988,390 | |

Class C | | | 1,430,285 | | | | 1,340,669 | |

Distributions reinvested | | | | | | | | |

Class A | | | 2,077,296 | | | | 1,170,685 | |

Class B | | | 522,694 | | | | 343,297 | |

Class C | | | 556,963 | | | | 380,745 | |

Cost of shares redeemed | | | | | | | | |

Class A | | | (11,078,834 | ) | | | (2,922,942 | ) |

Class B | | | (4,098,624 | ) | | | (512,280 | ) |

Class C | | | (4,012,623 | ) | | | (3,871,410 | ) |

| | | | | | | | |

Net increase (decrease) from capital share transactions | | | (2,970,676 | ) | | | 4,891,287 | |

| | | | | | | | |

Net increase in net assets | | | 1,424,799 | | | | 4,476,276 | |

| | | | | | | | |

Net assets: | | | | | | | | |

Beginning of year | | | 31,016,814 | | | | 26,540,538 | |

| | | | | | | | |

End of year | | $ | 32,441,613 | | | $ | 31,016,814 | |

| | | | | | | | |

Accumulated net investment loss at end of year | | $ | — | | | $ | (103 | ) |

| | | | | | | | |

Capital share activity: | | | | | | | | |

Shares sold | | | | | | | | |

Class A | | | 802,495 | | | | 641,932 | |

Class B | | | 104,269 | | | | 81,728 | |

Class C | | | 114,901 | | | | 110,434 | |

Shares reinvested | | | | | | | | |

Class A | | | 174,124 | | | | 99,888 | |

Class B | | | 45,216 | | | | 29,904 | |

Class C | | | 48,180 | | | | 33,166 | |

Shares redeemed | | | | | | | | |

Class A | | | (862,512 | ) | | | (239,609 | ) |

Class B | | | (321,701 | ) | | | (42,378 | ) |

Class C | | | (317,535 | ) | | | (318,091 | ) |

The accompanying notes are an integral part of the financial statements

10

| | |

| Financial Highlights | | Security Equity Fund |

| Selected data for each share of capital stock outstanding throughout each year | | Alpha Opportunity Series |

|

| | | | | | | | | | | | | | | | | | | | |

Class A | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | Year Ended

September 30,

2003a | |

Per Share Data | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 12.23 | | | $ | 12.37 | | | $ | 11.79 | | | $ | 10.21 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment lossb | | | (0.01 | ) | | | (0.06 | ) | | | (0.10 | ) | | | (0.16 | ) | | | (0.03 | ) |

Net gain on securities (realized and unrealized) | | | 2.99 | | | | 0.93 | | | | 1.50 | | | | 2.33 | | | | 0.24 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 2.98 | | | | 0.87 | | | | 1.40 | | | | 2.17 | | | | 0.21 | |

| | | | | | | | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | | | | | | | | |

Distributions from realized gains | | | (1.27 | ) | | | (1.01 | ) | | | (0.82 | ) | | | (0.59 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (1.27 | ) | | | (1.01 | ) | | | (0.82 | ) | | | (0.59 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 13.94 | | | $ | 12.23 | | | $ | 12.37 | | | $ | 11.79 | | | $ | 10.21 | |

| | | | | | | | | | | | | | | | | | | | |

Total Returnc | | | 26.10 | % | | | 7.39 | % | | | 12.26 | % | | | 21.68 | % | | | 2.10 | % |

| | | | | | | | | | | | | | | | | | | | |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 25,072 | | | $ | 20,595 | | | $ | 14,622 | | | $ | 6,556 | | | $ | 2,935 | |

| | | | | | | | | | | | | | | | | | | | |

Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.08 | )% | | | (0.50 | )% | | | (0.83 | )% | | | (1.48 | )% | | | (1.35 | )% |

Total expensesd | | | 2.88 | % | | | 3.20 | % | | | 2.94 | % | | | 3.57 | % | | | 3.25 | % |

Net expensese | | | 2.68 | % | | | 3.01 | % | | | 2.86 | % | | | 2.78 | % | | | 2.75 | % |

Net expenses prior to custodian earning credits and net of expense waivers | | | 2.88 | % | | | 3.10 | % | | | 2.86 | % | | | 2.79 | % | | | 2.75 | % |

Net expenses prior to performance fee adjustmentf | | | 2.77 | % | | | 2.82 | % | | | 2.78 | % | | | 2.78 | % | | | 2.75 | % |

| | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 1,697 | % | | | 1,302 | % | | | 1,502 | % | | | 1,175 | % | | | 867 | % |

| | | | | |

Class B | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | Year Ended

September 30,

2003a | |

Per Share Data | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 11.90 | | | $ | 12.15 | | | $ | 11.68 | | | $ | 10.20 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment lossb | | | (0.09 | ) | | | (0.15 | ) | | | (0.18 | ) | | | (0.25 | ) | | | (0.05 | ) |

Net gain on securities (realized and unrealized) | | | 2.88 | | | | 0.91 | | | | 1.47 | | | | 2.32 | | | | 0.25 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 2.79 | | | | 0.76 | | | | 1.29 | | | | 2.07 | | | | 0.20 | |

| | | | | | | | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | | | | | | | | |

Distributions from realized gains | | | (1.27 | ) | | | (1.01 | ) | | | (0.82 | ) | | | (0.59 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (1.27 | ) | | | (1.01 | ) | | | (0.82 | ) | | | (0.59 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 13.42 | | | $ | 11.90 | | | $ | 12.15 | | | $ | 11.68 | | | $ | 10.20 | |

| | | | | | | | | | | | | | | | | | | | |

Total Returnc | | | 25.14 | % | | | 6.56 | % | | | 11.39 | % | | | 20.68 | % | | | 2.00 | % |

| | | | | | | | | | | | | | | | | | | | |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 3,154 | | | $ | 4,846 | | | $ | 4,106 | | | $ | 2,324 | | | $ | 1,731 | |

| | | | | | | | | | | | | | | | | | | | |

Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.77 | )% | | | (1.24 | )% | | | (1.60 | )% | | | (2.25 | )% | | | (2.11 | )% |

Total expensesd | | | 3.59 | % | | | 3.95 | % | | | 3.69 | % | | | 4.29 | % | | | 4.01 | % |

Net expensese | | | 3.39 | % | | | 3.76 | % | | | 3.61 | % | | | 3.53 | % | | | 3.50 | % |

Net expenses prior to custodian earning credits and net of expense waivers | | | 3.59 | % | | | 3.85 | % | | | 3.61 | % | | | 3.53 | % | | | 3.50 | % |

Net expenses prior to performance fee adjustmentf | | | 3.51 | % | | | 3.57 | % | | | 3.53 | % | | | 3.53 | % | | | 3.50 | % |

| | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 1,697 | % | | | 1,302 | % | | | 1,502 | % | | | 1,175 | % | | | 867 | % |

The accompanying notes are an integral part of the financial statements

11

| | |

| Financial Highlights | | Security Equity Fund |

Selected data for each share of capital stock outstanding throughout each year | | Alpha Opportunity Series |

| | | | | | | | | | | | | | | | | | | | |

Class C | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | Year Ended

September 30,

2003a | |

Per Share Data | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 11.90 | | | $ | 12.15 | | | $ | 11.68 | | | $ | 10.20 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment lossb | | | (0.10 | ) | | | (0.15 | ) | | | (0.18 | ) | | | (0.25 | ) | | | (0.05 | ) |

Net gain on securities (realized and unrealized) | | | 2.90 | | | | 0.91 | | | | 1.47 | | | | 2.32 | | | | 0.25 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 2.80 | | | | 0.76 | | | | 1.29 | | | | 2.07 | | | | 0.20 | |

| | | | | | | | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | | | | | | | | |

Distributions from realized gains | | | (1.27 | ) | | | (1.01 | ) | | | (0.82 | ) | | | (0.59 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (1.27 | ) | | | (1.01 | ) | | | (0.82 | ) | | | (0.59 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 13.43 | | | $ | 11.90 | | | $ | 12.15 | | | $ | 11.68 | | | $ | 10.20 | |

| | | | | | | | | | | | | | | | | | | | |

Total Returnc | | | 25.24 | % | | | 6.56 | % | | | 11.39 | % | | | 20.68 | % | | | 2.00 | % |

| | | | | | | | | | | | | | | | | | | | |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 4,216 | | | $ | 5,576 | | | $ | 7,813 | | | $ | 3,143 | | | $ | 1,723 | |

| | | | | | | | | | | | | | | | | | | | |

Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.77 | )% | | | (1.18 | )% | | | (1.58 | )% | | | (2.24 | )% | | | (2.11 | )% |

Total expensesd | | | 3.60 | % | | | 3.95 | % | | | 3.68 | % | | | 4.30 | % | | | 4.01 | % |

Net expensese | | | 3.40 | % | | | 3.75 | % | | | 3.61 | % | | | 3.53 | % | | | 3.50 | % |

Net expenses prior to custodian earning credits and net of expense waivers | | | 3.60 | % | | | 3.83 | % | | | 3.61 | % | | | 3.53 | % | | | 3.50 | % |

Net expenses prior to performance fee adjustmentf | | | 3.51 | % | | | 3.57 | % | | | 3.53 | % | | | 3.53 | % | | | 3.50 | % |

| | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 1,697 | % | | | 1,302 | % | | | 1,502 | % | | | 1,175 | % | | | 867 | % |

a | Security Alpha Opportunity Series was initially capitalized on July 7, 2003 with a net asset value of $10 per share. Percentage amounts for the period, except total return have been annualized. |

b | Net investment income (loss) was computed using average shares outstanding throughout the period. |

c | Total return information does not reflect deduction of any sales charges imposed at the time of purchase for Class A shares or upon redemption for Class B and C shares. |

d | Total expense information reflects expense ratios absent expense reductions by the Investment Manager and custodian earnings credits, as applicable. |

e | Net expense information reflects the expense ratios after voluntary expense waivers, reimbursements and custodian earnings credits, as applicable. |

f | Net expenses prior to performance fee adjustment reflect ratios after voluntary expense waivers, reimbursements, custodian earnings credits, and before performance fees adjustments, as applicable. |

The accompanying notes are an integral part of the financial statements

12

| | |

| | Security Equity Fund |

| Manager’s Commentary | | Equity Series |

| November 15, 2007 | | (unaudited) |

Adviser, Security Global Investors

Mark Mitchell

Senior Portfolio Manager

To Our Shareholders:

Security Equity Fund Equity Series returned 10.33%1 in the period, lagging the benchmark S&P 500 Index’s return of 16.44% and the Series’ peer group median return of 15.92%. While disappointed in relative performance in fiscal 2007, we believe that our approach will deliver good performance over a long-term investment horizon.

Our strategy is to buy companies that are trading at a significant discount to their intrinsic value. Our investment approach is a defined and disciplined process of three clear philosophical tenants that drive our investment decisions: a valuation focus, a long-term perspective and an opportunistic approach.

This investment process is fundamentally driven and quantitatively aided. We use proprietary screens to identify potential companies for investment and then perform rigorous fundamental analysis to identify the best ideas. Through this fundamental research, we determine an estimate of intrinsic value and thus a valuation target for each idea. We construct the portfolios based on the level of conviction generated by this bottom-up analysis and the upside/downside profile associated with each company.

Health Care Stocks Top Performers

The Series’ health care holdings were up 15% compared to 9% for the index. Medco Health Solutions, Inc., was up 50%, driven by increasing mail order business and higher generic prescription penetration. Both Zimmer Holdings, up 16%, and Hospira, up 22%, contributed positive performance in the health care sector and the portfolio overall. Solid execution in each business helped drive their results.

Energy and Consumer Discretionary Disappointing

Energy sector holdings in the portfolio detracted even with an overweight in an outperforming sector due to stock selection. The sector returned 20% for the portfolio versus 43% for the S&P 500 Index. Evergreen Energy, Inc., down 51% (previously known as KFx) and BJ Services Company, down 11%, both contributed negatively to the Series performance. Evergreen Energy was hurt by concerns over the viability of the initial production results of its proprietary clean coal technology. BJ Services was impacted more generally by industry challenges in its core North American pressure pumping business.

The consumer discretionary sector in general experienced a difficult environment in fiscal 2007. The Series return was flat in the sector versus a gain of 6% for the Index. Home Depot, Inc., was the largest detractor, falling nearly 8% over the period, due to the impact of a slowing housing market. We feel confident that Home Depot still enjoys a solid competitive position and will benefit once the housing market improves.

2008 Market Outlook

Our bottom-up approach looks at market uncertainty in the context of the potential long-term impact on individual companies. Oftentimes, volatility provides opportunity. We are maintaining flexibility in the portfolios to take advantage of these opportunities as they arise. Our focus is on identifying companies with the ability to be substantially better over the next three to five years or have the potential to maintain their return on capital at current levels in a difficult economic environment. We are confident in our ability to find these companies and we are pleased with the positions we own today.

We believe that investing is a long-term pursuit that requires patience and a consistent approach. Dollar cost averaging is a sound way to build long-term value. We recognize there are many investment fund alternatives available today and thank you for your business and the confidence you place in us.

Sincerely,

Mark Mitchell

Senior Portfolio Manager

| 1 | Performance figures are based on Class A shares and do not reflect deduction of the sales charges or taxes that a shareholder would pay on distributions or the redemption of shares. |

13

| | |

| | Security Equity Fund |

| Performance Summary | | Equity Series |

| September 30, 2007 | | (unaudited) |

PERFORMANCE

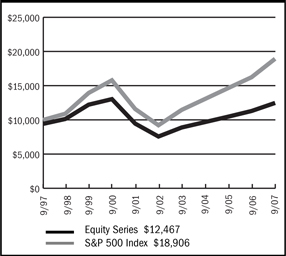

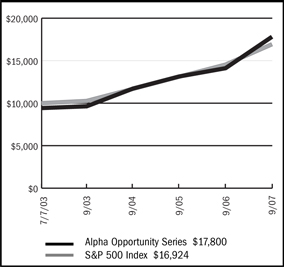

Security Equity Series vs. S&P 500 Index

$10,000 Over Ten Years

This chart assumes a $10,000 investment in Class A shares of Equity Series on September 30, 1997, reflects deduction of the 5.75% sales load and assumes all dividends reinvested. The chart does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of fund shares. The S&P 500 Index is a capitalization weighted index composed of 500 selected common stocks that represent the broad domestic economy and is a widely recognized unmanaged index of market performance.

Average Annual Returns

| | | | | | | | | | | | |

Periods Ended 9-30-07 | | 1 Year | | | 5 Years | | | 10 Years | | | Since

Inception | |

A Shares | | 10.33 | % | | 10.50 | % | | 2.83 | % | | — | |

| | | | |

A Shares with sales charge | | 3.96 | % | | 9.20 | % | | 2.23 | % | | — | |

| | | | |

B Shares | | 9.33 | % | | 9.66 | % | | 2.09 | % | | — | |

| | | | |

B Shares with CDSC | | 4.45 | % | | 9.38 | % | | 2.09 | % | | — | |

| | | | |

C Shares | | 9.45 | % | | 9.69 | % | | — | | | (0.86

(1-29-99 | )%

) |

| | | | |

C Shares with CDSC | | 8.47 | % | | 9.69 | % | | — | | | (0.86

(1-29-99 | )%

) |

The performance data above represents past performance that is not predictive of future results. The investment return and principal value of an investment in the Series will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The figures above do not reflect deduction of the maximum front-end sales charge of 5.75% for Class A shares or the contingent deferred sales charge of 5% for Class B shares and 1% for Class C shares, as applicable, except where noted. The figures do not reflect the deduction of taxes that a shareholder would pay on distributions or redemption of shares. Such figures would be lower if the maximum sales charge and any applicable taxes were deducted.

Portfolio Composition by Sector as of 9-30-07

| | | |

| |

Consumer Discretionary | | 10.20 | % |

| |

Consumer Staples | | 8.00 | |

| |

Energy | | 12.42 | |

| |

Financials | | 27.97 | |

| |

Health Care | | 9.37 | |

| |

Industrials | | 16.35 | |

| |

Information Technology | | 11.08 | |

| |

Telecommunication Services | | 2.63 | |

| |

Commercial Paper | | 1.98 | |

| |

Repurchase Agreement | | 0.10 | |

| |

Liabilities in excess of other assets | | (0.10 | ) |

| |

Total net assets | | 100.00 | % |

| | | |

The accompanying notes are an integral part of the financial statements

14

| | |

| | Security Equity Fund |

| Performance Summary | | Equity Series |

| September 30, 2007 | | (unaudited) |

PERFORMANCE

Information About Your Series Expenses

Calculating your ongoing Series expenses

Example

As a shareholder of the Series, you incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; contingent deferred sales charges on redemptions; and redemption fees, if any; and (2) ongoing costs, including management fees; distribution and/or service fees (12b-1); and other Series expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Series and to compare these costs with ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, April 1, 2007 – September 30, 2007.

Actual Expenses

The first line for each class of shares in the table provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each class of shares in the table provides information about hypothetical account values and hypothetical expenses based on the Series actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Series actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Series and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) on purchase payments, contingent deferred sales charges on redemptions, and redemption fees, if any. Therefore, the second line for each class of shares is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Series Expenses

| | | | | | | | | |

| | | Beginning

Account Value

04-01-07 | | Ending

Account Value

09-30-071 | | Expenses Paid

During

Period2 |

Equity Series - Class A | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,047.50 | | $ | 6.88 |

Hypothetical | | | 1,000.00 | | | 1,018.25 | | | 6.78 |

| | | |

Equity Series - Class B | | | | | | | | | |

Actual | | | 1,000.00 | | | 1,042.50 | | | 10.65 |

Hypothetical | | | 1,000.00 | | | 1,014.56 | | | 10.50 |

| | | |

Equity Series - Class C | | | | | | | | | |

Actual | | | 1,000.00 | | | 1,043.20 | | | 10.65 |

Hypothetical | | | 1,000.00 | | | 1,014.56 | | | 10.50 |

1 | The actual ending account value is based on the actual total return of the Series for the period from April 1, 2007 to September 30, 2007 after actual expenses and will differ from the hypothetical ending account value which is based on the Series expense ratio and a hypothetical annual return of 5% before expenses. The actual cumulative return at net asset value for the period from April 1, 2007 to September 30, 2007 was 4.75%, 4.25% and 4.32%, for Class A, B and C shares, respectively. |

2 | Expenses are equal to the Series annualized expense ratio (1.34%, 2.08% and 2.08% for Class A, B and C shares, respectively), net of earnings credits, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). |

15

| | |

| Schedule of Investments | | Security Equity Fund - Equity Series |

| September 30, 2007 | | |

| | | | | |

| | | Shares | | Value |

COMMON STOCK - 98.0% | | | | | |

Aerospace & Defense - 3.3% | | | | | |

General Dynamics Corporation | | 135,800 | | $ | 11,471,026 |

| | | | | |

Air Freight & Logistics - 3.3% | | | | | |

FedEx Corporation | | 107,700 | | | 11,281,575 |

| | | | | |

Broadcasting & Cable TV - 1.4% | | | | | |

CBS Corporation (CI.B) | | 158,100 | | | 4,980,150 |

| | | | | |

Building Products - 1.8% | | | | | |

USG Corporation * | | 167,000 | | | 6,270,850 |

| | | | | |

Coal & Consumable Fuels - 1.4% | | | | | |

Evergreen Energy, Inc. * | | 979,800 | | | 4,996,980 |

| | | | | |

Communications Equipment - 2.5% | | | | | |

ADC Telecommunications, Inc. * | | 447,757 | | | 8,780,515 |

| | | | | |

Consumer Finance - 12.7% | | | | | |

American Express Company | | 193,850 | | | 11,508,874 |

Capital One Financial Corporation | | 167,600 | | | 11,133,668 |

Discover Financial Services | | 199,000 | | | 4,139,200 |

First Marblehead Corporation | | 461,350 | | | 17,499,006 |

| | | | | |

| | | | | 44,280,748 |

| | | | | |

Data Processing & Outsourced Services - 2.8% | | | | | |

Western Union Company | | 456,400 | | | 9,570,708 |

| | | | | |

Drug Retail - 2.5% | | | | | |

CVS Caremark Corporation | | 217,600 | | | 8,623,488 |

| | | | | |

Electronic Manufacturing Services - 1.0% | | | | | |

Tyco Electronics, Ltd. | | 98,575 | | | 3,492,512 |

| | | | | |

Health Care Equipment - 3.3% | | | | | |

Covidien, Ltd. | | 98,575 | | | 4,090,863 |

Hospira, Inc. * | | 175,700 | | | 7,282,765 |

| | | | | |

| | | | | 11,373,628 |

| | | | | |

Health Care Services - 2.5% | | | | | |

Medco Health Solutions, Inc. * | | 97,250 | | | 8,790,427 |

| | | | | |

Home Improvement Retail - 3.9% | | | | | |

Home Depot, Inc. | | 421,700 | | | 13,679,948 |

| | | | | |

Hotels, Resorts & Cruise Lines - 2.2% | | | | | |

Carnival Corporation | | 158,800 | | | 7,690,684 |

| | | | | |

Hypermarkets & Super Centers - 5.5% | | | | | |

Costco Wholesale Corporation | | 122,800 | | | 7,536,236 |

Wal-Mart Stores, Inc. | | 267,000 | | | 11,654,550 |

| | | | | |

| | | | | 19,190,786 |

| | | | | |

Industrial Conglomerates - 8.0% | | | | | |

General Electric Company | | 451,400 | | | 18,687,960 |

McDermott International, Inc. * | | 89,000 | | | 4,813,120 |

Tyco International, Ltd. | | 98,575 | | | 4,370,815 |

| | | | | |

| | | | | 27,871,895 |

| | | | | |

Integrated Oil & Gas - 7.6% | | | | | |

Chevron Corporation | | 128,500 | | | 12,025,030 |

Exxon Mobil Corporation | | 153,700 | | | 14,226,472 |

| | | | | |

| | | | | 26,251,502 |

| | | | | |

IT Consulting & Other Services - 0.5% | | | | | |

Unisys Corporation * | | 277,000 | | | 1,833,740 |

| | | | | |

Movies & Entertainment - 2.6% | | | | | |

Time Warner, Inc. | | 498,000 | | | 9,143,280 |

| | | | | |

Multi-Line Insurance - 5.3% | | | | | |

American International Group, Inc. | | 274,400 | | | 18,563,160 |

| | | | | |

Oil & Gas Drilling - 1.2% | | | | | |

Transocean, Inc. * | | 36,200 | | | 4,092,410 |

| | | | | |

Oil & Gas Equipment & Services - 2.3% | | | | | |

Baker Hughes, Inc. | | 30,300 | | | 2,738,211 |

BJ Services Company | | 53,900 | | | 1,431,045 |

Halliburton Company | | 95,600 | | | 3,671,040 |

| | | | | |

| | | | | 7,840,296 |

| | | | | |

Other Diversified Financial Services - 5.3% | | | | | |

Citigroup, Inc. | | 244,600 | | | 11,415,482 |

JPMorgan Chase & Company | | 150,600 | | | 6,900,492 |

| | | | | |

| | | | | 18,315,974 |

| | | | | |

Pharmaceuticals - 3.6% | | | | | |

Johnson & Johnson | | 189,000 | | | 12,417,300 |

| | | | | |

Property & Casualty Insurance - 4.6% | | | | | |

Berkshire Hathaway, Inc. * | | 136 | | | 16,117,360 |

| | | | | |

Systems Software - 4.3% | | | | | |

Microsoft Corporation | | 505,300 | | | 14,886,138 |

| | | | | |

Wireless Telecommunication Services - 2.6% | | | | | |

Sprint Nextel Corporation | | 480,600 | | | 9,131,400 |

| | | | | |

TOTAL COMMON STOCK (Cost $278,832,0 51) | | | | $ | 340,938,480 |

| | | | | |

| | |

| | | Principal

Amount | | Value |

COMMERCIAL PAPER - 2.0% | | | | | |

Banking - 0.4% | | | | | |

UBS Finance (DE) LLC | | | | | |

4.68%, 10/10/2007 | | 1,500,000 | | | 1,498,245 |

| | | | | |

Brokerage - 0.6% | | | | | |

JP Morgan Chase & Company | | | | | |

4.70%, 10/3/2007 | | 2,000,000 | | | 1,999,478 |

| | | | | |

Financial Companies - Captive - 1.0% | | | | | |

General Electric Capital Corporation | | | | | |

4.60%, 10/1/2007 | | 1,400,000 | | | 1,400,000 |

The accompanying notes are an integral part of the financial statements

16

| | |

| Schedule of Investments | | Security Equity Fund - Equity Series |

September 30, 2007 - continued | | |

| | | | | | | |

| | | Principal

Amount | | Value | |

COMMERCIAL PAPER (continued) | | | | | | | |

Financial Companies - Captive (continued) | | | | | | | |

General Electric Capital Corporation (continued) | | | | | | | |

4.65%, 10/4/2007 | | | 2,000,000 | | $ | 1,999,225 | |

| | | | | | | |

| | | | | | 3,399,225 | |

| | | | | | | |

TOTAL COMMERCIAL PAPER (Cost $6,896,948) | | | | | $ | 6,896,948 | |

| | | | | | | |

REPURCHASE AGREEMENT - 0.1% | | | | | | | |

United Missouri Bank, 4.53%, dated 9/28/07; repurchase amount $333,126 (Collateralized by U.S. Treasury Note, 3.625%, 1/15/10 with a value of $339,930) | | $ | 333,000 | | $ | 333,000 | |

| | | | | | | |

TOTAL REPURCHASE AGREEMENT (Cost $333,000) | | | | | $ | 333,000 | |

| | | | | | | |

Total Investments (Security Equity Fund - Equity Series) | | | | | $ | 348,168,428 | |

(Cost $286,061,999) - 100.1% | | | | | | | |

Liabilities in Excess of Other Assets - (0.1)% | | | | | | (342,680 | ) |

| | | | | | | |

TOTAL NET ASSETS - 100.0% | | | | | $ | 347,825,748 | |

| | | | | | | |

Footnotes

Percentages are stated as a percent of net assets.

For federal income tax purposes the identified cost of investments owned at 9/30/2007 was $286,061,999.

| | |

| * | | - Non-income producing security |

See notes to financial statements.

The accompanying notes are an integral part of the financial statements

17

Security Equity Fund

Equity Series

Statement of Assets & Liabilities

September 30, 2007

| | | |

| Assets: | | |

Investments, at value* | | $ | 348,168,428 |

Cash | | | 251 |

Receivables: | | | |

Fund shares sold | | | 27,765 |

Dividends | | | 207,969 |

Prepaid expenses | | | 22,541 |

| | | |

Total assets | | | 348,426,954 |

| | | |

Liabilities: | | | |

Payable for: | | | |

Fund shares redeemed | | | 157,477 |

Management fees | | | 212,890 |

Custodian fees | | | 1,109 |

Transfer agent/maintenance fees | | | 31,895 |

Administration fees | | | 27,066 |

Professional fees | | | 40,885 |

12b-1 distribution plan fees | | | 86,356 |

Directors’ fees | | | 3,927 |

Other | | | 39,601 |

| | | |

Total liabilities | | | 601,206 |

| | | |

Net assets | | $ | 347,825,748 |

| | | |

Net assets consist of: | | | |

Paid in capital | | $ | 241,559,371 |

Undistributed net realized gain on sale of investments | | | 44,159,948 |

Net unrealized appreciation in value of investments | | | 62,106,429 |

| | | |

Net assets | | $ | 347,825,748 |

| | | |

Class A: | | | |

Capital shares outstanding (unlimited number of shares authorized) | | | 47,222,052 |

Net assets | | $ | 322,849,641 |

Net asset value and redemption price per share | | $ | 6.84 |

| | | |

Maximum offering price per share (net asset value divided by 94.25%) | | $ | 7.26 |

| | | |

Class B: | | | |

Capital shares outstanding (unlimited number of shares authorized) | | | 3,381,623 |

Net assets | | $ | 19,927,697 |

Net asset value, offering and redemption price per share (excluding any applicable contingent deferred sales charge) | | $ | 5.89 |

| | | |

Class C: | | | |

Capital shares outstanding (unlimited number of shares authorized) | | | 804,291 |

Net assets | | $ | 5,048,410 |

Net asset value, offering and redemption price per share (excluding any applicable contingent deferred sales charge) | | $ | 6.28 |

| | | |

* Investments, at cost | | $ | 286,061,999 |

Statement of Operations

For the Year Ended September 30, 2007

| | | | |

| Investment Income: | | | |

Dividends | | $ | 4,888,681 | |

Interest | | | 484,701 | |

| | | | |

Total investment income | | | 5,373,382 | |

| | | | |

Expenses: | | | | |

Management fees | | | 2,970,576 | |

Transfer agent/maintenance fees | | | 768,683 | |

Administration fees | | | 376,938 | |

Custodian fees | | | 29,163 | |

Directors’ fees | | | 20,917 | |

Professional fees | | | 37,799 | |

Reports to shareholders | | | 42,998 | |

Registration fees | | | 41,709 | |

Other expenses | | | 27,983 | |

12b-1 distribution fees - Class A | | | 915,806 | |

12b-1 distribution fees - Class B | | | 240,835 | |

12b-1 distribution fees - Class C | | | 56,710 | |

| | | | |

Total expenses | | | 5,530,117 | |

Less: | | | | |

Earnings credits applied | | | (8 | ) |

| | | | |

Net expenses | | | 5,530,109 | |

| | | | |

Net investment loss | | | (156,727 | ) |

| | | | |

Net Realized and Unrealized Gain (Loss): | | | | |

Net realized gain (loss) during the year on: | | | | |

Investments | | | 50,914,314 | |

Options written | | | 693,378 | |

| | | | |

Net realized gain | | | 51,607,692 | |

| | | | |

Net unrealized appreciation (depreciation) during the year on: | | | | |

Investments | | | (11,688,583 | ) |

Options written | | | 164,800 | |

| | | | |

Net unrealized depreciation | | | (11,523,783 | ) |

| | | | |

Net realized and unrealized gain | | | 40,083,909 | |

| | | | |

Net increase in net assets resulting from operations | | $ | 39,927,182 | |

| | | | |

The accompanying notes are an integral part of the financial statements

18

| | |

| | | Security Equity Fund |

| Statement of Changes in Net Assets | | Equity Series |

| | | | | | | | |

| | | Year Ended

September 30, 2007 | | | Year Ended

September 30, 2006 | |

Increase (decrease) in net assets from operations: | | | | | | | | |

Net investment loss | | $ | (156,727 | ) | | $ | (625,371 | ) |

Net realized gain during the year on investments | | | 51,607,692 | | | | 41,580,103 | |

Net unrealized depreciation during the year on investments | | | (11,523,783 | ) | | | (9,213,626 | ) |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 39,927,182 | | | | 31,741,106 | |

| | | | | | | | |

Distributions to shareholders from: | | | | | | | | |

Net investment income | | | | | | | | |

Class A | | | — | | | | (2,147,421 | ) |

Net realized gain | | | | | | | | |

Class A | | | (36,813,817 | ) | | | (11,068,277 | ) |

Class B | | | (2,833,129 | ) | | | (1,320,160 | ) |

Class C | | | (617,995 | ) | | | (182,232 | ) |

| | | | | | | | |

Total distributions to shareholders | | | (40,264,941 | ) | | | (14,718,090 | ) |

| | | | | | | | |

Capital share transactions: | | | | | | | | |

Proceeds from sale of shares | | | | | | | | |

Class A | | | 22,425,266 | | | | 52,710,115 | |

Class B | | | 4,149,590 | | | | 7,159,305 | |

Class C | | | 664,065 | | | | 1,001,095 | |

Distributions reinvested | | | | | | | | |

Class A | | | 33,789,629 | | | | 12,004,929 | |

Class B | | | 2,766,531 | | | | 1,296,700 | |

Class C | | | 607,148 | | | | 180,424 | |

Cost of shares redeemed | | | | | | | | |

Class A | | | (104,634,399 | ) | | | (84,851,352 | ) |

Class B | | | (14,318,878 | ) | | | (21,542,434 | ) |

Class C | | | (1,927,297 | ) | | | (1,287,944 | ) |

| | | | | | | | |

Net decrease from capital share transactions | | | (56,478,345 | ) | | | (33,329,162 | ) |

| | | | | | | | |

Net decrease in net assets | | | (56,816,104 | ) | | | (16,306,146 | ) |

| | | | | | | | |

Net assets: | | | | | | | | |

Beginning of year | | | 404,641,852 | | | | 420,947,998 | |

| | | | | | | | |

End of year | | $ | 347,825,748 | | | $ | 404,641,852 | |

| | | | | | | | |

Accumulated net investment income at end of year | | $ | — | | | $ | — | |

| | | | | | | | |

Capital share activity: | | | | | | | | |

Shares sold | | | | | | | | |

Class A | | | 3,287,276 | | | | 8,042,578 | |

Class B | | | 699,825 | | | | 1,205,513 | |

Class C | | | 105,654 | | | | 160,281 | |

Shares reinvested | | | | | | | | |

Class A | | | 5,073,518 | | | | 1,816,177 | |

Class B | | | 479,468 | | | | 221,280 | |

Class C | | | 98,723 | | | | 29,101 | |

Shares redeemed | | | | | | | | |

Class A | | | (15,274,912 | ) | | | (12,720,895 | ) |

Class B | | | (2,408,381 | ) | | | (3,666,875 | ) |

Class C | | | (307,016 | ) | | | (208,581 | ) |

The accompanying notes are an integral part of the financial statements

19

| | |

| Financial Highlights | | Security Equity Fund |

| Selected data for each share of capital stock outstanding throughout each year | | Equity Series |

| | | | | | | | | | | | | | | | | | | | |

Class A | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | Year Ended

September 30, 2003 | |

Per Share Data | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 6.85 | | | $ | 6.58 | | | $ | 6.50 | | | $ | 5.98 | | | $ | 5.09 | |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)a | | | — | | | | (0.01 | ) | | | 0.04 | | | | 0.01 | | | | 0.01 | |

Net gain on securities (realized and unrealized) | | | 0.69 | | | | 0.52 | | | | 0.49 | | | | 0.52 | | | | 0.88 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.69 | | | | 0.51 | | | | 0.53 | | | | 0.53 | | | | 0.89 | |

| | | | | | | | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | (0.04 | ) | | | — | | | | (0.01 | ) | | | — | |

Distributions from realized gains | | | (0.70 | ) | | | (0.20 | ) | | | (0.45 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (0.70 | ) | | | (0.24 | ) | | | (0.45 | ) | | | (0.01 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 6.84 | | | $ | 6.85 | | | $ | 6.58 | | | $ | 6.50 | | | $ | 5.98 | |

| | | | | | | | | | | | | | | | | | | | |

Total Returnb | | | 10.33 | % | | | 7.88 | % | | | 8.20 | % | | | 8.87 | % | | | 17.49 | % |

| | | | | | | | | | | | | | | | | | | | |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 322,850 | | | $ | 371,006 | | | $ | 375,280 | | | $ | 391,384 | | | $ | 430,161 | |

| | | | | | | | | | | | | | | | | | | | |

Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | 0.02 | % | | | (0.08 | )% | | | 0.57 | % | | | 0.08 | % | | | 0.23 | % |

Total expensesc | | | 1.34 | % | | | 1.34 | % | | | 1.30 | % | | | 1.28 | % | | | 1.25 | % |

Net expensesd | | | 1.34 | % | | | 1.34 | % | | | 1.30 | % | | | 1.28 | % | | | 1.25 | % |

Net expenses prior to custodian earning credits and net of expense waivers | | | 1.34 | % | | | 1.34 | % | | | 1.30 | % | | | 1.28 | % | | | 1.25 | % |

| | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 20 | % | | | 34 | % | | | 32 | % | | | 28 | % | | | 54 | % |

| | | | | |

Class B | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | Year Ended

September 30, 2003 | |

Per Share Data | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 6.04 | | | $ | 5.83 | | | $ | 5.85 | | | $ | 5.41 | | | $ | 4.64 | |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment lossa | | | (0.04 | ) | | | (0.05 | ) | | | (0.01 | ) | | | (0.04 | ) | | | (0.03 | ) |

Net gain on securities (realized and unrealized) | | | 0.59 | | | | 0.46 | | | | 0.44 | | | | 0.48 | | | | 0.80 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.55 | | | | 0.41 | | | | 0.43 | | | | 0.44 | | | | 0.77 | |

| | | | | | | | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | | | | | | | | |

Distributions from realized gains | | | (0.70 | ) | | | (0.20 | ) | | | (0.45 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (0.70 | ) | | | (0.20 | ) | | | (0.45 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 5.89 | | | $ | 6.04 | | | $ | 5.83 | | | $ | 5.85 | | | $ | 5.41 | |

| | | | | | | | | | | | | | | | | | | | |

Total Returnb | | | 9.33 | % | | | 7.16 | % | | | 7.35 | % | | | 8.13 | % | | | 16.59 | % |

| | | | | | | | | | | | | | | | | | | | |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 19,928 | | | $ | 27,842 | | | $ | 39,962 | | | $ | 49,600 | | | $ | 61,733 | |

| | | | | | | | | | | | | | | | | | | | |

Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.74 | )% | | | (0.83 | )% | | | (0.16 | )% | | | (0.67 | )% | | | (0.52 | )% |

Total expensesc | | | 2.09 | % | | | 2.09 | % | | | 2.05 | % | | | 2.03 | % | | | 2.00 | % |

Net expensesd | | | 2.09 | % | | | 2.09 | % | | | 2.05 | % | | | 2.03 | % | | | 2.00 | % |

Net expenses prior to custodian earning credits and net of expense waivers | | | 2.09 | % | | | 2.09 | % | | | 2.05 | % | | | 2.03 | % | | | 2.00 | % |

| | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 20 | % | | | 34 | % | | | 32 | % | | | 28 | % | | | 54 | % |

The accompanying notes are an integral part of the financial statements

20

| | |

| Financial Highlights | | Security Equity Fund |

| Selected data for each share of capital stock outstanding throughout each year | | Equity Series |

| | | | | | | | | | | | | | | | | | | | |

Class C | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | Year Ended

September 30, 2003 | |

Per Share Data | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 6.39 | | | $ | 6.16 | | | $ | 6.16 | | | $ | 5.69 | | | $ | 4.88 | |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment lossa | | | (0.05 | ) | | | (0.05 | ) | | | (0.01 | ) | | | (0.04 | ) | | | (0.03 | ) |

Net gain on securities (realized and unrealized) | | | 0.64 | | | | 0.48 | | | | 0.46 | | | | 0.51 | | | | 0.84 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.59 | | | | 0.43 | | | | 0.45 | | | | 0.47 | | | | 0.81 | |

| | | | | | | | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | | | | | | | | |

Distributions from realized gains | | | (0.70 | ) | | | (0.20 | ) | | | (0.45 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (0.70 | ) | | | (0.20 | ) | | | (0.45 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 6.28 | | | $ | 6.39 | | | $ | 6.16 | | | $ | 6.16 | | | $ | 5.69 | |

| | | | | | | | | | | | | | | | | | | | |

Total Returnb | | | 9.45 | % | | | 7.10 | % | | | 7.32 | % | | | 8.26 | % | | | 16.60 | % |

| | | | | | | | | | | | | | | | | | | | |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 5,048 | | | $ | 5,794 | | | $ | 5,706 | | | $ | 6,329 | | | $ | 6,651 | |

| | | | | | | | | | | | | | | | | | | | |

Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.73 | %) | | | (0.83 | %) | | | (0.18 | %) | | | (0.67 | %) | | | (0.52 | %) |

Total expensesc | | | 2.09 | % | | | 2.09 | % | | | 2.05 | % | | | 2.03 | % | | | 2.00 | % |

Net expensesd | | | 2.09 | % | | | 2.09 | % | | | 2.05 | % | | | 2.03 | % | | | 2.00 | % |

Net expenses prior to custodian earning credits and net of expense waivers | | | 2.09 | % | | | 2.09 | % | | | 2.05 | % | | | 2.03 | % | | | 2.00 | % |

| | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 20 | % | | | 34 | % | | | 32 | % | | | 28 | % | | | 54 | % |

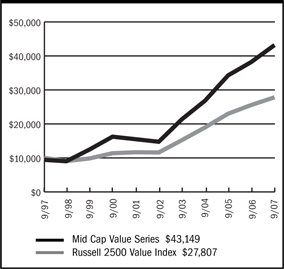

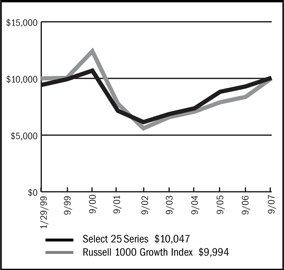

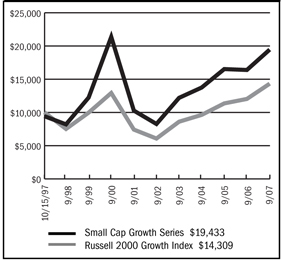

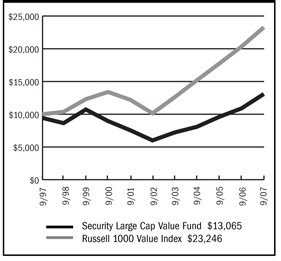

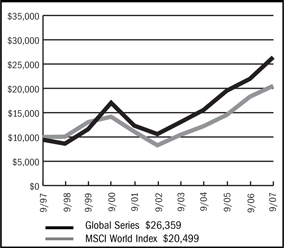

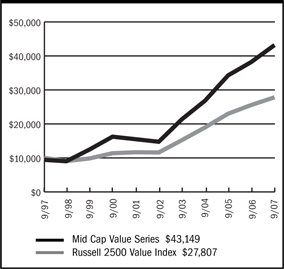

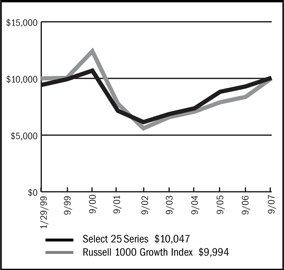

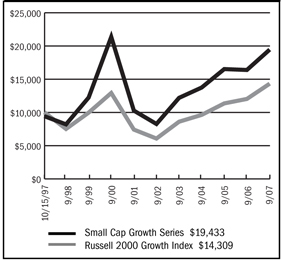

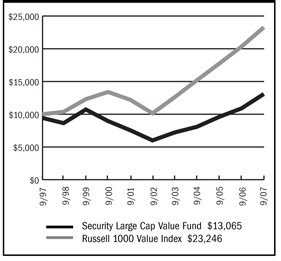

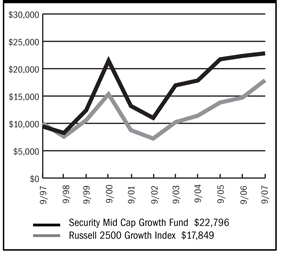

a | Net investment income (loss) was computed using average shares outstanding throughout the period. |