October 17, 2019

VIA EDGAR

Mr. DeCarlo McLaren

U.S. Securities and Exchange Commission

Division of Investment Management

100 F Street, NE

Washington, D.C. 20549

| |

| Re: | Guggenheim Funds Trust (File No. 333-233876) (the “Registrant”) |

Dear Mr. McLaren:

On behalf of the Registrant, we wish to respond by this letter to comments of the U.S. Securities and Exchange Commission (“SEC”) staff conveyed via telephone conversation between you and Julien Bourgeois and James V. Catano of Dechert LLP on October 15, 2019. These comments pertain to your review of the Registrant’s Information Statement/Prospectus on Form N-14 relating to the transfer of the assets of Guggenheim Mid Cap Value Institutional Fund (the “Target Fund”), a series of the Registrant, to Guggenheim Mid Cap Value Fund (the “Acquiring Fund” and, together with the Target Fund, the “Funds”), also a series of the Registrant, in exchange for Institutional Class shares of the Acquiring Fund and the assumption of the Target Fund’s liabilities by the Acquiring Fund, followed by the complete liquidation of the Target Fund (the “Reorganization”), as filed on September 20, 2019. Throughout this letter, capitalized terms have the same meaning as in the filing, unless otherwise noted. A summary of the SEC staff’s comments, followed by the Registrant’s responses, is set forth below.

Board Considerations with respect to the Reorganization

| |

| Comment 1: | Please confirm the disclosure stating that shareholders of the Funds should not experience an increase in their fees and expenses as a result of the Reorganization because the Investment Manager has agreed to waive its advisory fee (or otherwise reimburse expenses) under the terms of an amended and restated expense limitation agreement, which will continue in effect until February 1, 2021. Please consider disclosing that shareholders of the Funds could experience an increase in their fees and expenses if the expense limitation agreement was not in place. |

| |

| Response: | The Registrant confirms that shareholders of the Funds should not experience an increase in their fees and expenses as a result of the Reorganization because the Investment Manager has agreed to waive its advisory fee (or otherwise reimburse expenses) under the terms of an amended and restated expense limitation agreement, which will continue in effect until February 1, 2021. |

The Registrant has added the following disclosure in the “Questions and Answers” section of the Information Statement/Prospectus on Form N-14 in response to the questions “How will the Reorganization affect shareholder fees and expenses?”:

After February 1, 2021, if the expense limitation arrangement is not renewed, shareholders of the Acquiring Fund could experience higher fees and expenses.

Expenses of the Reorganization

| |

| Comment 2: | Please disclose who will bear the transactional costs of repositioning portfolio securities in connection with the Reorganization and, if the Funds will bear such costs, please disclose the estimated dollar amount of such costs. |

| |

| Response: | The Registrant expects that there will be no repositioning of portfolio securities in connection with the Reorganization and, therefore, no transactional costs. The Registrant has replaced the relevant disclosure throughout the Information Statement/Prospectus on Form N-14 with the following: |

The Investment Manager expects that any such there will be no transactional costs will be minimal given the similarities of the Funds.

Comparison of Investment Objective, Principal Investment Strategies and Principal Risks

| |

| Comment 3: | Please supplementally confirm that the investment objective, principal investment strategies and principal risks of the Acquiring Fund and the Target Fund are identical. |

| |

| Response: | The Registrant confirms that the investment objective, principal investment strategies and principal risks of the Acquiring Fund and the Target Fund are identical. |

Fund Performance

| |

| Comment 4: | Please show the performance of a class of the Acquiring Fund. |

| |

| Response: | The Registrant has added the disclosure appearing in the Appendix to this letter as an appendix to the Registrant’s Information Statement/Prospectus on Form N-14. |

Additional Information about the Funds

| |

| Comment 5: | Please confirm that the ability of the Investment Manager to recoup previously waived fees and/or reimbursed expenses under the expense limitation agreement is subject to the expense limitation in effect at the time of the waiver or reimbursement and at the time of the recoupment, if any. |

| |

| Response: | The Registrant confirms that the ability of the Investment Manager to recoup previously waived fees and/or reimbursed expenses under the expense limitation agreement is subject to the expense limitation in effect at the time of the waiver or reimbursement and at the time of the recoupment, if any. |

* * * * * * * *

Please call Julien Bourgeois at Dechert LLP at 202.261.3451 or James V. Catano at Dechert LLP at 202.261.3376 with any questions or comments regarding this letter, or if they may assist you in any way.

Sincerely,

/s/ Amy J. Lee

Amy J. Lee

Vice President and Chief Legal Officer

Guggenheim Funds Trust

Acquiring Fund Performance

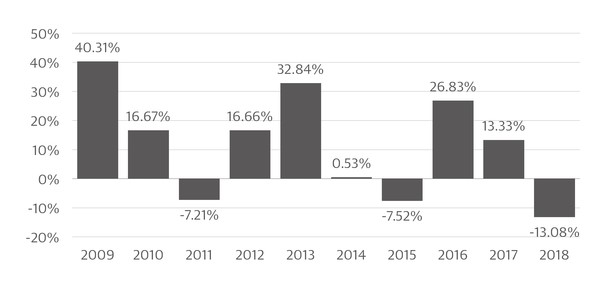

The following chart and table provide some indication of the risks of investing in the Acquiring Fund by showing the Fund’s Class A share calendar year performance from year to year and average annual returns for the one, five and ten year or since inception periods (if shorter), as applicable, for the Acquiring Fund’s Class A, Class C, and Class P shares compared to those of a broad measure of market performance. As with all mutual funds, past performance (before and after taxes) is not necessarily an indication of how the Acquiring Fund will perform in the future. Updated performance information is available on the Fund’s website at www.guggenheiminvestments.com or by calling 800.820.0888. Shares of the Acquiring Fund would have substantially similar performance because they invest in the same portfolio of securities. However, the performance of a class of shares would be higher than Class A shares of the Acquiring Fund to the extent the other class of shares pays lower expenses than Class A shares of the Acquiring Fund.

The bar chart does not reflect the impact of the sales charge applicable to Class A shares of the Acquiring Fund which, if reflected, would lower the returns shown.

|

| | |

Highest Quarter Return Q2 2009 25.21% | | Lowest Quarter Return Q3 2011 -19.78% |

Year to date total return as of September 30, 2019, is 18.07%.

AVERAGE ANNUAL TOTAL RETURNS (for the periods ended December 31, 2018)

After-tax returns shown in the table are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of any state or local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”). After-tax returns are shown for Class A only. After-tax returns for Class C and Class P will vary. The returns shown below reflect applicable sales charges, if any.

|

| | | | |

| | Inception | 1 Year | 5 Years or Since Inception | Since Inception |

| Class A | 5/1/1997 | | | |

| Return Before Taxes | | -17.20% | 2.04% | 9.93% |

| Return After Taxes on Distributions | | -20.16% | -0.69% | 8.06% |

| Return After Taxes on Distributions and Sale of Fund Shares | | -8.60% | 1.20% | 7.97% |

| Class C | 1/29/1999 | -14.46% | 2.26% | 9.75% |

| Class P | 5/1/2015 | -13.11% | 3.87% | N/A |

| Index | | | | |

Russell 2500® Value Index (reflects no deductions for fees, expenses or taxes) | | -12.36% | 4.16% | 11.62% |