As filed with the Securities and Exchange Commission on July 21, 2008

| Registration No. 333-150915 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

Amendment No. 1

to

FORM S-4

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

OPHTHALMIC IMAGING SYSTEMS

(Exact name of registrant as specified in its charter)

California (State or other jurisdiction of incorporation or organization) | 3841 (Primary Standard Industrial Classification Code Number) | 94-3035367 (IRS Employer Identification Number) |

| | |

221 Lathrop Way, Suite I

Sacramento, California 95815

(916) 646-2020

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Ariel Shenhar, Chief Financial Officer

Ophthalmic Imaging Systems

221 Lathrop Way, Suite I

Sacramento, California 95815

(916) 646-2020

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Henry I. Rothman, Esq.

Troutman Sanders LLP

The Chrysler Building

405 Lexington Avenue

New York, NY 10174

Tel: (212) 704-6000

Fax: (212) 704-6288

Approximate date of commencement of proposed sale of the securities to the public: As promptly as practicable after this Registration Statement becomes effective and upon consummation of the transactions described in the enclosed jointproxy statement/prospectus.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | | Accelerated Filer o |

| Non-accelerated filer o (Do not check if a smaller reporting company) | | Smaller reporting company x |

CALCULATION OF REGISTRATION FEE

Title of each class of

securities to be registered (1) | Amount to

be registered | Proposed

maximum

offering price per

unit | Proposed maximum

aggregate offering

price | Amount of

registration

fee |

Common stock, no par value | 15,922,836 (2) | $0.55 (3) | $8,757,560 (3) | $344.17 (4)(5) |

(1) | This Registration Statement relates to securities of the registrant issuable to holders of ordinary shares, par value NIS 0.1 per share (“MediVision ordinary shares”), of MediVision Medical Imaging Ltd., an Israeli corporation (“MediVision”), in the proposed merger of MV Acquisitions Ltd., an Israeli corporation and a wholly owned subsidiary of the registrant (“Merger Sub”), with and into MediVision. |

(2) | Based on the maximum number of shares to be issued in connection with the merger, calculated as the product of (a) 6,807,299, the aggregate number of shares of MediVision ordinary shares outstanding as of July 15, 2008 (other than shares owned by MediVision, Merger Sub or the registrant), plus 2,784,771 MediVision ordinary shares issuable upon conversion of Convertible Notes of MediVision, and (b) an exchange ratio of 1.66 of a share of the registrant’s common stock for each MediVision ordinary share. |

(3) | Estimated solely for the purpose of calculating the registration fee required by Section 6(b) of the Securities Act of 1933, as amended (the “Securities Act”), and calculated pursuant to Rule 457(f) under the Securities Act. Pursuant to Rule 457(f)(1) under the Securities Act, the proposed maximum aggregate offering price of the registrant’s common stock was calculated based upon the market value of MediVision ordinary shares (the securities to be cancelled in the merger) in accordance with Rule 457(c) under the Securities Act as follows: (a) .34 Euros ($.55), the average of the high and low prices per share of MediVision ordinary shares on July 15, 2008, as reported by the Euronext, multiplied by (b) 12,372,052, the amount of OIS common stock to be registered herein. |

(4) | Calculated by multiplying the proposed maximum offering price for all securities by 0.00003930. |

(5) | Registration fee of 286.90 previously paid. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission acting pursuant to said Section 8(a), may determine.

The information in this joint proxy statement/prospectus is not complete and may be changed. Ophthalmic Imaging Systems may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This joint proxy statement/prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted. |

SUBJECT TO COMPLETION, DATED MAY 14, 2008

[ date ], 2008

To the Shareholders of Ophthalmic Imaging Systems and the Shareholders of MediVision Medical Imaging Ltd.:

The boards of directors of Ophthalmic Imaging Systems (“OIS”) and MediVision Medical Imaging Ltd. (“MediVision”) each have approved the merger of MV Acquisitions Ltd., an Israeli corporation and wholly-owned subsidiary of OIS (“Merger Sub”) with and into MediVision. OIS believes that combining the strengths of OIS’ and MediVision is in the best interests of each company and its respective shareholders. This merger will strengthen OIS’ operational capabilities and product offerings and enhance its opportunities and capacity to continue to grow to serve the needs of its existing customers. OIS believes that both companies will benefit from improved operating efficiencies, including improved control of their research and development and international marketing capabilities, which were previously handled on a contractual basis by MediVision alone. The addition of MediVision’s new product pipeline is expected to help increase OIS’ footprint in the market, while the strategic relationship with Agfa Geveart, N.V., (“Agfa”), which will have representation on OIS’ board, will deepen its Picture Archiving Capture System (“PACS”) capabilities in the ophthalmology arena. MediVision’s German-based subsidiary, CCS Pawlowski GmbH, brings with it a significant share of the German market for digital imaging systems connected to non-midriatic fundus cameras. Both shareholder bodies will benefit from increased liquidity as a result of MediVision shareholders adding to the pool of OIS shareholders. In addition, MediVision shareholders will have shares of OIS, which is traded in a more efficient market on the OTC Bulletin Board.

Upon completion of the merger, MediVision shareholders will receive 1.66 shares of OIS for each ordinary share of MediVision that they own. As a result, OIS estimate that current MediVision shareholders will hold approximately 65% of the outstanding shares of OIS common stock on a fully diluted basis upon consummation of the merger. After the merger, OIS common stock will continue to be listed on the OTC Bulletin Board under the symbol “OISI” and MediVision’s ordinary shares will cease to trade on the Euronext.

OIS and MediVision will each hold a meeting of their respective shareholders to consider and vote on the merger agreement dated March 25, 2008, between OIS, Merger Sub and MediVision and the merger contemplated therein. Enclosed are materials containing important information about the merger of MediVision and Merger Sub, and why OIS believes the merger is the right decision for OIS and MediVision. Because the completion of the merger requires approval both of the OIS and MediVision shareholders, YOUR VOTE IS IMPORTANT. OIS and MediVision urge you to read the enclosed materials carefully and to promptly vote by following the instructions shown on the appropriate enclosed proxy or voting instruction form.

The boards of directors of OIS and MediVision have concluded that the merger offers significant benefits and, thus, each board recommends that you vote FOR the merger and other proposals contained in this joint proxy statement/prospectus.

For a discussion of risk factors that you should consider in evaluating the merger and the transactions contemplated by the merger agreement, see the section entitled “Risk Factors,” beginning on page 26 of this document.

OIS and MediVision urge you to vote FOR the merger agreement, the merger and other proposals contained in this joint proxy statement/prospectus by promptly submitting your proxy — by signing, dating and returning the enclosed proxy in the postage-paid envelope provided. Returning the proxy does not deprive you of your right to attend the shareholder meeting where the merger will be considered and to vote your shares in person. Thank you for your consideration of this matter and your continued support.

OIS AND MEDIVISION ENTHUSIASTICALLY SUPPORT THIS MERGER AND JOIN WITH ITS RESPECTIVE BOARDS OF DIRECTORS IN RECOMMENDING THAT YOU VOTE FOR THE MERGER AND OTHER PROPOSALS CONTAINED IN THIS JOINT PROXY STATEMENT/PROSPECTUS.

Sincerely,

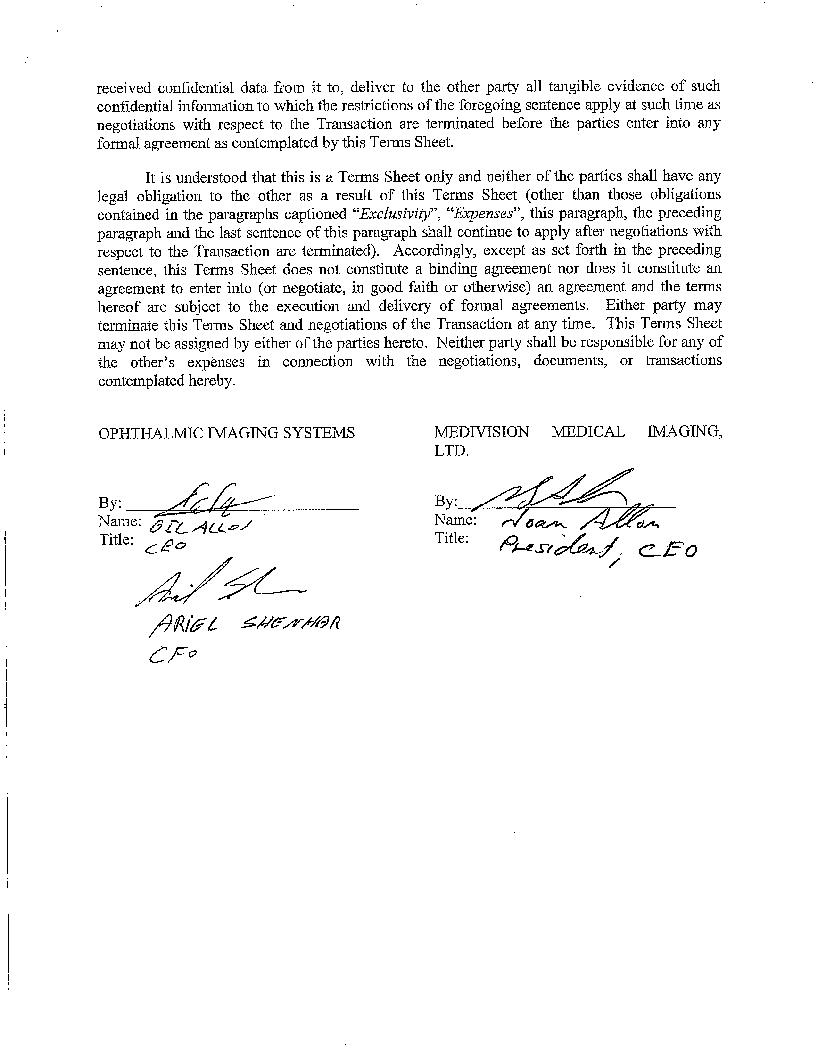

Gil Allon Chief Executive Officer Ophthalmic Imaging Systems | Noam Allon President and Chief Executive Officer MediVision Medical Imaging Ltd. |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the transactions described in this joint proxy statement/prospectus or the securities to be issued in connection with the merger or passed upon the adequacy of accuracy of this joint proxy statement/prospectus. Any representation to the contrary is a criminal offense.

This joint proxy statement/prospectus is dated [date], 2008 and is first being sent to the OIS and MediVision shareholders on or about [date], 2008.

OPHTHALMIC IMAGING SYSTEMS

221 Lathrop Way, Suite I

Sacramento, California 95815

Notice of Special Meeting of Shareholders

[date] , 2008

NOTICE IS HEREBY GIVEN that a Special Meeting of Shareholders (the “Special Meeting”) of OPHTHALMIC IMAGING SYSTEMS, a California corporation (referred to in this notice as “OIS”), will be held at the principal executive offices of OIS are located at 221 Lathrop Way, Suite I, Sacramento, California 95815, on [day],[date ], 2008, [time] [a/p.m.], to consider and act upon the following:

1. | | to approve and adopt (i) the merger agreement, dated as of March 25, 2008, by and among Ophthalmic Imaging Systems, MediVision Medical Imaging Ltd., an Israeli corporation, and MV Acquisitions Ltd., an Israeli corporation and wholly-owned subsidiary of OIS and (ii) the merger contemplated by such merger agreement; |

2. | | to approve and adopt the proposed amendment to the articles of incorporation to (i) increase the number of directors to no less than 7 and no more than 11, (ii) include a provision that eliminates cumulative voting upon OIS’ listing on the New York Stock Exchange, the American Stock Exchange, or the NASDAQ Stock Market, and (iii) include a provision which, commencing on the date of the closing of the merger, and as long as Agfa Geveart N.V., together with its affiliates (collectively “Agfa”), are the owner of at least 5% of the outstanding common stock of OIS, requires either unanimous approval of OIS’ board of directors or the approval of 66 2/3% of the shares entitled to vote, for certain transactions concerning certain types of mergers, acquisitions or dispositions of assets, or issuances of securities, or changes in OIS’ principal business purpose; and |

3. | | to transact such other business as may properly come before the Special Meeting or any adjournments thereof. |

Pursuant to the merger agreement, OIS will issue 1.66 shares of OIS common stock for each ordinary share of MediVision and MediVision will merge with and into MV Acquisitions Ltd., an Israeli corporation and a wholly-owned subsidiary of OIS, with MediVision as the surviving entity to continue as a wholly-owned subsidiary of OIS.

Information regarding the matters to be acted upon at the Special Meeting is contained in the accompanying joint proxy statement/prospectus.

You must own shares of common stock of OIS at the close of business on [record date] to vote at the Special Meeting. If you do not expect to be present, you are requested to fill in, date and sign the enclosed form of proxy, which is solicited by the board of directors of OIS, and to mail it promptly in the enclosed envelope. In the event you decide to attend the Special Meeting in person, you may, if you desire, revoke your proxy and vote your shares in person.

FOR MORE INFORMATION ABOUT VOTING PROCEDURES AND ABOUT THE MERGER DESCRIBED ABOVE, PLEASE REVIEW THE ACCOMPANYING DOCUMENT AND THE MERGER AGREEMENT ATTACHED TO IT AS ANNEX A.

This notice of Special Meeting and the accompanying proxy statement and proxy card are being mailed to OIS’ shareholders on or about [date], 2008.

| |

| | By Order of the Board of Directors | |

Sacramento, California ____ [date], 2008 | |

Ariel Shenhar

Secretary

| |

IMPORTANT |

It is important that your shares be represented at the Special Meeting. Each stockholder is urged to sign, date, and return the enclosed form of proxy which is being solicited on behalf of the board of directors. An envelope addressed to OIS’ transfer agent is enclosed for that purpose and needs no postage if mailed in the United States. |

MEDIVISION MEDICAL IMAGING LTD.

Industrial Zone, Yokneam Elit, Israel

Company’s Registered Number: 51-182860-0

Telephone No.: +972 (04) 989-4884 Fax No.: +972(04) 989-4883

_____________________

NOTICE OF SPECIAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON __________ , 2008

NOTICE IS HEREBY GIVEN that on ________, 2008, at 17:00 PM, Israeli time, the Special General Meeting of Shareholders (the “Special Meeting”) of MediVision Medical Imaging Ltd. (“MediVision”) will be held at the offices of MediVision’s Israeli legal counsel, Eitan Mehulal Pappo Barath & Shinar, Weissberger & Co, at 10 Abba Eban Blvd., Herzlia 46120, Israel. The matters on the agenda of the Special Meeting and a summary of the proposed resolutions are as follows:

1. | | to approve and adopt (i) the merger agreement, dated as of March 25, 2008, by and among MediVision Medical Imaging Ltd, Ophthalmic Imaging Systems (“OIS”), a U.S. based corporation, and MV Acquisitions Ltd., an Israeli corporation and wholly-owned subsidiary of OIS and (ii) the merger contemplated by such merger agreement; |

2. | | to approve and adopt an amendment to MediVision’s articles of association; |

3. | | to approve the grant of an exemption undertaking and indemnification undertaking to the members of MediVision’s board of directors (including its “external directors”) as well as its controlling shareholders and their representatives; |

4. | | to approve MediVision’s purchase of directors and officers insurance policy, with a coverage of up to $5,000,000 as of July, 2007 for a period of 12 months; and |

5. | | to transact such other business as may properly come before the Special Meeting or any adjournments thereof. |

Pursuant to the merger agreement, OIS will issue 1.66 shares of OIS common stock for each ordinary share of MediVision stock, and MediVision will merge with, and into, MV Acquisitions Ltd., a wholly-owned subsidiary of OIS, with MediVision as the surviving entity to continue as a wholly-owned subsidiary of OIS. Upon completion of the merger, MediVision’s shares will cease to be listed on the Euronext.

Information regarding the matters to be acted upon at the Special Meeting is contained in the accompanying proxy statement.

| |

| | | |

Yokneam-Elit, Israel ____ [date], 2008 | | | |

i

ii

iii

No person is authorized in connection with any offering made by this joint proxy statement/ prospectus to give any information or make any representation not contained in, or incorporated by reference into, this joint proxy statement/prospectus. If given or made, any such information or representation must not be relied on as having been authorized by OIS or MediVision. This joint proxy statement/prospectus does not constitute an offer to sell, or a solicitation of an offer to purchase, the securities offered by this joint proxy statement/prospectus, or the solicitation of a proxy, in any jurisdiction to or from any person to whom or from whom it is unlawful to make such offer, solicitation of an offer or proxy solicitation in such jurisdiction. Neither the delivery of this joint proxy statement/prospectus nor any distribution of securities pursuant to this joint proxy statement/prospectus shall, under any circumstances, create any implication that there has been no change(s) in the information set forth or incorporated into this joint proxy statement/prospectus by reference or in OIS’ affairs since the date of this joint proxy statement/prospectus.

iv

ABOUT THIS JOINT PROXY STATEMENT/PROSPECTUS

This document, which forms part of a registration statement on Form S-4 filed by Ophthalmic Imaging Systems, which is referred to as “OIS,” with the Securities and Exchange Commission, which is referred to as the “SEC,” constitutes (i) a proxy statement under Section 14(a) of the Securities Exchange Act of 1934, as amended, which is referred to as the “Exchange Act,” and the rules thereunder with respect to the Special Meeting of Shareholders of OIS, (ii) a prospectus of OIS in connection with the issuance of shares of OIS in the merger, and (iii) a management information circular and notice of meeting with respect to the Special Meeting of Shareholders of MediVision Medical Imaging, Ltd., which is referred to as “MediVision.”

References made to this “document,” means to the joint proxy statement/prospectus described above.

This document and the accompanying proxy and voting instruction forms will first be mailed to shareholders of OIS and MediVision on or about [date], 2008 and is dated [date], 2008. You should not assume that the information contained in this document is accurate as of any date other than that date. Neither the mailing of this document to OIS or MediVision shareholders, nor the issuance of OIS common stock, creates any implication to the contrary.

The current and post-merger information concerning OIS and MediVision and the information used to derive the pro forma financial information has been provided jointly by OIS and MediVision. The information concerning OIS contained or incorporated by reference in this document, including the attached annexes and schedules, has been provided by OIS. The information concerning MediVision contained or incorporated by reference in this document, including the attached annexes and schedules, has been provided by MediVision.

No person is authorized in connection with any offering made by this joint proxy statement/ prospectus to give any information or make any representation not contained in, or incorporated by reference into, this joint proxy statement/prospectus. If given or made, any such information or representation must not be relied on as having been authorized by OIS or MediVision. This joint proxy statement/prospectus does not constitute an offer to sell, or a solicitation of an offer to purchase, the securities offered by this joint proxy statement/prospectus, or the solicitation of a proxy, in any jurisdiction to or from any person to whom or from whom it is unlawful to make such offer, solicitation of an offer or proxy solicitation in such jurisdiction. Neither the delivery of this joint proxy statement/prospectus nor any distribution of securities pursuant to this joint proxy statement/prospectus shall, under any circumstances, create any implication that there has been no change(s) in the information set forth or incorporated into this joint proxy statement/prospectus by reference or in OIS’ affairs since the date of this joint proxy statement/prospectus.

1

ADDITIONAL INFORMATION

This joint proxy statement/prospectus incorporates important business and financial information about OIS from documents that OIS has filed with the Securities and Exchange Commission but that has not been included in or delivered with this joint proxy statement/prospectus. For a listing of documents incorporated by reference into this joint proxy statement/prospectus, please see “Where You Can Find More Information” beginning on page 194 of this joint proxy statement/prospectus.

OIS will provide you with copies of such documents relating to OIS (excluding all exhibits unless OIS has specifically incorporated by reference an exhibit in this joint proxy statement/prospectus), without charge, upon written or oral request to:

Ophthalmic Imaging Systems

221 Lathrop Way, Suite I

Sacramento, California 95815

Attn: Ariel Shenhar, Secretary

(916) 646-2020 x317

In order for you to receive timely delivery of the documents in advance of the OIS or MediVision Meetings, OIS should receive your request no later than five business days before the respective shareholders meetings or [date] , 2008.

2

FORWARD-LOOKING STATEMENTS

Some of the statements contained in this joint proxy statement/prospectus, including those relating to OIS’ strategies and other statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “estimates” or similar expressions, are forward-looking statements. Forward-looking statements include, without limitation, the information concerning possible or assumed future results of operations of OIS and MediVision as set forth under “The Merger — OIS’ Reasons for the Merger,” “The Merger — MediVision’s Reasons for the Merger,” “The Merger — Opinion of OIS’ Financial Advisor,” and “The Merger — Opinion of MediVision’s Financial Advisor.” These statements are not historical facts but instead represent only OIS’ and MediVision’s expectations, estimates and projections regarding future events.

Many factors could cause the actual results, performance or achievements of OIS and MediVision or the combined company to be materially different from any future results, performance, or achievements that may be expressed or implied by such forward-looking statements, including, among others:

| • | the businesses may not be integrated successfully or the anticipated improved financial performance, product quality and development may not be achieved or may take longer to realize than expected; |

| • | disruptions from the merger may make it more difficult to maintain relationships with customers, employees and suppliers; |

| • | competitive pressures may increase in the industry or markets in which OIS operates; |

| • | other combinations within the industry or other factors may limit OIS’ ability to improve its competitive position; |

| • | economic conditions generally and the medical instruments market specifically; |

| • | legislative or regulatory changes, including changes in healthcare regulation; |

| • | changes in the securities or currency-exchange markets; |

| • | the combined company may obtain credit on less favorable terms than those available to OIS or MediVision individually; |

| • | the failure of OIS’ shareholders and stockholders to approve the merger or the exercise by a material percentage of MediVision shareholders or OIS shareholders of their dissent rights; |

| • | dependence on key personnel; and |

| • | risk that OIS’ or MediVision’s analyses of these risks and forces could be incorrect or that the strategies developed to address them could be unsuccessful. |

Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as anticipated, believed, estimated or expected.

The forward-looking statements contained in this joint proxy statement/prospectus are not guarantees of future performance and involve risks and uncertainties that are difficult to predict. The future results and shareholder value of OIS may differ materially from those expressed in the forward-looking statements contained in this joint proxy statement/prospectus due to, among other factors, the matters set forth under “Risk Factors.” Except as required by law, neither OIS nor MediVision undertakes any obligation to update or release any revisions to these forward-looking statements to reflect events or circumstances after the date of this joint proxy statement/prospectus or to reflect the occurrence of unanticipated events.

3

The following questions and answers are intended to address briefly some commonly asked questions regarding the special meeting of OIS, the special meeting of MediVision and the merger. These questions and answers may not address all questions that may be important to you as a shareholder of OIS or MediVision. Please refer to the more detailed information contained elsewhere in this joint proxy statement/prospectus and the annexes attached to this joint proxy statement/prospectus.

Unless otherwise stated or the context otherwise requires; all references to “OIS” are to Ophthalmic Imaging Systems and all references to “MediVision” are to MediVision Medical Imaging Ltd.

QUESTIONS AND ANSWERS ABOUT THE MERGER

Q: | What are OIS and MediVision proposing? |

A: OIS and MediVision are proposing to combine the two companies, whereby MediVision will become a wholly owned subsidiary of OIS. OIS has formed MV Acquisitions Ltd., an Israeli corporation and wholly-owned subsidiary (“Merger Sub”), which will be merged with and into MediVision pursuant to the Israeli Companies Law of 1999, with MediVision as the surviving subsidiary corporation. In the merger, each outstanding ordinary share of MediVision will be exchanged into 1.66 shares of OIS’ common stock, no par value. On March 25, 2008, OIS, MediVision and Merger Sub entered into a merger agreement, providing for the merger as described.

Q: | What are the steps to the merger and what will shareholders receive as consideration? |

A: The following steps of the merger and the issuance of consideration in the merger will be carried out in accordance with, and subject to the terms and conditions of, the merger agreement and the other documents referred to in the merger agreement:

| • | Merger Sub will merge with and into MediVision, with MediVision as the surviving corporation. After completion of the merger, MediVision will be a wholly-owned subsidiary of OIS. Therefore, shareholders of OIS will not receive any consideration directly. In the merger, shareholders of MediVision will receive 1.66 shares of common stock of OIS in exchange for each ordinary share of MediVision they own, which this document refers to as the “conversion ratio.” This document refers to this transaction as the “merger.” No fractional shares of OIS common stock will be issued and any holder of MediVision shares entitled to receive a fractional share of OIS common stock will receive one additional share of OIS common stock in addition to the number of full OIS common stock to which it is entitled. |

| • | Upon consummation of the merger, OIS will cause the amendment of its articles of incorporation. The purpose of these amendments is to: |

| o | increase the number of directors to no less than 7 and no more than 11; |

| o | include a provision that eliminates cumulative voting upon OIS’ listing on the New York Stock Exchange, the American Stock Exchange, or the NASDAQ Stock Market; and |

| o | include a provision which, commencing on the closing of the merger, and as long as Agfa Geveart N.V., together with its affiliates (collectively “Agfa”), are the owner of at least 5% of the outstanding common stock of OIS, requires either unanimous approval of OIS’ board directors or the approval of 66 2/3% of the shares entitled to vote, for certain transactions concerning certain types of mergers, acquisitions or dispositions of assets, or issuances of securities, or changes in OIS’ principal business purpose. |

Q: | How do the OIS and MediVision Boards of Directors recommend that I vote regarding the merger? |

A: The board of directors of OIS and MediVision recommend that their respective shareholders vote “FOR” adoption of the merger agreement and approval of the merger contemplated therein. The board of OIS and a special independent committee appointed by OIS determined that the terms of the merger agreement and the merger are advisable, fair to, and in the best interest of OIS shareholders. The board of MediVision determined that the terms of the merger agreement and the merger are advisable, fair to, and in the best interest of MediVision shareholders.

4

Q: | Why are OIS and MediVision proposing to merge? |

A: OIS believes that combining the strengths of the two companies is in the best interests of each company and its respective shareholders. This merger will strengthen OIS’ operational capabilities and product offerings and enhance its opportunities and capacity to continue to grow to serve the needs of its existing customers. OIS believes that both companies will benefit from improved operating efficiencies, including improved control of their research and development and international marketing capabilities, which were previously handled on a contractual basis by MediVision alone. The addition of MediVision’s new product pipeline is expected to help increase OIS’ footprint in the market, while the strategic relationship with Agfa, which will have representation on OIS’ board, will deepen its PACS capabilities in the ophthalmology arena. MediVision’s German-based subsidiary brings with it a significant share of the German market for digital imaging systems connected to non-midriatic fundus cameras. Both shareholder bodies will benefit from increased liquidity as a result of MediVision’s shareholders adding to the pool of OIS shareholders. In addition, MediVision shareholders will have shares of OIS, which is traded in a more efficient market.

Q: | Are there risks I should consider in deciding whether to vote for the merger? |

A: Yes. You should carefully review the section entitled, “Risk Factors” beginning on page 26 of this joint proxy statement/prospectus.

Q: | What will happen to stock options and other stock-based awards in the merger? |

A: | OIS’ outstanding options and warrants will remain the same according to the terms thereof. |

MediVision’s outstanding options and warrants will be assumed by OIS in the merger. Each option or warrant so assumed will thereafter represent an option to purchase a number of shares of OIS common stock equal to the number of shares of MediVision ordinary shares subject to the option or warrants immediately prior to the merger (whether vested or not) multiplied by the conversion ratio which is 1.66, at an exercise price per share of common stock equal to the exercise price per share of such MediVision option or warrants in effect immediately prior to the closing divided by the conversion ratio of 1.66. The assumed options or warrants will have the similar terms as the original MediVision options or warrants. Conversion of exercise prices from Euros to US dollars will be converted at a rate of 1 Euro to 1.56 US dollars, the closing rate on the business day preceding the signing of the merger agreement, March 25, 2008.

Q: | What percentage of OIS will the shareholders of MediVision own after the merger? |

A: Prior to the merger, MediVision owns approximately 56% of OIS’ issued and outstanding shares of common stock. Upon completion of the merger, OIS estimates that MediVision shareholders will own approximately 65% of OIS’ issued and outstanding shares of common stock on a fully diluted basis. The shares of OIS currently owned by MediVision will become treasury shares.

Q: | Where will the OIS common stock be listed after the merger? |

A: | OIS common stock will continue to be listed on the OTC Bulletin Board under the symbol “OISI.” |

| MediVision ordinary shares will cease to be listed on the Euronext. |

Q: | When do OIS and MediVision expect to complete the merger? |

A: | OIS expects to complete the merger during the last quarter of 2008. |

Q: | Where can I find more information about the companies? |

5

A: Written or verbal requests of information can be made to the Secretary of OIS at:

Ophthalmic Imaging Systems

221 Lathrop Way, Suite I

Sacramento, California 95815

Attn: Ariel Shenhar, Secretary

(916) 646-2020 x317

You can find more information about OIS from the sources described under “Where You Can Find Additional Information”. Information about MediVision Medical Imaging Ltd. can be found on MediVision’s Web Site: www.medivision-ois.com. Information can also be obtained on the Euronext web site (www.euronext.com), ticker: MEDV.

In addition, the Annual and Quarterly Financial statements and other non-recurring information published by MediVision is available at no cost at MediVision’s headquarters. Written or verbal requests of information can be made to MediVision at:

MediVision Medical Imaging Ltd

Hermon Building, Industrial zone

PO Box 45, Yokneam-Elit 20692

ISRAEL

Attn: Gabby Bouganim, Secretary

(+972-4- 989 4884)

6

OIS SHAREHOLDER QUESTIONS AND ANSWERS

Q: | When and where is the Special Meeting of OIS shareholders? |

A: The Special Meeting of OIS shareholders will be held at its principal executive offices located at 221 Lathrop Way, Suite I, Sacramento, California 95815, on [day], __________, 2008, [time] [a/p.m.] (the “OIS Special Meeting”).

Q: | On what am I being asked to vote? |

A: OIS shareholders are being asked to (1) approve and adopt the merger agreement, dated as of March 25, 2008, by and among OIS, MediVision, and Merger Sub and the merger contemplated by the merger agreement (Proposal 1) and (2) approve the amendment of its articles of incorporation (Proposal 2). The purpose of these amendments is to:

| o | increase the number of directors to no less than 7 and no more than 11; |

| o | include a provision that eliminates cumulative voting upon OIS’ listing on the New York Stock Exchange, the American Stock Exchange, or the NASDAQ Stock Market; and |

| o | include a provision which, commencing on the closing of the merger, and as long as Agfa Geveart N.V., together with its affiliates (collectively “Agfa”), are the owner of at least 5% of the outstanding common stock of OIS, requires either unanimous approval of OIS’ board directors or the approval of 66 2/3% of the shares entitled to vote, for certain transactions concerning certain types of mergers, acquisitions or dispositions of assets, or issuances of securities, or changes in OIS’ principal business purpose. |

Q: | What vote is required to approve each of the proposals? |

A. Both proposal 1 and 2 will require (1) the affirmative vote of at least 75% of OIS’ common stock entitled to vote in an election of directors and (2) the affirmative vote of the holders of a majority of the shares of OIS’ common stock entitled to vote on the proposal who are not “interested shareholders” (as defined in OIS’ articles of incorporation) or affiliates of interested shareholders.(1)

__________________

(1) An “Interested Shareholder,” as defined in OIS’ Articles of Incorporation, is “any person (other than OIS or its subsidiary and other than any profit-sharing, employee stock ownership, stock option plan or other employee benefit plan of OIS or its subsidiary, or any trustee of or fiduciary with respect to any such capacity) who or which:

| (i) | is the beneficial owner, directly or indirectly, of more than 10% of the voting power of the outstanding of the shares of OIS entitled to vote generally in the election of directors (the “Voting Shares”); or |

| (ii) | is an “Affiliate” (as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as in effect on March 25, 1992) of OIS and at any time within the two-year period immediately prior to the date in question was the beneficial owner, directly or indirectly, of 10% or more of the voting power of the then outstanding Voting Shares; or |

| (iii) | is an assignee of or has otherwise succeeded to any Voting Shares which were at any time within the two-year period immediately prior to the date in question beneficially owned by any Interested Shareholder, if such assignment or succession shall have occurred in the course of a transaction or series of transactions not involving a public offering within the meaning of the securities Act of 1933.” |

To best of OIS’ knowledge, the only Interested Shareholder, as of the date of this Form S-4/A is MediVision, which owns 56% or 9,381,843 shares of OIS’ Voting Shares.

7

__________________

(1) Under the Articles of Incorporation, the approval of the merger agreement requires (i) the affirmative vote of 75% of all outstanding shares of common stock (the “75% of Outstanding Requirement”) and (ii) the affirmative votes of at least a majority of shareholders who are not Interested Shareholders or Affiliates of Interested Shareholders (the “Non-Interested Shareholders’ Approval Requirement”).

Therefore, the 75% of Outstanding Requirement require affirmative votes of 12,650,123 shares of common stock (including shares owned by MediVision and its Affiliates) based upon the number of total issued and outstanding shares of OIS’ common stock as of July 8, 2008.

For the purpose of the Non-Interested Shareholders’ Approval requirement, the votes of any and all Affiliates of MediVision and the votes of MediVision will not be counted. The following is a list of Affiliates of OIS’ only Interested Shareholder and their OIS shares, if any, as of the date hereof:

NAME | Reason FOR AFFILIATE OF INTERESTED SHAREHOLDER STATUS | # of OIS Shares owned |

CCS Pawlowski GmbH | CCS is an affiliate controlled by MediVision. MediVision owns 63% of CCS’ share capital. | - |

Delta Trading and Services (1986) Ltd. | Delta owns 31% or 2,139,360 shares of MediVision’s ordinary stock. | - |

Agfa Gevaert N.V. | Agfa owns 19% or 1,322,753 shares of MediVision’s ordinary stock. | - |

Intergamma Investment Ltd. | Intergamma owns 100% or all of the ordinary share capital of Delta Trading and Services (1986) Ltd. | - |

AWB Beteiligungs GmbH | AWB received 40,008 shares of OIS from MediVision within in the past 2 years. AWB owns less than 1% of OIS. | 40,008 |

Gil Allon | Mr. Allon is a director of OIS and its chief executive officer. He also owns 8% or 542,256 shares of MediVision’s ordinary stock. Gil Allon and Noam Allon are brothers and Shlomo Allon is their father. Together they own 21.8% or 1,476,808 shares of MediVision’s ordinary stock. | - |

Ariel Shenhar | Mr. Shenhar is a director of OIS’ board of directors and the chief financial officer. He also owns 0.7% or 49,568 shares of MediVision’s ordinary stock. Ariel Shenhar and Yuval Shenhar are brothers. Together they own 1.3% or 91,248 shares of MediVision’s ordinary stock. | - |

Yigal Berman | Mr. Berman is a director of OIS’ board of directors. He is also a director of Delta Trading and the VP Finance at Intergamma. | - |

Marc De Clerck | Mr. De Clerck is a director of OIS and MediVision. He is also a manager at Agfa. | - |

Noam Allon | Mr. Allon is a director of MediVision and its president and chief executive officer. Mr. Allon also owned 8% or 542,256 shares of MediVision’s ordinary stock. Gil Allon and Noam Allon are brothers and Shlomo Allon is their father. Together they own 21.8% or 1,476,808 shares of MediVision’s ordinary stock. | - |

Doron Maor | Mr. Maor is a director of MediVision. | - |

Mira Nesher | Ms. Nesher is a director of MediVision. | - |

Miri Kerbs | Ms. Kerbs is a director of MediVision. | - |

Shlomo Allon | Mr. Allon owns 5.8% or 392,296 shares of MediVision’s ordinary stock. Shlomo Allon is the father of Gil Allon and Noam Allon. Together they | - |

8

Q: How do I vote on the approval and adoption of the merger agreement and the merger and other proposals?

A. First, please review the information contained in this document, including the schedules and annexes. This document contains important information about OIS, MediVision, and the merger. It also contains important information about what the boards of directors of OIS and MediVision considered in evaluating the merger.

Second:

| • | If you are a registered holder of OIS common shares, please submit your proxy form promptly by signing, dating and returning the appropriate enclosed proxy form in the envelope provided so that your shares can be voted at the OIS Special Meeting. You may also attend in person and vote at the OIS Special Meeting, even if you have already submitted a proxy form. |

| • | If you hold your OIS common shares in non-registered name or “street” name, you must contact your broker or other nominee to obtain a broker voting instruction form (if you did not receive one together with this document) and for other instructions as to how to vote your shares. |

| • | If you hold your OIS common shares in both registered and non-registered name, you will receive both a proxy form and a broker voting instruction form. To ensure that all your shares are represented at the OIS Special Meeting, please submit a vote by mail for each proxy form or broker voting instruction form you receive. |

Q: | Am I entitled to dissent or appraisal rights in connection with the merger? |

A: Yes. Under California law, holders of OIS common stock are entitled to statutory dissenters’ or appraisal rights in connection with the merger. When the merger becomes effective, shareholders of OIS who do not vote in favor of the merger and comply with the procedures prescribed in Chapter 13 of the California General Corporation Law (“CGCL”), or Chapter 13, will be entitled to a judicial appraisal of the fair market value of their shares, which, for purposes of the exercise of appraisal rights under the CGCL, is determined as of the day before the first

__________________

(1)

NAME | Reason FOR AFFILIATE OF INTERESTED SHAREHOLDER STATUS | # of OIS Shares owned |

| own 21.8% or 1,476,808 shares of MediVision’s ordinary stock. | |

Yuval Shenhar | Mr. Shenhar owns 0.6% or 41,680 shares of MediVision’s ordinary stock. Yuval Shenhar and Ariel Shenhar are brothers. Together they own 1.3% or 91,248 shares of MediVision’s ordinary stock. | - |

As of July 8, 2008, 44% or 7,445,512 of OIS’ shares of common stock are owned by shareholders that are not Interested Shareholders or Affiliates of Interested Shareholders. Therefore, for the purpose of satisfying the Non-Interested Shareholders’ Approval Requirement, the affirmative vote of 3,722,757 shares from shareholders who are not MediVision or any of the persons listed above are required based upon the number of total issued and outstanding shares of OIS’ common stock as of July 8, 2008.

The implementation of Proposal 2 is contingent upon approval of Proposal 1. If the OIS shareholders do not approve the merger (Proposal 1), the merger agreement will be terminated and thus amendment to articles of incorporation (Proposal 2), regardless of shareholder approval, will not be implemented.

Consummation of the merger in Proposal 1 is also contingent upon approval of Proposal 2. The amendment to articles of incorporation is a condition to MediVision’s obligation to close the merger. Therefore, if the OIS shareholders approve the merger (Proposal 1) but do not approve the proposed amendment to articles of incorporation (Proposal 2), the merger agreement will be terminated and the merger will not be consummated, unless MediVision decides to waive such a closing condition and agrees to close the merger without amended articles of incorporation. OIS cannot assure you that in such event MediVision will waive such closing condition.

9

announcement of the terms of the merger, excluding any appreciation or depreciation in consequence of the merger, and to require OIS to purchase the shareholder’s shares for cash at such fair market value. See “The Merger – Dissenting Shareholders’ Rights” below and Annex E.

Q: What happens if I don’t indicate how to vote on my signed proxy form or broker voting instruction form?

A: If you sign and send in your proxy form but do not include instructions on how to vote your properly signed form, your shares will be voted:

| (1) | FOR the adoption of the merger agreement and the approval of the merger contemplated by such merger agreement (Proposal 1), |

| (2) | FOR the approval and adoption of the proposed amendment to the articles of incorporation (Proposal 2), |

| (3) | in accordance with management’s recommendation with respect to amendments or variations of the matters set forth in the notice of meeting or any other matters that may properly come before the OIS Special Meeting. |

If you sign and send in your broker voting instruction form but do not include instructions on how to vote your properly signed form, your shares will not be voted with respect to (i) the merger agreement and the merger contemplated therein (Proposal 1) (ii) the amendment to the articles of incorporation (Proposal 2), or (iii) or any other matters that may properly come before the OIS Special Meeting, and you will not be deemed present for quorum purposes.

Q: | What happens if I don’t return a proxy card or broker voting instruction form? |

A: If you are a registered or record holder of OIS common stock, not voting at the OIS Special Meeting will have the same effect as a vote AGAINST the approval and adoption of the merger agreement and the merger contemplated therein (Proposal 1) and AGAINST the approval and adoption of the proposed amendment to articles of incorporation (Proposal 2) because the affirmative vote of at least (1) 75% of OIS’ common stock entitled to vote in an election of directors and (2) a majority of those shares of OIS’ common stock entitled to vote on the proposal who are not “interested shareholders” (as defined in OIS’ articles of incorporation) or affiliates of interested shareholders, is required to approve and adopt the merger agreement and the merger transaction (Proposal 1) and the amendment to the articles of incorporation (Proposal 2).

Failing to return your proxy card may also contribute to a failure to obtain a quorum at the OIS Special Meeting. Under OIS’ bylaws, holders of shares representing a majority of the shares entitled to vote, present in person or represented by proxy, are necessary to constitute a quorum to take action with respect to the matters at the OIS Special Meeting.

Q: | Can I change my vote after I have mailed my signed proxy form or broker voting instruction form? |

A. Yes. You can change your vote before your proxy form or broker voting instruction form is voted at the OIS Special Meeting in one of three ways:

| Registered Holders. If you are a registered holder,: |

| • | First, before the OIS Special Meeting, you can deliver a signed notice of revocation of proxy to the Secretary of OIS at the address specified below at any time up to and including the last business day before the OIS Special Meeting. |

| • | Second, you can complete and submit a later-dated proxy form no later than 5:00 p.m. (local time) on the last business day before the OIS Special Meeting. |

10

| • | Third, you can attend the OIS Special Meeting and vote in person. Your attendance at the OIS Special Meeting alone will not revoke your proxy; rather, you must deposit a new proxy form or a notice of revocation of proxy with the Secretary of the OIS Special Meeting on the day of the OIS Special Meeting, before any vote is cast under the proxy’s authority, in order to revoke your previously submitted proxy form. |

If you are a registered holder and want to change your proxy directions by mail or by fax, you should send any notice of revocation or your completed new proxy form, as the case may be, to OIS at the following address:

Ophthalmic Imaging Systems

Attention: Ariel Shenhar, Secretary

221 Lathrop Way, Suite I

Sacramento, CA 95815

Fax: (916) 565-0415

Non-Registered Holders. If you are a non-registered holder and a broker, investment dealer, bank, trust company or other nominee holds your shares in “street name” and you have instructed such nominee to vote your shares and wish to change your vote, you must follow directions received from such nominee to change those instructions.

Q: If my broker or other nominee holds my shares in “street name,” will my broker or other nominee vote my shares for me?

A: No. Your broker or other nominee will NOT vote your shares unless it receives your specific instructions in a completed broker voting instruction form. After carefully reading and considering the information contained in this document, including the schedules and annexes , please follow the directions provided by your nominee with respect to voting procedures and complete a broker voting instruction form. Please ensure that your broker voting instruction form is submitted to your nominee in sufficient time to ensure that your vote is received by OIS on or before 5:00 p.m. (local time) on [date], 2008. If you have instructed a nominee to vote your shares and wish to change your vote, you must follow directions received from your nominee to change those instructions.

If you sign and send in your broker voting instruction form but do not include instructions on how to vote your properly signed form, your shares will not be voted with respect to (i) the merger agreement and the merger contemplated therein (Proposal 1) (ii) the amendment to the articles of incorporation (Proposal 2), or (iii) or any other matters that may properly come before the OIS Special Meeting, and you will not be deemed present for quorum purposes.

Q: | Who can help answer my questions about the merger? |

A: | If you have any questions on the proposed merger, please contact: |

Ariel Shenhar, CFO, Secretary,

Ophthalmic Imaging Systems

or

Joanna Ross, Finance Manager,

Ophthalmic Imaging Systems

Phone: (916) 646-2020

11

MEDIVISION STOCKHOLDER QUESTIONS AND ANSWERS

Q: | When and where is the Special General Meeting of the MediVision shareholders? |

A: The Special Meeting of MediVision shareholders will be held at the offices of MediVision’s Israeli legal counsel, Eitan Mehulal Pappo Barath & Shinar, Weissberger & Co, at 10 Abba Eban Blvd., Herzlia 46120, Israel. on [day], __________, 2008, [time] [a/p.m.] (the “MediVision Special Meeting”).

Q: | On what am I being asked to vote? |

A: | MediVision shareholders are being asked to: |

1. | | approve and adopt the merger agreement, dated as of March 25, 2008, by and among MediVision, OIS, and Merger Sub and the merger contemplated by the merger agreement; |

2. | | to approve and adopt an amendment to MediVision’s articles of association; |

3. | | to approve the grant of an exemption undertaking and indemnification undertaking to the members of MediVision’s board of directors (including its “external directors”) as well as its controlling shareholders and their representatives; |

4. | | to approve MediVision’s purchase of directors and officers insurance policy, with a coverage of up to $5,000,000 as of July, 2007 for a period of 12 months; and |

5. | | to transact such other business as may properly come before the Special Meeting or any adjournments thereof. |

Q: | Who is entitled to vote on each of the proposals? |

A: Only holders of MediVision ordinary shares as of the close of business on [date], 2008, the record date, are entitled to vote at the MediVision Special Meeting or any adjournment or postponement thereof. Each MediVision ordinary share is entitled to one vote.

Q: | What vote is required to approve each of the proposals? |

A. Proposal 1, approval and adoption of the merger agreement and the merger contemplated by the merger agreement will require the affirmative vote of at least 75% (not including abstentions) of the voting power represented at the meeting in person or by proxy, entitled to vote thereon and voting thereon, including the affirmative vote of Agfa, and (ii) such vote also includes the affirmative vote of the holders of at least one-third of all of the shares held by shareholders present and voting in person or by proxy (not including abstentions) who do not have a personal interest (as defined in the Israeli Companies Law) in the merger, or the total votes cast against the merger by shareholders present and voting in person or by proxy who do not have a personal interest in the merger do not exceed 1% of MediVision’s issued and outstanding share capital.

Q: | How do I vote on the approval and adoption of the merger agreement and the merger? |

A. First, please review the information contained in this document, including the schedules and annexes. This document contains important information about MediVision, OIS, and the merger. It also contains important information about what the boards of directors of MediVision and OIS considered in evaluating the merger

| • | If you are a registered holder of MediVision ordinary shares, please submit your proxy form promptly by signing, dating and returning the appropriate enclosed proxy form so that your shares can be voted at the MediVision Special Meeting. You may also attend in person and vote at the MediVision Special Meeting, even if you have already submitted a proxy form. |

12

| • | If you hold your MediVision ordinary shares in non-registered name or “street” name, you must contact your broker or other nominee to obtain a proxy form and for other instructions as to how to vote your shares. |

| • | You may also vote by way of a Voting Ballot. |

Q: | What happens if I don’t indicate how to vote on my signed proxy card or voting ballot? |

A: If you sign and send in your proxy form but do not include instructions on how to vote your properly signed form, your shares will be voted in accordance with the judgment of the person or persons voting the proxies. If you sign and send in a Voting Ballot but do indicate your vote, your shares will be voted FOR the approval and adoption of the merger agreement and the merger contemplated by such merger agreement.

Q: | What happens if I don’t return a proxy card or voting ballot? |

A: If you are a registered or a record holder of MediVision ordinary shares, not voting at the MediVision Special Meeting will mean that fewer votes will be required to defeat the proposal to approve the merger.

Failing to return your proxy card or Voting Ballot may also contribute to a failure to obtain a quorum at the MediVision Special Meeting. Under MediVision’s articles of association, the required quorum at any shareholders meeting is the presence of two shareholders present in person or by proxy, holding or representing at least one third of the total voting rights in MediVision on the Record Date, including the presence (in person or by proxy or by any communication media, at Agfa’s discretion) of a representative of Agfa.

Q: | Can I change my vote after I have mailed my signed proxy card or voting ballot? |

A: | Yes. You can change your vote before your proxy form is voted at the MediVision Special Meeting. |

| Registered Holders. If you are a registered holder, you can change your vote in one of three ways: |

| • | First, before the MediVision Special Meeting, you can deliver a signed notice of revocation of proxy to MediVision at the address specified below at any time up to 48 hours before the MediVision Special Meeting. |

| • | Second, you can complete and submit a later-dated proxy form no later than 48 hours before the MediVision Special Meeting. |

| • | Third, you can attend the MediVision Special Meeting and vote in person. Your attendance at the MediVision Special Meeting alone will not revoke your proxy; rather, you must deposit a new proxy form or a notice of revocation of proxy with MediVision on the day of the MediVision Special Meeting, before any vote is cast under the proxy’s authority, in order to revoke your previously submitted proxy form. |

If you are a registered holder and want to change your proxy directions by mail or by fax, you should send any notice of revocation or your completed new proxy form, as the case may be, to MediVision at the following address:

MediVision Medical Imaging Ltd

Attention: Gabby Bouganim, Secretary

Hermon Building, Industrial Zone

Yokneam-Elit 20692, Israel

Fax: +972-4- 989 4883

13

Non-Registered Holders. If you are a non-registered holder and a broker, investment dealer, bank, trust company or other nominee holds your shares in “street name” and you have instructed such nominee to vote your shares and wish to change your vote, you must follow directions received from such nominee to change those instructions.

A Voting Ballot may be revoked or changed by delivering written notice to MediVision to such effect and producing evidence of shareholder identity, as required under the Israeli Companies Law, provided this is done at least 24 hours prior to the time set for the MediVision Special Meeting.

Q: | Can I vote by telephone or electronically? |

A: | No. Votes must be given either personally or by proxy/voting ballot. |

Q: If my broker or other nominee holds my shares in “street name,” will my broker or other nominee vote my shares for me?

A: No. Your broker or other nominee will not vote your shares unless it receives your specific instructions in a completed broker voting instruction form. After carefully reading and considering the information contained in this document, including the schedules and annexes, please follow the directions provided by your nominee with respect to voting procedures and complete a broker voting instruction form. Please ensure that your broker voting instruction form is submitted to your nominee in sufficient time to ensure that your vote is received by MediVision on or before 5:00 p.m. (local time) on [date], 2008. If you have instructed a nominee to vote your shares and wish to change your vote, you must follow directions received from your nominee to change those instructions.

Q: | If I am an eligible shareholder, how do I get tax-deferred treatment under Israeli Law? |

A: MediVision is in the process of receiving a ruling under section 103k of the Israeli Tax Ordinance (“ITO”), according to which, Israeli shareholders residents will receive tax deferral treatment and will be tax liable upon the actual sale of the converted OIS shares, based on fulfillment of certain conditions and limitations imposed by the ruling.

Non-residents of Israel, including corporations, will generally be exempt from any capital gains tax in Israel from the conversion of shares as long as (i) the gains are not derived through a permanent establishment of the non-resident in Israel, (ii) the shares were bought when the company was listed on designated stock market, (iii) the shares remain listed for trading on a designated stock market and (iv) the shares were converted after being listed on designated stock market.

Q: | Do I need to send in my stock certificates now? |

A: Once closing conditions of the merger are satisfied, OIS will deliver to the Registrar of Companies of the State of Israel a notice informing the Companies Registrar of such satisfaction of closing conditions and the proposed date of the closing of the merger and requesting the Companies Registrar to issue a merger certificate evidencing the completion of the merger in accordance with the Israeli Companies Law after notice that the closing has occurred. The merger shall become effective upon the issuance by the Companies Registrar, after the closing, of the merger certificate.

TBD will act as conversion agent for the merger and will forward detailed instructions to the shareholders of MediVision regarding the surrender of their share certificates, together with a letter of transmittal, promptly after the merger is completed. You should not submit your certificates toTBD until you have received these materials. TBD will issue certificates of new OIS shares to all MediVision shareholders exchanging their shares as promptly as

14

practicable following its receipt of your certificates of MediVision shares and other required documents. YOU SHOULD NOT SEND ANY SHARE CERTIFICATES AT THIS TIME.

Q: | If I want to exercise my options or warrants, what do I do? |

A: MediVision’s outstanding options and warrants will be assumed by OIS in the merger. Each option or warrant so assumed will thereafter represent an option to purchase a numbers of shares of OIS common stock equal to the number of shares of MediVision ordinary shares subject to the option or warrants immediately prior to the merger (whether vested or not) multiplied by the conversion ratio which is 1.66, at an exercise price per share of Common Stock equal to the exercise price per share of such MediVision option or warrants in effect immediately prior to the closing divided by the conversion ratio of 1.66. The assumed options or warrants will have the similar terms as the original MediVision options or warrants. Conversion of exercises prices from Euros to US dollars will be converted at a rate of 1 Euro to 1.56 US dollars, the closing rate on the business day preceding the signing of the merger agreement, March 25, 2008.

Q: | Am I entitled to dissent or appraisal rights in connection with the merger? |

A: No. Under Israeli Law, holders of MediVision ordinary shares are not entitled to statutory dissenters’ or appraisal rights in connection with the merger.

Q: | Are there risks I should consider in deciding whether to vote for the merger? |

A: You should carefully review the section entitled, "Risk Factors" beginning on page 26 of this joint proxy statement/prospectus.

Q: | Who can help answer my questions about the merger? |

A: If you have any questions about the merger, please call Mr. Noam Allon, President and CEO of Medivision, at the follow number: +972-4-989 4884.

15

SUMMARY

This summary highlights selected information from this joint proxy statement/prospectus. It does not contain all of the information that may be important to you. You should carefully read this entire joint proxy statement/prospectus, including the annexes hereto, for a more complete understanding of the matters being considered at the special meetings.

Unless otherwise stated or the context otherwise requires, all references to “OIS” are to Ophthalmic Imaging Systems; all references to “MediVision” are to MediVision Medical Imaging Ltd.

Ophthalmic Imaging Systems

221 Lathrop Way, Suite I

Sacramento, California 95815

Phone: (916) 646-2020

OIS is engaged in the business of designing, developing, manufacturing and marketing digital imaging systems, image enhancement and analysis software and informatics solutions for use by practitioners in the ocular health field. OIS’ products are used for a variety of standard diagnostic test procedures performed in most eye care practices. Since its inception, OIS has developed products that have addressed primarily the needs of the ophthalmic angiography markets, both fluorescein and indocyanine green. The current flagship products in OIS’ angiography line are its WinStation digital imaging systems. These WinStation products are targeted primarily at retinal specialists and general ophthalmologists in the diagnosis and treatment of retinal diseases and other ocular pathologies. See “Business Information of OIS” for more information.

MediVision Medical Imaging Ltd

Hermon Building, Industrial Zone

Yokneam-Elit 20692, Israel

Phone: +972-4- 989 4884

MediVision designs, develops, manufactures and markets digital ophthalmic imaging systems. These systems capture and archive diagnostic images, providing a digital “patient record.” Future products which MediVision intends to focus on include more sophisticated systems for Ophthalmologists introducing additional diagnostic functions. Market penetration of MediVision’s current products is aimed at points of care such as hospitals, clinics and physicians in private practice in developed countries. MediVision’s main marketing efforts have to date largely been focused on the Western European market. MediVision has distribution arrangements with number of distributors in Holland, Greece, Denmark and United Kingdom. MediVision also market and sells its products in Germany and Belgium via its subsidiary and Branch accordingly. The headquarters of MediVision are located in Yokneam-Elit, a town situated close to Haifa, Israel. MediVision’s facility accommodates corporate functions, most of the R&D activities and management of domestic and European and International sales. See “Business Information of MediVision” for more information.

Comparative Per Share Data and Comparative Market Price Information

(see page 40)

OIS common stock is listed on the OTC Bulletin Board under the trading symbol “OISI.OB.” MediVision’s ordinary shares are quoted on the Euronext stock exchange under the trading symbol “MEDV.” Upon completion of the merger, MediVision’s ordinary shares will no longer trade on the Euronext.

The following tables set forth, for the periods presented, certain per share data of OIS and MediVision on a historical basis. The historical per share data of OIS and MediVision has been derived from, and should be read in conjunction with, the historical financial statements of OIS and MediVision incorporated by reference in this joint proxy statement/prospectus. See “Where You Can Find More Information.”

| | Three Months Ended | | Year Ended |

| | March 31, 2008 | | December 31, 2007 |

OIS—HISTORICAL | | | | | | | | |

Net income from continuing operations per share—basic | | | $ | ($0.02) | | | | $ | 0.09 | |

Net income from continuing operations per share—diluted | | | $ | ($0.02) | | | | $ | 0.09 | |

Book value at end of period—per common share outstanding | | | $ | 0.58 | | | | $ | 0.61 | |

| | | | | | | | | | |

| | Three Months Ended | | Year Ended |

| | March 31, 2008 | | December 31, 2007 |

MEDIVISION—HISTORICAL | | | | | | | | |

Net income from continuing operations per share—basic | | | $ | ($0.12) | | | | $ | ($0.07) | |

Net income from continuing operations per share—diluted | | | $ | ($0.12) | | | | $ | ($0.06) | |

Book value at end of period—per common share outstanding | | | $ | 1.30 | | | | $ | 1.43 | |

16

The following table sets forth the closing sale prices of OIS’ common stock and MediVision’s ordinary shares as reported on the OTC Bulletin Board and the Euronext, respectively, on (1) September 11, 2007, the last trading day before the public announcement of the merger, (2) March 26, 2008, the last trading day before public announcement that OIS and MediVision had executed the Merger Agreement, and (3) [date], the last trading day before the distribution of this proxy statement/prospectus. The price of OIS common stock has been converted from U.S. dollars to Euros and the price of MediVision ordinary shares has been converted from Euros to U.S. dollars, at the noon buying rate quoted by the Federal Reserve Bank of New York on such trading day. OIS urges you to obtain current market quotations for the OIS common stock and MediVision ordinary shares.

| | |

| OIS

Common Stock | MediVision

Ordinary Shares |

| | |

At September 11, 2007 | US$1.35/EURO.98 | US$1.92/EURO1.39 |

At March 26, 2008 | US$.38/ EURO.24 | US$1.18/EURO .75 |

At [date] | US$[#.#]/EURO[#.##] | US$#.##/EURO [#.##] |

The Merger

(see page 128)

Pursuant to the merger agreement, Merger Sub will merge with and into MediVision, pursuant to which Merger Sub will cease to exist, and MediVision will become a wholly-owned subsidiary of OIS. At the effective time of the merger, and as a result thereof, (1) each ordinary share, par value NIS 0.1 per share, of MediVision issued and outstanding immediately before the effective time of the merger, will be automatically converted into 1.66 shares of common stock, no par value, of OIS and each outstanding option to purchase MediVision shares, warrants or other rights to purchase MediVision shares will be assumed by OIS such that it is converted into an option, warrant or other right to purchase OIS Common Stock equal to the number of MediVision shares underlying such option, warrant or other right multiplied by 1.66.

The OIS Special Meeting

(see page 113)

When and Where.

The OIS Special Meeting will be held at [time] Pacific Standard Time on [date], 2008 at OIS’ principal executive offices, located at 221 Lathrop Way, Suite I, Sacramento, California 95815.

Purpose of the Special Meeting.

The purpose of the OIS Special Meeting is to (1) vote upon adoption of the merger agreement and approval of the merger contemplated therein (Proposal 1) and (2) OIS will cause the amendment of its articles of incorporation (Proposal 2) and (3) transact such other business as may properly come before the meeting.

The proposed amendments to the articles of incorporation are to:

| • | increase the number of directors to no less than 7 and no more than 11; |

| • | include a provision that eliminates cumulative voting upon OIS’ listing on the New York Stock Exchange, the American Stock Exchange, or the NASDAQ Stock Market; and |

| • | include a provision which, commencing on the closing of the merger, and as long as Agfa Geveart N.V., together with its affiliates (collectively “Agfa”), are the owner of at least 5% of the outstanding common stock of OIS, requires either unanimous approval of OIS’ board directors or the approval of 66 2/3% of the shares entitled to vote, for certain transactions concerning certain types of mergers, acquisitions or dispositions of assets, or issuances of securities, or changes in OIS’ principal business purpose. |

17

Record Date; Voting Power.

Only holders of OIS common stock as of the close of business on [date], 2008, the record date, are entitled to vote at the OIS Special Meeting or any adjournment or postponement thereof. Each share of OIS common stock is entitled to one vote.

Required Vote.

Both proposal 1 and 2 will require (1) the affirmative vote of at least 75% of OIS’ common stock entitled to vote in an election of directors and (2) the affirmative vote of the holders of a majority of the shares of OIS’ common stock entitled to vote on the proposal who are not “interested shareholders” (as defined in OIS’ articles of incorporation) or affiliates of interested shareholders. (For the definiiton of interested shareholder, see footnote 1 on page 7)

18

The MediVision Special Meeting

(see page 121)

The Special Meeting of MediVision shareholders will be held at the offices of MediVision’s Israeli legal counsel, Eitan Mehulal Pappo Barath & Shinar, Weissberger & Co, at 10 Abba Eban Blvd., Herzlia 46120, Israel on [day], __________, 2008, [time] [a/p.m.] (the “MediVision Special Meeting”).

Purpose of the Special Meeting.

The purpose of the MediVision Special Meeting is to (1) vote upon approval of the merger agreement and the merger contemplated therein, (2) vote upon approval and adoption of an amendment to MediVision’s articles of association, (3) vote upon the approval of the grant of an exemption undertaking and indemnification undertaking to the members of MediVision’s board of directors (including its “external directors”) as well as its controlling shareholders and their representatives, (4) vote on the approval of MediVision’s purchase of directors and officers insurance policy, with a coverage of up to $5,000,000 as of July, 2007 for a period of 12 months, and (5) transact such other business as may properly come before the meeting.

19

| Record Date; Voting Power. |

Only holders of MediVision ordinary shares as of the close of business on [date], 2008, the record date, are entitled to vote at the MediVision Special Meeting or any adjournment or postponement thereof. Generally, each MediVision ordinary share is entitled to one vote. Every shareholder entitled to vote in such election, or his, her, or its proxy, may cumulate such shareholder’s votes.

Required Vote.

Proposal 1, approval and adoption of the merger agreement and the merger contemplated by the agreement will require: (i) not less than 75% of the voting power represented at the meeting in person or by proxy, entitled to vote thereon and voting thereon, (not including abstentions) including the affirmative vote of Agfa, and (ii) such vote also includes the affirmative vote of the holders of at least 1/3 of all of the shares held by shareholders present and voting in person or by proxy (not including abstentions) who do not have a personal interest (as defined in the Israeli Companies Law) in the merger, or the total votes cast against the merger by shareholders present and voting in person or by proxy who do not have a personal interest in the merger do not exceed 1% of MediVision’s issued and outstanding share capital.

Proposal 2, approval and adoption of an amendment to MediVision’s articles of association will require the affirmative vote of at least 75% of the voting power represented at the meeting in person or by proxy, entitled to vote thereon and voting thereon, including the affirmative vote of Agfa.

Proposal 3, approval of the grant of an exemption undertaking and indemnification undertaking to the members of MediVision’s board of directors (including its “external directors”) as well as its controlling shareholders and their representatives, will require: (i) not less than 75% of the voting power represented at the meeting in person or by proxy, entitled to vote thereon and voting thereon, (not including abstentions) including the affirmative vote of Agfa, and (ii) such vote also includes the affirmative vote of the holders of at least 1/3 of all of the shares held by shareholders present and voting in person or by proxy (not including abstentions) who do not have a personal interest (as defined in the Israeli Companies Law) in the merger, or the total votes cast against the

20

merger by shareholders present and voting in person or by proxy who do not have a personal interest in the merger do not exceed 1% of MediVision’s issued and outstanding share capital.

Proposal 4, vote on the approval of MediVision’s purchase of directors and officers insurance policy, with a coverage of up to $5,000,000 as of July, 2007 for a period of 12 months, will require: (i) not less than 75% of the voting power represented at the meeting in person or by proxy, entitled to vote thereon and voting thereon, (not including abstentions) including the affirmative vote of Agfa, and (ii) such vote also includes the affirmative vote of the holders of at least 1/3 of all of the shares held by shareholders present and voting in person or by proxy (not including abstentions) who do not have a personal interest (as defined in the Israeli Companies Law) in the merger, or the total votes cast against the merger by shareholders present and voting in person or by proxy who do not have a personal interest in the merger do not exceed 1% of MediVision’s issued and outstanding share capital.

The Merger Agreement

(see page 152)

Recommendation of the Boards of Directors

(see pages 113 and 121)

The boards of directors of OIS and MediVision recommend that their respective shareholders vote “FOR” approval of the merger and the merger agreement. The boards of OIS and MediVision and a special independent committee appointed by OIS determined that the merger agreement and the merger are reasonable, fair to, and in the best interest of their respective shareholders.

In addition, OIS’ board of directors recommends that OIS shareholders vote “FOR” the approval and adoption of the amendment to OIS’ articles of incorporation.

Recommendation of Financial Advisors

OIS

(see page 132)

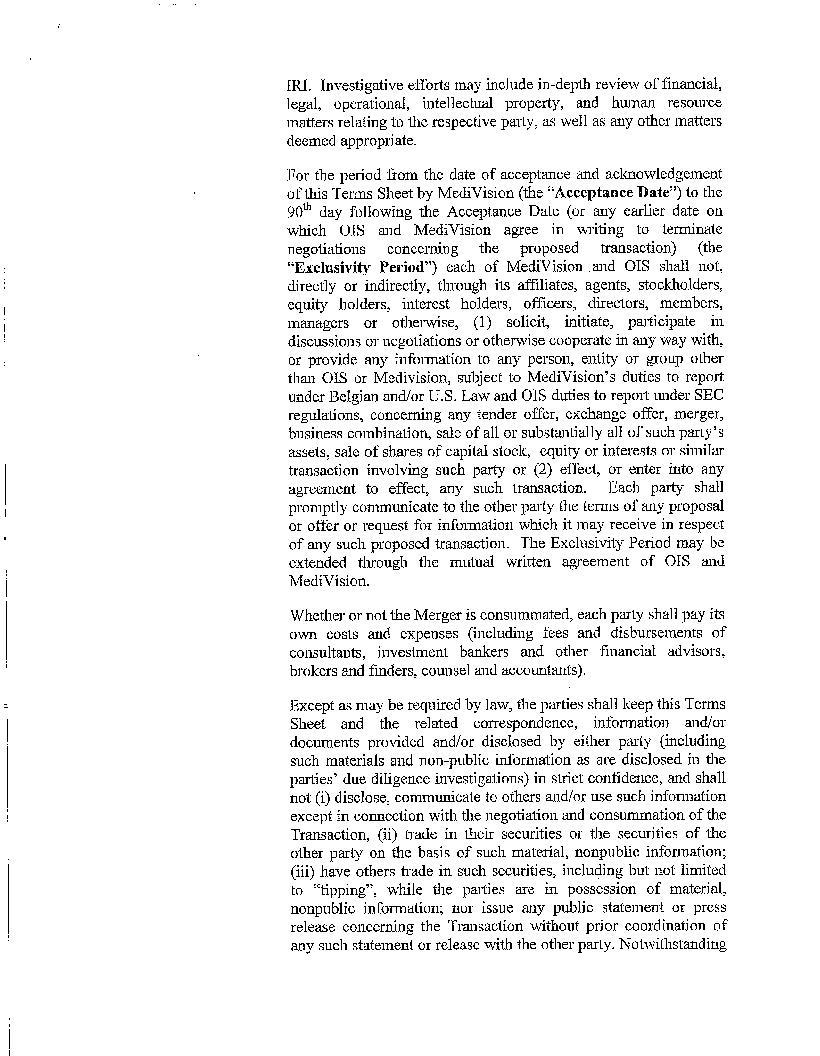

OIS’ financial advisor, Westwood Capital, LLC, delivered an opinion to the special independent committee and the board of directors of OIS to the effect that, as of March 13, 2008 and based upon and subject to the various considerations described in its written opinion, the conversion ratio was within a fair range, from a financial point of view, to the holders of OIS common stock, other than affiliates of OIS.