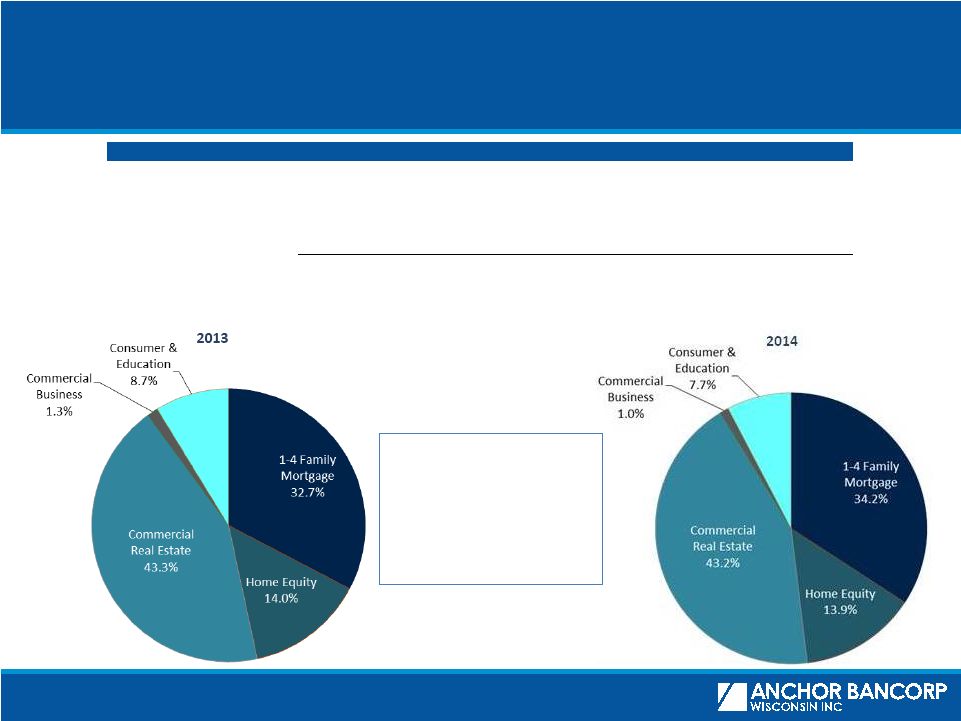

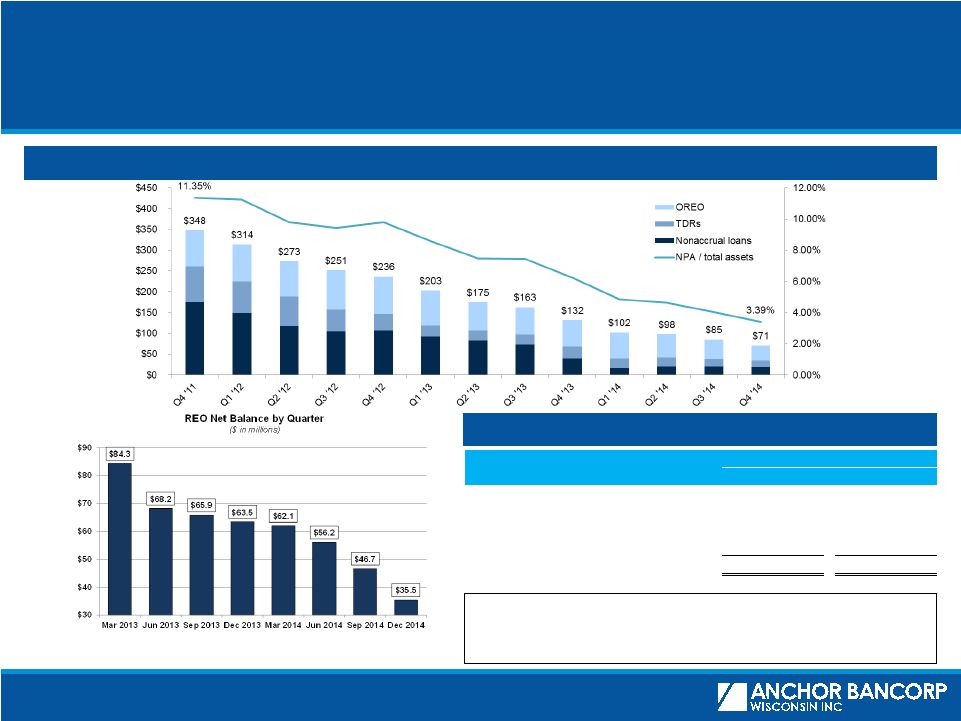

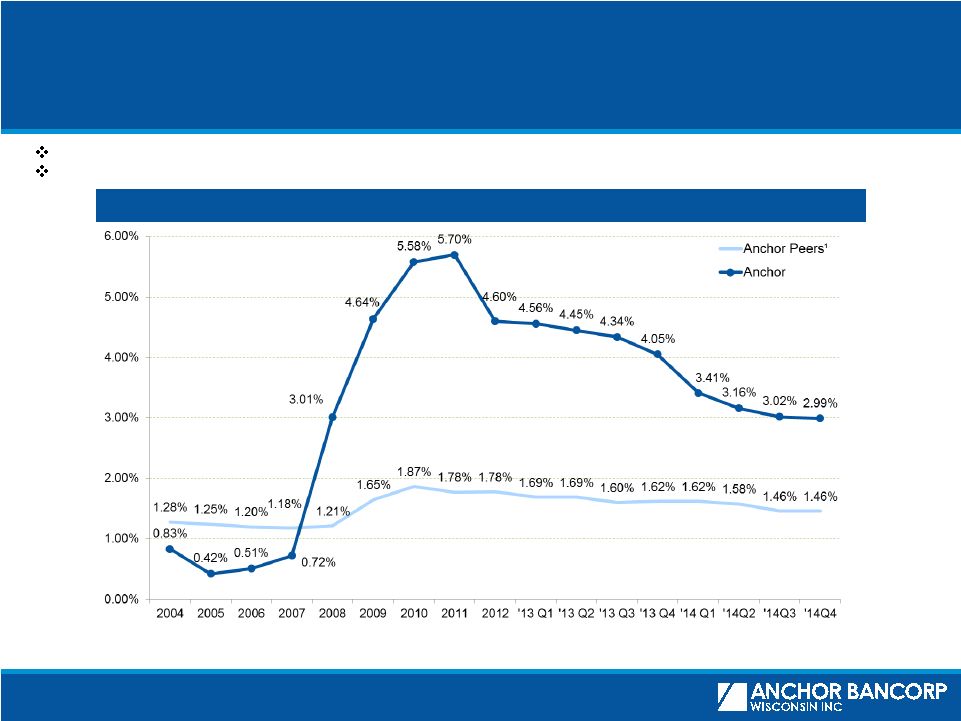

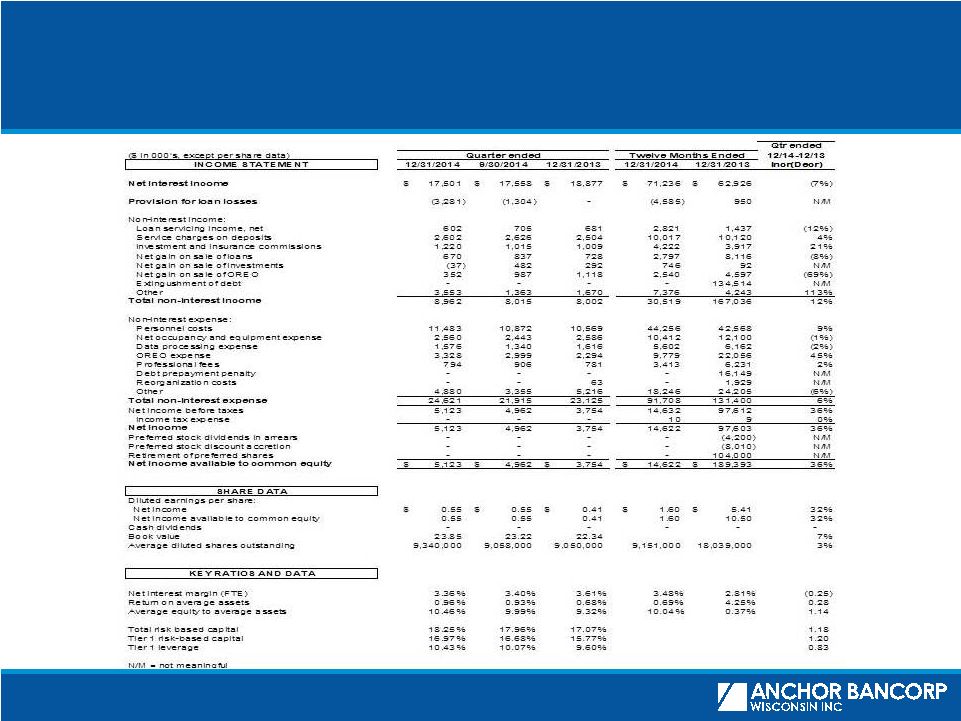

21 Consolidated Financial Summary (cont.) Ending balances (in 000's) 12/14-12/13 BALANCE SHEET 12/31/14 9/30/14 12/31/13 12/31/14 12/31/13 Incr(Decr) Assets: Investment securities 293,577 $ 294,105 $ 287,797 $ 294,599 $ 277,872 $ 6% Loans held for sale 5,608 5,145 4,137 6,594 3,085 114% Loans: Mortgage 1,197,365 1,185,377 1,242,172 1,224,720 1,232,132 (1%) Consumer 345,477 346,236 371,332 341,871 367,831 (7%) Commercial 16,579 16,252 21,863 16,514 21,591 (24%) Total loans 1,559,421 $ 1,547,865 $ 1,635,367 $ 1,583,105 $ 1,621,554 $ (2%) Allowance for loan losses (48,260) (49,377) (69,854) (47,037) (65,182) (28%) Interest earning deposits in banks 167,787 162,329 144,748 100,873 99,257 2% Other assets 148,898 160,877 177,792 144,245 175,888 (18%) Total assets 2,127,031 $ 2,120,944 $ 2,179,987 $ 2,082,379 $ 2,112,474 $ (1%) Liabilities and Stockholders' Equity: Total deposits 1,868,104 $ 1,872,362 $ 1,932,837 $ 1,814,171 $ 1,875,293 $ (3%) Other borrowed funds 14,982 14,520 19,167 13,752 12,877 7% Other liabilities 21,500 22,186 24,724 26,793 22,106 21% Total liabilities 1,904,586 $ 1,909,068 $ 1,976,728 $ 1,854,716 $ 1,910,276 $ (3%) Total stockholders' equity 222,445 211,876 203,259 227,663 202,198 13% Total liabilities & stockholders' equity 2,127,031 $ 2,120,944 $ 2,179,987 $ 2,082,379 $ 2,112,474 $ (1%) CREDIT QUALITY 12/31/14 9/30/14 12/31/13 12/31/2014 12/31/2013 Incr(Decr) Provision for loan losses (3,281) $ (1,304) $ - $ (4,585) $ 950 $ N/M Net charge-offs (3,281) 834 6,671 13,560 19,529 (149%) Ending allowance for loan losses 47,037 47,037 65,182 (28%) Key Metrics Loans 30 to 89 days past due 8,892 $ 9,979 $ 16,165 $ (45%) Non-performing loans (NPL) 35,115 38,352 68,497 (49%) Other real estate owned 35,491 46,725 63,460 (44%) Non-performing assets 70,606 85,077 131,957 (46%) Allowance for loan losses to NPL 133.95% 122.65% 95.16% 38.79 N/M = not meaningful Quarter ended Averages Ending balances |