Filed by Old National Bancorp

Pursuant to Rule 425 under the Securities Act of 1933

Subject Company: Anchor BanCorp Wisconsin Inc.

Commission File No.: 001-34955

On January 13, 2016, the below talking points prepared in connection with the proposed merger transaction between Old National Bancorp and Anchor BanCorp Wisconsin Inc. (“Anchor”) were provided to employees of Anchor’s wholly-owned subsidiary, AnchorBank:

Talking Points for conversations with AnchorBank clients (internal use only)

Please use these talking points in conjunction with the “Old National At A Glance” flyer to address client questions.

| | • | | On January 12, Old National agreed to acquire Anchor BanCorp Wisconsin Inc., and all AnchorBank branches. | |

| | • | | Absolutely nothing is changing right now. It’s still AnchorBank, and you should continue to bank as you always have (same checks, same locations, same ATMs). | |

| | • | | You can expect to see the same friendly faces you’ve become accustomed to seeing along with the same exceptional service. | |

| | • | | The partnership is expected to close in the 2nd quarter of this year. All AnchorBank branches will ultimately become Old National banking centers in 2016. The precise timing of this conversion is still to be determined; we will keep you informed as more details develop. | |

| | • | | Old National is a secure, FDIC-insured community bank that is fully committed to AnchorBank clients and to this community. | |

| | • | | Headquartered in Evansville, Ind. (in the southwestern corner of the state), Old National has been serving individuals, families, businesses and communities for more than 180 years. | |

| | • | | Old National operates 160 banking centers in Indiana, Illinois, Michigan and Kentucky. Old National entered the state of Michigan in 2013, and today has banking centers in Grand Rapids, Ann Arbor and Kalamazoo. Old National also has branches in Indianapolis, Fort Wayne, Bloomington and Lafayette, Ind., and in Louisville and Lexington, Ky. | |

| | • | | In addition to providing comprehensive retail, commercial and business banking services, Old National offers Wealth Management, Investments and Insurance services. | |

| | • | | Over time Old National will work with Anchor management to determine the best possible locations to serve our clients. Old National has no immediate plans to close any AnchorBank branches as a result of this acquisition. | |

| | • | | You can learn more atoldnational.com and by reviewing this “Old National At A Glance” flyer. | |

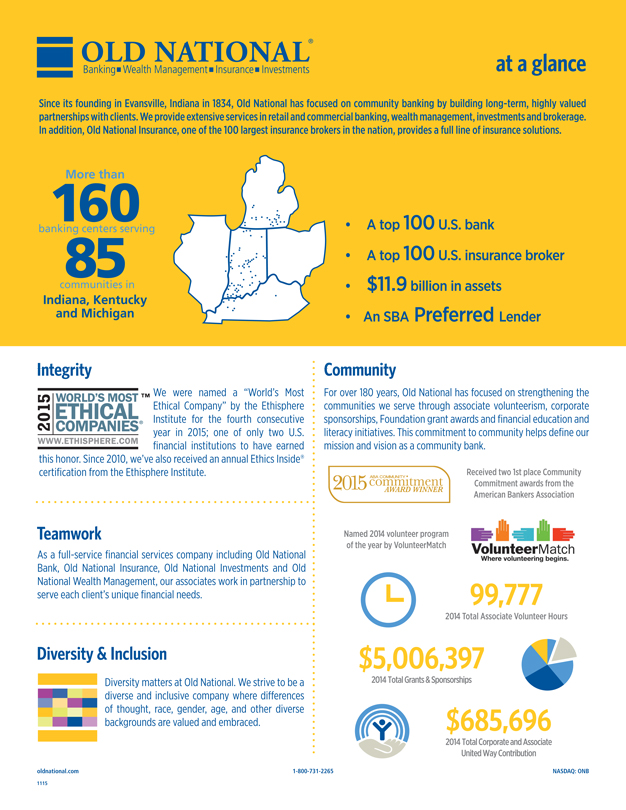

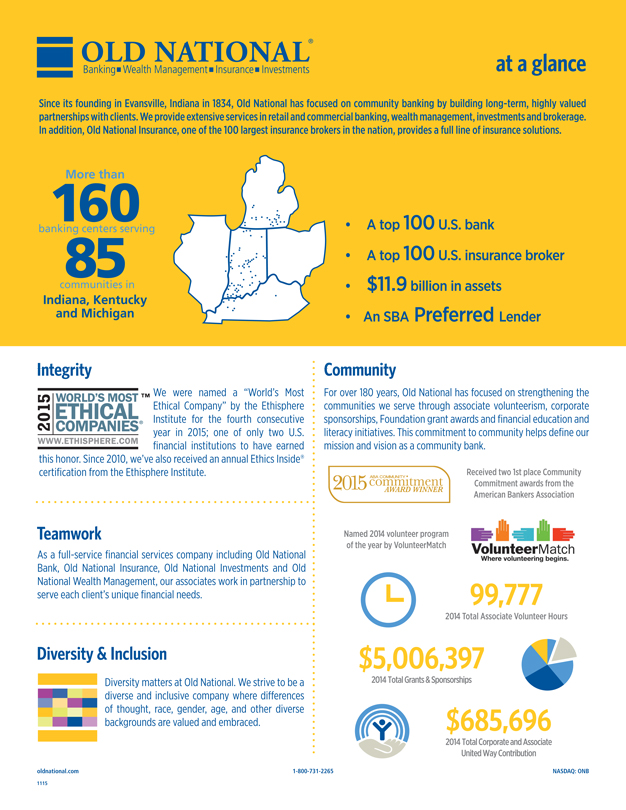

OLD NATIONAL

at a glance

Since its founding in Evansville, Indiana in 1834, Old National has focused on community banking by building long-term, highly valued partnerships with clients. We provide extensive services in retail and commercial banking, wealth management, investments and brokerage. In addition, Old National Insurance, one of the 100 largest insurance brokers in the nation, provides a full line of insurance solutions.

160 More than banking 85 centers serving communities in

Indiana, Kentucky and Michigan

A top 100 U.S. bank

A top 100 U.S. insurance broker

$11.9 billion in assets

An SBA Preferred Lender

Integrity

We were named a “World’s Most Ethical Company” by the Ethisphere Institute for the fourth consecutive year in 2015; one of only two U.S. financial institutions to have earned this honor. Since 2010, we’ve also received an annual Ethics Inside® certification from the Ethisphere Institute.

Teamwork

As a full-service financial services company including Old National Bank, Old National Insurance, Old National Investments and Old National Wealth Management, our associates work in partnership to serve each client’s unique financial needs.

Diversity & Inclusion

Diversity matters at Old National. We strive to be a diverse and inclusive company where differences of thought, race, gender, age, and other diverse backgrounds are valued and embraced.

Community

For over 180 years, Old National has focused on strengthening the communities we serve through associate volunteerism, corporate sponsorships, Foundation grant awards and financial education and literacy initiatives. This commitment to community helps define our mission and vision as a community bank.

Received two 1st place Community Commitment awards from the American Bankers Association

Named 2014 volunteer program of the year by VolunteerMatch

99,777

2014 Total Associate Volunteer Hours

$5,006,397

2014 Total Grants & Sponsorships

$685,696

2014 Total Corporate and Associate United Way Contribution

oldnational.com

1115

1-800-731-2265

NASDAQ: ONB

Additional Information for Shareholders

Communications in this document do not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed merger, ONB will file with the SEC a Registration Statement on Form S-4 that will include a Proxy Statement of Anchor and a Prospectus of ONB, as well as other relevant documents concerning the proposed transaction. Shareholders are urged to read the Registration Statement and the Proxy Statement/Prospectus regarding the merger when it becomes available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information. A free copy of the Proxy Statement/Prospectus, as well as other filings containing information about ONB and Anchor, may be obtained at the SEC’s Internet site (http://www.sec.gov). You will also be able to obtain these documents, free of charge, from ONB at www.oldnational.com under the tab “Investor Relations” and then under the heading “Financial Information” or from Anchor by accessing Anchor’s website at www.anchorbank.com under the tab “About Us.”

ONB and Anchor and certain of their directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Anchor in connection with the proposed merger. Information about the directors and executive officers of ONB is set forth in the proxy statement for ONB’s 2015 annual meeting of shareholders, as filed with the SEC on a Schedule 14A on March 13, 2015. Information about the directors and executive officers of Anchor is set forth in the proxy statement for Anchor’s 2015 annual meeting of shareholders, as filed with the SEC on a Schedule 14A on March 27, 2015. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the Proxy Statement/Prospectus regarding the proposed merger when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph.

Forward-Looking Statements

This document and accompanying material contain certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, statements about the expected timing, completion, financial benefits and other effects of the proposed merger between ONB and Anchor. Forward-looking statements can be identified by the use of the words “anticipate,” “believe,” “expect,” “intend,” “could” and “should,” and other words of similar meaning. These forward-looking statements express management’s current expectations or forecasts of future events and, by their nature, are subject to risks and uncertainties and there are a number of factors that could cause actual results to differ materially from those in such statements. Factors that might cause such a difference include, but are not limited to: expected cost savings, synergies and other financial benefits from the proposed merger might not be realized within the expected time frames and costs or difficulties relating to integration matters might be greater than expected; the requisite shareholder and regulatory approvals for the proposed merger might not be obtained; satisfaction of other closing conditions; delay in closing the proposed merger; the reaction to the transaction of the companies’ customers and employees; market, economic, operational, liquidity, credit and interest rate risks associated with ONB’s and Anchor’s businesses; competition; government legislation and policies (including the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act and its related regulations); ability of ONB and Anchor to execute their respective business plans (including integrating the ONB and Anchor businesses); changes in the economy which could materially impact credit quality trends and the ability to generate loans and gather deposits; failure or circumvention of our internal controls; failure or disruption of our information systems; significant changes in accounting, tax or regulatory practices or requirements; new legal obligations or liabilities or unfavorable resolutions of litigations; other matters discussed in this document and other factors identified in ONB’s Annual Report on Form 10-K and other periodic filings with the SEC. These forward-looking statements are made only as of the date of this document, and neither ONB nor Anchor undertakes an obligation to release revisions to these forward-looking statements to reflect events or conditions after the date of this document.