Exhibit 99.1

Stratus Properties Inc. 212 Lavaca St., Suite 300 Austin, Texas 78701 | NEWS RELEASE NASDAQ Symbol: “STRS” Financial and Media Contact:

Sydney Isaacs Abernathy MacGregor

713-343-0427 / SRI@abmac.com |

Stratus Properties Mails Letter to Stockholders

Highlights Value Creation Under Current Board

Urges Stockholders to Vote FOR Company’s Qualified Directors

AUSTIN, TX, May 16, 2016 – Stratus Properties Inc. (NASDAQ: STRS) (the “Company” or “Stratus”) today issued the following letter from its Board of Directors (the “Board”) to its stockholders.

May 16, 2016 Dear Fellow Stockholders: Your Company has delivered strong performance. Your Board has put in place a strategic plan, and we believe the plan is already creating value. We are also conducting a review of strategic alternatives to ensure we are taking the right steps to maximize value for all stockholders. One of our stockholders, Carl Berg, wants his nominees elected to your Board and wants to force the Company to be sold immediately in a “fire sale.” We are writing to you because we believe Mr. Berg’s plan could put the value of your investment at risk. If you want Stratus to continue its successful strategies for value creation and to evaluate all options to maximize value for ALL stockholders, then please vote TODAY for your Board’s nominees and against Mr. Berg’s stockholder proposal on the WHITE proxy card – by telephone, over the Internet, or by signing, dating and returning it in the postage-paid envelope provided. Sincerely, The Board of Directors of Stratus Properties Inc. YOUR VOTE IS IMPORTANT VOTE “FOR” ALL OF THE STRATUS BOARD NOMINEES AND “AGAINST” THE BERG STOCKHOLDER PROPOSAL ON THE WHITE PROXY CARD TODAY 1

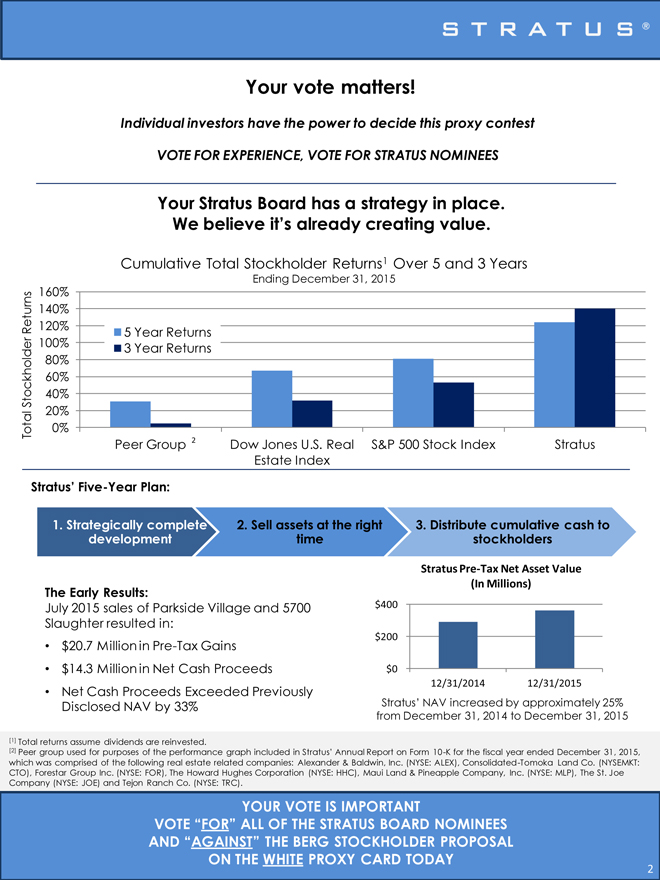

Your vote matters! 0% 20% 40% 60% 80% 100% 120% 140% 160% Peer Group Dow Jones U.S. Real Estate Index S&P 500 Stock Index Stratus Cumulative Total Stockholder Returns1 Over 5 and 3 Years Ending December 31, 2015 5 Year Returns 3 Year Returns 2 The Early Results: July 2015 sales of Parkside Village and 5700 Slaughter resulted in: •$20.7 Million in Pre-Tax Gains •$14.3 Million in Net Cash Proceeds •Net Cash Proceeds Exceeded Previously Disclosed NAV by 33% 1. Strategically complete development 2. Sell assets at the right time 3. Distribute cumulative cash to stockholders Stratus’ Five-Year Plan: May XX, 2016 Your Stratus Board has a strategy in place. We believe it’s already creating value. Individual investors have the power to decide this proxy contest VOTE FOR EXPERIENCE, VOTE FOR STRATUS NOMINEES Total Stockholder Returns [1] Total returns assume dividends are reinvested. [2] Peer group used for purposes of the performance graph included in Stratus’ Annual Report on Form 10-K for the fiscal year ended December 31, 2015, which was comprised of the following real estate related companies: Alexander & Baldwin, Inc. (NYSE: ALEX), Consolidated-Tomoka Land Co. (NYSEMKT: CTO), Forestar Group Inc. (NYSE: FOR), The Howard Hughes Corporation (NYSE: HHC), Maui Land & Pineapple Company, Inc. (NYSE: MLP), The St. Joe Company (NYSE: JOE) and Tejon Ranch Co. (NYSE: TRC). YOUR VOTE IS IMPORTANT VOTE “FOR” ALL OF THE STRATUS BOARD NOMINEES AND “AGAINST” THE BERG STOCKHOLDER PROPOSAL ON THE WHITE PROXY CARD TODAY $0 $200 $400 12/31/2014 12/31/2015 Stratus Pre-Tax Net Asset Value (In Millions) 2 Stratus’ NAV increased by approximately 25% from December 31, 2014 to December 31, 2015

We believe Stratus is well positioned to unlock further significant value Strong Austin economy supports continued asset value growth Experienced team with the necessary relationships and regulatory knowledge in Austin We believe Stratus’ current Board has the necessary skills, relationships, and corporate governance and development expertise to continue to build value VOTE THE WHITE PROXY CARD TODAY Stratus Nominees have the right leadership, experience, local market knowledge Mr. Beau Armstrong Deep industry and market expertise critical for execution Mr. Charles Porter Unique hospitality experience drives hotel, entertainment venue strategy WE BELIEVE MR. BERG’S PROXY CONTEST IS A SELF-SERVING CAMPAIGN Our View of Berg Nominees: Wrong People, Wrong Incentives, Wrong Strategy Berg plan: • Berg nominees: little or no • forced “fire sale,” minimal experience as public company analysis provided, driven by Mr. directors or with real estate in Austin Berg’s desire to exit his illiquid position Mr. Dean: has a “golden leash” agreement with Mr. Berg under which he would forego substantial value if the Company is not sold within three years, creating a clear financial incentive for Dean to work towards Mr. Berg’s short-term liquidity goals Mr. Knapp: has been a full-time employee of Mr. Berg’s companies for 20+ years Mr. Berg’s Record of Destroying Value Stockholders lost significant v alue while Mr. Berg was a director on boards of: Valence Technology, Focus Enhancements and Monolithic Systems. Stockholders in each of these companies lost substantial value.

Your Vote Is Important No Matter How Many Shares You Own If you have questions about how to vote your shares, or need additional assistance, please contact the firm assisting us in the solicitation of proxies: INNISFREE M&A INCORPORATED Stockholders Call Toll-Free: (888) 750-5834 Banks and Brokers Call Collect: (212) 750-5833 IMPORTANT We urge you NOT to sign any gold proxy card sent to you by Carl Berg. If you have already done so, you have every legal right to change your vote by using the enclosed WHITE proxy card to vote TODAY— by telephone, by Internet, or by signing, dating and returning the WHITE proxy card in the postage-paid envelope provided. Important Additional Information Stratus Properties Inc., its directors and certain of its executive officers are participants in the solicitation of proxies from Stratus stockholders in connection with the matters to be considered at Stratus’ 2016 Annual Meeting. Stratus has filed its definitive proxy statement and form of WHITE proxy card with the U.S. Securities and Exchange Commission (the “SEC”) on April 15, 2016 in connection with any such solicitation of proxies from Stratus stockholders. STRATUS STOCKHOLDERS ARE STRONGLY ENCOURAGED TO READ SUCH PROXY STATEMENT, ACCOMPANYING WHITE PROXY CARD (INCLUDING ANY AMENDMENTS AND SUPPLEMENTS THERETO) AND ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION. Information regarding the ownership of Stratus’ directors and executive officers in Stratus stock, restricted stock units and stock options is included in their SEC filings on Forms 3, 4, and 5, which can be found through Stratus’ website (www.stratusproperties.com) in the section “Investor Relations” or through the SEC’s website at www.sec.gov. Information can also be found in Stratus’ other SEC filings, including Stratus’ definitive proxy statement for the 2016 Annual Meeting and its Annual Report on Form 10-K for the year ended December 31, 2015 as updated by Stratus’ subsequent filings with the SEC. More detailed and updated information regarding the identity of potential participants, and their direct or indirect interests, by security holdings or otherwise, is set forth in the definitive proxy statement and other materials to be filed with the SEC in connection with Stratus’ 2016 Annual Meeting. Stockholders will be able to obtain any proxy statement, any amendments or supplements to the proxy statement and other documents filed by Stratus with the SEC for no charge at the SEC’s website at www.sec.gov. Copies will also be available at no charge at Stratus’ website at www.stratusproperties.com, by writing to Stratus Properties Inc. at 212 Lavaca Street, Suite 300, Austin, TX 78701, or by calling Stratus’ proxy solicitor, Innisfree M&A Incorporated, toll-free at 888-750-5834. Forward-Looking Statements This press release contains forward-looking statements in which Stratus discusses factors it believes may affect its future performance. Forward-looking statements are all statements other than statements of historical facts, such as statements regarding the implementation and potential results of Stratus’ five-year plan, projections or expectations related to operational and financial performance or liquidity, reimbursements for infrastructure costs, financing and regulatory matters, development plans and sales of properties, commercial leasing activities, timeframes for development, construction and completion of Stratus’ projects, capital expenditures, liquidity and capital resources, and other plans and objectives of management for future operations and activities. The words “anticipates,” “may,” “can,” “plans,” “believes,” “potential,” “estimates,” “expects,” “projects,” “intends,” “likely,” “will,” “should,” “to be” and any similar expressions and/or statements that are not historical facts are intended to identify those assertions as forward-looking statements. Your Vote Is Important No Matter How Many Shares You Own If you have questions about how to vote your shares, or need additional assistance, please contact the firm assisting us in the solicitation of proxies: INNISFREE M&A INCORPORATED Stockholders Call Toll-Free: (888) 750-5834 Banks and Brokers Call Collect: (212) 750-5833 IMPORTANT We urge you NOT to sign any gold proxy card sent to you by Carl Berg. If you have already done so, you have every legal right to change your vote by using the enclosed WHITE proxy card to vote TODAY— by telephone, by Internet, or by signing, dating and returning the WHITE proxy card in the postage-paid envelope provided.

Stratus cautions readers that forward-looking statements are not guarantees of future performance, and its actual results may differ materially from those anticipated, projected or assumed in the forward-looking statements. Important factors that can cause Stratus’ actual results to differ materially from those anticipated in the forward-looking statements include, but are not limited to, the outcome of the strategic review process, Stratus’ ability to refinance and service its debt and the availability of financing for development projects and other corporate purposes, Stratus’ ability to sell properties at prices its board considers acceptable, a decrease in the demand for real estate in the Austin, Texas market, changes in economic and business conditions, reductions in discretionary spending by consumers and corporations, competition from other real estate developers, hotel operators and/or entertainment venue operators and promoters, business opportunities that may be presented to and/or pursued by Stratus, the termination of sales contracts or letters of intent due to, among other factors, the failure of one or more closing conditions or market changes, the failure to attract customers for its developments or such customers’ failure to satisfy their purchase commitments, increases in interest rates, declines in the market value of its assets, increases in operating costs, including real estate taxes and the cost of construction materials, changes in external perception of the W Austin Hotel, changes in consumer preferences, changes in laws, regulations or the regulatory environment affecting the development of real estate, opposition from special interest groups with respect to development projects, weather-related risks and other factors described in more detail under the heading “Risk Factors” in Stratus’ Annual Report on Form 10-K for the year ended December 31, 2015, filed with the SEC as updated by Stratus’ subsequent filings with the SEC. Investors are cautioned that many of the assumptions upon which Stratus’ forward-looking statements are based are likely to change after the forward-looking statements are made. Further, Stratus may make changes to its business plans that could affect its results. Stratus cautions investors that it does not intend to update its forward-looking statements notwithstanding any changes in its assumptions, business plans, actual experience, or other changes, and Stratus undertakes no obligation to update any forward-looking statements. This press release also includes measures of estimated pre-tax net asset value (“NAV”), which are not recognized under U.S. generally accepted accounting principles (“GAAP”). We do not believe there is a directly comparable GAAP measure to NAV. We believe this measure can be helpful to investors in evaluating our business because NAV illustrates current embedded value in our real estate, which is carried on our GAAP balance sheet primarily at cost. Our management uses NAV as one of the metrics in evaluating progress on our five-year plan. NAV is not intended to be a performance measure that should be regarded as more meaningful than GAAP measures. Other companies may calculate this measure differently. For a discussion of NAV, including how our NAV is calculated, please see the Investor Presentation dated March 15, 2016, including the “Cautionary Statement,” available on our website at www.stratusproperties.com. 5 YOUR VOTE IS IMPORTANT VOTE “FOR” ALL OF THE STRATUS BOARD NOMINEES AND “AGAINST” THE BERG STOCKHOLDER PROPOSAL ON THE WHITE PROXY CARD TODAY

***

About Stratus Properties Inc.

Stratus is a diversified real estate company engaged primarily in the acquisition, entitlement, development, management, operation and sale of commercial, hotel, entertainment, and multi- and single-family residential real estate properties, primarily located in the Austin, Texas area, but including projects in certain other select markets in Texas.

Contacts:

Media: The Abernathy MacGregor Group

Sydney Isaacs, 713-343-0427

Investors: Innisfree

Scott Winter/Larry Miller, 212-750-5833