Exhibit 99.1

CREW GOLD CORPORATION

Annual Information Form

For the year ended June 30, 2005

September 5, 2005

TABLE OF CONTENTS

CERTAIN REFERENCES AND GLOSSARY

In this Annual Information Form ( “AIF” ), unless the context otherwise requires, references to the “Company”, “we”, “us”, “our” or similar terms refer to Crew Gold Corporation either alone or together with its subsidiaries, except to the extent the context requires otherwise.

The “Glossary of Terms” at page G-1 of this AIF contains definitions of terms used in this AIF.

DATE OF INFORMATION

The information in this AIF is presented as of June 30, 2005, unless otherwise indicated.

FORWARD LOOKING STATEMENTS

This AIF contains certain “forward looking statements”. These statements relate to future events or future performance and reflect our expectations regarding our growth, results of operations, performance, business prospects, opportunities or industry performance and trends. These forward looking statements reflect our current internal projections, expectations or beliefs and are based on information currently available to us. In some cases, forward looking statements can be identified by terminology such as “may”, “will”, “should”, “expect”, “plan”, “anticipate”, “believe”, “estimate”, “predict”, “potential”, “continue” or the negative of these terms or other comparable terminology. A number of factors could cause actual events or results to differ materially from the results discussed in the forward looking statements. In evaluating these statements, you should specifically consider various factors, including, but not limited to, the risks and uncertainties discussed under “Risk Factors” and elsewhere in this AIF. Actual results may differ materially from any forward looking statement. Although we believe that the forward looking statements contained in this AIF are based upon reasonable assumptions, you cannot be assured that actual results will be consistent with these forward looking statements. These forward looking statements are made as of the date of this AIF, and we assume no obligation to update or revise them to reflect new events or circumstances.

CURRENCY AND EXCHANGE RATES

In this AIF all monetary amounts are expressed in US dollars, unless otherwise indicated.

The following table reflects the high and low rates of exchange for one US dollar, expressed in Canadian dollars, in effect during the periods noted, the rates of exchange at the end of such periods and the average rates of exchange during such periods, based on the Bank of Canada noon spot rate of exchange:

| | Year Ended June 30 | |

| | 2005 | | 2004 | | 2003 | | 2002 | | 2001 | |

| | Cdn$ | | Cdn$ | | Cdn$ | | Cdn$ | | Cdn$ | |

High for the period | | 1.3460 | | 1.4116 | | 1.5942 | | 1.6132 | | 1.5789 | |

Low for the period | | 1.1774 | | 1.2692 | | 1.3342 | | 1.5099 | | 1.4641 | |

Rate at the end of the period | | 1.2256 | | 1.3404 | | 1.3553 | | 1.5187 | | 1.5177 | |

Average rate for the period | | 1.2504 | | 1.3433 | | 1.5101 | | 1.5685 | | 1.5190 | |

On June 30, 2005, the Bank of Canada noon spot rate of exchange was Cdn$1.2256 = US$1.00.

2

THE COMPANY

Crew was incorporated under the Company Act of the Province of British Columbia on March 31, 1980 under the name Ryan Energy Corp. (N.P.L). Crew changed its name to Ryan Resources Ltd. on December 18, 1985, to Canadian Crew Energy Corporation on January 21, 1988, to Crew Development Corporation on March 21, 1997 and to the present Crew Gold Corporation on December 15, 2003. As of January 28, 2000, Crew continued as a corporation in the Yukon Territory and is subject to the Business Corporations Act of the Yukon Territory.

The registered office of the Company is Suite 200-204 Lambert Street, Whitehorse, Yukon Territory YIA 3T2, Canada, and the head office of the Company is Abbey House, Wellington Way, Weybridge, Surrey, KT13 OTT, UK.

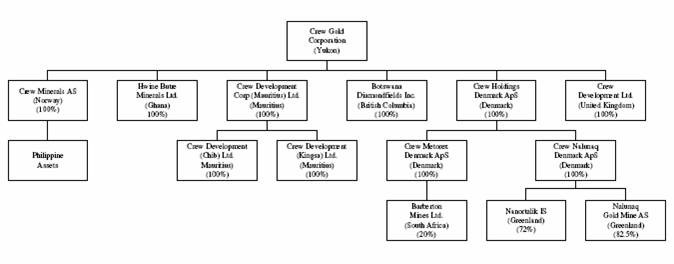

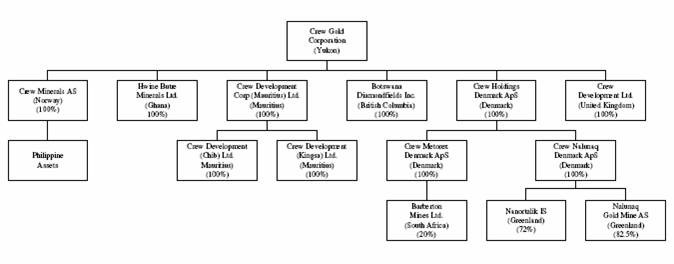

The following chart includes the principal operating subsidiaries and partnerships of the Company as of June 30, 2005 and, for each subsidiary or partnership, its place of organization and the Company’s percentage of voting interests beneficially owned or over which control or direction is exercised.

GENERAL DEVELOPMENT OF OUR BUSINESS

Overview

Crew is a public, internationally listed, international mining company focused on identifying, acquiring and developing resource projects worldwide but with a primary focus on gold. It is the Company’s objective to have direct interests in gold exploration and gold producing assets and enter into joint ventures with industrial partners for development of none-core assets presently owned by Crew. It is Crew’s objective to have the joint venture partners take all or the major part of the operating risks and capital expenditures in the non core assets. This strategy is a result of a management and Board evaluation of where the main potential for near term income is, as well as where the Company can see further growth based on the Company’s own financial and human resources. Crew believes that the combination of seeking premium returns by way of adding value to early-stage projects, supported by cash flows from a growing operating base, maximises the potential returns for shareholders, while mitigating the risks.

Crew seeks to maintain a balanced portfolio of both exploration projects and cash generating projects. There are distinct risk profiles the Company applies to different projects. The Company would normally seek to develop small and medium sized gold projects itself. With larger gold projects the Company would, from a risk and reward perspective, evaluate its human and financial resources before making a decision on the involvement of a potential partner.

All non-gold projects are placed in Crew Minerals AS, a wholly owned subsidiary. With all non-gold projects the Company’s strategy is, unlike gold projects, to take less financial and operational risk by seeking prospective partners.

At present, Crew has an operating mine in Greenland and a 20% interest in a gold mining operation in South Africa. In addition to its interests in commercial gold mining operations, Crew also holds gold and other development projects in Greenland, the Philippines and Norway.

3

History

In March 2002, the Company experienced a change of control as a direct consequence of a dissident shareholder action, which resulted in a change in the Board of Directors and the senior management. The new senior management placed a strategic focus on developing and operating gold and precious metals assets directly owned by the Company. First priority was given to the completion of the development of Nalunaq Gold Mine. Nalunaq commenced commercial production in July 2004.

In line with the stated corporate strategy, since March 2002, the Company:

(i) disposed of the majority of its investment in Metorex Limited, a South African based public company, and used the proceeds from this sale of shares to fund Nalunaq and other exploration;

(ii) formed Nalunaq Gold Mine A/S, in which the Company owns an 82.5% shareholding and introduced a new operational structure;

(iii) invested in Barberton Mines Limited (20% interest), a South African based gold mining operation;

(iv) acquired the mineral rights to the Seqi olivine project in western Greenland, subsequently signed an agreement in July 2003 with Minelco AB, a subsidiary of the Swedish iron ore producer LKAB for the development of the project and subsequently divested its interest to its industrial partner;

(v) restructured, consolidated and centralized it’s corporate offices to Weybridge, England; and

(vi) with its associated Philippine partner, acquired approximately 72.5% of the issued share capital of the Philippine based Apex Mining Company.

On October 27, 2004 the Company issued a $23.4 million five-year unsecured bond issue through a private placement. On June 27, 2005 the Company concluded a private placement of 17.6 million new common shares at NOK 8.20 per share realizing gross proceeds of NOK 144.3 million. On August 16, 2005 the Company announced a further private placement of 19.45 million new common shares at NOK 10.50 which is expected to realize gross proceeds of NOK 204.2 million. The private placements were directed towards institutional investors. The new funds raised put the Company in a strong treasury position and will be utilized to expand the Company’s portfolio of gold and other assets.

During the year, the Company continued its exploration work on the Nanortalik concession and the Company was awarded further exploration licences in Greenland.

On January 12, 2005 the Company was granted the exclusive title for two porphyry-molbdenite properties located in the Oslo region, Norway, the Hurdal and Skrukkelia Mo projects. The Hurdal project is the largest molybdenite deposit in Europe.

During the past year, in order to give maximum focus to the expansion of its gold interests, Crew decided to dispose of its entire interest in the Seqi Project to its industrial partner Minelco AG. The sale price consisted of an up front cash payment and a 17-year royalty agreement based on tonnage produced. The Company concluded this transaction on June 30, 2005.

In February 2005 the Company, together with its associated Philippine partner, Mapula Creek Gold Corp, executed an agreement to acquire approximately 72.5% of the issued share capital of the Philippine based Apex Mining Company, subject to the completion of satisfactory diligence. Apex Mining Company is listed on the Manila stock exchange and its principal asset is the Masara Gold Mine in the south of Mindano Island, which ceased production in March 2000. The mine was previously operated as a small-scale underground operation and has a treatment plant with the capacity to process 1,200 tonnes of ore per day. The transaction was closed in August 2005. The Company has engaged Snowden Mining Industry Consultants Pty Ltd to undertake an independent resource evaluation to establish the reserves and resources according to Canadian National Instrument 43-101. Further, the Company intends to undertake a development program to define and identify resources, to rehabilitate the processing plant and put in place new infrastructure required for a commercial gold mining operation. The Company plans to commence gold production by immediately opening underground faces in two areas as the commencement of systematic gold mining operation. Initial production is planned for the second half of fiscal 2006.

4

INDUSTRY INFORMATION

Exploration of Minerals (Excluding Hybrocarbons) in Greenland

Exploration and mining in Greenland are subject to the Danish Act on Mineral Resources in Greenland (consolidated act no. 386 of 18 June 1998) (the “Danish Mineral Act”).

According to the Danish Mineral Act all exploration in Greenland requires a prior exploration license from Greenland Home Rule, Bureau of Minerals and Petroleum (BMP). In order to be granted an exploration license, an application must be sent to BMP and the application needs to be approved by both the Joint Committee for Greenland Home Rule and the Danish Minister for Environment and Energy.

An exploration license may only be granted to legal entities domiciled in Greenland and comprised by Greenland taxation that are exclusively carrying out activities under the exploration license and are not subject to joint taxation. Further, it is a requirement that the applicant has the necessary expert knowledge and financial background with respect to the exploitation activities. Before an exploration license is granted, BMP shall approve certain plans for the exploration (e.g. exploration plans, environmental plans and safety plans).

The terms of an exploration license are subject to negotiations, but the normal standard terms are that the license is granted for a specified area. The period in which an exploration license is granted varies, but in general exploration licenses are given for a period of up to 5 years with the possibility of an extension of 5 years. The license may be extended up to a total period not exceeding 50 years.

An exploration license expires if no exploration work is carried out. The license will normally include an obligation to spend certain amounts on exploration in the exploration area per year and the exploration license may be subject to certain further conditions. There are no production royalties in Greenland, but a yearly license fee may payable to BMP.

The license holder is entitled to a subsequent mining license, if (i) the license holder identifies minerals, which the license holder intends to exploit commercially, (ii) the license holder provides duly documentation for viable commercial exploitation to BMP and (iii) BMP approves certain further required plans (e.g. safety plans, mining plans, environmental plans and plans for mine closure). BMP will normally require security for closure of the mine and clean up. A mining license is generally granted for a period of 30 years.

The Company currently, directly or indirectly, holds the following licenses in respect of Greenland:

Nalunaq License

On 7 April 2003, BMP granted a 30-year license to Nalunaq Gold Mine A/S for exploration of minerals. The license is granted under the provisions of articles 7 and 15 of the Danish Mineral Act.

It is an exclusive license for exploration of mineral resources (excl. hydrocarbons) for the area within longitudes and latitudes:

1: 60*21’N 44*48’W, 2: 60*21’N 44*49’W, 3: 60*20’N 44*49’W, 4: 60*20’N 44*53’W, 5: 60*23’N 44*53’W, 6: 60*23’N 44*49’W, 7: 60*22’N 44*49’W and 8: 60*22’N 44*48’W.

It is a condition under the Nalunaq License that the ultimate shareholder of Nalunaq Gold Mine A/S’ guarantees Nalunaq Gold Mine A/S’ obligations under the Nanulaq License. Further, Nalunaq Gold Mine A/S has provided a security deposit of DKK 4.2 million to the Government of Greenland to cover future estimated mine closure costs and a three-year monitoring program. The amount of the security deposit is based on an estimate of closure costs set out in a detailed closure plan prepared by BMP. The terms set out in the closure plan are not exhaustive and BMP has the right to set out additional terms in the event of future exploration activities within the area of the Nalunaq License.

Nanortalik License

On 12 July 2002 BMP granted an exploration license to Nalunaq I/S for exploration of mineral resources. The license is granted under the provisions of articles 7 and 15 of the Danish Mineral Act.

The license is an exclusive license for exploration of mineral resources (excl. hydrocarbons) for an onshore area at Nanortalik in Southwest Greenland.

5

Nalunaq I/S is obliged to spend certain exploration expenses in the exploration area. If this requirement is not meet, BMP may request to be paid 50% of the remaining amount in cash upon expiration of the license.

Mineral Exploration in the Philippines

A new mining law Republic Act 7942 “PHILIPPINE MINING ACT OF 1995” (“Mining Act”) was introduced in March 1995 and the revised implementing rules and regulations DAO 96-40 were issued in 1996. According to the new mining law, an Exploration Permit (EP) can be applied for by domestic or foreign owned companies. The maximum area under an EP that a qualified person may hold at any one time shall be:

(a) Onshore, in any one province –

(1) For individuals, 20 blocks; and

(2) For partnerships, corporations, cooperatives, or associations, 200 blocks (which is equivalent to 16,200 hectares or 162,000,000 square meters).

(b) Onshore, in the entire Philippines –

(1) For individuals, 40 blocks; and

(2) For partnerships, corporations, cooperatives, or associations, 400 blocks (which is equivalent to 32,400 hectares or 324,000,000 square meters).

(c) Offshore, beyond 500 meters from the mean low tide level –

(1) For individuals, 100 blocks; and

(2) For partnerships, corporations, cooperatives, or associations, 1,000 blocks.

An EP is issued for two years after fulfilment of all relevant requirements. An EP is renewable for two-year periods (but not to exceed a total term of six years) upon the approval of the Secretary of the DENR; provided that the renewal of an EP will be allowed only if the permitee has complied with all the terms and conditions of the EP and has not been found guilty of violation of any provision of the Mining Act and its implementing rules and regulations. The EP gives the right to prospect, survey, and carry out drilling and limited test operations in accordance with submitted work-programs. The EP secures the mineral right over the claimed area and it can be converted into a Mineral Production Sharing Agreement (MPSA) or a Financial and Technical Assistance Agreement (FTAA) after completed feasibility. An MPSA or FTAA is valid for 25 years and renewable for an additional 25 years.

The Philippine Government renewed the EP for the Mindoro Nickel Concession in February 1999 for a period of two years. In early 2001, the key section of the concession was granted a Mineral Production Agreement (MPSA), which secures the company exclusive rights to develop the property into a mine for a period of 25 years. The authorities are currently processing applications for other sections of the concession.

The Apex title is currently under a series of MPSA applications known as APSA 242, 244, 100 and 112A-B. APSA 242 and 244 are direct continuations of Mining Lease Contracts 124-125 and 83, 95, 96 and 97 respectively. The Mine Lease Contracts were granted under the old mining regulations and have to be replaced by MPSA under the Philippine Mining Act, as they expire. The applications have been endorsed by the municipal and provincial councils, have been approved by the commissioners of the National Commission of the Indigenous Peoples and the Regional Office of the Bureau of Mines and are now pending final approval by the DENR Secretary. These applications comprise 679 ha.

Applications have also been submitted for land under APSA 100 and 112A-B, covering several other old Apex claims. However, portions of these applications were noted to be in partial conflict with claims of North Davao Mining Corp. To facilitate the processing of the applications the Panel of Arbitrators designated certain areas of the Apex application as free, i.e areas without any conflict, while the remaining areas were declared in conflict. The free areas of APSA 100 and 112A-B, according to the authorities, were 2,553 hectares. Thus Apex presently has a total of 3,232 ha under MPSA application. Pursuant to the Definitive Agreement with the former Apex management, the former management undertook responsibility for the processing and approval of the MPSA applications. This process is now in progress.

6

Mineral Exploration in Norway

The 1972 Norwegian Mining Act divides minerals into two groups: claimable and non-claimable. In general, the claimable minerals are metal-bearing, and they belong to the state. In general, non-claimable minerals are classified as industrial minerals, and they belong to the landowner.

Any person or company that belongs to the European Economic Area (EEA) is allowed to claim the mineral rights to an area. A single claim area is limited to 300,000 m2, and its longest side cannot exceed 1,200 meters. There is no limit as to the number of claims allowed. The claiming procedure is as follows: A pre-claim (muting) is registered first. It may be held for 7 years, with a possible 3-year extension (total 10 years). A pre-claim is succeeded by a claim (utmål). Test or industrial exploration must be commenced within 10 years after the granting of a claim. However this time limit may be extended with the approval of the government.

Pre-claim holders have the right to prospect, survey, and carry out drilling and limited test explorations. If a claim holder believes that the claim area holds a feasible mineral deposit, a mining operation may be started after a number of conditions are fulfilled. Among these, a new mining operation requires permission from the agriculture and forest authorities in relation to the Planning and Building Act concerning pollution of the environment. There are no production royalties for mining licences in Norway. Certain fees are payable to landlords and the Government for registering and holding pre-claims, claims and during mining operations.

BUSINESS OF THE COMPANY

Business Overview

The business of the Company currently consists of the following ventures, each of which is described in more detail below:

(b) Nalunaq Gold mining operation in Greenland which commenced commercial production in July 2004;

(c) Gold mining operation in the Republic of South Africa through its 20% investment in Barberton Mines Ltd.; and

(d) Exploration projects located in Greenland, Ghana, Norway and the Philippines;

Crew has 11 employees in Weybridge, United Kingdom who provide technical, financial, and administrative and management expertise. In addition, the Company employs 20 people in the Philippines and 20 in Greenland. Mining operations in Greenland are conducted by independent contractors.

The following is a summary of the operations of the Company and it subsidiaries:

Gold Assets

Nalunaq Gold Mine - South Greenland (operational gold mine)

Property Description and Location

Nalunaq Gold Mine commenced commercial mining operations on July 1, 2004 after nearly 10 years of exploration and development. The mine is a high-grade gold deposit located approximately 40 kilometres NE of the town of Nanortalik in southern Greenland. The opening of Nalunaq marked a milestone for Greenland, being its first gold mine and the first new mine to be developed in the country for over 30 years. Transportation to Nalunaq takes approximately 40 minutes by helicopter from the international airport at Narsarsuaq. The terrain is moderately alpine with mountain peaks reaching 1200-1600 meters above sea level. Nalunaq mountain, which hosts the gold deposit, is 1340 meters high and located in a wide glacial valley reaching into the Saqqa Fjord about 9 km from the mine site. The deep, ice-free fjords allow easy access for shipping and the overall climate is moderate allowing full operations around the year.

Ownership and Management

The Company acquired a 50% interest in the Nalunaq project in 1998, and in June 2001 it gained operational control of Nalunaq by increasing its ownership to 82.5% in exchange for funding the development of the project and also providing project loan guarantees. Crew’s joint venture-partner, NunaMinerals, thereby reduced its interest in Nalunaq to 17.5%.

7

In December 2002 the joint venture transferred the ownership of the Nalunaq assets to a Greenlandic limited liability company, Nalunaq Gold Mine AS (“NGM”). NGM became the operator of the gold mine and the holder of the licenses from the Greenlandic and Danish authorities.

The Nalunaq Exploitation (Mining) License was granted by the Greenlandic and Danish Governments in 2003 for 30 years. The license covers an area of 16 km2 around the mine site, which was carved out from the original regional exploration license. After the formal approval of the license, NGM was granted permits to conduct pre-mining development work, including construction of a permanent mine camp, improvements to the infrastructure and access roads and also the building of the ship loader facility and stockpile pad near the fjord. In 2004, the Company received its final permits for the underground operation and commercial production levels were achieved in July 2004.

Geology

The Nalunaq deposit is a Proterozoic, shear-zone hosted gold mineralization. As a generic type, the Nalunaq deposit is a mesothermal vein-type gold mineralization, hosted in amphibolite-facies metavolcanic rocks. High-grade gold is associated with sheeted quartz veins, which are located in a large-scale shear structure that appears to be related to regional thrusting. However, possibly due to extensive post-mineralization deformation, there is no simple relationship between the gold grade and amount of quartz at Nalunaq.

The most pronounced structure at Nalunaq is a narrow zone of ductile shearing surrounded by relatively brittle margins. The Main Vein itself is hosted in a 1-2 meter wide shear zone with a remarkably constant orientation. The regular sheet has an average strike of 45-50º and an average dip of 36º SE, varying between 22º and 45º.

The presence of quartz is the single most important factor for the gold mineralization and occurs principally as sheeted veins with stripes and bands of included calc-silicates. The quartz veins vary from 0.05 meter to 1.8 meters in width and often display pinch and swell structure with clear evidence of both compressive and dilational post-mineralization deformation.

Systematic sampling of the underground exposures of the vein has shown that gold grade is subject to a pronounced nugget effect. Despite this variation a regular zonation in grade is clearly identifiable as a series of high-grade segments running approximately Northeast- Southwest throughout the mine area. The reason for this regularity is not clear. Observations suggest that the highest-grade sections occur when the structure is hosted in medium-grained metadolerite sills or is located very near the metadolerite/metapillow basalt contact. Lower grade segments generally seem to be hosted in finer-grained metapillow basalt.

Mineral Resource and Reserve Estimates

Following an intensive bulk sampling program in 2000, designed and supervised by independent mining consultants Strathcona Mineral Services, Canada, and subsequent underground exploration work in 2001-2002, an independent resource calculation for Nalunaq was prepared by SRK Consulting Engineers and Scientists (“SRK”) of Toronto, Ontario. The resource calculation defined 600,000 tonnes in measured and indicated mineral resources, holding 431,517 oz of contained gold, equivalent to an average grade of 22 g/t. In addition, the Resource Calculation identified 284,136 tonnes of inferred mineral resources, in areas immediately adjacent to the developed parts of Nalunaq, holding 182,782 oz gold. The inferred mineral resources excluded the drill-indicated structure of the south vein as well as widely spaced surface sampling of the north face of the Nalunaq Mountain, which was previously included in the Company’s internal resource assessment. The significant additional resource potential in these extensions, however, was recognized in SRK’s resource report. The resources calculations were conducted by M. Michaud of SRK. Mr. Michaud is independent of the Company and is a “qualified person” as defined in NI 43-101.

Resources

The exploration strategy for Nalunaq is two-fold. The first objective aims at replacing resources so that accessible reserves are maintained at a level of around 400,000 ounces. The second objective of ongoing exploration work was to increase the resource base to a point where the installation of an on-site processing plant could be economically feasible.

In 2004, three areas had been targeted as areas of potential expansion. Each of these was identified as having the potential for expansion of resources to replace ore that had been mined and additionally to support a potential investment in a local processing plant.

Resources at Nalunaq cannot be defined by drilling alone. In the past drilling has often proven to be an unreliable indicator. Low-grade intercepts have been found in areas that subsequently proved to be high-grade; however high-grade drill intercepts are usually a good sign of high-grade areas.

8

This irregularity is because of the nuggety nature of the narrow vein, which makes systematic sampling of drift faces the only viable source for resource calculations.

Surface drilling is considered only the first stage of a resource development program at Nalunaq. Underground drifting is required for reserves to be demonstrated as being proven or probable.

In calendar year 2005 an exploration program commenced during Q3 2005. The exploration program for the South Block (valley sector) on Nalunaq was developed with a time line of approximately six months followed by drilling in the Upper Block (mountain sector between 600-900 levels).

Subsequent to year end, a technical report to NI 43-101 standards, prepared by Snowden, is anticipated to be available on www.sedar.com.

Mining

Nalunaq has posed some considerable challenges due to the simple yet difficult geometry. The main parameters being the narrow vein width of 0.6 metres and the 40 degree dip that is just on the angle of repose of rock. The narrow width calls for a high degree of drilling and blasting accuracy to prevent dilution, and the dip both precludes efficient footwall layouts for mechanised mining and also requires some additional rock handling activities to ensure all the ore reports to the bottom of the stope for cleaning.

Following the extensive pre-production studies two mechanised mining methods were implemented, longhole open stoping and Alimak raise mining. The Alimak raise test stopes were abandoned due to low productivity and high dilution. The amount of mine development was then increased to convert the entire mine to the longhole method. This development was further increased once it was established, after two winter seasons on site, that the use of outside infrastructure was not productive and the weather conditions resulted in unacceptable production losses.

The longhole method comprises drifting horizontally on strike at 10 metre vertical spacing resulting in an ore block of about 16 metres on dip. The ore drifts are either mined as a whole face or in two cuts separating the ore and the waste (resue). This block is then subdivided into 14 metre wide stopes between 1.5 metre stability pillars. Each block is opened with a short raise along one pillar and then blasted using long blast-holes drilled either from the top or the bottom, giving the method its name. Following stoping and the removal of the ore, the stope has to be cleaned of any residual fine ore, some of which is at a high grade.

To access the drifts, from which all operations are carried out, a ramp is necessary and other mine openings to transfer the ore and waste to lower levels for transport or to supply access for mine services such ventilation, power and water.

The mine is operated through a Canadian mining contractor using convention drill jumbos and trackless loaders and trucks.

A great deal of emphasis has been placed this year upon first meeting production targets and then optimising the method to reduce costs and increase productivity. To this end a study based on the last two years experience is underway with Snowden Mining Industry Consultants (“Snowden”) and Australian Mining Consultants (AMC). A report and plan for the long-term development of the mine is expected by the end of this year. Part of this study will be the examination of the plans to implement a waste and ore washing and separation plant and the full treatment plant.

During the last year the design and engineering parameters for the various options for treatment plants at Nalunaq have been considered. The extensive test work undertaken for the Kvaerner feasibility study and the five treatment campaigns at the El Valle plant of Rio Narcea has provided a substantial basis for the plant design. Options to reduce both construction and decommissioning costs and alternative treatment routes were reviewed and final testwork is underway at SGS Lakefield in Canada and Wardell Armstrong in the UK.

The application to the Greenland government for permitting of the treatment plant has been prepared and will be submitted shortly.

The mine at Nalunaq now encompasses most of the original Target Block and some 40,000 square metres of ore has been mined as stopes or resue ore drives. The exploration results of the last year have resulted in new planning layouts for accessing the areas in the Upper and South Blocks and development has now started.

9

Once Nalunaq has confirmation of the drill results by the underground drifting the final approval for the plant and supporting infrastructure can be made, and is expected by the end of this year.

Ore Shipping

Nalunaq has no processing facilities. During the last two years the program to treat ore in Spain at the El Valle plant of Rio Narcea Gold Mines Ltda (RNGM) has continued with independent analysis and verification of the campaigns of treatment.

The ore is trucked down to the stockpile area by 25 tonne trucks operated by a contractor to a 60,000 tonne capacity ore stockpile at Nyhamn, the port facility established on the Saqqaa fjord 11km from the mine site. When there is sufficient ore a ship is requested from Fednav of Montreal with whom we have a three-year contract. The 28,000 to 40,000 tonne capacity vessels load at about 250 tonnes per hour and then travel to Spain across the North Atlantic. The ore is unloaded in Aviles in Spain by the harbour authorities and contractors under RNGM’s contract and supervision, and then trucked 60 km to the El Valle plant site.

The ore is treated in the El Valle plant that has a conventional circuit comprising grinding and gravity recovery of free gold, flotation recovery of fine gold and some minor sulphides to a concentrate, and leach recovery of soluble gold in a carbon in leach circuit. The process is fully documented and an independent consultant is in attendance when the Nalunaq ore is treated.

The Mine Village

The camp layout currently consists of 14 building units distributed in nine 10-person dormitory modules with larger units for the mine office, emergency facilities, drying rooms and showers, kitchen and cantina, storage rooms, a planning office and a recreational unit. The camp currently holds accommodation for about 100 people.

The camp layout creates the impression of a small village situated in the middle of the valley. The camp complex has its own borehole for potable water, a purification system and a biological wastewater treatment plant. Power is supplied from two 200 kVA generator units and telecommunication systems, provided by Tele Greenland, allow for individual room telephones and high-speed Internet connection.

The camp has an approved helistop facility and there are arranged regular flights from Qaqortoq via Narsarsuaq with onwards connection to the transatlantic flights. Preparations to restore and re-vegetate temporarily affected areas are underway.

The Assay Laboratory

Nalunaq is equipped with a fully functional assay laboratory. It consists of a preparation lab, a wet chemistry lab and an assay section with computerized AAS instrumentation.

The preparation lab consists of a drying oven, a conventional jaw crusher and splitting tables. Milling is done with an LM5 or LM1 gyratory steel mill, which enables grinding of up to 4 kgs of crushed rock to 80% less than 75 microns (0.075 mm) in a single batch. This provides an exceptional homogenisation of gold samples. The LM5 mill is considered the best for any gold sample preparation on the market today.

After milling, a 500 gram fraction is transferred to a polyethylene container and stored for leaching. The sample is substantially larger than conventional 50 g samples used for fire assay (FAA) and this provides a much more reliable assay basis than FAA. NGM has conducted an extensive comparison of the recovery of the Leachwell method it applies with traditional FAA and found the results to be consistent.

In the wet chemistry section of the lab, samples are filled with 500 g water and a Leachwell tablet is added. The tablet contains a cyanide leach agent and a catalyst, which intensifies the dissolution of gold. The container is then thoroughly stirred in a mechanical tumbler and the solids let to settle before a small solution fraction is extracted. The dissolved gold is then extracted from the cyanide solution with an organic extraction and an aqueous solution for analysis is prepared.

The final analysis of the gold content is then conducted in the AAS instrument and the result based on a comparative assay of a known standard solution. Every 10th sample is sent to an external assay lab and a control assay is conducted using independent FAA method with gravimetric or AAS finish, dependent on grade levels.

10

Environmental Work

Since its inception, NGM has been the subject of detailed environmental monitoring. Baseline studies have included sampling of water and plant materials and the installation of a weather station in the valley. A new weather station was established in the fjord in 2001. Ongoing environmental monitoring programs are maintained in the license area.

The monitoring programs include water samples which are collected from the river bi-weekly with sampling stations in the Upper Valley, at the waterfall, at the bridge and at the camp sanitary installation as well as sampling of the mine water run off. Biology programs include studies of the arctic char in the river, and in the fjord, fish caught at several stations have been collected and sent to NERI for their data bank. Dust is being sampled continuously during the summer program for analyses of nitrates and sulfates as well as lichen sampling along the road and around the camp and stockpile areas. Both the Lower and Upper Valleys have been mapped for vegetation and soil depth.

Meteorological data from the campsite and the weather station in the fjord are downloaded regularly. River monitoring is conducted with a pressure transducer which will enable continuous measurement. In addition, the river flow is measured using propellers several times over the year. In the fjord, conductivity-temperature-depth casts are conducted throughout the year at eight stations. An Acoustic Doppler Current Profiler was installed 2001 for continuous recording of oceanic currents. The current meter was recovered and downloaded in 2002 thereby acquiring one full year’s data.

Barberton Mines (operational gold mine)

Property Description and Location

Barberton Mines Limited (“Barberton”) is the operator of three small gold mines in the Barberton Greenstone Belt, in South Africa, known for prolific gold deposits in settings which are similar to other classical gold districts of Archean greenstone belts in Australia, Canada, and Africa. The three operations include the Sheba, the Fairview and the New Consort gold mines, all of which exploit numerous discrete ore bodies. The three mines are located within a 15 km radius of each other, about 10 km NE of Barberton. Total annual production at Barberton is today 330,000 tonnes with in situ grade of 10-11 g/t and 9.5 g/t recovered. This translates into an annual gold production of about 100,000 oz at a current cash cost of USD 300/oz, but with potential for rationalisation and improved economics.

Title and Ownership

In February 2003, Crew, as part of a consortium, signed a purchase agreement with Avgold Ltd. (Avgold) of South Africa for the purchase of Eastern Transvaal Consolidated (ETC), the predecessor of Barberton. The consortium consists of Metorex Ltd. (Metorex) 54%, MCI Resources Ltd. (MCI) 26% and Crew 20%. The purchase price was ZAR 255 million of which ZAR 150 million was bank financed. Crew participated with ZAR 30 million (CAD 5.5 million/ NOK 25 million), financed by the sale of 10 million shares in Metorex to a South African institution at ZAR 3.00 per share.

On October 29, 2003 it was agreed by Special Resolution to increase the authorised share capital of Barberton Mines Limited from ZAR 12,000,000 to ZAR 12,016,000 by the creation of 16,000 cumulative variable rate redeemable preference shares of ZAR 1 each. These shares have no voting rights. On December 23, 2003 the shareholder loans of ZAR 150,000,000 were converted to 15,000 cumulative variable rate redeemable preference shares of ZAR 1. The issue price of each of these shares was ZAR 10,000. ZAR 9,999, being the surplus between issue price and par value, was credited to share a premium account in Barberton.

In exchange for converting ZAR 30,000,000 of shareholder loans, Crew received 3,000 preference shares of par value ZAR 1 each with a deemed aggregate issue price of ZAR 3,000,000 (CDN$ 5,800,000). The exchange of shareholder loans for preference shares was recorded at the book value of the loans with no net increase in the carrying values of the Company’s investment in Barberton.

Production and Hedging

Current Year Performance | | | | 2004/2005 | | 2003/2004 | |

Gold Sold | | (kg) | | 3,301 | | 3,321 | |

Gold Price | | (R/kg) | | 96,175 | | 98,195 | |

Hedging Profit | | (R000’s) | | 21,689 | | 54,000 | |

EBITDA | | (R000’s) | | 31,125 | | 71,138 | |

11

Production of gold from Barberton’s three operations reduced year-on-year as a result of lower tonnes mined. Total gold sold amounted to 3,201 kilograms and at a mining cash cost of ZAR 83,234 per kilogram, the operations generated earnings of ZAR 31 million before interest and financing costs, but after accounting for income from early closure of gold hedges.

The price received during the year was assisted by selling 180 kilograms per month into a hedge that was established on acquisition of ETC.

During the year, the hedge put in place for 2006 was closed out, realizing a profit of ZAR 21.7 million. This cash was used to pay off the remainder of the loan. In order to protect future earnings, a further hedge was entered into for the 2006 financial year for 167.5 kilograms of gold per month at ZAR 90,269 per kilogram.

Mineral Resource and Reserve Estimates

The measured, indicated and inferred gold resources at Barberton currently consist of 1.47 million oz, of which 453,000 oz are inferred resources. The current mine plan is based on the extraction of 1.07 million oz over ten years from 2004. The mine plan average head grade is 10.5 g/t, and cash cost is forecasted by Metorex at USD 240/oz.

The various mines at Barberton have been in operation for up to 100 years. At intervals over this period the remaining life of each of the mines has often been forecast as only 6 to 10 years while new ore bodies, resources and reserves have constantly been discovered, as reported by Avgold.

Geology and Operation

The gold deposits are hosted in altered supracrustal rocks of the Barberton Supergroup, which includes basic greenstones, turbiditic greywackes and shales as well as epiclastic sandstones. The deposits are associated with brittle tectonics in shear structures hosted in folded and slightly metamorphosed rocks of all the above rock types. Strike and dip of the orebodies are highly variable and often of a discontinuous and erratic nature. Continuous structures rarely measure over 100 meters.

Most gold occurs in small fissures within the fractured and sheared host rocks. As the gold-bearing structures are discontinuous, individual ore bodies therefore generally require site-specific mining. This type of mining scenario is typical for many greenstone-hosted gold deposits; however, they are particularly labour intensive and leave few options for mechanized, cost effective mining due to the local nature of the individual occurrences. The erratic nature of the orebodies moreover prevents effective evaluation of the grade and resource potential outside the developed areas.

The gold ore is predominantly refractory, which means that only a small portion of the contained gold (3-5%) is free milling and available for low-cost gravity processing. The bulk of the gold is refractory and built into the arsenopyrite crystal lattice. This gold can only be retrieved through artificial oxidation of the concentrate, which is generally produced through froth flotation.

The oxidation at Barberton was previously based on roasting. Today, however, biologic oxidation (BiOx) is employed, which is more environmentally acceptable, but adds extra stages to the processing and produces a fair amount of residual arsenic compounds. After oxidation, the gold is retrieved from the concentrate by CIP extraction and elution before smelting.

Apex Mining Company

During the fiscal year, the Company announced its intention to acquire approximately 72.5% of the share capital of Apex Mining Company (“Apex”).

The Apex Transaction

Subsequent to year end, on August 24, 2005, Crew and its associated Philippine partner, Mapula Creek Gold Corp. (“Mapula”), signed a Definitive Agreement regarding the purchase of approximately 72.5% of the shares in Apex Mining Company. The transaction was concluded subsequent to year end by the transfer of the shares to Crew and Mapula against payment, subject to certain conditions, of USD 6.6 million. Crew acquired approximately 71.5% of Apex’s Class B shares and Mapula acquired approximately 73.5% of Apex’s Class A shares. Crew holds 40% of the shares of Mapula with the balance held by a retirement fund that has a Crew nominee as sole trustee and has as its beneficiaries Crew’s Philippine employees.

The Definitive Agreement triggered a mandatory bid on behalf of Crew and Mapula for the remaining shares in Apex Mining Company, being approximately 27.5% of the outstanding shares. This bid is pending and will be announced pursuant to the rules of the Philippine Stock Exchange and Securities and Exchange Commission.

12

Apex has a total of 3,232 ha of land under MPSA application, in continuation of earlier Mine Lease contracts under the old mining legislation. Pursuant to the Definitive Agreement with the former Apex management, the former management agreed to take responsibility for the processing and approval of the MPSA applications. This process in now in progress. In addition an area of about 1,790 ha surrounding the title area have also been applied by Apex, but other applications by North Davao Mining Co. have placed these areas in a title conflict, which currently resides with the Court of Arbitration.

Property Description and Location

Apex Mining Company is a Philippine-owned company, listed on the Philippine Stock Exchange and was engaged in gold mining in a mineral property located in the Maco municipality of Compostela Valley Province in Eastern Mindanao, the Philippines. Prior to completion of the acquisition, Apex had leased out various parts of its property to three sub-contractors in exchange of royalty and rental payments. These contractors operated on a small-scale in different parts of the property. The company also owns a processing plant, located near the mine site. This plant was also operated by the sub-contractors who were using various parts of the plant for processing of their ore, derived from the small-scale operations in the lease area.

The mineral property includes an assemblage of gold-vein deposits and a cluster of porphyry-copper ore bodies, located largely in a westerly portion of the property.

The due diligence studies showed that the Apex property did not have an up to date independently verified resource evaluation. The Mines and Geosciences Bureau (“MGB”), a Philippine government agency, had conducted an independent assessment, on behalf of the company, for the Philippine Stock Exchange in 2004. Their report stated that the property holds “existing gold reserves of 528,684 DMT at 9.15 g/t and a copper ore Mineral resource of 85,026,730 DMT at 0.4% Cu”. The report goes on to state that the property has estimated mineral resources of 6,128,745 DMT at 9.48 g/t gold and that the geologic conditions in the area favours mineralization below the 510 level, which can be proven if an exploration program is carried out in the future.

The Company has engaged Snowden Mining Industry Consultants Ltd (“Snowden”) to prepare an independent resource assessment based on the historical data. Snowden’s Technical Report is intended to satisfy requirements of the Canadian regulatory authorities on disclosure in relation to the Company’s acquisition of Apex and will be NI 43-101 compliant for reporting of historical data. Dr S.C. Dominy of Snowden will be the qualified person as defined by Canadian National Instrument 43-101.

Development Plan

Since the conclusion of the acquisition, Management s efforts have focused on commencing production from the existing plant facility. The agreed objectives are to initially establish a 500 t/d working mine by end 2005 and to further establish a 2000t/d working mine by end 2006. This will be subject to the resolution of permitting issues and at all times local management will work closely with the local communities to ensure no social distress arises.

The process will require immediate fitting of a portion of the existing plant to handle crushing milling and cyanidation of “clean ore” without need for flotation. Existing equipment will be used except for the crushing section, which will be leased as a mobile plant and erected near the mine portals from where the ore can be trucked to the plant. This will free up space at the plant for cleaning up and preparation for the second-stage construction.

With regard to ore-feed for the plant, initially the ore will be extracted from existing active faces using available equipment plus some supplementary equipment, which is currently being sourced. At the same time, underground development will be started to access and open further reserve areas. Proper mine planning cannot be conducted until the Company knows the results of the exploratory drilling and consequently the initial activities will be somewhat controlled by available access points and existing knowledge.

A major concern is safety and the local management will implement new safety guidelines for the operation on all levels. Currently, small-scale miners access the underground structures from numerous locations, many of which are unmapped and potentially unsafe. The regulation of the small-scale operators will be a priority and will be handled delicately. The social stability of the mine is a fundamental factor for a successful operation and this matter will be given the highest priority together with increased safety procedures for the operation.

The initial work on site is expected to include the following activities:

a) Exploration drilling where the preliminary results will form the basis for the first stage mine plan and the start of pre-mining underground development.

13

b) Initial assessment of temporary production sites within the existing infrastructure, to assess if these could prove a source for the initial processing of clean ore in the 300-500 tpd range.

c) Rehabilitation and refurbishment of the existing plant with a view to commencing production as soon as possible. This entire process will be undertaken in stages, the first stage will be the commencement of production. After this, further refurbishment will focus on increasing the plant’s capacity.

d) The sourcing of equipment for the initial underground work and limited mining. The minimum number of jumbo drills, compressors, air drills, haulage scoops and trucks are expected to be sourced locally as a supplement to available equipment. The equipment selection will be conducted with a view to the plans for an expanded production case.

e) The recruitment of suitably qualified personnel.

f) A NI 43-101 compliant technical report on the historical resource evaluation is being compiled for an independent resource assessment by Snowden, Australia where Dr Simon Dominey has been nominated the qualified person.

Nanortalik Gold Project - Greenland (early stage exploration)

Property Description and Location

The Nanortalik exploration license area is a 523 sq. km area located in southernmost Greenland. It is the remaining portion of the original Nalunaq concession area, after the Nalunaq Mining License has been carved out from the initial 1,081 sq. km concession and a reduction of 50% following renewal in 2003. The Company has located several gold occurrences in the district, in different geological settings, and believes that there is a potential for commercial gold deposits in the concession area. The results of fieldwork in 2003 and 2004 were encouraging and a more intensive program of drilling and developing specific targets was completed in 2005.

The Nanortalik Exploration License is held in Nanortalik I/S, a Joint-Venture between Crew and NunaMinerals. The property is operated by Crew as an early-stage exploration project where the ownership after the 2005 season is expected to be approximately 83% and NunaMinerals at approximately 17%, respectively. Future ownership ratios are based on the respective contributions of the Company and NunaMinerals. NunaMinerals notified Nanortalik IS in the spring of 2004 and 2005 that they had elected not to participate in the funding of the summer’s program and, as a consequence, will suffer a dilution of its share of the project, in accordance with the Joint Venture Agreement.

The Bureau of Minerals and Petroleum (BMP) set the work commitment at DKK 4.5 million per year in 2004 and 2005. Any excess or less spent amount can be transferred to the following year. BMP allows 50% overhead to all direct project costs.

Regional Exploration in Niaqornarsuk area

The regional exploration campaign in 2003 and 2004 gathered 352 sediment samples and 821 rock samples. The objective was to follow up with surface prospecting and sediment/screen sampling and in particular examine a series of significant NNE-SSW trending belts of anomalous samples.

Anomalous rock samples were found in nearly all of the areas covered by anomalous sediment sampling. 23 rock samples returned more than 1 g/t and 7 samples more than 3 g/t. The richest rock samples contained 56 and 33 g/t and were collected at the southern extension of the anomalous belt north of Nanisiaq. The results confirm the existence of at least two clusters of gold mineralization in the Nanisiaq peninsula. The high amount of glacial debris makes interpretation complicated.

During 2005, follow-up exploration was conducted in two localities, which appeared particularly promising from previous sampling. The one locality is known as LGM gold occurrence where previous sampling has returned samples in the range of 2-60 ppm. Preliminary results from this year’s work shows that two new high grade samples were located. These samples outline a continuation of the high grade zone already known.

The other locality is an area with several quartz veins, which last year returned gold values between 1-3 g/t. Preliminary results of the new samples collected this summer from this area were not promising.

14

Continued low-cost prospecting and sampling could lead to the recognition of the possibly unrecognized type of mineralization, which has caused the extensive gold signature of this area. The exploration so far has been unsuccessful in identifying mineralization with commercial dimensions, but one of the structures identified “Nanisiaq”, hosts a 2 km mineralized structure where systematic sampling has revealed 4 g/t gold on average over 1 meter. The volume of this occurrence is considered too small for commercial exploitation, and therefore has not been drilled, but nevertheless remains an important symptom of the potential of this area.

Lake-410 Drilling Program

Lake 410 has been known for highly anomalous sediment samples and free panning gold in the stream below Lake 410. Detailed mapping and outcrop sampling in 1994 -1996 led to the recognition of two consistently mineralized zones, named the Upper and the Lower Favourable Unit, both outcropping in the slopes below Lake 410. Sampling at several locations in these units have returned gold values in excess of 1 g/t.

In 2003, the area was drilled for the first time. The mineralized structure was identified in all 4 holes suggesting continuity of over at least 800 meters strike-length and showing some 300 down dip extension. The best results were obtained from drill hole no L410-001, which returned 2.12 g/t gold over 2 meters and from an intercept with thin quartz stringers in drill hole L410002, which returned 2.22 g/t over 2 meters. The associated alteration zones in these intercepts were 3-4 m wide and heavily impregnated with arsenopyrite.

Four holes were completed in 2005 which test the strike continuity of the best intercepts about 300 meters further NW of these and two other drill holes have been completed to test the down dip extension of the identified structure. The results so far are encouraging as the drilling encountered two clear intercepts and two questionable intercepts at the expected depth. However, assay results were low.

Akuliaruseq

In July 2004 Crew received confirmation of a grant of a new exclusive claim for an area of about 284 km2 in the Akuliaruseq peninsula in South Greenland. The area lies north of the current Nanortalik I/S claims. The peninsula hosts a number of significant gold anomalies and the concession is located on one of the most prominent transcrustal shear zones in South Greenland.

Some parts of the East coast and selected areas at Akuliaruseq have already been covered with earlier sampling and provided anomalous samples. The data is insufficient and unevenly distributed. To obtain full coverage of the peninsula, a systematic sediment sampling programme was conducted in summer of 2005. The field campaign was a typical first sweep of sediment and scree sampling to identify areas with anomalous gold content. These areas will subsequently be the target for follow-up prospecting and more systematic rock sampling. A large part of the field work was carried out along the coast from a small boat where the personnel could stay during the campaign and visited sampling stations along the shores using a zodiac or dinghy.

The more interior portion of the concession was accessed with helicopter and the establishment of fly camps for 2-3 days stay at each location and walking or helicopter lifts to various sampling areas. The area was largely covered by the 2005 program.

Hwini-Butre Gold Project, Ghana (advanced exploration)

Property Description and Location

The Hwini-Butre gold concession (the “HB Gold Concession”) is a gold exploration property in southwestern Ghana. The 45.4 km2 concession is located along the eastern contact of the prolific Ashanti Gold belt, less than 30 km from Takoradi, a major port city in Ghana. Access to the HB Gold Concession is via a 15 km fair quality gravel road located along the entire length of the property and is maintained by the operators of a palm oil plantation located further north.

Ownership

At year end, Hwini-Butre Minerals Ltd. (“HBM”) was a 100% owned Ghanaian subsidiary of Crew, and held 51% of the HB Gold Concession while the operator, St. Jude Resources Ltd (“St Jude”), owned 49% of the HB Gold Concession; the Government of Ghana retains a carried interest of 10%. St. Jude Resources Ltd. has been the operator of the license since 1995.

Subsequent to year end, the Company sold all of its shares in HBM to St. Jude for US$5 million, payable in 2,995,000 St. Jude common shares.

15

Non-Gold Assets

Mindoro Nickel-laterite Project, the Philippines (under exploration program)

Location and Title

Mindoro Nickel Project (MNP) is located on Mindoro Island in the Philippines approximately 200 km south of Manila. The concession comprises a 9,720-hectare (~100 sq km) area straddling the border between the Provinces of Oriental and Occidental Mindoro about 30 km from the coast. The area is entirely underlain by an extensive laterite mineralization as a result of the accumulation of nickel and cobalt in the tropical soil profile following intensive chemical weathering of the ultramafic source rocks in late Tertiary to recent times.

The original Exploration Permit for the Mindoro project was issued in 1997 and renewed in March 1999 for an additional two years. Subsequently, in December 2000, Aglubang Mining Corp. (AMC) was granted a Minerals Production Sharing Agreement (docketed as MPSA No167-2000-IV) covering a large part of the most developed project area and securing the Company rights to develop and exploit the resource over a 25-year period subject to certain conditions. The remaining parts of the concession area were included in another MPSA application by Alag-Ag Mining Corp. (AMI).

In 2001 the MPSA was unexpectedly cancelled by the new DENR Secretary. Aglubang Mining Corp appealed the decision with the President’s Office, on grounds of lacking constitutional rights to due process as defined in the terms of the agreement and in March 2004 the President’s Office issued a resolution revoking the order of cancellation and reinstated the MPSA in its initial powers. Management believes that the response of the Office of the President was a clear and strong signal of a change in the attitude of the Government of the Philippines towards mining.

The full concession area is controlled by the Aglubang and Alag-Ag Mining Corporations, respectively, which are owned by a consortium of Crew Minerals AS and a syndicate of Philippine holding corporations. In accordance with Philippine mining legislation agreements have been signed with the Mangyan people in the area, granting the resident indigenous tribes a royalty of 2% net profits of the mining revenues.

Pre-Feasibility Study

A pre-feasibility study on the Mindoro Nickel Project was completed by Kvaerner Metals, Australia in August 1998. This study considered a scenario with an annual production of 40,000 tonnes Nickel metal and 3,050 tonnes Cobalt metal. In addition, the proposed processing path will yield approximately 126,000 tonnes of ammonium sulfate as an in-line co-product. Ammonium sulfate is a preferred fertilizer for rice and sugar cane in the Philippines.

The pre-feasibility study was based on preliminary data of the property. The study also assumed that 25% of higher-grade ore would be imported from other areas, such as Palawan, to provide a 1.2% head grade in the early years of the Mindoro project. Field investigations demonstrated that many smaller deposits with high-grade material of ca. 1.6% Ni exists and makes viable shipping sources of higher-grade materials. It was subsequently decided for the feasibility study to source laterite only from the Mindoro deposit and have imported higher-grade ore as an optional benefit.

Later ore beneficiation test work demonstrated that the ore to the plant could be upgraded, leading to resulting grade in excess of the initial 1.2 % Ni assumed for the pre-feasibility study. New technology also allows use of the underlying saprolite, which was entirely excluded from the initial resource definition. Subsequent drilling and georadar surveying has confirmed that a significant saprolite resource exist under the limonite with almost the same thickness as the limonite and generally with higher Ni-values.

Environmental baseline studies have been completed while test work regarding environmental impact assessment and a final feasibility study remain to be finished. The Company is currently completing a thorough review of the data and is preparing a new resource estimate based on new samples and the upgrade test work conducted during the early part of the feasibility program, which was not included in the above resources evaluation.

Work conducted

The Company has completed more than 1,200 drill holes and test-pits, conducted metallurgical test work as well as extensive environmental studies. A computer-assisted resource model based on more than 10,000 assay results has been prepared and independently verified.

After the return of the title to AMC the Company re-initiated its resource update work and the feasibility study. The incorporation of new analytical data and update of the resource database is now being completed to include data from 243 new

16

drill holes and test pits, of which 119 holes were targeting resource expansion in adjacent subareas known as Upper Kisluyan and Buraboy areas, which lie outside the current resource definition in Lower Kisluyan.

Realization of the Project

Meetings held with representatives of the Philippine Government have indicated national interest for this project which, if not processed in Mindoro, may be lost for future exploitation, as the low-grade, high-tonnage ore will not allow for shipping to an external processing site. On the other hand, numerous small high-grade deposits found in various places nearby can be profitably shipped to Mindoro allowing for the additional exploitation of these deposits. Furthermore, the Company has been approached by potential industrial partners. Crew believes that a combination of governmental equity participation together with one or more industrial partners increases the potential for the realisation of this project. Crew is actively pursuing a model with considerable local participation believing this is one of the key success factors.

Memorandum of Understanding

In line with the Company’s strategy to develop its non-gold assets with an industrial partner in July 1, 2005, the Company signed a Memorandum of Understanding (MOU) on June 1, 2005 with Jilin JIEN Nickel Industry Corporation (“Jilin”) relating to the co-operative development of Mindoro Nickel Project. The Memorandum of Understanding ( MOU ) represents an agreement between Crew and Jilin on a joint contribution to further studies and test work. The MOU describes the framework for reaching a Definitive Agreement.

Pamplona Sulphur Deposit, Philippines (under exploration program)

Property Description and Location

The Pamplona sulphur deposit is located on the Filipino island of Negros, less than 5 km from a deep-sea port site, and consists of a mixed sulphur-sulphide ore with both native sulphur and pyrite/marcasite. Access to the deposit is by a 12 km partially rehabilitated forest road from Amlan on the Southeast coast of Negros Island. The nearest domestic airport is in Dumaguete, approximately 40 km from the project site.

Title and Ownership

The Philippine authorities, through the Department of Environment and Natural Resources, issued the Exploration Permit for the Pamplona Sulphur Deposit in Negros Island on July 4, 2003 for a period of 2 years, renewable for another 2+2 years, subject to the approval of submitted work plans and certain conditions.

The title has been granted to Altai Philippines Mining Corporation. Altai has assigned all rights to the Pamplona Sulphur property to Crew Minerals Philippines Inc, a wholly owned subsidiary of Crew, through an option agreement dated September 1998 and an amendment to the option agreement signed November 21, 2002, the latter concerning a reduction of the anniversary fees and buy-out terms.

Mineral Resource Estimates

The Pamplona Sulphur Deposit comprises 60 million tonnes of open-pitable measured mineral resources, within a total resource of 84 million tonnes with an average composition of 13.8% elemental sulphur and 17.0% sulphur as sulphide. Benguet Mining Corp. and Freeport-McMoran Copper & Gold Inc., the former concession holders, classified the deposit as a proven mineral reserve, but Crew has not completed an economic study on the deposit, and, therefore, has re-classified the resource as indicated according to the JORC Code. The resource evaluation was carried out on the basis of 178 diamond-core drill holes placed in a 60-meter grid pattern.

The License covers an area of 39 sq.km and is composed of two Exploration Permit areas named EP00007-VII and EXPA00068-VII. Crew acquired the Pamplona Sulphur Deposit in 1999 as a stand-alone project, although it has the potential to enhance the economics of the Mindoro Nickel Project. The formal assignment of the title to Crew Minerals Philippines Inc. (“CMP”) is in preparation following the approval of the Exploration Permits.

Work Completed

A new detailed topographical survey for the Pamplona open pit-area has been completed to take into account the rather extensive excavations conducted by Benguet Corp. in connection with trial mining in the 1970’s. This has allowed the Company to define a suitable sampling site for a 2,000 tonne bulk sample requested by a local fertilizer group for industrial testing. The sampling will be from a 10 x 50 meter NW trending trench excavated to about 6 meter depth. The bulk sample will be collected

17

in the lower 2-meters of the trench to ensure unoxidized materials. Adequate collection of drainage from the trench/pit will be diverted through settling dams with lime for neutralization of acid water before being decanted to the small stream, which drains the general area.

Seqi Olivine Deposit, West Greenland (development program)

Location and Title

The Seqi Olivine deposit in western Greenland is a significant resource of the industrial mineral olivine held until June 30, 2005 under an exploration licence by the Company. Under an agreement between the Company and Minelco AB, a LKAB subsidiary, (“Minelco”), in 2003, the Company undertook a study to address the feasibility and viability of developing a quarry on the deposit, crushing the olivine into specified products, and shipping the products to Minelco operations in Europe.

Seqi is situated on a remote site in artic terrain at position 64º59’N - 51º33’W a short distance from the Tasiussarssuaq Fjord, which is a branch of the Fiskefjord in West Greenland some 90 km North of Nuuk (Godthaab), the capital of Greenland. The nearest settlement is Atammik located some 24 nautical miles away, near the entry point of Fiskefjord.

The feasibility study addressed the technical aspects of developing the deposit as a large quarry with a crushing facility and ship loading capability, and has addressed, not exhaustively, the current economic context of commencing production as soon as practically possible.

In order to maximize its focus on gold projects, the Company decided to accept an offer from Minelco AB to dispose of its interest in the Seqi project. The Company concluded this transaction on June 30, 2005 when the sale proceeds of US$10 million were received.

In addition to the purchase price there is an annual fee to be paid by Minelco AB over 17 years based on produced tonnage. For years 3 through to 14 of production there is a guaranteed minimum royalty of USD 1 million per year based on production and subject to certain conditions. This royalty income will be recognized in the financial statements as it is earned.

Ringvassøy Gold Project, Norway (exploration asset)

Property Description and Location

The Ringvassøy gold project (the “Ringvassøy Gold Project”) is located in an Archean Greenstone belt, covering 250 km2 in northern Norway. Access to Ringvassøy Gold Project is by public paved roads from Tromsø, a regional city in northern Norway. The gold mineralization is associated with quartz veining and previous exploration by several groups, including the Corporation, has revealed widespread occurrence of anomalous gold in stream sediments.

Ownership

The property, consisting of 53 claims (about 14 km2), was acquired by the Corporation in 1999 and maintained with changing claim holding since then Annual claim adjustments reflect the results of the exploration program.

Mineral Resource and Reserve Estimates

The Ringvassøy Gold Project is an early-stage exploration project and has currently no defined resources.

Work Completed

Systematic exploration was started in 2000. The work in the summer of 2002 included a detailed helicopter-borne multidisciplinary geophysical survey and geological mapping and sampling, which were funded by a partner on an earn-in basis. The results of the geophysical survey were encouraging as the data revealed a number of large contrasting anomalies attributable to electrical and electromagnetic conductors, which may reflect potential mineralization. The partner, however, withdrew from the joint venture in late 2003 because of lack of funds to cover work commitment in 2003 and the property was returned to the Corporation.

A follow-up program was conducted in 2005 and concentrated on two areas where combined geophysical and geochemical anomalies had been established. The Tuven/Nordkjosvata area has returned anomalous gold samples including a sample of 9 g/t within a zone of 0.4 x 1.3 km. Stream sediments from this area are highly anomalous and contain numerous free panning gold grains.

18

The Tuven/Nordkjosvata area was tested with deep soil sampling, a method which has been particularly successful in northern Sweden in localizing buried gold mineralization in local moraine materials. Work included detailed prospecting and structural mapping. Two senior geologists with two assistants conducted the field work in about one week.

The other focus for the summer’s exploration was the Skilelva district where two deep soil profiles were sampled across a promising structure where highly anomalous sediment samples had previously been found. The area is located around 2 km from an area where large gold-bearing boulder has been found.

Nordli Molybdenum-Porphyry Deposit, Hurdal, Norway (exploration asset)

Property description and location

The Nordli (Hurdal) molybdenum deposit is located approximately 90 kilometres north of Oslo in the municipality of Hurdal. Crew Gold’s wholly owned subsidiary, Crew Minerals A/S was granted exclusive rights for an area of 2.25 km2 covering the main target in December 2004.

The area benefits from an evolved infrastructure and proximity to the international airport of Oslo, located less than 30 kilometres away.

Crew aims at a review of the project by conducting additional exploration drilling this year, to better evaluate the resource potential of the deposit.

Work completed

Crew has held meetings with the municipal representatives of Hurdal in 2005 with the participation of the Norwegian Mining Director, who explained mining legislation and procedures for mining projects. The political leaders expressed strong support for the project and the potential industrial development in the municipality. A public hearing is scheduled in Hurdal in October where management intends to present the project and the immediate work program.

The current work program is anticipating some 3,000 meters core drilling from 6 holes. The cost of this program is expected to be NOK 6-8 million and be completed by spring 2006. A local drill contractor has been contacted but the details of the program have not yet been fully completed.

RISK FACTORS

The following are certain risk factors relating to our business. Any of the following risks, as well as risks and uncertainty currently not known to us, could materially adversely affect our business, financial conditions or results of operations.

Introduction

The Company and its projects must be considered in light of the risks, expenses and difficulties frequently encountered by companies engaged in mining operations and the acquisition, exploration and development of mineral properties. These and other risk factors could materially affect the Company’s future operating results and cause actual future events to differ materially from those described in forward-looking statements. The key risk factors are outlined below.

Liquidity Risk

Liquidity risk measures the risk that the Company may not be able to meet its liabilities as they fall due and therefore, continue trading. The Company’s policy on overall liquidity is to ensure that the there are sufficient committed funds in place which, when combined with available cash resources, are sufficient to meet the funding requirements for the foreseeable future. The Company has secured sufficient funding to enable the continuance of normal trading and support its existing mining projects until these become cash positive and to further expand its development projects.

Exploration, Development and Operating Risk

The Company’s activities are primarily directed towards mining operations and the development of its mineral deposits. The Company is also engaged in exploration for additional mineral deposits.

19

Mining operations generally involve a high degree of risk. The Company’s Nalunaq operation is subject to all the hazards and risks normally encountered in the exploration, development and production of gold. These include unusual and unexpected geologic formations, rock bursts, cave-ins, adverse weather conditions, flooding and other conditions involved in the drilling and removal of material, any of which could result in damage to, or destruction of, mines and other producing facilities, damage to life or property, environmental damage and possible legal liability.

The exploration for and development of mineral deposits involves significant risks which even a combination of careful evaluation, experience and knowledge may not eliminate. While the discovery of an ore body may result in substantial rewards, few properties, which are explored, are ultimately developed into producing mines. Major expenses may be required to locate and establish mineral reserves, to develop metallurgical processes and to construct mining and processing facilities at a particular site. It is impossible to ensure that the exploration or development programs planned by the Company will result in profitable commercial mining operations.

Whether a mineral deposit will be commercially viable depends on a number of factors, some of which are: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; commodity prices (which are highly cyclical); and government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, and the combination of these factors could result in the Company not receiving an adequate return on invested capital.

There is no certainty that the expenditures made by the Company in its the search for and evaluation of mineral deposits will result in discoveries of commercially viable quantities of ore.

Insurance and Uninsured Risks