Filed Pursuant to Rule 424(b)(5)

Registration Statement No. 333-100577

Prospectus Supplement

(To Prospectus dated July 23, 2003)

Old Dominion Electric Cooperative

$250,000,000

5.676% 2003 Series A Bonds Due 2028

Old Dominion Electric Cooperative is offering 2003 Series A Bonds that will mature on December 1, 2028. We will pay interest on the bonds semi-annually on June 1 and December 1 of each year, commencing on December 1, 2003. The bonds will be subject to mandatory pro rata sinking fund redemption at a price equal to 100% of the principal amount of the bonds being redeemed, plus accrued interest, commencing December 1, 2005, and on December 1 of each year afterwards to and including December 1, 2027. The bonds also will be subject to optional, make-whole redemption. See “DESCRIPTIONOFTHE BONDS.” We will issue the bonds in multiples of $1,000.

Payment of the bonds initially will be secured by a first lien on substantially all of our tangible and some of our intangible properties, equally and ratably with all other obligations issued under our Indenture of Trust and Deed of Mortgage, dated as of May 1, 1992, as supplemented and amended. The lien may be released without the consent of the holders of the bonds. After the release of the lien, the bonds will be unsecured general obligations, ranking equally and ratably with all of our other unsecured and unsubordinated obligations, subject to some exceptions. See “DESCRIPTIONOFTHE DEBT SECURITIES” in the accompanying prospectus.

INVESTING IN THE BONDS INVOLVES RISKS. SEE “RISK FACTORS” BEGINNING ON PAGE 1 OF THE ACCOMPANYING PROSPECTUS FOR MORE INFORMATION.

|

| | | | |

| | | Principal

Amount | | Price to

Public | | Discounts and

Commissions | | Proceeds to

Old Dominion |

|

| | | | |

2003 Series A Bonds | | $ | 250,000,000 | | 100% | | 0.909% | | 99.091% |

|

| | | | |

Total | | $ | 250,000,000 | | $250,000,000 | | $2,272,500 | | $247,727,500 |

|

The price to the public for the bonds includes accrued interest, if any, from the date of authentication of the bonds. The proceeds to us do not reflect the expenses we will pay in connection with the offering other than underwriting discounts and commissions. See “UNDERWRITING.”

We expect the bonds will be available for delivery in New York, New York in book-entry form on or about July 29, 2003, through the facilities of The Depository Trust Company against payment for the bonds in immediately available funds.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement and the accompanying prospectus are truthful and complete. Any representation to the contrary is a criminal offense.

Joint Book-Running Managers

| JPMorgan | | Banc of America Securities LLC |

| |

| July 23, 2003 | | |

This document consists of two parts. The first part is this prospectus supplement, which describes the specific terms of the bonds we are offering and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference in that prospectus. The second part, the accompanying prospectus, gives more general information about debt securities we may offer from time to time, including debt securities other than the bonds we are offering in this prospectus supplement. If information in this prospectus supplement is inconsistent with the accompanying prospectus or the documents incorporated by reference in that prospectus, you should rely on this prospectus supplement.

You should read and consider all of the information contained in this prospectus supplement and the accompanying prospectus and all information incorporated by reference in either document in making your investment decision. You also should read and consider the information in the documents we have referred you to in “WHERETO FIND MORE INFORMATION ABOUT OLD DOMINION ELECTRIC COOPERATIVE” in this prospectus supplement.

We include cross-references in this prospectus supplement and the accompanying prospectus to captions in these materials where you can find additional related discussions. The table of contents in this prospectus supplement provides the pages on which these captions are located.

You should rely only on the information contained in or explicitly incorporated by reference in this prospectus supplement and the accompanying prospectus. We have not authorized anyone to provide you with different information. You should not assume that the information provided by this prospectus supplement, the accompanying prospectus or any information incorporated by reference in either document is accurate as of any date other than the date of that information.

TABLE OF CONTENTS

Prospectus Supplement

i

SUMMARY OF OFFERING

The following summary contains information about our company, the offering and the terms of the bonds that we believe is important. You should read this entire prospectus supplement and the accompanying prospectus and all information incorporated by reference in either document for a complete understanding of our company, the offering and the bonds. This prospectus supplement contains forward-looking statements based on our current expectations, assumptions, estimates and projections about us and our business and industry. These forward-looking statements involve risks and uncertainties. Actual events or results could differ materially from those described in these forward-looking statements as a result of a variety of factors. We will not update any forward-looking statements, even if new information becomes available or other events occur in the future, except as required by law.

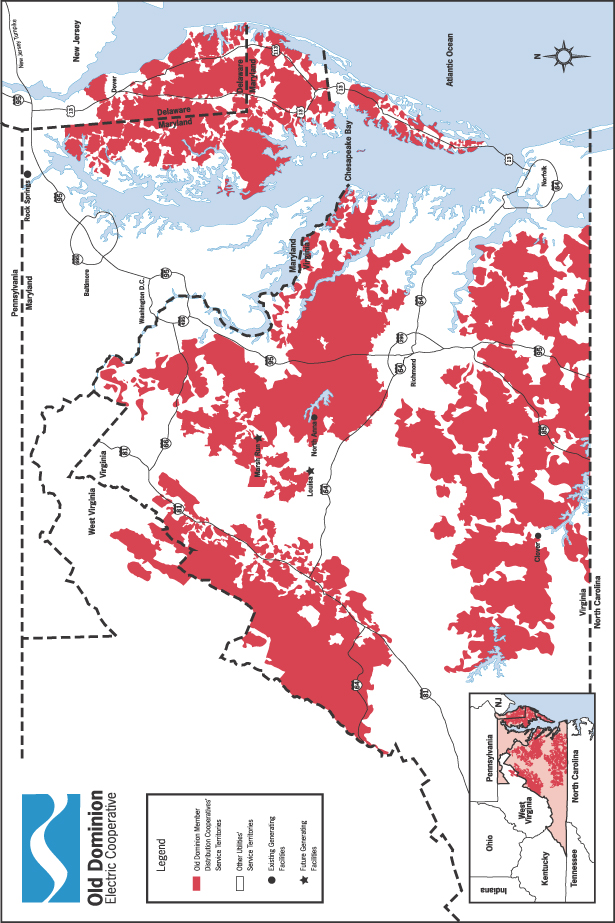

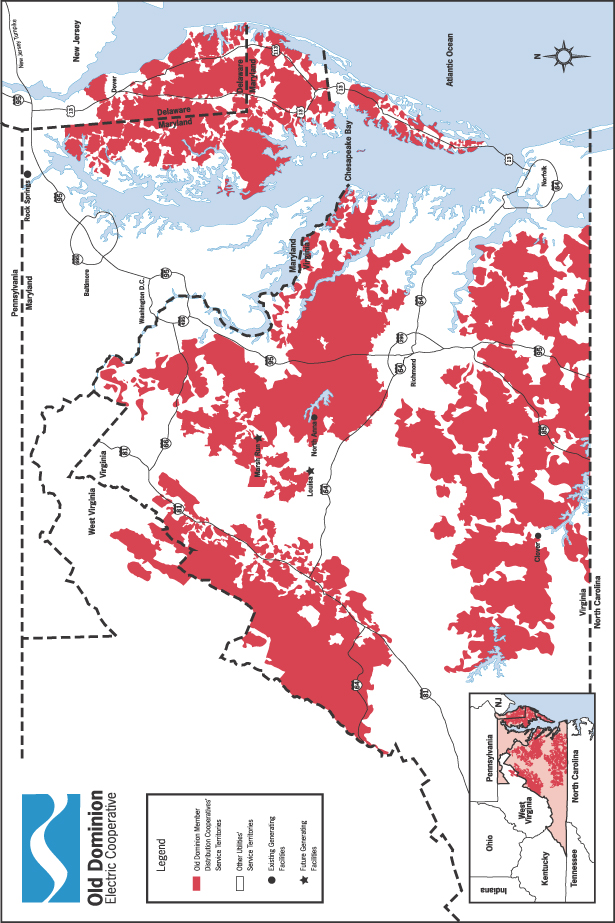

Old Dominion | We were formed in 1948 as a not-for-profit power supply cooperative. We provide wholesale electric services to our members. Our members include twelve customer-owned electric distribution cooperatives that sell electric services to customers in portions of Virginia, Delaware, Maryland and West Virginia. We also sell power to another member, TEC Trading, Inc., which is owned by our member distribution cooperatives. |

| | Our principal office is located at 4201 Dominion Boulevard, Glen Allen, Virginia 23060. Our telephone number is (804) 747-0592. |

| | In this prospectus supplement and the accompanying prospectus, the words “we,” “us” and “our” refer to Old Dominion Electric Cooperative unless the context indicates otherwise. |

Bonds Offered | $250,000,000 principal amount of 2003 Series A Bonds due December 1, 2028. The bonds will be issued in multiples of $1,000. |

Interest | The bonds will bear interest at 5.676% per year. We will pay interest on the bonds on June 1 and December 1, beginning December 1, 2003. |

Sinking Fund Redemption | The bonds will be subject to mandatory pro rata sinking fund redemption at a redemption price of 100% of the principal amount of the bonds being redeemed, plus accrued interest, commencing December 1, 2005, and on each December 1 afterwards to and including December 1, 2027. See “DESCRIPTIONOFTHE BONDS—Sinking Fund Redemption.” |

Make-Whole Redemption | We may redeem the bonds, in whole or in part, prior to their stated maturity, at our option. The redemption price for the bonds will equal the greater of: |

| | • | | 100% of the principal amount of the bonds being redeemed plus interest accrued through the redemption date but not yet due and payable; and |

| | • | | the sum of the present values of the remaining principal and interest payments on the bonds being redeemed, discounted at a |

S-1

| | rate equal to the sum of (1) the yield to maturity of the U.S. Treasury security having a life equal to, or the average yield to maturity of two U.S. Treasury securities closely corresponding to, the remaining average life of the bonds being redeemed and trading in the secondary market at the price closest to par, and (2) 20 basis points; |

| | plus,in either case, interest due and payable but unpaid on the bonds being redeemed. See “DESCRIPTIONOFTHE BONDS—Make-Whole Redemption.” |

Indenture | Payment of the bonds will be secured initially by a first lien on substantially all of our tangible and some of our intangible properties, equally and ratably with all other obligations issued under our Indenture of Trust and Deed of Mortgage, dated as of May 1, 1992, as supplemented and amended (the “Amended Indenture”). |

| | In 2001, we entered into an Amended and Restated Indenture which, if it becomes effective, will amend and restate the Amended Indenture (as amended and supplemented, the “Restated Indenture”). The Restated Indenture can become effective without the consent of the holders of the bonds. When the Restated Indenture becomes effective, the lien of the Amended Indenture will be released and the bonds will be unsecured general obligations, ranking equally and ratably with all of our other unsecured and unsubordinated obligations, subject to some exceptions. The earliest date we expect the Restated Indenture could become effective is December 1, 2003. When we refer to the “Indenture” in this prospectus supplement, we mean the Amended Indenture or the Restated Indenture, whichever is then in effect. See “DESCRIPTIONOFTHE DEBT SECURITIES—Amendments to the Indenture” in the accompanying prospectus. |

Reporting Obligations | We do not intend to register the bonds under Section 12(b) of the Securities Exchange Act of 1934. We are subject to the reporting requirements of Section 13(a) of the Securities Exchange Act, however, because we have another series of securities registered under the Securities Exchange Act. We intend to continue filing periodic reports under the Securities Exchange Act for so long as we have any publicly held debt securities. |

Market for Bonds | We do not intend to list the bonds on any securities exchange or have them quoted on the National Association of Securities Dealers Automated Quotation System. As a result, there may not be a secondary market for the bonds. The underwriters intend, but are not obligated, to make a market in the bonds. See “UNDERWRITING.” |

S-2

OLD DOMINION ELECTRIC COOPERATIVE

We were formed in 1948 as a not-for-profit power supply cooperative. We provide wholesale electric services to our members. Our members include twelve customer-owned electric distribution cooperatives that sell electric services to customers in portions of Virginia, Delaware, Maryland and West Virginia. Through our member distribution cooperatives, we provide retail electric service to more than 464,000 electric customers (meters) representing approximately 1.2 million people. We also sell power to another member, TEC Trading, Inc., which is owned by our member distribution cooperatives.

Our principal office is located at 4201 Dominion Boulevard, Glen Allen, Virginia 23060. Our telephone number is (804) 747-0592.

WHERE TO FIND MORE INFORMATION ABOUT

OLD DOMINION ELECTRIC COOPERATIVE

We file annual, quarterly and current reports and other information with the Securities and Exchange Commission (the “SEC”). You may read and copy any document that we file with the SEC at the SEC’s public reference room at 450 Fifth Street, N.W., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. You also may access our SEC filings on the SEC’s website at http://www.sec.gov.

INCORPORATION OF INFORMATION WE FILE WITH THE SEC

The SEC allows us to “incorporate by reference” into this prospectus supplement the information in documents we file with them, which means that we can disclose important information to you by referring you directly to those documents. The information incorporated by reference is considered to be a part of this prospectus supplement, and later information that we file with the SEC automatically will update and supersede this information, the accompanying prospectus and the information incorporated by reference in those documents. We incorporate by reference the documents listed below and any future filings we make with the SEC under Section 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act until we sell all of the bonds:

| • | | our Annual Report on Form 10-K for the year ended December 31, 2002; |

| • | | our Quarterly Report on Form 10-Q, as amended, for the quarter ended March 31, 2003; and |

| • | | our Current Report on Form 8-K dated July 17, 2003. |

You may request a free copy of any of these filings by writing or telephoning us at:

Old Dominion Electric Cooperative

4201 Dominion Boulevard

Glen Allen, Virginia 23060

Attn: Assistant Vice President and Controller

Telephone: (804) 747-0592

S-3

SUMMARY FINANCIAL DATA

The summary financial data below present selected historical information relating to our financial condition and results of operations. The financial data for the five years ended December 31, 2002, are derived from our audited consolidated financial statements. The financial data for the three-month periods ended March 31, 2003, and 2002, are derived from our unaudited condensed consolidated financial statements. The unaudited financial statements include all adjustments, consisting of normal recurring adjustments, which we consider necessary for a fair presentation of our financial position and results of operations for these periods. You should read the information contained in this table together with the financial data included or incorporated by reference in this prospectus supplement. See “WHERETO FIND MORE INFORMATION ABOUT OLD DOMINION ELECTRIC COOPERATIVE.”

| | | Three Months Ended

March 31,

| | | Years Ended December 31,

| |

| | | 2003

| | | 2002

| | | 2002

| | | 2001

| | | 2000

| | | 1999

| | | 1998

| |

| | | (in thousands, except ratios) | |

Operating revenues | | $ | 143,917 | | | $ | 132,247 | | | $ | 494,642 | | | $ | 487,287 | | | $ | 422,031 | | | $ | 390,060 | | | $ | 364,221 | |

Operating expenses | | | (129,684 | ) | | | (121,568 | ) | | | (450,659 | ) | | | (442,392 | ) | | | (377,335 | ) | | | (336,735 | ) | | | (298,026 | ) |

Operating margin | | | 14,233 | | | | 10,679 | | | | 43,983 | | | | 44,895 | | | | 44,696 | | | | 53,325 | | | | 66,195 | |

Net margin | | | 2,716 | | | | 2,516 | | | | 9,996 | | | | 8,440 | | | | 8,229 | | | | 9,839 | | | | 12,094 | |

Net electric plant | | $ | 978,403 | | | $ | 723,117 | | | $ | 938,086 | | | $ | 695,008 | | | $ | 648,898 | | | $ | 699,531 | | | $ | 766,966 | |

Total assets | | | 1,439,489 | | | | 1,274,959 | | | | 1,430,059 | | | | 1,254,933 | | | | 1,010,572 | | | | 1,050,512 | | | | 1,126,544 | |

Patronage capital | | | 238,250 | | | | 228,053 | | | | 235,534 | | | | 225,538 | | | | 224,598 | | | | 216,369 | | | | 206,530 | |

Long-term debt | | | 751,351 | | | | 625,914 | | | | 750,682 | | | | 625,232 | | | | 449,823 | | | | 509,606 | | | | 584,630 | |

Total capitalization | | | 989,170 | | | | 853,839 | | | | 975,305 | | | | 851,168 | | | | 674,165 | | | | 723,659 | | | | 791,857 | |

Margins for interest ratio | | | 1.47 | | | | 1.22 | | | | 1.20 | | | | 1.21 | | | | 1.20 | | | | 1.24 | | | | 1.34 | |

Ratio of earnings to fixed charges | | | 0.84 | | | | 1.02 | | | | 0.94 | | | | 1.14 | | | | 1.16 | | | | 1.16 | | | | 1.17 | |

Equity ratio | | | 24.1 | % | | | 26.7 | % | | | 23.9 | % | | | 26.5 | % | | | 33.3 | % | | | 29.8 | % | | | 26.1 | % |

The Indenture obligates us to establish the rates we charge our member distribution cooperatives to achieve a margins for interest ratio equal to at least 1.10. We calculate the margins for interest ratio by dividing our margins for interest by our interest charges. See “DESCRIPTIONOFTHE DEBT SECURITIES—Rate Covenant” in the accompanying prospectus for a description of the calculations of margins for interest and interest charges under the Amended Indenture. In 2002, the Amended Indenture was amended to modify the provisions for calculating margins for interest and interest charges. If we had calculated our margins for interest ratio under the prior provisions for each of the periods in which they were in effect, the ratio would have been 1.20 for each of those periods. In addition, if the prior provisions currently were in effect, our margins for interest ratio still would be 1.20 for the above periods occurring after the modification of the Amended Indenture.

We do not take the ratio of earnings to fixed charges or the equity ratio into account in setting our rates. Our ratio of earnings to fixed charges and our equity ratio are less than that of many investor-owned utilities because we operate on a not-for-profit basis and establish rates to collect sufficient revenue to recover our cost of service and produce margins sufficient to meet financial coverage requirements and accumulate additional equity required by our board of directors.

We calculate the ratio of earnings to fixed charges by dividing our earnings by our fixed charges. For purposes of this calculation, earnings are the sum of our net margins and our fixed charges less capitalized interest during the period. Our fixed charges consist of all of our interest costs, whether expensed or capitalized, amortization of debt issue costs and discount or premium related to our indebtedness, and the interest portion of our rent expense.

Our equity ratio equals our patronage capital divided by the sum of our long-term debt and patronage capital. Patronage capital consists of our aggregate net margins that we have not distributed to our members.

S-4

PLAN OF FINANCE AND USE OF PROCEEDS

We expect the net proceeds of this offering to be approximately $246.6 million after the payment of underwriting discounts and offering expenses. We expect to use the net proceeds as part of the funding required to:

| • | | redeem outstanding indebtedness; and |

| • | | finance capital expenditures relating to our generating facilities, including a portion of the future cost to develop and construct three combustion turbine facilities. |

Until applied for these purposes, we may temporarily invest the net proceeds of this offering or use the net proceeds for general corporate or working capital purposes.

Redemption of 1993 Bonds

On December 1, 2003, we currently expect to redeem our 7.48% First Mortgage Bonds, 1993 Series A due 2013 and our 7.78% First Mortgage Bonds, 1993 Series A due 2023. The cost to redeem these bonds on that date, including premium, is $153.7 million.

Capital Expenditures

We incur substantial capital expenditures each year related to additions to our electric plant and equipment. In recent years, we have made significant capital expenditures to develop and construct three combustion turbine facilities in Cecil County, Maryland and Louisa County and Fauquier County, Virginia. These facilities are known as Rock Springs, Louisa and Marsh Run, respectively. The actual and projected yearly costs, including capitalized interest, to develop and construct these facilities are as follows:

| | | Actual

| | Projected

|

Facility

| | 2000

| | 2001

| | 2002

| | 2003

| | 2004

| | Facility

Total

|

| | | (in millions) |

Rock Springs | | $ | 10.6 | | $ | 33.5 | | $ | 82.3 | | $ | 23.9 | | $ | — | | $ | 150.3 |

Louisa | | | 18.4 | | | 34.7 | | | 137.3 | | | 39.1 | | | — | | | 229.5 |

Marsh Run | | | 12.3 | | | 6.5 | | | 33.5 | | | 152.3 | | | 22.2 | | | 226.8 |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Yearly total | | $ | 41.3 | | $ | 74.7 | | $ | 253.1 | | $ | 215.3 | | $ | 22.2 | | $ | 606.6 |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

At March 31, 2003, we had expended an aggregate of $402.8 million in connection with the construction and development of these facilities since 2000. This amount includes loans we made to our subsidiary owning our interest in Rock Springs. The sources of these funds have been our internally generated funds and the net proceeds of previous issuances of indebtedness under the Indenture.

Additional Financings

To the extent not provided by our internally generated funds or the net proceeds of this offering, we may issue additional debt securities under the Indenture to fund the remaining costs required to (1) redeem the First Mortgage Bonds, 1993 Series A Bonds, if we elect to redeem those bonds, and (2) complete the combustion turbine facilities. We also may borrow amounts as necessary to fund these costs under our available lines of credit. The amount available under these lines of credit totals $245 million. The commitments under lines of credit we obtained primarily for the purpose of providing interim funding for the development and construction of the combustion turbine facilities total $120 million; the commitments under lines of credit we obtained for working capital purposes total $125 million. Currently, we have no amounts outstanding and do not expect to draw under our construction-related lines of credit or our general working capital lines of credit.

S-5

RECENT DEVELOPMENTS

As part of our regular evaluation of our power supply and resource options, on May 9, 2003, we issued a request for proposals to serve specified portions of our member distribution cooperatives’ capacity or energy requirements on the Delmarva Peninsula. We sought proposals for service beginning on January 1, 2004, and ending on May 31 of 2008 or 2013. We currently are evaluating responses to the request.

In addition to this request for proposals relating to the Delmarva Peninsula, we also are exploring our power supply options to serve our member distribution cooperatives’ requirements on the Virginia mainland. Currently, we are negotiating an arrangement granting us the option to purchase a portion of our intermediate energy requirements on the Virginia mainland at prices that will be based on specified heat rate and variable gas prices.

We cannot predict whether we will enter into any new power supply arrangements as a result of the request for proposals or our negotiations for an option to purchase a portion of our energy requirements on the Virginia mainland. In all events, we will continue to take actions to evaluate and balance our power supply portfolio from time to time pursuant to our long-term power supply strategy. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Future Issues—Reliance on Energy Purchases” in Part II, Item 7 of our Annual Report on Form 10-K for the year ended December 31, 2002.

S-6

DESCRIPTION OF THE BONDS

The following description of the particular terms of the 2003 Series A Bonds supplements and, to the extent inconsistent, replaces the description of the general terms and provisions of the debt securities set forth in the accompanying prospectus. Some defined terms in the Indenture are used in this summary without capitalization; those terms have the meanings given to them in the accompanying prospectus or the Indenture. The bonds are “debt securities” referred to in the accompanying prospectus.

The 2003 Series A Bonds will be issued under the Amended Indenture. See “DESCRIPTIONOFTHE DEBT SECURITIES—Amendments to Indenture” in the accompanying prospectus for a description of possible future amendments to the Indenture.

General

The bonds will mature on December 1, 2028. We will pay interest on the bonds at the annual rate of 5.676% (on the basis of a 360-day year of twelve 30-day months), from the date of issuance or from the most recent interest payment date to which interest has been paid or provided for, payable semi-annually on June 1 and December 1 of each year. The first interest payment date will be December 1, 2003. On each interest payment date, we will pay interest to the person in whose name the bonds are registered at the close of business on the regular record date for that interest payment, which is the 15th day (whether or not a business day) of the calendar month next preceding the interest payment date. If interest on the bonds is not punctually paid or duly provided for, we will pay that amount instead to each registered holder of the bonds on a special record date not more than 15 nor less than 10 days prior to the date of the proposed payment. Principal of, and premium (if any) and interest on, the bonds will be payable, and the transfer of interests in the bonds will be effected, through the facilities of The Depository Trust Company, as described under “DESCRIPTIONOFTHE DEBT SECURITIES—Book-Entry System; Exchangeability” in the accompanying prospectus. The bonds will be issued in multiples of $1,000.

Make-Whole Redemption

We may redeem the bonds, in whole or in part, on any date prior to their maturity, at our option. We must give at least 30 days, but not more than 60 days, prior notice of redemption mailed to the registered address of each holder of bonds being redeemed except as otherwise required by the procedures of The Depository Trust Company. The redemption price for the bonds will be equal to the greater of:

| • | | 100% of the principal amount of the bonds being redeemed plus interest accrued through the redemption date but not yet due and payable; and |

| • | | the sum of the present values of the remaining principal and interest payments on the bonds being redeemed, discounted on a semi-annual basis (assuming a 360-day year consisting of twelve 30-day months) at a rate equal to the sum of (1) the yield to maturity of the U.S. Treasury security having a life equal to the remaining average life of the maturity of bonds being redeemed and trading in the secondary market at the price closest to par, and (2) 20 basis points; |

plus, in either case, interest due and payable but unpaid on the bonds being redeemed.

If there is no U.S. Treasury security having a life equal to the remaining average life of the bonds being redeemed, the discount rate will be calculated using a yield to maturity determined on a straight-line basis (rounding to the nearest calendar month, if necessary) from the average yield to maturity of two U.S. Treasury securities having lives most closely corresponding to the remaining average life of the bonds being redeemed and trading in the secondary market at the price closest to par.

If less than all of the outstanding bonds are to be redeemed, the bonds to be redeemed will be selected by the trustee in any method it deems fair and appropriate and the portion of the bonds not so redeemed will be in multiples of $1,000.

S-7

If we give notice of the optional redemption of the bonds but the trustee does not have enough funds on deposit to pay the full redemption price of the bonds to be redeemed, those bonds will remain outstanding as though no redemption notice had been given. The failure of the trustee to have sufficient funds to effect the redemption will not constitute a payment or other default by us under the Indenture and we will not be liable to any holder of those bonds as a result of the failed redemption. If the trustee has enough designated funds on deposit to effect a redemption at the time we give notice of the redemption, then we are obligated to redeem the bonds as provided in that notice.

Sinking Fund Redemption

The bonds will be redeemed, on a pro rata basis, through the operation of a mandatory sinking fund, commencing on December 1, 2005, and continuing on December 1 in each year afterwards to the maturity date for the bonds upon not less than 30 nor more than 60 days’ notice mailed to each holder (a person in whose name a bond is registered in the register maintained by the trustee) of bonds being redeemed at the holder’s registered address, except as otherwise required by the procedures of The Depository Trust Company. The sinking fund redemption price will be equal to 100% of the principal amount of the bonds being redeemed plus accrued interest to the redemption date, including interest due on an interest payment date that is on or prior to the redemption date. The principal amount of the bonds being redeemed and the redemption dates as well as the principal amount payable on the maturity date, are set forth below.

Date

| | Amount

|

December 1, 2005 | | $ | 10,417,000 |

December 1, 2006 | | | 10,417,000 |

December 1, 2007 | | | 10,417,000 |

December 1, 2008 | | | 10,417,000 |

December 1, 2009 | | | 10,417,000 |

December 1, 2010 | | | 10,417,000 |

December 1, 2011 | | | 10,417,000 |

December 1, 2012 | | | 10,417,000 |

December 1, 2013 | | | 10,417,000 |

December 1, 2014 | | | 10,417,000 |

December 1, 2015 | | | 10,417,000 |

December 1, 2016 | | | 10,417,000 |

December 1, 2017 | | | 10,417,000 |

December 1, 2018 | | | 10,417,000 |

December 1, 2019 | | | 10,417,000 |

December 1, 2020 | | | 10,417,000 |

December 1, 2021 | | | 10,416,000 |

December 1, 2022 | | | 10,416,000 |

December 1, 2023 | | | 10,416,000 |

December 1, 2024 | | | 10,416,000 |

December 1, 2025 | | | 10,416,000 |

December 1, 2026 | | | 10,416,000 |

December 1, 2027 | | | 10,416,000 |

December 1, 2028(1) | | | 10,416,000 |

| (1) | | The final maturity date of the bonds. |

The bonds that we acquire and surrender for cancellation or redeem (other than by means of sinking fund redemptions) will be credited against future sinking fund payments for the bonds and the principal payment to be made on the maturity date of the bonds, in proportion to the respective amounts of those sinking fund and principal payments.

S-8

Book-Entry System

The bonds will be issued in the form of one or more global bonds, which will be deposited with, and on behalf of, The Depository Trust Company, New York, New York, called DTC, and registered in the name of Cede & Co., DTC’s nominee. Beneficial interests in the global bonds will be represented through book-entry accounts of financial institutions acting on behalf of beneficial owners as direct and indirect participants in DTC. Investors may elect to hold interests in the bonds through DTC if they are participants in that system, or indirectly through organizations which are participants in the system. A more detailed description of the procedures of DTC, with respect to the bonds is set forth in the accompanying prospectus under “DESCRIPTIONOFTHE DEBT SECURITIES—Book-Entry System; Exchangeability.”

S-9

UNDERWRITING

Subject to the terms and conditions in the underwriting agreement, dated the date of this prospectus supplement, between us and J.P. Morgan Securities Inc. and Banc of America Securities LLC, as underwriters, the underwriters severally have agreed to purchase and we have agreed to sell to them the respective principal amounts of the bonds set forth below opposite their respective names:

Underwriter

| | Amount

|

J.P. Morgan Securities Inc. | | $ | 175,000,000 |

Banc of America Securities LLC | | $ | 75,000,000 |

| | |

|

|

Total | | $ | 250,000,000 |

| | |

|

|

The underwriting agreement provides that the obligations of the underwriters to pay for and accept delivery of the bonds are subject to approval of related legal matters by their counsel and to other conditions. The underwriters are committed to purchase all of the bonds if they purchase any of the bonds.

The underwriters propose to offer all or part of the bonds directly to the public at the offering price set forth on the cover page of this prospectus supplement. After the initial offering, the public offering price may be changed.

We estimate that our expenses in connection with the sale of the bonds, other than underwriting discounts, will be approximately $1.1 million. This estimate includes the expenses we will pay relating to printing, rating agency fees, trustees’ fees and legal fees, including the fees of counsel to the underwriters, among other expenses.

We have agreed to indemnify the underwriters against some civil liabilities, including liabilities under the Securities Act of 1933, or to contribute to payments the underwriters may be required to make in connection with the sale of the bonds.

The bonds are a new issue of securities with no established trading market. We cannot give any assurances to you concerning the liquidity of, or the development of a trading market for, the bonds. The underwriters may make a market in the bonds, but are not obligated to do so and may discontinue making a market at any time without notice.

In order to facilitate the offering of the bonds, the underwriters may engage in transactions that stabilize, maintain or otherwise affect the price of the bonds. Specifically, the underwriters may overallot in connection with the offering, creating short positions in the bonds for their own accounts. In addition, to cover overallotments or to stabilize the price of the bonds, the underwriters may bid for and purchase the bonds in the open market. Any of these activities may stabilize or maintain the market price of the bonds above independent market levels. The underwriters are not required to engage in these activities and may end any of the activities at any time. The underwriters may also impose a penalty bid. This occurs when one underwriter repays to another underwriter a portion of the underwriting discount received by it because repurchased bonds have been sold by or for the account of the repaying underwriter in stabilizing or short covering transactions.

We expect that the bonds will be available for delivery against payment for the bonds in immediately available funds on or about July 29, 2003, the fourth business day following the date of this prospectus supplement (“T+4”). Under Rule 15c6-1 under the Securities Exchange Act, trades of securities in the secondary market generally are required to settle within three business days following the pricing of the trades, unless the parties to any trade expressly agree otherwise. We have agreed with the underwriters in the underwriting agreement to settle the bonds on a T+4 trade cycle.

We may engage in other transactions with the underwriters and their affiliates from time to time in the ordinary course of business.

S-10

LEGAL OPINIONS

LeClair Ryan, A Professional Corporation, and Orrick, Herrington & Sutcliffe LLP will pass upon the legality and enforceability of the bonds for us. Sutherland Asbill & Brennan LLP will pass upon other legal matters in connection with the bonds for the underwriters.

EXPERTS

The consolidated financial statements of Old Dominion Electric Cooperative as of December 31, 2002, and December 31, 2001, and for the three years ended December 31, 2002, appearing in Old Dominion Electric Cooperative’s Annual Report on Form 10-K for the year ended December 31, 2002, have been audited by Ernst & Young LLP, independent auditors, as set forth in their report thereon included therein and incorporated herein by reference. These consolidated financial statements are incorporated herein by reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

S-11

APPENDIX A

MEMBER FINANCIAL AND STATISTICAL INFORMATION

Financial and statistical information relating to our twelve member distribution cooperatives is set forth in the following tables. Table 1 contains selected operational and financial information. Tables 2 and 3 show the average number of customers served and annual megawatt-hour sales by each member distribution cooperative by customer class. Table 4 identifies the annual revenues of each member distribution cooperative by customer class. Tables 5 and 6 describe other selected financial information.

The assets, liabilities, equity, revenues, and margins of the member distribution cooperatives should not be attributed to us. The member distribution cooperatives are not our subsidiaries, but rather our owners. We have no legal interest in their properties, liabilities, equity, revenues or margins. In addition, the revenues of our member distribution cooperatives are not pledged to us, but their revenues are the source from which they pay for the capacity and energy they receive from us. Revenues of the member distribution cooperatives are, however, pledged under their respective mortgages or other financial documents.

Our member distribution cooperatives operate on a not-for-profit basis. Accumulated margins remaining after payment of expenses and provision for depreciation constitute patronage capital of the customers of these members. Refunds of accumulated patronage capital to the individual customers are made from time to time on a patronage basis subject to each member distribution cooperative’s policies and in conformity with limitations contained in each member distribution cooperative’s financing arrangements.

The information in the tables below may not be indicative of the future results of our member distribution cooperatives. The recent enactment of legislation enabling retail customers to choose their supplier of electric service, but not transmission and distribution service, may significantly affect the member distribution cooperatives’ future results and financial conditions.

The information in the tables below has been taken from the Rural Utilities Service (“RUS”) Financial and Statistical Reports (RUS Form 7) prepared by our member distribution cooperatives. Neither we nor the RUS has independently verified this information. We have compiled the information in the “Total” columns from these RUS Forms 7.

S-A-1

TABLE 1

OLD DOMINION ELECTRIC COOPERATIVE

SELECTED STATISTICS OF EACH MEMBER*

(As of December 31)

| | | A&N

| | BARC

| | Choptank

| | Community

| | Delaware

|

2002 | | | | | | | | | | |

Full time employees | | 42 | | 50 | | 159 | | 32 | | 118 |

Total miles energized | | 1,197 | | 1,901 | | 5,387 | | 1,463 | | 5,381 |

Average monthly residential revenue ($ per consumer) | | 86.53 | | 85.97 | | 103.31 | | 118.99 | | 94.82 |

Average monthly residential (KWh per consumer) | | 918 | | 815 | | 1,114 | | 1,370 | | 1,087 |

Average residential revenue (cents per KWh) | | 9.42 | | 10.55 | | 9.28 | | 8.69 | | 8.72 |

Total equity as a percentage of assets | | 39.9 | | 37.6 | | 43.0 | | 55.5 | | 48.7 |

| | | | | |

2001 | | | | | | | | | | |

Full time employees | | 41 | | 51 | | 155 | | 31 | | 116 |

Total miles energized | | 1,178 | | 1,885 | | 5,284 | | 1,444 | | 5,203 |

Average monthly residential revenue ($ per consumer) | | 83.12 | | 89.58 | | 102.00 | | 118.00 | | 92.67 |

Average monthly residential (KWh per consumer) | | 892 | | 841 | | 1,097 | | 1,350 | | 1,056 |

Average residential revenue (cents per KWh) | | 9.32 | | 10.65 | | 9.30 | | 8.74 | | 8.77 |

Total equity as a percentage of assets | | 40.0 | | 36.4 | | 42.8 | | 53.6 | | 48.9 |

| | | | | |

2000 | | | | | | | | | | |

Full time employees | | 40 | | 48 | | 159 | | 30 | | 115 |

Total miles energized | | 1,167 | | 1,864 | | 5,207 | | 1,430 | | 5,027 |

Average monthly residential revenue ($ per consumer) | | 75.77 | | 74.94 | | 99.43 | | 111.03 | | 90.34 |

Average monthly residential (KWh per consumer) | | 874 | | 828 | | 1,064 | | 1,346 | | 1,031 |

Average residential revenue (cents per KWh) | | 8.67 | | 9.05 | | 9.34 | | 8.25 | | 8.76 |

Total equity as a percentage of assets | | 39.3 | | 36.1 | | 42.2 | | 51.1 | | 48.2 |

| * | | These figures were compiled from Form 7 Financial and Statistical Reports. |

S-A-2

TABLE 1—(Continued)

OLD DOMINION ELECTRIC COOPERATIVE

SELECTED STATISTICS OF EACH MEMBER*

(As of December 31)

Mecklenburg

| | Northern

Neck

| | Northern

Virginia

| | Prince

George

| | Rappahannock

| | Shenandoah

Valley

| | Southside

| | Total

|

| | | | | | | | | | | | | | | |

| 124 | | 53 | | 290 | | 40 | | 285 | | 113 | | 172 | | 1,478 |

| 4,207 | | 1,860 | | 5,236 | | 1,086 | | 10,996 | | 4,834 | | 7,552 | | 51,100 |

| 90.12 | | 97.34 | | 125.26 | | 115.49 | | 118.44 | | 105.25 | | 116.39 | | 110.25 |

| 973 | | 991 | | 1,289 | | 1,312 | | 1,251 | | 1,203 | | 1,097 | | 1,164 |

| 9.26 | | 9.83 | | 9.72 | | 8.80 | | 9.46 | | 8.75 | | 10.61 | | 9.47 |

| 39.5 | | 50.5 | | 59.0 | | 45.2 | | 41.3 | | 46.5 | | 34.2 | | 46.9 |

| | | | | | | |

| | | | | | | | | | | | | | | |

| 123 | | 52 | | 293 | | 34 | | 279 | | 111 | | 153 | | 1,439 |

| 4,179 | | 1,827 | | 5,120 | | 1,074 | | 10,545 | | 4,765 | | 7,446 | | 49,950 |

| 88.07 | | 94.15 | | 123.09 | | 113.52 | | 115.47 | | 106.88 | | 114.54 | | 108.33 |

| 936 | | 971 | | 1,159 | | 1,247 | | 1,205 | | 1,197 | | 1,064 | | 1,110 |

| 9.41 | | 9.69 | | 10.62 | | 9.11 | | 9.58 | | 8.93 | | 10.77 | | 9.76 |

| 40.6 | | 50.9 | | 57.0 | | 46.8 | | 42.7 | | 46.0 | | 33.9 | | 46.7 |

| | | | | | | |

| | | | | | | | | | | | | | | |

| 122 | | 48 | | 315 | | 34 | | 267 | | 113 | | 156 | | 1,447 |

| 4,145 | | 1,806 | | 4,950 | | 1,058 | | 10,294 | | 4,701 | | 7,340 | | 48,989 |

| 79.20 | | 85.61 | | 102.74 | | 104.84 | | 109.78 | | 87.34 | | 97.63 | | 97.04 |

| 931 | | 948 | | 1,150 | | 1,335 | | 1,229 | | 1,206 | | 1,079 | | 1,107 |

| 8.51 | | 9.03 | | 8.93 | | 7.85 | | 8.93 | | 7.24 | | 9.05 | | 8.76 |

| 38.4 | | 50.2 | | 52.6 | | 47.9 | | 43.4 | | 44.8 | | 32.0 | | 45.0 |

S-A-3

TABLE 2

OLD DOMINION ELECTRIC COOPERATIVE

AVERAGE NUMBER OF CUSTOMERS SERVED BY EACH MEMBER*

(As of December 31)

| | | A&N

| | BARC

| | Choptank

| | Community

| | Delaware

|

2002 | | | | | | | | | | |

Residential service (farm & non-farm) | | 9,978 | | 10,993 | | 38,747 | | 8,086 | | 56,603 |

Commercial & industrial—Small | | 642 | | 580 | | 3,427 | | 1,504 | | 5,397 |

Commercial & industrial—Large | | 2 | | 2 | | 14 | | 2 | | 1 |

Irrigation | | 84 | | 0 | | 0 | | 11 | | 189 |

Other electric service | | 125 | | 0 | | 280 | | 29 | | 454 |

| | |

| |

| |

| |

| |

|

Total customers served | | 10,831 | | 11,575 | | 42,468 | | 9,632 | | 62,644 |

| | | | | |

2001 | | | | | | | | | | |

Residential service (farm & non-farm) | | 9,791 | | 10,844 | | 38,246 | | 7,995 | | 54,665 |

Commercial & industrial—Small | | 630 | | 582 | | 3,107 | | 1,462 | | 4,647 |

Commercial & industrial—Large | | 2 | | 2 | | 14 | | 2 | | 1 |

Irrigation | | 78 | | 0 | | 0 | | 10 | | 182 |

Other electric service | | 129 | | 0 | | 274 | | 27 | | 426 |

| | |

| |

| |

| |

| |

|

Total customers served | | 10,630 | | 11,428 | | 41,641 | | 9,496 | | 59,921 |

| | | | | |

2000 | | | | | | | | | | |

Residential service (farm & non-farm) | | 9,692 | | 10,669 | | 37,765 | | 7,907 | | 53,237 |

Commercial & industrial—Small | | 611 | | 583 | | 2,722 | | 1,423 | | 3,974 |

Commercial & industrial—Large | | 2 | | 2 | | 15 | | 2 | | 2 |

Irrigation | | 67 | | 0 | | 0 | | 9 | | 167 |

Other electric service | | 127 | | 0 | | 265 | | 28 | | 403 |

| | |

| |

| |

| |

| |

|

Total customers served | | 10,499 | | 11,254 | | 40,767 | | 9,369 | | 57,783 |

| * | | These figures were compiled from Form 7 Financial and Statistical Reports. |

S-A-4

TABLE 2—(Continued)

OLD DOMINION ELECTRIC COOPERATIVE

AVERAGE NUMBER OF CUSTOMERS SERVED BY EACH MEMBER*

(As of December 31)

Mecklenburg

| | Northern

Neck

| | Northern

Virginia

| | Prince

George

| | Rappahannock

| | Shenandoah

Valley

| | Southside

| | Total

|

| | | | | | | | | | | | | | | |

| 28,089 | | 15,048 | | 101,901 | | 8,777 | | 76,752 | | 29,311 | | 45,194 | | 429,479 |

| 1,403 | | 856 | | 7,031 | | 904 | | 3,972 | | 4,888 | | 1,561 | | 32,165 |

| 8 | | 0 | | 32 | | 6 | | 214 | | 19 | | 249 | | 549 |

| 0 | | 0 | | 0 | | 0 | | 0 | | 0 | | 0 | | 284 |

| 278 | | 76 | | 14 | | 91 | | 637 | | 0 | | 191 | | 2,175 |

| |

| |

| |

| |

| |

| |

| |

|

| 29,778 | | 15,980 | | 108,978 | | 9,778 | | 81,575 | | 34,218 | | 47,195 | | 464,652 |

| | | | | | | |

| | | | | | | | | | | | | | | |

| 27,722 | | 14,717 | | 97,255 | | 8,623 | | 73,932 | | 28,845 | | 44,209 | | 416,844 |

| 1,397 | | 861 | | 6,685 | | 877 | | 3,890 | | 4,642 | | 1,521 | | 30,301 |

| 10 | | 0 | | 29 | | 6 | | 207 | | 17 | | 248 | | 538 |

| 0 | | 0 | | 0 | | 0 | | 0 | | 0 | | 0 | | 270 |

| 268 | | 76 | | 15 | | 91 | | 636 | | 0 | | 182 | | 2,124 |

| |

| |

| |

| |

| |

| |

| |

|

| 29,397 | | 15,654 | | 103,984 | | 9,597 | | 78,665 | | 33,504 | | 46,160 | | 450,077 |

| | | | | | | |

| | | | | | | | | | | | | | | |

| 27,392 | | 14,480 | | 92,394 | | 8,308 | | 71,297 | | 28,229 | | 43,319 | | 404,689 |

| 1,347 | | 845 | | 6,443 | | 829 | | 3,768 | | 4,449 | | 1,472 | | 28,466 |

| 12 | | 0 | | 29 | | 33 | | 193 | | 14 | | 232 | | 536 |

| 0 | | 0 | | 0 | | 0 | | 0 | | 0 | | 0 | | 243 |

| 261 | | 75 | | 15 | | 91 | | 547 | | 0 | | 169 | | 1,981 |

| |

| |

| |

| |

| |

| |

| |

|

| 29,012 | | 15,400 | | 98,881 | | 9,261 | | 75,805 | | 32,692 | | 45,192 | | 435,915 |

S-A-5

TABLE 3

OLD DOMINION ELECTRIC COOPERATIVE

ANNUAL MEGAWATT-HOUR SALES BY CUSTOMER CLASS OF EACH MEMBER*

(As of December 31)

| | | | | |

| | | A&N

| | BARC

| | Choptank

| | Community

| | Delaware

|

2002 | | | | | | | | | | |

Residential service (farm & non-farm) | | 109,974 | | 107,482 | | 517,835 | | 132,917 | | 738,403 |

Commercial & industrial—Small | | 25,677 | | 28,711 | | 154,586 | | 17,878 | | 133,906 |

Commercial & industrial—Large | | 71,179 | | 21,839 | | 74,215 | | 2,701 | | 9,998 |

Irrigation | | 1,252 | | 0 | | 0 | | 257 | | 2,665 |

Other electric service | | 1,696 | | 0 | | 561 | | 8,511 | | 6,043 |

| | |

| |

| |

| |

| |

|

Total megawatt-hour sales | | 209,778 | | 158,032 | | 747,197 | | 162,264 | | 891,015 |

| | | | | |

2001 | | | | | | | | | | |

Residential service (farm & non-farm) | | 104,748 | | 109,503 | | 503,267 | | 129,491 | | 692,917 |

Commercial & industrial—Small | | 24,447 | | 29,601 | | 144,847 | | 17,478 | | 121,680 |

Commercial & industrial—Large | | 71,245 | | 19,734 | | 76,854 | | 3,235 | | 10,317 |

Irrigation | | 981 | | 0 | | 0 | | 267 | | 1,498 |

Other electric service | | 1,748 | | 0 | | 487 | | 7,869 | | 5,728 |

| | |

| |

| |

| |

| |

|

Total megawatt-hour sales | | 203,169 | | 158,837 | | 725,456 | | 158,340 | | 832,140 |

| | | | | |

2000 | | | | | | | | | | |

Residential service (farm & non-farm) | | 101,650 | | 106,006 | | 482,329 | | 127,674 | | 658,847 |

Commercial & industrial—Small | | 24,040 | | 29,597 | | 134,679 | | 17,623 | | 113,859 |

Commercial & industrial—Large | | 72,790 | | 17,691 | | 77,753 | | 2,764 | | 10,536 |

Irrigation | | 721 | | 0 | | 0 | | 205 | | 771 |

Other electric service | | 1,677 | | 0 | | 205 | | 7,111 | | 5,444 |

| | |

| |

| |

| |

| |

|

Total megawatt-hour sales | | 200,878 | | 153,294 | | 694,966 | | 155,377 | | 789,457 |

| * | | These figures were compiled from Form 7 Financial and Statistical Reports. |

S-A-6

TABLE 3—(Continued)

OLD DOMINION ELECTRIC COOPERATIVE

ANNUAL MEGAWATT-HOUR SALES BY CUSTOMER CLASS OF EACH MEMBER*

(As of December 31)

Mecklenburg

| | Northern

Neck

| | Northern

Virginia

| | Prince

George

| | Rappahannock

| | Shenandoah

Valley

| | Southside

| | Total

|

| | | | | | | | | | | | | | | |

| 328,025 | | 178,890 | | 1,575,816 | | 138,217 | | 1,152,634 | | 423,200 | | 594,941 | | 5,998,333 |

| 63,215 | | 33,300 | | 653,549 | | 24,150 | | 101,685 | | 101,849 | | 21,443 | | 1,359,948 |

| 104,091 | | 0 | | 300,992 | | 54,817 | | 993,406 | | 181,381 | | 100,003 | | 1,914,622 |

| 0 | | 0 | | 0 | | 0 | | 0 | | 0 | | 0 | | 4,174 |

| 26,953 | | 1,632 | | 2,964 | | 30,349 | | 5,790 | | 0 | | 22,857 | | 107,356 |

| |

| |

| |

| |

| |

| |

| |

|

| 522,283 | | 213,821 | | 2,533,321 | | 247,533 | | 2,253,515 | | 706,430 | | 739,244 | | 9,384,433 |

| | | | | | | |

| | | | | | | | | | | | | | | |

| 311,316 | | 171,543 | | 1,352,553 | | 128,990 | | 1,068,980 | | 414,478 | | 564,282 | | 5,552,067 |

| 60,134 | | 31,159 | | 602,381 | | 22,910 | | 100,746 | | 98,828 | | 20,387 | | 1,274,599 |

| 115,143 | | 0 | | 281,401 | | 48,828 | | 915,094 | | 170,867 | | 91,226 | | 1,803,944 |

| 0 | | 0 | | 0 | | 0 | | 0 | | 0 | | 0 | | 2,746 |

| 25,330 | | 1,504 | | 2,710 | | 30,708 | | 5,839 | | 0 | | 22,828 | | 104,750 |

| |

| |

| |

| |

| |

| |

| |

|

| 511,922 | | 204,206 | | 2,239,044 | | 231,436 | | 2,090,658 | | 684,173 | | 698,723 | | 8,738,106 |

| | | | | | | |

| | | | | | | | | | | | | | | |

| 306,040 | | 164,760 | | 1,275,375 | | 133,127 | | 1,051,670 | | 408,656 | | 560,760 | | 5,376,894 |

| 60,987 | | 30,786 | | 618,612 | | 8,982 | | 99,945 | | 95,156 | | 19,730 | | 1,253,996 |

| 116,043 | | 0 | | 261,955 | | 60,400 | | 936,254 | | 167,782 | | 85,789 | | 1,809,757 |

| 0 | | 0 | | 0 | | 0 | | 0 | | 0 | | 0 | | 1,697 |

| 25,036 | | 1,443 | | 2,678 | | 30,046 | | 6,082 | | 0 | | 11,069 | | 90,791 |

| |

| |

| |

| |

| |

| |

| |

|

| 508,106 | | 196,989 | | 2,158,620 | | 232,555 | | 2,093,951 | | 671,594 | | 677,348 | | 8,533,135 |

S-A-7

TABLE 4

OLD DOMINION ELECTRIC COOPERATIVE

ANNUAL REVENUES BY CUSTOMER CLASS OF EACH MEMBER*

(As of December 31)

| | | | | |

| | | A&N

| | BARC

| | Choptank

| | Community

| | Delaware

|

2002 | | | | | | | | | | | | | | | |

Residential service (farm & non-farm) | | $ | 10,360,813 | | $ | 11,340,628 | | $ | 48,037,095 | | $ | 11,546,287 | | $ | 64,404,712 |

Commercial & industrial—Small | | | 2,462,511 | | | 2,700,894 | | | 12,481,477 | | | 1,660,044 | | | 10,160,818 |

Commercial & industrial—Large | | | 4,821,577 | | | 1,473,267 | | | 4,397,450 | | | 182,528 | | | 596,999 |

Irrigation | | | 115,680 | | | 0 | | | 0 | | | 38,849 | | | 229,601 |

Other electric service | | | 183,002 | | | 0 | | | 98,347 | | | 700,521 | | | 785,568 |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

Total electric sales | | | 17,943,583 | | | 15,514,789 | | | 65,014,369 | | | 14,128,229 | | | 76,177,698 |

Other operating revenue | | | 295,190 | | | 373,534 | | | 973,487 | | | 158,750 | | | 1,082,304 |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

Total operating revenue | | $ | 18,238,773 | | $ | 15,888,323 | | $ | 65,987,856 | | $ | 14,286,979 | | $ | 77,260,002 |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

| | | | | |

2001 | | | | | | | | | | | | | | | |

Residential service (farm & non-farm) | | $ | 9,766,132 | | $ | 11,657,348 | | $ | 46,813,497 | | $ | 11,320,453 | | $ | 60,788,404 |

Commercial & industrial—Small | | | 2,310,651 | | | 2,792,251 | | | 12,217,194 | | | 1,632,842 | | | 9,383,937 |

Commercial & industrial—Large | | | 4,640,489 | | | 1,471,847 | | | 4,555,199 | | | 208,281 | | | 621,447 |

Irrigation | | | 100,336 | | | 0 | | | 0 | | | 37,856 | | | 147,529 |

Other electric service | | | 184,626 | | | 0 | | | 96,216 | | | 646,509 | | | 732,747 |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

Total electric sales | | | 17,002,234 | | | 15,921,446 | | | 63,682,106 | | | 13,845,941 | | | 71,674,064 |

Other operating revenue | | | 281,594 | | | 268,878 | | | 1,053,261 | | | 153,591 | | | 1,080,185 |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

Total operating revenue | | $ | 17,283,828 | | $ | 16,190,324 | | $ | 64,735,367 | | $ | 13,999,532 | | $ | 72,754,249 |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

| | | | | |

2000 | | | | | | | | | | | | | | | |

Residential service (farm & non-farm) | | $ | 8,812,142 | | $ | 9,594,712 | | $ | 45,058,674 | | $ | 10,534,632 | | $ | 57,712,465 |

Commercial & industrial—Small | | | 2,111,398 | | | 2,275,994 | | | 11,440,508 | | | 1,575,090 | | | 8,849,499 |

Commercial & industrial—Large | | | 4,228,437 | | | 1,222,104 | | | 4,587,028 | | | 169,772 | | | 644,569 |

Irrigation | | | 71,110 | | | 0 | | | 0 | | | 31,015 | | | 58,810 |

Other electric service | | | 166,815 | | | 0 | | | 78,648 | | | 556,784 | | | 687,221 |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

Total electric sales | | | 15,389,902 | | | 13,092,810 | | | 61,164,858 | | | 12,867,293 | | | 67,952,564 |

Other operating revenue | | | 256,752 | | | 214,945 | | | 927,203 | | | 132,419 | | | 793,366 |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

Total operating revenue | | $ | 15,646,654 | | $ | 13,307,755 | | $ | 62,092,061 | | $ | 12,999,712 | | $ | 68,745,930 |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

| * | | These figures were compiled from Form 7 Financial and Statistical Reports. |

S-A-8

TABLE 4—(Continued)

OLD DOMINION ELECTRIC COOPERATIVE

ANNUAL REVENUES BY CUSTOMER CLASS OF EACH MEMBER*

(As of December 31)

Mecklenburg

| | Northern

Neck

| | Northern

Virginia

| | Prince George

| | Rappahannock

| | Shenandoah

Valley

| | Southside

| | Total

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| $ | 30,375,753 | | $ | 17,576,800 | | $ | 153,174,448 | | $ | 12,163,411 | | $ | 109,087,449 | | $ | 37,019,648 | | $ | 63,119,273 | | $ | 568,206,317 |

| | 5,436,632 | | | 3,046,258 | | | 61,910,313 | | | 2,006,755 | | | 9,983,541 | | | 9,008,575 | | | 2,129,946 | | | 122,987,764 |

| | 5,958,657 | | | 0 | | | 16,153,548 | | | 3,352,194 | | | 46,888,793 | | | 10,646,818 | | | 6,820,397 | | | 101,292,228 |

| | 0 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | | | 384,130 |

| | 2,066,001 | | | 157,270 | | | 480,915 | | | 2,210,381 | | | 668,809 | | | 0 | | | 2,367,516 | | | 9,718,330 |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| | 43,837,043 | | | 20,780,328 | | | 231,719,224 | | | 19,732,741 | | | 166,628,592 | | | 56,675,041 | | | 74,437,132 | | | 802,588,769 |

| | 332,258 | | | 377,986 | | | 2,782,926 | | | 184,474 | | | 1,721,099 | | | 842,067 | | | 469,688 | | | 9,593,763 |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| $ | 44,169,301 | | $ | 21,158,314 | | $ | 234,502,150 | | $ | 19,917,215 | | $ | 168,349,691 | | $ | 57,517,108 | | $ | 74,906,820 | | $ | 812,182,532 |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| $ | 29,298,582 | | $ | 16,627,636 | | $ | 143,650,731 | | $ | 11,746,561 | | $ | 102,444,764 | | $ | 36,995,227 | | $ | 60,763,979 | | $ | 541,873,314 |

| | 5,366,810 | | | 2,842,015 | | | 60,753,701 | | | 1,896,173 | | | 9,943,901 | | | 9,000,733 | | | 2,017,573 | | | 120,157,781 |

| | 7,010,928 | | | 0 | | | 13,649,916 | | | 3,090,185 | | | 46,629,742 | | | 10,618,878 | | | 6,272,395 | | | 98,769,307 |

| | 0 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | | | 285,721 |

| | 1,943,797 | | | 141,955 | | | 486,810 | | | 2,231,158 | | | 632,533 | | | 0 | | | 2,128,553 | | | 9,224,904 |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| | 43,620,117 | | | 19,611,606 | | | 218,541,158 | | | 18,964,077 | | | 159,650,940 | | | 56,614,838 | | | 71,182,500 | | | 770,311,027 |

| | 336,533 | | | 370,486 | | | 2,777,876 | | | 170,416 | | | 1,342,989 | | | 733,252 | | | 558,791 | | | 9,127,852 |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| $ | 43,956,650 | | $ | 19,982,092 | | $ | 221,319,034 | | $ | 19,134,493 | | $ | 160,993,929 | | $ | 57,348,090 | | $ | 71,741,291 | | $ | 779,438,879 |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| $ | 26,032,950 | | $ | 14,876,158 | | $ | 113,915,590 | | $ | 10,451,665 | | $ | 93,927,535 | | $ | 29,585,909 | | $ | 50,751,772 | | $ | 471,254,204 |

| | 4,834,196 | | | 2,588,116 | | | 48,480,651 | | | 734,859 | | | 9,095,678 | | | 7,407,798 | | | 1,690,076 | | | 101,083,863 |

| | 5,997,707 | | | 0 | | | 13,654,104 | | | 3,227,972 | | | 37,689,528 | | | 8,222,205 | | | 5,617,040 | | | 85,260,466 |

| | 0 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | | | 160,935 |

| | 1,702,272 | | | 125,819 | | | 431,646 | | | 1,790,177 | | | 602,628 | | | 0 | | | 811,885 | | | 6,953,895 |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| | 38,567,125 | | | 17,590,093 | | | 176,481,991 | | | 16,204,673 | | | 141,315,369 | | | 45,215,912 | | | 58,870,773 | | | 664,713,363 |

| | 294,781 | | | 334,472 | | | 1,897,892 | | | 158,306 | | | 1,279,555 | | | 501,629 | | | 356,497 | | | 7,147,817 |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| $ | 38,861,906 | | $ | 17,924,565 | | $ | 178,379,883 | | $ | 16,362,979 | | $ | 142,594,924 | | $ | 45,717,541 | | $ | 59,227,270 | | $ | 671,861,180 |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

S-A-9

TABLE 5

OLD DOMINION ELECTRIC COOPERATIVE

SELECTED STATISTICS OF EACH MEMBER*

(As of December 31)

| | | | | |

| | | A&N

| | BARC

| | Choptank

| | Community

| | Delaware

|

2002 | | | | | | | | | | | | | | | |

Operating revenue and patronage capital | | $ | 18,238,773 | | $ | 15,888,323 | | $ | 65,987,857 | | $ | 14,286,979 | | $ | 77,260,002 |

Depreciation and amortization | | | 1,200,480 | | | 1,416,153 | | | 5,035,547 | | | 820,641 | | | 8,477,990 |

Other operating expenses | | | 14,981,975 | | | 12,218,963 | | | 53,170,241 | | | 11,937,770 | | | 62,855,081 |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

Electric operating margins | | | 2,056,318 | | | 2,253,207 | | | 7,782,069 | | | 1,528,568 | | | 5,926,931 |

Other income | | | 837,710 | | | 218,895 | | | 1,223,602 | | | 255,937 | | | 1,318,919 |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

Gross operating margins | | | 2,894,028 | | | 2,472,102 | | | 9,005,671 | | | 1,784,505 | | | 7,245,850 |

Interest on long-term debt | | | 817,009 | | | 1,318,347 | | | 4,381,651 | | | 542,127 | | | 2,299,914 |

Other deductions | | | 29,506 | | | 14,646 | | | 208,764 | | | 471 | | | 133,176 |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

Net margins | | $ | 2,047,513 | | $ | 1,139,109 | | $ | 4,415,256 | | $ | 1,241,907 | | $ | 4,812,760 |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

| | | | | |

2001 | | | | | | | | | | | | | | | |

Operating revenue and patronage capital | | $ | 17,283,828 | | $ | 16,190,324 | | $ | 64,735,360 | | $ | 13,999,532 | | $ | 72,754,249 |

Depreciation and amortization | | | 1,160,554 | | | 1,320,128 | | | 4,723,452 | | | 795,352 | | | 8,586,222 |

Other operating expenses | | | 14,531,213 | | | 12,463,506 | | | 53,980,832 | | | 11,112,135 | | | 60,502,792 |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

Electric operating margins | | | 1,592,061 | | | 2,406,690 | | | 6,031,076 | | | 2,092,045 | | | 3,665,235 |

Other income | | | 367,107 | | | 309,685 | | | 1,251,171 | | | 226,444 | | | 1,280,216 |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

Gross operating margins | | | 1,959,168 | | | 2,716,375 | | | 7,282,247 | | | 2,318,489 | | | 4,945,451 |

Interest on long-term debt | | | 892,292 | | | 1,251,015 | | | 4,423,688 | | | 618,363 | | | 2,650,045 |

Other deductions | | | 36,461 | | | 14,151 | | | 102,763 | | | 8,678 | | | 54,458 |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

Net margins | | $ | 1,030,415 | | $ | 1,451,209 | | $ | 2,755,796 | | $ | 1,691,448 | | $ | 2,240,948 |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

| | | | | |

2000 | | | | | | | | | | | | | | | |

Operating revenue and patronage capital | | $ | 15,646,655 | | $ | 13,307,755 | | $ | 62,092,062 | | $ | 12,999,712 | | $ | 68,745,930 |

Depreciation and amortization | | | 1,959,462 | | | 1,200,492 | | | 4,580,392 | | | 1,238,079 | | | 8,136,360 |

Other operating expenses | | | 12,726,863 | | | 10,671,646 | | | 51,739,205 | | | 10,338,783 | | | 57,157,098 |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

Electric operating margins | | | 960,330 | | | 1,435,617 | | | 5,772,465 | | | 1,422,850 | | | 3,452,472 |

Other income | | | 368,829 | | | 321,815 | | | 1,298,628 | | | 420,636 | | | 3,448,261 |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

Gross operating margins | | | 1,329,159 | | | 1,757,432 | | | 7,071,093 | | | 1,843,486 | | | 6,900,733 |

Interest on long-term debt | | | 834,577 | | | 1,268,673 | | | 4,326,002 | | | 651,839 | | | 2,837,668 |

Other deductions | | | 35,378 | | | 15,698 | | | 345,358 | | | 9,946 | | | 67,285 |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

Net margins | | $ | 459,204 | | $ | 473,061 | | $ | 2,399,733 | | $ | 1,181,701 | | $ | 3,995,780 |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

| * | | These figures were compiled from Form 7 Financial and Statistical Reports. |

S-A-10

TABLE 5—(Continued)

OLD DOMINION ELECTRIC COOPERATIVE

SELECTED STATISTICS OF EACH MEMBER*

(As of December 31)

Mecklenburg

| | Northern

Neck

| | Northern

Virginia

| | | Prince George

| | Rappahannock

| | Shenandoah

Valley

| | | Southside

| | Total

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| $ | 44,169,301 | | $ | 21,158,314 | | $ | 234,331,839 | | | $ | 19,917,215 | | $ | 168,349,691 | | $ | 57,517,108 | | | $ | 74,906,820 | | $ | 812,012,222 |

| | 2,892,396 | | | 1,454,372 | | | 11,105,820 | | | | 1,042,143 | | | 10,992,525 | | | 4,567,055 | | | | 5,881,748 | | | 54,886,870 |

| | 37,646,845 | | | 17,332,520 | | | 174,009,619 | | | | 17,523,219 | | | 140,248,268 | | | 45,326,903 | | | | 58,644,027 | | | 645,895,431 |

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

|

| |

|

| |

|

|

| | 3,630,060 | | | 2,371,422 | | | 49,216,400 | | | | 1,351,853 | | | 17,108,898 | | | 7,623,150 | | | | 10,381,045 | | | 111,229,921 |

| | 881,122 | | | 321,225 | | | 6,342,151 | | | | 337,589 | | | 3,305,473 | | | 1,033,706 | | | | 1,154,459 | | | 17,230,788 |

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

|

| |

|

| |

|

|

| | 4,511,182 | | | 2,692,647 | | | 55,558,551 | | | | 1,689,442 | | | 20,414,371 | | | 8,656,856 | | | | 11,535,504 | | | 128,460,709 |

| | 2,005,410 | | | 840,520 | | | 8,182,619 | | | | 606,805 | | | 7,807,296 | | | 2,569,342 | | | | 5,535,876 | | | 36,906,916 |

| | 28,681 | | | 31,996 | | | 806,849 | | | | 23,588 | | | 173,489 | | | (1,740 | ) | | | 989,776 | | | 2,439,202 |

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

|

| |

|

| |

|

|

| $ | 2,477,091 | | $ | 1,820,131 | | $ | 46,569,083 | | | $ | 1,059,049 | | $ | 12,433,586 | | $ | 6,089,254 | | | $ | 5,009,852 | | $ | 89,114,591 |

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

|

| |

|

| |

|

|

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| $ | 43,956,650 | | $ | 19,982,091 | | $ | 220,128,926 | | | $ | 19,134,492 | | $ | 160,993,928 | | $ | 57,347,818 | | | $ | 71,741,291 | | $ | 778,248,489 |

| | 2,750,493 | | | 1,486,783 | | | 10,847,594 | | | | 969,112 | | | 11,228,638 | | | 4,469,132 | | | | 5,502,567 | | | 53,840,027 |

| | 35,460,112 | | | 16,603,275 | | | 167,655,995 | | | | 16,713,060 | | | 135,359,340 | | | 44,337,460 | | | | 55,566,211 | | | 624,285,931 |

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

|

| |

|

| |

|

|

| | 5,746,045 | | | 1,892,033 | | | 41,625,337 | | | | 1,452,320 | | | 14,405,950 | | | 8,541,226 | | | | 10,672,513 | | | 100,122,531 |

| | 890,561 | | | 322,633 | | | 6,289,786 | | | | 334,604 | | | 2,702,360 | | | 968,466 | | | | 1,078,815 | | | 16,021,848 |

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

|

| |

|

| |

|

|

| | 6,636,606 | | | 2,214,666 | | | 47,915,123 | | | | 1,786,924 | | | 17,108,310 | | | 9,509,692 | | | | 11,751,328 | | | 116,144,379 |

| | 2,460,953 | | | 863,298 | | | 9,464,023 | | | | 678,862 | | | 8,270,752 | | | 2,874,588 | | | | 5,891,903 | | | 40,339,782 |

| | 196,424 | | | 55,191 | | | 537,833 | | | | 66,857 | | | 568,847 | | | 48,019 | | | | 83,660 | | | 1,773,342 |

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

|

| |

|

| |

|

|

| $ | 3,979,229 | | $ | 1,296,177 | | $ | 37,913,267 | | | $ | 1,041,205 | | $ | 8,268,711 | | $ | 6,587,085 | | | $ | 5,775,765 | | $ | 74,031,255 |

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

|

| |

|

| |

|

|

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| $ | 38,861,906 | | $ | 17,924,565 | | $ | 184,389,898 | | | $ | 16,362,979 | | $ | 142,594,924 | | $ | 45,717,541 | | | $ | 59,227,270 | | $ | 677,871,197 |

| | 2,668,175 | | | 1,894,486 | | | 11,130,605 | | | | 996,970 | | | 10,332,017 | | | 3,599,265 | | | | 5,079,389 | | | 52,815,692 |

| | 32,738,287 | | | 15,051,705 | | | 145,329,096 | | | | 14,240,889 | | | 117,687,193 | | | 37,726,723 | | | | 47,378,603 | | | 552,786,091 |

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

|

| |

|

| |

|

|

| | 3,455,444 | | | 978,374 | | | 27,930,197 | | | | 1,125,120 | | | 14,575,714 | | | 4,391,553 | | | | 6,769,278 | | | 72,269,414 |

| | 568,526 | | | 312,264 | | | 6,900,703 | | | | 309,856 | | | 2,547,284 | | | 928,300 | | | | 1,056,056 | | | 18,481,158 |

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

|

| |

|

| |

|

|

| | 4,023,970 | | | 1,290,638 | | | 34,830,900 | | | | 1,434,976 | | | 17,122,998 | | | 5,319,853 | | | | 7,825,334 | | | 90,750,572 |

| | 2,283,679 | | | 852,474 | | | 10,071,664 | | | | 577,877 | | | 8,053,535 | | | 2,821,390 | | | | 5,323,929 | | | 39,903,307 |

| | 97,270 | | | 31,690 | | | (44,125 | ) | | | 27,069 | | | 197,945 | | | 27,104 | | | | 48,051 | | | 858,669 |

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

|

| |

|

| |

|

|

| $ | 1,643,021 | | $ | 406,474 | | $ | 24,803,361 | | | $ | 830,030 | | $ | 8,871,518 | | $ | 2,471,359 | | | $ | 2,453,354 | | $ | 49,988,596 |

|

| |

|

| |

|

|

| |

|

| |

|

| |

|

|

| |

|

| |

|

|

S-A-11

TABLE 6

OLD DOMINION ELECTRIC COOPERATIVE

CONDENSED BALANCE SHEET OF EACH MEMBER*

(As of December 31)

| | | | | |

| | | A&N

| | BARC

| | Choptank

| | Community

| | Delaware

|

2002 | | | | | | | | | | |

Assets | | | | | | | | | | |

Total utility plant | | 41,389,061 | | 46,294,365 | | 159,531,358 | | 28,707,854 | | 168,602,464 |

Accumulated depreciation | | 13,674,510 | | 13,154,836 | | 42,971,986 | | 9,821,502 | | 79,884,441 |

| | |

| |

| |

| |

| |

|

Net utility plant | | 27,714,551 | | 33,139,529 | | 116,559,372 | | 18,886,352 | | 88,718,023 |

Other assets | | 11,637,762 | | 8,394,334 | | 39,619,668 | | 8,953,705 | | 43,182,156 |

| | |

| |

| |

| |

| |

|

Total assets | | 39,352,313 | | 41,533,863 | | 156,179,040 | | 27,840,057 | | 131,900,179 |

| | |

| |

| |

| |

| |

|

| | | | | |

Equities and liabilities | | | | | | | | | | |

Equity | | 15,705,422 | | 15,623,172 | | 67,138,081 | | 15,452,776 | | 64,238,926 |

Long term debt | | 20,344,878 | | 22,715,231 | | 76,852,430 | | 10,265,930 | | 46,899,628 |

Other liabilities | | 3,302,013 | | 3,195,460 | | 12,188,529 | | 2,121,351 | | 20,761,625 |

| | |

| |

| |

| |

| |

|

Total equity and liabilities | | 39,352,313 | | 41,533,863 | | 156,179,040 | | 27,840,057 | | 131,900,179 |

| | |

| |

| |

| |

| |

|

| | | | | |

2001 | | | | | | | | | | |

Assets | | | | | | | | | | |

Total utility plant | | 38,353,514 | | 43,981,408 | | 151,128,988 | | 28,338,018 | | 162,703,039 |

Accumulated depreciation | | 13,011,148 | | 12,271,651 | | 39,342,251 | | 9,898,778 | | 74,469,983 |

| | |

| |

| |

| |

| |

|

Net utility plant | | 25,342,366 | | 31,709,757 | | 111,786,737 | | 18,439,240 | | 88,233,056 |

Other assets | | 10,083,579 | | 9,478,760 | | 38,803,206 | | 9,105,810 | | 38,252,507 |

| | |

| |

| |

| |

| |

|

Total assets | | 35,425,945 | | 41,188,517 | | 150,589,943 | | 27,545,050 | | 126,485,563 |

| | |

| |

| |

| |

| |

|

| | | | | |

Equities and liabilities | | | | | | | | | | |

Equity | | 14,171,955 | | 15,000,450 | | 64,414,369 | | 14,777,424 | | 61,829,932 |

Long term debt | | 18,439,115 | | 23,417,904 | | 72,567,973 | | 10,748,279 | | 44,869,669 |

Other liabilities | | 2,814,875 | | 2,770,163 | | 13,607,601 | | 2,019,347 | | 19,785,962 |

| | |

| |

| |

| |

| |

|

Total equity and liabilities | | 35,425,945 | | 41,188,517 | | 150,589,943 | | 27,545,050 | | 126,485,563 |

| | |

| |

| |

| |

| |

|

| | | | | |

2000 | | | | | | | | | | |

Assets | | | | | | | | | | |

Total utility plant | | 36,256,772 | | 41,115,629 | | 147,504,106 | | 27,323,286 | | 157,057,629 |

Accumulated depreciation | | 12,116,310 | | 11,565,968 | | 36,811,331 | | 10,154,234 | | 68,060,894 |

| | |

| |

| |

| |

| |

|

Net utility plant | | 24,140,462 | | 29,549,661 | | 110,692,775 | | 17,169,052 | | 88,996,735 |

Other assets | | 10,641,018 | | 8,278,640 | | 37,197,291 | | 9,674,234 | | 38,327,499 |

| | |

| |

| |

| |

| |

|

Total assets | | 34,781,480 | | 37,828,301 | | 147,890,066 | | 26,843,286 | | 127,324,234 |

| | |

| |

| |

| |

| |

|

| | | | | |

Equities and liabilities | | | | | | | | | | |

Equity | | 13,678,447 | | 13,664,461 | | 62.371,878 | | 13,711,137 | | 61,395,258 |

Long term debt | | 16,693,016 | | 22,103,569 | | 71,155,699 | | 11,137,571 | | 46,703,490 |

Other liabilities | | 4,410,017 | | 2,060,271 | | 14,362,489 | | 1,994,578 | | 19,225,486 |

| | |

| |

| |

| |

| |

|

Total equity and liabilities | | 34,781,480 | | 37,828,301 | | 147,890,066 | | 26,843,286 | | 127,324,234 |

| | |

| |

| |

| |

| |

|

| * | | These figures were compiled from Form 7 Financial and Statistical Reports. |

S-A-12

TABLE 6—(Continued)

OLD DOMINION ELECTRIC COOPERATIVE

CONDENSED BALANCE SHEET OF EACH MEMBER*

(As of December 31)

Mecklenburg

| | Northern

Neck

| | Northern

Virginia

| | Prince

George

| | Rappahannock

| | Shenandoah

Valley

| | Southside

| | Total

|

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| 103,549,022 | | 48,496,467 | | 417,671,979 | | 34,101,607 | | 366,503,575 | | 119,501,577 | | 192,033,253 | | 1,726,382,582 |

| 31,715,565 | | 17,260,968 | | 116,089,239 | | 10,927,726 | | 103,470,658 | | 42,050,521 | | 49,069,866 | | 530,091,818 |

| |

| |

| |

| |

| |

| |

| |

|

| 71,833,457 | | 31,235,499 | | 301,582,740 | | 23,173,881 | | 263,032,917 | | 77,451,056 | | 142,963,387 | | 1,196,290,764 |

| 28,613,795 | | 11,397,329 | | 184,229,508 | | 10,533,722 | | 108,714,589 | | 32,467,042 | | 38,342,990 | | 526,086,600 |

| |

| |

| |

| |

| |

| |

| |

|

| 100,447,252 | | 42,632,828 | | 485,812,248 | | 33,707,603 | | 371,747,506 | | 109,918,098 | | 181,306,377 | | 1,722,377,364 |

| |

| |

| |

| |

| |

| |

| |

|

| | | | | | | |

| | | | | | | | | | | | | | | |

| 39,652,678 | | 21,515,547 | | 286,770,440 | | 15,230,363 | | 153,434,119 | | 51,115,944 | | 62,025,120 | | 807,902,588 |

| 48,888,488 | | 16,658,501 | | 150,536,368 | | 12,609,633 | | 181,567,887 | | 49,607,443 | | 95,879,536 | | 732,825,953 |

| 11,906,086 | | 4,458,780 | | 48,505,440 | | 5,867,607 | | 36,745,500 | | 9,194,711 | | 23,401,721 | | 181,648,823 |

| |

| |

| |

| |

| |

| |

| |

|

| 100,447,252 | | 42,632,828 | | 485,812,248 | | 33,707,603 | | 371,747,506 | | 109,918,098 | | 181,306,377 | | 1,722,377,364 |

| |

| |

| |

| |

| |

| |

| |

|

| | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| 98,873,515 | | 45,257,964 | | 399,668,765 | | 30,947,128 | | 336,613,405 | | 112,829,917 | | 183,358,447 | | 1,632,054,108 |

| 30,147,973 | | 16,308,846 | | 106,765,335 | | 10,489,550 | | 95,737,900 | | 38,984,056 | | 47,884,200 | | 495,311,671 |

| |

| |

| |

| |

| |

| |

| |

|

| 68,725,542 | | 28,949,118 | | 292,903,430 | | 20,457,578 | | 240,875,505 | | 73,845,861 | | 135,474,247 | | 1,136,742,437 |

| 25,736,187 | | 10,475,151 | | 179,027,946 | | 10,275,973 | | 92,061,500 | | 33,770,881 | | 36,930,754 | | 494,002,254 |

| |

| |

| |

| |

| |

| |

| |

|

| 94,461,729 | | 39,424,269 | | 471,931,376 | | 30,733,551 | | 332,937,005 | | 107,616,742 | | 172,405,001 | | 1,630,744,691 |

| |

| |

| |

| |

| |

| |

| |

|

| | | | | | | |

| | | | | | | | | | | | | | | |