Year End 2016 Investor Briefing March 22, 2017 Exhibit 99.1

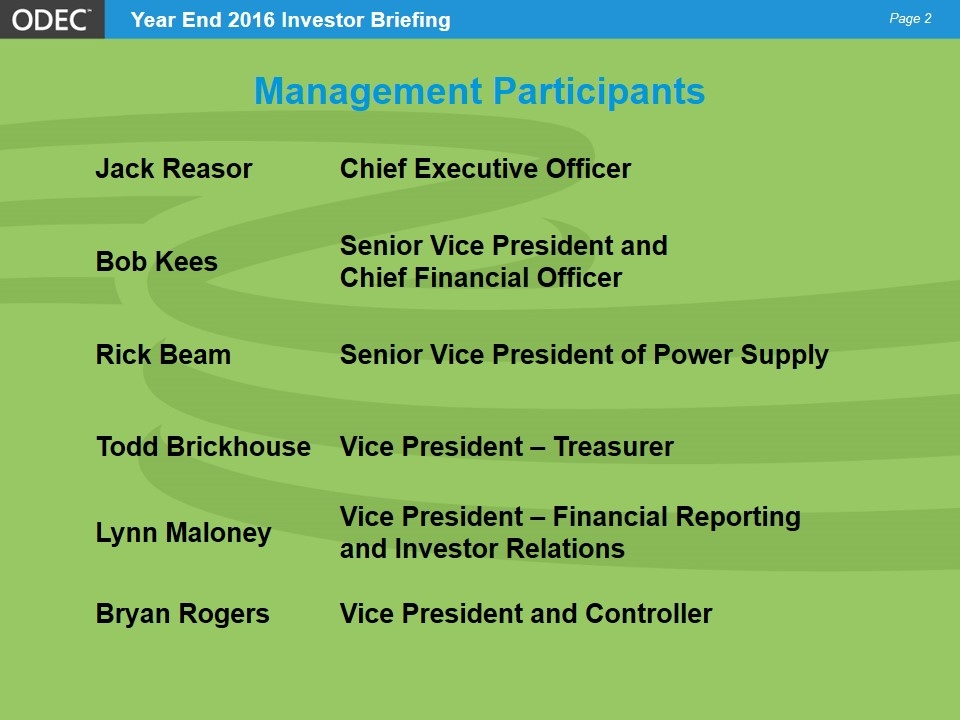

Management Participants Jack Reasor Chief Executive Officer Bob Kees Senior Vice President and Chief Financial Officer Rick Beam Senior Vice President of Power Supply Todd Brickhouse Vice President – Treasurer Lynn Maloney Vice President – Financial Reporting and Investor Relations Bryan Rogers Vice President and Controller Page 2

Note Regarding Forward-Looking and Other Statements The information contained herein, and presented by representatives of Old Dominion Electric Cooperative (ODEC or we or our), include, or are based upon, forward-looking statements and assumptions regarding matters that could have an impact on our business, financial condition, and future operations. These statements and assumptions, based on our expectations and estimates, are not guarantees of future performance, and are subject to risks, uncertainties, and other factors that could cause our actual results to differ materially from those described herein. These risks, uncertainties and other factors include, but are not limited to, general business conditions, federal and state legislative and regulatory actions, and general credit and capital market conditions. Any forward-looking statement or assumption speaks only as of the date on which the statement or assumption is made, and we undertake no obligation to update any forward- looking statements or assumptions to reflect events or circumstances after this date, even if new information becomes available or other events occur after the date of this presentation. These presentation materials highlight some of the information contained in our SEC filings and is qualified in its entirety by the detailed information contained in our SEC filings and elsewhere in this presentation. This presentation may not contain all the information that is important to you. You should read this information in conjunction with the detailed information contained elsewhere in our SEC filings. Page

OVERVIEW

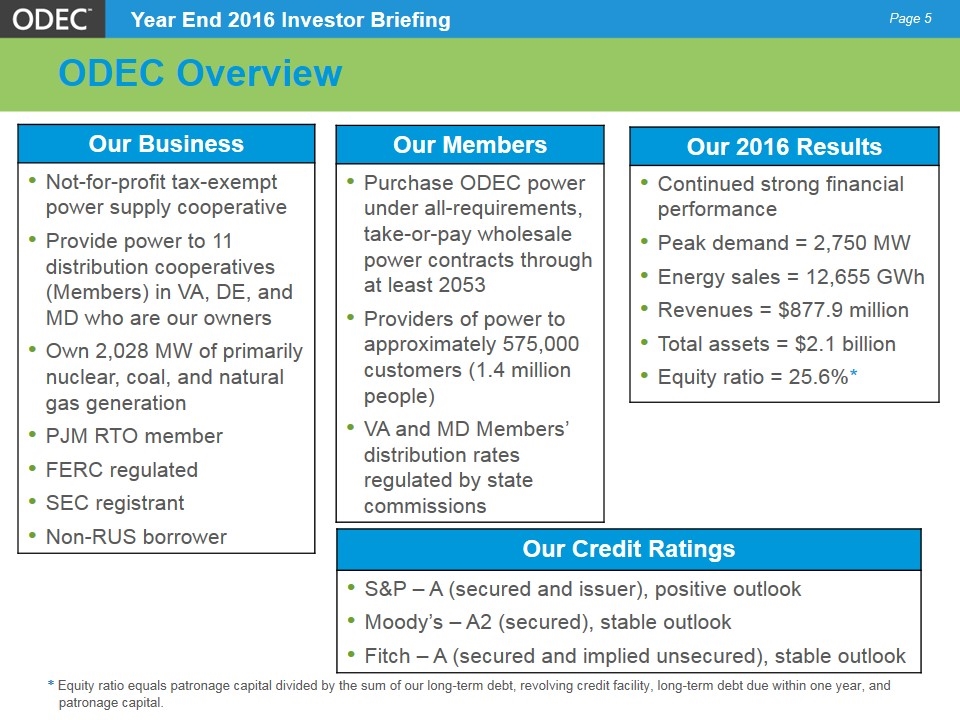

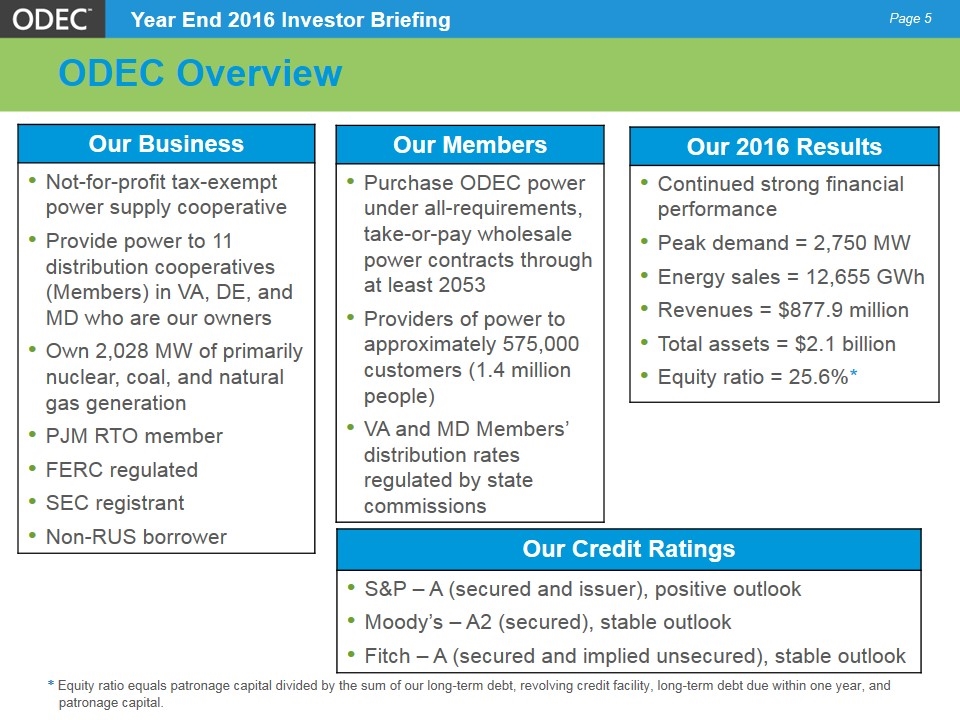

ODEC Overview Our Business Not-for-profit tax-exempt power supply cooperative Provide power to 11 distribution cooperatives (Members) in VA, DE, and MD who are our owners Own 2,028 MW of primarily nuclear, coal, and natural gas generation PJM RTO member FERC regulated SEC registrant Non-RUS borrower Our Members Purchase ODEC power under all-requirements, take-or-pay wholesale power contracts through at least 2053 Providers of power to approximately 575,000 customers (1.4 million people) VA and MD Members’ distribution rates regulated by state commissions Our 2016 Results Continued strong financial performance Peak demand = 2,750 MW Energy sales = 12,655 GWh Revenues = $877.9 million Total assets = $2.1 billion Equity ratio = 25.6%* Our Credit Ratings S&P – A (secured and issuer), positive outlook Moody’s – A2 (secured), stable outlook Fitch – A (secured and implied unsecured), stable outlook * Equity ratio equals patronage capital divided by the sum of our long-term debt, revolving credit facility, long-term debt due within one year, and patronage capital. Page

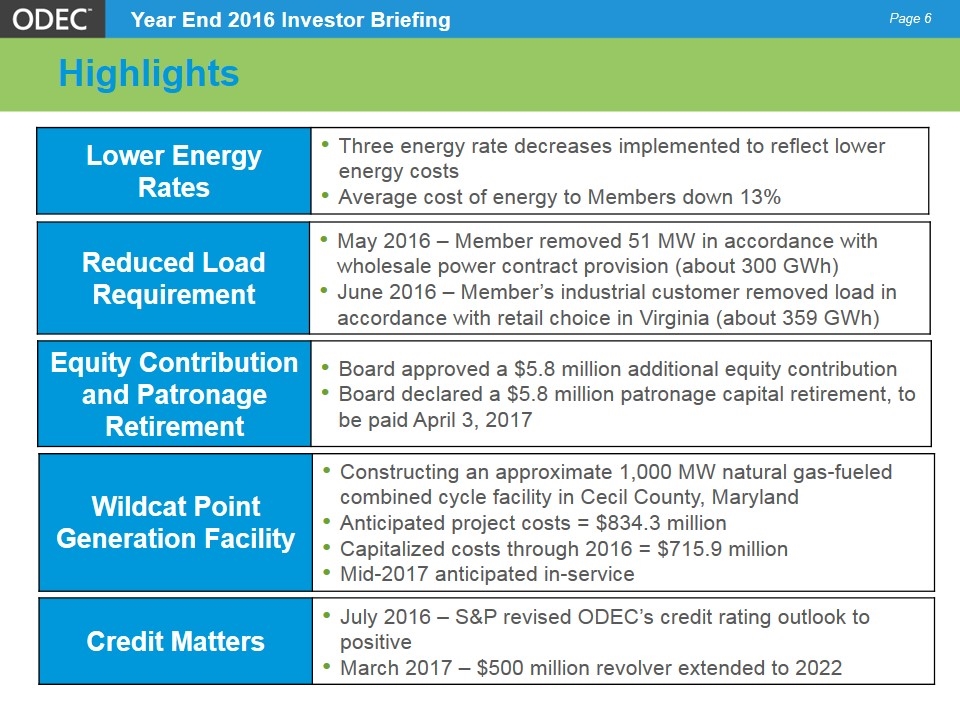

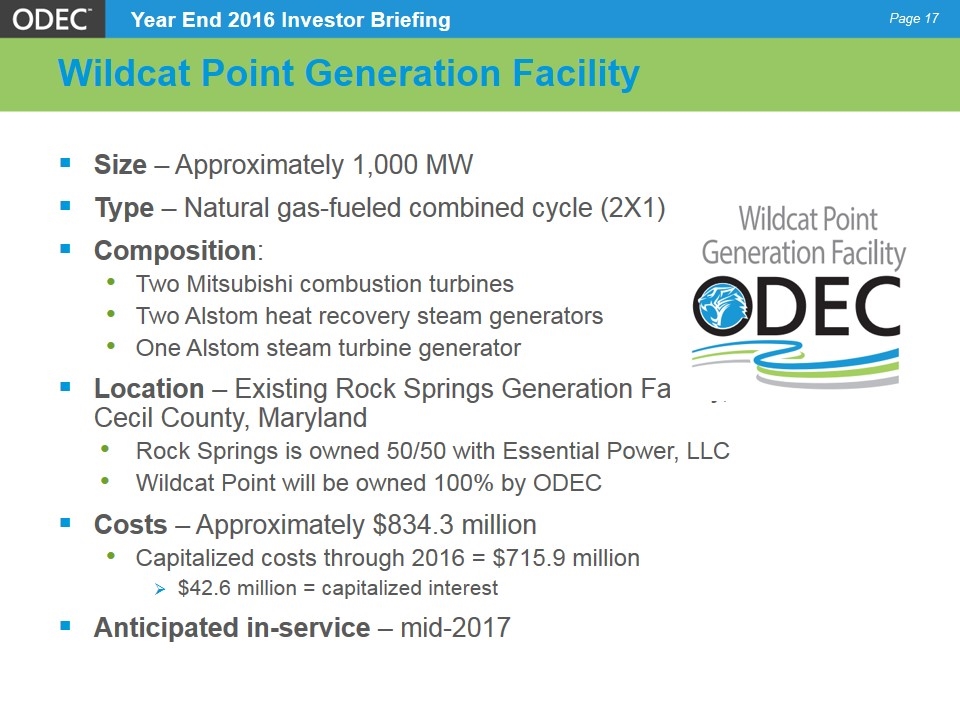

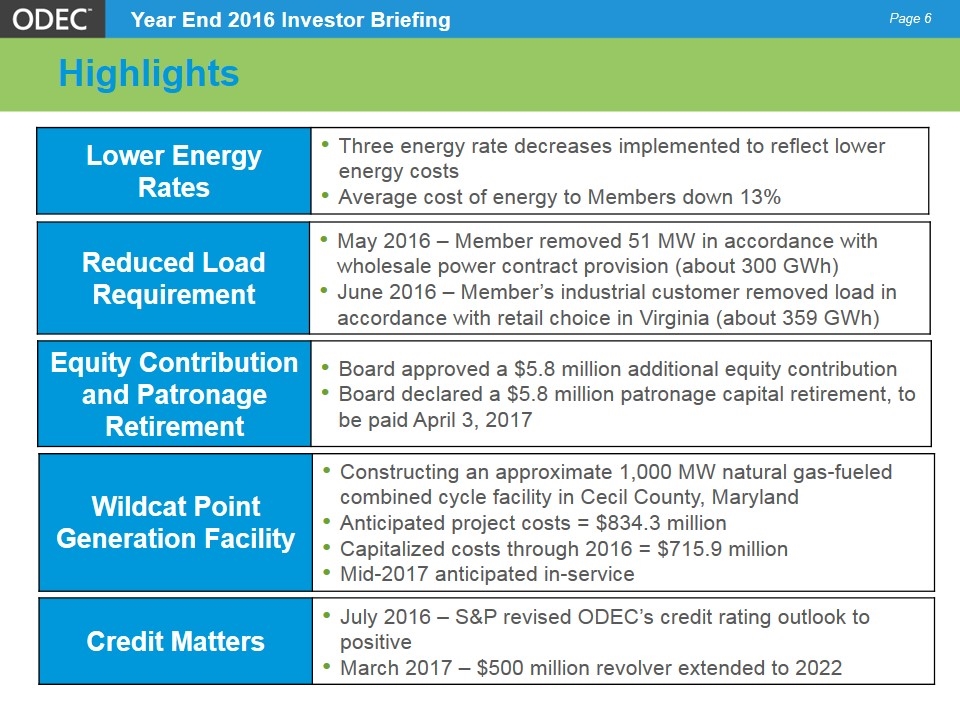

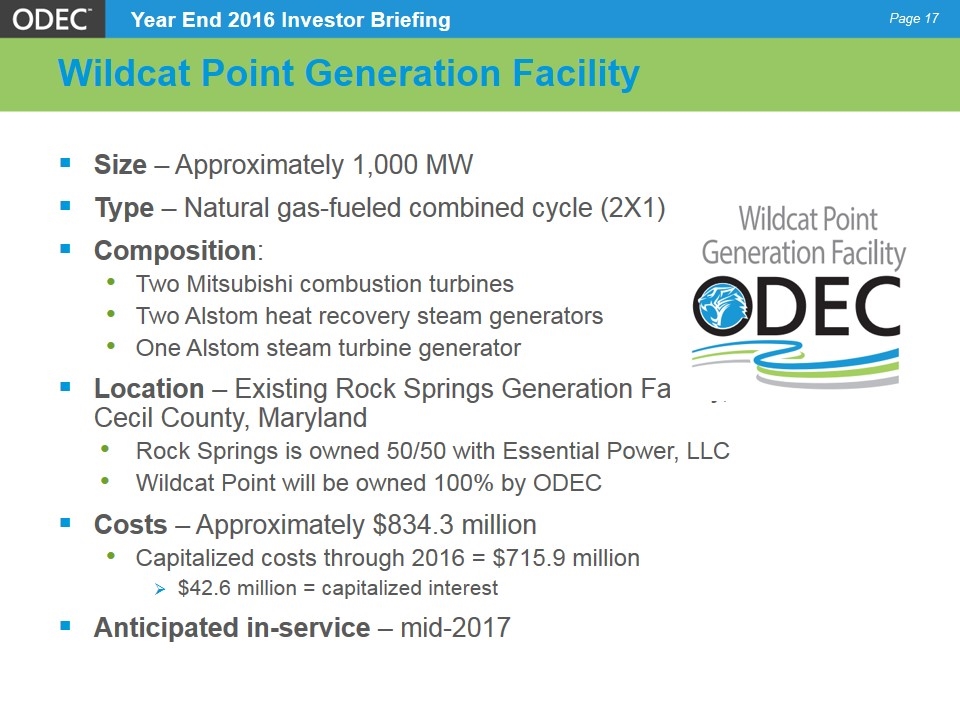

Highlights Page Wildcat Point Generation Facility Constructing an approximate 1,000 MW natural gas-fueled combined cycle facility in Cecil County, Maryland Anticipated project costs = $834.3 million Capitalized costs through 2016 = $715.9 million Mid-2017 anticipated in-service Reduced Load Requirement May 2016 – Member removed 51 MW in accordance with wholesale power contract provision (about 300 GWh) June 2016 – Member’s industrial customer removed load in accordance with retail choice in Virginia (about 359 GWh) Credit Matters July 2016 – S&P revised ODEC’s credit rating outlook to positive March 2017 – $500 million revolver extended to 2022 Lower Energy Rates Three energy rate decreases implemented to reflect lower energy costs Average cost of energy to Members down 13% Equity Contribution and Patronage Retirement Board approved a $5.8 million additional equity contribution Board declared a $5.8 million patronage capital retirement, to be paid April 3, 2017

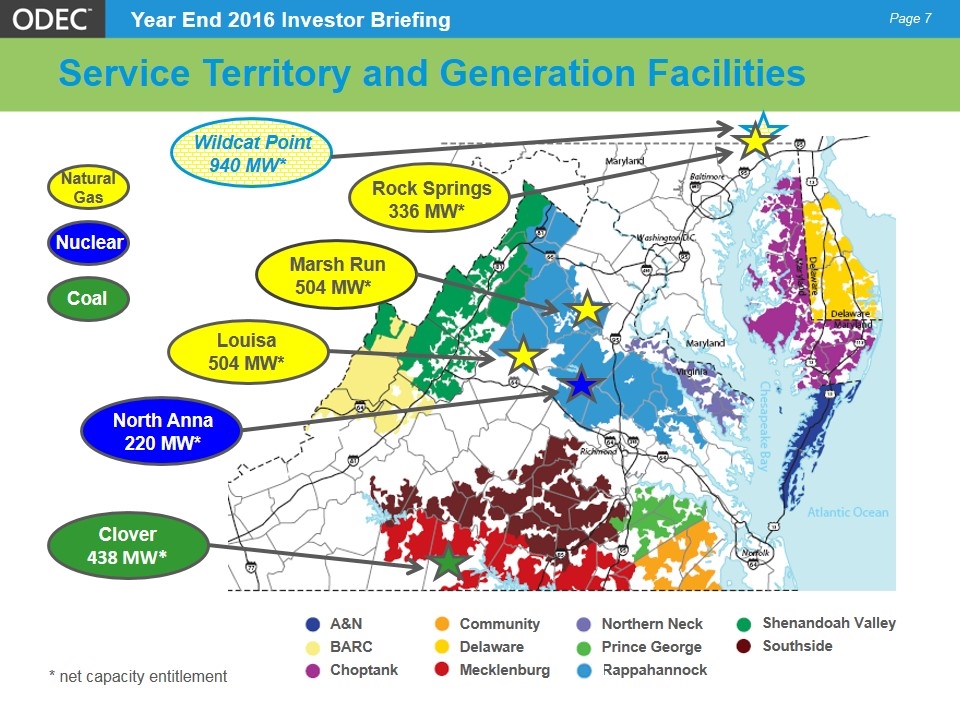

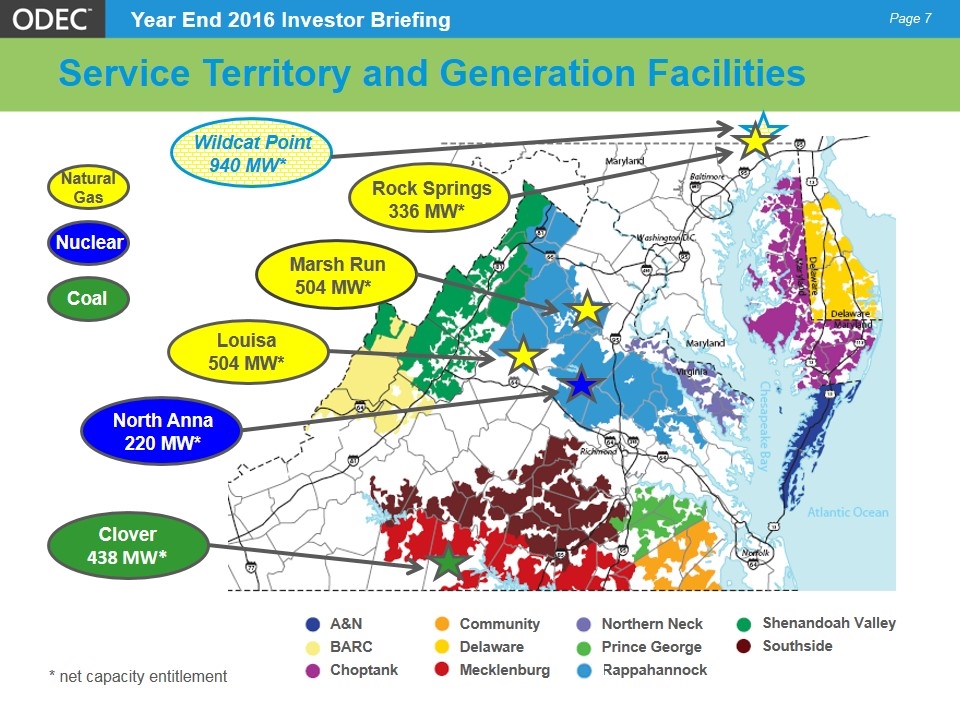

Rock Springs 336 MW* Marsh Run 504 MW* Louisa 504 MW* Clover 438 MW* North Anna 220 MW* Natural Gas Nuclear Coal A&N BARC Choptank Community Delaware Mecklenburg Northern Neck Prince George Rappahannock Shenandoah Valley Southside Service Territory and Generation Facilities Page Wildcat Point 940 MW* * net capacity entitlement

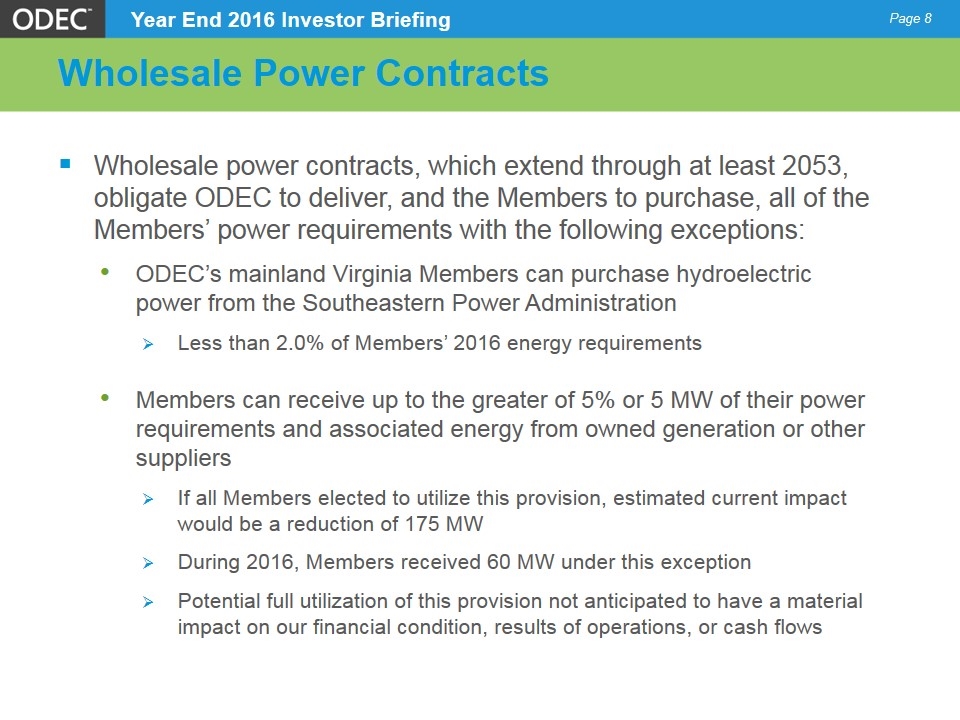

Wholesale Power Contracts Wholesale power contracts, which extend through at least 2053, obligate ODEC to deliver, and the Members to purchase, all of the Members’ power requirements with the following exceptions: ODEC’s mainland Virginia Members can purchase hydroelectric power from the Southeastern Power Administration Less than 2.0% of Members’ 2016 energy requirements Members can receive up to the greater of 5% or 5 MW of their power requirements and associated energy from owned generation or other suppliers If all Members elected to utilize this provision, estimated current impact would be a reduction of 175 MW During 2016, Members received 60 MW under this exception Potential full utilization of this provision not anticipated to have a material impact on our financial condition, results of operations, or cash flows Page

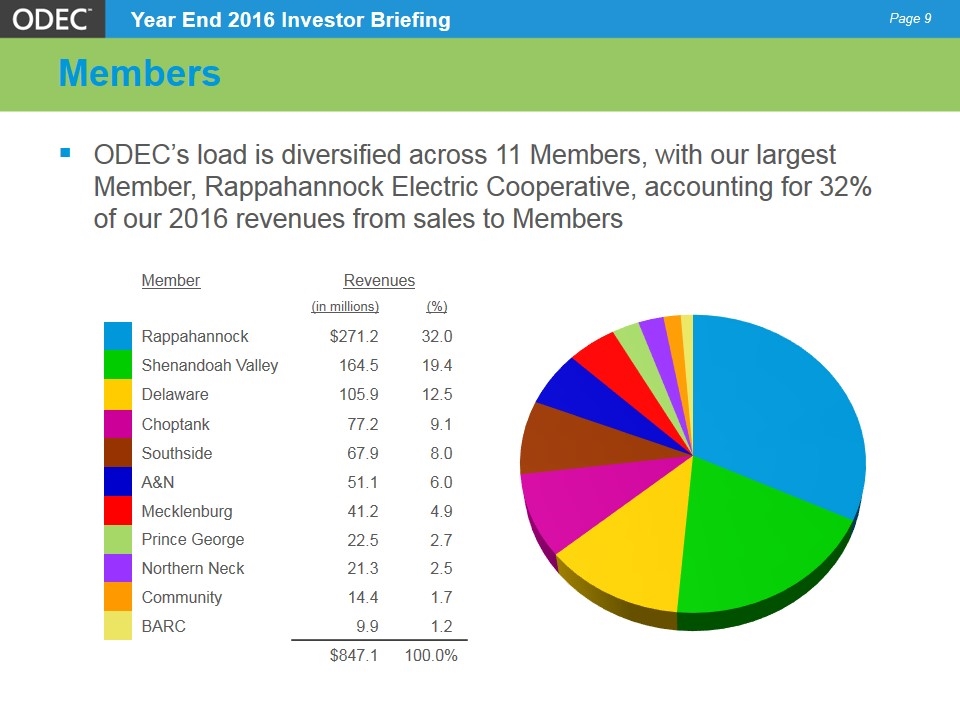

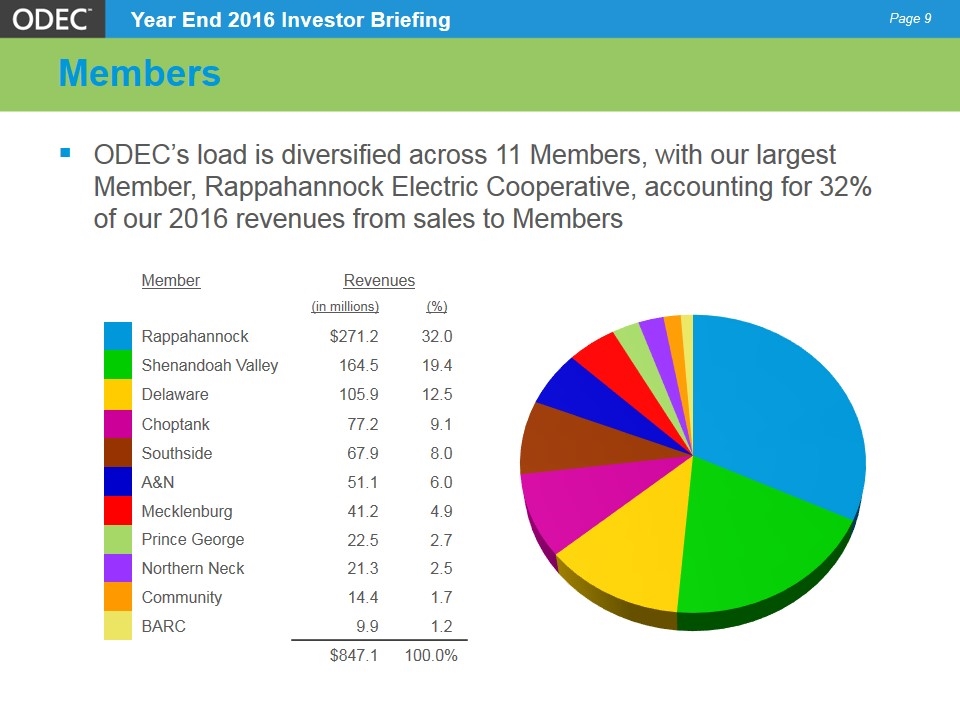

Members ODEC’s load is diversified across 11 Members, with our largest Member, Rappahannock Electric Cooperative, accounting for 32% of our 2016 revenues from sales to Members Member Revenues (in millions) (%) Rappahannock $271.2 32.0 Shenandoah Valley 164.5 19.4 Delaware 105.9 12.5 Choptank 77.2 9.1 Southside 67.9 8.0 A&N 51.1 6.0 Mecklenburg 41.2 4.9 Prince George 22.5 2.7 Northern Neck 21.3 2.5 Community 14.4 1.7 BARC 9.9 1.2 $847.1 100.0% Page

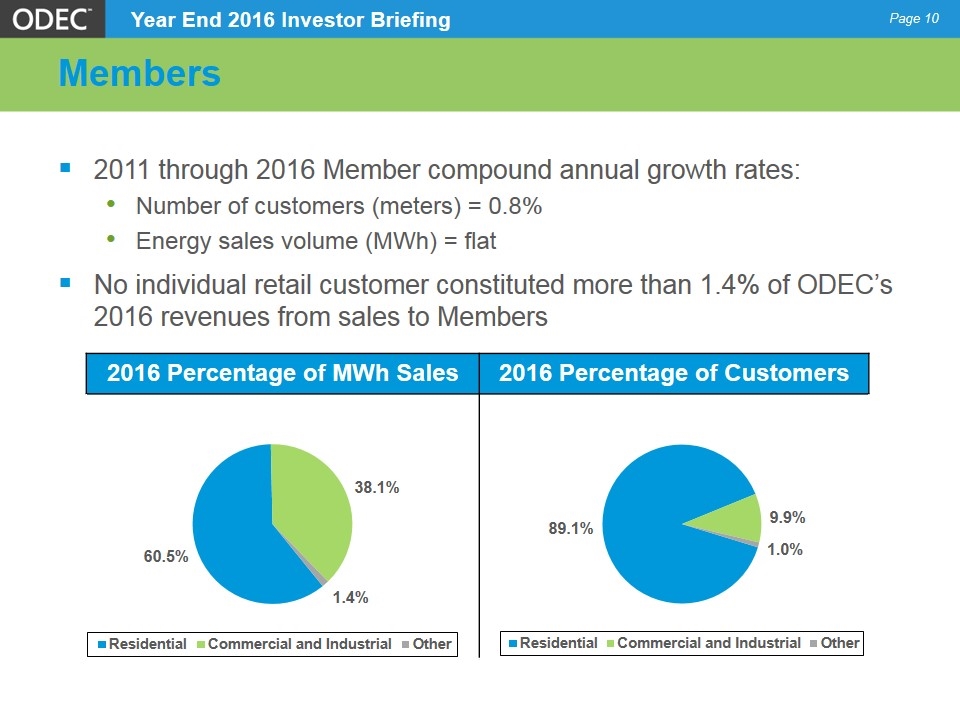

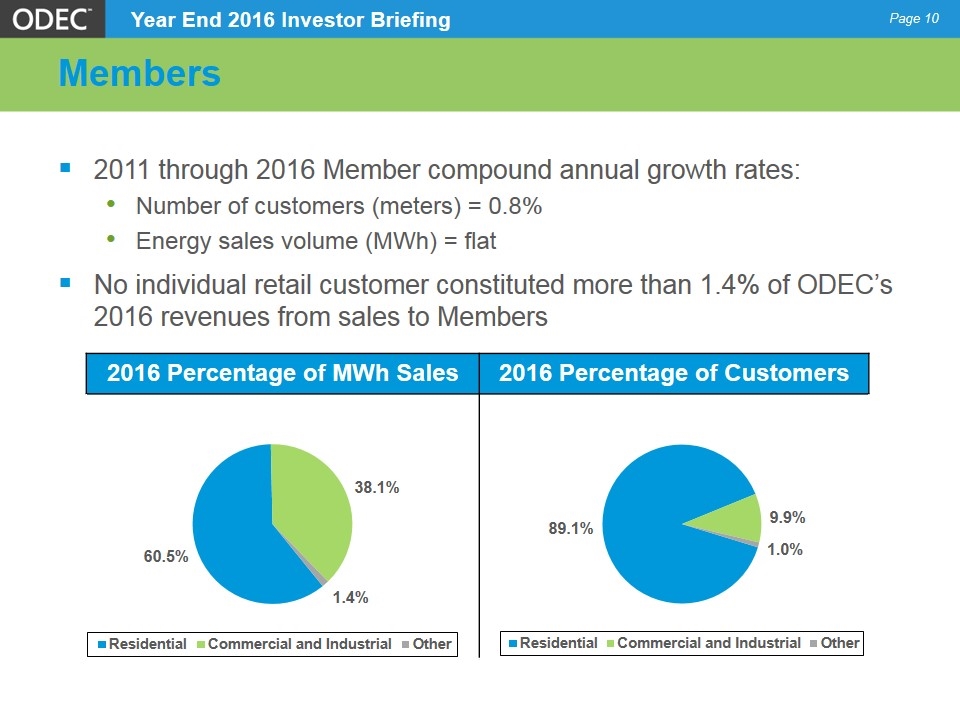

Members 2011 through 2016 Member compound annual growth rates: Number of customers (meters) = 0.8% Energy sales volume (MWh) = flat No individual retail customer constituted more than 1.4% of ODEC’s 2016 revenues from sales to Members Page 2016 Percentage of MWh Sales 2016 Percentage of Customers

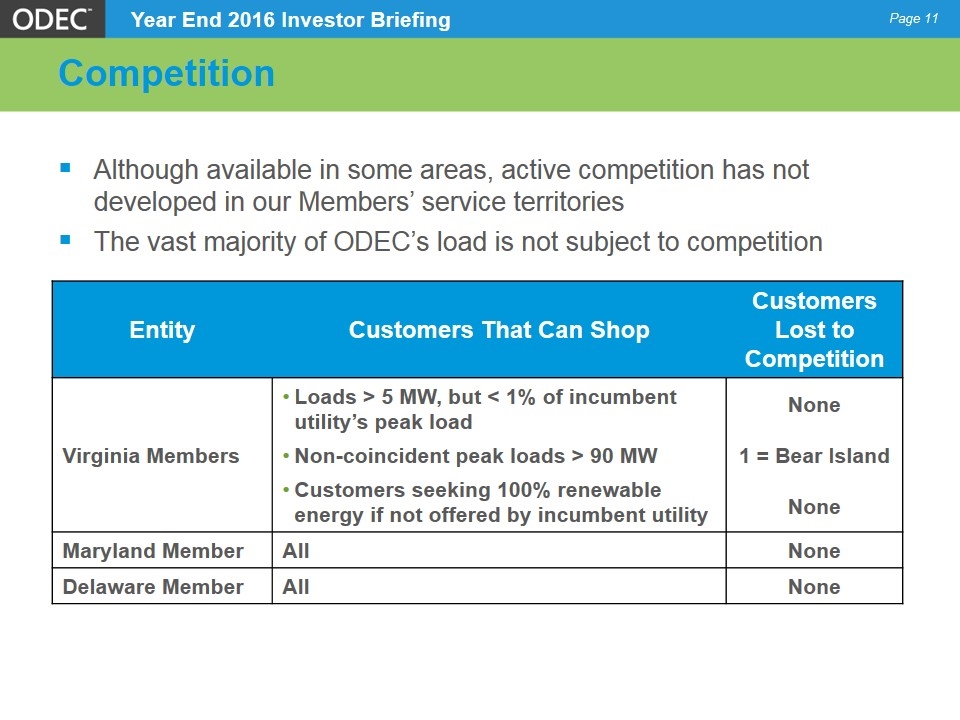

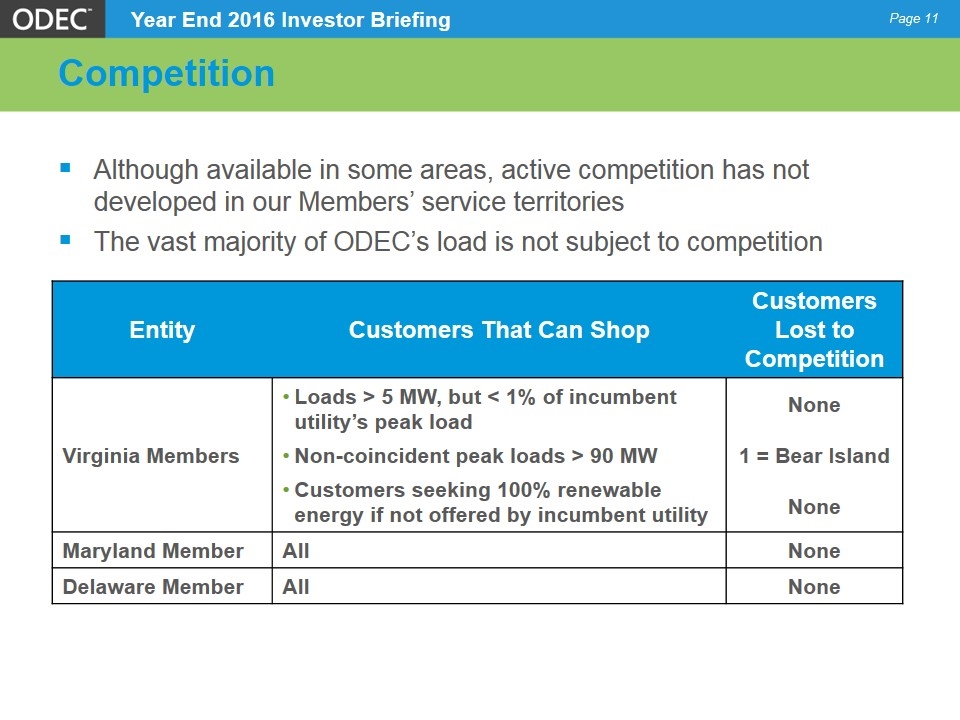

Competition Although available in some areas, active competition has not developed in our Members’ service territories The vast majority of ODEC’s load is not subject to competition Page Entity Customers That Can Shop Customers Lost to Competition Virginia Members Loads > 5 MW, but < 1% of incumbent utility’s peak load Non-coincident peak loads > 90 MW Customers seeking 100% renewable energy if not offered by incumbent utility None 1 = Bear Island None Maryland Member All None Delaware Member All None

RATES AND POWER SUPPLY

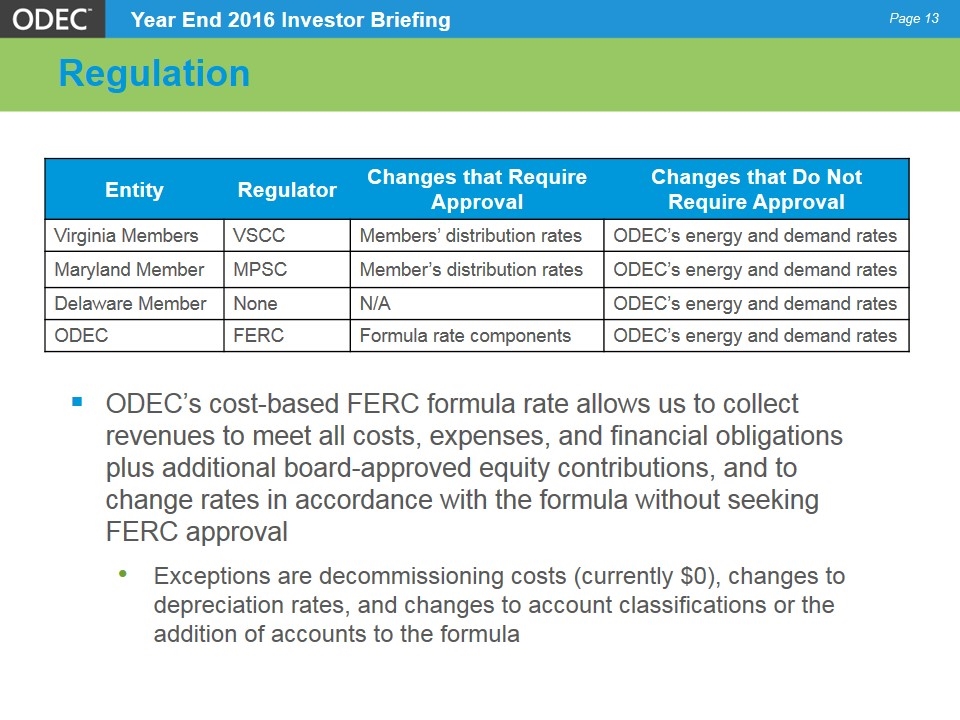

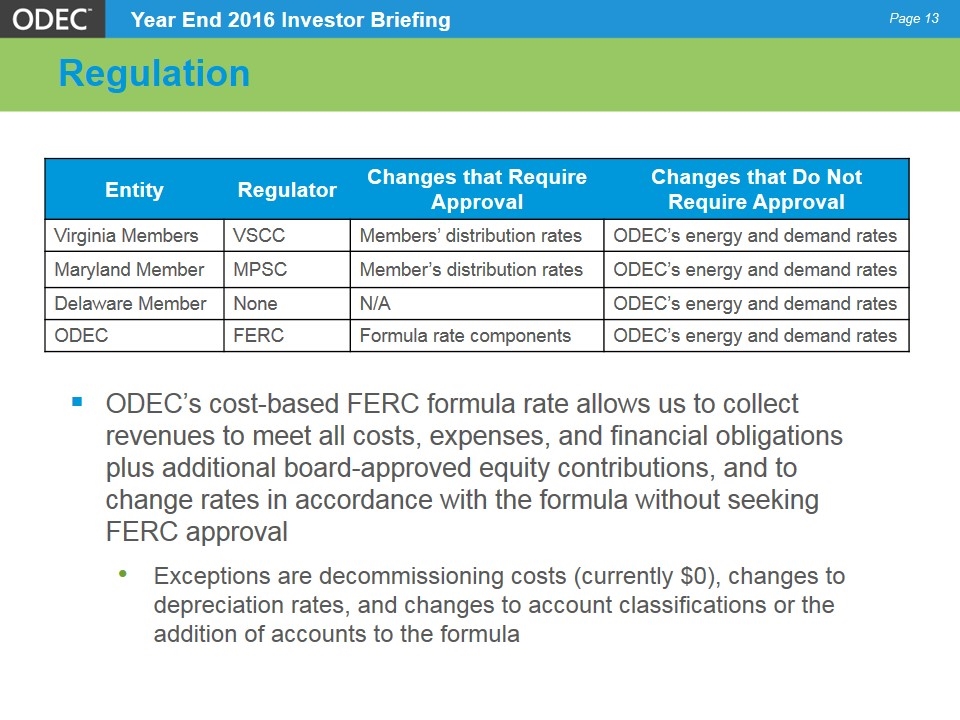

Regulation Page Entity Regulator Changes that Require Approval Changes that Do Not Require Approval Virginia Members VSCC Members’ distribution rates ODEC’s energy and demand rates Maryland Member MPSC Member’s distribution rates ODEC’s energy and demand rates Delaware Member None N/A ODEC’s energy and demand rates ODEC FERC Formula rate components ODEC’s energy and demand rates ODEC’s cost-based FERC formula rate allows us to collect revenues to meet all costs, expenses, and financial obligations plus additional board-approved equity contributions, and to change rates in accordance with the formula without seeking FERC approval Exceptions are decommissioning costs (currently $0), changes to depreciation rates, and changes to account classifications or the addition of accounts to the formula

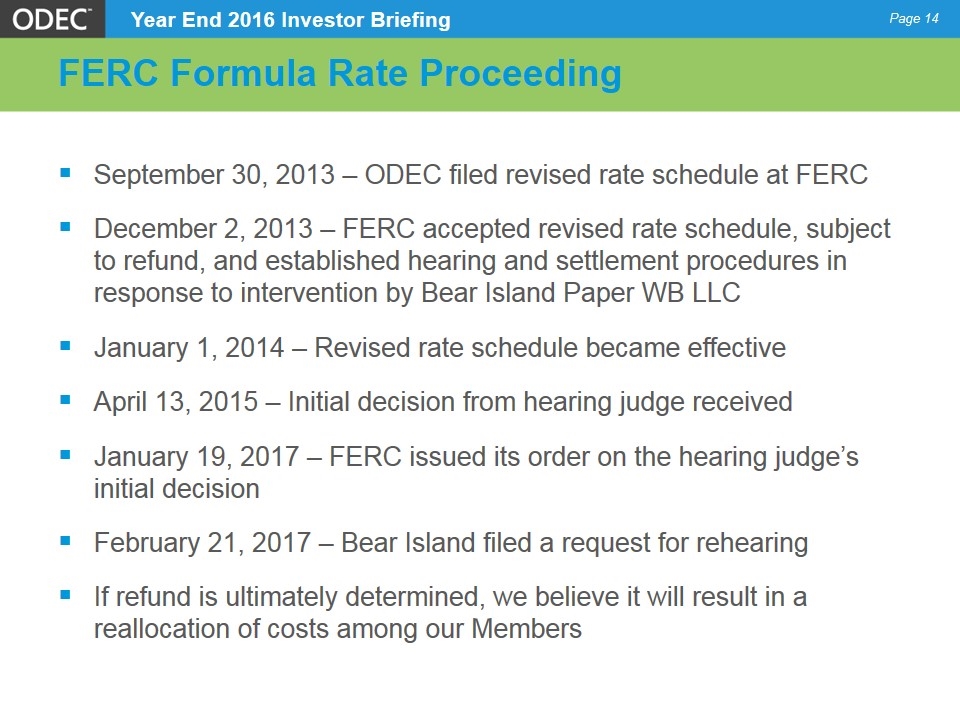

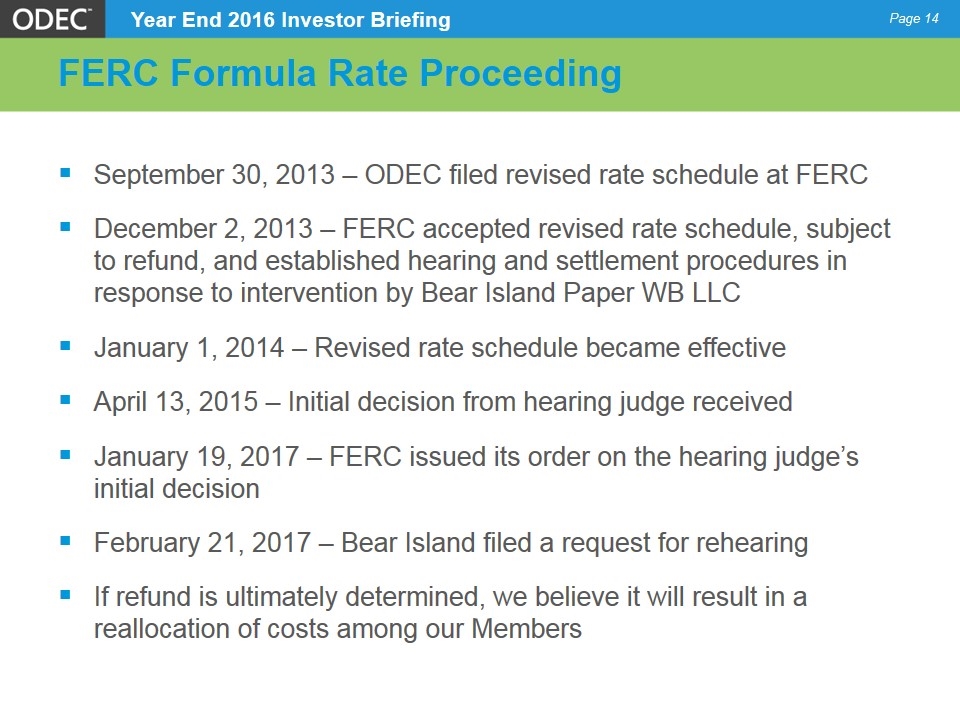

FERC Formula Rate Proceeding September 30, 2013 – ODEC filed revised rate schedule at FERC December 2, 2013 – FERC accepted revised rate schedule, subject to refund, and established hearing and settlement procedures in response to intervention by Bear Island Paper WB LLC January 1, 2014 – Revised rate schedule became effective April 13, 2015 – Initial decision from hearing judge received January 19, 2017 – FERC issued its order on the hearing judge’s initial decision February 21, 2017 – Bear Island filed a request for rehearing If refund is ultimately determined, we believe it will result in a reallocation of costs among our Members Page

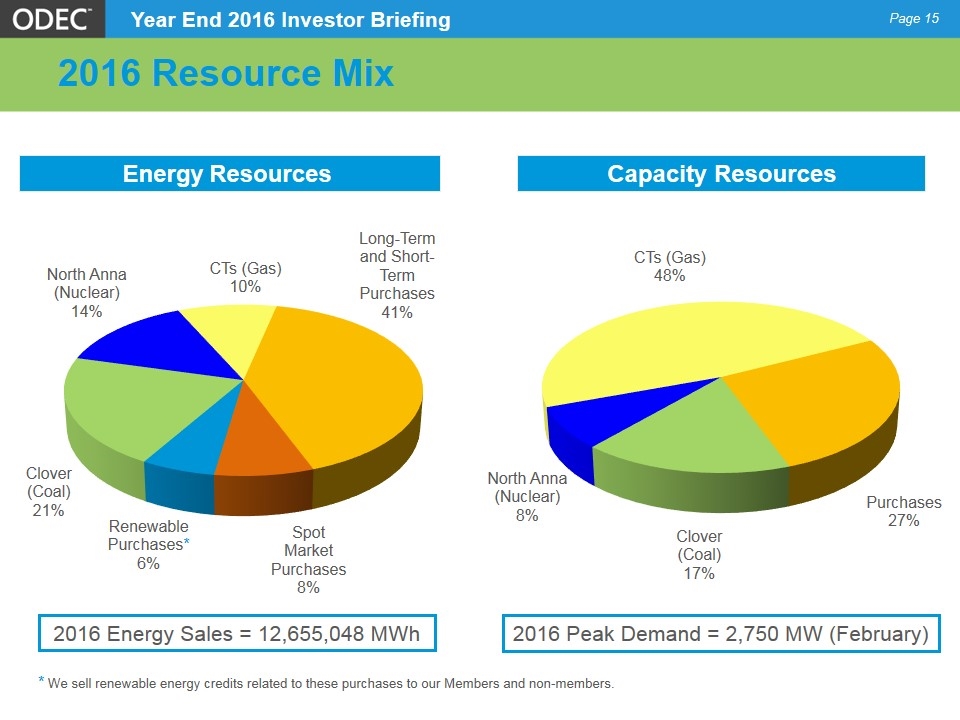

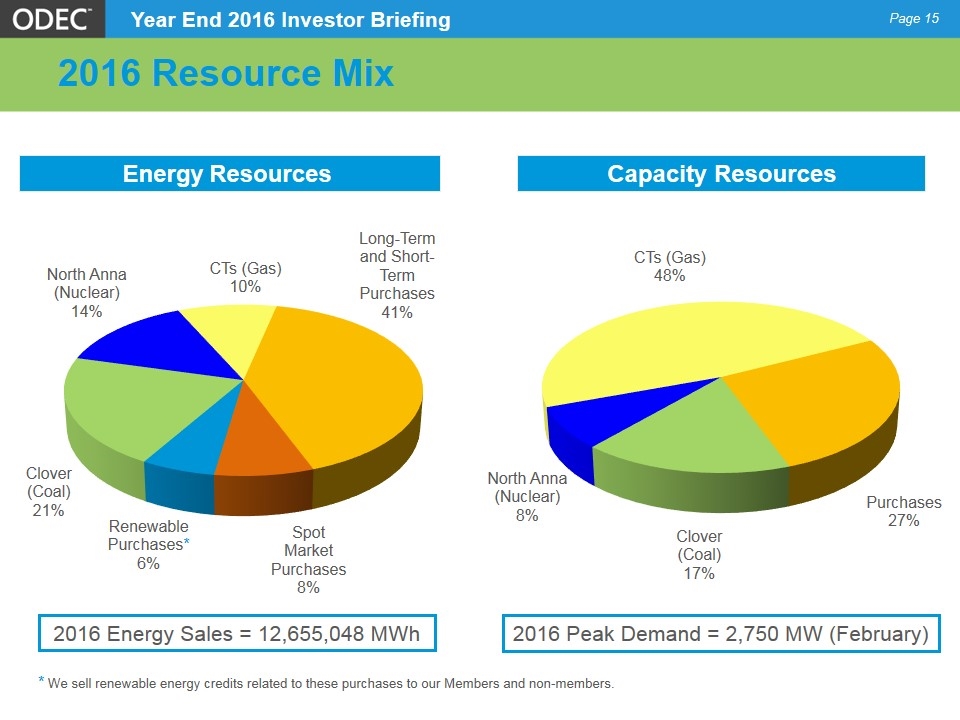

2016 Resource Mix Page Energy Resources Capacity Resources 2016 Energy Sales = 12,655,048 MWh * We sell renewable energy credits related to these purchases to our Members and non-members. 2016 Peak Demand = 2,750 MW (February)

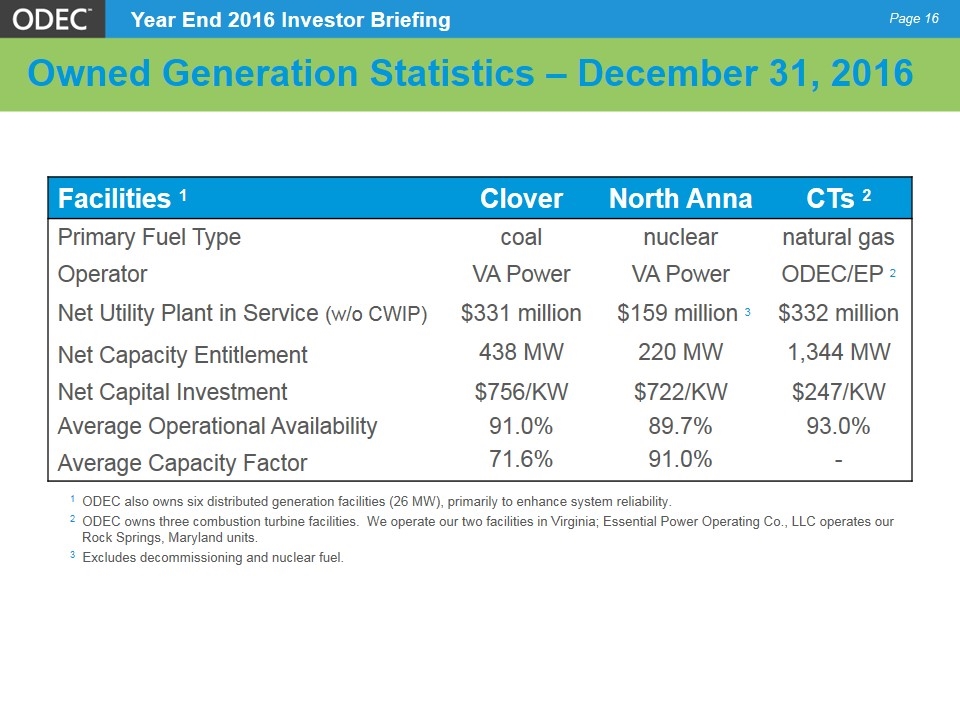

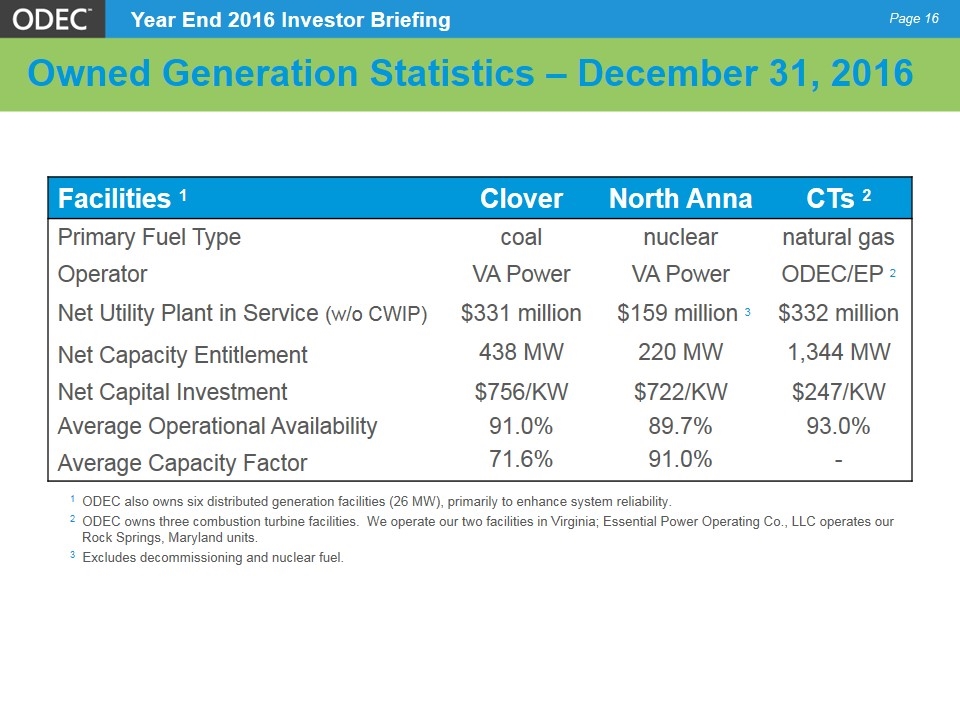

Owned Generation Statistics – December 31, 2016 Facilities 1 Clover North Anna CTs 2 Primary Fuel Type coal nuclear natural gas Operator VA Power VA Power ODEC/EP 2 Net Utility Plant in Service (w/o CWIP) $331 million $159 million 3 $332 million Net Capacity Entitlement 438 MW 220 MW 1,344 MW Net Capital Investment $756/KW $722/KW $247/KW Average Operational Availability 91.0% 89.7% 93.0% Average Capacity Factor 71.6% 91.0% - 1 ODEC also owns six distributed generation facilities (26 MW), primarily to enhance system reliability. 2 ODEC owns three combustion turbine facilities. We operate our two facilities in Virginia; Essential Power Operating Co., LLC operates our Rock Springs, Maryland units. 3 Excludes decommissioning and nuclear fuel. Page

Wildcat Point Generation Facility Page Fall 2015 Size – Approximately 1,000 MW Type – Natural gas-fueled combined cycle (2X1) Composition: Two Mitsubishi combustion turbines Two Alstom heat recovery steam generators One Alstom steam turbine generator Location – Existing Rock Springs Generation Facility, Cecil County, Maryland Rock Springs is owned 50/50 with Essential Power, LLC Wildcat Point will be owned 100% by ODEC Costs – Approximately $834.3 million Capitalized costs through 2016 = $715.9 million $42.6 million = capitalized interest Anticipated in-service – mid-2017

Wildcat Point – Site Looking Northwest Page

Wildcat Point – Site Looking South Page

Wildcat Point – Gas Turbine Building Page

Wildcat Point – Control Room Page

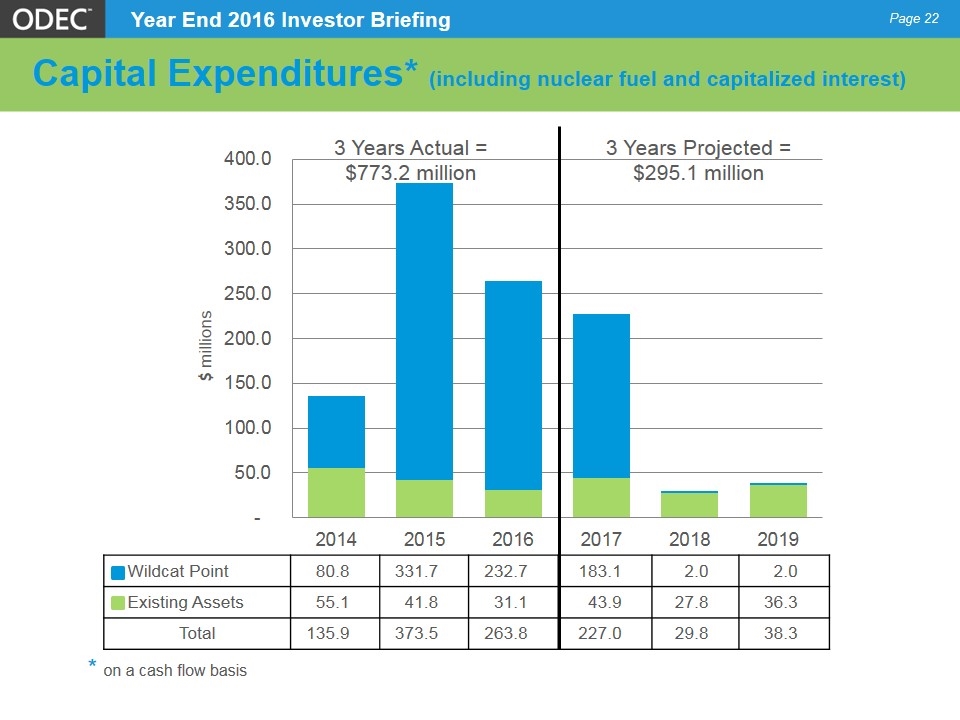

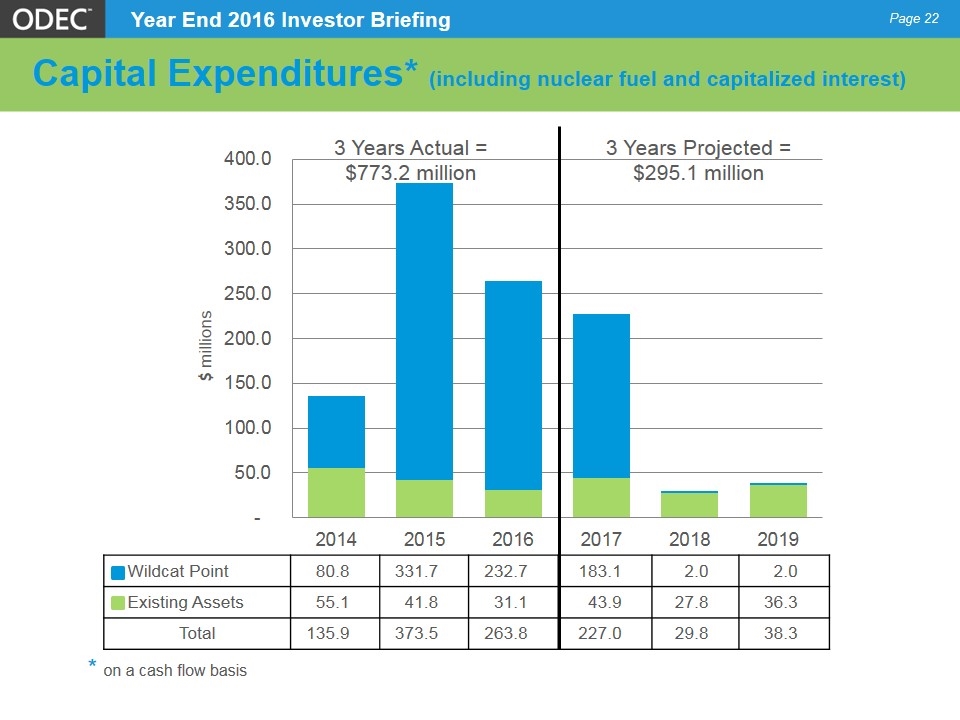

Capital Expenditures* (including nuclear fuel and capitalized interest) 3 Years Projected = $295.1 million 3 Years Actual = $773.2 million Wildcat Point 80.8 331.7 232.7 183.1 2.0 2.0 Existing Assets 55.1 41.8 31.1 43.9 27.8 36.3 Total 135.9 373.5 263.8 227.0 29.8 38.3 $ millions Page * on a cash flow basis

FINANCE

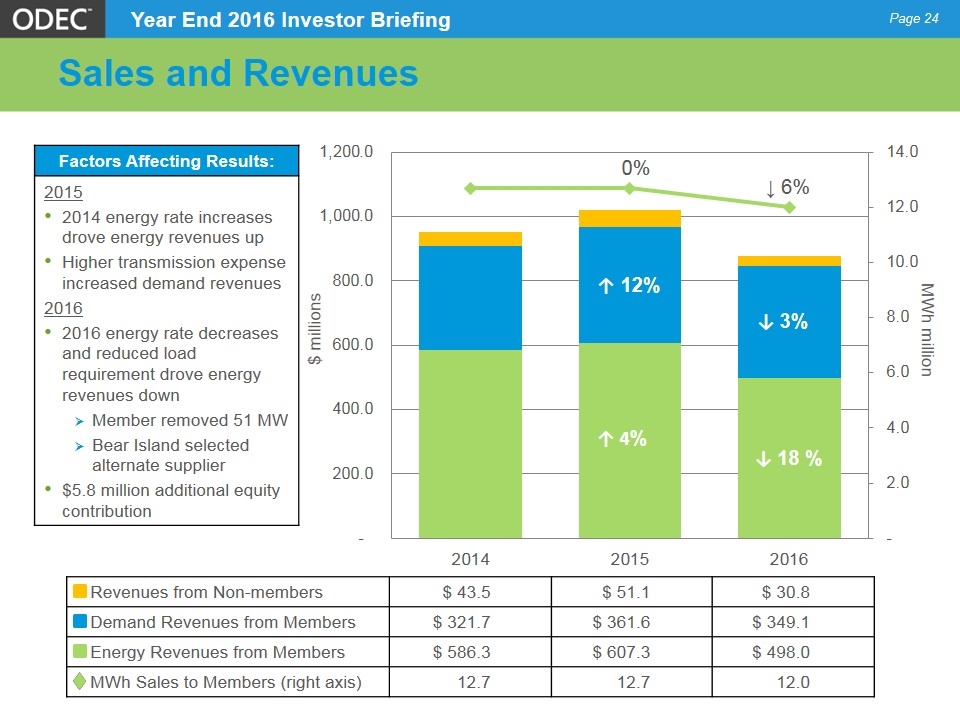

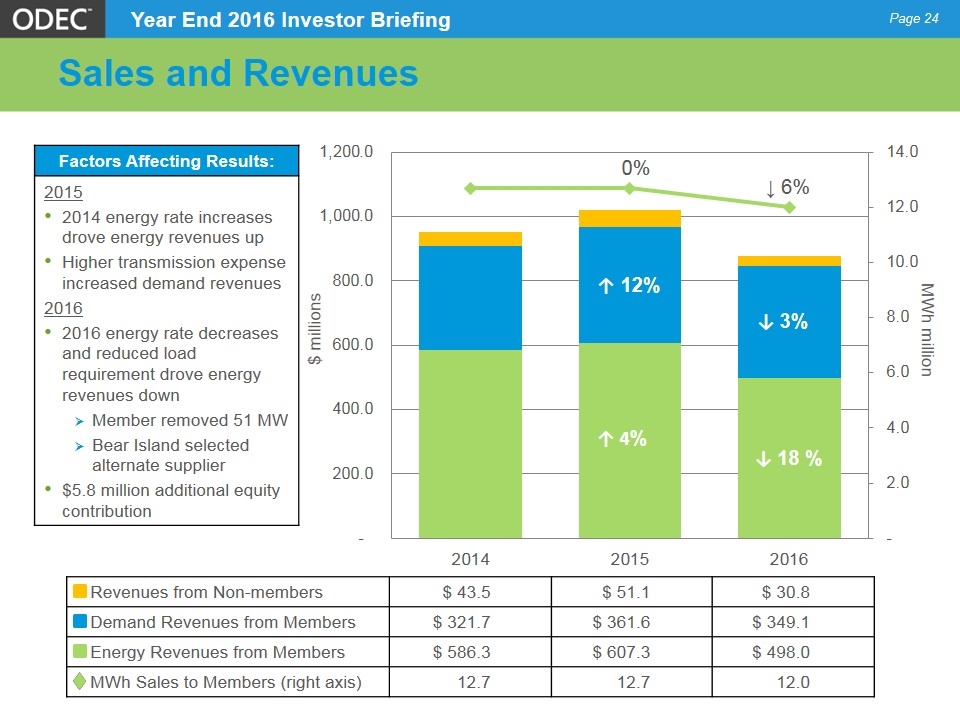

Sales and Revenues MWh million ↑ 4% ↓ 18 % ↑ 12% ↓ 3% 0% ↓ 6% Revenues from Non-members $ 43.5 $ 51.1 $ 30.8 Demand Revenues from Members $ 321.7 $ 361.6 $ 349.1 Energy Revenues from Members $ 586.3 $ 607.3 $ 498.0 MWh Sales to Members (right axis) 12.7 12.7 12.0 $ millions Page Factors Affecting Results: 2015 2014 energy rate increases drove energy revenues up Higher transmission expense increased demand revenues 2016 2016 energy rate decreases and reduced load requirement drove energy revenues down Member removed 51 MW Bear Island selected alternate supplier $5.8 million additional equity contribution

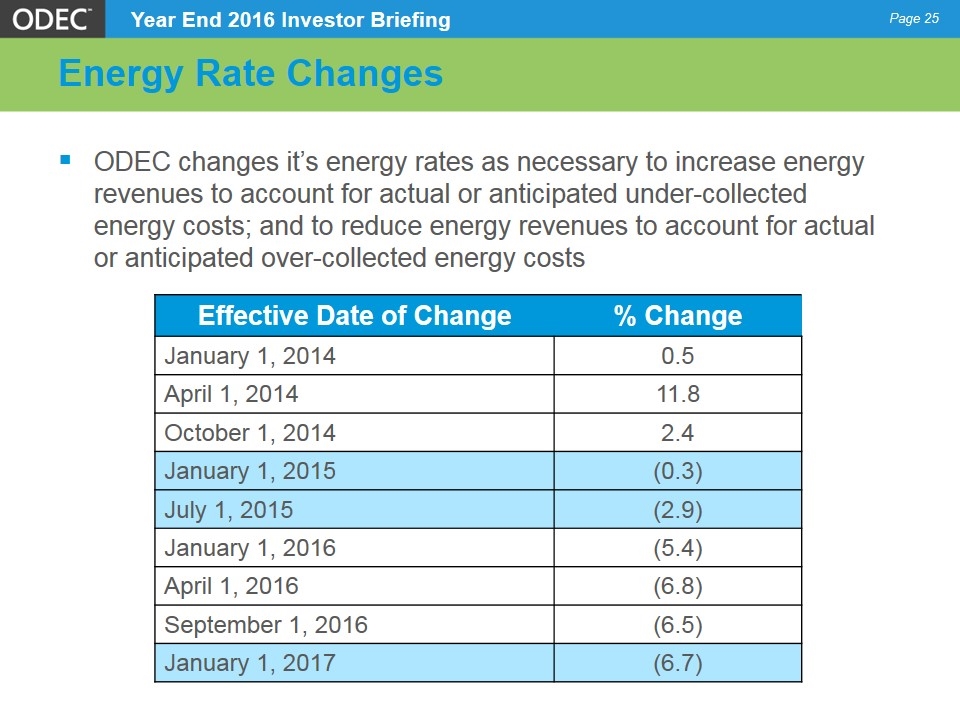

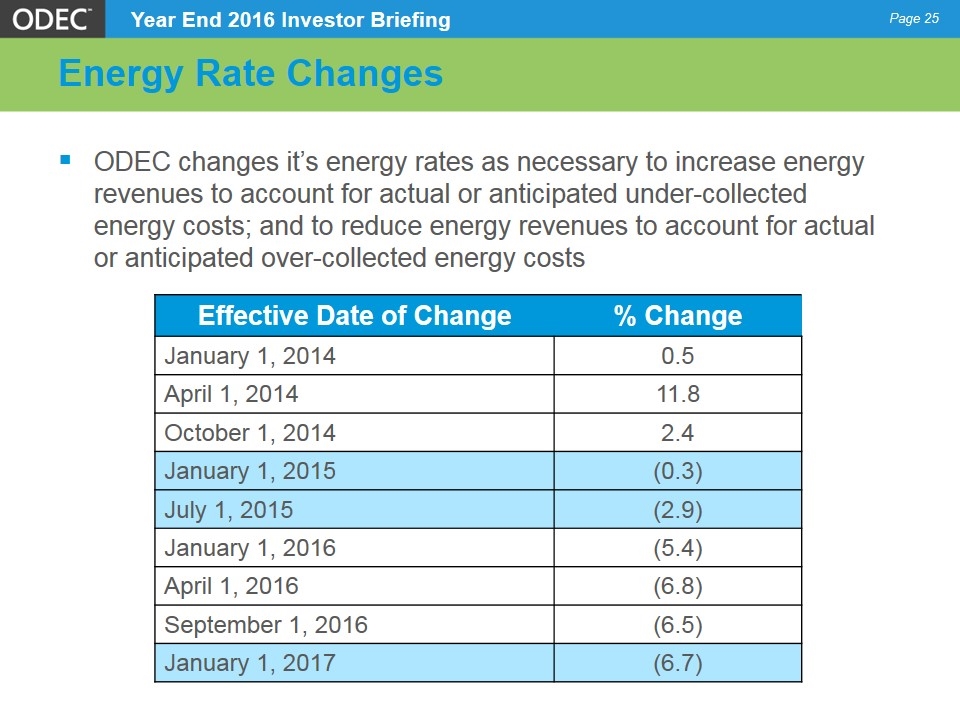

Energy Rate Changes Page Effective Date of Change % Change January 1, 2014 0.5 April 1, 2014 11.8 October 1, 2014 2.4 January 1, 2015 (0.3) July 1, 2015 (2.9) January 1, 2016 (5.4) April 1, 2016 (6.8) September 1, 2016 (6.5) January 1, 2017 (6.7) ODEC changes it’s energy rates as necessary to increase energy revenues to account for actual or anticipated under-collected energy costs; and to reduce energy revenues to account for actual or anticipated over-collected energy costs

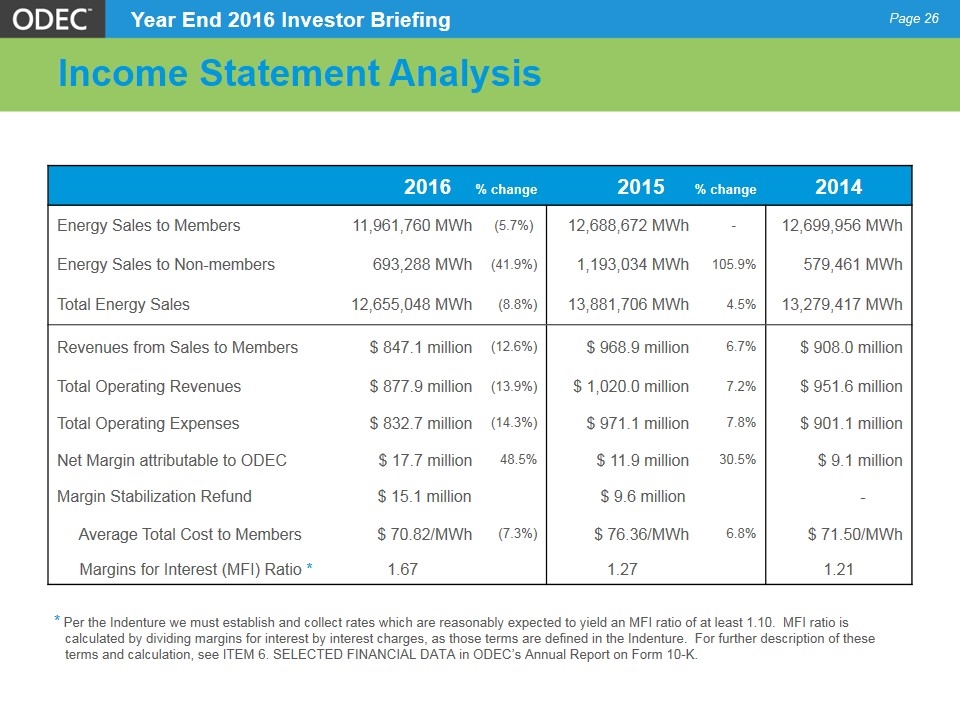

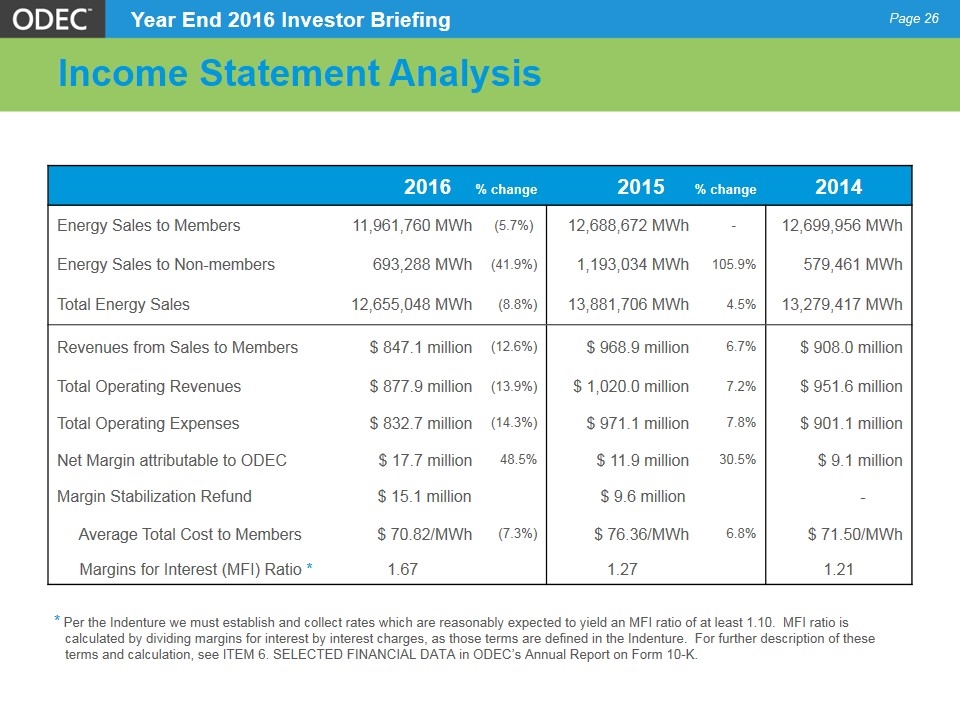

Income Statement Analysis 2016 % change 2015 % change 2014 Energy Sales to Members 11,961,760 MWh (5.7%) 12,688,672 MWh - 12,699,956 MWh Energy Sales to Non-members 693,288 MWh (41.9%) 1,193,034 MWh 105.9% 579,461 MWh Total Energy Sales 12,655,048 MWh (8.8%) 13,881,706 MWh 4.5% 13,279,417 MWh Revenues from Sales to Members $ 847.1 million (12.6%) $ 968.9 million 6.7% $ 908.0 million Total Operating Revenues $ 877.9 million (13.9%) $ 1,020.0 million 7.2% $ 951.6 million Total Operating Expenses $ 832.7 million (14.3%) $ 971.1 million 7.8% $ 901.1 million Net Margin attributable to ODEC $ 17.7 million 48.5% $ 11.9 million 30.5% $ 9.1 million Margin Stabilization Refund $ 15.1 million $ 9.6 million - Average Total Cost to Members $ 70.82/MWh (7.3%) $ 76.36/MWh 6.8% $ 71.50/MWh Margins for Interest (MFI) Ratio * 1.67 1.27 1.21 * Per the Indenture we must establish and collect rates which are reasonably expected to yield an MFI ratio of at least 1.10. MFI ratio is calculated by dividing margins for interest by interest charges, as those terms are defined in the Indenture. For further description of these terms and calculation, see ITEM 6. SELECTED FINANCIAL DATA in ODEC’s Annual Report on Form 10-K. Page

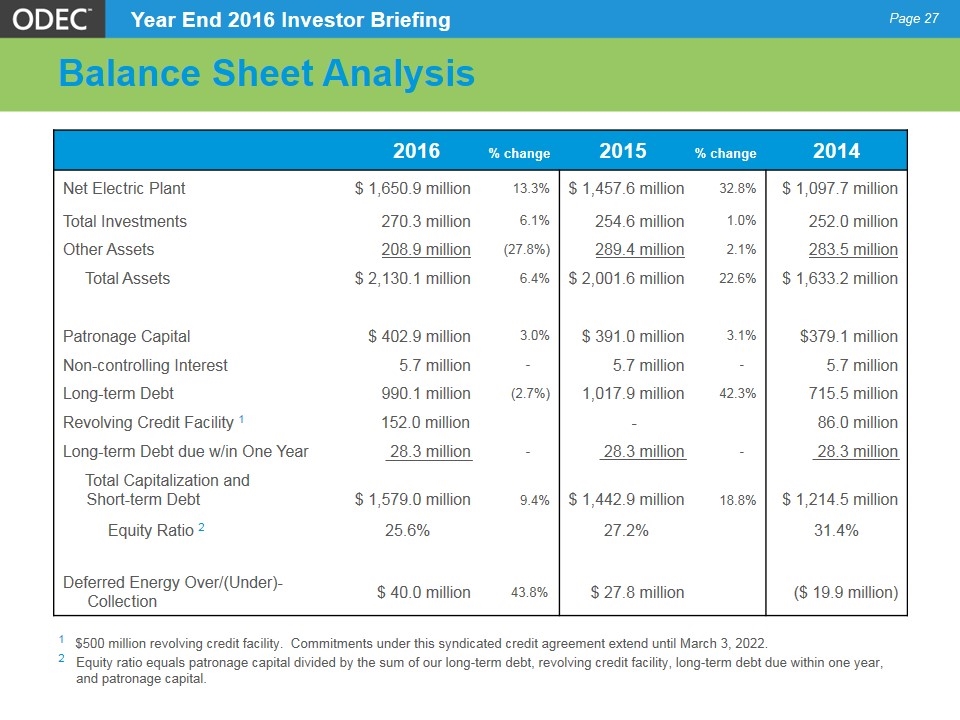

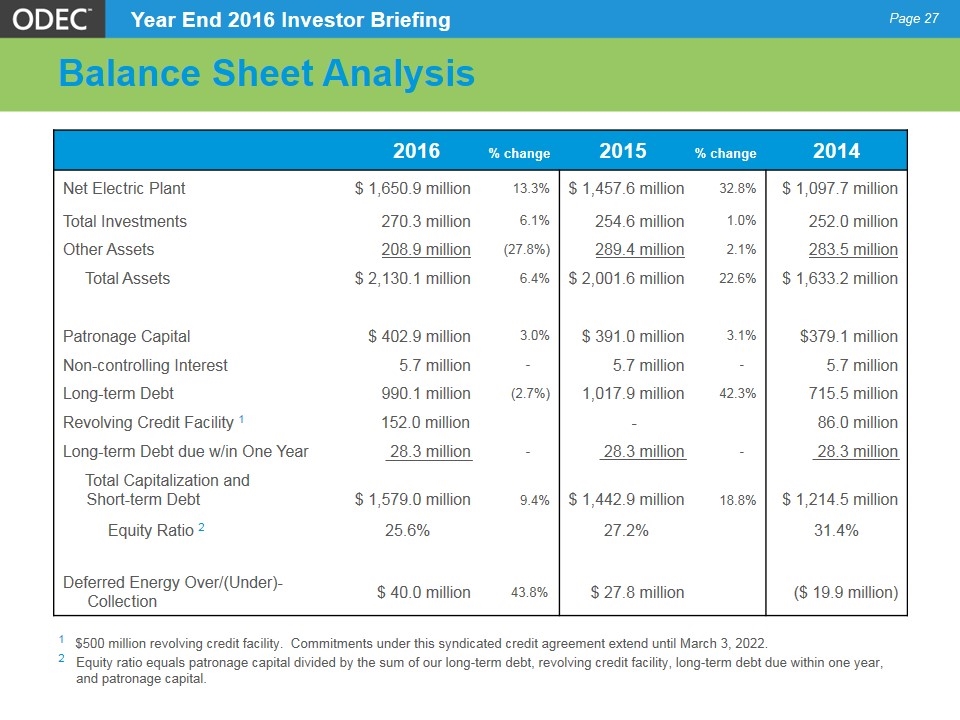

Balance Sheet Analysis 2016 % change 2015 % change 2014 Net Electric Plant $ 1,650.9 million 13.3% $ 1,457.6 million 32.8% $ 1,097.7 million Total Investments 270.3 million 6.1% 254.6 million 1.0% 252.0 million Other Assets 208.9 million (27.8%) 289.4 million 2.1% 283.5 million Total Assets $ 2,130.1 million 6.4% $ 2,001.6 million 22.6% $ 1,633.2 million Patronage Capital $ 402.9 million 3.0% $ 391.0 million 3.1% $379.1 million Non-controlling Interest 5.7 million - 5.7 million - 5.7 million Long-term Debt 990.1 million (2.7%) 1,017.9 million 42.3% 715.5 million Revolving Credit Facility 1 152.0 million - 86.0 million Long-term Debt due w/in One Year 28.3 million - 28.3 million - 28.3 million Total Capitalization and Short-term Debt $ 1,579.0 million 9.4% $ 1,442.9 million 18.8% $ 1,214.5 million Equity Ratio 2 25.6% 27.2% 31.4% Deferred Energy Over/(Under)- Collection $ 40.0 million 43.8% $ 27.8 million ($ 19.9 million) 1 $500 million revolving credit facility. Commitments under this syndicated credit agreement extend until March 3, 2022. 2 Equity ratio equals patronage capital divided by the sum of our long-term debt, revolving credit facility, long-term debt due within one year, and patronage capital. Page

Summary Page Economically stable, highly residential service territory Long-term all-requirements wholesale power contracts Favorable regulatory environment Diversified portfolio of power supply resources Wildcat Point to reduce reliance on purchased power Consistently strong financial performance SEC registrant and Sarbanes-Oxley compliant Proven ability to secure liquidity and access capital High quality (“A” and “A2”) credit ratings

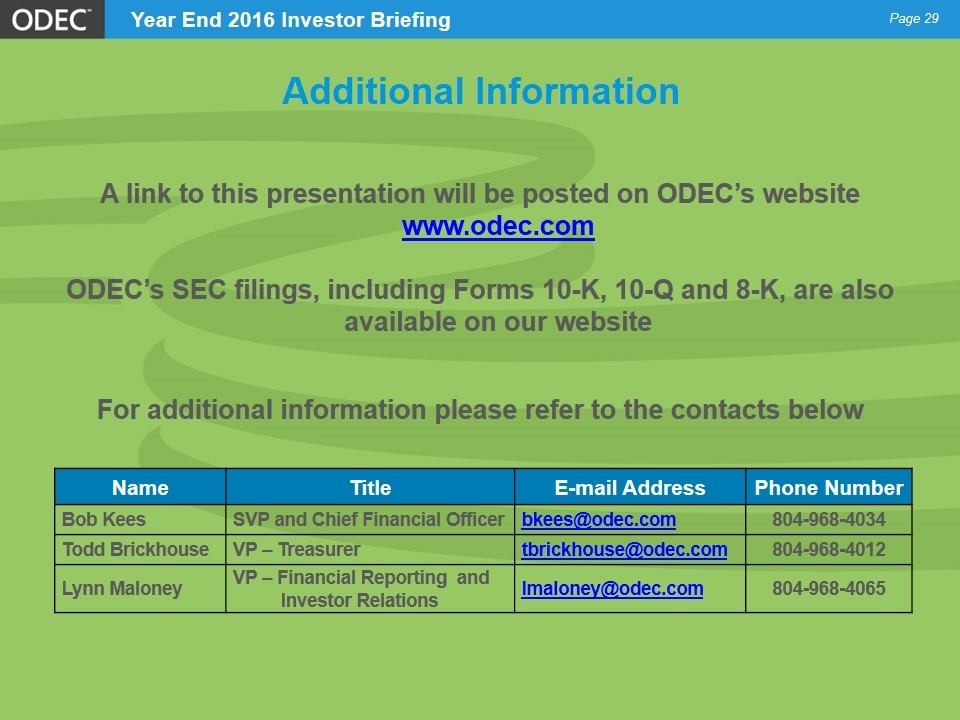

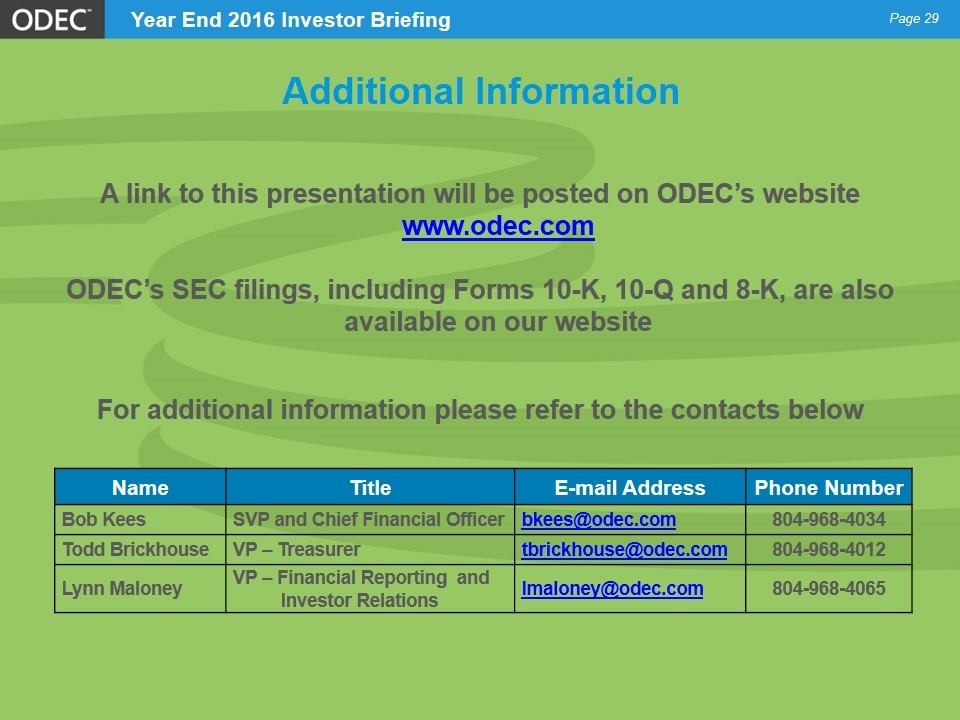

Additional Information Name Title E-mail Address Phone Number Bob Kees SVP and Chief Financial Officer bkees@odec.com 804-968-4034 Todd Brickhouse VP – Treasurer tbrickhouse@odec.com 804-968-4012 Lynn Maloney VP – Financial Reporting and Investor Relations lmaloney@odec.com 804-968-4065 Page A link to this presentation will be posted on ODEC’s website www.odec.com ODEC’s SEC filings, including Forms 10-K, 10-Q and 8-K, are also available on our website For additional information please refer to the contacts below