2019 Annual Meeting of Shareholders April 30, 2019 Laval, Quebec Exhibit 99.1

This presentation contains forward-looking information and statements, within the meaning of applicable securities laws (collectively, “forward-looking statements”), including, but not limited to, statements regarding Bausch Health's future prospects and performance, including the Company’s targeted three-year CAGR of revenue growth and Adjusted EBITDA (non-GAAP) growth, anticipated revenue from our Significant Seven products, the expected impact on long-term growth of new product approvals (including approvals of the Significant Seven), the timing and number of expected product launches, the anticipated submission, approval and launch dates for certain of our pipeline products and R&D programs (including DUOBRII™(provisional name)) the anticipated number of submissions for regulatory approval of our pipeline products and the anticipated timing of such submissions, the expected reported revenue growth and expected revenue generated from the Significant Seven, expected cash generated from operations and the anticipated uses of same, expected growth in R&D investment and the amount of such growth, anticipated continued improvement in operational efficiency (Project CORE) and the expected impact of such efficiencies, management’s commitments and expected targets and our ability to achieve the action plan and expected targets in the periods anticipated. Forward-looking statements may generally be identified by the use of the words “plans”, “projects”, "anticipates," "expects," “goals”, "intends," "should," "could," "would," "may," "will," "believes," "estimates," "potential," "target," “commit,” or "continue" and variations or similar expressions. These forward-looking statements, including management’s expectations and expected targets for 2019 and beyond, are based upon the current expectations and beliefs of management and are provided for the purpose of providing additional information about such expectations and beliefs and readers are cautioned that these statements may not be appropriate for other purposes. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results and events to differ materially from those described in these forward-looking statements. These risks and uncertainties include, but are not limited to, the risks and uncertainties discussed in the Company's most recent annual and quarterly reports and detailed from time to time in the Company's other filings with the Securities and Exchange Commission and the Canadian Securities Administrators, which risks and uncertainties are incorporated herein by reference. In addition, certain material factors and assumptions have been applied in making these forward-looking statements, including assumptions respecting our targeted three-year CAGR of revenue growth and Adjusted EBITDA (non-GAAP) growth including, without limitation, expectations on constant currency and mid-point of 2019 guidance, assumptions regarding our expectations regarding revenue growth in 2019, including, but not limited to, expectations on exchange rate and midpoint of 2019 guidance, and that the risks and uncertainties outlined above will not cause actual results or events to differ materially from those described in these forward-looking statements, and additional information regarding certain of these material factors and assumptions may also be found in the Company’s filings described above. The Company believes that the material factors and assumptions reflected in these forward-looking statements are reasonable, but readers are cautioned not to place undue reliance on any of these forward-looking statements. These forward-looking statements speak only as of the date hereof. Valeant undertakes no obligation to update any of these forward-looking statements to reflect events or circumstances after the date of this presentation or to reflect actual outcomes, unless required by law. Forward-Looking Statements

To supplement the financial measures prepared in accordance with U.S. generally accepted accounting principles (GAAP), the Company uses certain non-GAAP financial measures, including Adjusted EBITDA, Organic Revenue Growth and Constant Currency. Management uses non-GAAP measures as key metrics in the evaluation of company performance and the consolidated financial results and, in part, in the determination of cash bonuses for its executive officers. The Company believes non-GAAP measures are useful to investors in their assessment of our operating performance and the valuation of our Company. In addition, non-GAAP measures address questions the Company routinely receives from analysts and investors and, in order to assure that all investors have access to similar data, the Company has determined that it is appropriate to make this data available to all investors. However, non-GAAP measures are not prepared in accordance with GAAP nor do they have any standardized meaning under GAAP. In addition, other companies may use similarly titled non-GAAP financial measures that are calculated differently from the way we calculate such measures. Accordingly, our non-GAAP financial measures may not be comparable to similar non-GAAP measures. We caution investors not to place undue reliance on such non-GAAP measures, but instead to consider them with the most directly comparable GAAP measures. Non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation. They should be considered as a supplement to, not a substitute for, or superior to, the corresponding measures calculated in accordance with GAAP. The reconciliations of these historic non-GAAP measures to the most directly comparable financial measures calculated and presented in accordance with GAAP are shown in the appendix hereto. However, for guidance and expected CAGR purposes, the Company does not provide reconciliations of projected Adjusted EBITDA (non-GAAP) to projected GAAP net income (loss), due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations. In periods where significant acquisitions or divestitures are not expected, the Company believes it might have a basis for forecasting the GAAP equivalent for certain costs, such as amortization, that would otherwise be treated as a non-GAAP adjustment to calculate projected GAAP net income (loss). However, because other deductions (e.g., restructuring, gain or loss on extinguishment of debt and litigation and other matters) used to calculate projected net income (loss) may vary significantly based on actual events, the Company is not able to forecast on a GAAP basis with reasonable certainty all deductions needed in order to provide a GAAP calculation of projected net income (loss) at this time. The amounts of these deductions may be material and, therefore, could result in GAAP net income (loss) being materially different from (including materially less than) projected Adjusted EBITDA (non-GAAP). Non-GAAP Information

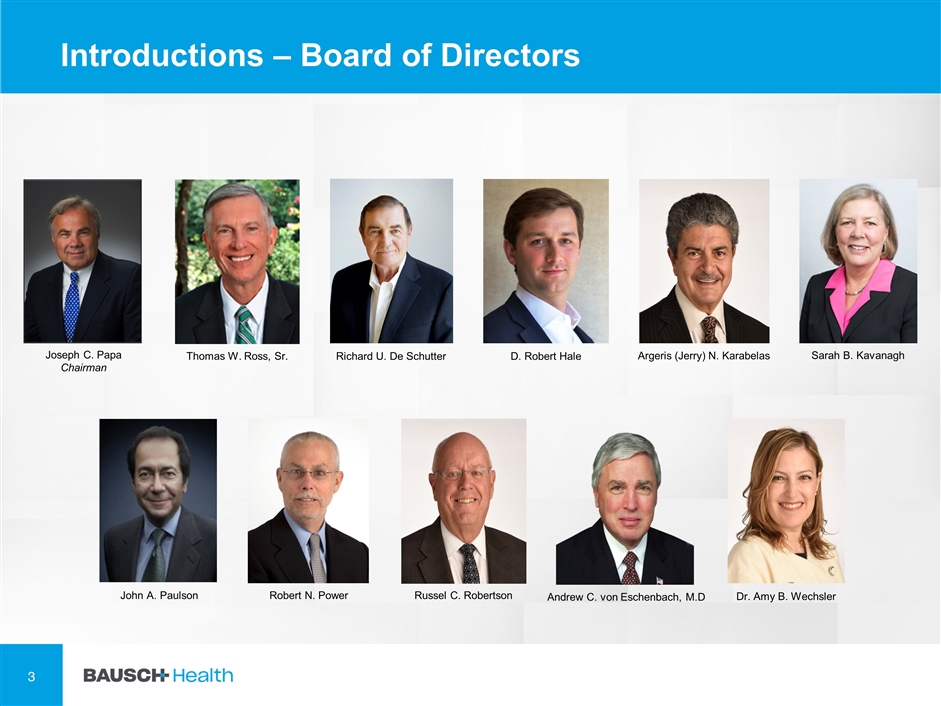

Introductions – Board of Directors Joseph C. Papa Chairman Richard U. De Schutter D. Robert Hale Argeris (Jerry) N. Karabelas John A. Paulson Robert N. Power Russel C. Robertson Thomas W. Ross, Sr. Dr. Amy B. Wechsler Sarah B. Kavanagh Andrew C. von Eschenbach, M.D

Remarks from Chairman & CEO Joseph C. Papa 2019 Annual Meeting of Shareholders April 30, 2019

Impact on the World Today Every day more than 150 million people around the world use a Bausch Health product.

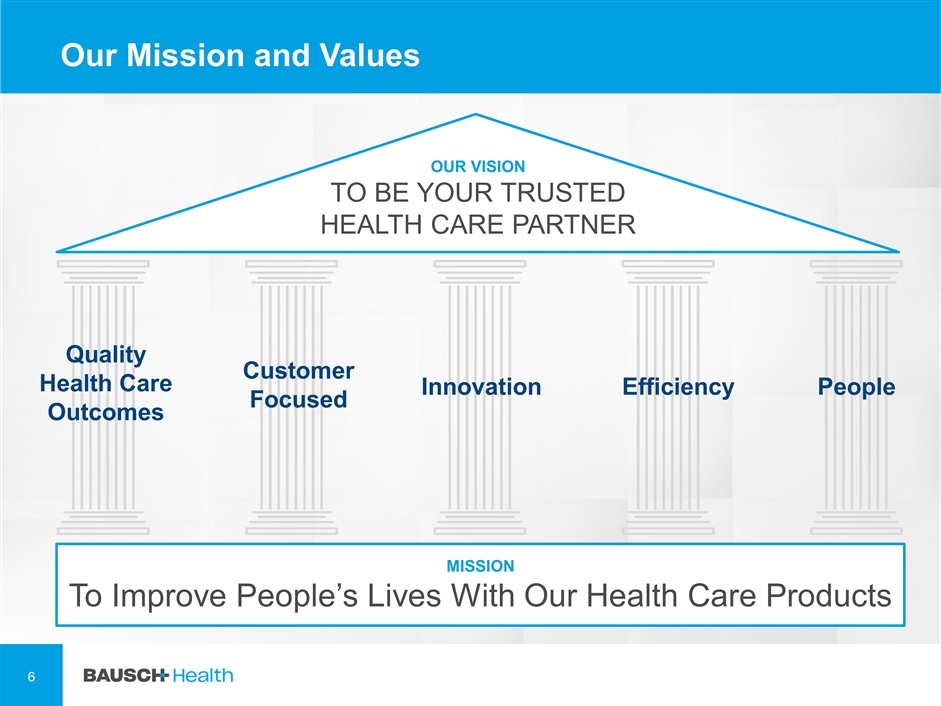

Our Mission and Values Quality Health Care Outcomes Customer Focused Innovation Efficiency People OUR VISION TO BE YOUR TRUSTED HEALTH CARE PARTNER MISSION To Improve People’s Lives With Our Health Care Products

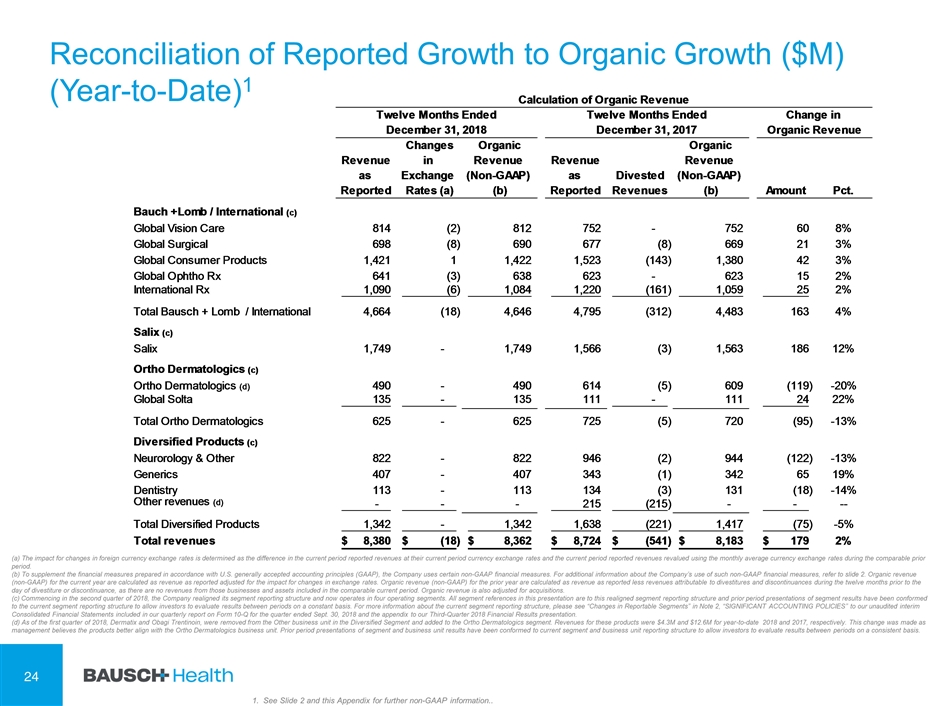

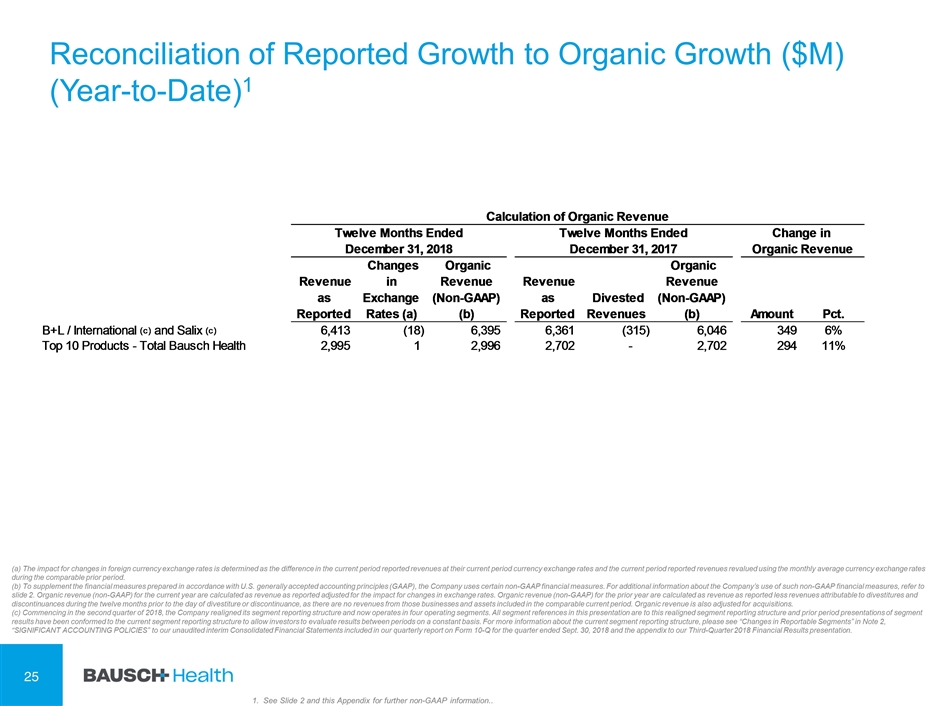

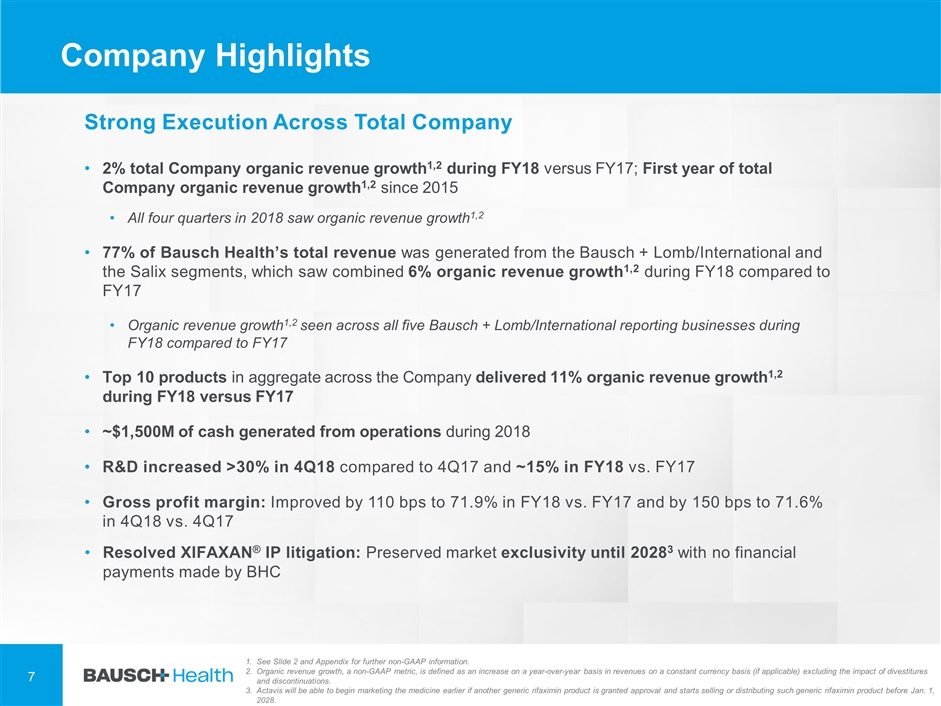

Company Highlights Strong Execution Across Total Company 2% total Company organic revenue growth1,2 during FY18 versus FY17; First year of total Company organic revenue growth1,2 since 2015 All four quarters in 2018 saw organic revenue growth1,2 77% of Bausch Health’s total revenue was generated from the Bausch + Lomb/International and the Salix segments, which saw combined 6% organic revenue growth1,2 during FY18 compared to FY17 Organic revenue growth1,2 seen across all five Bausch + Lomb/International reporting businesses during FY18 compared to FY17 Top 10 products in aggregate across the Company delivered 11% organic revenue growth1,2 during FY18 versus FY17 ~$1,500M of cash generated from operations during 2018 R&D increased >30% in 4Q18 compared to 4Q17 and ~15% in FY18 vs. FY17 Gross profit margin: Improved by 110 bps to 71.9% in FY18 vs. FY17 and by 150 bps to 71.6% in 4Q18 vs. 4Q17 Resolved XIFAXAN® IP litigation: Preserved market exclusivity until 20283 with no financial payments made by BHC See Slide 2 and Appendix for further non-GAAP information. Organic revenue growth, a non-GAAP metric, is defined as an increase on a year-over-year basis in revenues on a constant currency basis (if applicable) excluding the impact of divestitures and discontinuations. Actavis will be able to begin marketing the medicine earlier if another generic rifaximin product is granted approval and starts selling or distributing such generic rifaximin product before Jan. 1, 2028.

Company Highlights Driving Growth with New Pipeline and Promoted Products ~250 projects in our global pipeline and anticipate submitting over 125 of those projects for regulatory approval in 2019 and 2020 DUOBRII™ (Received FDA Approval and Launch Expected in June) 10 key product launches, including two co-promotions, during 2018 Four Significant Seven products launched in 2018: VYZULTA® (Launch began Dec. 2017), LUMIFY®, AQUALOX® (SiHy daily) and BRYHALI™ Reduced and Refinanced Debt Repaid >$1B of debt in 2018 with cash generated from operations ~$8.3B of debt refinanced in 2018 to extend maturities and provide more flexibility Bausch + Lomb ULTRA® Multifocal for Astigmatism 1 1 1. Co-promotion arrangement with third party.

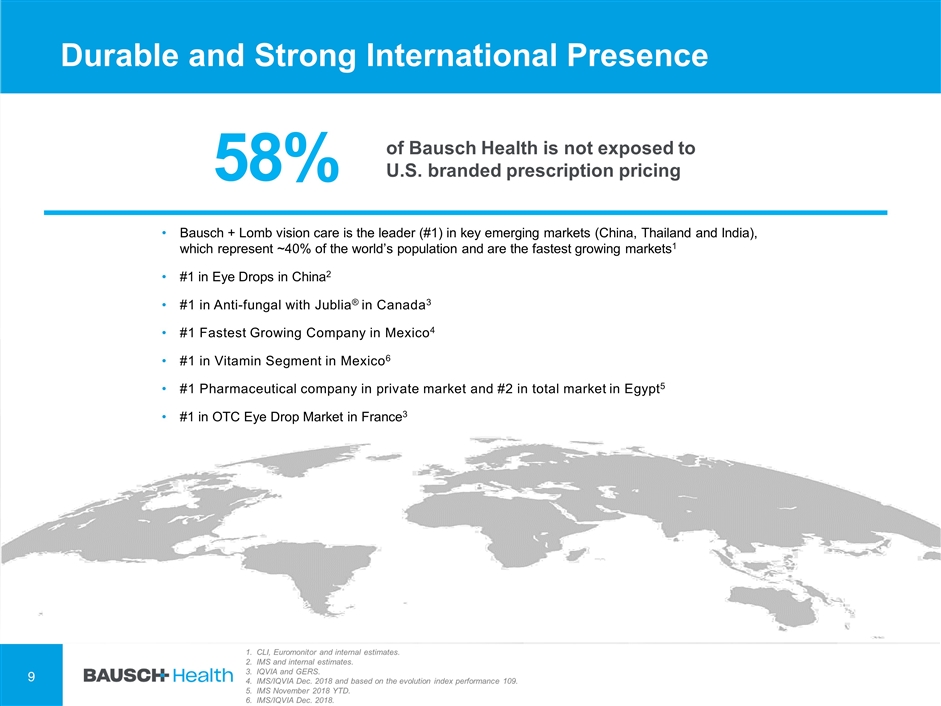

Durable and Strong International Presence CLI, Euromonitor and internal estimates. IMS and internal estimates. IQVIA and GERS. IMS/IQVIA Dec. 2018 and based on the evolution index performance 109. IMS November 2018 YTD. IMS/IQVIA Dec. 2018. Bausch + Lomb vision care is the leader (#1) in key emerging markets (China, Thailand and India), which represent ~40% of the world’s population and are the fastest growing markets1 #1 in Eye Drops in China2 #1 in Anti-fungal with Jublia® in Canada3 #1 Fastest Growing Company in Mexico4 #1 in Vitamin Segment in Mexico6 #1 Pharmaceutical company in private market and #2 in total market in Egypt5 #1 in OTC Eye Drop Market in France3 58% of Bausch Health is not exposed to U.S. branded prescription pricing

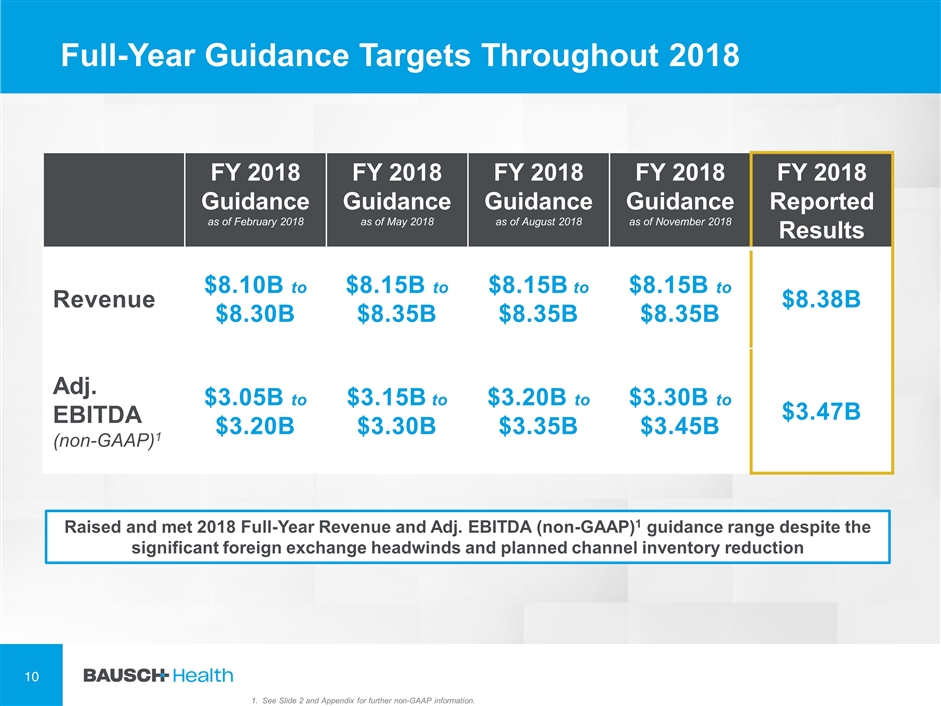

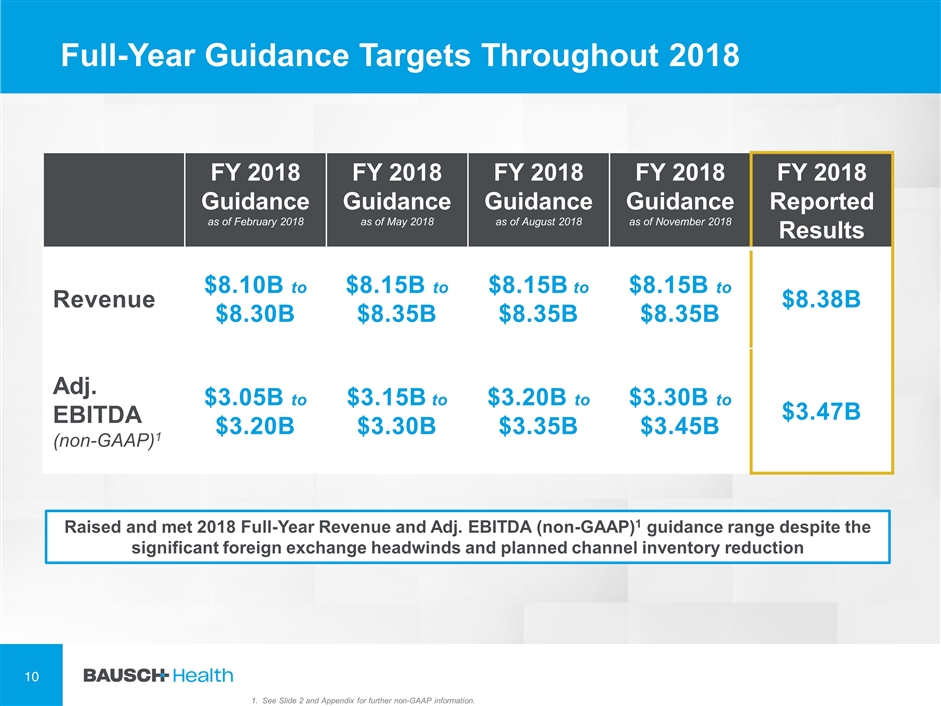

Full-Year Guidance Targets Throughout 2018 FY 2018 Guidance as of February 2018 FY 2018 Guidance as of May 2018 FY 2018 Guidance as of August 2018 FY 2018 Guidance as of November 2018 FY 2018 Reported Results Revenue $8.10B to $8.30B $8.15B to $8.35B $8.15B to $8.35B $8.15B to $8.35B $8.38B Adj. EBITDA (non-GAAP)1 $3.05B to $3.20B $3.15B to $3.30B $3.20B to $3.35B $3.30B to $3.45B $3.47B Raised and met 2018 Full-Year Revenue and Adj. EBITDA (non-GAAP)1 guidance range despite the significant foreign exchange headwinds and planned channel inventory reduction See Slide 2 and Appendix for further non-GAAP information.

Bausch + Lomb/International and Salix are driving the pivot to offense 77% of the total company generated 6% organic revenue growth1,2 during 2018 Bausch + Lomb/International 56% Salix 21% Ortho Dermatologics 7% Diversified Products 16% Global Vision Care Global Surgical Global Consumer Global Ophtho Rx International Rx +8% +3% +3% +2% +2% 56% of total company generated 4% organic revenue growth1,2 during 2018 21% of total company generated 12% organic revenue growth1,2 during 2018 See Slide 2 and Appendix for further non-GAAP information. Organic revenue growth, a non-GAAP metric, is defined as an increase on a year-over-year basis in revenues on a constant currency basis (if applicable) excluding the impact of divestitures and discontinuations. Bausch Health: Pivoting to Offense

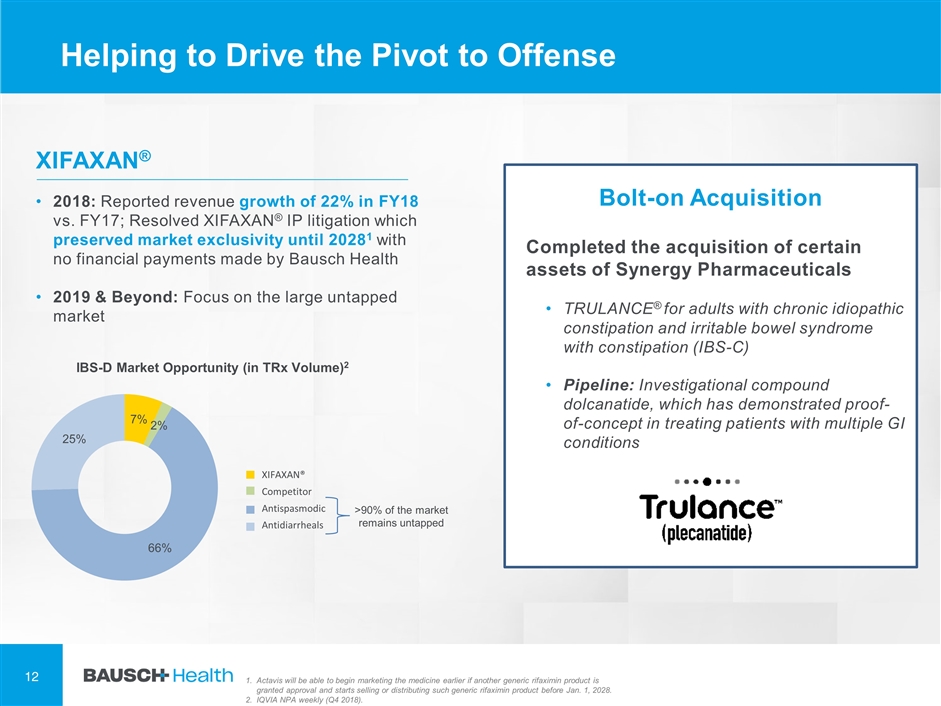

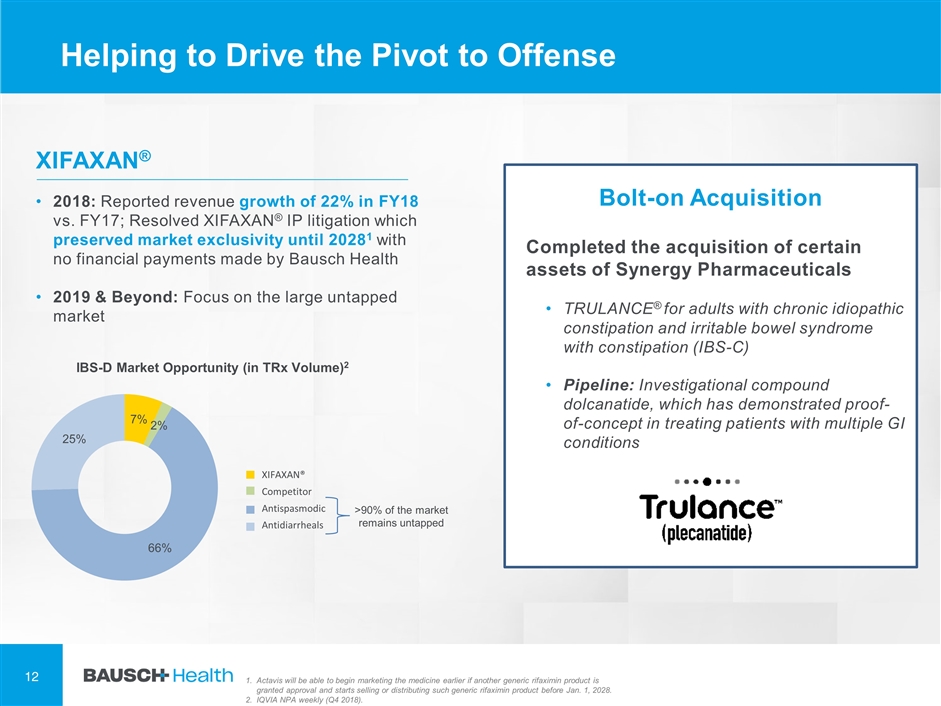

2018: Reported revenue growth of 22% in FY18 vs. FY17; Resolved XIFAXAN® IP litigation which preserved market exclusivity until 20281 with no financial payments made by Bausch Health 2019 & Beyond: Focus on the large untapped market Actavis will be able to begin marketing the medicine earlier if another generic rifaximin product is granted approval and starts selling or distributing such generic rifaximin product before Jan. 1, 2028. IQVIA NPA weekly (Q4 2018). Completed the acquisition of certain assets of Synergy Pharmaceuticals TRULANCE® for adults with chronic idiopathic constipation and irritable bowel syndrome with constipation (IBS-C) Pipeline: Investigational compound dolcanatide, which has demonstrated proof-of-concept in treating patients with multiple GI conditions XIFAXAN® Helping to Drive the Pivot to Offense Bolt-on Acquisition IBS-D Market Opportunity (in TRx Volume)2 XIFAXAN® Competitor Antispasmodic Antidiarrheals >90% of the market remains untapped

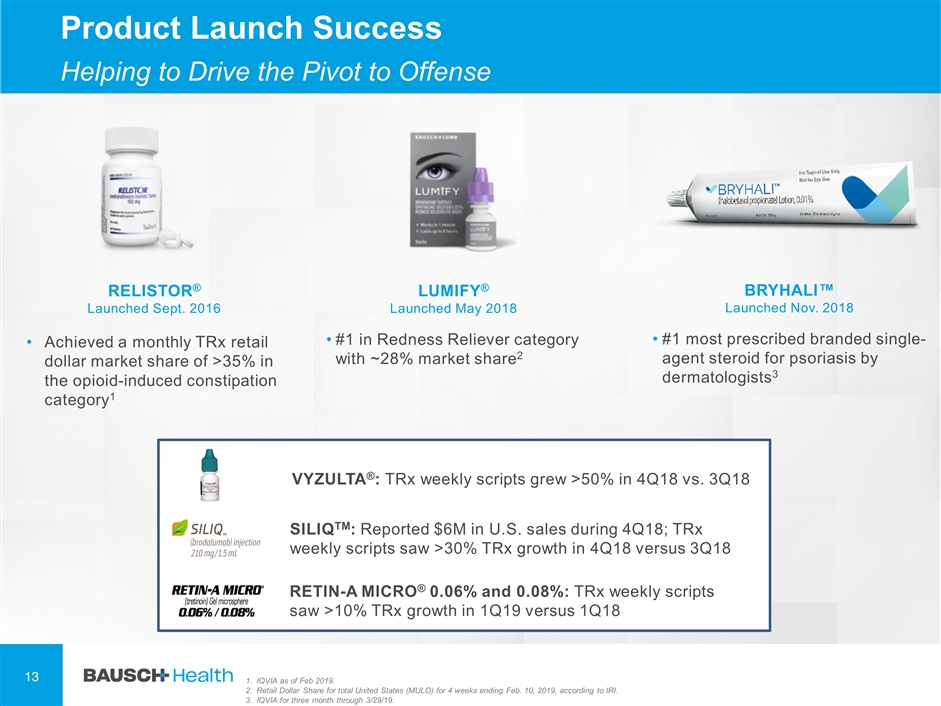

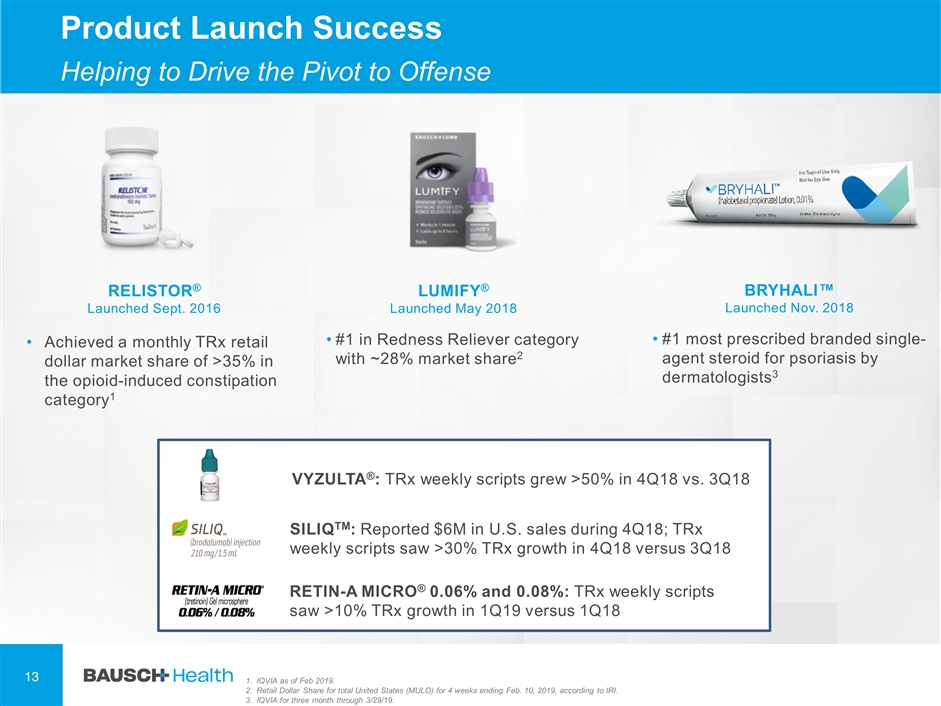

IQVIA as of Feb 2019. Retail Dollar Share for total United States (MULO) for 4 weeks ending Feb. 10, 2019, according to IRI. IQVIA for three month through 3/29/19. Product Launch Success Helping to Drive the Pivot to Offense BRYHALI™ Launched Nov. 2018 #1 most prescribed branded single-agent steroid for psoriasis by dermatologists3 RELISTOR® Launched Sept. 2016 Achieved a monthly TRx retail dollar market share of >35% in the opioid-induced constipation category1 LUMIFY® Launched May 2018 #1 in Redness Reliever category with ~28% market share2 VYZULTA®: TRx weekly scripts grew >50% in 4Q18 vs. 3Q18 SILIQTM: Reported $6M in U.S. sales during 4Q18; TRx weekly scripts saw >30% TRx growth in 4Q18 versus 3Q18 RETIN-A MICRO® 0.06% and 0.08%: TRx weekly scripts saw >10% TRx growth in 1Q19 versus 1Q18

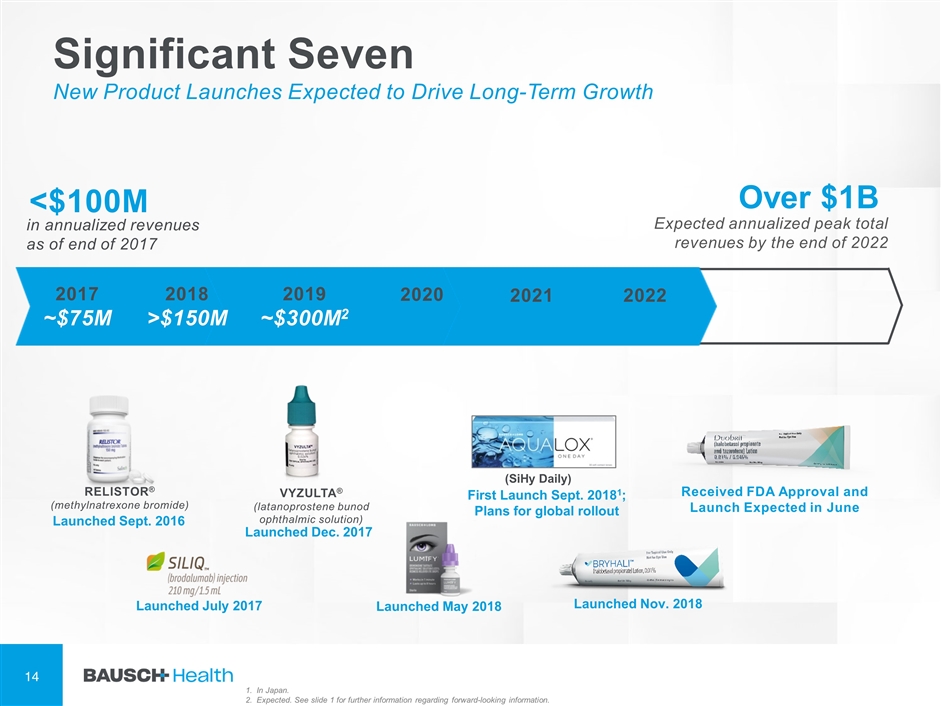

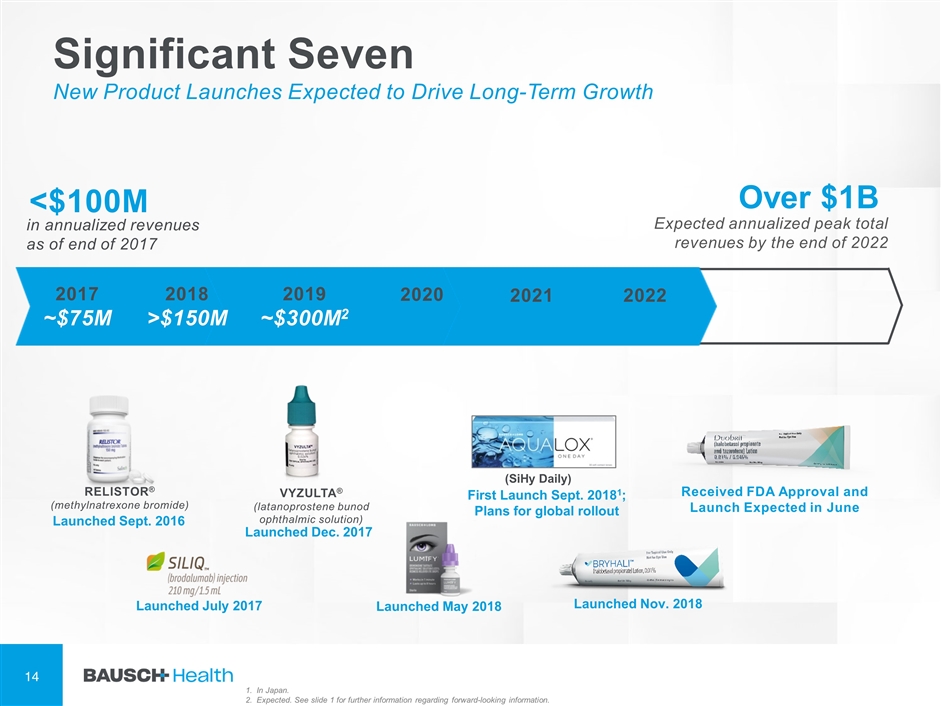

Over $1B Significant Seven New Product Launches Expected to Drive Long-Term Growth Launched Sept. 2016 RELISTOR® (methylnatrexone bromide) Launched Dec. 2017 VYZULTA® (latanoprostene bunod ophthalmic solution) Launched July 2017 Launched May 2018 First Launch Sept. 20181; Plans for global rollout <$100M in annualized revenues as of end of 2017 Expected annualized peak total revenues by the end of 2022 (SiHy Daily) Launched Nov. 2018 2017 ~$75M 2018 >$150M 2019 ~$300M2 2020 2021 2022 In Japan. Expected. See slide 1 for further information regarding forward-looking information. Received FDA Approval and Launch Expected in June

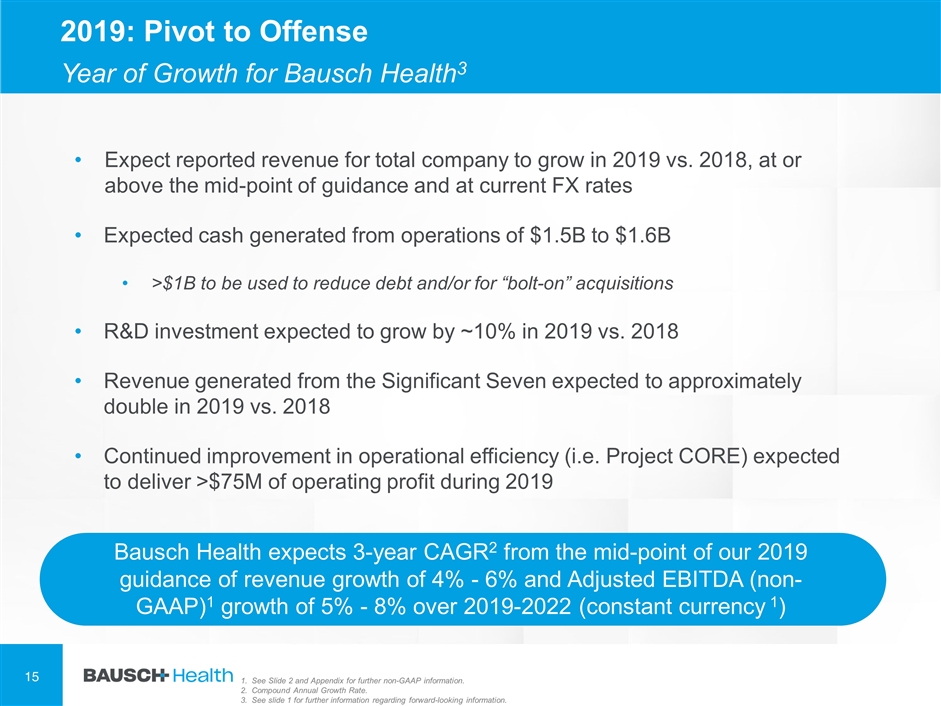

Bausch Health expects 3-year CAGR2 from the mid-point of our 2019 guidance of revenue growth of 4% - 6% and Adjusted EBITDA (non-GAAP)1 growth of 5% - 8% over 2019-2022 (constant currency 1) Expect reported revenue for total company to grow in 2019 vs. 2018, at or above the mid-point of guidance and at current FX rates Expected cash generated from operations of $1.5B to $1.6B >$1B to be used to reduce debt and/or for “bolt-on” acquisitions R&D investment expected to grow by ~10% in 2019 vs. 2018 Revenue generated from the Significant Seven expected to approximately double in 2019 vs. 2018 Continued improvement in operational efficiency (i.e. Project CORE) expected to deliver >$75M of operating profit during 2019 2019: Pivot to Offense Year of Growth for Bausch Health3 See Slide 2 and Appendix for further non-GAAP information. Compound Annual Growth Rate. See slide 1 for further information regarding forward-looking information.

Question & Answer Period

Appendix

Non-GAAP Appendix Description of Non-GAAP Financial Measures To supplement the financial measures prepared in accordance with U.S. generally accepted accounting principles (GAAP), the Company uses certain non-GAAP financial measures, as follows. These measures do not have any standardized meaning under GAAP and other companies may use similarly titled non-GAAP financial measures that are calculated differently from the way we calculate such measures. Accordingly, our non-GAAP financial measures may not be comparable to similar non-GAAP measures. We caution investors not to place undue reliance on such non-GAAP measures, but instead to consider them with the most directly comparable GAAP measures. Non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation. They should be considered as a supplement to, not a substitute for, or superior to, the corresponding measures calculated in accordance with GAAP. Adjusted EBITDA (non-GAAP) Adjusted EBITDA (non-GAAP) is GAAP net (loss) income (its most directly comparable GAAP financial measure) adjusted for certain items, as further described in the following slides. Management of the Company believes that Adjusted EBITDA (non-GAAP), along with the GAAP measures used by management, most appropriately reflect how the Company measures the business internally and sets operational goals and incentives, especially in light of the Company's new strategies. In particular, the Company believes that Adjusted EBITDA (non-GAAP) focuses management on the Company's underlying operational results and business performance. As a result, the Company uses Adjusted EBITDA (non-GAAP) both to assess the actual financial performance of the Company and to forecast future results as part of its guidance. Management believes Adjusted EBITDA (non-GAAP) is a useful measure to evaluate current performance. Adjusted EBITDA (non-GAAP) is intended to show our unleveraged, pre-tax operating results and therefore reflects our financial performance based on operational factors. In addition, cash bonuses for the Company's executive officers and other key employees are based, in part, on the achievement of certain Adjusted EBITDA (non-GAAP) targets. . Description of Non-GAAP Financial Measures Adjusted EBITDA (non-GAAP) Adjusted EBITDA (non-GAAP) Adjustments Organic Revenue Growth Constant Currency

Non-GAAP Appendix Adjusted EBITDA reflects adjustments based on the following items: Restructuring and integration costs: The Company has incurred restructuring costs as it implemented certain strategies, which involved, among other things, improvements to its infrastructure and operations, internal reorganizations and impacts from the divestiture of assets and businesses. In addition, in connection with the its acquisition of certain assets of Synergy, the Company has incurred certain severance and integration costs which were not essential to complete, close or report the acquisition. With regard to infrastructure and operational improvements which the Company has taken to improve efficiencies in the businesses and facilities, these tend to be costs intended to right size the business or organization that fluctuate significantly between periods in amount, size and timing, depending on the improvement project, reorganization or transaction. With regard to the severance and integration costs associated with the acquisition of certain assets of Synergy, these costs are specific to the acquisition itself and provided no benefit to the ongoing operations of the Company. As a result, the Company does not believe that such costs (and their impact) are truly representative of the underlying business. The Company believes that the adjustments of these items provide supplemental information with regard to the sustainability of the Company's operating performance, allow for a comparison of the financial results to historical operations and forward-looking guidance and, as a result, provide useful supplemental information to investors. Acquired in-process research and development costs: The Company has excluded expenses associated with acquired in-process research and development, as these amounts are inconsistent in amount and frequency and are significantly impacted by the timing, size and nature of acquisitions. Furthermore, as these amounts are associated with research and development acquired, the Company does not believe that they are a representation of the Company's research and development efforts during the period. Asset Impairments: The Company has excluded the impact of impairments of finite-lived and indefinite-lived intangible assets, as well as impairments of assets held for sale, as such amounts are inconsistent in amount and frequency and are significantly impacted by the timing and/or size of acquisitions and divestitures. The Company believes that the adjustments of these items correlate with the sustainability of the Company's operating performance. Although the Company excludes intangible impairments from its non-GAAP expenses, the Company believes that it is important for investors to understand that intangible assets contribute to revenue generation. Goodwill Impairments: The Company has excluded the impact of goodwill impairment. When the Company has made acquisitions where the consideration paid was in excess of the fair value of the net assets acquired, the remaining purchase price is recorded as goodwill. For assets that we developed ourselves, no goodwill is recorded. Goodwill is not amortized but is tested for impairment. For periods prior to Jan. 1, 2018, the amount of goodwill impairment is measured as the excess of the carrying value of a reporting unit's goodwill over its implied fair value. However, in January 2017, new accounting guidance was issued which simplifies the subsequent measurement of an impairment to goodwill. Under the new guidance, which the Company early adopted effective Jan. 1, 2018, the amount of goodwill impairment is measured as the excess of a reporting unit's carrying value over its fair value. Management excludes these charges in measuring the performance of the Company and the business. Description of Non-GAAP Financial Measures Adjusted EBITDA (non-GAAP) Adjusted EBITDA (non-GAAP) Adjustments Organic Revenue Growth Constant Currency

Non-GAAP Appendix Share-based Compensation: The Company has excluded the impact of costs relating to share-based compensation. The Company believes that the exclusion of share-based compensation expense assists investors in the comparisons of operating results to peer companies. Share-based compensation expense can vary significantly based on the timing, size and nature of awards granted. Acquisition-related adjustments excluding amortization of intangible assets and depreciation expense: The Company has excluded the impact of acquisition-related costs and fair value inventory step-up resulting from acquisitions as the amounts and frequency of such costs and adjustments are not consistent and are significantly impacted by the timing and size of its acquisitions. In addition, the Company has excluded the impact of acquisition-related contingent consideration non-cash adjustments due to the inherent uncertainty and volatility associated with such amounts based on changes in assumptions with respect to fair value estimates, and the amount and frequency of such adjustments is not consistent and is significantly impacted by the timing and size of the Company's acquisitions, as well as the nature of the agreed-upon consideration. Loss on extinguishment of debt: The Company has excluded loss on extinguishment of debt as this represents a cost of refinancing our existing debt and is not a reflection of our operations for the period. Further, the amount and frequency of such charges are not consistent and are significantly impacted by the timing and size of debt financing transactions and other factors in the debt market out of management's control. Other Non-GAAP Charges: The Company has excluded certain other amounts, including legal and other professional fees incurred in connection with recent legal and governmental proceedings, investigations and information requests respecting certain of our distribution, marketing, pricing, disclosure and accounting practices, litigation and other matters, and net gain on sale of assets. In addition, the Company has excluded certain other expenses, such as IT infrastructure investment, that are the result of other, non-comparable events to measure operating performance. These events arise outside of the ordinary course of continuing operations. Given the unique nature of the matters relating to these costs, the Company believes these items are not normal operating expenses. For example, legal settlements and judgments vary significantly, in their nature, size and frequency, and, due to this volatility, the Company believes the costs associated with legal settlements and judgments are not normal operating expenses. In addition, as opposed to more ordinary course matters, the Company considers that each of the recent proceedings, investigations and information requests, given their nature and frequency, are outside of the ordinary course and relate to unique circumstances. The Company believes that the exclusion of such out-of-the-ordinary-course amounts provides supplemental information to assist in the comparison of the financial results of the Company from period to period and, therefore, provides useful supplemental information to investors. However, investors should understand that many of these costs could recur and that companies in our industry often face litigation. Please also see the reconciliation tables in this appendix for further information as to how these non-GAAP measures are calculated for the periods presented. Description of Non-GAAP Financial Measures Adjusted EBITDA (non-GAAP) Adjusted EBITDA (non-GAAP) Adjustments Organic Revenue Growth Constant Currency

Non-GAAP Appendix Organic Revenue Growth Organic revenue growth, a non-GAAP metric, is defined as a change on a period-over-period basis in revenues on a constant currency basis (if applicable) excluding the impact of recent acquisitions, divestitures and discontinuations. Organic revenue growth is change in GAAP Revenue (its most directly comparable GAAP financial measure) adjusted for certain items, as further described below, of businesses that have been owned for one or more years. The Company uses organic revenue growth to assess performance of its business units and operating and reportable segments, and the Company in total, without the impact of foreign currency exchange fluctuations and recent acquisitions, divestitures and product discontinuations. The Company believes that such measure is useful to investors as it provides a supplemental period-to-period comparison. Organic revenue growth reflects adjustments for: (i) the impact of period-over-period changes in foreign currency exchange rates on revenues and (ii) the revenues associated with acquisitions, divestitures and discontinuations of businesses divested and/ or discontinued. These adjustments are determined as follows: Foreign currency exchange rates: Although changes in foreign currency exchange rates are part of our business, they are not within management’s control. Changes in foreign currency exchange rates, however, can mask positive or negative trends in the business. The impact for changes in foreign currency exchange rates is determined as the difference in the current period reported revenues at their current period currency exchange rates and the current period reported revenues revalued using the monthly average currency exchange rates during the comparable prior period. Acquisitions, divestitures and discontinuations: In order to present period-over-period organic revenues on a comparable basis, revenues associated with acquisitions, divestitures and discontinuations are adjusted to include only revenues from those businesses and assets owned during both periods. Accordingly, organic revenue growth excludes from the current period revenues attributable to each acquisition for twelve months subsequent to the day of acquisition, as there are no revenues from those businesses and assets included in the comparable prior period. Organic revenue growth excludes from the prior period (but not the current period), all revenues attributable to each divestiture and discontinuance during the twelve months prior to the day of divestiture or discontinuance, as there are no revenues from those businesses and assets included in the comparable current period. With respect to fourth quarter and full year 2019, the Company also made further adjustments to organic revenue growth to adjust for the Company’s Project CORE relating to channel inventory reduction. Please also see the reconciliation in this Appendix for further information as to how this non-GAAP measure is calculated for the periods presented. Organic Revenue Growth Description of Non-GAAP Financial Measures Adjusted EBITDA (non-GAAP) Adjusted EBITDA (non-GAAP) Adjustments Constant Currency

Constant Currency Appendix Constant Currency Changes in the relative values of non-US currencies to the US dollar may affect the Company’s financial results and financial position. To assist investors in evaluating the Company’s performance, we have adjusted for foreign currency effects. Constant currency impact is determined by comparing 2018 reported amounts adjusted to exclude currency impact, calculated using 2017 monthly average exchange rates, to the actual 2017 reported amounts. Description of Non-GAAP Financial Measures Adjusted EBITDA (non-GAAP) Adjusted EBITDA (non-GAAP) Adjustments Organic Revenue Growth Constant Currency

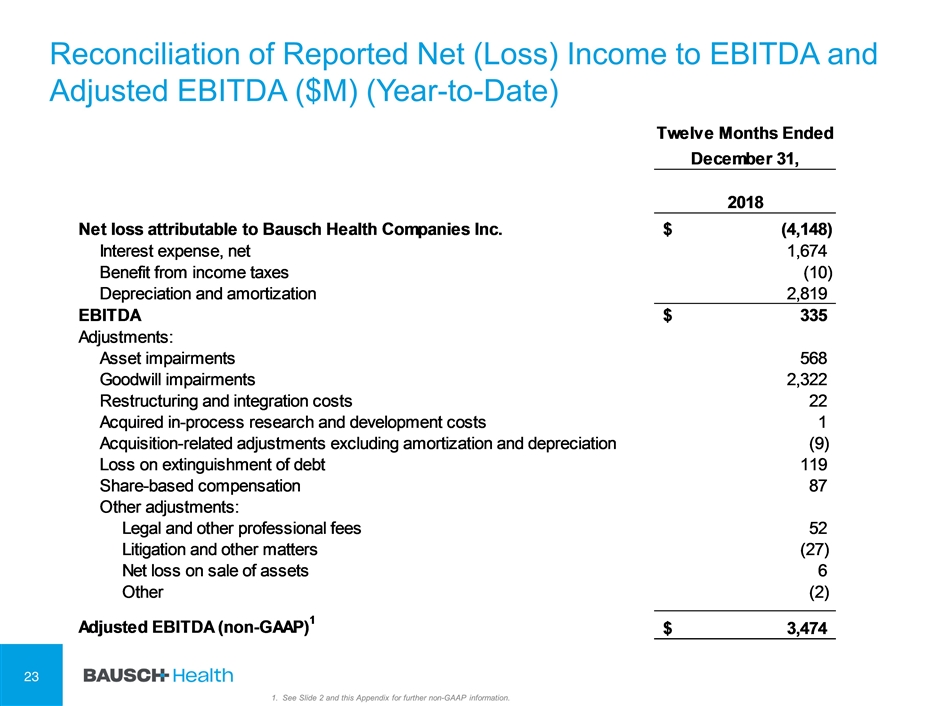

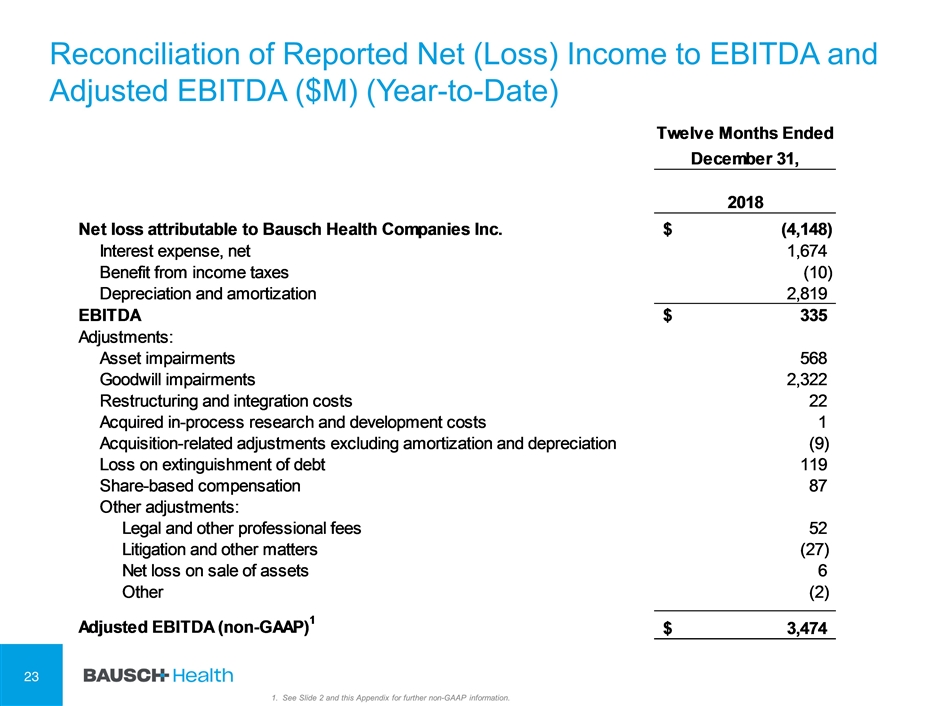

Reconciliation of Reported Net (Loss) Income to EBITDA and Adjusted EBITDA ($M) (Year-to-Date) See Slide 2 and this Appendix for further non-GAAP information.

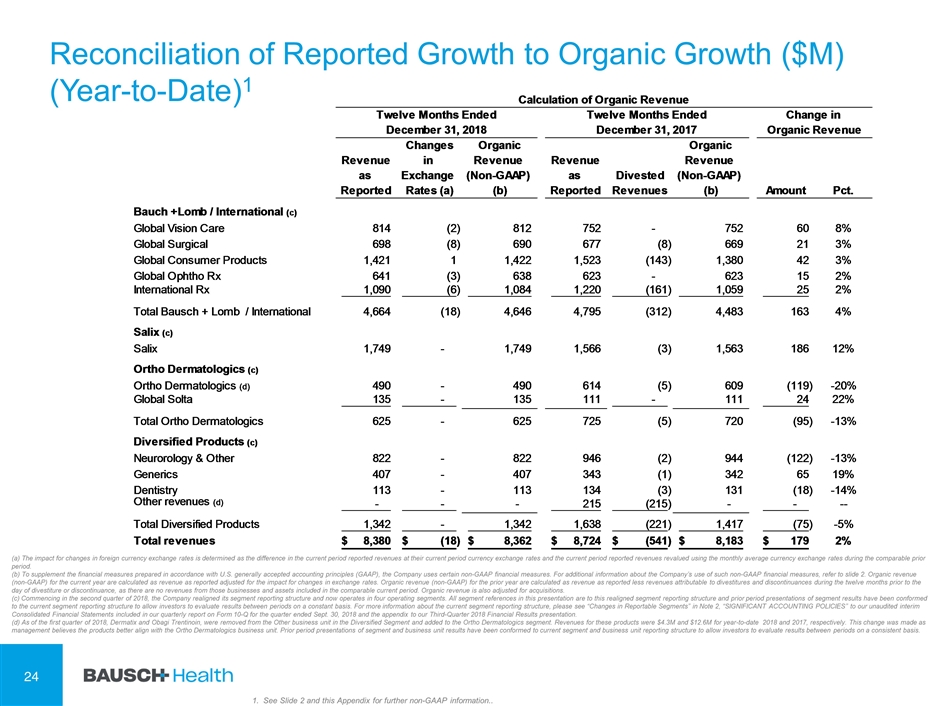

Reconciliation of Reported Growth to Organic Growth ($M) (Year-to-Date)1 (a) The impact for changes in foreign currency exchange rates is determined as the difference in the current period reported revenues at their current period currency exchange rates and the current period reported revenues revalued using the monthly average currency exchange rates during the comparable prior period. (b) To supplement the financial measures prepared in accordance with U.S. generally accepted accounting principles (GAAP), the Company uses certain non-GAAP financial measures. For additional information about the Company’s use of such non-GAAP financial measures, refer to slide 2. Organic revenue (non-GAAP) for the current year are calculated as revenue as reported adjusted for the impact for changes in exchange rates. Organic revenue (non-GAAP) for the prior year are calculated as revenue as reported less revenues attributable to divestitures and discontinuances during the twelve months prior to the day of divestiture or discontinuance, as there are no revenues from those businesses and assets included in the comparable current period. Organic revenue is also adjusted for acquisitions. (c) Commencing in the second quarter of 2018, the Company realigned its segment reporting structure and now operates in four operating segments. All segment references in this presentation are to this realigned segment reporting structure and prior period presentations of segment results have been conformed to the current segment reporting structure to allow investors to evaluate results between periods on a constant basis. For more information about the current segment reporting structure, please see “Changes in Reportable Segments” in Note 2, “SIGNIFICANT ACCOUNTING POLICIES” to our unaudited interim Consolidated Financial Statements included in our quarterly report on Form 10-Q for the quarter ended Sept. 30, 2018 and the appendix to our Third-Quarter 2018 Financial Results presentation. (d) As of the first quarter of 2018, Dermatix and Obagi Trentinoin, were removed from the Other business unit in the Diversified Segment and added to the Ortho Dermatologics segment. Revenues for these products were $4.3M and $12.6M for year-to-date 2018 and 2017, respectively. This change was made as management believes the products better align with the Ortho Dermatologics business unit. Prior period presentations of segment and business unit results have been conformed to current segment and business unit reporting structure to allow investors to evaluate results between periods on a consistent basis. See Slide 2 and this Appendix for further non-GAAP information..

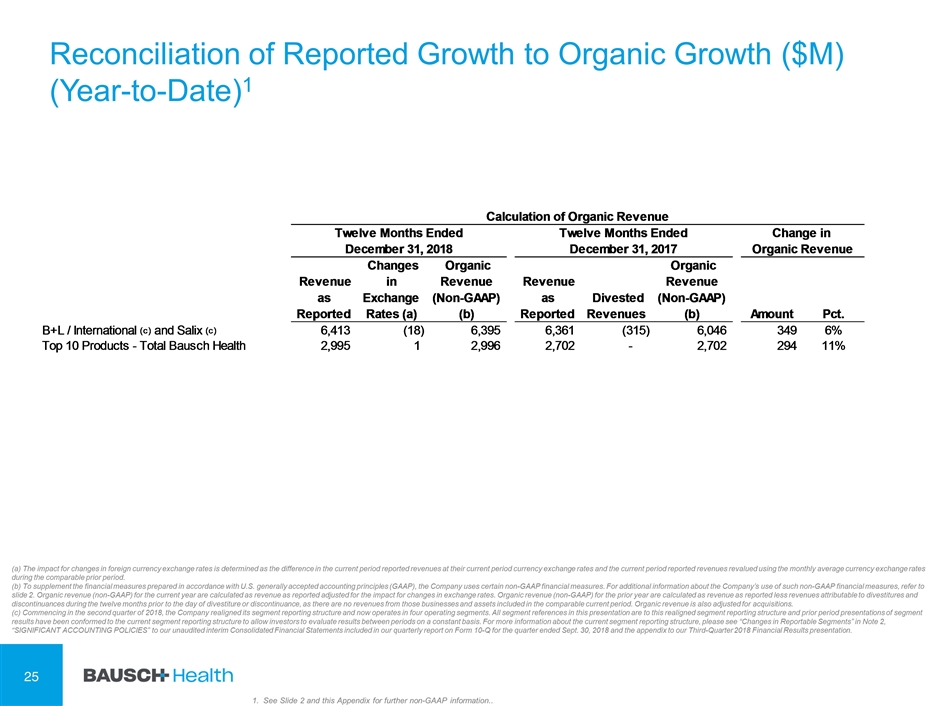

Reconciliation of Reported Growth to Organic Growth ($M) (Year-to-Date)1 (a) The impact for changes in foreign currency exchange rates is determined as the difference in the current period reported revenues at their current period currency exchange rates and the current period reported revenues revalued using the monthly average currency exchange rates during the comparable prior period. (b) To supplement the financial measures prepared in accordance with U.S. generally accepted accounting principles (GAAP), the Company uses certain non-GAAP financial measures. For additional information about the Company’s use of such non-GAAP financial measures, refer to slide 2. Organic revenue (non-GAAP) for the current year are calculated as revenue as reported adjusted for the impact for changes in exchange rates. Organic revenue (non-GAAP) for the prior year are calculated as revenue as reported less revenues attributable to divestitures and discontinuances during the twelve months prior to the day of divestiture or discontinuance, as there are no revenues from those businesses and assets included in the comparable current period. Organic revenue is also adjusted for acquisitions. (c) Commencing in the second quarter of 2018, the Company realigned its segment reporting structure and now operates in four operating segments. All segment references in this presentation are to this realigned segment reporting structure and prior period presentations of segment results have been conformed to the current segment reporting structure to allow investors to evaluate results between periods on a constant basis. For more information about the current segment reporting structure, please see “Changes in Reportable Segments” in Note 2, “SIGNIFICANT ACCOUNTING POLICIES” to our unaudited interim Consolidated Financial Statements included in our quarterly report on Form 10-Q for the quarter ended Sept. 30, 2018 and the appendix to our Third-Quarter 2018 Financial Results presentation. See Slide 2 and this Appendix for further non-GAAP information..