Morgan Stanley Insured Municipal Income Trust (the ‘‘Trust’’) is registered under the Investment Company Act of 1940, as amended, as a diversified, closed-end management investment company. The Trust's investment objective is to provide current income which is exempt from federal income tax. The Trust was organized as a Massachusetts business trust on March 12, 1992 and commenced operations on February 26, 1993.

Morgan Stanley Insured Municipal Income Trust

Notes to Financial Statements  April 30, 2006 (unaudited) continued

April 30, 2006 (unaudited) continued

D. Federal Income Tax Policy — It is the Trust’s policy to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its taxable and nontaxable income to its shareholders. Accordingly, no federal income tax provision is required.

E. Dividends and Distributions to Shareholders — Dividends and distributions to shareholders are recorded on the ex-dividend date.

F. Use of Estimates — The preparation of financial statements in accordance with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts and disclosures. Actual results could differ from those estimates.

2. Investment Advisory/Administration Agreements

Pursuant to an Investment Advisory Agreement with Morgan Stanley Investment Advisors Inc. (the ‘‘Investment Adviser’’), the Trust pays an advisory fee, calculated weekly and payable monthly, by applying the annual rate of 0.27% to the Trust's weekly net assets including preferred shares.

Pursuant to an Administration Agreement with Morgan Stanley Services Company Inc. (the ‘‘Administrator’’), an affiliate of the Investment Adviser, the Trust pays an administration fee, calculated weekly and payable monthly, by applying the annual rate of 0.08% to the Trust’s weekly net assets including preferred shares.

3. Security Transactions and Transactions with Affiliates

The cost of purchases and proceeds from sales of portfolio securities, excluding short-term investments, for the six months ended April 30, 2006, aggregated $34,082,755 and $43,941,892, respectively.

Morgan Stanley Trust, an affiliate of the Investment Adviser and Administrator, is the Trust's transfer agent.

The Trust has an unfunded noncontributory defined benefit pension plan covering certain independent Trustees of the Trust who will have served as independent Trustees for at least five years at the time of retirement. Benefits under this plan are based on factors which include years of service and compensation. The Trustees voted to close the plan to new participants and eliminate the future benefits growth due to increases to compensation after July 31, 2003. Aggregate pension costs for the six months ended April 30, 2006, included in Trustees' fees and expenses in the Statement of Operations amounted to $3,079. At April 30, 2006, the Trust had an accrued pension liability of $54,793 which is included in accrued expenses in the Statement of Assets and Liabilities.

The Trust has an unfunded Deferred Compensation Plan (the ‘‘Compensation Plan’’) which allows each independent Trustee to defer payment of all, or a portion, of the fees he receives for serving on the Board of Trustees. Each eligible Trustee generally may elect to have the deferred amounts credited with a return equal to the total return on one or more of the Morgan Stanley funds that are offered as investment options under

22

Morgan Stanley Insured Municipal Income Trust

Notes to Financial Statements  April 30, 2006 (unaudited) continued

April 30, 2006 (unaudited) continued

the Compensation Plan. Appreciation/depreciation and distributions received from these investments are recorded with an offsetting increase/decrease in the deferred compensation obligation and do not affect the net asset value of the Trust.

4. Preferred Shares of Beneficial Interest

The Trust is authorized to issue up to 1,000,000 non-participating preferred shares of beneficial interest having a par value of $.01 per share, in one or more series, with rights as determined by the Trustees, without approval of the common shareholders. The Trust has issued Series 1 through 5 Auction Rate Preferred Shares (‘‘preferred shares’’) which have a liquidation value of $50,000 per share plus the redemption premium, if any, plus accumulated but unpaid dividends, whether or not declared, thereon to the date of distribution. The Trust may redeem such shares, in whole or in part, at the original purchase price of $50,000 per share plus accumulated but unpaid dividends, whether or not declared, thereon to the date of redemption.

Dividends, which are cumulative, are reset through auction procedures.

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| SERIES |  | SHARES* |  | AMOUNT IN

THOUSANDS* |  | RATE* |  | RESET

DATE |  | RANGE OF

DIVIDEND RATES** |

| 1 |  | | 400 | |  | $ | 20,000 | |  | | 3.60 | % |  | 05/01/06 |  | 2.30% – 3.70% |

| 2 |  | | 900 | |  | | 45,000 | |  | | 3.70 | |  | 05/01/06 |  | 2.58 – 3.75 |

| 3 |  | | 1,000 | |  | | 50,000 | |  | | 2.24 | |  | 07/10/06 |  | 2.24 |

| 4 |  | | 400 | |  | | 20,000 | |  | | 3.46 | |  | 05/01/06 |  | 2.85 – 3.64 |

| 5 |  | | 400 | |  | | 20,000 | |  | | 3.60 | |  | 05/01/06 |  | 2.20 – 3.70 |

|

| * | As of April 30, 2006. |

| ** | For the six months ended April 30, 2006. |

Subsequent to April 30, 2006 and up through June 2, 2006, the Trust paid dividends to each of the Series 1 through 5 at rates ranging from 2.24% to 3.70% in the aggregate amount of $550,539.

The Trust is subject to certain restrictions relating to the preferred shares. Failure to comply with these restrictions could preclude the Trust from declaring any distributions to common shareholders or purchasing common shares and/or could trigger the mandatory redemption of preferred shares at liquidation value.

The preferred shares, which are entitled to one vote per share, generally vote with the common shares but vote separately as a class to elect two Trustees and on any matters affecting the rights of the preferred shares.

23

Morgan Stanley Insured Municipal Income Trust

Notes to Financial Statements  April 30, 2006 (unaudited) continued

April 30, 2006 (unaudited) continued

5. Common Shares of Beneficial Interest

Transactions in common shares of beneficial interest were as follows:

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  | SHARES |  | PAR VALUE |  | CAPITAL

PAID IN

EXCESS OF

PAR VALUE |

| Balance, October 31, 2004 |  | | 23,238,838 | |  | $ | 232,388 | |  | $ | 336,033,369 | |

| Treasury shares purchased and retired (weighted average discount 11.07%)*. |  | | (1,108,679 | ) |  | | (11,087 | ) |  | | (15,468,307 | ) |

| Balance, October 31, 2005 |  | | 22,130,159 | |  | | 221,301 | |  | | 320,565,062 | |

| Treasury shares purchased and retired (weighted average discount 8.68%)*. |  | | (471,200 | ) |  | | (4,712 | ) |  | | (6,694,020 | ) |

| Balance, April 30, 2006 |  | | 21,658,959 | |  | $ | 216,589 | |  | $ | 313,871,042 | |

|

| * | The Trustees have voted to retire the shares purchased. |

6. Dividends to Common Shareholders

On March 28, 2006, the Trust declared the following dividends from net investment income:

|  |  |  |  |  |  |  |  |  |  |

AMOUNT

PER SHARE |  | RECORD

DATE |  | PAYABLE

DATE |

| $0.0675 |  | | May 5, 2006 | |  | | May 19, 2006 | |

| $0.0675 |  | | June 9, 2006 | |  | | June 23, 2006 | |

|

7. Expense Offset

The expense offset represents a reduction of custodian and transfer agent fees and expenses for earnings on cash balances maintained by the Trust.

8. Risks Relating to Certain Financial Instruments

The Trust may invest a portion of its assets in residual interest bonds, which are inverse floating rate municipal obligations. The prices of these securities are subject to greater market fluctuations during periods of changing prevailing interest rates than are comparable fixed rate obligations.

To hedge against adverse interest rate changes, the Trust may invest in financial futures contracts or municipal bond index futures contracts (‘‘futures contracts’’).

These futures contracts involve elements of market risk in excess of the amount reflected in the Statement of Assets and Liabilities. The Trust bears the risk of an unfavorable change in the value of the underlying securities. Risks may also arise upon entering into these contracts from the potential inability of the counterparties to meet the terms of their contracts.

24

Morgan Stanley Insured Municipal Income Trust

Notes to Financial Statements  April 30, 2006 (unaudited) continued

April 30, 2006 (unaudited) continued

9. Federal Income Tax Status

The amount of dividends and distributions from net investment income and net realized capital gains are determined in accordance with federal income tax regulations which may differ from generally accepted accounting principles. These ‘‘book/tax’’ differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the capital accounts based on their federal tax-basis treatment; temporary differences do not require reclassification. Dividends and distributions which exceed net investment income and net realized capital gains for tax purposes are reported as distributions of paid-in-capital.

As of October 31, 2005, the Trust had temporary book/tax differences primarily attributable to book amortization of discounts on debt securities, mark-to-market of open futures contracts and dividend payable.

25

Morgan Stanley Insured Municipal Income Trust

Financial Highlights

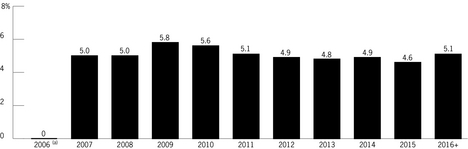

Selected ratios and per share data for a common share of beneficial interest outstanding throughout each period:

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  | FOR THE SIX

MONTHS ENDED

APRIL 30, 2006 |  | FOR THE YEAR ENDED OCTOBER 31, |  |

| |  | 2005 |  | 2004 |  | 2003 |  | 2002 |  | 2001 |

| |  | (unaudited) |  | | | |  | | | |  | | | |  | | | |  | | | |

| Selected Per Share Data: |  | | | |  | | | |  | | | |  | | | |  | | | |  | | | |

| Net asset value, beginning of period |  | $ | 15.50 | |  | $ | 15.60 | |  | $ | 15.76 | |  | $ | 15.67 | |  | $ | 15.42 | |  | $ | 14.44 | |

| Income (loss) from investment operations: |  | | | |  | | | |  | | | |  | | | |  | | | |  | | | |

| Net investment income* |  | | 0.47 | |  | | 0.94 | |  | | 0.95 | |  | | 1.01 | |  | | 1.04 | |  | | 1.03 | |

| Net realized and unrealized gain (loss) |  | | (0.02 | ) |  | | (0.19 | ) |  | | 0.17 | |  | | 0.03 | |  | | 0.11 | |  | | 0.90 | |

| Common share equivalent of dividends paid to preferred shareholders* |  | | (0.10 | ) |  | | (0.13 | ) |  | | (0.12 | ) |  | | (0.10 | ) |  | | (0.13 | ) |  | | (0.22 | ) |

Total income from investment

operations |  | | 0.35 | |  | | 0.62 | |  | | 1.00 | |  | | 0.94 | |  | | 1.02 | |  | | 1.71 | |

| Less dividends and distributions from: |  | | | |  | | | |  | | | |  | | | |  | | | |  | | | |

| Net investment income |  | | (0.40 | ) |  | | (0.81 | ) |  | | (0.92 | ) |  | | (0.90 | ) |  | | (0.82 | ) |  | | (0.78 | ) |

| Net realized gain |  | | (0.05 | ) |  | | — | |  | | (0.29 | ) |  | | — | |  | | — | |  | | — | |

| Total dividends and distributions. |  | | (0.45 | ) |  | | (0.81 | ) |  | | (1.21 | ) |  | | (0.90 | ) |  | | (0.82 | ) |  | | (0.78 | ) |

Anti-dilutive effect of acquiring treasury

shares*. |  | | 0.03 | |  | | 0.09 | |  | | 0.05 | |  | | 0.05 | |  | | 0.05 | |  | | 0.05 | |

| Net asset value, end of period |  | $ | 15.43 | |  | $ | 15.50 | |  | $ | 15.60 | |  | $ | 15.76 | |  | $ | 15.67 | |  | $ | 15.42 | |

| Market value, end of period |  | $ | 14.53 | |  | $ | 13.86 | |  | $ | 14.09 | |  | $ | 14.73 | |  | $ | 14.05 | |  | $ | 14.13 | |

| Total Return† |  | | 8.21 | % (1) |  | | 4.19 | % |  | | 3.91 | % |  | | 11.53 | % |  | | 5.35 | % |  | | 16.70 | % |

Ratios to Average Net Assets of

Common Shareholders: |  | | | |  | | | |  | | | |  | | | |  | | | |  | | | |

| Total expenses (before expense offset) |  | | 0.76 | % (2) |  | | 0.80 | % (3) |  | | 0.82 | % (3) |  | | 0.75 | % (3) |  | | 0.72 | % |  | | 0.71 | % |

Net investment income before preferred

stock dividends |  | | 6.05 | % (2) |  | | 6.01 | % |  | | 6.11 | % |  | | 6.38 | % |  | | 6.82 | % |  | | 6.84 | % |

| Preferred stock dividends |  | | 1.25 | % (2) |  | | 0.81 | % |  | | 0.76 | % |  | | 0.66 | % |  | | 0.87 | % |  | | 1.43 | % |

Net investment income available to

common shareholders |  | | 4.80 | % (2) |  | | 5.20 | % |  | | 5.35 | % |  | | 5.72 | % |  | | 5.95 | % |  | | 5.41 | % |

| Supplemental Data: |  | | | |  | | | |  | | | |  | | | |  | | | |  | | | |

Net assets applicable to common

shareholders, end of period, in

thousands |  | | $334,109 | |  | | $342,956 | |  | | $362,468 | |  | | $382,145 | |  | | $396,360 | |  | | $405,226 | |

Asset coverage on preferred shares at

end of period |  | | 318 | % |  | | 321 | % |  | | 334 | % |  | | 346 | % |  | | 355 | % |  | | 361 | % |

| Portfolio turnover rate |  | | 7 | % (1) |  | | 15 | % |  | | 17 | % |  | | 43 | % |  | | 17 | % |  | | 13 | % |

|

|

| * | The per share amounts were computed using an average number of common shares outstanding during the period. |

| † | Total return is based upon the current market value on the last day of each period reported. Dividends and distributions are assumed to be reinvested at the prices obtained under the Trust's dividend reinvestment plan. Total return does not reflect brokerage commissions. |

| (1) | Not annualized. |

| (2) | Annualized. |

| (3) | Does not reflect the effect of expense offset of 0.01%. |

See Notes to Financial Statements

26

Morgan Stanley Insured Municipal Income Trust

Revised Investment Policy

On August 24, 2005, the Trustees of Morgan Stanley Insured Municipal Income Trust (the ‘‘Trust’’) approved a change to the Trust's investment policy with respect to inverse floating rate municipal obligations whereby the Trust now would be permitted to invest up to 15% of its assets in inverse floating rate municipal obligations. The inverse floating rate municipal obligations in which the Trust will invest are typically created through a division of a fixed rate municipal obligation into two separate instruments, a short-term obligation and a long-term obligation. The interest rate on the short-term obligation is set at periodic auctions. The interest rate on the long-term obligation is the rate the issuer would have paid on the fixed income obligation: (i) plus the difference between such fixed rate and the rate on the short-term obligation, if the short-term rate is lower than the fixed rate; or (ii) minus such difference if the interest rate on the short-term obligation is higher than the fixed rate. The interest rates on these obligations generally move in the reverse direction of market interest rates. If market interest rates fall, the interest rate on the obligation will increase and if market interest rates increase, the interest rate on the obligation will fall. Inverse floating rate municipal obligations offer the potential for higher income than is available from fixed rate obligations of comparable maturity and credit rating. They also carry greater risks. In particular, the prices of inverse floating rate municipal obligations are more volatile, i.e. , they increase and decrease in response to changes in interest rates to a greater extent than comparable fixed rate obligations.

27

|  |  |

Trustees Michael Bozic

Charles A. Fiumefreddo

Edwin J. Garn

Wayne E. Hedien

James F. Higgins

Dr. Manuel H. Johnson

Joseph J. Kearns

Michael E. Nugent

Fergus Reid Officers Charles A. Fiumefreddo

Chairman of the Board Ronald E. Robison

President and Principal Executive Officer J. David Germany

Vice President Dennis F. Shea

Vice President Barry Fink

Vice President Amy R. Doberman

Vice President Carsten Otto

Chief Compliance Officer Stefanie V. Chang Yu

Vice President Francis J. Smith

Treasurer and Chief Financial Officer Mary E. Mullin

Secretary Transfer Agent Morgan Stanley Trust

Harborside Financial Center, Plaza Two

Jersey City, New Jersey 07311 Independent Registered Public Accounting Firm Deloitte & Touche LLP

Two World Financial Center

New York, New York 10281 Investment Adviser Morgan Stanley Investment Advisors Inc.

1221 Avenue of the Americas

New York, New York 10020 The financial statements included herein have been taken from the records of the Trust without examination by the independent auditors and accordingly they do not express an opinion thereon. Investments and services offered through Morgan Stanley DW Inc., member SIPC. © 2006 Morgan Stanley

IIMRPT-37958RPT-RA06-00483P-Y04/06 |  | MORGAN STANLEY FUNDS |

Morgan Stanley

Insured Municipal

Income Trust

Semiannual Report

April 30, 2006

|

|

Item 2. Code of Ethics.

Not applicable for semiannual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semiannual reports.

Item 4. Principal Accountant Fees and Services

Not applicable for semiannual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable for semiannual reports.

Item 6.

Refer to Item 1.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End

Management Investment Companies.

Not applicable for semiannual reports.

Item 8. Portfolio Managers of Closed-End Management Investment Companies

Applicable only to reports covering periods ending on or after December 31,

2005.

Item 9. Closed-End Fund Repurchases

REGISTRANT PURCHASE OF EQUITY SECURITIES

- ------------------------------- ----------------- --------------------- --------------------- ---------------------

Period (a) Total (b) Average Price (c) Total Number of (d) Maximum Number

Number of Paid per Share (or Shares (or Units) (or Approximate

Shares (or Unit) Purchased as Part Dollar Value) of

Units) Purchased of Publicly Shares (or Units)

Announced Plans or that May Yet Be

Programs Purchased Under the

Plans or Programs

- ------------------------------- ----------------- --------------------- --------------------- ---------------------

November 1, 2005--November

30, 2005 51,000 $13.7414 N/A N/A

- ------------------------------- ----------------- --------------------- --------------------- ---------------------

December 1, 2005--December

31, 2005 67,100 $13.7613 N/A N/A

- ------------------------------- ----------------- --------------------- --------------------- ---------------------

January 1, 2006--January 31,

2006 99,100 $14.2235 N/A N/A

- ------------------------------- ----------------- --------------------- --------------------- ---------------------

February 1, 2006--February

28, 2006 79,800 $14.4562 N/A N/A

- ------------------------------- ----------------- --------------------- --------------------- ---------------------

March 1, 2006--

March 31, 2006 106,200 $14.3293 N/A N/A

- ------------------------------- ----------------- --------------------- --------------------- ---------------------

April 1, 2006--

April 30, 2006 68,000 $14.5867 N/A N/A

- ------------------------------- ----------------- --------------------- --------------------- ---------------------

Total 471,200 $14.1831 N/A N/A

- ------------------------------- ----------------- --------------------- --------------------- ---------------------

Item 10. Submission of Matters to a Vote of Security Holders

Not applicable.

Item 11. Controls and Procedures

(a) The Trust's principal executive officer and principal financial officer have

concluded that the Trust's disclosure controls and procedures are sufficient to

ensure that information required to be disclosed by the Trust in this Form N-CSR

was recorded, processed, summarized and reported within the time periods

specified in the Securities and Exchange Commission's rules and forms, based

upon such officers' evaluation of these controls and procedures as of a date

within 90 days of the filing date of the report.

(b) There were no changes in the registrant's internal control over financial

reporting that

2

occurred during the second fiscal quarter of the period covered

by this report that has materially affected, or is reasonably likely to

materially affect, the registrant's internal control over financial reporting.

Item 12. Exhibits

(a) Code of Ethics - Not applicable for semiannual reports.

(b) A separate certification for each principal executive officer and principal

financial officer of the registrant are attached hereto as part of EX-99.CERT.

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and

the Investment Company Act of 1940, the registrant has duly caused this report

to be signed on its behalf by the undersigned, thereunto duly authorized.

Morgan Stanley Insured Municipal Income Trust

/s/ Ronald E. Robison

Ronald E. Robison

Principal Executive Officer

June 20, 2006

Pursuant to the requirements of the Securities Exchange Act of 1934 and

the Investment Company Act of 1940, this report has been signed by the following

persons on behalf of the registrant and in the capacities and on the dates

indicated.

/s/ Ronald E. Robison

Ronald E. Robison

Principal Executive Officer

June 20, 2006

/s/ Francis Smith

Francis Smith

Principal Financial Officer

June 20, 2006

4

EXHIBIT 12 B1

CERTIFICATION OF PRINCIPAL EXECUTIVE OFFICER

CERTIFICATIONS

--------------

I, Ronald E. Robison, certify that:

1. I have reviewed this report on Form N-CSR of Morgan Stanley Insured

Municipal Income Trust;

2. Based on my knowledge, this report does not contain any untrue statement of

a material fact or omit to state a material fact necessary to make the

statements made, in light of the circumstances under which such statements

were made, not misleading with respect to the period covered by this

report;

3. Based on my knowledge, the financial statements and other financial

information included in this report, fairly present in all material

respects the financial condition, results of operations, changes in net

assets, and cash flows (if the financial statements are required to include

a statement of cash flows) of the registrant as of, and for, the periods

presented in this report;

4. The registrant's other certifying officers and I are responsible for

establishing and maintaining disclosure controls and procedures (as defined

in Rule 30a-3(c) under the Investment Company Act of 1940) and internal

control over financial reporting (as defined in Rule 30a-3(d) under the

Investment Company Act of 1940) for the registrant and have:

a) designed such disclosure controls and procedures, or caused such disclosure

controls and procedures to be designed under our supervision, to ensure

that material information relating to the registrant, including its

consolidated subsidiaries, is made known to us by others within those

entities, particularly during the period in which this report is being

prepared;

b) designed such internal control over financial reporting, or caused such

internal control over financial reporting to be designed under our

supervision, to provide reasonable assurance regarding the reliability of

financial reporting and the preparation of financial statements for

external purposes in accordance with generally accepted accounting

principles;

c) evaluated the effectiveness of the registrant's disclosure controls and

procedures and presented in this report our conclusions about the

effectiveness of the disclosure controls and procedures, as of a date

within 90 days prior to the filing date of this report based on such

evaluation; and

d) disclosed in this report any change in the registrant's internal control

over financial reporting that occurred during the registrant's most recent

fiscal half-year (the registrant's second fiscal half-year in the case of

an annual report) that has materially affected, or is reasonably likely to

materially affect, the registrant's internal control over financial

reporting; and

5. The registrant's other certifying officer(s) and I have disclosed to the

registrant's auditors and the audit committee of the registrant's board of

directors (or persons performing the equivalent functions):

5

a) all significant deficiencies and material weaknesses in the design or

operation of internal control over financial reporting which are reasonably

likely to adversely affect the registrant's ability to record, process,

summarize, and report financial information; and

b) any fraud, whether or not material, that involves management or other

employees who have a significant role in the registrant's internal controls

over financial reporting.

Date: June 20, 2006

/s/ Ronald E. Robison

Ronald E. Robison

Principal Executive Officer

6

EXHIBIT 12 B2

CERTIFICATION OF PRINCIPAL FINANCIAL OFFICER

CERTIFICATIONS

--------------

I, Francis Smith, certify that:

1. I have reviewed this report on Form N-CSR of Morgan Stanley Insured

Municipal Income Trust;

2. Based on my knowledge, this report does not contain any untrue statement of

a material fact or omit to state a material fact necessary to make the

statements made, in light of the circumstances under which such statements

were made, not misleading with respect to the period covered by this

report;

3. Based on my knowledge, the financial statements and other financial

information included in this report, fairly present in all material

respects the financial condition, results of operations, changes in net

assets, and cash flows (if the financial statements are required to include

a statement of cash flows) of the registrant as of, and for, the periods

presented in this report;

4. The registrant's other certifying officers and I are responsible for

establishing and maintaining disclosure controls and procedures (as defined

in Rule 30a-3(c) under the Investment Company Act of 1940) and internal

control over financial reporting (as defined in Rule 30a-3(d) under the

Investment Company Act of 1940) for the registrant and have:

a) designed such disclosure controls and procedures, or caused such disclosure

controls and procedures to be designed under our supervision, to ensure

that material information relating to the registrant, including its

consolidated subsidiaries, is made known to us by others within those

entities, particularly during the period in which this report is being

prepared;

b) designed such internal control over financial reporting, or caused such

internal control over financial reporting to be designed under our

supervision, to provide reasonable assurance regarding the reliability of

financial reporting and the preparation of financial statements for

external purposes in accordance with generally accepted accounting

principles;

c) evaluated the effectiveness of the registrant's disclosure controls and

procedures and presented in this report our conclusions about the

effectiveness of the disclosure controls and procedures, as of a date

within 90 days prior to the filing date of this report based on such

evaluation; and

d) disclosed in this report any change in the registrant's internal control

over financial reporting that occurred during the registrant's most recent

fiscal half-year (the registrant's second fiscal half-year in the case of

an annual report) that has materially affected, or is reasonably likely to

materially affect, the registrant's internal control over financial

reporting; and

5. The registrant's other certifying officer(s) and I have disclosed to the

registrant's auditors and the audit committee of the registrant's board of

directors (or persons performing the equivalent functions):

7

a) all significant deficiencies and material weaknesses in the design or

operation of internal control over financial reporting which are reasonably

likely to adversely affect the registrant's ability to record, process,

summarize, and report financial information; and

b) any fraud, whether or not material, that involves management or other

employees who have a significant role in the registrant's internal controls

over financial reporting.

Date: June 20, 2006

/s/ Francis Smith

Francis Smith

Principal Financial Officer

8

SECTION 906 CERTIFICATION

Certification Pursuant to 18 U.S.C. Section 1350,

As Adopted Pursuant to

Section 906 of the Sarbanes-Oxley Act of 2002

Morgan Stanley Insured Municipal Income Trust

In connection with the Report on Form N-CSR (the "Report") of the

above-named issuer for the period ended April 30, 2006 that is accompanied by

this certification, the undersigned hereby certifies that:

1. The Report fully complies with the requirements of Section 13(a) or

15(d) of the Securities Exchange Act of 1934; and

2. The information contained in the Report fairly presents, in all

material respects, the financial condition and results of operations of

the Issuer.

Date: June 20, 2006 /s/ Ronald E. Robison

---------------------------

Ronald E. Robison

Principal Executive Officer

A signed original of this written statement required by Section 906 has been

provided to Morgan Stanley Insured Municipal Income Trust and will be retained

by Morgan Stanley Insured Municipal Income Trust and furnished to the Securities

and Exchange Commission or its staff upon request.

9

SECTION 906 CERTIFICATION

Certification Pursuant to 18 U.S.C. Section 1350,

As Adopted Pursuant to

Section 906 of the Sarbanes-Oxley Act of 2002

Morgan Stanley Insured Municipal Income Trust

In connection with the Report on Form N-CSR (the "Report") of the

above-named issuer for the period ended April 30, 2006 that is accompanied by

this certification, the undersigned hereby certifies that:

1. The Report fully complies with the requirements of Section 13(a) or

15(d) of the Securities Exchange Act of 1934; and

2. The information contained in the Report fairly presents, in all

material respects, the financial condition and results of operations of

the Issuer.

Date: June 20, 2006 /s/ Francis Smith

----------------------

Francis Smith

Principal Financial Officer

A signed original of this written statement required by Section 906 has been

provided to Morgan Stanley Insured Municipal Income Trust and will be retained

by Morgan Stanley Insured Municipal Income Trust and furnished to the Securities

and Exchange Commission or its staff upon request.

10

April 30, 2006 (unaudited)

April 30, 2006 (unaudited)