SECURITIES AND EXCHANGE COMMISSION

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

811-06590

Invesco Value Municipal Income Trust

(Exact name of registrant as specified in charter)

1555 Peachtree Street, N.E., Suite 1800 Atlanta, Georgia 30309

(Address of principal executive offices) (Zip code)

Glenn Brightman 1555 Peachtree Street, N.E., Suite 1800 Atlanta, Georgia 30309

(Name and address of agent for service)

Registrant’s telephone number, including area code: (713)

626-1919

Date of fiscal year end: 2/29

Date of reporting period: 2/29/2024

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

(a) The Registrant’s annual report transmitted to shareholders pursuant to Rule

30e-1

under the Investment Company Act of 1940 is as follows:

| | |

| | |

Annual Report to Shareholders | | |

Invesco Value Municipal Income Trust

Management’s Discussion of Trust Performance

| | | | |

| |

| |

| For the fiscal year ended February 29, 2024, Invesco Value Municipal Income Trust (the Trust), at net asset value (NAV), outperformed its style-specific benchmark, the S&P Municipal Bond 5+ Year Investment Grade Index. The Trust’s return can be calculated based on either the market price or the NAV of its shares. NAV per share is determined by dividing the value of the Trust’s portfolio securities, cash and other assets, less all liabilities and preferred shares, by the total number of common shares outstanding. Market price reflects the supply and demand for Trust shares. As a result, the two returns can differ, as they did during the fiscal year. | |

| |

| |

Total returns, 2/28/23 to 2/29/24 | |

| Trust at NAV | | | 8.28 | % |

| Trust at Market Value | | | 1.58 | |

S&P Municipal Bond Index (Broad Market Index) | | | 5.50 | |

S&P Municipal Bond 5+ Year Investment Grade Index (Style-Specific Index) | | | 5.88 | |

| Market Price Discount to NAV as of 2/29/24 | | | -13.04 | |

| |

Source(s): RIMES Technologies Corp. | | | | |

Amount includes the effect of the Adviser pay-in for an economic loss that occurred on October 4, 2023. Had the pay-in not been made the 1 year NAV total return would have been 8.15%. The performance data quoted represent past performance and cannot guarantee comparable future results; current performance may be lower or higher. Investment return, NAV and common share market price will fluctuate so that you may have a gain or loss when you sell shares. Please visit invesco.com/us for the most recent month-end performance. Performance figures reflect Trust expenses, the reinvestment of distributions (if any) and changes in NAV for performance based on NAV and changes in market price for performance based on market price. Since the Trust is a closed-end management investment company, shares of the Trust may trade at a discount or premium from the NAV. This characteristic is separate and distinct from the risk that NAV could decrease as a result of investment activities and may be a greater risk to investors expecting to sell their shares after a short time. The Trust cannot predict whether shares will trade at, above or below NAV. The Trust should not be viewed as a vehicle for trading purposes. It is designed primarily for risk-tolerant long-term investors. | |

Market conditions and your Trust

During the fiscal year ended February 29, 2024, investment grade municipal bonds returned 5.42%, high yield municipal bonds returned 8.30% and taxable municipal bonds returned 4.78%.

1

At the beginning of the fiscal year, investors were hopeful for the 2023 calendar year, despite ongoing concerns about inflation and interest rates; however, in March, the focus unexpectedly shifted as Silicon Valley Bank collapsed after a bank run, marking the second-largest bank failure in US history. Fears about the health of the global banking system ensued, and demand for perceived safe-haven asset classes increased, driving down Treasury and municipal yields. Although three other bank failures followed, fears of larger systemic instability faded in the following months.

Debt ceiling concerns dominated most of the second quarter of 2023. The US government could have defaulted on its debt obligations, causing economic fallout across the global economy, had congressional action not been taken in early June. After months of

negotiations between the White House and congressional leaders, just ahead of the payment deadline, the US Congress passed and President Biden signed into law

the Fiscal Responsibility Act, an agreement that suspends the limit on the federal debt ceiling until 2025 in exchange for capping federal spending.

In its efforts to rein in inflation without harming employment or the overall economy, the Federal Reserve Board (the Fed) continued with its most aggressive monetary policy since the 1980s. The Fed raised the federal funds rate in March, May and July, bringing the target rate to 5.50%.

2

However, investor sentiment shifted in early November, as the Fed held interest rates steady and publicly backed away from the rate hike it had signaled for December. Bond yields fell, igniting a rally across the fixed income market, including municipal bonds. The rally continued through November and into December as inflation continued to ease, and US economic growth remained contained. In December, the Fed again left interest rates unchanged and adopted a transitory tone, suggesting to market participants that rate cuts might be coming in 2024.

2

New municipal supply continued at a slow pace as issuers, with cash on their balance sheets, have been reluctant to issue at higher interest rates. However, 2024 began with the highest

tax-exempt

supply seen over a January-February period since 2007: $60 billion.

1

This skewed the fiscal year’s new issuance

total to $388 billion, up 15% from the previous year’s $338 billion.

1

2024 was also constructive in terms of inflows to municipal funds. Following two years of outsized inflows and outflows, the municipal market began its return to a more normalized trend as we finished the fiscal year.

3

As a result of Puerto Rico’s restructuring of $22 billion of general obligation debt in March 2022, marking significant progress towards its long-winded bankruptcy process, the Commonwealth’s weight in the Bloomberg High Yield Municipal Bond Index increased from 13% in February 2019 to 17% in March 2022 as the newly restructured bonds reentered the index.

1

During the fiscal year, the focus turned to the Puerto Rico Electric and Power Authority (PREPA). As of February 29, 2024, bankruptcy negotiations and U.S. District Court proceedings related to PREPA were ongoing.

Municipal bonds have a long history of low defaults as many are issued to fund essential services to Americans. This continues to be the case as evidenced by S&P rating changes – during calendar year 2023, S&P’s rating activity was positive, with 949 ratings upgraded versus 278 downgraded, translating to more than three upgrades for every downgrade.

4

This positive dynamic, which we believe will continue, likely stems from benefits of the various federal stimulus measures, including the American Rescue Plan Act, the Infrastructure Investment and Jobs Act and the Inflation Reduction Act, as well as higher revenues collected by state and local governments.

We believe the valuable benefits of municipal bonds will prevail over current market volatility and economic uncertainty. We continue to rely on our experienced portfolio managers and credit analysts to weather the economic challenges while identifying marketplace opportunities to add long-term value for shareholders.

During the fiscal year, an overweight allocation in tobacco settlement bonds contributed to the Trust’s relative return compared to its style-specific benchmark. An overweight exposure to

non-rated

bonds was additive to relative performance. On a state level, bonds domiciled in Wisconsin contributed to relative return.

Underweight allocations to state and local general obligation bonds were detractive from relative return over the fiscal year. An underweight exposure to AAA and

AA-rated†

bonds detracted from relative return. On a state level, bonds domiciled in Pennsylvania detracted from relative performance.

One important factor affecting the Trust’s performance relative to its style-specific benchmark was the use of leverage. The Trust uses leverage because we believe that, over time, leveraging can provide opportunities for additional income and total return for common shareholders. However, the use of

| | |

| | Invesco Value Municipal Income Trust |

leverage also can expose common shareholders to additional volatility. For example, if the prices of securities held by a trust decline, the negative effect of these valuation changes on common-share NAV and total return is magnified by the use of leverage. Conversely, leverage may enhance common-share returns during periods when the prices of securities held by a trust generally are rising.

Over the fiscal year, leverage contributed to the Trust’s performance relative to its style-specific benchmark. The Trust achieved a leveraged position through the use of inverse floating rate securities and variable rate muni term preferred (VMTP) shares. Inverse floating rate securities or tender option bonds (TOBs) are instruments that have an inverse relationship to a referenced interest rate. VMTPs are a variable rate form of preferred stock with a mandatory redemption date. Inverse floating rate securities and VMTPs can be an efficient way to manage duration, yield curve exposure and credit exposure, potentially enhancing yield. At the close of the fiscal year, leverage accounted for 32% of the Trust’s total assets and it contributed to returns. For more information about the Trust’s use of leverage, see the Notes to Financial Statements later in this report.

We wish to remind you that the Trust is subject to interest rate risk, meaning when interest rates rise, the value of fixed income securities tends to fall. The degree to which the value of fixed income securities may decline due to rising interest rates may vary depending on the speed and magnitude of the increase in interest rates, as well as individual security characteristics, such as price, maturity, duration and coupon and market forces, such as supply and demand for similar securities. We are monitoring interest rates, and the market, economic and geopolitical factors that may impact the direction, speed and magnitude of changes to interest rates across the maturity spectrum, including the potential impact of monetary policy changes by the Fed and certain foreign central banks. If interest rates rise or fall faster than expected, markets may experience increased volatility, which may affect the value and/or liquidity of certain of the Trust’s investments and/or the market price of the Trust’s common shares.

Thank you for investing in Invesco Value Municipal Income Trust and for sharing our long-term investment horizon.

1 Source: Bloomberg LP

2 Source: US Federal Reserve

3 Source: Lipper Inc.

4 Source: Standard & Poor’s

† Standard & Poor’s, Fitch Ratings, Moody’s. A credit rating is an assessment provided by a nationally recognized statistical rating organization (NRSRO) of the creditworthiness of an issuer with respect to debt obligations, including specific securities, money market instruments or other debts. Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest); ratings are subject to change without notice.

“Non-Rated”

indicates the debtor was not rated and should not be interpreted as indicating low quality. For more

information on rating methodology, please visit spglobal.com, fitchratings.com and ratings.moodys.com.

Jack Connelly

Josh Cooney

Tim O’Reilly

Mark Paris

John Schorle

Rebecca Setcavage

Julius Williams

The views and opinions expressed in management’s discussion of Trust performance are those of Invesco Advisers, Inc. and its affiliates. These views and opinions are subject to change at any time based on factors such as market and economic conditions. These views and opinions may not be relied upon as investment advice or recommendations, or as an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Trust. Statements of fact are from sources considered reliable, but Invesco Advisers, Inc. makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

See important Trust and, if applicable, index disclosures later in this report.

| | |

| | Invesco Value Municipal Income Trust |

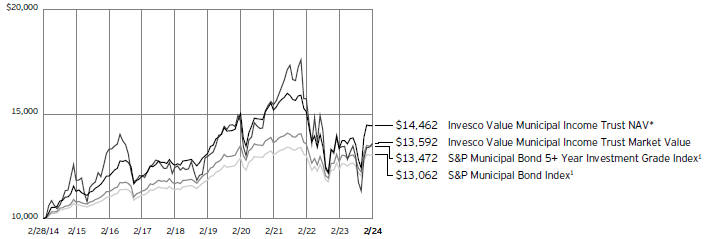

Your Trust’s Long-Term Performance

Results of a $10,000 Investment

Trust and index data from 2/28/14

1 Source: RIMES Technologies Corp.

*Amount includes the effect of the Adviser

pay-in

for an economic loss that occurred on October 4, 2023. Had the

pay-in

not been made the 1 year NAV total return would have been 8.15%.

Past performance cannot guarantee future results.

Performance shown in the chart does not reflect deduction of taxes a shareholder would pay on Trust distributions or sale of Trust shares.

| | |

| | Invesco Value Municipal Income Trust |

| | | | | | | | |

| |

Average Annual Total Returns | |

| |

| | | | | | | |

| 10 Years | | | 3.76 | % | | | 3.12 | % |

| 5 Years | | | 1.95 | | | | 0.92 | |

| 1 Year | | | 8.28 | | | | 1.58 | |

Amount includes the effect of the Adviser

pay-in

for an economic loss that occurred on October 4, 2023. Had the

pay-in

not been made the 1 year NAV total return would have been 8.15%.

The performance data quoted represent past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/performance for the most recent

month-end

performance.

Performance figures do not reflect deduction of taxes a shareholder would pay on Trust distributions or sale of Trust shares. Investment return and principal value will fluctuate so that you may have a gain or loss when you sell shares.

| | |

| | Invesco Value Municipal Income Trust |

| ∎ | Unless otherwise stated, information presented in this report is as of February 29, 2024, and is based on total net assets applicable to common shares. |

| ∎ | Unless otherwise noted, all data is provided by Invesco. |

| ∎ | To access your Trust’s reports, visit invesco.com/fundreports. |

About indexes used in this report

| ∎ | The is a broad, market value-weighted index that seeks to measure the performance of the US municipal bond market. |

| ∎ | The S&P Municipal Bond 5+ Year Investment Grade Index seeks to measure the performance of investment grade US municipal bonds with maturities equal to or greater than five years. |

| ∎ | The Trust is not managed to track the performance of any particular index, including the index(es) described here, and consequently, the performance of the Trust may deviate significantly from the performance of the index(es). |

| ∎ | A direct investment cannot be made in an index. Unless otherwise indicated, index |

| | results include reinvested dividends, and they do not reflect sales charges. Performance of the peer group, if applicable, reflects fund expenses; performance of a market index does not. |

Application of Control Share Provisions

| | Effective August 1, 2022, the Trust became automatically subject to newly enacted control share acquisition provisions within the Delaware Statutory Trust Act (the “Control Share Provisions”). In general, the Control Share Provisions limit the ability of holders of “control beneficial interests” to vote their shares of a fund above various threshold levels that start at 10% unless the other shareholders of such fund vote to reinstate those rights. “Control beneficial interests” are aggregated to include the holdings of related parties and shares acquired before the effective date of the Control Share Provisions. A fund’s board of trustees may exempt acquisitions from the application of the Control Share Provisions. |

At a Board meeting held on March 15-17, 2023, the Board approved the exemption of the Trust’s preferred shares from application of the Control Share Provisions.

The foregoing is only a summary of certain aspects of the Control Share Provisions. Shareholders should consult their own legal counsel with respect to the application of the Control Share Provisions to their beneficial interests of the Trust and any subsequent acquisitions of beneficial interests.

|

| NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE |

| | |

| | Invesco Value Municipal Income Trust |

Dividend Reinvestment Plan

The dividend reinvestment plan (the Plan) offers you a prompt and simple way to reinvest your dividends and capital gains distributions (Distributions) into additional shares of your Invesco

closed-end

Trust (the Trust). Under the Plan, the money you earn from Distributions will be reinvested automatically in more shares of the Trust, allowing you to potentially increase your investment over time. All shareholders in the Trust are automatically enrolled in the Plan when shares are purchased.

| | You may increase your shares in your Trust easily and automatically with the Plan. |

| | Shareholders who participate in the Plan may be able to buy shares at below-market prices when the Trust is trading at a premium to its net asset value (NAV). In addition, transaction costs are low because when new shares are issued by the Trust, there is no brokerage fee, and when shares are bought in blocks on the open market, the per share fee is shared among all participants. |

| | You will receive a detailed account statement from Computershare Trust Company, N.A. (the Agent), which administers the Plan. The statement shows your total Distributions, date of investment, shares acquired, and price per share, as well as the total number of shares in your reinvestment account. You can also access your account at invesco.com/closed-end. |

| | The Agent will hold the shares it has acquired for you in safekeeping. |

Who can participate in the Plan

If you own shares in your own name, your purchase will automatically enroll you in the Plan. If your shares are held in “street name” – in the name of your brokerage firm, bank, or other financial institution – you must instruct that entity to participate on your behalf. If they are unable to participate on your behalf, you may request that they reregister your shares in your own name so that you may enroll in the Plan.

If you haven’t participated in the Plan in the past or chose to opt out, you are still eligible to participate. Enroll by visiting

invesco.com/closed-end,

by calling toll-free 800 341 2929 or by notifying us in writing at Invesco

Closed-End

Funds, Computershare Trust Company, N.A., P.O. Box 43078, Providence, RI 02940-3078. If you are writing to us, please include the Trust name and account number and ensure that all shareholders listed on the account sign these written instructions. Your participation in the Plan will begin with the next Distribution payable after the Agent receives your authorization, as long as they receive it before the “record date,” which is generally 10 business days before the Distribution is paid. If your authorization arrives after such record date, your participation in the Plan will begin with the following Distribution.

If you choose to participate in the Plan, your Distributions will be promptly reinvested for you, automatically increasing your shares. If the Trust is trading at a share price that is equal to its NAV, you’ll pay that amount for your reinvested shares. However, if the Trust is trading above or below NAV, the price is determined by one of two ways:

| | 1. | Premium: If the Trust is trading at a premium – a market price that is higher than its NAV –you’ll pay either the NAV or 95 percent of |

| | | the market price, whichever is greater. When the Trust trades at a premium, you may pay less for your reinvested shares than an investor purchasing shares on the stock exchange. Keep in mind, a portion of your price reduction may be taxable because you are receiving shares at less than market price. |

| | 2. | Discount: If the Trust is trading at a discount – a market price that is lower than its NAV – you’ll pay the market price for your reinvested shares. |

There is no direct charge to you for reinvesting Distributions because the Plan’s fees are paid by the Trust. If the Trust is trading at or above its NAV, your new shares are issued directly by the Trust and there are no brokerage charges or fees. However, if the Trust is trading at a discount, the shares are purchased on the open market, and you will pay your portion of any per share fees. These per share fees are typically less than the standard brokerage charges for individual transactions because shares are purchased for all participants in blocks, resulting in lower fees for each individual participant. Any service or per share fees are added to the purchase price. Per share fees include any applicable brokerage commissions the Agent is required to pay.

The automatic reinvestment of Distributions does not relieve you of any income tax that may be due on Distributions. You will receive tax information annually to help you prepare your federal income tax return.

Invesco does not offer tax advice. The tax information contained herein is general and is not exhaustive by nature. It was not intended or written to be used, and it cannot be used, by any taxpayer for avoiding penalties that may be imposed on the taxpayer under US federal tax laws. Federal and state tax laws are complex and constantly changing. Shareholders should always consult a legal or tax adviser for information concerning their individual situation.

How to withdraw from the Plan

You may withdraw from the Plan at any time by calling 800 341 2929, by visiting invesco.com/

closed-end

or by writing to Invesco

Closed-End

Funds, Computershare Trust Company, N.A., P.O. Box 43078, Providence, RI 02940-3078. Simply indicate that you would like to withdraw from the Plan, and be sure to include your Trust name and account number. Also, ensure that all shareholders listed on the account sign these written instructions. If you withdraw, you have three options with regard to the shares held in the Plan:

| | 1. | If you opt to continue to hold your non-certificated whole shares (Investment Plan Book Shares), they will be held by the Agent electronically as Direct Registration Book-Shares (Book-Entry Shares) and fractional shares will be sold at the then-current market price. Proceeds will be sent via check to your address of record after deducting applicable fees, including per share fees such as any applicable brokerage commissions the Agent is required to pay. |

| | 2. | If you opt to sell your shares through the Agent, we will sell all full and fractional shares and send the proceeds via check to your address of record after deducting $2.50 per account and a brokerage charge. |

| | 3. | You may sell your shares through your financial adviser through the Direct Registration System (DRS). DRS is a service within the securities industry that allows Trust shares to be held in your name in electronic format. You retain full ownership of your shares, without having to hold a share certificate. You should contact your financial adviser to learn more about any restrictions or fees that may apply. |

The Trust and Computershare Trust Company, N.A. may amend or terminate the Plan at any time. Participants will receive at least 30 days written notice before the effective date of any amendment. In the case of termination, Participants will receive at least 30 days written notice before the record date for the payment of any such Distributions by the Trust. In the case of amendment or termination necessary or appropriate to comply with applicable law or the rules and policies of the Securities and Exchange Commission or any other regulatory authority, such written notice will not be required.

To obtain a complete copy of the current Dividend Reinvestment Plan, please call our Client Services department at 800 341 2929 or visit

invesco.com/closed-end.

| | |

| | Invesco Value Municipal Income Trust |

| | | | | |

| | |

| |

| Revenue Bonds | | | | 79.26 | % |

| |

| General Obligation Bonds | | | | 16.54 | |

| |

| | | | 3.64 | |

| |

| Other | | | | 0.56 | |

| | | | | | | |

| | | | | |

| | |

| 1. | | North Texas Tollway Authority, Series 2008 D, Ref. RB | | | | 2.27 | % |

| | |

| 2. | | New Jersey (State of) Transportation Trust Fund Authority, Series 2006 C, RB | | | | 2.05 | |

| | |

| 3. | | Illinois (State of) Toll Highway Authority, Series 2013 A, RB | | | | 1.93 | |

| | |

| 4. | | William S. Hart Union High School District (Election of 2008), Series 2009 A, GO Bonds | | | | 1.30 | |

| | |

| 5. | | University of Massachusetts Building Authority, Series 2022-1, RB | | | | 1.27 | |

The Trust’s holdings are subject to change, and there is no assurance that the Trust will continue to hold any particular security.

Data presented here are as of February 29, 2024.

| | |

| | Invesco Value Municipal Income Trust |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | |

Municipal Obligations–148.27% (a) | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Birmingham (City of), AL Special Care Facilities Financing Authority (Methodist Home for the Aging); | | | | | | | | | | | | | | |

| Series 2016, RB | | | 5.25% | | | | 06/01/2025 | | | $ | 270 | | | $ 268,122 |

| Series 2016, RB | | | 5.75% | | | | 06/01/2045 | | | | 20 | | | 17,527 |

Black Belt Energy Gas District (The); Series 2023 B, RB (b) | | | 5.25% | | | | 12/01/2030 | | | | 1,420 | | | 1,539,785 |

| Lower Alabama Gas District (The); Series 2016 A, RB | | | 5.00% | | | | 09/01/2046 | | | | 920 | | | 998,345 |

Southeast Energy Authority A Cooperative District (No. 2); Series 2021 B, RB (b) | | | 4.00% | | | | 12/01/2031 | | | | 1,480 | | | 1,487,817 |

Southeast Energy Authority A Cooperative District (No. 3); Series 2022 A-1, RB (b) | | | 5.50% | | | | 12/01/2029 | | | | 1,405 | | | 1,504,468 |

Tuscaloosa (County of), AL Industrial Development Authority (Hunt Refining); Series 2019 A, Ref. IDR (c) | | | 5.25% | | | | 05/01/2044 | | | | 860 | | | 856,759 |

| | | | | | | | | | | | | | | 6,672,823 |

| | | | |

| | | | | | | | | | | | | | |

Northern Tobacco Securitization Corp.; Series 2021 A-1, Ref. RB | | | 4.00% | | | | 06/01/2050 | | | | 420 | | | 390,266 |

| | | | |

| | | | | | | | | | | | | | |

Arizona (State of) Industrial Development Authority (Leman Academy of Excellence); Series 2019 A, RB (c) | | | 5.00% | | | | 07/01/2039 | | | | 1,195 | | | 1,174,833 |

Arizona (State of) Industrial Development Authority (Master Academy of Nevada - Bonanza Campus); Series 2020 A, RB (c) | | | 5.00% | | | | 12/15/2040 | | | | 250 | | | 248,019 |

| Glendale (City of), AZ Industrial Development Authority (The Beatitudes Campus); | | | | | | | | | | | | | | |

| Series 2017, Ref. RB | | | 5.00% | | | | 11/15/2032 | | | | 1,280 | | | 1,216,588 |

| Series 2017, Ref. RB | | | 5.00% | | | | 11/15/2045 | | | | 980 | | | 805,277 |

| La Paz (County of), AZ Industrial Development Authority (Charter School Solutions- Harmony Public Schools); Series 2018 A, RB | | | 5.00% | | | | 02/15/2048 | | | | 700 | | | 686,129 |

| Maricopa (County of), AZ Industrial Development Authority (Legacy Traditional Schools); | | | | | | | | | | | | | | |

| | | 5.00% | | | | 07/01/2054 | | | | 550 | | | 522,815 |

| | | 4.00% | | | | 07/01/2051 | | | | 875 | | | 700,991 |

Mesa (City of), AZ; Series 2022 A, RB (INS - BAM) (d) | | | 5.00% | | | | 07/01/2046 | | | | 3,025 | | | 3,314,286 |

Phoenix (City of), AZ Industrial Development Authority (Legacy Traditional Schools); Series 2014 A, RB (c) | | | 6.50% | | | | 07/01/2034 | | | | 435 | | | 438,226 |

Pima (County of), AZ Industrial Development Authority (American Leadership Academy); Series 2019, Ref. RB (c) | | | 5.00% | | | | 06/15/2052 | | | | 360 | | | 334,785 |

Pima (County of), AZ Industrial Development Authority (Grande Innovations Academy); Series 2018, RB (c) | | | 5.25% | | | | 07/01/2048 | | | | 1,175 | | | 1,098,458 |

| Pima (County of), AZ Industrial Development Authority (Tucson Medical Center); Series 2021, Ref. RB | | | 3.00% | | | | 04/01/2051 | | | | 1,055 | | | 754,796 |

| Salt River Project Agricultural Improvement & Power District; Series 2023 B, RB | | | 5.00% | | | | 01/01/2048 | | | | 3,370 | | | 3,741,262 |

| Yuma (City of), AZ Industrial Development Authority (Regional Medical Center); | | | | | | | | | | | | | | |

| Series 2014 A, RB | | | 5.00% | | | | 08/01/2032 | | | | 1,050 | | | 1,055,237 |

| Series 2014 A, RB | | | 5.25% | | | | 08/01/2032 | | | | 2,000 | | | 2,014,340 |

| | | | | | | | | | | | | | | 18,106,042 |

| | | | |

| | | | | | | | | | | | | | |

| Alhambra Unified School District (Election of 2004); | | | | | | | | | | | | | | |

Series 2009 B, GO Bonds (INS - AGC) (d)(e) | | | 0.00% | | | | 08/01/2035 | | | | 3,010 | | | 2,039,988 |

Series 2009 B, GO Bonds (INS - AGC) (d)(e) | | | 0.00% | | | | 08/01/2036 | | | | 2,675 | | | 1,726,783 |

Bay Area Toll Authority (San Francisco Bay Area); Series 2023 F-2, RB (f) | | | 4.13% | | | | 04/01/2054 | | | | 5,000 | | | 5,007,440 |

| Beverly Hills Unified School District (Election of 2008); | | | | | | | | | | | | | | |

| | | 0.00% | | | | 08/01/2026 | | | | 2,720 | | | 2,536,663 |

| | | 0.00% | | | | 08/01/2031 | | | | 5,270 | | | 4,257,341 |

| California (State of); | | | | | | | | | | | | | | |

Series 2020, GO Bonds (INS - BAM) (d) | | | 3.00% | | | | 11/01/2050 | | | | 1,680 | | | 1,350,484 |

| | | 5.25% | | | | 09/01/2053 | | | | 3,370 | | | 3,850,080 |

California (State of) Community Choice Financing Authority (Clean Energy); Series 2024, RB (b) | | | 5.00% | | | | 04/01/2032 | | | | 2,525 | | | 2,711,866 |

California (State of) Community Housing Agency (Annadel Apartments); Series 2019 A, RB (c) | | | 5.00% | | | | 04/01/2049 | | | | 835 | | | 694,463 |

California (State of) County Tobacco Securitization Agency (Alameda County Tobacco Asset Securitization Corp.); Series 2006 C, RB (e) | | | 0.00% | | | | 06/01/2055 | | | | 10,335 | | | 1,020,448 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| | Invesco Value Municipal Income Trust |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| California (State of) County Tobacco Securitization Agency (Los Angeles County Securitization Corp.); | | | | | | | | | | | | | | |

| | | 5.00% | | | | 06/01/2049 | | | $ | 55 | | | $ 56,963 |

Series 2020 B-2, Ref. RB (e) | | | 0.00% | | | | 06/01/2055 | | | | 1,680 | | | 323,799 |

| California (State of) Health Facilities Financing Authority (Cedars-Sinai Health System); Series 2021, Ref. RB | | | 5.00% | | | | 08/15/2051 | | | | 4,375 | | | 4,772,230 |

| California (State of) Health Facilities Financing Authority (PIH Health); Series 2020 A, RB | | | 4.00% | | | | 06/01/2050 | | | | 4,175 | | | 3,945,929 |

| California (State of) Housing Finance Agency (Social Certificates); | | | | | | | | | | | | | | |

| Series 2021 A, RB | | | 3.25% | | | | 08/20/2036 | | | | 5 | | | 4,428 |

Series 2021-2A, Revenue Ctfs. (CEP - FHLMC) | | | 3.75% | | | | 03/25/2035 | | | | 4,075 | | | 3,997,334 |

| | | 4.38% | | | | 09/20/2036 | | | | 836 | | | 827,741 |

| California (State of) Infrastructure & Economic Development Bank; | | | | | | | | | | | | | | |

Series 2003 A, RB (b)(f)(g) | | | 5.00% | | | | 01/01/2028 | | | | 6,700 | | | 7,366,710 |

| | | 5.00% | | | | 01/01/2028 | | | | 4,500 | | | 4,921,204 |

California (State of) Infrastructure & Economic Development Bank (Bay Area Toll Bridges); Series 2003 A, RB (b)(f)(g) | | | 5.00% | | | | 01/01/2028 | | | | 3,300 | | | 3,628,380 |

California (State of) Municipal Finance Authority (Bella Mente Montessori Academy); Series 2018 A, RB (c) | | | 5.00% | | | | 06/01/2048 | | | | 195 | | | 181,030 |

California (State of) Municipal Finance Authority (CHF-Davis I, LLC - West Village Student Housing); Series 2018, RB | | | 5.00% | | | | 05/15/2037 | | | | 1,330 | | | 1,402,700 |

California (State of) Municipal Finance Authority (Linxs APM); Series 2018 A, RB (h) | | | 5.00% | | | | 12/31/2043 | | | | 2,000 | | | 2,000,159 |

California (State of) Municipal Finance Authority (William Jessup University); Series 2019, Ref. RB (c) | | | 5.00% | | | | 08/01/2039 | | | | 250 | | | 236,614 |

| California (State of) Pollution Control Financing Authority; | | | | | | | | | | | | | | |

| | | 5.00% | | | | 07/01/2027 | | | | 810 | | | 813,745 |

| | | 5.00% | | | | 07/01/2030 | | | | 190 | | | 190,786 |

| | | 5.00% | | | | 07/01/2037 | | | | 1,990 | | | 1,991,906 |

| | | 5.00% | | | | 11/21/2045 | | | | 2,325 | | | 2,326,251 |

California (State of) Statewide Communities Development Authority (Loma Linda University Medical Center); Series 2016 A, RB (c) | | | 5.25% | | | | 12/01/2056 | | | | 995 | | | 999,612 |

California State University; Series 2019 A, RB (f) | | | 5.00% | | | | 11/01/2049 | | | | 2,130 | | | 2,297,823 |

Clovis Unified School District (Election of 2004); Series 2004 A, GO Bonds (INS - NATL) (d)(e) | | | 0.00% | | | | 08/01/2029 | | | | 1,360 | | | 1,152,119 |

CSCDA Community Improvement Authority (Jefferson-Anaheim Social Bonds); Series 2021 A, RB (c) | | | 3.13% | | | | 08/01/2056 | | | | 840 | | | 601,184 |

CSCDA Community Improvement Authority (Oceanaire-Long Beach Social Bonds); Series 2021 A-2, RB (c) | | | 4.00% | | | | 09/01/2056 | | | | 840 | | | 637,842 |

CSCDA Community Improvement Authority (Parallel-Anaheim Social Bonds); Series 2021, RB (c) | | | 4.00% | | | | 08/01/2056 | | | | 505 | | | 421,539 |

| Dry Creek Joint Elementary School District (Election of 2008-Measure E); | | | | | | | | | | | | | | |

| | | 0.00% | | | | 08/01/2043 | | | | 2,120 | | | 924,933 |

| | | 0.00% | | | | 08/01/2044 | | | | 1,090 | | | 452,327 |

| | | 0.00% | | | | 08/01/2045 | | | | 6,270 | | | 2,473,043 |

| | | 0.00% | | | | 08/01/2048 | | | | 4,610 | | | 1,573,148 |

| El Segundo Unified School District (Election of 2008); | | | | | | | | | | | | | | |

Series 2009 A, GO Bonds (e) | | | 0.00% | | | | 08/01/2031 | | | | 4,155 | | | 3,293,506 |

Series 2009 A, GO Bonds (e) | | | 0.00% | | | | 08/01/2032 | | | | 3,165 | | | 2,419,470 |

Golden State Tobacco Securitization Corp.; Series 2021 B-2, Ref. RB (e) | | | 0.00% | | | | 06/01/2066 | | | | 2,245 | | | 255,554 |

| Los Angeles (City of), CA Department of Airports (Green Bonds); | | | | | | | | | | | | | | |

| | | 5.50% | | | | 05/15/2035 | | | | 1,750 | | | 2,039,596 |

| | | 5.50% | | | | 05/15/2037 | | | | 1,985 | | | 2,281,114 |

| | | 4.00% | | | | 05/15/2042 | | | | 705 | | | 698,529 |

Los Angeles (City of), CA Department of Water & Power; Series 2020 B, RB (f) | | | 5.00% | | | | 07/01/2050 | | | | 2,350 | | | 2,558,518 |

| Menifee Union School District (Election of 2008); | | | | | | | | | | | | | | |

Series 2009 C, GO Bonds (INS - AGC) (d)(e) | | | 0.00% | | | | 08/01/2034 | | | | 1,665 | | | 1,178,337 |

Series 2009 C, GO Bonds (INS - AGC) (d)(e) | | | 0.00% | | | | 08/01/2035 | | | | 300 | | | 203,321 |

Moreland School District (Crossover Series 14); Series 2006 C, Ref. GO Bonds (INS - AMBAC) (d)(e) | | | 0.00% | | | | 08/01/2029 | | | | 3,350 | | | 2,824,374 |

| | | | | | | | | | | | | | |

| Series 2009 B, RB | | | 6.13% | | | | 11/01/2029 | | | | 830 | | | 891,920 |

| Series 2009 B, RB | | | 6.50% | | | | 11/01/2039 | | | | 585 | | | 752,117 |

Oak Grove School District (Election of 2008); Series 2009 A, GO Bonds (e) | | | 0.00% | | | | 08/01/2028 | | | | 2,400 | | | 2,106,524 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| | Invesco Value Municipal Income Trust |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Patterson Joint Unified School District (Election of 2008); | | | | | | | | | | | | | | |

Series 2009 B, GO Bonds (INS - AGM) (d)(e) | | | 0.00% | | | | 08/01/2034 | | | $ | 3,825 | | | $ 2,646,740 |

Series 2009 B, GO Bonds (INS - AGM) (d)(e) | | | 0.00% | | | | 08/01/2035 | | | | 4,120 | | | 2,742,636 |

Series 2009 B, GO Bonds (INS - AGM) (d)(e) | | | 0.00% | | | | 08/01/2036 | | | | 300 | | | 189,918 |

Series 2009 B, GO Bonds (INS - AGM) (d)(e) | | | 0.00% | | | | 08/01/2037 | | | | 1,785 | | | 1,073,480 |

Poway Unified School District (Election of 2008 - School Facilities Improvement District No. 2007-1); | | | | | | | | | | | | | | |

Series 2009 A, GO Bonds (e) | | | 0.00% | | | | 08/01/2028 | | | | 7,840 | | | 6,856,659 |

Series 2009 A, GO Bonds (e) | | | 0.00% | | | | 08/01/2031 | | | | 8,475 | | | 6,713,115 |

| Regents of the University of California Medical Center; | | | | | | | | | | | | | | |

| | | 4.00% | | | | 05/15/2053 | | | | 5,430 | | | 5,365,891 |

| Series 2022 P, RB | | | 3.50% | | | | 05/15/2054 | | | | 2,015 | | | 1,779,574 |

Sacramento (City of), CA Unified School District; Series 2024 B, GO Bonds (INS - BAM) (d) | | | 4.00% | | | | 08/01/2048 | | | | 1,230 | | | 1,220,692 |

| San Diego (County of), CA Regional Airport Authority; | | | | | | | | | | | | | | |

| Series 2021 A, RB | | | 4.00% | | | | 07/01/2051 | | | | 2,060 | | | 2,023,073 |

| | | 5.00% | | | | 07/01/2048 | | | | 2,525 | | | 2,668,475 |

San Francisco (City & County of), CA Airport Commission; Series 2019 E, RB (h) | | | 5.00% | | | | 05/01/2038 | | | | 675 | | | 716,034 |

San Francisco (City & County of), CA Airport Commission (San Francisco International Airport); Series 2021 A, Ref. RB (h) | | | 5.00% | | | | 05/01/2036 | | | | 610 | | | 669,120 |

San Jose Evergreen Community College District (Election of 2004); Series 2008 B, GO Bonds (INS - AGM) (d)(e) | | | 0.00% | | | | 09/01/2030 | | | | 1,600 | | | 1,301,878 |

Silicon Valley Tobacco Securitization Authority (Santa Clara); Series 2007 A, RB (e) | | | 0.00% | | | | 06/01/2041 | | | | 3,445 | | | 1,311,635 |

William S. Hart Union High School District (Election of 2008); Series 2009 A, GO Bonds (e) | | | 0.00% | | | | 08/01/2033 | | | | 11,350 | | | 8,312,892 |

| | | | | | | | | | | | | | | 142,811,727 |

| | | | |

| | | | | | | | | | | | | | |

Adams & Arapahoe Joint School District No. 28J Aurora; Series 2023 A, Ref. GO Bonds (INS - BAM) (d) | | | 4.50% | | | | 12/01/2058 | | | | 2,390 | | | 2,390,815 |

| Aurora Crossroads Metropolitan District No. 2; Series 2020 B, GO Bonds | | | 7.75% | | | | 12/15/2050 | | | | 500 | | | 480,575 |

| Aurora Highlands Community Authority Board; Series 2021 A, Ref. RB | | | 5.75% | | | | 12/01/2051 | | | | 840 | | | 783,462 |

| Belford North Metropolitan District; Series 2020 A, GO Bonds | | | 5.50% | | | | 12/01/2050 | | | | 1,045 | | | 970,000 |

| Centerra Metropolitan District No. 1 (In the City of Loveland); | | | | | | | | | | | | | | |

| | | 5.00% | | | | 12/01/2047 | | | | 1,680 | | | 1,570,086 |

| Series 2020 A, Ref. GO Bonds | | | 5.00% | | | | 12/01/2051 | | | | 670 | | | 622,103 |

| Colorado (State of) Health Facilities Authority (Adventist Health System/Sunbelt Obligated Group); Series 2018 A, RB | | | 5.00% | | | | 11/15/2048 | | | | 1,705 | | | 1,764,262 |

| Colorado (State of) Health Facilities Authority (CommonSpirit Health); | | | | | | | | | | | | | | |

| | | 5.00% | | | | 08/01/2044 | | | | 3,680 | | | 3,840,334 |

| | | 4.00% | | | | 08/01/2049 | | | | 1,675 | | | 1,563,251 |

| Colorado (State of) Science and Technology Park Metropolitan District No. 1; Series 2018, Ref. RB | | | 5.00% | | | | 12/01/2033 | | | | 500 | | | 502,497 |

Colorado Crossing Metropolitan District No. 2; Series 2020 A-1, Ref. GO Bonds | | | 5.00% | | | | 12/01/2047 | | | | 500 | | | 426,105 |

| Colorado Springs (City of), CO; Series 2023 A, RB | | | 5.25% | | | | 11/15/2053 | | | | 5,000 | | | 5,568,126 |

| Denver (City & County of), CO; | | | | | | | | | | | | | | |

Series 2018 A, Ref. RB (h) | | | 5.00% | | | | 12/01/2048 | | | | 5,740 | | | 5,904,210 |

Series 2018 A, Ref. RB (h) | | | 5.25% | | | | 12/01/2048 | | | | 1,710 | | | 1,778,552 |

| | | 5.00% | | | | 11/15/2047 | | | | 1,985 | | | 2,101,075 |

| Great Western Metropolitan District; Series 2020, Ref. GO Bonds | | | 4.75% | | | | 12/01/2050 | | | | 460 | | | 415,280 |

| Hogback Metropolitan District; Series 2021 A, GO Bonds | | | 5.00% | | | | 12/01/2041 | | | | 725 | | | 672,753 |

| Jefferson (County of), CO Center Metropolitan District No. 1; Series 2020 B, Ref. RB | | | 5.75% | | | | 12/15/2050 | | | | 740 | | | 739,870 |

| Johnstown Plaza Metropolitan District; Series 2022, Ref. GO Bonds | | | 4.25% | | | | 12/01/2046 | | | | 782 | | | 659,783 |

| Mirabelle Metropolitan District No. 2; Series 2020 A, GO Bonds | | | 5.00% | | | | 12/01/2049 | | | | 645 | | | 605,900 |

| Mulberry Metropolitan District No. 2; Series 2022, RB | | | 7.00% | | | | 12/01/2034 | | | | 750 | | | 782,809 |

| Neu Town Metropolitan District; Series 2018 A, Ref. GO Bonds | | | 5.38% | | | | 12/01/2046 | | | | 700 | | | 693,373 |

| North Range Metropolitan District No. 3; Series 2020 A, GO Bonds | | | 5.00% | | | | 12/01/2040 | | | | 500 | | | 497,324 |

| Rampart Range Metropolitan District No. 5; Series 2021, RB | | | 4.00% | | | | 12/01/2051 | | | | 500 | | | 373,503 |

| Sky Ranch Community Authority Board; Series 2022 A, RB | | | 5.75% | | | | 12/01/2052 | | | | 500 | | | 489,025 |

| Village Metropolitan District (The); Series 2020, Ref. GO Bonds | | | 4.15% | | | | 12/01/2030 | | | | 425 | | | 413,936 |

| White Buffalo Metropolitan District No. 3; | | | | | | | | | | | | | | |

| Series 2020, GO Bonds | | | 5.50% | | | | 12/01/2050 | | | | 500 | | | 482,736 |

| Series 2023, GO Bonds | | | 8.00% | | | | 12/15/2035 | | | | 605 | | | 605,365 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| | Invesco Value Municipal Income Trust |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Windler Public Improvement Authority; | | | | | | | | | | | | | | |

| | | 4.13% | | | | 12/01/2051 | | | $ | 1,335 | | | $ 706,101 |

| | | 4.50% | | | | 12/01/2041 | | | | 2,070 | | | 1,198,667 |

| | | | | | | | | | | | | | | 39,601,878 |

| | | | |

District of Columbia–3.33% | | | | | | | | | | | | | | |

| District of Columbia; Series 2022 A, RB | | | 5.00% | | | | 07/01/2047 | | | | 1,670 | | | 1,840,411 |

| District of Columbia (Provident Group - Howard Properties LLC); Series 2013, RB | | | 5.00% | | | | 10/01/2045 | | | | 310 | | | 299,663 |

District of Columbia Water & Sewer Authority; Series 2022, RB (f) | | | 5.00% | | | | 10/01/2044 | | | | 5,805 | | | 6,254,220 |

District of Columbia Water & Sewer Authority (Green Bonds); Series 2022 C-1, RB | | | 4.00% | | | | 10/01/2051 | | | | 3,335 | | | 3,311,992 |

| Metropolitan Washington Airports Authority (Dulles Metrorail and Capital Improvement); Series 2019 B, Ref. RB | | | 4.00% | | | | 10/01/2049 | | | | 1,675 | | | 1,575,475 |

| Washington Metropolitan Area Transit Authority (Green Bonds); Series 2023 A, RB | | | 5.25% | | | | 07/15/2053 | | | | 7,185 | | | 7,954,258 |

| | | | | | | | | | | | | | | 21,236,019 |

| | | | |

| | | | | | | | | | | | | | |

| Alachua (County of), FL Health Facilities Authority (Terraces at Bonita Springs); | | | | | | | | | | | | | | |

Series 2022 A, Ref. RB (c) | | | 5.00% | | | | 11/15/2061 | | | | 1,075 | | | 734,986 |

| | | 6.50% | | | | 11/15/2033 | | | | 100 | | | 86,221 |

| Brevard (County of), FL Health Facilities Authority (Health First Obligated Group); Series 2022 A, Ref. RB | | | 4.00% | | | | 04/01/2052 | | | | 500 | | | 461,683 |

| Broward (County of), FL; | | | | | | | | | | | | | | |

| | | 4.00% | | | | 09/01/2044 | | | | 840 | | | 827,138 |

| | | 4.00% | | | | 10/01/2047 | | | | 4,110 | | | 4,048,023 |

| Broward (County of), FL (Convention Center Expansion); Series 2021, RB | | | 4.00% | | | | 09/01/2047 | | | | 3,360 | | | 3,256,684 |

Cape Coral (City of) FL; Series 2023, Ref. RB (INS - BAM) (d) | | | 5.50% | | | | 03/01/2043 | | | | 1,610 | | | 1,825,194 |

Capital Trust Agency, Inc. (Sarasota-Manatee Jewish Housing Council, Inc.); Series 2017, Ref. RB (c) | | | 5.00% | | | | 07/01/2037 | | | | 1,380 | | | 1,144,263 |

Collier (County of), FL Industrial Development Authority (The Arlington of Naples); Series 2014 A, RB (Acquired 12/16/2013; Cost $1,639,192) (c)(k)(l) | | | 7.75% | | | | 05/15/2035 | | | | 1,678 | | | 45,301 |

| Davie (Town of), FL (Nova Southeastern University); Series 2018, Ref. RB | | | 5.00% | | | | 04/01/2048 | | | | 1,390 | | | 1,421,402 |

| Florida (State of) North Broward Hospital District; Series 2017 B, Ref. RB | | | 5.00% | | | | 01/01/2042 | | | | 1,190 | | | 1,225,728 |

Florida Development Finance Corp. (Green Bonds); Series 2019 B, RB (c)(h) | | | 7.38% | | | | 01/01/2049 | | | | 670 | | | 686,739 |

| Fort Lauderdale (City of), FL; Series 2023 A, RB | | | 5.50% | | | | 09/01/2053 | | | | 2,525 | | | 2,882,717 |

| Greater Orlando Aviation Authority; | | | | | | | | | | | | | | |

| | | 5.00% | | | | 10/01/2052 | | | | 510 | | | 518,988 |

| | | 4.00% | | | | 10/01/2044 | | | | 1,000 | | | 975,729 |

Hillsborough (County of), FL Aviation Authority (Tampa International Airport); Series 2018 E, RB (h) | | | 5.00% | | | | 10/01/2048 | | | | 2,525 | | | 2,597,125 |

| Lake (County of), FL (Lakeside at Waterman Village); | | | | | | | | | | | | | | |

| Series 2020 A, Ref. RB | | | 5.50% | | | | 08/15/2040 | | | | 650 | | | 614,348 |

| Series 2020 A, Ref. RB | | | 5.75% | | | | 08/15/2050 | | | | 285 | | | 263,556 |

| Series 2020 A, Ref. RB | | | 5.75% | | | | 08/15/2055 | | | | 1,055 | | | 963,908 |

| Lee (County of), FL; | | | | | | | | | | | | | | |

| | | 5.00% | | | | 10/01/2034 | | | | 1,030 | | | 1,132,992 |

| Series 2022, RB | | | 5.25% | | | | 08/01/2049 | | | | 1,670 | | | 1,795,479 |

Miami (City of) & Dade (County of), FL School Board; Series 2022 A, GO Bonds (INS - BAM) (d) | | | 5.00% | | | | 03/15/2052 | | | | 1,980 | | | 2,125,904 |

| Miami-Dade (County of), FL; | | | | | | | | | | | | | | |

| Series 2021, RB | | | 4.00% | | | | 10/01/2051 | | | | 3,150 | | | 3,041,816 |

Series 2022 A, Ref. RB (h) | | | 5.25% | | | | 10/01/2052 | | | | 505 | | | 535,563 |

Series 2023 A, Ref. RB (h) | | | 5.00% | | | | 10/01/2047 | | | | 2,140 | | | 2,244,817 |

Subseries 2021 A-2, Ref. RB (INS - AGM) (d) | | | 4.00% | | | | 10/01/2049 | | | | 2,525 | | | 2,457,437 |

Subseries 2021 B-1, Ref. RB (h) | | | 4.00% | | | | 10/01/2050 | | | | 985 | | | 922,126 |

Miami-Dade (County of), FL Expressway Authority; Series 2010 A, RB (INS - AGM) (d) | | | 5.00% | | | | 07/01/2035 | | | | 3,415 | | | 3,417,461 |

| Miami-Dade (County of), FL Transit System; Series 2022, RB | | | 5.00% | | | | 07/01/2052 | | | | 2,320 | | | 2,483,023 |

| Osceola (County of), FL; | | | | | | | | | | | | | | |

Series 2020 A-2, Ref. RB (e) | | | 0.00% | | | | 10/01/2044 | | | | 1,000 | | | 354,074 |

Series 2020 A-2, Ref. RB (e) | | | 0.00% | | | | 10/01/2048 | | | | 1,500 | | | 418,753 |

Series 2020 A-2, Ref. RB (e) | | | 0.00% | | | | 10/01/2051 | | | | 600 | | | 141,429 |

Series 2020 A-2, Ref. RB (e) | | | 0.00% | | | | 10/01/2052 | | | | 455 | | | 101,491 |

Series 2020 A-2, Ref. RB (e) | | | 0.00% | | | | 10/01/2054 | | | | 390 | | | 77,856 |

| Sarasota (County of), FL Public Hospital District (Sarasota Memorial Hospital); Series 2022, RB | | | 4.00% | | | | 07/01/2052 | | | | 1,345 | | | 1,279,529 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| | Invesco Value Municipal Income Trust |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| South Miami Health Facilities Authority, Inc. (Baptist Health South Florida Obligated Group); Series 2017, Ref. RB | | | 4.00% | | | | 08/15/2047 | | | $ | 840 | | | $ 789,918 |

| Tallahassee (City of), FL (Tallahassee Memorial Health Care, Inc.); Series 2016, RB | | | 5.00% | | | | 12/01/2055 | | | | 1,335 | | | 1,333,868 |

Tampa (City of), FL; Series 2020 A, RB (e) | | | 0.00% | | | | 09/01/2049 | | | | 3,340 | | | 984,813 |

| | | | | | | | | | | | | | | 50,218,082 |

| | | | |

| | | | | | | | | | | | | | |

Brookhaven Development Authority (Children’s Healthcare of Atlanta, Inc.); Series 2019 A, RB (f)(i) | | | 4.00% | | | | 07/01/2044 | | | | 3,380 | | | 3,339,705 |

| Columbia (City of), GA (Wellstar Health System, Inc.); Series 2023, RAC | | | 5.13% | | | | 04/01/2048 | | | | 1,095 | | | 1,186,420 |

| Main Street Natural Gas, Inc.; | | | | | | | | | | | | | | |

| | | 4.00% | | | | 12/01/2028 | | | | 1,235 | | | 1,234,402 |

| | | 4.00% | | | | 11/01/2027 | | | | 1,260 | | | 1,220,318 |

| | | 5.00% | | | | 03/01/2030 | | | | 1,760 | | | 1,867,851 |

| | | 5.00% | | | | 09/01/2031 | | | | 1,685 | | | 1,803,190 |

| | | | | | | | | | | | | | | 10,651,886 |

| | | | |

| | | | | | | | | | | | | | |

| Hawaii (State of) Department of Budget & Finance (Hawaii Pacific Obligated Group); | | | | | | | | | | | | | | |

| Series 2024, RB | | | 5.00% | | | | 07/01/2041 | | | | 2,320 | | | 2,564,010 |

| Series 2024, RB | | | 5.50% | | | | 07/01/2052 | | | | 2,430 | | | 2,683,648 |

Hawaii (State of) Department of Transportation (Airports Division); Series 2013, COP (h) | | | 5.00% | | | | 08/01/2028 | | | | 1,775 | | | 1,775,433 |

| | | | | | | | | | | | | | | 7,023,091 |

| | | | |

| | | | | | | | | | | | | | |

| Idaho (State of) Health Facilities Authority (Valley Vista Care Corp.); Series 2017 A, Ref. RB | | | 5.25% | | | | 11/15/2047 | | | | 1,800 | | | 1,363,787 |

| | | | |

| | | | | | | | | | | | | | |

| Chicago (City of), IL; | | | | | | | | | | | | | | |

| Series 2002 B, GO Bonds | | | 5.50% | | | | 01/01/2037 | | | | 630 | | | 635,397 |

| Series 2005 D, Ref. GO Bonds | | | 5.50% | | | | 01/01/2040 | | | | 395 | | | 397,146 |

| Series 2007 E, Ref. GO Bonds | | | 5.50% | | | | 01/01/2042 | | | | 315 | | | 316,449 |

| Series 2014, RB | | | 5.00% | | | | 11/01/2039 | | | | 750 | | | 754,362 |

| Series 2015 A, GO Bonds | | | 5.50% | | | | 01/01/2033 | | | | 3,145 | | | 3,181,184 |

| Chicago (City of), IL (O’Hare International Airport); | | | | | | | | | | | | | | |

| | | 5.00% | | | | 01/01/2052 | | | | 5,000 | | | 5,037,586 |

| Series 2017 D, RB | | | 5.00% | | | | 01/01/2052 | | | | 1,465 | | | 1,495,431 |

| Chicago (City of), IL Metropolitan Water Reclamation District (Green Bonds); Series 2021 A, GO Bonds | | | 4.00% | | | | 12/01/2051 | | | | 1,000 | | | 957,079 |

Chicago (City of), IL Midway International Airport; Series 2014 A, Ref. RB (b)(g)(h) | | | 5.00% | | | | 04/03/2024 | | | | 1,100 | | | 1,101,294 |

| Illinois (State of); | | | | | | | | | | | | | | |

| Series 2014, GO Bonds | | | 5.25% | | | | 02/01/2033 | | | | 1,100 | | | 1,101,199 |

| Series 2014, GO Bonds | | | 5.00% | | | | 05/01/2035 | | | | 285 | | | 285,397 |

| Series 2014, GO Bonds | | | 5.00% | | | | 05/01/2036 | | | | 1,000 | | | 1,001,255 |

| Series 2016, GO Bonds | | | 5.00% | | | | 11/01/2036 | | | | 715 | | | 734,100 |

| Series 2016, GO Bonds | | | 5.00% | | | | 01/01/2041 | | | | 1,750 | | | 1,772,250 |

| Series 2017 D, GO Bonds | | | 5.00% | | | | 11/01/2026 | | | | 1,840 | | | 1,921,658 |

| Series 2018 A, GO Bonds | | | 5.00% | | | | 05/01/2030 | | | | 1,135 | | | 1,220,601 |

| Series 2020, GO Bonds | | | 5.50% | | | | 05/01/2039 | | | | 1,040 | | | 1,149,757 |

Illinois (State of) Development Finance Authority (CITGO Petroleum Corp.); Series 2002, RB (h) | | | 8.00% | | | | 06/01/2032 | | | | 360 | | | 360,366 |

Illinois (State of) Finance Authority (DePaul College Prep Foundation); Series 2023, Ref. RB (c) | | | 5.50% | | | | 08/01/2043 | | | | 580 | | | 614,476 |

Illinois (State of) Finance Authority (Lutheran Communities Obligated Group); Series 2019 A, Ref. RB (Acquired 10/05/2022; Cost $549,300) (l) | | | 5.00% | | | | 11/01/2049 | | | | 670 | | | 527,183 |

| Illinois (State of) Finance Authority (Mercy Health Corp.); Series 2016, Ref. RB | | | 5.00% | | | | 12/01/2046 | | | | 2,440 | | | 2,471,938 |

Illinois (State of) Finance Authority (Roosevelt University); Series 2019 A, RB (c) | | | 6.13% | | | | 04/01/2058 | | | | 965 | | | 919,360 |

| Illinois (State of) Finance Authority (Three Crowns Park); | | | | | | | | | | | | | | |

| Series 2017, Ref. RB | | | 4.00% | | | | 02/15/2027 | | | | 175 | | | 172,606 |

| Series 2017, Ref. RB | | | 5.25% | | | | 02/15/2037 | | | | 200 | | | 201,839 |

Illinois (State of) Metropolitan Pier & Exposition Authority (McCormick Place Expansion); Series 2002 A, RB (INS - NATL) (d)(e) | | | 0.00% | | | | 12/15/2029 | | | | 3,520 | | | 2,856,713 |

Illinois (State of) Sports Facilities Authority; Series 2014, Ref. RB (INS - AGM) (d) | | | 5.25% | | | | 06/15/2031 | | | | 1,060 | | | 1,063,906 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| | Invesco Value Municipal Income Trust |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Illinois (State of) Toll Highway Authority; Series 2013 A, RB (b)(f)(g) | | | 5.00% | | | | 04/02/2024 | | | $ | 12,300 | | | $ 12,314,945 |

| | | | | | | | | | | | | | | 44,565,477 |

| | | | |

| | | | | | | | | | | | | | |

| Indiana (State of) Finance Authority (Indiana University Health Obligated Group); Series 2019 A, RB | | | 4.00% | | | | 12/01/2049 | | | | 1,010 | | | 961,940 |

| Indiana (State of) Finance Authority (KIPP Indianapolis, Inc.); Series 2020 A, RB | | | 5.00% | | | | 07/01/2055 | | | | 460 | | | 427,730 |

| Indiana (State of) Finance Authority (Ohio Valley Electrical Corp.); Series 2012 A, RB | | | 4.25% | | | | 11/01/2030 | | | | 1,795 | | | 1,805,851 |

Indiana (State of) Finance Authority (US Steel Corp.); Series 2012, RB (h) | | | 5.75% | | | | 08/01/2042 | | | | 240 | | | 240,054 |

| Northern Indiana Commuter Transportation District; Series 2024, RB | | | 5.25% | | | | 01/01/2049 | | | | 1,665 | | | 1,853,018 |

| Valparaiso (City of), IN (Pratt Paper, LLC); | | | | | | | | | | | | | | |

| | | 6.75% | | | | 01/01/2034 | | | | 1,500 | | | 1,503,592 |

| | | 7.00% | | | | 01/01/2044 | | | | 1,080 | | | 1,082,301 |

| | | | | | | | | | | | | | | 7,874,486 |

| | | | |

| | | | | | | | | | | | | | |

| Iowa (State of) Board of Regents (University of Iowa Hospital & Clinics); Series 2022 B, RB | | | 3.00% | | | | 09/01/2056 | | | | 615 | | | 449,492 |

| Iowa (State of) Finance Authority (Alcoa, Inc.); Series 2012, RB | | | 4.75% | | | | 08/01/2042 | | | | 1,265 | | | 1,254,220 |

Iowa (State of) Finance Authority (Iowa Fertilizer Co.); Series 2022, Ref. RB (b) | | | 5.00% | | | | 12/01/2042 | | | | 1,735 | | | 1,834,267 |

Iowa (State of) Tobacco Settlement Authority; Series 2021 B-1, Ref. RB | | | 4.00% | | | | 06/01/2049 | | | | 1,200 | | | 1,211,996 |

| | | | | | | | | | | | | | | 4,749,975 |

| | | | |

| | | | | | | | | | | | | | |

| Wichita (City of), KS (Presbyterian Manors, Inc.); | | | | | | | | | | | | | | |

| | | 6.38% | | | | 05/15/2043 | | | | 1,500 | | | 1,329,532 |

| Series 2018 I, Ref. RB | | | 5.00% | | | | 05/15/2047 | | | | 1,000 | | | 711,679 |

| | | | | | | | | | | | | | | 2,041,211 |

| | | | |

| | | | | | | | | | | | | | |

Henderson (City of), KY (Pratt Paper LLC); Series 2022 A, RB (c)(h) | | | 4.70% | | | | 01/01/2052 | | | | 665 | | | 646,841 |

| Kentucky (Commonwealth of) Economic Development Finance Authority (Next Generation Kentucky Information Highway); | | | | | | | | | | | | | | |

| Series 2015 A, RB | | | 5.00% | | | | 07/01/2037 | | | | 1,110 | | | 1,118,881 |

| Series 2015 A, RB | | | 5.00% | | | | 07/01/2040 | | | | 1,915 | | | 1,922,338 |

| Series 2015 A, RB | | | 5.00% | | | | 01/01/2045 | | | | 1,245 | | | 1,246,480 |

| Kentucky (Commonwealth of) Municipal Power Agency (Prairie State); Series 2019 A, Ref. RB | | | 4.00% | | | | 09/01/2045 | | | | 1,000 | | | 912,473 |

Kentucky (Commonwealth of) Public Energy Authority; Series 2023 A-1, Ref. RB (b) | | | 5.25% | | | | 02/01/2032 | | | | 1,685 | | | 1,817,400 |

| | | | | | | | | | | | | | | 7,664,413 |

| | | | |

| | | | | | | | | | | | | | |

Louisiana (State of) Local Government Environmental Facilities & Community Development Authority (St. John the Baptist); Series 2019, RB (c) | | | 3.90% | | | | 11/01/2044 | | | | 845 | | | 748,021 |

| New Orleans (City of), LA Aviation Board; Series 2015 A, RB | | | 5.00% | | | | 01/01/2045 | | | | 1,145 | | | 1,151,124 |

| St. Tammany (Parish of), LA Public Trust Financing Authority (Christwood); Series 2015, Ref. RB | | | 5.25% | | | | 11/15/2037 | | | | 1,850 | | | 1,757,923 |

| Tobacco Settlement Financing Corp.; Series 2013 A, Ref. RB | | | 5.25% | | | | 05/15/2035 | | | | 610 | | | 614,851 |

| | | | | | | | | | | | | | | 4,271,919 |

| | | | |

| | | | | | | | | | | | | | |

Howard (County of), MD (Downtown Columbia); Series 2017 A, RB (c) | | | 4.50% | | | | 02/15/2047 | | | | 1,500 | | | 1,402,540 |

| Maryland (State of) Health & Higher Educational Facilities Authority (Stevenson University); Series 2021, Ref. RB | | | 4.00% | | | | 06/01/2055 | | | | 1,000 | | | 816,260 |

| Prince George’s (County of), MD (Collington Episcopal Life Care Community, Inc.); Series 2017, Ref. RB | | | 5.00% | | | | 04/01/2028 | | | | 690 | | | 690,557 |

| Rockville (City of), MD (Ingleside at King Farm); Series 2017 B, RB | | | 4.25% | | | | 11/01/2037 | | | | 175 | | | 153,711 |

| | | | | | | | | | | | | | | 3,063,068 |

| | | | |

| | | | | | | | | | | | | | |

| Massachusetts (Commonwealth of); Series 2023, RB | | | 5.00% | | | | 06/01/2053 | | | | 5,155 | | | 5,639,275 |

| Massachusetts (Commonwealth of) (Rail Enhancement Program) (Sustainability Bonds); Series 2022, RB | | | 5.00% | | | | 06/01/2050 | | | | 675 | | | 726,404 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| | Invesco Value Municipal Income Trust |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | |

Massachusetts–(continued) | | | | | | | | | | | | | | |

| Massachusetts (Commonwealth of) Port Authority; | | | | | | | | | | | | | | |

Series 2019 A, Ref. RB (h) | | | 5.00% | | | | 07/01/2036 | | | $ | 1,005 | | | $ 1,081,123 |

| | | 5.00% | | | | 07/01/2046 | | | | 1,055 | | | 1,110,418 |

Massachusetts (Commonwealth of) Water Resources Authority; Series 2007 B, Ref. RB (INS - AGM) (d) | | | 5.25% | | | | 08/01/2031 | | | | 2,000 | | | 2,386,096 |

University of Massachusetts Building Authority; Series 2022-1, RB | | | 5.00% | | | | 11/01/2052 | | | | 7,550 | | | 8,095,708 |

| | | | | | | | | | | | | | | 19,039,024 |

| | | | |

| | | | | | | | | | | | | | |

Academy of Warren; Series 2020 A, RB (c) | | | 5.00% | | | | 05/01/2035 | | | | 290 | | | 282,721 |

| Detroit (City of), MI; Series 2018, GO Bonds | | | 5.00% | | | | 04/01/2035 | | | | 250 | | | 259,228 |

Detroit (City of), MI Downtown Development Authority (Catalyst Development); Series 2018 A, Ref. RB (INS - AGM) (d) | | | 5.00% | | | | 07/01/2036 | | | | 2,000 | | | 2,004,917 |

| Grand Rapids Economic Development Corp. (Beacon Hill at Eastgate); Series 2017 A, Ref. RB | | | 5.00% | | | | 11/01/2052 | | | | 2,360 | | | 2,027,292 |

| Lansing (City of), MI Board of Water & Light; Series 2024 A, Ref. RB | | | 5.25% | | | | 07/01/2054 | | | | 3,645 | | | 4,035,269 |

| Michigan (State of); Series 2023, RB | | | 5.50% | | | | 11/15/2049 | | | | 4,560 | | | 5,244,012 |

Michigan (State of) Building Authority (Facilities Program); Series 2016 I, RB (f) | | | 5.00% | | | | 04/15/2041 | | | | 2,715 | | | 2,809,390 |

| Michigan (State of) Finance Authority (Detroit Water & Sewerage Department); | | | | | | | | | | | | | | |

| | | 5.00% | | | | 07/01/2033 | | | | 550 | | | 552,245 |

| | | 5.00% | | | | 07/01/2029 | | | | 550 | | | 552,639 |

| Michigan (State of) Finance Authority (Landmark Academy); | | | | | | | | | | | | | | |

| Series 2020, Ref. RB | | | 5.00% | | | | 06/01/2035 | | | | 170 | | | 162,929 |

| Series 2020, Ref. RB | | | 5.00% | | | | 06/01/2045 | | | | 490 | | | 442,988 |

Michigan (State of) Finance Authority (Trinity Health Credit Group); Series 2017 MI, RB (f)(g)(i) | | | 5.00% | | | | 12/01/2046 | | | | 3,655 | | | 3,754,237 |

| Michigan (State of) Housing Development Authority; Series 2023 A, RB | | | 5.10% | | | | 10/01/2053 | | | | 1,950 | | | 2,061,302 |

Michigan (State of) Strategic Fund (Canterbury Health Care, Inc.); Series 2016, RB (Acquired 08/27/2019; Cost $395,059) (c)(k)(l) | | | 5.00% | | | | 07/01/2026 | | | | 385 | | | 360,580 |

Michigan (State of) Strategic Fund (Green Bonds); Series 2021, RB (b)(h) | | | 4.00% | | | | 10/01/2026 | | | | 2,025 | | | 2,030,851 |

Michigan (State of) Strategic Fund (I-75 Improvement Project); Series 2018, RB (h) | | | 5.00% | | | | 12/31/2032 | | | | 750 | | | 790,195 |

| | | | | | | | | | | | | | | 27,370,795 |

| | | | |

| | | | | | | | | | | | | | |

| Bethel (City of), MN (Spectrum High School); Series 2017 A, Ref. RB | | | 4.25% | | | | 07/01/2047 | | | | 425 | | | 357,598 |

| Duluth (City of), MN Economic Development Authority (Essentia Health Obligated Group); Series 2018, Ref. RB | | | 5.00% | | | | 02/15/2048 | | | | 590 | | | 599,620 |

| Minnesota Agricultural & Economic Development Board (Healthpartners Obligated Group); Series 2024, RB | | | 5.25% | | | | 01/01/2054 | | | | 1,685 | | | 1,854,395 |

| St. Paul (City of), MN Housing & Redevelopment Authority (Hope Community Academy); Series 2020, RB | | | 5.00% | | | | 12/01/2055 | | | | 430 | | | 319,639 |

| | | | | | | | | | | | | | | 3,131,252 |

| | | | |

| | | | | | | | | | | | | | |

| Mississippi Business Finance Corp. (System Energy Resources, Inc.); Series 2021, RB | | | 2.38% | | | | 06/01/2044 | | | | 1,115 | | | 707,186 |

| | | | |

| | | | | | | | | | | | | | |

| Kansas City (City of), MO Industrial Development Authority (Downtown Redevelopment District); Series 2011 A, Ref. RB | | | 5.50% | | | | 09/01/2027 | | | | 980 | | | 981,810 |

| Kansas City (City of), MO Industrial Development Authority (Kansas City International Airport); | | | | | | | | | | | | | | |

| | | 5.00% | | | | 03/01/2046 | | | | 4,700 | | | 4,810,376 |

Series 2019 B, RB (INS - AGM) (d)(h) | | | 5.00% | | | | 03/01/2049 | | | | 1,005 | | | 1,032,268 |

| Kirkwood (City of), MO Industrial Development Authority (Aberdeen Heights); Series 2017 A, Ref. RB | | | 5.25% | | | | 05/15/2050 | | | | 475 | | | 366,468 |

| Missouri (State of) Health & Educational Facilities Authority (Lutheran Senior Services); Series 2019, Ref. RB | | | 5.00% | | | | 02/01/2048 | | | | 340 | | | 323,595 |

| St. Louis (County of), MO Industrial Development Authority (Friendship Village of Sunset Hills); | | | | | | | | | | | | | | |

| Series 2012, RB | | | 5.00% | | | | 09/01/2042 | | | | 2,000 | | | 1,913,910 |

| Series 2013 A, RB | | | 5.50% | | | | 09/01/2033 | | | | 1,375 | | | 1,375,815 |

| St. Louis (County of), MO Industrial Development Authority (Friendship Village West County); Series 2018 A, RB | | | 5.00% | | | | 09/01/2038 | | | | 1,820 | | | 1,805,183 |

Taney (County of), MO Industrial Development Authority (Big Cedar Infrastructure); Series 2023, RB (c) | | | 6.00% | | | | 10/01/2049 | | | | 770 | | | 773,061 |

| | | | | | | | | | | | | | | 13,382,486 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| | Invesco Value Municipal Income Trust |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Central Plains Energy Project (No. 3); Series 2017 A, Ref. RB | | | 5.00% | | | | 09/01/2042 | | | $ | 3,740 | | | $ 4,050,872 |

Central Plains Energy Project (No. 5); Series 2022-1, RB (b) | | | 5.00% | | | | 10/01/2029 | | | | 840 | | | 881,986 |

Omaha (City of), NE Public Power District; Series 2022, RB (f)(i) | | | 5.25% | | | | 02/01/2052 | | | | 2,080 | | | 2,277,065 |

| | | | | | | | | | | | | | | 7,209,923 |

| | | | |

| | | | | | | | | | | | | | |

| Clark (County of), NV Water Reclamation District; Series 2023, GO Bonds | | | 5.00% | | | | 07/01/2053 | | | | 5,295 | | | 5,744,201 |

| | | | |

| | | | | | | | | | | | | | |

New Hampshire (State of) Business Finance Authority; Series 2020-1A, RB | | | 4.13% | | | | 01/20/2034 | | | | 300 | | | 292,946 |

New Hampshire (State of) Business Finance Authority (Social Bonds); Series 2022-1A, RB | | | 4.38% | | | | 09/20/2036 | | | | 1,635 | | | 1,613,903 |

| New Hampshire (State of) Health and Education Facilities Authority; Series 2020 A, RB | | | 5.00% | | | | 08/01/2059 | | | | 1,105 | | | 1,186,940 |

| New Hampshire (State of) Housing Finance Authority; Series 2023 D, RB (CEP - GNMA) | | | 5.13% | | | | 07/01/2053 | | | | 1,025 | | | 1,062,874 |

| | | | | | | | | | | | | | | 4,156,663 |

| | | | |

| | | | | | | | | | | | | | |

New Jersey (State of) Economic Development Authority; Series 2005 N-1, Ref. RB (INS - AMBAC) (d) | | | 5.50% | | | | 09/01/2024 | | | | 3,390 | | | 3,424,622 |

New Jersey (State of) Economic Development Authority (Continental Airlines, Inc.); Series 1999, RB (h) | | | 5.25% | | | | 09/15/2029 | | | | 210 | | | 210,483 |

New Jersey (State of) Economic Development Authority (The Goethals Bridge Replacement); Series 2013, RB (h) | | | 5.38% | | | | 01/01/2043 | | | | 2,250 | | | 2,256,163 |

| New Jersey (State of) Health Care Facilities Financing Authority (Inspira Health Obligated Group); Series 2017, RB | | | 4.00% | | | | 07/01/2047 | | | | 2,590 | | | 2,446,422 |

| New Jersey (State of) Transportation Trust Fund Authority; | | | | | | | | | | | | | | |

Series 2006 C, RB (INS - AGC) (d)(e) | | | 0.00% | | | | 12/15/2026 | | | | 14,305 | | | 13,119,396 |

| Series 2018 A, Ref. RB | | | 5.00% | | | | 12/15/2035 | | | | 880 | | | 950,784 |

| | | 5.00% | | | | 06/15/2029 | | | | 1,575 | | | 1,642,999 |

| | | 5.00% | | | | 06/15/2030 | | | | 535 | | | 557,687 |

| Series 2022, RB | | | 5.25% | | | | 06/15/2046 | | | | 1,425 | | | 1,569,095 |

| Tobacco Settlement Financing Corp.; | | | | | | | | | | | | | | |

| Series 2018 A, Ref. RB | | | 5.00% | | | | 06/01/2046 | | | | 2,895 | | | 2,962,926 |

| Series 2018 A, Ref. RB | | | 5.25% | | | | 06/01/2046 | | | | 1,675 | | | 1,736,879 |

| Series 2018 B, Ref. RB | | | 5.00% | | | | 06/01/2046 | | | | 1,850 | | | 1,885,244 |

| | | | | | | | | | | | | | | 32,762,700 |

| | | | |

| | | | | | | | | | | | | | |

Build NYC Resource Corp. (Pratt Paper, Inc.); Series 2014, Ref. RB (c)(h) | | | 5.00% | | | | 01/01/2035 | | | | 1,600 | | | 1,609,533 |

| Erie Tobacco Asset Securitization Corp.; Series 2005 A, RB | | | 5.00% | | | | 06/01/2045 | | | | 2,500 | | | 2,429,698 |

| Metropolitan Transportation Authority (Green Bonds); | | | | | | | | | | | | | | |

Series 2020 A-1, RB (INS - AGM) (d) | | | 4.00% | | | | 11/15/2041 | | | | 1,175 | | | 1,176,865 |

| | | 5.25% | | | | 11/15/2055 | | | | 1,340 | | | 1,419,736 |

New York & New Jersey (States of) Port Authority; Series 2020 221, RB (h) | | | 4.00% | | | | 07/15/2055 | | | | 2,340 | | | 2,172,166 |

| New York (City of), NY; | | | | | | | | | | | | | | |

| Series 2020 C, GO Bonds | | | 5.00% | | | | 08/01/2043 | | | | 2,480 | | | 2,679,090 |

Subseries 2014 I-2, VRD GO Bonds (m) | | | 3.10% | | | | 03/01/2040 | | | | 1,685 | | | 1,685,000 |

Subseries 2022 D-1, GO Bonds (f) | | | 5.25% | | | | 05/01/2038 | | | | 1,355 | | | 1,569,472 |

Subseries 2022 D-1, GO Bonds (f) | | | 5.25% | | | | 05/01/2042 | | | | 2,305 | | | 2,592,233 |

Subseries 2023 E-1, GO Bonds | | | 5.25% | | | | 04/01/2047 | | | | 1,500 | | | 1,666,810 |

| New York (City of), NY Municipal Water Finance Authority; | | | | | | | | | | | | | | |

| | | 4.00% | | | | 06/15/2050 | | | | 1,670 | | | 1,637,042 |

| | | 5.00% | | | | 06/15/2050 | | | | 3,395 | | | 3,643,282 |

| Series 2020, Ref. RB | | | 5.00% | | | | 06/15/2050 | | | | 1,710 | | | 1,835,055 |

| New York (City of), NY Transitional Finance Authority; | | | | | | | | | | | | | | |

| | | 4.00% | | | | 11/01/2045 | | | | 860 | | | 851,971 |

| | | 4.00% | | | | 02/01/2051 | | | | 2,535 | | | 2,446,685 |

| Series 2024 B, RB | | | 4.38% | | | | 05/01/2053 | | | | 2,190 | | | 2,197,878 |

New York (State of) Dormitory Authority; Series 2022, RB (f) | | | 4.00% | | | | 03/15/2046 | | | | 5,000 | | | 4,926,622 |

| New York (State of) Dormitory Authority (City of New York); | | | | | | | | | | | | | | |

Series 2005 A, RB (INS - AMBAC) (d) | | | 5.50% | | | | 05/15/2028 | | | | 2,900 | | | 3,219,555 |

Series 2005 A, RB (INS - AMBAC) (d) | | | 5.50% | | | | 05/15/2029 | | | | 2,455 | | | 2,790,120 |

New York (State of) Dormitory Authority (Memorial Sloan Kettering Cancer); Series 2022 1-B, RB | | | 4.00% | | | | 07/01/2051 | | | | 3,635 | | | 3,507,937 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| | Invesco Value Municipal Income Trust |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | |

New York (State of) Dormitory Authority (New York University); Series 2001-1, RB (INS - BHAC) (d) | | | 5.50% | | | | 07/01/2031 | | | $ | 1,040 | | | $ 1,175,371 |

New York (State of) Power Authority; Series 2020 A, RB (f) | | | 4.00% | | | | 11/15/2045 | | | | 3,700 | | | 3,668,208 |

New York (State of) Power Authority (Green Bonds); Series 2020, RB (f) | | | 4.00% | | | | 11/15/2055 | | | | 4,175 | | | 4,032,888 |

| New York (State of) Thruway Authority; | | | | | | | | | | | | | | |

| Series 2019 B, RB | | | 4.00% | | | | 01/01/2050 | | | | 4,790 | | | 4,616,144 |

Series 2019 B, RB (INS - AGM) (d)(f)(i) | | | 4.00% | | | | 01/01/2050 | | | | 2,625 | | | 2,587,204 |

New York (State of) Thruway Authority (Group 3); Series 2021 A-1, Ref. RB | | | 4.00% | | | | 03/15/2046 | | | | 2,495 | | | 2,465,521 |

| New York Counties Tobacco Trust IV; | | | | | | | | | | | | | | |

| Series 2005 A, RB | | | 5.00% | | | | 06/01/2045 | | | | 285 | | | 271,364 |

| | | 6.25% | | | | 06/01/2041 | | | | 1,300 | | | 1,300,308 |

New York Counties Tobacco Trust V; Series 2005 S-2, RB (e) | | | 0.00% | | | | 06/01/2050 | | | | 10,140 | | | 1,597,304 |

New York Counties Tobacco Trust VI; Series 2016 A-1, Ref. RB | | | 5.75% | | | | 06/01/2043 | | | | 3,135 | | | 3,230,799 |

New York Liberty Development Corp. (3 World Trade Center); Series 2014, Class 1, Ref. RB (c) | | | 5.00% | | | | 11/15/2044 | | | | 6,095 | | | 6,096,618 |

| New York State Urban Development Corp. (Bidding Group 3); Series 2021 A, Ref. RB | | | 4.00% | | | | 03/15/2045 | | | | 3,350 | | | 3,313,641 |

| New York Transportation Development Corp. (American Airlines, Inc. John F. Kennedy International Airport); | | | | | | | | | | | | | | |

| | | 5.25% | | | | 08/01/2031 | | | | 520 | | | 548,566 |

| | | 5.38% | | | | 08/01/2036 | | | | 960 | | | 1,003,109 |

| | | 5.38% | | | | 06/30/2060 | | | | 2,160 | | | 2,267,732 |

| New York Transportation Development Corp. (American Airlines, Inc.); | | | | | | | | | | | | | | |

| | | 5.00% | | | | 08/01/2026 | | | | 995 | | | 995,254 |

| | | 5.00% | | | | 08/01/2031 | | | | 1,340 | | | 1,340,064 |

| New York Transportation Development Corp. (Delta Air Lines, Inc. LaGuardia Airport Terminals C&D Redevelopment); | | | | | | | | | | | | | | |

| | | 5.00% | | | | 01/01/2033 | | | | 2,075 | | | 2,145,094 |

| | | 5.00% | | | | 01/01/2034 | | | | 1,295 | | | 1,338,304 |

| | | 5.00% | | | | 01/01/2036 | | | | 1,240 | | | 1,276,860 |

| | | 5.00% | | | | 10/01/2040 | | | | 2,015 | | | 2,079,826 |

| | | 4.38% | | | | 10/01/2045 | | | | 1,160 | | | 1,144,602 |

| New York Transportation Development Corp. (LaGuardia Airport Terminal B Redevelopment); | | | | | | | | | | | | | | |

| | | 5.00% | | | | 07/01/2046 | | | | 3,055 | | | 3,038,608 |

| | | 5.25% | | | | 01/01/2050 | | | | 1,660 | | | 1,660,457 |

New York Transportation Development Corp. (Terminal 4 JFK International Airport); Series 2022, RB (h) | | | 5.00% | | | | 12/01/2038 | | | | 1,265 | | | 1,343,839 |

| Rockland Tobacco Asset Securitization Corp.; Series 2001, RB | | | 5.75% | | | | 08/15/2043 | | | | 1,500 | | | 1,520,014 |

| Triborough Bridge & Tunnel Authority (MTA Bridges & Tunnels); | | | | | | | | | | | | | | |

| Series 2020 A, RB | | | 5.00% | | | | 11/15/2054 | | | | 750 | | | 798,861 |

| Series 2021 A, RB | | | 5.00% | | | | 11/15/2056 | | | | 1,130 | | | 1,206,930 |

| | | 5.00% | | | | 05/15/2051 | | | | 5,480 | | | 5,874,796 |

| TSASC, Inc.; Series 2016 B, Ref. RB | | | 5.00% | | | | 06/01/2045 | | | | 2,575 | | | 2,360,311 |

| | | | | | | | | | | | | | | 112,355,347 |

| | | | |

| | | | | | | | | | | | | | |

| Charlotte (City of), NC (Charlotte Douglas International Airport); Series 2017 A, RB | | | 5.00% | | | | 07/01/2047 | | | | 2,055 | | | 2,135,803 |

North Carolina (State of) Turnpike Authority (Triangle Expressway System); Series 2024, RB (INS - AGM) (d)(e) | | | 0.00% | | | | 01/01/2052 | | | | 3,500 | | | 880,862 |

| | | | | | | | | | | | | | | 3,016,665 |

| | | | |

| | | | | | | | | | | | | | |

| Ward (County of), ND (Trinity Obligated Group); | | | | | | | | | | | | | | |

| Series 2017 C, RB | | | 5.00% | | | | 06/01/2048 | | | | 2,315 | | | 1,932,083 |

| Series 2017 C, RB | | | 5.00% | | | | 06/01/2053 | | | | 1,725 | | | 1,387,105 |

| | | | | | | | | | | | | | | 3,319,188 |

| | | | |

| | | | | | | | | | | | | | |

| Akron, Bath & Copley Joint Township Hospital District (Summa Health Obligated Group); Series 2016, Ref. RB | | | 5.25% | | | | 11/15/2046 | | | | 790 | | | 805,244 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| | Invesco Value Municipal Income Trust |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Buckeye Tobacco Settlement Financing Authority; | | | | | | | | | | | | | | |

| | | 4.00% | | | | 06/01/2048 | | | $ | 5,315 | | | $ 4,947,228 |

| | | 5.00% | | | | 06/01/2055 | | | | 8,255 | | | 7,878,224 |

Series 2020 B-3, Ref. RB (e) | | | 0.00% | | | | 06/01/2057 | | | | 8,650 | | | 907,131 |

Cleveland (City of) & Cuyahoga (County of), OH Port Authority (Constellation Schools); Series 2014 A, Ref. RB (c) | | | 6.50% | | | | 01/01/2034 | | | | 1,000 | | | 1,000,319 |

| Cleveland (City of), OH; | | | | | | | | | | | | | | |

Series 2008 B-2, RB (INS - NATL) (d)(e) | | | 0.00% | | | | 11/15/2026 | | | | 3,545 | | | 3,241,931 |

Series 2008 B-2, RB (INS - NATL) (d)(e) | | | 0.00% | | | | 11/15/2028 | | | | 3,845 | | | 3,294,249 |

Series 2008 B-2, RB (INS - NATL) (d)(e) | | | 0.00% | | | | 11/15/2038 | | | | 2,800 | | | 1,483,075 |

Columbus (City of) & Franklin (County of), OH Finance Authority (Easton); Series 2020, RB (c) | | | 5.00% | | | | 06/01/2028 | | | | 645 | | | 647,254 |

| Cuyahoga (County of), OH (MetroHealth System); | | | | | | | | | | | | | | |

| Series 2017, Ref. RB | | | 5.25% | | | | 02/15/2047 | | | | 1,805 | | | 1,816,683 |

| Series 2017, Ref. RB | | | 5.50% | | | | 02/15/2052 | | | | 795 | | | 805,739 |

| Series 2017, Ref. RB | | | 5.00% | | | | 02/15/2057 | | | | 1,915 | | | 1,880,080 |

| Franklin (County of), OH (Nationwide Children’s Hospital); Series 2019, RB | | | 5.00% | | | | 11/01/2048 | | | | 1,360 | | | 1,512,278 |