UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Under Rule 14a-12 |

KOHL’S CORPORATION |

(Name of Registrant as Specified in Its Charter) |

| |

MACELLUM BADGER FUND, LP MACELLUM BADGER FUND II, LP MACELLUM ADVISORS, LP MACELLUM ADVISORS GP, LLC JONATHAN DUSKIN GEORGE R. BROKAW FRANCIS KEN DUANE PAMELA J. EDWARDS STACY HAWKINS JEFFREY A. KANTOR PERRY M. MANDARINO CYNTHIA S. MURRAY KENNETH D. SEIPEL CRAIG M. YOUNG |

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| ☐ | Fee paid previously with preliminary materials: |

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

Macellum Badger Fund, LP, a Delaware limited partnership (“Macellum Badger”), together with the other participants named herein, has filed a preliminary proxy statement and accompanying WHITE proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit votes for the election of its slate of highly-qualified director nominees at the 2022 annual meeting of shareholders of Kohl’s Corporation, a Wisconsin corporation (the “Company”).

Item 1: On March 4, 2022, Macellum Badger issued the following press release:

Macellum Highlights Key Concerns With Kohl’s Strategy Ahead of Analyst Day

NEW YORK--(BUSINESS WIRE)--Macellum Advisors GP, LLC (together with its affiliates, “Macellum” or “we”), a long-term holder of nearly 5% of the outstanding common shares of Kohl’s Corporation (NYSE: KSS) (“Kohl’s” or the “Company”), today highlighted key concerns with the Company’s strategy ahead of its analyst day on March 7, 2022.

Jonathan Duskin, Macellum’s Managing Partner, commented:

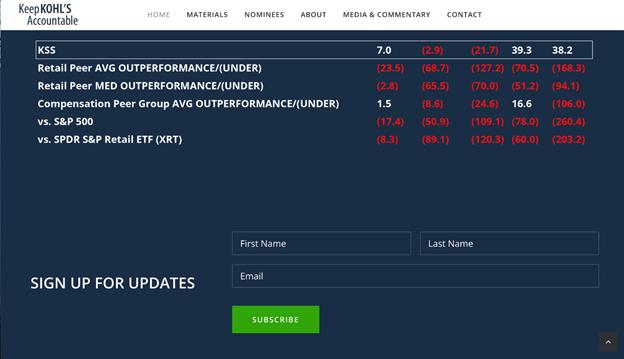

“While management celebrated its success and made dismissive excuses about the Company’s considerable loss of market share to its retail peer group, we see the fourth quarter fiscal year 2021 results through a different lens.1 We remain skeptical of Kohl’s’ future with the current Board of Directors and management configuration. The central issues in our mind remain: (1.) an inability to grow sales versus 2019 levels, (2.) gross margin gains that are looking increasingly one-time in nature due to dramatic deceleration and management’s plan to increase inventories, (3.) an inability to contain costs and (4.) poor capital allocation and balance sheet optimization. In advance of Monday’s analyst day, we believe there are several overarching questions that management must address.”

Key Questions for Kohl’s Management:

| 1. | Why were sales uniquely hampered by supply chain issues compared to many other retail peers? Kohl’s posted the worst full-year sales growth compared to its retail peer group, down 2.2% from 2019 levels with the gap growing in the fourth quarter fiscal year 2021 as the Company significantly lagged Macy’s and Dillard’s. We find it particularly worrisome that even Nordstrom – which is struggling with its own turnaround efforts – was able to post better sales results in the fourth quarter fiscal year 2021 than Kohl’s. |

| 2. | How does Kohl’s expect to increase gross margins over time, particularly when inventories are increasing? We have speculated that Kohl’s’ gross margin gains were largely the result of lower markdowns caused by the pandemic’s inventory disruptions rather than systematic changes in the merchandising process. Given that the gross margin change versus 2019 in the fourth quarter fiscal year 2021 sequentially declined ~310 basis points from the third quarter fiscal year 2021 – one of the largest declines among companies in its retail peer group that have reported so far – we believe shareholders’ concerns are warranted. |

| 3. | When and how will Kohl’s see meaningful margin expansion in the absence of sales growth? While Kohl’s was able to leverage SG&A for the first three quarters of 2021 versus 2019 levels, that trend ended in the fourth quarter fiscal year 2021 with SG&A deleveraging by 50 basis points versus 2019. Although we acknowledge that inflationary cost pressures exist today, we believe the Company needs to do more to offset them through higher gross margins or by cutting costs in other areas. |

1 Retail peer group includes: AEO, BBBY, BKE, BURL, CTRN, DDS, DKS, GPS, HIBB, JWN, M, PLCE, ROST, TGT, TJX, URBN, WSM.

| 4. | What assumptions are necessary to make the Sephora investment accretive? We are supportive of the addition of Sephora shops and believe they can drive traffic to Kohl’s stores, but we remain concerned about the Company spending excessively and the ultimate accretion to the bottom line. It would appear from the increase in capital expenditures necessary to build out the Sephora shops that each shop is costing close to $1 million ($200 million of additional capital expenditures above their historic maintenance capital expenditure levels for 200 additional doors versus 2021). |

With an average store generating $16 million in sales, a mid-single-digit lift from Sephora shops should equate to $800K of sales. At a 50% margin (we assume a higher-than-average gross margin for cosmetics), that equates to $400K of gross margin that management disclosed the Company split 50/50 with Sephora. The result is $200K gross margin for Kohl’s. With additional staffing necessary to support the Sephora experience (part of the Company’s rationale for the increase in SG&A of ~$150–200 million implied in guidance), it is possible each shop only generates $100K or less of incremental profit. That would imply almost a 10-year payback. Also, assuming five to 10 years for amortization of the capital expenditures, it is difficult to envision these shops being accretive to EBIT – or just breaking even. Further, we observe that most companies’ remodel benefits peak early – not grow over time.

| 5. | Given that the Company disclosed its plan to build inventories, what, if any, plan is in place to increase inventory turns? We believe Kohl’s’ slow inventory turn rate has been a root cause of high markdowns, cluttered stores and lack of fresh offerings. |

| 6. | Why has Kohl’s failed to address its significant real estate opportunity? None of the Company’s announced initiatives have addressed the more than $8 billion in real estate sitting idle on the balance sheet. We view this as a substantial missed opportunity, especially given that very few retailers own their real estate. Not only does Kohl’s trade at one of the lowest valuations in the sector, but it currently receives no credit for the value of its owned real estate. We believe the opportunity to monetize these assets will not exist forever, particularly in what is likely a rising rate environment. |

| 7. | What are the Company’s new margin targets? With lower gross margins, increasing inventory, rising SG&A and increasing depreciation and amortization costs, we struggle to see a path to higher margins without meaningful sales growth. Unfortunately, the current Board and management team have not been able to deliver top-line growth. Over the last decade, Kohl’s has had zero same-store sales growth in an industry that has grown 33%.2 Even if every Kohl’s store had a Sephora during the fourth quarter fiscal year 2021, and those shops fueled a mid-single-digit lift as the Company just reiterated, overall sales would have been flat versus 2019 and still trailed Macy’s, Dillard’s and the vast majority of peers. We fear Kohl’s’ guidance for 2022 leaves little margin for error and could result in meaningfully lower EBIT if sales don’t materialize. |

We believe the Company’s disappointing fourth quarter fiscal year 2021 results and plan to increase capital expenditures only serve to erode investors’ confidence in the ability of the current Board and management team to establish a credible plan to create meaningful shareholder value. We believe a properly refreshed Board can develop a superior strategic, financial and operating plan that targets stronger earnings and value creation, while also running a fair and robust strategic alternatives process that would determine what is the best risk-adjusted return for shareholders. We hope shareholders join us in calling on the Company to hit pause on increasing expenses and capital expenditures while it should be objectively evaluating credible sale offers from well-capitalized buyers.

2 Source: U.S. Census Bureau, Advance Monthly Retail Trade Survey, Clothing & Clothing Accessories Stores.

About Macellum

Macellum Capital Management is an activist investment firm, with deep expertise in the retail and consumer sectors, founded in 2009 by Jonathan Duskin. Macellum invests in undervalued companies that it believes can appreciate significantly in value as a result of a change in corporate strategy or improvements in operations, capital allocation or corporate governance. Macellum’s investment team, advisors and network of industry experts draw upon their extensive strategic, operating and boardroom experience to assist companies in designing and implementing initiatives to improve long-term shareholder value. Macellum prefers to constructively engage with management to improve its governance and performance for the benefit of all stockholders. However, when management is entrenched, Macellum has run successful proxy contests to effectuate meaningful change. Macellum has run successful election contests to effectuate meaningful change at many companies, including at The Children’s Place Inc., Citi Trends, Inc., Bed Bath and Beyond and Big Lots, Inc. Learn more at www.macellumcapitalmanagement.com.

Certain Information Concerning the Participants

Macellum Badger Fund, LP, a Delaware limited partnership (“Macellum Badger”), together with the other participants named herein, has filed a preliminary proxy statement and accompanying WHITE proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit votes for the election of its slate of highly-qualified director nominees at the 2022 annual meeting of shareholders of Kohl’s Corporation, a Wisconsin corporation (the “Company”).

MACELLUM BADGER STRONGLY ADVISES ALL SHAREHOLDERS OF THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS’ PROXY SOLICITOR.

The participants in the proxy solicitation are anticipated to be Macellum Badger, Macellum Badger Fund II, LP, a Delaware limited partnership (“Macellum Badger II”), Macellum Advisors, LP, a Delaware limited partnership (“Macellum Advisors”), Macellum Advisors GP, LLC, a Delaware limited liability company (“Macellum GP”), Jonathan Duskin, George R. Brokaw, Francis Ken Duane, Pamela J. Edwards, Stacy Hawkins, Jeffrey A. Kantor, Perry M. Mandarino, Cynthia S. Murray, Kenneth D. Seipel and Craig M. Young.

As of the date hereof, Macellum Badger directly beneficially owns 216,204 shares of Common Stock, $0.01 par value per share, of the Company (the “Common Stock”), including 1,000 shares in record name. As of the date hereof, Macellum Badger II directly beneficially owns 6,338,528 shares of Common Stock. As the investment manager of Macellum Badger and Macellum Badger II, Macellum Advisors may be deemed to beneficially own the 216,204 shares of Common Stock beneficially directly owned by Macellum Badger and 6,338,528 shares of Common Stock beneficially owned directly by Macellum Badger II. As the general partner of Macellum Badger, Macellum Badger II and Macellum Advisors, Macellum GP may be deemed to beneficially own the 216,204 shares of Common Stock beneficially owned directly by Macellum Badger and 6,338,528 shares of Common Stock beneficially owned directly by Macellum Badger II. As the sole member of Macellum GP, Mr. Duskin may be deemed to beneficially own the 216,204 shares of Common Stock beneficially owned directly by Macellum Badger and 6,338,528 shares of Common Stock beneficially owned directly by Macellum Badger II.

As of the date hereof, none of George R. Brokaw, Francis Ken Duane, Pamela J. Edwards, Stacy Hawkins, Jeffrey A. Kantor, Perry M. Mandarino, Cynthia S. Murray, Kenneth D. Seipel or Craig M. Young own beneficially or of record any securities of the Company.

Contacts

For Investors:

Saratoga Proxy Consulting

John Ferguson / Joe Mills, 212-257-1311

info@saratogaproxy.com

For Media:

Longacre Square Partners

Casie Connolly / Bela Kirpalani, 646-386-0091

macellum@longacresquare.com

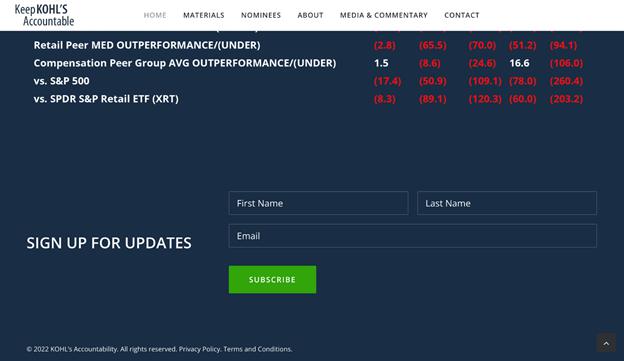

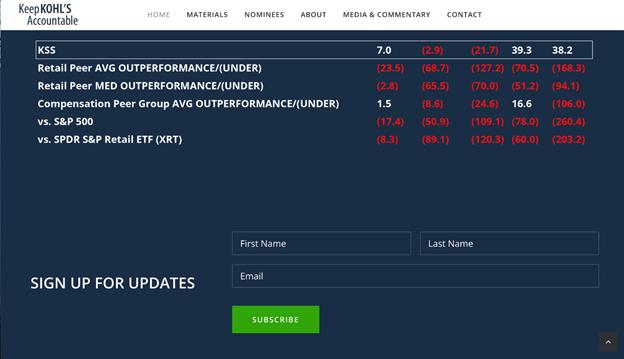

Item 2: On March 4, 2022, Macellum Badger uploaded the following materials to https://KeepKohlsAccountable.com:

Item 3: On March 4, 2022, Jonathan Duskin, Chief Executive Officer of Macellum Capital Management, LLC, was quoted in the following article published by Activist Insight:

Macellum questions Kohl’s strategy ahead of analyst meeting

Activist Insight

March 4, 2022

Macellum Advisors has criticized Kohl’s loss of market share under its current board, days ahead of the company’s March 7 analyst meeting.

Macellum, which has nominated 10 director candidates for the retail chain, said in a Friday press release that it was concerned with Kohl’s “inability” to grow sales versus 2019, its gross margin gains that are “looking increasingly one-time,” its “inability” to contain costs, and the company’s poor capital allocation.

“While management celebrated its success and made dismissive excuses about the company’s considerable loss of market share to its retail peer group, we see the fourth quarter fiscal year 2021 results through a different lens. We remain skeptical of Kohl’s' future with the current board of directors and management configuration,” said Duskin.

The release went on to question Kohl’s strategy, including why sales were “uniquely hampered” compared to other retailers, how the company will increase gross margins over time, and when Kohl’s will see “meaningful margin expansion in the absence of sales growth,” among other things.

Macellum nominated 10 directors to Kohl’s board in February and last week criticized the company for taking measures to discourage suitors and suppress dissenting voices.

Kohl’s said the activist “continues to make contradictory and counterproductive claims,” in a statement last week.

Shares in Kohl’s were little changed in morning trading Friday at $58.41 per share.

Item 4: On March 4, 2022, Jonathan Duskin was quoted in the following article published by Women’s Wear Daily:

Kohl’s Staging Investor Day Amid Unceasing Activist Pressure

Women’s Wear Daily

By David Moin

March 4, 2022

Kohl's investor day will be held virtually and include a Q&A session.

Kohl’s Corp. executives will lay out its past successes and strategies for the future at its annual investor day on Monday, though it’s likely not all shareholders will like what they hear.

Kohl’s for months has been under fire by certain activist investors, in particular Macellum Advisors, a long-term holder of nearly 5 percent of the outstanding common shares of Kohl’s. Macellum is seeking to control the board with its own slate of 10 proposed directors that is subject to shareholder approval. Engine Capital has also been putting pressure on Kohl’s.

Last Tuesday, the Menomonee Falls, Wisc.-based Kohl’s reported that its fourth-quarter net income — impacted by inventory shortages, slowed traffic due to Omicron and some tax implications — declined 13 percent but noted that its operating income, which eliminates the impact of the tax difference, was up 42 percent, and that for all of 2021, the company swung into profitability.

Kohl’s chief executive officer Michelle Gass said the company has “fundamentally restructured to be more profitable. That will be sustained. It’s really important that we delivered record earnings per share of $7.33 in 2021, which far surpassed our previous high of $5.60 in 2018. Our business is healthy.”

Jonathan Duskin, Macellum’s managing partner, doesn’t think so.

On Friday, just three days before Kohl’s investor day, Duskin stated, “We see the fourth-quarter fiscal year 2021 results through a different lens. We remain skeptical of Kohl’s’ future with the current board of directors and management configuration. The central issues in our mind remain an inability to grow sales versus 2019 levels, gross margin gains that are looking increasingly one-time in nature due to dramatic deceleration and management’s plan to increase inventories, an inability to contain costs and poor capital allocation and balance sheet optimization.”

He’s hoping that the Kohl’s team addresses his concerns at the investor day, which will be virtual and include a Q&A component.

Duskin pointed out that Kohl’s 2021 sales performance, down 2.2 percent from 2019 levels, lagged Macy’s, Dillard’s and Nordstrom, and speculated that Kohl’s’ gross margin gains were largely the result of lower markdowns caused by the pandemic’s inventory disruptions rather than systematic changes in the merchandising process

While expressing support for the rollout of Sephora shops inside Kohl’s, as traffic builders, Duskin wrote, “We remain concerned about the company spending excessively and the ultimate accretion to the bottom line. It would appear from the increase in capital expenditures necessary to build out the Sephora shops that each shop is costing close to $1 million, $200 million of additional capital expenditures above their historic maintenance capital expenditure levels for 200 additional doors versus 2021.

Duskin also cited a “slow inventory turn rate” as being “the root cause of high markdowns, cluttered stores and lack of fresh offerings” and criticized Kohl’s for not evaluating offers to buy the company and not monetizing real estate. He said the company is letting $8 billion in real estate “sit idle.”

“We hope shareholders join us in calling on the company to hit pause on increasing expenses and capital expenditures while it should be objectively evaluating credible sale offers from well-capitalized buyers.”

The Kohl’s board has already rejected at least two bids to take over the company, though more could arise, and has much support from the vendor community. Over the past couple of years, Kohl’s, led by Gass, has sharpened its assortment to become more of a destination for active, casual, outerwear and special sizes offerings, adding such brands as Calvin Klein, Lands’ End, Cole Haan, Eddie Bauer, while building up offerings of Nike, Adidas, Champion, Under Armour, as well as Sephora.

In addition, Kohl’s is spending $3 billion on a share repurchasing program, and expects sales to be up 2 to 3 percent this year. “We are feeling very confident there,” Gass said on Tuesday. “The biggest driver there will be Sephora and that’s been proved based on having Sephora open in 200 doors today.” Kohl’s expects to open another 400 Sephora shops this year, and 250 more in 2023.

Item 5: On March 4, 2022, Jonathan Duskin was quoted in the following article published by BizTimes:

Macellum “remains skeptical” of Kohl’s outlook following company’s 2021 earnings report

BizTimes

By Maredithe Meyer

March 4, 2022

Asks retailer to address concerns over lagging sales, increasing costs ahead of investor day

In response to the report of Kohl’s fiscal 2021 results and ahead of its annual investor day next week, activist investor Macellum Capital Management is voicing criticism about the retailer’s current turnaround strategy.

Macellum, which owns a 5% stake in Menomonee Falls-based Kohl’s Corp., issued a press release Friday morning with seven “key questions” directed at Kohl’s management. It’s the group’s latest move in an ongoing campaign to take over the company’s board of directors.

Kohl’s on Tuesday reported earnings of $299 million for the fourth quarter of fiscal 2021, down 13% from the same period in 2020, citing pandemic-related supply chain disruption. Earnings for the full year totaled $938 million, coming back from a loss of $163 million in 2020 – a direct result of the COVID-19 pandemic. Compared to pre-pandemic 2019, earnings were up 35%, but net sales were down 5% for the quarter and 2% for the full year. It also reported a record-setting $7.33 earnings per share in 2021, topping the previous high of $5.60 in 2018.

Chief executive officer Michelle Gass said Kohl’s remains “extremely confident in the future growth and cash flow generation of our business.” During the company’s earnings conference call, she assured analysts and investors that the board is committed to its fiduciary duty to act in the best interest of shareholders.

Kohl’s board recently approved a 100% increase in its dividend, which boosts its quarterly dividend from 25 cents to 50 cents per common share. The last time the company’s dividend was 50 cents was 2016. Prior to the pandemic, Kohl’s increased its dividend 5% to 70 cents per share.

“While management celebrated its success and made dismissive excuses about the company’s considerable loss of market share to its retail peer group, we see the fourth quarter fiscal year 2021 results through a different lens,” said Macellum managing partner Jonathan Duskin in the news release Friday.

He cited the group’s central concerns, which have been well documented through open letters and proxy filings: stagnant sales compared to 2019; gross margin gains that appear short-lived; increasing costs; and poor capital allocation and balance sheet optimization. The group urged Kohl’s management to address their questions in advance of investor day, to be held virtually on March 7, from 8 to 11 a.m.

Macellum questioned Kohl’s lagging sales performance in comparison to industry peers Dillard’s and Macy’s, which both posted better results for the year and quarter. And as inventory costs increase, they asked: how will Kohl’s continue expanding its gross margin without also increasing sales?

“Although we acknowledge that inflationary cost pressures exist today, we believe the company needs to do more to offset them through higher gross margins or by cutting costs in other areas,” according to the release.

It also poked holes in Kohl’s newly launched partnership with beauty retail giant Sephora. Kohl’s said Sephora’s shop-in-shops, now in 200 of its stores and growing, contributed to a mid-single digit sales boost at those locations. But Macellum argues the partnership comes at too high of a cost. A major chunk of Kohl’s $605 million in capital expenditures in 2021 went toward the build out of Sephora shops, and with 400 more opening this year, Kohl’s expects to spend $850 million in 2022.

“With additional staffing necessary to support the Sephora experience … it is possible each shop only generates $100,000 or less of incremental profit. That would imply almost a 10-year payback. Also, assuming five to 10 years for amortization of the capital expenditures, it is difficult to envision these shops being accretive to EBIT (earnings before interest and taxes) – or just breaking even. Further, we observe that most companies’ remodel benefits peak early – not grow over time,” said Macellum.

Additionally, the firm made another push for a large-scale sale-leaseback transaction of Kohl’s store properties as a way to create shareholder value. Kohl’s has stood in opposition to the suggestion since it was proposed by Macellum and other activist investors through a similar overhaul campaign last year. Kohl’s owns more than 400 of its 1,162 department stores locations across the U.S., and Macellum estimates that adds up to $7 billon to $8 billion in real estate value.

“We view this as a substantial missed opportunity, especially given that very few retailers own their real estate … We believe the opportunity to monetize these assets will not exist forever, particularly in what is likely a rising rate environment,” the firm said.

Macellum urged fellow shareholders to call on Kohl’s to stop increasing expenses and capital expenditures “while it should be objectively evaluating credible sale offers from well-capitalized buyers.”

Kohl’s did not immediately respond to a request for comment Friday.

Macellum has nominated a slate of 10 director nominees for election at the retailer’s 2022 annual meeting this spring, on a date yet-to-be-announced, when shareholders will cast their vote on who will lead the department store operator going forward.