UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

KOHL’S CORPORATION |

(Name of Registrant as Specified in Its Charter) |

| |

MACELLUM BADGER FUND, LP MACELLUM BADGER FUND II, LP MACELLUM ADVISORS, LP MACELLUM ADVISORS GP, LLC JONATHAN DUSKIN GEORGE R. BROKAW FRANCIS KEN DUANE PAMELA J. EDWARDS STACY HAWKINS JEFFREY A. KANTOR PERRY M. MANDARINO CYNTHIA S. MURRAY KENNETH D. SEIPEL CRAIG M. YOUNG |

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| ☐ | Fee paid previously with preliminary materials: |

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

Macellum Badger Fund, LP, a Delaware limited partnership (“Macellum Badger”), together with the other participants named herein, has filed a definitive proxy statement and accompanying WHITE proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit votes for the election of its slate of highly-qualified director nominees at the 2022 annual meeting of shareholders of Kohl’s Corporation, a Wisconsin corporation (the “Company”).

Item 1: On April 4, 2022, Macellum Badger was quoted in the following article published by the Milwaukee Journal Sentinel:

Activist investor Macellum critical of Kohl's Corp. sales process, calling it 'flawed and opaque'

Milwaukee Journal Sentinel

By Ricardo Torres

April 4, 2022

Activist investor Macellum Capital Management is again calling out Kohl's Corp. board of directors for its review of potential sellers and other financial alternatives, saying the process "appears to be flawed and opaque."

"In all of our years investing in the public market, we have never seen a corporate leadership team operate in a more defensive and insular manner when many shareholders seem very supportive of a sale and various suitors have expressed interest," Macellum said in a letter to the board Monday.

Kohl's fired right back saying it won't let Macellum pressure it into a sale.

In a statement, Kohl's said its board "will not allow Macellum’s ill-informed commentary and push for a quick sale at any price to drive process decisions."

Macellum owns nearly 5% of Kohl's and is trying to take over the board with its own slate of nominees.

In January, a group led by Acacia Research Corp. made an unsolicited offer of $9 billion to be the Menomonee Falls-based department store chain. Kohl's rejected the offer saying the price was too low.

The letter also claimed Kohl's stock would not be trading as high as it has recently had rumors of a sale were not made public.

"The board should consider that absent the prospect of a sale, the company’s share price would likely be even lower due to investors’ dissatisfaction with management’s three-year plan," the letter reads. "We believe Kohl’s has traded up nearly 30% over the past two months for one reason: investors are enthusiastic about the possibility of finally achieving a reasonable return via a sale."

Kohl's countered that its board is carefully studying sale proposals, that its board members are more qualified to make such a decision than Macellum's proposed slate of directors, and added that a sale may not be in the best interest of the company or its shareholders.

"The board is thoughtfully and thoroughly evaluating proposals to realize full and fair shareholder value and weighing those against the value-creation potential of a compelling strategic plan," the company stated. "Kohl’s Board is far more qualified to direct this process than Macellum and its slate of nominees, over half of whom have never served on a public company board and none of whom have served on a board of a retail company approaching the size of Kohl’s."

Kohl's has reported receiving multiple nonbinding proposals without committed financing, and the company is continuing with its due diligence "so that they have the opportunity to refine and improve their proposals and include committed financing and binding documentation."

Canadian retailer Hudson Bay has been reported to be a possible buyer.

Also in the letter, Macellum submitted a list of questions to the board regarding the process for a possible sale.

Kohl's scheduled the shareholder meeting for May 11, setting up a showdown with the activist investors and shareholders to decide which vision of the company's future to go with.

Item 2: On April 4, 2022, Macellum Badger was quoted in the following article published by 13D Monitor:

Macellum Issues Letter to the Kohl's Board Regarding the Need for a Transparent Update on the Company's Sale Process

"Business Wire (04/04/22)"

Macellum Advisors GP, LLC, which holds nearly 5% of the outstanding common shares of Kohl's Corp. (KSS), sent an open letter to the company's board on April 4. Macellum, which is seeking to install a slate of nominees to the board at the company's 2022 Annual Meeting, wrote, "In all of our years investing in the public market, we have never seen a corporate leadership team operate in a more defensive and insular manner when many shareholders seem very supportive of a sale and various suitors have expressed interest." The letter cites its abrupt rejection of "two credible and well-capitalized acquirers," its implementation of an "onerous, two-tiered poison pill that could only serve to chill acquirers' interest," and its rejection of "our offers to compromise by appointing a Macellum principal as a director and involving that individual in the process." According to Macellum, "A number of sizable shareholders have informed us that they are extremely frustrated with the board's poorly communicated process, which has followed two decades of perpetual stagnation." The letter lists questions that Kohl's board must answer "to regain some semblance of credibility and demonstrate respect for its fiduciary duty." Macellum wrote, "Rather than promoting uninspiring plans and trying to attack us, we hope the board finally takes steps to address these critical questions via a public communication well ahead of the Annual Meeting."

Item 3: On April 4, 2022, Macellum Badger was quoted in the following article published by Activist Insight:

Macellum presses Kohl’s to run transparent sale process

Activist Insight

April 4, 2022

Macellum Advisors has criticized retailer Kohl’s for running a “flawed and opaque review of strategic alternatives”.

In a Monday letter to Kohl’s board, 5% shareholder Macellum, who is concurrently running a proxy contest for 10 board seats, said “we have never seen a corporate leadership team operate in a more defensive and insular manner when many shareholders seem very supportive of a sale and various suitors have expressed interest.”

The activist said Kohl’s has failed to communicate “clearly and effectively��� about its “purported” process for evaluating potential acquirers’ overtures.

Shares in Kohl’s are up 19% year-to-date at $59.80 per share, which Macellum attributes to “investors [being] enthusiastic about the possibility of finally achieving a reasonable return via a sale.”

Macellum has called on Kohl’s to become more transparent with the process, asking the company to reveal details such as the number of interested parties, the final date bids will be gathered, and whether there are any pre-conditions that could dissuade interested parties, among other things.

Kohl’s recently authorized Goldman Sachs to coordinate with select bidders on behalf of the retailer, claiming it had received multiple indications of interest.

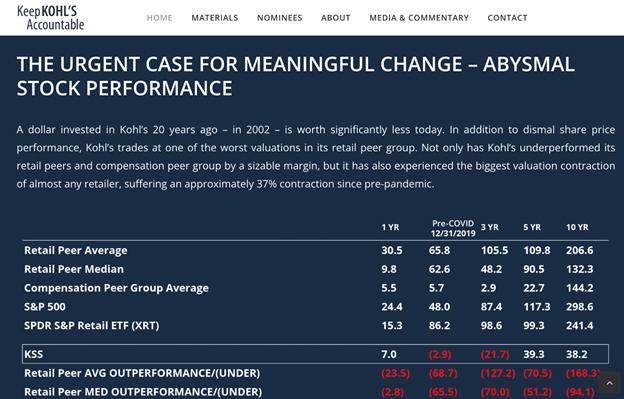

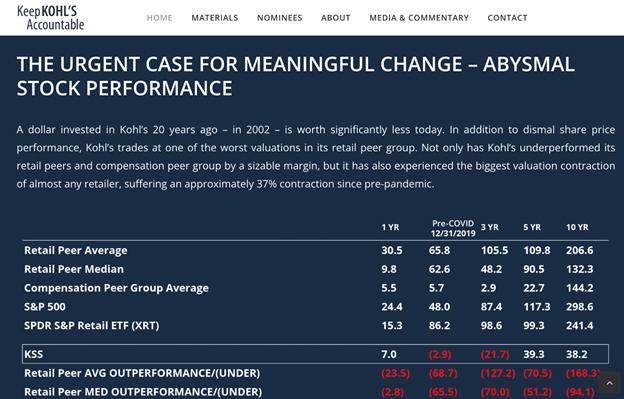

Item 4: On April 4, 2022, Macellum Badger uploaded the following materials to https://KeepKohlsAccountable.com: