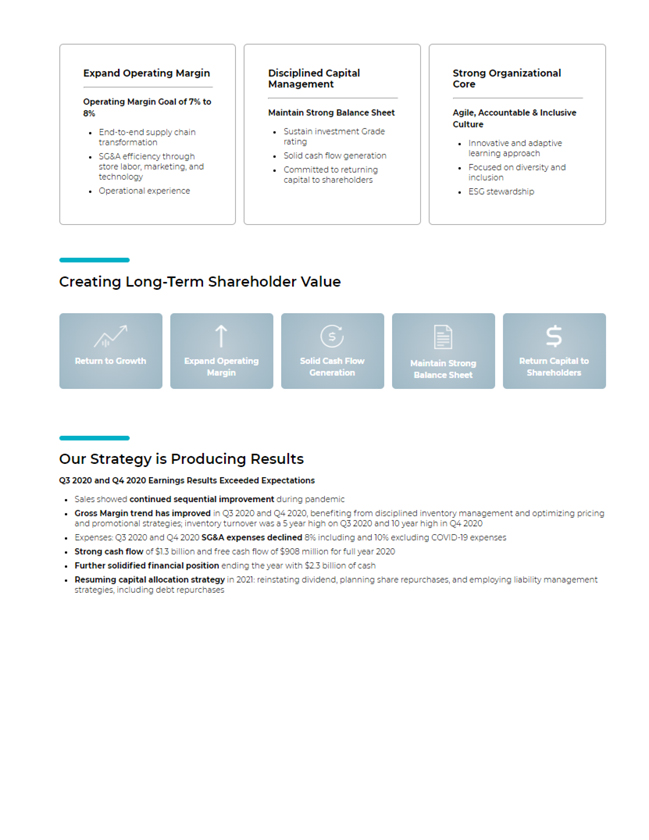

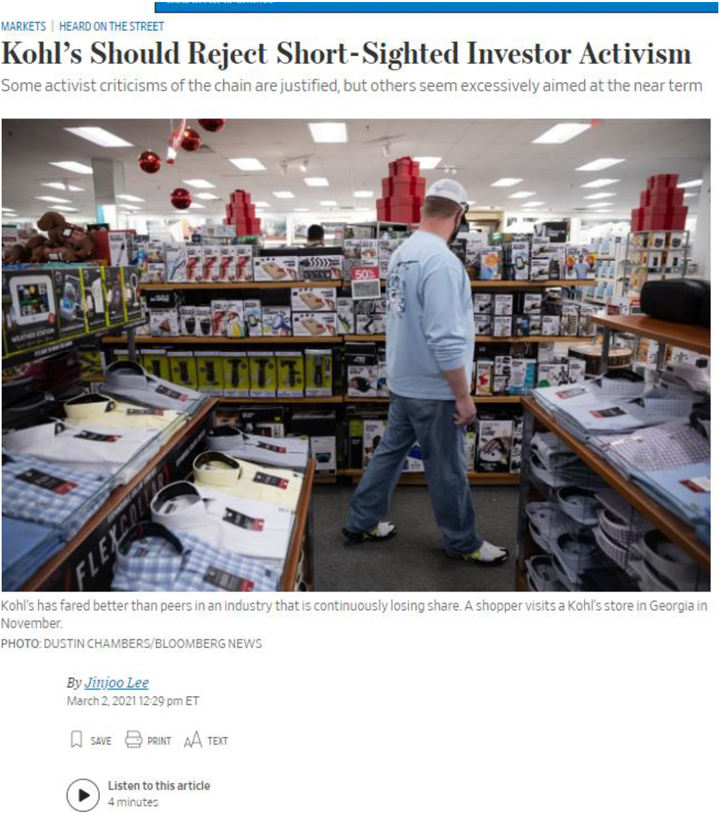

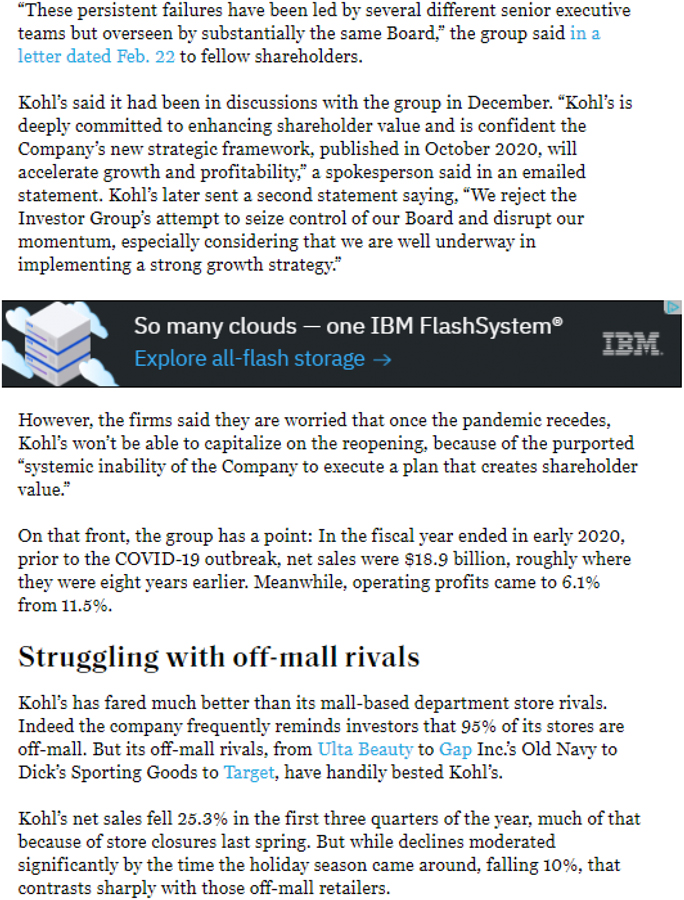

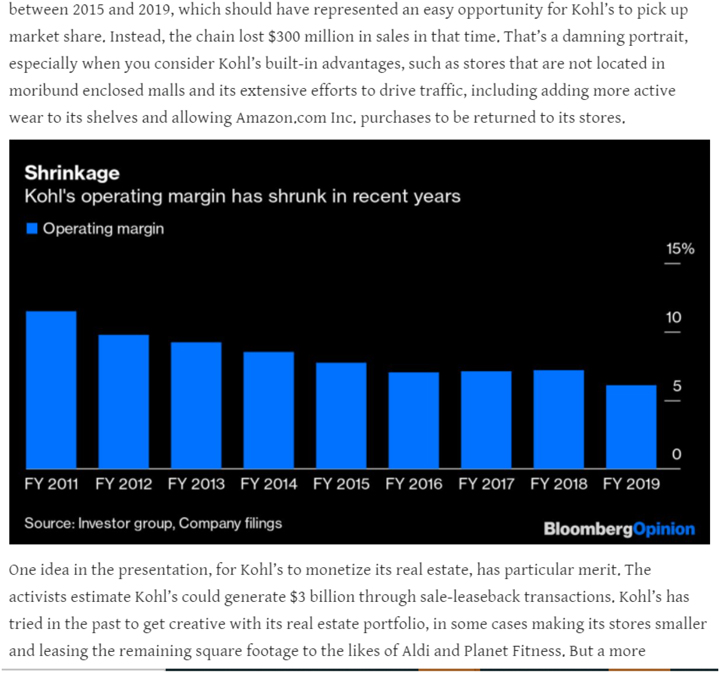

What’s more, the firms said, they are worried that once the pandemic recedes, Kohl’s won’t be able to capitalize on the reopening because of the purported “systemic inability of the Company to execute a plan that creates shareholder value.” On that front, the group has a point: in the fiscal year ended in early 2020, prior to the COVID-19 outbreak, net sales were $18.9 billion, roughly where they were eight years earlier. Meanwhile, operating profits came to 6.1% from 11.5%. Struggling with off-mall rivals Kohl’s has fared much better than its mall-based department store rivals. Indeed the company frequently reminds investors that 95% of its stores are off-mall. But its off-mall rivals, from Ulta Beauty to Gap Inc’s Old Navy, Dick’s Sporting Goods and Target, have handily bested Kohl’s. Kohl’s net sales fell 25.3% in the first three quarters of the year, much of that because of store closures last spring. But while declines moderated significantly by the time the holiday season came around, falling 10%, that contrasts sharply with those off-mall retailers. Kohl’s unveiled a new turnaround strategy in October predicated on building on its recent success in activewear, further phasing out weak store brands and finally becoming a sizable player in beauty. The company also promised to get its operating profit margins back up to the 7-8% range. (It will provide an update on that effort next week when it reports fourth-quarter financial results.)

A previous turnaround strategy in 2014, called the ‘Greatness Agenda,’ also based on a bigger beauty business and refreshed storebrands failed to change Kohl’s overall sales trajectory.

Still, under Gass, who has been Kohl’s CEO since 2018, the retailer has made big moves that likely averted big sales declines. After joining Kohl’s in 2013, she was the architect of Kohl’s big push into activewear, notably bringing in Under Armour: the category is now 20% of sales and Gass has said that could hit 30%.

Kohl’s has finally pared stale brands like Dana Buchman and Rock & Republic, but struggled to create new ones with the same touch and agility as Target has. Instead, Kohl’s has focused on bringing in more national brands that its rivals don’t carry, such as Lands’ End, Cole Haan, and TOMS.

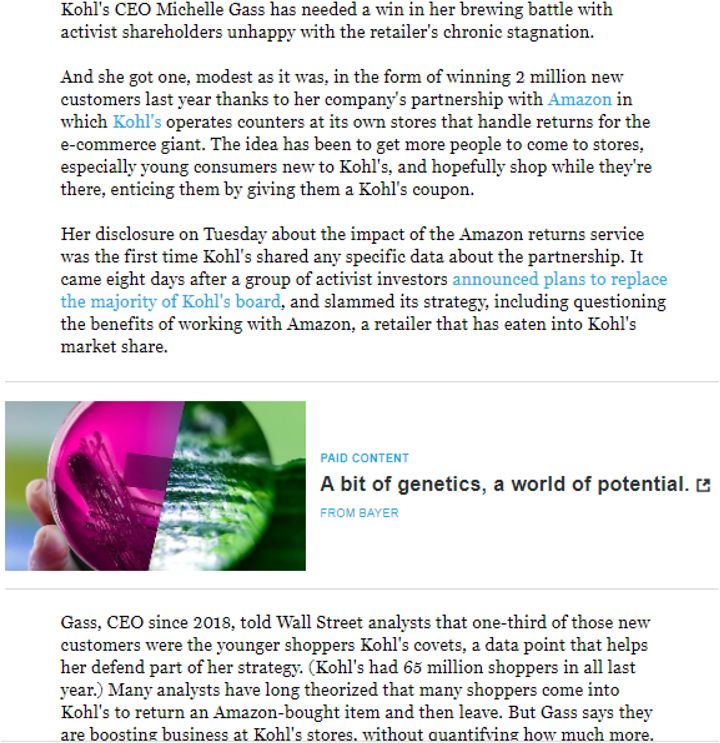

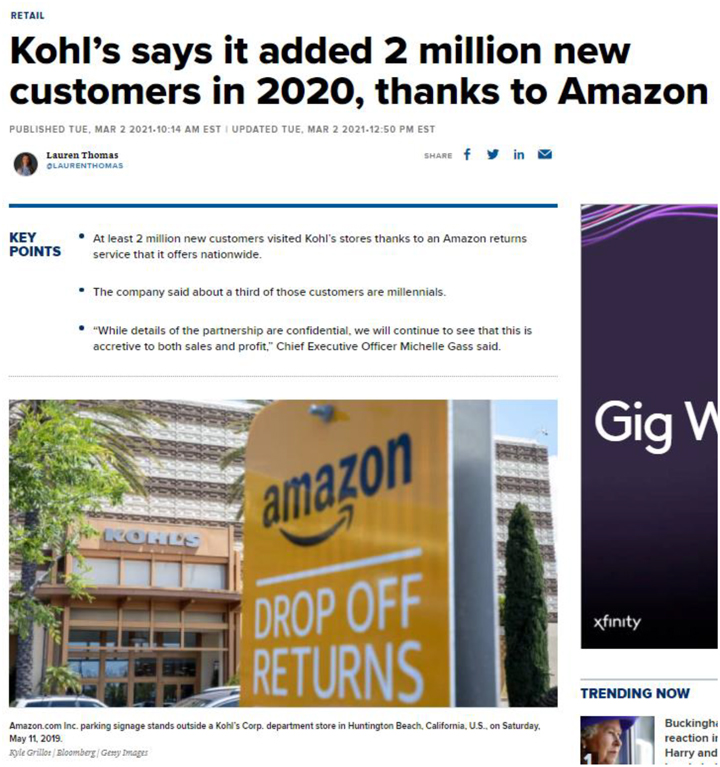

And in a daring move, Kohl’s has teamed up with Amazon to handle returns in its stores for the e¬commerce giant, betting that the extra shopper traffic would lift sales. The company doesn’t give out much information on that front so it’s hard to know whether the partnership has panned out.

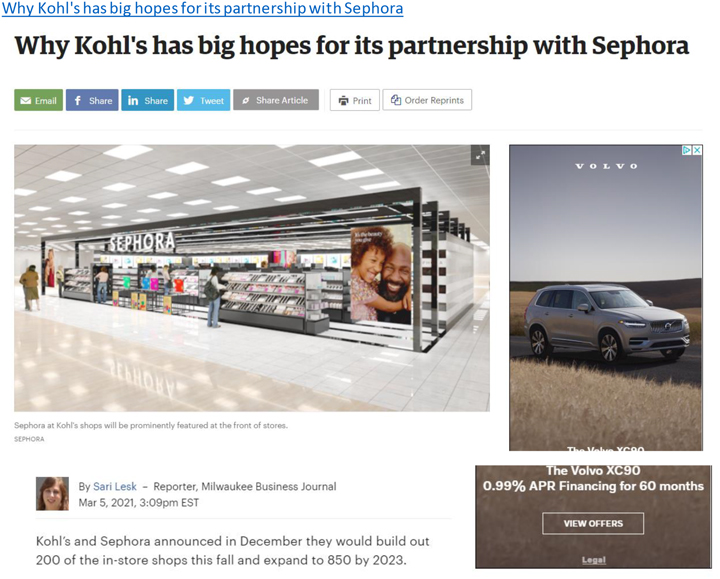

More recently, Gass landed a coup by winning a shop-in-shop partnership with LVMH’s Sephora away from Penney, instantly and finally making Kohl’s a major player in the beauty wars. The challenge of course will to see if Kohl’s manages to get Sephora customers to shop in the rest of its stores too, something they did not do much at Penney. (Kohl’s will be going up against the upcoming Ulta Beauty shops within Target stores.)

For all its problems, Kohl’s has plenty going for it. Many competitors are withering, it has a ton of stores dotting the country offering well known brands, and a loyal clientele. But ultimately, it also struggles to offer customers things they cannot find elsewhere or online.

What’s more, as Target’s holiday results as well as those of Walmart, have shown, customers are consolidating shopping trips during the pandemic, opting to get every things from clothes to groceries to sports gear under the same roof.

It’s anybody’s guess if they will continue to do so after COVID-19 recedes. But Kohl’s will have to make a very compelling case to get them to break these new habits.