UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

KOHL’S CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

THE FOLLOWING IS A PRESENTATION RELEASED BY THE COMPANY ON APRIL 21, 2022

This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The Company intends forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “anticipates,” “plans,” or similar expressions to identify forward-looking statements. Such statements, including statements regarding the outcome and timing of the strategic alternatives review process, are subject to certain risks and uncertainties, which could cause the Company’s actual results to differ materially from those anticipated by the forward-looking statements, and there can be no guarantee that the process will result in an agreement to sell the Company or that any such agreement will ultimately be consummated. These risks and uncertainties include, but are not limited to, risks described more fully in Item 1A in the Company’s Annual Report on Form 10-K, which are expressly incorporated herein by reference, and other factors as may periodically be described in the Company’s filings with the SEC. Forward-looking statements relate to the date initially made, and Kohl’s undertakes no obligation to update them.

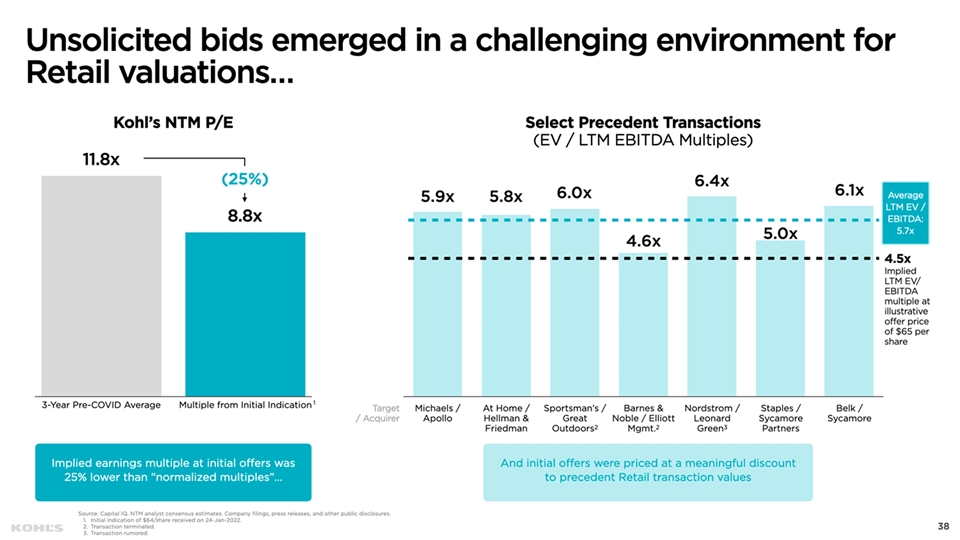

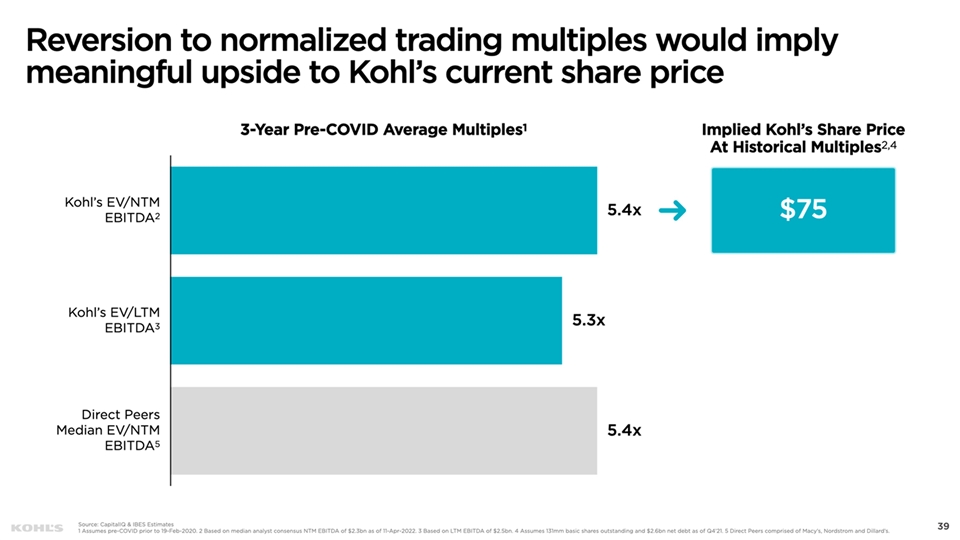

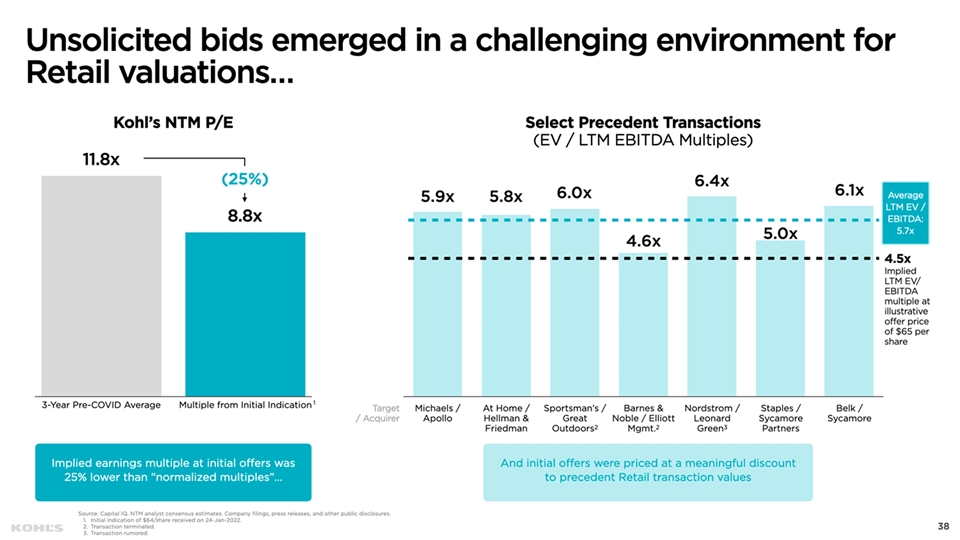

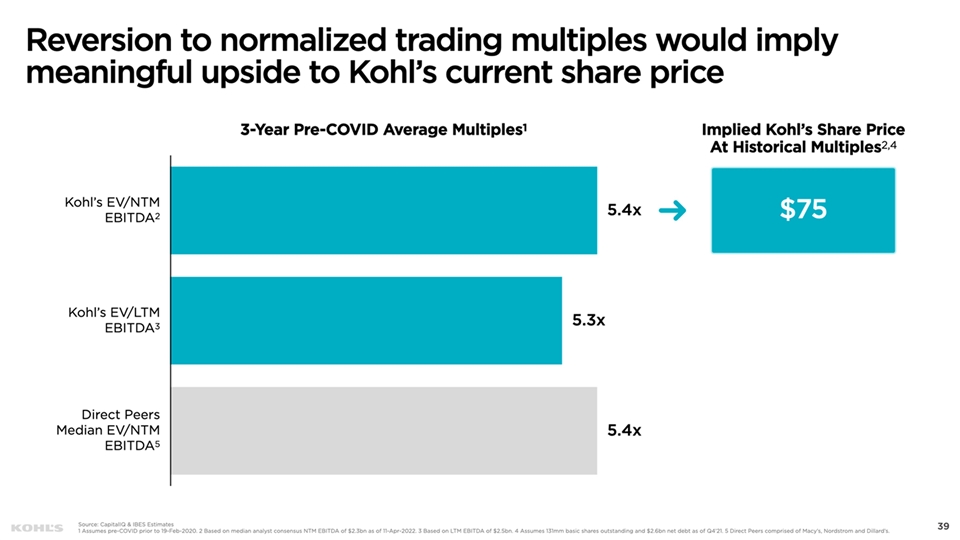

38 Implied earnings multiple at initial offers was 25% lower than “normalized multiples”... And initial offers were priced at a meaningful discount to precedent Retail transaction values

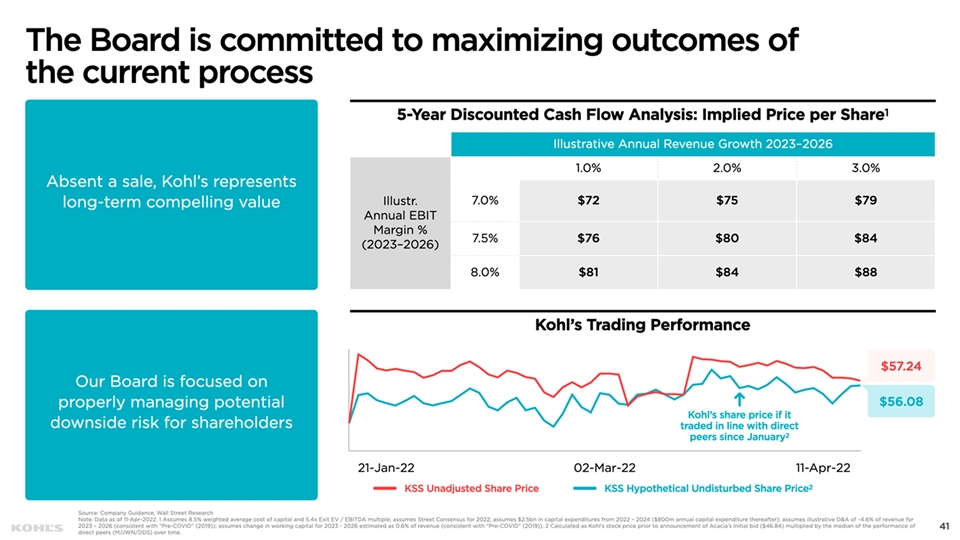

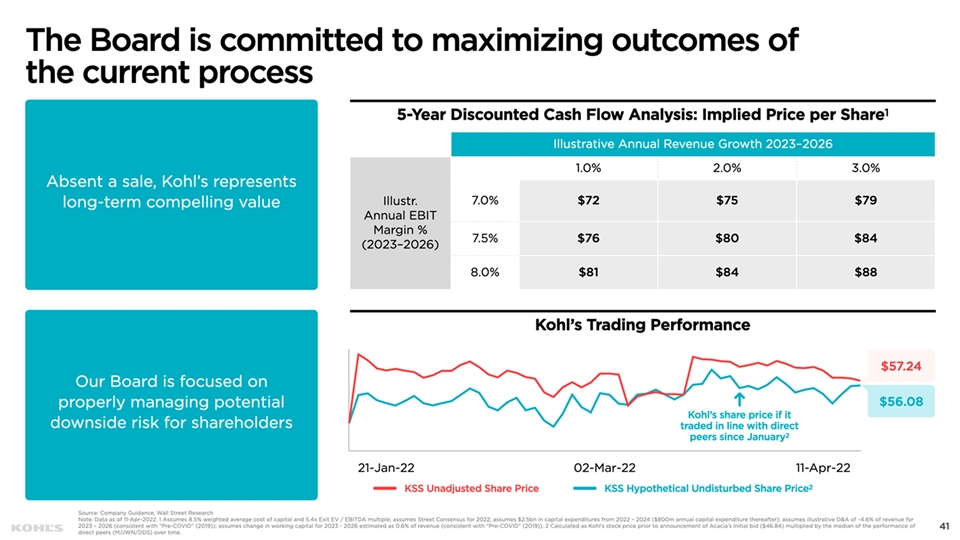

Source: Company Guidance, Wall Street Research Note: Today’s data as of 11-Apr-2022. 1 Assumes 8.5% weighted average cost of capital and 5.4x Exit EV / EBITDA multiple; assumes Street Consensus for 2022; assumes $2.5bn in capital expenditures from 2022 – 2024 ($800m annual capital expenditure thereafter); assumes illustrative D&A of ~4.6% of revenue for 2023 – 20226 (consistent with “Pre-COVID” (2019)); assumes change in working capital for 2023 - 2026 estimated as 0.6% of revenue (consistent with “Pre-COVID” (2019)). 2 Calculated as Kohl’s stock price prior to announcement of Acacia’s initial bid ($46.84) multiplied by the median of the performance of direct peers (M/JWN/DDS) over time. 41

THE FOLLOWING PRESS RELEASE WAS ISSUED ON APRIL 21, 2022 IN CONNECTION WITH THE PRESENTATION:

Kohl’s Releases Investor Presentation Highlighting Strong, Highly Qualified

Board of Directors and Strategy to Create Value

MENOMONEE FALLS, Wis. – April 21, 2022 – Kohl’s Corporation (NYSE:KSS) (“Kohl’s” or the “Company”) today released an additional presentation detailing progress on its strategy and initiatives to maximize shareholder value. The Company provided an overview of Kohl’s high caliber Board of Directors (the “Board”), which has the right experience to oversee the go-forward strategy while evaluating the ongoing review of expressions of interest to buy the Company. By comparison, the proposed slate nominated by Macellum Advisors GP (“Macellum”) is unqualified and inexperienced.

The presentation, along with other resources for shareholders, is available at KohlsMomentum.com. The website is regularly updated with relevant information for shareholders.

Highlights of the presentation include:

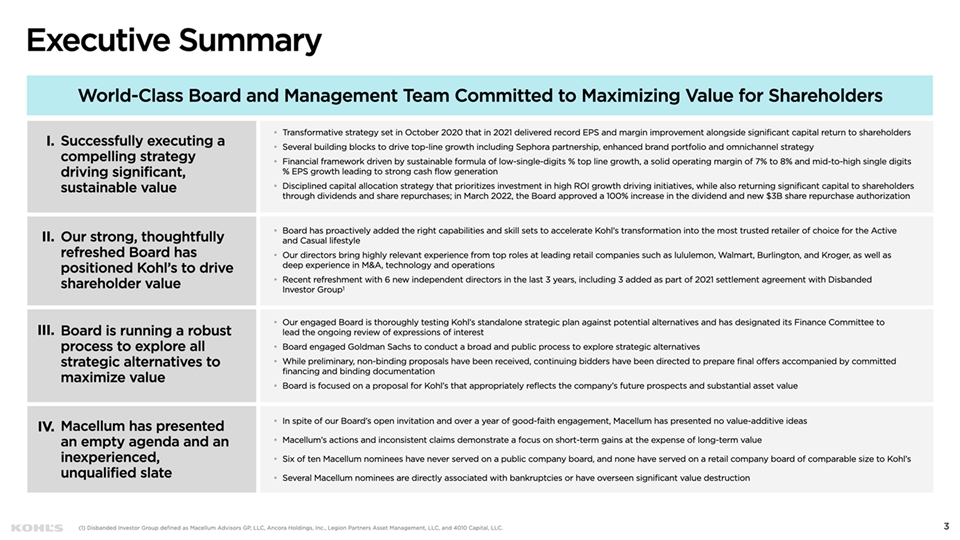

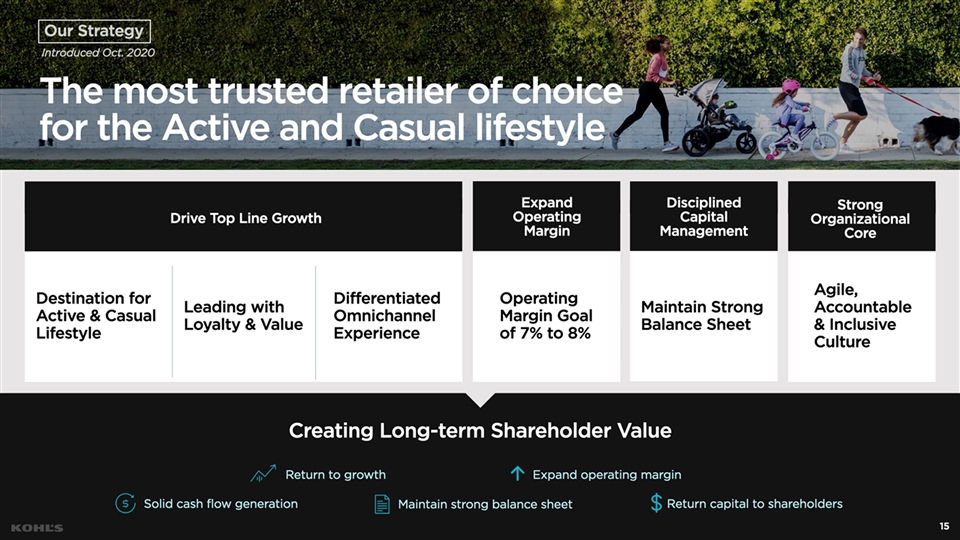

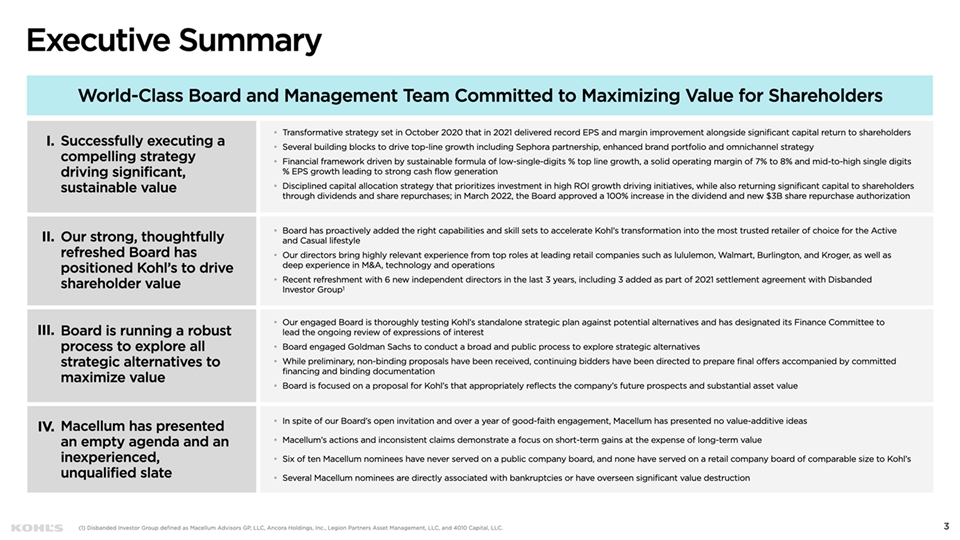

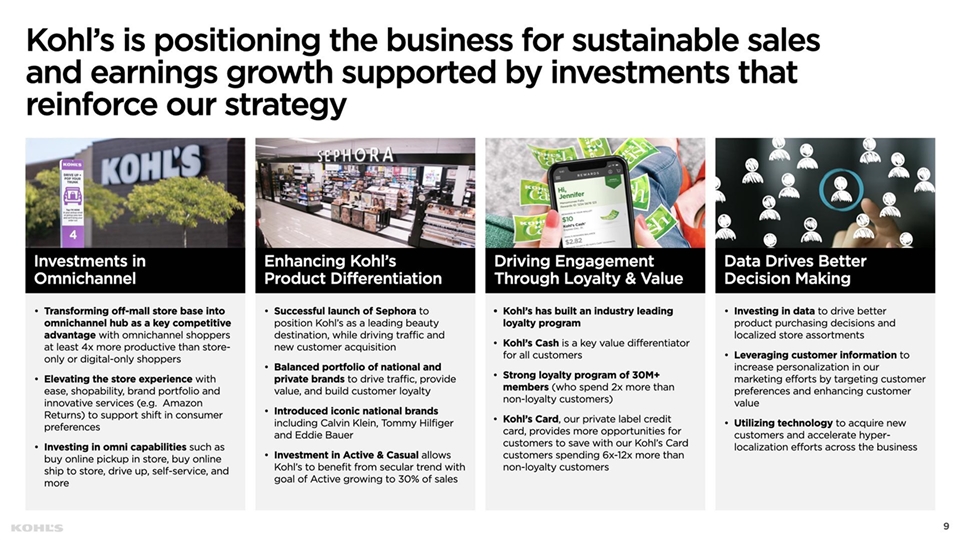

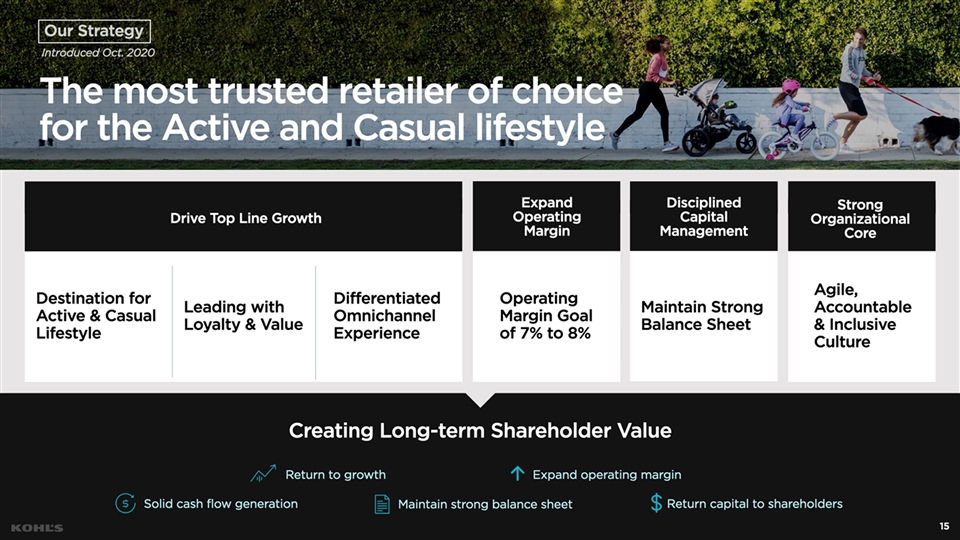

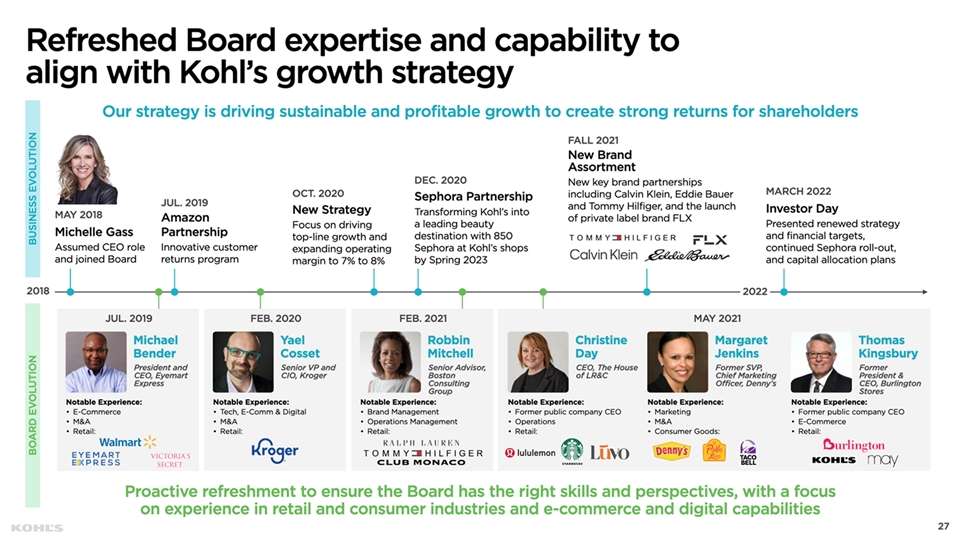

Kohl’s is executing a compelling strategy to drive significant, sustainable value.

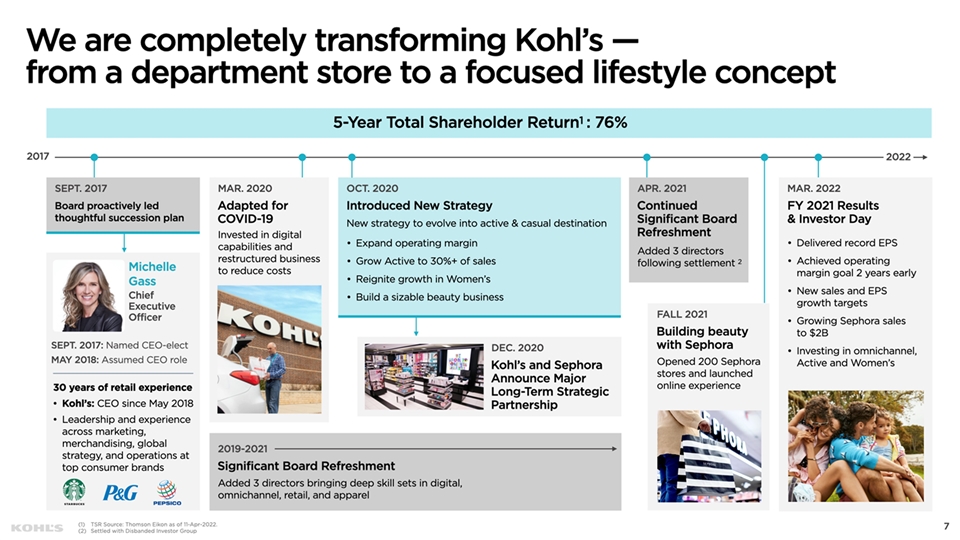

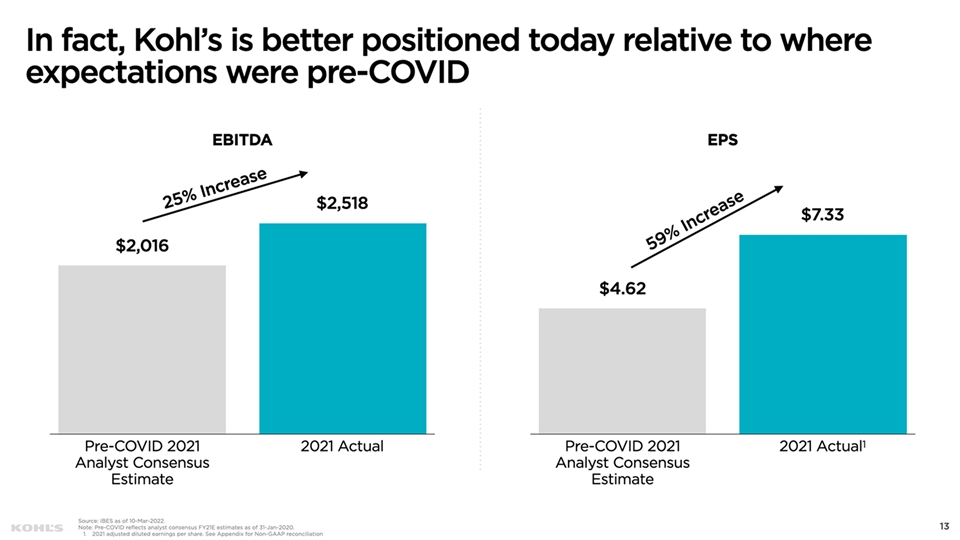

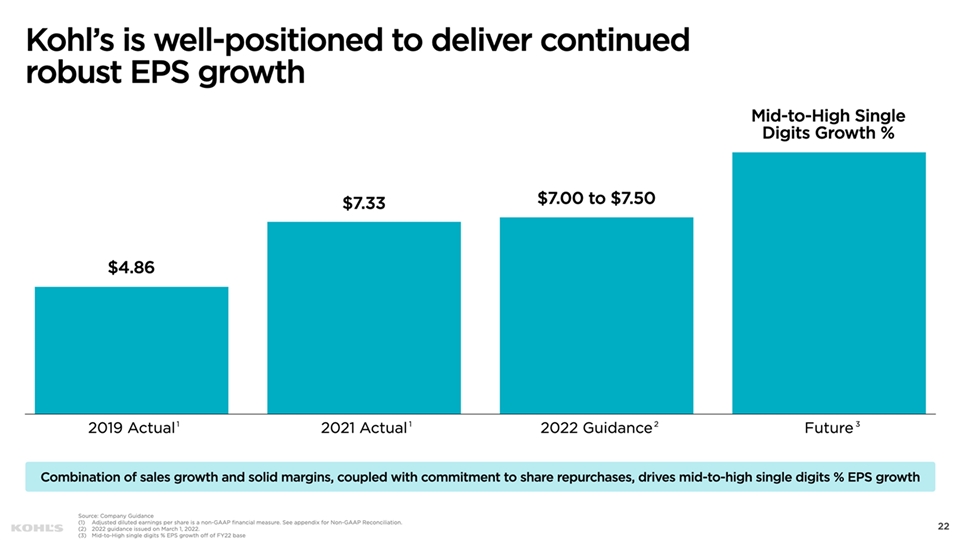

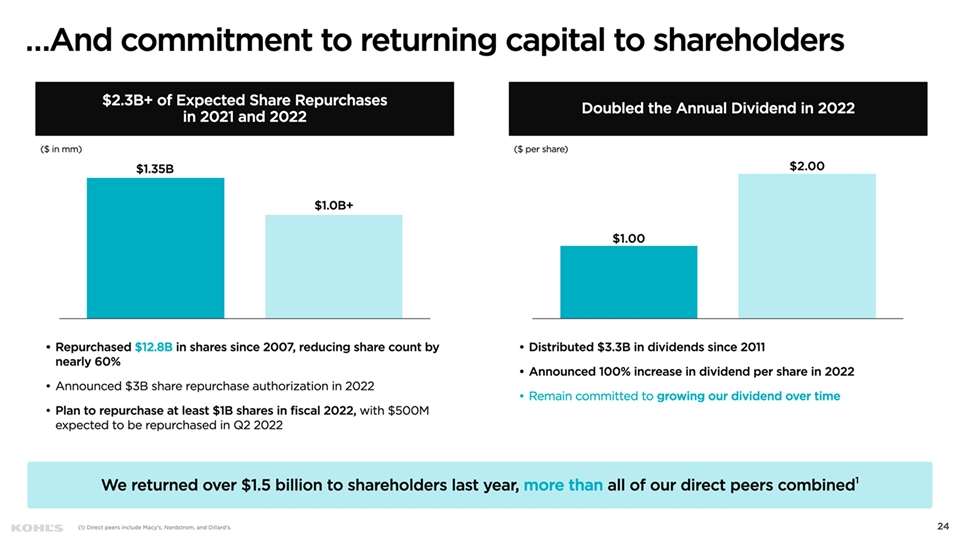

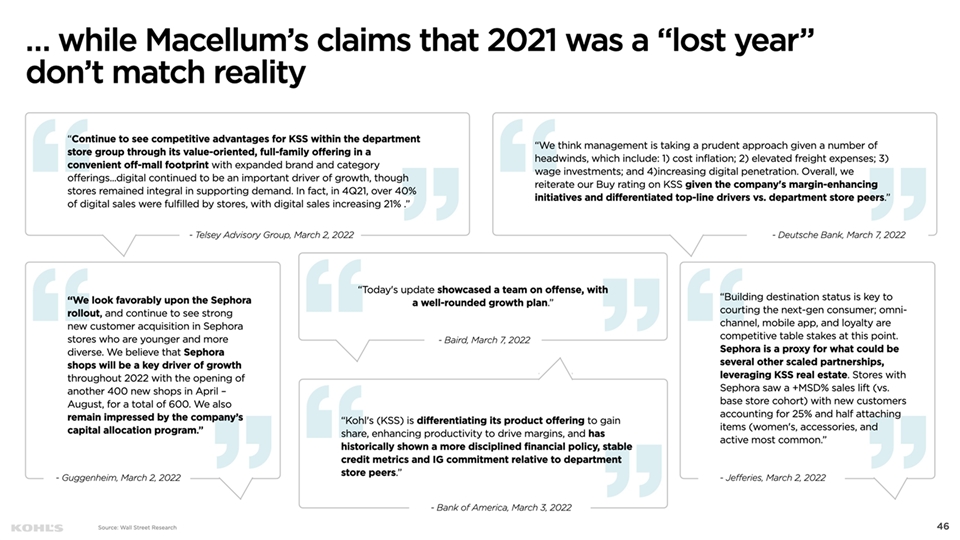

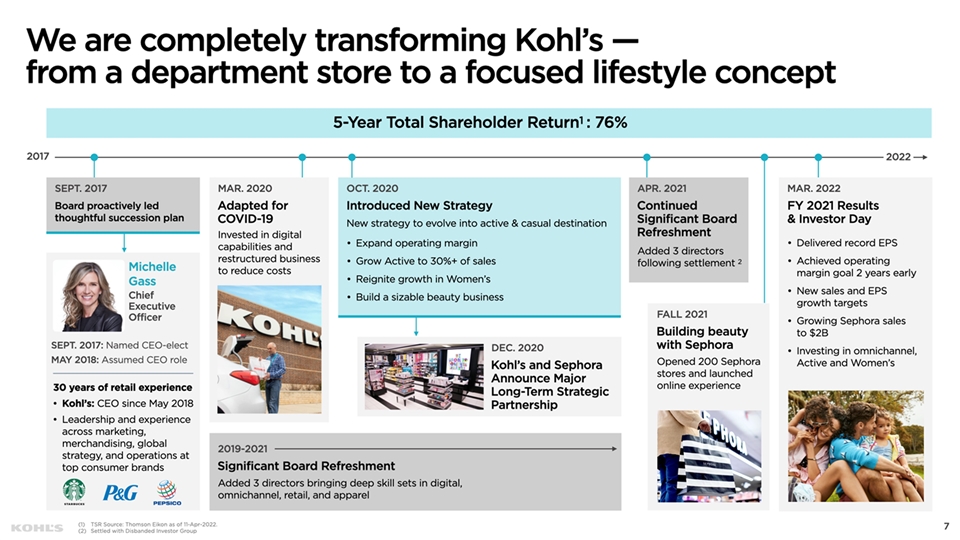

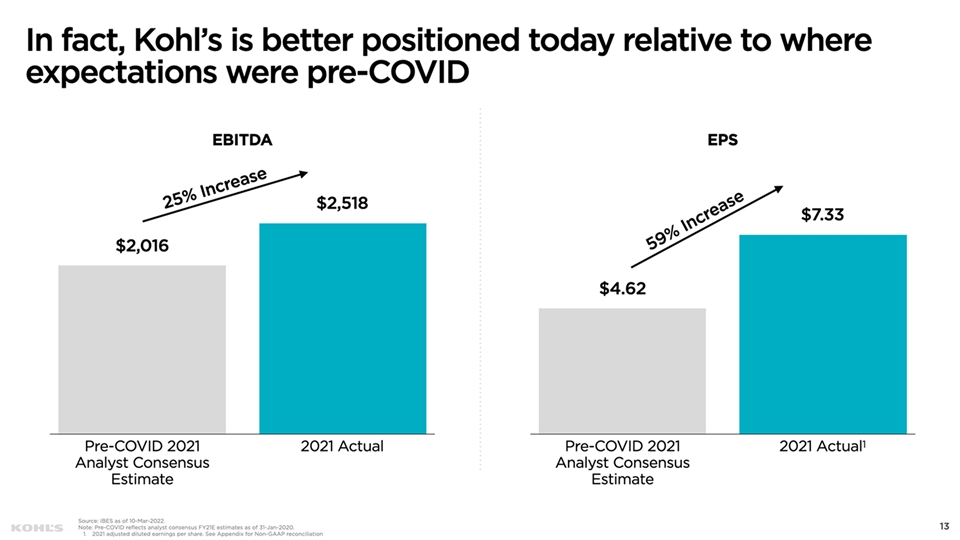

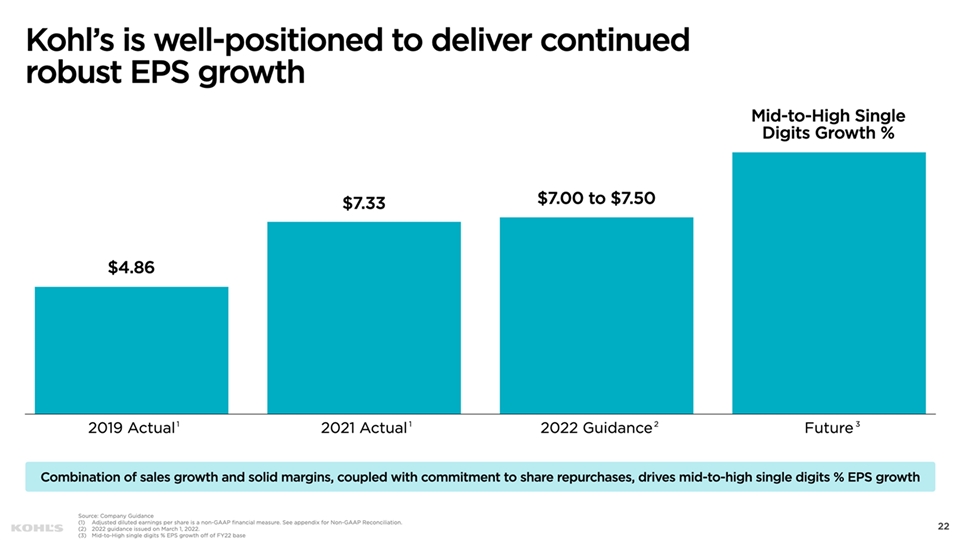

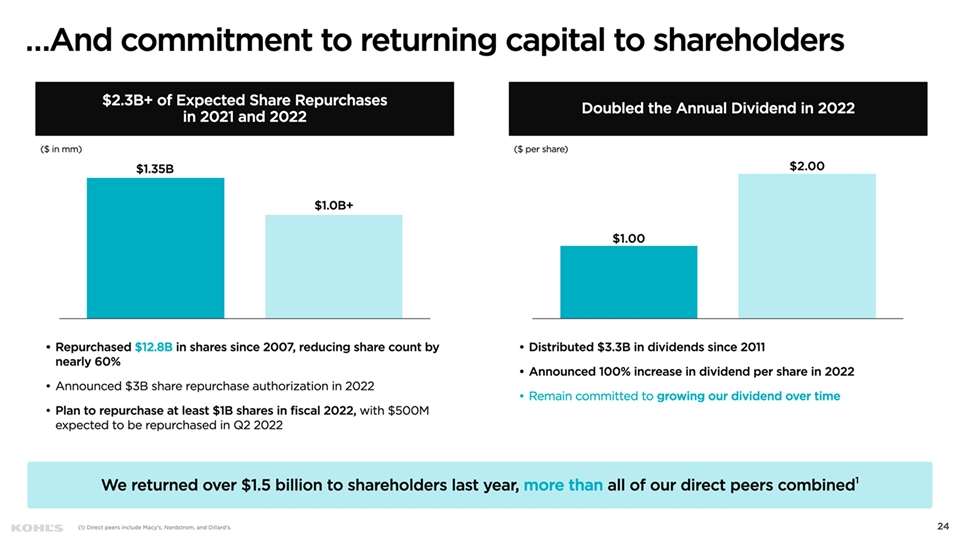

| | • | Our transformative strategy set in October 2020 delivered record EPS and margin improvement in 2021 alongside significant capital return to shareholders, including over $1.5 billion in share repurchases and dividends. |

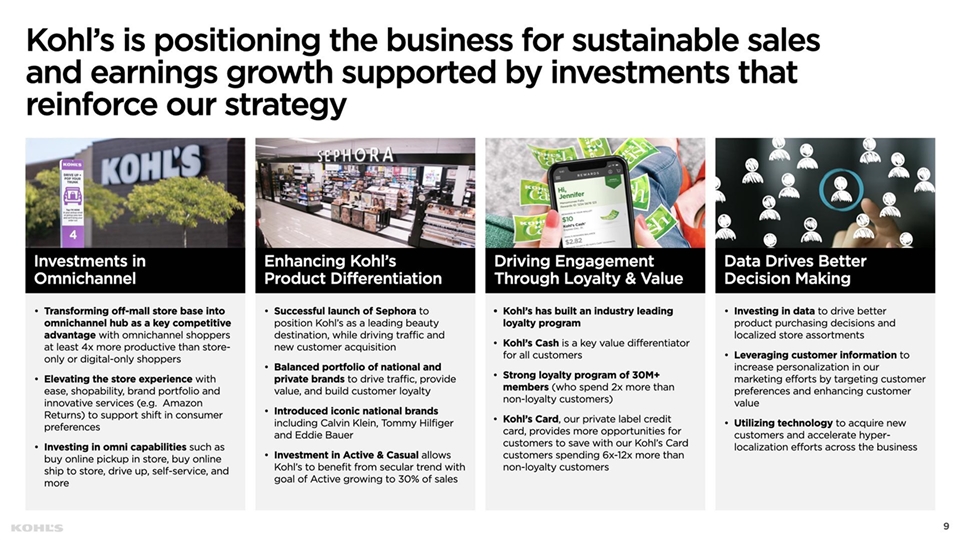

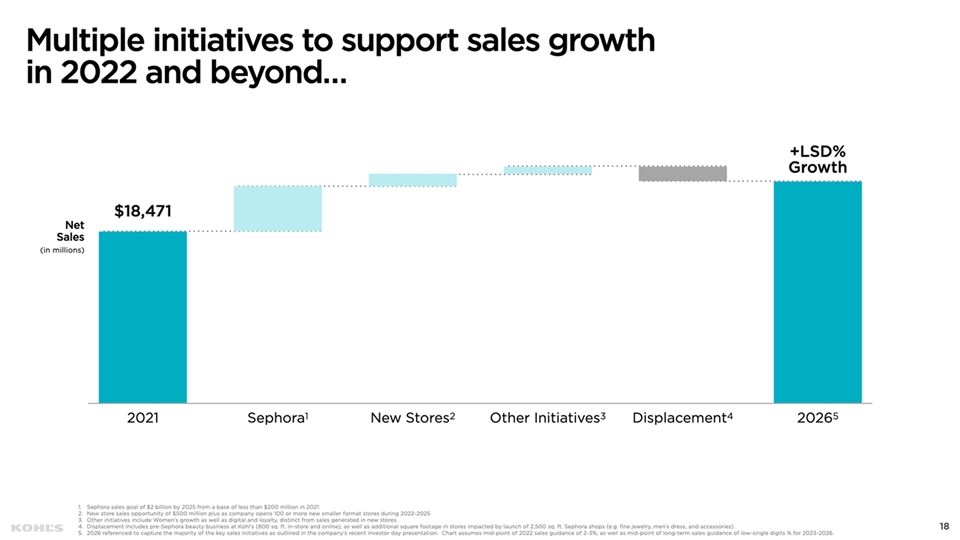

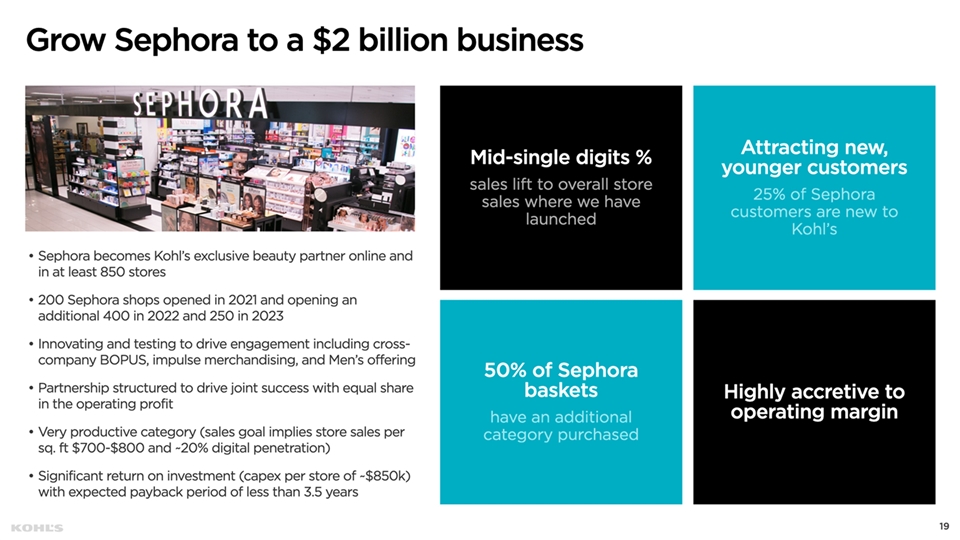

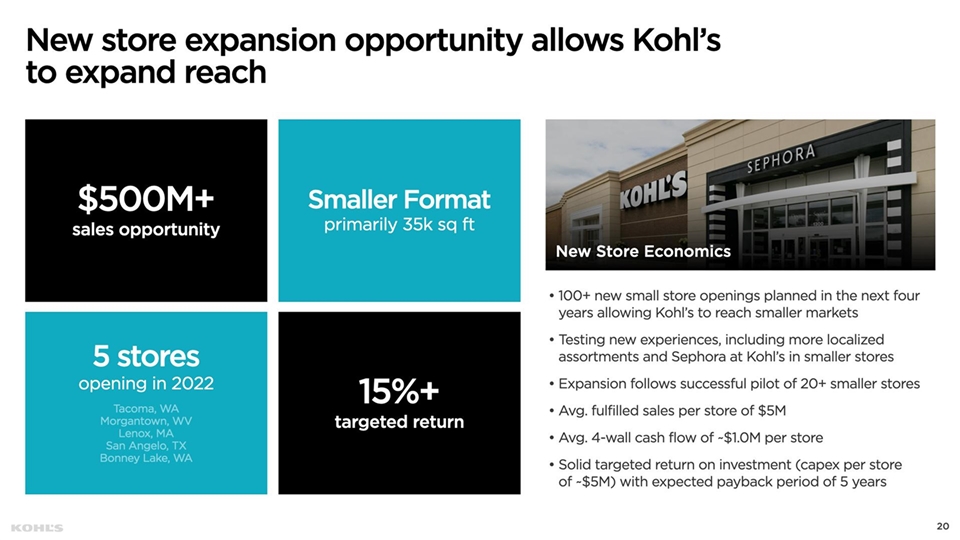

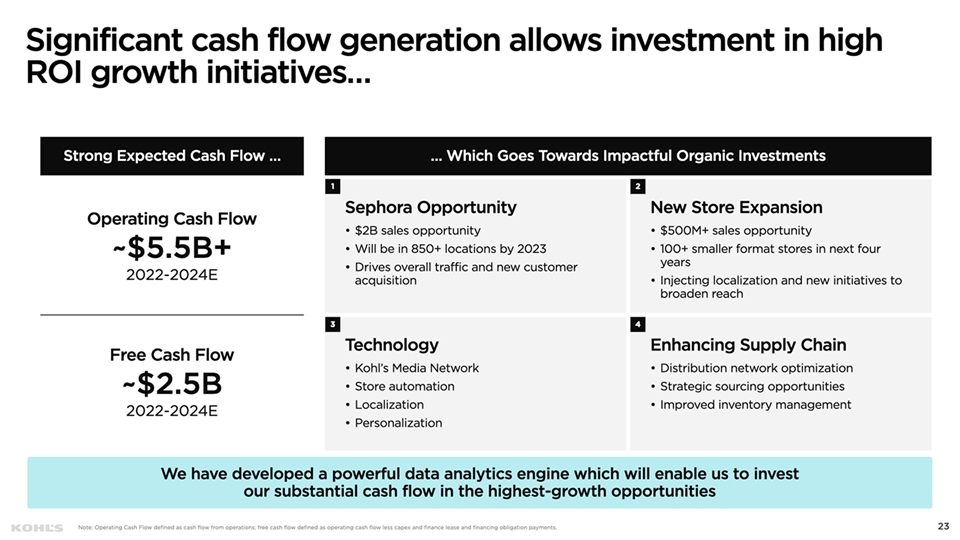

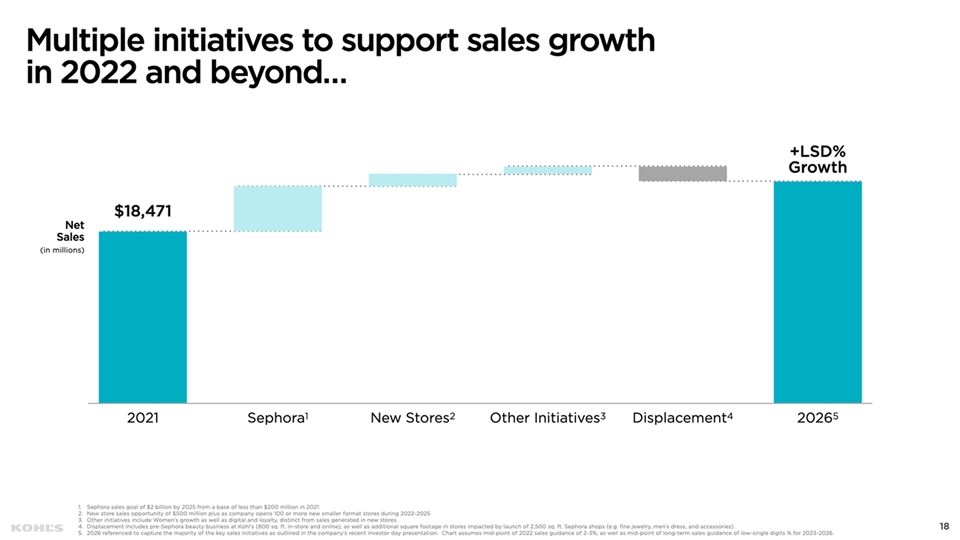

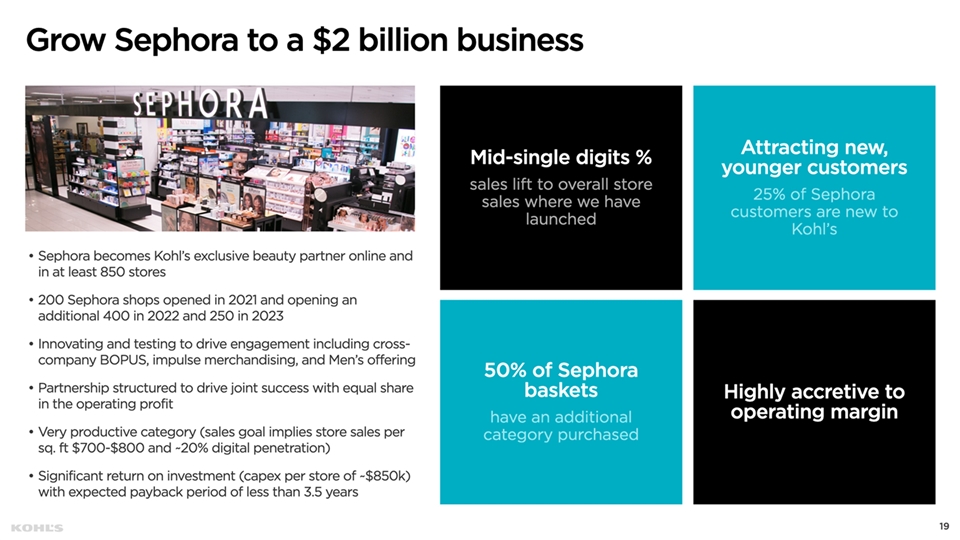

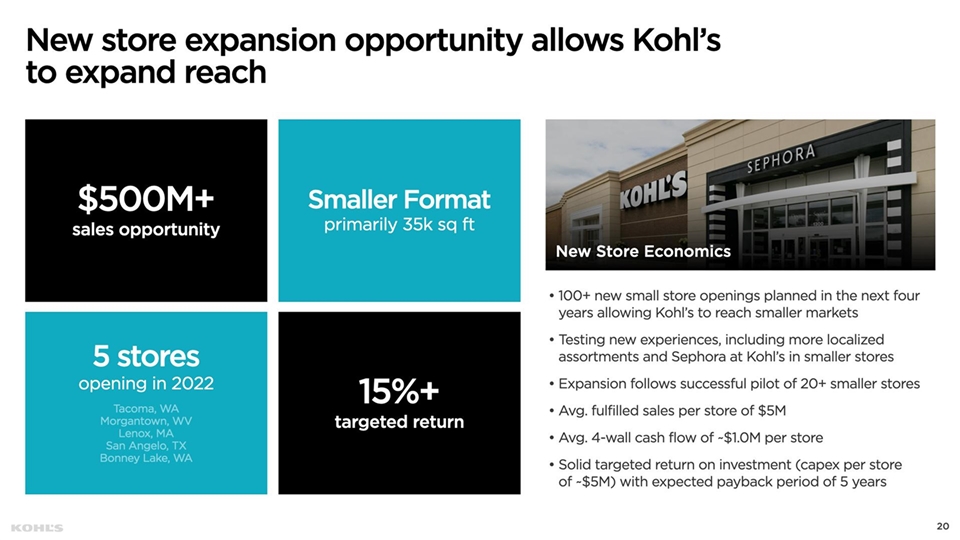

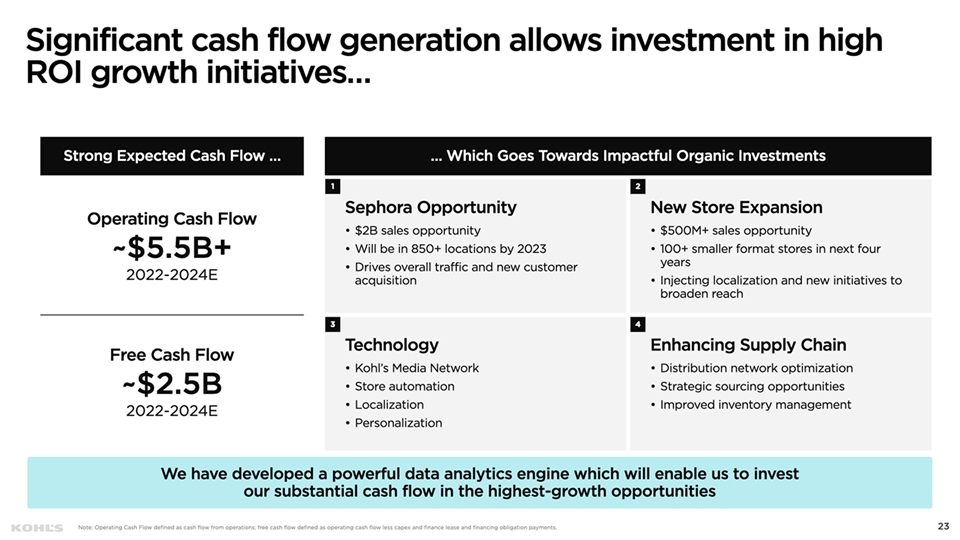

| | • | Key building blocks to drive top-line growth include the Sephora partnership, enhanced brand portfolio, and omnichannel strategy. |

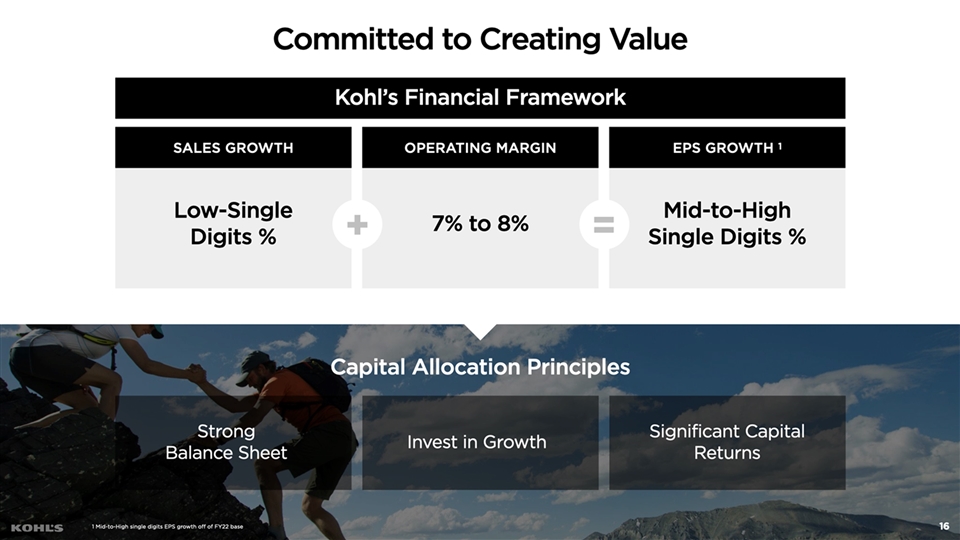

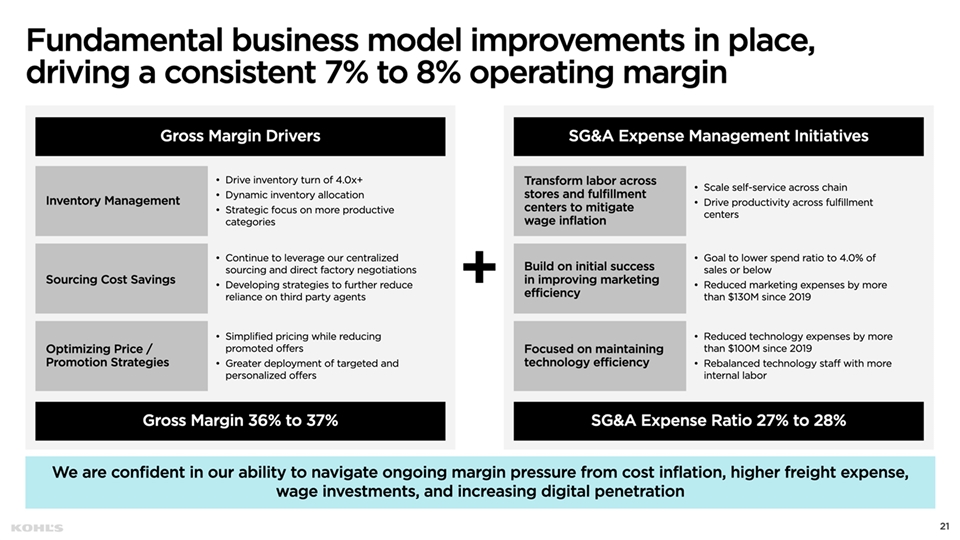

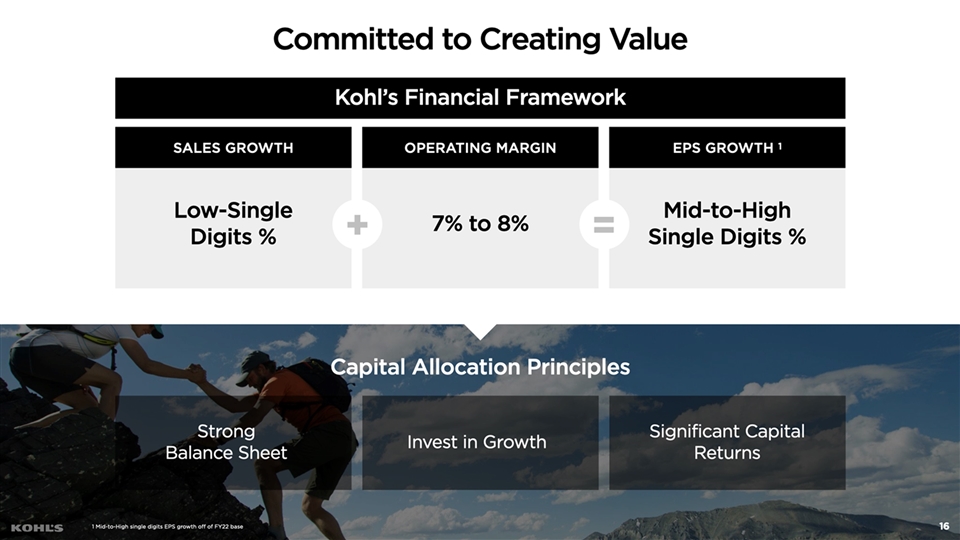

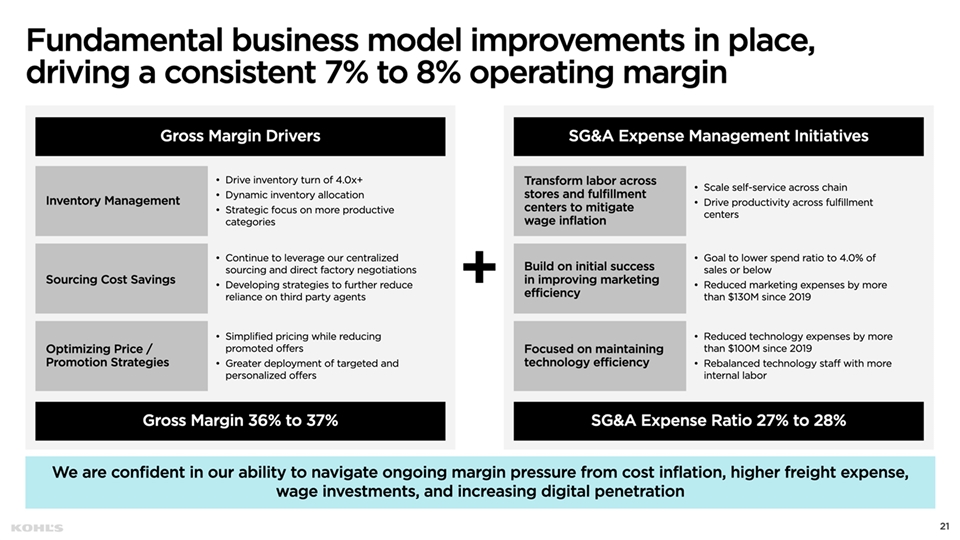

| | • | Our financial framework is driven by a sustainable formula of annual low-single-digit % top-line growth, a solid operating margin of 7% to 8% and mid-to-high single-digit percentage EPS growth leading to strong cash flow generation. |

| | • | Kohl’s is implementing a disciplined capital allocation strategy that prioritizes investment in high ROI growth driving initiatives, while also returning significant capital to shareholders through dividends and share repurchases; in March 2022, the Board approved a 100% increase in the dividend and new $3 billion share repurchase authorization. |

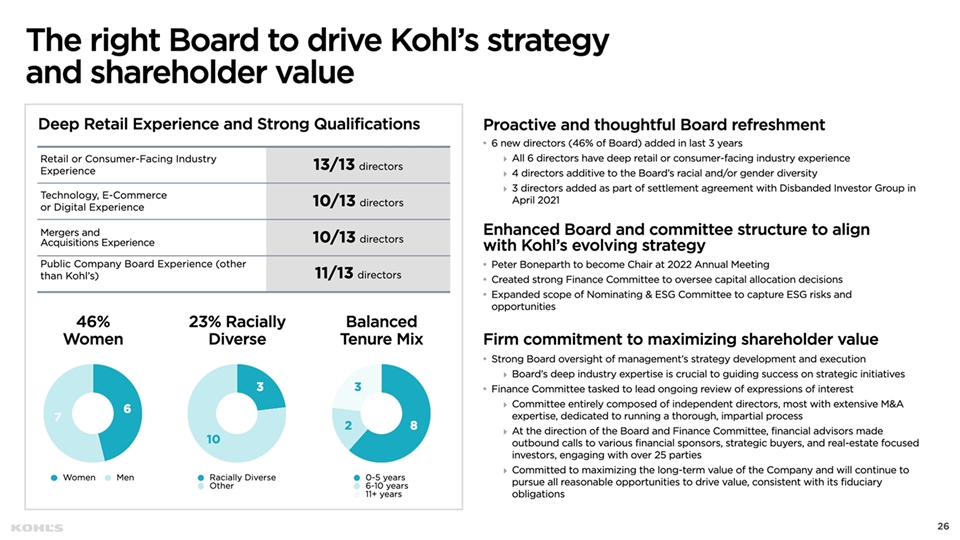

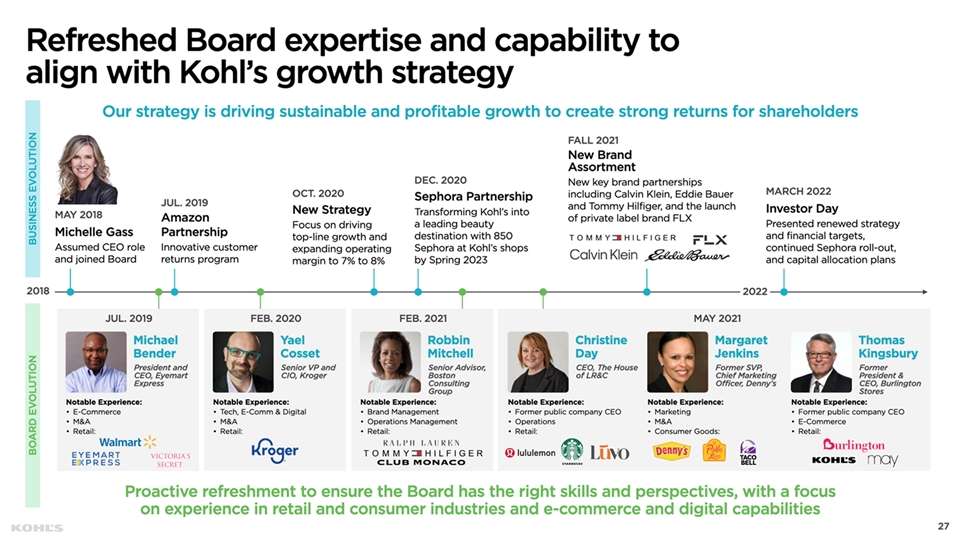

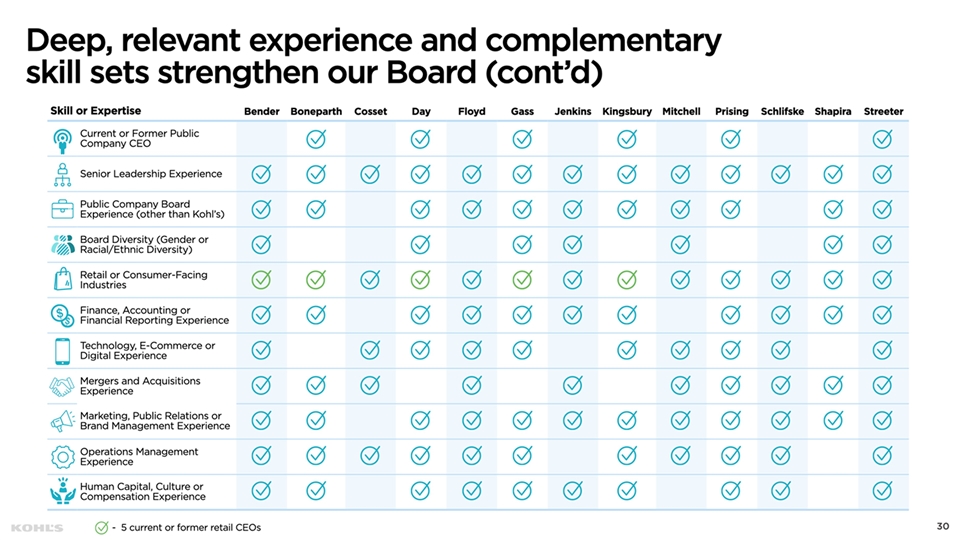

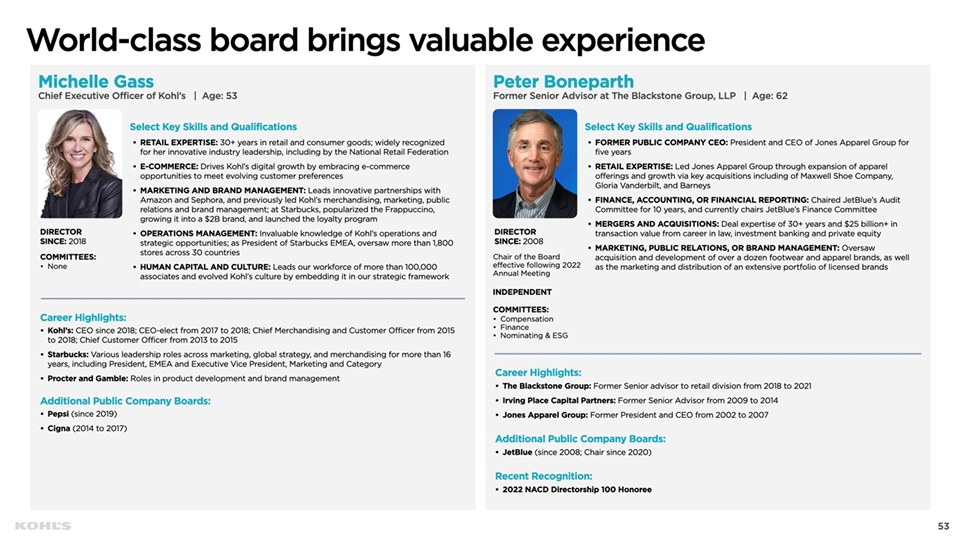

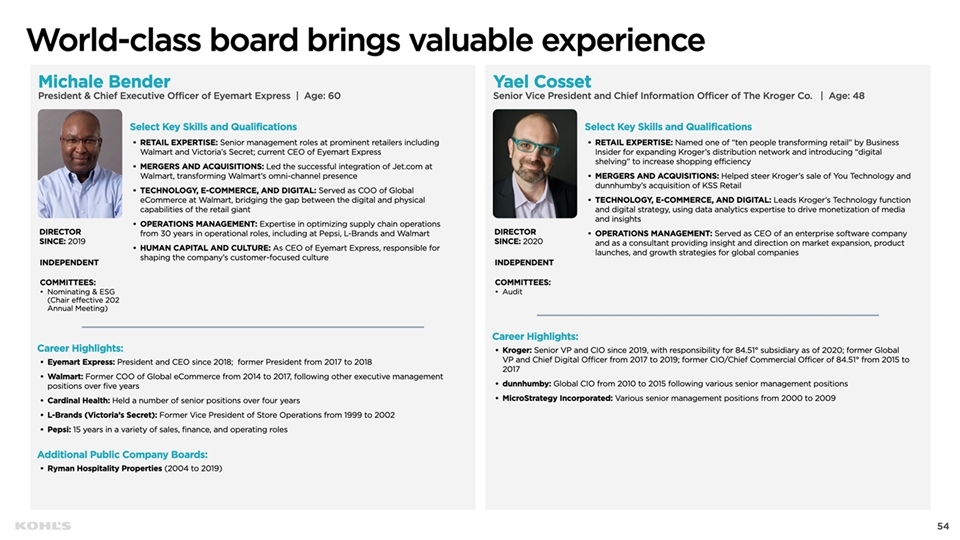

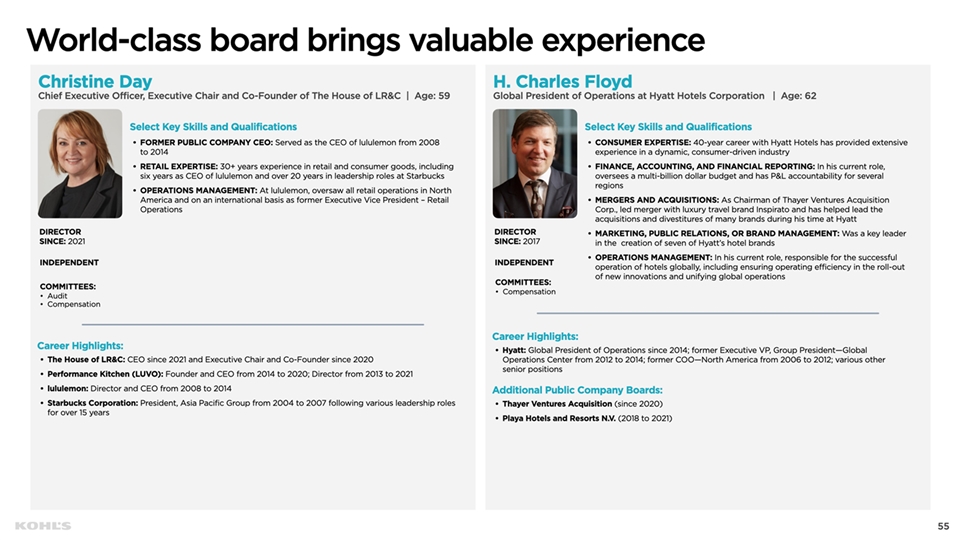

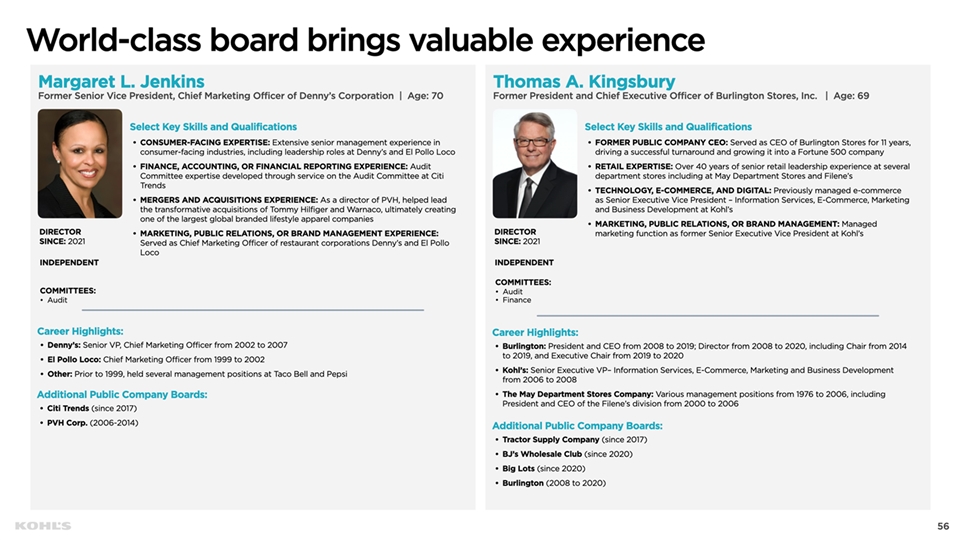

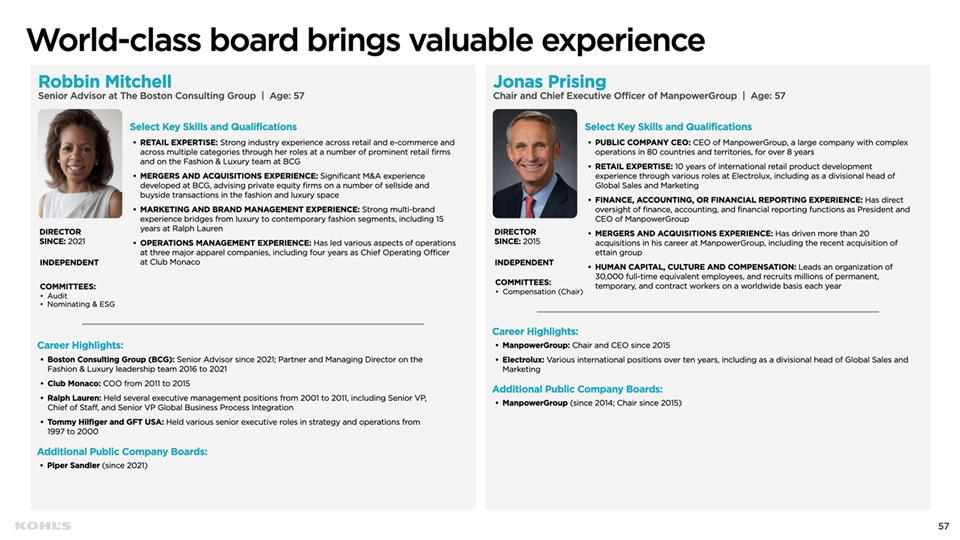

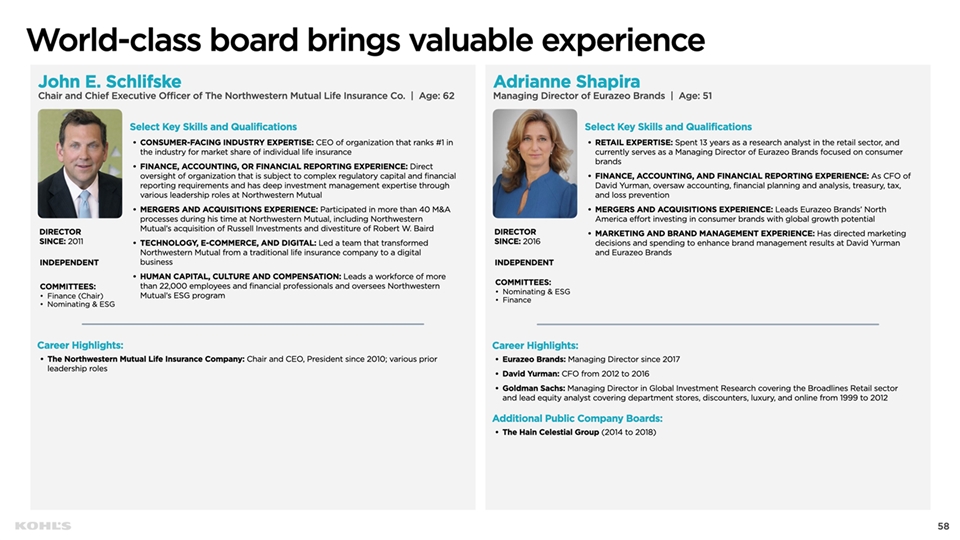

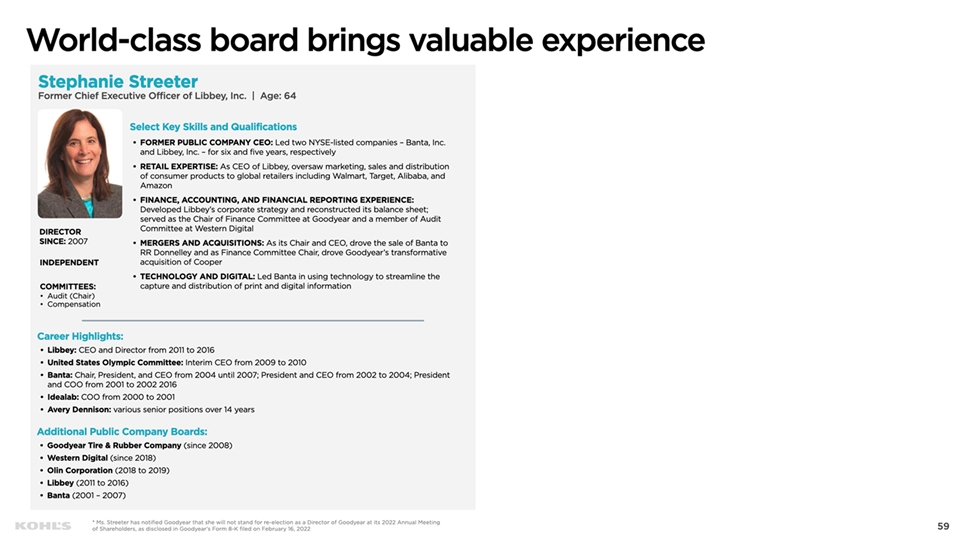

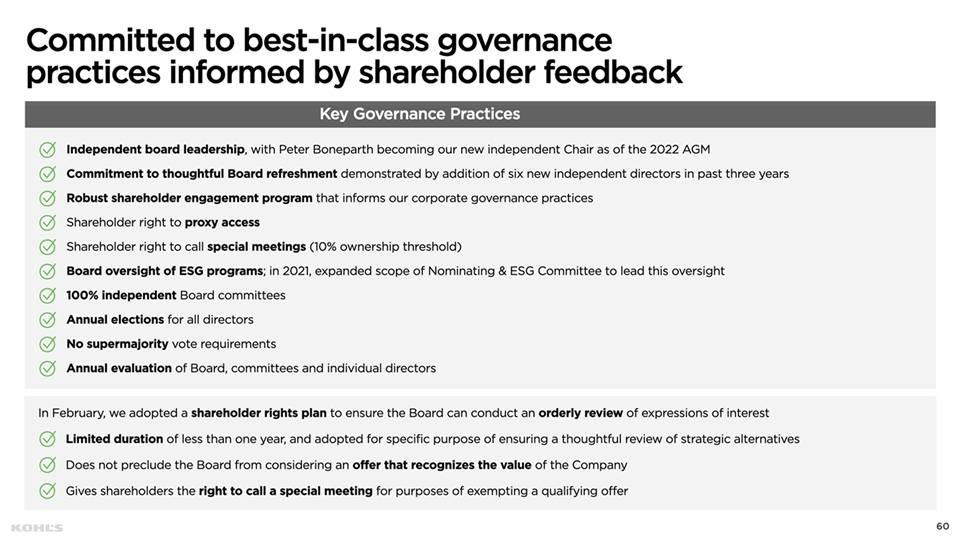

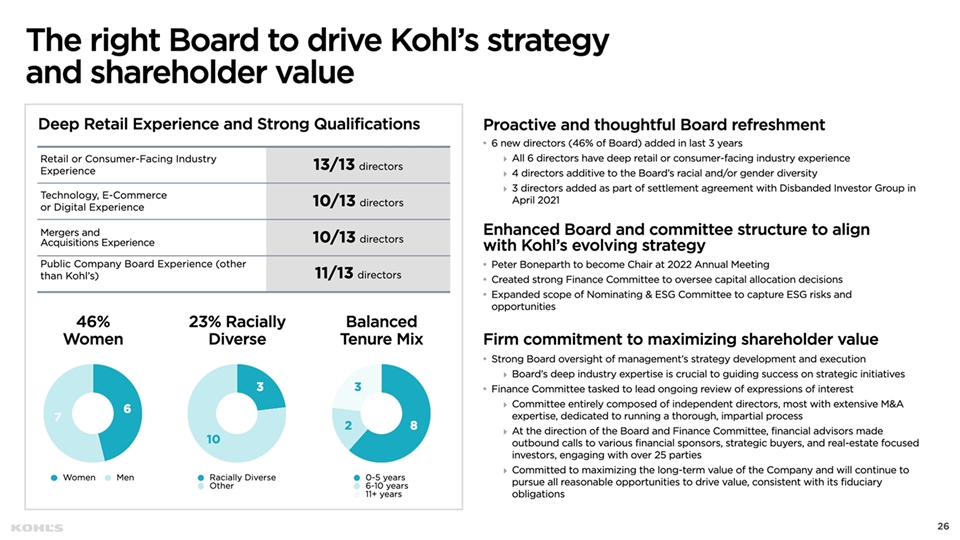

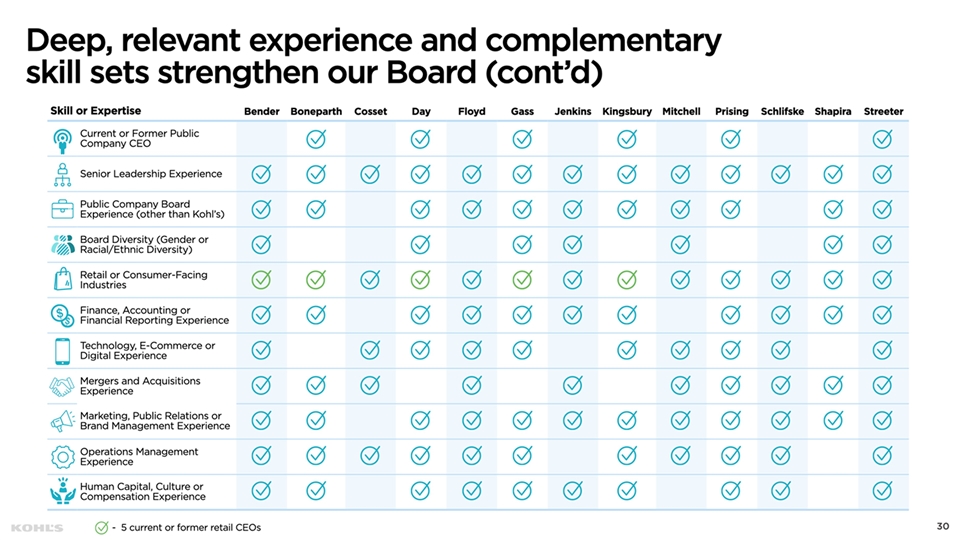

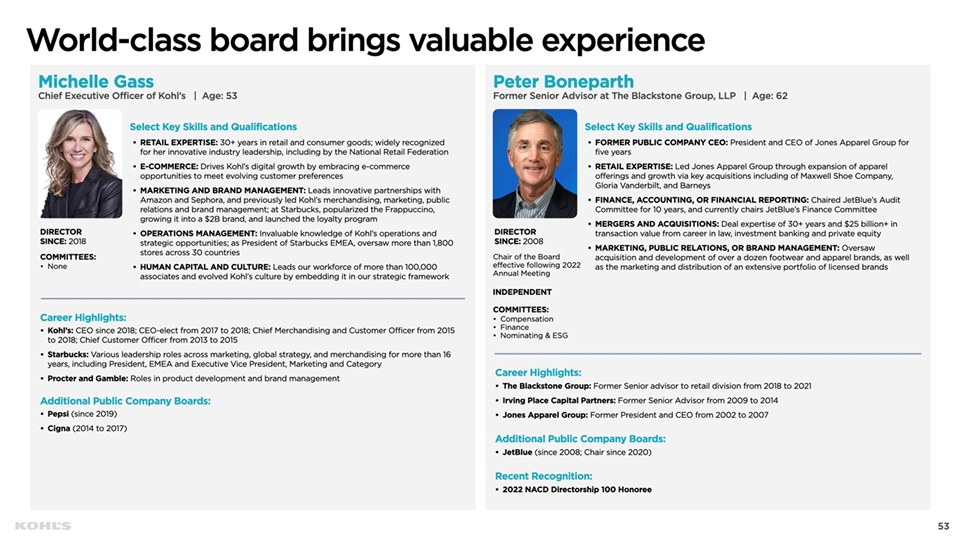

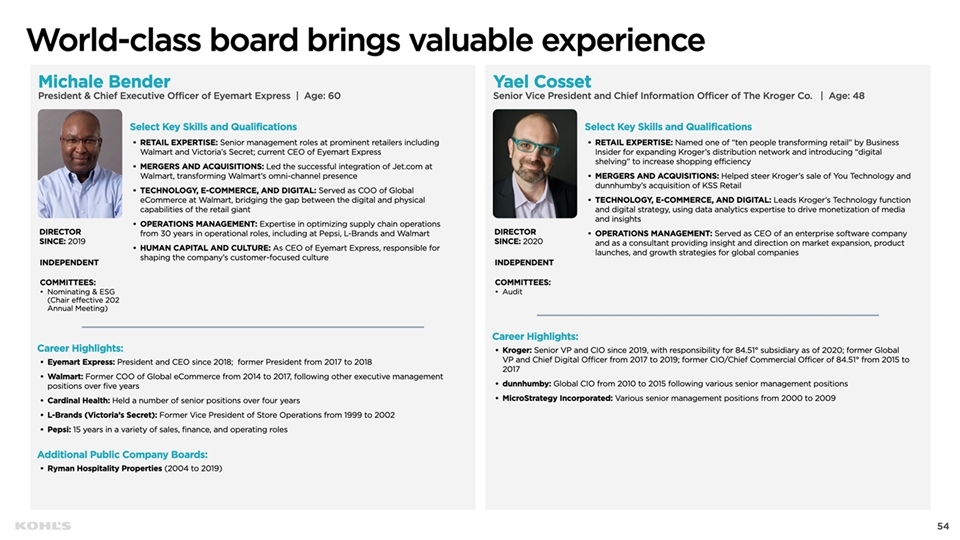

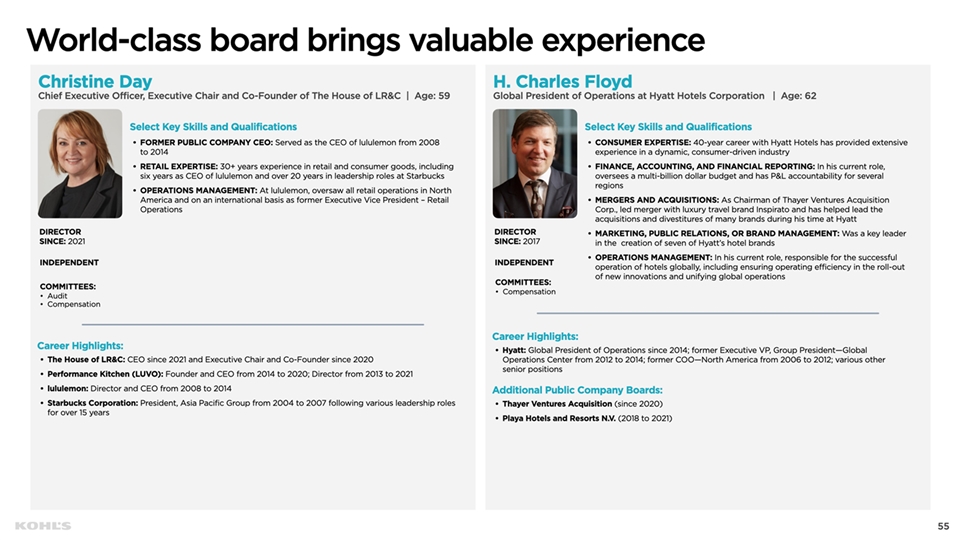

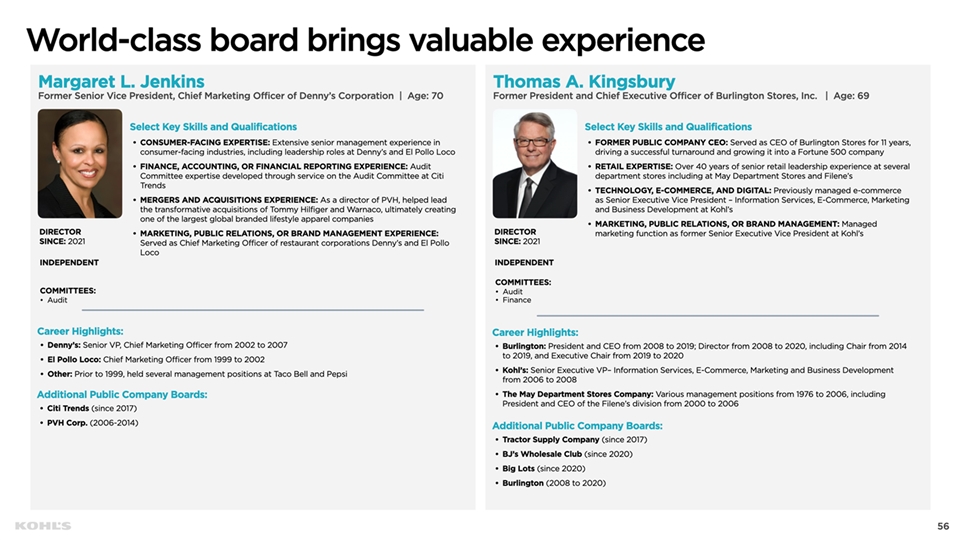

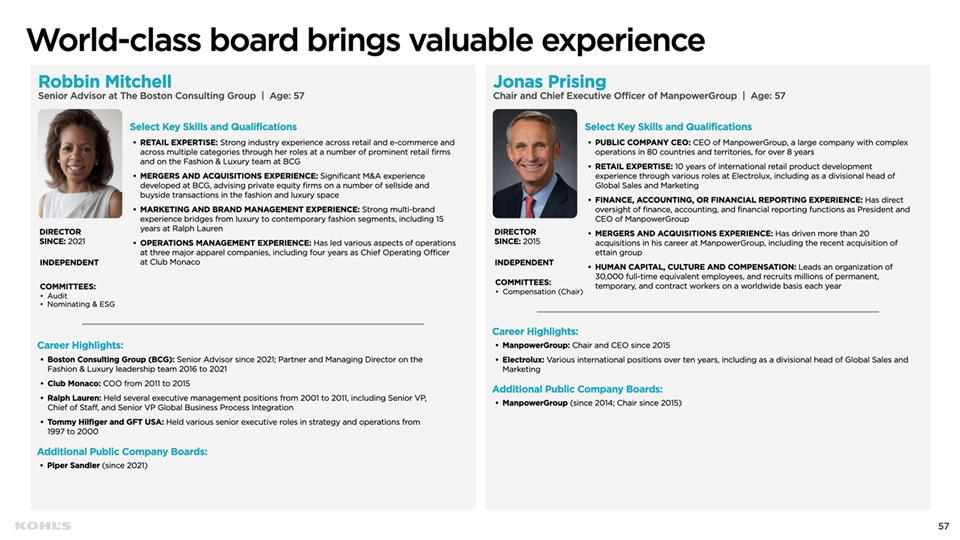

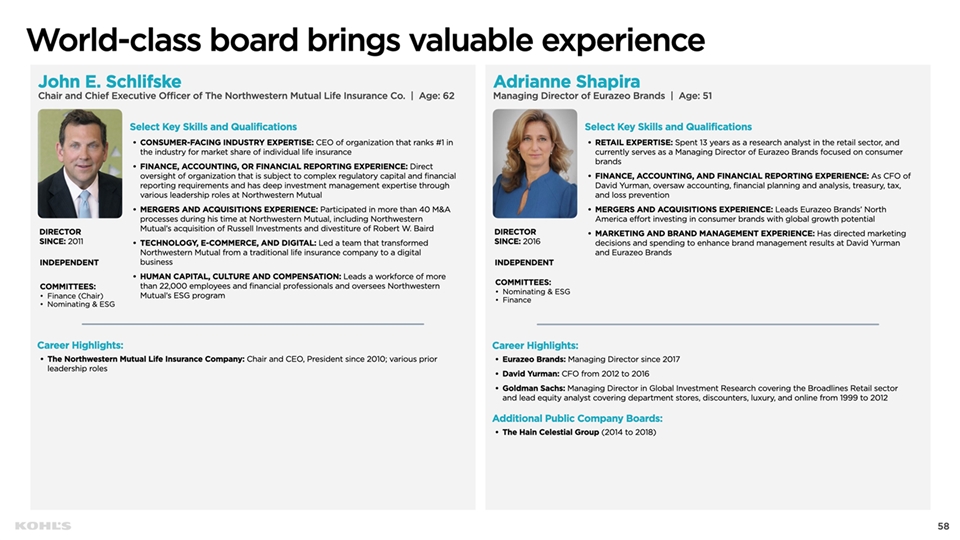

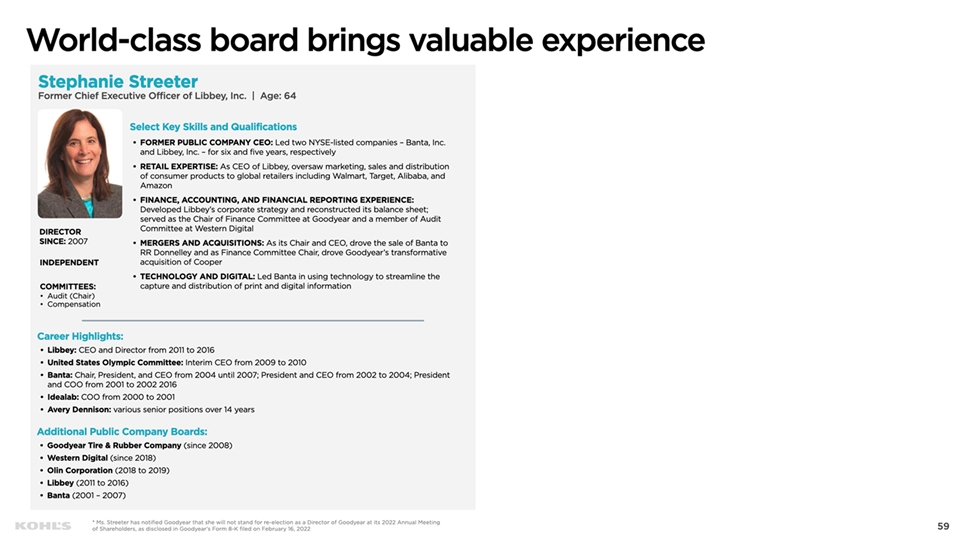

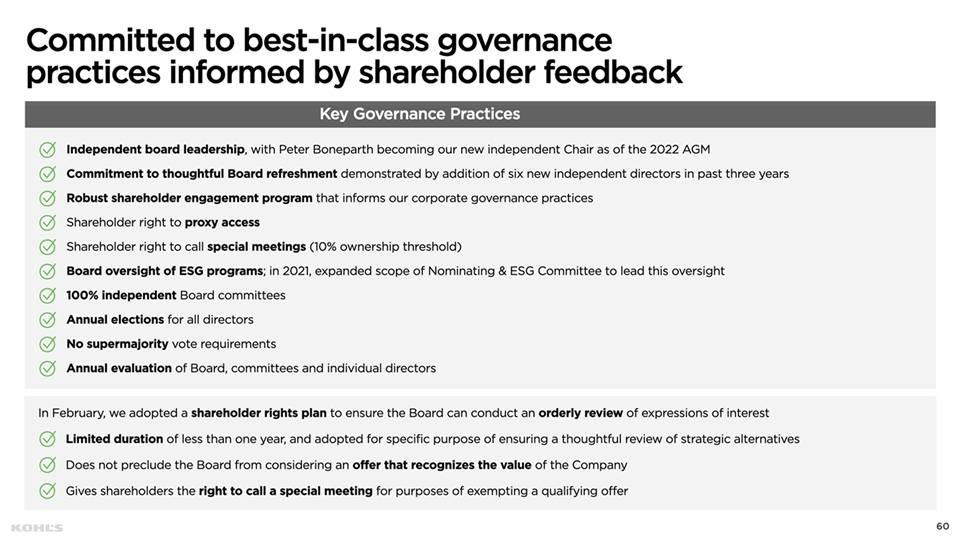

Our strong, thoughtfully refreshed Board has positioned Kohl’s to drive shareholder value.

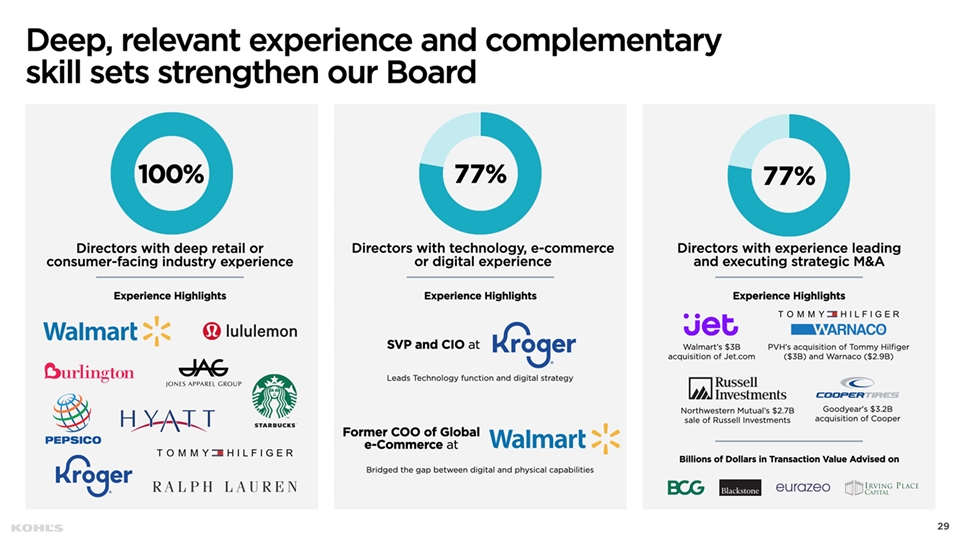

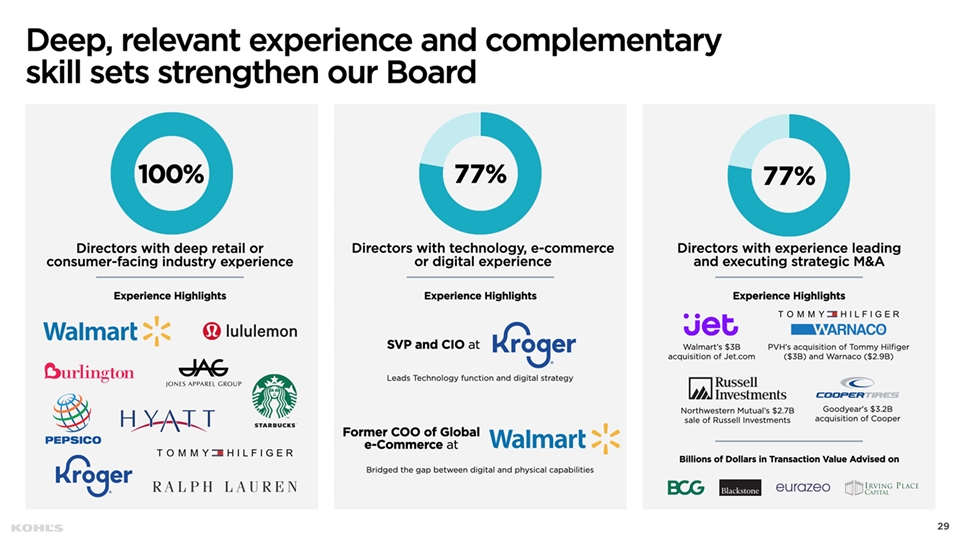

| | • | Kohl’s Board has proactively added the right capabilities and skill sets to accelerate Kohl’s transformation into the most trusted retailer of choice for the Active and Casual lifestyle. |

| | • | Our directors bring highly relevant experience from top roles at leading retail companies, such as Walmart, Burlington, lululemon, and Kroger, as well as deep experience in M&A, technology, and operations. |

| | • | The Board has recent refreshment with six new independent directors in the last three years, including three added as part of the 2021 settlement agreement with Macellum and other investors.1 |

| 1 | 2021 settlement agreement reached with Macellum Advisors GP, LLC, Ancora Holdings, Inc., Legion Partners Asset Management, LLC, and 4010 Capital, LLC. |

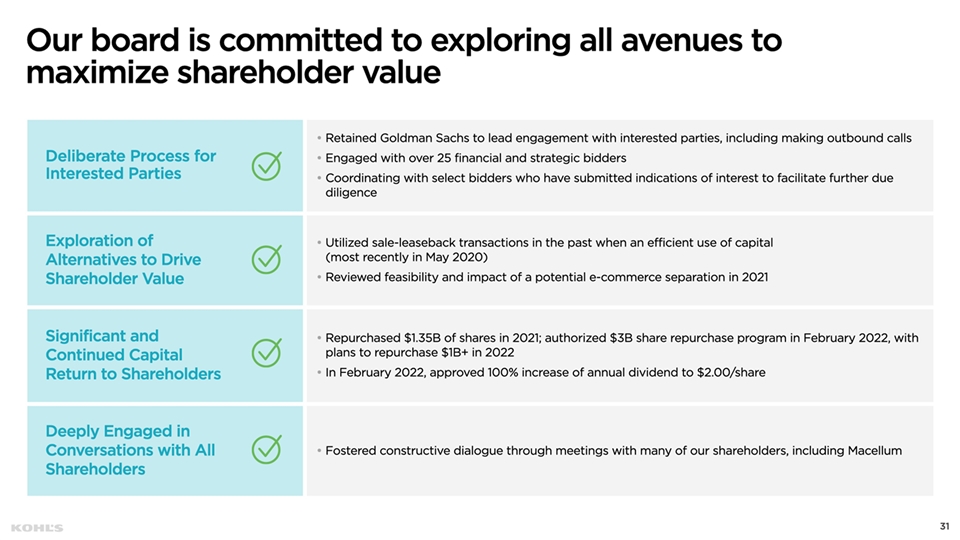

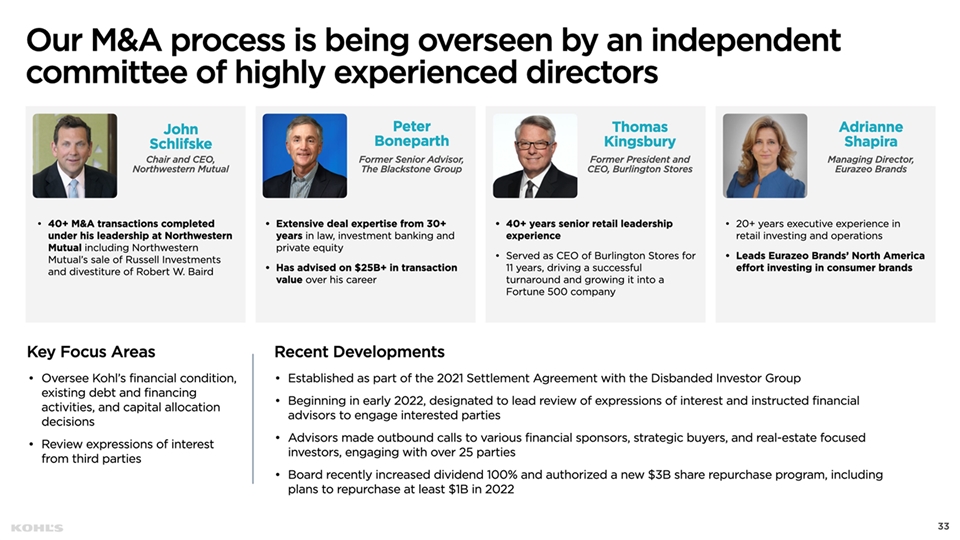

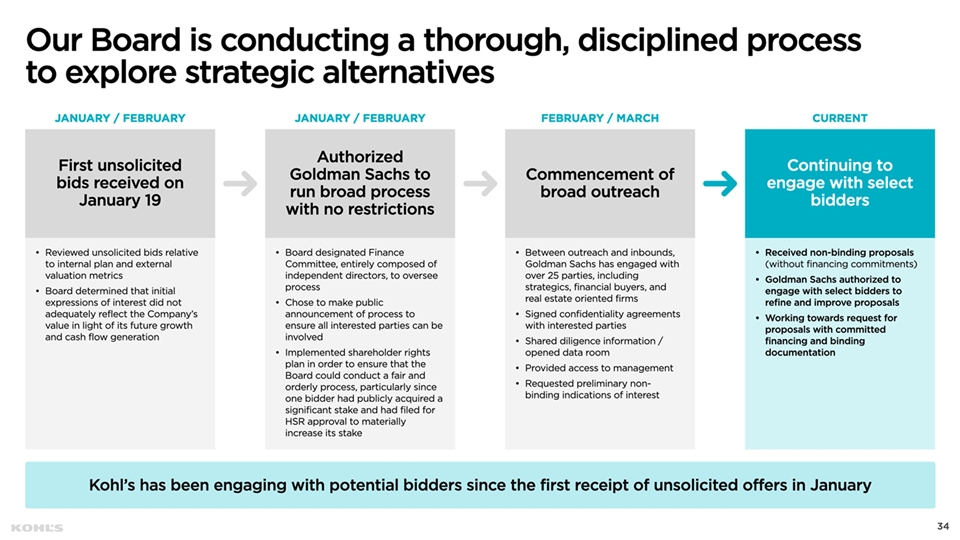

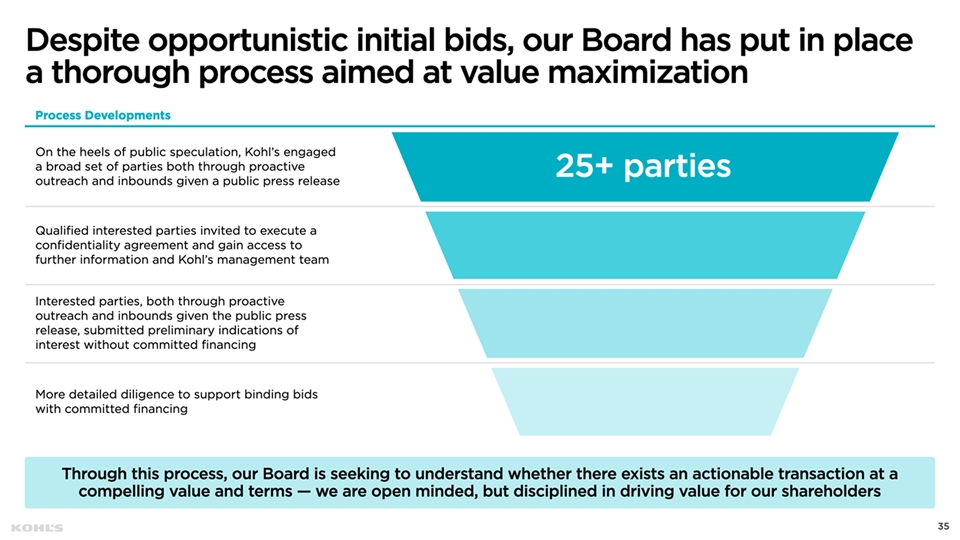

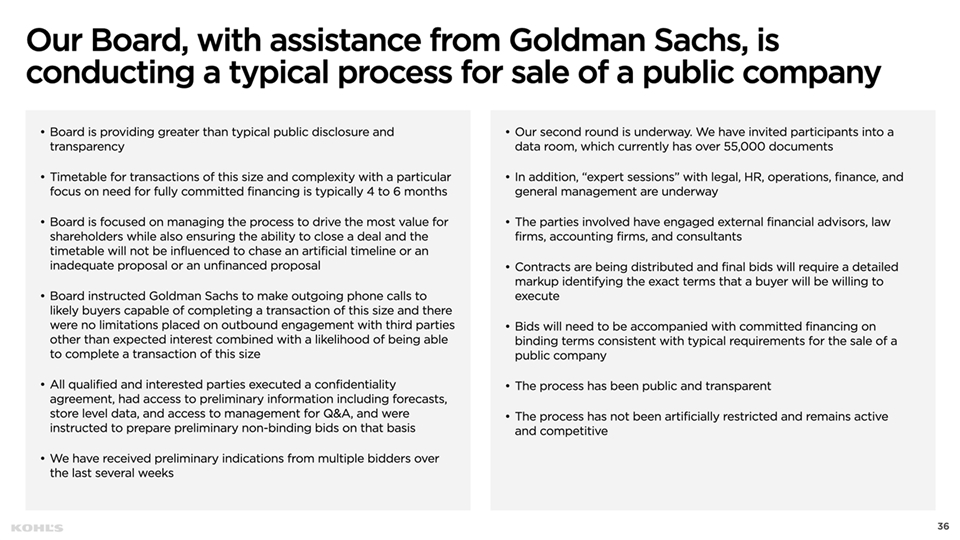

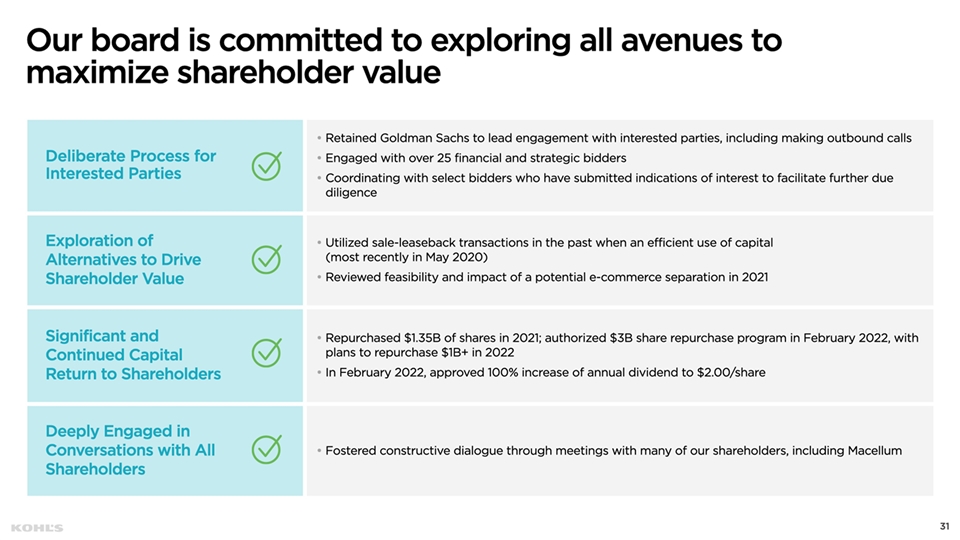

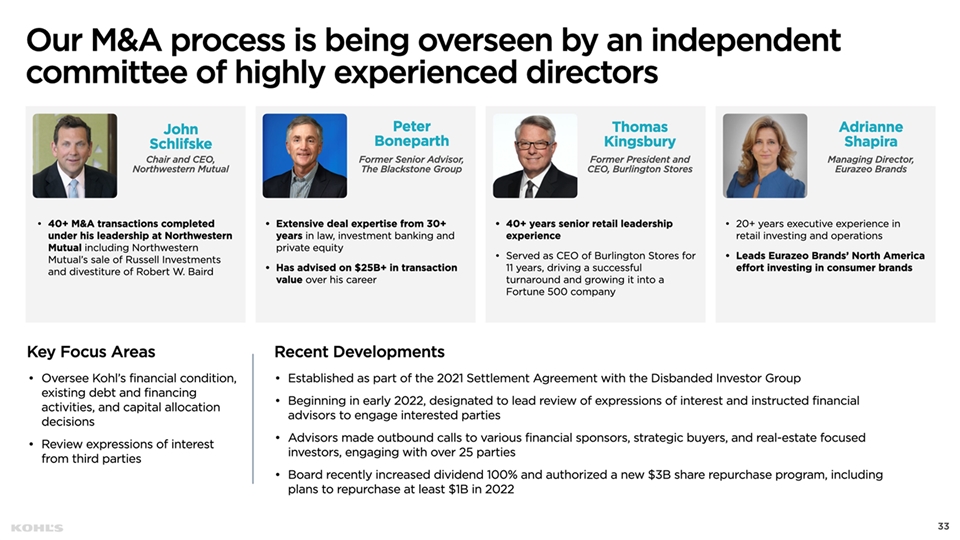

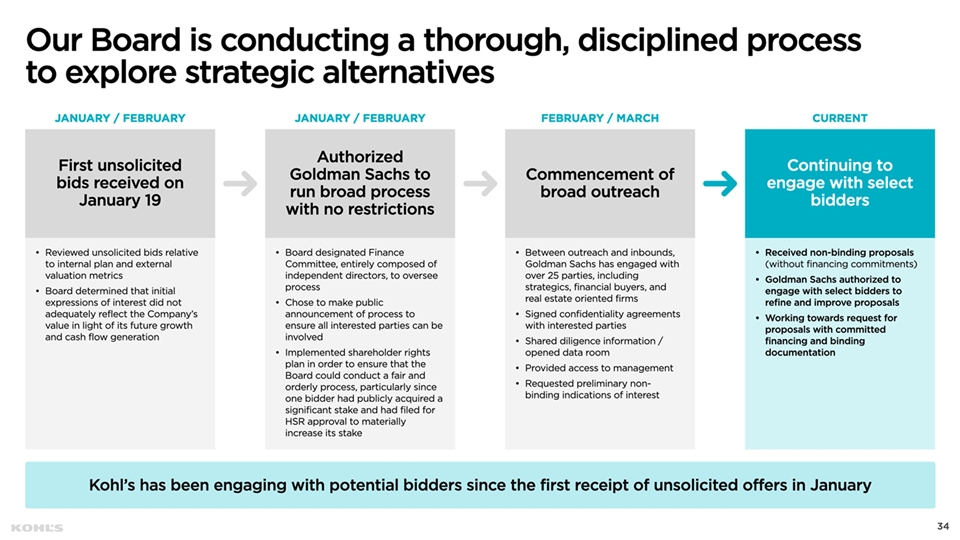

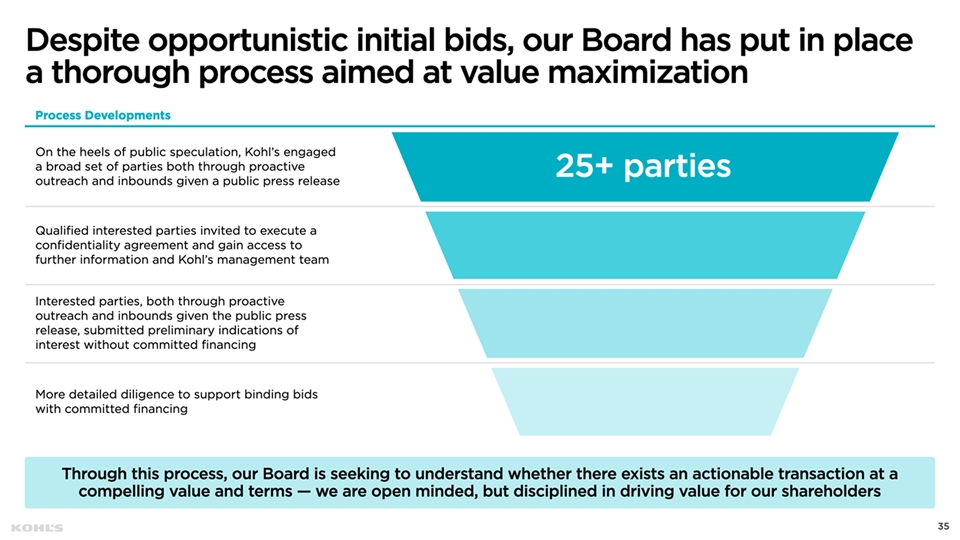

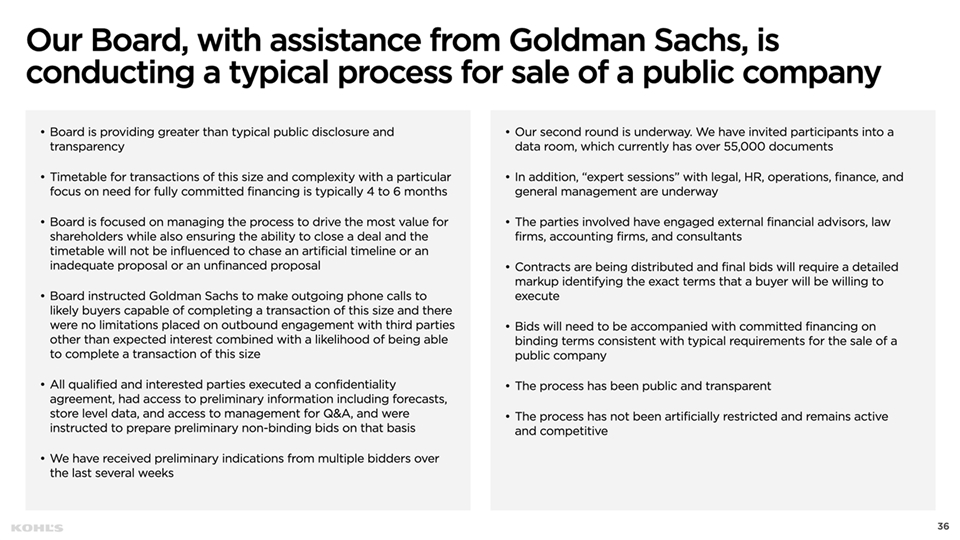

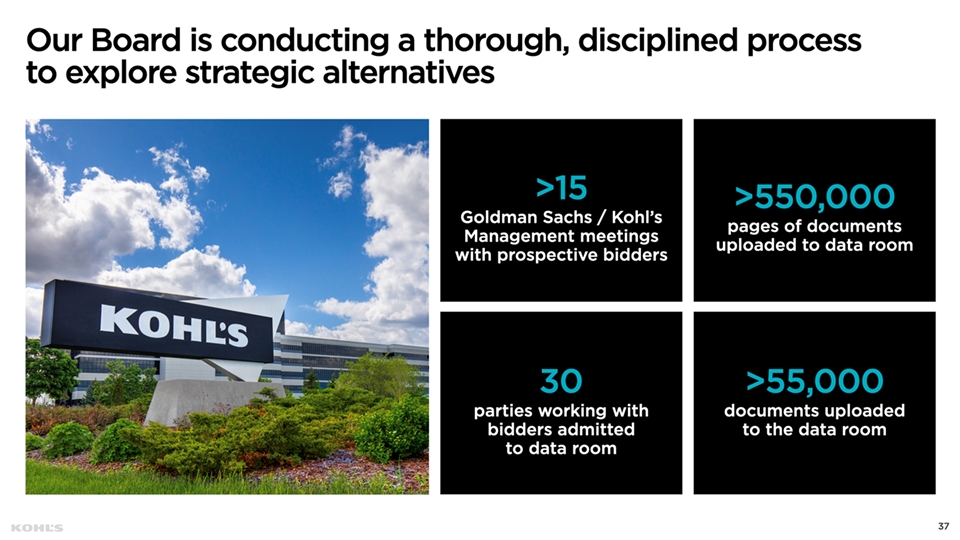

The Kohl’s Board is running a robust process to explore all pathways to maximize value.

| | • | Our engaged Board is thoroughly testing Kohl’s standalone strategic plan against potential alternatives and has designated its Finance Committee to lead the ongoing review of expressions of interest. |

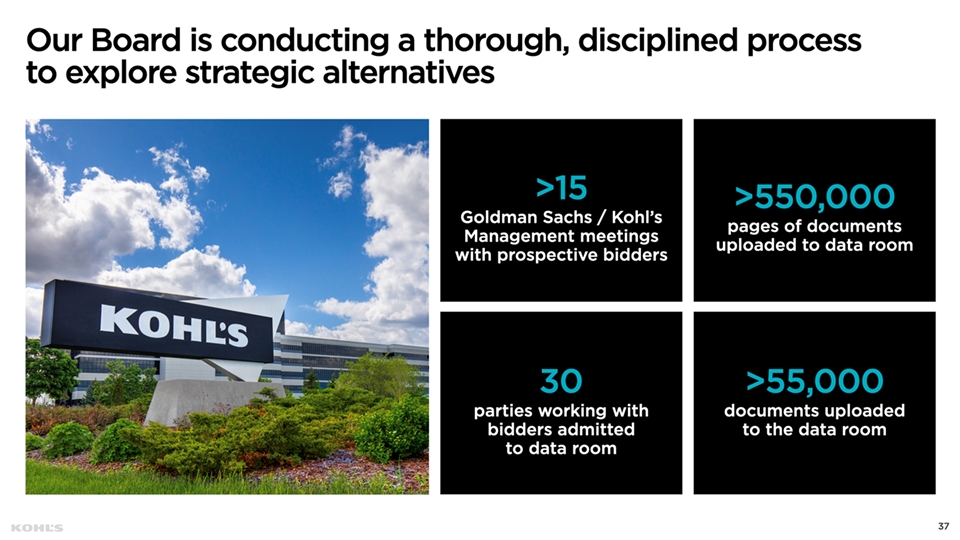

| | • | The Board engaged Goldman Sachs to conduct a broad process to explore strategic alternatives. |

| | • | To date, Goldman Sachs has engaged with over 25 parties. Select bidders have been invited to a data room containing over 550,000 pages across over 55,000 documents, as well as meetings with management. |

| | • | While preliminary, non-binding proposals have been received, further diligence is ongoing with requests for proposals including committed financing and binding documentation. |

| | • | The Board has the right skills and expertise to drive our strategy forward while evaluating any value-creating opportunities for shareholders. |

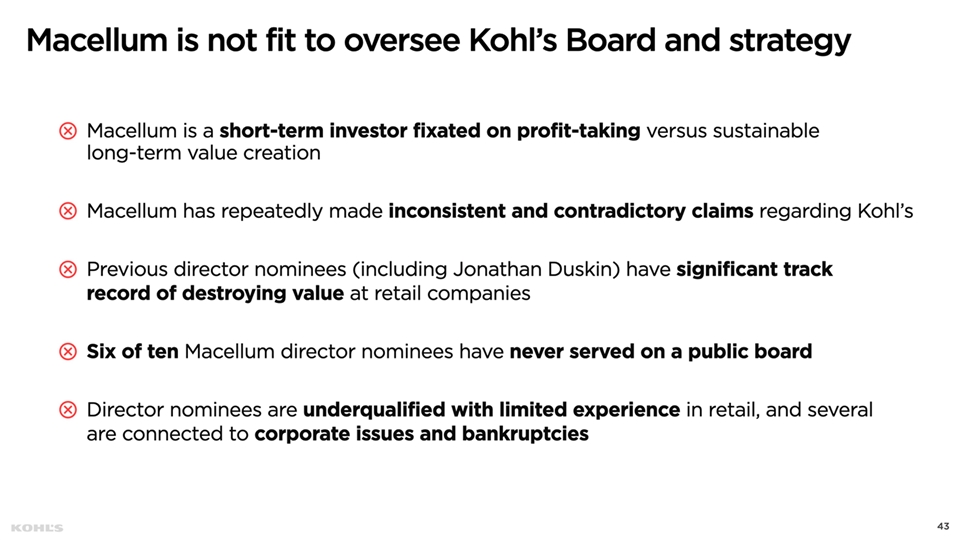

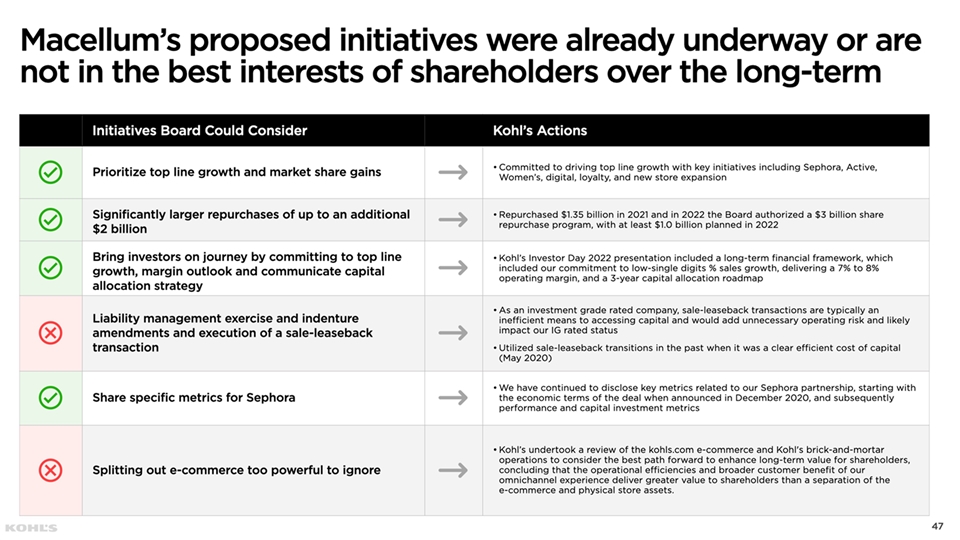

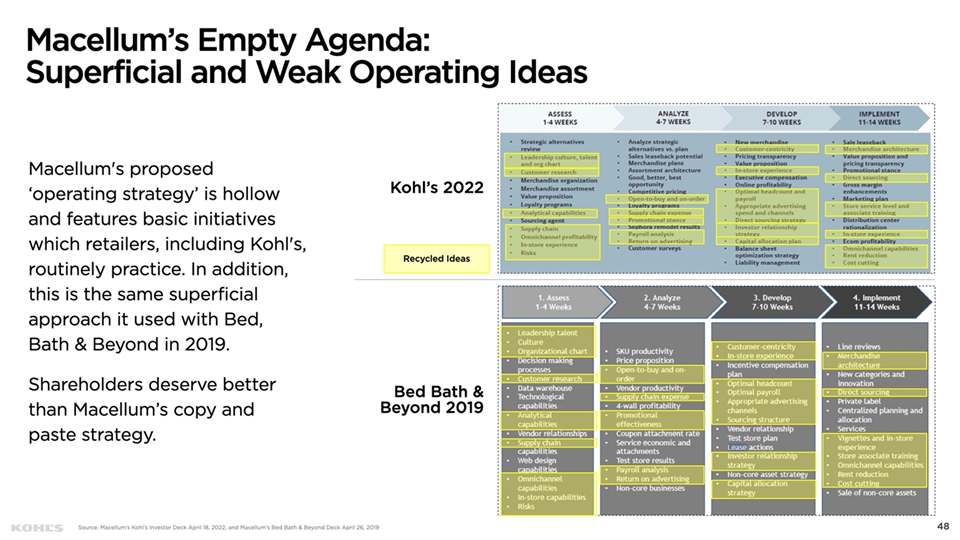

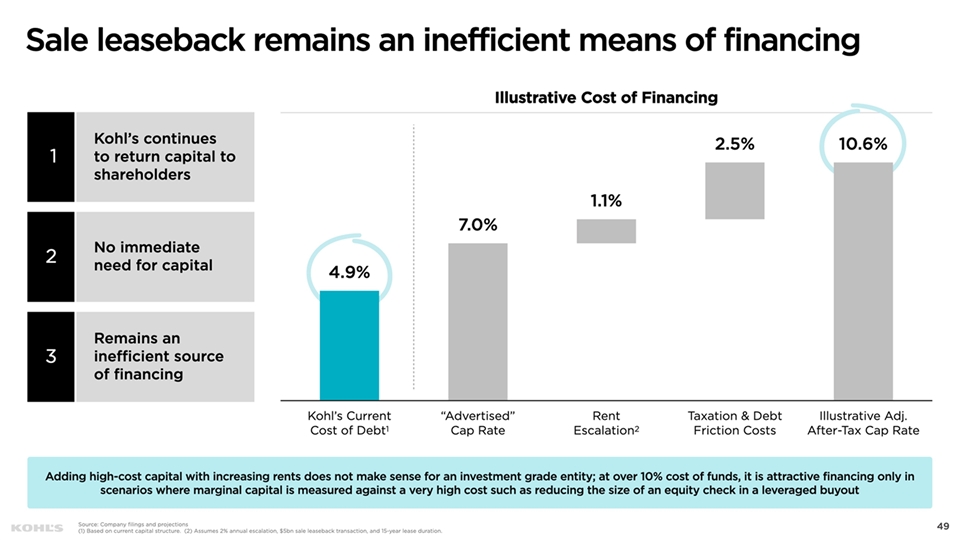

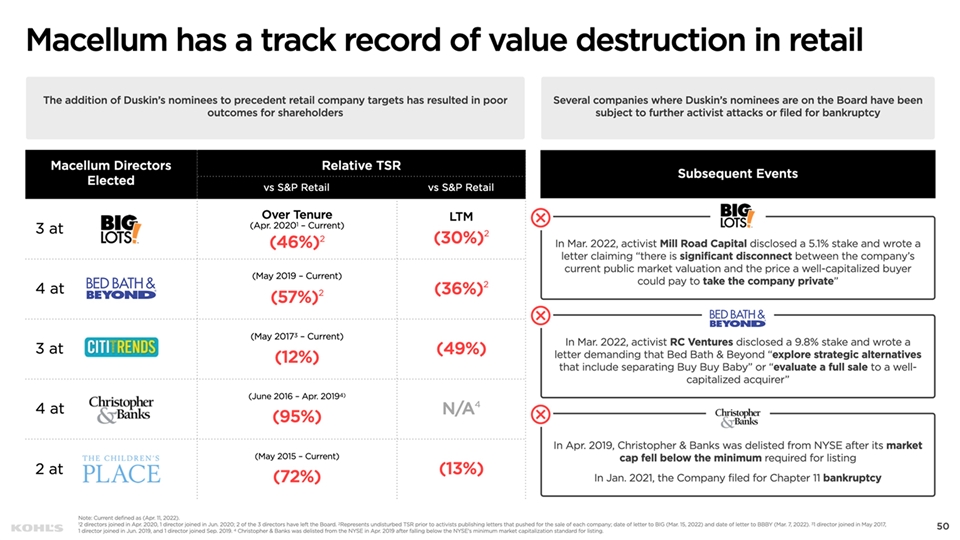

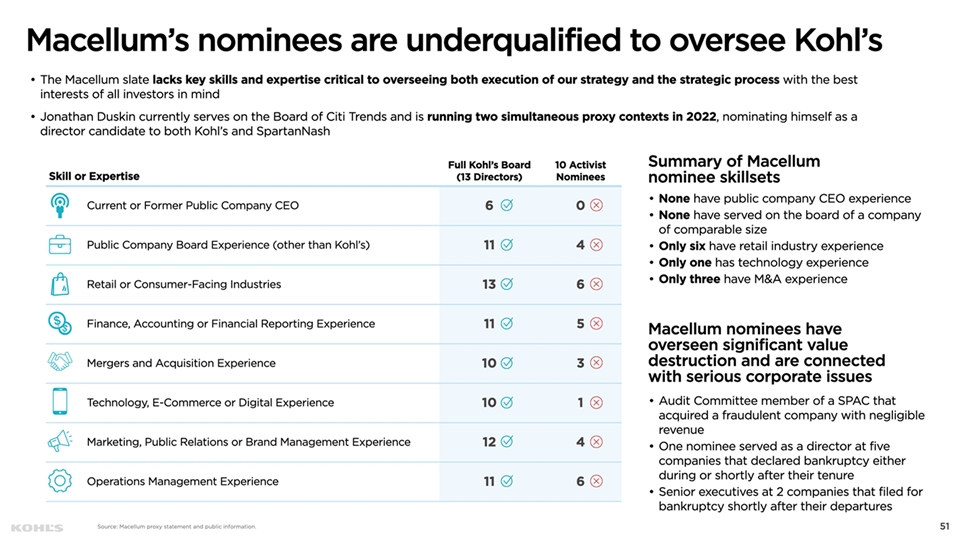

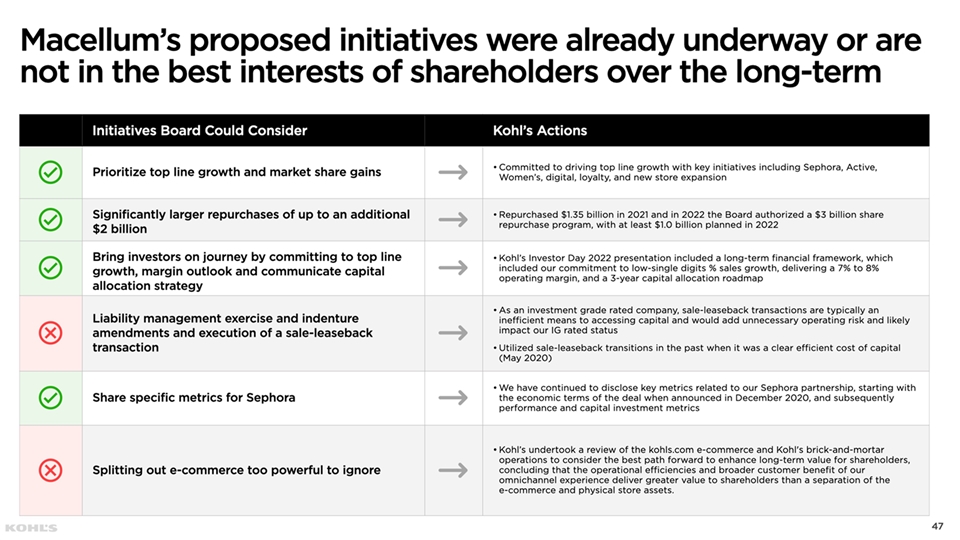

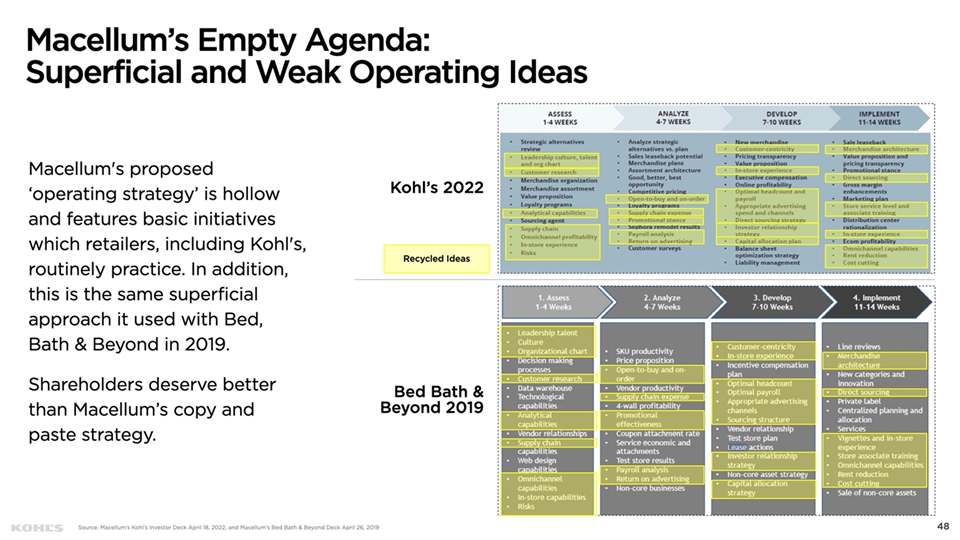

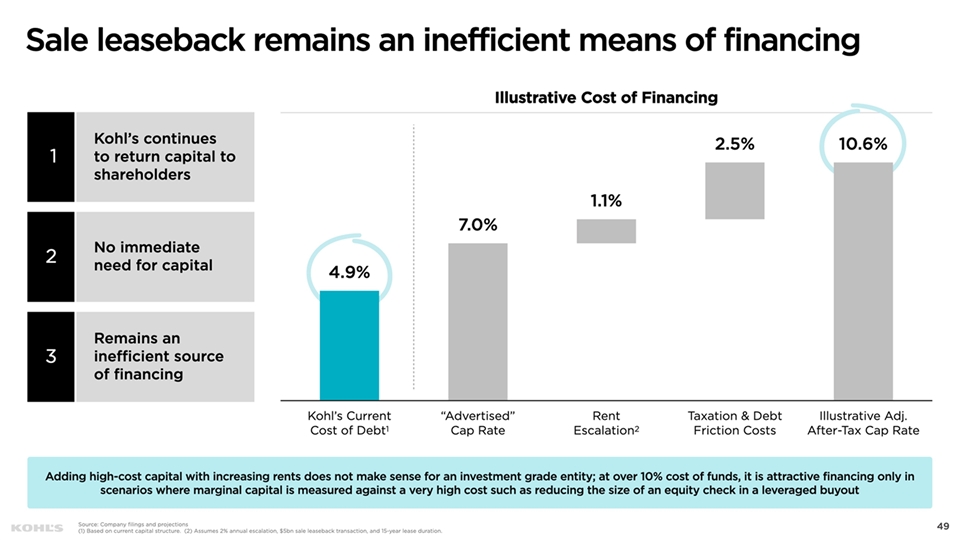

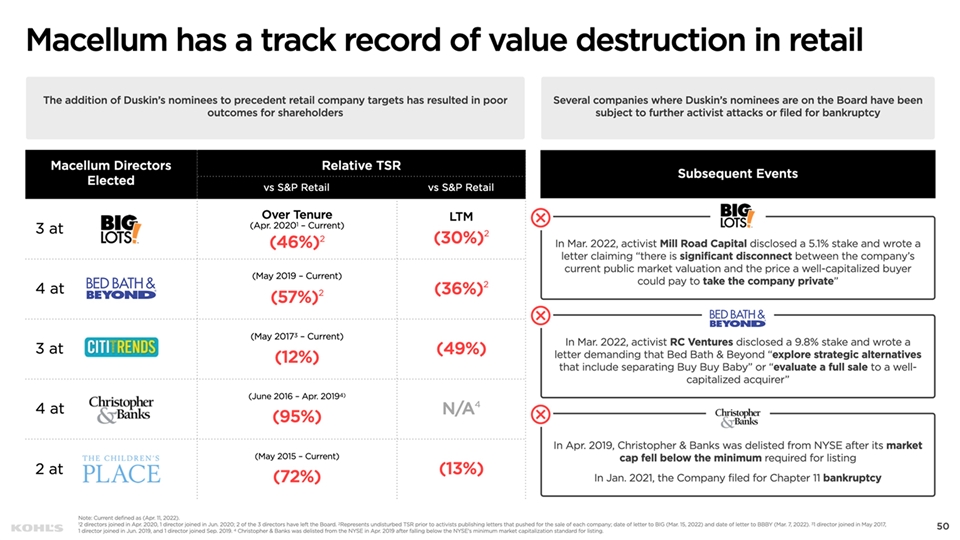

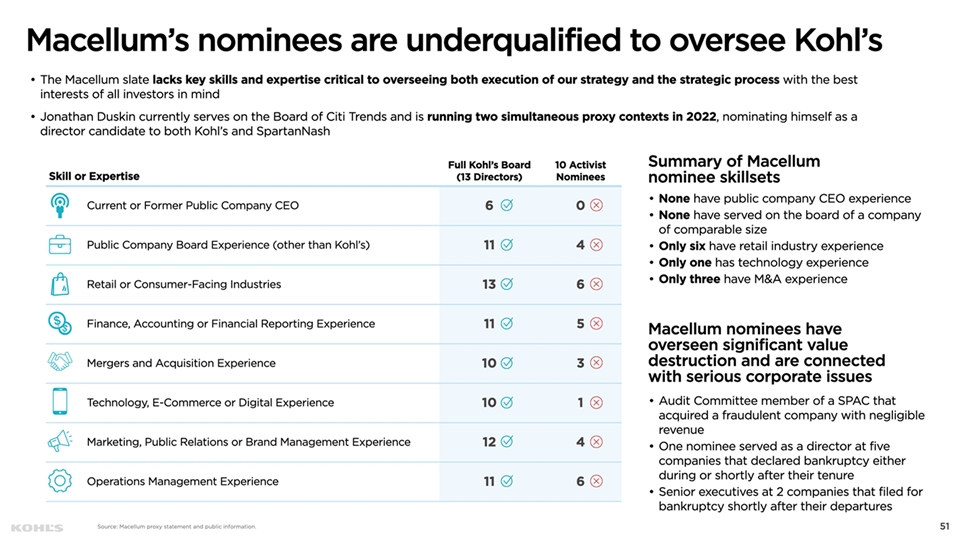

Macellum has presented an empty agenda and an inexperienced, unqualified slate.

| | • | In spite of our Board’s open invitation to constructively share ideas and over a year of good-faith engagement, Macellum has presented no value-additive ideas. |

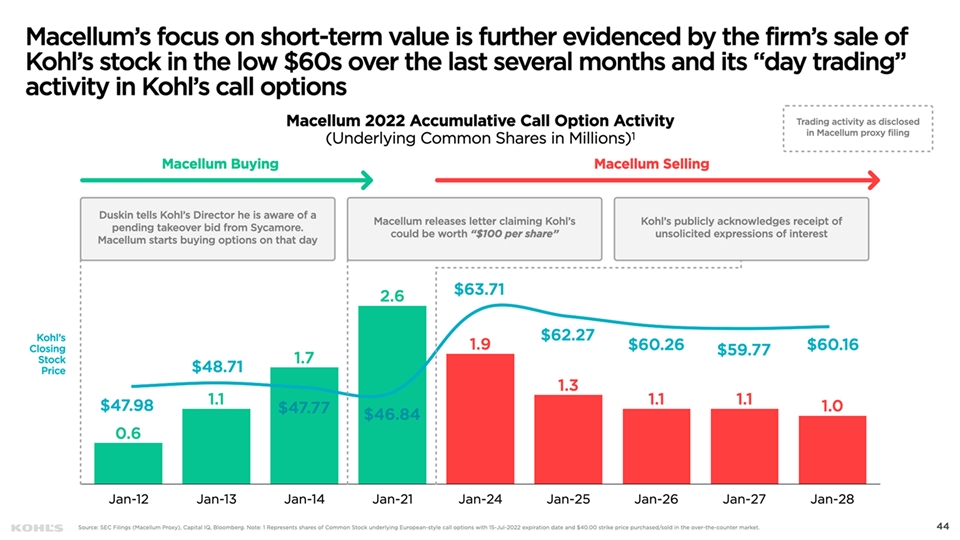

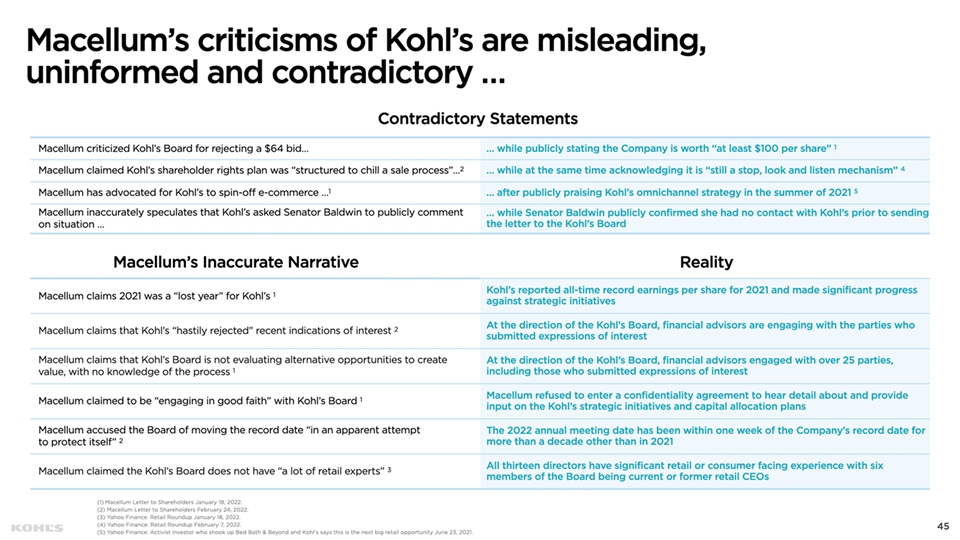

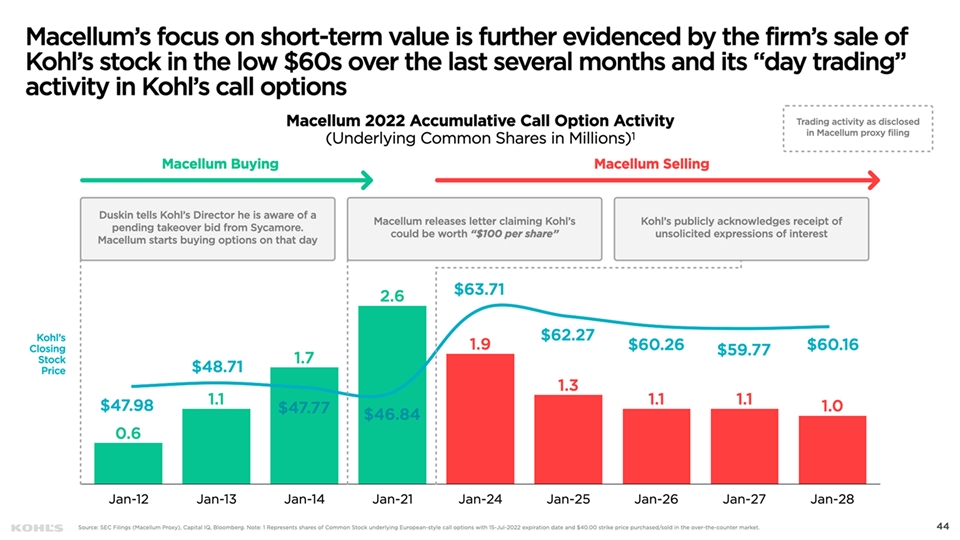

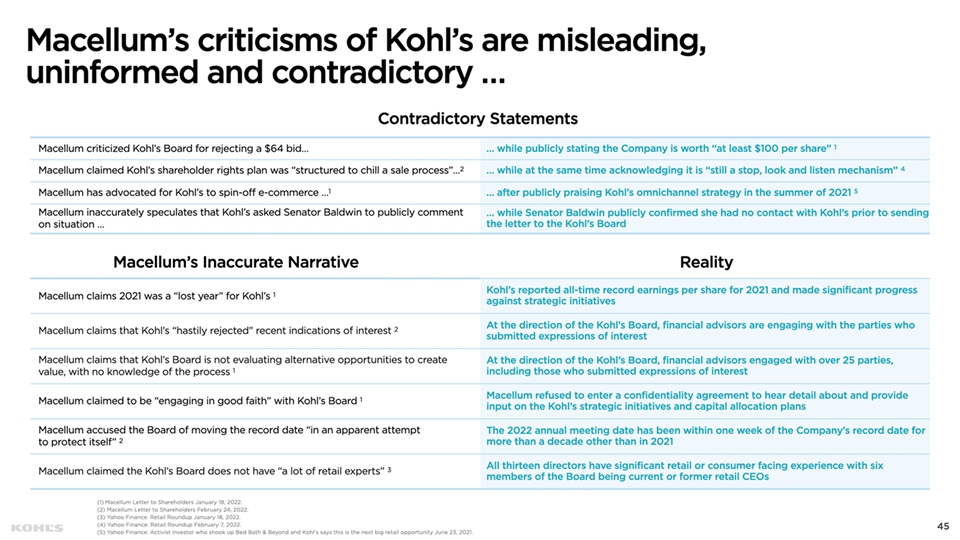

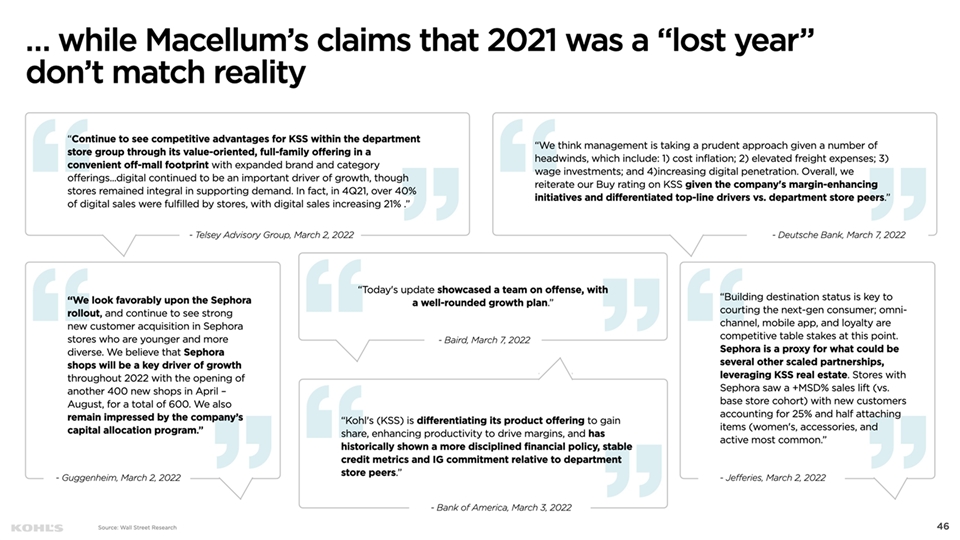

| | • | Macellum’s actions and inconsistent claims demonstrate a focus on short-term gains at the expense of long-term value. |

| | • | Six of ten Macellum nominees have never served on a public company board, and none have served on a retail company board of comparable size to Kohl’s. |

| | • | Several Macellum nominees are directly associated with bankruptcies or have overseen significant value destruction. |

PROTECT THE VALUE OF YOUR INVESTMENT. VOTE THE BLUE CARD TODAY FOR ALL 13 OF KOHL’S HIGHLY QUALIFIED DIRECTORS

VISIT WWW.KOHLSMOMENTUM.COM FOR MORE INFORMATION

|

YOUR VOTE IS IMPORTANT! Please refer to the enclosed BLUE proxy card for information on how to vote by telephone or by Internet, or simply sign and date the BLUE proxy card and return it in the postage-paid envelope provided. If you have any questions, or need assistance in voting your shares, please call our proxy solicitor: INNISFREE M&A INCORPORATED TOLL-FREE, at 1-877-687-1874 BANKS AND BROKERS MAY CALL COLLECT, at 1-212-750-5833 |

Cautionary Statement Regarding Forward-Looking Information

This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The Company intends forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” ��anticipates,” “plans,” or similar expressions to identify forward-looking statements. Such statements, including statements regarding the outcome and timing of the sale process, are subject to certain risks and uncertainties, which could cause the Company’s actual results to differ materially from those anticipated by the forward-looking statements, and there can be no guarantee that the process will result in an agreement to sell the Company or that any such agreement will ultimately be consummated. These risks and uncertainties include, but are not limited to, risks described more fully in Item 1A in the Company’s Annual Report on Form 10-K, which are expressly incorporated herein by reference, and other factors as may periodically be described in the Company’s filings with the SEC. Forward-looking statements relate to the date initially made, and Kohl’s undertakes no obligation to update them.

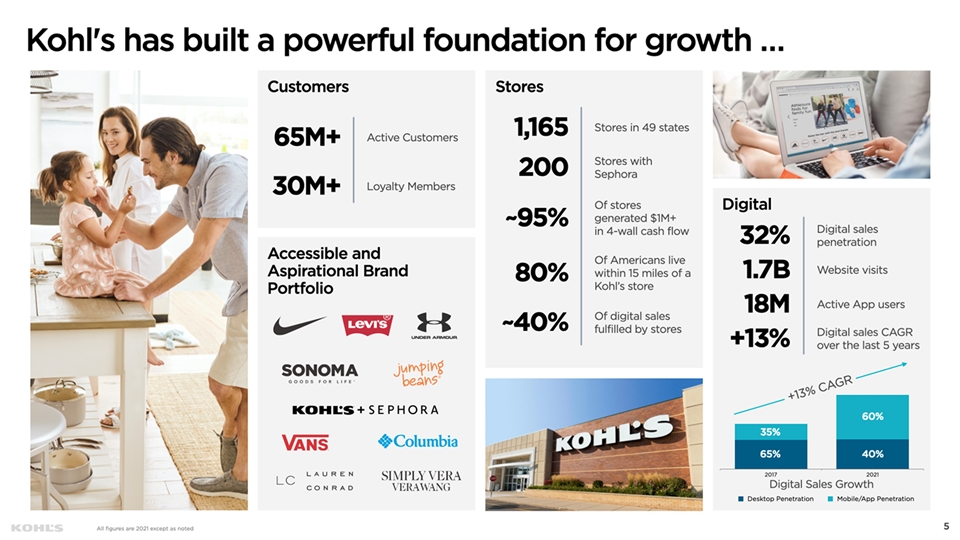

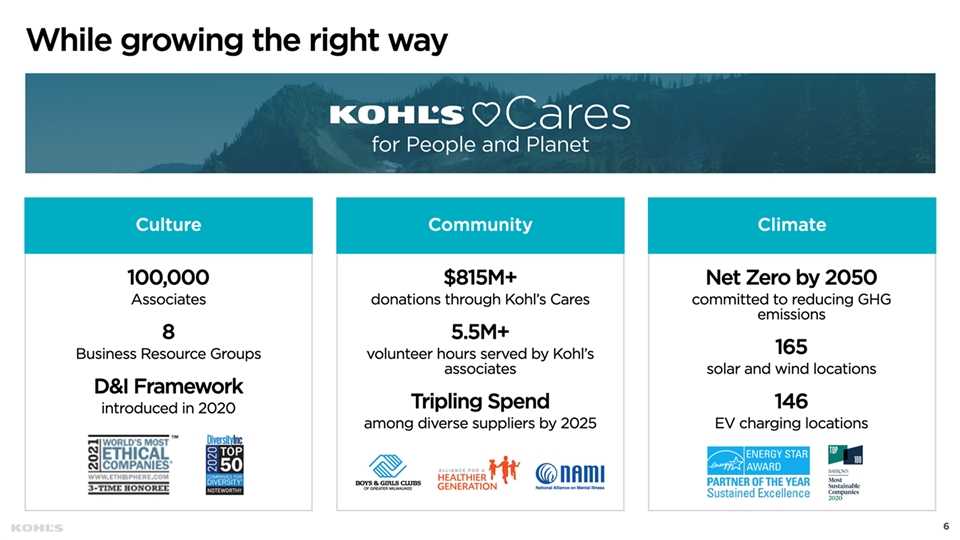

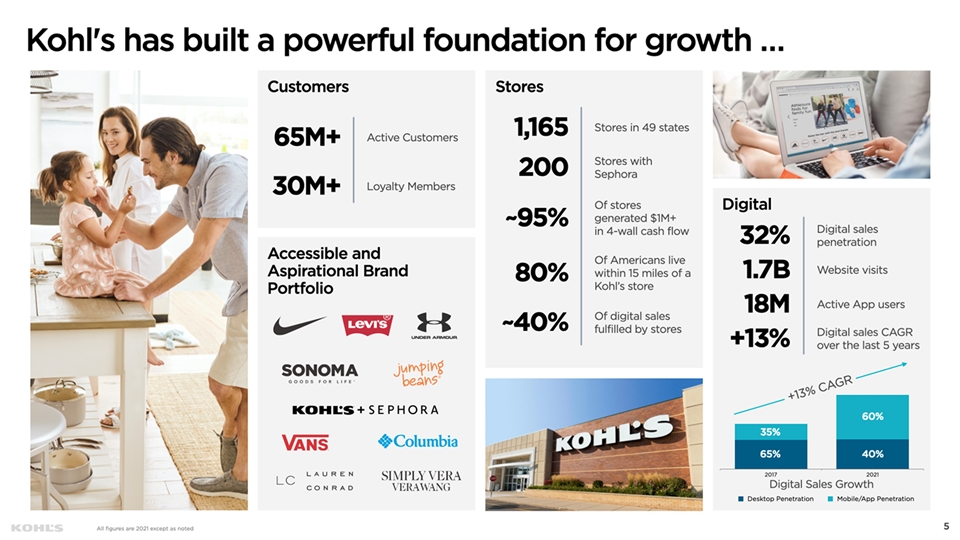

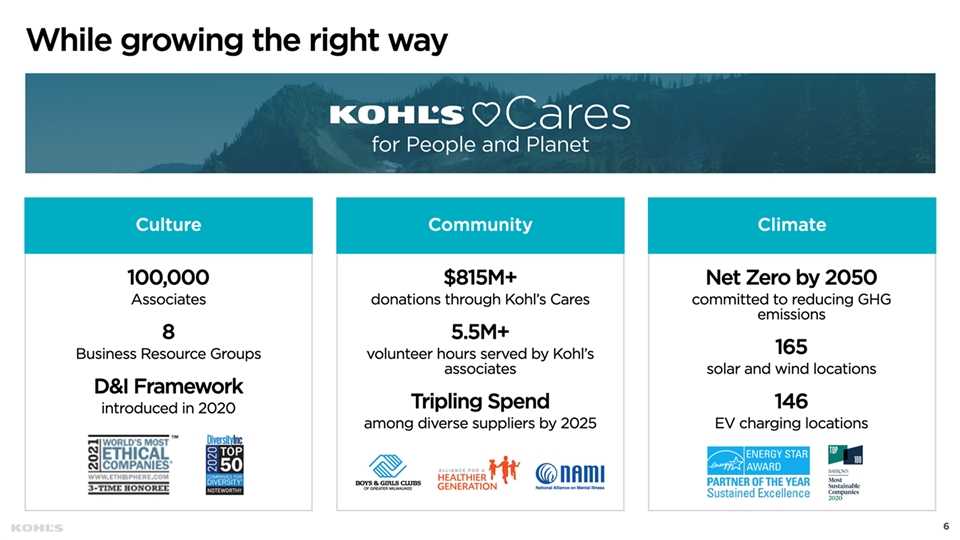

About Kohl’s

Kohl’s (NYSE: KSS) is a leading omnichannel retailer. With more than 1,100 stores in 49 states and the online convenience of Kohls.com and the Kohl’s App, Kohl’s offers amazing national and exclusive brands at incredible savings for families nationwide. Kohl’s is uniquely positioned to deliver against its strategy and its vision to be the most trusted retailer of choice for the active and casual lifestyle. Kohl’s is committed to progress in its diversity and inclusion pledges, and the company’s environmental, social and corporate governance (ESG) stewardship. For a list of store locations or to shop online, visit Kohls.com. For more information about Kohl’s impact in the community or how to join our winning team, visit Corporate.Kohls.com or follow @KohlsNews on Twitter.

Investor Relations:

Mark Rupe, (262) 703-1266, mark.rupe@kohls.com

Media:

Jen Johnson, (262) 703-5241, jen.johnson@kohls.com

Lex Suvanto, (646) 775-8337, lex.suvanto@edelman.com

THE FOLLOWING LETTER WAS ALSO MAILED TO SHAREHOLDERS ON APRIL 21, 2022:

World-Class Board and Management Team Committed to Maximizing Value for Shareholders Dear Fellow Shareholder, The value of your investment is at stake at Kohl’s Annual Meeting this year. We want you to know that your voice matters to our Board – regardless of the number of shares you hold – and we want to make sure that you are heard. By voting using the BLUE card enclosed, we believe you can have a significant impact on the future value of your investment. Your Board, working closely with Kohl’s management team, has acted decisively to put the Company on a new trajectory for improved performance, making key investments to support the strategy we announced in October 2020. In 2021, Kohl’s execution of that strategy delivered record earnings per share (EPS) and expanded margins alongside significant capital return to shareholders. The table below provides an overview of the actions the Board has and will continue to take to maximize value for shareholders, as well as a summary of Macellum’s empty agenda. PROTECT THE VALUE OF YOUR INVESTMENT IN KOHL’S BY VOTING THE BLUE PROXY CARD TODAY. 1 Successfully executing a compelling strategy driving significant, sustainable value Transformative strategy set in October 2020 delivered record 2021 EPS and expanded margins alongside significant capital return to shareholders, including over $1.5B in share repurchases and dividends. Several building blocks implemented to drive top-line growth including the Sephora partnership, enhanced brand portfolio and omnichannel strategy. Disciplined capital allocation strategy with plans to repurchase an additional $1B+ in 2022 under new $3B share repurchase authorization and a 100% increase in dividend for 2022 equating to an annual rate of $2.00 per share, while investing in high ROI growth driving initiatives. 2 Our strong, thoughtfully refreshed Board has positioned Kohl’s to drive shareholder value Our directors bring highly relevant experience from top roles at leading retail companies, such as Walmart, Burlington, lululemon, and Kroger, as well as deep experience in M&A, technology, and operations. Recent refreshment with 6 new independent directors in the last 3 years, including 3 added as part of the 2021 settlement agreement with Macellum and other investors.1 3 Your Board is running a robust process to explore all strategic alternatives to maximize value Your Board engaged Goldman Sachs to conduct a broad process to explore strategic alternatives. To date, Goldman Sachs has engaged with over 25 parties. Select bidders have been invited to a data room containing over 550,000 pages across over 55,000 documents, as well as meetings with management. While preliminary, non-binding proposals have been received, further diligence is ongoing with requests for proposals with committed financing and binding documentation. The Board has the right skills and expertise to drive our strategy forward while evaluating any value-creating opportunities for shareholders. 4 Macellum has presented an empty agenda In spite of our Board’s open invitation to constructively share ideas and over a year of good-faith engagement, Macellum has presented no value-additive ideas. Macellum’s actions and inconsistent claims demonstrate a focus on short-term profit-taking over long-term value. Six of 10 Macellum nominees have never served on a public company board, and none have served on a retail company board of comparable size to Kohl’s. Several Macellum nominees are directly associated with bankruptcies and have overseen significant value destruction.

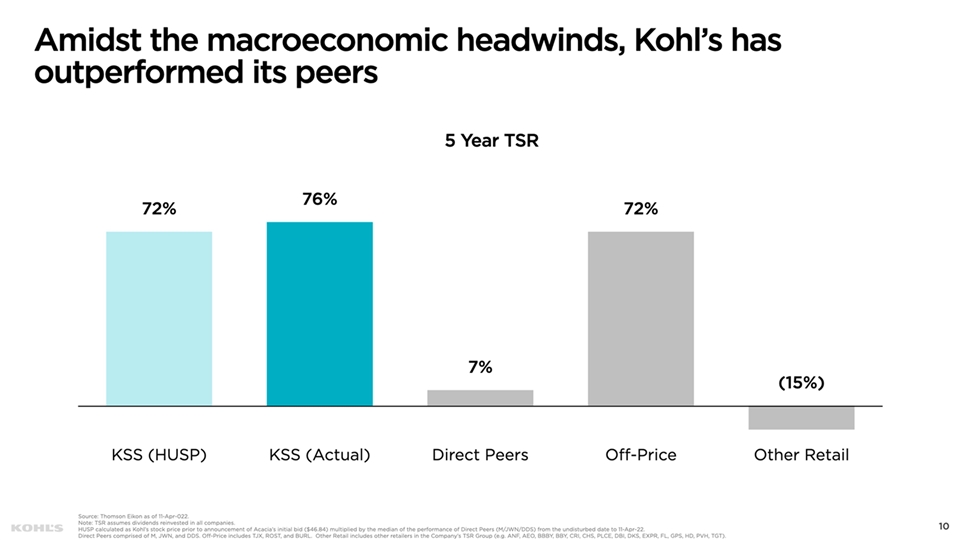

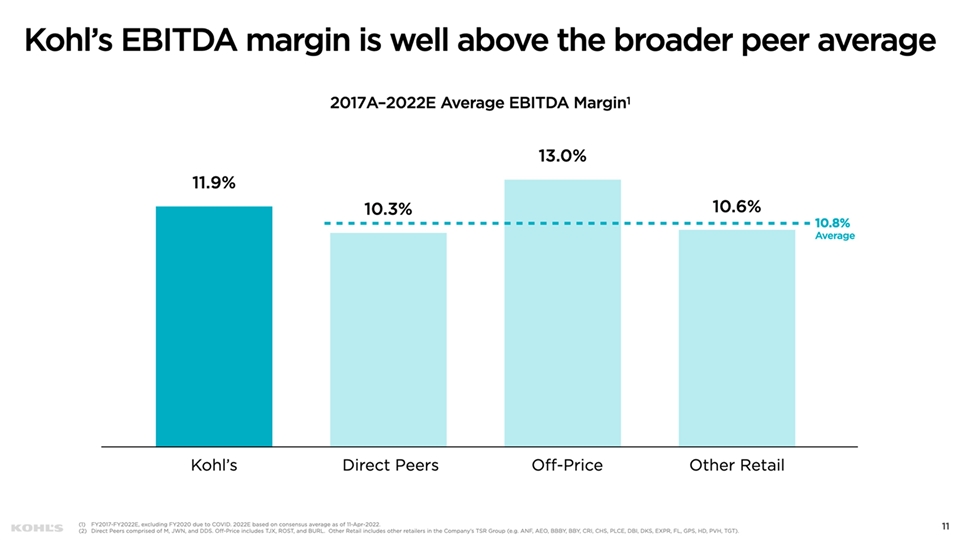

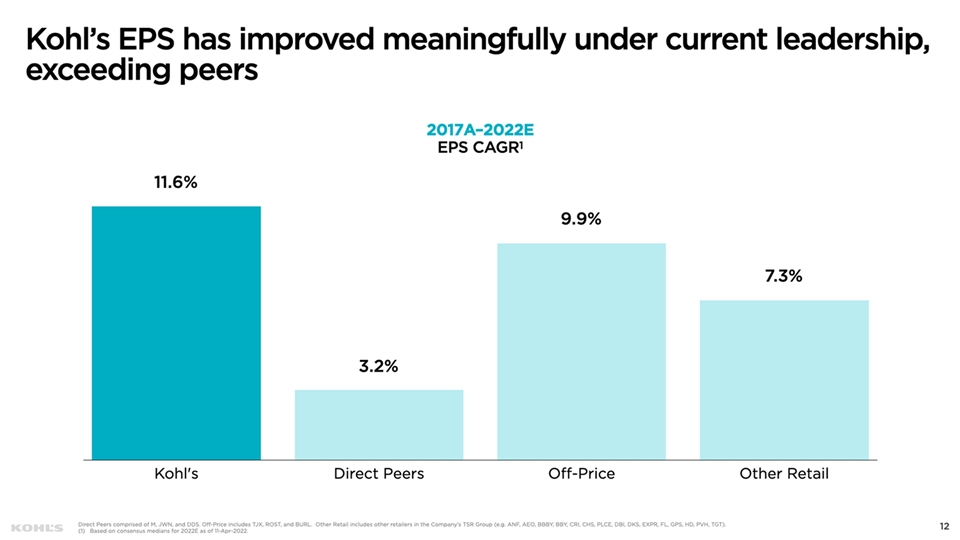

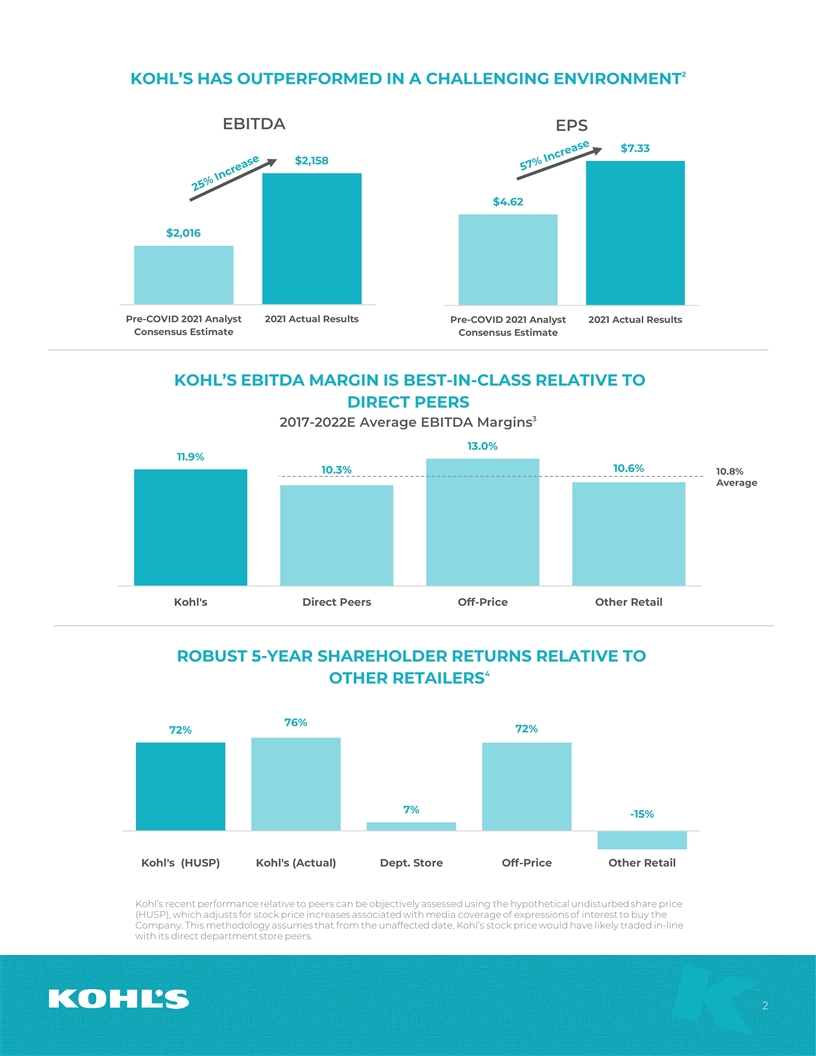

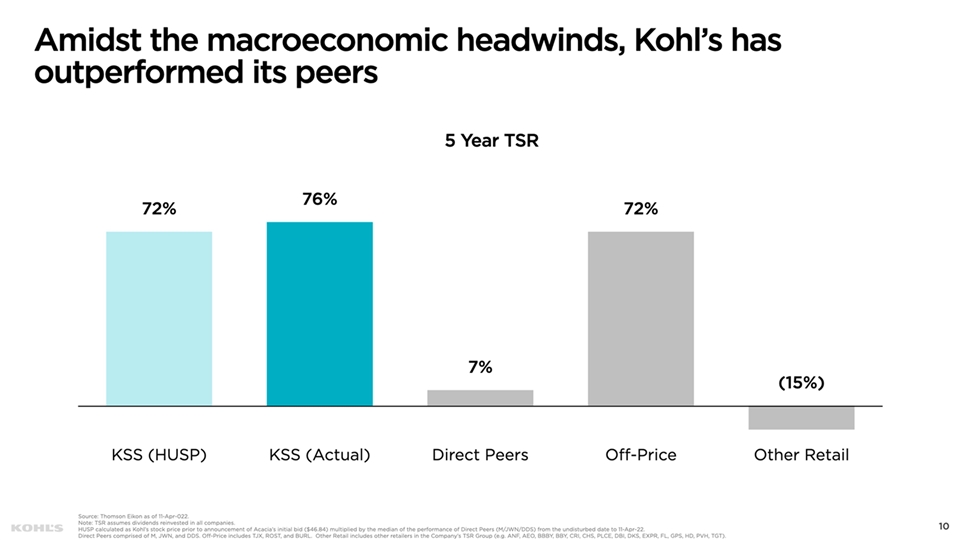

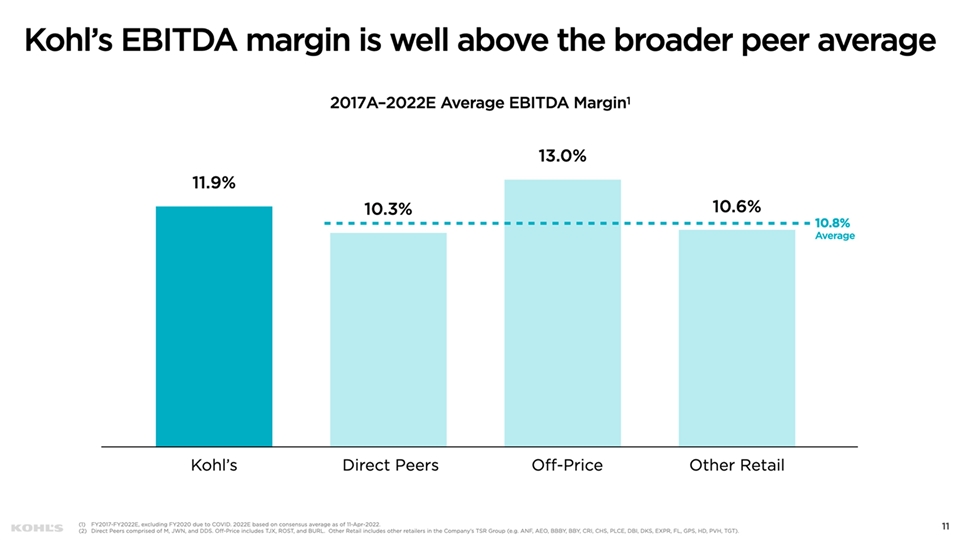

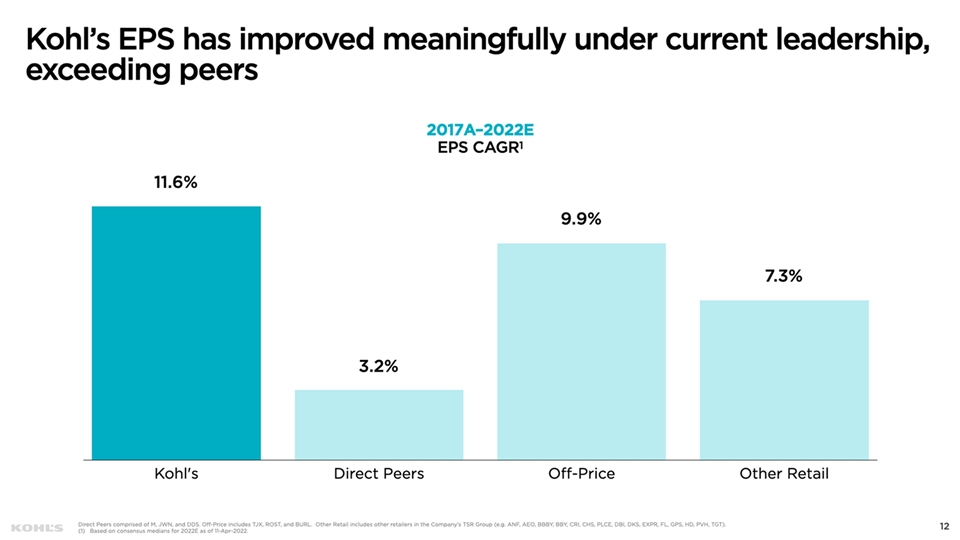

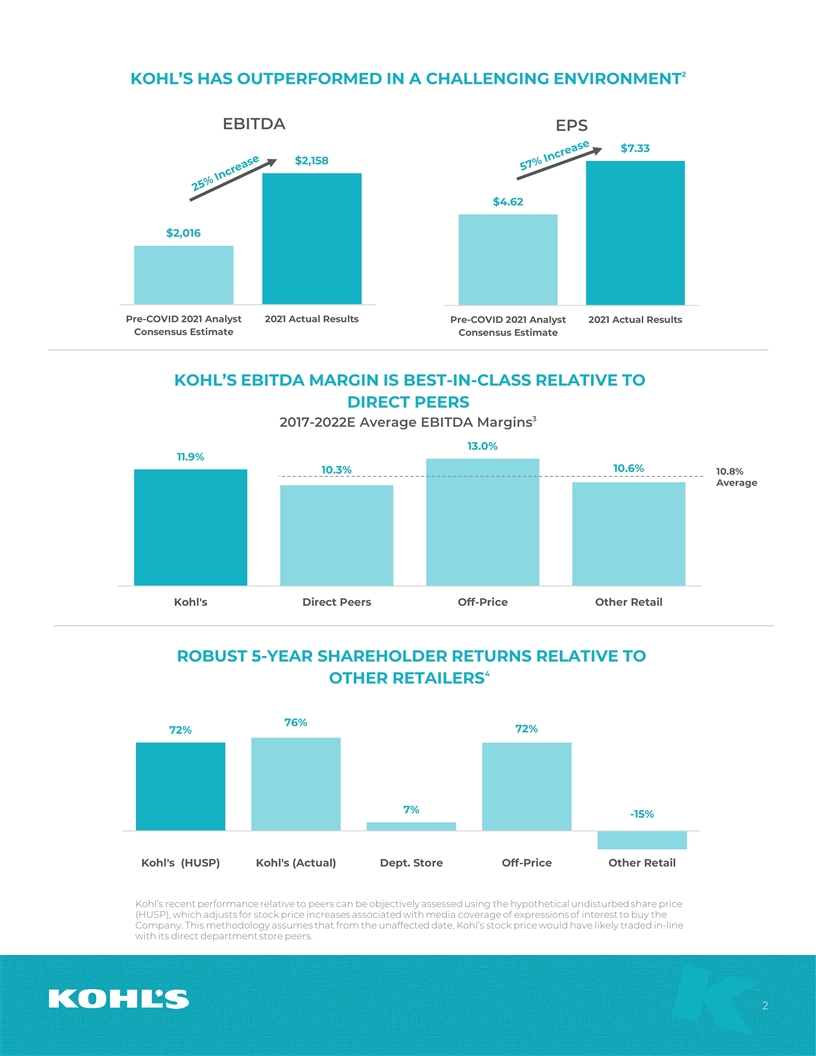

25% Increase 57% Increase Kohl’s recent performance relative to peers can be objectively assessed using the hypothetical undisturbed share price (HUSP), which adjusts for stock price increases associated with media coverage of expressions of interest to buy the Company. This methodology assumes that from the unaffected date, Kohl’s stock price would have likely traded in-line with its direct department store peers. 10.8% Average KOHL’S HAS OUTPERFORMED IN A CHALLENGING ENVIRONMENT2

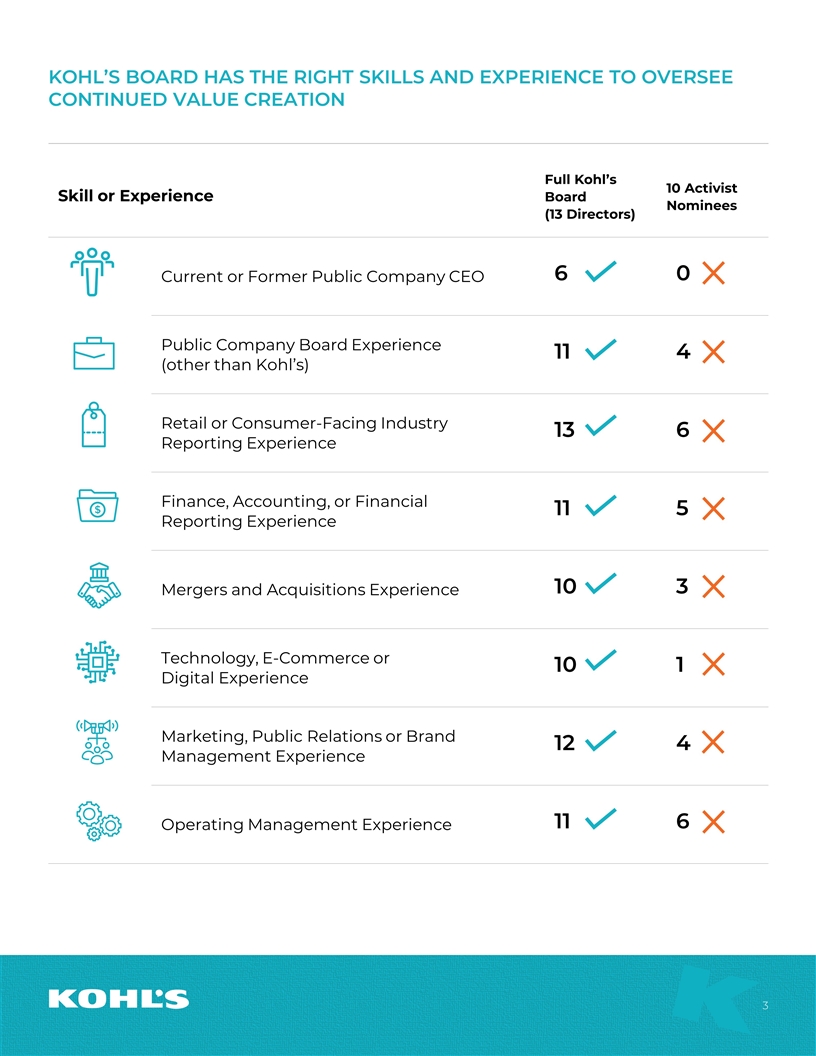

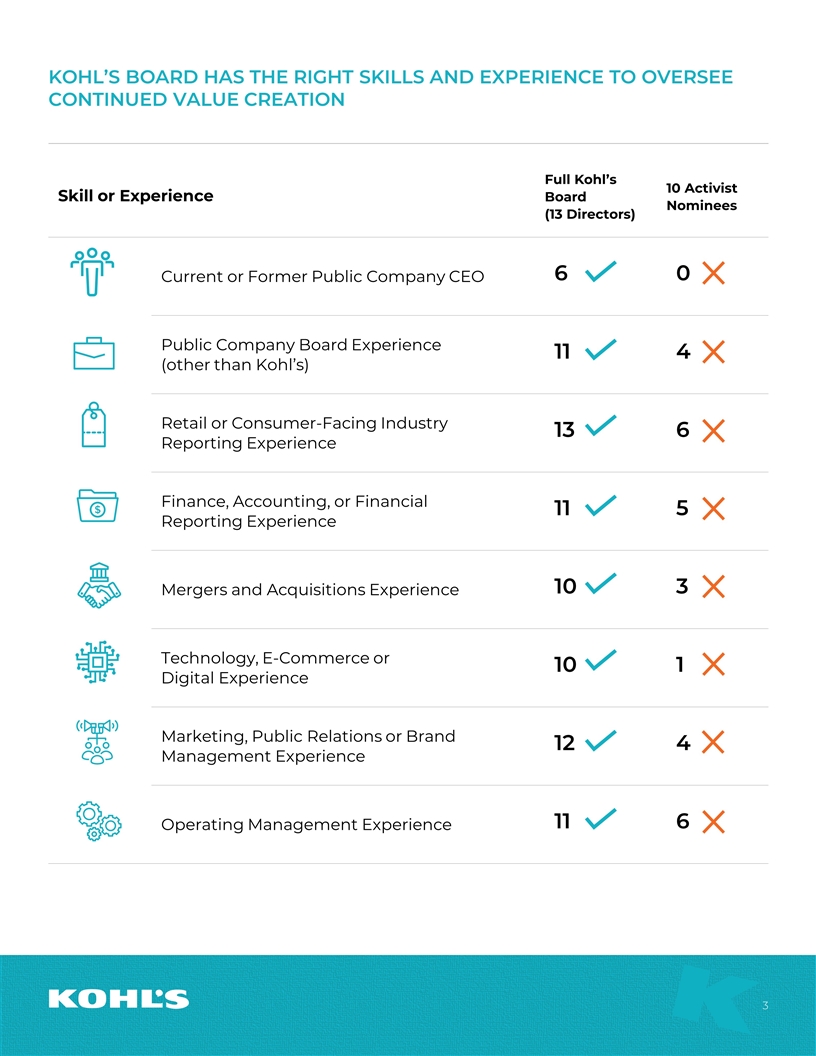

Skill or Experience Full Kohl’s Board (13 Directors) 10 Activist Nominees Current or Former Public Company CEO 6 0 Public Company Board Experience (other than Kohl’s) 11 4 Retail or Consumer-Facing Industry Reporting Experience 13 6 Finance, Accounting, or Financial Reporting Experience 11 5 Mergers and Acquisitions Experience 10 3 Technology, E-Commerce or Digital Experience 10 1 Marketing, Public Relations or Brand Management Experience 12 4 Operating Management Experience 11 6 KOHL’S BOARD HAS THE RIGHT SKILLS AND EXPERIENCE TO OVERSEE CONTINUED VALUE CREATION

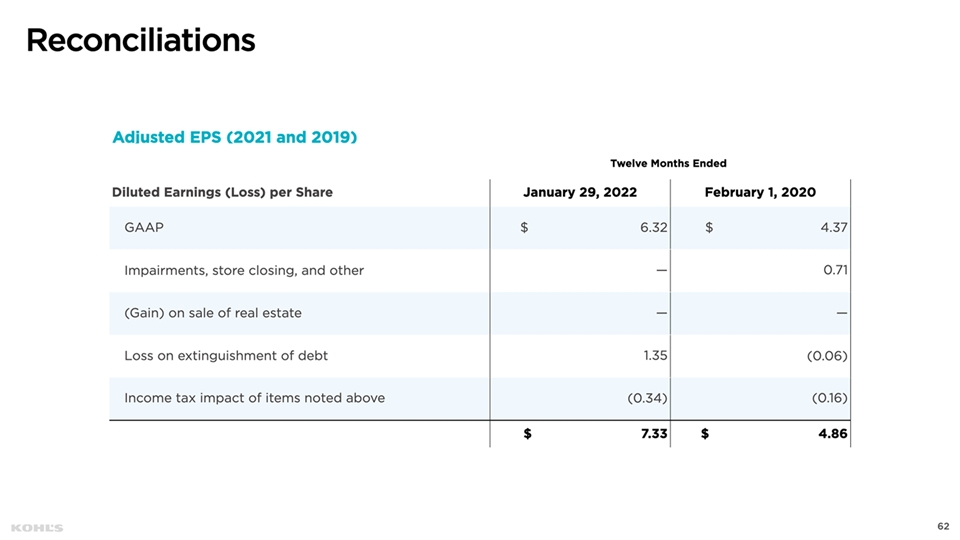

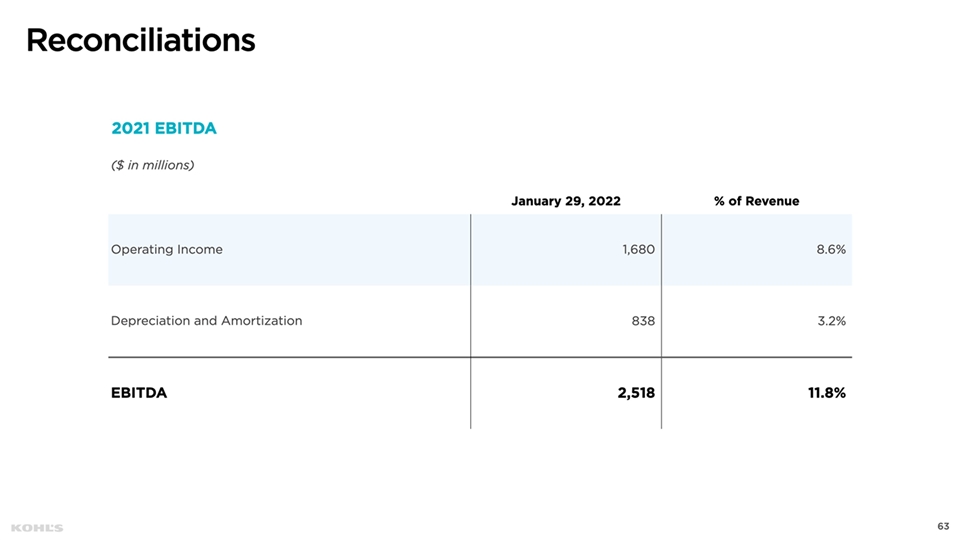

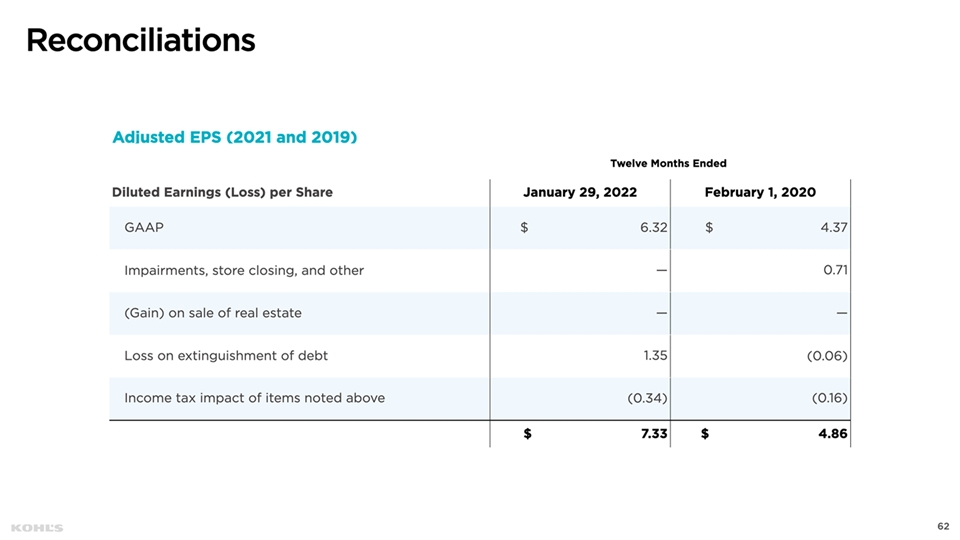

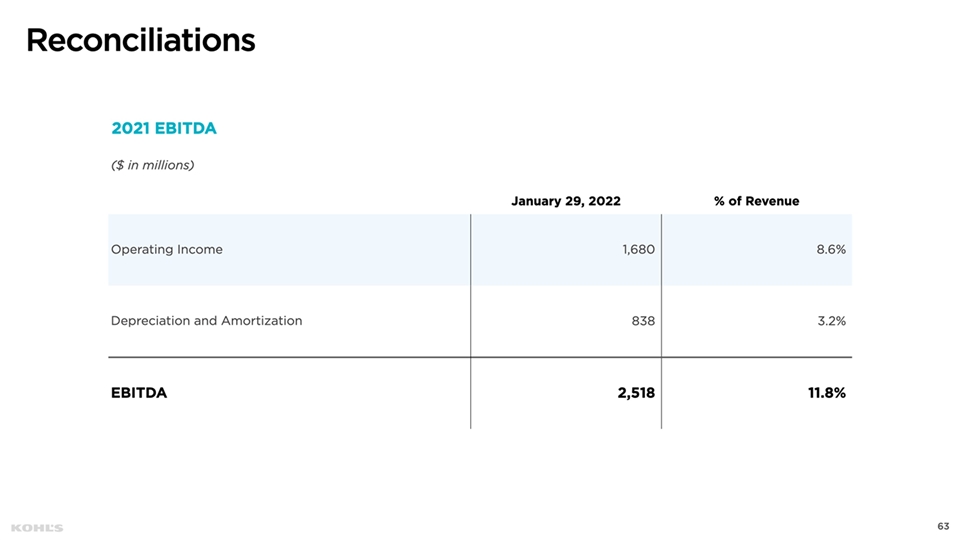

VISIT WWW.KOHLSMOMENTUM.COM FOR MORE INFORMATION PROTECT THE VALUE OF YOUR INVESTMENT. VOTE THE BLUE CARD TODAY FOR ALL 13 OF KOHL’S HIGHLY QUALIFIED DIRECTORS. Cautionary Statement Regarding Forward-Looking Information This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The Company intends forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “anticipates,” “plans,” or similar expressions to identify forward-looking statements. Such statements, including statements regarding the outcome and timing of the strategic review process, are subject to certain risks and uncertainties, which could cause the Company’s actual results to differ materially from those anticipated by the forward-looking statements, and there can be no guarantee that the process will result in an agreement to sell the Company or that any such agreement will ultimately be consummated. These risks and uncertainties include, but are not limited to, risks described more fully in Item 1A in the Company’s Annual Report on Form 10-K, which are expressly incorporated herein by reference, and other factors as may periodically be described in the Company’s filings with the SEC. Forward-looking statements relate to the date initially made, and Kohl’s undertakes no obligation to update them. Non-GAAP Financial Measures In addition, this letter contains non-GAAP financial measures, including Adjusted EPS and Adjusted EBITDA. Reconciliations of all non-GAAP measures to the most directly comparable GAAP measures are included in the appendix of the Company’s presentation date March 7th, 2022, filed with the SEC. About Kohl's Kohl’s (NYSE: KSS) is a leading omnichannel retailer. With more than 1,100 stores in 49 states and the online convenience of Kohls.com and the Kohl's App, Kohl's offers amazing national and exclusive brands at incredible savings for families nationwide. Kohl’s is uniquely positioned to deliver against its strategy and its vision to be the most trusted retailer of choice for the active and casual lifestyle. Kohl’s is committed to progress in its diversity and inclusion pledges, and the company's environmental, social and corporate governance (ESG) stewardship. For a list of store locations or to shop online, visit Kohls.com. For more information about Kohl’s impact in the community or how to join our winning team, visit Corporate.Kohls.com or follow @KohlsNews on Twitter. 1 2021 settlement agreement reached with Macellum Advisors GP, LLC, Ancora Holdings, Inc., Legion Partners Asset Management, LLC, and 4010 Capital, LLC. 2 Adjusted Earnings per Share. 3FY2017-FY2022, excluding FY2020 due to COVID. 2022E based on consensus average as of 14-Mar-2022. Direct Peers comprised of Macy’s, Nordstrom and Dillard’s, and the average calculated as average of each’s EBITDA margins between 2017-2022E, excluding 2020. 4 As of April 11, 2022. TSR assumes dividends reinvested. Direct peers include DDS, M, JWN; Off-price peers include BURL, TJX, ROST; Other peers include the other retailers in the Company’s TSR Peer Group which represent a wide cross-section of retailers. YOUR VOTE IS IMPORTANT! Please refer to the enclosed BLUE proxy card for information on how to vote by telephone or by Internet, or simply sign and date the BLUE proxy card and return it in the postage-paid envelope provided. If you have any questions, or need assistance in voting your shares, please call our proxy solicitor: INNISFREE M&A INCORPORATED TOLL-FREE, at 1-877-687-1874 BANKS AND BROKERS MAY CALL COLLECT, at 1-212-750-5833