- KSS Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Kohl's (KSS) 8-KKohl’s Reports Third Quarter Fiscal 2024 Financial Results

Filed: 26 Nov 24, 7:01am

Update images w/Fall/Winter theme Exhibit 99.2 Q3 November 26, 2024

16

“We have taken significant action to reposition Kohl’s for future growth. And while we are making progress against our strategic priorities, our efforts have yet to fully yield the intended outcome due in part to a continued challenging consumer environment. During the second quarter, our customers exhibited more discretion in their spending, which pressured our sales even as customers transacted more frequently. This overshadowed strong performance in our key growth areas, including Sephora, home decor, gifting, and impulse. In spite of this, we continued to execute well operationally, enabling us to deliver a 13% increase in earnings driven by gross margin expansion and strong inventory and expense management.” ” However, We “Our third quarter results did not meet our expectations as sales remained soft in our apparel and footwear businesses. Although we had a strong collective performance across our key growth areas, including Sephora, home decor, gifting, and impulse, and also benefited from the opening of Babies “R” Us shops in 200 of our stores, these were unable to offset the declines in our core business. Importantly, we delivered gross margin expansion and managed expenses tightly in the quarter. “We are not satisfied with our performance in 2024 and are taking aggressive action to reverse the sales declines. Our conviction in our strategy remains strong, however we must execute at a higher level and ensure we are putting the customer first in everything we do. We are approaching our financial outlook for the year more conservatively given the third quarter underperformance and our expectation for a highly competitive holiday season,” ” “We have taken significant action to reposition Kohl’s for future growth. And while we are making progress against our strategic priorities, our efforts have yet to fully yield the intended outcome due in part to a continued challenging consumer environment and softness in some of our core businesses. During the second quarter, our customers exhibited more discretion in their spending, which pressured our sales even as customers transacted more frequently. This overshadowed strong performance in our key growth areas, including Sephora, home decor, gifting, and impulse. In spite of this, we continued to execute well operationally, enabling us to deliver a 13% increase in earnings driven by gross margin expansion and strong inventory and expense management.” “Looking ahead, we are focused on ensuring that the substantial work that we’ve done across product, value, and experience is fully recognized by both new and existing customers. We will also capitalize on new opportunities such as our partnership with Babies “R” Us and continue to benefit from our key growth areas. Our conviction in our strategy remains strong and our operating discipline, solid cash flow generation, and healthy balance sheet will continue to support us as we work to return Kohl’s to growth.”

1,178 Stores Q3 2024 Pls add FLX logo

, ~ 15% Q3 growth of more than 9% Q3 Solid demand fragrance and hair care growth in Yves Saint Laurent, , and Laneige

50% 25% Impulse sales in Q3 grew more than 40% as we introduced queuing lines in 200 additional stores Initial sales contribution from our partnership with Babies “R” Us as we opened ~200 Q3 40% in-store baby shops and expanded our baby gear and accessories presence on 200 Kohls.com Expanded gifting assortment in Q3 to prepare for the holiday season

Increasing touchpoints with our most engaged customers through more targeted offers and direct mail Building Increasing relevancy of apparel & footwear offerings in 2024 Increase Inventory in Private Apparel Brands ● Balance our inventory buys in the near-term to ensure we have the proper support for our key private brands, which is already underway as evident with increased in-transit inventory at end of Q3 ● Ensure we are leveraging market brands opportunistically through a chase approach rather than as a replacement for private brands Repositioning Juniors offering next to Regain Traction in Select Categories Sephora in stores to better capitalize ● Jewelry: Reintroducing fine jewelry in 200 stores and expanded in-aisle Q3 on cross shopping opportunities in placement of bridge jewelry in all stores this holiday season 2024 ● Petites: Re-establishing presence by increasing offering and expanding to all stores in Q4 ● Intimates: Accelerating newness in key brands with incremental marketing support in Q4 Q1 2024 with positive sales growth ● Legacy home: Increasing innovation, new brand introductions, and stronger value messaging during the competitive holiday season Drive Increased Traffic ● Increasing our promotional activity, while also deploying more targeted offers and direct mail ● Marketing efforts focused on maximizing impact during key shopping days ● Continuing to leverage Kohl’s Cash and Kohl’s Rewards as a value differentiator Legacy home (kitchen electrics, floor care, and bedding): Women’s ● Strengthening young men’s ● Driving infant and category through newborn apparel the introduction of sales through new brands ● Continuing to Babies “R” Us including amplify polished cross shopping Aeropostale and casual through Quiksilver private and market brands

(7%) to (8%) (6%) to (7%) (5.5%) to (6.5%) vs. 2023 (3%) to (5%) vs. 2023 3.0% to 3.2% 3.4% to 3.8% 3.0% to 3.3% $1.20 to $1.50 Dividend: $0.50 quarterly dividend payable December 24, 2024

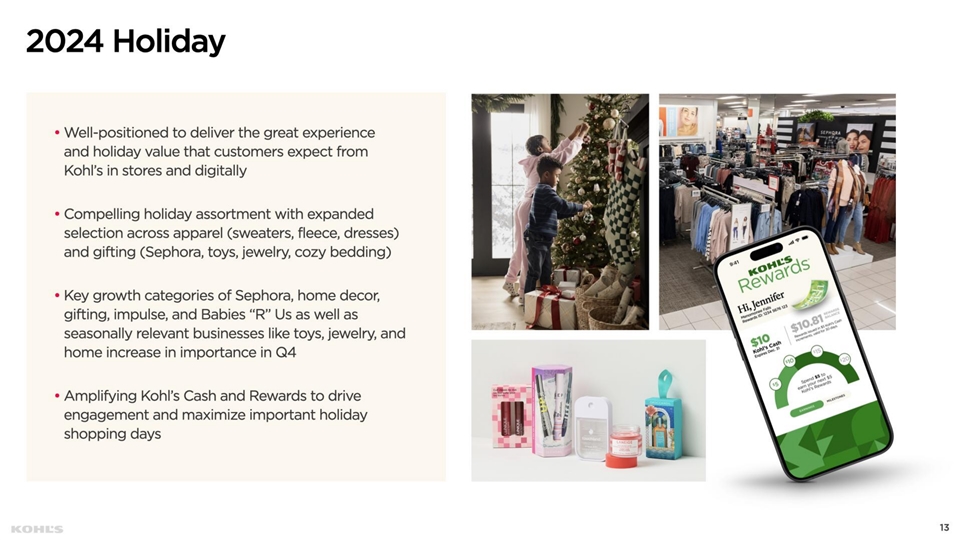

as well as seasonally relevant businesses like toys, jewelry, and home Holiday Well-positioned to deliver the great experience and holiday value that customers expect from Kohl’s in stores and digitally Compelling holiday assortment with expanded selection across apparel (sweaters, fleece, dresses) and gifting (Sephora, toys, jewelry, cozy bedding) Key growth categories of Sephora, home decor, gifting, impulse, and Babies “R” Us increase in importance in Q4 Amplifying Kohl’s Cash and Rewards to drive engagement and maximize important holiday shopping days 13

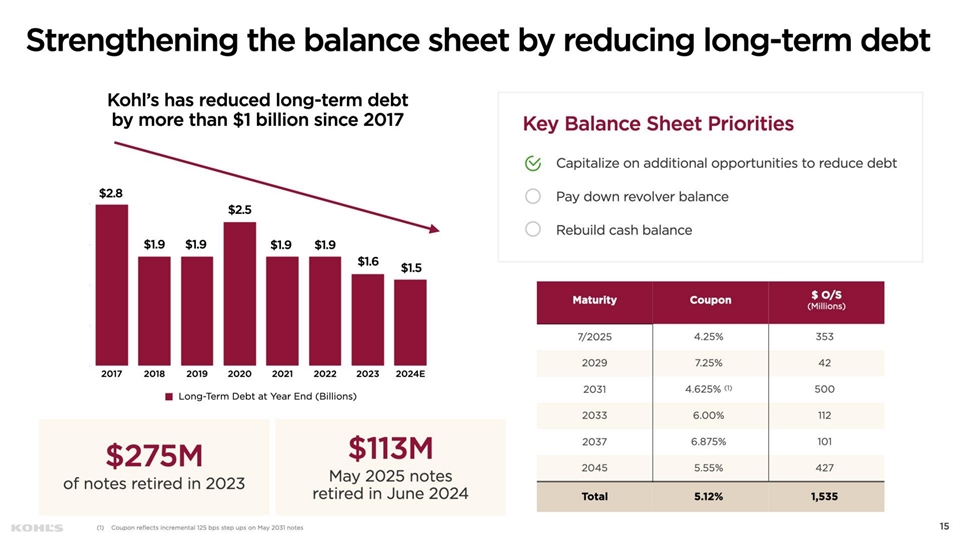

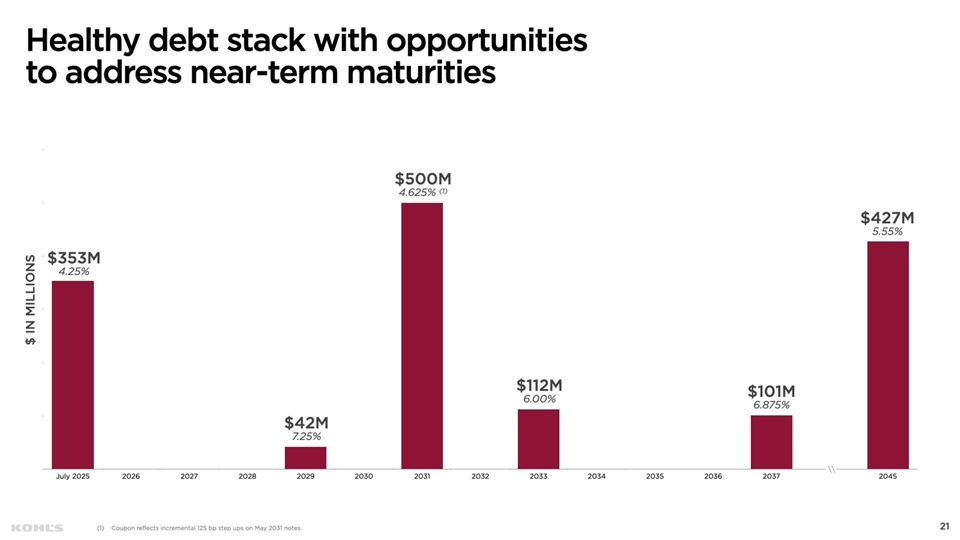

Coupon reflects incremental 125 bps step ups on May 2031 notes

16 Q3

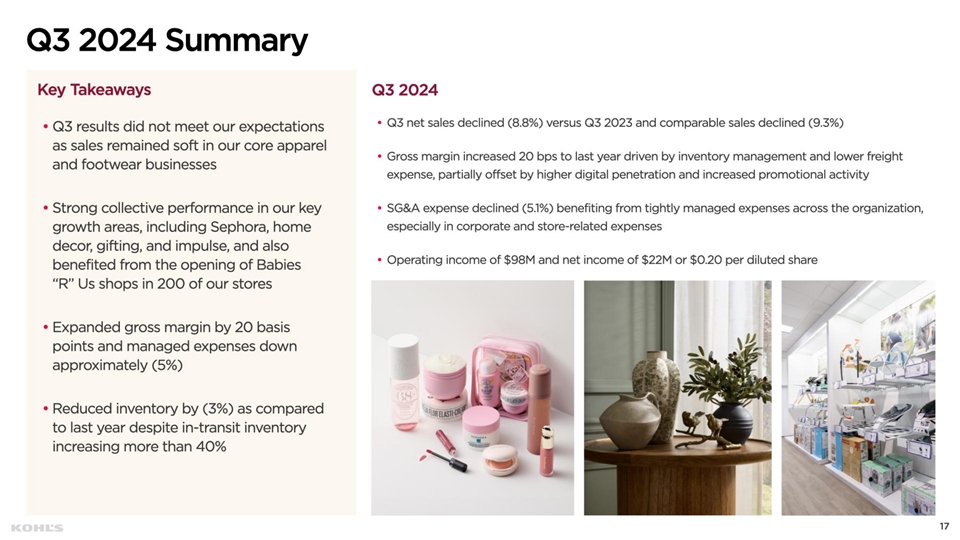

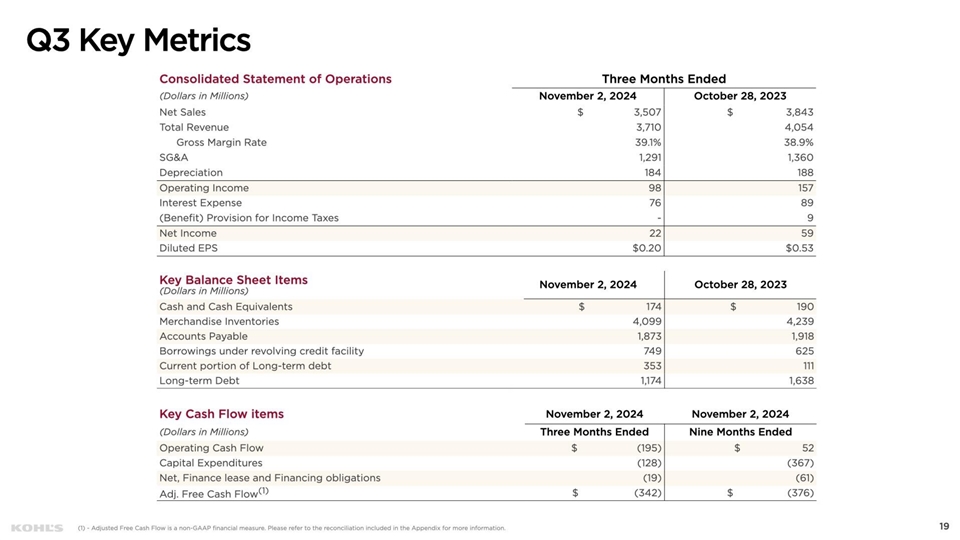

Q3 Q3 Q3 net sales declined (8.8%) versus Q3 2023 and comparable sales declined (9.3%) Q3 results did not meet our expectations as sales remained soft in our core apparel and footwear businesses Gross margin increased 20 bps to last year driven by inventory management and lower freight expense, partially offset by higher digital penetration and increased promotional activity SG&A expense declined (5.1%) benefiting from tightly managed expenses across the organization, Strong collective performance Delivered continued strong performance in our key growth especially in corporate and store-related expenses areas, including Sephora, home decor, gifting, and impulse, and also benefited from the opening of Babies Operating income of $98M and net income of $22M or $0.20 per diluted share “R” Us shops in 200 of our stores Expanded gross margin by 20 basis points and managed expenses down approximately (5%) Reduced inventory by (3%) as compared to last year despite in-transit inventory increasing more than 40% 17

Q3 Deleveraged 125 basis points vs Q3 2023 Increased 20 bps vs Q3 2023 $1,360M 39.1% $1,291M 38.9% 33.5% 34.8% Q3 Q3 Q3 Q3 Q3 Q3 Inventory management and lower freight expense Tightly managed expenses across the organization, especially in corporate and store-related expenses Higher digital penetration and increased promotional activity Investments in marketing, technology and growth categories 18 technology, and growth

Updated w/ link in notes Q3 (Benefit) Provision for Income Taxes 19

20 21

21 22

Update with link in description (rows 74-81) (20) (62) 1 1 22

Update images w/Fall/Winter theme