- KSS Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEFC14A Filing

Kohl's (KSS) DEFC14AProxy in contested solicitation

Filed: 19 Mar 21, 5:06pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. 1)

| Filed by the Registrant |  | Filed by a Party other than the Registrant |

| Check the appropriate box: | |

| Preliminary Proxy Statement |

| Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material Pursuant to §240.14a-12 |

Kohl’s Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | ||

| No fee required. | |

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| Fee paid previously with preliminary materials. | |

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

HAS A POWERFUL FOUNDATION

TO ACCELERATE GROWTH

| 65M | 30M | 29M | ||||

| ACTIVE CUSTOMERS | LOYALTY MEMBERS | KOHL’S CHARGE CARD | ||||

| HOLDERS | ||||||

| 1,162 | 90% | 600M | ||||

| NATIONWIDE BASE | OF STORES GENERATED | STORE VISITS | ||||

| OF CONVENIENT | OVER $1M IN 4-WALL | |||||

| STORE LOCATIONS | CASHFLOW | |||||

| 40% | 1.6B | 16M | ||||

| DIGITAL SALES | WEBSITE VISITS | KOHL’S APP USERS | ||||

| PENETRATION IN 2020 | IN 2020 |

ACCESSIBLE AND ASPIRATIONAL BRAND PORTFOLIO

Figures presented based on 2019 results except as noted. Store locations as of January 30, 2021

| NOTICE OF ANNUAL MEETING OF SHAREHOLDERS | May 12, 2021 8:00 a.m. Central Time Kohl’s Corporation N56 W17000 Ridgewood Drive |

To Our Shareholders:

The Annual Meeting of Shareholders of Kohl’s Corporation will be held virtually on May 12 , 2021, at 8:00 a.m. Central Time. Due to the continuing public health implications of the COVID-19 pandemic and our desire to promote the health and welfare of our shareholders, the Annual Meeting will be held exclusively online via a live interactive webcast on the internet. You will not be able to attend the Annual Meeting in person at a physical location.

The proxy statement for the Annual Meeting and accompanying BLUE proxy card is first being mailed to shareholders on or about March 24 , 2021.

The purposes of the Annual Meeting are:

| 1. | To elect twelve individuals to serve as Directors for a one-year term and until their successors are duly elected and qualified; |

| 2. | To approve, by an advisory vote, the compensation of our named executive officers; |

| 3. | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending January 29, 2022; |

| 4. | To consider and vote upon the shareholder proposal described below, if properly presented at the meeting; and |

| 5. | To consider and act upon any other business that may properly come before the meeting or any adjournment thereof. |

We believe that the nominees recommended by our Board of Directors (the “Company Nominees”) are best positioned to serve our Company and our shareholders. Accordingly, our Board of Directors unanimously recommends that you vote “FOR ALL” of the Company Nominees on the BLUE proxy card.

A group of our shareholders consisting of Macellum Badger Fund, LP (together with its affiliates, “Macellum”), Legion Partners Holdings, LLC (together with its affiliates, “Legion Partners”), 4010 Partners, LP (together with its affiliates, “4010”) and Ancora Advisors, LLC (together with its affiliates, “Ancora” and together with Legion Partners, 4010, and Macellum, the “Investor Group”) has notified us that it intends to nominate a slate of five nominees (the “Investor Group Nominees”) for election as Directors at the Annual Meeting in opposition to the Company Nominees recommended by our Board of Directors. You may receive solicitation materials from the Investor Group, including proxy statements and proxy cards. The Company is not responsible for the accuracy of any information provided by or in relation to the Investor Group or the Investor Group Nominees contained in the solicitation materials filed or disseminated by or on behalf of the Investor Group or any other statements that the Investor Group or its representatives may make.

Our Board of Directors unanimously recommends that you vote “FOR ALL” twelve of the Company Nominees recommended by our Board of Directors on the BLUE proxy card, and strongly urges you not to sign or return any proxy card that may be sent to you by the Investor Group. If you have previously submitted a proxy card sent to you by the Investor Group, you can change your vote by using the enclosed BLUE proxy card to vote for the twelve Company Nominees recommended by our Board of Directors.

Only shareholders of record at the close of business on March 24 , 2021 are entitled to notice of and to vote at the meeting.

It is extremely important that your shares are represented and voted at the Annual Meeting no matter how large or small your holdings may be. You are urged to date, sign and return the BLUE proxy card. Please vote as soon as possible in one of these three ways, even if you plan to attend the meeting:

| INTERNET Follow the instructions on your BLUE proxy card to vote via the Internet. | ||

| BY TELEPHONE Follow the instructions on your BLUE proxy card to vote by telephone. | ||

| BY MAIL You may complete, sign, date and return your BLUE proxy card by mail using the envelope provide. | ||

KOHL’S CORPORATION / 2021 PROXY STATEMENT 1

Even if you vote in advance, you may still decide to attend the virtual Annual Meeting of Shareholders, withdraw your proxy, and vote your shares at the Annual Meeting. For more information, see “May I change or revoke my vote after I submit my proxy,” which begins on page 12.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be Held virtually on May 12 , 2021: The 2020 Annual Report on Form 10-K and proxy statement of Kohl’s Corporation are available at www.proxyvote.com.

We appreciate your continued confidence in our company and your support for our strategy. We look forward to seeing you on May 12 , 2021.

By Order of the Board of Directors

Michelle D. Gass

Chief Executive Officer

Menomonee Falls, Wisconsin

March 19 , 2021

KOHL’S CORPORATION / 2021 PROXY STATEMENT 2

KOHL’S CORPORATION / 2021 PROXY STATEMENT 3

Background to the Solicitation

The following is a chronology of material communications and events leading up to this proxy solicitation.

In 2020, the Company’s Board of Directors (the “Board”) and management team successfully navigated the COVID-19 pandemic. In addition, over the past few years, the Board and management team have launched multiple initiatives to grow the Company’s business and set the Company on a path of long-term sustainable growth. The Company has made bold enhancements to its strategic plan to accelerate top line growth, and increase profitability to 7% to 8% operating margin. The Company has expanded its lead in key segments, including active, and forged new partnerships with iconic retailers like Sephora.

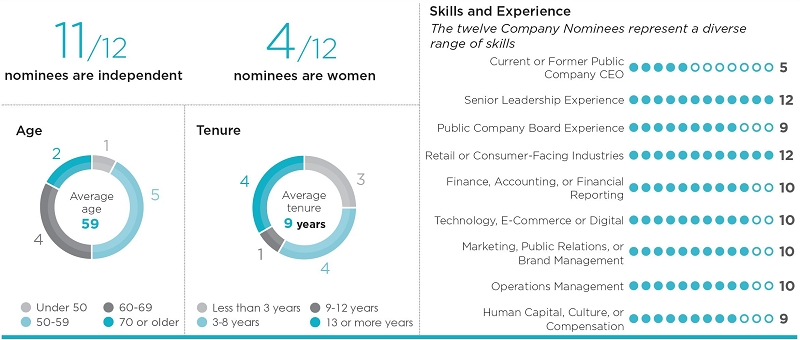

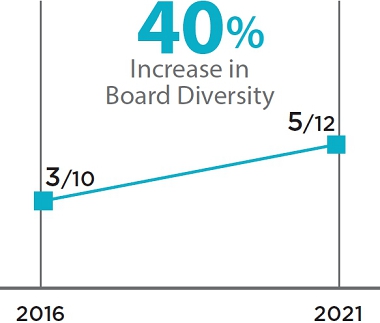

The Company has also sought to enhance its governance by expanding the skill set and experience of its Board to allow for a more diverse perspective in the Company’s boardroom. The current Board features eleven independent directors and the Company’s Chief Executive Officer. Half of the Company’s directors have a tenure of less than six years, with the most recent addition, Robbin Mitchell, joining on February 17, 2021. The Company’s Governance & Nominating Committee works to ensure that the Board is comprised of individuals who are diverse in terms of background, perspectives, industry experience and financial expertise.

Since Spring of 2020, the Company has actively engaged with members of the Investor Group, seeking to understand their ideas and underlying assumptions about the Company. As detailed below, despite multiple requests from the Company, the Investor Group did not provide any detailed plans for the Company to consider prior to the Investor Group releasing a public letter to the Company’s shareholders on February 22, 2021.

In the months of April, May and July of 2020, the Company’s Vice President of Investor Relations, Mark Rupe, repeatedly met with representatives of the Investor Group and responded to questions concerning the Company’s business, including its response to COVID-19, top line growth, capital expenditures, and how the terms of the Company’s bond indenture impacted its ability to engage in sale leasebacks.

In May 2020, a representative of Macellum implied interest in a meeting with the Company’s Chief Financial Officer, Jill Timm, and the Company’s Chief Executive Officer, Michelle Gass, at a later time, but failed to follow up during the months that immediately followed to set a specific time for the meeting.

On August 25, 2020, Mr. Rupe met with a representative of Macellum regarding the Company’s business, including the Company’s actions to improve women’s performance, loyalty program, inventory, market share opportunities and rationale for a previous sale leaseback transaction. During the meeting, the representative of Macellum requested a meeting with Ms. Timm and, potentially, Ms. Gass, but, except for the meeting that was cancelled at Macellum’s request described below, failed to follow up to set a specific time for the meeting over the next few months.

On August 31, 2020, Mr. Rupe met with a representative of 4010. They discussed the Company’s business in general, including SG&A, capital expenditures, marketing and ecommerce. The same day, Mr. Rupe also met with representatives of Legion Partners in connection with similar matters.

In the months of September, October and November of 2020, Mr. Rupe continued to engage with members of the Investor Group with respect to the business of the Company, such as public material arrangements entered into by the Company, including the Company’s indenture and sale leaseback arrangements, as well as other general questions about the Company’s business, including its digital sales and the footprint of the Company’s stores. Mr. Rupe cooperated with and provided feedback to the Investor Group.

On September 9, 2020, a representative of Macellum cancelled a meeting Macellum had previously scheduled with Ms. Timm and Mr. Rupe for September 10, 2020.

On October 20, 2020, the Company released an investor presentation sharing the Company’s new strategic framework. Highlights from this presentation included:

| ■ | expanding Operating Margin goal of 7% to 8% through end-to-end supply chain transformation, SG&A efficiency and operational excellence; |

| ■ | driving top line growth by becoming the destination for the active and casual lifestyle, leading with loyalty and value, and offering a differentiated omni-channel experience; |

KOHL’S CORPORATION / 2021 PROXY STATEMENT 4

| ■ | creating long-term shareholder value through disciplined capital management, a strong balance sheet, expanded operating margin and return of capital to shareholders; and |

| ■ | maintaining an agile, accountable and inclusive culture. |

On November 17, 2020, the Company announced its earnings for the third quarter of 2020 and held its third quarter 2020 earnings conference call, during which it reviewed its updated strategic framework to increase long-term shareholder value.

On November 19, 2020, Mr. Rupe met separately with representatives of Ancora and Macellum to discuss the third quarter earnings release. During these meetings, Mr. Rupe discussed the Company’s updated strategic framework to increase long-term shareholder value and responded to questions. Representatives of Macellum requested a meeting with Ms. Gass. As part of the Company’s continued efforts to work constructively with the Investor Group and further understand its ideas and underlying assumptions about the Company, the Company accepted the meeting request, but given the constraints on Ms. Gass’ time due to the Company’s increased holiday sales activity during the week of Thanksgiving and first week of December, the Company offered a meeting with Ms. Timm which Macellum accepted.

On November 30, 2020, Legion Partners delivered a letter addressed to Ms. Gass. In the letter, Legion Partners indicated that it was writing as a concerned shareholder, and requested a meeting with Ms. Gass within the next two weeks. As part of the Company’s continued efforts to work constructively with the Investor Group and further understand their ideas and underlying assumptions about the Company, Ms. Gass accepted the meeting, scheduled for December 11, 2020.

On December 1, 2020, the Company announced its long-term strategic partnership with Sephora to create a new era of elevated beauty at the Company, combining the Company’s expansive customer reach and omni-channel convenience with Sephora’s prestige service, product selection and beauty experience.

On December 3, 2020, Ms. Timm and Mr. Rupe met with representatives of Macellum about the Company’s business, discussing the Company’s recent performance in various categories, including sales growth, margins, SG&A expenses, inventory and category growth. During the meeting, Ms. Timm requested that the representatives of Macellum provide any detailed plans that the Investor Group has for the Company so that the Board and management could consider them, but Macellum declined to do so.

On December 11, 2020, Ms. Gass, Ms. Timm and Mr. Rupe met with representatives of Legion Partners and 4010. Ms. Timm and Mr. Rupe discussed the Company’s historical operating margins, the women’s apparel category, the impact of competitors closing their stores, the Company’s store footprint, capital allocation and the Company’s relationship with partners. Ms. Gass provided background on the Company’s performance in 2017, 2018 and 2019, and publicly available information concerning the Company’s roadmap to achieve a 7% to 8% operating margin. During the meeting, Ms. Gass and Ms. Timm requested that the representatives of Legion Partners and 4010 provide any detailed plans that the Investor Group has for the Company so that the Board and management could consider them, but Legion Partners and 4010 declined to do so.

On December 23, 2020, the members of the Board received a letter (the “December 23 Letter”) from the Investor Group noting that the Investor Group beneficially owned, in the aggregate, approximately 2.2% of the Company’s shares at such time. The letter requested a meeting with the Board to share the Investor Group’s perspectives on performance and better understand the Board’s plans for the Company. As part of the Company’s continued efforts to work constructively with the Investor Group and further understand their ideas and underlying assumptions about the Company, the Board accepted the meeting, to be attended by independent Board members.

On January 5, 2021, the Investor Group delivered a presentation to the Company that provided background information on the Investor Group as well the Investor Group’s perspectives on the Company’s historical performance (the “Investor Group Deck”). The Investor Group Deck did not contain any detailed plans that the Investor Group has for the Company so that the Board and management could consider them.

On January 6, 2021, independent members of the Board, consisting of the Chair of the Company’s Governance and Nominating Committee, Peter Boneparth, and the Chair of the Company’s Audit Committee, Stephanie Streeter, as well as Mr. Rupe met with representatives of the Investor Group as requested in the Investor Group’s December 23 Letter. During this meeting, the representatives of the Investor Group stated that it beneficially owned, in the aggregate, 3.6% of the Company’s shares. They suggested that substantial change was needed at the Company and that they would be fielding a large number of candidates for election at the upcoming Annual Meeting, without elaborating further on either point. Mr. Boneparth and Ms. Streeter noted the substantial number of new directors that the Company has added to the Board in recent years, and referenced the Company’s strategy to accelerate top line growth and increase profitability to 7% to 8% operating margin. The representatives of the Investor Group committed to providing plans for the Company regarding the Company’s operating margin for the Board and management to consider, but failed to deliver those plans prior to the Investor Group releasing a public letter to the Company’s shareholders.

KOHL’S CORPORATION / 2021 PROXY STATEMENT 5

On January 11, 2021, Macellum delivered a Notice of Intention to Nominate Individuals for Election as Directors for Consideration at the 2021 Annual Meeting of Shareholders of Kohl’s Corporation (the “Nomination Notice”) to the Company’s Senior Executive Vice President, General Counsel and Corporate Secretary, Jason Kelroy. In the Nomination Notice, Macellum notified the Board that it would be nominating nine nominees (the “Original Investor Group Nominees”) for election to the Board at the Annual Meeting. As of the date of the Nomination Notice, the Investor Group stated that it beneficially owned 6,163,305 shares of the Company, including 878,600 shares underlying call options. The Company responded to Macellum confirming receipt of the Nomination Notice and preserving the Company’s right to assert or determine that the nominations were not properly made and take actions with respect to nominations as permitted by the Company’s Bylaws and applicable law. The Nomination Notice also disclosed that on October 23, 2020, the Investor Group entered into a certain group agreement (the “Group Agreement”) in which, among other things, (a) the Investor Group agreed to the joint filing of statements on Schedule 13D with respect to the securities of the Company, (b) the Investor Group agreed to solicit proxies or written consents for the election of the Original Investor Group Nominees, or any other person(s) nominated by the Investor Group, to the Board at the Annual Meeting, (c) the Investor Group agreed to provide notice to the Investor Group’s legal counsel and a representative of Legion Partners of all trading in the securities of the Company, and not to sell or hedge any securities of the Company without the prior written consent of the other parties to the Group Agreement, and (d) Macellum, Legion Partners and Ancora agreed to bear all expenses incurred in connection with the Investor Group’s activities.

Also on January 11, 2021, counsel to Macellum delivered a notice (the “HSR Notice”) to Mr. Kelroy pursuant to the Premerger Notification Rules of the Federal Trade Commission, promulgated under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”). The HSR Notice stated that Macellum intended to acquire voting securities of the Company sufficient to exceed the $100 million reporting threshold, as amended from time to time, under the HSR Act and that Macellum intended to file a Notification and Report Form with the Federal Trade Commission and the Antitrust Division of the U.S. Department of Justice. In response, the Company made its required filings under the HSR Act on January 25, 2021. Macellum’s waiting period under the HSR Act expired on February 10, 2021.

On January 12, 2021, Macellum delivered a letter to the Company requesting to inspect certain shareholder books, records and documents, which was fulfilled by the Company following entry into the confidentiality agreement described below.

On January 19, 2021, counsel to Macellum and a representative of Latham & Watkins LLP (“Latham”), the Company's outside counsel along with Godfrey & Kahn, S.C., had a call, during which it was discussed that further engagement between the Investor Group and the Company, including independent members of the Board, regarding any detailed plans that the Investor Group has for the Company so that the Board and management could consider them would be helpful.

On January 22, 2021, the Company and Macellum entered into a customary confidentiality agreement in connection with Macellum’s request for inspection of certain shareholder books, records and documents.

On January 27, 2021, Mr. Rupe received correspondence from a representative of Legion Partners requesting a meeting with members of the Board and senior management. As part of the Company’s continued efforts to work constructively with the Investor Group and further understand their ideas and underlying assumptions about the Company, the Company accepted the meeting scheduled for February 5, 2021. In advance of the meeting, the Company again requested that the Investor Group provide any detailed plans that the Investor Group has for the Company so that the Board and management could consider them in conjunction with the Board’s evaluation of the Original Investor Group Nominees.

On February 4, 2021, the Company provided its business update for the fourth quarter of 2020, with Ms. Gass noting that the Company’s fourth quarter performance exceeded expectations across all key metrics and highlighting the Company’s focus on gross margin and management of expenses.

On February 5, 2021, independent members of the Board, consisting of Peter Boneparth and the Chair of the Company’s Compensation Committee, Jonas Prising, as well as Ms. Gass and Mr. Rupe met with representatives of the Investor Group. During the meeting, the Investor Group noted that it then beneficially owned 4.7% of the Company. Ahead of the meeting, the Investor Group shared slides nearly identical to the previously provided Investor Group Deck without any detailed plans for the Company for the Board and management to consider. During the meeting, the Investor Group intimated that it had compelling plans for the Company’s future, but again provided no specific details of these plans.

On February 6, 2021, independent Board member Peter Boneparth met with a representative of Macellum with respect to the Investor Group’s concerns and desire for board seats. The representative of Macellum indicated that the Investor Group was interested in filling four to five board seats with members of the Original Investor Group Nominees. Mr. Boneparth noted a willingness of the Company to discuss the addition of one or two directors to the Board in order to work constructively with the Investor Group.

KOHL’S CORPORATION / 2021 PROXY STATEMENT 6

On February 14, 2021, Macellum delivered a letter (the “February 14 Letter”) to the Company requesting that the Board take action under certain Company agreements to address the potential change of control that would result in the composition of the Board if the nine Original Investor Group Nominees were elected. On February 21, 2021, the Company delivered a letter to Macellum noting the Board’s commitment to fulfilling its fiduciary obligations to the Company and its shareholders and the Board’s commitment to make determinations consistent with those obligations at a time that is appropriate and sufficient for shareholders to make any relevant voting decisions.

On February 17, 2021, the Company announced that Robbin Mitchell joined the Board as an independent director, bringing extensive retail industry operating experience and expertise in areas important to the Company’s growth strategy, including women’s apparel, active and beauty. Ms. Mitchell’s appointment, the result of discussions with Ms. Mitchell since August 2020, was part of the continuous Board refreshment process at the Company, which brings directors appointed in the past five years to half of the Board, and continues to enhance its diversity.

On February 17, 2021, independent Board member Mr. Boneparth met with a representative of Macellum to review the Company’s recruitment of Ms. Mitchell, and the benefits to the Board and the Company’s shareholders given her significant apparel, retail and leadership experience. During the meeting, the representative of Macellum stated that the Investor Group had sent the February 14 Letter in order to preserve its rights and that it was not seeking a change of control at the Company. The representative of Macellum reiterated the Investor Group’s desire to fill four or five of the Board’s seats with Original Investor Group Nominees.

On February 19, 2021, Mr. Boneparth met with a representative of Macellum noting the Company’s continued efforts to work constructively with the Investor Group and further understand their ideas and underlying assumptions about the Company. Mr. Boneparth offered to provide the Investor Group additional meetings with senior members of Company management ahead of the Company’s earnings call so that the Company could provide greater detail on its performance and expectations and consider any plans that the Investor Group may have for the Company, subject to the Investor Group’s entry into a non-disclosure and standstill agreement that would expire upon the Company’s earnings call. The representative of Macellum noted that he would take the offer back to the Investor Group.

On February 22, 2021, the Investor Group filed a Schedule 13D, disclosing a combined 9.5% stake in the Company and noting its intent to nominate the nine Original Investor Group Nominees for election to the Board at the Annual Meeting. The Investor Group attached a public letter to its filing, in which it commented on the composition of the Board and the Company’s performance. This public letter was the first time that the Investor Group provided any detailed plans that the Investor Group has for the Company. The same day, the Company issued a press release noting that it was committed to maintaining constructive engagement with all shareholders. The press release highlighted:

| ■ | the Company’s commitment to ongoing refreshment of the Board, as demonstrated by the fact that half of the Board is comprised of directors added in the past five years; |

| ■ | the Company’s new strategic framework to accelerate growth and profitability, along with its major long-term partnership with Sephora; |

| ■ | the Company’s strong third quarter and preliminary fourth quarter results for the fiscal year ended January 30, 2021; |

| ■ | the seven equity analyst upgrades that the Company recently received; and |

| ■ | the significant shareholder value creation since the introduction of the Company’s new strategic framework. |

On February 23, 2021, the Investor Group filed a preliminary proxy statement with the SEC.

On February 25, 2021, a representative of Macellum reached out to Mr. Boneparth regarding the Company’s offer made the prior week to schedule additional meetings between the Company’s management and the Investor Group in advance of the Company’s earnings call. Due to the Company’s focus on earnings, the release of which was then just five days away, Mr. Boneparth noted that there was no longer available time for these meetings, but welcomed further engagement after the earnings release.

On March 2, 2021, the Company issued its earnings release for the fourth quarter of the fiscal year ended January 30, 2021 (the “Earnings Release”), which highlighted the following:

| ■ | a strengthened financial position ending the period with $2.3 billion of cash; |

| ■ | a resumption of the Company’s capital allocation strategy in 2021, including reinstating its dividend; and |

| ■ | the Company’s 2021 financial outlook. |

On March 5, 2021, the Investor Group issued a press release in response to the Earnings Release, including a comparison between the 2021 and 2019 guidance. The same day, the Company issued a statement in response to media inquiries noting the weakness of this comparison given the effects of the COVID-19 pandemic, while re-affirming the Company’s interest in hearing new ideas to help increase value for the Company and its shareholders.

KOHL’S CORPORATION / 2021 PROXY STATEMENT 7

On March 7, 2021, the representative of Macellum and Mr. Boneparth spoke again. The two exchanged views about the proxy contest initiated by the Investor Group. The representative of Macellum requested a meeting with Ms. Gass and a meeting with Kohl’s directors.

On March 8, 2021, Mr. Boneparth advised the representative of Macellum that he would arrange a meeting with Ms. Gass in the near-term, and suggested that a meeting with members of the Board would be considered subsequent to the meeting with Ms. Gass.

On March 11, 2021, the Investor Group issued a press release announcing it had filed a revised proxy statement, reducing its slate from nine nominees to five nominees. On that same day, the Company issued a responsive statement detailing how the Company’s directors outmatch the Investor Group’s slate of nominees on relevant experience and that the Investor Group’s proposals threaten to disrupt the Company’s business momentum. The Company’s statement noted that the Company is continuing to engage in good faith with Investor Group with the objective of finding common ground that serves the interest of all shareholders.

On March 12, 2021, the Investor Group delivered a Notice of Withdrawal of Nomination of Certain Individuals for Election as Directors at the 2021 Annual Meeting of Shareholders of Kohl’s Corporation, which purported to withdraw the nomination of four of the Original Investor Group Nominees, with the Investor Group’s slate stated to now be composed of the remaining five, who are the Investor Group Nominees.

On March 13, 2021, Mr. Boneparth reached out to a representative of Macellum to schedule a meeting between the two of them to occur after the meeting between the Macellum representative and Ms. Gass previously scheduled for March 16, 2021.

On March 16, 2021, prior to engaging with Ms. Gass or taking the opportunity to engage with the Board of Directors, the Investor Group mailed its definitive proxy statement. Later that day, Ms. Gass and Mr. Rupe met with a representative of Macellum, as previously scheduled. Ms. Gass conveyed her continued confidence in the Company’s strategy. She reiterated the Board’s commitment to shareholder engagement and hearing any value-enhancing ideas and feedback. Also on March 16, 2021, Mr. Boneparth spoke with representatives of Macellum and Ancora and extended an invitation to schedule the previously requested opportunity to present to the Board of Directors. Later in the day, the Macellum representative called Mr. Boneparth and declined the opportunity to meet with the Board of Directors at this time.

We continue in good faith to seek an agreed resolution of these matters. At the time of filing this definitive proxy statement, however, we have not been successful in doing so.

KOHL’S CORPORATION / 2021 PROXY STATEMENT 8

| Admission | ■ | Admission to the Annual Meeting is restricted to shareholders of record as of the record date and/or their designated representatives. |

| ■ | Shareholders and/or their designated representatives will need to pre-register by 8:00 am Central Time on May 11 , 2021, by visiting www.cesonlineservices.com/kss21_vm. Please have your BLUE proxy card containing your control number available and follow the instructions to complete your registration request. | |

| ■ | Shareholders whose shares are held in “street name” through a bank, broker or other nominee as of the record date will need to pre-register by 8:00 am Central Time on May 11 , 2021, by visiting www.cesonlineservices.com/kss21_vm . Please have your voting instruction form or other communication containing your control number available and follow the instructions to complete your registration request. | |

| ■ | Requests to register to participate in the Annual Meeting must be received no later than 8:00 am Central Time on May 11 , 2021. | |

| ■ | After registering, shareholders will receive a confirmation email with a link and instructions for accessing the Annual Meeting. | |

| Proxy Materials | ■ | This proxy statement and the accompanying BLUE proxy card is first being mailed to our shareholders on or about March 24 , 2021. |

| How to Vote | ■ | It is important that your shares be represented and voted at the Annual Meeting. |

| ■ | Whether or not you plan to attend the virtual Annual Meeting, please vote as soon as possible. You are urged to follow the instructions on the BLUE proxy card to vote by telephone or via the Internet or to date, sign and return the accompanying BLUE proxy card in the envelope provided to you, even if you plan to attend the Annual Meeting, so that if you are unable to attend the Annual Meeting, your shares can be voted. Voting now will not limit your right to change your vote or to attend the Annual Meeting. Please note the voting procedures described under “How Do I Vote?” on page 11 of the proxy statement. | |

| ■ | If you are a registered shareholder and you timely pre-register, you may attend the virtual Annual Meeting and vote your shares, and your vote will revoke any proxy you have previously submitted. | |

| ■ | If your shares are held in the name of a bank, broker or other nominee, you must obtain a “legal proxy” in pdf., .gif, .jpg or .png file format. Please contact your bank, broker or other nominee for assistance in obtaining a “legal proxy” in order to vote at the Annual Meeting. |

Our Board of Directors unanimously recommends that you vote on the BLUE proxy card or by telephone or via the Internet as set forth on the BLUE proxy card “FOR ALL” twelve of the Company Nominees to serve as Directors of the Company until the 2022 Annual Meeting of Shareholders, or, in each case, until their successors are duly elected and qualified.

This proxy statement gives you information on the twelve Company Nominees recommended by our Board of Directors who are standing for election, our independent auditors, and our named executive officers and their compensation. Because the following summary does not contain all of the information you should consider, you should carefully read this proxy statement in its entirety before voting your shares. For more complete information regarding our 2020 performance, please review our Annual Report on Form 10-K for the fiscal year ended January 30, 2021.

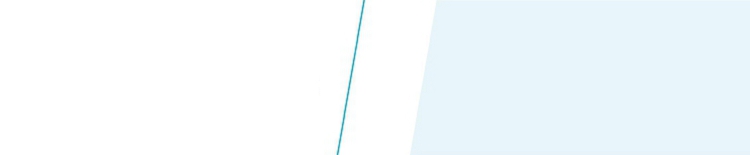

The Company Nominees have expertise in numerous key areas including finance, e-commerce, technology, marketing, operations management, and human capital. All also have experience in retail or consumer-facing industries. We believe this experience, together with their industry knowledge, integrity, ability to devote time and energy, and commitment to the interests of all our shareholders is necessary to execute our strategic plan and makes them best positioned to assist in creating value for all of our shareholders. All of the members of our Board of Directors, other than Michelle Gass, our Chief Executive Officer, are independent.

Our Board of Directors has many best governance practices in place, including its annual elections for all Directors, majority vote standard in uncontested Director elections, independent chairmanship, “proxy access” allowing eligible shareholders to include their own nominees for Director in our proxy materials, our shareholders’ right to directly communicate with and raise concerns to the Board or an individual Directors, a retirement policy and stock ownership requirements.

The Investor Group has notified us that it intends to nominate a slate of five nominees for election as Directors at the Annual Meeting in opposition to the Company Nominees recommended by our Board of Directors. We value the Investor Group’s investment and input, and we

KOHL’S CORPORATION / 2021 PROXY STATEMENT 9

have evaluated the skills, qualifications and attributes of the Investor Group Nominees as a whole relative to those of the Company Nominees. Ultimately, we believe that the Company Nominees are best positioned to serve our Company and our shareholders, and unanimously recommend that you vote “FOR ALL” twelve of the Company Nominees and that you discard any proxy card you may receive from the Investor Group.

Questions and Answers About the Meeting and Voting

When and where will the meeting take place?

The Annual Meeting of Shareholders of Kohl’s Corporation will be held virtually on May 12 , 2021, at 8:00 a.m. Central Time. Due to the continuing public health implications of the COVID-19 pandemic and our desire to promote the health and welfare of our shareholders, the Annual Meeting will be held exclusively online via a live interactive webcast on the internet. You will not be able to attend the Annual Meeting in person at a physical location.

How can I attend the meeting?

Admission to the Annual Meeting is restricted to shareholders of record as of the record date and/or their designated representatives. Pre-registration by 8:00 a.m. Central Time on May 11 , 2021, is required. You may pre-register by visiting www.cesonlineservices.com/ kss21_vm and following the instructions to complete your registration request.

What is the purpose of the meeting?

At the virtual Annual Meeting of Shareholders, you will be asked to vote on the following matters:

| ■ | the election of twelve individuals to serve as Directors for a one-year term; |

| ■ | the approval, on an advisory basis, of the compensation of our named executive officers; |

| ■ | the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending January 29, 2022; |

| ■ | the shareholder proposal described below if properly presented at the meeting; and |

| ■ | any other business that may properly come before the meeting or any adjournment of the meeting. |

Could other matters be decided at the meeting?

Our Bylaws require shareholders to notify us in advance if they intend to request a vote on any matter not described in our proxy statement. The deadline for notification has passed, and we are not aware of any other matters that could be brought before the meeting. However, if any other business is properly presented at the meeting, your completed proxy gives authority to Jason Kelroy and Elizabeth McCright to vote your shares on such matters at their discretion.

Who is entitled to attend and vote at the meeting?

All shareholders who owned our common stock at the close of business on March 24 , 2021 (the record date for the meeting) or their duly appointed proxies may attend and vote at the meeting and at any adjournment of the meeting. As of the date of this proxy , there were approximately 157,592,637 shares of our common stock oustanding.

Each share of our common stock outstanding on the record date is entitled to one vote on each of the twelve Director nominees and one vote on each other matter.

How many votes must be present to hold the meeting?

The presence in person or by proxy of the holders of a majority of the outstanding shares of our common stock entitled to vote at the meeting will constitute a quorum for the transaction of business. Abstentions and broker “non-votes” (described below) are counted as present for purposes of determining whether there is a quorum.

Am I a shareholder of record or a beneficial owner, and why does it matter?

Shareholder of record (also known as a record holder)

If your shares are registered directly in your name with Kohl’s transfer agent, you are considered the shareholder of record with respect to those shares.

Beneficial owner (also known as holding shares in “street name”)

If your shares are held on your behalf by a bank, broker, or other nominee, then you are the beneficial owner of shares held in “street name.”

As a beneficial owner, you have the right to instruct your nominee on how to vote the shares held in your account. Because the Investor Group has indicated its intention to deliver proxy materials in opposition to our Board of

KOHL’S CORPORATION / 2021 PROXY STATEMENT 10

Directors to your broker to forward to you on their behalf, with respect to accounts to which the Investor Group mails its proxy materials, brokers will not have discretion to vote on any of the Proposals to be considered at the Annual Meeting. Therefore, if you do not provide specific voting instructions, your nominee may not vote on any of the Proposals. If your nominee cannot vote on Proposals because you haven’t provided instructions, this is known as a “broker non-vote.”

How do I vote?

If you are a shareholder of record as of the record date, you may vote at the virtual Annual Meeting or vote by proxy as described below. Even if you plan to attend the meeting, we encourage you to vote in advance in one of three ways:

| ■ | Follow the instructions on your BLUE proxy card to vote over the Internet; |

| ■ | Follow the instructions on your BLUE proxy card to vote over the telephone; or |

| ■ | Sign and return the enclosed BLUE proxy card in the pre-paid envelope provided according to the included instructions. |

The BLUE proxy cards are being solicited on behalf of our Board of Directors.

If you are a beneficial owner, please contact the bank, broker, or other nominee that holds your shares for instructions on how to vote.

What is a proxy?

A proxy is your legal designation of another person to vote on matters transacted at the Annual Meeting based upon the stock you own. That other person is called a proxy. If you designate someone as your proxy in a written document, that document is also called a proxy or a proxy card. The form of BLUE proxy card accompanying this proxy statement designates each of Jason Kelroy, Corporate Secretary, and Elizabeth McCright, Assistant Corporate Secretary, as proxies for the Annual Meeting.

If I submit a proxy, how will my shares be voted?

By giving us your proxy, you authorize the individuals named as proxies on the BLUE proxy card to vote your shares in accordance with the instructions you provide. If you sign and return a BLUE proxy card without indicating your instructions, your vote will be cast in accordance with the recommendation of our Board of Directors:

| ■ | “FOR ALL” twelve of the Company Nominees to our Board of Directors, as described in this proxy statement. |

| ■ | “FOR” approval of the compensation of the Company’s named executive officers |

| ■ | “FOR” the ratification of our independent registered public accounting firm |

| ■ | “AGAINST” the shareholder proposal regarding the right to act by written consent |

If any other matters are brought before the meeting, Jason Kelroy and Elizabeth McCright will vote your shares on such matters at their discretion.

May my broker vote my shares for me?

Applicable SEC and stock exchange regulations severely limit the matters your broker may vote on without having been instructed to do so by you. In particular, your broker may not vote on the election of Directors without instructions from you.

The ratification of our independent registered public accounting firm (Proposal 3) would normally be considered “routine” under applicable stock exchange rules, and brokers typically can vote on routine matters without instructions. However, because the Investor Group has indicated its intention to deliver proxy materials in opposition to our Board of Directors to your broker to forward to you on their behalf, with respect to accounts to which the Investor Group mails its proxy materials, brokers will not have discretion to vote on “routine” matters, including Proposal 3. As a result, if you do not instruct your broker on how to vote your shares regarding each of the Proposals to be considered at the Annual Meeting, then your shares may not be voted on these matters. We urge you to instruct your broker about how you wish your shares to be voted.

What should I do if I receive a proxy card from the Investor Group?

The Investor Group has stated its intent to nominate five alternative Director nominees for election at the Annual Meeting. You may receive proxy solicitation materials from the Investor Group, including an opposing proxy statement and proxy card. Our Board of Directors urges you to discard and not sign or return any proxy card sent to you by the Investor Group. If you have previously voted using a proxy card sent to you by the Investor Group, you have the right to change your vote by using the BLUE proxy card to vote by Internet, telephone or mail or by attending the Annual Meeting as described in the answer to the question above captioned “How do I vote?” Only the latest-dated proxy you submit will be counted.

| OUR BOARD URGES YOU NOT TO VOTE FOR ANY INDIVIDUALS WHO MAY BE NOMINATED BY THE INVESTOR GROUP OR ITS AFFILIATES. |

KOHL’S CORPORATION / 2021 PROXY STATEMENT 11

May I change or revoke my vote after I submit my proxy?

Yes. If you are a shareholder of record and wish to change your vote, you may:

| ■ | cast a new vote following the instructions on the BLUE proxy card to vote by telephone or via the Internet; |

| ■ | cast a new vote by mailing a new proxy card with a later date; or |

| ■ | attend the virtual Annual Meeting of Shareholders and follow the instructions to vote during the meeting. |

If you are a beneficial owner, you can revoke any prior voting instructions by contacting the bank, broker, or other nominee that holds your shares or by obtaining a legal proxy from your bank, broker, or other nominee and voting at the virtual Annual Meeting.

If you wish to revoke your proxy rather than change your vote, our Corporate Secretary must receive your written revocation prior to the meeting.

What are the Board’s voting recommendations, and how many votes are required to approve each proposal?

| Proposal | Votes required to pass | Board’s recommendation | Effect of abstentions and broker non-votes | |||

| PROPOSAL ONE — Election of Directors | Because the Investor Group has notified us that it intends to nominate a slate of five nominees for election as Directors at the Annual Meeting in opposition to the Company Nominees recommended by our Board of Directors, the election of Directors is considered a “contested election.” Accordingly, in accordance with our Amended and Restated Articles of Incorporation a plurality voting standard rather than a majority voting standard will apply for the election of Directors. This means that the twelve nominees receiving the highest number of “FOR” votes will be elected, whether they be Company Nominees, Investor Group Nominees, or a mix of both. | FOR each Company Nominee | Votes withheld and broker non-votes will result in the applicable nominees receiving fewer “FOR” votes for purposes of determining the nominees receiving the highest number of “FOR” votes. For additional information on how your shares will be voted, see “If I submit a proxy, how will my shares be voted?” above. | |||

| PROPOSAL TWO — Advisory approval of the compensation of our named executive officers | This proposal will be approved if the number of votes cast “for” the proposal exceeds the number of votes cast “against” it. | FOR | No effect. | |||

| PROPOSAL THREE — Ratification of our independent registered public accounting firm | This proposal will be approved if the number of votes cast “for” the proposal exceeds the number of votes cast “against” it. | FOR | No effect. Under applicable stock exchange rules, because the Investor Group has indicated its intention to deliver proxy materials in opposition to our Board of Directors to your broker to forward to you on their behalf, with respect to accounts to which the Investor Group mails its proxy materials, brokers will not have discretion to vote on “routine” matters, including this proposal. | |||

| PROPOSAL FOUR — Shareholder proposal regarding the right to act by written consent | This proposal will be approved if the number of votes cast “for” the proposal exceeds the number of votes cast “against” it. | AGAINST | No effect. |

We recommend that you discard any proxy card you receive from the Investor Group.

KOHL’S CORPORATION / 2021 PROXY STATEMENT 12

What happens if I do not vote by proxy?

If you are a shareholder of record and you do not vote by proxy, your shares will not be voted unless you vote during the meeting. If you are a beneficial owner and you do not provide your broker with specific voting instructions, your broker may vote your shares only on Proposal Three and will declare a broker non-vote for Proposals One, Two, and Four. However, if the Investor Group delivers proxy materials in opposition to our Board of Directors to your broker to forward to you on their behalf, your broker will not have discretion to vote on “routine” matters, including Proposal Three. In that case, a broker non-vote will also be declared on Proposal Three.

What happens if the meeting is adjourned?

If the meeting is adjourned, your proxy will remain valid and may be voted when the meeting is convened or reconvened. You may change or revoke your proxy as set forth above under the caption “May I change or revoke my vote after I submit my proxy?”

Will the Company’s independent registered public accounting firm participate in the meeting?

Yes. A representative of Ernst & Young LLP will be present at the meeting and will be available to make a statement and answer appropriate questions.

Are members of the Board of Directors required to attend the meeting?

While the Board has not adopted a formal policy requiring Directors to attend annual meetings, Directors are encouraged to do so. Eight of the then current Directors standing for re-election attended the 2020 Annual Meeting of Shareholders.

Who is soliciting my proxy?

The Company is soliciting your proxy to be used at the meeting. The BLUE proxy appoints two of our executives, Jason Kelroy and Elizabeth McCright, as your representatives to vote your shares as you instruct on your proxy card. This way, your shares will be voted even if you do not attend the meeting. Even if you plan to attend the meeting, it is a good idea to vote your shares in advance, just in case your plans change.

Who will pay the expenses incurred in connection with the solicitation of my vote?

The Company will pay the expenses of soliciting proxies on the BLUE proxy card. Proxies on the BLUE proxy card may be solicited by our Directors, officers or employees in person or by telephone, mail, electronic transmission or facsimile transmission. We also pay all expenses related to the Annual Meeting of Shareholders. In addition to soliciting proxies by mail, we may solicit proxies by telephone, personal contact, and electronic means. None of our Directors, officers, or employees will be specially compensated for these activities.

We have hired Innisfree M&A Incorporated to assist with the solicitation of proxies for a fee of $ 800,000 plus reimbursement of out-of-pocket expenses. We also reimburse brokers, fiduciaries, and custodians for their costs in forwarding proxy materials to beneficial owners of our common stock, but we will not pay any compensation for their services. In addition to the higher fee payable to our proxy solicitor this year, t he total amount estimated to be spent in connection with the Company’s proxy solicitation is approximately $ 10 million , of which approximately $ 3.5 million has been incurred by the Company as of the date of this proxy statement. Our expenses related to the solicitation of proxies from shareholders this year will substantially exceed those normally spent for an annual shareholders’ meeting because the Investor Group has initiated a contested election of Directors. These additional solicitation costs are expected to include: the fee payable to our proxy solicitor; fees of our financial advisor, outside counsel and other advisors to advise the Company in connection with a contested solicitation of proxies; increased mailing costs, such as the costs of additional mailings of solicitation material to shareholders, including printing costs, postage and the reimbursement of reasonable expenses of banks, brokerage houses and other agents incurred in forwarding solicitation materials to beneficial owners of our shares; and the costs of retaining an independent inspector of election.

Can I view these proxy materials electronically?

Yes. You may view our 2021 proxy materials at www. proxyvote.com. You may also use our corporate website at https://corporate.kohls.com to view all of our filings with the Securities and Exchange Commission, including this proxy statement and our Annual Report on Form 10-K for the fiscal year ended January 30, 2021.

KOHL’S CORPORATION / 2021 PROXY STATEMENT 13

How can I receive copies of Kohl’s year-end Securities and Exchange Commission filings?

We will furnish without charge to any shareholder, upon request, a copy of this proxy statement and/or our Annual Report on Form 10-K, including financial statements, for the fiscal year ended January 30, 2021. Any such request should be directed to Kohl’s Corporation, N56 W17000 Ridgewood Drive, Menomonee Falls, Wisconsin 53051, Attention: Investor Relations, or investor.relations@kohls.com. We will provide the exhibits to the Form 10-K upon payment of the reasonable expenses of furnishing them.

How can I submit a proposal for Kohl’s 2022 Annual Meeting of Shareholders?

You may present matters for consideration at our next Annual Meeting of Shareholders either by having the matter included in our proxy statement and proxy card in accordance with Rule 14a-8 under the Securities Exchange Act of 1934 or by conducting your own proxy solicitation.

If you want your proposal included in our proxy statement and listed on our proxy card for the 2022 Annual Meeting of Shareholders, we must receive your written proposal by November 24 , 2021, at Corporate Secretary, Attention: Legal, Kohl’s Corporation, N56 W17000 Ridgewood Drive, Menomonee Falls, Wisconsin 53051. You may submit a proposal only if you meet the ownership and holding requirements in Rule 14a-8, and you must continue to meet such ownership and holding requirements through the date of the 2022 Annual Meeting of shareholders and otherwise comply with the Rule 14a-8 requirements then in effect.

If you decide to conduct your own proxy solicitation, we must receive written notice of your intent to present your proposal at the 2022 Annual Meeting of Shareholders, as required by our Bylaws, by January 12 , 2022. If you submit a proposal for the 2022 Annual Meeting of Shareholders after that date, your proposal cannot be considered at the meeting.

How can I nominate a candidate for the Board of Directors?

Pursuant to procedures set forth in our Bylaws, our Governance & Nominating Committee will consider shareholder nominations for Directors if we receive timely written notice, in proper form, of the intent to make a nomination at an Annual Meeting of Shareholders. If you decide to conduct your own proxy solicitation, to be timely for the 2022 Annual Meeting of Shareholders, we must receive the notice by January 12 , 2022. To be in proper form, the notice must, among other things, include each nominee’s written consent to serve as a Director if elected, a description of all arrangements or understandings between the nominating shareholder and each nominee, and information about the nominating shareholder and each nominee. Among other things, a shareholder proposing a Director nomination must disclose any hedging, derivative or other complex transactions involving our common stock to which the shareholder is a party. These requirements are detailed in our Bylaws, which will be provided to you upon written request.

In addition, an eligible shareholder, or a group of up to 20 shareholders, that has continuously owned at least 3% of Kohl’s outstanding common stock for three years may include in Kohl’s proxy materials Director nominations of up to the greater of two Directors and 20% of the number of Directors currently serving on the Kohl’s Board, subject to the terms and conditions specified in our Bylaws. To be timely for inclusion in the proxy materials for our 2022 Annual Meeting of Shareholders, our Corporate Secretary must receive your nomination between October 25 , 2021, and November 24 , 2021. The requirements for proxy access are detailed in our Bylaws, which will be provided to you upon written request.

What if I have additional questions?

If you have any questions or require any assistance with voting your shares, please contact our proxy solicitor at the contact listed below:

Innisfree M&A Incorporated

Shareholders may call toll free: (877) 717-3905

Banks and Brokers may call collect: (212) 750-5833

KOHL’S CORPORATION / 2021 PROXY STATEMENT 14

Consistent with many other retail companies, our fiscal year ends on the Saturday closest to January 31 each year. References in this proxy statement to a “fiscal year” are to the calendar year in which the fiscal year begins. The information in this proxy statement relates primarily to fiscal 2020, which ended January 30, 2021.

|  |  | ||

| MEETING DATE | LOCATION | RECORD DATE | ||

| May 12 , 2021 at 8:00 a.m. | Virtually at | March 24 , 2021 | ||

| Central Time | www.cesonlineservices.com/kss21_vm. | |||

Matters to be Voted Upon at the Annual Meeting

Our Board of Directors Unanimously recommends that you vote:

| ■ | “FOR ALL” twelve of the Company Nominees in Proposal 1 |

| ■ | “FOR” the compensation of our named executive officers in Proposal 2 |

| ■ | “FOR” the ratification of Ernst & Young LLP as our independent registered public accounting firm for fiscal 2021 in Proposal 3 |

| ■ | “AGAINST” the proposal for Shareholder Right to Act By Written Consent in Proposal 4 on the accompanying BLUE proxy card or by telephone or via the Internet as set forth on the BLUE proxy card. |

Please note the voting procedures described under “How Do I Vote?” on page 11 of the proxy statement.

KOHL’S CORPORATION / 2021 PROXY STATEMENT 15

The following table introduces the Company Nominees.

All of the Company Nominees are independent except Michelle Gass, Chief Executive Officer of Kohl’s.

| Committee Memberships | ||||||||||||||

| Directors | Principal Occupation | Age | Director Since | Other Public Boards | Audit | Compensation | Governance & Nominating | |||||||

| Michael Bender | President and Chief Executive Officer of Eyemart Express, LLC | 59 | 2019 | 0 |  |  | ||||||||

| Peter Boneparth | Senior advisor to a division of The Blackstone Group, LLP, advising on the retail industry | 61 | 2008 | 1 |  |  | ||||||||

| Steve A. Burd | Founder and Chief Executive Officer of Burd Health LLC | 71 | 2001 | 0 |  |  | ||||||||

| Yael Cosset | Senior Vice President and Chief Information Officer of The Kroger Co. | 47 | 2020 | 0 |  |  | ||||||||

| H. Charles Floyd | Global President of Operations of Hyatt Hotels Corporation | 64 | 2017 | 2 |  |  | ||||||||

| Michelle Gass | Chief Executive Officer of Kohl’s | 53 | 2018 | 1 | ||||||||||

| Robbin Mitchell | Partner and Managing Director at the Boston Consulting Group | 56 | 2021 | 0 |  | |||||||||

| Jonas Prising | Chairman and Chief Executive Officer of ManpowerGroup | 56 | 2015 | 1 |  |  | ||||||||

| John E. Schlifske | Chairman and Chief Executive Officer of The Northwestern Mutual Life Insurance Company | 61 | 2011 | 0 |  |  | ||||||||

| Adrianne Shapira | Managing Director of Eurazeo Brands | 50 | 2016 | 0 |  |  | ||||||||

Frank V. Sica | Partner, Tailwind Capital | 70 | 1988 | 2 |  |  | ||||||||

| Stephanie A. Streeter | Former Chief Executive Officer of Libbey, Inc. | 63 | 2007 | 2 |  |  | ||||||||

Independent Chairman of the Board.

Independent Chairman of the Board. Chair.

Chair.

| 2021 BOARD NOMINEE HIGHLIGHTS |

|

KOHL’S CORPORATION / 2021 PROXY STATEMENT 16

2020 was an unprecedented year, marked by a pandemic that halted business and wreaked havoc on the global economy. Although Kohl’s entered fiscal 2020 in a strong financial position, the onset of the COVID-19 pandemic required management to efficiently pivot the entire organization. When the crisis began, management’s first priority was the safety and well-being of Kohl’s customers and associates. Management’s second priority was preserving financial liquidity and flexibility to ensure the Company’s long-term viability and position Kohl’s for long-term success. Management quickly took the necessary actions, in many cases outpacing competitors, to ensure business continuity.

Kohl’s management also introduced a new strategic framework in fiscal 2020 to drive long-term Company success and shareholder value. The Company’s new vision is to be “the most trusted retailer of choice for the active and casual lifestyle.” This new strategy has four key focus areas.

Driving top line growth

Management’s initiatives include expanding Kohl’s active and outdoor business to at least 30% of net sales, reigniting growth in the women’s business, building a sizable beauty business, driving category productivity and inventory turn, and capturing market share from the retail industry disruption. We have already taken significant steps in these areas, including forming a new major long-term strategic partnership with Sephora, the largest prestige beauty retailer in the world.

Expanding operating margin

Management has established a goal of expanding the Company’s operating margin to 7% to 8% (up from an adjusted operating margin of 6.1% in 2019). To achieve that goal, management is focused on driving both gross margin improvement and selling, general, and administrative expense leverage.

Maintaining disciplined capital management

Management is committed to prudent balance sheet management with the long-term objective of sustaining Kohl’s Investment Grade credit rating.

Sustaining an agile, accountable, and inclusive culture

Fostering a diverse, equitable, and inclusive environment for Kohl’s associates, customers, and suppliers is an important focus. Our new diversity and inclusion framework includes a number of key initiatives across three pillars: Our People, Our Customers, and Our Communities. In addition, management continues to build on the Company’s commitment to Environmental, Social, and Corporate Governance (“ESG”).

Because of the efforts of our management and associates during this challenging year, Kohl’s significantly outperformed its peers and is well-positioned to benefit from the significant industry disruption caused by the COVID-19 pandemic. For more information on our response to the pandemic and plans for the future, please see the Compensation Discussion and Analysis.

Our compensation program is a pay-for-performance model based on the philosophy that we should incentivize our executive officers to improve Kohl’s financial performance, profitably grow the business, and increase shareholder value. That philosophy drove several actions in fiscal 2020. All of the then-NEOs recommended that the Compensation Committee not award the NEOs annual merit increases that would have otherwise been considered in March 2020, and the Committee accepted that recommendation. In addition, Ms. Gass waived the portion of her fiscal 2020 base salary and our Board members waived their cash retainers that would have been paid during the peak of the pandemic while the majority of our stores remained closed. We also revised certain elements of our executive compensation program in fiscal 2020 in response to the COVID-19 pandemic and its unprecedented impact on our business, while ensuring fairness to Kohl’s shareholders. These actions recognize Kohl’s 2020 results, management’s success in leading through the COVID-19 pandemic as many of our competitors struggled (and in some cases failed), and the early results of our new strategic framework. For more information, please see the Compensation Discussion and Analysis.

KOHL’S CORPORATION / 2021 PROXY STATEMENT 17

We have adopted strong and effective policies and procedures to promote effective and independent corporate governance, including:

| All of the Directors but one are independent, as determined under the standards of the New York Stock Exchange; |

| The Board’s three standing committees are composed solely of independent Directors; |

| Non-management Directors meet privately in executive sessions in conjunction with each regular Board meeting; |

| Independent Directors communicate regularly regarding appropriate Board agenda topics and other Board-related matters; |

| All Board members have complete access to management and outside advisors; |

| The Board is committed to active refreshment, demonstrated by the addition of six new Directors in the past five years; and |

| Effective February 2021, the Governance & Nominating Committee has been renamed the Nominating & ESG Committee, with an updated charter that more specifically defines the committee’s responsibility for oversight of Kohl’s Environmental, Social and Corporate Governance (“ESG”) programs. |

KOHL’S CORPORATION / 2021 PROXY STATEMENT 18

ELECTION OF DIRECTORS

Our Board of Directors currently consists of twelve members, 11 of whom are standing for re-election. In February 2021, upon the recommendation of the Governance & Nominating Committee, Robbin Mitchell was appointed by the full Board of Directors to serve until the 2021 Annual Meeting of Shareholders, when she will stand for election for the first time. A non-management Director first recommended Ms. Mitchell for appointment to the Board of Directors. After a thorough round of interviews, the Governance & Nominating Committee and the Board of Directors unanimously agreed that she would add significant value to the Board. Each Director is elected annually to serve until the next Annual Meeting of Shareholders and until the Director’s successor is duly elected.

We believe the Company Nominees are best positioned to serve our Company and our shareholders. Accordingly, our Board of Directors unanimously recommends that you vote “FOR ALL” twelve of the Company Nominees on the BLUE proxy card.

The Investor Group has notified us that it intends to nominate a slate of five nominees for election as Directors at the Annual Meeting in opposition to the Company Nominees recommended by our Board of Directors. As a result, the election of Directors is considered a “contested election” pursuant to Section 14 of the Securities Exchange Act of 1934. Accordingly, a plurality voting standard rather than a majority voting standard will apply for the election of Directors, and the twelve nominees who receive the highest number of “FOR” votes will be elected. Votes withheld and broker non-votes will result in the applicable nominees receiving fewer “FOR” votes for purposes of determining the nominees receiving the highest number of “FOR” votes.

Our Board of Directors unanimously recommends that you vote on the BLUE proxy card, via the Internet, by telephone or by mail “FOR ALL” twelve of the Company Nominees to serve as Directors until the 2022 Annual Meeting of Shareholders, or, in each case, until their successors are elected and qualified.

In addition, our Board of Directors strongly urges you to discard any proxy card that may be sent to you by the Investor Group. Electing to “WITHHOLD” with respect to any Investor Group Nominee on any Investor Group proxy card is not the same as voting for the Company Nominees. Instead, an election to “WITHHOLD” with respect to any Investor Group Nominee on any Investor Group proxy card will revoke any previous proxy that you have already submitted. If you have already voted using a proxy card sent to you by the Investor Group, you have the right to change your mind. We urge you to revoke that proxy by voting “FOR ALL” twelve Company Nominees recommended by our Board of Directors by using the enclosed BLUE proxy card.

Only the latest validly executed proxy that you submit will be counted.

Properly executed proxies will be voted as marked. Unmarked proxies will be voted in favor of electing the individuals named below (each of whom is now a Director) as Directors to serve until the 2022 Annual Meeting of Shareholders and until their successors are duly elected and qualified.

We expect that all of the Company Nominees will be able to serve on the Board of Directors if elected. However, if before the election one or more Company Nominees are unable to serve or for good cause will not serve (a situation that we do not anticipate), the proxy holders will vote the proxies for the remaining Company Nominees and for any substitute nominee(s) chosen by our Board of Directors (unless our Board reduces the number of Directors to be elected). If any substitute nominees are designated, we will file an amended proxy statement that, as applicable, identifies the substitute nominees, discloses that such nominees have consented to being named in the revised proxy statement and to serve if elected, and includes certain biographical and other information about such nominees required by the rules of the SEC.

| THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE FOR ALL TWELVE OF THE COMPANY NOMINEES TO SERVE AS DIRECTORS BY USING THE BLUE PROXY CARD. |

IF YOU SIGN AND DATE YOUR BLUE PROXY CARD BUT NO INSTRUCTIONS ARE SPECIFIED, YOUR SHARES

WILL BE VOTED TO ELECT ALL OF THE COMPANY NOMINEES.

KOHL’S CORPORATION / 2021 PROXY STATEMENT 19

“Supplemental Information Regarding Participants” sets forth information relating to the Company Nominees and certain of our officers and employees who are considered “participants” in our solicitation under the rules of the SEC because of their position as Directors of the Company or as nominees for Director, or because they may be soliciting proxies on our behalf.

If you have any questions or require any assistance with voting your shares, please contact our proxy solicitor at the number listed below:

Innisfree M&A Incorporated

Shareholders may call toll free: (877) 717-3905

Banks and Brokers may call collect: (212) 750-5833

Information about Company Nominees

The Board of Directors, and particularly its Governance & Nominating Committee, regularly considers whether the Board is made up of individuals with the necessary experience, qualifications, attributes, and skills, taken as a whole, to enable the Board to satisfy its oversight responsibilities effectively. In making these decisions, the Governance & Nominating Committee focuses primarily on the information in each Company Nominee’s individual biography, set forth below.

The matrix below identifies the balance of skills and qualifications each Company Nominee brings to the Board. We believe this combination of skills and qualifications demonstrates that our Board is well positioned to provide effective oversight and strategic advice to management.

| Skill or Expertise | Bender | Boneparth | Burd | Cosset | Floyd | Gass | Mitchell | Prising | Schlifske | Shapira | Sica | Streeter | ||||||||||||||

| Current or Former Public Company CEO |  |  |  |  |  | ||||||||||||||||||||

| Senior Leadership Experience |  |  |  |  |  |  |  |  |  |  |  |  | |||||||||||||

| Public Company Board Experience (other than Kohl’s) |  |  |  |  |  |  |  |  |  | ||||||||||||||||

| Board Diversity (Gender or Racial/Ethnic Diversity) |  |  |  |  |  | ||||||||||||||||||||

| Retail or Consumer-Facing Industries |  |  |  |  |  |  |  |  |  |  |  |  | |||||||||||||

| Finance, Accounting or Financial Reporting Experience |  |  |  |  |  |  |  |  |  |  | |||||||||||||||

| Technology, E-Commerce or Digital Experience |  |  |  |  |  |  |  |  |  |  | |||||||||||||||

| Marketing, Public Relations or Brand Management Experience |  |  |  |  |  |  |  |  |  |  | |||||||||||||||

| Operations Management Experience |  |  |  |  |  |  |  |  |  |  | |||||||||||||||

| Human Capital, Culture or Compensation Experience |  |  |  |  |  |  |  |  |  | ||||||||||||||||

KOHL’S CORPORATION / 2021 PROXY STATEMENT 20

| MICHAEL BENDER President and Chief Executive Officer of Eyemart Express, LLC | ||

Age 59 INDEPENDENT Committees: ■ Audit ■ Governance & Nominating Other Directorships: ■ Ryman Hospitality Properties, Inc. (2004-2019) | Experience ■ Eyemart Express, LLC, an eyecare retailer: President and Chief Executive Officer since January 2018; President from September 2017 to January 2018. ■ Walmart Inc.: Chief Operating Officer of Global eCommerce from 2014 to 2017, following other executive management positions over a five-year period. ■ Cardinal Health, Inc., a global, integrated healthcare services and products company: Held a number of senior positions over four years. ■ L-Brands, Inc.–Victoria’s Secret Stores, an international specialty retailer: Vice President of Store Operations from 1999-2002. ■ PepsiCo, Inc.: 15 years in a variety of sales, finance, and operating roles.

Skills and Qualifications ■ Senior leadership experience: Mr. Bender has been a senior executive for the past 15 years. ■ Retail or consumer-facing industry: Mr. Bender’s career has taken him to several prominent retailers, from Victoria’s Secret to Walmart and now to his current role leading Eyemart Express. ■ Finance, accounting, or financial reporting experience: As President and CEO of Eyemart Express, Mr. Bender has direct oversight of its finance and accounting functions. He has also held several field and HQ-based finance roles focused on financial planning, analysis and competitive strategy. Mr. Bender also chaired the audit committee for several years when he was a board member at Ryman Hospitality Properties. ■ Technology, e-commerce, or digital experience: As Chief Operating Officer of Global eCommerce at Walmart, Mr. Bender helped bridge the gap between the company’s digital and physical capabilities—a set of skills he now deploys at Eyemart Express. ■ Marketing, public relations, or brand management experience: Mr. Bender held several senior positions at Cardinal Health that included responsibility for marketing efforts to key customers. In his current CEO role, he ultimately oversees all marketing and PR/Communications efforts for Eyemart Express. ■ Operations management experience: Mr. Bender developed his expertise in optimizing supply chain operations during his 30 years in operational roles—first at PepsiCo, then as Vice President of Store Operations for L-Brands, and finally as Chief Operating Officer of Global eCommerce at Walmart. ■ Human capital, culture, or compensation experience: As President and CEO of Eyemart Express, Mr. Bender is responsible for shaping and reinforcing the company’s customer-focused culture. He also chaired the compensation committee at Ryman Hospitality Properties for several years. | |

| PETER BONEPARTH Senior advisor at The Blackstone Group, LLP | ||

Age 61 INDEPENDENT Committees: ■ Governance & Nominating (chair) ■ Compensation Other Directorships: ■ JetBlue Airways Corporation (since 2008), Chairman since May 2020 | Experience ■ The Blackstone Group, LLP, a global investment firm: Senior advisor to a division that advises on the retail industry since February 2018. ■ Irving Place Capital Partners, a private equity group: Senior Advisor from 2009 to 2014. ■ Jones Apparel Group, a designer and marketer of apparel and footwear: President and Chief Executive Officer from 2002 to 2007.