UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under § 240.14a-12 |

The Payden & Rygel Investment Group

(Name of Registrant as Specified In Its Charter)

(Names of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials: |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

The Payden & Rygel Investment Group

333 South Grand Avenue, 40th Floor

Los Angeles, California 90071

September 15, 2023

Dear Shareholder,

Please review this letter and the enclosed proxy statement regarding important matters pertaining to your investment. A special joint meeting of shareholders (“Meeting”) of each series (each, a “Fund” and together, the “Funds”) of The Payden & Rygel Investment Group (the “Trust”), will be held on November 10, 2023, at 10 a.m. Pacific Time at the principal executive offices of the Trust, 333 South Grand Avenue, Los Angeles, California 90071. The purpose of the Meeting is to seek shareholder approval of the following proposals:

| | 1. | The election of ten Trustees as members of the Board of Trustees (“Board”) of the Trust (“Proposal 1”); and |

| | 2. | An amendment to the current fundamental investment policy of certain Funds regarding industry concentration (“Proposal 2”). |

The question and answer section that follows discusses Proposals 1 and 2. The proxy statement itself provides greater detail about Proposals 1 and 2. The Board of Trustees recommends that you read the enclosed materials carefully and vote in favor of Proposals 1 and 2.

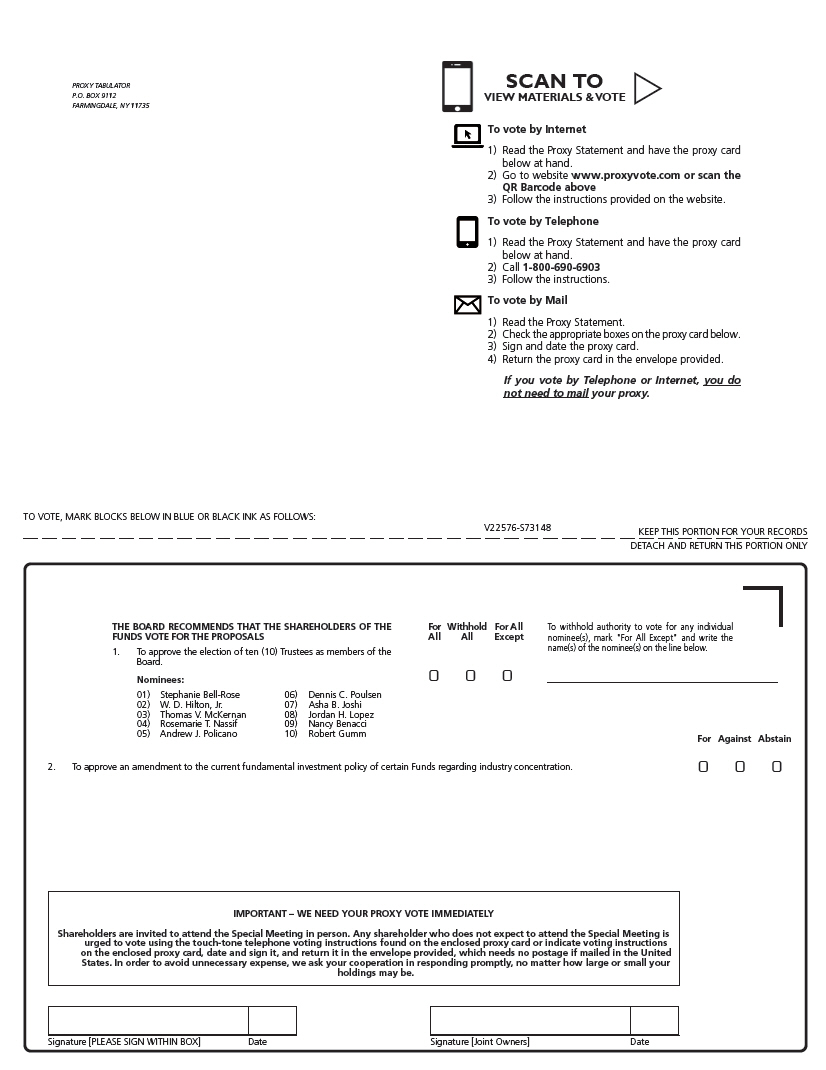

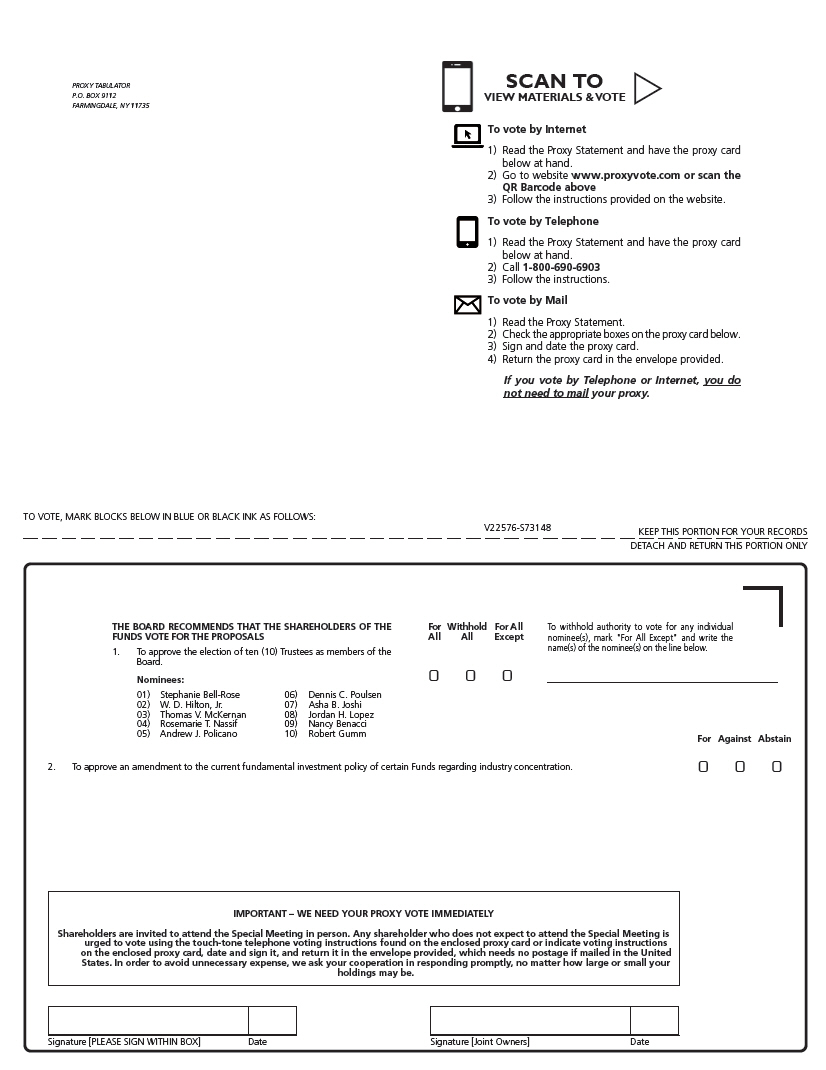

You may choose one of the following options to authorize a proxy to vote your shares (which is commonly known as proxy voting) or to vote in person at the meeting:

| | • | | Mail: Complete and return the enclosed proxy card. |

| | • | | Internet: Access the website shown on your proxy card and follow the online instructions. |

| | • | | Telephone (automated service): Call the toll-free number shown on your proxy card and follow the recorded instructions. |

| | • | | In person: Attend the special shareholder meeting on November 10, 2023. |

If you need any assistance or have any questions regarding the proposals or how to vote your shares, please call Broadridge Financial Solutions, Inc., our proxy solicitation firm, toll free at 1-866-584-0574 during the hours of 9:00 a.m. and 10:00 p.m. ET Monday through Friday, and 10:00 a.m. and 6:00 p.m. ET on Saturday and Sunday.

Thank you for your response and for your continued investment in the Funds.

|

| Sincerely, |

|

/s/ Mary Beth Syal |

| Mary Beth Syal |

| Principal Executive Officer of the Trust |

2

Questions and Answers

While we encourage you to read the full text of the enclosed proxy statement, for your convenience, we have provided a brief overview of the proposals that require a shareholder vote.

| Q. | Why am I receiving this proxy statement? |

| A. | You are receiving these proxy materials, including the proxy statement, Notice of Special Joint Meeting of Shareholders and your proxy card, because you are a shareholder of one or more series (“Funds”) of The Payden & Rygel Investment Group (the “Trust”) and have the right to notice of, and to vote on, important matters concerning the governance of the applicable Fund(s). In particular, shareholders of all Funds are being asked to consider and vote on a proposal to elect nominees to the Board of Trustees (the “Board” and each member thereof, a “Trustee”) of the Trust (“Proposal 1”), and shareholders of certain Funds are being asked to consider and vote on a proposal to amend the current fundamental investment policy of those Funds regarding industry concentration (“Proposal 2”). |

| Q. | How does the Board recommend that I vote? |

| A. | After careful consideration, the Board unanimously recommends that shareholders vote FOR each of the Proposals. |

| Q. | Who is eligible to vote? |

| A. | Any person who owned shares of a Fund on the “record date,” which is September 5, 2023 (even if that person has since sold those shares), are eligible to vote at the meeting. |

If you are a street name shareholder, you will receive voting instructions from your broker, bank or other nominee. You must follow the voting instructions provided by your broker, bank or other nominee in order to direct your broker, bank or other nominee on how to vote your Shares. Street name shareholders should generally be able to vote by telephone or by Internet or by signing, dating and returning a voting instruction form. However, the availability of telephone and Internet voting will depend on the voting process of your broker, bank or other nominee. If you are a street name shareholder, you may not vote your Shares by ballot in person at the Meeting unless you obtain a legal proxy from your broker, bank or other nominee.

| Q. | Who are the nominees for Trustee that shareholders of the Funds are being asked to elect in Proposal 1? |

| A. | There are ten (10) nominees (“Nominees”). The Board currently includes eight (8) Trustees, including six (6) Trustees who are not “interested persons” of the Trust as defined in the Investment Company Act of 1940, as amended (“1940 Act”) (“Independent Trustees”): Stephanie Bell-Rose, W.D. Hilton, Jr., Thomas V. McKernan, Rosemarie T. Nassif, Andrew J. Policano, and Dennis C. Poulsen, and two (2) Trustees who are deemed “interested persons” of the Trust as defined in the 1940 Act (“Interested Trustees”), Asha B. Joshi and Jordan H. Lopez. In addition to the current Trustees, two additional Nominees are being presented for election to the Board at the Meeting: Nancy Benacci and Robert Gumm. If elected by the shareholders at the Meeting, Ms. Benacci and Mr. Gumm will join the Board as Independent Trustees. |

| Q. | Why are shareholders being asked to elect Trustees? |

| A. | The Trust’s Master Trust Agreement does not require the annual election of Trustees. However, in accordance with Section 16(a) of the 1940 Act, the Board may appoint Trustees to fill vacancies if after doing so at least two-thirds of the Trustees have been elected by the shareholders of the Trust. |

3

The Board believes it is in the best interests of the Trust for the shareholders to elect or re-elect all of the Trustees so that all members of the Board will have been elected by the shareholders and the Board will have greater flexibility to appoint additional Trustees in the future to fill vacancies without incurring the expense of additional shareholder meetings.

Because the Trust is not required to, and does not, hold regular annual shareholder meetings, each Nominee, if elected, will hold office until his or her successor is elected and qualified or until he or she dies, retires, resigns, or is removed.

In selecting the Nominees not currently serving as Trustees, the Governance Committee reviewed the backgrounds and qualifications of several candidates and ultimately selected Nancy Benacci and Robert Gumm. In reaching their determinations, the members of the Governance Committee carefully considered all of the factors described above, and, with the subsequent concurrence of the entire Board, concluded that these Nominees possessed excellent qualifications and their skills would add dimension to the current Board composition. The Governance Committee also concluded that these Nominees would ably represent the shareholders’ interests and determined that the Nominees should be recommended for election by shareholders of the Funds.

| Q. | Why are shareholders of certain Funds being asked to approve a change to those Funds’ fundamental investment policy regarding industry concentration? |

| A. | The 1940 Act requires every mutual fund to adopt a fundamental investment policy with respect to concentrating its investments in a particular industry or group of industries. If a fund intends to concentrate its investments (i.e., invest more than 25% of its total assets, exclusive of certain items) in an industry or group of industries, the fund is required to disclose in its prospectus the industry or group of industries in which it will concentrate. If a fund does not intend to concentrate its investments, it may not invest in any given industry if, upon making the investment, more than 25% of the value of the fund’s assets would be invested in such industry. |

Each of the Payden California Municipal Social Impact Fund, Payden Cash Reserves Money Market Fund, Payden Core Bond Fund, Payden Corporate Bond Fund, Payden Emerging Markets Bond Fund, Payden Emerging Markets Corporate Bond Fund, Payden Emerging Markets Local Bond Fund, Payden Floating Rate Fund, Payden Global Fixed Income Fund, Payden Global Low Duration Fund, Payden GNMA Fund, Payden High Income Fund, Payden Limited Maturity Fund, Payden Low Duration Fund, Payden Managed Income Fund, and Payden U.S. Government Fund currently has a fundamental investment policy (the “Current Policy”) that does not explicitly restrict each respective Fund from concentrating its investments in a particular industry. To align the Current Policy with the applicable regulatory requirements, the Board recommends that each of the Funds listed above adopt an amended fundamental investment policy (the “Amended Policy”) not to invest in a given industry if, upon making the investment, more than 25% of the value of each respective Fund’s assets would be invested in such industry.

| Q. | Will the Amended Policy result in any changes to my Fund? |

| A. | None of the Funds have concentrated their investments in an industry or group of industries. Accordingly, the approval of the Amended Policy is not expected to result in any changes to the objectives, principal investment strategies or principal risks of any Fund. In addition, the approval of the Amended Policy is not expected to have any impact on a Fund’s current classification as a “diversified” or “non-diversified” fund, as that term is defined in the 1940 Act. |

4

| Q. | Who is paying for this proxy mailing and for the other expenses and solicitation costs associated with this shareholder meeting? |

| A. | The expenses incurred in connection with preparing the proxy statement and its enclosures and all related legal and solicitation expenses will be paid by the Funds, allocated among them on the basis of their relative net assets. |

| Q. | What vote is required to elect the Nominees? |

| A. | The election of each Nominee will be voted upon separately by the shareholders of the Trust, voting together without regard to Fund. Each Nominee will be elected as a Trustee of the Trust if he or she receives a plurality of the votes cast, voting together without regard to Fund, when a quorum is present. A vote of a “plurality” of shares means that a Nominee would only need to receive more “yes” votes than a competing candidate to be elected to the Board. Since each Nominee is running unopposed, each Nominee effectively needs only one vote to be elected if a quorum is present at the Meeting. The approval of any Nominee is not contingent on the approval of the other Nominees. |

| Q. | What vote is required to amend the Current Policy? |

| A. | Approval of the Amended Policy with respect to a Fund will require the vote of a “majority of the outstanding voting securities” of the Fund, as defined in the 1940 Act, when a quorum is present. As defined by the 1940 Act, a “majority of the outstanding voting securities” of a Fund means the affirmative vote of the lesser of (a) 67% or more of the voting securities of the Fund present at a shareholder meeting if the holders of more than 50% of the outstanding voting securities of the Fund are present in person or by proxy, or (b) more than 50% of the outstanding voting securities of the Fund. The shareholders of each applicable Fund will vote on the approval of Proposal 2 separately from the shareholders of each other applicable Fund, and the proposal will only take effect for a Fund if approved by a majority of the outstanding voting securities of its shareholders. The shareholders of each applicable Fund will vote on Proposal 2 in the aggregate as one class, and not by class of shares. |

| Q. | How can I cast my vote? |

| A. | You may vote in any of four ways: |

| | • | | By telephone, with a toll-free call to the phone number indicated on the proxy card. |

| | • | | By internet, by accessing the website shown on your proxy card and following the online instructions. |

| | • | | By mailing in your proxy card. |

| | • | | In person at the meeting in Los Angeles, California on November 10, 2023. |

We encourage you to vote via telephone using the control number on your proxy card and following the simple instructions or via the internet using the website shown on your proxy card and following the online instructions because these methods result in the most efficient means of transmitting your vote and reduce the need for the Funds to conduct telephone and email solicitations and/or follow up mailings. If you would like to change your previous vote, you may vote again using any of the methods described above.

| Q. | What will happen if there are not enough votes to hold the Meeting? |

| A. | A certain percentage of the Trust’s or a Fund’s shares, as applicable (often referred to as “quorum”) must be represented at the meeting. It is important that shareholders vote online or by telephone, or complete and return signed proxy cards promptly, to ensure there is a quorum for the Meeting. You may be contacted by a representative of the Trust or a proxy solicitor if we do not hear from you. If we have not received sufficient votes to have a quorum at the Meeting, or have not received enough votes to approve the proposals, we may adjourn the Meeting so we can seek more votes. |

5

| Q. | Who should I call for additional information about this Proxy Statement? |

| A. | If you need any assistance or have any questions regarding the Proposal or how to vote your shares, please call Broadridge Financial Solutions, Inc., our proxy solicitation firm, toll free at 1-866-584-0574 during the hours of 9:00 a.m. and 10:00 p.m. ET Monday through Friday, and 10:00 a.m. and 6:00 p.m. ET on Saturday and Sunday. The representatives can assist with any questions you may have regarding this event. |

6

IMPORTANT INFORMATION FOR SHAREHOLDERS

The Payden & Rygel Investment Group

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To be held November 10, 2023

Notice is hereby given that The Payden & Rygel Investment Group (the “Trust”) will hold a special meeting of shareholders (the “Meeting”) of each of the series of the Trust (each a “Fund” and together, the “Funds”) on November 10, 2023, at 10 a.m. Pacific Time at the principal executive offices of the Trust, 333 South Grand Avenue, Los Angeles, California 90071.

The purpose of the Meeting is to consider and act upon the following Proposals and to transact such other business as may properly come before the Meeting or any adjournments thereof:

| | |

Proposal | | Description |

| 1 | | To approve the election of ten Trustees as members of the Board. All shareholders of the Trust will vote on Proposal 1, with the shareholders of each Fund voting together. |

| |

| 2 | | To approve an amendment to the current fundamental investment policy of certain Funds regarding industry concentration. Only the shareholders of the following Funds, with the shareholders of each applicable Fund voting separately from the shareholders of each other applicable Fund: Payden California Municipal Social Impact Fund Payden Cash Reserves Money Market Fund Payden Core Bond Fund Payden Corporate Bond Fund Payden Emerging Markets Bond Fund Payden Emerging Markets Corporate Bond Fund, Payden Emerging Markets Local Bond Fund Payden Floating Rate Fund Payden Global Fixed Income Fund Payden Global Low Duration Fund Payden GNMA Fund Payden High Income Fund Payden Limited Maturity Fund Payden Low Duration Fund Payden Managed Income Fund Payden U.S. Government Fund |

The Board of Trustees of the Trust unanimously recommends that you vote in favor of the Proposals.

Shareholders of record of a Fund at the close of business on the record date, September 5, 2023, are entitled to notice of and to vote at the Meeting and any adjournment(s) or postponements thereof. The Notice of Special Meeting of Shareholders, proxy statement and proxy card are being mailed on or about September 15, 2023, to such shareholders of record.

7

You may choose one of the following options to authorize a proxy to vote your shares (which is commonly known as proxy voting) or to vote in person at the meeting:

| | • | | Mail: Complete and return the enclosed proxy card. |

| | • | | Internet: Access the website shown on your proxy card and follow the online instructions. |

| | • | | Telephone (automated service): Call the toll-free number shown on your proxy card and follow the recorded instructions. |

| | • | | In person: Attend the special shareholder meeting on November 10, 2023. |

|

| By Order of the Board of Trustees, |

|

/s/ Mary Beth Syal |

| Mary Beth Syal |

| Principal Executive Officer of the Trust |

IMPORTANT – WE NEED YOUR PROXY VOTE IMMEDIATELY

Shareholders are invited to attend the Meeting in person. Any shareholder who does not expect to attend the Meeting is urged to vote using the touch-tone telephone voting instructions or the website found on the enclosed proxy card or indicate voting instructions on the enclosed proxy card, date and sign it, and return it in the envelope provided, which needs no postage if mailed in the United States. In order to avoid unnecessary expense, we ask your cooperation in responding promptly, no matter how large or small your holdings may be.

8

The Payden & Rygel Investment Group

333 South Grand Avenue

Los Angeles, California 90071

PROXY STATEMENT FOR

SPECIAL JOINT MEETING OF SHAREHOLDERS

TO BE HELD ON

NOVEMBER 10, 2023

This proxy statement is being provided to the shareholders of the separate series (each, a “Fund” and collectively, the “Funds”) of The Payden & Rygel Investment Group (the “Trust”) in connection with the solicitation of proxies by, and on behalf of, the Board of Trustees (each, a “Trustee” and collectively, the “Trustees” or the “Board”) of the Trust to be used at the special joint meeting of shareholders of the Funds and any adjournments thereof (the “Meeting”). The Meeting will be held on November 10, 2023, at 10 a.m. Pacific Time at the principal executive offices of the Trust, 333 South Grand Avenue, Los Angeles, California 90071. The purpose of the Meeting is to seek shareholder approval of the following proposals:

| | 1. | The election of ten Trustees as members of the Board (“Proposal 1”); and |

| | 2. | An amendment to the current fundamental investment policy of certain Funds regarding industry concentration (“Proposal 2”). |

Shareholders also will be asked to transact any other business as may properly come before the Meeting. The Funds that comprise the Trust are set forth below:

Payden Absolute Return Bond Fund

Payden California Municipal Social Impact Fund

Payden Cash Reserves Money Market Fund

Payden Core Bond Fund

Payden Corporate Bond Fund

Payden Emerging Markets Bond Fund

Payden Emerging Markets Corporate Bond Fund

Payden Emerging Markets Local Bond Fund

Payden Equity Income Fund

Payden Floating Rate Fund

Payden Global Fixed Income Fund

Payden Global Low Duration Fund

Payden GNMA Fund

Payden High Income Fund

Payden Limited Maturity Fund

Payden Low Duration Fund

Payden Managed Income Fund

Payden Securitized Income Fund

Payden Strategic Income Fund

Payden U.S. Government Fund

9

Shareholders of record at the close of business on September 5, 2023 (the “Record Date”) are entitled to notice of, and to vote at, the Meeting. Distribution of the Notice of Special Meeting of Shareholders, this proxy statement (“Proxy Statement”) and the proxy card (collectively, the “proxy materials”) is scheduled to begin on or about September 15, 2023.

Important Notice Regarding the Availability of Proxy Materials

for the Shareholder Meeting to be Held on November 10, 2023:

The Notice of Meeting, Proxy Statement and Proxy Card

are available at www.proxyvote.com.

| | |

| |

| Which Proposal Affects My Fund? |

| | |

| Proposal | | Description |

| | |

| 1 | | To approve the election of ten Trustees as members of the Board. All shareholders of the Trust will vote on Proposal 1, with the shareholders of each Fund voting together. |

| | |

| 2 | | To approve an amendment to the current fundamental investment policy of certain Funds regarding industry concentration. Only the shareholders of the following Funds, with the shareholders of each applicable Fund voting separately from the shareholders of each other applicable Fund: Payden California Municipal Social Impact Fund Payden Cash Reserves Money Market Fund Payden Core Bond Fund Payden Corporate Bond Fund Payden Emerging Markets Bond Fund Payden Emerging Markets Corporate Bond Fund, Payden Emerging Markets Local Bond Fund Payden Floating Rate Fund Payden Global Fixed Income Fund Payden Global Low Duration Fund Payden GNMA Fund Payden High Income Fund Payden Limited Maturity Fund Payden Low Duration Fund Payden Managed Income Fund Payden U.S. Government Fund |

Please read the Proxy Statement carefully before voting on the Proposals. If you need additional copies of this Proxy Statement or proxy card, please first contact Payden Mutual Funds at 1-800-572-9336 or Broadridge Financial Solutions, Inc. at the number listed on your proxy card. Additional copies of this Proxy Statement will be delivered to you promptly upon request.

For a free copy of each Fund’s Annual Report for the fiscal year ended October 31, 2022, or each Fund’s most recent Semi-Annual Report, please call 1-800-572-9336 or write to Payden Mutual Funds at P.O. Box 1611, Milwaukee, Wisconsin 53201-1611.

10

PROPOSAL 1

ELECTION OF TRUSTEES

Introduction and Background

The Board of Trustees (the “Board” and each member thereof, a “Trustee”) currently includes eight (8) Trustees, including six (6) Trustees who are not “interested persons” of the Trust as defined in the Investment Company Act of 1940, as amended (“1940 Act”) (“Independent Trustees”): Stephanie Bell-Rose, W.D. Hilton, Jr., Thomas V. McKernan, Rosemarie T. Nassif, Andrew J. Policano, and Dennis C. Poulsen, and two (2) Trustees who are deemed “interested persons” of the Trust as defined in the 1940 Act (“Interested Trustees”), Asha B. Joshi and Jordan H. Lopez. Messrs. Hilton, McKernan, Policano and Poulsen and Ms. Nassif were elected to serve on the Board at a shareholder meeting held on December 11, 2008, and Mses. Bell-Rose and Joshi and Mr. Lopez were appointed. The Board appointed Ms. Bell-Rose on April 1, 2020, Mr. Lopez on September 15, 2020 and Ms. Joshi on December 20, 2021.

In addition to the Trustees above, two additional nominees are being presented for election to the Board at the Meeting: Nancy Benacci and Robert Gumm. If elected by the shareholders at the Meeting, Ms. Benacci and Mr. Gumm will join the Board as Independent Trustees. As discussed below, Ms. Benacci and Mr. Gumm have considerable corporate board and academic experience. The Board believes that their addition to the Board would enhance its ability to oversee the operations of the Trust. Following the shareholder election, ten (10) Trustees would comprise the Board (two (2) Interested Trustees and eight (8) Independent Trustees), each of whom would have been elected by shareholders.

Effective as of the close of business on December 19, 2023, Ms. Nassif will retire as a Trustee. No replacement is being proposed. Accordingly, effective December 20, 2023, nine (9) Trustees would comprise the Board (two (2) Interested Trustees and seven (7) Independent Trustees), each of whom would have been elected by shareholders.

Shareholders are being asked to elect each of the individuals nominated by the Board listed below (each, a “Nominee” and collectively, the “Nominees”) as a member of the Board. The Trust’s Master Trust Agreement does not require the annual election of Trustees. However, in accordance with Section 16(a) of the 1940 Act, the Board may appoint Trustees to fill vacancies if after doing so at least two-thirds of the Trustees have been elected by the shareholders of the Trust. The Board believes it is in the best interests of the Trust for the shareholders to elect or re-elect all of the Trustees so that all members of the Board will have been elected by the shareholders and the Board will have greater flexibility to appoint additional Trustees in the future to fill vacancies without incurring the expense of additional shareholder meetings. Because the Trust is not required to, and does not, hold regular annual shareholder meetings, each Nominee, if elected, will hold office until his or her successor is elected and qualified or until he or she dies, retires, resigns, or is removed. Any Trustee may be removed, with or without cause, any time by: (i) written instrument, signed by at least two-thirds of the Trustees, and specifying the date upon which such removal shall become effective; (ii) vote of shareholders holding not less than two-thirds of the shares then outstanding, at any meeting called for that purpose; or (iii) written declaration signed by shareholders holding not less than two-thirds of the shares then outstanding and filed with the Trust’s custodian.

The Governance Committee of the Board considered the proposed slate of Nominees and determined to recommend the election of the Nominees to the full Board. At a meeting held on June 20, 2023, the Board considered those nominations. Thereafter, by unanimous written consent, the Board approved those nominations and called a meeting of shareholders to allow shareholders of the Trust to vote on the election of the Nominees.

11

The ten (10) persons discussed below have been nominated to serve on the Board of Trustees of the Trust. The persons named as proxies on your proxy card will vote for the election of all of the individuals listed below unless authority to vote for any or all of the Nominees is withheld on the proxy card. The Nominees, if elected, will take office following the Meeting. Each of the Nominees listed below has consented to serve as a Trustee, if elected. However, if any Nominee should become unavailable for election due to events not known or anticipated, the persons named as proxies will vote for such other Nominees as the current Board may recommend.

The Trustees of the Trust are responsible for the overall management of the Funds, including establishing the Funds’ policies, general supervision and review of their investment activities. Massachusetts law requires each Trustee to perform his or her duties as a Trustee, including duties as a member of any Board committee on which he or she serves, in good faith, in a manner he or she reasonably believes to be in the best interests of the Trust, and with the care that an ordinarily prudent person in a like position would use under similar circumstances. The officers of the Trust, who administer the Funds’ daily operations, are appointed by the Board.

Information Concerning the Trustees and Trustee Nominees

The names and ages of the Trustees and Trustee Nominees, their principal occupations during the past five years and certain of their other affiliations are provided below. In addition, the tables include information concerning other directorships held by each Trustee and Trustee Nominees in other registered investment companies or publicly traded companies.

| | | | | | | | | | | | |

Name, Address and Age | | Position

with the

Trust | | Year First

Elected/Appointed

as a Trustee of the

Trust** | | Principal

Occupation(s) During Past

Five Years | | Number

of Trust

Series

Overseen

by

Trustee | | Other

Directorships

Held by

Trustee | | Other Relevant Experience |

| Current Independent Trustees |

| | | | | | |

Stephanie Bell-Rose 333 South Grand Avenue, Los Angeles CA 90071 Age: 66 | | Trustee | | 2020 | | Retired, Senior Managing Director, TIAA (insurance company) | | All (20) | | None | | Corporate Director Experience |

| | | | | | |

W.D. Hilton, Jr. 333 South Grand Avenue, Los Angeles, CA 90071 Age: 76 | | Trustee | | 1993 | | Trustee/ Administrator, Asbestos Bankruptcy Trusts; General Partner, Mendenhall Partners Ltd. (real estate investment company); Private Investor | | All (20) | | None | | Bank board experience Executive management (CFO) experience Board service for charitable/ educational/nonprofit organizations |

| | | | | | |

Thomas V. McKernan 333 South Grand Avenue, Los Angeles, CA 90071 Age: 78 | | Trustee | | 1993 | | Retired, Vice Chair, Automobile Club of Southern California; Former Director, Forest Lawn Memorial Parks (cemeteries and mortuaries company); Director, First American Financial Corporation | | All (20) | | None | | Executive management (CFO) experience Corporate Director experience |

12

| | | | | | | | | | | | |

Name, Address and Age | | Position

with the

Trust | | Year First

Elected/Appointed

as a Trustee of the

Trust** | | Principal

Occupation(s) During Past

Five Years | | Number

of Trust

Series

Overseen

by

Trustee | | Other

Directorships

Held by

Trustee | | Other Relevant Experience |

| | | | | | |

Rosemarie T. Nassif 333 South Grand Avenue, Los Angeles, CA 90071 Age: 81 | | Trustee | | 2008 | | Executive Director, Center for Catholic Education, Loyola Marymount University; President Emerita, Holy Names University | | All (20) | | None | | Bank board experience Board service for charitable/ educational/nonprofit organizations |

| | | | | | |

Andrew J. Policano 333 South Grand Avenue, Los Angeles, CA 90071 Age: 73 | | Trustee | | 2008 | | Former Dean, The Paul Merage School of Business, University of California Irvine | | All (20) | | None | | Published research — finance & economics Board service for charitable/ educational/nonprofit organizations Ph.D — Economics |

| | | | | | |

Dennis C. Poulsen 333 South Grand Avenue, Los Angeles, CA 90071 Age: 80 | | Trustee | | 1992 | | Chairman, Clean Energy Enterprises (clean energy technology investments); Private Investor | | All (20) | | None | | Executive management (CEO) experience Board service for charitable/ educational/nonprofit organizations J.D. |

|

| Current Interested Trustees* |

| | | | | | |

Asha B. Joshi 333 South Grand Avenue, Los Angeles, CA 90071 Age: 65 | | Trustee | | 2021 | | Managing Director, Payden & Rygel | | All (20) | | None | | |

| | | | | | |

Jordan H. Lopez 333 South Grand Avenue, Los Angeles, CA 90071 Age 42 | | Trustee | | 2020 | | Director, Payden & Rygel | | All (20) | | None | | |

13

| | | | | | | | | | | | |

Name, Address and Age | | Position

with the

Trust | | Year First

Elected/Appointed

as a Trustee of the

Trust** | | Principal

Occupation(s) During Past

Five Years | | Number

of Trust

Series

Overseen

by

Trustee | | Other

Directorships

Held by

Trustee | | Other Relevant Experience |

| Independent Trustee Nominees Not Currently Serving As Trustees |

| | | | | | |

Nancy Benacci 333 South Grand Avenue, Los Angeles, CA 90071 Age: 68 | | Trustee | | N/A | | Retired, Managing Director, KeyBanc Capital Markets (investment banking products); Director, Cincinnati Financial Corporation (insurance company) | | All (20) | | Director, Cincinnati Financial Corporation, 2020 to present; Director, Regis Corporation (hair care salon company) | | |

Robert Gumm 333 South Grand Avenue, Los Angeles, CA 90071 Age: 61 | | Trustee | | N/A | | Retired Partner, PricewaterhouseCoopers LLP (accounting firm) | | All (20) | | None | | CPA |

| (*) | “Interested persons” of the Trust by virtue of their affiliation with Payden & Rygel, the investment adviser to the Funds. |

| (**) | Because the Trust is not required to, and does not, hold regular annual shareholder meetings, each Trustee holds office until his or her successor is elected and qualified or until he or she dies, retires, resigns, or is removed. |

Information Concerning the Board

The Role of the Board. The Board provides oversight of the management and operations of all of the Funds. Like all mutual funds, the day-to-day responsibility for the management and operation of the Funds is the responsibility of various service providers to the Funds, such as the Funds’ investment advisers, distributor, administrator, custodian and transfer agent. The Board approves all significant agreements between the Funds and their service providers. The Board has appointed various senior individuals of the adviser to the Funds to serve as officers of the Trust, with responsibility to monitor and report to the Board on the day-to-day operations of the Funds. In conducting this oversight, the Board receives regular reports from these officers and service providers regarding the operations of each of the Funds. The Board has appointed a Chief Compliance Officer who administers the compliance program for the Funds and regularly reports to the Board as to compliance matters. Some of these reports are provided as part of formal board meetings which are typically held quarterly, in person, and involve the Board’s review of recent operations of the various Funds. From time to time, one or more members of the Board may also meet with Trust officers in less formal settings, between formal board meetings, to discuss various topics. In all cases, however, the role of the Board and of any individual Trustee of the Trust is one of oversight and not of management of the day-to-day affairs of the Funds and its oversight role does not make the Board a guarantor of the investments, operations or activities of the various Funds.

14

Board Leadership Structure. The Board has structured itself in a manner that it believes allows it to effectively perform its oversight function. It has established three standing committees, an Audit Committee, a Liquidity and Valuation Committee and a Governance Committee, which are discussed in greater detail below under “Board Committees.” More than two-thirds of the members of the Board are Independent Trustees. The members of each of the Audit Committee and the Governance Committee are all Independent Trustees. The Chair of the Board is an Independent Trustee.

Board Oversight of Risk Management. As part of its oversight function, the Board receives and reviews various risk management reports and assessments and discusses these matters with appropriate management and other personnel. Because risk management is a broad concept comprised of many elements (such as, for example, investment risk, issuer and counterparty risk, compliance risk, operational risks, business continuity risks, etc.) the oversight of different types of risks is handled in different ways. For example, the Audit Committee supports the Board’s oversight of risk management in a variety of ways, including (i) meeting with the Funds’ Treasurer and with the Funds’ independent registered public accounting firm to discuss, among other things, the internal control structure of the Funds’ financial reporting function and compliance with the requirements of the Sarbanes-Oxley Act of 2002, and (ii) reporting to the Board as to these and other matters. Similarly, the Liquidity and Valuation Committee supports the Board’s oversight of risk management in the context of the pricing of securities and any potential impact on the net asset value for the various Funds.

Information about Each Trustee’s Qualification, Experience, Attributes or Skills. The Governance Committee of the Board and the Board itself select Independent Trustees with a view toward constituting a board of trustees that, as a body, possesses the qualifications, skills, attributes and experience to appropriately oversee the actions of each of the service providers to each of the Funds, to decide upon matters of general policy and to represent the long-term interests of the shareholders of each of the Funds. In doing so, the Governance Committee and the Board consider the qualifications, skills, attributes and experience of the current Board members, with a view toward maintaining a board that is diverse in viewpoint, experience, education and skills.

The Board seeks Independent Trustees who have high ethical standards and the highest levels of integrity and commitment, who have inquiring and independent minds, mature judgment, good communication skills, and other complementary personal qualifications and skills that enable them to function effectively in the context of the board and committee structure of the Trust, and who have the ability and willingness to dedicate sufficient time to effectively fulfill their duties and responsibilities.

As indicated in the chart above, each Independent Trustee has a significant record of accomplishments in governance, business, not-for-profit organizations, government service, academia, law, accounting or other professions. Although no single list could identify all experience upon which each Independent Trustee draws in connection with his or her service, the chart summarizes key experience for each Independent Trustee. These references to the qualifications, attributes and skills of the Independent Trustees are pursuant to the disclosure requirements of the SEC, and shall not be deemed to impose any greater responsibility or liability on any Trustee or the Board as a whole. Notwithstanding the accomplishments listed, none of the Independent Trustees is considered an “expert” within the meaning of the Federal securities laws with respect to information in the registration statement for the Funds.

Interested Trustees have similar qualifications, skills and attributes as the Independent Trustees. Interested Trustees serve as senior officers of Payden & Rygel or its affiliates. This management role with the service providers to the Funds also permits them to make a significant contribution to the Board.

15

Board Committees

The Board has established three standing committees — an Audit Committee, a Liquidity and Valuation Committee and a Governance Committee. The functions performed by each of these committees are described below. Each current Trustee of the Trust attended 75% or more of the respective meetings of the full Board and of any committees of which he or she was a member that were held during the fiscal year ended October 31, 2022. The full Board met four times during the fiscal year ended October 31, 2022.

Audit Committee. Each Independent Trustee is a member of the Trust’s Audit Committee. The principal responsibilities of the Audit Committee are to: (i) oversee the Trust’s accounting and financial reporting policies and practices, its internal controls and, as appropriate, the internal controls of certain service providers; (ii) oversee the quality and objectivity of the Trust’s financial statements and the independent audit thereof; (iii) act as a liaison between the Trust’s independent registered public accounting firm and the full Board; (iv) oversee the selection of independent counsel and monitor its continued performance; (v) develop and recommend to the Board for its approval, an annual board self-assessment process; and (vi) receive reports from its members as to matters of regulatory news, industry developments or matters of interest learned through such member’s participation in industry forums, conferences or other programs in the nature of continuing education. Thomas V. McKernan, an Independent Trustee, is Chair of the Audit Committee. The Audit Committee met four times during the fiscal year ended October 31, 2022.

Liquidity and Valuation Committee. The Liquidity and Valuation Committee’s principal function is to generally oversee the Trust’s pricing policies and procedures for securities in which the Funds invest as applied on a day-to-day basis by the Trust’s management and the Funds’ investment advisers. The Liquidity and Valuation Committee also oversees the Trust’s liquidity risk management program. In addition, the Liquidity and Valuation Committee is responsible for recommending changes in these policies and procedures for adoption by the Board. Rosemarie T. Nassif, Stephanie Bell-Rose, Asha B. Joshi and Jordan H. Lopez are the Trustee members of the Liquidity and Valuation Committee, and Rosemarie T. Nassif is Chairman of the Liquidity and Valuation Committee. The Liquidity and Valuation Committee met four times during the fiscal year ended October 31, 2022.

Governance Committee. The Governance Committee is responsible for the identification and evaluation of possible candidates to serve as Trustees of the Trust. Each Independent Trustee is a member of the Governance Committee. Andrew J. Policano is Chair of the Governance Committee. The Governance Committee is composed of Andrew Policano, Chair, along with W.D. Hilton, Thomas V. McKernan, and Dennis Poulsen, and met six times during the fiscal year ended October 31, 2022. Shareholders may recommend names of Trustee candidates for consideration as an independent Trustee by the Governance Committee by written submission to: The Payden & Rygel Investment Group, Attention: Reza Pishva, Secretary, 333 South Grand Avenue, 39th Floor, Los Angeles, CA 90071.

The Governance Committee evaluates candidates’ qualifications for Board membership and the independence of such candidates under the requirements of the 1940 Act. The Governance Committee believes that the significance of each Nominee’s experience, qualifications, attributes or skills is particular to that individual, meaning there is no single litmus test of these matters, and that board effectiveness is best evaluated at the group level, not at the individual trustee level. As a result, the Governance Committee has not established specific, minimum qualifications that must be met by an individual wishing to serve as a trustee of the Trust. When evaluating candidates for a position on the Board, the Governance Committee considers the potential impact of the candidate, along with his or her particular experiences, on the Board as a whole. The diversity of a candidate’s background or experiences, when considered in comparison to the background and experiences of other members of the Board, may or may not impact the Governance Committee’s view as to the candidate. In assessing these matters, the Governance Committee typically considers the following minimum criteria: (i) the candidate’s experience as a director or senior officer of

16

public companies or other fund complexes; (ii) the candidate’s educational background; (iii) the candidate’s reputation for high ethical standards and personal and professional integrity; (iv) any specific financial, technical or other expertise possessed by the candidate, and the extent to which such expertise would complement the Board’s existing mix of skills and qualifications; (v) the candidate’s perceived ability to contribute to the ongoing functions of the Board, including the candidate’s ability and commitment to attend meetings regularly and work collaboratively with other members of the Board; (vi) the candidate’s ability to qualify as an Independent Trustee under the requirements of the 1940 Act, the candidate’s independence from the Funds’ service providers and the existence of any other relationships that might give rise to conflict of interest or the appearance of a conflict of interest; and (vii) such other factors as the Governance Committee determines to be relevant in light of the existing composition of the Board and any anticipated vacancies or other transitions (e.g., whether or not a candidate is an “audit committee financial expert” under the federal securities laws).

Trustee Compensation. For the fiscal year ended October 31, 2022, each Independent Trustee received an annual retainer of $110,000 (paid quarterly at the rate of $27,500 per quarter), plus $10,000 for each in-person Board meeting, $4,500 for each Special Board meeting, $4,000 for each in-person Governance Committee and Liquidity Committee meeting, $4,500 for each in-person Audit Committee meeting, $2,500 for each Special Committee Meeting, and reimbursement of related expenses. The chair of the Board received an annual retainer of $35,000, the chair of the Audit Committee received an annual retainer of $14,000 and each chair of any other Board Committee received an annual retainer of $12,000, in each case in addition to the annual Board retainer received by all Independent Trustees. The following table sets forth the aggregate compensation paid by the Trust for the fiscal year ended October 31, 2022 to the Trustees who are not affiliated with Payden or Payden/Kravitz Investment Advisers LLC, the prior investment adviser to the Payden Managed Income Fund, and the aggregate compensation paid to such Trustees for services on the Board. The Trust does not maintain a retirement plan for its Trustees.

| | | | | | | | | | | | | | | | |

Name | | Aggregate

Compensation

from the

Trust | | | Pension or

Retirement

Benefits

Accrued as

Part of

Trust

Expenses | | | Estimated

Annual

Benefits

Upon

Retirement | | | Total

Compensation

From the

Trust and

Trust

Complex Paid

to Trustee | |

| Stephanie Bell-Rose | | $ | 187,500 | | | | None | | | | N/A | | | $ | 187,500 | |

| W.D. Hilton, Jr. | | $ | 241,500 | | | | None | | | | N/A | | | $ | 241,500 | |

| Thomas V. McKernan | | $ | 202,000 | | | | None | | | | N/A | | | $ | 202,000 | |

| Rosemarie T. Nassif | | $ | 208,000 | | | | None | | | | N/A | | | $ | 208,000 | |

| Andrew J. Policano | | $ | 200,000 | | | | None | | | | N/A | | | $ | 200,000 | |

| Dennis C. Poulsen | | $ | 188,000 | | | | None | | | | N/A | | | $ | 188,000 | |

Trust Fund Shares Owned by Trustees as of December 31, 2022.

17

| | | | |

Name | | Dollar Range of Fund

Shares Owned* | | Aggregate Dollar Range of

Shares Owned in All Trust

Funds |

Independent Trustees | | | | |

W.D. Hilton, Jr | | | | Over $100,000 |

Payden Core Bond Fund | | Over $100,000 | | |

Payden Corporate Bond Fund | | Over $100,000 | | |

Payden Emerging Markets Bond Fund | | Over $100,000 | | |

Payden Emerging Markets Corporate Bond Fund | | Over $100,000 | | |

Payden Equity Income Fund | | $10,001 - $50,000 | | |

Payden Floating Rate Fund | | Over $100,000 | | |

Payden Global Low Duration Fund | | Over $100,000 | | |

Payden High Income Fund | | Over $100,000 | | |

Payden Limited Maturity Fund | | Over $100,000 | | |

Thomas V. McKernan | | | | Over $100,000 |

Payden California Municipal Social Impact Fund | | Over $100,000 | | |

Payden Low Duration Fund | | Over $100,000 | | |

Payden Strategic Income Fund | | Over $100,000 | | |

Payden Equity Income Fund | | Over $100,000 | | |

Payden High Income Fund | | Over $100,000 | | |

Payden Emerging Markets Bond Fund | | Over $100,000 | | |

Rosemarie T. Nassif | | | | Over $100,000 |

Payden Emerging Markets Bond Fund | | $10,001 - $50,000 | | |

Payden High Income Fund | | $50,001 - $100,000 | | |

Payden Low Duration Bond Fund | | $10,001 - $50,000 | | |

Stephanie Bell-Rose | | | | $50,000 - $100,000 |

Payden Equity Income Fund | | $50,000 - $100,000 | | |

Andrew J. Policano | | | | Over $100,000 |

Payden Corporate Bond Fund | | $10,001 - $50,000 | | |

Payden Emerging Markets Bond Fund | | $1 - $10,000 | | |

Payden Global Fixed Income Fund | | $10,001 - $50,000 | | |

Payden Global Low Duration Bond Fund | | $1 - $10,000 | | |

Payden High Income Fund | | $50,001 - $100,000 | | |

Payden Equity Income Fund | | $10,001 - $50,000 | | |

Payden Low Duration Bond Fund | | $1 - $10,000 | | |

Dennis C. Poulsen | | | | Over $100,000 |

Payden Emerging Markets Bond Fund | | $10,001 - $50,000 | | |

Payden Emerging Markets Local Bond Fund | | $1 - $10,000 | | |

Payden Equity Income Fund | | Over $100,000 | | |

Payden High Income Fund | | $10,001 - $50,000 | | |

Interested Trustees | | | | |

Asha B. Joshi | | None | | |

Jordan H. Lopez | | None | | |

Trustee Nominees | | | | |

Nanci Benacci | | None | | |

Robert Gumm | | None | | |

| * | Ownership disclosure is made using the following ranges: None; $1 - $10,000; $10,001 - $50,000; $50,001 - $100,000; and over $100,000. |

18

Officers

The current officers of the Trust who perform policy-making functions and their affiliations and principal occupations for the past five years are as set forth below.

| | | | | | | | |

Name, Address and Age | | Position with the Trust | | Year First Elected

As An Officer of

the Trust | | Principal Occupation(s) During Past 5 Years | | Number of Trust Series

Overseen by Officer |

| | | | |

Mary Beth Syal 333 South Grand Avenue Los Angeles, CA 90071 Age: 61 | | Principal Executive Officer and Chief Operating Officer | | 2021 | | Managing Director and Director, Payden & Rygel | | All (20) |

| | | | |

Brian W. Matthews 333 South Grand Avenue Los Angeles, CA 90071 Age: 62 | | Principal Financial Officer and Chief Financial Officer | | 2003 | | Managing Director, CFO and Director, Payden & Rygel | | All (20) |

| | | | |

Bradley F. Hersh 333 South Grand Avenue Los Angeles, CA 90071 Age: 54 | | Vice President, Treasurer and Assistant Secretary | | 1998 | | Managing Director and Treasurer, Payden & Rygel | | All (20) |

| | | | |

Sandi A. Brents 333 South Grand Avenue Los Angeles, CA 90071 Age: 52 | | Vice President, Chief Compliance Officer and Assistant Secretary | | 2016 | | Senior Vice President, Risk Management and Senior Compliance Officer, Payden & Rygel | | All (20) |

| | | | |

Reza Pishva 333 South Grand Avenue Los Angeles, CA 90071 Age: 48 | | Secretary | | 2021 | | Director, General Counsel and Chief Compliance Officer, Payden & Rygel | | All (20) |

Shareholder Communications

The Board of Trustees provides a process for shareholders to communicate with the Board of Trustees as a whole and/or each of the Trustees individually. Shareholders should forward such correspondence by U.S. mail or other courier service to the Secretary of the Trust. Correspondence addressed to the Board will be forwarded to each Trustee, and correspondence addressed to a particular Trustee will be forwarded to that Trustee.

Board Considerations

In selecting the Nominees not currently serving as Trustees, the Governance Committee reviewed the backgrounds and qualifications of several candidates and ultimately selected Nancy Benacci and Robert Gumm. In reaching their determinations, the members of the Governance Committee carefully considered all of the factors described above, and, with the subsequent concurrence of the entire Board, concluded that these Nominees possessed excellent qualifications and their skills would add dimension to the current Board composition. The Governance Committee also concluded that these Nominees would ably represent the shareholders’ interests and determined that the Nominees should be recommended for election by shareholders of the Funds.

19

The Board approved the proposal to add Trustees to the Board for a number of reasons. The Board evaluated the current size of the Board and determined that adding a Trustee (accounting for the retirement of Ms. Nassif effective December 19, 2023 and contemplated future retirements in the coming years) would expand the breadth and depth of the Board by providing an opportunity to add Trustees with varied backgrounds and qualifications. The Board also considered that an increase in the number of Independent Trustees on the Board would be beneficial to current and future shareholders of the Funds.

In addition, the Board considered that an increase in the number of Independent Trustees represents an increase in Trustees’ fees, reflecting the increased responsibilities of board members under new regulatory requirements. The Board also considered that the additional fees are immaterial when compared to the overall expenses of the Funds. The Board believes the governance benefits likely to result from having additional Trustees should outweigh any of these additional fees.

In determining to recommend the current Trustees of the Trust as nominees to the Board of Trustees, the Board considered the Nominees’ business experience, the varied backgrounds and qualifications of each of the Nominees, as well as their prior experience serving on the Board. As a result, the Board of Trustees concluded that recommendation of the election of each of the Nominees is in the best interest of the shareholders of the Funds.

Required Vote

The election of each Nominee will be voted upon separately by the shareholders of the Trust, voting together without regard to Fund. Each Nominee will be elected as a Trustee of the Trust if he or she receives a plurality of the votes cast, voting together without regard to Fund, when a quorum is present. A vote of a “plurality” of shares means that a Nominee would only need to receive more “yes” votes than a competing candidate to be elected to the Board. Since each Nominee is running unopposed, each Nominee effectively needs only one vote to be elected if a quorum is present at the Meeting. The approval of any Nominee is not contingent on the approval of the other Nominees.

If any of the current Trustees who were previously elected to the Board by the shareholders of the Trust are not re-elected, they will remain in office and still will be considered as having been elected by the shareholders of the Trust.

THE BOARD RECOMMENDS THAT THE SHAREHOLDERS ELECT ALL TRUSTEE NOMINEES.

20

PROPOSAL 2

APPROVAL OF CHANGE TO FUNDAMENTAL INVESTMENT POLICY

The 1940 Act requires every mutual fund to adopt a fundamental investment policy with respect to concentrating its investments in a particular industry or group of industries. A mutual fund is considered by the Securities and Exchange Commission (“SEC”) staff to concentrate its investments in a particular industry or group of industries if it invests more than 25% of its total assets (exclusive of certain items such as cash, U.S. government securities, securities of other investment companies, and certain tax-exempt securities) in a particular industry or group of industries. If a fund intends to concentrate its investments in an industry or group of industries, the fund is required to disclose in its prospectus the industry or group of industries in which it will concentrate. If a fund does not intend to concentrate its investments, it may not invest in any given industry if, upon making the investment, more than 25% of the value of the fund’s assets would be invested in such industry. As this is a “fundamental” policy, this means that it may be modified only by a vote of a majority of the investment company’s outstanding voting securities (as defined in the 1940 Act).

Each of the Payden California Municipal Social Impact Fund, Payden Cash Reserves Money Market Fund, Payden Core Bond Fund, Payden Corporate Bond Fund, Payden Emerging Markets Bond Fund, Payden Emerging Markets Corporate Bond Fund, Payden Emerging Markets Local Bond Fund, Payden Floating Rate Fund, Payden Global Fixed Income Fund, Payden Global Low Duration Fund, Payden GNMA Fund, Payden High Income Fund, Payden Limited Maturity Fund, Payden Low Duration Fund, Payden Managed Income Fund, and Payden U.S. Government Fund (in this Proposal 2, each a “Fund” and collectively, the “Funds”) currently has the following fundamental investment policy regarding industry concentration (the “Current Policy”)

Current Fundamental Policy

No Fund is restricted from concentrating its investments in securities of any one or more issuers conducting their principal business activities in the same industry.

Although none of the Funds have concentrated their investments in an industry or group of industries, the Current Policy does not explicitly restrict a Fund with respect to concentrating its investments in a particular industry.

The Payden Managed Income Fund, but no other Fund, currently has the following non-fundamental policy, which may be changed by the Board without shareholder approval:

Payden Managed Income Fund Non-Fundamental Policy

The Payden Managed Income Fund will not purchase any security which would cause 25% or more of its total assets at the time of purchase to be invested in the securities of any one or more issuers conducting their principal business activities in the same industry, provided that (i) there is no limitation with respect to U.S. Government obligations and repurchase obligations secured by such obligations, (ii) wholly owned finance companies are considered to be in the industries of their parents, (iii) Standard and Poor’s Depository Receipts (“SPDRs”) and other similar derivative instruments are divided according to the industries of their underlying common stocks, and (iv) utilities are divided according to their services (for example, gas, gas transmission, electric and telephone will each be considered a separate industry). Each foreign government and supranational organization is considered to be an industry.

To align the fundamental investment policies of the Funds with the applicable regulatory requirements in a manner that could not be changed without shareholder approval, the Board recommends that each of the Funds listed above adopt the following fundamental investment policy (“Amended Policy”) regarding industry concentration:

21

Amended Fundamental Policy

The Fund will not purchase any security which would cause 25% or more of its total assets at the time of purchase to be invested in the securities of any one or more issuers conducting their principal business activities in the same industry, provided that (i) there is no limitation with respect to U.S. Government obligations and repurchase obligations secured by such obligations, (ii) wholly owned finance companies are considered to be in the industries of their parents, (iii) Standard and Poor’s Depository Receipts (“SPDRs”) and other similar derivative instruments are divided according to the industries of their underlying common stocks, and (iv) utilities are divided according to their services (for example, gas, gas transmission, electric and telephone will each be considered a separate industry). Each foreign government and supranational organization is considered to be an industry.

The Board has concluded that the changes to the Funds’ fundamental investment policies regarding industry concentration are appropriate in order to align the Current Policy with the applicable regulatory requirements, reflect the Funds’ practices, and further make this policy fundamental, such that it cannot be changed without shareholder approval. At a board meeting on June 20, 2023, Payden & Rygel recommended, and the Board considered, the amendment of the Current Policy. Thereafter, by unanimous written consent, the Board approved the change from the Current Policy to the Amended Policy and called a meeting of shareholders of the Funds to approve this change.

As noted above, none of the Funds have concentrated their investments in an industry or group of industries. Accordingly, the approval of the Amended Policy is not expected to result in any changes to the objectives, principal investment strategies or principal risks of any Fund. In addition, the approval of the Amended Policy is not expected to have any impact on a Fund’s current classification as a “diversified” or “non-diversified” fund, as that term is defined in the 1940 Act.

If the shareholders approve this proposal with respect to each Fund, the amended policy will take effect shortly after the Meeting upon the filing of a supplement to each Fund’s Prospectus and Statement of Additional Information announcing the change to the fundamental policy regarding industry concentration. As the proposed fundamental policy is identical to the Payden Managed Income Fund’s current non-fundamental policy, if shareholders of the Payden Managed Income Fund approve Proposal 2, the Payden Managed Income Fund’s non-fundamental policy would be eliminated. If shareholders of a Fund do not approve Proposal 2, that Fund will continue to operate with its current fundamental investment policies. In addition, the Fund would continue not to concentrate its investment in an industry or group of industries and adopt a non-fundamental investment policy that is identical to the Amended Policy.

Required Vote

Approval of this Proposal 2 with respect to a Fund will require the vote of a “majority of the outstanding voting securities” of the Fund, as defined in the 1940 Act, when a quorum is present. As defined by the 1940 Act, a “majority of the outstanding voting securities” of a Fund means the affirmative vote of the lesser of (a) 67% or more of the voting securities of the Fund present at a shareholder meeting if the holders of more than 50% of the outstanding voting securities of the Fund are present in person or by proxy, or (b) more than 50% of the outstanding voting securities of the Fund. The shareholders of each applicable Fund will vote on the approval of Proposal 2 separately from the shareholders of each other applicable Fund, and the proposal will only take effect for a Fund if approved by a majority of the outstanding voting securities of its shareholders. The shareholders of each applicable Fund will vote on Proposal 2 in the aggregate as one class, and not by class of shares.

22

THE BOARD RECOMMENDS THAT THE SHAREHOLDERS OF THE FUNDS VOTE FOR PROPOSAL 2.

OTHER INFORMATION

Investment Adviser Administrator and Principal Underwriter

The principal executive offices of the Trust are located at 333 South Grand Avenue, Los Angeles, California 90071. The principal executive offices of Payden & Rygel, the investment adviser to all of the Funds, are located at the same address as the Trust.

The Trust’s administrator, Treasury Plus, Inc., and distributor, Payden & Rygel Distributors, are located at the same address as the Trust.

Independent Registered Public Accounting Firm

Deloitte & Touche LLP (“Deloitte”) serves as the independent registered public accounting firm for each of the Funds. Deloitte performs an annual audit of the financial statements of the Funds. The Trust does not expect any representatives of Deloitte to be present at the Meeting or to make a statement or respond to questions.

Audit Fees. For the fiscal years ended October 31, 2021 and October 31, 2022, Deloitte billed the Funds $[ ] and $[ ], respectively, for professional services rendered for the audit of the Funds’ annual financial statements and services that are normally provided in connection with statutory and regulatory filings.

Audit-Related Fees. For the fiscal years ended October 31, 2021 and October 31, 2022, Deloitte billed the Funds $[ ] and $[ ], respectively, for assurance and related services that are reasonably related to the performance of the audit of the Funds’ financial statements and that are not reported above.

Tax Fees. For the fiscal years ended October 31, 2021 and October 31, 2022, Deloitte billed the Funds $[ ] and $[ ], respectively, for professional services rendered for tax compliance, tax advice and tax planning.

All Other Fees. For the fiscal years ended October 31, 2021 and October 31, 2022, Deloitte billed the Funds $[ ] and $[ ], respectively, for products and services other than the services reported above.

Audit and Governance Committee Pre-Approval Policies and Procedures. The Audit Committee has adopted policies and procedures with regard to the pre-approval of services. The Committee shall pre-approve all auditing services and permissible non-audit services (e.g., tax services) to be provided to the Trust by independent registered public accounting firm, including the fees and other compensation to be paid to the independent registered public accounting firm. The Committee may delegate to one or more of its members the authority to grant pre-approvals and requires that the decisions of any member to whom authority is delegated shall be presented to the full Committee at each of its scheduled meetings. The Committee shall also pre-approve the independent registered public accounting firm’s engagements for non-audit services with the Adviser and any affiliate of the Adviser that provides ongoing services to the Trust, if the engagement relates directly to the operations and financial reporting of the Trust. [All of the services described under “Audit-Related Fees,” “Tax Fees” and “All Other Fees” were approved by the Audit Committee pursuant to these policies and procedures.]

Non-Audit Fees. For the fiscal years ended October 31, 2021 and October 31, 2022, Deloitte billed the Funds $[ ] and $[ ], respectively, for the Funds, the Adviser or any affiliate of the Adviser that provides services to the Funds for non-audit fees. These fees relate entirely to tax services provided to the Funds as noted above. The Audit Committee has considered whether the provision of non-audit services that were rendered to the Adviser and any affiliate of the Adviser that provides services to the Funds that were not pre-approved is compatible with maintaining Deloitte’s independence.

23

VOTING INFORMATION

Who is Eligible To Vote

Shareholders of record of a Fund as of the close of business on the Record Date, September 5, 2023, are entitled to be present and to vote at the Meeting and any adjournments or postponements thereof. Each whole share is entitled to one vote on each matter on which it is entitled to vote, and each fractional share is entitled to a proportionate fractional vote. The number of shares of each class of each Fund issued and outstanding as of the Record Date is included in Appendix A.

Security Ownership of Management, Trustees and Principal Shareholders

A list of shareholders who owned of record five percent (5%) or more of the shares of a class of a Fund as of the Record Date is included in Appendix B, as well as information regarding Trustee and officer ownership of Fund shares. As of the Record Date, to the best of the knowledge of the Trust, no Trustee or officer of the Trust beneficially owned 1% or more of the outstanding shares of any of the Fund, and the Trustees and the officers of the Trust, as a group, beneficially owned less than 1% of the outstanding shares of any of the Funds. The Trust is aware of no arrangements, the operation of which at a subsequent date may result in a change in control of the Trust.

Quorum, Adjournment and Method of Tabulation

There must be a quorum of shares represented at the Meeting, in person or by proxy, to take action on any matter relating to the Funds. Under the Trust’s Master Trust Agreement, thirty percent (30%) of the shares entitled to vote shall be a quorum for the transaction of business, but any lesser number shall be sufficient for adjournments. Any adjourned session or sessions may be held within a reasonable time after the date set for the original meeting without the necessity of further notice.

With respect to each Proposal, in the event that a quorum is not present at the Meeting, or if there are insufficient votes to approve the applicable Proposal by the time of the Meeting, the proxies or their substitutes may propose that such Meeting be adjourned one or more times to permit further solicitation. Any adjournment by the shareholders requires the affirmative vote of a majority of the total number of shares that are present in person or by proxy when the adjournment is being voted upon. If a quorum is present, and a proposal to adjourn the meeting to permit further solicitation is received, the proxies or their substitutes will vote in favor of such adjournment all shares that they are entitled to vote in favor of the Proposal and the proxies or their substitutes will vote against any such adjournment any shares for which they are directed to vote against the Proposal.

For purposes of determining the presence of a quorum for the Meeting, the inspectors will count as present the total number of shares voted “for” or “against” approval of any Proposal, as well as all shares represented by proxies that reflect abstentions and “broker non-votes” (i.e., shares held by brokers or nominees, typically in “street name,” as to which (i) instructions have not been received from the beneficial owners or the person entitled to vote, and (ii) the broker or nominee does not have discretionary voting power on the matter). Abstentions and broker non-votes will not be counted as votes cast for purposes of determining whether sufficient votes have been received to approve the Proposal. Accordingly, to the extent that the vote of a “majority of the outstanding voting securities” of a Fund, as discussed in the following section, is obtained by the affirmative vote of 67% or more of the shares present or represented by proxy because the holders of more than 50% of the outstanding shares are represented, abstentions and broker non-votes will have the effect of shares voted “against” a Proposal.

24

Shareholders are urged to vote or forward their voting instructions promptly. As there are no proposals on which brokers may vote in their discretion on behalf of their clients pursuant to applicable New York Stock Exchange rules, the Trust does not expect to receive any broker non-votes.

Required Vote

With respect to Proposal 1, the election of each Nominee will be voted upon separately by the shareholders of the Trust, voting together without regard to Fund. Each Nominee will be elected as a Trustee of the Trust if he or she receives a plurality of the votes cast, voting together without regard to Fund, when a quorum is present. A vote of a “plurality” of shares means that a Nominee would only need to receive more “yes” votes than a competing candidate to be elected to the Board. Since each Nominee is running unopposed, each Nominee effectively needs only one vote to be elected if a quorum is present at the Meeting. The approval of any Nominee is not contingent on the approval of the other Nominees.

With respect to Proposal 2, the shareholders of each of the Payden California Municipal Social Impact Fund, Payden Cash Reserves Money Market Fund, Payden Core Bond Fund, Payden Corporate Bond Fund, Payden Emerging Markets Bond Fund, Payden Emerging Markets Corporate Bond Fund, Payden Emerging Markets Local Bond Fund, Payden Floating Rate Fund, Payden Global Fixed Income Fund, Payden Global Low Duration Fund, Payden GNMA Fund, Payden High Income Fund, Payden Limited Maturity Fund, Payden Low Duration Fund, Payden Managed Income Fund, and Payden U.S. Government Fund will vote on the approval of Proposal 2 with respect to each shareholder’s Fund. Approval of Proposal 2 with respect to a Fund will require the vote of a “majority of the outstanding voting securities” of the Fund, as defined in the 1940 Act, when a quorum is present. As defined by the 1940 Act, a “majority of the outstanding voting securities” of a Fund means the affirmative vote of the lesser of (a) 67% or more of the voting securities of the Fund present at a shareholder meeting if the holders of more than 50% of the outstanding voting securities of the Fund are present in person or by proxy, or (b) more than 50% of the outstanding voting securities of the Fund. The shareholders of each applicable Fund will vote on the approval of Proposal 2 separately from the shareholders of each other applicable Fund, and the proposal will only take effect for a Fund if approved by a majority of the outstanding voting securities of its shareholders. The shareholders of each applicable Fund will vote on Proposal 2 in the aggregate as one class, and not by class of shares.

Proxies and Voting at the Meeting

Shareholders may use the proxy card provided if they are unable to attend the Meeting in person or wish to have their shares voted by a proxy even if they do attend the Meeting. Any shareholder of a Fund giving a proxy has the power to revoke it prior to its exercise by mail (addressed to the Secretary at the principal executive office of the Trust shown at the beginning of this proxy statement), or in person at the Meeting, by executing a superseding proxy or by submitting a notice of revocation to the applicable Fund. A superseding proxy may also be executed by voting via telephone or online. The superseding proxy need not be voted using the same method (mail, telephone, or online) as the original proxy vote. In addition, although mere attendance at the Meeting will not revoke a proxy, a shareholder present at the Meeting may withdraw a previously submitted proxy and vote in person. If you need any assistance or have any questions regarding the Proposals or how to vote your shares, please call Broadridge Financial Solutions, Inc., our proxy solicitation firm, toll free at 1-866-584-0574 during the hours of 9:00 a.m. and 10:00 p.m. ET Monday through Friday, and 10:00 a.m. and 6:00 p.m. ET on Saturday and Sunday. The representatives can assist with any questions you may have regarding this event.

All properly executed proxies received in time for the Meeting will be voted as specified in the proxy. If no specification is made, all properly executed proxies will be voted in favor of each Nominee and FOR Proposal 2. Proxies for Proposal 1 marked “Withheld” with respect to one or more Nominees will not be counted for or against such Nominee(s), and will accordingly have no effect on the vote. Proxies will be voted in the discretion of the persons named as proxies on such procedural matters that may properly come before the Meeting. If any other business comes before the Meeting, your shares will be voted at the discretion of the persons named as proxies.

25

Telephonic Voting. Shareholders may call the toll-free phone number indicated on their proxy card to vote their shares. Shareholders will need to enter the control number set forth on their proxy card and then will be prompted to answer a series of simple questions. The telephonic procedures are designed to authenticate a shareholder’s identity, to allow shareholders to vote their shares and to confirm that their instructions have been properly recorded.

Internet Voting. Shareholders may access the website shown on their proxy card and follow the online instructions to vote their shares. The online procedures are designed to authenticate a shareholder’s identity, to allow shareholders to vote their shares and to confirm that their instructions have been properly recorded.

Method of Solicitation and Expenses

The solicitation of proxies will occur principally by mail, but proxies may also be solicited by telephone, e-mail or other electronic means, facsimile or personal interview. If instructions are recorded by telephone, the person soliciting the proxies will use procedures designed to authenticate shareholders’ identities to allow shareholders to authorize the voting of their shares in accordance with their instructions, and to confirm that a shareholder’s instructions have been properly recorded.

Payden & Rygel has engaged Broadridge Financial Solutions, Inc. to assist in the solicitation of proxies, including preparing, printing and mailing the enclosed proxy card and this proxy statement. The costs of the solicitation, which are estimated to be approximately $[ ], will be borne by the Funds, allocated among them on the basis of their relative net assets. In addition, the Funds will request broker-dealer firms, custodians, nominees, and fiduciaries to forward proxy materials to the beneficial owners of their shares held of record by such persons. The Funds may reimburse such broker-dealer firms, custodians, nominees and fiduciaries for their reasonable expenses incurred in connection with such proxy solicitation.

Officers and employees of the Trust and Payden & Rygel and/or their affiliates, who will receive no extra compensation for their services, may solicit proxies by telephone, e-mail or other electronic means, letter or facsimile. Broadridge Financial Solutions, Inc. has also been retained as proxy tabulator.

Shareholder Proposals for Future Meetings