GLOBAL ENTERTAINMENT CORPORATION

1600 North Desert Drive, Suite 301

Tempe, AZ 85281

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD APRIL 14, 2011

To the shareholders of Global Entertainment Corporation:

You are hereby notified that Global Entertainment Corporation (the Company) will hold an annual meeting (the Meeting) of its shareholders on April 14, 2011, at 9:00 a.m. at 1600 North Desert Drive, Suite 301, Tempe, AZ 85281. Only shareholders of the Company may attend the Meeting. Shareholders who own shares registered in their names will be admitted to the Meeting upon verification of record share ownership. Shareholders who own shares through banks, brokerage firms, nominees or other account custodians must present proof of beneficial share ownership (such as a brokerage account statement) to be admitted.

The following items of business will be addressed at the Meeting:

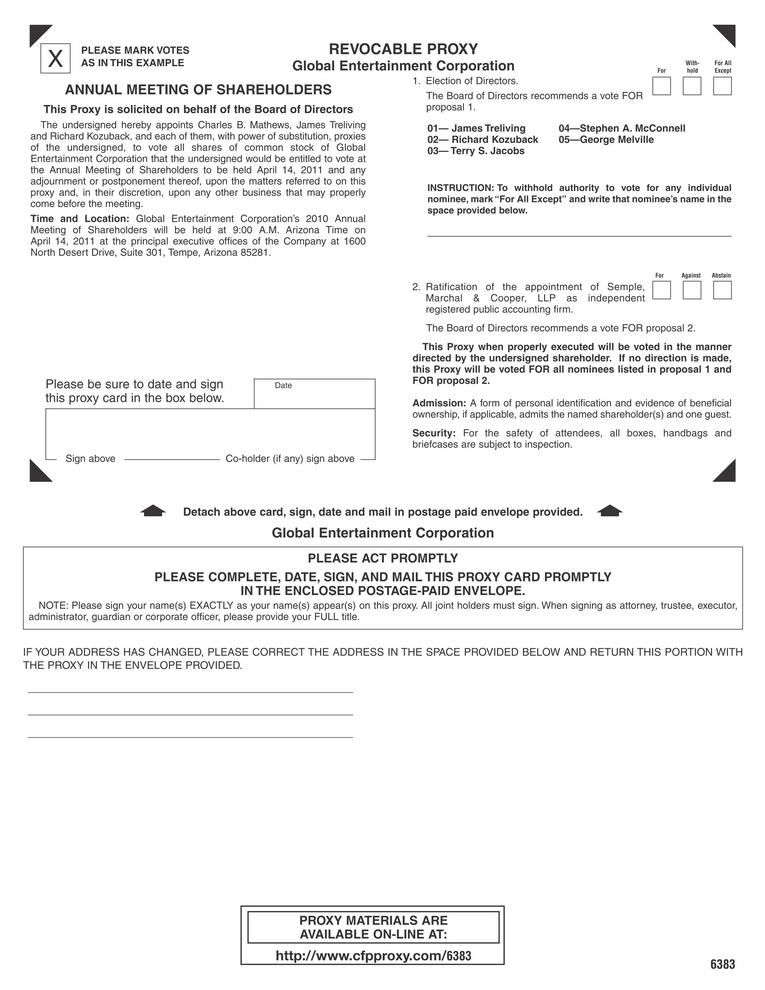

1. The election of five members to the Board of Directors to serve until the next annual meeting of shareholders and until their successors are elected;

2. To ratify the selection of Semple, Marchal & Cooper, LLP to serve as our independent registered public accounting firm for the fiscal year ending May 31, 2011; and

3. To transact such other business as may properly come before the Meeting or any postponements or adjournments thereof. Management is presently aware of no other business to come before the Meeting.

Details relating to the above proposals are set forth in the attached Proxy Statement. All shareholders of record of our common stock as of the close of business on February 14, 2011, will be entitled to notice of and to vote at the Meeting and any adjournment or postponements thereof.

A copy of our 2010 Annual Report to Shareholders is enclosed. Management cordially invites you to attend the Meeting. Please mark, sign, date and promptly return the enclosed proxy card so that your shares can be voted, regardless of whether you expect to attend the Meeting. If you attend, you may withdraw your proxy and vote in person.

By Order of the Board of Directors,

Steven E. Lee

Secretary

Tempe, Arizona

February 23, 2011

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON APRIL 14, 2011:

This Proxy Statement, including the Notice of Annual Meeting of Shareholders, the Company’s 2010 Annual Report and the Annual Report on Form 10-K is available on the Internet at www.cfpproxy.com/6383.

GLOBAL ENTERTAINMENT CORPORATION

1600 North Desert Drive, Suite 301

Tempe, AZ 85281

PROXY STATEMENT

GENERAL

Our Board of Directors is providing this Proxy Statement in connection with the Company’s solicitation of proxies to be voted at the Annual Meeting of Shareholders (the Meeting) to be held on April 14, 2011 at 9:00 a.m., local Arizona time, at 1600 North Desert Drive, Suite 301, Tempe, AZ 85281, and at any adjournments or postponements of the Meeting. This Proxy Statement and accompanying notice of the Meeting are first being mailed to shareholders on or about March 7, 2011.

At our Annual Meeting, shareholders will act upon the matters outlined in the notice of meeting on the cover page of this Proxy Statement, including the election of directors and the ratification of the appointment of our independent registered public accounting firm. In addition, management will report on the performance of the Company and respond to questions from shareholders.

VOTING RIGHTS AND COST OF MAILING

Our common stock is the only type of security entitled to vote. On February 14, 2011 the record date for determination of shareholders entitled to vote, we anticipate that we will have 6,656,062 shares of common stock outstanding. Each shareholder of record on the record date will be entitled to one vote for each share of common stock held by such shareholder on that date. Shares of common stock may not be voted cumulatively.

The shares represented by all proxies that are properly executed and submitted will be voted at the Meeting in accordance with the instructions indicated thereon. Unless otherwise directed, votes will be cast (i) for the election of the nominees for directors hereinafter named; (ii) for the ratification of Semple, Marchal & Cooper, LLP as our independent registered public accounting firm and (iii) in accordance with the best judgment of the persons acting under the proxy concerning other matters as may properly come before the Meeting or any postponements or adjournments thereof. Shareholders who hold their shares in “street name” (i.e., in the name of a bank, broker or other record holder) must vote their shares in the manner prescribed by their brokers. After a quorum is declared, the holders of a majority of the shares represented at the Meeting in person or by proxy and entitled to vote will be required to approve any proposed matters.

We will bear the entire cost of the preparation, assembly, printing and mailing of this Proxy Statement. Copies of this Proxy Statement will be furnished to brokerage houses, fiduciaries and custodians holding shares in their names that are beneficially owned by others so that they may forward this material to such beneficial owners. In addition, we may reimburse these persons for their costs of forwarding the material to the beneficial owners.

QUORUM REQUIREMENT

Our Bylaws and Nevada law provide that the holders of a majority of our common stock issued and outstanding and entitled to vote, either in person or by proxy shall constitute a quorum for the transaction of business at a shareholders’ meeting. As of the record date, it is anticipated that 6,656,062 shares of common stock, representing the same number of votes, will be outstanding. Thus, the presence of the holders of common stock representing at least 3,328,031 votes will be required to establish a quorum. In determining the presence of a quorum at the Meeting, proxies received but marked as abstentions are counted as present and broker non-votes are not counted as present. A broker “non-vote” occurs when a broker, bank or other holder of record holding shares for a benefic ial owner does not vote on a particular proposal because the broker, bank or other holder of record does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner.

VOTES REQUIRED

With respect to the election of the five director nominees and the ratification of our independent registered public accountants, the holders of a majority of the issued and outstanding shares of voting stock must approve the actions taken.

HOW TO VOTE

By Mail or Facsimile

Be sure to complete, mark, sign and date the proxy card or voting instruction card and return it in the envelope provided or via facsimile to 480-994-0759. Votes submitted by mail must be received on or before April 14, 2011. If you are a shareholder of record and you return your signed proxy card but do not indicate your voting preferences, the persons named in the proxy card will vote the shares represented by that proxy as recommended by the Board.

All shareholders may vote in person at the Meeting. If you are a beneficial owner of shares, you must obtain a legal proxy from your broker, bank or other holder of record and present it to the inspectors of election with your ballot to be able to vote at the Meeting.

CHANGING YOUR VOTE AFTER YOU RETURN YOUR PROXY CARD

Any shareholder of record giving a proxy may revoke it at any time before it is voted at the Meeting by delivering to the Company written notice of revocation or a proxy bearing a later date, or by attending the Meeting in person and casting a ballot, although attendance at the Meeting will not by itself revoke a previously granted proxy. You may change your vote by using any one of these methods regardless of the procedure used to cast your previous vote.

If you are a beneficial owner of shares, you may submit new voting instructions by contacting your bank, broker or other holder of record. You may also vote in person at the Meeting if you obtain a legal proxy as described in the response to the previous question.

DISSENTER’S RIGHTS OR APPRAISAL

Pursuant to applicable Nevada law, there are no dissenter’s or appraisal rights relating to the matters to be acted upon at the Meeting.

BOARD’S RECOMMENDATIONS

Unless you give other instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board. The Board’s recommendations are set forth together with the description of each item in this Proxy Statement. In summary, the Board recommends a vote:

| · | FOR the election as directors of the nominees named in this Proxy Statement. (See Proposal 1). |

| · | FOR the ratification of the appointment of Semple, Marchal & Cooper, LLP as our independent registered public accounting firm. (See Proposal 2). |

| · | In accordance with the best judgment of the persons acting under the proxy concerning other matters that are properly brought before the Meeting and at any adjournment or postponement thereof. |

PROPOSAL NO. 1: ELECTION OF DIRECTORS

During the prior fiscal year, the Board of Directors consisted of seven members. Messrs. Bowlin and Schwartz resigned, effective September 19, 2010, and the Board has determined that it is in the best interest of the Company to continue to have five members. The remaining five members of the Board are standing for re-election. We determine whether our directors are “independent” using the current standards set by the NYSE Euronext. All of the nominated directors, except for Mr. Kozuback, who is our Chief Executive Officer, are independent.

JAMES TRELIVING is Chairman of the Board of Directors of the Company, serving in that position since 2003. He is also Chairman of the Board of Directors of WPHL Holdings, Inc. Mr. Treliving is a chairman and owner of Boston Pizza International, Inc., an $800 million (Canadian) full-service pizza and pasta restaurant franchise chain with over 300 locations in Canada. Mr. Treliving is also chief executive officer and owner of Boston Pizza Restaurants, LP, doing business as Boston’s the Gourmet Pizza, a full-service pizza and pasta restaurant franchise chain with over 50 locations in the United States and Mexico. Mr. Treliving has won the Pacific Canada Ernst & Young “Entrepreneur of the Year” award for Hospitality and Tourism and the British Columbia American Marketing Association’s “Marketer of the Year” award. Boston Pizza was named one of Canada’s “50 Best Managed Companies” 15 years in row and has won the Pinnacle “Company of the Year” award. Mr. Treliving is also involved in the oil and gas, property construction and development industries. Prior to purchasing Boston Pizza with George Melville in 1983, Mr. Treliving owned and operated multiple franchised Boston Pizza restaurants. Among other attributes, skills, experiences and qualifications, our Board benefits from Mr. Treliving’s experience as a chief executive officer, business development accomplishments and experience with franchise businesses.

RICHARD KOZUBACK is a member of our Board of Directors and is the President and CEO of the Company, serving in that position since 2003. He is also a member of the Board of Directors of WPHL Holdings, Inc. Mr. Kozuback has over 30 years of experience in the hockey industry, having played Canadian Junior Hockey and having coached and managed various hockey teams in Canada and the United States. From 1993 to 1994, Mr. Kozuback was Head Coach and General Manager of the Tri-City Americans, a Western Hockey League team, as well as Head Coach of the Phoenix Cobras, a Roller Hockey International team. From 1991 to 1993, Mr. Kozuback was Associate Coach of the Phoenix Roadrunners, a member of the International Hockey League and farm team to the Los Angeles Kings, a National Hockey League team. ; Mr. Kozuback was Head Hockey Coach at the University of Wisconsin River Falls from 1986-1989 where his team won an NCAA Championship in the 1987-1988 season. From 1982 to 1986 Mr. Kozuback was owner, General Manager and Coach of the Penticton Knights Junior A Hockey team; Canadian Champions in 1985-1986. Mr. Kozuback attended the University of Alberta, Canada, where he received a degree in Education and taught at the high school level for eight years (British Columbia) and at the collegiate level (Wisconsin) for three years. Among other attributes, skills, experiences and qualifications, our Board benefits form Mr. Kozuback’s history with the Company, his leadership experience in the sports entertainment industry and his relationships in our industry.

TERRY S. JACOBS has been a member of our Board of Directors since 2000, is Chairman, President and Chief Executive Officer of The JFP Group, LLC, a private real estate development, management and investment group since September 2005. Mr. Jacobs served as Chairman of the Board and Chief Executive Officer of Regent Communications, a Nasdaq listed company, which is the owner and operator of 75 radio stations in 15 markets, from its founding in 1996 to 2005. He currently serves as a member of the Board of Directors of American Financial Group, Inc., a NYSE Euronext listed company. He was a member of the Board of Directors of Capital Title Group, Inc., a then Nasdaq listed company, until 2006, when the company was acquired. Mr. Jacobs’ b usiness experience includes the founding of Jacor Communications, Inc. in 1979, serving as Chairman and Chief Executive Officer as the company grew to be the ninth largest radio group in the United States, as well as the founding of Regent Communications, Inc. Mr. Jacobs holds a Bachelor of Business Administration and Master of Actuarial Science from Georgia State University and is a Fellow of the Casualty Actuarial Society and Member of the American Academy of Actuaries. Mr. Jacobs is a member of the Board of the National Football Foundation and College Hall of Fame. Among other attributes, skills, experiences and qualifications, our Board benefits from Mr. Jacob’s management experience, knowledge from service on several public company boards and business skills.

STEPHEN A McCONNELL became a member of our Board of Directors in April 2006. Mr. McConnell has served as the President of Solano Ventures, an investment fund devoted to small and mid-sized companies. Mr. McConnell currently serves on the board of Mobile Mini, Inc., a Nasdaq listed company. He was a director of Capital Title Group, Inc., a then Nasdaq listed company, until September 2006, when the company was acquired. He also was a director of Miracor Diagnostics, Inc., from August 2002 until October 2006. Mr. McConnell was Chairman and majority stockholder of G-L Industries, LLC, a Salt Lake City-based manufacturer of wood glue-lam beams used in the construction industry, from 1998 to 2004. Mr. McConnell served as Chairman of the Board of Mallco Lumber & Building Materials, Inc., a wholesale distributor of construction lumber and doors from September 1991 to June 1997. From 1991 to 1995, Mr. McConnell served as President of Belt Perry Associates, Inc., a property tax appeal firm. Mr. McConnell served as President and Chief Executive Officer of N-W Group, Inc., a publicly held corporation, from 1985 through 1991. Mr. McConnell holds a Bachelor’s degree from Harvard College and an MBA from Harvard Business School. Among other attributes, skills, experiences and qualifications, our Board benefits from Mr. McConnell’s knowledge of finance and accounting, current and prior service on public company boards, and experience as a public company chief executive officer.

GEORGE MELVILLE is a member of our Board of Directors and was a director of WPHL, Inc. from its inception in 1995 until May 2003. He also serves as a director and as Vice President of WPHL Holdings. Mr. Melville currently serves as one of two chairmen and owners of Boston Pizza. Together with Mr. Treliving, the other chairman of Boston Pizza, Mr. Melville has won the Pacific Canada Ernst & Young “Entrepreneur of the Year” award for Hospitality and Tourism and the British Columbia American Marketing Association’s “Marketer of the Year” award. Boston Pizza was named one of Canada’s “50 Best Managed Companies” 15 years in row and has won the Pinnacle “Company of the Year” award. Mr. Melville is also involved in the oil and gas, property construction and development industries. Prior to purchasing Boston Pizza with Mr. Treliving in 1983, Mr. Melville owned and operated multiple franchised Boston Pizza restaurants and was an accountant with Peat, Marwick, Mitchell & Co. Mr. Melville is an accredited Chartered Accountant. Among other attributes, skills, experiences and qualifications, our Board benefits from Mr. Melville’s knowledge of finance and accounting, director experience, business development accomplishments and experience with franchise businesses.

Certain entities affiliated with the JFP Group, LLC are involved in related civil actions brought by lenders to commercial real estate development projects owned or managed by JFP Group, LLC or its affiliates. Mr. Jacobs is a member, manager or guarantor of each of these entities. In November and December 2009, this litigation resulted in several foreclosure actions, and in at least two cases, the appointment of a receiver to oversee properties. Settlement negotiations are ongoing with respect to the litigation and underlying loans. The Board does not consider these actions as an impediment to Mr. Jacobs’ ability to faithfully and productively serve as a director of the Company.

All nominees have consented to be named and have indicated that they will serve if re-elected. If re-elected, each director will hold office until the next annual meeting of shareholders or until a successor is elected and qualified. If any nominee is not able to serve, the Board intends to fill the vacancy until another director nominee can be elected. The Board is unaware of any circumstance likely to make the nominees named above unavailable for election. Additional information about each of the nominated directors, and directors who served during the prior fiscal year, can be found in the “Directors and Executive Officers” section below.

The Board of Directors unanimously recommends a vote “FOR” the election of all nominees.

PROPOSAL NO. 2: RATIFICATION OF SELECTION OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Directors, upon the recommendation of the Audit Committee, has selected Semple, Marchal & Cooper, LLP, an independent registered public accounting firm, to audit the books, records, and accounts of the Company and its subsidiaries for the year ending May 31, 2011.

The firm of Semple, Marchal & Cooper, LLP audits our books annually, has offices in or convenient to the localities in the United States where the Company or its subsidiaries operate and is considered to be well qualified. Semple, Marchal & Cooper, LLP has audited our books since 2000.

Shareholder ratification of the selection of Semple, Marchal & Cooper, LLP as our independent registered public accounting firm is not required by our Bylaws or otherwise. Despite shareholder ratification of the selection of Semple, Marchal & Cooper, LLP, the Audit Committee and the Board, in their discretion, may direct the appointment of different independent registered public accounting firms at any time if they determine that such an appointment would be in the best interests of the Company and its shareholders.

Semple, Marchal & Cooper, LLP has no direct or indirect material financial interest in the Company or any of its subsidiaries. A representative of Semple, Marchal & Cooper, LLP is expected to be available at the Meeting and will be given the opportunity to make a statement on behalf of Semple, Marchal & Cooper, LLP, if they so desire. The representative also will be available to respond to questions raised by shareholders in attendance at the Meeting.

PRINICIPAL ACOUNTANT FEES AND SERVICES

AUDIT FEES

The aggregate fees billed by Semple, Marchal & Cooper, LLP for professional services rendered for the audit of our annual financial statements and review of our Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q, for the fiscal years ended May 31, 2010 and 2009, were approximately $107,000 and $152,000, respectively.

AUDIT RELATED FEES

In each of the last two fiscal years, there were no fees billed for assurance and related services rendered by the principal accountant that are reasonably related to the performance of the audit or review of our financial statements and are not reported under the “AUDIT FEES” paragraph above.

TAX FEES

Semple, Marchal & Cooper, LLP prepared the company’s tax returns for state and federal purposes. Tax return preparation fees billed in the fiscal years ended May 31, 2010 and 2009 were approximately $17,000 and $15,000, respectively.

ALL OTHER FEES

Other than the services described above under “Audit Fees”, during the fiscal year ended 2009, Semple, Marchal & Cooper, LLP also provided services related to a Securities and Exchange Commission compliance matter and billed related fees of approximately $16,000.

AUDIT COMMITTEE REPORT

The Audit Committee oversees the financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process including the systems of internal controls. In fulfilling its oversight responsibilities, the Committee reviewed the audited financial statements in the Annual Report on Form 10-K with management including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements.

The Committee reviewed and discussed with the independent registered public accountants, who are responsible for expressing an opinion on the conformity of those audited financial statements with generally accepted accounting principles in the United States, their judgments as to the quality, not just the acceptability, of our accounting principles and such other matters as are required to be discussed with the Committee under generally accepted auditing standards.

The Committee discussed with the Company’s independent registered public accountants, who are responsible for expressing an opinion on the conformity of the Company’s audited financial statements with generally accepted accounting principles in the United States, all matters required to be discussed by Statement on Auditing Standards No. 61. In addition, our independent registered public accountants also provided to the committee the written disclosures required by the applicable requirements of the Public Company Accounting Oversight Board relating to the independent registered public accountant’s communications with the Committee concerning independence. The Committee discussed with our independent registered public accounting fir m the overall scope and plans for their audit.

In reliance on the reviews and discussions referred to above, the Committee recommended to the Board of Directors (and the Board approved) that the audited financial statements be included in the Annual Report on Form 10-K for the year ended May 31, 2010, for filing with the Securities and Exchange Commission.

Terry S. Jacobs

Stephen A McConnell

George Melville

Dated: September 28, 2010

AUDIT COMMITTEE PRE-APPROVAL POLICIES AND PROCEDURES

All of the 2010 and 2009 audit services provided by Semple, Marchal & Cooper, LLP were approved by the Audit Committee. The Audit Committee implemented pre-approval policies and procedures related to the provision of audit and non-audit services. Under these procedures, the Audit Committee pre-approves both the type of services to be provided by our independent registered public accounting firm and the estimated fees related to these services. During the approval process, the Audit Committee considers the impact of the types of services and related fees on the independence of the registered public accounting firm. These services and fees must be deemed compatible with the maintenance of the registered public accounting firm’s independence, in compliance with the SEC rules and regulations. ; Throughout the year, the Audit Committee and, if necessary, the Board of Directors, reviews revisions to the estimates of audit and non-audit fees initially approved.

The Board of Directors unanimously recommends a vote “FOR” ratification of the appointment of Semple, Marchal &Cooper, LLP as our independent registered public accounting firm.

INFORMATION ABOUT THE COMPANY AND ITS MANAGEMENT

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

The directors, executive officers, and other key employees of the Company and their ages and their positions as of February 17, are as follows:

| Name | | Age | | Position | |

| | | | | |

| James Treliving | | 69 | | Director and Chairman of the Board |

| Richard Kozuback | | 56 | | Director, CEO and President |

| Terry S. Jacobs | | 68 | | Director |

| Stephen A McConnell | | 58 | | Director |

| George Melville | | 66 | | Director |

| Steven E. Lee | | 53 | | Executive Vice President and Chief Administrative Officer |

| Charles B. Mathews | | 47 | | Vice President and Chief Financial Officer |

JAMES TRELIVING is Chairman of the Board of Directors of the Company, serving in that position since 2003. He is also Chairman of the Board of Directors of WPHL Holdings, Inc. Mr. Treliving is a chairman and owner of Boston Pizza International, Inc., an $800 million (Canadian) full-service pizza and pasta restaurant franchise chain with over 300 locations in Canada. Mr. Treliving is also chief executive officer and owner of Boston Pizza Restaurants, LP, doing business as Boston’s the Gourmet Pizza, a full-service pizza and pasta restaurant franchise chain with over 50 locations in the United States and Mexico. Mr. Treliving has won the Pacific Canada Ernst & Young “Entrepreneur of the Year” award for Hospitality and Tourism and the British Columbia American Marketing Associati on’s “Marketer of the Year” award. Boston Pizza was named one of Canada’s “50 Best Managed Companies” for 15 years and has won the Pinnacle “Company of the Year” award. Mr. Treliving is also involved in the oil and gas, property construction and development industries. Prior to purchasing Boston Pizza with George Melville in 1983, Mr. Treliving owned and operated multiple franchised Boston Pizza restaurants. Among other attributes, skills, experiences and qualifications, our Board benefits from Mr. Treliving’s experience as a chief executive officer, business development accomplishments and experience with franchise businesses.

RICHARD KOZUBACK is a member of our Board of Directors and is the President and CEO of the Company, serving in that position since 2003. He is also a member of the Board of Directors of WPHL Holdings, Inc. Mr. Kozuback has over 30 years of experience in the hockey industry, having played Canadian Junior Hockey and having coached and managed various hockey teams in Canada and the United States. From 1993 to 1994, Mr. Kozuback was Head Coach and General Manager of the Tri-City Americans, a Western Hockey League team, as well as Head Coach of the Phoenix Cobras, a Roller Hockey International team. From 1991 to 1993, Mr. Kozuback was Associate Coach of the Phoenix Roadrunners, a member of the International Hockey League and farm team to the Los Angeles Kings, a National Hockey League team. & #160;Mr. Kozuback was Head Hockey Coach at the University of Wisconsin River Falls from 1986-1989 where his team won an NCAA Championship in the 1987-1988 season. From 1982 to 1986 Mr. Kozuback was owner, General Manager and Coach of the Penticton Knights Junior A Hockey team; Canadian Champions in 1985-1986. Mr. Kozuback attended the University of Alberta, Canada, where he received a degree in Education and taught at the high school level for eight years (British Columbia) and at the collegiate level (Wisconsin) for three years. Among other attributes, skills, experiences and qualifications, our Board benefits from Mr. Kozuback’s history with the Company, his leadership experience in the sports entertainment industry and his relationships in our industry.

TERRY S. JACOBS has been a member of our Board of Directors since 2000, is Chairman and Chief Executive Officer of Jamos Capital, LLC, a private equity management and investment company, and is Chairman, President and Chief Executive Officer of The JFP Group, LLC, a private real estate development, management and investment group since September 2005. Mr. Jacobs served as Chairman of the Board and Chief Executive Officer of Regent Communications, a Nasdaq listed company, which is the owner and operator of 75 radio stations in 15 markets, from its founding in September 1996 to September 2005. He currently serves as a member of the Board of Directors of American Financial Group, Inc., a NYSE Euronext listed company. He was a member of the Board of Directors of Capital Title Group, Inc., a then Nasdaq list ed company, until 2006, when the company was acquired. Mr. Jacobs’ business experience includes the founding of Jacor Communications, Inc. in 1979, serving as Chairman and Chief Executive Officer as the company grew to be the ninth largest radio group in the United States, as well as the founding of Regent Communications, Inc. Mr. Jacobs holds a Bachelor of Business Administration and Master of Actuarial Science from Georgia State University and is a Fellow of the Casualty Actuarial Society and Member of the American Academy of Actuaries. Mr. Jacobs is a member of the Board of the National Football Foundation and College Hall of Fame. Among other attributes, skills, experiences and qualifications, our Board benefits from Mr. Jacob’s management experience, knowledge from service on several public company boards and business skills.

STEPHEN A McCONNELL became a member of our Board of Directors in April 2006. Mr. McConnell has served as the President of Solano Ventures, an investment fund devoted to small and mid-sized companies. Mr. McConnell currently serves on the board of Mobile Mini, Inc., a Nasdaq listed company. He was a director of Capital Title Group, Inc., a then Nasdaq listed company, until September 2006, when the company was acquired. He also was a director of Miracor Diagnostics, Inc., from August 2002 until October 2006. Mr. McConnell was Chairman and majority stockholder of G-L Industries, LLC, a Salt Lake City-based manufacturer of wood glue-lam beams used in the construction industry, from 1998 to 2004. Mr. McConnell served as Chairman of the Board of Mallco Lumber & Building Ma terials, Inc., a wholesale distributor of construction lumber and doors from September 1991 to June 1997. From 1991 to 1995, Mr. McConnell served as President of Belt Perry Associates, Inc., a property tax appeal firm. Mr. McConnell served as President and Chief Executive Officer of N-W Group, Inc., a publicly held corporation, from 1985 through 1991. Mr. McConnell holds a Bachelor’s degree from Harvard College and an MBA from Harvard Business School. Among other attributes, skills, experiences and qualifications, our Board benefits from Mr. McConnell’s knowledge of finance and accounting, current and prior service on public company boards, and experience as a public company chief executive officer.

GEORGE MELVILLE is a member of our Board of Directors and was previously a director of WPHL, Inc. from its inception in 1995 until May 2003. He also serves as a Director and as Vice President of WPHL Holdings. Mr. Melville currently serves as one of two chairmen and owners of Boston Pizza. Together with Mr. Treliving, the other chairman of Boston Pizza, Mr. Melville has won the Pacific Canada Ernst & Young “Entrepreneur of the Year” award for Hospitality and Tourism and the British Columbia American Marketing Association’s “Marketer of the Year” award. Boston Pizza was named one of Canada’s “50 Best Managed Companies” 15 years in a row and has won the Pinnacle “Company of the Year” award. Mr. Melville is also involved in the oil and gas, property development, and construction industries. Prior to purchasing Boston Pizza with Mr. Treliving in 1983, Mr. Melville owned and operated multiple franchised Boston Pizza restaurants and was an accountant with Peat, Marwick, Mitchell & Co. Mr. Melville is an accredited Chartered Accountant. Among other attributes, skills, experiences and qualifications, our Board benefits from Mr. Melville’s knowledge of finance and accounting, director experience, business development accomplishments, and experience with franchise businesses.

STEVEN E. LEE has served as our Executive Vice President, Chief Administrative Officer and Secretary since September 2010. Prior to joining the Company, Mr. Lee was a Senior Vice President and General Counsel at Scott Communities, a residential home builder with operations in Arizona and Texas, where his responsibilities included negotiating land acquisitions, vendor contracts and sales contracts, managing forward planning, entitlements and IT functions and overseeing the company’s human resources from 2003 to May 2009. Mr. Lee is a licensed attorney in the State of Arizona.

CHARLES B. MATHEWS has served as our Vice President and Chief Financial Officer since October 2010. Since 2000 until he joined us, Mr. Mathews was the Managing Partner of Mathews & Mann, LLC, an accounting and business consulting firm in Phoenix, Arizona. From December 2007 to March 2009, Mr. Mathews was Chief Financial Officer of Education 2020, a virtual education company focused on students in grades 6-12. From March 2004 to November 2007, Mr. Mathews was Executive Vice President and Chief Financial Officer of Quepasa Corporation, a publicly held leading Hispanic internet portal. Mr. Mathews, a CPA, earned his B.A. in Business Administration from Alaska Pacific University and an MBA from Arizona State University.

Under current standards of the NYSE Euronext, Messrs. Jacobs, McConnell, Melville and Treliving are independent directors.

CODE OF ETHICS

We have a code of business ethics (“Code”) that applies to all of our employees, including our principal executive officer, principal financial officer and principal accounting officer. This code embodies our principles and practices relating to the ethical conduct of our business and our commitment to honesty, fair dealing and full compliance with all laws and regulations affecting our business. Our website address is www.globalentertainment2000.com. On our website we make available, free of charge, our code of ethics.

BENEFICIAL OWNERSHIP OF THE COMPANY’S SECURITIES

The following table sets forth, as of February 17, 2011, the number and percentage of outstanding shares of our common stock beneficially owned by i) each person known by us to beneficially own more than 5% of such stock, (ii) each of our directors, (iii) the Chief Executive Officer and each of the other named executive officers, and (iv) all directors and officers as a group. Except as otherwise indicated, we believe that each of the beneficial owners of its common stock listed below, based on information furnished by such owners, has sole investment and voting power with respect to such shares, subject to community property laws where applicable.

| Name and Address of Beneficial Owner (1) | | Shares | | | | |

| Beneficially | Percent of |

| Owned(2) | Total (3) |

| | | | | | | |

| James Treliving (4) | | 354,457 | | | 5.26 | % |

| Richard Kozuback (5) | | 490,068 | | | 7.32 | % |

| Terry S. Jacobs (6) | | 95,171 | | | 1.43 | % |

| Stephen A McConnell (7) | | 32,443 | | | 0.49 | % |

| George Melville (8) | | 435,236 | | | 6.45 | % |

| Rudy R. Miller (9) | | 521,210 | | | 7.72 | % |

| WPHL Holdings, Inc. (10) | | 2,750,000 | | | 41.32 | % |

| Ron Thom (11) | | 370,726 | | | 5.57 | % |

| David J. Contis (12) | | 650,891 | | | 9.78 | % |

| All executive officers and directors as a group (5 persons) (13) | | 1,407,375 | | | 20.42 | % |

| (1) | Unless otherwise noted, the mailing address of each of the listed shareholders is c/o Global Entertainment Corporation, 1600 North Desert Drive, Suite 301, Tempe, AZ 85281. |

| (2) | A person is deemed to be the beneficial owner of securities that that beneficial owner has the right to acquire within 60 days from February 17, 2011. |

| (3) | In calculating percentage ownership, all shares of common stock that the named shareholder has the right to acquire within 60 days of February 17, 2011, are deemed to be outstanding for the purpose of computing the percentage of common stock owned by such stockholder, but are not deemed outstanding for the purpose of computing the percentage of common stock owned by any other stockholder. Shares and percentages beneficially owned are based upon 6,656,062 shares outstanding on February 17, 2011. |

| (4) | Includes 3,000 shares held directly, 87,500 shares purchasable upon exercise of options, 262,819 shares beneficially owned by Mr. Treliving through his beneficial ownership interest in WPHL Holdings, Inc., and 1,138 shares beneficially owned by Mr. Treliving through his beneficial ownership interest in S&T Holdings. |

| (5) | Includes 40,000 shares purchasable upon exercise of options by Mr. Kozuback, 52,860 shares held directly and 397,208 shares beneficially owned by Mr. Kozuback through his beneficial ownership interest in WPHL Holdings, Inc. |

| (6) | Includes 75,171 shares held directly and 20,000 shares purchasable upon exercise of options. |

| (7) | Includes 32,443 shares held directly. |

| (8) | Includes 5,000 shares held directly, 87,500 shares purchasable upon exercise of options, 341,598 shares beneficially owned by Mr. Melville through his beneficial ownership interest in WPHL Holdings, Inc., and 1,138 shares beneficially owned by Mr. Melville through his beneficial ownership interest in S&T Holdings LTD. |

| (9) | Includes 428,210 shares owned by Miller Capital Corporation (MCC), for which Mr. Miller serves as Chairman, President, and Chief Executive Officer, 500 shares held directly by Mr. Miller, 32,500 shares purchasable upon exercise of options by Mr. Miller and 60,000 shares purchasable upon exercise of warrants by MCC. Mr. Miller beneficially owns all of the shares of our common stock held and warrants to purchase shares of our common stock held by MCC. |

| (10) | Shares of our common stock held by WPHL Holdings, Inc. are beneficially owned by the following persons who are the beneficial owners of more than 5% of our common stock (in the amounts indicated): Ron Thom (370,726), George Melville (341,598), James Treliving (262,819) and Richard Kozuback (397,208). |

| (11) | Includes 370,726 shares held by Mr. Thom through his beneficial ownership interest in WPHL Holdings, Inc. |

| (12) | Based on information in a Schedule 13D filed by David J. Contis with the SEC January 6, 2011. Mr. Contis reported that he has sole power to vote and dispose of all 650,891 shares. The address for Mr. Contis is Two North Riverside Plaza, Suite 600, Chicago, Illinois 60606. |

| (13) | Includes Messrs. Treliving, Kozuback, McConnell, Melville, and Jacobs. |

Board Leadership Structure and Risk Oversight

The Board of Directors has established a leadership structure in which responsibilities are allocated between the Chairman of the Board and the Chief Executive Officer. The Chief Executive Officer is responsible for setting strategic direction, leading the company day-to-day and, ultimately, the company’s performance. The Chairman provides guidance, establishes priorities and procedures for the work of the Board and presides over meetings of the Board. This structure enables the Chief Executive Officer to focus on the Company’s day-to-day business, while the independent Chairman focuses on leading the Board in its responsibilities of acting in the best interests of the Company and its stockholders. The Board has the discretion under the By-laws to combine the roles in the future i f it deems it advisable and in the best interest of the Company to do so.

Our management is primarily responsible for assessing and managing risk, while the Board oversees and reviews certain aspects of the Company’s risk management efforts. As part of that oversight, the Board meets regularly to discuss the strategic direction and the issues and opportunities facing the Company. Throughout the year, the Board provides guidance to management regarding strategy and critically reviews operating plans that are intended to implement that strategy. Each year, the Board holds a meeting with senior management dedicated to discussing and reviewing operating plans and overall corporate strategy. A discussion of key risks to the plans and strategy, as well as risk mitigation plans and activities, is conducted during that meeting. The involvement of the Board in setting business strategy is critical to the determination of the types and appropriate levels of risk undertaken by the Company. Also, more particularly, and as discussed below, the Audit Committee focuses on oversight of financial risks relating to the Company; the Compensation Committee focuses primarily on risks relating to remuneration of officers and other employees; and the Nominating and Governance Committee focuses on reputational and corporate governance risks relating to the Company.

BOARD MEETINGS AND COMMITTEES

The Board of Directors held six meetings during the fiscal year ended May 31, 2010. During this period, each Board member attended or participated in at least 75% of (i) the total number of meetings of the Board that were held while he was a member and (ii) the total number of meetings held by all committees of the Board on which he was a member and while he was a member.

During the year ended May 31, 2010, we had an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. The Audit Committee and Compensation Committee were each formed in October 2000 and the Nominating and Corporate Governance Committee was formed in April 2006. Effective November 1, 2010 the Board of Directors elected to consolidate the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee into the full Board and their functions will be performed by the full Board.

During the year ended May 31, 2010, the Audit Committee consisted of Messrs. Jacobs, McConnell and Melville. The Audit Committee, which adopted a formal written charter, made recommendations to the Board concerning the selection of outside auditors, reviews our financial statements and considers such other matters in relation to the internal controls and external audit of our financial affairs as may be necessary or appropriate in order to facilitate accurate and timely financial reporting. On our website, www.globalentertainment2000.com, we make available, our Audit Committee Charter. The Audit Committee was comprised of outside directors who are not officers or employees of the Company or its subsidiaries. In the opinion of the Board, and as “independent” is defined under the cu rrent standards of the NYSE Euronext, Messrs. Jacobs, McConnell and Melville are independent of management and free of any relationship that would interfere with their exercise of independent judgment as members of this committee. The Board has determined that Mr. Jacobs is an “audit committee financial expert,” as that term is defined in the rules and regulations promulgated by the Securities and Exchange Commission. In addition, the Board has determined that all members of the Audit Committee are financially literate, knowledgeable, and qualified to review our financial statements. The Audit Committee held five meetings during the fiscal year ended May 31, 2010.

Prior to the resignation of Messrs. Bowlin and Schwartz, the Compensation Committee was comprised of Messrs. Treliving, Bowlin and Schwartz, all of whom are “independent” as defined under the current standards of the NYSE Euronext. The Compensation Committee determined the salary and incentive compensation of our officers and provided recommendations for the salaries and incentive compensation for other employees. The Compensation Committee also administered our long-term incentive plans, including reviewing management recommendations with respect to option and restricted stock grants and taking other actions as may be required in connection with its compensation and incentive plans. Among other items, the Compensation Committee reviewed the profitability of the Company and industry standard s in determining executive and director compensation. The Compensation Committee, following consultation with the Chief Executive Officer, made recommendations to the Board of Directors regarding the amount and form of compensation of directors, executive officers and employees. The Compensation Committee held one meeting during the fiscal year ended May 31, 2010.

During the year ended May 31, 2010, the Nominating and Corporate Governance Committee developed and recommended to the full Board of Directors, a set of corporate governance principles and made recommendations for nominees to the Board of Directors. Prior to the resignation of Messrs. Bowlin and Schwartz, the Nominating and Corporate Governance Committee was comprised of Messrs. Schwartz, Bowlin, Jacobs and McConnell all of whom are “independent” as defined under the current standards of the NYSE Euronext. This Committee held no meetings during the fiscal year ended May 31, 2010. For the fiscal year ended May 31, 2010, the business of the Committee was conducted during meetings of the full Board of Directors, including the nomination of the directors included in this Proxy Statement. &# 160;The Nominating and Corporate Governance Committee does not currently have a charter.

We do not have a formal policy with regard to the consideration of diversity when considering candidates for election as directors, but believe that diversity is an important factor in determining the composition of the Board. Consequently, the Committee strives to nominate directors with diverse experience and backgrounds that complement each other so that, as a group, the Board will possess the appropriate talent, skills, and expertise to oversee the Company’s business. In considering whether to recommend any candidate for inclusion in the Board’s director nominees, including those submitted by stockholders, the Committee will apply the selection criteria set forth above.

Nominations of candidates for election as directors may be made by the Board of Directors.

In evaluating the suitability of potential nominees for membership on the Board, the Nominating and Governance Committee considered the Board’s current composition, including expertise, diversity, and balance of inside, outside and independent directors, and consider the general qualifications of the potential nominees, such as:

Unquestionable integrity and honesty;

The ability to exercise sound, mature and independent business judgment in the best interests of the shareholders as a whole;

Recognized leadership in business or professional activity;

A background and experience that will complement the talents of the other board members;

Willingness and capability to take the time to actively participate in board and committee meetings and related activities;

Ability to work professionally and effectively with other board members and the Company’s management;

An age to enable the director to remain on the Board long enough to make an effective contribution; and

Lack of realistic possibilities of conflict of interest or legal prohibition.

The Committee also saw that all necessary and appropriate inquiries are made into the backgrounds of such candidates. There are no stated minimum criteria for director nominees, although the Nominating and Corporate Governance Committee also consided such other factors as it deemed to be in the best interests of the Company and its shareholders. The Committee did not have a different policy with respect to the evaluation and consideration of nominations made by shareholders.

Any shareholder wishing to send communications to the Board of Directors or to any individual member of the Board should forward a written communication to the attention of the Secretary of the Company at the address listed on this information statement, and the Secretary will then forward such communications to the intended recipients. All written communications that pertain to legitimate shareholder interests and to legitimate business matters of the Company and that are otherwise appropriate matters for the Board to consider will be forwarded. The Board does not have a written policy regarding the attendance at annual meetings by all Directors. All of the directors attended the 2009 annual meeting held October 15, 2009.

DIRECTOR COMPENSATION

The following table sets forth compensation information with respect to our non-employee directors as of the end of the last fiscal year.

| Name | | Fees Earned or Paid in Cash (1) ($) | | | Stock Awards (2) ($) | | | Total ($) | |

| | | | | | | | | | | | | |

| James Treliving | | | 16,652 | | | | 700 | | | | 17,352 | |

| Michael L. Bowlin (3) | | | 14,199 | | | | 700 | | | | 14,899 | |

| Terry S. Jacobs | | | 21,525 | | | | 700 | | | | 22,225 | |

| Stephen A McConnell | | | 16,149 | | | | 700 | | | | 16,849 | |

| George Melville | | | 16,149 | | | | 700 | | | | 16,849 | |

| Mark Schwartz (3) | | | 16,654 | | | | 700 | | | | 17,354 | |

| (1) | Includes amounts paid in the fiscal year ended May 31, 2010, for fees. |

| (2) | All stock awards reflected are valued at the closing market price of our common stock on the October 15, 2009 grant date of $0.35 per share. |

| (3) | Messrs. Bowlin and Schwartz resigned from the Board, effective September 19, 2010. |

New non-employee directors were initially awarded 2,000 restricted shares and will receive an additional 2,000 restricted shares following each year that they serve as a director to the Company. Effective November 1, 2010, new non-employee directors are initially awarded 5,000 restricted shares and will receive an additional 5,000 restricted shares following each year that they serve as a director to the Company.

Effective November 1, 2010, the Company revised the non-employee compensation as a result of the elimination of the committees. Effective November 1, 2010, the revised non-employee director compensation included paying non-employee directors an annual retainer of $15,000, $1,000 per meeting, and $500 per telephonic meeting.

Effective December 1, 2009, the non-employee director compensation included paying non-employee directors an annual retainer of $9,000, $900 per meeting and $450 per telephonic meeting. In addition, each non-employee director received $450 for each Committee meeting. The Chairman of the Audit Committee received an additional annual retainer of $4,500 and other committee chairmen receive an annual retainer of $2,250.

For the period from June 1, 2009 until November 30, 2009, director compensation included paying non-employee directors an annual retainer of $10,000, $1,000 per meeting and $500 per phone-conference meeting. In addition, each non-employee director received $500 for each Committee meeting. The Chairman of the Audit Committee received an additional annual retainer of $5,000 and other committee chairmen received an annual retainer of $2,500.

In June 2010, the Company entered into an agreement with Boston Pizza Restaurants (USA), Inc. (“BPR”) which established a credit facility. As amended in August 2010, the Company borrowed $500 thousand, secured by the Company’s collectible accounts receivable. Under the terms of the agreement, borrowings must occur on or prior to June 30, 2011, and must be repaid in full by August 31, 2011. Interest on the outstanding principal balances was computed daily at the rate of prime plus 7% and was payable quarterly. In addition, the Company paid quarterly an amount equal to 0.5% of the unused commitment. The Company’s directors, James Treliving and George Melville, are the beneficial owners of 100% of BPR, significant shareholders of the Company, and directors of th e Company. In connection with the agreement, James Treliving and George Melville were each granted in July 2010 options for the purchase of 15 thousand shares of common stock, at a strike price of $0.20 per share. These options vested on December 31, 2010, and expire December 31, 2020. In December 2010, the outstanding balance of this credit facility was capitalized into a new line of credit and security agreement.

On December 13, 2010, the Company entered into a line of credit and security agreement with BPR. Under the agreement the Company may borrow up to $2,000,000, subject to certain limitations on the amount and frequency of borrowings. Borrowings can occur no more than once per month and must occur on or prior to April 30, 2011, and all outstanding amounts must be repaid in full by June 30, 2011. The Company has the right under the agreement to two successive six month extensions, provided that the Company pays an extension fee of $20 thousand for each such ex tension. Interest on the outstanding principal balances is computed daily at the rate of 12.75%. The agreement is secured by all of the accounts receivable of the Company and its subsidiaries and by a pledge of all of the Company's interest in the wholly-owned subsidiaries Global Entertainment Ticketing, a Nevada corporation and Western Professional Hockey League, Inc., a Texas corporation. The Agreement contains customary events of default, including failure to make payments when due or the dissolution, insolvency and bankruptcy of the Company. In connection with the agreement, Mr. Treliving and/or Mr. Melville, on a combined basis, will be granted options under the Company's 2007 Long-Term Incentive Plan for the purchase of 50 thousand shares of the Company’s common stock, at a strike price of $0.20 per share. The options will vest on June 30, 2011, and expire June 30, 2021.

EXECUTIVE COMPENSATION AND OTHER RELATED INFORMATION

The following table provides certain summary information concerning the compensation earned during the fiscal years ended May 31, 2010 and 2009, by our Chief Executive Officer and each officer whose salary and bonus was in excess of $100,000, for services rendered in all capacities to the Company and its subsidiaries. The individuals included in the following table will be referred to in this Proxy Statement as the named executive officers.

SUMMARY COMPENSATION TABLE

| | Year | | Salary ($) | | | All Other Compensation (1) ($) | | | Total ($) | |

| | | | | | | | | | | | | | |

| Richard Kozuback (2) | 2010 | | | 190,000 | | | | 9,250 | | | | 199,250 | |

| | 2009 | | | 200,000 | | | | 9,100 | | | | 209,100 | |

| | | | | | | | | | | | | | |

| James Domaz (3) | 2010 | | | 153,900 | | | | 1,500 | | | | 155,400 | |

| | 2009 | | | 162,000 | | | | 1,500 | | | | 163,500 | |

| | | | | | | | | | | | | | |

| James Yeager (4) | 2010 | | | 149,154 | | | | 1,500 | | | | 150,654 | |

| | 2009 | | | 157,008 | | | | 1,500 | | | | 158,508 | |

| (1) | Under the joint operating agreement with CHL, Inc., as modified June 4, 2008, the executive committee members of the Central Hockey League receive a fee of $8,500 per year beginning June 1, 2008. Mr. Kozuback is an executive committee member. For the fiscal year ended May 31, 2010 and the fiscal year ended May 31, 2009, Mr. Kozuback agreed to allocate $1,500 of this fee to Mr. Yeager and $1,500 of this fee to Mr. Domaz, and $5,500 to himself. The remainder of Mr. Kozuback’s other compensation in each year is car allowance. |

| (2) | Effective December 1, 2009, Mr. Kozuback agreed to temporarily reduce his salary from an annual base salary of $200,000 to an annual base salary of $180,000. Effective July 1, 2010, Mr. Kozuback agreed to further temporarily reduce his salary to an annual base salary of $160,000. |

| (3) | Effective December 1, 2009, Mr. Domaz agreed to reduce his salary from an annual base salary of $162,000 to an annual base salary of $145,800. Effective July 1, 2010, Mr. Domaz agreed to further reduce his salary to an annual base salary of $120,000. The Company eliminated the position of General Counsel as part of an internal reorganization, effective September 17, 2010, and Mr. Domaz’s employment was terminated as of that date. |

| (4) | Effective December 1, 2009, Mr. Yeager agreed to reduce his salary from an annual base salary of $157,000 to an annual base salary of $141,300. Effective July 1, 2010, Mr. Yeager agreed to further reduce his salary to an annual base salary of $120,000. Effective October 17, 2010, Mr. Yeager’s employment was terminated. |

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

| | | Option Awards | | | Stock Awards | |

| Name | | | Number of Securities Underlying Unexercised Options (#) Exercisable (1) | | | Option Exercise Price ($) | | | Option Expiration Date | | | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | | | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($) | |

| | | | | | | | | | | | | | | | |

| Richard Kozuback | | | 20,000 | | | | 5.75 | | | 02/23/2015 | | | | — | | | | — | |

| | | 10,000 | | | | 5.40 | | | 06/01/2015 | | | | — | | | | — | |

| | | 10,000 | | | | 8.50 | | | 11/18/2015 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

| James Domaz | | | — | | | | — | | | | — | | | | 2,500 | (2) | | | 500 | (3) |

| | | | | | | | | | | | | | | | | | | | | |

| James Yeager | | | — | | | | — | | | | — | | | | 3,750 | (2) | | | 750 | (3) |

| (1) | All options held by our named executive officers at May 31, 2010, are fully vested and exercisable. There were no options granted to our directors or executive officers during the fiscal year ended May 31, 2010. |

| (2) | Unvested stock awards were to vest one-half in October 2010 and the remaining one-half in October 2011. As a result of the termination of Mr. Domaz and Mr. Yeager prior to the vesting date, these awards were forfeited. |

| (3) | Value of unvested awards is calculated by taking the closing market price of our common stock on May 31, 2010, of $0.20 per share, multiplied by the number of restricted stock shares unvested. The amounts in these columns may not represent amounts actually realized by these officers. |

EMPLOYMENT AGREEMENTS AND CHANGE IN CONTROL ARRANGEMENTS

Effective April 18, 2010, the employment agreement with Mr. Kozuback automatically renewed for one year at an annual base salary of $200,000. Effective December 1, 2009, Mr. Kozuback agreed to temporarily reduce his salary to an annual base salary of $180,000. Effective June 1, 2010, Mr. Kozuback agreed to further temporarily reduce his salary to an annual base salary of $160,000.

EQUITY COMPENSATION PLAN INFORMATION (as of May 31, 2010)

| Plan Category | | | Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) | | | Weighted-average exercise price of outstanding options, warrants and rights (b) | | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) | |

| | | | | | | | | | |

| Equity compensation plans approved by security holders | | | | | | | | | |

| (a) 2000 Long-Term Incentive Plan | | | 291,000 | | | $ | 5.00 | | | | 307,149 | |

| (b) 2007 Long-Term Incentive Plan (1) | | | ¾ | | | | ¾ | | | | 259,100 | |

| Total | | | 291,000 | (2) | | $ | 5.00 | (2) | | | 566,249 | |

| (1) | 2007 Long-Term Incentive plan awards take the form of grants of restricted stock, as described more fully below. |

| (2) | Restricted stock issued under the 2007 Long-Term Incentive plan has been excluded from calculation of totals for columns (a) and (b). |

2000 LONG-TERM INCENTIVE PLAN

The Board of Directors and shareholders have adopted the Global Entertainment Corporation 2000 Long-Term Incentive Plan. The principal purpose of the plan is to promote the success, and enhance the value, of the Company by linking the personal interests of its key employees to those of its stockholders and by providing its key employees with an incentive for outstanding performance. The plan provides for a variety of compensation awards, including non-qualified stock options, incentive stock options that are within the meaning of Section 422 of the Internal Revenue Code, and restricted stock awards. Under the provisions of the plan, incentive stock options may not be granted under the plan after January 2011. Other types of awards may still be granted after January 2011.

A total of 750,000 shares of common stock are reserved for issuance under the plan. As of May 31, 2010, we had outstanding options to purchase 291,000 shares of common stock under the 2000 Long-Term Incentive Plan, with a weighted average exercise price of $5.00 per share. As of May 31, 2010, options to acquire 151,851 shares of common stock had been exercised, leaving 307,149 options available for issuance under the 2000 Long-Term Incentive Plan.

2007 LONG-TERM INCENTIVE PLAN

The Board of Directors and shareholders adopted the 2007 Long-Term Incentive Plan. The 2007 Plan authorizes the Board of Directors to grant restricted stock awards to selected officers, employees, outside consultants and directors of the Company or its wholly owned subsidiaries for up to an aggregate of 320,000 shares of our common stock. Awards to non-employee directors vest over two years, awards to officers and employees vest over four years, and awards made to consultants or advisors shall be determined by the Compensation Committee of the Board of Directors.

As of May 31, 2010, we had issued 28,000 shares of restricted stock with two year vesting terms to various directors as compensation for service on the Board, 12,500 shares to officers with various vesting terms, 6,400 shares to employees with various vesting terms and 14,000 shares of restricted stock with one year vesting terms as part of our financial consulting agreements with Miller Capital Corporation.

The Board of Directors, or the Compensation Committee of the Board of Directors, designates the participants in the plan, determines the type and amount of awards granted, the terms and conditions of each award, sets the exercise price of the awards, and makes all other decisions relating to the issuance of awards under the plan.

The Board of Directors, or the Compensation Committee of the Board of Directors, is authorized to terminate, amend or modify the plan. We have attempted to structure the plan in a manner such that remuneration attributable to stock options and other awards will not be subject to the deduction limitation contained in Section 162(m) of the Internal Revenue Code.

CERTAIN RELATIONSHIPS AND RELATED PARTIES

We have entered into agreements with Miller Capital Markets, LLC (MCM) and Miller Capital Corporation (MCC). Rudy Miller, a principal and major equity holder of MCM and MCC, beneficially held over 5% of our common stock as of the date of these agreements and the date of this Proxy Statement. During the year ended May 31, 2010, fees and expenses of approximately $159 thousand were incurred under these, and predecessor agreements.

Investment Banking Service Agreement

In March 2010, we entered into an investment banking service agreement with MCM. The agreement is effective February 2010, and has a term of one year. Pursuant to this agreement, MCM will advise us with respect to potential mergers, acquisitions, and public and private financing transactions.

In consideration for these services, MCM will receive 10% of the gross proceeds of any private placement of equity and 4% of the gross proceeds of any private placement of debt. With respect to public offerings, MCM will receive a percentage of the gross proceeds of such offerings as follows: (i) 2.75% for offerings of $10 million or less, (ii) 2.25% for offerings of $10 million to $20 million, (iii) 1.75% for offerings of $20 million to $30 million, and (iv) 1.25% of offerings of $30 million or more. MCM will also have the right to receive warrants to purchase shares or units equivalent to 10% of the shares or units issued as part of any equity transaction wherein MCM provided services under this agreement, with the exercise price of such warrants being equal to 110% of the per share or unit value of the equity s ecurities issued. Warrants would expire in five years from the date of the equity offering, and would include piggyback registration rights for MCM on any future registration statements we file. At any time within 12 months of a successful debt or equity financing event during the term of this agreement, MCM will have the right of first refusal to serve as our investment banker for any other financing transaction.

If we are acquired or involved in a merger with or acquisition of another business or entity, MCM will receive (i) 5% of the consideration from $1 up to $3 million, plus (ii) 4% of the consideration from $3 million to $6 million, plus (iii) 3% of the consideration from $6 million to $9 million, plus (iv) 2% of the consideration from $9 million to $12 million, plus (v) 1% of the consideration in excess of $12 million.

Financial Services Consulting Agreement

In March 2010, we entered into a consulting agreement with MCC. The agreement is effective February 2010, with a term of one year. MCC will provide financial consulting services related to our funding requirements, public and private debt and equity financing, potential merger and acquisition transactions, and investor relations. As consideration for its services, MCC will receive twelve monthly payments of $9 thousand each; additionally, MCC received a restricted stock grant of 2,000 shares of our common stock February in 2010 that vest in February 2011.

Loan and Security Agreement

In June 2010, we entered into a loan and security agreement with Boston Pizza Restaurants (USA), Inc. (BPR) which establishes a credit facility. As amended in August 2010, we may borrow up to $500 thousand, not to exceed the amount of our collectible accounts receivable. Under the terms of the agreement, borrowings must occur on or prior to June 30, 2011, and must be repaid in full by August 31, 2011. Interest on the outstanding principal balances is computed daily at the rate of prime plus 7% and is payable quarterly. In addition, we must pay quarterly an amount equal to 0.5% of any unused commitment. The agreement is secured by our accounts receivable. Our directors James Treliving and George Melville are the beneficial owners of 100% of BPR. In co nnection with the agreement, James Treliving and George Melville were each granted in July 2010 options for the purchase of 15,000 shares of common stock, at a strike price of $0.20 per share. The options will vested December 31, 2010, and expire December 31, 2020. In December 2010, the outstanding balance of this credit facility was capitalized into a new line of credit and security agreement.

On December 13, 2010, the Company entered into a line of credit and security agreement with BPR. Under the agreement the Company may borrow up to $2,000,000, subject to certain limitations on the amount and frequency of borrowings. Borrowings can occur no more than once per month and must occur on or prior to April 30, 2011, and all outstanding amounts must be repaid in full by June 30, 2011. The Company has the right under the agreement to two successive six month extensions, provided that the Company pays an extension fee of $20 thousand for each such extension. Interest on the outstanding principal balances is computed daily at the rate of 12.75%. The agreement is secured by all of the accounts receivable of The Company and its subsidiaries and by a pledge of all of the Company's interest in the wholly-owned subsidiaries Global Ente rtainment Ticketing, a Nevada corporation and Western Professional Hockey League, Inc., a Texas corporation. The Agreement contains customary events of default, including failure to make payments when due or the dissolution, insolvency and bankruptcy of the Company. In connection with the agreement, Mr. Treliving and/or Mr. Melville, on a combined basis, will be granted options under the Company's 2007 Long-Term Incentive Plan for the purchase of 50 thousand shares of the Company’s common stock, at a strike price of $0.20 per share. The options will vest on June 30, 2011, and expire June 30, 2021.

Ticket Processing Agreement

In August 2010, we entered into a ticket processing agreement with brand.LIVE Management Group, Inc. (brand.LIVE). Our directors James Treliving and George Melville are the beneficial owners of a majority interest in brand.Live. The agreement terminates June 12, 2012 absent early termination in accordance with the terms of the agreement. Either party may extend the term an additional two years by giving the other party written notice prior to June 12, 2012. Under the terms of the agreement, we receive fees for each ticket processed for brand.LIVE. We expect to receive fees of approximately $100,000 in fiscal year 2011 under this agreement.

SHAREHOLDER PROPOSALS FOR 2011 SHAREHOLDERS’ MEETING

Shareholders are entitled to present proposals for action at a forthcoming meeting if they comply with the requirements of the proxy rules promulgated by the SEC and our Bylaws. Proposals of stockholders of the Company intended to be presented for consideration at our 2011 Annual Meeting of Shareholders and included in our proxy statement for that year must be received by the Company no later than May 31, 2011, in order that they be included in any proxy statement and form of proxy related to that meeting.

OTHER BUSINESS

The Board does not know of any other business to be presented at the Meeting and does not intend to bring before the Meeting any matter other than the proposals described herein. However, if any other business should come before the Meeting, or any adjournments thereof, the persons named in the accompanying proxy will have discretionary authority to vote all proxies.

Regardless of the number of shares you own, it is important that your shares be represented at the Meeting. Accordingly, you are respectfully requested to mark, sign, date, and return the accompanying proxy card at your earliest convenience.

By order of the Board of Directors,

Charles B. Mathews

Chief Financial Officer