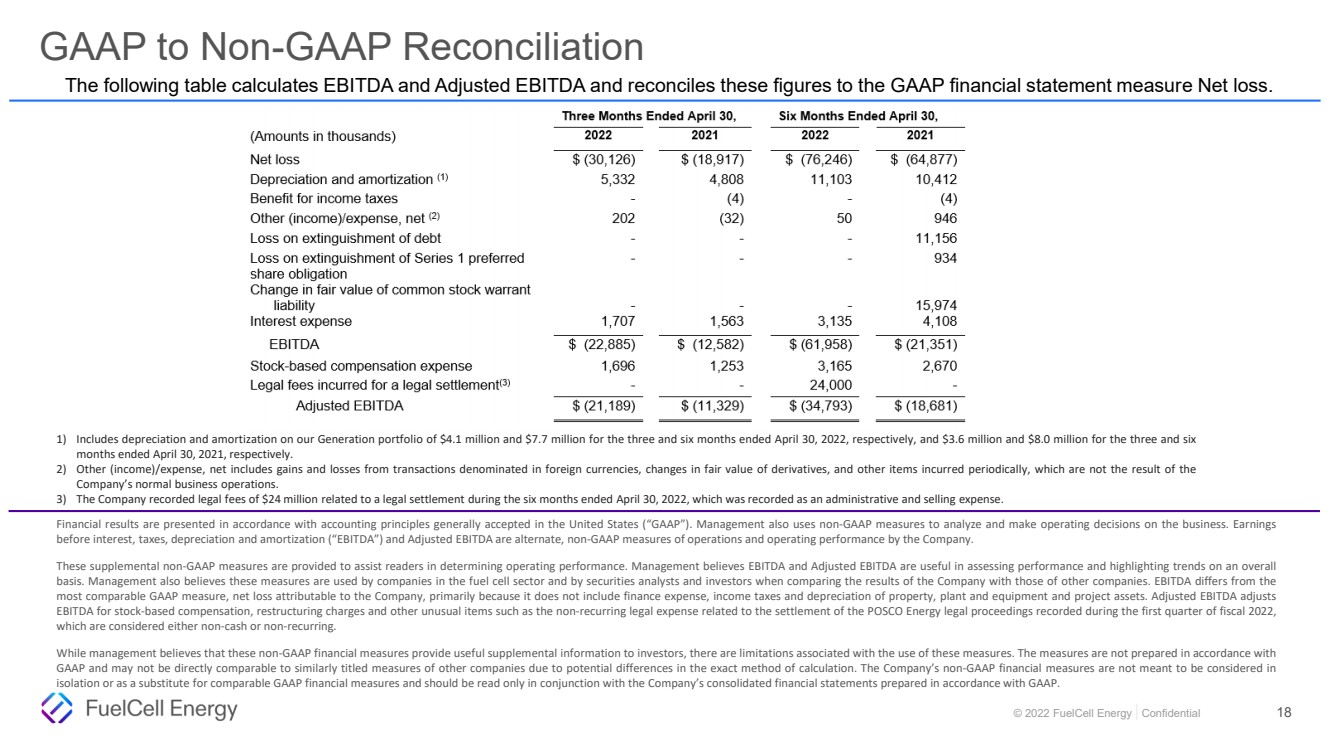

| © 2022 FuelCell Energy Confidential 2 This presentation contains forward - looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 regarding future events or our future financial performance that involve certain contingencies and uncertainties, including those discussed in our Annual Report on Form 10 - K for the fiscal year ended October 31 , 2021 , in the section entitled "Management's Discussion and Analysis of Financial Condition and Results of Operations” .. The forward - looking statements include, without limitation, statements with respect to the Company’s anticipated financial results and statements regarding the Company’s plans and expectations regarding the continuing development, commercialization and financing of its current and future fuel cell technologies, the expected timing of completion of the Company’s ongoing projects, the Company’s business plans and strategies, the markets in which the Company expects to operate, and the size and scope of its total addressable market opportunities, which is an estimate based on currently available public information and the application of management’s current assumptions and business judgment .. Projected and estimated numbers contained herein are not forecasts and may not reflect actual results .. These forward - looking statements are not guarantees of future performance, and all forward - looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those projected .. Factors that could cause such a difference include, without limitation : general risks associated with product development and manufacturing ; general economic conditions ; changes in interest rates, which may impact project financing ; supply chain disruptions ; changes in the utility regulatory environment ; changes in the utility industry and the markets for distributed generation, distributed hydrogen, and fuel cell power plants configured for carbon capture or carbon separation ; potential volatility of commodity and energy prices that may adversely affect our projects ; availability of government subsidies and economic incentives for alternative energy technologies ; our ability to remain in compliance with U .. S .. federal and state and foreign government laws and regulations and the listing rules of The Nasdaq Stock Market ; rapid technological change ; competition ; the risk that our bid awards will not convert to contracts or that our contracts will not convert to revenue ; market acceptance of our products ; changes in accounting policies or practices adopted voluntarily or as required by accounting principles generally accepted in the United States ; factors affecting our liquidity position and financial condition ; government appropriations ; the ability of the government and third parties to terminate their development contracts at any time ; the ability of the government to exercise “march - in” rights with respect to certain of our patents ; our ability to successfully market and sell our products internationally ; our ability to implement our strategy ; our ability to reduce our levelized cost of energy and deliver on our cost reduction strategy generally ; our ability to protect our intellectual property ; litigation and other proceedings ; the risk that commercialization of our products will not occur when anticipated or, if it does, that we will not have adequate capacity to satisfy demand ; our need for and the availability of additional financing ; our ability to generate positive cash flow from operations ; our ability to service our long - term debt ; our ability to increase the output and longevity of our platforms and to meet the performance requirements of our contracts ; our ability to expand our customer base and maintain relationships with our largest customers and strategic business allies ; changes by the U .. S .. Small Business Administration or other governmental authorities to, or with respect to the implementation or interpretation of, the Coronavirus Aid, Relief, and Economic Security Act, the Paycheck Protection Program or related administrative matters ; and concerns with, threats of, or the consequences of, pandemics, contagious diseases or health epidemics, including the novel coronavirus, and resulting supply chain disruptions, shifts in clean energy demand, impacts to our customers’ capital budgets and investment plans, impacts to our project schedules, impacts to our ability to service existing projects, and impacts on the demand for our products, as well as other risks set forth in the Company’s filings with the Securities and Exchange Commission, including the Company’s Annual Report on Form 10 - K for the fiscal year ended October 31 , 2021 .. The forward - looking statements contained herein speak only as of the date of this presentation .. The Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any such statement contained herein to reflect any change in the Company’s expectations or any change in events, conditions or circumstances on which any such statement is based .. The Company refers to non - GAAP financial measures in this presentation. The Company believes that this information is useful to understanding its operating results and assessing performance and highlighting trends on an overall basis. Please refer to the Company’s earnings release and the appendix to t his presentation for further disclosure and reconciliation of non - GAAP financial measures. (As used herein, the term “GAAP” refers to generally accepted accounting principles in the U.S.) The information set forth in this presentation is qualified by reference to, and should be read in conjunction with, our Annu al Report on Form 10 - K for the fiscal year ended October 31, 2021, filed with the SEC on December 29, 2021, our Form 10 - Q for the three months ended April 30, 2022, filed with the SEC on Ju ne 9, 2022, and our earnings release for the second fiscal quarter of 2022, filed as an exhibit to our Current Report on Form 8 - K filed with the SEC on June 9, 2022. Safe Harbor Statement |