2014 and Beyond Analyst Day Chicago - November 14, 2013 NASDAQ: LGND

2 The following presentation contains forward-looking statements regarding Ligand’s prospects, plans and strategies, drug development programs and collaborations. Forward-looking statements include financial projections, expectations regarding research and development programs, and other statements including words such as “will,“ “should,” “could,” “plan,” etc. Actual events or results may differ from Ligand’s expectations. For example, drug development program benefits may not be realized and there can be no assurance that Ligand will achieve its guidance in 2013 or thereafter or that third party research summarized herein is correct or complete. The forward-looking statements made in the presentation are subject to several risk factors, including, statements regarding intent, belief, or current expectations of the Ligand, its internal and partnered programs, including Promacta®, Kyprolis™, and Duavee™, Ligand’s reliance on collaborative partners for milestone and royalty payments, royalty and other revenue projections based on third party research, regulatory hurdles facing Ligand's and partner's product candidates, uncertainty regarding Ligand's and partner's product development costs, the possibility that Ligand's and partner's drug candidates might not be proved to be safe and efficacious and commercial performance of Ligand's and/or its partner's products, risks related to Ligand’s internal controls, its compliance with regulations, accounting principles and public disclosure, and other risks and uncertainties described in its public filings with the Securities and Exchange Commission, available at www.sec.gov. Additional risks may apply to forward-looking statements made in this presentation. Our trademarks, trade names and service marks referenced herein include Ligand and Captisol. Each other trademark, trade name or service mark appearing in this presentation belongs to its owner. Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect our good faith beliefs (or those of the indicated third parties) and speak only as of the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement, and Ligand undertakes no obligation to revise or update this presentation to reflect events or circumstances or update third party research numbers after the date hereof. This caution is made under the safe harbor provisions of Section 21E of the Securities Exchange Act of 1934. Safe Harbor Statement

3 Agenda 1) Business Overview • Events Transforming Ligand • 2014 Growth and Beyond John Higgins President & CEO 2) “Shots-on-Goal” Portfolio Select Program Updates Nishan de Silva, M.D., VP, Corporate Development 3) Research & Technology Platform Highlights of Key Assets Matt Foehr Chief Operating Officer 4) Menopause: Yesterday, Today and Tomorrow Cynthia A. Stuenkel, M.D. 5) Glucagon Keith Marschke, Ph.D., VP, Biology 6) Financial Overview and Outlook John Sharp Chief Financial Officer

4 Ligand . . . 2014 and Beyond • 2013 was a break-out year for Ligand turning sustainably profitable and realizing major portfolio events • Today, Ligand is transforming into a high-growth financial company with economic rights to some of the world’s most important medicines • Our “Shots-on-Goal” business model is stronger than ever and projected to continue to drive the business significantly for the next 15 years and beyond • Company has the potential to realize accelerated growth given projected: — Near doubling of revenue generating assets over the next year — Significant increase in profitability and cash-flow

5 Excellent Productivity Recently from 3 Main Pillars of the Business • Outlook: Continued strong performance among all three projected for 2014 Largest Assets Financial Performance Portfolio Promacta 38% Kyprolis 261 % Captisol sales New data, regulatory and commercial events Extraordinary P&L efficiency Bold movement into turning profitable cash- flow positive Added 20 net assets 2 approvals 6 P3 results/NDAs filed 2 Orphan Designations

6 What’s Happened Over Past 12 Months Approvals for Major New Markets and Drugs New Licenses Adding >$100 m of Potential Fees and Royalties Late Stage Clinical Advances Acquisition that Substantially Increased Assets Financials Promacta-HCV Duavee Spectrum CURx Ethicor Azure Others BACE CE-Melphalan Carbamazepine IV Noxafil IV Promacta ORT Selexis First year operational profitability Cash-flow positive 110% increase in shareholder’s equity 56% reduction in debt

. . . By the Numbers 7

90 Over 8 Fully funded Shots-on-Goal

4 9 New partnered products expected to launch in 2014

20 Partnered products by 2020 10

$700 Million 11 In potential milestone payments from existing deals Over

$800 Million 12 Projected R&D investment by our partners on our programs in the next year Over

80 Over 13 Clinical trials run by our partners in 2014

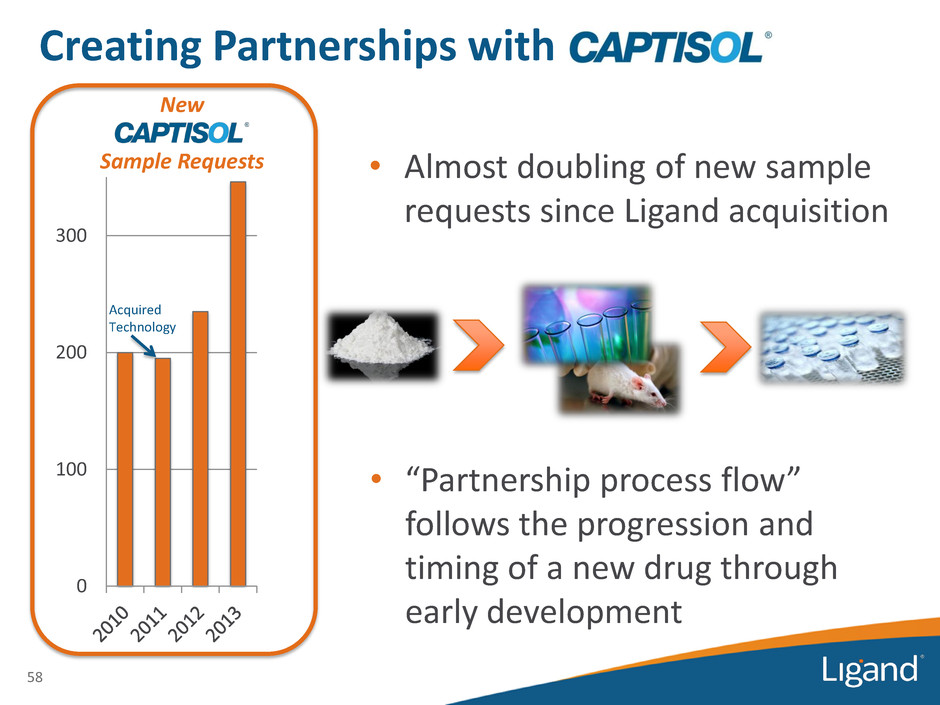

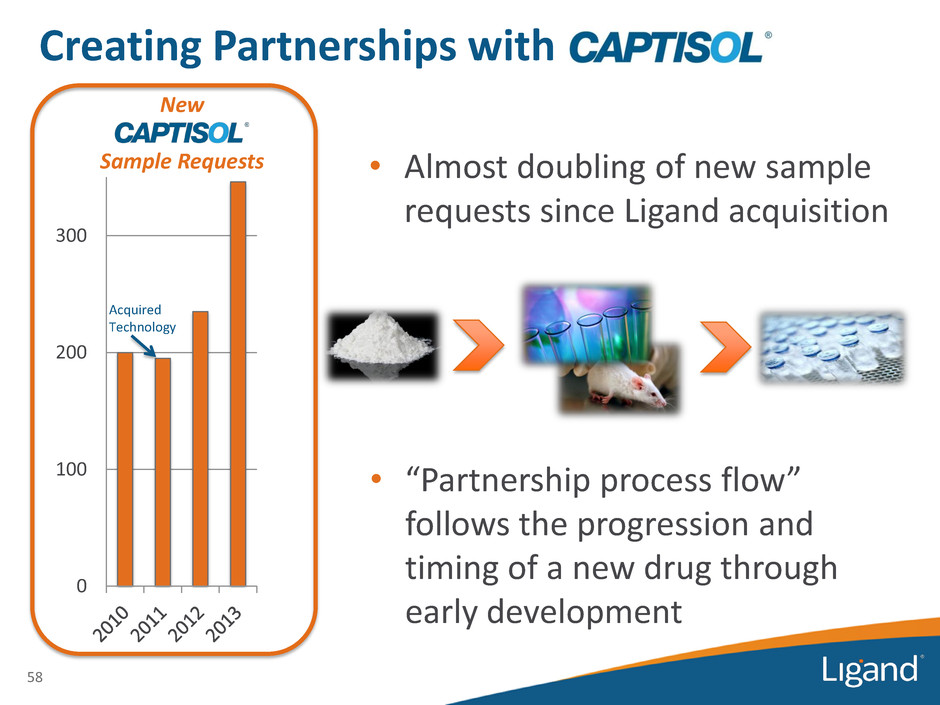

77% 14 Increase in requests for Captisol samples since we acquired the technology

$800 Million 15 In gross tax assets Over

85% 16 Net income compounded annual growth rate projected for next three years Over

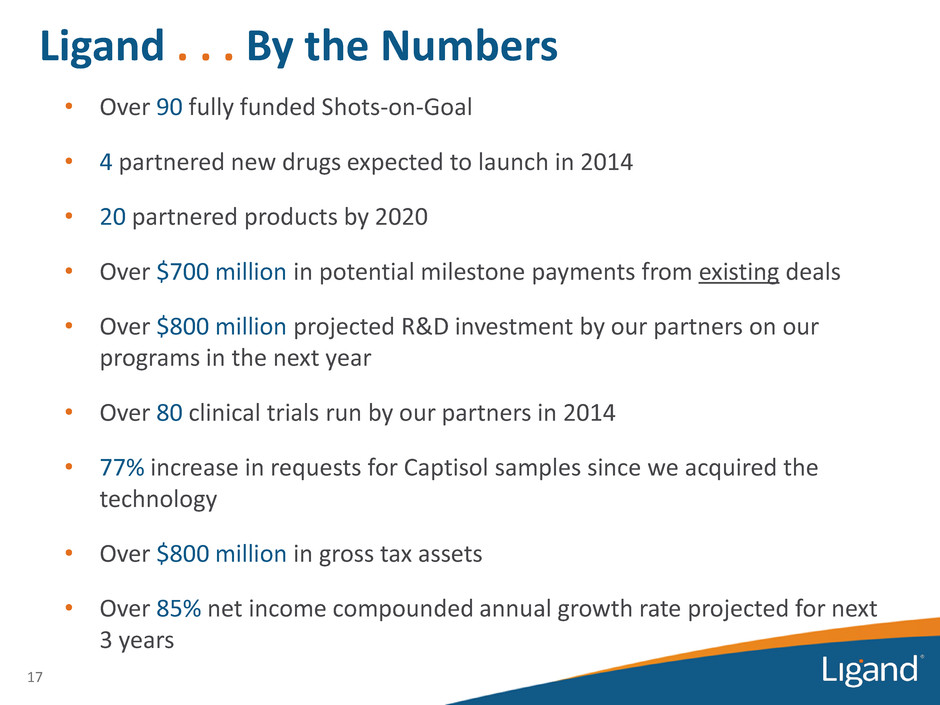

17 • Over 90 fully funded Shots-on-Goal • 4 partnered new drugs expected to launch in 2014 • 20 partnered products by 2020 • Over $700 million in potential milestone payments from existing deals • Over $800 million projected R&D investment by our partners on our programs in the next year • Over 80 clinical trials run by our partners in 2014 • 77% increase in requests for Captisol samples since we acquired the technology • Over $800 million in gross tax assets • Over 85% net income compounded annual growth rate projected for next 3 years Ligand . . . By the Numbers

18 Pharmaceutical Royalties Economic rights to some of the industry's most exciting programs Why is Ligand a Compelling Company?

19 Why is Ligand a Compelling Company? Driving • Novel and pioneering research for significant programs • Cutting-edge formulation technology that is making major drugs possible • Investor-oriented business model with a uniquely qualified team for executing the plan Beyond an extraordinary portfolio of royalties, what else makes Ligand special?

“Shots-on-Goal” Business Model

21 • Ligand’s business model is premised on these basic principals: — The more programs in development the more likely you will have success — A company does not need to retain full program rights to generate significant revenue and cash flow “Shots-on-Goal” Business Model

22 • Ligand has two primary business objectives: — Drive R&D to earliest inflection point for partnering — Acquire assets efficiently to further build portfolio • The Goal: Above average returns, below average risk — Economic rights to major pharma programs — High-margin, high-growth, recurring revenue — Low costs, lean capital structure — Broad portfolio diversity “Shots-on-Goal” Business Model

23 0 20 40 60 80 100 2007 2013 9 90 + In six years… 10x increase in fully-funded programs 6x increase in royalty bearing products What does this tell us? 1. We are executing well to expand our portfolio 2. Our partners are doing their job getting new products to the market Partnered Programs Ligand’s Business Model is Thriving

• We estimate our partners will spend over $800 million next year in R&D to advance our programs — 14 Phase 3 trials — 23 Phase 2 trials — 42 Phase 1 trials — 2 Phase 4 trials — 19 preclinical programs — Manufacturing scale-up — Regulatory filing fees Ligand’s Business Model is Thriving Fully-funded partnerships driving future growth 24

25 Research Technology Deal Making Strong Execution Continues to Define Ligand Driving Largest Portfolio of Royalty Assets Ever for Ligand

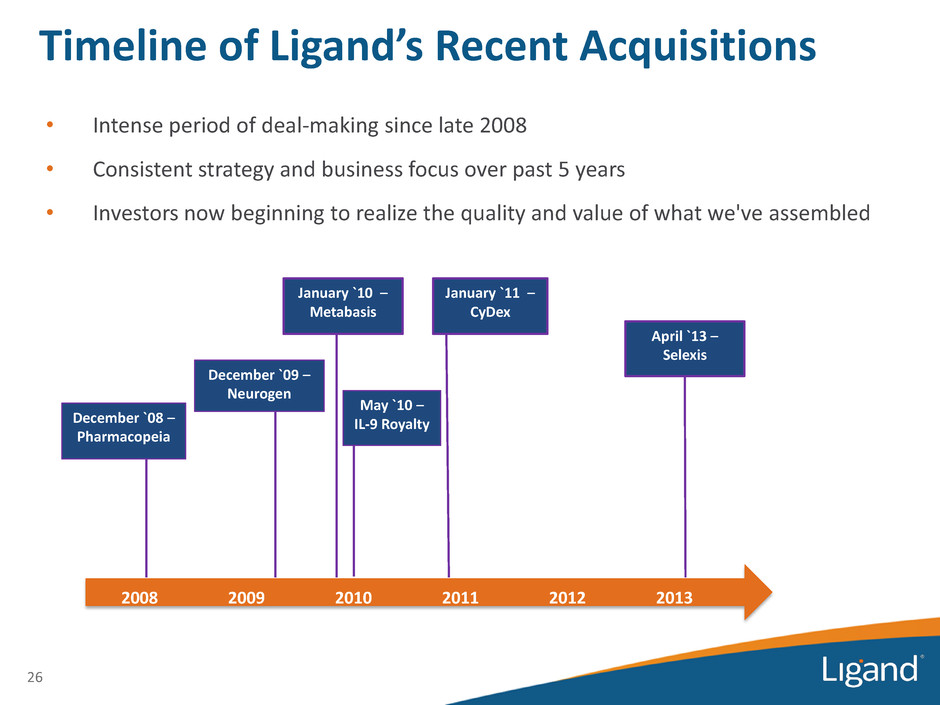

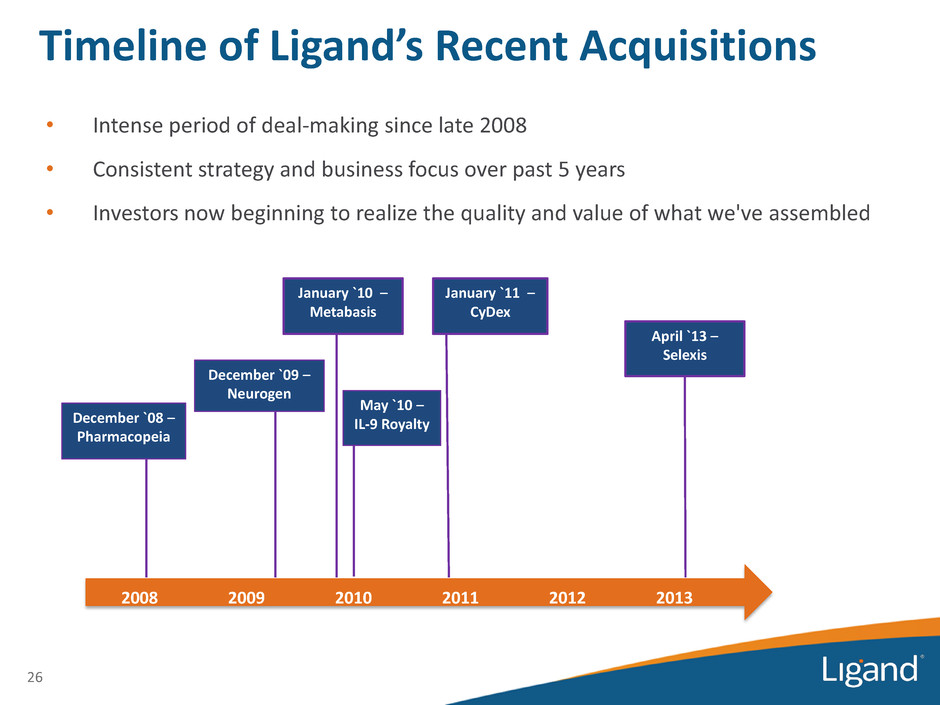

26 • Intense period of deal-making since late 2008 • Consistent strategy and business focus over past 5 years • Investors now beginning to realize the quality and value of what we've assembled Timeline of Ligand’s Recent Acquisitions December `08 – Pharmacopeia December `09 – Neurogen January `10 – Metabasis May `10 – IL-9 Royalty January `11 – CyDex April `13 – Selexis 2008 2009 2010 2011 2012 2013

27 Ligand is uniquely positioned to generate significant cash flow per share – High-quality revenue – High gross margins – Low operating costs – Significant tax assets – Low share count Ligand . . . 2014 and Beyond

28 $ billi o n s $ billi o n s High Low Average Sales figures converted from GBP to USD Conversion rate = 1.60 9 GSK covering analysts reports as of 10/23/13 19 AMGN covering analysts reports as of 10/22/13 Revenue Outlook for Two Blockbusters Sell-Side Analyst Projections

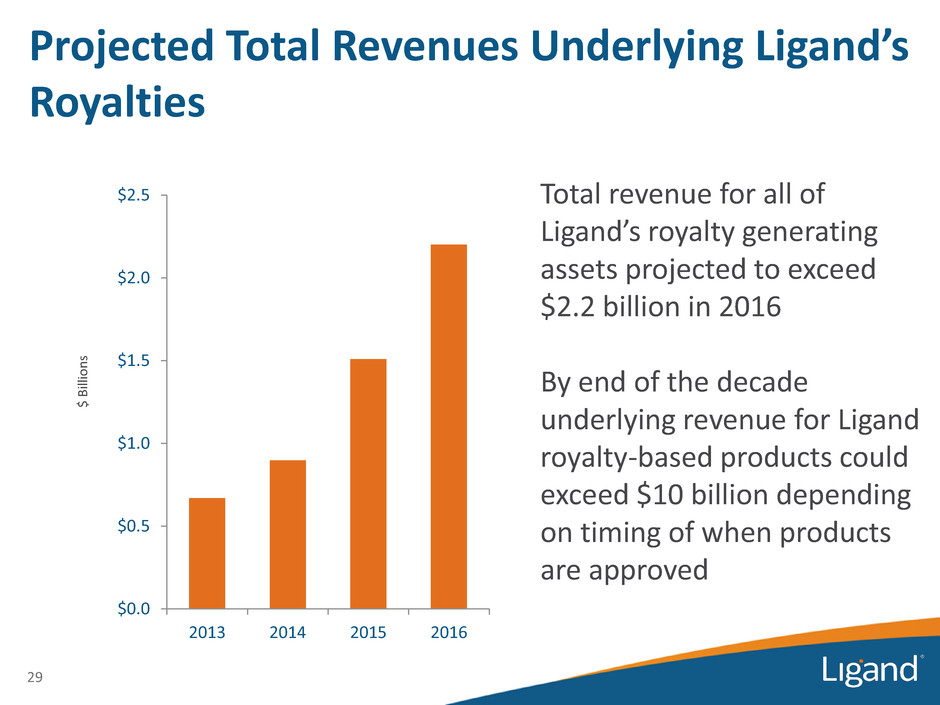

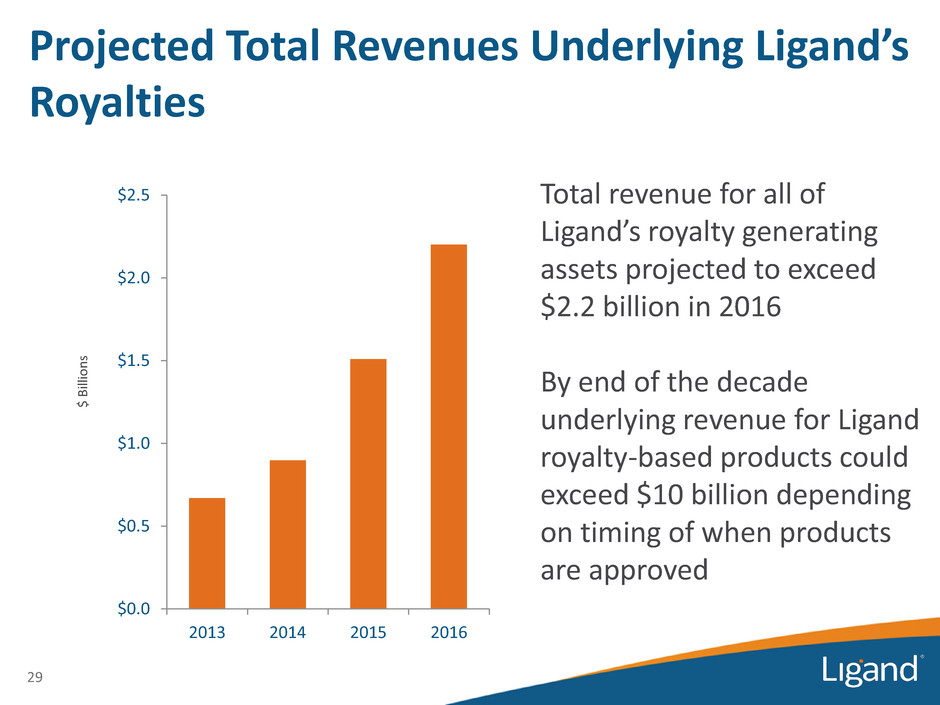

29 Projected Total Revenues Underlying Ligand’s Royalties $ Bi lli o n s $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 2013 2014 2015 2016 Total revenue for all of Ligand’s royalty generating assets projected to exceed $2.2 billion in 2016 By end of the decade underlying revenue for Ligand royalty-based products could exceed $10 billion depending on timing of when products are approved

30 Royalties > $165 million Deal Fees, Material Sales >$35 million • Fablyn • Dela IV • Nexterone • Carb IV • Conbriza • RE - 021 • CE - Topi • More than quadrupling of revenue in 5 years • No increase in operating expense required to produce this growth • Does not assume any royalty contributions from other 50+ programs not mentioned on this slide • Promacta • Kyprolis • Duavee • Melphalan Illustrative Potential Revenue >$200 $0 $30 $60 $90 $120 $150 $180 $210 2013 2018 $ m ill io n s Illustrative 2018 Ligand Revenue Potential >$200 million $45 - $46

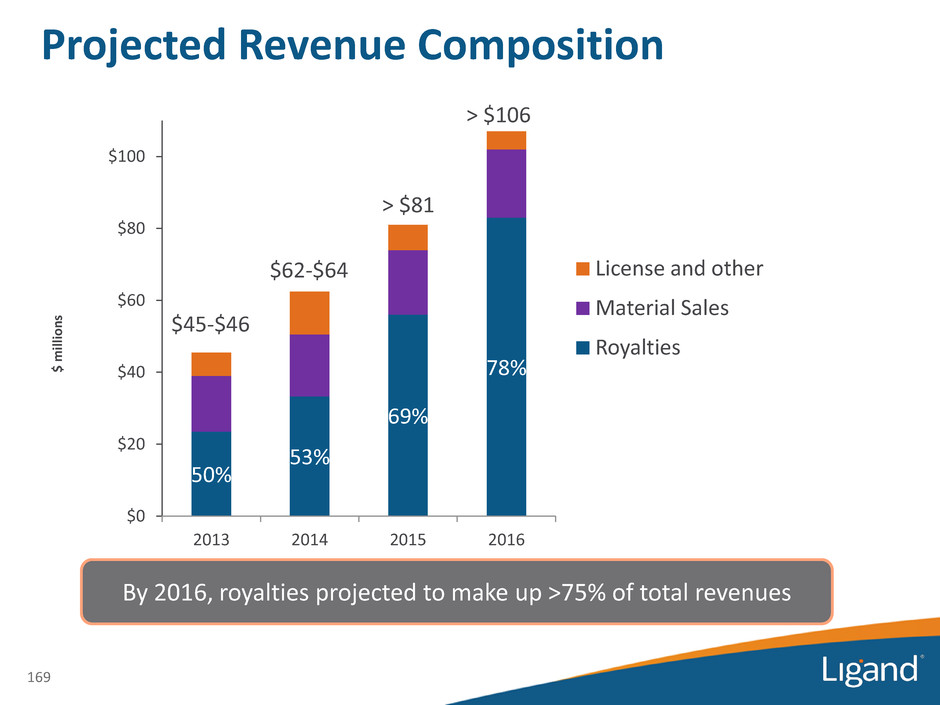

31 • High annual revenue growth projected for next three years — 2014: $62 - $64 million — 2015: > $81 million — 2016: > $106 million • Low annual cash expenses of approximately $20 million per year • Significant earnings per share growth projected next three years — 2014: $1.40 - $1.45 — 2015: > $2.13 — 2016: > $3.18 Three-Year Financial Outlook EPS Outlook based on Non-GAAP EPS (excludes CVRs, discontinued operations and stock-based comp)

32 1) Acquire assets to continue building “Shots-on-Goal” portfolio 2) Return capital to shareholders: — Dividends — Share repurchases What Does Ligand Plan To Do with Its Excess Cash?

33 Portfolio Overview Nishan de Silva

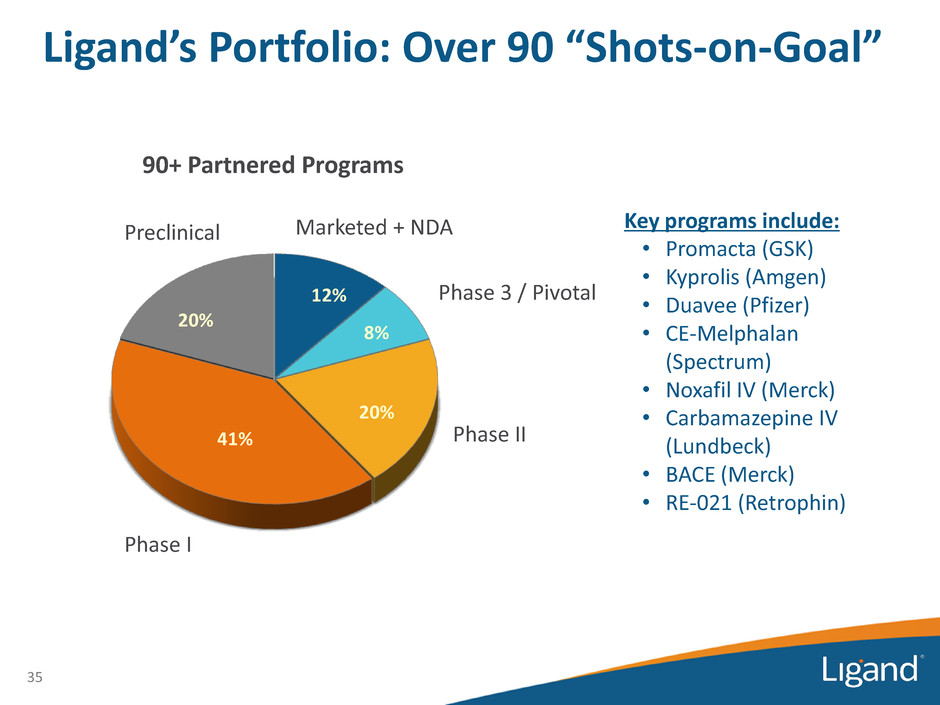

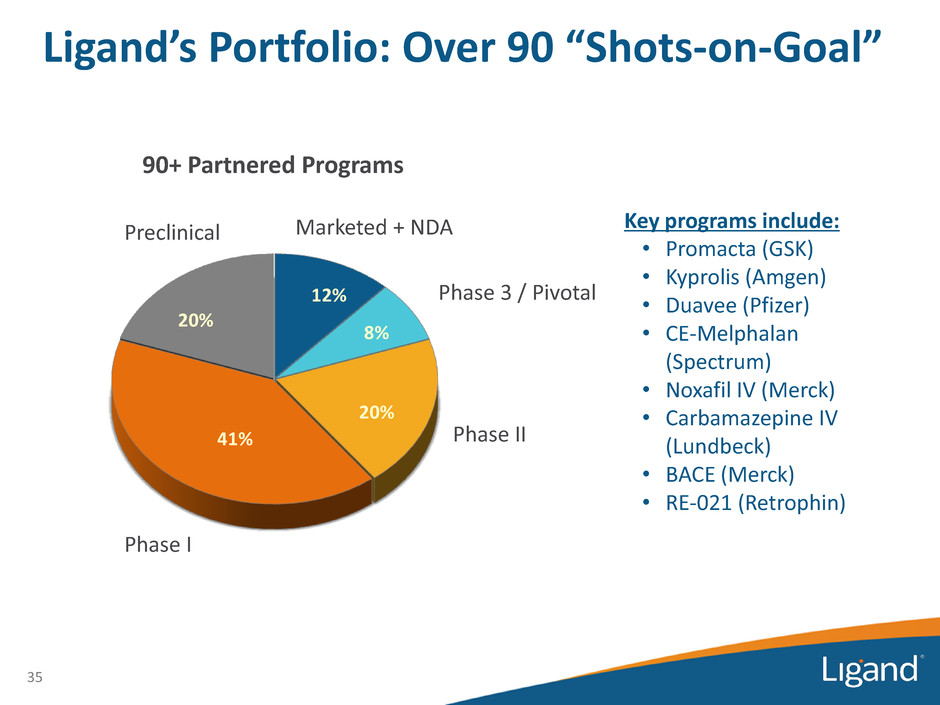

• Large and diverse portfolio of opportunities maximizes odds of business success • Ligand has a robust portfolio of partnered programs • Portfolio has grown by more than 20 programs net in the last year through acquisitions and licensing deals Ligand’s Business Model: “Shots-on-Goal” 34

12% 8% 20% 41% 20% 35 Preclinical Marketed + NDA Phase 3 / Pivotal Phase II Phase I Key programs include: • Promacta (GSK) • Kyprolis (Amgen) • Duavee (Pfizer) • CE-Melphalan (Spectrum) • Noxafil IV (Merck) • Carbamazepine IV (Lundbeck) • BACE (Merck) • RE-021 (Retrophin) 90+ Partnered Programs Ligand’s Portfolio: Over 90 “Shots-on-Goal”

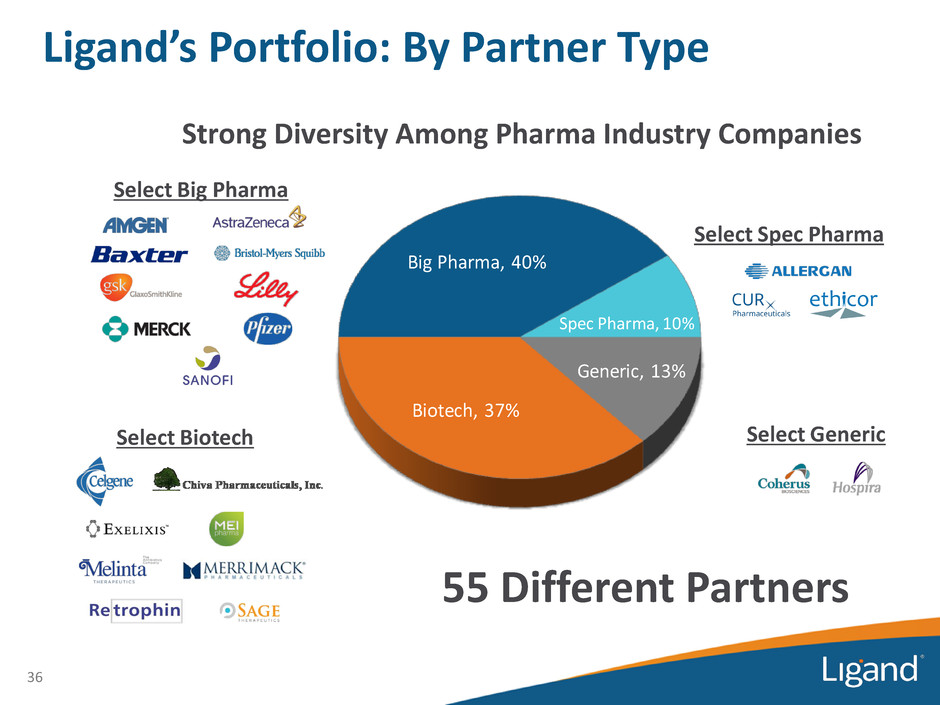

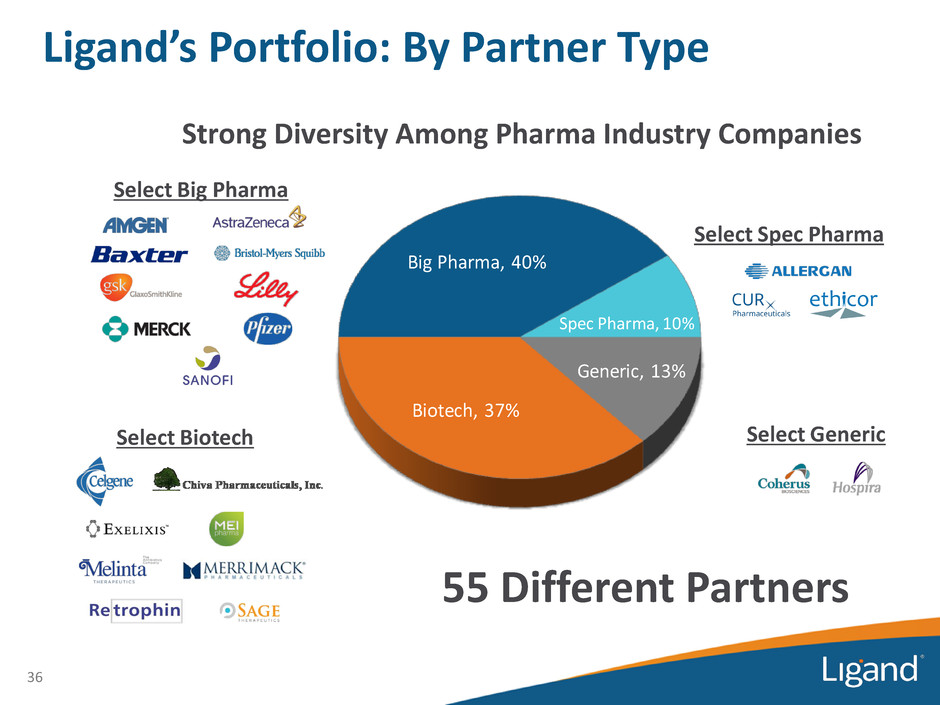

Biotech, 37% Big Pharma, 40% Spec Pharma, 10% Generic, 13% 36 55 Different Partners Select Big Pharma Select Biotech Strong Diversity Among Pharma Industry Companies Select Spec Pharma Select Generic Ligand’s Portfolio: By Partner Type

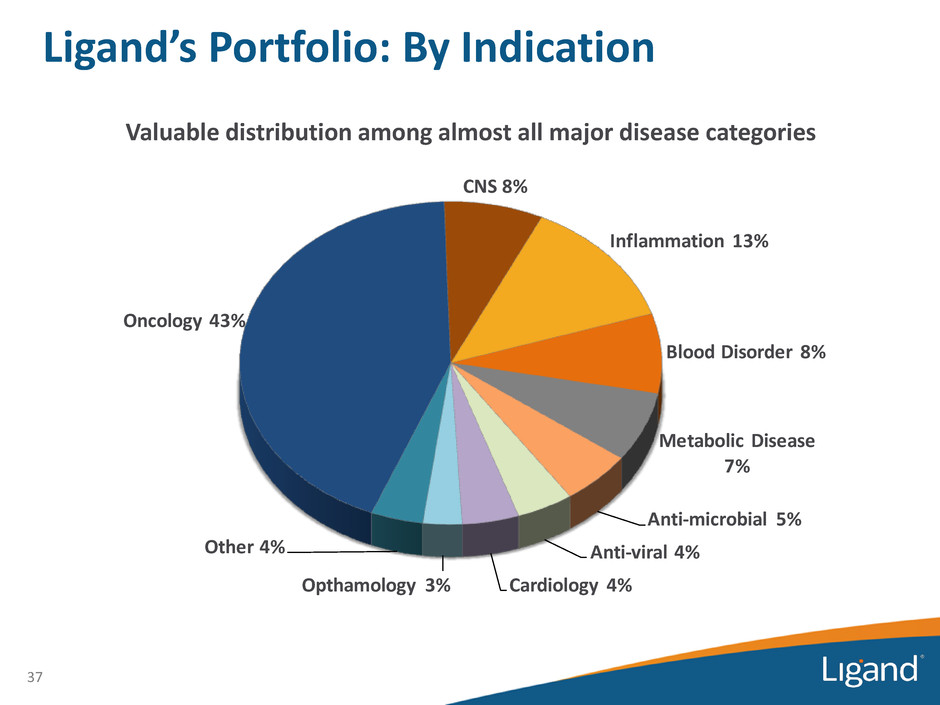

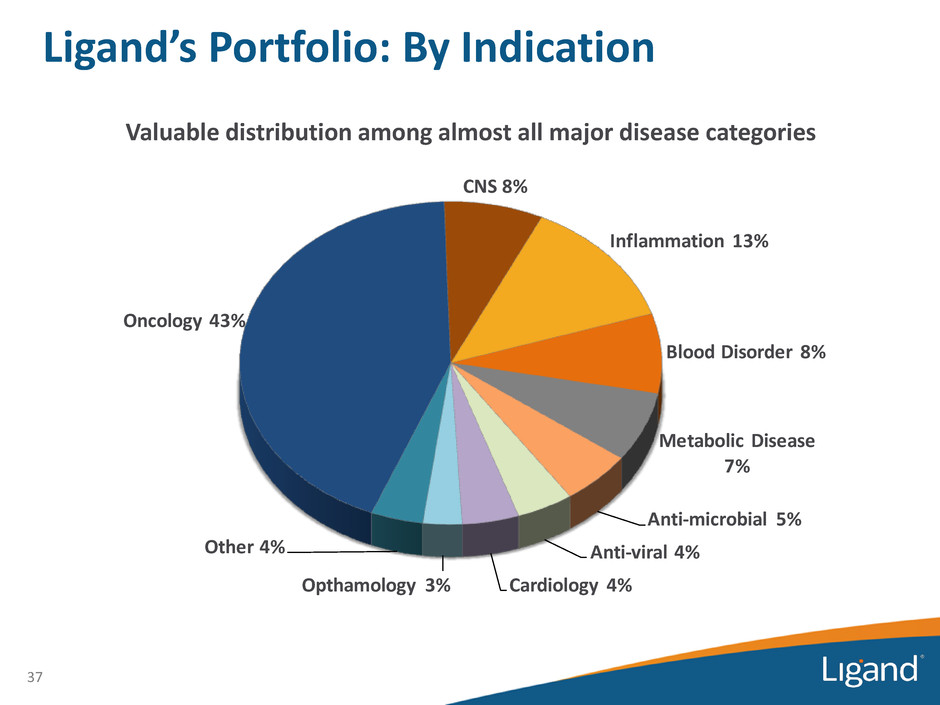

Oncology 43% CNS 8% Inflammation 13% Blood Disorder 8% Metabolic Disease 7% Anti-microbial 5% Anti-viral 4% Cardiology 4%Opthamology 3% Other 4% 37 Valuable distribution among almost all major disease categories Ligand’s Portfolio: By Indication

38 • Realistically, not all 90 programs will make it to market considering standard pharma success rates • But, given current program status, here is how new products could enter the market through 2020 Year 2014 2015 2016 2017 2018 2019 2020 Potential New Commercial Products 4 3 2 1 14 17 29 Cumulative Potential Commercial Products 9 12 14 15 29 46 75 • 10 new products could launch by 2017, tripling the number of products currently generating revenue Significant Growth Potential from New Products

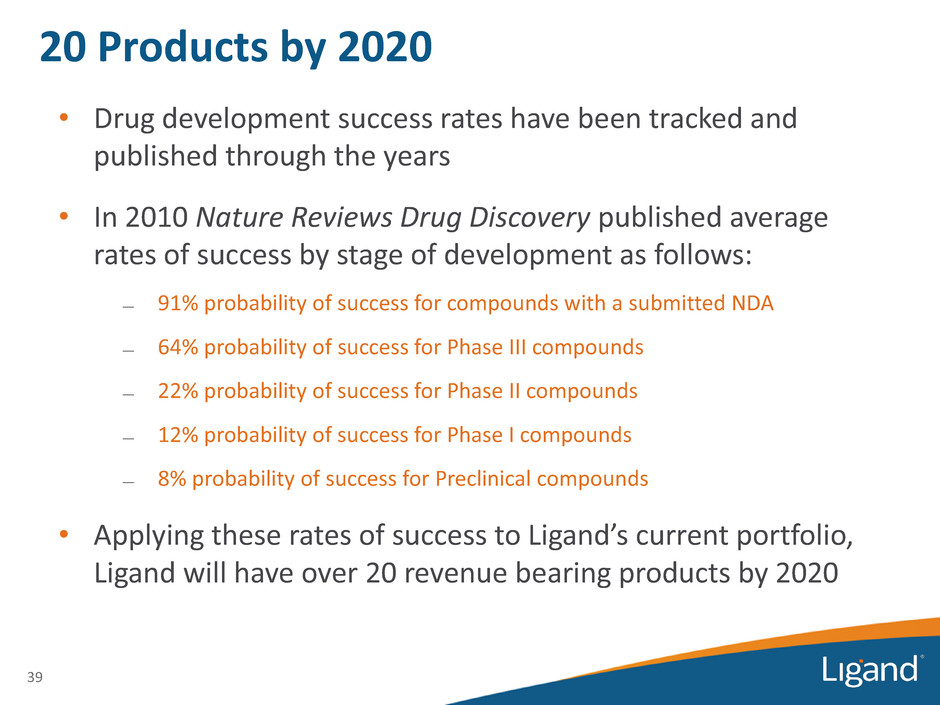

39 • Drug development success rates have been tracked and published through the years • In 2010 Nature Reviews Drug Discovery published average rates of success by stage of development as follows: ― 91% probability of success for compounds with a submitted NDA ― 64% probability of success for Phase III compounds ― 22% probability of success for Phase II compounds ― 12% probability of success for Phase I compounds ― 8% probability of success for Preclinical compounds • Applying these rates of success to Ligand’s current portfolio, Ligand will have over 20 revenue bearing products by 2020 20 Products by 2020

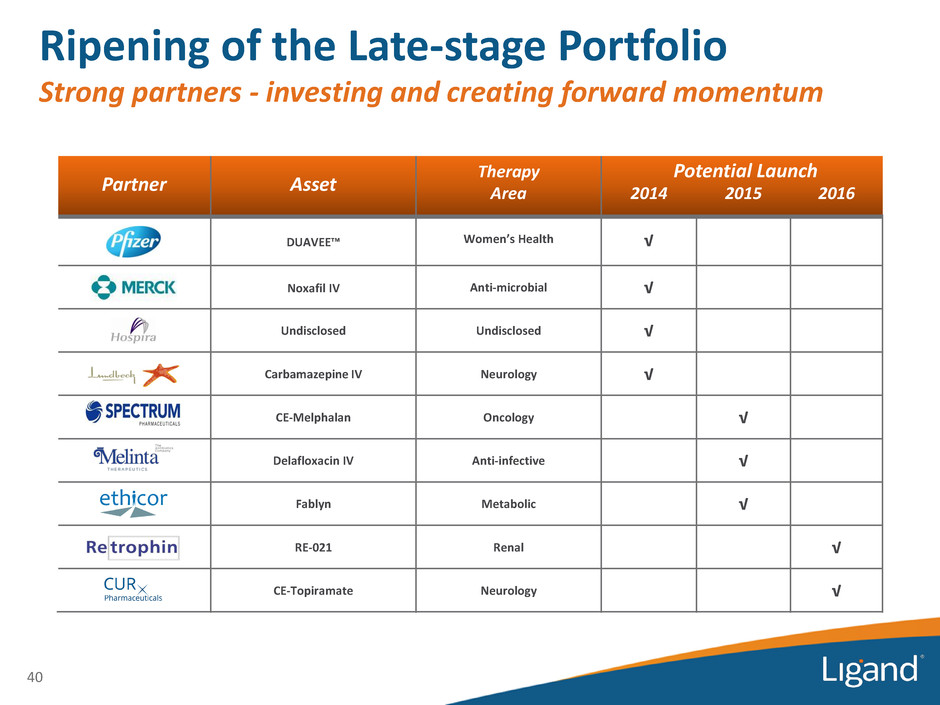

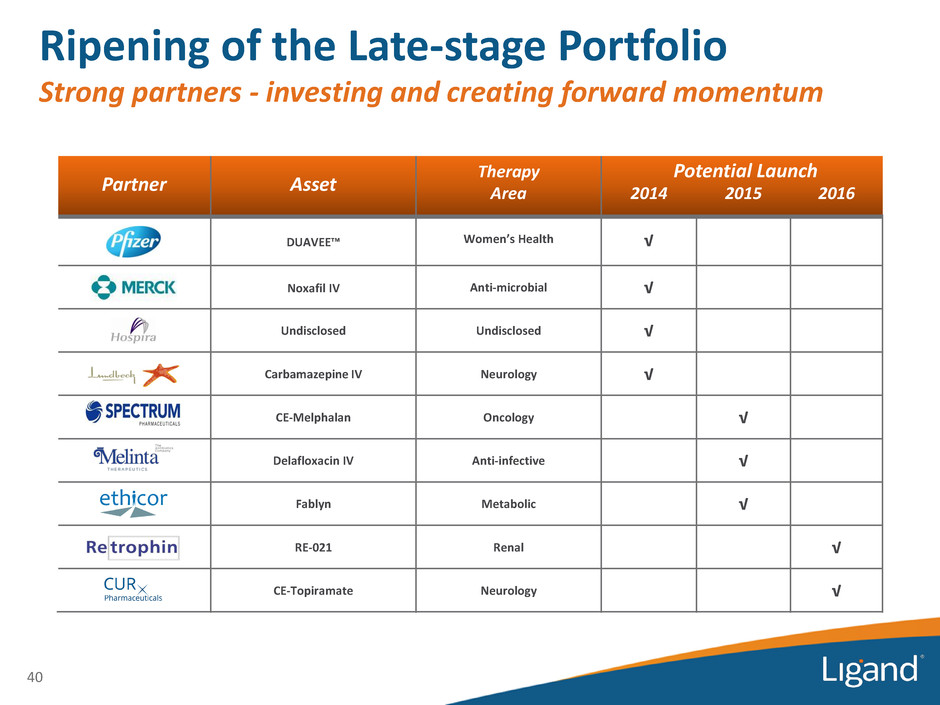

Ripening of the Late-stage Portfolio Strong partners - investing and creating forward momentum Partner Asset Therapy Area 2014 2015 2016 DUAVEE™ Women’s Health √ Noxafil IV Anti-microbial √ Undisclosed Undisclosed √ Carbamazepine IV Neurology √ CE-Melphalan Oncology √ Delafloxacin IV Anti-infective √ Fablyn Metabolic √ RE-021 Renal √ CE-Topiramate Neurology √ Potential Launch 40

• April 2013 acquired royalty rights to over 15 biotech programs • Selexis technology increases yields for biologic manufacturing • Royalty assets an excellent fit with Ligand’s business model • Expands Ligand’s royalty portfolio beyond small molecules into biologics • $4.5 million acquisition price • Potential for ~$17 million in milestones and an estimated over $40 million in annual royalties from these assets 41 Selexis Acquisition Highlights

45% 55% 42 Novel Biologics with: • Merrimack • Baxter • Aveo • CSL • Glenmark • Others Biosimilars with: • Coherus • Biocad • Others Selexis deal includes royalties on novel and biosimilar biologics Selexis Portfolio Acquisition

• Partners pursuing monoclonal antibodies for large market opportunities in oncology and inflammatory diseases: ― Inflammatory disease targets include lupus and rheumatoid arthritis ― Cancer targets include lung, ovarian, breast, gastric and colorectal tumors • All biologics are first-in-class, novel mechanisms • Portfolio highlights include: ― Merrimack Pharmaceuticals: MM-121, MM-111, MM-302 and MM-151 ― Baxter: BAX69 • Merrimack entered worldwide partnership with Sanofi for MM-121 in 2009 ― $60M upfront, up to $470M milestones, tiered royalties 43 Selexis Portfolio: Novel Biologics

• Biosimilars market projected to potentially exceed $20 billion worldwide in 2020 • Biosimilars for blockbuster novel biologics in the acquired Selexis portfolio include: ― Rituxan ― Enbrel ― Remicaid • Hot area - multiple recent deals with hundreds of millions of dollars in milestones and royalties for biosimilars development 44 Selexis: Biosimilar Biologics Source: IMS Health “Shaping the Biosimilars Opportunity”, December 2011 ― Humira ― Avastin ― Herceptin

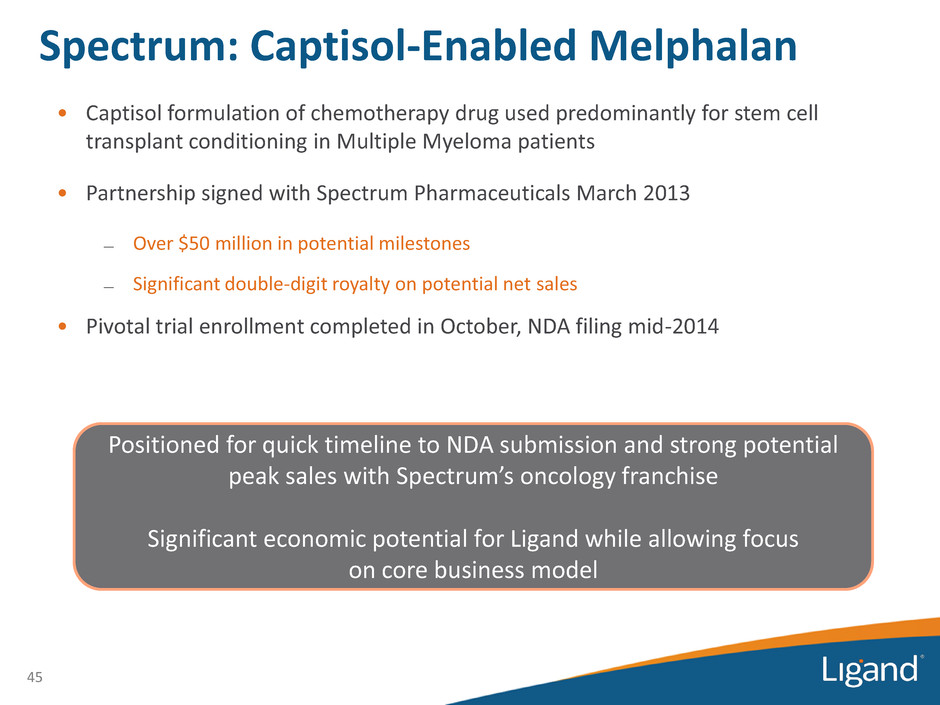

• Captisol formulation of chemotherapy drug used predominantly for stem cell transplant conditioning in Multiple Myeloma patients • Partnership signed with Spectrum Pharmaceuticals March 2013 ― Over $50 million in potential milestones ― Significant double-digit royalty on potential net sales • Pivotal trial enrollment completed in October, NDA filing mid-2014 45 Spectrum: Captisol-Enabled Melphalan Positioned for quick timeline to NDA submission and strong potential peak sales with Spectrum’s oncology franchise Significant economic potential for Ligand while allowing focus on core business model

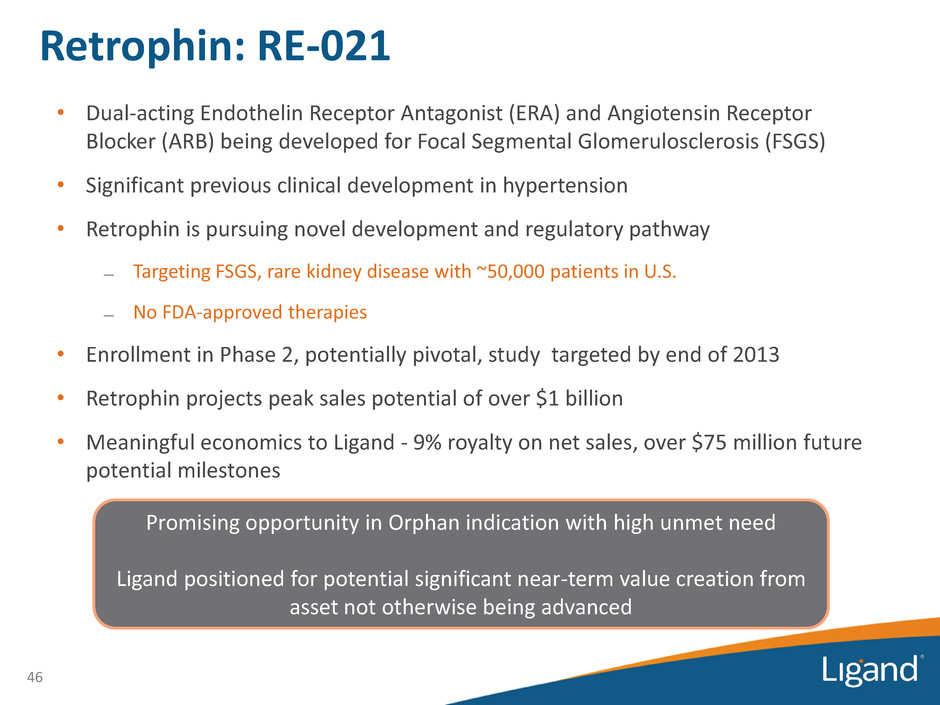

• Dual-acting Endothelin Receptor Antagonist (ERA) and Angiotensin Receptor Blocker (ARB) being developed for Focal Segmental Glomerulosclerosis (FSGS) • Significant previous clinical development in hypertension • Retrophin is pursuing novel development and regulatory pathway ― Targeting FSGS, rare kidney disease with ~50,000 patients in U.S. ― No FDA-approved therapies • Enrollment in Phase 2, potentially pivotal, study targeted by end of 2013 • Retrophin projects peak sales potential of over $1 billion • Meaningful economics to Ligand - 9% royalty on net sales, over $75 million future potential milestones 46 Retrophin: RE-021 Promising opportunity in Orphan indication with high unmet need Ligand positioned for potential significant near-term value creation from asset not otherwise being advanced

• Captisol formulation of anti-epileptic drug otherwise available only orally — Captisol allows IV formulation for first time — Targeted at seizures in hospitalized epilepsy patients who are unable to take oral topiramate • Ligand obtained Orphan Drug Designation and published Phase I results while evaluating partnership opportunities • Licensing transaction signed with CURx — $21 million net potential milestones — 6% – 7.5% net royalties 47 CURx: Captisol-Enabled Topiramate CURx poised to focus on CE-topiramate as their lead asset Novel drug for treating epileptic patients in hospital setting

48 • Captisol-enabled formulation of widely used oral antiepileptic drug • Lundbeck completed Phase 3 trial and secured Orphan Designation in 2013 • 2.7 million adults in US have epilepsy, making it the third most common neurological disorder after Alzheimer's and stroke1 • Phase 3 data presentation and NDA submission expected by end of 2013 1Epilepsy Foundation data Potential first and only injectable form, an alternative for patients with epilepsy who may be hospitalized or otherwise temporarily unable to take oral form Carbamazepine IV

49 • Captisol-enabled IV formulation of global anti-fungal, leveraging existing NOXAFIL® franchise • Merck presented positive Phase 3 study of patients at risk of invasive fungal infection at ICAAC in September • Noxafil, marketed globally by Merck, currently only available as an oral suspension • Ligand recently received NDA milestone payment Captisol enabled the IV form, represents a potential significant advancement for the treatment of invasive fungal infection NOXAFIL® IV

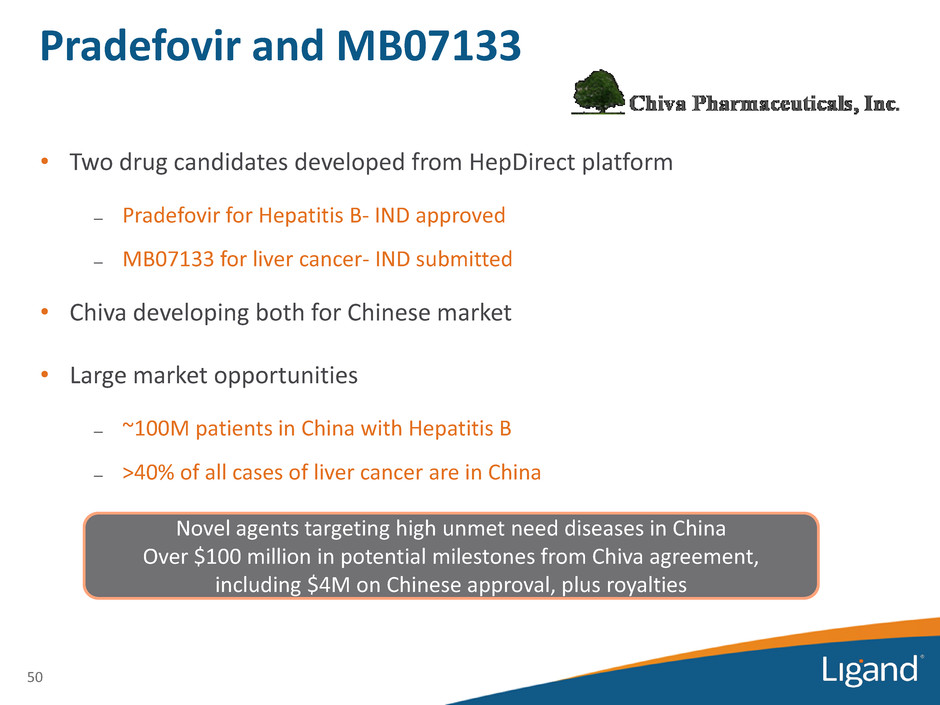

50 • Two drug candidates developed from HepDirect platform — Pradefovir for Hepatitis B- IND approved — MB07133 for liver cancer- IND submitted • Chiva developing both for Chinese market • Large market opportunities — ~100M patients in China with Hepatitis B — >40% of all cases of liver cancer are in China Novel agents targeting high unmet need diseases in China Over $100 million in potential milestones from Chiva agreement, including $4M on Chinese approval, plus royalties Pradefovir and MB07133

Driving Future Growth: Technology and R&D Matt Foehr

52 • Ligand’s technologies, research, and acquired unpartnered assets position us to do more deals and create future growth opportunities Three Ways to Drive New Deals Technology • Captisol® • HepDirect™ Research • Oral GCSF • IRAK-4 • SARMs Acquired Assets • Glucagon Receptor Antagonist • Captisol- enabled Fosphenytoin

53 • Partnering-driven, backed by strong science ― Drive R&D to earliest inflection point for partnering • Focus on de-risking, through internal or external milestones, with a goal of partnering ― Leverage ripening science and landscape evolution ― External milestones - allowing others’ investments to build value • Over 15 internal R&D programs, but we focus investment on a select few each year Ligand’s R&D Model Targeted, value-based project advancement

54 Translating R&D Investment into Future Profits Carefully designed R&D investment to drive partnering Ligand’s Added Value Regulatory Path Initiate Pivotal Trial Orphan Designation Melphalan Topiramate Intellectual Property Licensing Package RE-021 Program

55 Translating R&D Investment into Future Profits Carefully designed R&D investment to drive partnering Ligand’s Added Value Regulatory Path Initiate Pivotal Trial Orphan Designation Melphalan Topiramate Intellectual Property Licensing Package RE-021 Program Partner Up-Front Milestones Royalties $3 mm $50 mm Double Digit Undisclosed $21 mm 6.0-7.5% $1 mm $75 mm 9% Potential

56 Translating R&D Investment into Future Profits Carefully designed R&D investment to drive partnering Ligand’s Added Value Regulatory Path Initiate Pivotal Trial Orphan Designation Melphalan Topiramate Intellectual Property Licensing Package RE-021 Program Partner Up-Front Milestones Royalties $3 mm $50 mm Double Digit Undisclosed $21 mm 6.0-7.5% $1 mm $75 mm 9% Potential Drug Discovery, IND Phase 1 Trial Glucagon Goal to partner

57 • Addresses continued and growing industry need → formulation solubility and stability ― Makes major drugs possible: Kyprolis™ ― Makes existing drugs better: Nexterone®, CE-Melphalan, Noxafil® IV • The right technology at the right time ― Combinatorial chemistry/screening advances have greatly increased number of promising drugs that have solubility issues • Issued patents in the US through 2029, in Europe through 2025, and additional patents issued and pending • Clinical and regulatory success, combined with vast safety database have significantly increased awareness and visibility Platform for Continued Growth

58 New Sample Requests 0 100 200 300 • Almost doubling of new sample requests since Ligand acquisition • “Partnership process flow” follows the progression and timing of a new drug through early development Acquired Technology Creating Partnerships with

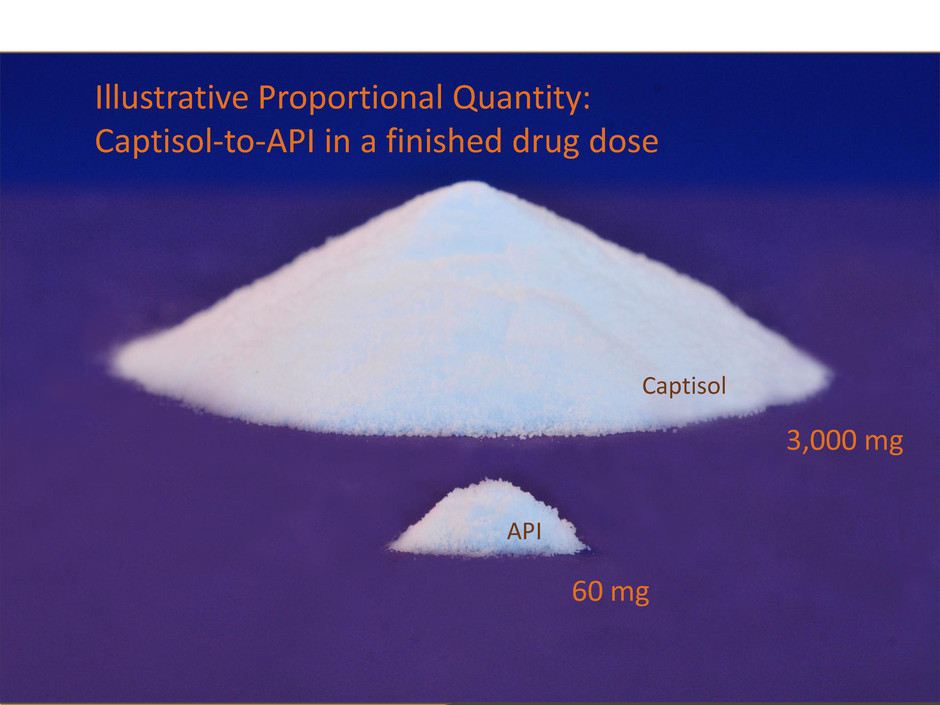

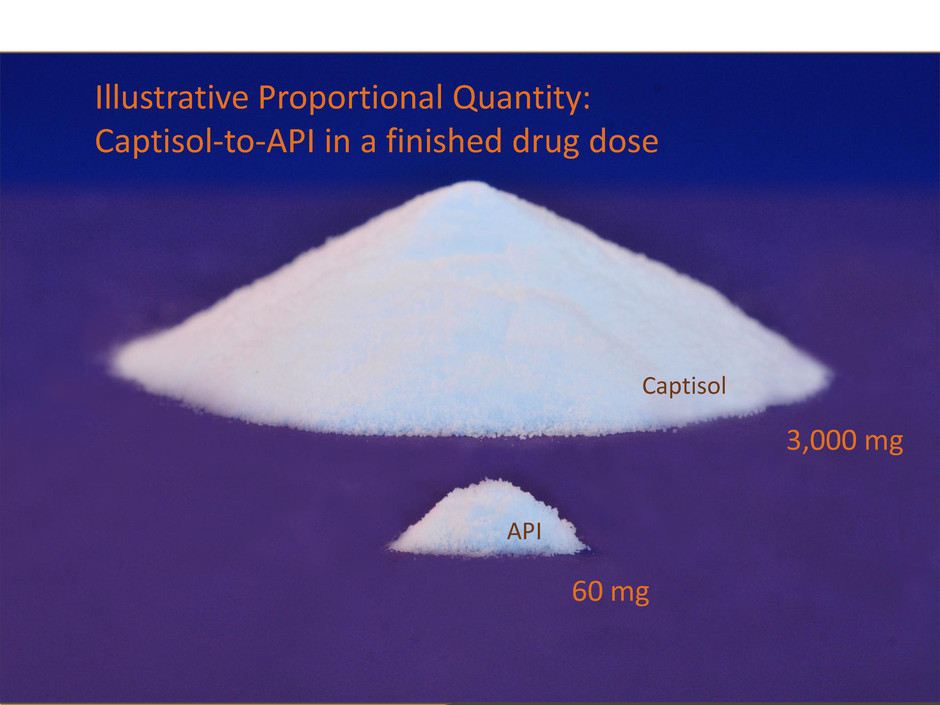

59 Illustrative Proportional Quantity: Captisol-to-API in a finished drug dose 60 mg 3,000 mg Captisol API

60 • Patented prodrug technology designed to deliver drugs directly to the liver ― Proven efficient and selective in prodrug conversion ― Reduces extra-hepatic exposure through intracellular metabolism and biliary excretion HepDirect™ Partnering Platform - Targeted Drug Delivery • An ideal delivery technology for diseases of the liver or for molecular targets located in the liver • Advantages include improved safety and increased efficacy/potency

Highlights of Key Assets

62 • Oral medicine that boosts platelets to treat thrombocytopenia • Marketed by GSK • Long patent protection through 2027 • Potential for major label expansion — Over 25 active clinical trials — Recent/upcoming data presented in: MDS, AML, CLL and Aplastic Anemia • Royalty rates of 4.7% to 9.4% 6.6% 9.4% Promacta

• Thrombocytopenia (low platelet) market represents a major global commercial opportunity • Similar to anemia and neutropenia, thrombocytopenia is made up of a number of “sub-markets” of thrombocytopenia-inducing diseases in which medical need is real, life threatening and unmet • Three different areas create this growth opportunity: ITP HCV ORT Idiopathic Thrombocytopenia Thrombocytopenia Induced by the Hepatitis C Virus Oncology Related Thrombocytopenia Growing and Gaining Market Share Globally Recent Launch with Significant Global Upside Multiple Promising Expansion Opportunities 63 Promacta: Pillars of Future Growth

64 • Steroids, platelet transfusion, splenectomy all create significant treatment challenges • Pediatrics account for half of new diagnoses per year • Initially launched for ITP indication in 2009, now marketed in 94 countries • Continued market share growth quarterly 6.6% 9.4% Promacta: ITP • Idiopathic Thrombocytopenia (ITP) is an autoimmune disease characterized by low platelet count, rash and significant risk of bleeding

65 Worldwide HCV prevalence Worldwide HCV with low platelets Patients required for ~$2B annual sales 150+ million • Thrombocytopenia exhibited in sickest sub-set of HCV patients • 100,000 patients represents ~2% of worldwide patients with low platelets • While significant evolution of HCV treatment paradigm is occurring, feasible for Promacta to reach an impactful number of patients worldwide • Indication first launched in 2013, now in 37 countries, with more countries expected in the future 5.3 million Source: World Health Organization Hepatitis C Fact Sheet 100,000 Promacta: Thrombocytopenia in HCV

66 • Recent Advisory Committee Panel recommends a drug approved for: — Genotype 2 and 3 in combination with Ribavirin — Genotype 1 and 4 in combination with Ribavirin and interferon • Revolutionary new drugs are poised to profoundly alter Hepatitis C treatment • For mild, moderate and even severe patients, new oral drugs represent an extraordinary medical advancement • Conventional expectations are that: ― The need for interferon-based regimens, which actively destroy platelets, will sharply decrease ― Prevalence of HCV will subside Platelets and the Evolving Hepatitis C Space

67 • Despite dramatic landscape shifts, there is a necessary role for platelet generation in the sickest Hepatitis C patients — End-stage Hepatitis C patients are cirrhotic → liver so diseased it produces low platelets and supportive care necessary to reduce bleeding risks — While US poised for approval of new drugs, other markets are years behind and treatment approaches may evolve differently • If only 0.03% of global population (50,000) of Hepatitis C patients receive Promacta, the annual Promacta revenue would be approximately $1 billion Platelets and the Evolving Hepatitis C Space Healthy Human Liver Cirrhotic HCV-infected Human Liver

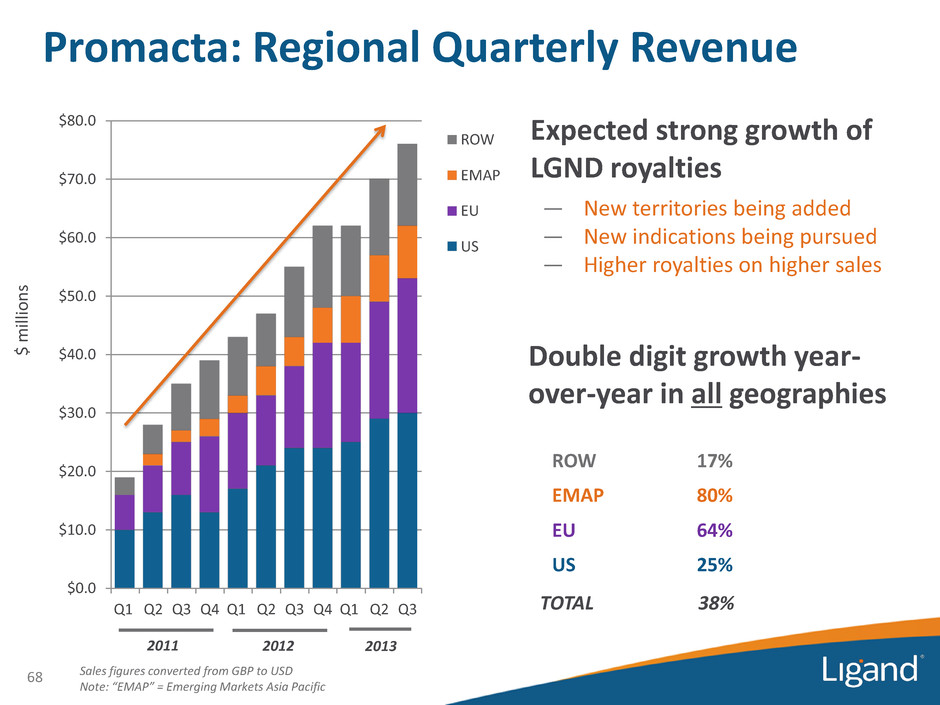

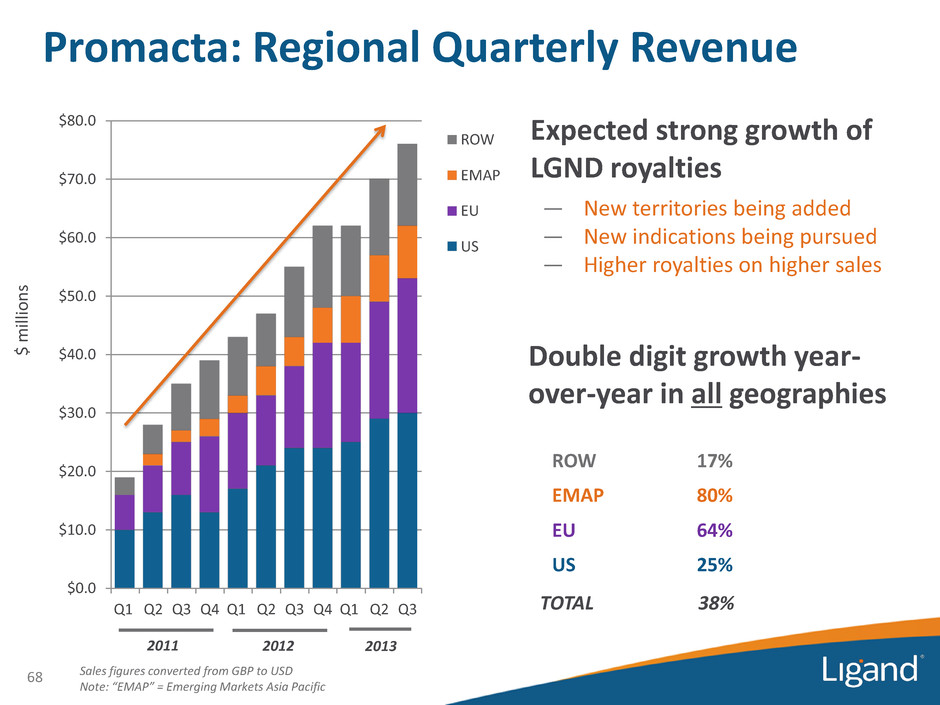

$ m ill ion s Sales figures converted from GBP to USD Note: “EMAP” = Emerging Markets Asia Pacific 68 2011 ROW 17% EMAP 80% EU 64% US 25% TOTAL 38% Promacta: Regional Quarterly Revenue $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 $80.0 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 ROW EMAP EU US 2012 2013 Expected strong growth of LGND royalties — New territories being added — New indications being pursued — Higher royalties on higher sales Double digit growth year- over-year in all geographies

Promacta: Label Expansion • GSK investing significantly to expand indications for Promacta, over 25 active clinical trials ITP (94 Markets) Hepatitis C (37 Markets) Potential Future Indications Aplastic Anemia MDS AML CIT Others • Data at recent and upcoming medical meetings raises visibility and potential for the drug CLL Current Indications 69

Oncology Related Thrombocytopenia Chemotherapy -induced (CIT) Cancers of the Blood Myelodysplastic Syndrome (MDS) Acute Myeloid Leukemia (AML) Bone Marrow Suppression Broad set of significant global unmet medical needs Chronic Lymphocytic Leukemia (CLL) Cancer Treatment Attacking Platelets 70 Promacta: Oncology Related Thrombocytopenia

Myelodysplastic Syndromes (MDS) Acute Myeloid Leukemia (AML) Chronic Lymphocytic Leukemia (CLL) Cancers of the Blood Patients have severe cytopenia, need frequent transfusions Fast-progressing cancer of the blood Slow-progressing cancer Excess bleeding results in major complications or death for nearly 25% of patients1 Clinically, Promacta shown to increase platelets and pre-clinically, inhibits leukemia growth Data presented at EHA and ASH Initial clinical data in CLL indicates 80% response rate in CLL-associated ITP, 55% overall response rate Phase 2 interim data to be presented at ASH in December Data from Phase 2 placebo-controlled studies reported at EHA and ASH Abnormal red blood cells and platelets can quickly crowd out normal cells Focused in white blood cells ~19,000 new diagnoses in US each year2 ~14,500 new diagnoses in US each year2 ~16,000 new diagnoses in US each year2 1Expert Opinion: Thrombocytopenia & Myelodysplastic Syndrome medscape.org/viewarticle/565023 2 National Cancer Institute, SEER Cancer Review, 2012 71 Promacta: Oncology Related Thrombocytopenia

• Disease where bone marrow does not produce enough new cells • Patients have pan-cytopenia, or low red cells, low white cells and low platelets • ~7,000 new cases of AA diagnosed each year1 72 Promacta: Development in Aplastic Anemia 1American Cancer Society, 2013 and Marrow Forums, 2013 • Suggestions of potential use beyond supportive care - New England Journal of Medicine publication — Patients refractory to immunosuppressive therapy at high risk of death and bleeding — 44% achieved response in at least one type of blood cell, with minimal toxicity — Improvements seen in platelets and red and white cells

$0 $200 $400 $600 $800 $1,000 $1,200 2015 2016 2017 2018 2019 2020 73 Promacta Projections: GSK Sell-Side Analysts Annual Revenue Projections $ mi lli on s High Low Average Sales figures converted from GBP to USD Conversion rate : £1 = $1.60 9 GSK covering analysts reporting as of 10/23/13

74 • Amgen acquired Onyx October 1, 2013 — Amgen - true pioneer in treatment of serious illness with a global presence in over 50 countries • Established agent in 3rd Line+ multiple myeloma • Major investment by Amgen, focused on expanding label and geographies — Front-Line: Phase 3 (CLARION) — Relapsed: Phase 3 (ASPIRE)/Phase 3 (ENDEAVOR) — Relapsed/Refractory: Phase 3 (FOCUS) • Global MM market projected to exceed $14 billion by 2018 • Royalty rates of 1.5% to 3.0% 9.4% Kyprolis

75 • Amgen projects primary analysis of FOCUS trial in relapsed/ refractory MM to occur in 1H 2014 • Independent Data Monitoring committee review of interim analysis of ASPIRE in relapsed MM projected in 1H 2014 • Upcoming data and presentations at ASH 9.4% Kyprolis: Upcoming Events 1Amgen Q3 2013 presentation

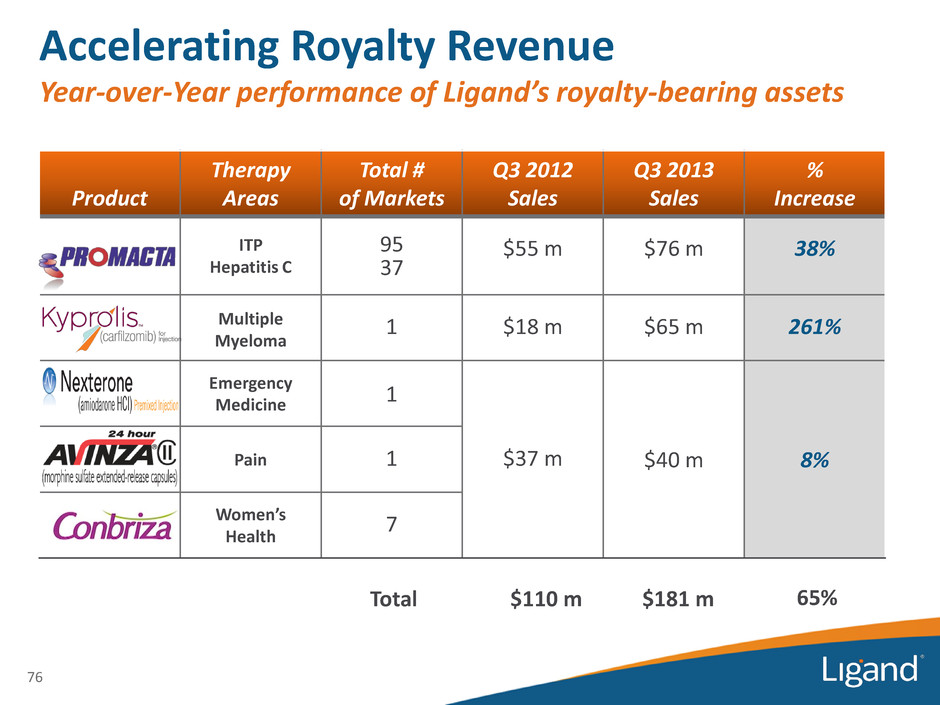

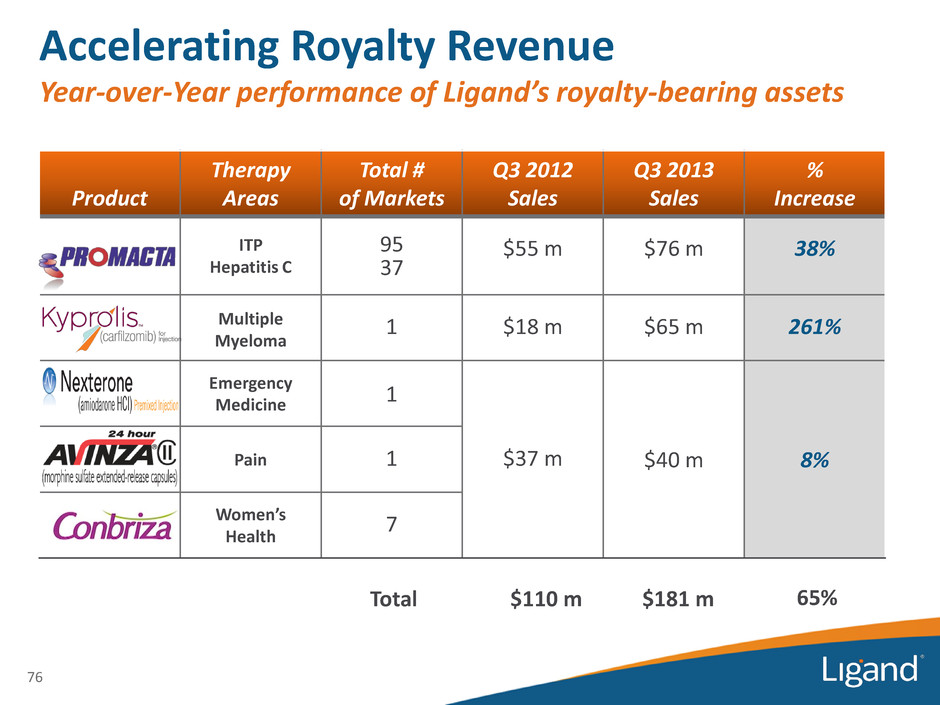

Accelerating Royalty Revenue Year-over-Year performance of Ligand’s royalty-bearing assets Product Therapy Areas Total # of Markets Q3 2012 Sales Q3 2013 Sales % Increase ITP Hepatitis C 95 37 $55 m $76 m 38% Multiple Myeloma 1 $18 m $65 m 261% Emergency Medicine 1 Pain 1 $37 m $40 m 8% Women’s Health 7 76 Total $110 m $181 m 65%

MK-8931: BACE1 Inhibitor • Merck is developing MK-8931, an oral beta-secretase (BACE1) inhibitor, for potential treatment of Alzheimer's disease (AD) • MK-8931 is first BACE1 inhibitor demonstrated to lower β- amyloid in the cerebral spinal fluid of people with AD • Merck has the leading position in the BACE-inhibition field, which has included Eli Lilly, Eisai, Roche and Janssen/Shionogi • Last December, Merck began a Phase 2/3 study to assess the safety and efficacy of MK-8931 in patients with mild-to- moderate AD 77 Potential major advancement in Alzheimer’s Disease

BACE1 and the Amyloid Hypothesis • The presence of β-amyloid plaques in the brain is a well-known manifestation of Alzheimer's disease (AD) • The amyloid hypothesis asserts that formation of amyloid β peptides that lead to β-amyloid plaques in the brain is a primary contributor to the underlying cause of AD • BACE1 believed to be key enzyme in production of amyloid β peptides • Evidence suggests that inhibiting BACE1 decreases production of amyloid β peptide, may therefore reduce β-amyloid plaque formation and modify disease progression 78 Neurons with Amyloid Plaques, Gaertner, 2013

MK-8931 Clinical Trials • Merck’s EPOCH trial began in late 2012 – Phase 2/3, 78-week, randomized, placebo-controlled, parallel-group, double- blind trial in patients with mild to moderate AD – 200 patient Phase 2 safety portion of the study; anticipated to enroll up to 1,700 patients in the main Phase 3 cohort – Primary outcomes are change from baseline in: Alzheimer's Disease Assessment Scale Cognitive Subscale (ADAS-Cog) score Alzheimer's Disease Cooperative Study – Activities of Daily Living (ADCS-ADL) score • Interim safety assessment expected in the coming months 79

DUAVEE™

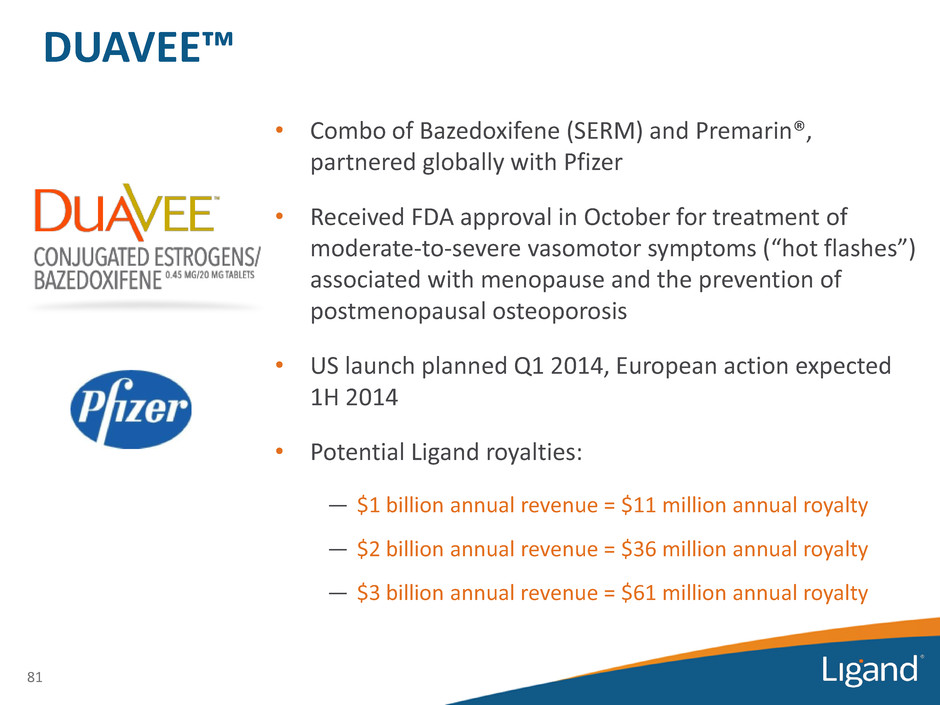

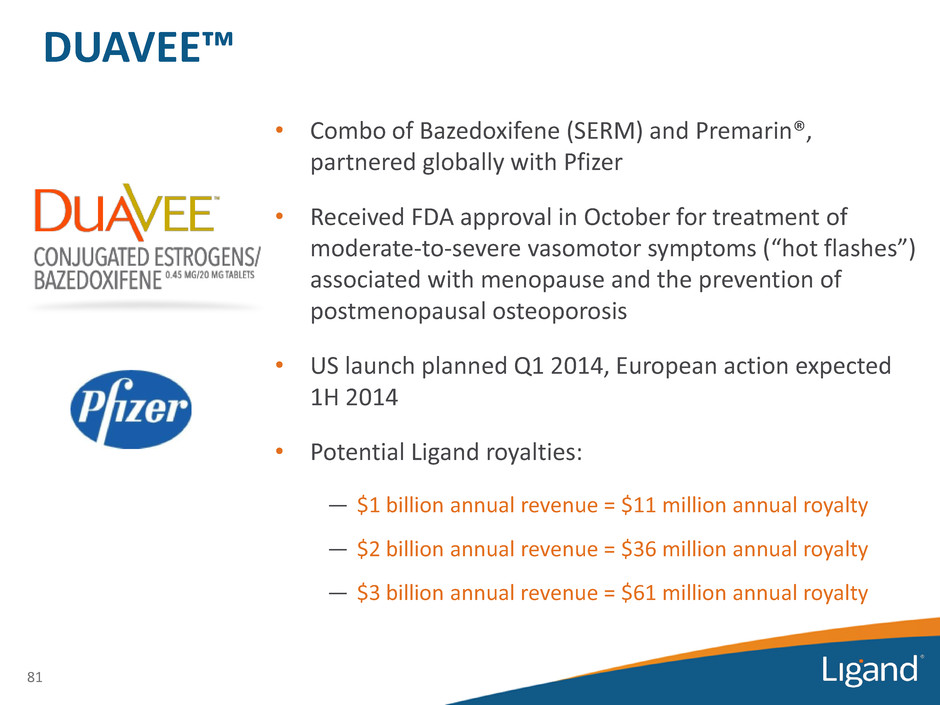

81 • Combo of Bazedoxifene (SERM) and Premarin®, partnered globally with Pfizer • Received FDA approval in October for treatment of moderate-to-severe vasomotor symptoms (“hot flashes”) associated with menopause and the prevention of postmenopausal osteoporosis • US launch planned Q1 2014, European action expected 1H 2014 • Potential Ligand royalties: — $1 billion annual revenue = $11 million annual royalty — $2 billion annual revenue = $36 million annual royalty — $3 billion annual revenue = $61 million annual royalty 9.4% DUAVEE™

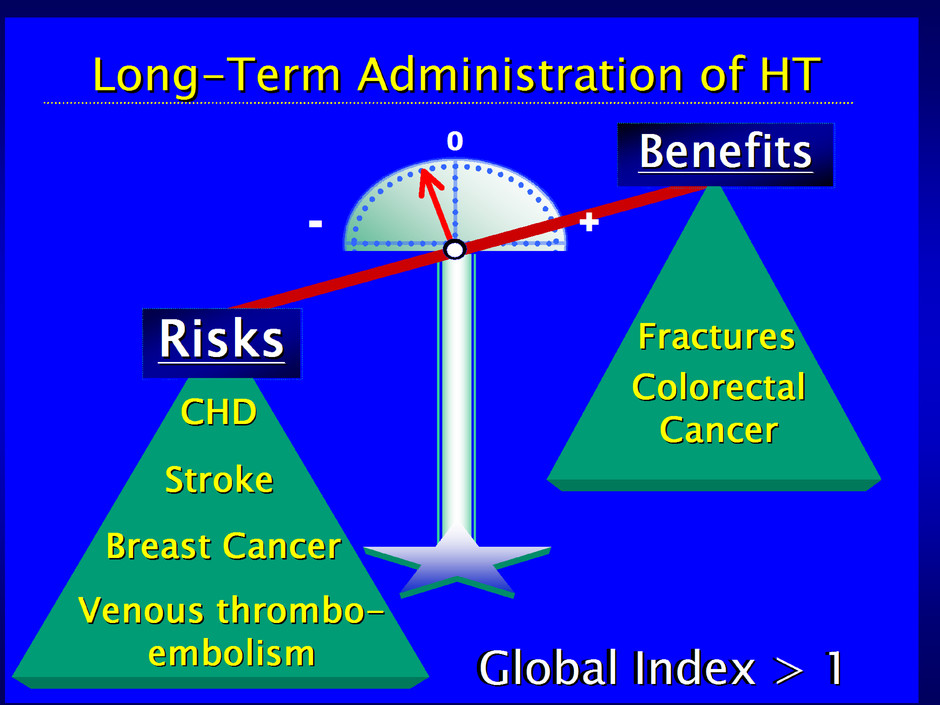

82 • Hormone replacement therapy for menopausal symptoms was once a 4 billion dollar category — 22 million prescriptions written for Prempro® in the US in 2001, with revenue greater than $2 billion — Safety concerns raised by Women’s Health Initiative (WHI) led to sharp declines in use and decreased development investment in the area • Evolution of views on WHI data and recent advances in highly selective synthetic estrogens could restore and surpass the former market • Greatly underserved category now at ~$2 billion annually • Osteoporosis prevention also represents an additional, significant opportunity for improved agents — Raloxifene sales of $1.4 billion in 2011 Menopause and Hormone Therapy Wyeth data; NIHCM Foundation Data, 2001 and 2012

83 Pfizer Preparing for DUAVEE™ Launch

Dr. Cynthia A. Stuenkel

• Clinical Professor of Medicine, UCSD • Established one of the first Menopause Clinics in 1988 • Expert in: — Management of post-menopausal symptoms — Hormone therapy — Osteoporosis — Breast cancer prevention • Past-President of the North American Menopause Society • National spokesperson for Endocrine Society’s Hormone Health Network • Author of editorials, reviews and chapters relating to menopause 85 Introducing Dr. Cynthia Stuenkel

Managing Menopause Symptoms: Yesterday, Today, and Tomorrow Cynthia A. Stuenkel, MD University of California, San Diego Ligand Pharmaceuticals, Inc. Analyst Day November 14, 2013

A Contemporary Approach to Menopause The menopause experience Brief history of hormone therapy Expanding role of available therapies

1542-1587

The Contemporary Woman…

The Contemporary Woman… 51 year old CFO, executive coach, who sits on multiple Fortune 100 boards, presents with the chief complaint: “I don‟t know what‟s happening to me!”

The Contemporary Woman… 51 year old CFO, executive coach, who sits on multiple Fortune 100 boards, presents with the chief complaint: “I don‟t know what‟s happening to me!” She awakens at night feeling incredibly hot, then sweaty, followed by a chill. Her last period was 6 months ago. She admits to discomfort with intercourse.

The Contemporary Woman… 51 year old CFO, executive coach, who sits on multiple Fortune 100 boards, presents with the chief complaint: “I don‟t know what‟s happening to me!” She awakens at night feeling incredibly hot, then sweaty, followed by a chill. Her last period was 6 months ago. She admits to discomfort with intercourse. She desires symptom relief and better sleep…and she wants it now!

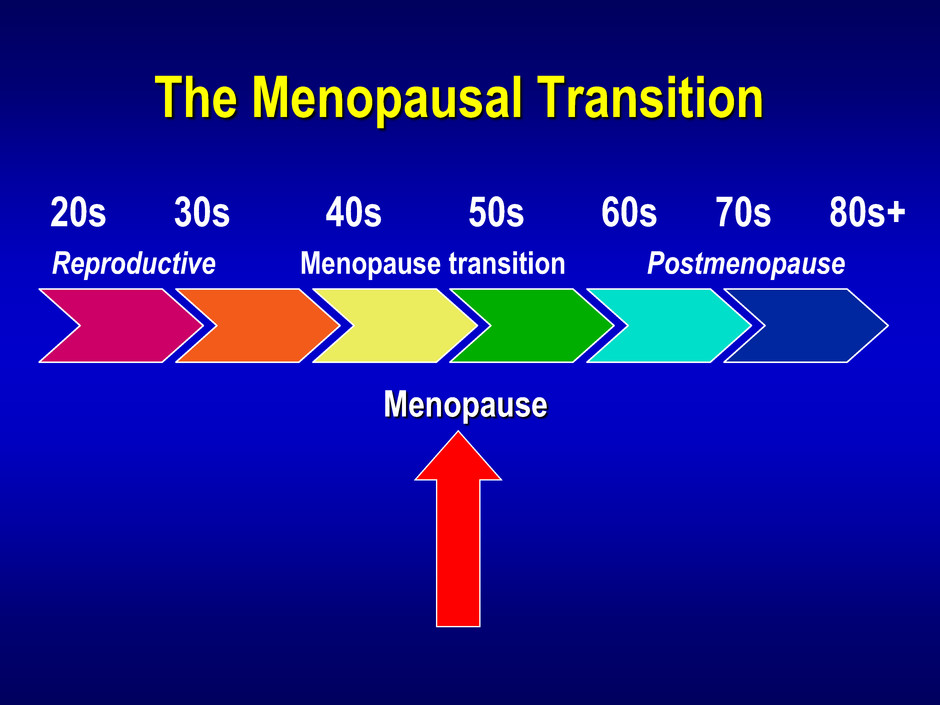

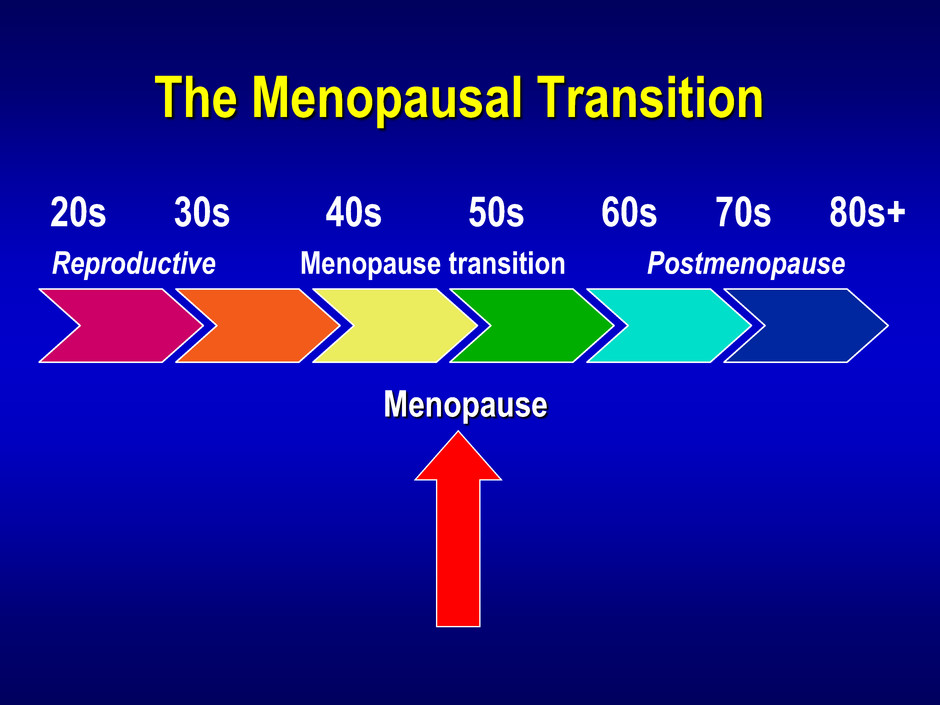

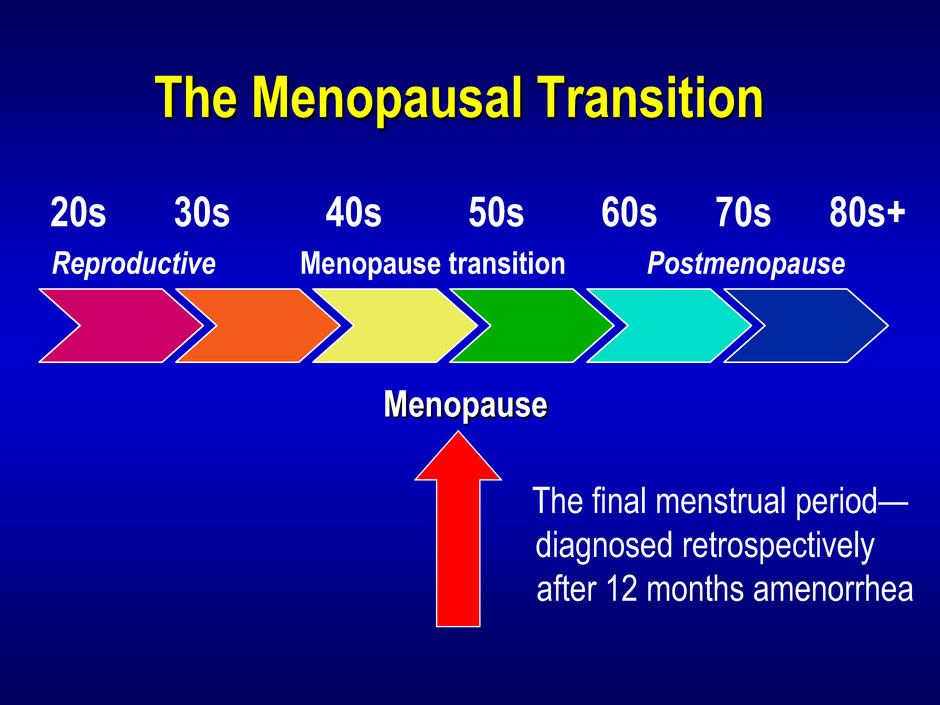

The Menopausal Transition 20s 30s 40s 50s 60s 70s 80s+ Reproductive Menopause transition Postmenopause

The Menopausal Transition 20s 30s 40s 50s 60s 70s 80s+ Reproductive Menopause transition Postmenopause Menopause

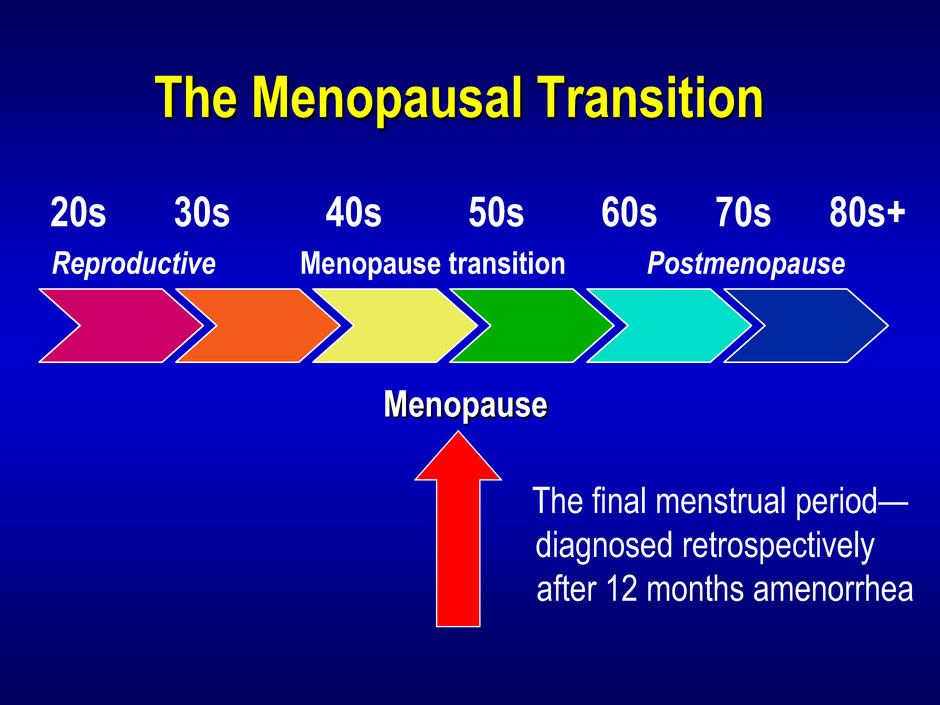

The Menopausal Transition 20s 30s 40s 50s 60s 70s 80s+ Reproductive Menopause transition Postmenopause The final menstrual period— diagnosed retrospectively after 12 months amenorrhea Menopause

Consequences of Menopause The Good News Liberates women from: Inconvenience and discomfort of monthly menstrual cycles Associated mood swings Concerns with contraception and potential for unintended pregnancy

Consequences of Menopause The Bad News Decline in estrogen associated with: Vasomotor symptoms Depressive and anxiety symptoms, sleep disorders, memory complaints Urogenital atrophy Osteoporosis

The Menopausal Landscape Today In 2000, there were an estimated 45.6 million postmenopausal women in the US www.menopause.org; www.hormone.org

The Menopausal Landscape Today In 2000, there were an estimated 45.6 million postmenopausal women in the US By 2020, the number is expected to be > 50 million www.menopause.org; www.hormone.org

The Menopausal Landscape Today In 2000, there were an estimated 45.6 million postmenopausal women in the US By 2020, the number is expected to be > 50 million In a 2012 survey by the Endocrine Society 70% of women not treated for menopause symptoms 62% had never discussed symptoms with provider www.menopause.org; www.hormone.org

Approach to Symptom Relief in the Postmenopausal Woman Her subjective experience How bothered is she? Her desires regarding therapeutic options What does she want? Her medical history, age, time since menopause Will therapy be safe?

The Hormone Health Network www.hormone.org

www.menopause.org

Benefits of Estrogen Therapy Estrogen therapy improves: Vasomotor symptoms Depressive symptoms, sleep disorders, memory complaints Urogenital atrophy Osteoporosis

Benefits of Estrogen Therapy Estrogen therapy improves: Vasomotor symptoms Depressive symptoms, sleep disorders, memory complaints Urogenital atrophy Osteoporosis

Benefits of Estrogen Therapy Estrogen therapy improves: Vasomotor symptoms Depressive symptoms, sleep disorders, memory complaints Urogenital atrophy Osteoporosis

Benefits of Estrogen Therapy Estrogen therapy improves: Vasomotor symptoms Depressive symptoms, sleep disorders, memory complaints Urogenital atrophy Osteoporosis

Benefits of Estrogen Therapy Estrogen therapy improves: Vasomotor symptoms Depressive symptoms, sleep disorders, memory complaints Urogenital atrophy Osteoporosis

A Brief History…

The Beginning… Premarin introduced in 1942 • Distributed by Wyeth Ayerst • Conjugated equine estrogens (CEE) • Prepared from urine collected from pregnant mares

The 60’s “Feminine Forever” Robert A. Wilson, MD 1966

Feminine Forever Robert Wilson, MD, 1966 “At age 50, there are no ova, no follicles, no theca, no estrogen---truly a galloping catastrophe.”

Feminine Forever Robert Wilson, MD, 1966 But with estrogen… “Breasts and genital organs will not shrivel. Such women will be more pleasant to live with and will not become dull and unattractive.”

Feminine Forever Robert Wilson, MD, 1966 But with estrogen… “Breasts and genital organs will not shrivel. Such women will be more pleasant to live with and will not become dull and unattractive.”

The 70’s Unopposed estrogen therapy increases the risk of endometrial (uterine) cancer New England Journal of Medicine, 1976

The 70’s Progestogen therapy, when combined with estrogen, reduces uterine risk Medroxyprogesterone acetate (MPA) Provera

“Despite the absence of clinical trial data, by the mid-1990s it was almost dogma that hormone therapy would prevent coronary heart disease in postmenopausal women.” The 90’s

“Documentation that all postmenopausal patients had been offered estrogen was one of the criteria used to evaluate the quality of medical practice. Not to recommend estrogen therapy was thought to be unethical.” The 90’s Elizabeth Barrett-Connor, MD J Clin Endocrinol Metab, 2003

Premarin, conjugated equine estrogen (CEE), was the most widely dispensed prescription drug in the U.S. The 90’s

1992-2002…

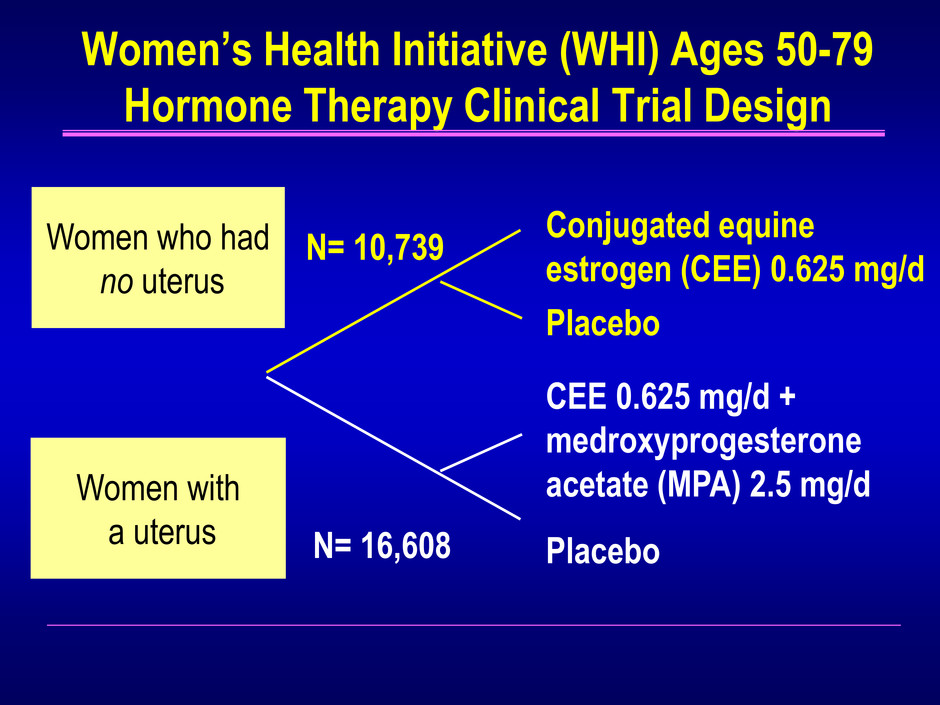

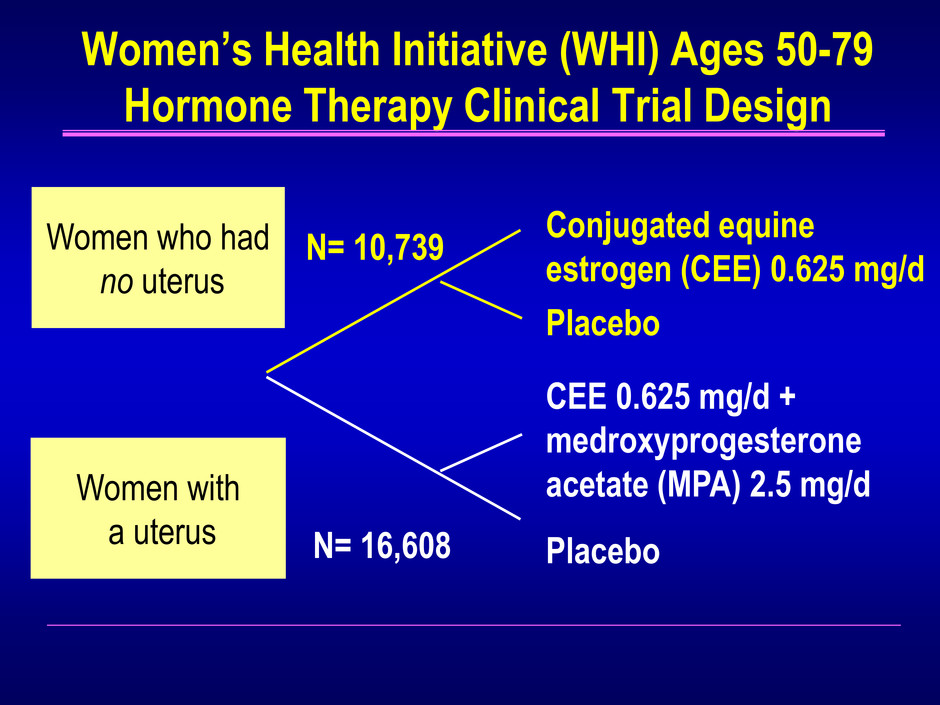

Women’s Health Initiative (WHI) Ages 50-79 Hormone Therapy Clinical Trial Design Women with a uterus Women who had no uterus Conjugated equine estrogen (CEE) 0.625 mg/d Placebo CEE 0.625 mg/d + medroxyprogesterone acetate (MPA) 2.5 mg/d Placebo N= 16,608 N= 10,739

Trends in Menopausal Hormone Therapy Use, 2000-2009 • Tsai SA, et al. Menopause 2011; 18:385

Trends in Menopausal Hormone Therapy Use, 2000-2009 • Tsai SA, et al. Menopause 2011; 18:385

Trends in Menopausal Hormone Therapy Use, 2000-2009 • Tsai SA, et al. Menopause 2011; 18:385 76%

Nonprescription Remedies Prescription Rx Estrogen Mind-Body and Behavior Lifestyle Modification Treatments of Menopause- Associated Vasomotor Symptoms Stuenkel CA. in Women & Health, Elsevier, 2013.

Lessons learned…

1. Neither estrogen nor combined therapy is indicated for primary prevention of chronic conditions. AHA 2011; NAMS 2012, ACOG 2013; USPSTF 2013

2. When hormone therapy is discontinued, the rates of most risks (and benefits) return to baseline. Manson JE, et al. JAMA 2013; 310:1353

3. A woman’s age and years since menopause at the time of initiation of hormone therapy affect clinical cardiovascular outcomes. Rossouw JE, et al. JAMA 2007;297:1465.

A Decade after the WHI— The Experts Do Agree Goal: acknowledge benefits and risks of hormone therapy for relief of menopausal symptoms Stuenkel CA., et al. Menopause. 2012 Aug;19(8):846-847; J Clin Endocrinol Metab 2012; Aug;97(8):2617-8; Fertil Steril. 2012 Aug;98(2):313-4.

A Decade after the WHI— The Experts Do Agree: Endorsements • Academy of Women’s Health • American Academy of Family Physicians • American Academy of Physician Assistants • American Association of Clinical Endocrinologists • American Medical Women’s Association • Asociacion Mexicana para el Estudio del Climaterio • Association of Reproductive Health Professionals • National Association of Nurse Practitioners in Women’s Health • SIGMA Canadian Menopause Society • National Osteoporosis Foundation • Society for the Study of Reproduction • Society of Obstetricians & Gynaecologists of Canada

4. The effects of unopposed estrogen differ from combined estrogen and progestogen therapy. Manson JE, et al. JAMA 2013; 310:1353

Divergence of Benefit-Risk Profile in the WHI Women Age 50 to 59 Years CE Placebo CE/MPA CHD Endpoints Breast Cancer *CHD endpoints: myocardial infarction and CHD death LaCroix AZ, et al. JAMA 2011; Rossouw JE et al. JAMA, 2007; Heiss G et al, JAMA, 2008; by CA Stuenkel, 2013. MORE BENEFIT MORE HARM

Concerns with Progestogen Therapy Tolerability issues -Vaginal bleeding -Breast tenderness -Mood effects -Breast density Diverging safety profile of E versus E+P Alternative progestogen regimens are unproven regarding safety and efficacy Another method is needed to protect the uterus

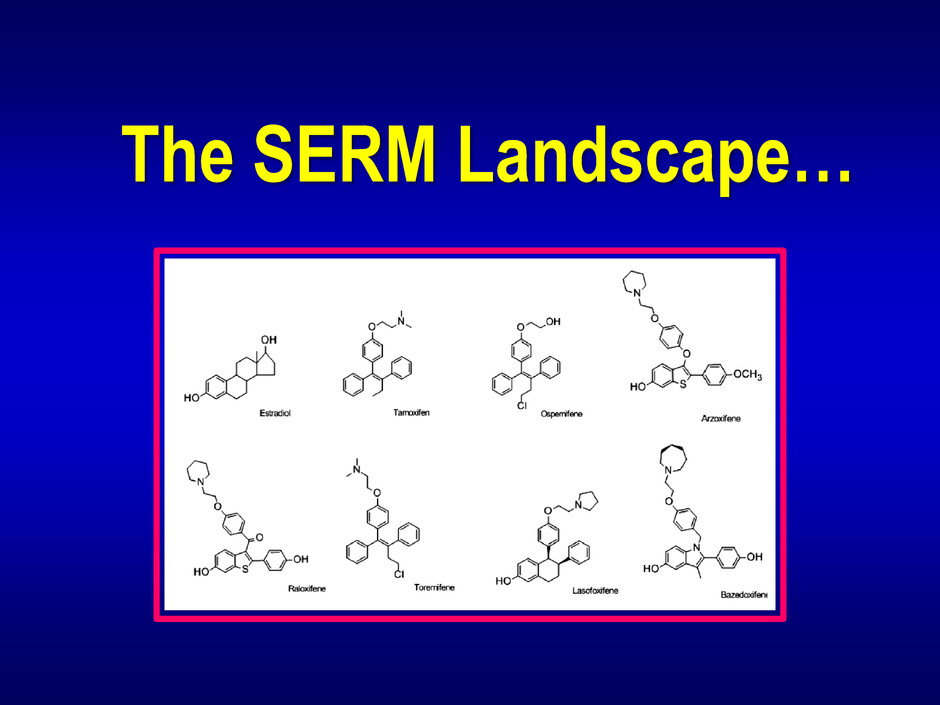

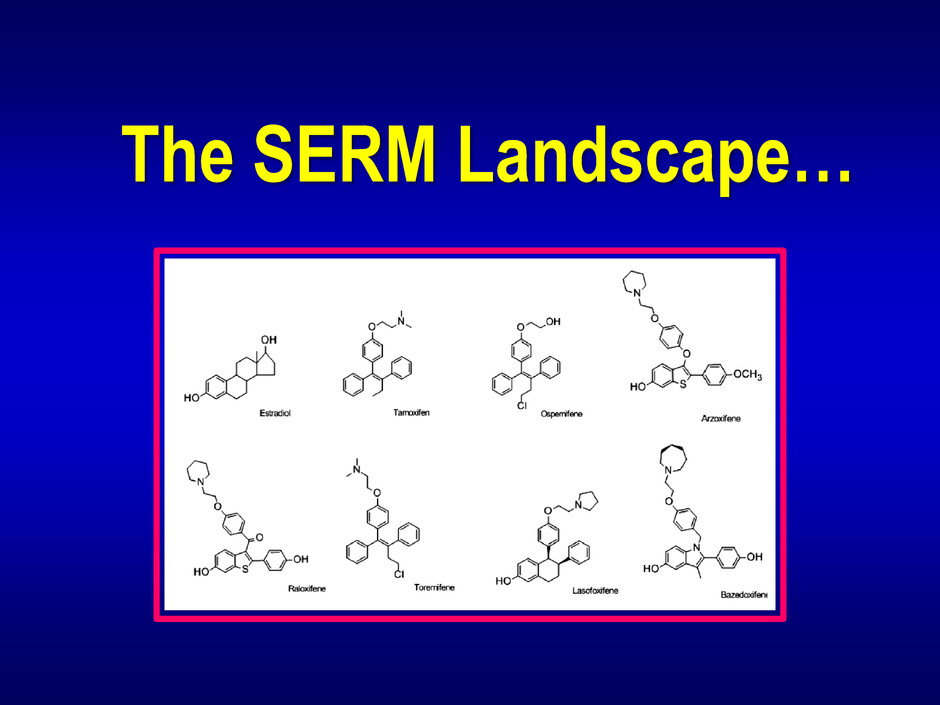

The SERM Landscape…

SERM Nomenclature Selective Estrogen Receptor Modulator Abbreviated as „SERM‟ FDA preferred terminology Estrogen Agonist/ Antagonist with Tissue-Selective Effects

Model of Estrogen Receptor Pharmacology Nelson ER Wardell SE, McDonnell DP Bone 2013; 53:42-50.

Menopause Management Clinical Indications for SERM Rx Prevention and Treatment Breast cancer Osteoporosis Symptom Relief Dyspareunia Vasomotor symptoms

Menopause Management Clinical Indications for SERM Rx Prevention and Treatment Breast cancer Osteoporosis Symptom Relief Dyspareunia Vasomotor symptoms

Menopause Management Clinical Indications for SERM Rx Prevention and Treatment Breast cancer Osteoporosis Symptom Relief Dyspareunia Vasomotor symptoms

Ospemifene: Treatment of Dyspareunia FDA approval February 26, 2013 Oral 60 mg tablet taken once daily with food Indication: • Treatment of moderate to severe dyspareunia • A symptom of vulvar and vaginal atrophy due to menopause www.fda.gov/NewsEvents

Menopause Management Clinical Indications for SERM Rx Prevention and Treatment Breast cancer Osteoporosis Symptom Relief Dyspareunia Vasomotor symptoms

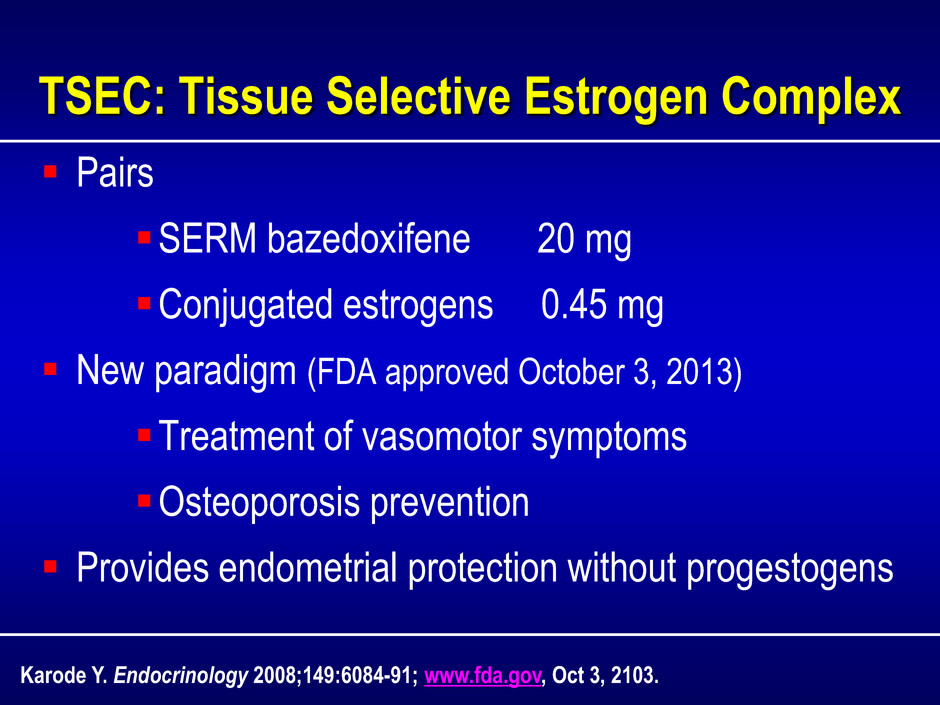

TSEC: Tissue Selective Estrogen Complex Pairs SERM bazedoxifene 20 mg Conjugated estrogens 0.45 mg New paradigm (FDA approved October 3, 2013) Treatment of vasomotor symptoms Osteoporosis prevention Provides endometrial protection without progestogens Karode Y. Endocrinology 2008;149:6084-91; www.fda.gov, Oct 3, 2103.

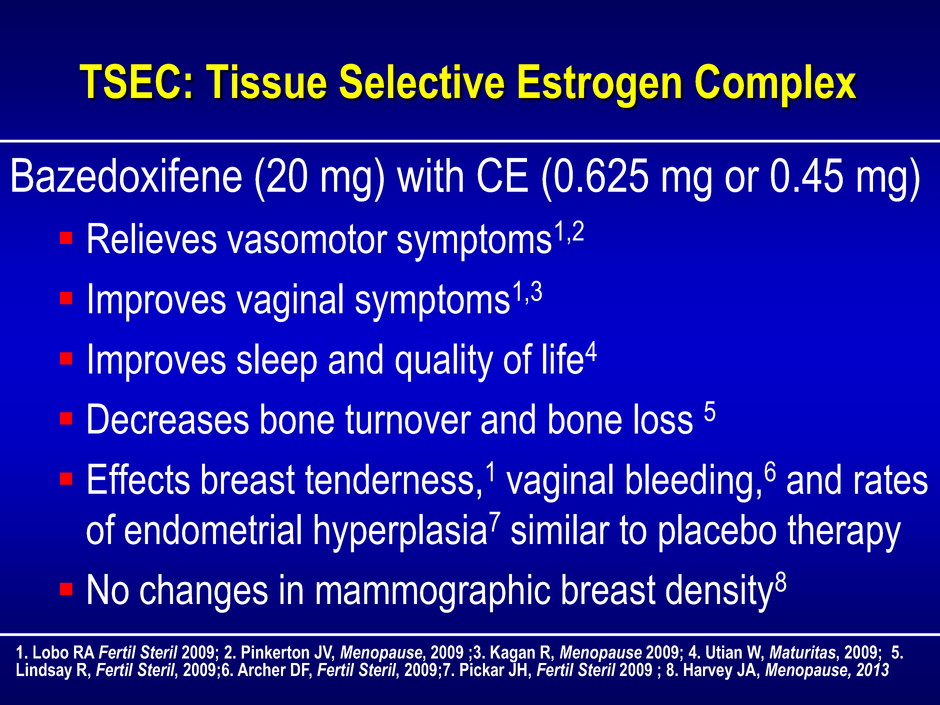

TSEC: Tissue Selective Estrogen Complex Bazedoxifene (20 mg) with CE (0.625 mg or 0.45 mg) Relieves vasomotor symptoms1,2 Improves vaginal symptoms1,3 Improves sleep and quality of life4 Decreases bone turnover and bone loss 5 Effects breast tenderness,1 vaginal bleeding,6 and rates of endometrial hyperplasia7 similar to placebo therapy No changes in mammographic breast density8 1. Lobo RA Fertil Steril 2009; 2. Pinkerton JV, Menopause, 2009 ;3. Kagan R, Menopause 2009; 4. Utian W, Maturitas, 2009; 5. Lindsay R, Fertil Steril, 2009;6. Archer DF, Fertil Steril, 2009;7. Pickar JH, Fertil Steril 2009 ; 8. Harvey JA, Menopause, 2013

Breast Density Effects of Bazedoxifene-Conjugated Estrogens Pinkerton JV et al. Obstet Gynecol 2013; 121:959-68.; 1 year trial

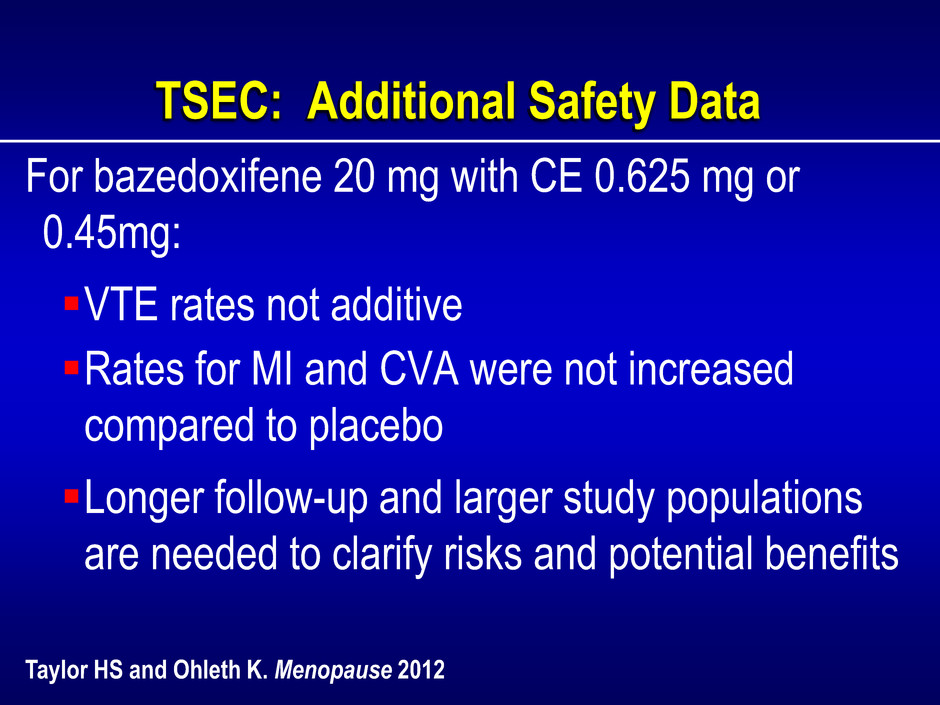

TSEC: Additional Safety Data For bazedoxifene 20 mg with CE 0.625 mg or 0.45mg: VTE rates not additive Rates for MI and CVA were not increased compared to placebo Longer follow-up and larger study populations are needed to clarify risks and potential benefits Taylor HS and Ohleth K. Menopause 2012

Menopause Management Summary and Conclusions Although estrogen has been known for over 70 years to be the most effective agent to relieve symptoms of menopause, unique challenges remain for managing signs and symptoms of the menopause transition and maintaining postmenopausal health

Menopause Management Summary and Conclusions For women with a uterus, combined estrogen and progestogen therapy increases risks and decreases patient tolerability of postmenopausal hormone therapy SERM (Selective Estrogen Receptor Modulator) or TSEC (Tissue Selective Estrogen Complex) therapy has progressed from preventive indications to relief of menopausal symptoms Additional follow-up of newer therapies for longer periods of time will clarify the risk/benefit profiles

Menopause Management Summary and Conclusions The menopause transition, when viewed as a portal to the second half of life, becomes a critical window to reassess lifestyle, recognize ongoing and potential health concerns, and take a proactive approach to future wellbeing

Managing Menopause Symptoms: Yesterday, Today, and Tomorrow Cynthia A. Stuenkel, MD University of California, San Diego Ligand Pharmaceuticals, Inc. Analyst Day November 14, 2013

Keith Marschke, Ph.D.

Introducing Keith Marschke, Ph.D. • Vice President of Biology • Joined Ligand in 1994 • Held leadership roles in some of Ligand’s most successful discovery programs — TPO, EPO, GCSF — SARM and SERMs • Ph.D. in Molecular and Cellular Pathobiology from the Bowman Gray School of Medicine- Wake Forest University — Postdoctoral research in the Laboratories of Reproductive Biology at the University of North Carolina • Author of more than 50 scientific publications 153

Glucagon Receptor Antagonist Program

Diabetes: A Growing Global Epidemic 155 • Currently affects over 350 million people worldwide — 26 million in U.S. (11% of adult population) — 2 million Americans diagnosed every year • By 2050, 1 in 3 adults in U.S. will have diabetes if trend continues 2013 Non-Diabetics Diabetics Source: American Diabetes Association “Fast Facts” 2013; CDC “National Diabetes Fact Sheet” 2011; WHO Diabetes Fact Sheet; International Diabetes Federation Atlas, 2012 Update 2050

Major Global Market for Diabetes Drugs $33 B $60+ B Sources: Brinson Patrick report 12/3/12; SunTrust report 6/25/13 • One of the largest drug categories • Global market projected to double to over $60 billion by 2020 • Combination therapy highly prevalent and necessary to optimize management of the disease • Significant opportunity for novel treatment mechanisms 156

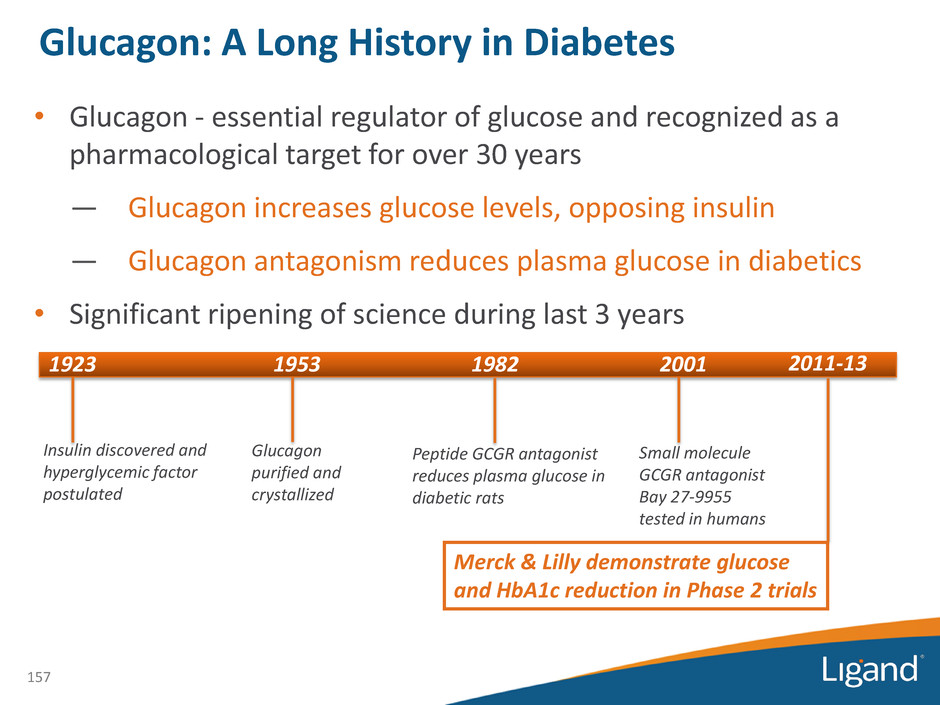

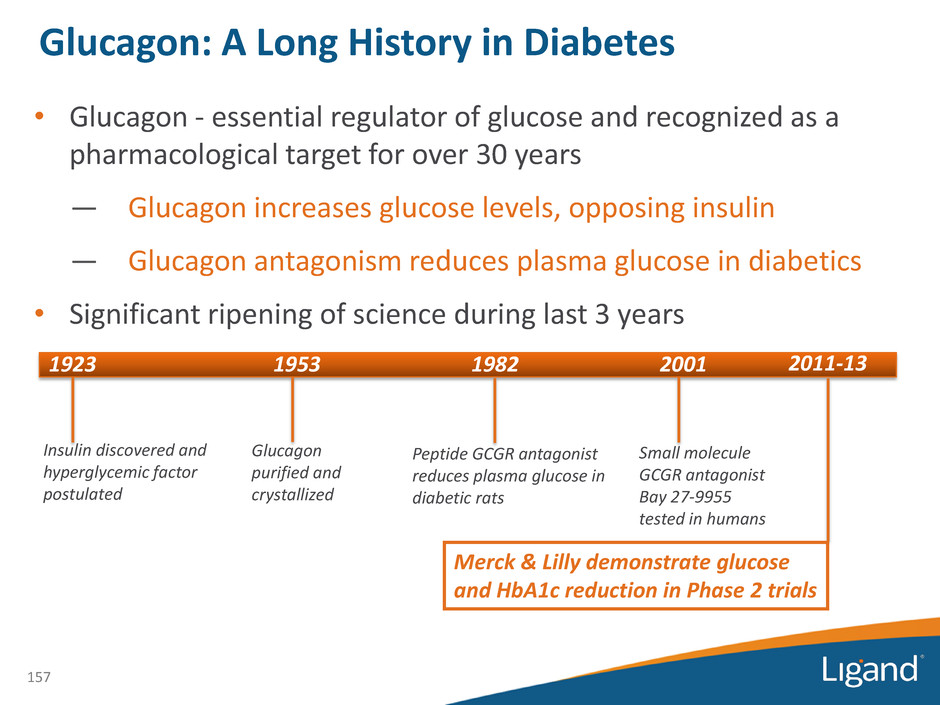

• Glucagon - essential regulator of glucose and recognized as a pharmacological target for over 30 years — Glucagon increases glucose levels, opposing insulin — Glucagon antagonism reduces plasma glucose in diabetics • Significant ripening of science during last 3 years 1923 1953 1982 Insulin discovered and hyperglycemic factor postulated Glucagon purified and crystallized Peptide GCGR antagonist reduces plasma glucose in diabetic rats 2001 Small molecule GCGR antagonist Bay 27-9955 tested in humans 2011-13 Merck & Lilly demonstrate glucose and HbA1c reduction in Phase 2 trials 157 Glucagon: A Long History in Diabetes

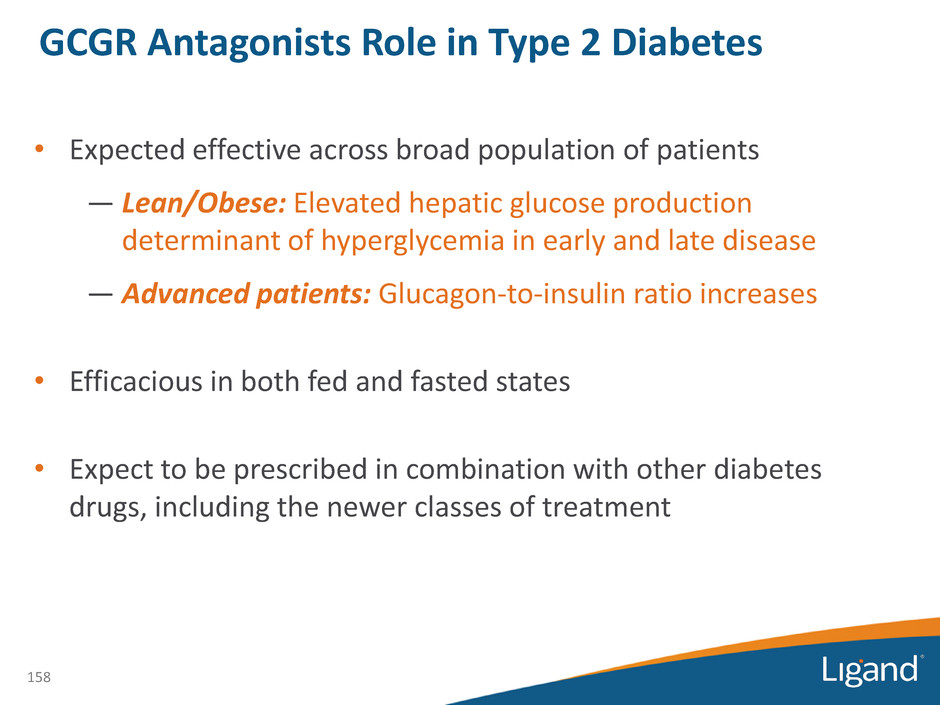

• Expected effective across broad population of patients — Lean/Obese: Elevated hepatic glucose production determinant of hyperglycemia in early and late disease — Advanced patients: Glucagon-to-insulin ratio increases • Efficacious in both fed and fasted states • Expect to be prescribed in combination with other diabetes drugs, including the newer classes of treatment 158 GCGR Antagonists Role in Type 2 Diabetes

Class Estimated Peak Sales Potential Potential Drugs in 2020 DPP-IV Inhibitors $12 Billion 5 GLP-1 Agonists $7 Billion 5 SGLT-2 Inhibitors $2 Billion 4 GCGR Antagonists ++++ 2 Source: Thompson Reuters, Annual Reports • Branded treatments have multi-billion dollar sales potential • By 2020, existing classes will all have 4-5 competing agents • GCGR antagonist class: Only two companies, including Ligand, could potentially share multibillion-dollar opportunity by 2020 159 Significant Opportunity for GCGR Antagonists

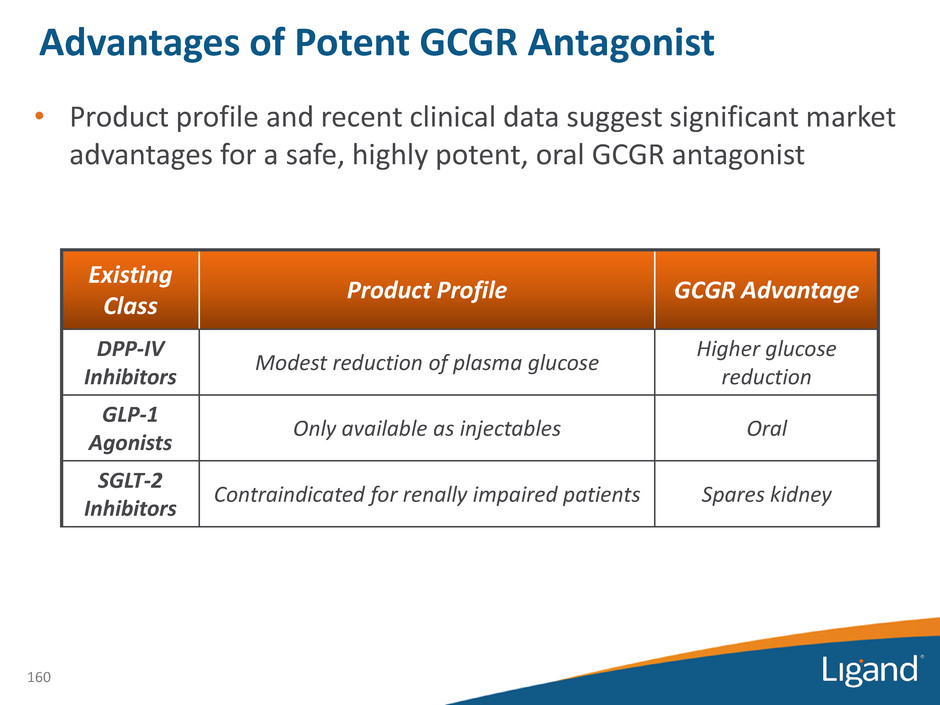

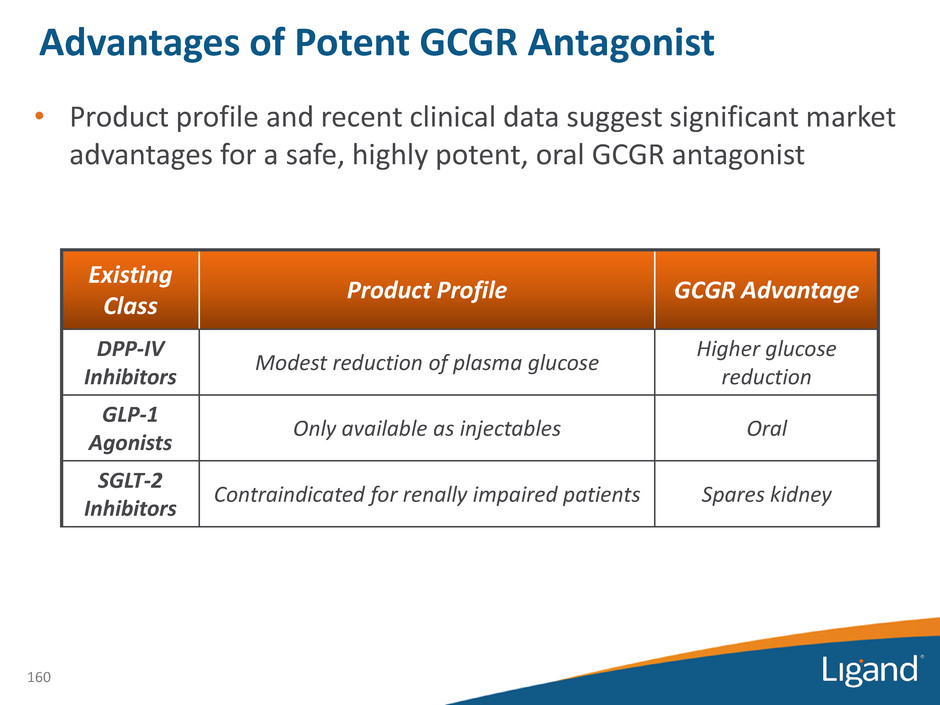

Existing Class Product Profile GCGR Advantage DPP-IV Inhibitors Modest reduction of plasma glucose Higher glucose reduction GLP-1 Agonists Only available as injectables Oral SGLT-2 Inhibitors Contraindicated for renally impaired patients Spares kidney • Product profile and recent clinical data suggest significant market advantages for a safe, highly potent, oral GCGR antagonist 160 Advantages of Potent GCGR Antagonist

Class Company Lilly AZ BMS Merck BI Takeda Novartis Sanofi GSK Novo J&J DPP-IV Inhibitors √ √ √ √ √ √ √ GLP-1 Agonists √ √ √ √ √ √ SGLT-2 Inhibitors √ √ √ √ √ √ GCGR Antagonist √ Commercial or late-stage clinical assets Single region molecules not shown • Major diabetes players can fill a hole in their treatment offerings, newer players could make a significant market impact • Over the past 5 years there have been 28 licensing deals in diabetes with disclosed deal payments of $7.9 billion 161 Global Diabetes “Dance Card”

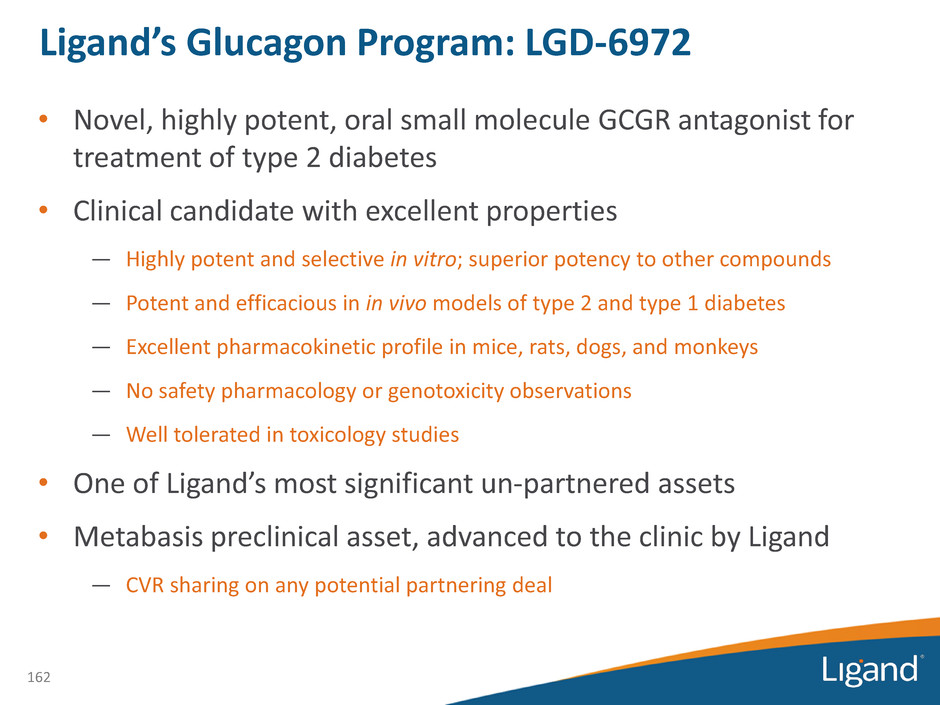

Ligand’s Glucagon Program: LGD-6972 • Novel, highly potent, oral small molecule GCGR antagonist for treatment of type 2 diabetes • Clinical candidate with excellent properties — Highly potent and selective in vitro; superior potency to other compounds — Potent and efficacious in in vivo models of type 2 and type 1 diabetes — Excellent pharmacokinetic profile in mice, rats, dogs, and monkeys — No safety pharmacology or genotoxicity observations — Well tolerated in toxicology studies • One of Ligand’s most significant un-partnered assets • Metabasis preclinical asset, advanced to the clinic by Ligand — CVR sharing on any potential partnering deal 162

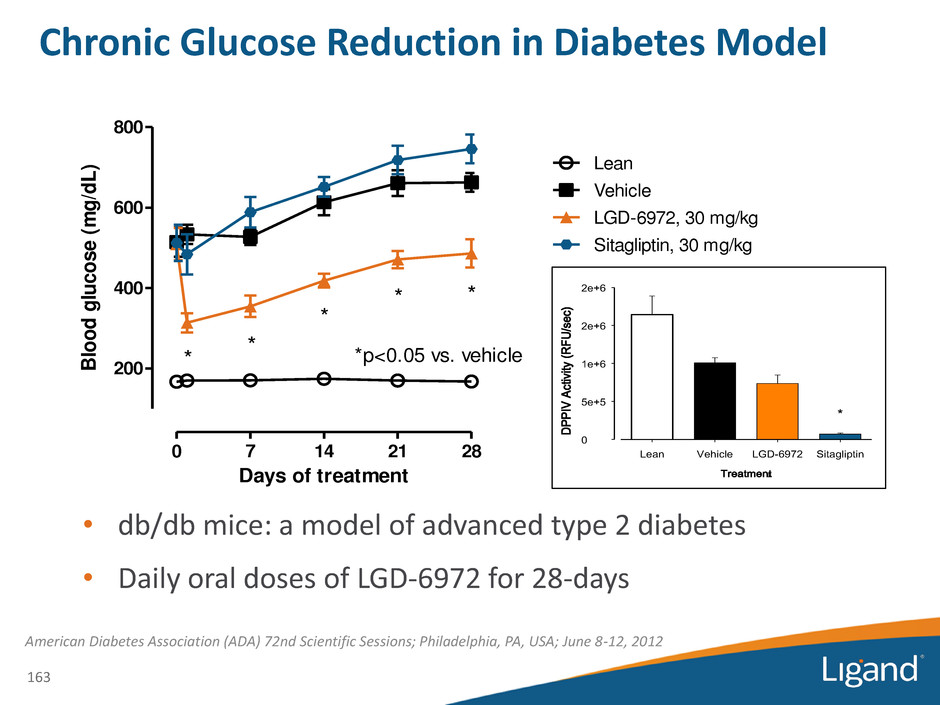

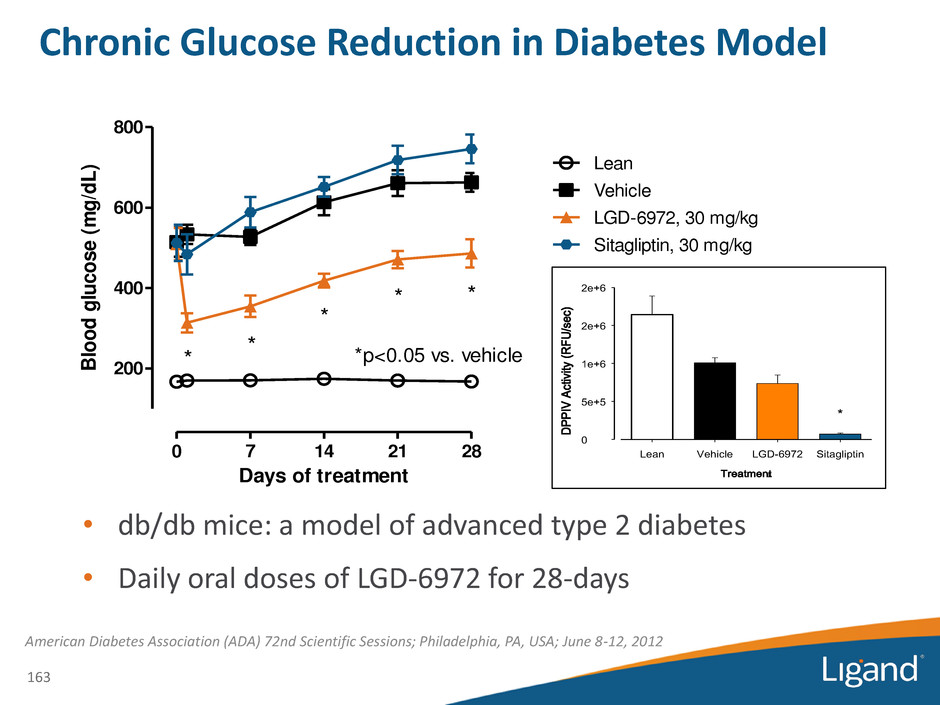

Treatment Lean Vehicle LGD-6972 Sitagliptin D P P IV A ct iv ity ( R F U /s e c) 0 5e+5 1e+6 2e+6 2e+6 * * Chronic Glucose Reduction in Diabetes Model • db/db mice: a model of advanced type 2 diabetes • Daily oral doses of LGD-6972 for 28-days American Diabetes Association (ADA) 72nd Scientific Sessions; Philadelphia, PA, USA; June 8-12, 2012 0 7 14 21 28 200 400 600 800 Vehicle LGD-6972, 30 mg/kg Sitagliptin, 30 mg/kg * * * * * Lean *p<0.05 vs. vehicle Days of treatment Bl oo d glu co se (m g/ dL ) 163

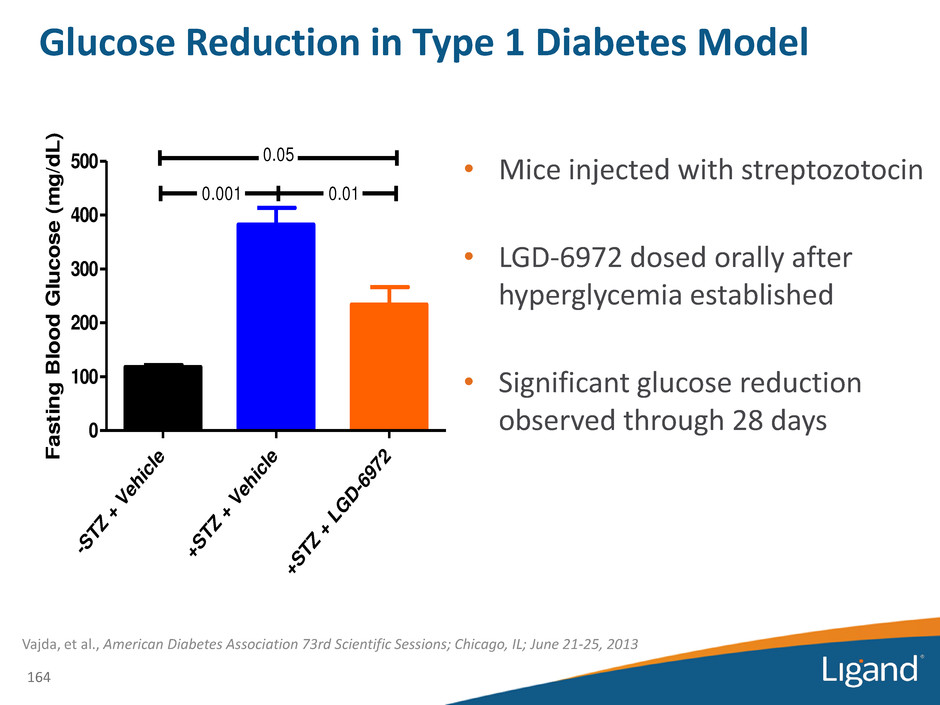

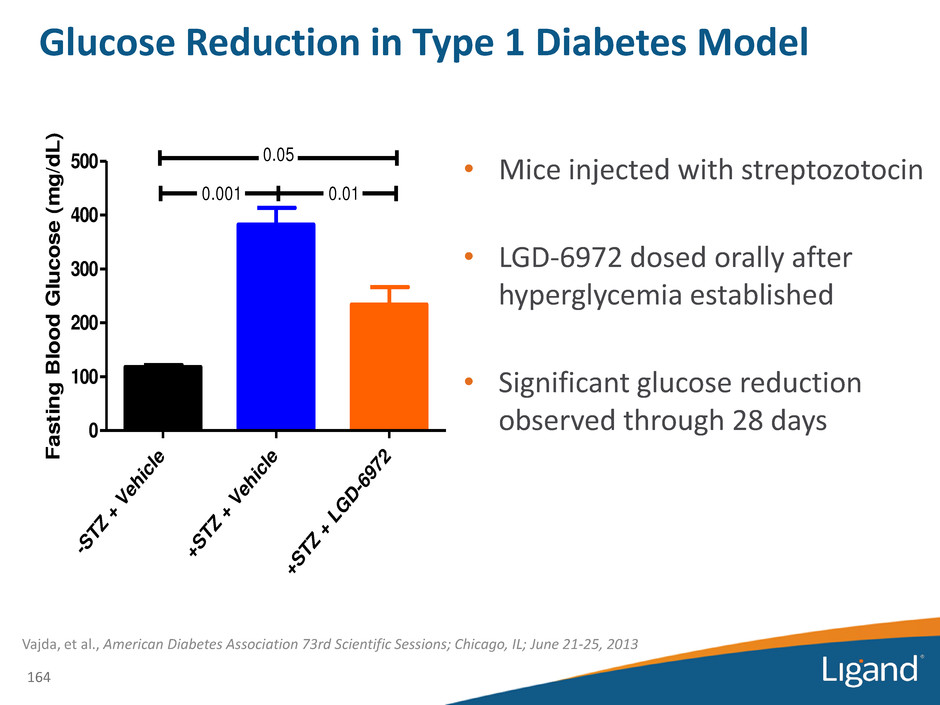

Glucose Reduction in Type 1 Diabetes Model • Mice injected with streptozotocin • LGD-6972 dosed orally after hyperglycemia established • Significant glucose reduction observed through 28 days 164 -S TZ + V eh ic le +S TZ + V eh ic le +S TZ + L G D -6 97 2 0 100 200 300 400 500 0.05 0.001 0.01 F a s ti n g B lo o d G lu c o s e ( m g /d L ) Vajda, et al., American Diabetes Association 73rd Scientific Sessions; Chicago, IL; June 21-25, 2013

165 • Primary objective: Evaluate the safety and tolerability of single oral doses of LGD-6972 in healthy subjects and subjects with type 2 diabetes — Double-blind, placebo-controlled, randomized ascending dose study • Enrollment planned for 56 participants — Six groups of healthy subjects and one group of subjects with diabetes — 8 subjects per group (6 LGD-6972 and 2 placebo) • Trial initiated November 2013 Phase I Clinical Trial Design

Financial Overview and Outlook John Sharp

$0 $10 $20 $30 $40 $50 $60 $70 $80 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Low Operating Costs $ m il lio n s Combined R&D and G&A Cash Expense Do not need to increase costs to grow revenue from existing portfolio Focused spending discipline, elimination of costs not driving value 167

45% 45% 10% Company Operations Facilities, insurance, taxes and administrative expenses 2013 Cost Structure • Annual cash costs of <$20 million • Efficient cost structure that supports activities to further expand the “Shots-on-Goal” portfolio Pipeline Costs Research & development, business development and patent costs Public Company Costs Audit, public filing costs, legal and D&O insurance 168

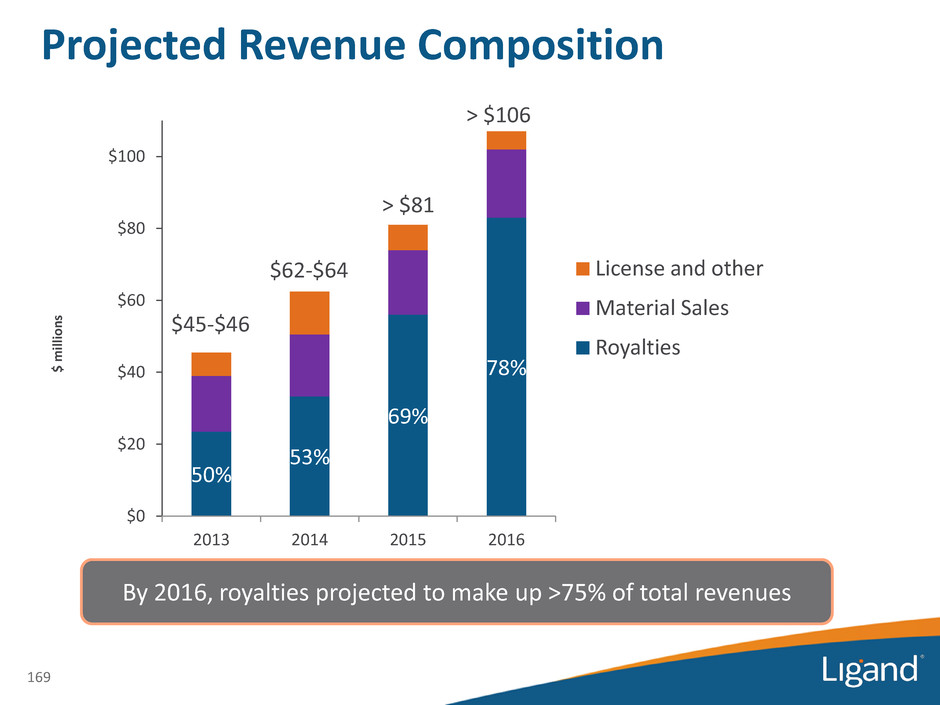

Projected Revenue Composition 50% 53% 69% 78% $0 $20 $40 $60 $80 $100 2013 2014 2015 2016 License and other Material Sales Royalties > $106 $45-$46 $62-$64 > $81 By 2016, royalties projected to make up >75% of total revenues $ m il lio n s 169

2014 – 2016 Revenue Buildup • Royalty revenue: — Derived from sell-side research analysis and analyst projections for Promacta and Kyprolis • Captisol sales: — Projected to be between $15 and $20 million per year • License/milestones: — Projected to be between $5 and $10 million per year based on potential milestones for existing deals — Does not include significant new deals 170

Gross Margins • Royalties – 100% gross margin • License and Milestone payments – 100% gross margin • Captisol Material Sales – Projected 55% gross margin for 2014 - 2016 — Cost of goods % dependent on type of sale — Clinical: ~80% gross margin — Commercial: ~50% gross margin • For 2014 - 2016, majority of revenue will be derived from royalties and license/milestone payments Projected ~ 90% gross margin for combined projected revenue for 2014 - 2016 171

• High annual revenue growth projected for next three years — 2014: $62 - $64 million — 2015: > $81 million — 2016: > $106 million • Low annual cash expenses of approximately $20 million per year • Significant earnings per share growth projected next three years — 2014: $1.40 - $1.45 — 2015: > $2.13 — 2016: > $3.18 Three-Year Financial Outlook EPS Outlook based on Non-GAAP EPS (excludes CVRs, discontinued operations and stock-based comp) and based on 21.2 million, 21.7 million and 22.2million "fully diluted shares outstanding” for 2014, 2015 and 2016, respectively 172

Tax Assets • Ligand has three types of tax assets — Net operating loss carryforwards (NOLs) — Tax credits — Future tax deductions • Based on continued tax analysis, Ligand’s projected gross tax assets have increased by $59 million over the past year, from $747 million to $806 million 173

Summary of Tax Assets • NOLs: — $511 million of federal NOLs (~$464 million unrestricted) — $185 million of state NOLs • Tax credits: — $19.5 million of federal R&D tax credits — $17.5 million of state R&D tax credits • Future deductions: — $73 million of future federal NOLs (capitalized R&D) Based on current outlook, we expect to utilize the majority of our tax assets over the next 6 years 174

Projected Tax Expense • Ligand currently has a full “valuation allowance” against its deferred $245 million tax assets – Until “valuation allowance” is released, annual book tax expense is equal to $0.5 million plus actual taxes paid • Upon reaching consistent, multi-year profitability, Ligand will release the “valuation allowance” and record a tax benefit of approximately $245 million – Subsequent to the release of the “valuation allowance”, annual book expense will be equal to taxable income multiplied by the statutory rate (~38%) – Actual tax payments expected to be < 2% of pre-tax income For Illustration Purposes 2014 2015 2016 2017 2018 Book tax rate 5% -613% 38% 38% 38% Taxes paid rate* 2% 2% 2% 2% 2% * Assumes no future section 382 ownership changes to limit NOL use 175

Long-term Cash Planning Significant High-Quality Revenue Growth + Flat Cash Expenses + > $800 Million of Tax Assets = Accumulation of potentially large cash balance to be used for opportunistic acquisitions or returned to shareholders 176

2013 Financial Guidance ($ in millions) Revenue Royalties 6.8$ - 7.0$ 23.2$ - 23.4$ Material sales 3.7 - 4.0 15.9 - 16.2 License and other 0.5 - 1.0 5.9 - 6.4 11.0$ - 12.0$ 45.0$ - 46.0$ Cost of goods sold 45% 40% Combined R&D and G&A 5.9$ - 6.4$ 26.5$ - 27.0$ EPS - Non-GAAP 0.15$ - 0.17$ 0.49$ - 0.51$ EPS - Non-GAAP (excl Stock Comp) 0.22$ - 0.24$ 0.77$ - 0.79$ Full Year 2013 4th Quarter 2013 • Ligand now completing it’s first full year of operational profitability and closely monitors the business on a cash basis • Consistent with industry peers, going forward, Ligand will exclude stock- based compensation expense from non-GAAP net income and EPS 177

Milestone Partner LGND Est. Timing CE-Carbamazapine NDA filing Lundbeck December RE-021 FONT-3 Phase 2 initiation Retrophin December ASH Conference (Promacta, Kyprolis, Oral GCSF) GSK, Onyx, LGND December AES Conference (CE-Carbamazepine) Lundbeck December Undisclosed (Captisol program) Phase 1 initiation Sage December Pradefovir Phase 1 initiation Chiva Q1 ‘14 BACE Phase 2/3 safety data Merck Q1 ‘14 BACE Phase 2/3 Phase 3 initiations Merck Q1 ‘14 Undisclosed (Captisol program) Phase 2 initiation Vertex Q1 ‘14 DUAVEE™ US Launch Pfizer Q1 ‘14 Fablyn launch Ethicor Q2 ‘14 Kyprolis Phase 3 data Onyx 1H ‘14 178 Potential Upcoming News and Catalysts

Milestone Partner LGND Est. Timing Melphalan NDA filing Spectrum 1H ‘14 MEI-143 Phase 2 initiation MEI Pharma 1H ‘14 MEI-344 Phase 1b initiation MEI Pharma 1H ‘14 CE-Delafoxacin Phase 3 completion Melinta Q3 ‘14 DUAVEE™ EU Approval Pfizer Q3 ‘14 EHA Conference (Promacta, Kyprolis) GSK, Onyx June ‘14 EASL Conference (HepDirect Technology) LGND June ’14 Glucagon Phase I data LGND 2H ’14 IV-Topiramate Phase 2 initiation CURx 2H ‘14 Alzheimer’s Assoc Int’l Conference (BACE) Merck July ‘14 Noxafil-IV Approval Merck Q3 ‘14 Undisclosed (Captisol Program) Launch Hospira Q3 ‘14 CE-Carbamazepine Approval Lundbeck Q4 ‘14 CE-Delafloxacin NDA filing Melinta Q4 ‘14 179 Potential Upcoming News and Catalysts

2014 and Beyond Analyst Day Chicago - November 14, 2013 NASDAQ: LGND