2018 and Beyond Analyst Day New York – November 14, 2017 NASDAQ: LGND

The following presentation contains forward-looking statements regarding Ligand’s prospects, plans and strategies, drug development programs and collaborations. Forward-looking statements include financial projections, expectations regarding research and development programs, and other statements including words such as “will,“ “should,” “could,” “plan,” etc. Actual events or results may differ from Ligand’s expectations. For example, drug development program benefits may not be realized and there can be no assurance that Ligand will achieve its guidance in 2017 or thereafter or that third party research summarized herein is correct or complete. The forward-looking statements made in the presentation are subject to several risk factors, including, statements regarding intent, belief, or current expectations of the Ligand, its internal and partnered programs, including Promacta™, Kyprolis® and EVOMELA®, Ligand’s reliance on collaborative partners for milestone and royalty payments, royalty and other revenue projections based on third party research, regulatory hurdles facing Ligand's and partners’ product candidates, uncertainty regarding Ligand's and partners’ product development costs, the possibility that Ligand's and partners’ drug candidates might not be proved to be safe and efficacious and commercial performance of Ligand's and/or its partners’ products, risks related to Ligand’s internal controls, its compliance with regulations, accounting principles and public disclosure, and other risks and uncertainties described in its public filings with the Securities and Exchange Commission, available at www.sec.gov. Additional risks may apply to forward-looking statements made in this presentation. Information regarding partnered products and programs comes from information publicly released by our partners. This presentation describes the typical roles and responsibilities of Ligand and our partners, and is not intended to be a complete description in all cases. Our trademarks, trade names and service marks referenced herein include Ligand and Captisol. Each other trademark, trade name or service mark appearing in this presentation belongs to its owner. The process for reconciliation between adjusted financial numbers presented on slide 99 and 101, and the corresponding GAAP figures is shown on slide 100. Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect our good faith beliefs (or those of the indicated third parties) and speak only as of the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement, and Ligand undertakes no obligation to revise or update this presentation to reflect events or circumstances or update third party research numbers after the date hereof. This caution is made under the safe harbor provisions of Section 21E of the Securities Exchange Act of 1934. Safe Harbor Statement 2

Today’s Agenda Business Overview and Commercial Assets John Higgins, CEO OmniAb Technology Overview Roland Buelow, Ph.D., VP, Antibody Technologies Pipeline and Technology Highlights Matt Foehr, President and COO Partner Presentations: Sermonix Pharmaceuticals Lasofoxifene David Portman, M.D., CEO Melinta Therapeutics Baxdela Lyn Baranowski, SVP, Corp Dev & Strategy Viking Therapeutics VK5211(SARM) and VK2809(TR-β) Brian Lian, Ph.D., CEO GRA Diabetes Program Eric Vajda, Ph.D., VP, Preclinical R&D Financial Overview and Outlook Matt Korenberg, CFO 3

• Realities of the pharmaceutical industry – Most drug research programs fail, but not all – Programs are not all of equal value – different time to market, risk, economics • BUT, the more quality programs you have, the higher likelihood of success – Diversified across a full range of industry partners – Diversified across a broad spectrum of therapeutic indications • A shot-on-goal for Ligand is a fully funded partnership – Backed by license to Ligand’s patents, know-how and/or data – Sharing of future economics based on partner’s success 4 Shots-on-Goal Business Model The “LIGAND MODEL”

The “LIGAND MODEL” The Balance in Our Business • Conduct early research, discover drugs • Decide which indications to pursue • Provide tools that make drugs possible • Design studies; manage regulatory work • License data and patents • Price drugs and secure reimbursement • Acquire new technologies and assets • Market drugs • Operate with low costs and maintain lean sharecount • Fund all development and commercialization 5 What We Do: What Our Partners Do:

0 15 30 45 60 75 90 105 120 135 150 165 2008 2017 9 0 2 4 6 8 10 12 14 16 18 2008 2017 Fu lly -Fu n d ed Pr ogr ams (“Sh ot s- o n -Goa l”) Ligand’s Portfolio Continues to Grow 165 + Ligand’s Achievement: Portfolio Expansion Partners’ Achievement: Approved Products Excellent record as drug researcher, innovator and licensor Our partners are doing their job getting new products to the market Latest product approvals include Baxdela and Bryxta 1 17 C o m me rc ial P ro d u ct s Ge n er at in g R ev en u e fo r Li ga n d 6

RPT – Ligand’s Foundation of Value 7 Revenue Pipeline Technology

Revenue High Growth High Margin Strong Protection Pipeline Large and Growing High Quality Many Late Stage Technology Best-in-Class Leverageable Strong IP RPT – Ligand’s Foundation of Value 8

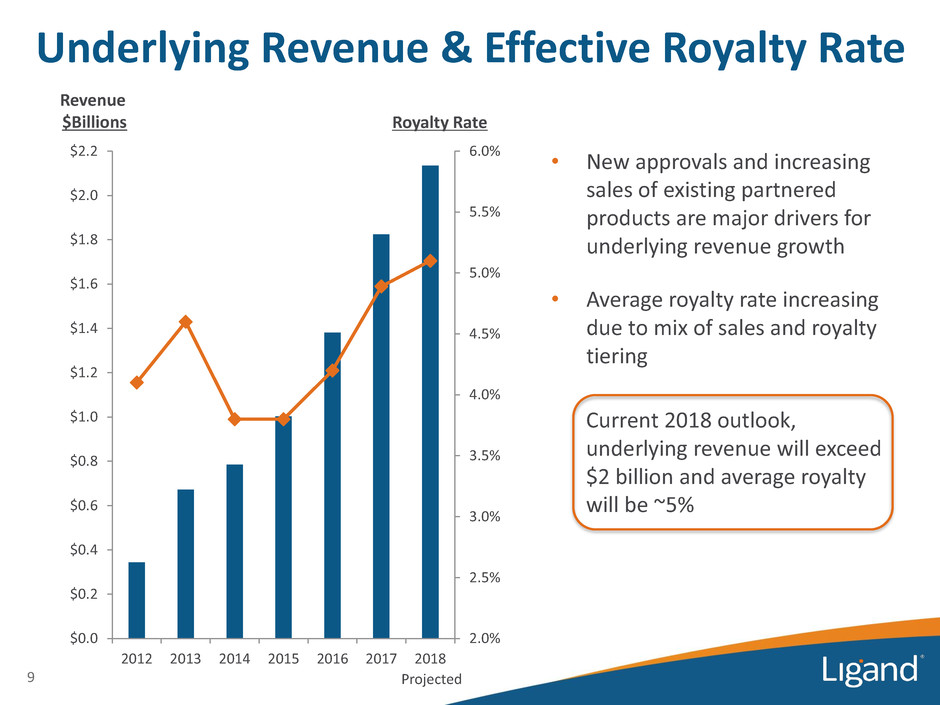

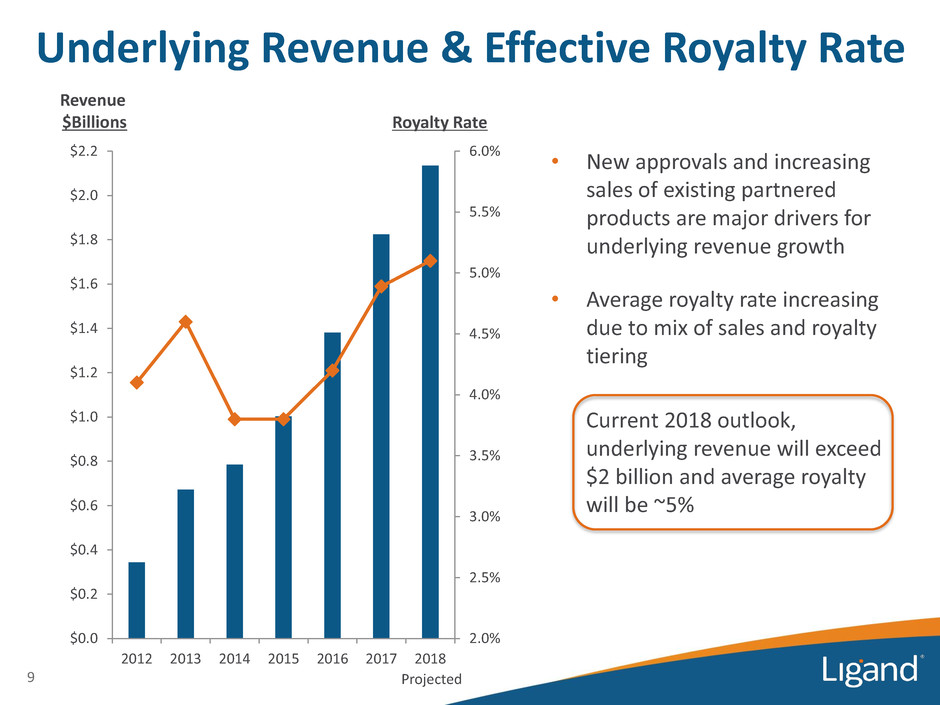

Underlying Revenue & Effective Royalty Rate 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 5.5% 6.0% $0.0 $0.2 $0.4 $0.6 $0.8 $1.0 $1.2 $1.4 $1.6 $1.8 $2.0 $2.2 2012 2013 2014 2015 2016 2017 2018 Revenue $Billions 9 Projected • New approvals and increasing sales of existing partnered products are major drivers for underlying revenue growth • Average royalty rate increasing due to mix of sales and royalty tiering Current 2018 outlook, underlying revenue will exceed $2 billion and average royalty will be ~5% Royalty Rate

10 Ligand’s Cash Generation is Increasing $0 $20 $40 $60 $80 $100 $120 $140 2012 2013 2014 2015 2016 2017 Ligand Revenue Cash Operating Expenses Actual Estimated • Strong revenue growth – 95% gross margins • Cash operating expense levels low and relatively flat • Significant increase in annual cash flow $ Milli o n s

Intellectual Property at Ligand • Over 800 worldwide issued patents • Significant investment in intellectual property supports licensing and helps further protect existing programs – Highly diverse patent portfolio – Many programs have layers of IP protection: NCE, formulation, use, etc. – Current and emerging programs are well-protected • Innovation and acquisitions have continued to yield substantial growth in Ligand’s patent portfolio 11

RPT – Ligand’s Foundation of Value Revenue High Growth High Margin Strong Protection Pipeline Large and Growing High Quality Many Late Stage Technology Best-in-Class Leverageable Strong IP 12

Pipeline • In pharmaceuticals, most programs fail; but not ALL programs • Ligand’s pipeline is: — Large and growing — Highly diversified — Many programs have top-tier sponsorship • Unique economic structure of Ligand’s pipeline: — Our deals are fully funded — Ligand is not generating big annual losses OR diluting shareholders to finance its pipeline • Many of Ligand’s major assets are still development-stage 13 Why is Ligand’s Pipeline Valuable?

Ligand’s Portfolio Continues to Grow Over 165 Partnered Programs • Portfolio remains diversified across development stages • Over 95 different partners • Nearly 55% of programs in clinical development or later • 11% marketed or NDA stage 14 Preclinical Phase 1 Phase 2 Phase 3NDA Marketed 45% 9% 22% 18% 4%2%

Ligand Portfolio Highlights • We estimate our partners will conduct over 200 studies and spend over $2 billion in 2018 on R&D to advance our programs • Total potential payments under existing contracts for our more than 165 partnerships exceed $2 billion • Ligand is partnered with major companies for some of the industry’s most important potential medicines • Ligand-based programs are major assets for partners Foundational for mega-acquisitions – e.g., Novartis with GSK-Oncology (Promacta), Amgen with Onyx (Kyprolis), BMS with Cardioxyl Foundational for IPO, reverse mergers or important financings – e.g., Melinta, Viking, Aldeyra, Retrophin, Sermonix, Marinus, others 15

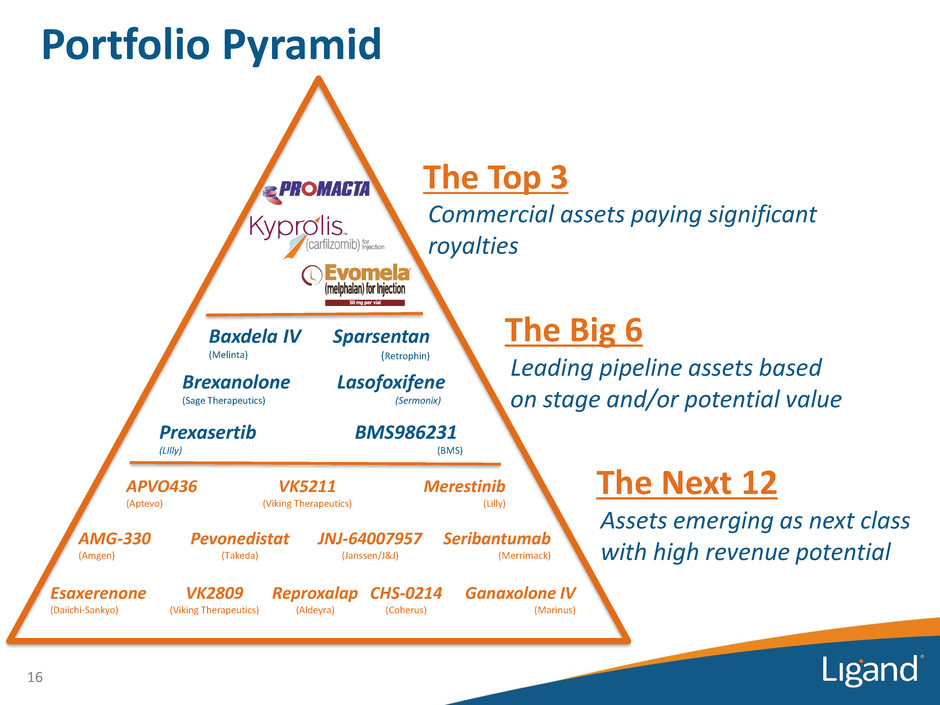

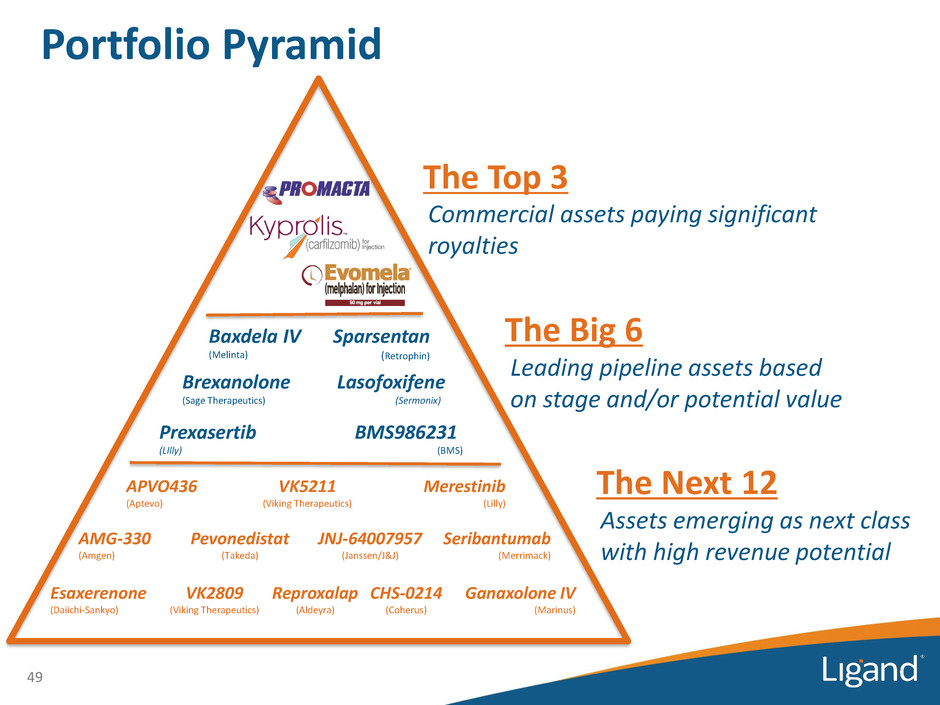

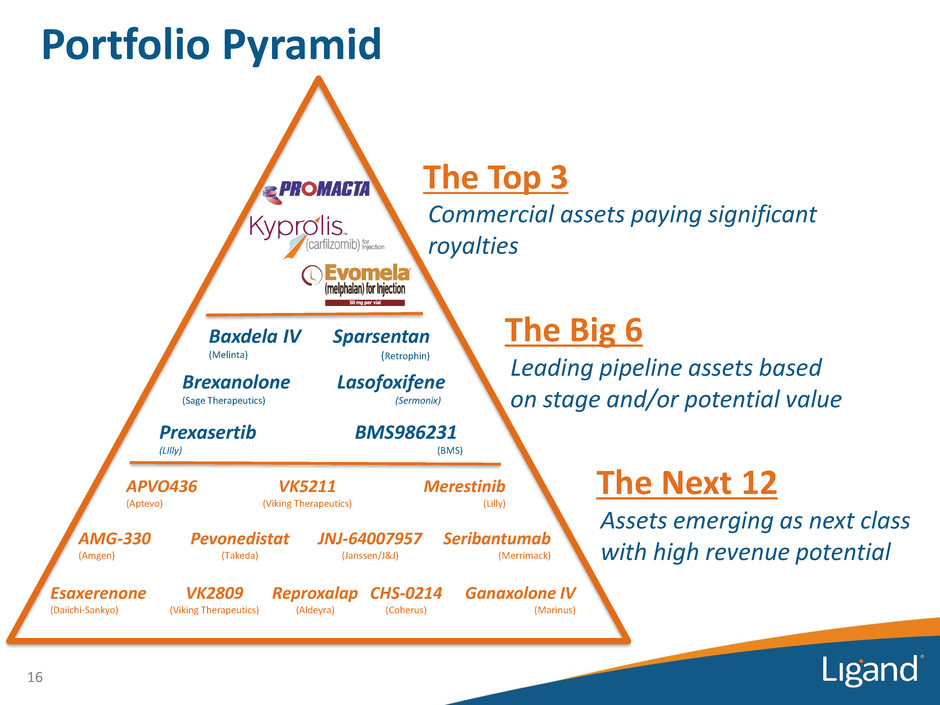

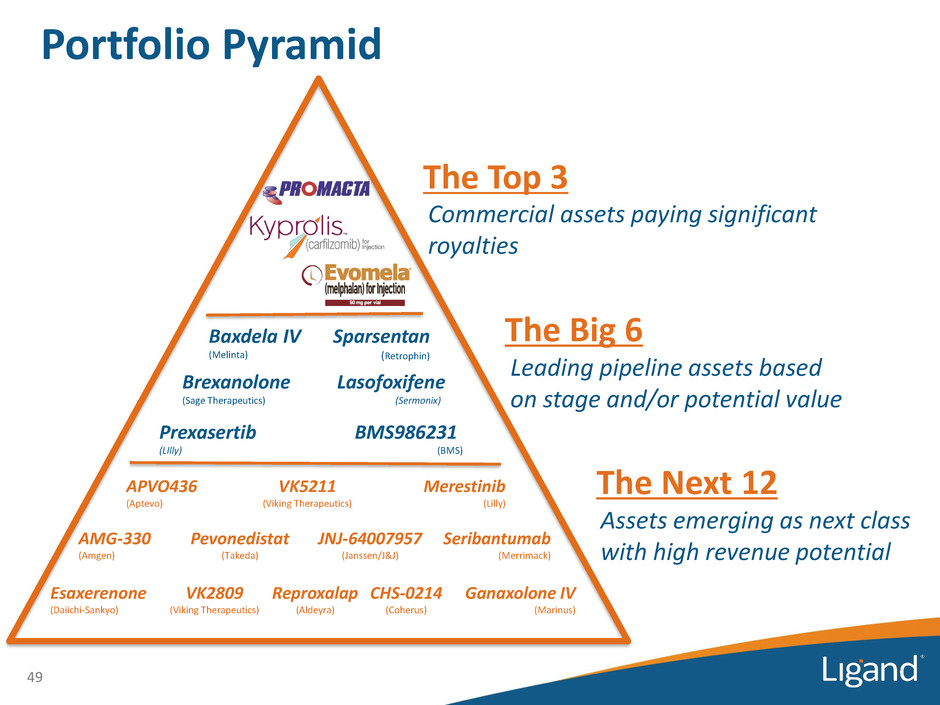

Portfolio Pyramid 16 Commercial assets paying significant royalties Prexasertib (LIlly) Lasofoxifene (Sermonix) Brexanolone (Sage Therapeutics) Sparsentan (Retrophin) Baxdela IV (Melinta) BMS986231 (BMS) APVO436 (Aptevo) VK5211 (Viking Therapeutics) VK2809 (Viking Therapeutics) Merestinib (Lilly) AMG-330 (Amgen) Pevonedistat (Takeda) JNJ-64007957 (Janssen/J&J) Seribantumab (Merrimack) Reproxalap (Aldeyra) CHS-0214 (Coherus) Esaxerenone (Daiichi-Sankyo) Ganaxolone IV (Marinus) The Top 3 The Big 6 Leading pipeline assets based on stage and/or potential value The Next 12 Assets emerging as next class with high revenue potential

Portfolio Pyramid Power of our Pipeline • 18 companies with over 100 trials conducted and in-progress in 2017 • Estimated >$500 million spent funding the programs partnered with Ligand in 2017 alone • Leading assets for Ligand Leading assets for partners — Discussed on most quarterly conference calls — For many partners, Ligand program is the leading/main program — Highly diversified indications and drug types • Ligand typically contributed drug and technology inventions, and shares in meaningful program economics 17 What the Pyramid Represents

18 • Drug development success rates have been tracked and published through the years • BIO published average rates of success by stage of development as follows: ― 85% probability of success for compounds with a submitted NDA ― 50% probability of success for Phase 3 compounds ― 15% probability of success for Phase 2 compounds ― 10% probability of success for Phase 1 compounds ― 7% probability of success for Preclinical compounds • Applying these current rates of success to Ligand’s current portfolio, Ligand projects having over 24 revenue bearing products by 2020 24 Commercial Products by 2020 Published Industry Success Rates Reference: Biotechnology Innovation Organization (BIO) 2016 published averages rates of success by stage of development

24 Commercial Products by 2020 • > 24 products projected to be generating commercial revenue for Ligand by the end of this decade • These revenue-generating assets expected to come from existing portfolio; future deals could be additive to this outlook 2008 2017 2020 Projected 1 17 > 24 19 C o m me rc ial P ro d u ct s Ge n er at in g R ev en u e

RPT – Ligand’s Foundation of Value Revenue High Growth High Margin Strong Protection Pipeline Large High Quality Many Late Stage Technology Best-in-Class Leverageable Strong IP 20

Two Major Technology Platforms Market Leading, Best-in-Class Potential Launch 21 Highly-pure, pharmaceutical grade ingredient with reliable supply Broad, global patent protection Large Drug Master Files Now with most pharma partners, most approved products Only antibody discovery platform with three species Platform with the most partners Strong market protection and long patent coverage for products Fast-growing number of drug candidates moving to the clinic

Last year, Ligand made a MAJOR strategic investment into antibody discovery by acquiring OMT, Inc. for ~$178 million Ligand’s continued investment in 2017 has solidified its position with the Best-in-Class antibody discovery platform 22 Antibody Technologies Like with Captisol, Ligand has made a “right time” investment into a major technology platform to deliver significant returns for the next 20 years Antibodies: Major Opportunities

Antibody treatments are the fastest-growing segment of the pharmaceutical industry 23 Antibodies: Major Opportunities WHY? • “Because they work”1 • Many of the largest drugs on the market are antibodies • Significant allocation of R&D resources toward antibodies 1 Janice Reichert, PhD - President, The Antibody Society, 2017

Success rates for antibody drug candidates have been nearly DOUBLE the rate for small- molecule drug candidates… 24 WHY? Antibodies: Major Opportunities Clinical Development success rates 2006-2015 (Bio, Biomedtracker and Amplion) Antibodies can be highly-targeted and bind very selectively to specific molecules

Ligand is at the right place and right time with a highly-valuable technology platform 25 There is a large and growing demand for antibody research tools More companies, more dollars than ever No signs of slowing, given research investments Industry is shifting to biological-based research Antibodies: Major Opportunities

26 The OmniAb Platform “Three Species – One License” By 2025, platform projected to generate: • >$300 million of contract revenue • > 40 clinical-stage programs • > 150 research-stage candidates • OmniAb products on the market

Roland Buelow, Ph.D. VP, Antibody Technologies

1. The biology, history and success of antibodies 2. OmniAb: A best-in-class technology 3. Our partners’ perspectives 4. Future outlook for OmniAb platform 28 OmniAb® Technology Topics

• Antibody therapy leverages an animal’s ability to generate proteins that bind very selectively to specific molecules • It is possible to create an antibody that is specific to almost any cell target 29 Biology of Antibodies The Power of the Immune System • Antibodies can influence the biology of target cells: — As agonists or antagonists — Influencing signaling — Even facilitating the selective killing of diseased cells

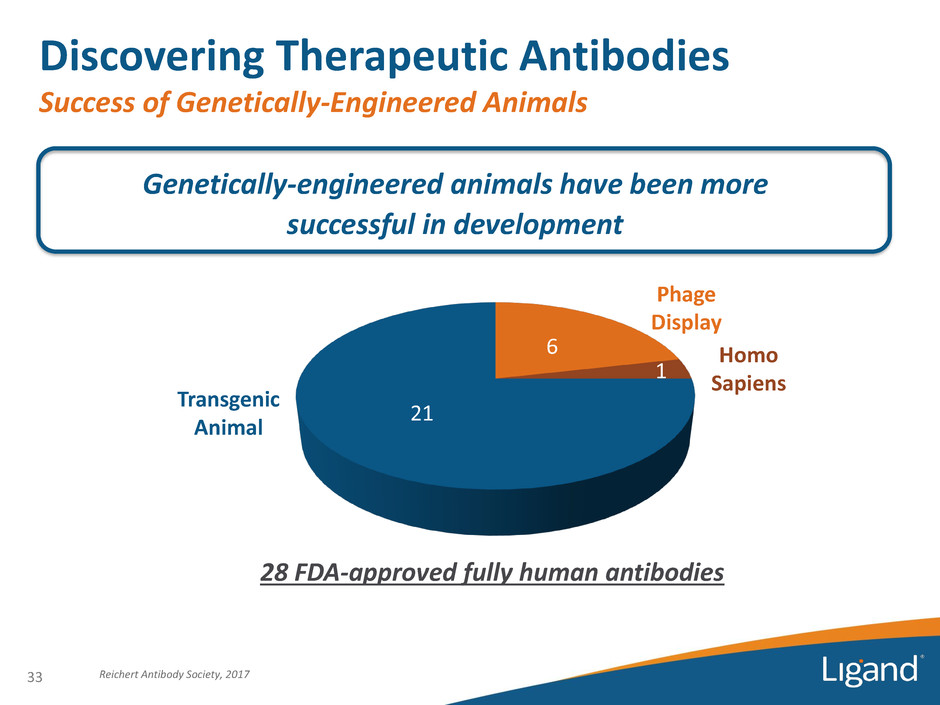

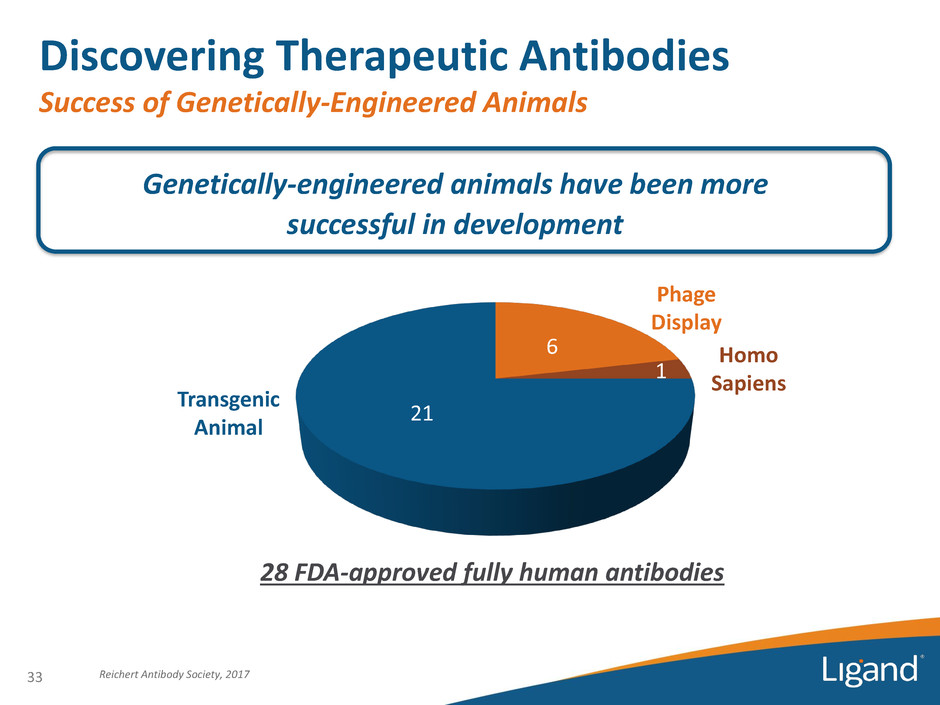

• Display technologies using Phage or Yeast have been used for the discovery of antibodies — Lack selectivity that can be achieved with in vivo animal systems — It’s well established that antibodies from Phage libraries often run into problems with stability, aggregation and other “manufacturability” challenges • Newer, cutting-edge and the most successful antibody discovery platforms are animal-based technologies that yield fully-human antibodies — Antibodies derived from animal systems are optimized in vivo and can be referred to as naturally optimized human antibodies™ • Superiority of animal-derived antibodies is clearly illustrated by the fact that the vast majority of antibodies now approved and on the market come from animals 30 Antibody Discovery and Research History and Facts

0 100 200 300 400 500 600 2008 2017 150 A n ti b odies in cli n ic al d ev elop m en t 557 • The number of antibodies in clinical development has more than tripled since 2008 Antibodies: Major R&D and Sales Growth 31 Nelson et al., Nature Reviews, 2010 Reichert Antibody Society, 2017 BioPharm Insight, March 2016 $0 $50 $100 $150 2011 2020 Sales o f A n ti b od y- B ase d T h er ap eu ti cs ( B ill ions $ ) Projected • Global sales of antibodies in 2020 estimated to approach $150 billion in 2020

Likelihood of Approval at Phase 1 Clinical Development success rates 2006-2015 (Bio, Biomedtracker and Amplion) Industry is Recognizing Higher Success Rates for Biologics • Success rates for antibody classes is nearly twice the rate of small molecules • Industry continues to make substantial investment in novel antibodies Type of Drug Likelihood of Approval at Phase 1 Stage Small molecules 6.2% Biologics/Antibodies 11.5% “Over the past 15 years, it has become clear that antibody therapeutics are both versatile and successful. The industry continues to be very interested in antibody- based therapeutics development, because they work.” Janice Reichert, PhD President, The Antibody Society Reichert Antibody Society, 2017 32

Discovering Therapeutic Antibodies Success of Genetically-Engineered Animals Genetically-engineered animals have been more successful in development 28 FDA-approved fully human antibodies Reichert Antibody Society, 2017 6 1 21 Phage Display Homo Sapiens Transgenic Animal 33

Optimization by Bioengineering 6-12 months (or longer) Discovering Human Antibodies The Immune System is Faster than Bioengineering 34 • Multi-step, iterative process • Possible gain/loss of activity • Labor intensive • Costly • Time consuming • No further engineering required • Significant time efficiency Optimized Naturally by Immune System 7-14 days Optimized Human Antibody Optimized Human Antibody

35 Extreme Competition Partners Want Newest and Best Technologies • Multiple companies pursuing similar targets, making efficiency and speed to market critical • Partners want the best • Partners want OmniAb Antibody research is highly competitive

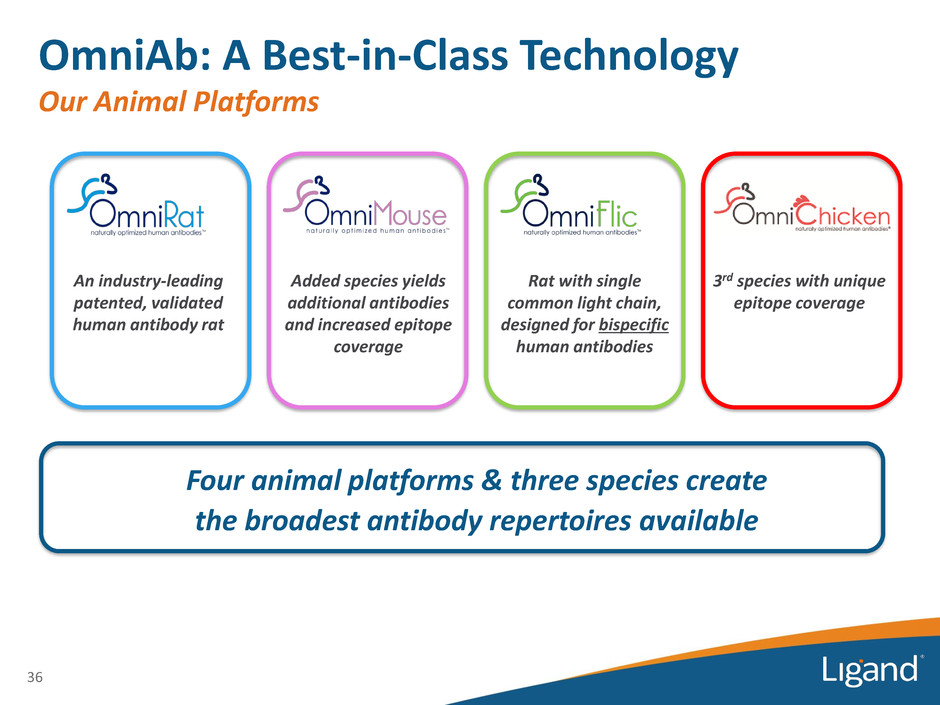

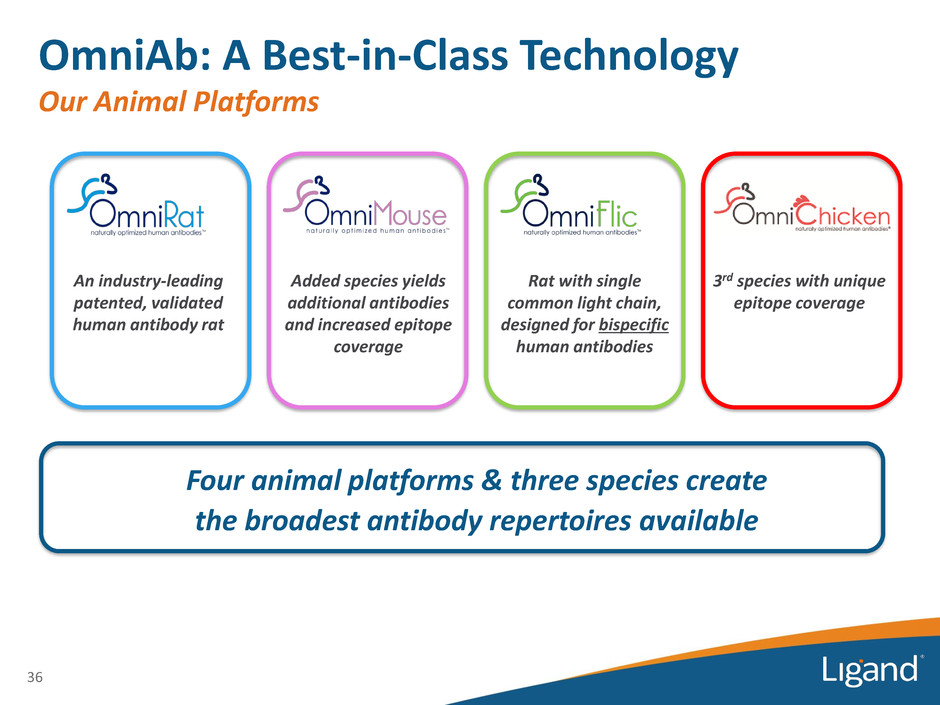

OmniAb: A Best-in-Class Technology Our Animal Platforms 36 Four animal platforms & three species create the broadest antibody repertoires available An industry-leading patented, validated human antibody rat Added species yields additional antibodies and increased epitope coverage Rat with single common light chain, designed for bispecific human antibodies 3rd species with unique epitope coverage

OmniAb: A Best-in-Class Technology Acquisition of OmniChicken™ Solidified Leadership Position Addition of OmniChicken offers partners unparalleled epitope coverage Mouse Response Rat Response Chicken Response Overlap area represents novel and cross-reactive epitopesNon-overlap area represents novel epitopes • Because of evolutionary distance between birds and mammals, chickens enable the generation of novel antibodies against targets that are not immunogenic in rodents 37

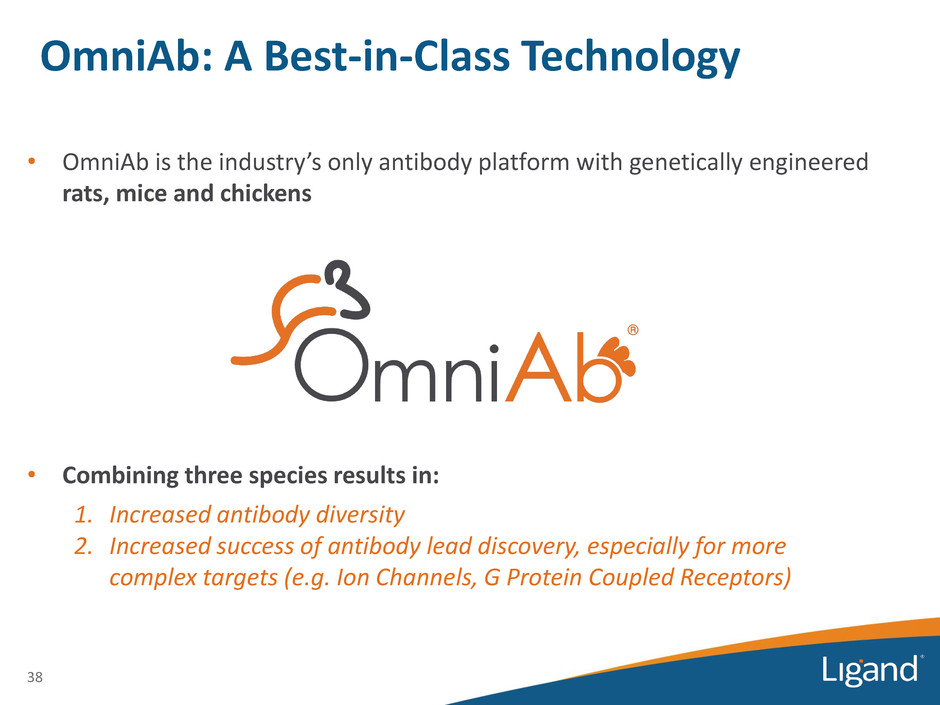

38 OmniAb: A Best-in-Class Technology • OmniAb is the industry’s only antibody platform with genetically engineered rats, mice and chickens • Combining three species results in: 1. Increased antibody diversity 2. Increased success of antibody lead discovery, especially for more complex targets (e.g. Ion Channels, G Protein Coupled Receptors)

0 600 1200 2015 2016 2017 Animals Ordered Rats Mice OmniAb: A Best-in-Class Tecnology Demand for Omni Rodents is Growing 39 Year-to-date • Partners are ordering more OmniRats and OmniMice following Ligand’s acquisition of OmniAb in early 2016

Partners report that they have obtained the highest quality antibodies for the most difficult targets when using OmniAb 40 OmniAb: A Best-in-Class Technology Broad Use We estimate that over 300 antibody targets have been or are being pursued by OmniAb partners

• Broad protection exists under issued OmniAb patents, with Freedom- to-Operate for all indications worldwide • Key internal know-how further protects assets • Other discovery technologies have been subject of significant complexity relating to Freedom-to-Operate OmniAb: A Best-in-Class Technology 41 Intellectual Property Publications Innovation & Customer Service • Science publication of OmniRat created global visibility for OmniAb technology • Partner clinical progress creates continued visibility and clinical validation • Recent publications describing OmniChicken have continued visibility Science 2009, July 24, 325: 433 mAbs 2017, 942: 0870 • Next generation animals, launching in 2018, keep OmniAb on cutting edge • Ligand’s renowned customer service creates optimal partner experience • Have recently added OmniChicken collaboration services

OmniAb: A Best-in-Class Technology Active Initiatives Create Broad Awareness with Targeted Audience 42

OmniAb: Our Partners’ Perspectives Time and Productivity Gains “We are getting high-affinity antibodies in a rapid period of time … this improves our cycle times for antibody discovery substantially” “For us, this saves significant time as we do not need to humanize” 43 Time Savings “There are major benefits to leveraging the in vivo selection pressure of an animal to select an antibody for you” “15 out of 15 targets we have pursued with the technology have yielded high-quality antibodies” “The animal-based approach is best for identifying quality antibodies” “With the OmniAb technology, your hit is your lead” Productivity/Efficiency of Animal-based System, High Antibody Quality with OmniAb

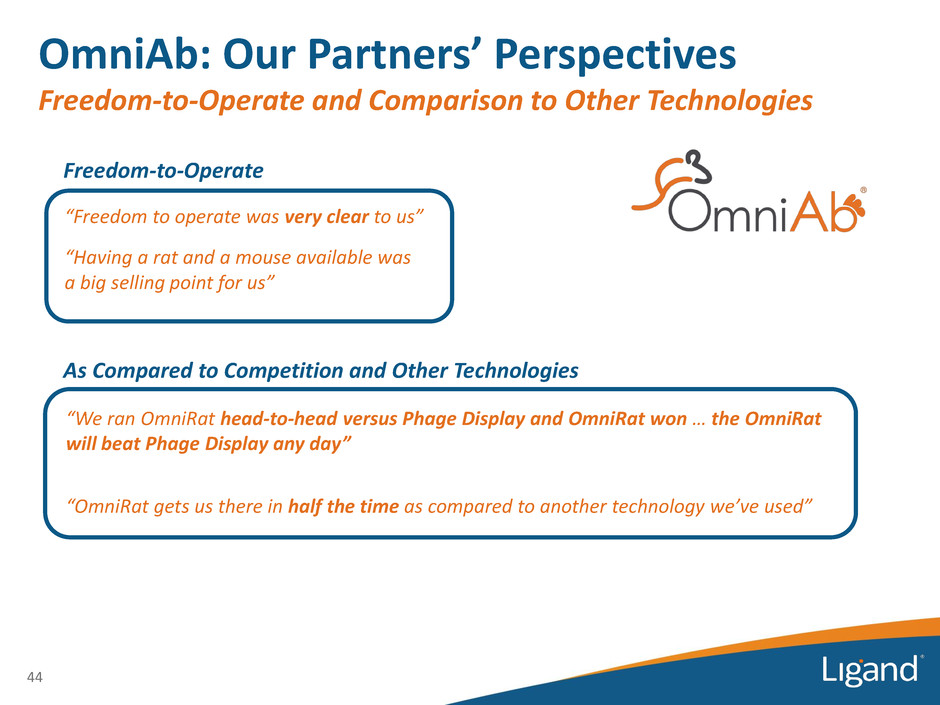

OmniAb: Our Partners’ Perspectives Freedom-to-Operate and Comparison to Other Technologies “We ran OmniRat head-to-head versus Phage Display and OmniRat won … the OmniRat will beat Phage Display any day” “OmniRat gets us there in half the time as compared to another technology we’ve used” 44 As Compared to Competition and Other Technologies “Freedom to operate was very clear to us” “Having a rat and a mouse available was a big selling point for us” Freedom-to-Operate

45 OmniAb: A Best-in-Class Technology “Three Species – One License”

0 1 2 3 4 5 6 7 8 2017 2018 2019 2020 • There are 4 OmniAb-discovered antibodies in the clinic today — Increased frequency and depth of interaction with our partners provides insights into potential new clinical starts • We now estimate a total of ~25 clinical- stage programs using OmniAb- discovered antibodies by 2020 46 OmniAb: Future Outlook Potential New Clinical Starts by Year N ew P h ase 1 I n iti atio n s Projected OmniAb-Derived Antibody Clinical Initiations

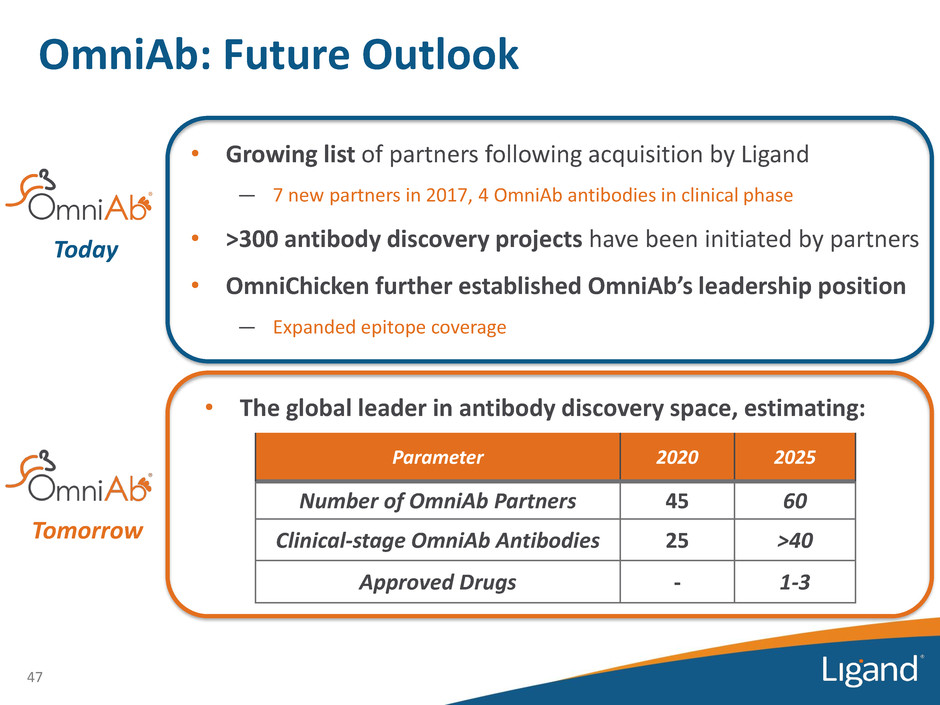

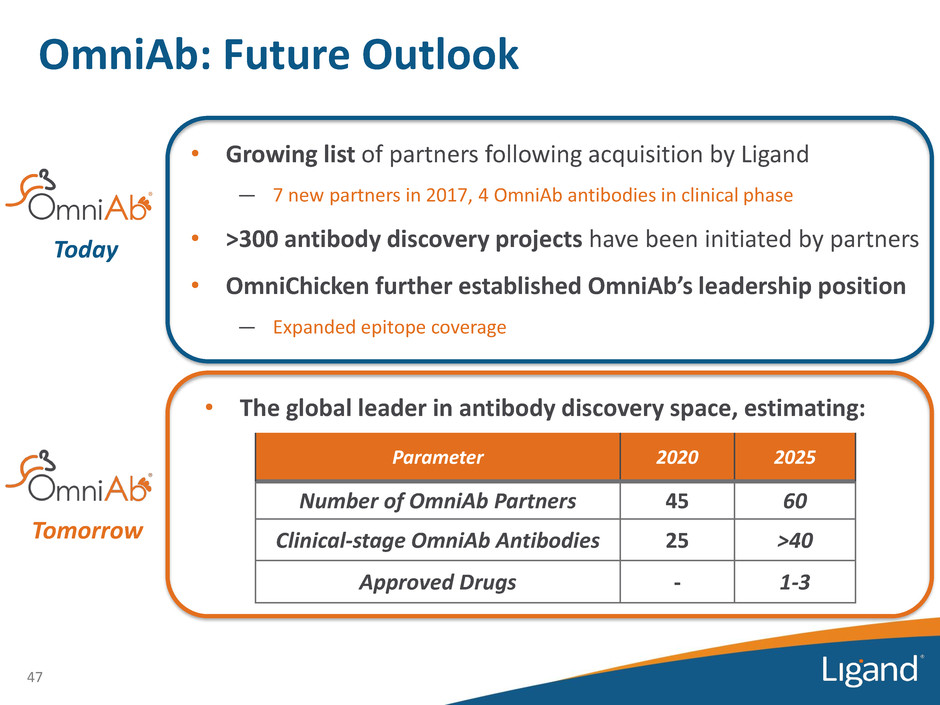

OmniAb: Future Outlook • Growing list of partners following acquisition by Ligand — 7 new partners in 2017, 4 OmniAb antibodies in clinical phase • >300 antibody discovery projects have been initiated by partners • OmniChicken further established OmniAb’s leadership position — Expanded epitope coverage 47 Today Tomorrow Parameter 2020 2025 Number of OmniAb Partners 45 60 Clinical-stage OmniAb Antibodies 25 >40 Approved Drugs - 1-3 • The global leader in antibody discovery space, estimating:

Portfolio Pyramid Matt Foehr

Portfolio Pyramid 49 Commercial assets paying significant royalties Prexasertib (LIlly) Lasofoxifene (Sermonix) Brexanolone (Sage Therapeutics) Sparsentan (Retrophin) Baxdela IV (Melinta) BMS986231 (BMS) APVO436 (Aptevo) VK5211 (Viking Therapeutics) VK2809 (Viking Therapeutics) Merestinib (Lilly) AMG-330 (Amgen) Pevonedistat (Takeda) JNJ-64007957 (Janssen/J&J) Seribantumab (Merrimack) Reproxalap (Aldeyra) CHS-0214 (Coherus) Esaxerenone (Daiichi-Sankyo) Ganaxolone IV (Marinus) The Top 3 The Big 6 Leading pipeline assets based on stage and/or potential value The Next 12 Assets emerging as next class with high revenue potential

Promacta®

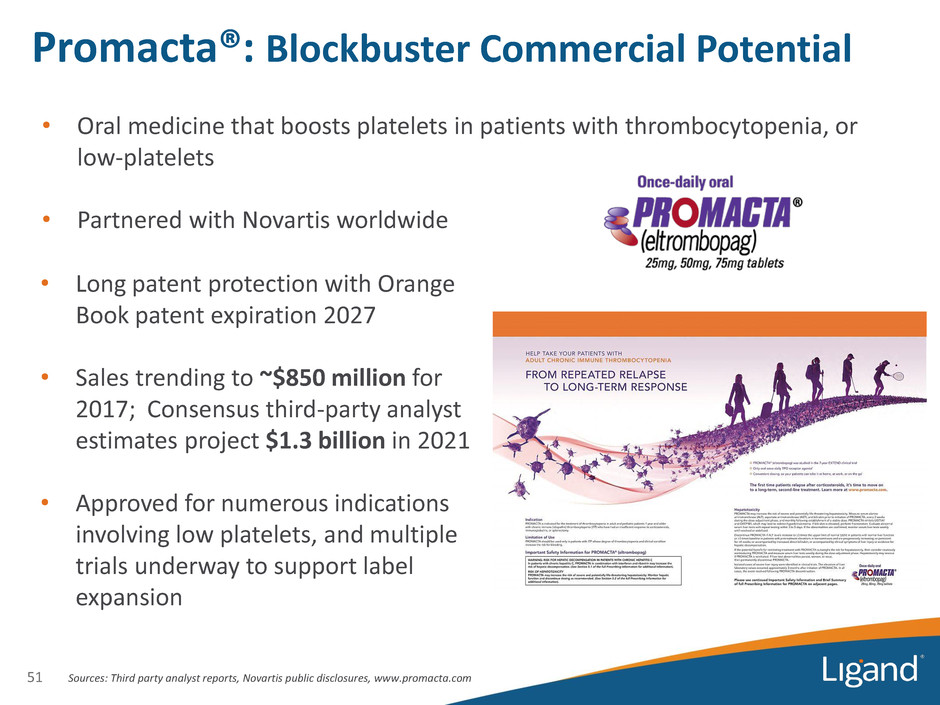

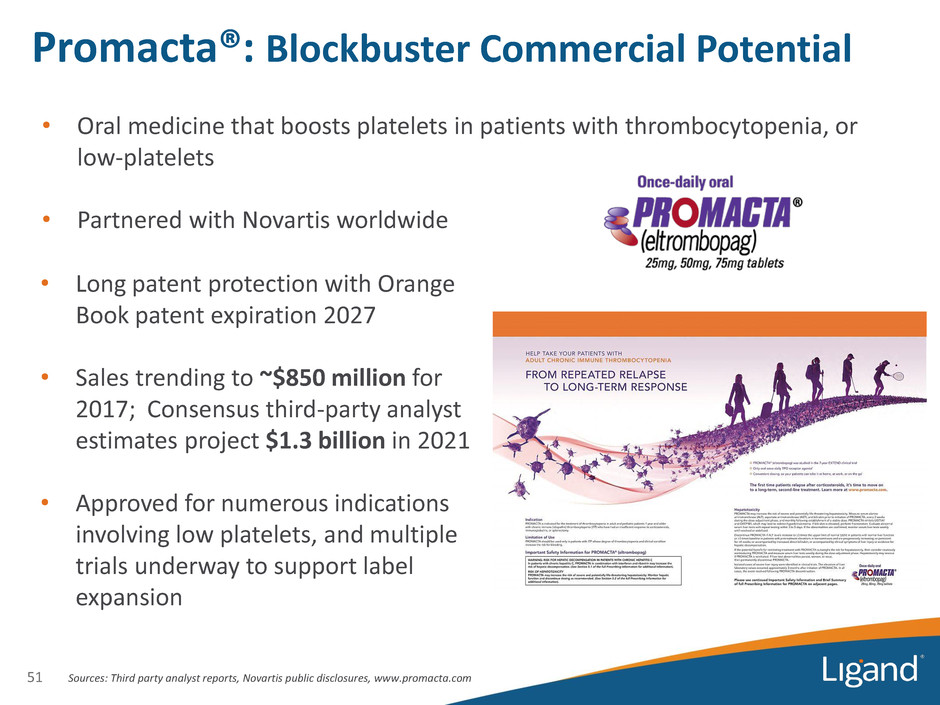

• Oral medicine that boosts platelets in patients with thrombocytopenia, or low-platelets • Partnered with Novartis worldwide Promacta®: Blockbuster Commercial Potential 51 • Long patent protection with Orange Book patent expiration 2027 • Sales trending to ~$850 million for 2017; Consensus third-party analyst estimates project $1.3 billion in 2021 • Approved for numerous indications involving low platelets, and multiple trials underway to support label expansion Sources: Third party analyst reports, Novartis public disclosures, www.promacta.com

• Novartis plans global regulatory filings for first-line SAA in 2018 • Low-to-intermediate risk-1 MDS data recently published in Lancet Haematology Promacta: Label Expansion • 36 ongoing clinical trials • Recent data and events have continued to demonstrate the significant potential for and interest in Promacta 52 Source: clintrials.gov and Novartis public management commentary • Novartis conducting or supporting studies to expand label — First-line Severe Aplastic Anemia (SAA): Phase 2 SOAR and Phase 3 RACE studies in combination with immunosuppressive therapy (cyclosporine +/- horse ATG) — Low to intermediate risk MDS: Phase 2 studies underway conducted by NIH/NHLBI (US) and Associazione Qol-one (EU) — CIT: Phase 2 study of thrombocytopenia associated with tyrosine kinase therapy in CML or myelofibrosis

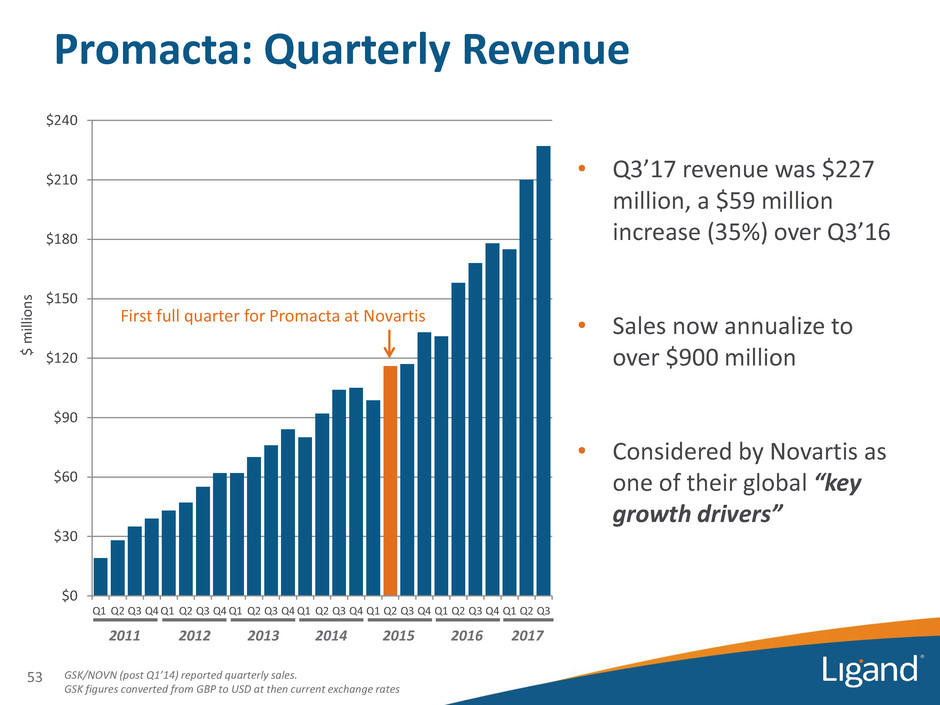

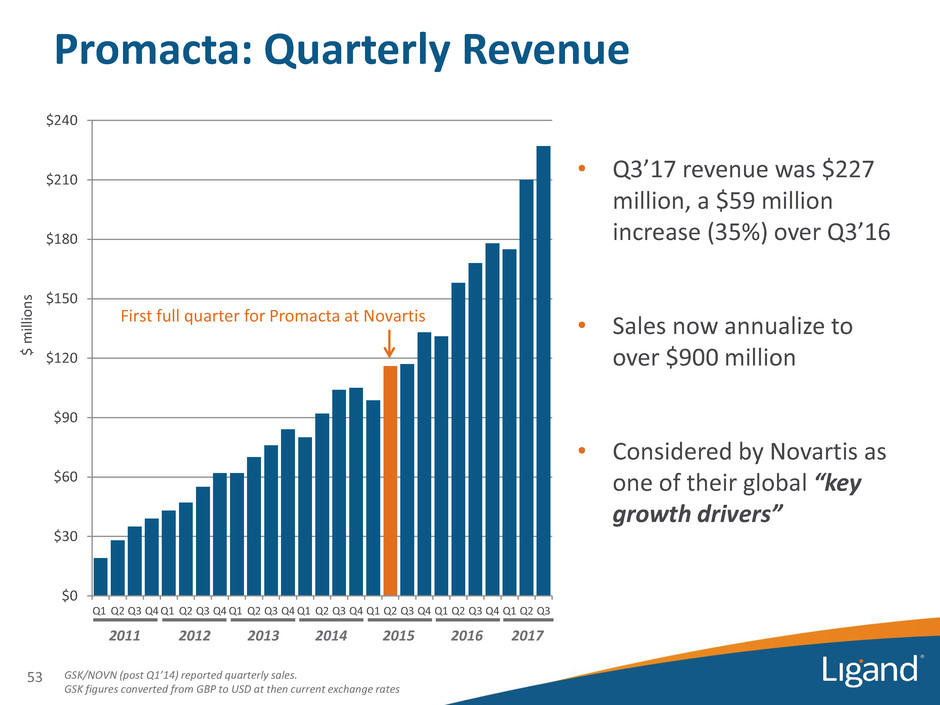

$ milli o n s GSK/NOVN (post Q1’14) reported quarterly sales. GSK figures converted from GBP to USD at then current exchange rates 2012 $0 $30 $60 $90 $120 $150 $180 $210 $240 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 2013 2014 2015 • Q3’17 revenue was $227 million, a $59 million increase (35%) over Q3’16 • Sales now annualize to over $900 million • Considered by Novartis as one of their global “key growth drivers” 2016 First full quarter for Promacta at Novartis Promacta: Quarterly Revenue 2011 53 2017

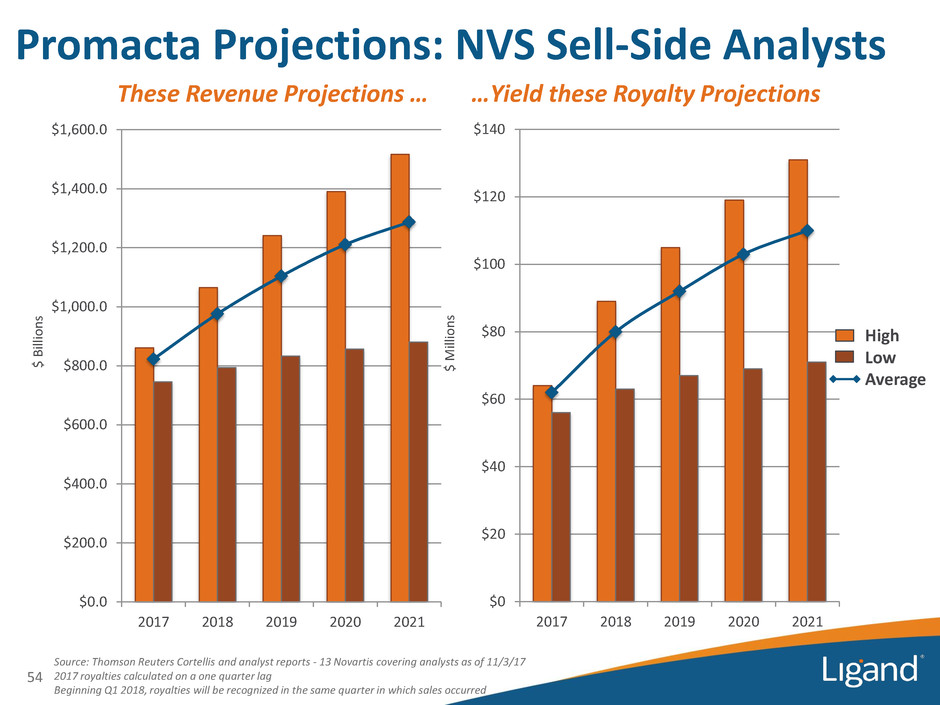

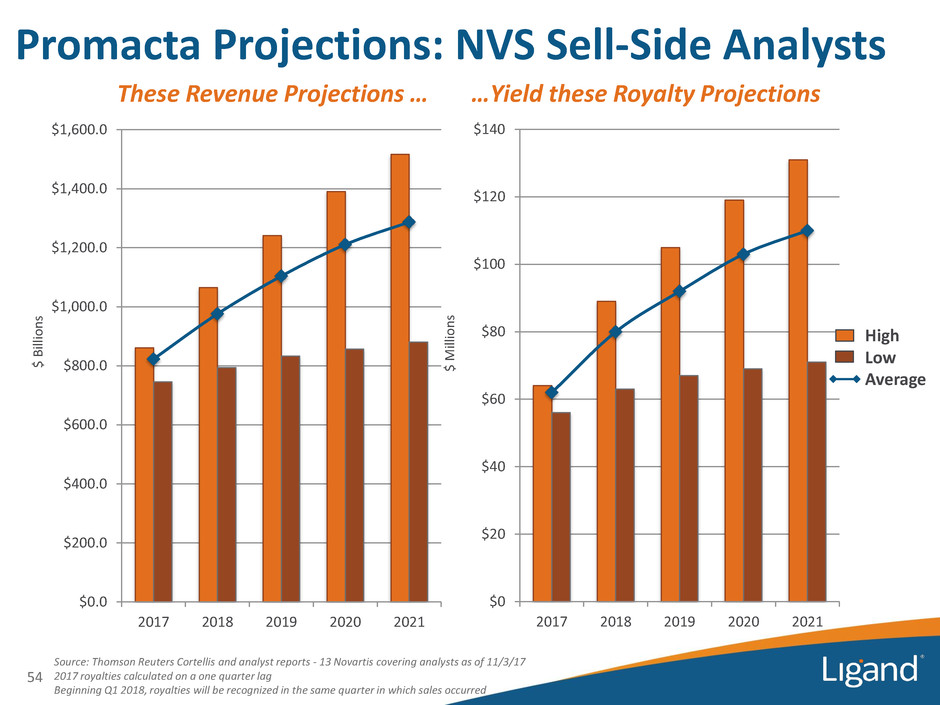

$0 $20 $40 $60 $80 $100 $120 $140 2017 2018 2019 2020 2021 Source: Thomson Reuters Cortellis and analyst reports - 13 Novartis covering analysts as of 11/3/17 2017 royalties calculated on a one quarter lag Beginning Q1 2018, royalties will be recognized in the same quarter in which sales occurred $0.0 $200.0 $400.0 $600.0 $800.0 $1,000.0 $1,200.0 $1,400.0 $1,600.0 2017 2018 2019 2020 2021 Promacta Projections: NVS Sell-Side Analysts 54 These Revenue Projections … …Yield these Royalty Projections $ Bil lio n s $ M ill io n s High Low Average

Kyprolis®

• Kyprolis viewed as best-in- class proteasome inhibitor for multiple myeloma (MM) • Developed and marketed by Amgen — Utilizes Ligand’s Captisol technology Kyprolis 56 1 KYPROLIS is also approved in Argentina, Australia, Bahrain, Canada, Hong Kong, Israel, Kuwait, Lebanon, Macao, Mexico, Thailand, Colombia, S. Korea, Qatar, Switzerland, Singapore, Taiwan, Jordan, Egypt, Saudi Arabia, United Arab Emirates, Turkey, Russia, Brazil, India and Oman. Additional regulatory applications for KYPROLIS are underway and have been submitted to health authorities worldwide. Sources: Amgen public disclosures, www.kyprolis.comww.kyprolis.com • Approved for relapsed or refractory MM in the US, EU and Japan (Ono)1 — As single agent, or in combination with dexamethasone or Revlimid and dexamethasone • In the last 8 months, Kyprolis has demonstrated overall survival improvement in both the Phase 3 ENDEAVOR and Phase 3 ASPIRE studies, bolstering the value proposition for the drug in a competitive space

Kyprolis Amgen Public Commentary - ASPIRE and ENDEAVOR Phase 3 Data 57 Source: Amgen Q2’17 earnings call, July 25, 2017 Kyprolis is developed and marketed by Amgen “We completed two pivotal studies showing an overall survival benefit for KYPROLIS patients with relapsed disease, underscoring our confidence in this molecule as the new standard of care for these patients.” Robert A. Bradway Chairman & Chief Executive Officer “With these two new sets of overall survival data, our message to physicians is simple and powerful: When multiple myeloma relapses, don't put your patient's survival at risk.” Anthony C. Hooper Executive Vice President, Global Commercial Operations “In each case, KYPROLIS reduced the risk of death by 21%, and improved survival by approximately eight months, a very meaningful clinical result that reinforces the role for KYPROLIS in driving deep and durable responses.” Sean E. Harper, MD Executive Vice President, Research & Development

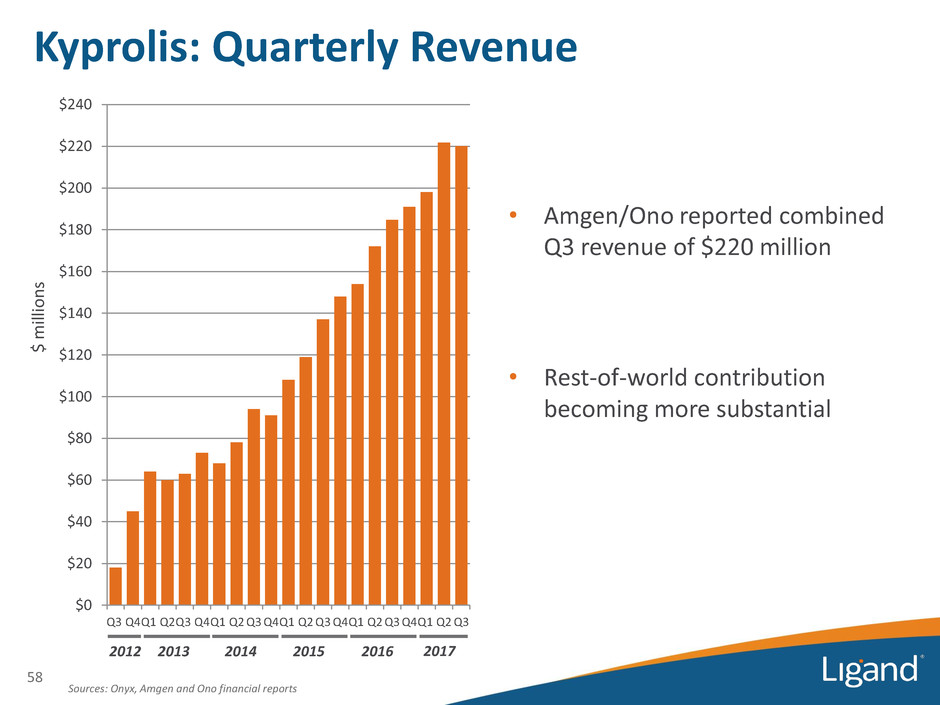

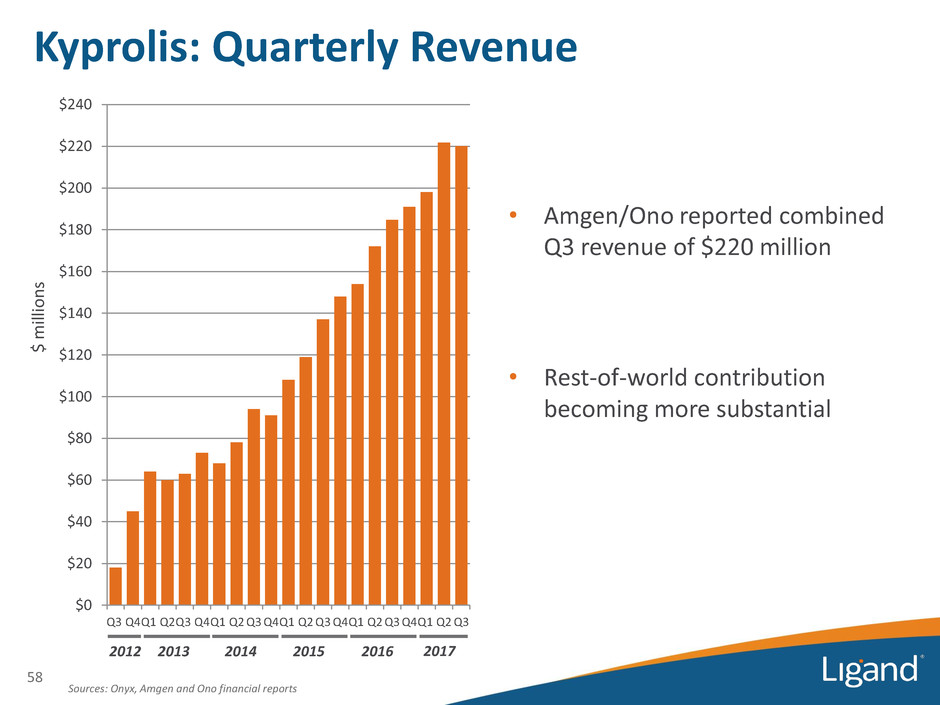

Sources: Onyx, Amgen and Ono financial reports $ m ill ion s 2012 $0 $20 $40 $60 $80 $100 $120 $140 $160 $180 $200 $220 $240 Q3 Q4Q1 Q2Q3 Q4Q1 Q2 Q3 Q4Q1 Q2 Q3 Q4Q1 Q2 Q3 Q4Q1 Q2 Q3 2013 2014 • Amgen/Ono reported combined Q3 revenue of $220 million • Rest-of-world contribution becoming more substantial Kyprolis: Quarterly Revenue 2015 2016 58 2017

Kyprolis Status 59 Source: Third party analyst reports, see slide 61 Kyprolis is developed and marketed by Amgen • Third-party analysts estimate product on track to exceed $830 million in global revenue in 2017 • Factors supporting potential revenue growth: 1. New or recently-launched territories 2. Label expansion potentially supported from ongoing trials 3. Use in combination with other medications

Kyprolis Status and Plans 60 Source: Amgen public disclosures dated July 25, 2017 and October 25, 2017, www.clinicaltrials.gov – www.kyprolis.com Kyprolis is developed and marketed by Amgen • Amgen is very active with clinical and regulatory activities for Kyprolis ― Submitted sNDA to include Overall Survival data from ENDEAVOR study ▪ Under review at FDA, with target action date of April 30, 2018 ― Regulatory submissions in preparation for ASPIRE Overall Survival data ― Once-Weekly Dosing: Interim analysis of Phase 3 ARROW trial showed superior efficacy and comparable safety ― Relapsed/Refractory Multiple Myeloma: Phase 3 trial in combination with Janssen’s Darzalex® began in Q2 2017 ― Front-Line Multiple Myeloma: Designing Phase 3 study in combination with Revlimid and dexamethasone

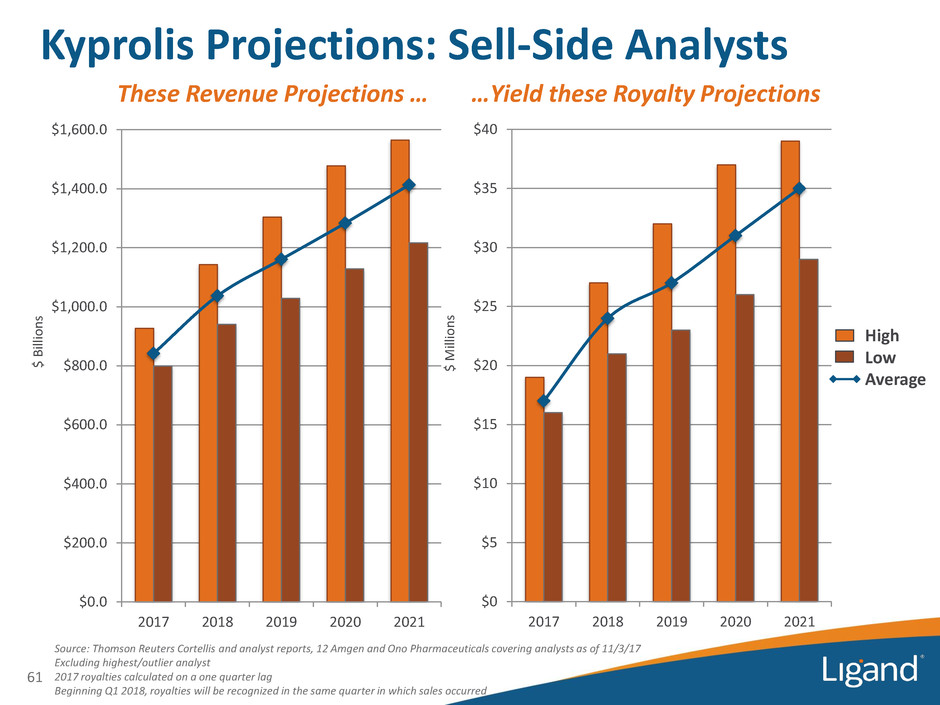

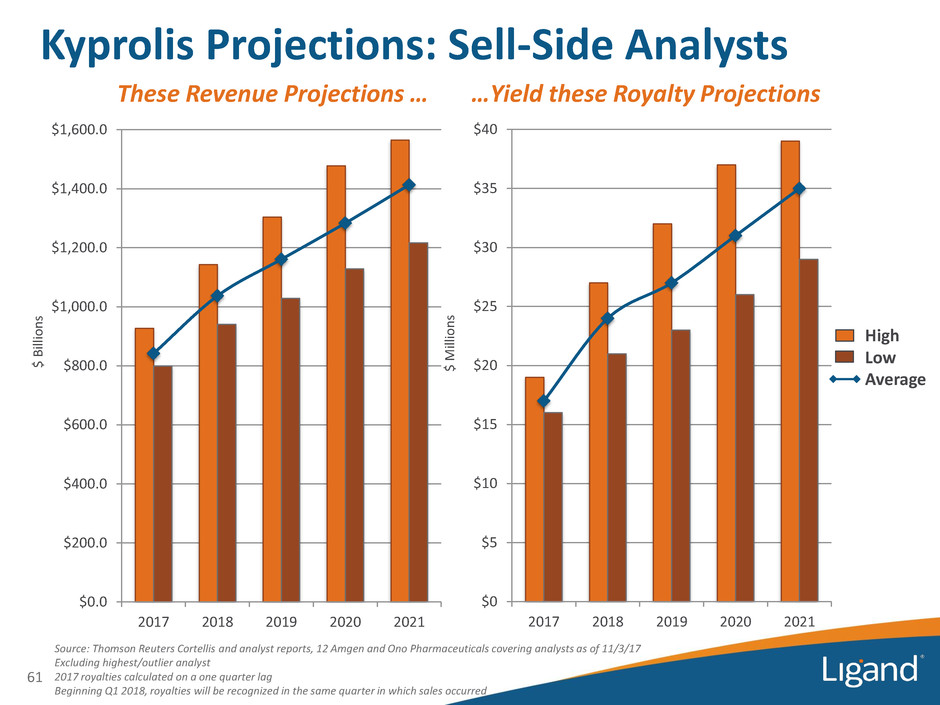

$0 $5 $10 $15 $20 $25 $30 $35 $40 2017 2018 2019 2020 2021 Source: Thomson Reuters Cortellis and analyst reports, 12 Amgen and Ono Pharmaceuticals covering analysts as of 11/3/17 Excluding highest/outlier analyst 2017 royalties calculated on a one quarter lag Beginning Q1 2018, royalties will be recognized in the same quarter in which sales occurred $0.0 $200.0 $400.0 $600.0 $800.0 $1,000.0 $1,200.0 $1,400.0 $1,600.0 2017 2018 2019 2020 2021 Kyprolis Projections: Sell-Side Analysts 61 These Revenue Projections … …Yield these Royalty Projections $ Bil lio n s $ M ill io n s High Low Average

EVOMELA®

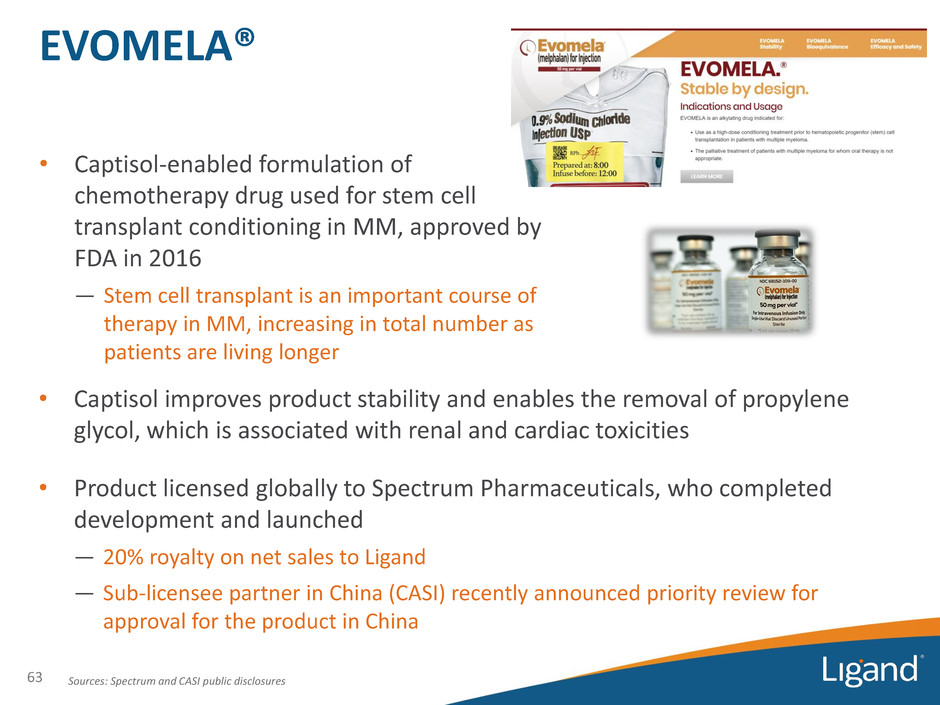

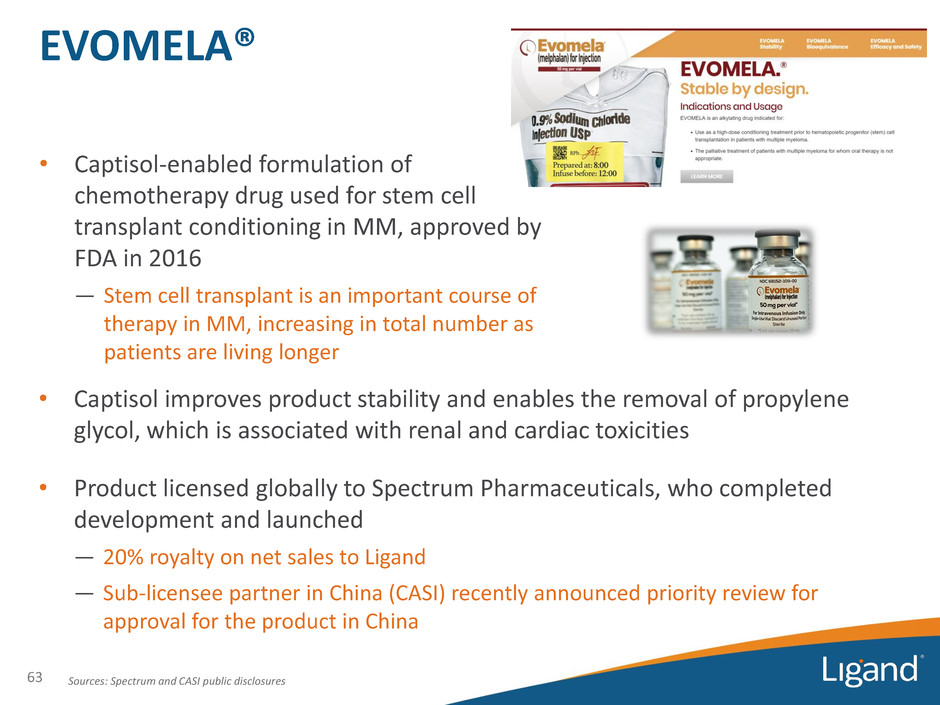

• Captisol improves product stability and enables the removal of propylene glycol, which is associated with renal and cardiac toxicities • Product licensed globally to Spectrum Pharmaceuticals, who completed development and launched ― 20% royalty on net sales to Ligand ― Sub-licensee partner in China (CASI) recently announced priority review for approval for the product in China 63 EVOMELA® • Captisol-enabled formulation of chemotherapy drug used for stem cell transplant conditioning in MM, approved by FDA in 2016 ― Stem cell transplant is an important course of therapy in MM, increasing in total number as patients are living longer Sources: Spectrum and CASI public disclosures

$0 $2 $4 $6 $8 $10 $12 Q2 Q3 Q4 Q1 Q2 Q3 • Initial adoption strong given label and clear benefits • Product on track to do $33 - $38 million in 2017 • Third-party analyst outlook indicates revenue potential of $50 - $60 million in 2020 • Factors supporting potential revenue growth: 1. International sales from licensees 2. Further US market expansion 3. New labeled indications 64 EV O M EL A S al es ($ M M ) “Regarding EVOMELA, we are thrilled with the performance. We are the market leader and the market has spoken on the differentiation of the product.” Tom Riga Chief Commercial Officer Source: Thomson Reuters Cortellis and analyst reports Spectrum November 2, 2017 earnings call EVOMELA: Launch Performance 2016 2017

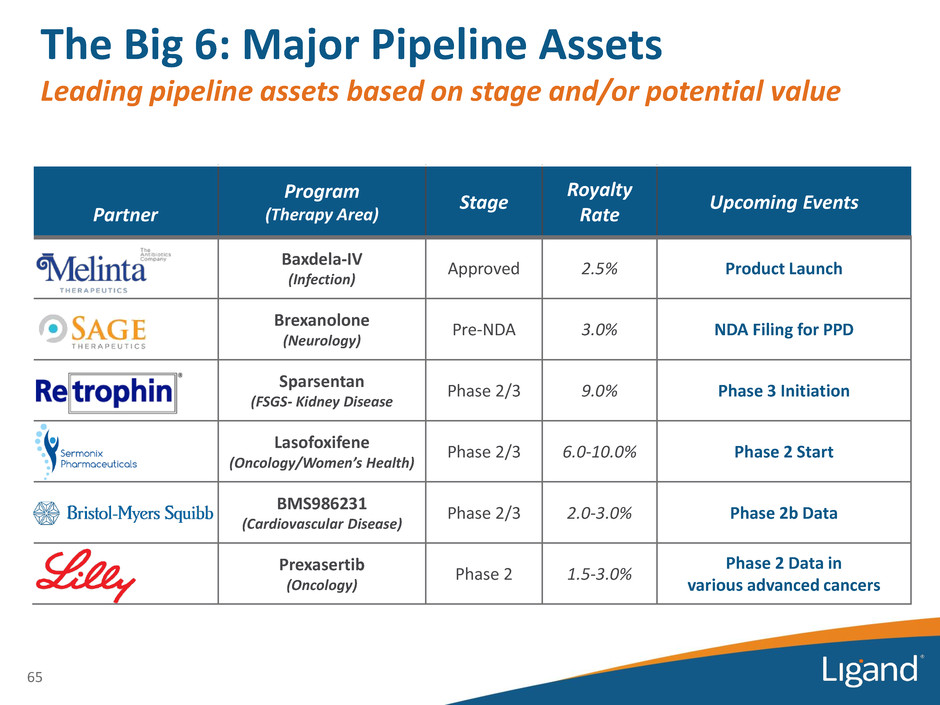

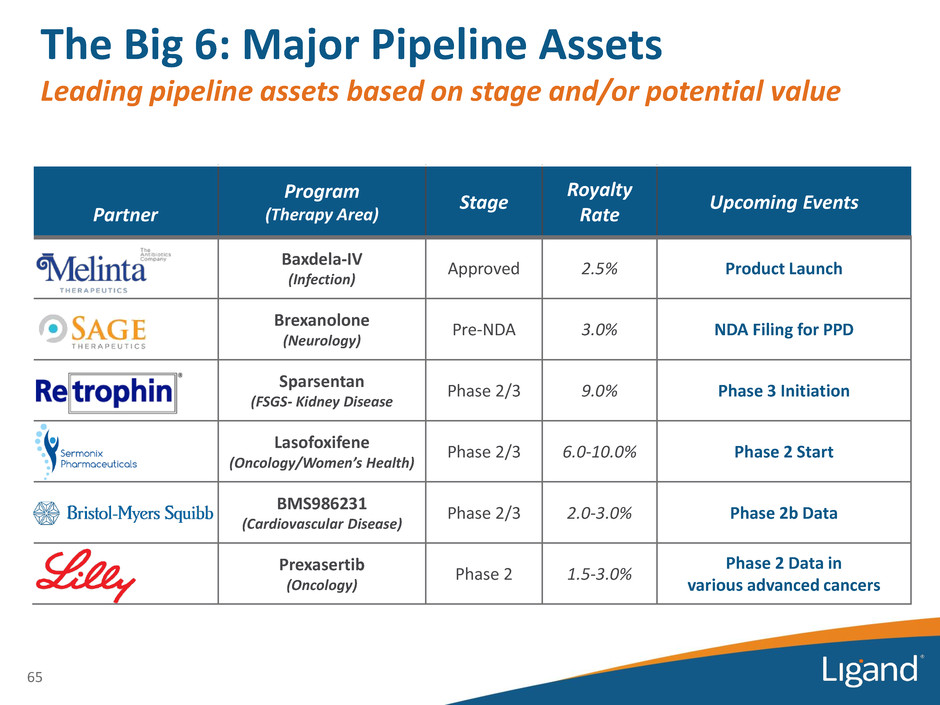

Partner Program (Therapy Area) Stage Royalty Rate Upcoming Events Baxdela-IV (Infection) Approved 2.5% Product Launch Brexanolone (Neurology) Pre-NDA 3.0% NDA Filing for PPD Sparsentan (FSGS- Kidney Disease Phase 2/3 9.0% Phase 3 Initiation Lasofoxifene (Oncology/Women’s Health) Phase 2/3 6.0-10.0% Phase 2 Start BMS986231 (Cardiovascular Disease) Phase 2/3 2.0-3.0% Phase 2b Data Prexasertib (Oncology) Phase 2 1.5-3.0% Phase 2 Data in various advanced cancers The Big 6: Major Pipeline Assets Leading pipeline assets based on stage and/or potential value 65

Brexanolone (Pre-NDA) • Brexanolone (SAGE-547) IV is Sage’s proprietary, Captisol-enabled, formulation of allopregnanolone ― Allosteric GABAA receptor modulator • In development as an acute interventional treatment for post-partum depression (PPD) • Announced positive top-line data on November 9, 2017 from two Phase 3 HUMMINGBIRD trials in severe and moderate PPD ― Brexanolone provided rapid and durable reduction over 30 days in depressive symptoms as measured by HAM-D in both placebo-controlled multi-center trials 66 The Big 6: Neurology “In these studies, brexanolone provided a profound and durable effect over the study period that could be an important step in potentially changing the way health care providers think about treating this disorder.” – Dr. Samantha Meltzer-Brody, M.D., M.P.H., associate professor and director of UNC Perinatal Psychiatry Program of the UNC Center for Women’s Mood Disorders Nov. 9, 2017 Source: Sage Therapeutics public disclosures

Sparsentan (Phase 2/3) • In development for treatment of focal segmental glomerulosclerosis (FSGS), a rare kidney disorder that often leads to end-stage renal disease ― Could be first FDA-approved therapy for FSGS ― IgA nephropathy identified as added potential indication • Met primary efficacy endpoint in Phase 2 DUET study, demonstrating >2-fold reduction in proteinuria compared to Irbesartan after 8-week, double-blind treatment period ― Progressive reduction in proteinuria, combined with stable kidney function (eGFR), during 40-week open label period • Retrophin plans to initiate pivotal Phase 3 in FSGS in 2018 The Big 6: Kidney Disease “These [open-label extension] findings … underscore the potential of sparsentan to be a durable approach to treating FSGS.” – Bill Rote, PhD, Sr. VP and Head of R&D, Retrophin, November 3, 2017 67 Source: Retrophin public disclosures, and Retrophin data on file November 2017

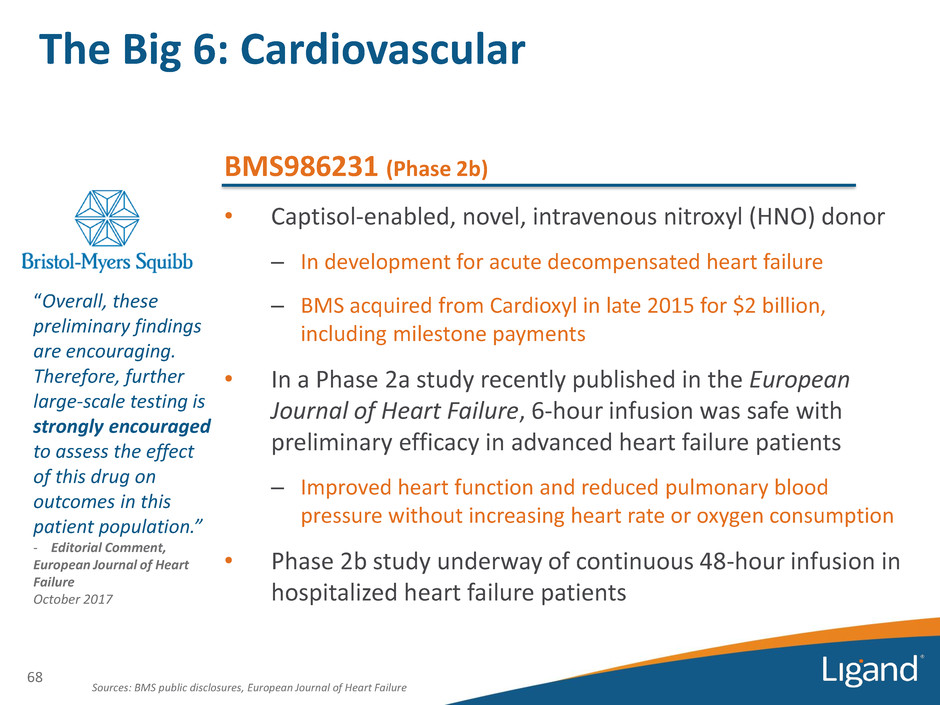

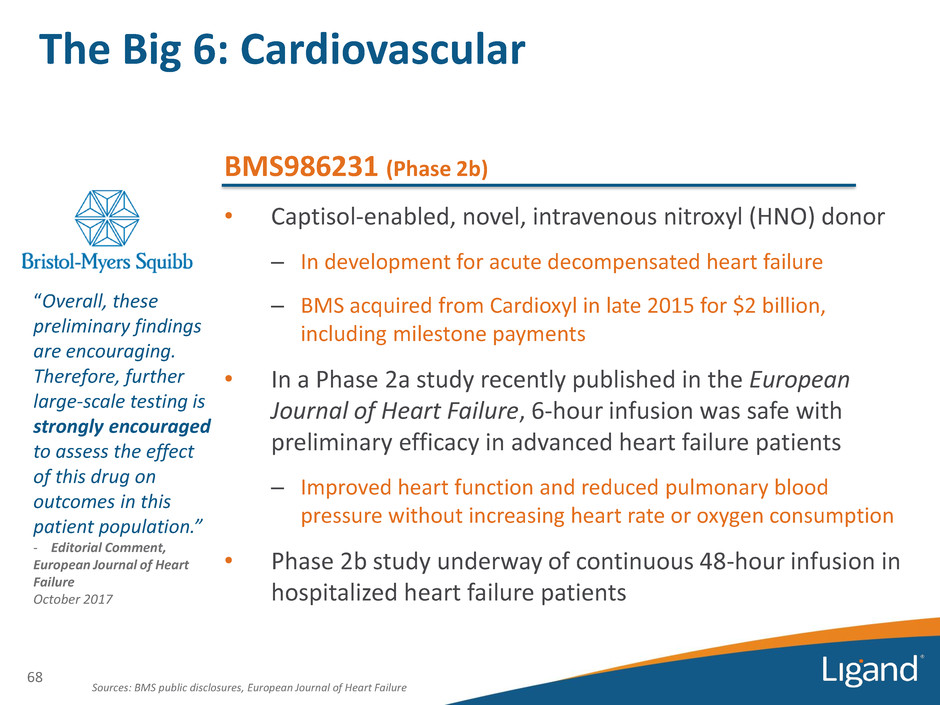

BMS986231 (Phase 2b) • Captisol-enabled, novel, intravenous nitroxyl (HNO) donor – In development for acute decompensated heart failure – BMS acquired from Cardioxyl in late 2015 for $2 billion, including milestone payments • In a Phase 2a study recently published in the European Journal of Heart Failure, 6-hour infusion was safe with preliminary efficacy in advanced heart failure patients – Improved heart function and reduced pulmonary blood pressure without increasing heart rate or oxygen consumption • Phase 2b study underway of continuous 48-hour infusion in hospitalized heart failure patients 68 The Big 6: Cardiovascular “Overall, these preliminary findings are encouraging. Therefore, further large-scale testing is strongly encouraged to assess the effect of this drug on outcomes in this patient population.” - Editorial Comment, European Journal of Heart Failure October 2017 Sources: BMS public disclosures, European Journal of Heart Failure

Prexasertib (Phase 2) • Captisol-enabled, small molecule checkpoint kinase 1 (CHK1) and CHK2 inhibitor – CHK inhibitors induce DNA double-strand breaks, increased replication stress and cancer cell death • Highlighted as a “Priority Internal Development Program” by Lilly for focused internal R&D investment • Demonstrated promising activity in Phase 2 trial in platinum-sensitive and resistant, high-grade ovarian cancer – 35% of BRCAwt+ ovarian cancer patients achieved partial response; ~2x higher than historical controls • Ongoing trials in small cell lung cancer, head and neck cancer, and advanced metastatic cancer 69 The Big 6: Oncology Source: Lilly public disclosures “Prexasertib is a first- in-class agent. … We look forward to continued development of prexasertib in ovarian and other cancer types” - Dr. Levi Garraway, SVP, Oncology Global Development & Medical Affairs July 25, 2017

The Next 12

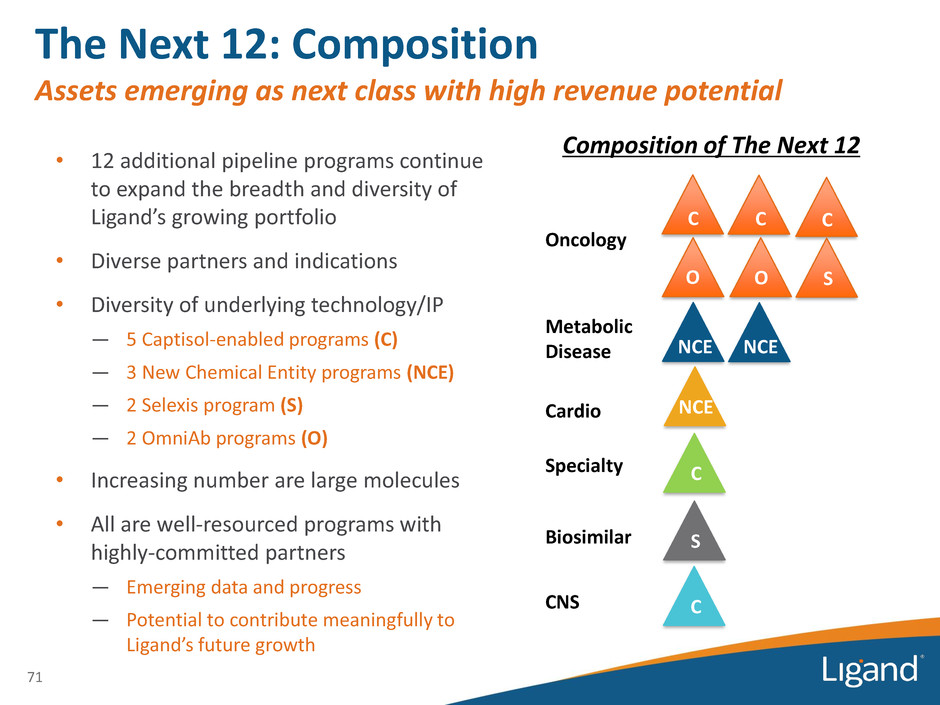

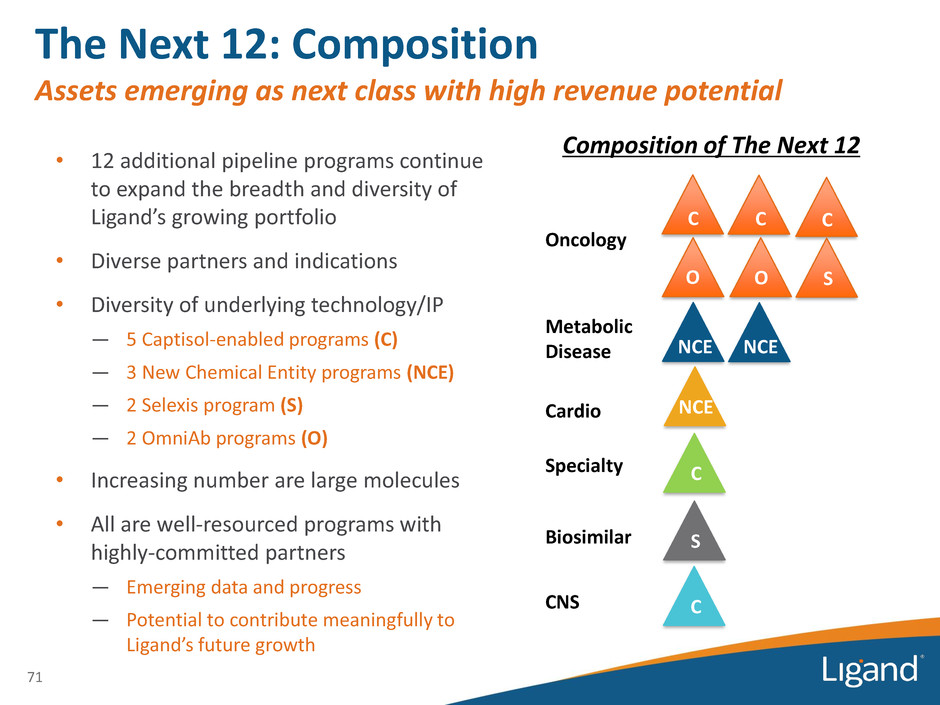

The Next 12: Composition Assets emerging as next class with high revenue potential • 12 additional pipeline programs continue to expand the breadth and diversity of Ligand’s growing portfolio • Diverse partners and indications • Diversity of underlying technology/IP — 5 Captisol-enabled programs (C) — 3 New Chemical Entity programs (NCE) — 2 Selexis program (S) — 2 OmniAb programs (O) • Increasing number are large molecules • All are well-resourced programs with highly-committed partners — Emerging data and progress — Potential to contribute meaningfully to Ligand’s future growth Composition of The Next 12 Oncology Metabolic Disease Biosimilar C C C O SO NCE NCE S 71 Specialty C Cardio NCE CNS C

Merestinib (Phase 2) • Captisol-enabled, small molecule MET kinase inhibitor – Reversible type II ATP-competitive inhibitor of MET • Phase 1 and Phase 2 trials underway in advanced cancer and biliary tract cancer – Trials expected to complete in 1H and 2H 2018, respectively 72 The Next 12: Oncology Source: Public information published by partners/licensees Pevonedistat (MLN4924, Phase 2) • Captisol-enabled, novel NEDD8 activating enzyme inhibitor • Previous studies have indicated effectiveness in melanoma patients who were resistant to other therapies • Currently being investigated in high-risk MDS – Phase 2 in advanced MDS estimated completion Dec. 2017 – Phase 3 PANTHER study in high-risk MDS to begin Nov. 2017

73 The Next 12: Oncology AMG-330 (Phase 1) • Captisol-enabled, anti-CD33 x anti-CD3 bispecific T-cell engager (BiTE®) antibody, for treatment of acute myeloid leukemia (AML) • Phase 1 study in relapsed/refractory AML underway – Data read-out estimated 2018 (clinicaltrials.gov) Sources: Public information published by partners/licensees, www.clinicaltrials.gov Seribantumab (MM-121, Phase 2) • First-in-class, HER3 mAb targeting heregulin (HRG) positive cancers; a Selexis technology program – Granted orphan drug designation for HRG-positive NSCLC in October 2017 and Fast Track designation in July 2016 • Two Phase 2 studies in NSCLC and breast cancer in-progress – Phase 2 NSCLC study data expected 2H 2018 – Phase 2 breast cancer trial started August 2017

74 APVO436 (Preclinical) • Bispecific anti-CD123 and anti-CD3 OmniAb-derived mAb – CD123 is highly expressed in several hematological malignancies (e.g. AML, ALL and MDS) • Designed to simultaneously target CD123 and CD3 and redirect T-cell cytotoxicity against CD123-expressing tumors – Preclinical data presented at AACR-NCI-EORTC Molecular Targets and Cancer Therapeutics annual meeting in October The Next 12: Antibodies JNJ-64007957 (Phase 1) • Novel, bispecific anti-BCMA x CD3 OmniAb-derived mAb being developed for multiple myeloma (MM) – Binds validated target B Cell Maturation Antigen (BCMA) and CD3, with potent activity demonstrated in MM models • Phase 1 underway in patients with multiple myeloma – Estimated primary completion Nov. 2018 (clinicaltrials.gov) Source: Public information published by partners/licensees, www.clinicaltrials.gov

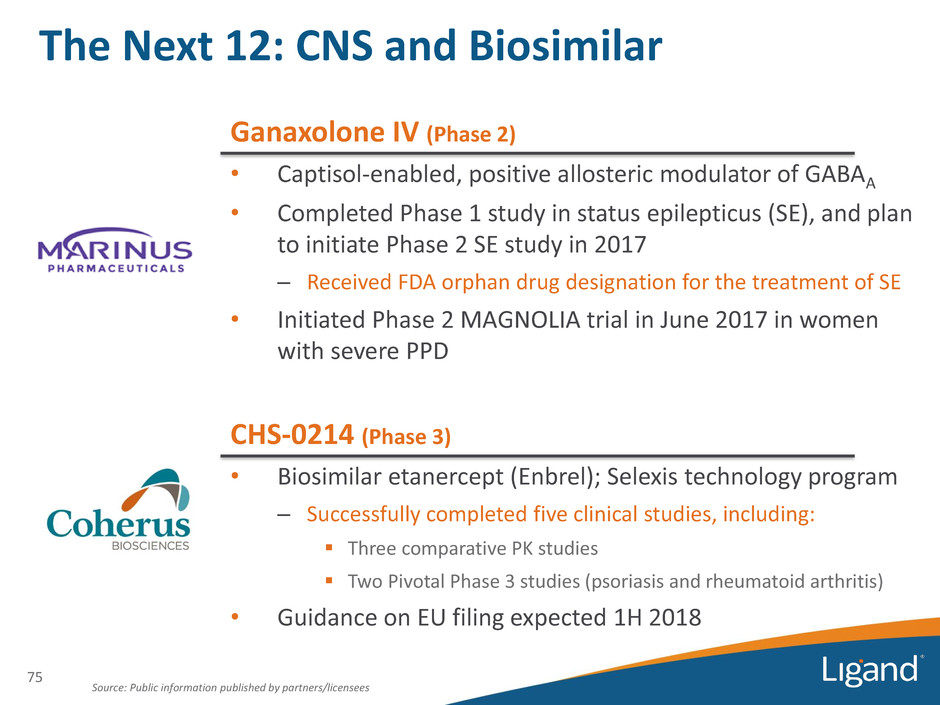

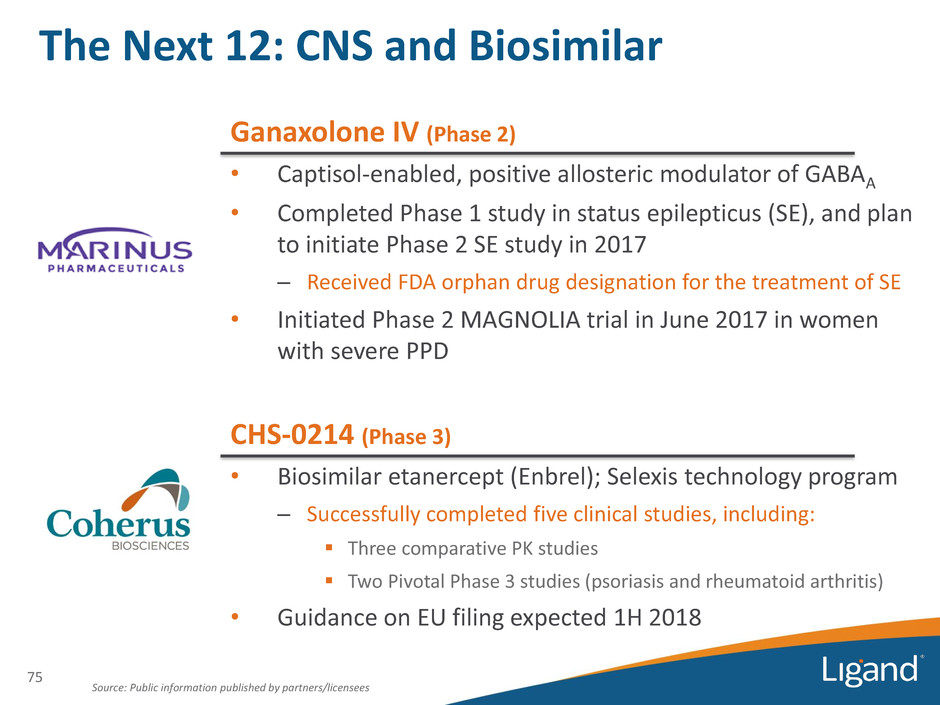

75 The Next 12: CNS and Biosimilar CHS-0214 (Phase 3) • Biosimilar etanercept (Enbrel); Selexis technology program – Successfully completed five clinical studies, including: ▪ Three comparative PK studies ▪ Two Pivotal Phase 3 studies (psoriasis and rheumatoid arthritis) • Guidance on EU filing expected 1H 2018 Ganaxolone IV (Phase 2) • Captisol-enabled, positive allosteric modulator of GABAA • Completed Phase 1 study in status epilepticus (SE), and plan to initiate Phase 2 SE study in 2017 – Received FDA orphan drug designation for the treatment of SE • Initiated Phase 2 MAGNOLIA trial in June 2017 in women with severe PPD Source: Public information published by partners/licensees

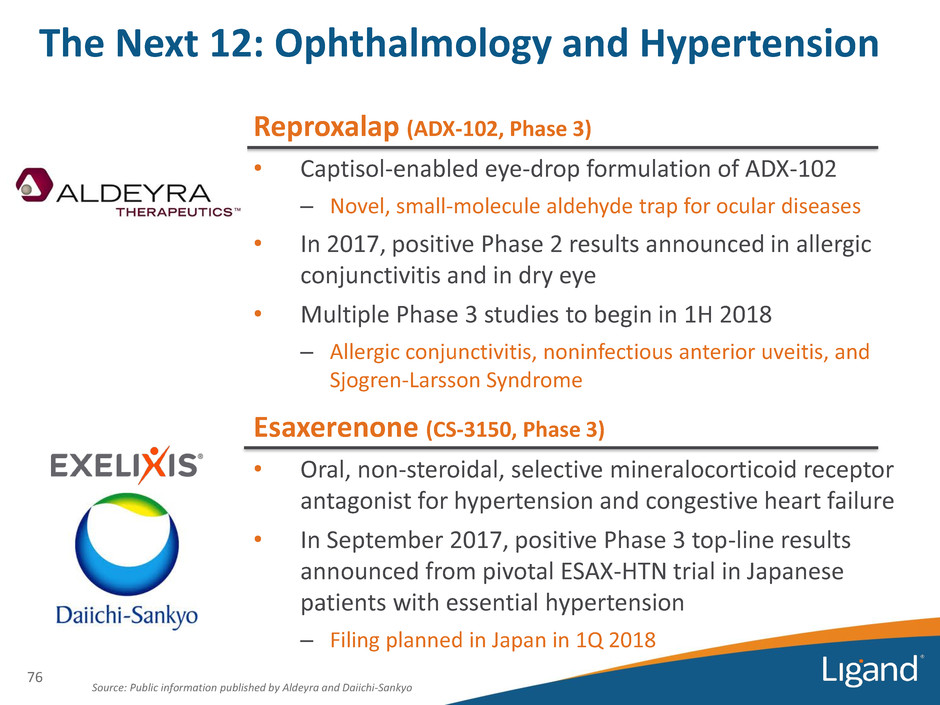

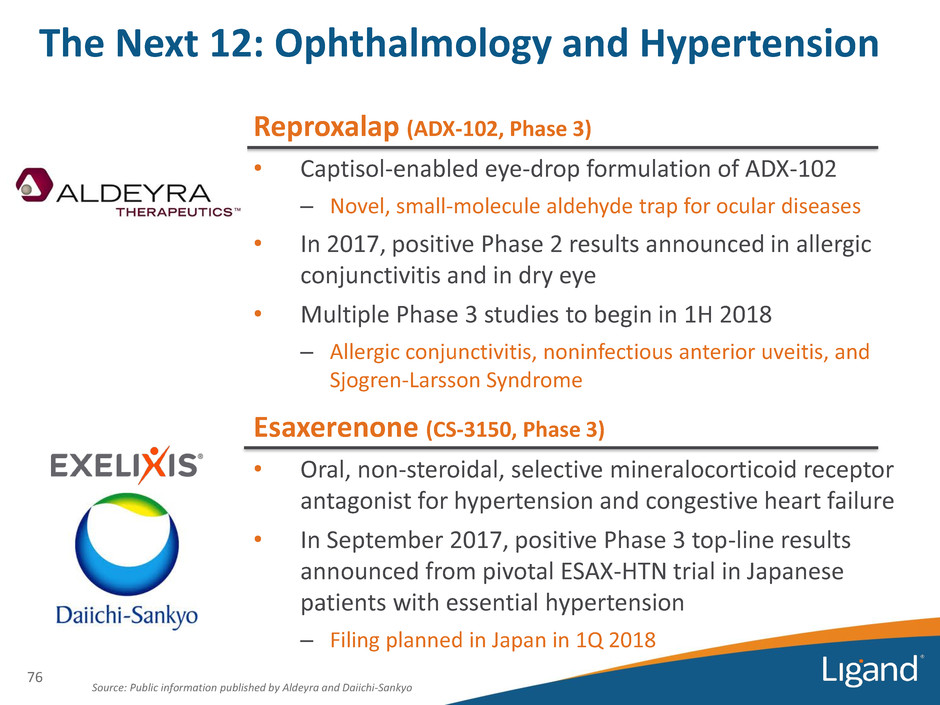

76 The Next 12: Ophthalmology and Hypertension Reproxalap (ADX-102, Phase 3) • Captisol-enabled eye-drop formulation of ADX-102 – Novel, small-molecule aldehyde trap for ocular diseases • In 2017, positive Phase 2 results announced in allergic conjunctivitis and in dry eye • Multiple Phase 3 studies to begin in 1H 2018 – Allergic conjunctivitis, noninfectious anterior uveitis, and Sjogren-Larsson Syndrome Source: Public information published by Aldeyra and Daiichi-Sankyo Esaxerenone (CS-3150, Phase 3) • Oral, non-steroidal, selective mineralocorticoid receptor antagonist for hypertension and congestive heart failure • In September 2017, positive Phase 3 top-line results announced from pivotal ESAX-HTN trial in Japanese patients with essential hypertension – Filing planned in Japan in 1Q 2018

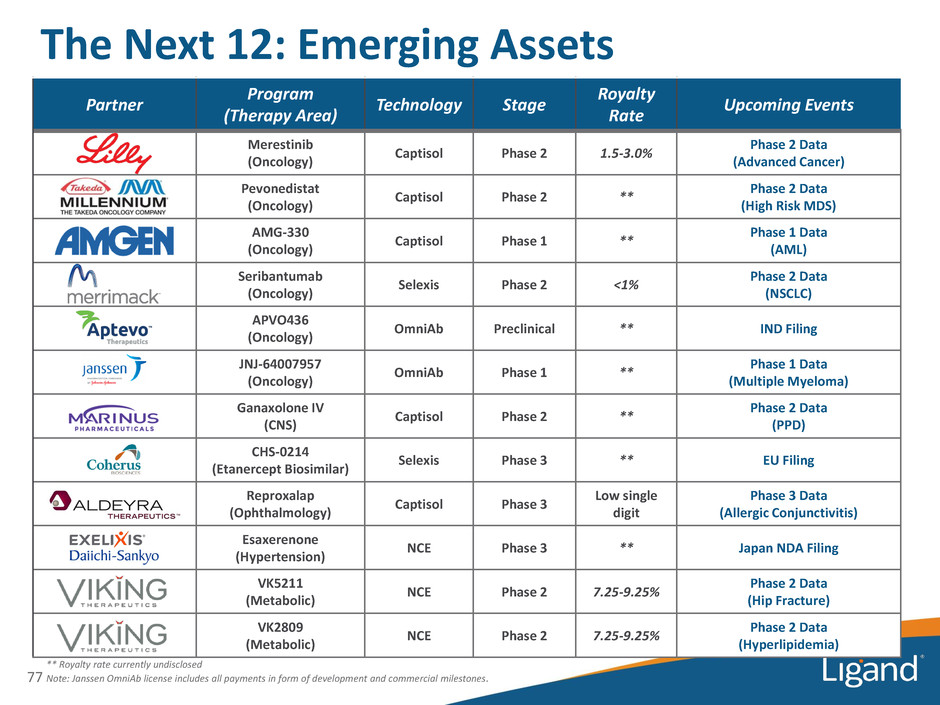

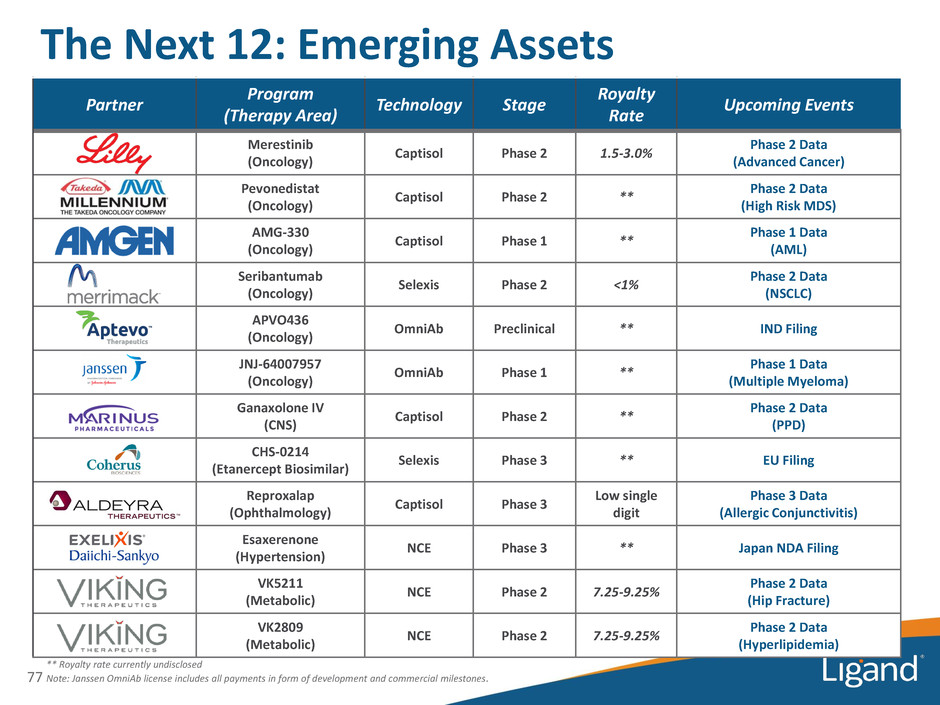

Partner Program (Therapy Area) Technology Stage Royalty Rate Upcoming Events Merestinib (Oncology) Captisol Phase 2 1.5-3.0% Phase 2 Data (Advanced Cancer) Pevonedistat (Oncology) Captisol Phase 2 ** Phase 2 Data (High Risk MDS) AMG-330 (Oncology) Captisol Phase 1 ** Phase 1 Data (AML) Seribantumab (Oncology) Selexis Phase 2 <1% Phase 2 Data (NSCLC) APVO436 (Oncology) OmniAb Preclinical ** IND Filing JNJ-64007957 (Oncology) OmniAb Phase 1 ** Phase 1 Data (Multiple Myeloma) Ganaxolone IV (CNS) Captisol Phase 2 ** Phase 2 Data (PPD) CHS-0214 (Etanercept Biosimilar) Selexis Phase 3 ** EU Filing Reproxalap (Ophthalmology) Captisol Phase 3 Low single digit Phase 3 Data (Allergic Conjunctivitis) Esaxerenone (Hypertension) NCE Phase 3 ** Japan NDA Filing VK5211 (Metabolic) NCE Phase 2 7.25-9.25% Phase 2 Data (Hip Fracture) VK2809 (Metabolic) NCE Phase 2 7.25-9.25% Phase 2 Data (Hyperlipidemia) The Next 12: Emerging Assets 77 ** Royalty rate currently undisclosed Note: Janssen OmniAb license includes all payments in form of development and commercial milestones.

Matt Foehr

The leading cyclodextrin technology • Captisol is a patented cyclodextrin designed to: — Maximize safety — Improve solubility, stability and bioavailability — Lessen the volatility, irritation, smell or taste of drugs • Supported with highly reliable supply and world-class technical service — Multisite and multi-metric-ton cGMP supply chain using highest-quality partner ▪ 2.5 metric ton batch size, validated to pharmaceutical standards — Globally-recognized solubility experts on Ligand team 79

A Successful Platform - Five Initiatives Building for the Future 80 1. Recently extended manufacturing agreement with Hovione through 2024 — Captisol partners value high product quality and stability of supply 2. Adding new European distribution center, further supporting global nature of our partners’ manufacturing plans and driving business efficiencies 3. Continuing to discover new use settings for Captisol to expand and diversify our customer base — Recent peer-reviewed publications

81 4. Investing in a global intellectual property estate with composition, process and product-specific patent families — Issued patents in over 60 countries — Patent coverage through 2033 in major markets 5. Our expanding Drug Master File (DMF) safety package is a key value-driver, BOTH strengthening and accelerating regulatory filings for our partners — Vast safety and clinical database with >200 clinical and safety studies maintained with FDA — Key toxicology studies expanding dose and use in specific patient populations added recently A Successful Platform - Five Initiatives Building for the Future

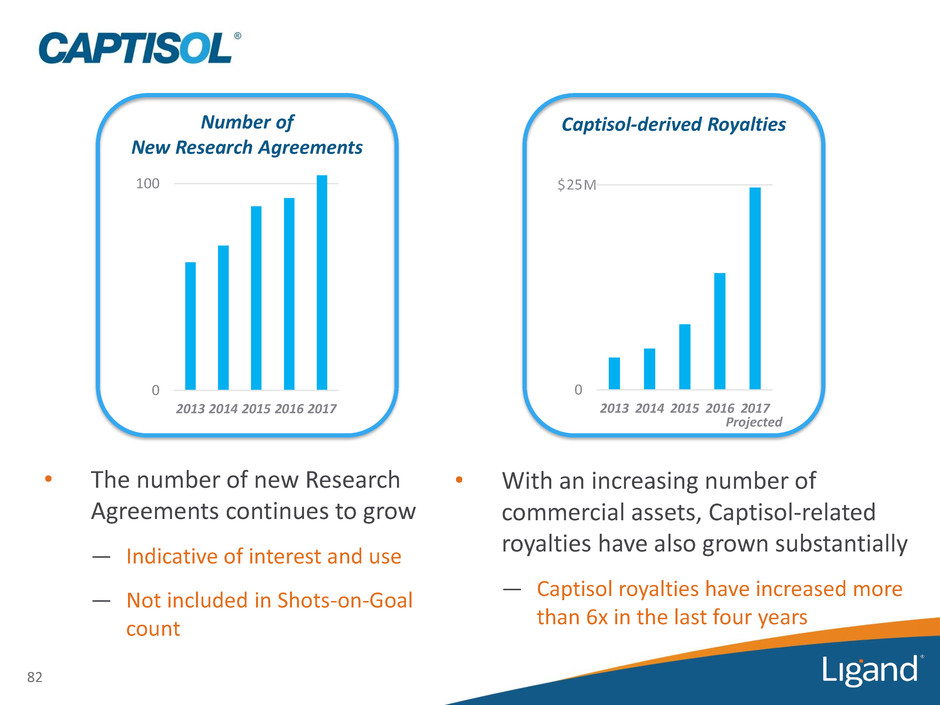

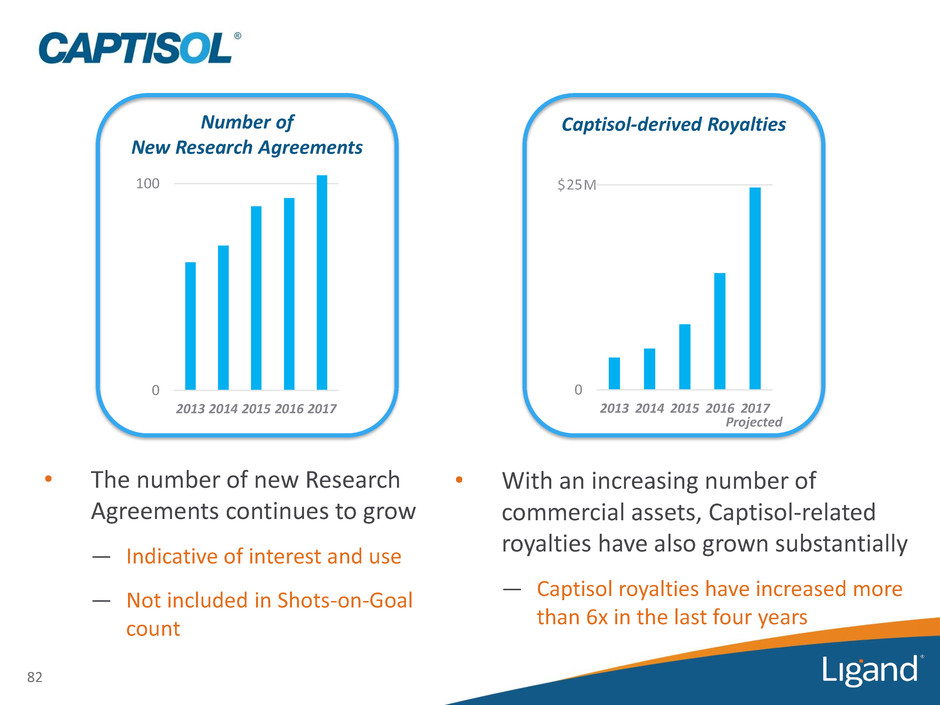

82 Number of New Research Agreements 0 100 2013 2014 2015 2016 2017 • The number of new Research Agreements continues to grow — Indicative of interest and use — Not included in Shots-on-Goal count 0 25 2013 2014 2015 2016 2017 Captisol-derived Royalties • With an increasing number of commercial assets, Captisol-related royalties have also grown substantially — Captisol royalties have increased more than 6x in the last four years $ M Projected

83 • The AAPS annual meeting is the world's top gathering of pharmaceutical scientists — AAPS includes >10,000 of the top formulators and pharmaceutical scientists • 2017 Captisol partner event on November 13th had largest turnout ever — Recognized major partner achievements at evening awards ceremony The Leading Cyclodextrin Technology

Glucagon Receptor Antagonist Program Eric Vajda, Ph.D. VP, Preclinical R&D

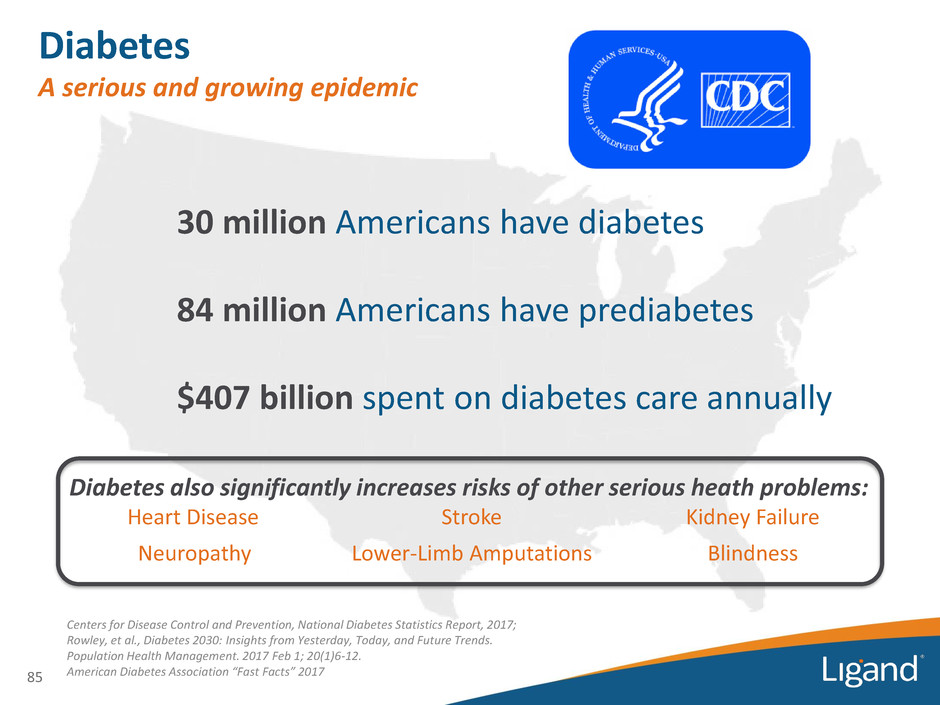

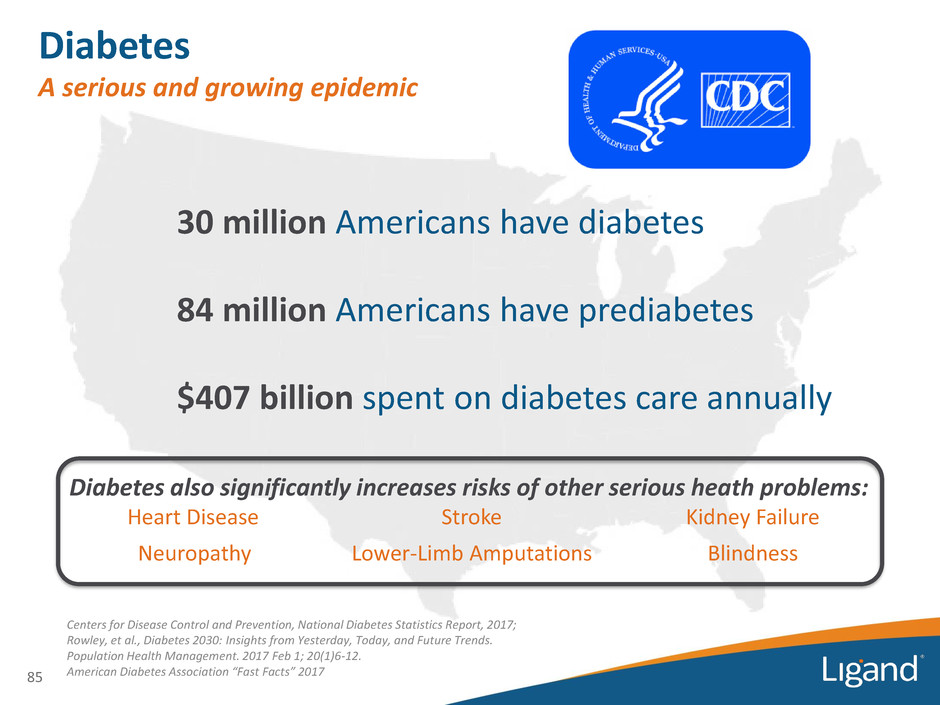

85 Centers for Disease Control and Prevention, National Diabetes Statistics Report, 2017; Rowley, et al., Diabetes 2030: Insights from Yesterday, Today, and Future Trends. Population Health Management. 2017 Feb 1; 20(1)6-12. American Diabetes Association “Fast Facts” 2017 30 million Americans have diabetes 84 million Americans have prediabetes $407 billion spent on diabetes care annually Diabetes A serious and growing epidemic Diabetes also significantly increases risks of other serious heath problems: Heart Disease Stroke Kidney Failure Neuropathy Lower-Limb Amputations Blindness

Existing Diabetes Therapies are Blockbusters But many patients still not meeting glycemic goals 86 Marketer Drug Reduction in HbA1c (%)1 Global Sales2 Januvia® (sitagliptin) 0.7 $6.1 B Tradjenta® (linagliptin) 0.6 $1.5 B Onglyza® (saxagliptin) 0.7 - 0.8 $720 M Jardiance® (empagliflozin) 0.3 - 0.8 $600 M3 Invokana® (canagliflozin) 0.6 - 0.8 $1.4 B Farxiga® (dapagliflozin) 0.4-0.5 $835 M Victoza® (liraglutide) 1.1 $3.0 B Trulicity® (dulaglutide) 0.9 - 1.1 $926 M Byetta/Bydureon® (exenatide) 0.5 - 0.9 $254 M/$578 M 1Placebo corrected. Source: Prescribing information. Clinical trials with novel drug as add-on therapy to metformin 2Global sales according to company full year 2016 financial reports unless otherwise noted 3Glabal sales are estimated from Eli Lilly 2016 report and Boehringer Ingelheim 2015 report DP P -I V SG LT -2 G LP -1

Glucagon Receptor Research 87 • Glucagon receptor physiology remains an active field of research in 2017 "The human glucagon receptor, GCGR, belongs to the class B G-protein-coupled receptor family and plays a key role in glucose homeostasis and the pathophysiology of type 2 diabetes" Source: Nature, Jun 8;546(7657):259-264, 2017

Need for Novel Therapies Advantages of a Potent GRA Existing Class Product Profile GRA Advantage GRA Potentially Competitive with Class Potential GRA Combo with Class DPP-IV Modest reduction of plasma glucose Higher glucose reduction √ √ SGLT-2 Contraindicated for renally impaired patients, safety considerations Potentially effective in renally impaired √ √ GLP-1 Only available as injectables Oral √ √ • Product profile and recent clinical data suggest significant market advantages for a safe, highly potent, oral GRA 88

Insulin Signalling is defective 89 Diabetic Patients

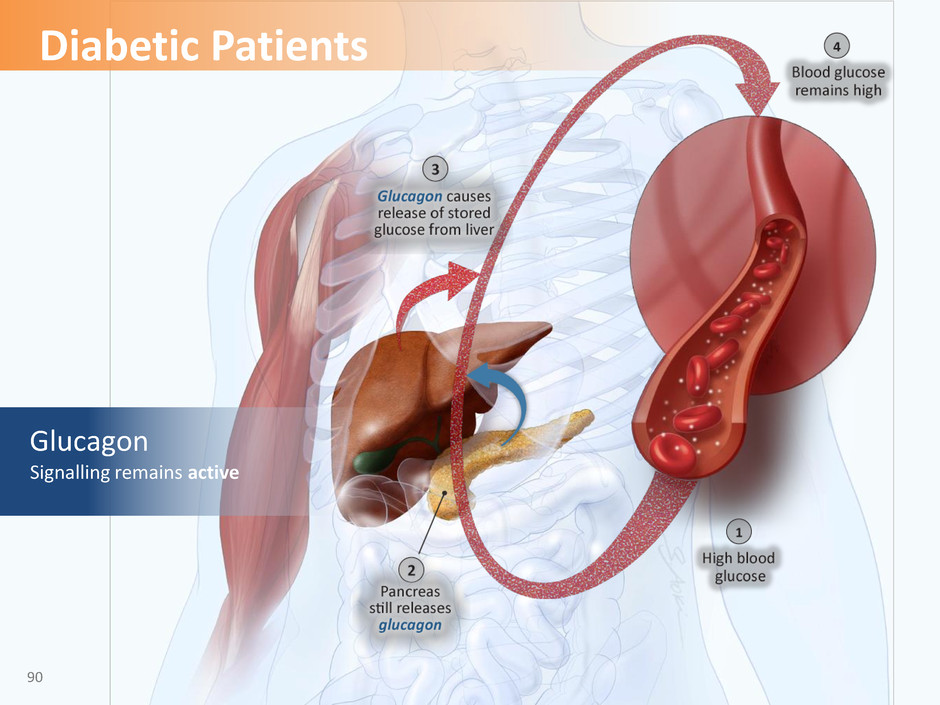

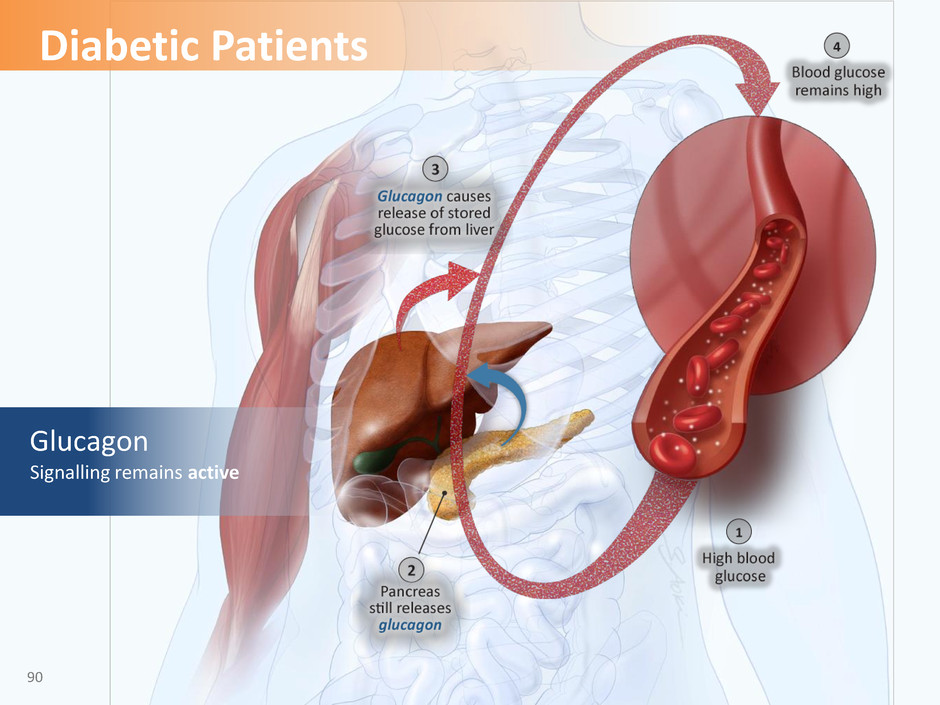

Glucagon Signalling remains active 90 Diabetic Patients

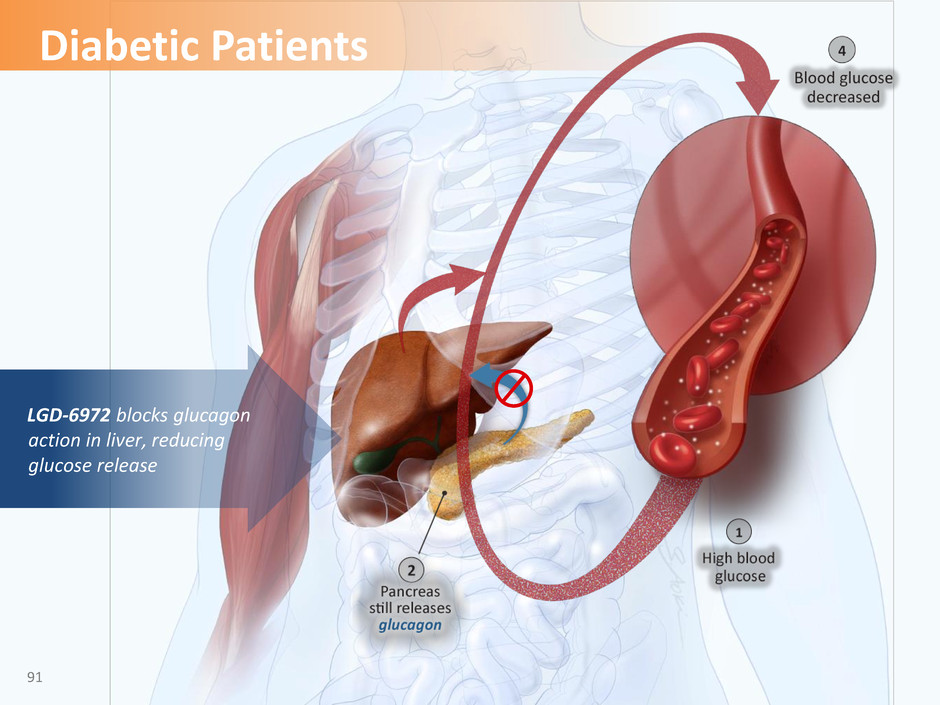

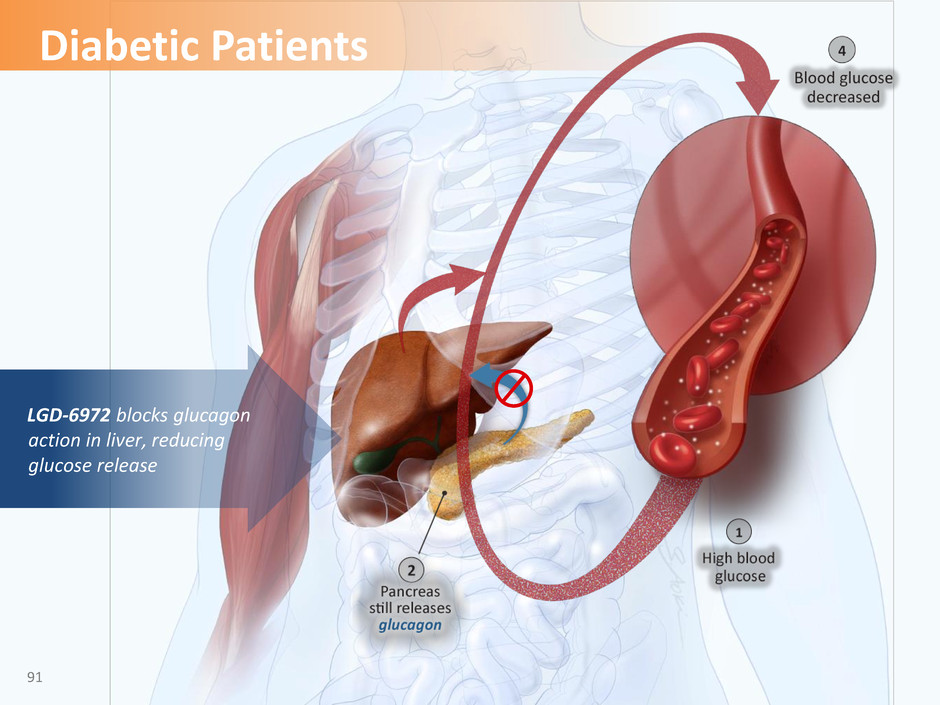

LGD-6972 blocks glucagon action in liver, reducing glucose release 91 Diabetic Patients

• LGD-6972 is an oral small molecule that potently binds to the glucagon receptor in vitro and competitively antagonizes the actions of glucagon — Glucose reduction has been demonstrated in animal models of both type 1 and type 2 diabetes • Clinical trials have demonstrated favorable efficacy and safety profiles • LGD-6972 has novel chemistry and strong drug-like properties • Global patents, if granted, would not be expected to expire until 2035 Ligand’s GRA: LGD-6972 92 Reference WO 2015/191900

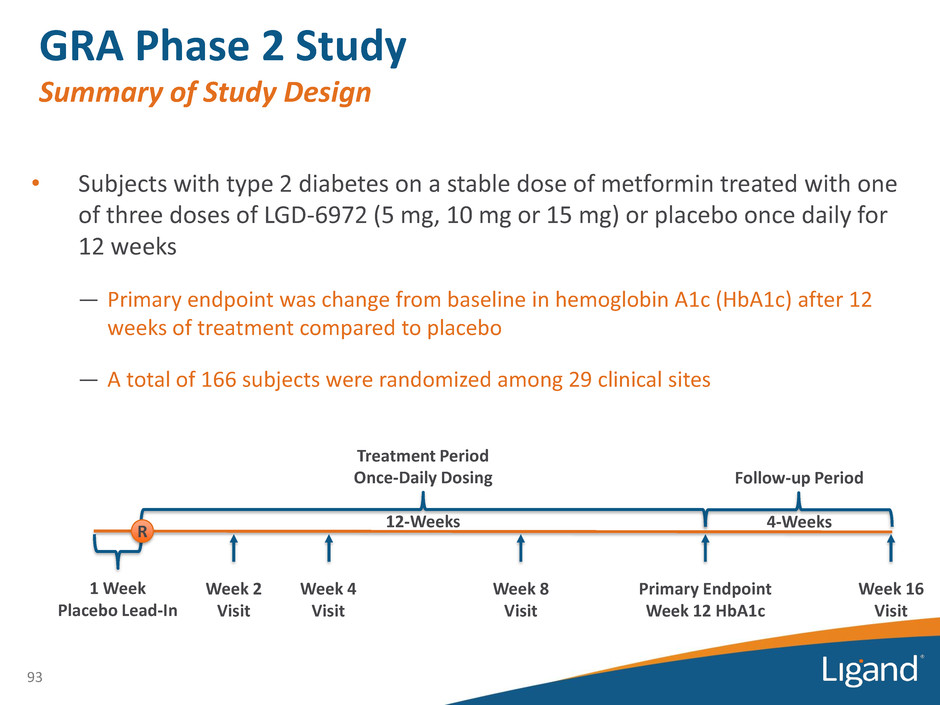

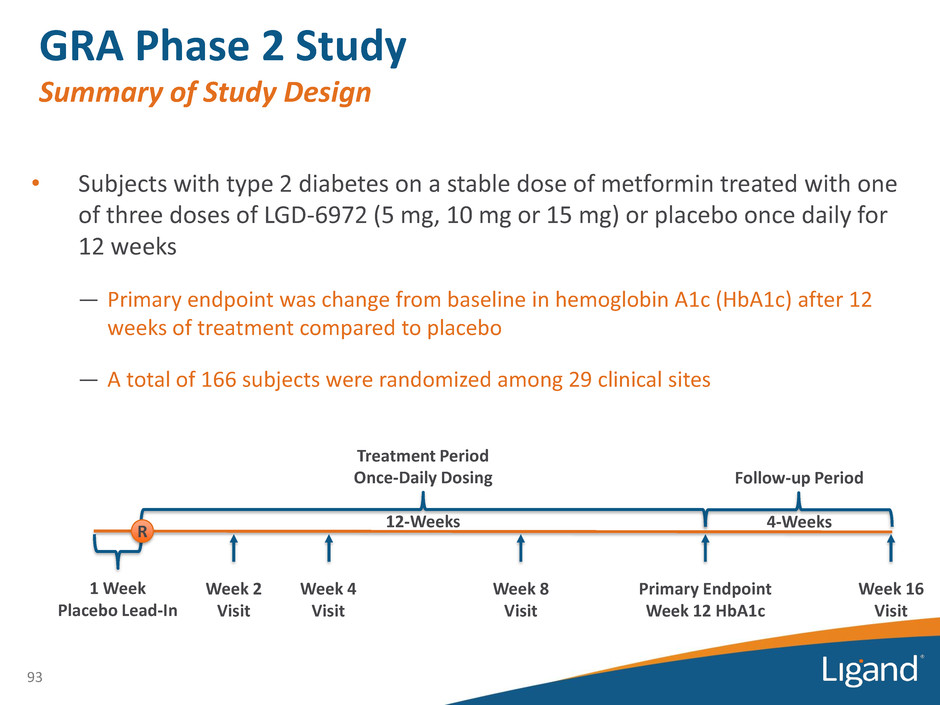

• Subjects with type 2 diabetes on a stable dose of metformin treated with one of three doses of LGD-6972 (5 mg, 10 mg or 15 mg) or placebo once daily for 12 weeks — Primary endpoint was change from baseline in hemoglobin A1c (HbA1c) after 12 weeks of treatment compared to placebo — A total of 166 subjects were randomized among 29 clinical sites 93 GRA Phase 2 Study Summary of Study Design Treatment Period Once-Daily Dosing 12-Weeks 1 Week Placebo Lead-In Follow-up Period 4-Weeks R Primary Endpoint Week 12 HbA1c Week 2 Visit Week 4 Visit Week 8 Visit Week 16 Visit

ITT Population Placebo (n = 41) 5 mg (n = 43) 10 mg (n = 39) 15 mg (n = 40) Baseline HbA1c % (SD) 8.16 (0.99) 8.23 (1.06) 8.27 (0.93) 8.19 (0.89) Change from Baseline1 -0.15 (0.11) -0.90 (0.11) -0.92 (0.12) -1.20 (0.11) p-value vs. Placebo - <0.0001 <0.0001 <0.0001 94 1LS-mean (SE) Change from Baseline to Week 12 with LOCF • LGD-6972 treatment for 12 weeks achieved high statistical significance (p < 0.0001) at all doses tested in the primary endpoint of change from baseline in HbA1c compared to placebo — Demonstrated a robust, dose-dependent reduction in HbA1c GRA Phase 2 Study Top-Line Results - Announced in Q3 • LGD-6972 was safe and well-tolerated with no drug-related SAEs and no dose- dependent changes in lipids, body weight or blood pressure

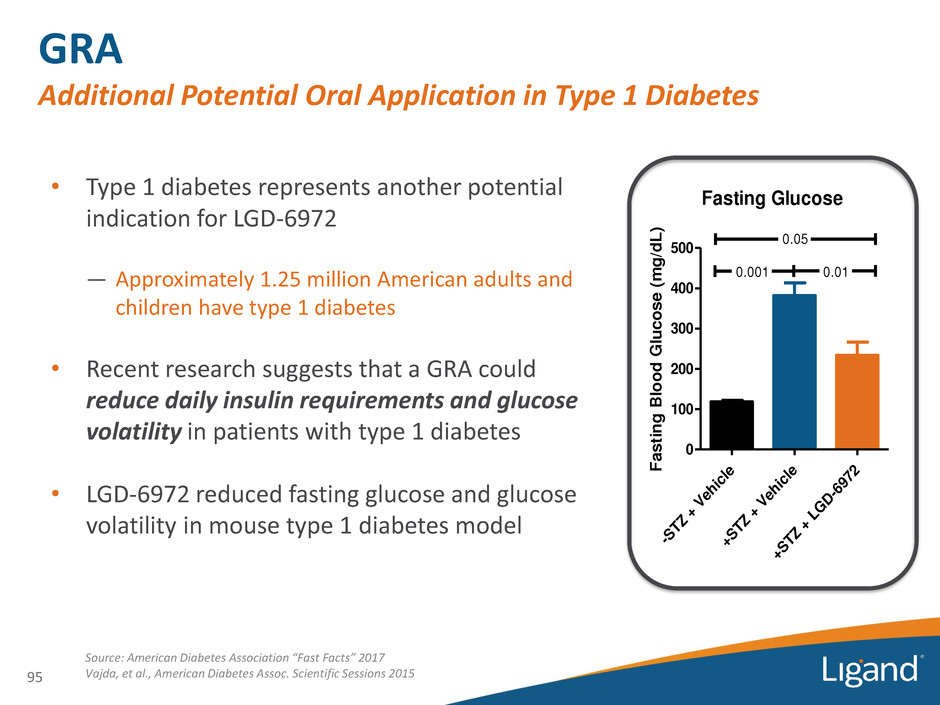

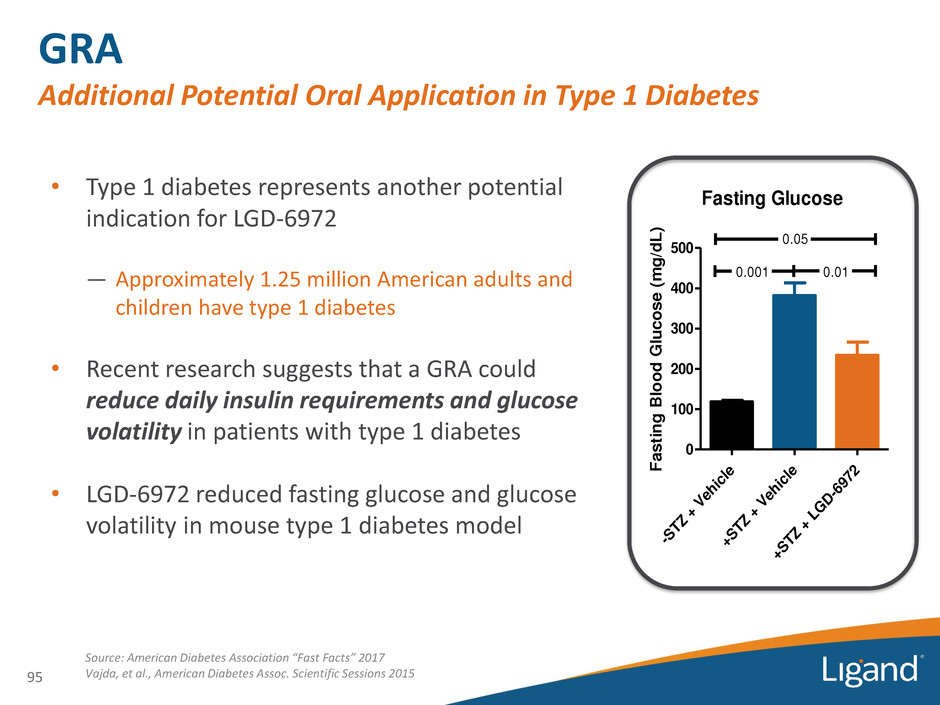

• Type 1 diabetes represents another potential indication for LGD-6972 — Approximately 1.25 million American adults and children have type 1 diabetes • Recent research suggests that a GRA could reduce daily insulin requirements and glucose volatility in patients with type 1 diabetes • LGD-6972 reduced fasting glucose and glucose volatility in mouse type 1 diabetes model GRA Additional Potential Oral Application in Type 1 Diabetes 95 Fasting Glucose -S T Z + V eh ic le +S T Z + V eh ic le +S T Z + L G D -6 97 2 0 100 200 300 400 500 0.05 0.001 0.01 F a s t in g B lo o d G lu c o s e ( m g /d L ) Source: American Diabetes Association “Fast Facts” 2017 Vajda, et al., American Diabetes Assoc. Scientific Sessions 2015

Financial Overview and Outlook Matt Korenberg

Strong Financial Performance and Outlook • 2017 continues Ligand’s track record of annual growth in revenues, cash flow and profits • Financial outlook for 2018 and beyond expected to show continued growth and the leverage in our model • Substantial long-term growth potential from existing commercial assets and robust pipeline • Certainty and longevity of growth profile provides attractive opportunity for investors 97

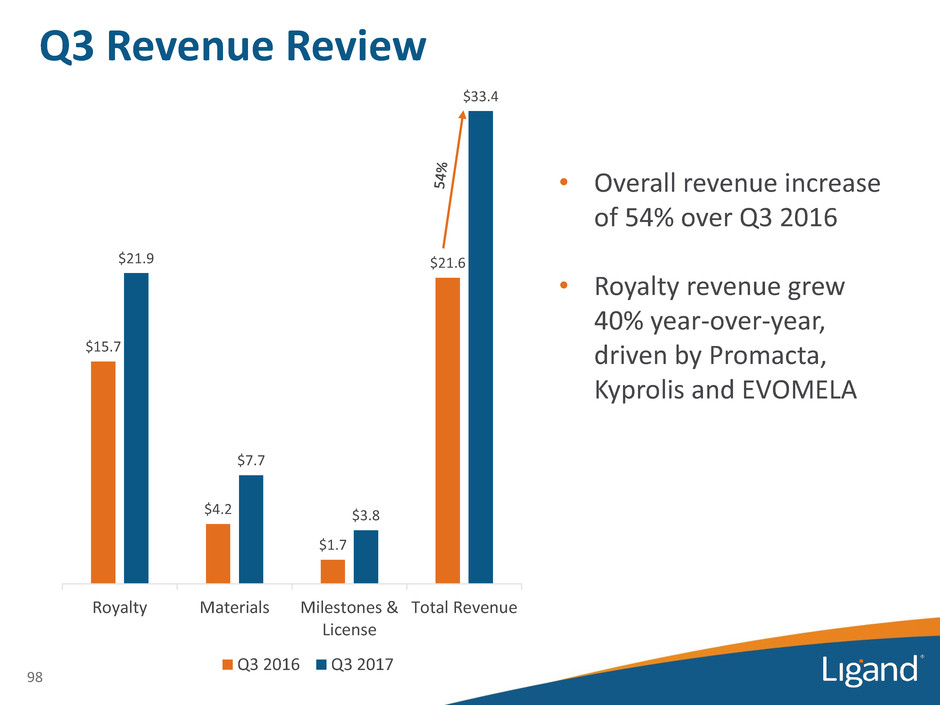

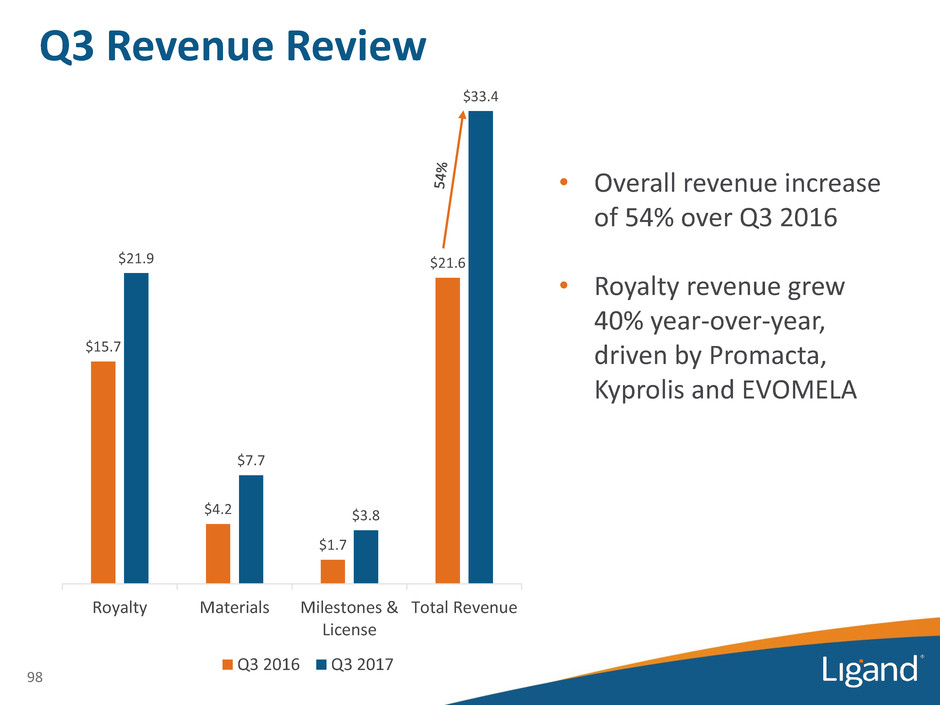

Q3 Revenue Review 98 $15.7 $4.2 $1.7 $21.6 $21.9 $7.7 $3.8 $33.4 Royalty Materials Milestones & License Total Revenue Q3 2016 Q3 2017 • Overall revenue increase of 54% over Q3 2016 • Royalty revenue grew 40% year-over-year, driven by Promacta, Kyprolis and EVOMELA

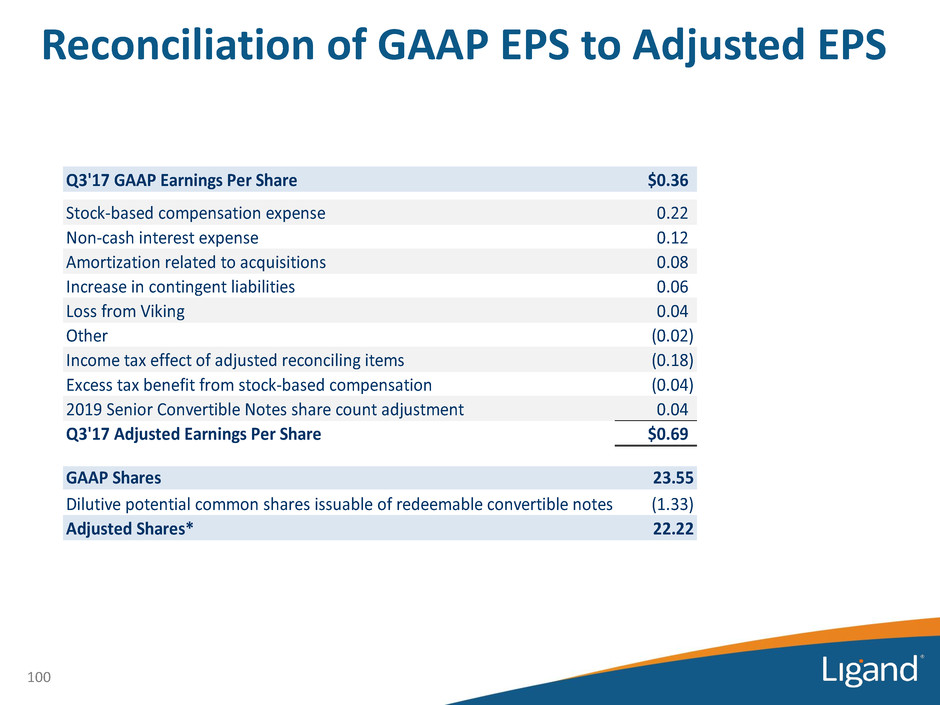

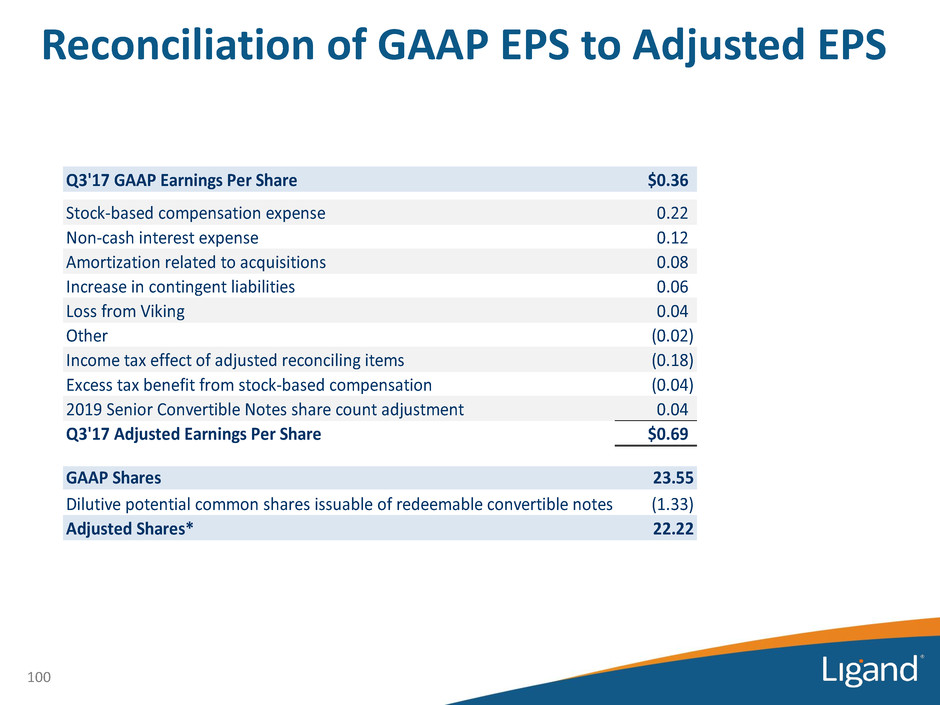

• Corporate gross margin at 93% for Q3 2017 reflecting mix of revenue • Cash operating expenses ~$6.5M with full year on track for $30M to $31M – up slightly due to expected Q4 Crystal integration and operating expenses • Income tax expense for GAAP of $3.6M, effective tax rate 30%; cash tax rate to remain <1% • GAAP Net Income of $8.4M or $0.36 per share compared to $1.1M or $0.05 per share a year ago. Adjusted Net Income of $15.3M or $0.69 per share compared to $9.6M or $0.44 per share a year ago • Finished the quarter with cash and equivalents of $202M, and now have $175M net of Crystal acquisition, as of November 14, 2017 Q3 Results Review 99

Reconciliation of GAAP EPS to Adjusted EPS 100 Q3'17 GAAP Earnings Per Share $0.36 Stock-based compensation expense 0.22 Non-cash interest expense 0.12 Amortization related to acquisitions 0.08 Increase in contingent liabilities 0.06 Loss from Viking 0.04 Other (0.02) Income tax effect of adjusted reconciling items (0.18) Excess tax benefit from stock-based compensation (0.04) 2019 Senior Convertible Notes share count adjustment 0.04 Q3'17 Adjusted Earnings Per Share $0.69 GAAP Shares 23.55 Dilutive potential common shares issuable of redeemable convertible notes (1.33) Adjusted Shares* 22.22

$0 $10 $20 $30 $40 $50 $60 $70 $80 $90 $100 $110 $120 $130 $140 2012 2013 2014 2015 2016 2017 Royalty Materials Milestone/License Sustained Revenue Growth $49 $65 $72 $ m ill io n s $109 101 • Consistent, strong annual revenue growth driven by: — High royalty growth — Increasing contribution from milestones — Consistent contribution from material sales • 2017 Adjusted EPS guidance recently increased to $2.95 to $3.00 $31 $134 - $136 Projected

Commentary on 2018 Revenue Outlook • Formal guidance will be given in early 2018 • Royalty: — Partner revenue reports of Q4 product sales will impact outlook • Materials: — Timing of orders at year end may shift revenue between 2017 and 2018 • Milestone/License: — Timing of milestones at year end may shift revenue between 2017 and 2018 102

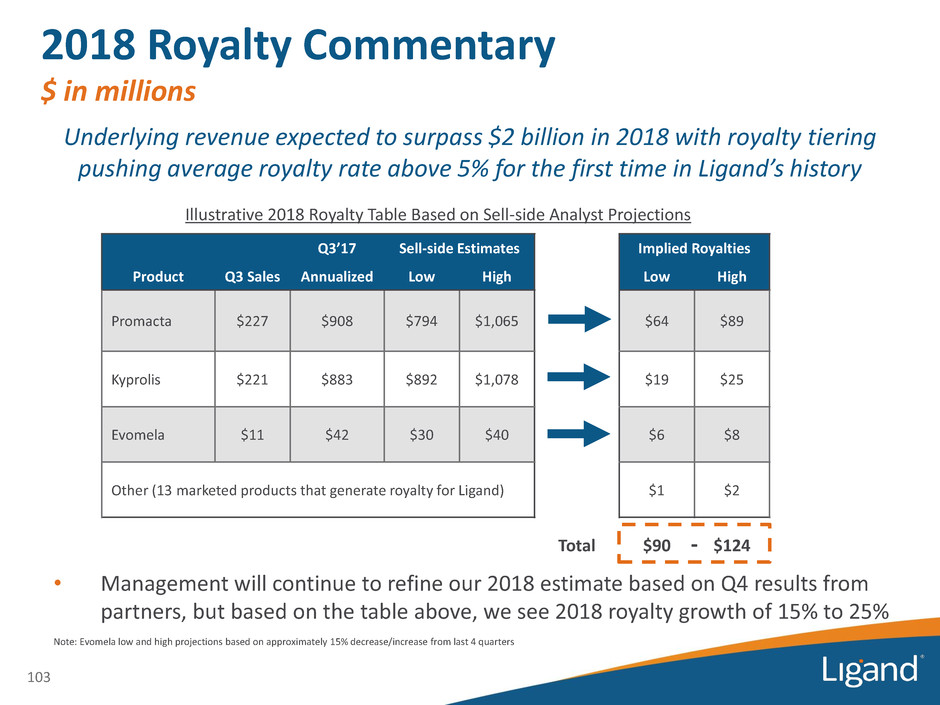

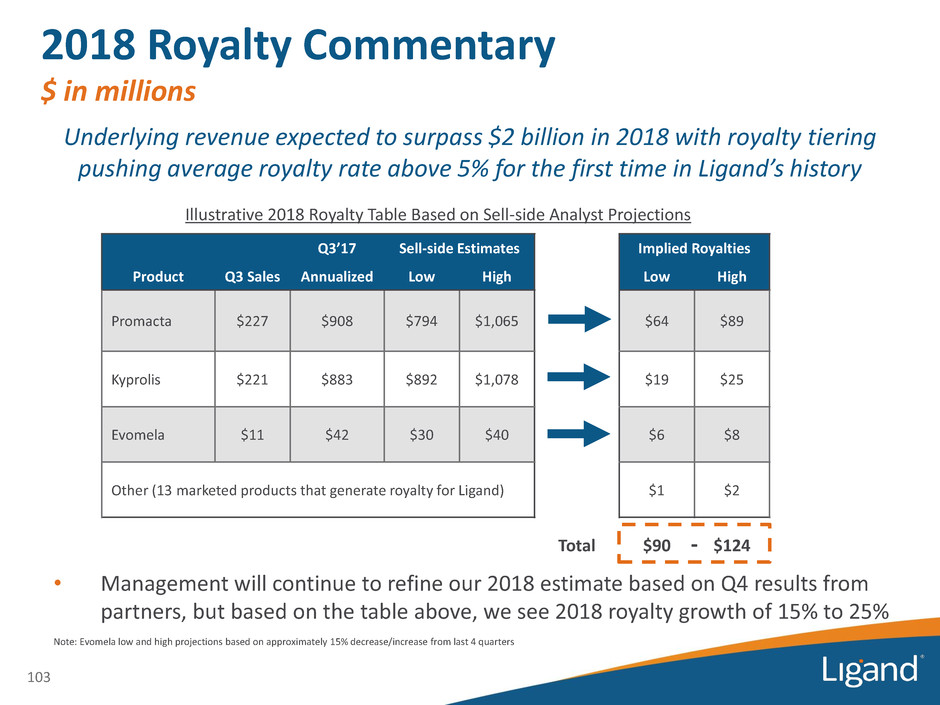

2018 Royalty Commentary $ in millions 103 Product Q3 Sales Q3’17 Sell-side Estimates Implied Royalties Annualized Low High Low High Promacta $227 $908 $794 $1,065 $64 $89 Kyprolis $221 $883 $892 $1,078 $19 $25 Evomela $11 $42 $30 $40 $6 $8 Other (13 marketed products that generate royalty for Ligand) $1 $2 Total $90 $124 Note: Evomela low and high projections based on approximately 15% decrease/increase from last 4 quarters • Management will continue to refine our 2018 estimate based on Q4 results from partners, but based on the table above, we see 2018 royalty growth of 15% to 25% Illustrative 2018 Royalty Table Based on Sell-side Analyst Projections - Underlying revenue expected to surpass $2 billion in 2018 with royalty tiering pushing average royalty rate above 5% for the first time in Ligand’s history

$0 $5 $10 $15 $20 $25 $30 2011 2012 2013 2014 2015 2016 2017 Clinical Commercial 2018 Materials Revenue Commentary $ m ill io n s Actual Projected Confidential104 • 2018 outlook generally in line with 2017 projected revenue

Summary of 2017 Milestone/License 105 3.2 1.0 4.0 1.2 3.4 1.0 2.5 $6.6 $1.0 $0.9 $5.0 $1.0 $5.3 $3.7 YTD Q3 Q4 Estimated Expecting $23 - $24 million in milestone/license payments across more than 50 events in 2017

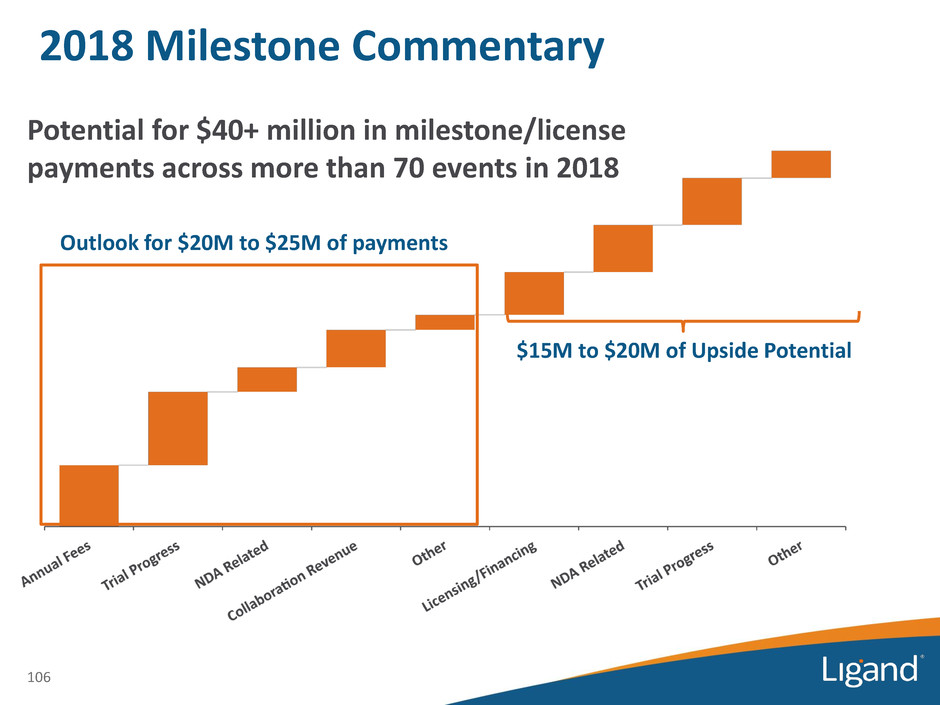

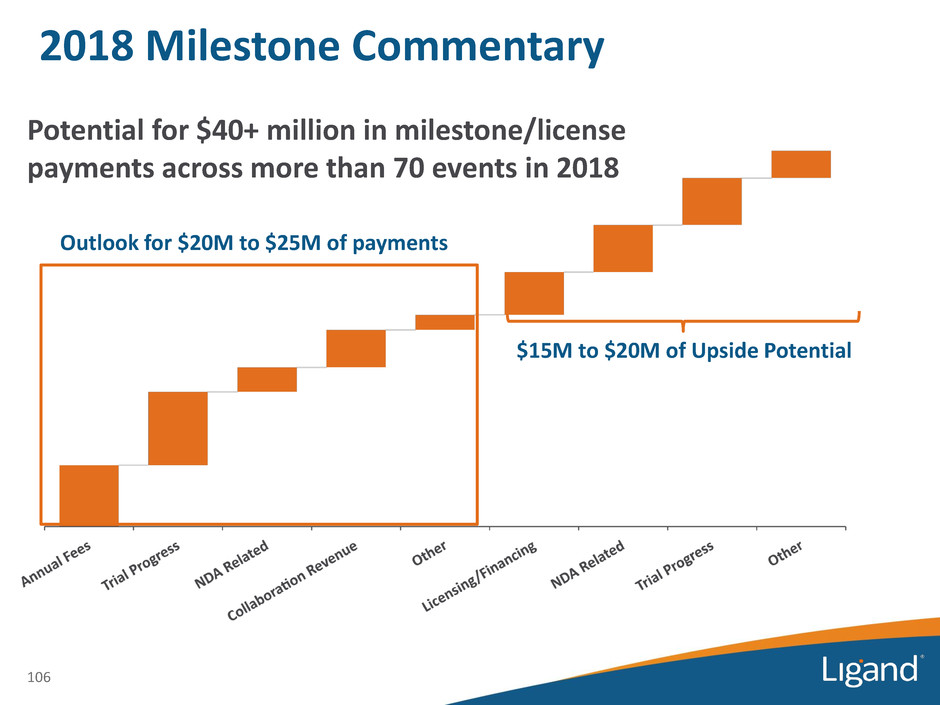

2018 Milestone Commentary 106 Outlook for $20M to $25M of payments $15M to $20M of Upside Potential Potential for $40+ million in milestone/license payments across more than 70 events in 2018

50% 40% 10% Company Operations Facilities, insurance, taxes and administrative expenses 2018 Projected Cost Structure • Cash expenses of $30 to $32 million, similar to expected 2017 expenses • Efficient cost structure that supports activities to further expand the “Shots-on-Goal” portfolio Pipeline Costs Research & development, business development and patent maintenance costs Public Company Costs Audit, public filing costs, legal, Board costs 107

2018 Outlook Revenue • Royalty Q4 will inform; sell-side analyst research shows $90M to $124M centering around 15% to 25% growth • Materials 2018 demand expected to be in line with 2017 demand of ~$23M • Milestone/License initial analysis shows $20M to $25M with $15M to $20M potential upside Corporate gross margins • 94% - 96% Cash operating expense • Expected to be relatively flat to 2017 at $31M Fully-diluted share count • Approximately 22.3M at year end with no 2018 issuance expected beyond stock based compensation Adjusted EPS tax rate • Expected range of 36% to 39% Cash tax rate • <1% 2018 Preliminary Outlook 108

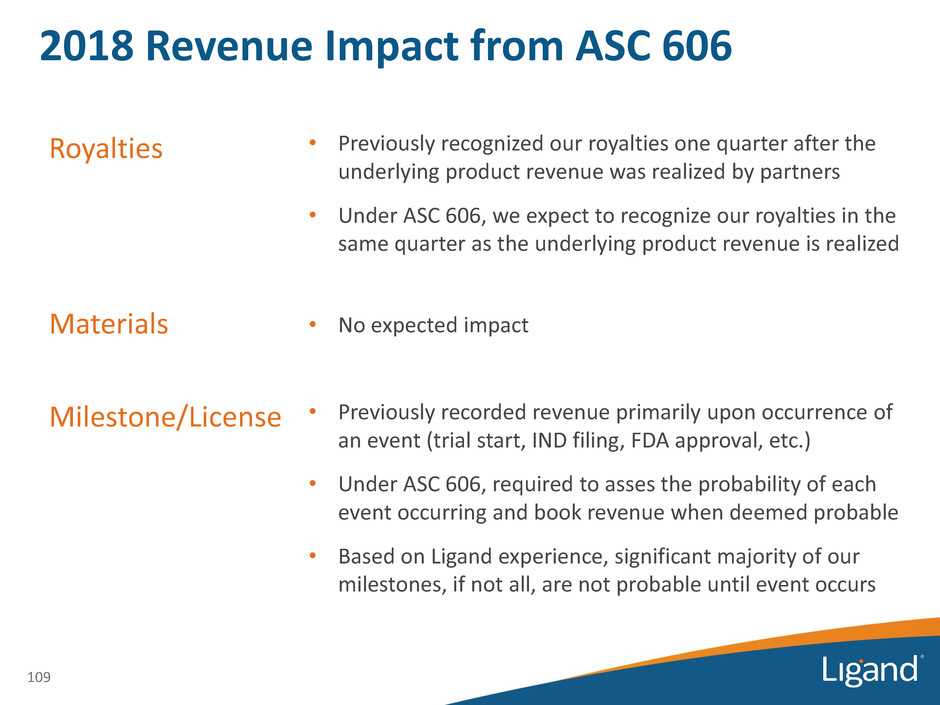

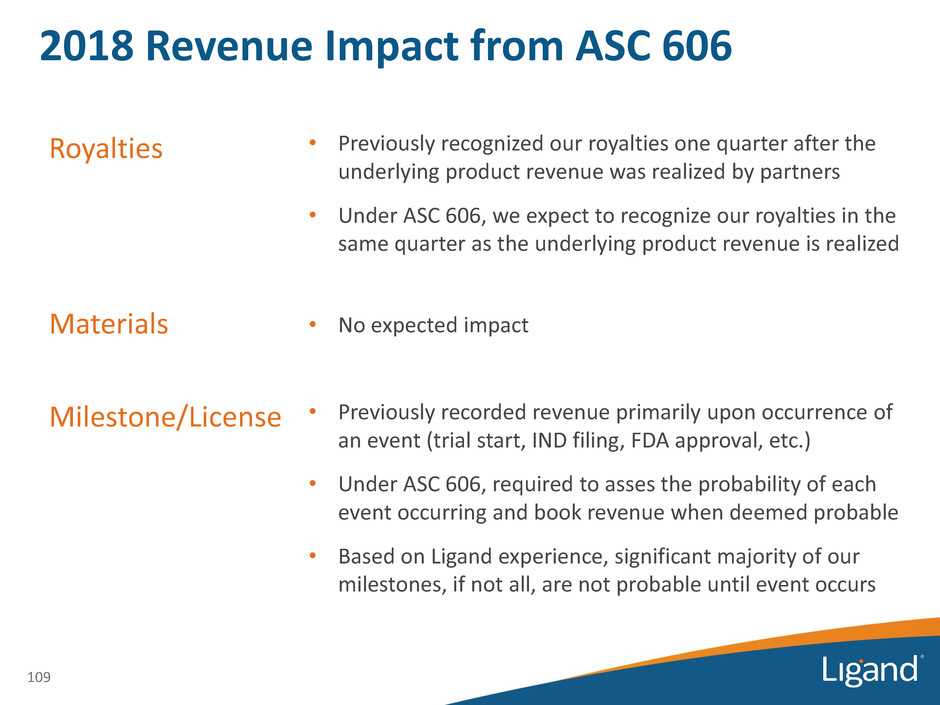

Royalties • Previously recognized our royalties one quarter after the underlying product revenue was realized by partners • Under ASC 606, we expect to recognize our royalties in the same quarter as the underlying product revenue is realized Materials • No expected impact Milestone/License • Previously recorded revenue primarily upon occurrence of an event (trial start, IND filing, FDA approval, etc.) • Under ASC 606, required to asses the probability of each event occurring and book revenue when deemed probable • Based on Ligand experience, significant majority of our milestones, if not all, are not probable until event occurs 2018 Revenue Impact from ASC 606 109

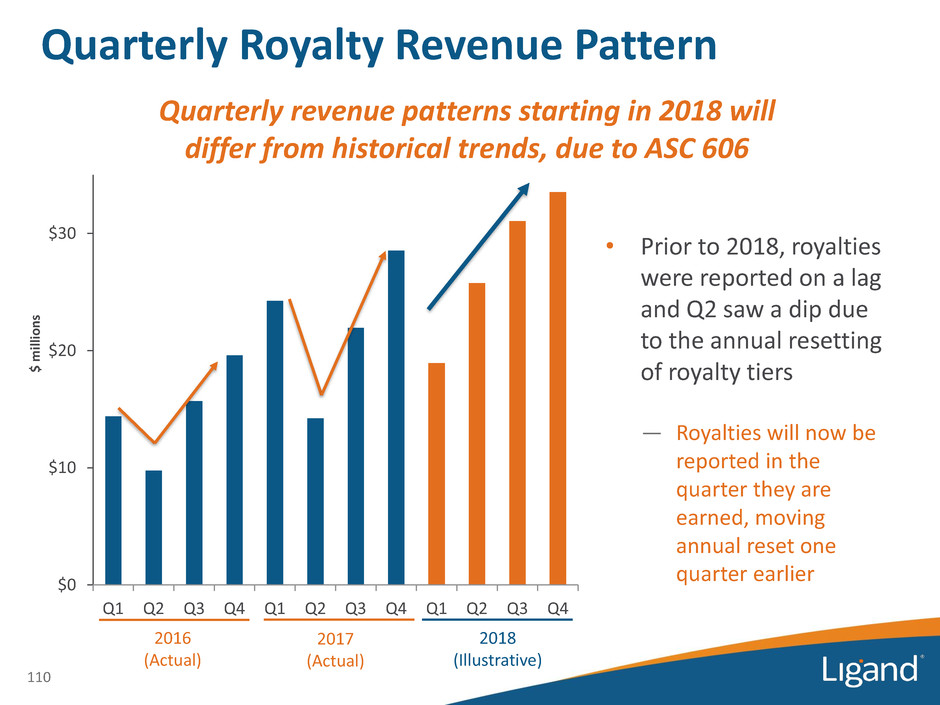

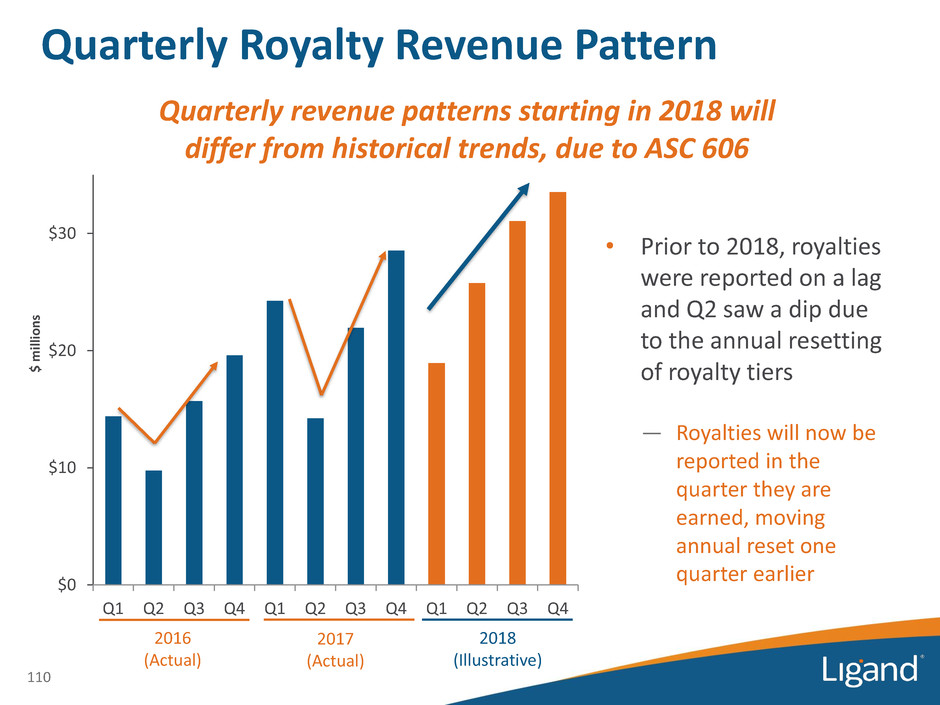

$0 $10 $20 $30 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Quarterly Royalty Revenue Pattern $ m ill io n s 110 2016 (Actual) Quarterly revenue patterns starting in 2018 will differ from historical trends, due to ASC 606 2017 (Actual) 2018 (Illustrative) • Prior to 2018, royalties were reported on a lag and Q2 saw a dip due to the annual resetting of royalty tiers — Royalties will now be reported in the quarter they are earned, moving annual reset one quarter earlier

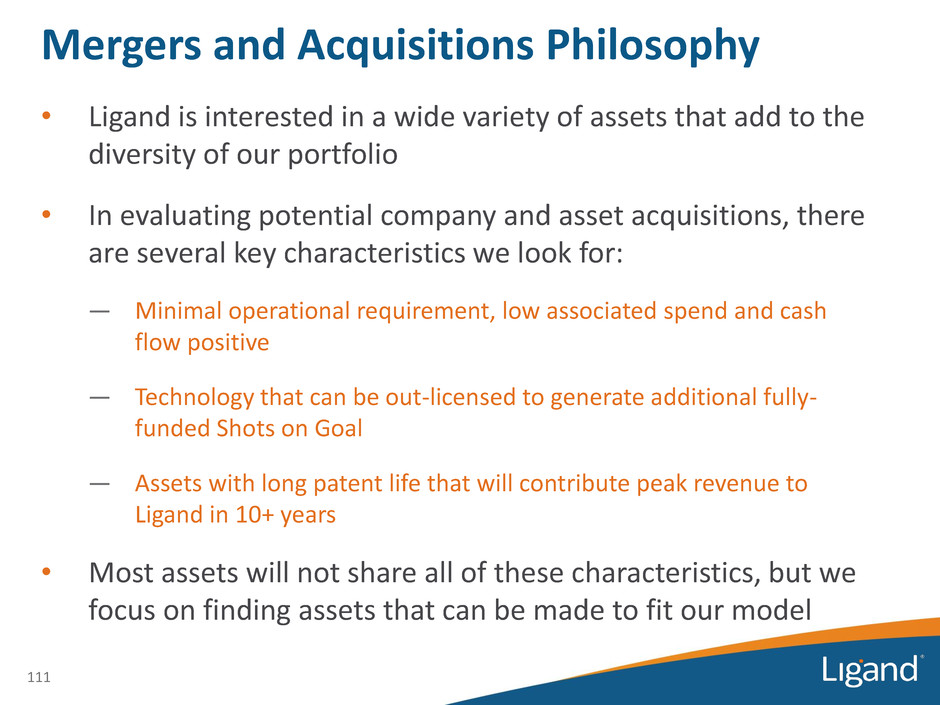

Mergers and Acquisitions Philosophy • Ligand is interested in a wide variety of assets that add to the diversity of our portfolio • In evaluating potential company and asset acquisitions, there are several key characteristics we look for: — Minimal operational requirement, low associated spend and cash flow positive — Technology that can be out-licensed to generate additional fully- funded Shots on Goal — Assets with long patent life that will contribute peak revenue to Ligand in 10+ years • Most assets will not share all of these characteristics, but we focus on finding assets that can be made to fit our model 111

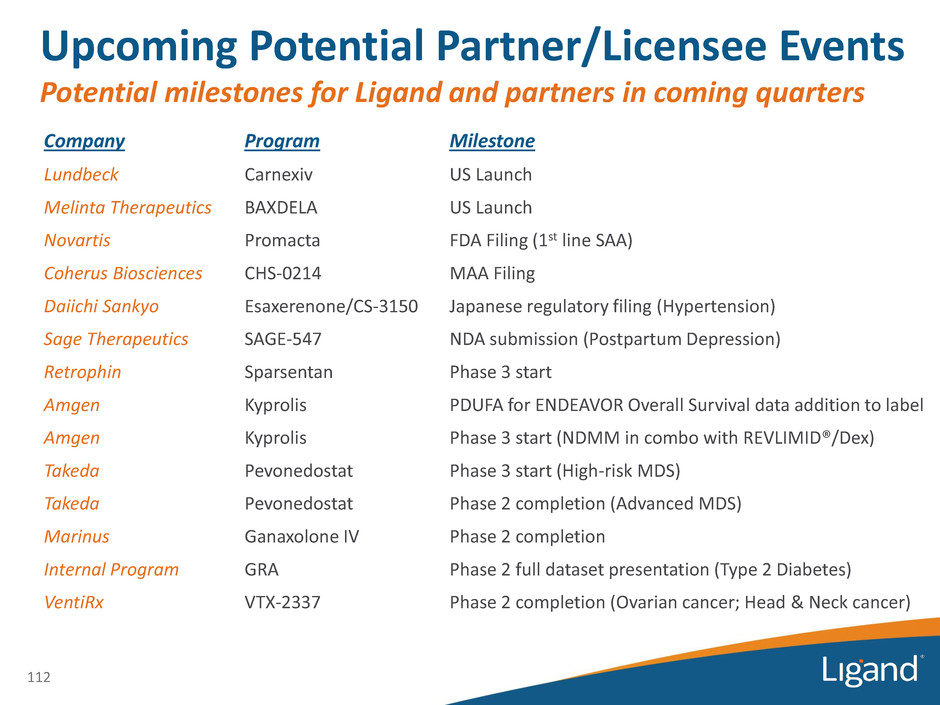

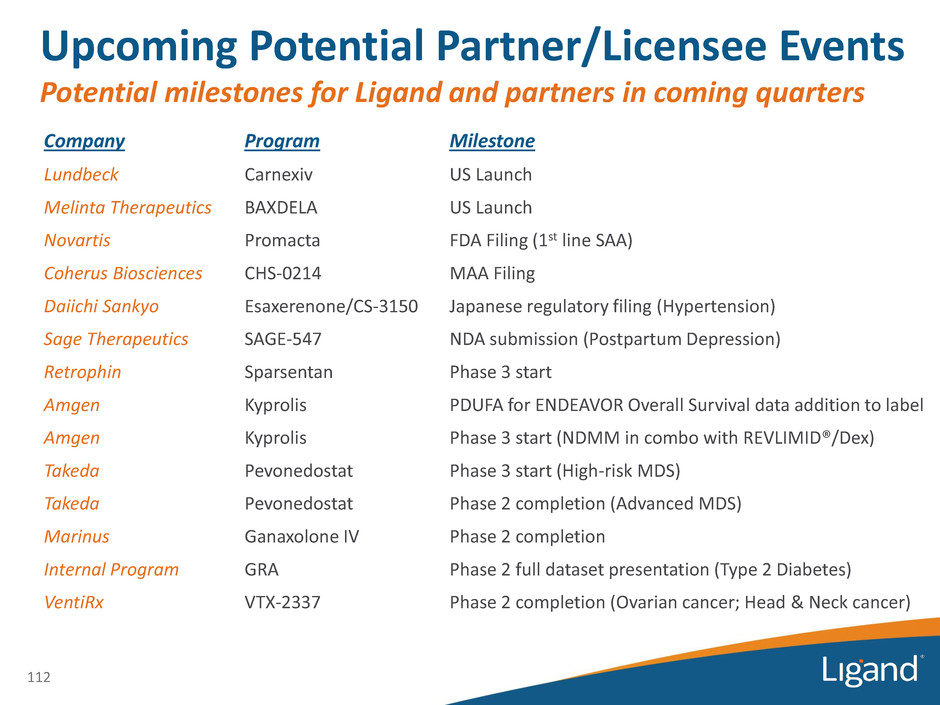

Upcoming Potential Partner/Licensee Events Potential milestones for Ligand and partners in coming quarters Company Program Milestone Lundbeck Carnexiv US Launch Melinta Therapeutics BAXDELA US Launch Novartis Promacta FDA Filing (1st line SAA) Coherus Biosciences CHS-0214 MAA Filing Daiichi Sankyo Esaxerenone/CS-3150 Japanese regulatory filing (Hypertension) Sage Therapeutics SAGE-547 NDA submission (Postpartum Depression) Retrophin Sparsentan Phase 3 start Amgen Kyprolis PDUFA for ENDEAVOR Overall Survival data addition to label Amgen Kyprolis Phase 3 start (NDMM in combo with REVLIMID®/Dex) Takeda Pevonedostat Phase 3 start (High-risk MDS) Takeda Pevonedostat Phase 2 completion (Advanced MDS) Marinus Ganaxolone IV Phase 2 completion Internal Program GRA Phase 2 full dataset presentation (Type 2 Diabetes) VentiRx VTX-2337 Phase 2 completion (Ovarian cancer; Head & Neck cancer) 112

Upcoming Potential Partner/Licensee Events Potential milestones for Ligand and partners in coming quarters Company Program Milestone Lilly Merestinib Phase 2 completion (Biliary Tract Cancer) Lilly Prexasertib Phase 2 completion (Small Cell Lung Cancer) Viking Therapeutics VK5211 Phase 2 completion (Hip Fracture) Viking Therapeutics VK2809 Phase 2 completion (Hypercholesterolemia/NASH) Aldeyra Therapeutics Reproxalap (ADX-102) Phase 2 completion (Allergic Conjunctivitis) GSK GSK2894512 Phase 2 completion (Atopic Dermatitis) CURx Pharma IV-Topiramate Phase 2 start (Epilepsy) Sermonix Lasofoxifene Phase 2 start (Breast Cancer) Bristol Meyers Squibb CXL-1427/BMS-986231 Phase 2 completion (Heart Failure) Precision Biologics NPC-1C Phase 1/2 completion (Pancreatic Cancer) GSK GSK2816126 Phase 1 completion (DLBCL) Aptevo Therapeutics APVO436 IND filing (AML) Vireo Health Cannabinoids IND for Captisol-enabled Formulations 113