UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

(Rule 14a-101)

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF

THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under 240.14a-12 |

LIGAND PHARMACEUTICALS INCORPORATED

Name of Registrant as Specified In Its Charter

Name of Person(s) Filing Proxy Statement, if other than the Registrant

Payment of Filing Fee (Check the appropriate box):

| | | | | |

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) Title of each class of securities to which transaction applies: (2) Aggregate number of securities to which transaction applies: (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): (4) Proposed maximum aggregate value of transaction: (5) Total fee paid: |

| | | | | |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) Amount Previously Paid: (2) Form, Schedule or Registration Statement No.: (3) Filing Party: (4) Date Filed: |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

| | | | | |

| MEETING DATE | Friday, June 4, 2021 |

| TIME | 8:30 a.m. (Pacific Time) |

| VIRTUAL MEETING LINK AND PASSWORD | www.meetingcenter.io/293363962 Password: LGND2021 |

| RECORD DATE | April 13, 2021 |

Dear Stockholder:

The annual meeting of stockholders of Ligand Pharmaceuticals Incorporated (“Ligand” or the “Company”) will be held on June 4, 2021 at 8:30 a.m. Pacific time. You will be able to attend and participate in the annual meeting online, vote your shares electronically and submit your questions during the meeting by visiting: www.meetingcenter.io/293363962 on the meeting date and at the time described in the accompanying proxy statement. The password for the meeting is LGND2021. There is no physical location for the annual meeting. The annual meeting will be held for the following purposes:

1. To elect a board of directors for the forthcoming year. Our board of directors has nominated the following nine persons, each to serve for a one year term to expire at the 2022 annual meeting of stockholders: Jason Aryeh, Sarah Boyce, Todd Davis, Nancy Gray, John Higgins, John Kozarich, John LaMattina, Sunil Patel and Stephen Sabba.

2. To ratify the selection of Ernst & Young LLP as our independent registered accounting firm for the fiscal year ending December 31, 2021.

3. To consider and vote upon, on an advisory basis, the compensation of our named executive officers as disclosed in this proxy statement pursuant to the compensation disclosure rules of the Securities and Exchange Commission (the “SEC”).

4. To transact such other business as may properly come before the meeting or any adjournment(s) thereof.

Stockholders of record at the close of business on April 13, 2021 will be entitled to vote at the annual meeting. We have elected to use the internet as our primary means of providing our proxy materials to stockholders. Most stockholders will receive only a Notice of Internet Availability of Proxy Materials with instructions for accessing the proxy materials, including our Proxy Statement and annual report, and for voting via the internet. The Notice of Internet Availability of Proxy Materials also provides information on how stockholders may obtain paper copies of our proxy materials free of charge, if they so choose.

Our stock transfer books will remain open between the record date, April 13, 2021, and the date of the meeting. A list of stockholders entitled to vote at the annual meeting will be available for inspection at our offices and at the meeting. Whether or not you plan to participate in the virtual annual meeting via live webcast, please vote by internet or telephone as described in the enclosed proxy materials or, if you request that the proxy materials be mailed to you, by signing, dating and returning the proxy card enclosed with those materials. If you attend the virtual annual meeting and vote at the meeting through the virtual annual meeting portal, your proxy will be revoked

automatically and only your vote at the annual meeting will be counted. The prompt return of your proxy will assist us in preparing for the annual meeting.

This proxy statement and our annual report are available electronically at www.envisionreports.com/LGND.

| | |

| By Order of the Board of Directors, |

|

| /s/ CHARLES S. BERKMAN |

Charles S. Berkman Senior Vice President, General Counsel & Secretary |

San Diego, California

April 23, 2021

TABLE OF CONTENTS

PROXY STATEMENT SUMMARY

BUSINESS HIGHLIGHTS

2020 was a year filled with opportunities and challenges as a result of the pandemic. Through it all, Ligand continued to execute its strategies to deliver stellar financial, scientific, and operating performance. As a life science technology company, we are built upon several diverse technology platforms to serve our large portfolio of partners and customers. Our focus is to develop or acquire technologies that help pharmaceutical companies discover and develop medicines. In 2020, we played a vital role in helping serve global human health by supplying Captisol to Gilead Sciences, a component in Veklury®, the first FDA approved anti-viral treatment for sever COVID-19, and delivered to investors a more diversified company with a substantially expanded growth outlook.

There have been four recent defining factors driving our value, which are further discussed in the “Executive Compensation and Other Information” section:

•major expansion of our OmniAb antibody discovery platform;

•the most prolific acquisition year in our history, diversifying and adding to our growth prospects;

•serving Gilead to meet their Veklury production needs to help address the ongoing global health crisis; and

•strong revenue growth and effective capital deployment.

We have a very talented leadership team, a highly engaged, experienced board of directors, and a dedicated team of scientists driving the business. In parallel with our business success, we are a team that cares about our communities and the environment. We are dedicated to social equality and have implemented measures to help elevate our voice on this important topic. And we are implementing measures to reduce our carbon footprint and minimize consumables and other factors of production in running our technology. What we do matters. We are contributing to the advancement of some vitally important medicines to advance human health.

The summary below highlights certain information that may be found elsewhere in this proxy statement. We encourage you to read the entire proxy statement before casting your vote.

OUR BOARD’S VOTING RECOMMENDATIONS

| | | | | | | | | | | |

| Item | Description of Proposal | Recommendation | Page |

| 1 | Election of directors | FOR | |

| 2 | Ratification of independent registered public accounting firm | FOR | |

| 3 | Approval of compensation of named executive officers | FOR | |

DIRECTOR NOMINEES

Please find a list of director nominees to our Board of Directors (the “Board”) below. We maintain a diverse Board, which represents a wide range of experience and perspectives important to enhance the Board's effectiveness in fulfilling its oversight role. Additional information for each nominee can be found under “Proposal 1: Election of Directors”.

| | | | | | | | | | | |

| Name | Age* | Director Since | Professional Background |

John W. Kozarich, Ph.D. (N) | 71 | 2003 | Interim CEO of Curza Global, LLC Former Vice President for Merck Research Laboratories |

| John L. Higgins | 51 | 2007 | Chief Executive Officer of Ligand Pharmaceuticals Incorporated |

Jason M. Aryeh (HC)(N) | 52 | 2006 | Founder and Managing General Partner of JALAA Equities, LP |

Sarah Boyce(HC) | 49 | 2019 | President and CEO of Avidity Biosciences, Inc. |

Todd C. Davis(HC) | 60 | 2007 | Founder and Managing Partner of RoyaltyRx Capital |

Nancy R. Gray, Ph.D.(A)(N) | 61 | 2017 | President and CEO of Gordon Research Conferences |

John L. LaMattina, Ph.D.(HC) | 71 | 2011 | Senior Partner at PureTech Ventures Former President for Pfizer Global R&D |

Sunil Patel(A) | 49 | 2010 | Former Executive Vice President and Chief Financial Officer for OncoMed Pharmaceuticals |

Stephen L. Sabba, M.D.(A)(N) | 61 | 2008 | Leading Health Care Analyst and Portfolio Manager for Knott Partners, L.P. |

* As of April 13, 2021

(A) Member of the audit committee

(HC) Member of the human capital management and compensation committee

(N) Member of the nominating and corporate governance committee

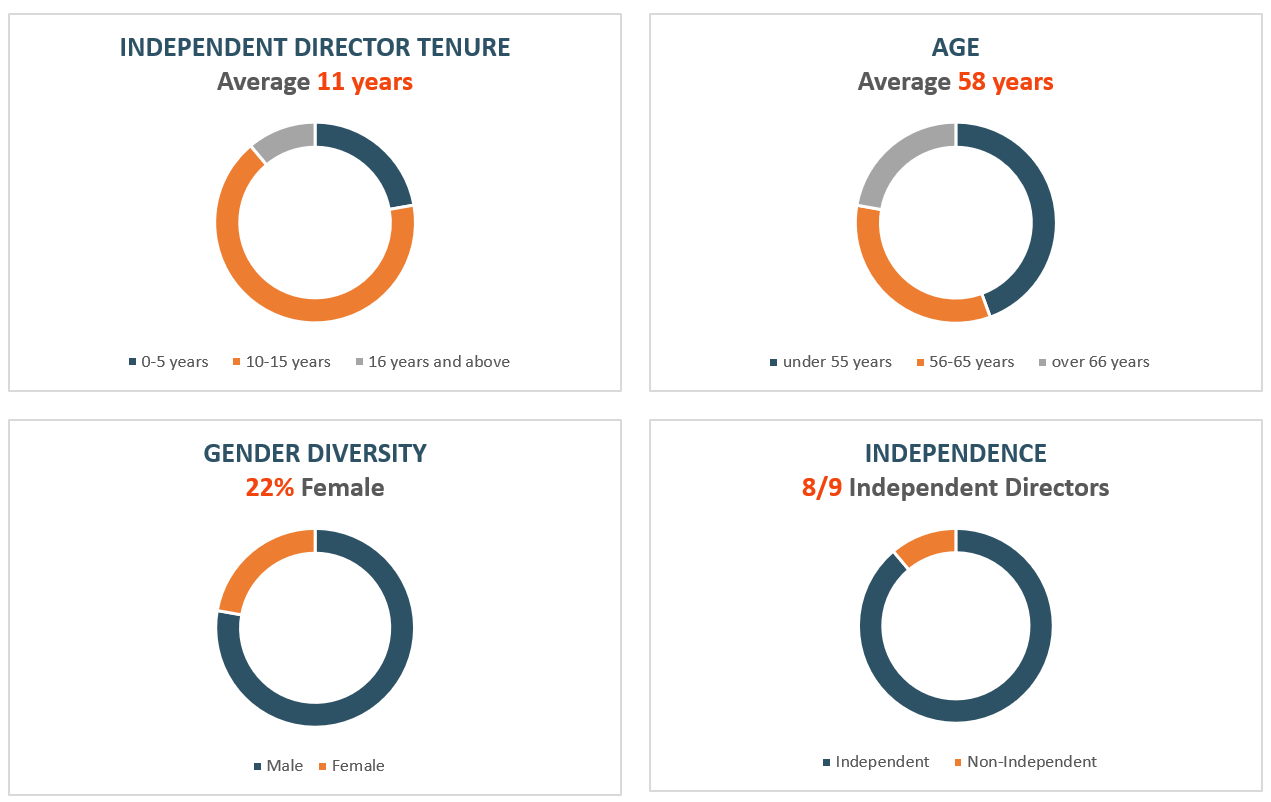

CURRENT BOARD COMPOSITION

2020 ESG HIGHLIGHTS

We aim to deliver long-term sustainable value to our stakeholders by promoting a diverse, inclusive and supportive culture; inspiring innovation; and fostering trust throughout our organization and within the communities we serve. Our corporate sustainability program continually identifies, assesses and manages the environmental, social and governance (ESG) factors that are relevant to our long-term performance. Our sustainability program takes into account the interests of our key stakeholders including employees, partners, our communities and our shareholders.

Our ESG priorities include energy and resource efficiency, employee and board diversity, workplace health and safety, waste management, human capital management, leadership with vendors and partners on environmental goals, business ethics and compliance, and data privacy and protection.

Our board of directors reviews and assesses our ESG programs to ensure we are meeting our commitments to all of our stakeholders. In addition, our directors have committed themselves to various environmental and social diversity initiatives such as founding a non-profit conservation company, volunteering on boards of multiple non-profit organizations dedicated to social equality and meeting the needs of members of underrepresented groups, as well as sponsoring programs focused on identifying and providing high-value R&D jobs for women and people in underrepresented communities. See www.ligand.com for information about our ESG initiatives. Selected aspects of our program are discussed below.

| | | | | |

| Focus Areas | Description |

| Environmental | During 2020, we implemented green initiatives that reduce our overall carbon footprint, reduce water requirements in our contractor’s manufacturing processes, minimized packaging to reduce waste and fuel for shipping, implemented employee programs to educate and provide incentives for conservation, established recycling and disposal programs for corporate and laboratory materials and electronic waste, and began a program installing low-voltage lighting. We also donated surplus equipment and materials obtained through our acquisitions to institutions of higher education and finalized safety programs. In addition, we hold regular safety meetings and inspections to minimize risks associated with our R&D work. We established the Ligand Environmental Action Force (LEAF), a committee of employee volunteers with representatives at all of operating sites that manages corporate conservation initiatives and promotes awareness and involvement in environmental and conservation programs. |

| Social | As a growing organization, we have active employee recruiting and our priority is to hire the best and pursue a racially and gender diverse organization built on inclusion and trust. Our recent efforts include: •adding two female directors to our board over the past few years; •providing our employees work equipment in a safe and ergonomic manner; •providing our laboratory workers all necessary personal protective equipment; •encouraging our employees to be charitable and to support local, national, and international 501(c)(3) organizations by providing a company match to employee charitable cash contributions; and •supporting employee involvement in local community service, conservation, and social justice programs by offering paid time off.

We also established the Alliance for Social Equality (ASE), a committee of employee volunteers with representatives at all of operating sites to promote education, awareness and involvement in social equality and diversity. |

| Governance | ESG matters are managed and monitored by senior management throughout the year and our board of directors exercise oversight over ESG matters. During 2020, we established an Extended Leadership Team that periodically discusses and review workforce diversity and inclusion, we reviewed and provided additional employee training on cybersecurity policies, and conducted risk assessment of the COVID-19 pandemic and of the changes as a result of working remotely due to the COVID-19 pandemic. Recently we updated the charter and mission of our board of director’s Compensation Committee to meet a broader mandate to oversee Human Capital Management. |

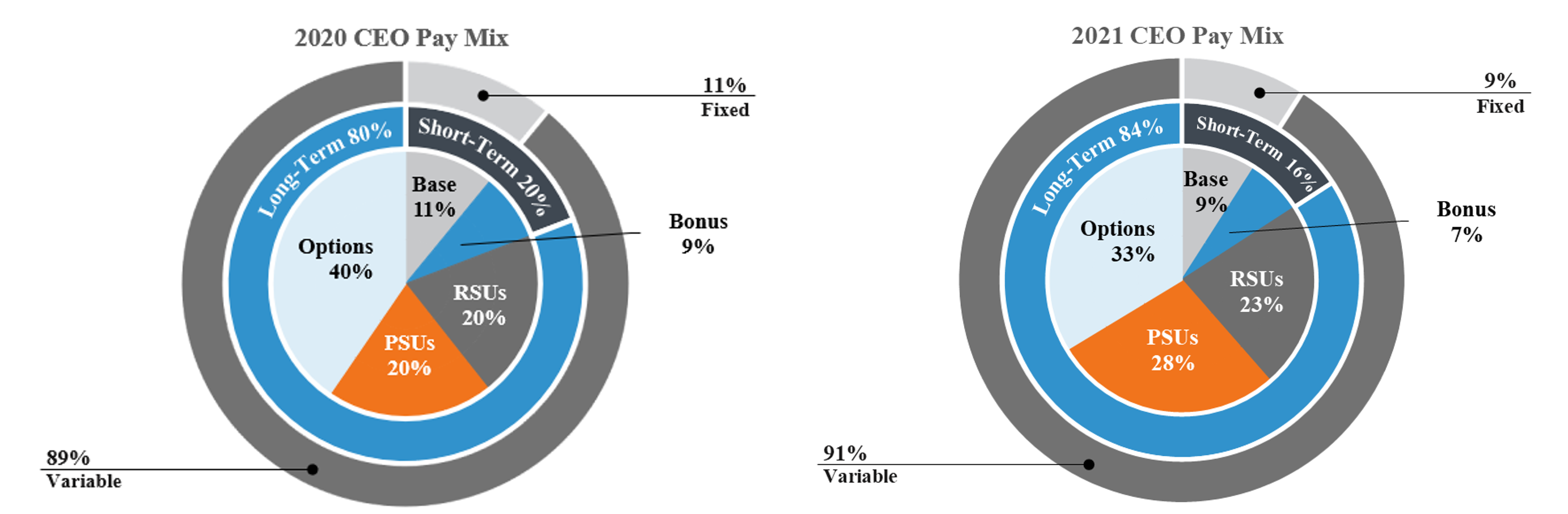

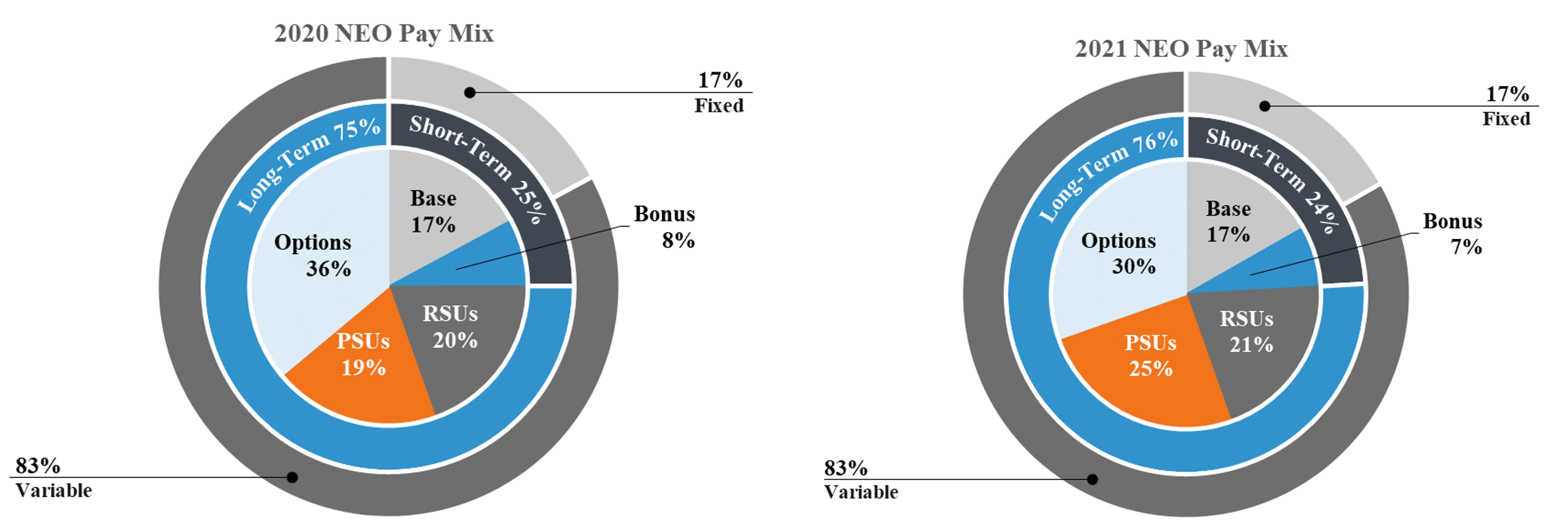

2020 EXECUTIVE COMPENSATION HIGHLIGHTS

We endeavor to maintain sound executive compensation policies and practices consistent with our executive compensation philosophy. The following table highlights some of our executive compensation policies and practices, which are structured to drive performance and align our executives’ interests with our shareholders’ long-term interests. For more detailed information, please see the discussion under “Compensation Discussion and Analysis—Our Executive Compensation Practices.”

| | | | | | | | |

| What We Do | | |

| Pay for Performance | a | A substantial portion of our executives’ total direct compensation is performance-based or “at risk.” |

| Balanced Mix of Pay Components | a | Target compensation is not overly weighted toward annual cash compensation and balances cash and long-term equity awards to align with our short- and long-term goals. |

| Annual Say-on-Pay Vote | a | We seek an annual non-binding advisory vote from our stockholders to approve our executive compensation programs. |

| Independent Compensation Consultant | a | The Human Capital Management and Compensation Committee retains an independent compensation consultant. |

| Annual Peer Group Analysis | a | The Human Capital Management and Compensation Committee reviews external market data when making compensation decisions and annually reviews our peer group with its independent compensation consultant. |

| Annual Compensation Risk Assessment | a | Each year we perform an assessment of any risks that could result from our compensation plans and programs. |

| Double-Trigger Change in Control Benefits | a | We require a double-trigger (or both a change in control and termination of an executive’s employment) before vesting of equity awards is accelerated. |

| Limited Perquisites | a | We provide our named executive officers with perquisites on a limited basis. |

| What We Do Not Do | | |

| No Employment Agreements | r | We do not provide our executive officers with employment agreements |

| No Tax Gross-Ups | r | We do not provide tax gross ups to our executives for “excess parachute payments.” |

| No Stock Option Repricing | r | We prohibit option repricing without stockholder approval. |

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

| | | | | |

| What is the purpose of the annual meeting? | At our annual meeting, stockholders will act on the items outlined in the notice of meeting that is attached to this proxy statement. These include the election of directors, the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm and the approval, on an advisory basis, of the compensation of the named executive officers as disclosed in this proxy statement. |

| How can I attend the annual meeting? | The annual meeting will be conducted virtually via live webcast. You are entitled to participate in the annual meeting only if you were a stockholder of the Company as of the close of business on 4/13/2021, or if you hold a valid proxy for the annual meeting. No physical meeting will be held.

You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting www.meetingcenter.io/293363962. The password for the meeting is “LGND2021”. You also will be able to vote your shares online by attending the annual meeting by webcast. Questions and answers may be grouped by topic and substantially similar questions may be grouped and answered once. In order to promote fairness, efficient use of time and in order to ensure all stockholders are responded to, we will respond to up to two questions from a single stockholder.

To participate in the Annual Meeting, you will need to review the information included on your Notice, on your proxy card or on the instructions that accompanied your proxy materials.

If you hold your shares through an intermediary, such as a bank or broker, and wish to attend the annual meeting, you must register in advance using the instructions below.

The online meeting will begin promptly at 8:30 a.m., Pacific time. We encourage you to access the meeting prior to the start time leaving ample time for the check in. Please follow the registration instructions as outlined in this proxy statement. |

| | | | | |

| How do I register to attend the annual meeting virtually on the internet? | If you are a registered shareholder (i.e., you hold your shares through our transfer agent, Computershare), you do not need to register to attend the virtual annual meeting. Please follow the instructions on the notice or proxy card that you received.

If you hold your shares through an intermediary, such as a bank or broker, commonly known as holding shares in “street name,” you must register in advance to attend the virtual annual meeting. To register to attend the annual meeting you must submit proof of your proxy power (legal proxy) reflecting your ownership of shares of Ligand common stock along with your name and email address to Computershare. Requests for registration must be labeled as “Legal Proxy” and be received no later than 2:00 p.m., Pacific time, on June 1, 2021. Contact your bank or broker to obtain the legal proxy to provide to Computershare.

You will receive a confirmation of your registration by email after Computershare receives your registration materials.

Requests for registration should be directed to our transfer agent Computershare at the following: •By email - Forward the email from your broker, or attach an image of your legal proxy, to legalproxy@computershare.com •By mail – Computershare Ligand Pharmaceuticals Incorporated Legal Proxy P.O. Box 43001 Providence, RI 02940-3001 |

| What if I have trouble accessing the Annual Meeting virtually? | The virtual meeting platform is fully supported across browsers (MS Edge, Firefox, Chrome and Safari) and devices (desktops, laptops, tablets and cell phones) running the most up-to-date version of applicable software and plugins. Participants should ensure that they have a strong WiFi connection wherever they intend to participate in the meeting. We encourage you to access the meeting prior to the start time. A link on the meeting page will provide further assistance should you need it or you may call 1-888-724-2416. |

| Who can vote at the meeting? | Only stockholders of record as of the close of business on the Record Date are entitled to vote the shares of stock they held on that date. Stockholders may vote by attending the annual meeting or by proxy (see “How can I attend the annual meeting” above and “How do I vote by proxy?” below). Each holder of shares of common stock is entitled to one vote for each share of stock held on the proposals presented in this proxy statement. Our amended and restated bylaws provide that a majority of all of the shares of the stock entitled to vote, whether present in person (including as a participant in the virtual annual meeting) or represented by proxy, will be a quorum for the transaction of business at the meeting. |

| How many votes do I have? | Each share of our common stock that you own as of April 13, 2021 entitles you to one vote. The Notice of Internet Availability of Proxy Materials that is sent to you, or the proxy card or voting instruction form that is included in the proxy materials mailed to you if you have requested delivery by mail, will show the number of shares that you are entitled to vote. |

| What is a “broker non-vote”? | A broker non-vote occurs when a broker holding shares for a beneficial owner, commonly known as holding shares in “street name,” does not vote on a particular proposal because the broker does not have discretionary voting power with respect to that proposal and has not received instructions from the beneficial owner. |

| | | | | |

| How are votes counted? | Directors will be elected by a favorable vote of a plurality of the aggregate votes present, as an attendee to the live webcast or by proxy, at the annual meeting. Accordingly, abstentions will not affect the outcome of the election of candidates for director. Absent instructions from the beneficial owner of such shares, a broker is not entitled to vote shares held for a beneficial owner on certain non-routine items, such as the election of directors, the approval, on an advisory basis, of the compensation of the named executive officers as disclosed in this proxy statement and any stockholder proposals. Thus, if the beneficial owner does not give a broker specific instructions, the beneficially owned shares may not be voted on this proposal and will not be counted in determining the number of shares necessary for approval, although they will count for purposes of determining whether a quorum exists. Stockholders are not permitted to cumulate their shares for the purpose of electing directors or otherwise.

The proposal to ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021 requires the affirmative vote of a majority of the aggregate votes present, as an attendee to the live webcast or by proxy, and entitled to vote at the annual meeting. Abstentions will have the same effect as a vote against this proposal. However, ratification of the selection of Ernst & Young LLP is considered a routine matter on which a broker or other nominee is empowered to vote. Accordingly, no broker non-votes will result from this proposal.

Approval of the non-binding advisory resolution on our executive compensation requires the affirmative vote of a majority of the aggregate votes present, as an attendee to the live webcast or by proxy, and entitled to vote at the annual meeting. Abstentions will have the same effect as a vote against this proposal. Absent instructions from the beneficial owner of such shares, a broker is not entitled to vote shares held for a beneficial owner on the resolution to approve the compensation of our named executive officers. As a result, broker non-votes will have no effect on the outcome of the vote.

All votes will be counted by an inspector of elections appointed for the meeting. The inspector will count separately “yes” votes, “no” votes, abstentions and broker non-votes. Shares represented by proxies that reflect abstentions or broker non-votes will be counted as shares that are present and entitled to vote for purposes of determining the presence of a quorum.

Voting results will be tabulated and certified by our mailing and tabulating agent, Computershare. |

| | | | | |

| Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials? | Pursuant to rules adopted by the SEC, we have elected to provide access to our proxy materials over the internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials to our stockholders who have not previously requested the receipt of paper proxy materials advising them that they can access this proxy statement, the 2020 annual report and voting instructions over the internet at http://www.envisionreports.com/LGND, by calling toll-free (866) 641-4276, or by sending an e-mail to investorvote@computershare.com with “Proxy Materials Ligand Pharmaceuticals” in the subject line. Include in the message your full name and address, plus the number located in the shaded bar on the reverse, and state in the email that you want a paper copy of current meeting materials. You can also state your preference to receive a paper copy for future meetings. There is no charge for you requesting a copy. Please make your request for a copy on or before May 25, 2021 to facilitate timely delivery. In addition, stockholders may request to receive proxy materials electronically by email or in printed form by mail on an ongoing basis. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice of Internet Availability of Proxy Materials or request to receive a printed set of the proxy materials. Our proxy statement and related materials are first being made available to our shareholders on or about April 23, 2021. We encourage stockholders to take advantage of the availability of the proxy materials on the internet to help reduce the environmental impact of the annual meeting. |

| | | | | | | | |

| How do I vote by proxy? | Record Holders |

| If you are a stockholder of record on the Record Date, you may vote in one of the following four ways: |

| : | By the internet. You may go to www.envisionreports.com/LGND 24 hours a day, 7 days a week, and follow the instructions. You will need the 15-digit control number that is included in the Notice of Internet Availability of Proxy Materials, proxy card or voting instructions form that is sent to you. The internet voting system allows you to confirm that the system has properly recorded your votes. This method of voting will be available up until 11:59 p.m. EDT, on June 3, 2021. |

| ' | By telephone. On a touch-tone telephone, you may call toll-free 1-800-652-8683, 24 hours a day, 7 days a week, and follow the instructions. You will need the 15 digit control number that is included in the Notice of Internet Availability of Proxy Materials, proxy card or voting instructions form that is sent to you. As with internet voting, you will be able to confirm that the system has properly recorded your votes. This method of voting will be available up until 11:59 p.m. EDT, on June 3, 2021. |

| . | By mail. If you are a stockholder of record, and you elect to receive your proxy materials by mail, you may vote by proxy by marking, dating, and signing your proxy card exactly as your name appears on the card and returning it by mail in the postage-paid envelope that will be provided to you. You should mail the proxy card form in plenty of time to allow delivery prior to the meeting. Do not mail the proxy card or voting instruction form if you are voting over the internet or by telephone. |

| : | At the annual meeting. You may vote your shares at the virtual annual meeting by the internet if you attend via live webcast. See “How can I attend the annual meeting?” and “How do I register to attend the annual meeting virtually on the internet?” above for additional details. |

| Even if you plan to attend the annual meeting, we encourage you to vote over the internet or by telephone prior to the meeting. It is fast and convenient, and votes are recorded and confirmed immediately. |

| Beneficial Owners: Shares Registered in the Name of a Broker or Bank |

| If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than directly from us. Simply complete and mail the proxy card to ensure that your vote is counted. You may be eligible to vote your shares electronically over the Internet or by telephone. A large number of banks and brokerage firms offer Internet and telephone voting. If your bank or brokerage firm does not offer Internet or telephone voting information, please complete and return your proxy card in the self-addressed, postage-paid envelope provided. To vote during the annual meeting, you must obtain a valid proxy from your broker, bank or other agent and register with Computershare no later than 2:00 p.m., Pacific time, on June 1, 2021. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form. See “How do I register to attend the annual meeting virtually on the internet” above for additional details on how to register with Computershare. |

| | | | | |

| May I revoke my proxy? | If you give us your proxy, you may revoke it at any time before it is exercised. You may revoke your proxy by sending in another signed proxy with a later date, by notifying our corporate secretary, Charles S. Berkman, in writing before the annual meeting that you have revoked your proxy, or by attending the annual meeting and voting during the meeting. |

| What is the quorum requirement? | A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if the holders of a majority in voting power of the shares of common stock issued, outstanding and entitled to vote are present via live webcast or represented by proxy at the annual meeting. On the Record Date, there were 16,652,080 shares outstanding and entitled to vote. Accordingly, 8,326,041 shares must be represented by stockholders present at the annual meeting or by proxy to have a quorum. Your shares will be counted towards the quorum only if you submit a valid proxy vote or vote at the annual meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, either the chairperson of the annual meeting or a majority in voting power of the stockholders entitled to vote at the annual meeting, present in person (as an attendee to the live webcast) or represented by proxy, may adjourn the annual meeting to another time or place. |

| I share an address with another stockholder, and we received only one paper copy of the proxy materials and annual report. How may I obtain an additional copy of these materials? | The rules of the SEC permit us, under certain circumstances, to send a single set of the Notice of Internet Availability of Proxy Materials, proxy materials, and annual reports to any household at which two or more stockholders reside. This procedure, known as householding, reduces the volume of duplicate information you receive and helps to reduce our expenses.

In order to take advantage of this opportunity, we have delivered only one Notice of Internet Availability of Proxy Materials or, if you previously requested to receive paper proxy materials by mail, one proxy statement and annual report to stockholders who share an address (unless we received contrary instructions from the affected stockholders prior to the mailing date). We will mail a separate copy of any of these documents, if requested. Requests for separate copies of any of these documents, either now or in the future, as well as requests for single copies in the future by stockholders who share an address and are currently receiving multiple copies, can be made by stockholders of record by contacting our corporate secretary at Ligand Pharmaceuticals Incorporated, 3911 Sorrento Valley Boulevard, Suite 110, San Diego, CA 92121, or by telephone at (858) 550-7500. Such requests by street name holders should be made through their bank, broker or other holder of record. |

| How can I find out the results of the voting at the annual meeting? | Preliminary voting results will be announced at the annual meeting. Final voting results will be published in a Current Report on Form 8-K to be filed with the SEC within four business days after the annual meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an amendment to the Form 8-K to publish the final results. |

Proposal no. 1

ELECTION OF DIRECTORS

The persons named below have been nominated by our board of directors to serve as directors of our company until the next annual meeting of stockholders and until their successors have been elected and qualified. The nine candidates receiving the highest number of affirmative votes of the shares entitled to vote at the annual meeting will be elected directors of our company. As of the date of this proxy statement, our board of directors is not aware of any nominee who is unable to or will decline to serve as a director. If, however, any of those named are unable to serve at the time of the annual meeting, the proxyholders may exercise discretionary authority to vote for substitutes.

BUSINESS EXPERIENCE OF DIRECTOR NOMINEES

Jason M. Aryeh has served as a member of our board of directors since September 2006. Mr. Aryeh has more than twenty years of equity investment experience focused on the life sciences industry. He is the Founder and Managing General Partner of JALAA Equities, LP, a private investment fund focused on the biotechnology and medical device sectors. He has served in such capacity since 1997. Mr. Aryeh currently serves on the board of directors of Orchestra BioMed and Anebulo Pharmaceuticals. Since 2006, Mr. Aryeh has served as chairman of the board, on the board of directors or as a consultant to many public and private life sciences companies and charitable foundations, including the Cystic Fibrosis Foundation’s Therapeutics Board. Mr. Aryeh also serves as chairman of the board of directors of Rio Grande Renewables, LLC, a renewable energy company he co-founded in 2009. Mr. Aryeh earned a B.A. in economics, with honors, from Colgate University, and is a member of the Omnicron Delta Epsilon Honor Society in economics. Mr. Aryeh’s experience in capital markets, including his service as managing general partner of a hedge fund focused on the life sciences sector, contributed to our board of directors’ conclusion that he should serve as a director of our company.

Sarah Boyce has served as a member of our board of director since October 2019. Since October 2019, Ms. Boyce has served as President and Chief Executive Officer of Avidity Biosciences, Inc., a publicly-traded biotechnology company. Prior to joining Avidity, she served as a Director and President of Akcea Therapeutics, a publicly-traded biopharmaceutical company focused on serious and rare diseases, from April 2018 through September 2019. Ms. Boyce served as Chief Business Officer at Ionis Pharmaceuticals from January 2015 to April 2018, where she was responsible for business development, alliance management, patient advocacy and investor relations. Prior to Ionis, she served as Vice President, Head of International Business Strategy and Operations at Forest Laboratories, Inc. Ms. Boyce held various positions with Alexion Pharmaceuticals Inc., Novartis Group AG, Bayer AG and F. Hoffmann-La Roche AG. Ms. Boyce also currently serves on the Board of Directors of Berkeley Lights Inc., a publicly-held biopharmaceutical company. Ms. Boyce received a B.S. degree in microbiology from the University of Manchester, England. Ms. Boyce’s executive experience in the biopharmaceutical industry and knowledge of our business contributed to our board of directors’ conclusion that she should serve as a director of our company.

Todd C. Davis has served as a member of our board of director since March 2007. He is the Founder and Managing Partner of RoyaltyRx Capital, a special opportunities investment firm founded in 2018. From 2006 until 2018, Mr. Davis was a Founder & Managing Partner of Cowen/HealthCare Royalty Partners, a global healthcare investment firm. He has almost thirty years of experience in both operations and investing in the biopharmaceutical and life science industries. Mr. Davis has been involved in over $3 billion in healthcare financings including growth equity, public equity turnarounds, structured debt and royalty acquisitions. He has also led, structured and closed over 40 additional intellectual property licenses, as well as hybrid royalty-debt deals. Previously, Mr. Davis was a partner at Paul Capital Partners, where he co-managed that firm’s royalty investments as a member of the Royalty Management Committee. He also served as a partner responsible for biopharmaceutical growth equity investments at Apax Partners. Mr. Davis began his business career in sales at Abbott Laboratories where he held several commercial roles of increasing responsibility. He subsequently held general management, business development, and licensing roles at Elan Pharmaceuticals. Mr. Davis is a navy veteran and holds a B.S. from the U.S. Naval Academy and an M.B.A. from Harvard University. He currently serves on the board of Palvella Therapeutics Inc., a privately-held biopharmaceutical company, BioDelivery Sciences International, Inc., a publicly-traded specialty pharmaceutical company, and Vaxart, Inc., a publicly-traded specialty pharmaceutical company. He is also a board member of the Harvard Business School Healthcare Alumni Association. Mr. Davis’ financial and accounting expertise and his

service as a director of public and private companies contributed to our board of directors’ conclusion that he should serve as a director of our company.

Nancy R. Gray, Ph.D., has served as a member of our board of directors since of August 2017. Dr. Gray has acted as the President and CEO of Gordon Research Conferences (GRC), a non-profit organization focused on organizing international scientific conferences, since 2003. In her capacity as CEO of the GRC, she is dedicated to social equality initiatives such as managing a diversity initiative that supports the attendance of over 250 U.S. underrepresented minority scientists at GRC each year and working with HBCUs (historically black colleges and universities) to recruit minority undergraduate students for summer internships at GRC. From December 1997 until August 2003 she served as the Director of Membership for the American Chemical Society. Prior to that, Dr. Gray worked as a Senior Research Scientist at Exxon/Mobil Research and Engineering, a subsidiary of Exxon Mobil Corporation focused on researching oil and gas. Dr. Gray is a Fellow of the Royal Society of Chemistry, a Fellow of the American Association for the Advancement of Science and a member of the American Chemical Society. She was a Research Fellow at the Foundation on Matter Institute for Atomic and Molecular Physics in Amsterdam, and completed the Harvard Executive Education Finance for Senior Executives program. She also has authored or co-authored numerous scientific articles. Dr. Gray received her B.S. in Chemistry from the University of Notre Dame in 1981 and her Ph.D. in Fuel Science from The Pennsylvania State University in 1985. Dr. Gray’s scientific background and knowledge of the biotechnology industry contributed to our board of directors’ conclusion that she should serve as a director of our company.

John L. Higgins is our Chief Executive Officer, a position he has held since January 2007 and he has been a member of our board of directors since March 2007. Prior to joining our company, Mr. Higgins served as Chief Financial Officer at Connetics Corporation, a specialty pharmaceutical company, since 1997, and also served as Executive Vice President, Finance and Administration and Corporate Development at Connetics until its acquisition by Stiefel Laboratories, Inc. in December 2006. Before joining Connetics, he was a member of the executive management team at BioCryst Pharmaceuticals. Prior to BioCryst, Mr. Higgins was a member of the healthcare banking team of Dillon, Read & Co. Inc., an investment banking firm. Mr. Higgins serves on the board, audit committee and nominations & governance committee of Bio-Techne Corporation, a publicly-traded life sciences services. Mr. Higgins has served as a director on numerous public and private companies. He also serves as the chairperson of the board of trustees of Academy of Whole Learning, a non-profit organization dedicated to providing educational and therapy services to children of underrepresented communities. He graduated Magna Cum Laude from Colgate University with an A.B. in economics. Mr. Higgins’ executive experience operating and managing public biotechnology companies, his prior service on other company boards and his financial transaction experience as an investment banker in the biopharmaceutical industry contributed to our board of directors’ conclusion that he should serve as a director of our company.

John W. Kozarich, Ph.D., has served as a member of our board since March 2003. Since November 2019, Dr. Kozarich has served as interim Chief Executive Officer of Curza Global, LLC, a biopharmaceutical company, where he has served as a member of the board of directors since February 2019. Dr. Kozarich also serves as Distinguished Scientist Emeritus of ActivX Biosciences, Inc., and previously served as ActivX’s Chairman and President from 2004 through March 2017. From 1992 to 2001, Dr. Kozarich was vice president at Merck Research Laboratories and previously held professorships at the University of Maryland and Yale University School of Medicine. Dr. Kozarich is also an adjunct professor of Chemical Biology and Medicinal Chemistry at the University of Texas, Austin and serves on the board of Intec Pharma Ltd., a publicly-traded biotechnology company. Previously, Dr. Kozarich served as a director of ActivX Biosciences Inc., Corium Intl, Novelion Therapeutics and Retrophin, Inc. He is also a recipient of the Distinguished Scientist Award from the San Diego Section of the American Chemical Society. Dr. Kozarich earned his B.S. in chemistry, summa cum laude, from Boston College, his Ph.D. in biological chemistry from the Massachusetts Institute of Technology, and was an NIH Postdoctoral Fellow at Harvard. In selecting Dr. Kozarich to serve as a director, the board considered, among other things, his valuable pharmaceutical and international experience, including his service at Merck Research Laboratories, which is part of one of the world’s largest pharmaceutical companies, and his service with ActivX Biosciences, Inc., Novelion Therapeutics Inc. and Corium Intl. Our company also benefits from Dr. Kozarich’s financial and accounting experience in the pharmaceutical and biotechnology industries.

John L. LaMattina, Ph.D., has served as a member of our board since February 2011. He spent 30 years at Pfizer Inc. with his last position starting in 2004 as President, Pfizer Global R&D. Dr. LaMattina began his career at Pfizer as a medicinal chemist in 1977. During his career, he was appointed to various positions of increasing responsibility for Pfizer Central Research, including Vice President of U.S. Discovery Operations in 1993, Senior Vice President of Worldwide Discovery Operations in 1998, Senior Vice President of Worldwide Development in 1999. Dr. LaMattina graduated with cum laude

honors from Boston College with a B.S. in Chemistry. He received a Ph.D. from the University of New Hampshire in Organic Chemistry and subsequently was at Princeton University in the National Institutes of Health Postdoctoral Fellowship program. Dr. LaMattina is currently a senior advisor and board member at PureTech Health and serves on the boards of directors of Immunome, Inc., a publicly-traded biopharmaceutical company, and several privately-held biopharmaceutical companies. From 2013 until May 2020, Dr. LaMattina served on the board of directors of Zafgen, Inc., a publicly-traded biotechnology company, until its acquisition by Chondrial Therapeutics, Inc. and subsequent name change to Larimar Therapeutics, Inc. Dr. LaMattina also serves on the scientific advisory board of Frequency Therapeutics, a publicly-trade biotechnology company. Dr. LaMattina is a contributing writer to Forbes magazine. Dr. LaMattina’s scientific and strategic knowledge of the biopharmaceutical industry and his directorship of public and private biopharmaceutical companies contributed to our board of directors’ conclusion that he should serve as a director of our company.

Sunil Patel has served as a member of our board of directors since October 2010. He has more than 20 years of senior management and R&D experience in the biotechnology industry. Mr. Patel has worked as an independent consultant to biotechnology companies advising on strategy and corporate development initiatives since March 2018. From 2009 to March 2018, Mr. Patel served in executive roles of increasing responsibility at OncoMed Pharmaceuticals, a publicly-traded biotechnology company, most recently as Executive Vice President and Chief Financial Officer. Mr. Patel has held senior management positions in corporate development, marketing, and strategy with BiPar Sciences, Allos Therapeutics, Connetics, Abgenix and Gilead Sciences. Mr. Patel also worked at McKinsey & Company serving biotechnology and pharmaceutical clients and has held scientific research positions at ZymoGenetics and ProCyte. Mr. Patel received his undergraduate degree in Chemistry at the University of California, Berkeley, and master’s degree in Molecular Bioengineering/Biotechnology at the University of Washington. Mr. Patel executive and corporate development experience in the biopharmaceutical industry, contributed to our board of directors’ conclusion that he should serve as a director of our company.

Stephen L. Sabba, M.D., has served as a member of our board of directors since August 2008. Dr. Sabba has been a leading Bio/Pharma Analyst and Fund Manager for Knott Partners, L.P., an investment fund company, since November 2006. Previously he was a Partner and Director of Research with Kilkenny Capital Management, a Chicago-based Health Care hedge fund. Prior to that, Dr. Sabba was Director of Research at Sturza’s Medical Research, and previously was a gastroenterologist and internist in private practice at Phelps Hospital in North Tarrytown, New York. He received his M.D. from the New York University School of Medicine, and completed a residency in internal medicine and a fellowship in gastroenterology at the Veterans Administration Medical Center in New York City. He earned a B.S. with honors at Cornell University. Dr. Sabba served as a member of the board of the directors for Novelion Therapeutics Inc., a leading Canadian biotech company from June 2012 to January 2020. Dr. Sabba’s experience in accounting and capital markets and deep knowledge of the biopharmaceutical industry, including his background as a medical doctor, contributed to our board of directors’ conclusion that he should serve as a director of our company.

DIRECTOR INDEPENDENCE

Our board of directors has determined that, with the exception of Mr. Higgins, each of the directors is an independent director under the Nasdaq Global Market listing standards. The independent directors have two or more regularly scheduled executive sessions per year at which only the independent directors are present.

BOARD MEETINGS AND COMMITTEES

Our board of directors held nine meetings, all by telephone, and acted by unanimous written consent four times during the year ended December 31, 2020. During such year, each incumbent director attended all of the meetings of our board of directors and of each the committees on which he or she served which were held during the periods in which he or she served. We do not have a policy regarding attendance of the directors at the annual meeting. At our 2020 annual meeting of stockholders, none of our then-current directors was in attendance.

Our board of directors has an audit committee, a nominating and corporate governance committee and a human capital management and compensation committee. Each committee is described below. Each of these committees has a written charter approved by our board of directors. A copy of each charter can be found in the “Investors—Governance” section of our website at www.ligand.com. Our board of directors has determined that each member of these committees meets the

applicable rules and regulations regarding independence and that each member is free of any relationship that would interfere with his or her individual exercise of independent judgment with regard to our company.

Audit Committee

The audit committee is primarily responsible for overseeing our accounting and financial reporting processes, auditing of financial statements, systems of internal control, and financial compliance programs. The audit committee currently consists of Dr. Gray, Mr. Patel and Dr. Sabba (chair). The audit committee held zero in-person and four telephonic meetings during 2020. After reviewing the qualifications of all current committee members and any relationship they may have that might affect their independence from the Company, our board of directors has determined that (i) all current committee members are “independent” as defined under Section 10A of the Securities Exchange Act of 1934, as amended, (ii) all current committee members are “independent” as defined under the applicable Nasdaq Global Market listing standards, (iii) all current committee members have the ability to read and understand financial statements and (iv) Dr. Sabba qualifies as an “audit committee financial expert.” The latter determination is based on a qualitative assessment of his level of knowledge and experience based on a number of factors, including his formal education and experience.

Nominating and Corporate Governance Committee

The nominating and corporate governance committee is responsible for identifying and recommending candidates for director of our company. The nominating and corporate governance committee currently consists of Mr. Aryeh (chair) and Drs. Kozarich, Gray and Sabba. Each member of the nominating and corporate governance committee is an independent director under the Nasdaq Global Market listing standards. The nominating and corporate governance committee held zero in-person meeting and two telephonic meetings during 2020.

The nominating and corporate governance committee considers nominees recommended by stockholders, if submitted in writing to the Secretary at our principal executive offices and accompanied by the author’s full name, current address and telephone number. The nominating and corporate governance committee has set no specific minimum qualifications for candidates it recommends, but considers each individual’s qualifications, such as high personal integrity and ethics, relevant expertise and professional experience, as a whole. The nominating and corporate governance committee and the board as a whole consider it beneficial to us to have directors with a diversity of backgrounds and skills. The nominating and corporate governance committee and the board as a whole have no formal policy with regard to the consideration of diversity in identifying director nominees. The nominating and corporate governance committee considers candidates throughout the year and makes recommendations as vacancies occur or the size of our board of directors expands. Candidates are identified from a variety of sources including recommendations by stockholders, current directors, management, and other parties. The nominating and corporate governance committee considers all such candidates in the same manner, regardless of source. Under its charter, the nominating and corporate governance committee may retain a search firm to identify and recommend candidates but has not done so to date.

Human Capital Management and Compensation Committee

The Human Capital Management and Compensation Committee has the authority to review, monitor and discuss with management the Company’s strategies, policies and practices related to human capital management within the Company’s workforce, including with respect to diversity and inclusion initiatives and programs, employee development, retention and engagement, workplace safety, corporate culture and succession planning. The Committee also has the authority to review and monitor the appropriateness, effectiveness, risk mitigation effects and value creation of such strategies, policies and practices. The committee reviews and approves our compensation policies, sets executive officers’ compensation and administers our incentive plans. The Human Capital Management and Compensation Committee consists of Messrs. Aryeh and Davis (chair), Dr. LaMattina and Ms. Boyce. Each member is an independent director under the Nasdaq Global Market listing standards. The Human Capital Management and Compensation Committee held five meetings with zero in-person and five by telephone, and acted by unanimous written consent four time during 2020.

BOARD LEADERSHIP STRUCTURE

Our board of directors has nominated nine persons to serve as directors of our company until the next annual meeting of stockholders, eight of whom are independent. We separate the roles of chief executive officer and chairman of our board of

directors in recognition of the differences between the two roles. The chief executive officer is responsible for setting the strategic direction for our company and the day-to-day leadership and performance of our company, while the chairman of our board of directors provides guidance to the chief executive officer and presides over meetings of the full board of directors. We believe that this separation of responsibilities provides a balanced approach to managing the board of directors and overseeing the Company.

BOARD’S ROLE IN RISK OVERSIGHT

Our board of directors is actively involved in oversight of risks that could affect our company. The board’s role in our risk oversight process includes receiving regular reports from members of senior management on areas of material risk to our company, including risks associated with our operational, financial, legal and regulatory functions. The full board (or the appropriate board committee in the case of risks that are under the purview of a particular committee) receives these reports from the appropriate “risk owner” within the organization to enable it to understand our risk identification, risk management and risk mitigation strategies. When a board committee engages in a discussion related to areas of material risk to our company, the chairperson of the relevant committee reports on the discussion to the full board during the committee reports portion of the next board meeting. This enables the board and its committees to coordinate the risk oversight role.

POLICY REGARDING TRANSACTIONS IN COMPANY SECURITIES

Our insider trading policy provides that officers, directors and employees and their respective family members (including spouses, minor children or any other family members living in the same household), should ordinarily not directly or indirectly participate in transactions involving trading activities which by their aggressive or speculative nature may give rise to an appearance of impropriety. Such activities would include the purchase of put or call options, or the writing of such options. In addition, put and call options and other hedging transactions are not permitted under a 10b5-1 trading plan implemented by any officer, director or employee. Aside from such prohibitions, we do not maintain any other policies regarding hedging transactions by our directors, officers and employees.

CORPORATE AND GOVERNANCE HIGHLIGHTS

Our board of directors is highly committed to policies and practices focused on environmental sustainability, positively impacting our social community and maintaining and cultivating good corporate governance. By focusing on such environmental, social and governance (ESG) policies and practices, we believe we can affect a meaningful and positive change in our community and maintain our open, collaborative corporate culture. We create a workplace where all employees are treated with dignity and respect, and individual differences are valued, all with the goal of securing the trust and satisfaction of our employees. We foster this culture through our robust learning and development program and our competitive compensation and health and benefit programs. Our culture supports inclusion, individuality and respect within the workplace. We will continue our proactive shareholder and employee engagement in 2021. See www.ligand.com for information about our ESG policies and practices.

ENVIRONMENTAL, HEALTH AND SAFETY (EHS)

We are committed to providing a safe and healthy workplace, promoting environmental excellence in our communities, and complying with all relevant regulations and industry standards. We establish and monitor programs to prevent injuries and maintain compliance with applicable regulations. By focusing on such practices, we believe we can affect a meaningful, positive change in our community and maintain a healthy and safe environment. Our animal health facility in Emeryville, California, has received accreditation from Association for Assessment and Accreditation of Laboratory Animal Care International (AAALAC), a non-profit organization that promotes the humane treatment of animals in science through voluntary accreditation and assessment programs. We expect to continue our commitment to high quality standard in 2021.

COMMUNICATING WITH THE BOARD OF DIRECTORS

Stockholders may communicate with our board of directors or individual directors by mail, in care of the Secretary, at our principal executive offices. Letters are distributed to the board of directors, or to any individual director or directors as

appropriate, depending on the content of the letter. However, items that are unrelated to the duties and responsibilities of the board of directors will be excluded. In addition, material that is illegal, inappropriate or similarly unsuitable will be excluded. Any letter that is filtered out under these standards, however, will be made available to any director upon request.

COMPENSATION OF DIRECTORS

Cash Compensation

Under our non-employee director compensation policy in effect during 2020, each director is eligible to receive an annual retainer of $50,000. No meeting fees are paid. In addition, the chairperson of the board will receive an additional annual retainer of $30,000. Non-employee directors also receive additional annual retainers for service on committees of the board, as provided in the table below. Directors may elect to receive their retainers in cash or vested shares of our common stock, which shares are issued under our 2002 Stock Incentive Plan, or the 2002 Plan, although none of our directors elected to do so during 2020.

Non-employee members of our board of directors are also reimbursed for expenses incurred in connection with such service.

| | | | | | | | | | | |

| Service | Annual Retainer (Chair) | | Annual Retainer (Member) |

| Audit Committee | $20,000 | | $10,000 |

| Human Capital Management and Compensation Committee | 15,000 | | 7,500 |

| Nominating and Corporate Governance Committee | 10,000 | | 5,000 |

Equity Compensation

Pursuant to our non-employee director compensation policy, each new non-employee director an initial grant of stock options and restricted stock units, or RSUs, under our 2002 Plan. These initial awards are granted effective on the date on which a recipient first becomes a non-employee director of our company. In addition, effective on the date of each annual meeting of stockholders, each non-employee director receives an annual grant of stock options and RSUs under the 2002 Plan. In April 2020, on the recommendation of the Human Capital Management and Compensation Committee based on a review of our peer group companies, our board revised its policy regarding the initial and annual grants to non-employee directors to provide for the following initial and annual awards.

| | | | | | | | | | | |

| Target Value of RSU Award(1) | Target Value of Option Award(2) | Total Target Value of Award |

| Initial Grant | $145,000 | $280,000 | $425,000 |

| Annual Grant | 85,000 | 175,000 | 260,000 |

(1) The actual number of RSUs to be awarded is calculated by dividing (a) the target grant value of the RSU award, by (b) the average closing price per share of our common stock on the Nasdaq Global Market (or such other established stock exchange or national quotation system on which the stock is quoted) for the 60-calendar day period prior to the date of grant.

(2) The actual number of options to be awarded is calculated using the Black-Scholes option pricing model (utilizing the same assumptions that we utilize in the preparation of our financial statements).

The exercise price of options granted to our directors is equal to the fair market value of our common stock on the Nasdaq Global Select Market on the effective date of grant. The initial awards vest in three equal annual installments on each of the first three anniversaries following the date of grant. The annual awards vest in full on the earlier of (1) the date of the annual meeting of our stockholders following the grant date, and (2) on the first anniversary of the date of grant. In addition, all awards will vest in full in the event of a change in control or a hostile take-over, each as defined under our 2002 Stock Incentive Plan, or the 2002 Plan. A non-employee director is able to exercise his or her stock options that were vested at the time of his or her cessation of board service until the first to occur of (1) the third anniversary of the date of his or her cessation of board service, or (2) the original expiration date of the term of such stock options.

Non-Employee Director Ownership Guidelines

Our non-employee director compensation policy contains ownership guidelines so that members of the board are required to own shares with a value of at least three times the then-current annual retainer after they have completed three years of board service. As of the date of this proxy statement, all non-employee directors were in compliance with these guidelines.

DIRECTOR COMPENSATION TABLE

The following table provides information related to the compensation of each of our non-employee directors for fiscal 2020. John Higgins, our only employee director, receives no compensation for his service as a member of the board. Mr. Higgins’ compensation is described under “Executive Compensation and Other Information” below.

| | | | | | | | | | | | | | | | | | | | | | | |

| Name | Cash Fees | | Stock Awards (1) | | Option Awards(1) | | Total |

| Jason M. Aryeh | $67,624 | | $97,709 | | $166,300 | | $331,633 |

| Todd Davis | 65,124 | | 97,709 | | 166,300 | | 329,133 |

| Nancy Gray | 60,124 | | 97,709 | | 166,300 | | 324,133 |

| John W. Kozarich | 85,124 | | 97,709 | | 166,300 | | 349,133 |

| Sunil Patel | 60,124 | | 97,709 | | 166,300 | | 324,133 |

| Stephen L. Sabba | 75,124 | | 97,709 | | 166,300 | | 339,133 |

| John L. LaMattina | 57,624 | | 97,709 | | 166,300 | | 321,633 |

| Sarah Boyce | 57,624 | | 97,709 | | 166,300 | | 321,633 |

(1) Reflects the grant date fair value for stock and option awards granted in 2020, calculated in accordance with FASB ASC Topic 718. The assumptions used to calculate the value of stock and option awards are set forth under Note 9 of the Notes to Consolidated Financial Statements included in our Annual Report on Form 10-K for the year ended December 31, 2020, filed with the SEC on February 24, 2021.

As of December 31, 2020, our non-employee directors listed in the table above held outstanding stock awards and options as follows:

| | | | | | | | | | | |

| Name | Number of Shares Underlying Outstanding Restricted Stock Units | | Number of Shares Underlying Outstanding Stock Options |

| Jason M. Aryeh | 831 | | 19,864 |

| Todd Davis | 831 | | 11,469 |

| Nancy Gray | 831 | | 12,465 |

| John W. Kozarich | 831 | | 41,869 |

| Sunil Patel | 831 | | 19,864 |

| Stephen L. Sabba | 831 | | 41,869 |

| John L. LaMattina | 831 | | 24,699 |

| Sarah Boyce | 1,785 | | 7,751 |

RECOMMENDATION OF THE BOARD OF DIRECTORS

The board of directors unanimously recommends a vote FOR the nominees listed above.

Proposal no. 2

RATIFICATION OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

On April 8, 2021, our Audit Committee approved the selection of Ernst & Young LLP as its independent registered public accounting firm. You are being asked to ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021. Neither the firm nor any of its members has any relationship with us or any of our affiliates, except in the firm’s capacity as our independent registered public accounting firm.

Stockholder ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm is not required by Delaware law, our certificate of incorporation, our amended and restated bylaws, or otherwise. However, the board of directors is submitting the selection of Ernst & Young LLP to the stockholders for ratification as a matter of good corporate practice. In the event the stockholders fail to ratify the selection, the board of directors will reconsider its selection. Even if the selection is ratified, the board of directors or its audit committee, in its discretion, may direct the appointment of a different independent auditing firm at any time during the year if such a change would be in our and our stockholders’ best interests.

Representatives of Ernst & Young LLP are expected to be present at the annual meeting, and will have the opportunity to make a statement if they desire to do so and are expected to be available to respond to appropriate questions. The affirmative vote of the holders of a majority of the shares represented and voting at the annual meeting will be required to ratify the selection of Ernst & Young LLP.

INDEPENDENT AUDITOR’S FEES

The following is a summary of the fees incurred by us from Ernst & Young LLP, our independent registered public accounting firm for the fiscal year ended December 31, 2020 and 2019:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fee Category | | Fiscal Year 2020 Fees | | | Fiscal Year 2019 Fees |

Audit Fees(1) | | $ | 795,335 | | | | $ | 790,105 | |

Audit-related fees(2) | | 404,000 | | | | 514,147 | |

Tax Fees(3) | | 1,675,247 | | | | 911,085 | |

| Total Fees | | $ | 2,874,582 | | | | $ | 2,215,337 | |

(1) Audit fees consist of amounts for professional services rendered in connection with the integrated audit of our consolidated financial statements and related schedule and internal control over financial reporting, review of the interim condensed consolidated financial statements included in quarterly reports.

(2) For the fiscal years ended December 31, 2020 and 2019, audit-related fees were primarily incurred for accounting consultations.

(3) Tax fees for the fiscal years ended December 31, 2020 and 2019, related to services rendered for federal, state and international tax compliance and tax consulting projects including the analysis of our net operating loss carryforwards, Research and Development tax credit analysis, international tax planning, issuance of the 2018 convertible notes and business combination. The increase in the tax fees in 2020 as compared to 2019 was primarily driven by the Research and Development tax credit analysis, business combinations and the sale of Vernalis R&D business.

In considering the nature of the services provided by Ernst & Young LLP during the 2020 fiscal year, the audit committee determined that such services are compatible with the provision of independent audit services.

The audit committee discussed these services with Ernst & Young LLP and our management to determine that they are permitted under the rules and regulation concerning auditor independence promulgated by the SEC to implement the Sarbanes-Oxley Act of 2002, as well as the American Institute of Certified Public Accountants.

All services performed by Ernst & Young LLP in 2020 and 2019 were pre-approved in accordance with the requirements of the audit committee charter.

Except as stated above, there were no other fees charged by Ernst & Young LLP for 2020 or 2019. The audit committee considers the provision of these services to be compatible with maintaining the independence of Ernst & Young LLP. None of the fees paid to Ernst & Young LLP under the category “Tax Fees” described above were approved by the audit committee after services were rendered pursuant to the de minimis exception established by the SEC.

AUDIT COMMITTEE POLICY REGARDING PRE-APPROVAL OF AUDIT AND PERMISSIBLE NON-AUDIT SERVICES OF OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our audit committee has established a policy that all audit and permissible non-audit services provided by our independent registered public accounting firm will be pre-approved by the audit committee. These services may include audit services, audit-related services, tax services and other services. The audit committee considers whether the provision of each non-audit service is compatible with maintaining the independence of our auditors. Pre-approval is detailed as to the particular service or category of services and is generally subject to a specific budget. Our independent registered public accounting firm and management are required to periodically report to the audit committee regarding the extent of services provided by the independent registered public accounting firm in accordance with this pre-approval, and the fees for the services performed to date.

RECOMMENDATION OF THE BOARD OF DIRECTORS

Our board of directors unanimously recommends that stockholders vote FOR the ratification of the selection of Ernst & Young LLP to serve as our independent registered public accounting firm for the year ending December 31, 2021.

AUDIT COMMITTEE REPORT

The following is the report delivered by the audit committee of the Company’s board of directors with respect to the principal factors considered by such committee in its oversight of the accounting, auditing and financial reporting practices of the Company for 2020.

The audit committee oversees the Company’s financial reporting process on behalf of the board of directors. Management has the primary responsibility for the financial statements and the reporting process including the systems of internal controls. In fulfilling its oversight responsibilities, the audit committee reviewed and discussed the audited financial statements in the Company’s annual report with management, including a discussion of any significant changes in the selection or application of accounting principles, the reasonableness of significant judgments, the clarity of disclosures in the financial statements and the effect of any new accounting initiatives.

The audit committee reviewed and discussed with Ernst & Young LLP, who is responsible for expressing an opinion on the conformity of the Company’s audited consolidated financial statements with generally accepted accounting principles, their judgments as to the quality, not just the acceptability, of the Company’s accounting principles and such other matters as are required to be discussed with the audit committee under generally accepted auditing standards, including those matters required under Auditing Standard 1301 (Communications with Audit Committees). In addition, the audit committee has discussed with Ernst & Young LLP their independence from management and the Company, and has received from Ernst & Young LLP the written disclosures and the letter required by the Public Company Accounting Oversight Board Rule 3526.

The audit committee met with Ernst & Young LLP to discuss the overall scope of their services, the results of their audit and reviews, its evaluation of the Company’s internal controls and the overall quality of the Company’s financial reporting. Ernst & Young LLP, as the Company’s independent registered public accounting firm, also periodically updates the audit committee about new accounting developments and their potential impact on the Company’s reporting. The audit committee’s meetings with Ernst & Young LLP were held with and without management present. The audit committee is not employed by the Company, nor does it provide any expert assurance or professional certification regarding the Company’s financial statements. The audit committee relies, without independent verification, on the accuracy and integrity of the information provided, and representations made, by management and the Company’s independent registered public accounting firm.

In reliance on the reviews and discussions referred to above, the audit committee has recommended to the Company’s board of directors that the audited consolidated financial statements be included in this proxy statement and in our annual report for the year ended December 31, 2020.

This report of the audit committee shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that we specifically incorporate this information by reference, and shall not otherwise be deemed filed under such acts.

The foregoing report has been furnished by the audit committee.

Stephen L. Sabba, M.D., Chairperson of the Audit Committee

Nancy Ryan Gray, Ph.D.

Sunil Patel

Proposal no. 3

APPROVAL OF COMPENSATION OF THE NAMED

EXECUTIVE OFFICERS

Under the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”), our stockholders are entitled to vote at the annual meeting to provide advisory approval of the compensation of our named executive officers as disclosed in this proxy statement pursuant to the compensation disclosure rules of the SEC. This proposal, commonly known as a “say-on-pay” proposal, gives our stockholders the opportunity to express their views on our named executive officers’ compensation. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the philosophy, policies and practices described in this proxy statement. Pursuant to the Dodd-Frank Act, the stockholder vote on executive compensation is an advisory vote only, and it is not binding on us or our board of directors.

Although the vote is non-binding, our Human Capital Management and Compensation Committee and board of directors value the opinions of the stockholders and will consider the outcome of the vote when making future compensation decisions. As described more fully in the Compensation Discussion and Analysis section of this proxy statement, our executive compensation program is designed to attract, retain and motivate individuals with superior ability, experience and leadership capability to deliver on our annual and long-term business objectives necessary to create stockholder value. We urge stockholders to read the Compensation Discussion and Analysis section of this proxy statement, which describes in detail how our executive compensation policies and procedures operate and are intended to operate in the future. The Human Capital Management and Compensation Committee and the board of directors believe that our executive compensation program fulfills these goals and is reasonable, competitive and aligned with our performance and the performance of our executives.

We are asking our stockholders to indicate their support for our named executive officer compensation as described in this proxy statement. Accordingly, we ask that our stockholders vote “FOR” the following resolution:

“RESOLVED, that Ligand Pharmaceuticals Incorporated stockholders approve, on an advisory basis, the compensation of the named executive officers, as disclosed in Ligand Pharmaceuticals Incorporated’s Proxy Statement for the 2021 annual meeting of stockholders, pursuant to the compensation disclosure rules of the SEC, including the Compensation Discussion and Analysis, the 2020 Summary Compensation Table and the other related tables and disclosure.”

RECOMMENDATION OF THE BOARD OF DIRECTORS

Our board of directors unanimously recommends that stockholders vote FOR the approval, on an advisory basis, of the compensation of the named executive officers as disclosed in this proxy statement pursuant to the compensation disclosure rules of the SEC.

EXECUTIVE OFFICERS

The names of our executive officers and their ages, titles and biographies as of April 13, 2021 are set forth below.

John L. Higgins, 51, is being considered for the position of director of our company. See “Election of Directors”

for a discussion of Mr. Higgins’ business experience.