- LGND Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

Ligand Pharmaceuticals (LGND) 425Business combination disclosure

Filed: 9 Sep 09, 12:00am

Filed by Ligand Pharmaceuticals Incorporated

Pursuant to Rule 425 under the

Securities Act of 1933

Subject Company: Ligand Pharmaceuticals Incorporated

Commission File No: 001-33093

The following slides will be presented by officers of Ligand Pharmaceuticals Incorporated on September 9, 2009 at the Thomas Weisel Partners Healthcare Conference in Boston, Massachusetts:

1 1 John L. Higgins President and Chief Executive Officer Syed Kazmi, Ph.D. Business Development and Strategic Planning |

2 Safe Harbor Statement • The following presentation contains forward-looking statements regarding the proposed acquisition of Neurogen by Ligand, including projections regarding expectations for potential research and development payments, savings in operational costs, cash burn rates, timing of achieving positive cash flow, and potential revenue and profits of a combined company. • The forward looking statements made in the presentation are subject to several risk factors, including, but not limited to the reliance on collaborative partners for milestone and royalty payments, regulatory hurdles facing product candidates, uncertain product development costs, disputes regarding ownership of intellectual property, the commercial success of approved products, the failure of Neurogen’s stockholders to approve the merger, Ligand’s or Neurogen’s inability to satisfy the conditions of the merger, or that the merger is otherwise delayed or ultimately not consummated, and a failure of the combined businesses to be integrated successfully. Additional risks may apply to forward looking statements made in this presentation. • The risk factors facing Ligand and Neurogen are explained in greater detail in the Company’s and Neurogen’s filings with the SEC, including the most recently filed annual reports on Form 10-K and quarterly reports on Form 10-Q, as well as other public filings. |

3 Additional Information and Where to Find It • Ligand intends to file with the SEC a Registration Statement on Form S-4, which will include a proxy statement of Neurogen and other relevant materials in connection with the proposed transaction. The proxy statement will be mailed to the stockholders of Neurogen. Investors and security holders of Neurogen are urged to read the proxy statement and the other relevant materials when they become available because they will contain important information about Ligand, Neurogen and the proposed transaction. The proxy statement and other relevant materials (when they become available), and any other documents filed by Ligand or Neurogen with the SEC, may be obtained free of charge at the SEC's web site at www.sec.gov. In addition, investors and security holders may obtain free copies of the documents filed with the SEC by Ligand by going to Ligand’s Investor Relations page on its corporate website at www.ligand.com. Investors and security holders may obtain free copies of the documents filed with the SEC by Neurogen by going to Neurogen’s Investor Relations page on its corporate website at www.neurogen.com. Investors and security holders of Neurogen are urged to read the proxy statement and the other relevant materials when they become available before making any voting or investment decision with respect to the proposed transaction. • Ligand and its respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Neurogen in favor of the proposed transaction. Information concerning Ligand’s directors and executive officers is set forth in Ligand’s proxy statement for its 2008 annual meeting of shareholders, which was filed with the SEC on April 29, 2008, and annual report on Form 10-K filed with the SEC on March 5, 2008. • Neurogen and its respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Neurogen in favor of the proposed transaction. Information about Neurogen’s executive officers and directors and their ownership of Neurogen common stock is set forth Neurogen’s amended annual report on Form 10-K, which was filed with the SEC on April 30, 2009. Investors and security holders may obtain more detailed information regarding the direct and indirect interests of Neurogen and its respective executive officers and directors in the acquisition by reading the proxy statement regarding the merger, which will be filed with the SEC. |

4 Fundamentals of a Strong Biotech Company • Strong balance sheet • Spending discipline • Strong discovery capabilities and track record • Robust pipeline of partnerable assets • Revenue diversity Operating structure that has the potential to generate substantial cash flows and profitability |

5 Ligand Company Overview • Company with great assets - Two royalty streams, plus two more royalty-bearing products recently approved - Ten pharma deals with over 21 development programs and over $600 million of potential milestones - Prolific drug discovery engine has produced multitudes of drug candidates • Highly successful drug discovery capabilities - Focus on early-stage drug discovery and development - Partner pipeline assets at earliest value inflection point • Leadership focused on shareholders and market credibility - Cost-efficient R&D business with tight spending discipline - Clear communication and transparency with investors - Clarity on how to drive a business forward in this market environment • Commitment to driving shareholder value and to transparency on the business with goal to drive strong cash flow and earnings |

6 Ligand – Recent events • Signed agreement to acquire Neurogen, public company with drug screening assets, cash, pipeline and a drug partnership • PROMACTA ® Phase I/II trial initiated with MDS • CONBRIZA™ approved in Europe for the treatment of osteoporosis • FABLYN® Approved in Europe for the treatment of osteoporosis • Entered license agreement with ParinGenix for Phase II COPD drug • Completed lease buyout, substantially reducing contractual lease costs going forward • Initiated Phase I SARM trial • Wyeth JAK 3 data presented at ACS |

7 Pending Neurogen Acquisition Stock-for-Stock Acquisition Consideration - Net proceeds from sale of real estate - Net proceeds from sale of Aplindore - $3 million for Phase III trial initiation for Merck VR1 program - $4 million if license H3 program CVRs $11 million in Ligand Common Stock, plus potential for Four Contingent Value Rights (CVR) Transaction Value 4Q 2009 Anticipated Closing Date Ligand to acquire Neurogen (NRGN) Deal Actual timing of the transaction will depend on a number of factors, some of which are beyond either company’s control. |

8 Opportunity with Neurogen Acquisition • Acquire fully funded research partnership Merck VR1 program • Access pipeline assets Numerous opportunities including oral EPO and H3 antagonist • Leverage drug discovery capabilities of both companies Accelerated Intelligent Drug Design platform • Gain estimated $7 million in net cash • Acquire substantial NOLs before limitations |

9 Partnership Highlights |

10 Significant Value in Royalty Partnerships • Numerous deals with ten pharmaceutical companies • More than 21 different programs being pursued including the largest untapped markets Muscle wasting, COPD, thrombocytopenia, pain, asthma, Alzheimer’s • More than $600 million in potential R&D and milestone payments from existing deals Ligand has one of the strongest, most diverse royalty partnership rosters in the small cap biotech universe |

11 Pharmaceutical Partnerships |

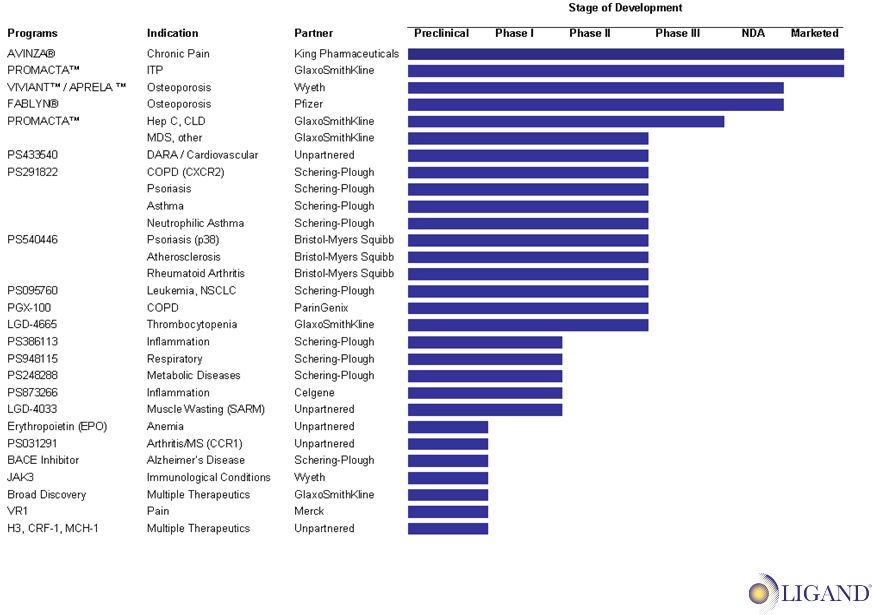

12 Combined Product Pipeline |

13 • PROMACTA approved for treatment of thrombocytopenia in patients with chronic immune ITP in November 2008. • Two Phase III Hepatitis trials ongoing • Phase III trial in Chronic Liver Disease ongoing • Phase I/II MDS trial initiated Spring 2009 • Phase I Sarcoma trial ongoing • Submitted MAA for the long-term treatment of ITP in December 2008. • LGD-4665 and other Ligand TPO molecules licensed to GSK in December 2008 & Collaboration Highlights |

14 Thrombocytopenia - Causes of Disease • Decreased production of platelets Myelodysplastic syndrome Hepatitis C Cancer in the bone marrow (leukemia) Aplastic anemia • Increased destruction of platelets Autoimmune, such as ITP Sequestration in the spleen • Drug-induced Myelosuppression by chemotherapy regimens Anti-virals in Hep C therapies Thrombocytopenia is a condition in which there is an abnormally low level of platelets in the blood. Regardless of the underlying cause, thrombocytopenia leads to decreased platelet counts, which puts patients at greater risk for bleeding and serious adverse events. |

15 Medical Significance of Thrombocytopenia (US) (Estimated markets) Potential Treatable Patients ITP ~60,000 Hepatitis C ~120,000 Chronic Liver Disease ~400,000 Myelodysplastic syndrome ~20,000 Leukemia / lymphoma ~50,000 Chemotherapy induced thrombocytopenia ~140,000 Intensive care unit – acquired ~500,000 Bone marrow transplants ~50,000 Lupus ~100,000 Cirrhosis ~113,000 HIV/other ~600,000 ~ 2 million platelet transfusions per year |

16 ParinGenix License • In June 2009, Ligand granted exclusive license rights to ParinGenix for three issued U.S. patents relating to certain desulfated heparin compounds • ParinGenix lead compound, PGX-100, is an intravenous formulation of 2-O, 3-O desulfated heparin which is in a Phase IIb trial for the treatment of acute COPD exacerbations (~700,000 patients require hospitalization every year) • License terms $350,000 upfront payment 3% royalty on net sales in the US • The transaction adds another potential lucrative royalty stream to Ligand's already promising list of partnered, fully funded, royalty- bearing programs |

17 SERM Collaborations • Bazedoxifene Monotherapy: CONBRIZA approved in Europe in April 2009 Viviant pending approval in the U.S. • Bazedoxifene in Combination with Premarin CE (APRELA): Phase III data published in Fertility and Sterility NDA planned for in 2010 • Lasofoxifene (FABLYN) for osteoporosis treatment • Approved in Europe in March 2009 for the treatment of osteoporosis • NDA pending approval in U.S.; FDA issued Complete Response Letter in January 2009 |

18 Collaboration Highlights & • Collaboration began in November 1997 • Partnership resulted in lead and back-up p38 kinase inhibitor compounds • Anti-inflammatory therapeutics Ongoing Clinical Trials: • Phase II in rheumatoid arthritis • Phase II in psoriasis • Phase II in atherosclerosis The Opportunity: • Large, established target markets • If successfully developed, Ligand estimates product could be on market in 2014 p38 Kinase Inhibitors |

19 & • Collaboration began in October 1998 • Collaboration produced multiple drug candidates Completed Clinical Trials: • Phase II in COPD • Phase II in asthma • Phase II in psoriasis The Opportunity: • Large, established target markets • If successfully developed, Ligand estimates product could be on market in 2014 Chemokine Receptor CXCR2 Program Collaboration Highlights |

20 Collaboration Highlights & Other Research Program Ongoing Clinical Trials: • Enzyme inhibitor in Phase II for oncology • Candidate for inflammatory diseases in Phase I • Candidate for respiratory diseases in Phase I Recent Event: • BACE inhibitor for Alzheimer’s in development, resulting in a milestone payment of $1 million |

21 Collaboration Highlights & • Collaboration began March 2006 • Identify and advance molecules in chosen therapeutic programs to development stage Milestone and Royalty: • 7 compounds identified to date • Success-based milestone payments and up to double-digit royalties upon commercialization • Seventh lead compound identified resulting in a milestone payment of $500,000 Broad Discovery Program |

22 Collaboration Highlights & • Collaboration began in December 2006 $3 million per year in research funding • Alliance based on development of JAK3 kinase inhibitors for systemic administration for immunological and inflammatory diseases • Success-based milestone payments and up to double-digit royalties upon commercialization JAK-3 Kinase |

23 SARM Program Overview |

24 Selective Androgen Receptor Modulator Program • LGD-4033 is a selective androgen receptor modulator (SARM), designed to provide the benefits of androgen receptor stimulation on skeletal muscle and bone without the side effects of the currently marketed androgens • LGD-4033 has demonstrated increased skeletal muscle mass and bone mineral density while sparing the prostate in males and masculinizing effects in females in preclinical models • A Phase I study was initiated in summer 2009 to evaluate the safety, tolerability and pharmacokinetic profile of LGD-4033 (expected completion 1H2010) • Target Indications: Sarcopenia & frailty, cachexia, osteoporosis, hypogonadism, sexual dysfunction Market Need: Convenient, prostate-sparing androgen receptor modulator with activity in bone, muscle and CNS |

25 Research Engine |

26 Ligand Research Platform • Technology - Gene reporter assays for nuclear receptors and JAK/STAT-coupled receptors - Ultra high-throughput screening platform combined with the world’s largest proprietary compound collection (5 + million compounds) • Highly flexible screening platform: cell-free and cell-based assays; functional and binding assays • Consistently high rate of success across all classes of targets • Preclinical Development - Extensive track record both independently and with partners - Total of 48 clinical candidates discovered and 24 INDs filed • Solid track record for publications - Quality journals: Science, Cell, Endocrinology, Journal of Medicinal Chemistry - First reports for many important discoveries: • Hematopoietic receptor-targeted small molecule drugs • Non-steroidal selective androgen receptor modulators • Non-steroidal selective progesterone receptor modulators • RXR-selective retinoid |

27 Ligand Development & Partnerships • Clinical strategy to run Phase I-II programs through proof-of-concept • 13 NDAs and MAAs submitted for Ligand discovered drugs • 5 approved products from Ligand technology: Targretin, Panretin, Promacta, Fablyn, Conbriza • Established track record for partnering with over 40 collaborations with more than 30 different companies • Experience in multiple therapeutic areas • More than 21 different programs being pursued including the largest untapped markets Muscle wasting, COPD, thrombocytopenia, pain, asthma, osteoporosis, Alzheimer’s |

28 Pro Forma Financial Forecast * Assumes Neurogen Acquisition closes in Q4 2009 • Projected to have approximately $50 million in cash at year-end 2009 • Given our current outlook on the combined businesses, 2010 pro forma operating business projected to be approximately cash-flow neutral with expenses in line with revenue • Potential for additional revenue and cash infusion from new license agreements • More than $500 million in potential Net Operating Loss carry-forwards before limitations Robustly capitalized company that has sufficient cash to make it to profitability without additional financings |

29 Potential Near-Term Milestone and Events • Completion of Schering Plough CXCR2 Trial in COPD • Compound nomination from JAK-3 program by Wyeth for pre-clinical development • Compound nomination by GSK from drug discovery collaboration • Nomination of Oral EPO drug candidate • VIVIANT FDA Action • Potential for over $10 million in milestone payments from existing collaborations Milestone or Event • SARM Phase I trial completion • PROMACTA EU NDA Action • PROMACTA data at ASH |