Exhibit 99.2

Exhibit 99.2

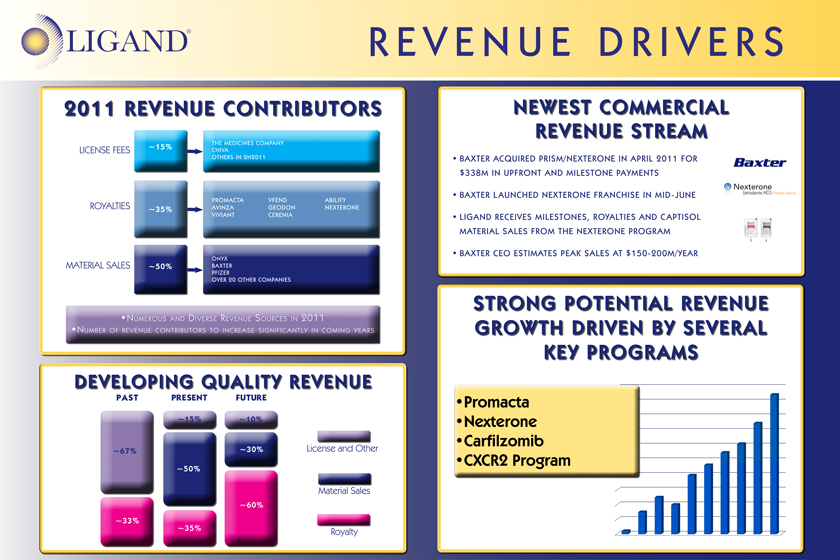

REVENUE DRIVERS

2011 REVENUE CONTRIBUTORS

LICENSE FEES ~15% THE MEDICINES COMPANY CHIVA OTHERS IN 2H2011

ROYALTIES ~ 35% PROMACTA AVINZA VIVIANT

VFEND GEODON CERENIA

ABILIFY NEXTERONE

MATERIAL SALES ~50% ONYX BAXTER PFIZER OVER 20 OTHER COMPANIES

NUMEROUS AND DIVERSE REVENUE SOURCES IN 2011

NUMBERS OF REVENUE CONTRIBUTORS TO INCREASE SIGNIFICANTLY IN COMING YEARS

DEVELOPING QUALITY REVENUE

PAST ~67% ~33%

PRESENT ~15% ~50% ~35%

FUTURE ~10% ~30% ~60%

License and Other

Material Sales

Royalty

NEWEST COMMERCIAL REVENUE STREAM

BAXTER ACQUIRED PRISM / NEXTERONE IN APRIL 2011 FOR $338m IN UPFRONT AND MILESTONE PAYMENTS

BAXTER LAUNCHED NEXTERONE FRANCHISE IN MID-JUNE

LIGAND RECEIVES MILESTONES, ROYALTIES AND CAPTISOL MATERIAL SALES FROM THE NEXTERONE PROGRAM

BAXTER CEO ESTIMATES PEAK SALES AT $150-200M/YEAR

STRONG POTENTIAL REVENUE GROWTH DRIVEN BY SEVERAL KEY PROGRAMS

Promacta

Nexterone

Carfilzomib

CXCR2 Program

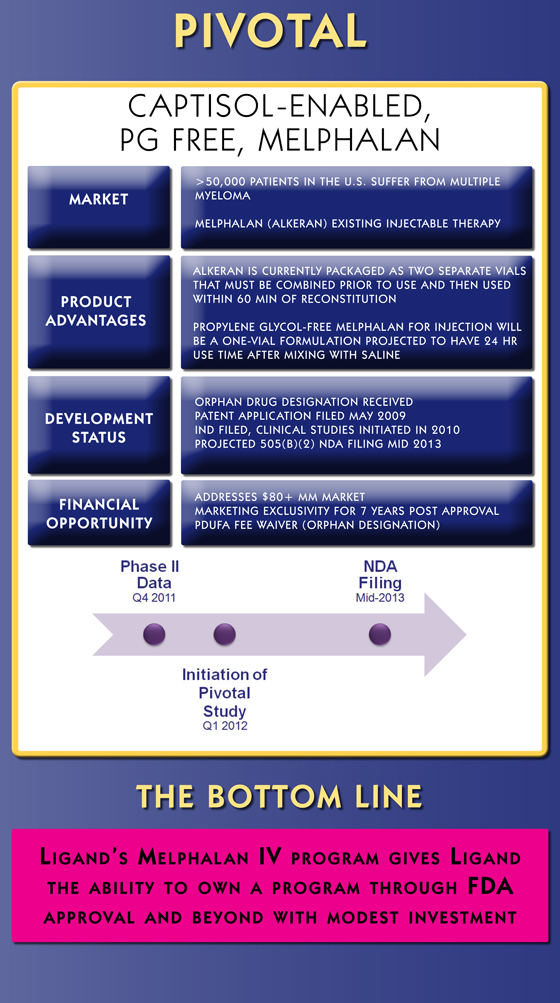

Pivotal

Captisol-EnablEd, pG FrEE, MElphal an

market

>50,000 patients in the U.s. sUffer from mUltiple myeloma

melphal an (alkeran) existing injectable therapy

Product advantages

alkeran is cUrrently packaged as two separate vials that mUst be combined prior to Use and then Used within 60 min of reconstitUtion

propylene glycol-free melphal an for injection will be a one-vial formUl ation projected to have 24 hr Use time after mixing with saline

develoPment status

orphan drUg designation received patent applic ation filed may 2009 ind filed, clinic al stUdies initiated in 2010 projected 505(b)(2) nda filing mid 2013

Financial oPPortunity

addresses $80+ mm market marketing exclUsivity for 7 years post approval pdUfa fee waiver (orphan designation)

the Bottom line

L igand ‘ s M eLphaL an iV prograM giVes L igand

the abiLity to own a prograM through Fda

approVaL and beyond with Modest investment

Phase ii ready

sarM

lgd-4033

sarm

preclinical

Supportive animal toxicity data

Unique AR binding & selective activity Muscle and bone building activity in animal models

clinical

Most potent oral SARM

Ph. I efficacy trends

Well tolerated with improved safety over anabolic steroids

commercial

Potential to address large unmet

medical needs in both specialty

& long-term muscle wasting patient

Populations

lean mass (kg) change from Baseline up to day 28

average leg Press Force (newton) change from Baseline up to day 28

the Bottom line

Ligand’s sarM prograM oFFers opportunities For new reVenue through potentiaL Licensing

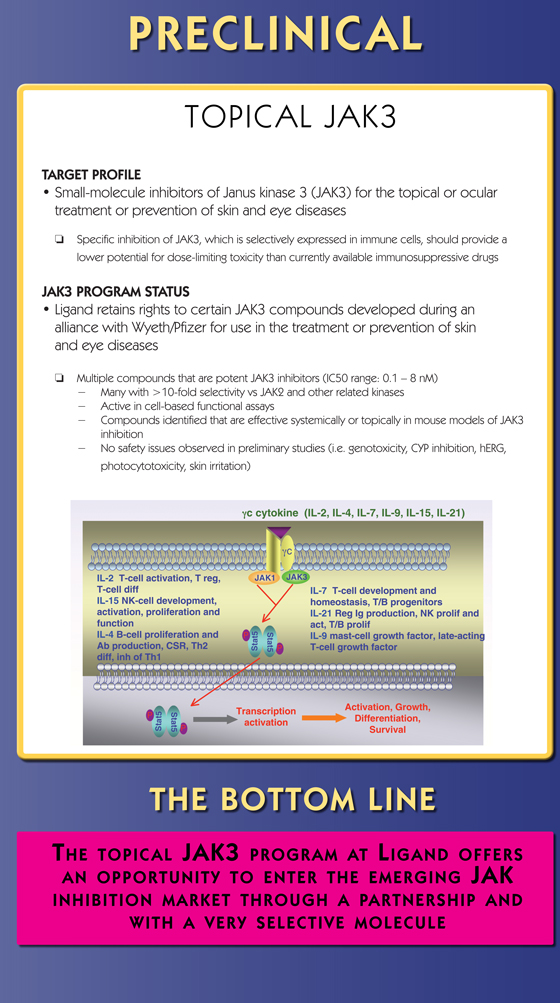

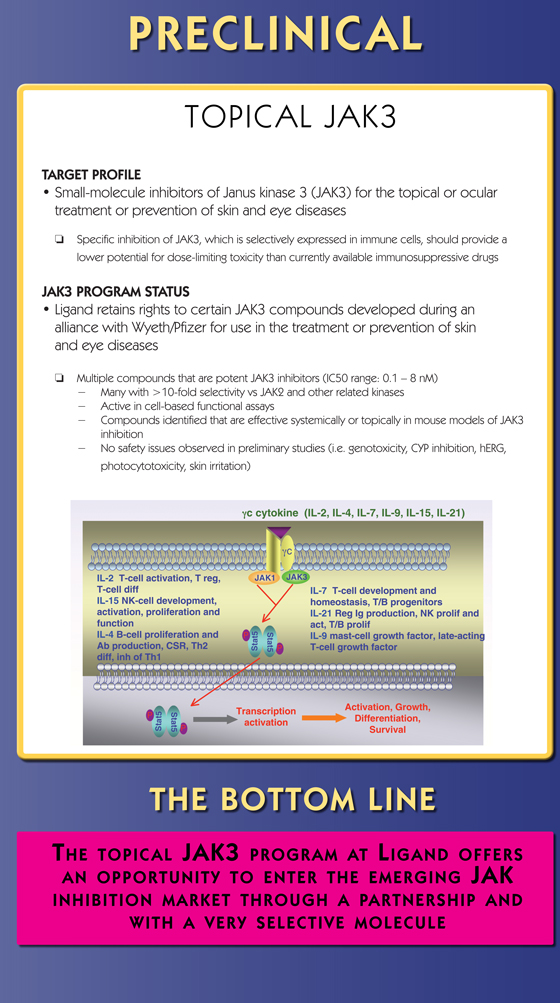

PRECLINICAL

TOPICAL JAK3

target ProFile

Small-molecule inhibitors of Janus kinase 3 (JAK3) for the topical or ocular treatment or prevention of skin and eye diseases

Specific inhibition of JAK3, which is selectively expressed in immune cells, should provide a

lower potential for dose-limiting toxicity than currently available immunosuppressive drugs

Jak3 Program status

Ligand retains rights to certain JAK3 compounds developed during an alliance with Wyeth/Pfizer for use in the treatment or prevention of skin and eye diseases Multiple compounds that are potent JAK3 inhibitors (IC50 range: 0.1 – 8 nM)

Many with >10-fold selectivity vs JAK2 and other related kinases

Active in cell-based functional assays

Compounds identified that are effective systemically or topically in mouse models of JAK3

inhibition

No safety issues observed in preliminary studies (i genotoxicity, CYP inhibition, hERG

photocytotoxicity, skin irritation)

c cytokine

(IL-2, IL-4, IL-7, IL-9, IL-15, IL-21)

c

IL-2 T-cell activation, T reg,

JAK1

JAK3

T-cell diff

IL-7 T-cell development and

IL-15 NK-cell development,

homeostasis, T/B progenitors

activation, proliferation and

IL-21 Reg Ig production, NK prolif andfunction act, T/B prolif IL-4 B-cell proliferation and P

IL-9 mast-cell growth factor, late-acting

Ab production, CSR, Th2

Stat5

Stat5 P

T-cell growth factor

diff, inh of Th1

Transcription

Activation, Growth,

P Stat5

Stat5

activation

Differentiation,

P

Survival

the Bottom line

the topic aL JaK3 prograM at Ligand oFFers an opportunity to enter the eMerging JaK inhibition MarKet through a partnership and with a Very seLectiVe MoLecuLe

Discovery

Pii

Fructose BisPhosPha-tase (FBP) inhiBitor

Novel dIABeteS MeChANISM of ACtIoN ClINICAl PoC dAtA IN hANd

Preclinical

glucagon recePtor antagonist

Novel dIABeteS MeChANISM of ACtIoN heP-dIReCt dRIveN lIveR tARgetINg minimizes side-effects

discovery

dgat inhiBitor

Novel dIABeteS MeChANISM of ACtIoN PoteNtIAl foR dUAl dIABeteS/oBeSIty activity

discovery

glucokinase (gk) activator

Novel dIABeteS MeChANISM of ACtIoN lIgANd tISSUe tARgetINg teChNology

the Bottom line

Ligand s portFoLio

oF diabetes

assets

giVes

us

the

opportunity

to

engage

in

a

broad

M

etaboLic

d isease

c oLL aboration