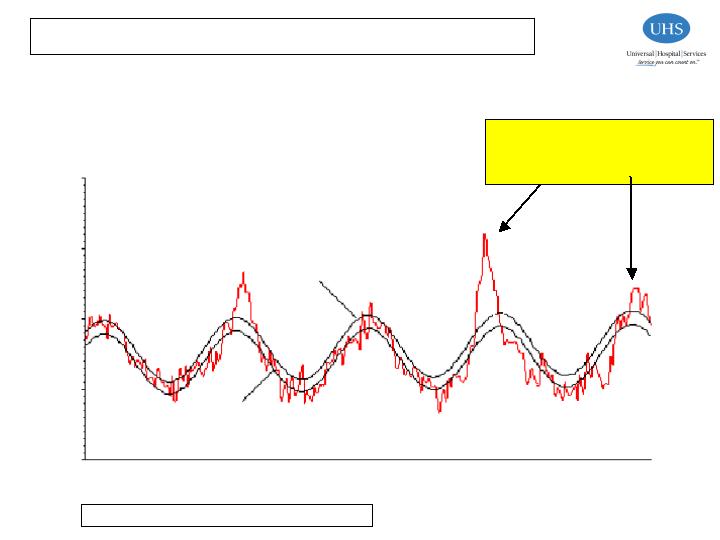

2004

2005

% Change

Revenues

$4.7

$7.5

59%

Gross Margin

$1.5

$2.0

36%

Gross Margin %

32%

27%

1st Quarter

$ millions

1st Quarter trends:

Strong organic growth across the board, including our resident based programs (12 new CHAMP

signings in 1Q-2005) and Manufacturers Services

Lower Gross Margin % in 2005 primarily due to effects of the ACES acquisition (acquired at end of Mar

2004), which is a lower margin business than our base Services business

Absent the ACES acquisition impact, revenue growth would have been ~ 30% for the quarter

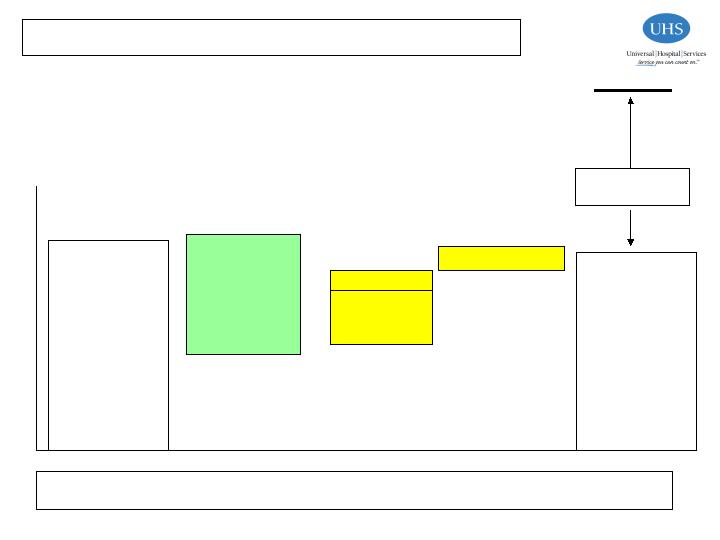

Technical Services:

Maintain & Repair Customer-owned Equipment:

Non-resident, response-based Biomedical Services

Resident-Based Programs:

CHAMP®: small hospitals in rural areas

Resident Biomed: larger hospitals in urban areas

Manufacturer Services

Professional Services:

Technology baseline assessments

Vendor neutral Capital Planning Services

Product comparison research and reports

Equipment product of choice

Equipment utilization studies

Manage

& Utilize

Equipment

Lifecycle

ServicesSM

Plan &

Acquire

Redeploy

& Remarket

Maintain

& Repair

Technical & Professional Services

11

2004

2005

% Change

Revenues

$4.4

$4.6

5%

Gross Margin

$1.0

$1.0

-7%

Gross Margin %

24%

21%

1st Quarter

$ millions

Asset recovery and equipment brokerage

New equipment sales

Logistics Management

Disposable Sales (rationalizing this activity)

1st Quarter trends:

Performance as expected across the line in new / used equipment and brokerage

Disposables: continued rationalization of this lower margin business

Excluding disposables, the segment’s revenue growth was ~ 20% in Q1

This segment’s results will typically be choppy quarter-to-quarter due to its transactional nature

Manage

& Utilize

Equipment

Lifecycle

ServicesSM

Plan &

Acquire

Redeploy

& Remarket

Maintain

& Repair

Medical Equipment Sales and Remarketing

12