Exhibit 99.1

Universal Hospital Services (UHOS) Deutsche High Yield Conference October 2007

Forward Looking Statements Body: Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995: Universal Hospital Services, Inc. believes statements in this presentation looking forward in time involve risks and uncertainties as detailed in our annual report on Form 10K for the year ended December 31, 2006 and Form 10Q for the 6 months ended June 30, 2007, filed with the Securities and Exchange Commission. This presentation contains non-GAAP measures as defined by SEC rules. Reconciliations of these measures to the most directly comparable GAAP measures are contained in the appendix.

Leading provider of Medical Equipment Lifecycle Services Equipment rental Servicing of customer owned equipment Monetize customer equipment Relationships with> 7,400 customers, including: > 3,800 hospitals> 3,400 alternate care sites, and > 200 manufacturers Largest most modern Rental fleet in the industry: ~ 186,000 units owned and ~ 400,000 customer units managed and maintained UHS - Who We Are Enhance customers’ operational efficiency, nursing satisfaction and improve clinical outcomes

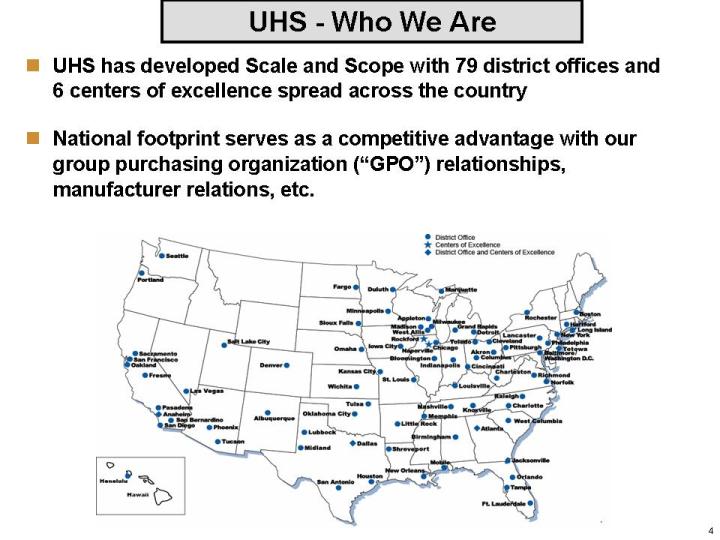

UHS has developed Scale and Scope with 79 district offices and 6 centers of excellence spread across the country National footprint serves as a competitive advantage with our group purchasing organization (“GPO”) relationships, manufacturer relations, etc. UHS - Who We Are

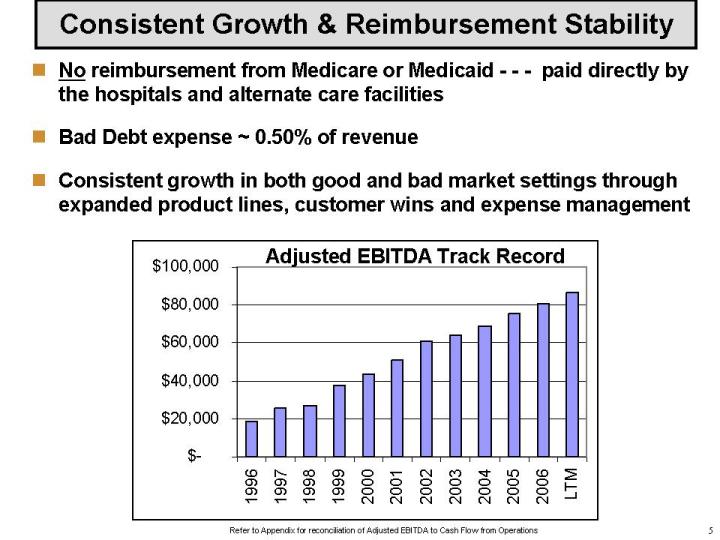

No reimbursement from Medicare or Medicaid - - - paid directly by the hospitals and alternate care facilities Bad Debt expense ~ 0.50% of revenue Consistent growth in both good and bad market settings through expanded product lines, customer wins and expense management Consistent Growth & Reimbursement Stability Adjusted EBITDA Track Record Refer to Appendix for reconciliation of Adjusted EBITDA to Cash Flow from Operations

What We Do: Examples of Medical Equipment Rental Fleet Infusion Pumps Ventilators Monitors Specialty Beds Bariatrics UHS is involved with numerous other products, but we’re not a manufacturer.

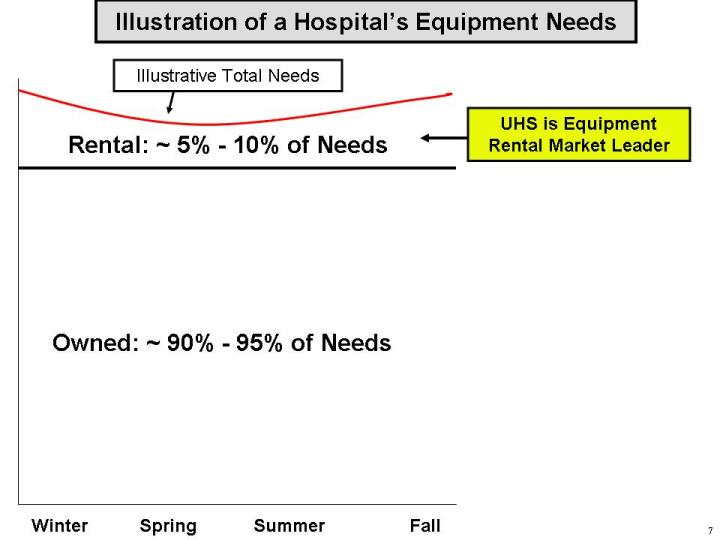

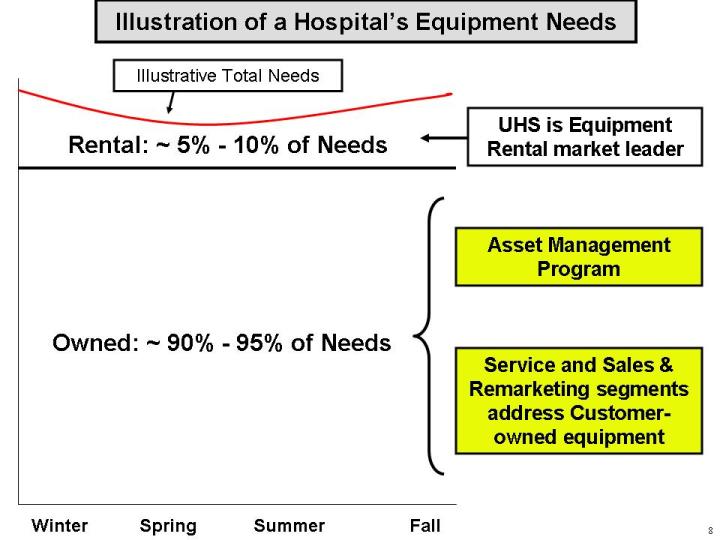

UHS is Equipment Rental Market Leader Illustration of a Hospital’s Equipment Needs Owned: ~ 90% - 95% of Needs Rental: ~ 5% - 10% of Needs Winter Fall Summer Spring Illustrative Total Needs

UHS is Equipment Rental market leader Illustration of a Hospital’s Equipment Needs Owned: ~ 90% - 95% of Needs Rental: ~ 5% - 10% of Needs Winter Fall Summer Spring Illustrative Total Needs Asset Management Program Service and Sales & Remarketing segments address Customer- owned equipment

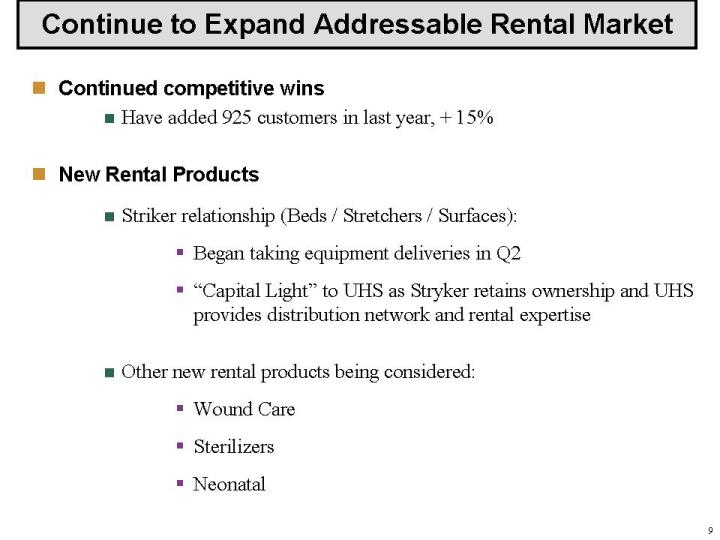

Continued competitive wins Have added 925 customers in last year, + 15% New Rental Products Striker relationship (Beds / Stretchers / Surfaces): Began taking equipment deliveries in Q2 “Capital Light” to UHS as Stryker retains ownership and UHS provides distribution network and rental expertise Other new rental products being considered: Wound Care Sterilizers Neonatal Continue to Expand Addressable Rental Market

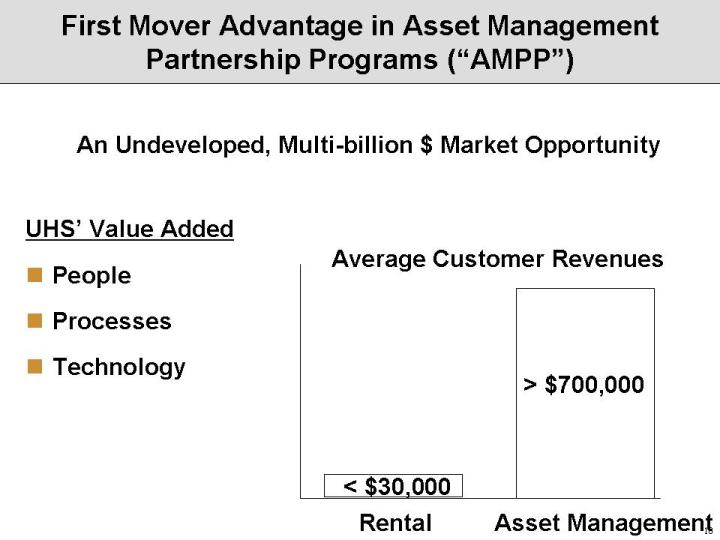

First Mover Advantage in Asset Management Partnership Programs (“AMPP”) Body:UHS’ Value Added People Processes Technology Average Customer Revenues Rental Asset Management > $700,000 < $30,000 An Undeveloped, Multi-billion $ Market Opportunity

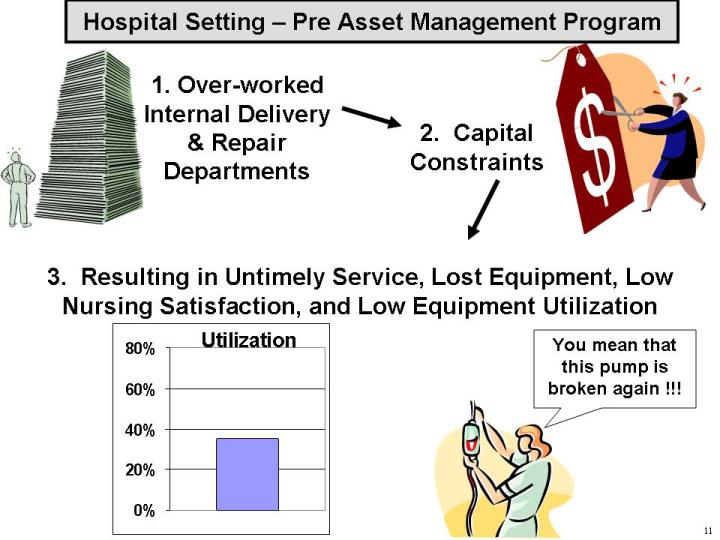

You mean that this pump is broken again !!! 1. Over-worked Internal Delivery & Repair Departments 2. Capital Constraints 3. Resulting in Untimely Service, Lost Equipment, Low Nursing Satisfaction, and Low Equipment Utilization Utilization Hospital Setting – Pre Asset Management Program

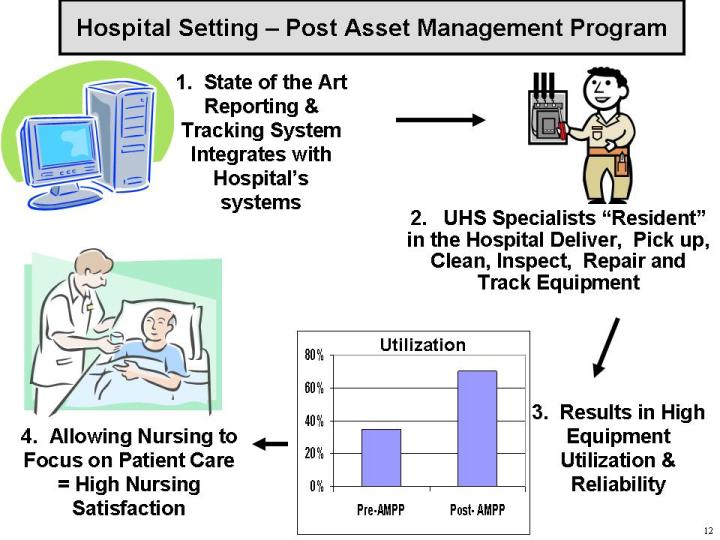

Hospital Setting – Post Asset Management Program 3. Results in High Equipment Utilization & Reliability 4. Allowing Nursing to Focus on Patient Care = High Nursing Satisfaction 2. UHS Specialists “Resident” in the Hospital Deliver, Pick up, Clean, Inspect, Repair and Track Equipment 1. State of the Art Reporting & Tracking System Integrates with Hospital’s systems Utilization

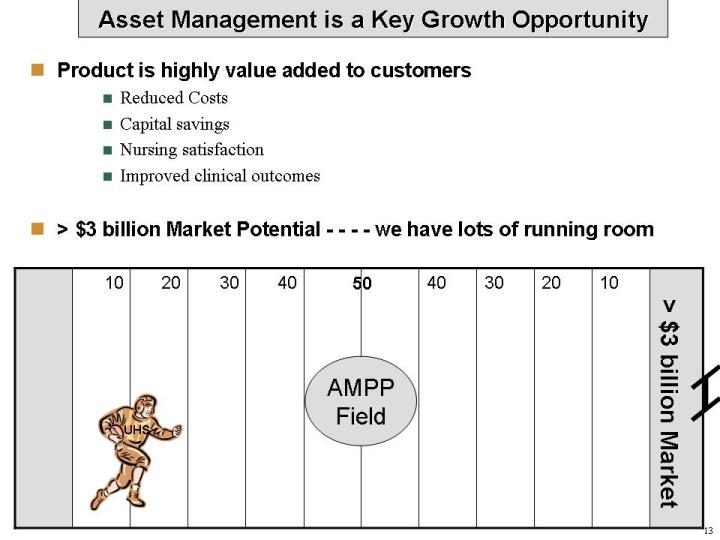

Asset Management is a Key Growth Opportunity Product is highly value added to customers Reduced Costs Capital savings Nursing satisfaction Improved clinical outcomes > $3 billion Market Potential - - - - we have lots of running room AMPP Field 50 UHS > $3 billion Market

2007 Market Headwinds Weak Census Sub-par Flu Season High Gasoline Costs

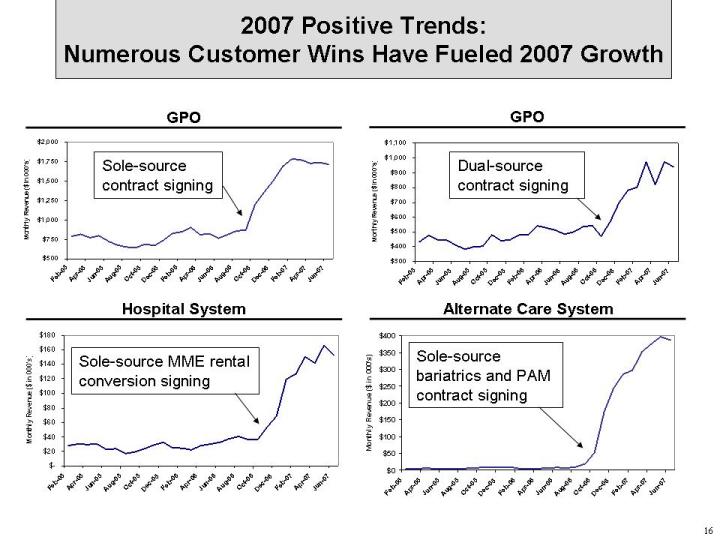

2007 Positive Trends: Numerous Customer Wins Have Fueled 2007 Growth (Gp:) GPO (Gp:) GPO (Gp:) Hospital System (Gp:) Alternate Care System Sole-source contract signing Dual-source contract signing Sole-source MME rental conversion signing Sole-source bariatrics and PAM contract signing

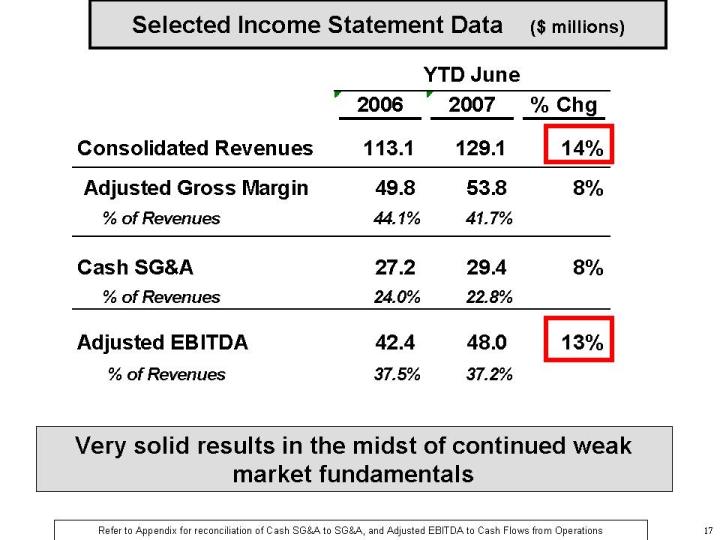

Selected Income Statement Data ($ millions) Very solid results in the midst of continued weak market fundamentals Refer to Appendix for reconciliation of Cash SG&A to SG&A, and Adjusted EBITDA to Cash Flows from Operations

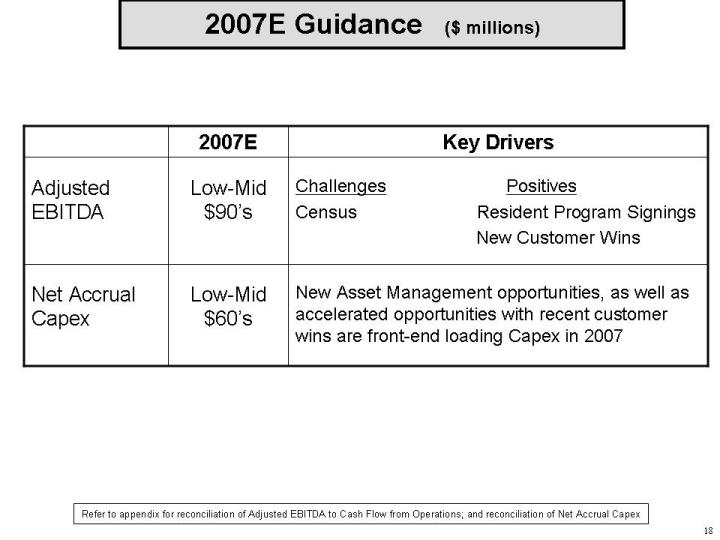

2007E Guidance ($ millions) Refer to appendix for reconciliation of Adjusted EBITDA to Cash Flow from Operations; and reconciliation of Net Accrual Capex

Leverage & Liquidity Overview – June 30, 2007 ($ millions) $ 6/30/07 Borrowing Base $135 Available Liquidity = $121 06/30/07 Net Revolver Usage = Borrowed $12 L/Cs $2 Leverage Calculation 8.50% PIK Notes$ 230.0 Floating Rate Notes 230.0 10.125% Notes 9.9 Revolver 12.0 Capitalized Leases 7.8 Cash on Hand (3.5) Net Debt at 6/30/07 $ 486.2 2007E EBITDA Low-Mid $90’s Leverage 5.1x – 5.4x Swapped to all-in fixed rate of 9.07% through 6/1/2012

Continued competitive takeaways and new product introduction in rental Significant AMPP opportunities Execution on “capital light” deals; more in the works Customers experiencing volume and credit issues - - - - UHS will stay close to customers to provide solutions Outlook Outlook

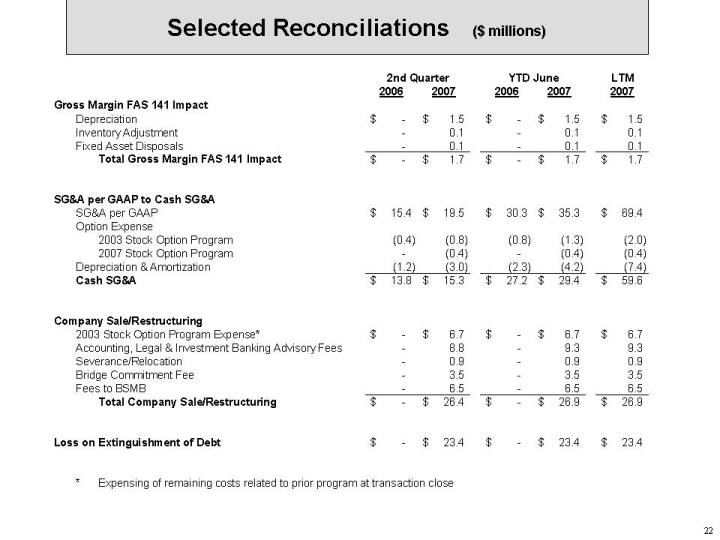

Selected Reconciliations ($ millions)

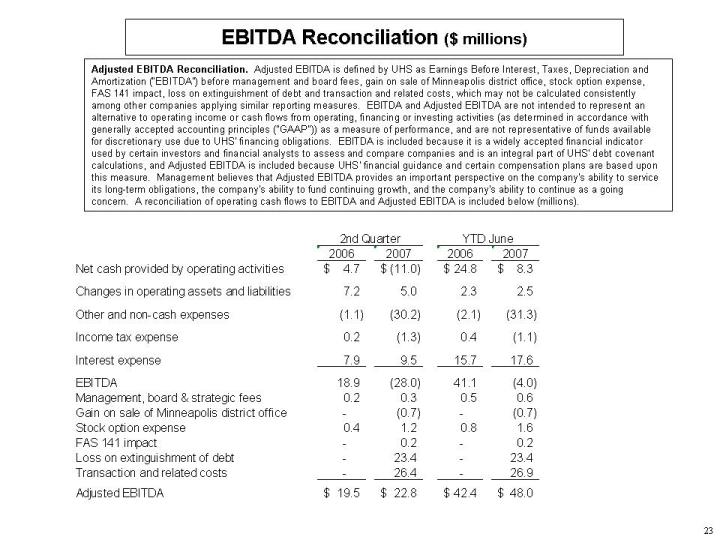

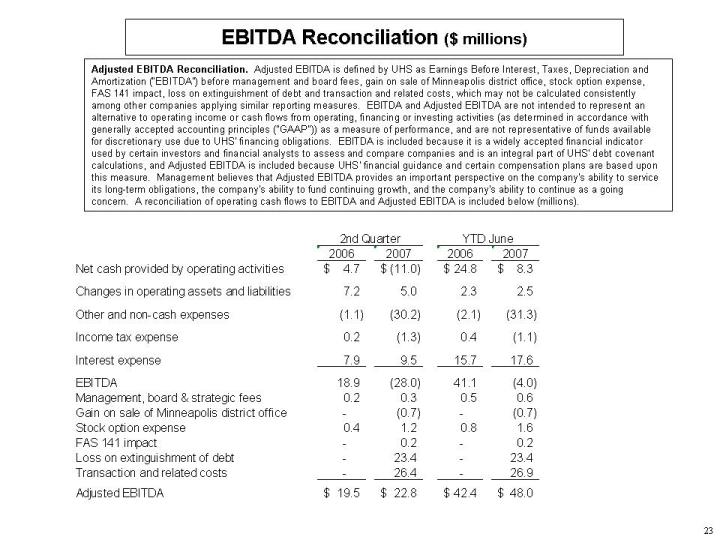

EBITDA Reconciliation ($ millions) Adjusted EBITDA Reconciliation. Adjusted EBITDA is defined by UHS as Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”) before management and board fees, gain on sale of Minneapolis district office, stock option expense, FAS 141 impact, loss on extinguishment of debt and transaction and related costs, which may not be calculated consistently among other companies applying similar reporting measures. EBITDA and Adjusted EBITDA are not intended to represent an alternative to operating income or cash flows from operating, financing or investing activities (as determined in accordance with generally accepted accounting principles ("GAAP")) as a measure of performance, and are not representative of funds available for discretionary use due to UHS' financing obligations. EBITDA is included because it is a widely accepted financial indicator used by certain investors and financial analysts to assess and compare companies and is an integral part of UHS' debt covenant calculations, and Adjusted EBITDA is included because UHS' financial guidance and certain compensation plans are based upon this measure. Management believes that Adjusted EBITDA provides an important perspective on the company's ability to service its long-term obligations, the company's ability to fund continuing growth, and the company's ability to continue as a going concern. A reconciliation of operating cash flows to EBITDA and Adjusted EBITDA is included below (millions).

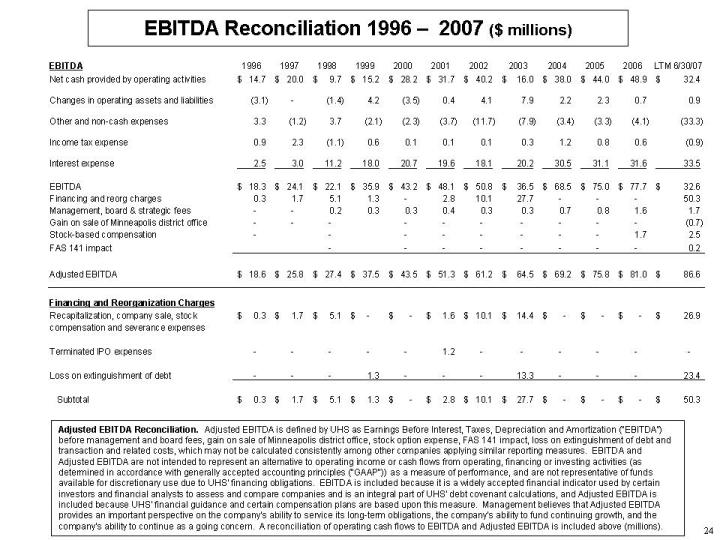

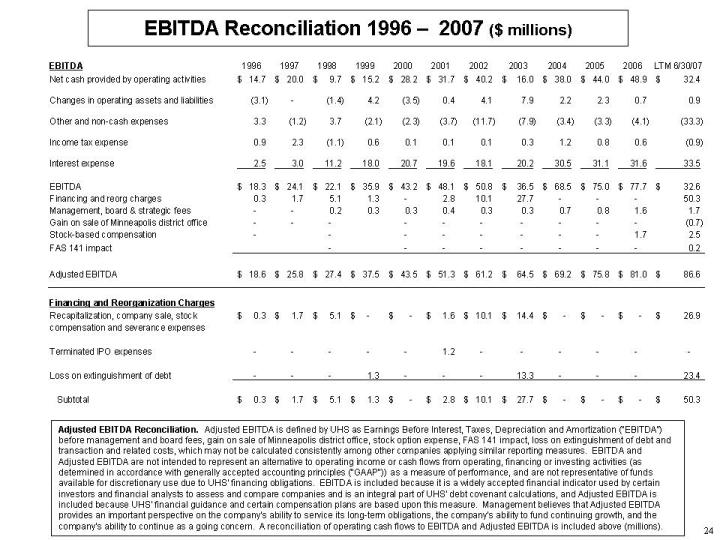

EBITDA Reconciliation 1996 – 2007 ($ millions) Adjusted EBITDA Reconciliation. Adjusted EBITDA is defined by UHS as Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”) before management and board fees, gain on sale of Minneapolis district office, stock option expense, FAS 141 impact, loss on extinguishment of debt and transaction and related costs, which may not be calculated consistently among other companies applying similar reporting measures. EBITDA and Adjusted EBITDA are not intended to represent an alternative to operating income or cash flows from operating, financing or investing activities (as determined in accordance with generally accepted accounting principles ("GAAP")) as a measure of performance, and are not representative of funds available for discretionary use due to UHS' financing obligations. EBITDA is included because it is a widely accepted financial indicator used by certain investors and financial analysts to assess and compare companies and is an integral part of UHS' debt covenant calculations, and Adjusted EBITDA is included because UHS' financial guidance and certain compensation plans are based upon this measure. Management believes that Adjusted EBITDA provides an important perspective on the company's ability to service its long-term obligations, the company's ability to fund continuing growth, and the company's ability to continue as a going concern. A reconciliation of operating cash flows to EBITDA and Adjusted EBITDA is included above (millions).

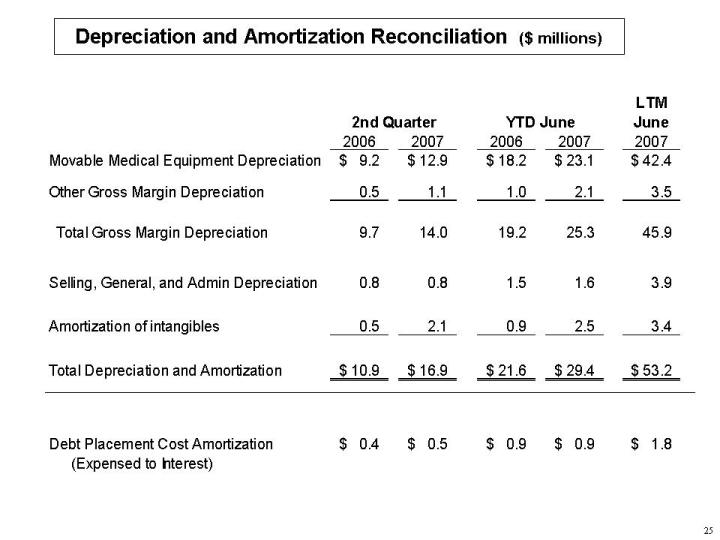

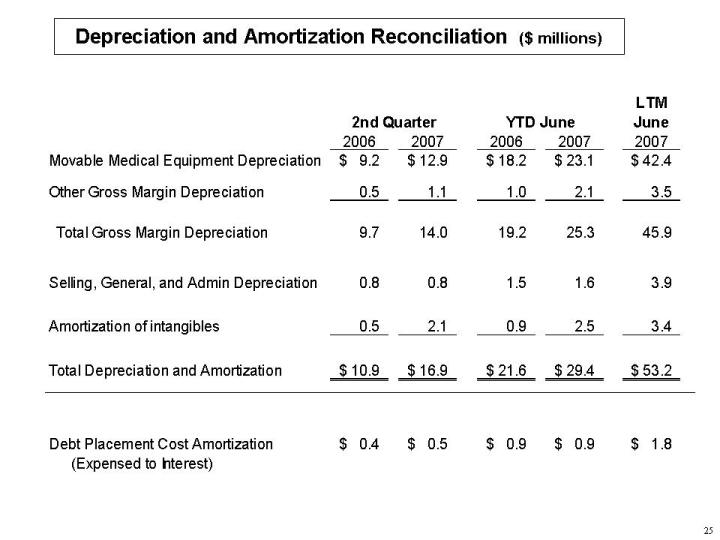

Depreciation and Amortization Reconciliation ($ millions)

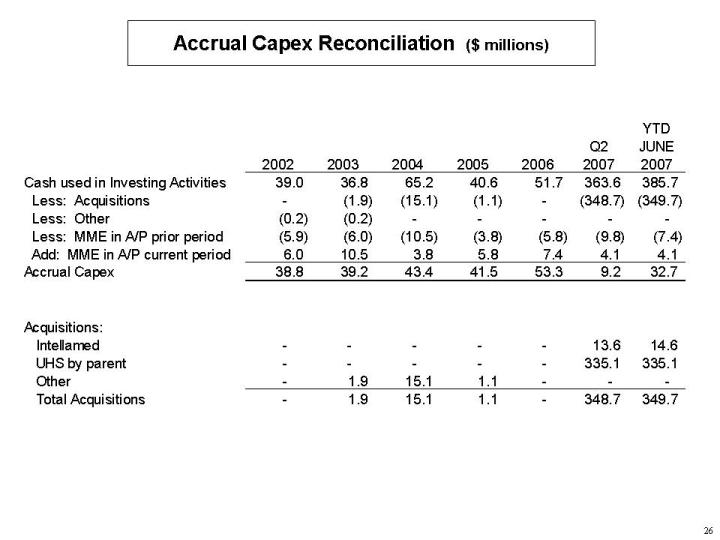

Accrual Capex Reconciliation ($ millions)