Exhibit 99.3

1 Lehman High Yield Bond and Syndicated Loan Conference March 14, 2008

2 Forward Looking Statements Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995: Universal Hospital Services, Inc. believes statements in this presentation looking forward in time involve risks and uncertainties as detailed in our annual report on Form 10-K for the year ended December 31, 2007 filed with the Securities and Exchange Commission. This presentation contains non-GAAP measures as defined by SEC rules. Reconciliations of these measures to the most directly comparable GAAP measures are contained in the appendix.

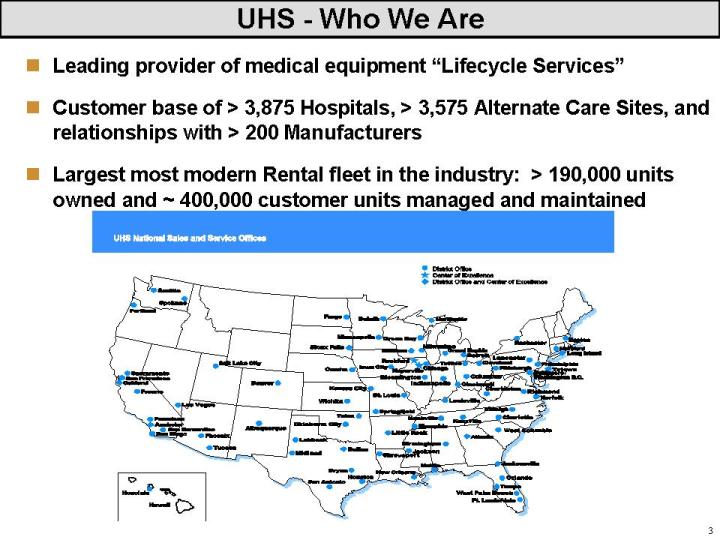

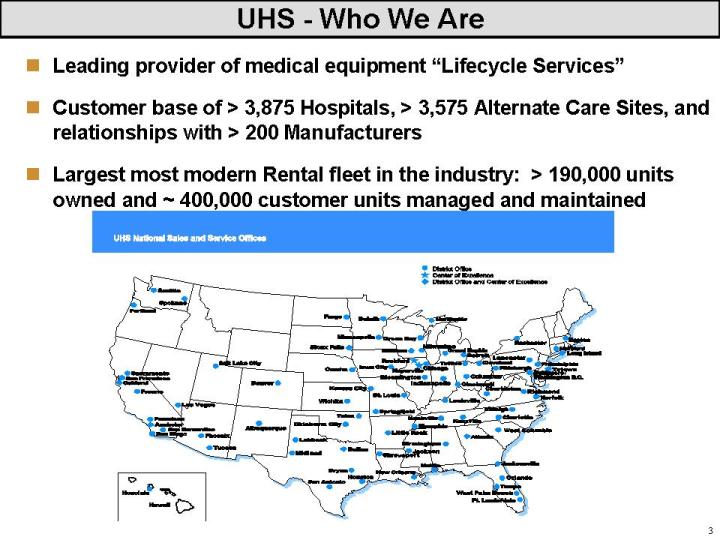

3 Leading provider of medical equipment "Lifecycle Services" Customer base of > 3,875 Hospitals, > 3,575 Alternate Care Sites, and relationships with > 200 Manufacturers Largest most modern Rental fleet in the industry: > 190,000 units owned and ~ 400,000 customer units managed and maintained UHS - Who We Are

4 What We Do: Examples of Medical Equipment Rental Fleet Infusion Pumps Ventilators Monitors Specialty Beds Bariatrics UHS is involved with numerous other products, but we’re not a manufacturer.

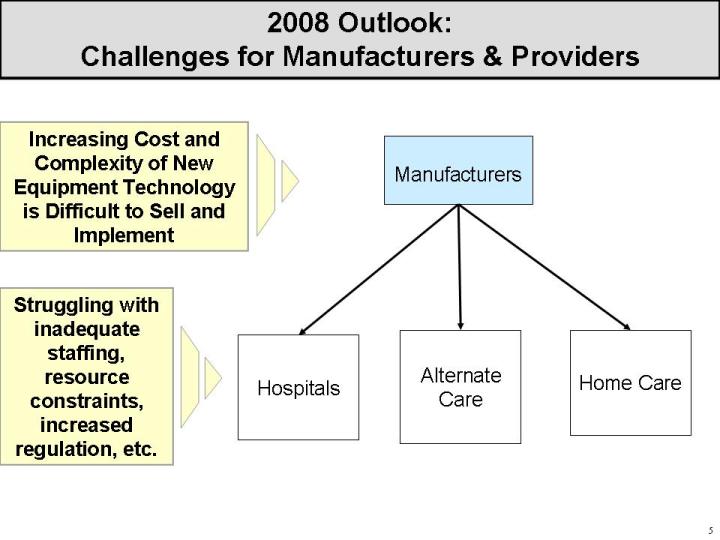

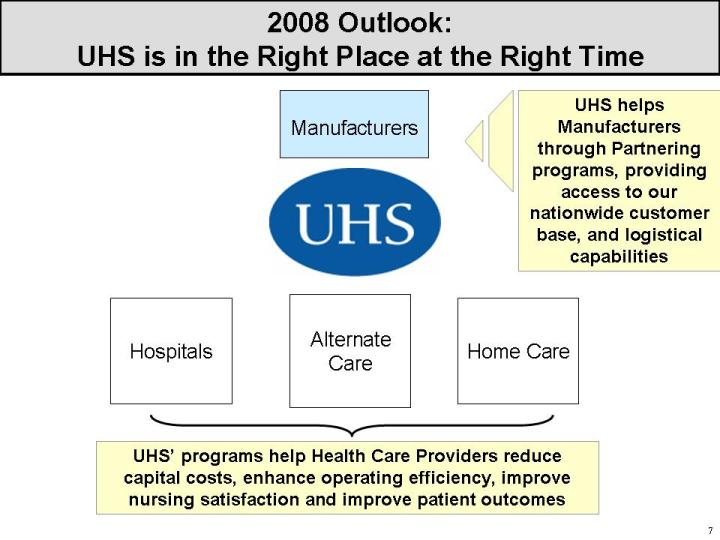

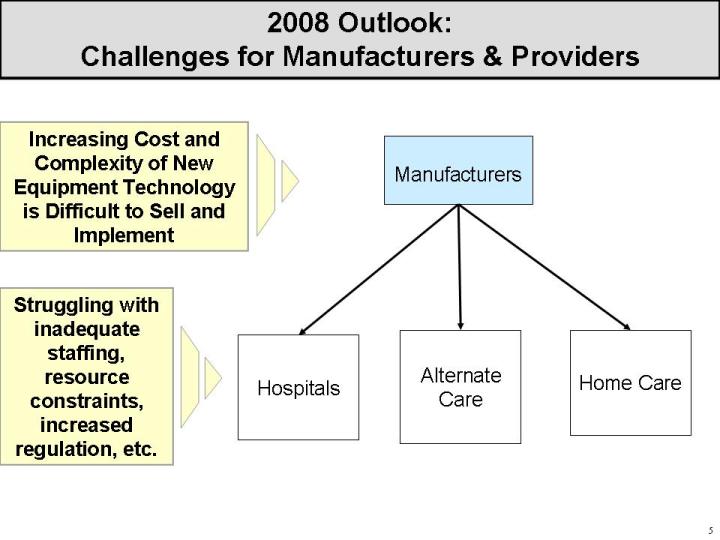

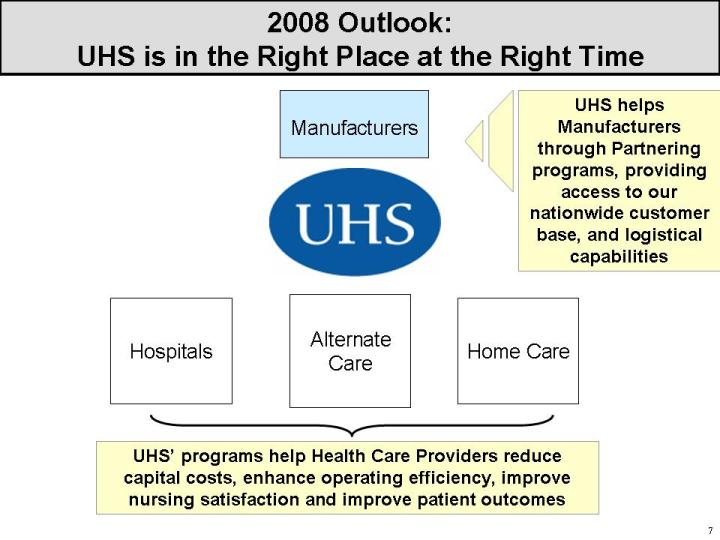

5 Manufacturers Increasing Cost and Complexity of New Equipment Technology is Difficult to Sell and Implement Struggling with inadequate staffing, resource constraints, increased regulation, etc. 2008 Outlook: Challenges for Manufacturers & Providers Hospitals Alternate Care Home Care

6 Quote from a Fortune 500 medical equipment manufacturer: "We are developing medical equipment that provides better and better therapies and outcomes for patients. The problem is that our customers are less and less able to afford them, or to make effective clinical use of them in the current healthcare setting." The "New Technology Conundrum"

7 Manufacturers UHS helps Manufacturers through Partnering programs, providing access to our nationwide customer base, and logistical capabilities UHS’ programs help Health Care Providers reduce capital costs, enhance operating efficiency, improve nursing satisfaction and improve patient outcomes Hospitals Alternate Care Home Care 2008 Outlook: UHS is in the Right Place at the Right Time

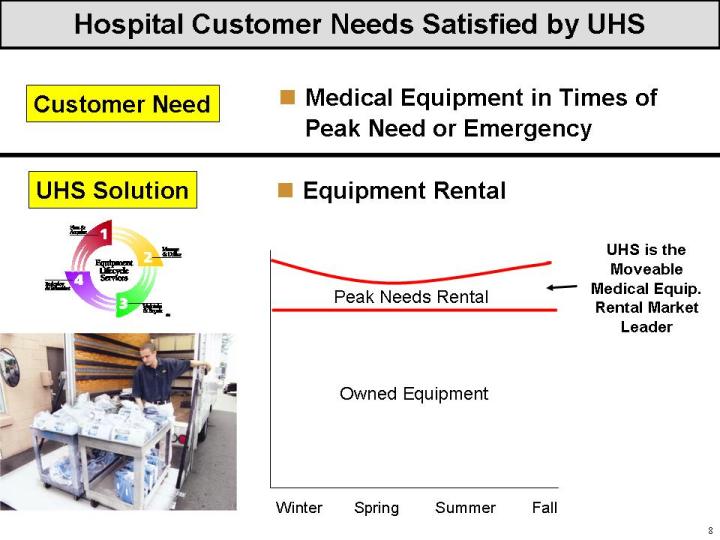

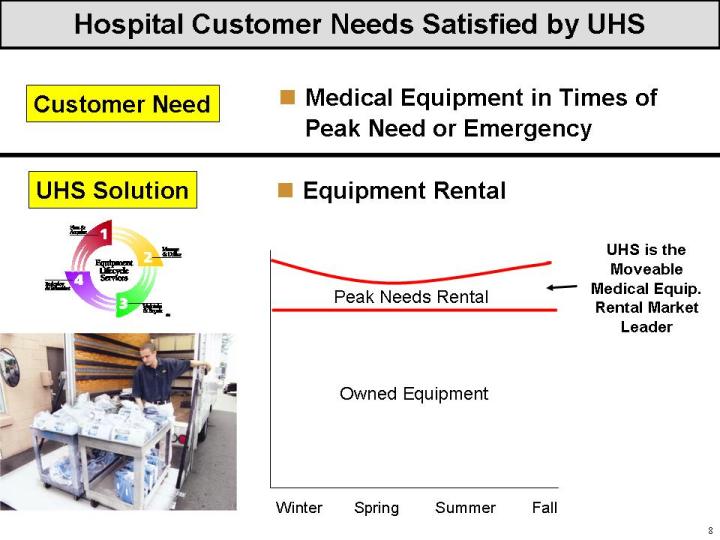

8 Equipment Rental Medical Equipment in Times of Peak Need or Emergency Hospital Customer Needs Satisfied by UHS Customer Need UHS Solution Peak Needs Rental Owned Equipment Winter Spring Summer Fall UHS is the Moveable Medical Equip. Rental Market Leader

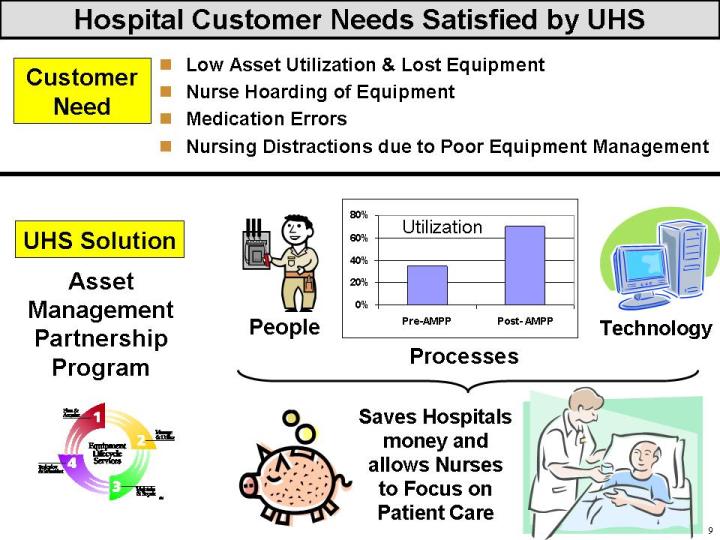

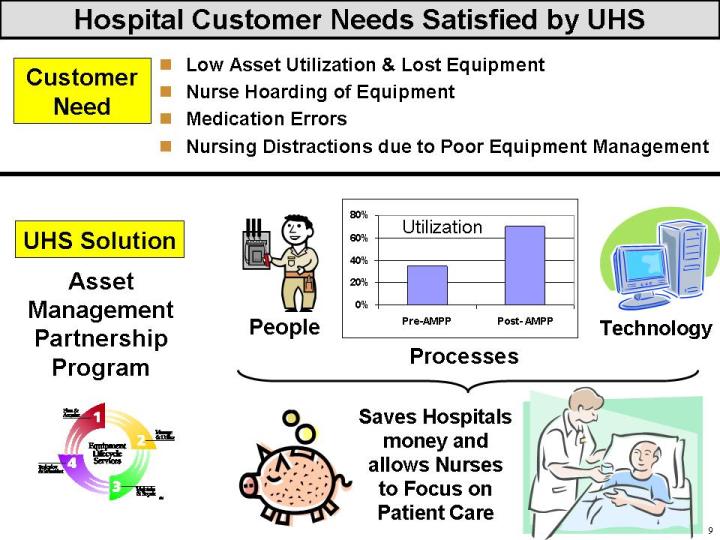

9 Hospital Customer Needs Satisfied by UHS Customer Need UHS Solution Low Asset Utilization & Lost Equipment Nurse Hoarding of Equipment Medication Errors Nursing Distractions due to Poor Equipment Management Asset Management Partnership Program People Technology Processes Saves Hospitals money and allows Nurses to Focus on Patient Care

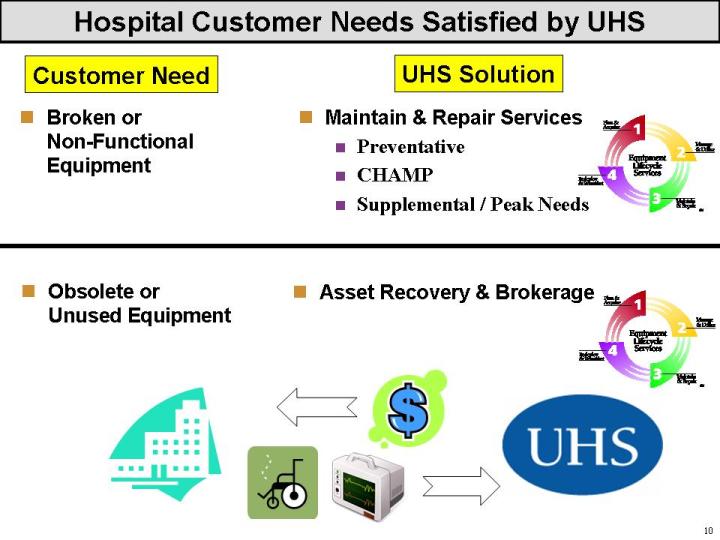

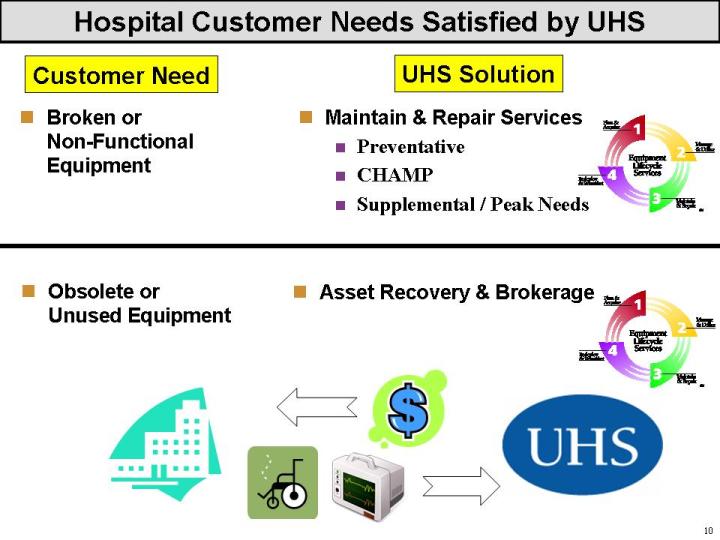

10 Hospital Customer Needs Satisfied by UHS Customer Need UHS Solution Broken or Non-Functional Equipment Obsolete or Unused Equipment Asset Recovery & Brokerage Maintain & Repair Services Preventative CHAMP Supplemental / Peak Needs

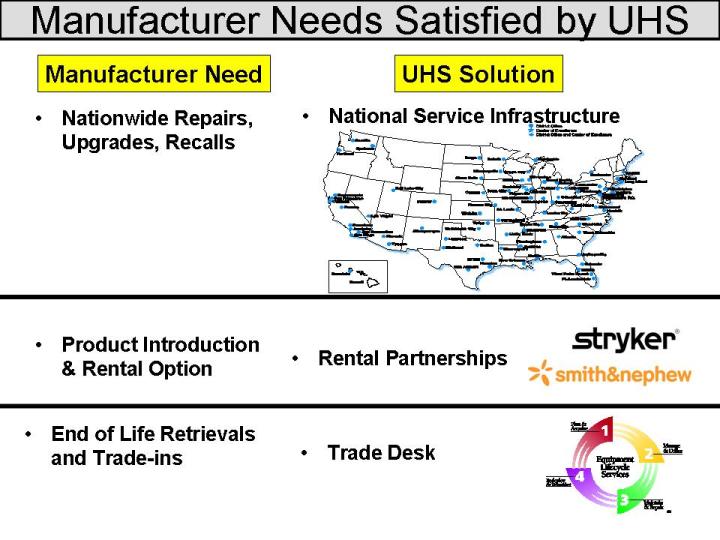

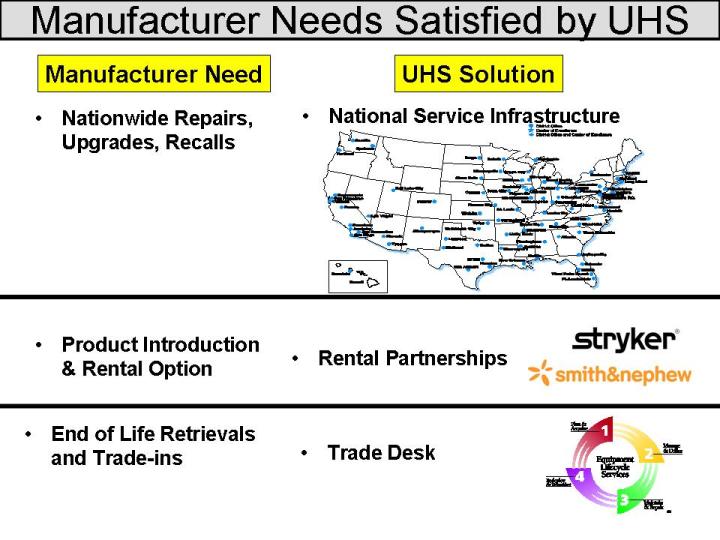

11 Manufacturer Needs Satisfied by UHS Manufacturer Need UHS Solution Nationwide Repairs, Upgrades, Recalls National Service Infrastructure Product Introduction & Rental Option End of Life Retrievals and Trade-ins Rental Partnerships Trade Desk

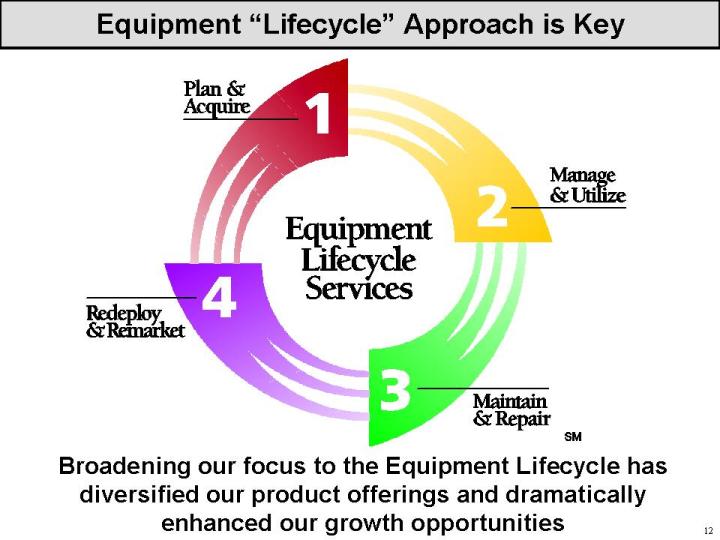

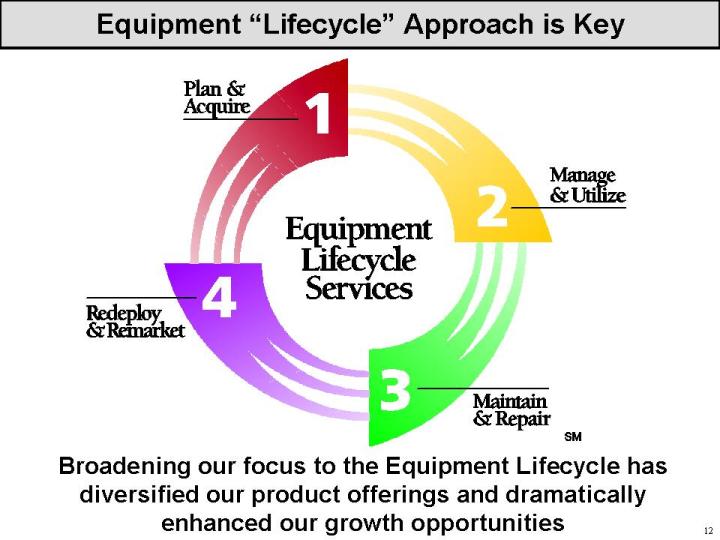

12 Equipment "Lifecycle" Approach is Key Broadening our focus to the Equipment Lifecycle has diversified our product offerings and dramatically enhanced our growth opportunities

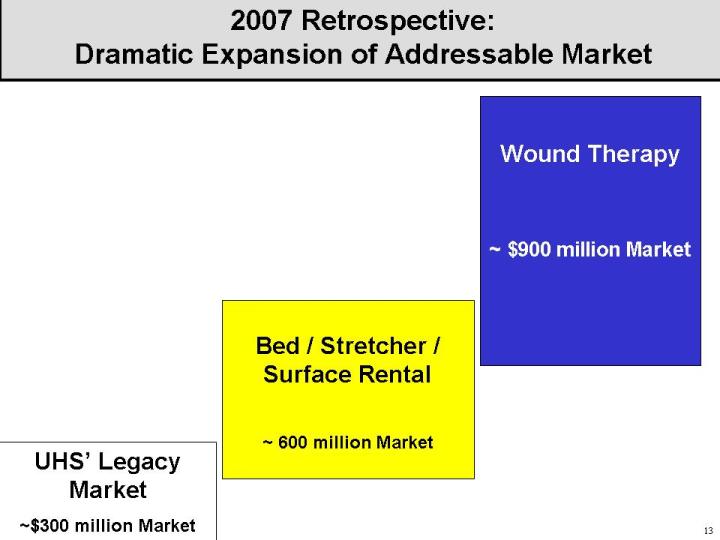

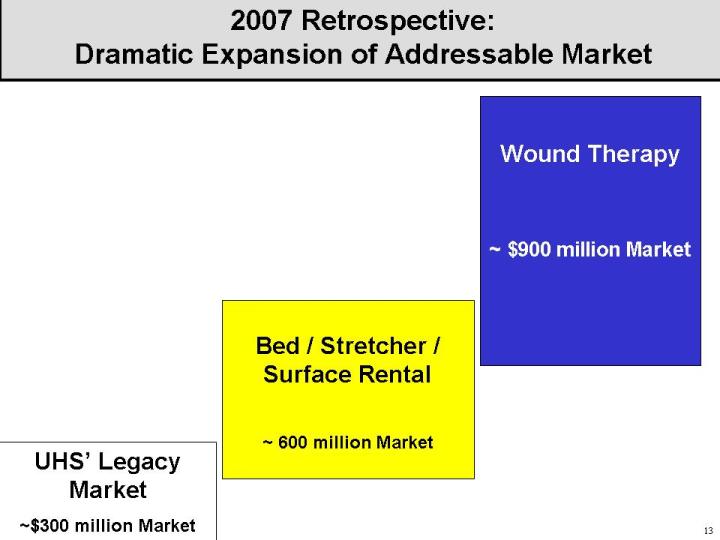

13 UHS’ Legacy Market $300 million Market Bed / Stretcher / Surface Rental 600 million Market Wound Therapy $900 million Market 2007 Retrospective: Dramatic Expansion of Addressable Market

14 2007 Performance

15 Weak Census Sub-par Flu Season High Gasoline Costs Challenges Opportunities Customer Growth Asset Management Partnership Programs 2007 Retrospective: Market Setting Manufacturer Partnerships

16 (Gp:) 15% increase in Outsourcing customer count in past 15 months 2007 Retrospective: Robust Customer Adds Outsourcing Customer Adds

17 Financial Summary ($ millions) Refer to appendix for reconciliation of Adjusted EBITDA to Cash Flows from Operations UHS

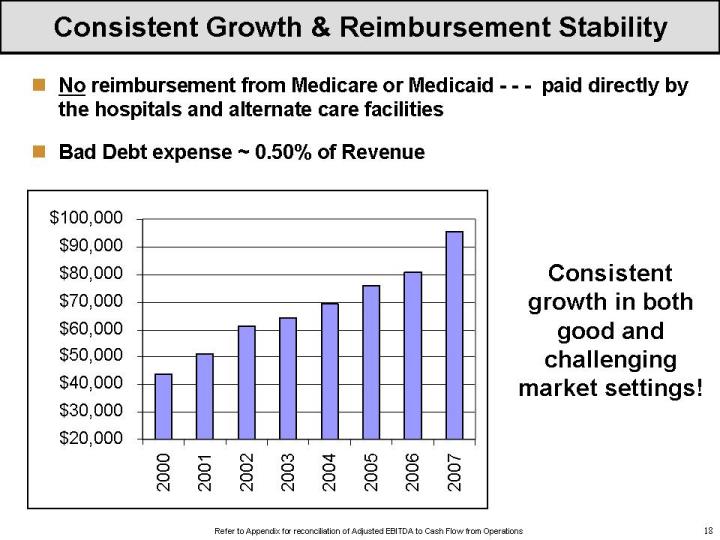

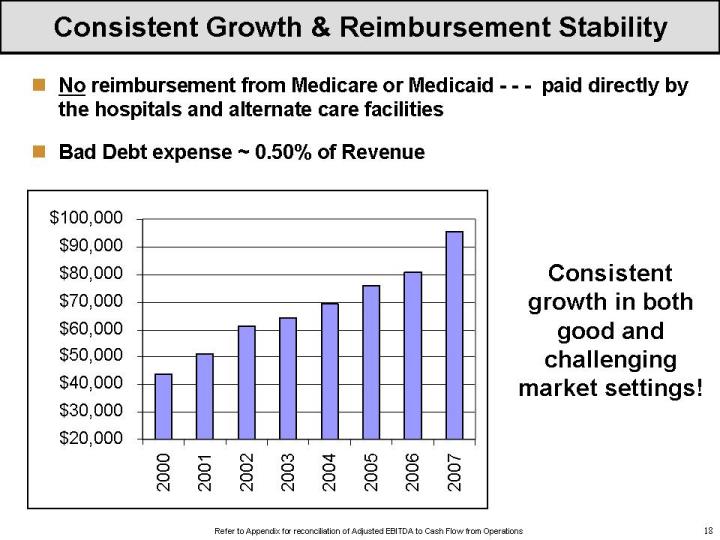

18 No reimbursement from Medicare or Medicaid - - - paid directly by the hospitals and alternate care facilities Bad Debt expense ~ 0.50% of Revenue Consistent Growth & Reimbursement Stability Refer to Appendix for reconciliation of Adjusted EBITDA to Cash Flow from Operations Consistent growth in both good and challenging market settings!

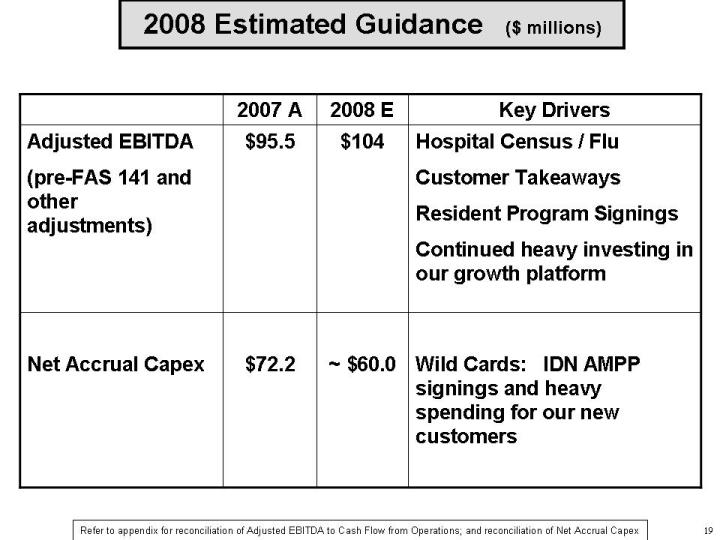

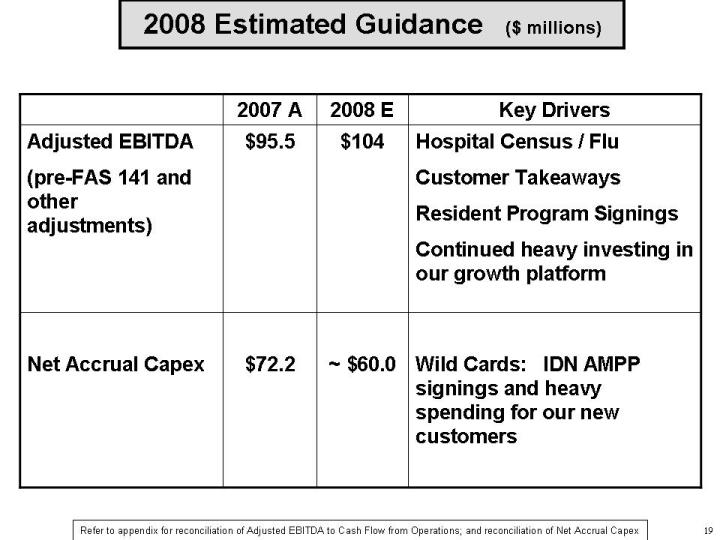

19 2008 Estimated Guidance ($ millions) Refer to appendix for reconciliation of Adjusted EBITDA to Cash Flow from Operations; and reconciliation of Net Accrual Capex

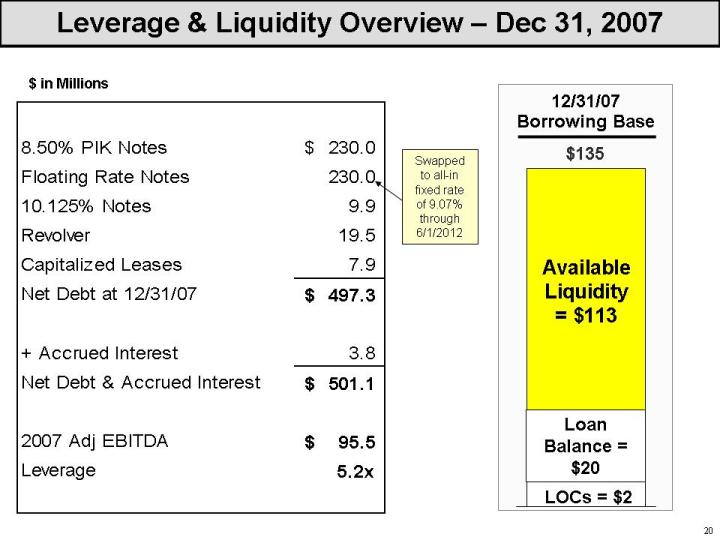

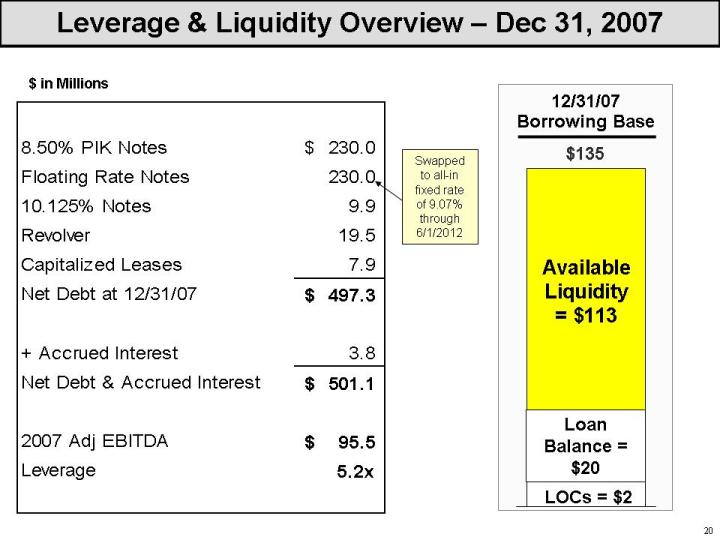

20 $135 Available Liquidity = $113 12/31/07 Borrowing Base LOCs = $2 Leverage & Liquidity Overview – Dec 31, 2007 $ in Millions Loan Balance = $20 Swapped to all-in fixed rate of 9.07% through 6/1/2012

21 Excellent opportunities in numerous areas: Beds / Stretchers / Surfaces Wound Therapy Asset Management Will take advantage of this momentum and invest heavily in our platform to accelerate growth Sales Specialists / Geographic Expansion / Fleet / Technology Disciplined approach to acquisitions Strategy is to build for the future! UHS’ Momentum is Positive

22 Appendix

23 EBITDA Reconciliation: Q4 and YTD Adjusted EBITDA Reconciliation. Adjusted EBITDA is defined by UHS as Earnings Before Interest, Taxes, Depreciation and Amortization ("EBITDA") before management and board fees, gain on sale of Minneapolis district office, stock option expense, FAS 141 impact, loss on extinguishment of debt and transaction and related costs, which may not be calculated consistently among other companies applying similar reporting measures. EBITDA and Adjusted EBITDA are not intended to represent an alternative to operating income or cash flows from operating, financing or investing activities (as determined in accordance with generally accepted accounting principles ("GAAP")) as a measure of performance, and are not representative of funds available for discretionary use due to UHS' financing obligations. EBITDA is included because it is a widely accepted financial indicator used by certain investors and financial analysts to assess and compare companies and is an integral part of UHS' debt covenant calculations, and Adjusted EBITDA is included because UHS' financial guidance and certain compensation plans are based upon this measure. Management believes that Adjusted EBITDA provides an important perspective on the Company's ability to service its long-term obligations, the Company's ability to fund continuing growth, and the Company's ability to continue as a going concern. A reconciliation of operating cash flows to EBITDA and Adjusted EBITDA is included below (millions).

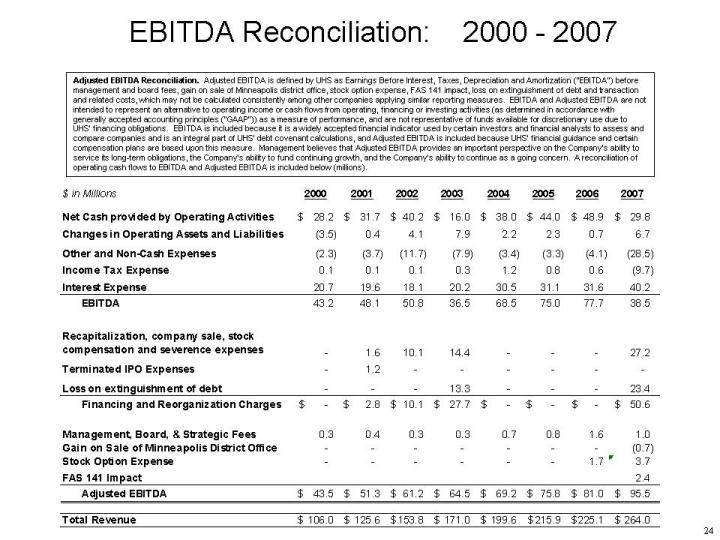

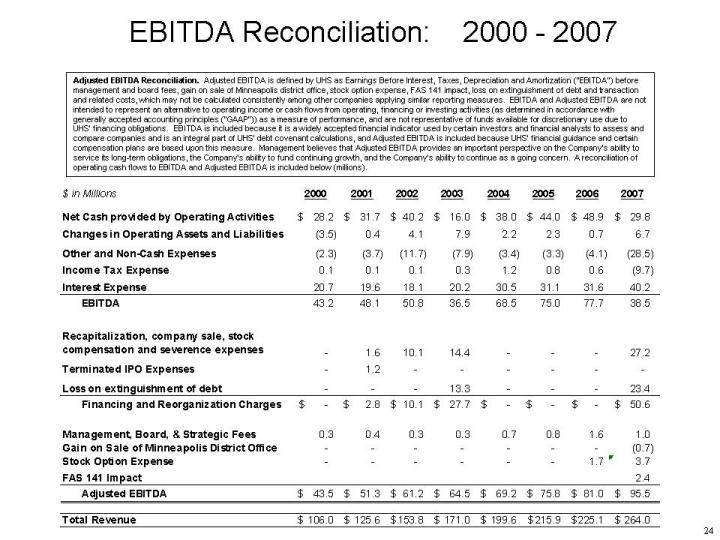

24 EBITDA Reconciliation: 2000 - 2007 Adjusted EBITDA Reconciliation. Adjusted EBITDA is defined by UHS as Earnings Before Interest, Taxes, Depreciation and Amortization ("EBITDA") before management and board fees, gain on sale of Minneapolis district office, stock option expense, FAS 141 impact, loss on extinguishment of debt and transaction and related costs, which may not be calculated consistently among other companies applying similar reporting measures. EBITDA and Adjusted EBITDA are not intended to represent an alternative to operating income or cash flows from operating, financing or investing activities (as determined in accordance with generally accepted accounting principles ("GAAP")) as a measure of performance, and are not representative of funds available for discretionary use due to UHS' financing obligations. EBITDA is included because it is a widely accepted financial indicator used by certain investors and financial analysts to assess and compare companies and is an integral part of UHS' debt covenant calculations, and Adjusted EBITDA is included because UHS' financial guidance and certain compensation plans are based upon this measure. Management believes that Adjusted EBITDA provides an important perspective on the Company's ability to service its long-term obligations, the Company's ability to fund continuing growth, and the Company's ability to continue as a going concern. A reconciliation of operating cash flows to EBITDA and Adjusted EBITDA is included below (millions).

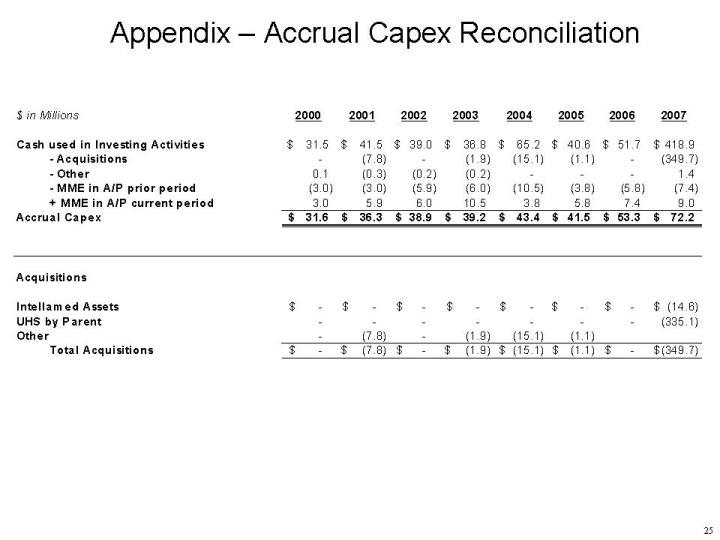

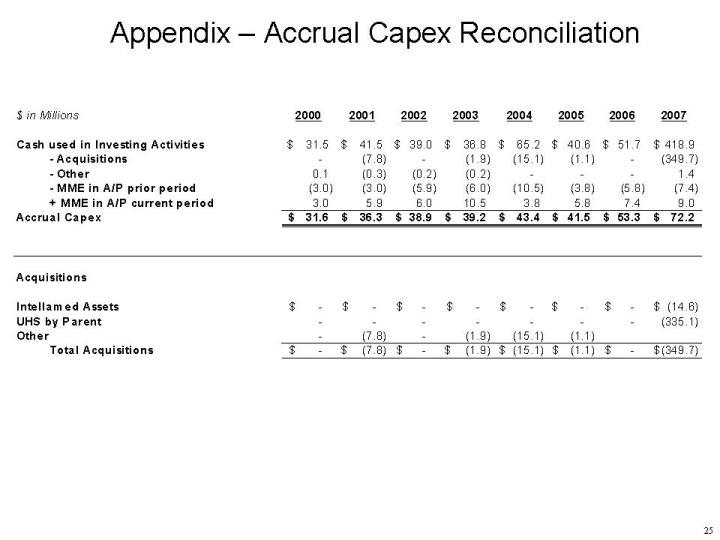

25 Appendix – Accrual Capex Reconciliation