UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

(Mark One)

| x | Annual Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2005,

or

| ¨ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to .

Commission File Number: 000-20086

UNIVERSAL HOSPITAL SERVICES, INC.

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 41-0760940 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

7700 France Avenue South, Suite 275

Edina, Minnesota 55435-5228

(Address of principal executive offices, including zip code)

(952) 893-3200

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes x No ¨

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Larger accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The number of shares of common stock, $.01 par value, outstanding as of March 26, 2006, was 123,447,269.21.

DOCUMENTS INCORPORATED BY REFERENCE

None.

FORM 10-K TABLE OF CONTENTS

2

PART I

ITEM 1: Business

OUR COMPANY

Universal Hospital Services, Inc. (“we”, “our” or “UHS”) is a leading, nationwide provider of medical equipment outsourcing and services to the health care industry. Our customers include national, regional and local acute care hospitals, alternate site providers (such as nursing homes and home care providers) and medical equipment manufacturers. Our diverse customer base includes more than 3,200 acute care hospitals and approximately 3,100 alternate site providers. We also have extensive and long-standing relationships with over 200 major medical equipment manufacturers and many of the nation’s largest group purchasing organizations (“GPOs”) and integrated delivery networks (“IDNs”). All of our services leverage our nationwide network of 75 offices and more than 65 years of experience managing and servicing all aspects of movable medical equipment. The fees for these services are paid directly by our customers and not through reimbursement from governmental or other third-party payors. We commenced operations in 1939, originally incorporated in Minnesota in 1954 and reincorporated in Delaware in 2001.

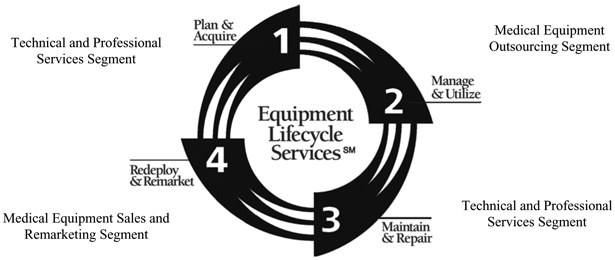

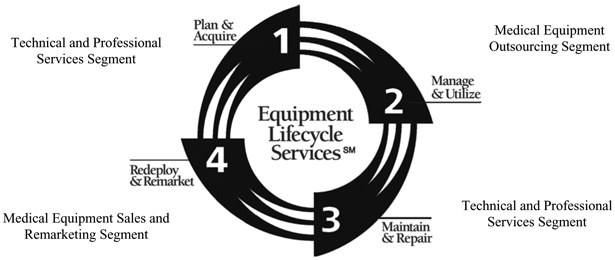

As a leading medical equipment lifecycle services company, we design and offer comprehensive solutions for our customers that increase equipment and staff productivity and support optimal patient care.

Effective January 1, 2004, we began reporting our financial results in three segments to reflect how we manage our business. Our operating segments consist of Medical Equipment Outsourcing, Technical and Professional Services, and Medical Equipment Sales and Remarketing. We evaluate the performance of our operating segments based on gross margin. The accounting policies of the individual operating segments are the same as those of the entire company. Our revenue, profits, and assets for our operating segments for the prior three years are described in “Item 6 – Selected Financial Data.”

3

Medical Equipment Outsourcing Segment- Manage & Utilize

Our flagship business is our Medical Equipment Outsourcing segment, which accounted for $167.7 million, or approximately 77.7%, of our revenues for the year ended December 31, 2005. This segment represented 78.4% and 82.0% of total revenue for the years ended December 31, 2004, and 2003, respectively. We own approximately 161,000 pieces of movable medical equipment, primarily in the categories of respiratory therapy, newborn care, critical care, patient monitors, and bariatric and pressure area management.

We currently provide outsourcing services to more than 3,200 acute care hospitals in the United States, including some of the nation’s premier healthcare institutions. Our re-entry into the bariatric market during the second quarter of 2004 has given us new opportunities with many of our existing customers.

We have contracts in place with many of the leading national GPOs for both the acute care and alternate site markets. We also have agreements directly with national acute care and alternate site providers. We expect much of our future growth in this segment to be driven by our customers outsourcing more of their movable medical equipment needs and taking full advantage of our expanded offering of long-term outsourcing agreements and Asset Management Partnership Programs (“AMPPs”).

In our outsourcing programs we provide our customers with the use of movable medical equipment that we maintain for our customers by performing preventative maintenance, repairs, cleaning and testing, and maintaining certain reporting records. We also provide prompt replacement of any non-working equipment and the flexibility to upgrade equipment as technology changes. We have three primary outsourcing programs:

| | • | | Supplemental and Peak Needs Usage.Our basic outsourcing program is renting patient-ready, movable medical equipment to our customers on a supplemental or peak needs basis. Many of our customers have traditionally owned only the amounts and types of such equipment necessary to service their usual and customary bed census and their typical range of treatment offerings. Our customer rely on us to fulfill many of their equipment needs when they experience a peak in census, do not have the resources to maintain their owned equipment in patient-ready condition, or require equipment for less common treatments. The equipment can be obtained on a daily, monthly or pay-per-use basis. Supplemental and peak needs activity is impacted by changes in hospital patient census and patient acuity which typically fluctuate on a seasonal basis; |

| | • | | Long-Term Outsourcing Agreements.We also offer our customers the opportunity to obtain movable medical equipment through long-term outsourcing agreements. By executing a long-term outsourcing agreement, our customers are able to secure the availability of an identified pool of patient-ready equipment and to pay for it over a number of months, years or on a pay-per-use basis; and |

4

Asset Management Partnership Programs.Our AMPP program allows our customers to outsource the responsibilities and costs of effectively managing movable medical equipment, with the added benefit of enhancing equipment utilization. With UHS asset management, equipment types and quantities are adjusted to meet changes in patient census and acuity. Our employees work at the customers’ sites to integrate our equipment management process and technology tools into the customers’ day-to-day operations. We assume full responsibility for delivering equipment where and when it is needed, removing equipment that is no longer in use and cleaning equipment between every patient use. We also perform required training and “in service” sessions to keep our customers’ staffs fully-trained and knowledgeable about the use and operation of key equipment. Our AMPP programs include management of our equipment at the customer’s facility and/or management of customer-owned equipment. As of December 31, 2005, we had 47 AMPP programs.

Our medical equipment programs enable health care providers to replace the fixed costs of owning and/or leasing medical equipment with variable costs that are more closely related to their revenues and current equipment needs. The increased flexibility and services provided to our customers allows them to:

| | • | | access our extensive data and expertise on the cost, performance, features and functions of all major items of medical equipment; |

| | • | | increase productivity of available equipment; |

| | • | | reduce maintenance and management costs through the use of our technology and knowledgeable outsourcing staff; |

| | • | | increase the productivity and satisfaction of their nursing staff by allowing them to focus on primary patient care responsibilities, leading to lower attrition rates; |

| | • | | reduce equipment obsolescence risk; and |

| | • | | facilitate compliance with regulatory and record keeping requirements and manufacturers’ specifications on tracking and maintenance of medical equipment. |

Technical and Professional Services Segment – Plan & Acquire; Maintain & Repair

Our Technical and Professional Services segment accounted for $29.7 million, or approximately 13.7%, of our revenues for the year ended December 31, 2005. This segment represented 12.8% and 8.6% of total revenue for the years ended December 31, 2004, and 2003, respectively. We leverage our 65 plus years of experience and our extensive equipment database in repairing and maintaining medical equipment. We offer a broad range of inspection, preventative maintenance, repair, logistic and consulting services through our team of over 200 technicians and professionals located in our nationwide network of offices.

Our Technical and Professional Services segment offerings are less capital intensive than our Medical Equipment Outsourcing segment and provide a complementary alternative for customers that wish to own their medical equipment but lack the expertise, funding or scale to perform maintenance, repair and analytical functions.

5

Our technicians are trained and certified on an ongoing basis directly by equipment manufacturers to enable them to be skilled in servicing a wide spectrum of medical equipment. They are required to maintain current certifications, to be cross-trained across equipment lines and to refresh their training on a regular basis. We also operate a quality assurance department to develop and document our own quality standards for our equipment. All equipment maintenance, inspection and repair services are performed to our specifications. We utilize proprietary record keeping software to record these services which meets the applicable standards of the Joint Commission on Accreditation of Healthcare Organizations (“JCAHO”), the National Fire Protection Association (“NFPA”) and the Food and Drug Administration (“FDA”). These maintenance records are available to our customers and to regulatory agencies to verify the maintenance of our equipment throughout its useful life.

Programs

| | • | | Supplemental Maintenance and Repair Services.We provide maintenance and repair services that supplement the customer’s current maintenance management practices on a scheduled and unscheduled basis. As part of these services, we provide service documentation that supports the customer’s regulatory reporting requirements. These maintenance and repair services include fee-for-service arrangements, scheduled maintenance and inspection services, full service maintenance, inspection and repair services and vendor management services in which we manage the manufacturer and/or third part vendors for service delivery, typically on laboratory and radiology equipment. |

| | • | | Resident Programs. We also provide full and part-time resident-based equipment maintenance programs that provide all the benefits of our supplemental maintenance and repair programs but with the addition of onsite UHS employees, coordinated management of subcontractors, and a broad range of equipment management consulting services. We market these programs under the TEAM (“Technical Equipment Asset Management”) and CHAMP® (“Community Hospital Asset Management Program”) names. Through these programs, UHS coordinates the service and maintenance needs of an entire facility for all clinical equipment. |

As of December 31, 2005, we had 84 TEAM and CHAMP® resident programs within this segment.

| | • | | Consulting Services. We provide equipment consulting services as part of our other equipment management programs or as stand alone services. Some examples of our consulting services include technology baseline assessments, product comparison research and equipment utilization studies. |

6

Customers

| | • | | Manufacturers.We provide our services to medical equipment manufacturers that do not have the nationwide support or infrastructure to service their products. Our offerings include logistics and loaner management programs, depot or on-site warranty repair, non-warranty repair, product recall, field upgrades, maintenance or repairs, and onsite installation and in-service education. |

| | • | | Large Hospitals.We provide our services to large hospitals on a supplemental and fully outsourced basis. Our services are requested by in-house hospital biomedical departments on a supplemental basis because of our wealth of experience and expertise with movable medical equipment and to alleviate the increasing workload demands on in-house departments. |

| | • | | Small Hospitals and Critical Access Hospitals.We offer full lifecycle asset management services, including professional and technical services, to small hospitals (those with fewer than 150 beds) and Critical Access Hospitals. Critical Access Hospitals are rural community hospitals that receive cost-based Medicare reimbursement. These customers typically lack the resources to evaluate, acquire, manage, maintain, repair and dispose of medical equipment or technology and draw upon our vast experience in these areas to assist them. Our premier service to these customers is our CHAMP® program. |

| | • | | Alternate Site Providers.We offer our technical and repair services to alternate site providers, such as nursing homes and home care providers. Our nationwide service and repair network allows equipment to be repaired on site, or picked up and repaired in one of our offices. |

While our contracts with GPOs once were solely to provide medical equipment outsourcing services, we have expanded some of our agreements with these organizations to include Technical and Professional Services.

Medical Equipment Sales and Remarketing Segment- Redeploy & Remarket

Our Medical Equipment Sales and Remarketing segment accounted for $18.6 million, or approximately 8.6%, of our revenues for the year ended December 31, 2005. This segment represented 8.8% and 9.4% of total revenue for the years ended December 31, 2004, and 2003, respectively. This segment includes three distinct business activities:

| | • | | Medical Equipment Remarketing and Disposal.We are one of the nation’s largest buyers and sellers of pre-owned movable medical equipment. We also buy, source, remarket and dispose of pre-owned medical equipment for our customers through our Asset Recovery Program. This program provides our customers the ability to sell their unneeded assets for immediate cash or credit. We provide fair market value assessments and buy-out proposals on equipment |

7

the customer intends to traded-in for equipment upgrades so that the customer can evaluate the manufacturer’s offer. Customers can also take advantage of our disposal services, which remove equipment that has no remaining economic value in a safe and environmentally appropriate manner. We educate hospitals on the optimal opportunity to evaluate upgrades based on the changes in technology and market conditions for their current equipment. We also remarket used medical equipment to secondary market buyers.

UHS remarkets used medical equipment to hospitals, alternate care providers, veterinarians and equipment brokers. This segment of our business focuses on providing solutions to customers that have capital budget dollars available. We offer a wide range of equipment from our standard movable medical equipment to diagnostic, ultrasound and x-ray equipment. Total used and fleet equipment sales increased 29.4% over 2004 and we continue to view this as a growth opportunity.

| | • | | Specialty Medical Equipment Sales and Distribution.We use our national infrastructure to provide sales and distribution for manufacturers of specialty medical equipment. Our distribution services include providing demo services and product maintenance services. We act as distributors only for a limited number of products that are particularly suited to our national distribution network, or for those products that fit with our ability to provide technical support. We currently sell equipment in many product lines including, but not limited to, percussion vests, continuous passive motion machines, patient monitors, patient transfer systems and infant security systems. |

| | • | | Disposables Sales.We offer our customers single use disposable items. Most of these items are used in connection with our outsourced equipment. Although we do not view this as a core growth business, we offer these products as a convenience to customers and to complement our full medical equipment lifecycle offerings. |

BUSINESS OPERATIONS

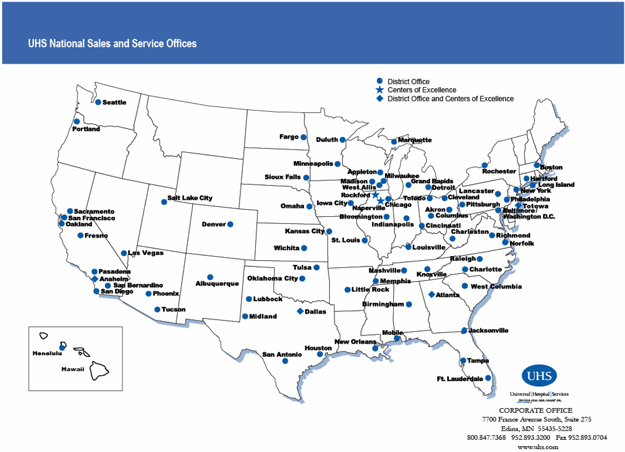

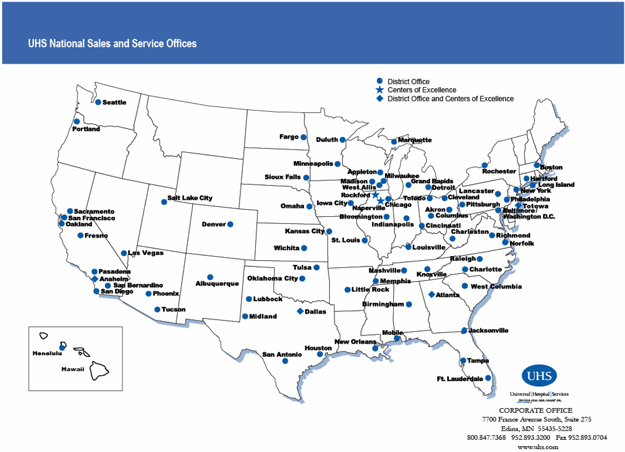

District Offices

We currently operate 75 district offices throughout the United States, which allows us to service customers in all 50 states. Each district office maintains an inventory of equipment and other items tailored to accommodate the needs of individual customers within its geographical area. Should additional or unusual equipment be required by one of our customers, a district office can draw upon the resources of all of our other districts, with access to approximately 161,000 owned pieces of equipment, and is often able to obtain the necessary equipment within 24 hours.

Our district offices are staffed by multi-disciplined teams of sales professionals, service representatives, customer account representatives and biomedical equipment technicians trained to provide the spectrum of services we offer our customers.

8

In late 2005 we combined the former Customer Service and Technical Services organizations into one Operations organization. This move was made to leverage operating efficiencies and further enhance customer service. Most district offices are now staffed with dedicated technicians that perform technical services on UHS-owned and customer-owned equipment. The combination also enables us to offer warranty, non-warranty, upgrades and other services to our healthcare and equipment manufacturer customers.

Centers of Excellence

Our district office network is supported by six strategically located Centers of Excellence that focus on providing more specialized depot technical services on a regional and national basis. Centers of Excellence also provide overflow support and specialized depot service functions for our district offices and customized depot service operations for our manufacturer customers.

Centralized Functions

Our corporate office is located in Edina, Minnesota. We have centralized many of the key elements of our equipment and service offerings in order to maximize our operating

9

efficiencies and uniformity of service. Some of the critical aspects of our business that we have centralized include contract administration, purchasing, pricing, logistics, and information technology.

Rental Equipment Fleet

We acquire medical equipment to meet our customers’ needs in five primary product areas: respiratory therapy, newborn care, critical care, patient monitors and bariatric and pressure area management. We maintain one of the most technologically advanced equipment fleets in the industry, routinely acquiring new and pre-owned equipment to enhance our fleet. Our specialized equipment portfolio managers evaluate new products each year to keep abreast of current market technology and to determine whether to add new products to our equipment fleet. In making equipment purchases, we consider a variety of factors, including manufacturer credibility, repair and maintenance costs, anticipated user demand, equipment mobility, and anticipated obsolescence. As of December 31, 2005, we owned approximately 161,000 pieces of equipment available for use by our customers.

During 2005, approximately 90% of our movable medical equipment purchases were from over 150 manufacturers and 10% from the used equipment market. Our ten largest manufacturers of movable medical equipment supplied approximately 56% (measured in dollars spent) of our direct movable medical equipment purchases. In 2005, our largest movable medical equipment supplier was Cardinal Health, Inc., which accounted for over 20% of our movable medical equipment purchases.

We seek to ensure availability of equipment at favorable prices. Although we do not generally enter into long-term fixed price contracts with suppliers of our equipment, we may receive price discounts related to the volume of our purchases. The purchase price we pay for equipment generally ranges from $1,000 to $45,000 per item.

OUR STRENGTHS

We believe our business model presents an attractive value proposition to our customers and has resulted in significant growth in recent years. We service customers across the spectrum of the equipment life cycle as a result of our position as one of the industry’s largest purchasers, outsourcers and resellers of movable medical equipment.

We attribute our historical success to, and believe that our potential for future growth comes from, the following strengths:

Unique position in the health care arena. We believe that we are the only national company providing full movable medical equipment lifecycle services to the health care industry. While we have competitors that may offer various stages of the lifecycle, none provide the comprehensive approach to customers that we do. Our extensive and long-standing relationships with more than 3,200 hospitals, approximately 3,100 alternate site providers, over 200 medical equipment manufacturers and the nation’s most prominent GPOs and IDNs present a considerable competitive advantage over our smaller regional competitors.

10

We are uniquely positioned in the health care industry as a result of our:

| | • | | investment in the industry’s largest, most extensive and modern fleet of movable medical equipment; |

| | • | | nationwide infrastructure for service and logistics; |

| | • | | proprietary medical equipment management software and tools; |

| | • | | commitment to customer service that has earned us a reputation as a leader in quality and service in our industry; and |

| | • | | extensive knowledge and experience in acquiring, managing, maintaining and remarketing medical equipment. |

Large, modern equipment fleet. We own and manage an extensive, modern fleet of movable medical equipment, consisting of approximately 161,000 owned units. This modern equipment fleet, along with our quality assurance programs and tools, minimizes obsolescence risk and places us in a leadership position in the areas of quality and patient safety. It also places us in a unique position to service “high end” acute care hospitals, such as teaching, research or specialty institutions that demand the most current technology to satisfy the increasingly complex needs of their patients.

Nationwide infrastructure. We have a broad, nationwide service network coupled with focused and customized operations at the local level. Our extensive network of district offices and Centers of Excellence and our 24-hours-a-day, 365 days-a-year service capabilities enable us to compete effectively for large, national contracts as well as to drive growth regionally and locally.

Proprietary software and asset management tools. We have used our more than 65 years of experience and our extensive database of equipment management information to develop sophisticated software technology and management tools. These tools have allowed us to become a leader in meeting the demands of customers by delivering sophisticated asset management programs that we use to drive cost efficiencies, equipment productivity and patient safety programs. We believe that our continued and significant investment in new tools and technology will help us to maintain our leadership role in the industry.

Superior customer service.We have a long-standing reputation among our customers for service and quality. This reputation is largely due to our customer service culture, which is continuously reinforced through significant investment in hiring and training resources. We strive to seamlessly integrate our employees and service offerings into the operations of our customers. This aggressive focus on customer service has helped us achieve a high customer retention rate.

Proven management team. We have an industry leading management team with an average of approximately 12 years of health care experience. Our management team has

11

successfully supervised the development of our competitive strategy, continually enhanced our service and product offerings, established our nationwide coverage and furthered our reputation as the industry’s service and quality leader.

Industry with favorable fundamentals. Our business benefits from the overall favorable trends in health care in general and our segments in particular. There is a fundamental shift in the needs of hospitals and alternate site providers from supplemental and peak needs supply of movable medical equipment to full equipment lifecycle asset management programs. This move to full outsourcing is not unlike trends in similar services at hospitals including food services, laundry, professional staffing and technology. The strong fundamentals in medical equipment outsourcing are being driven by the following trends:

| | • | | Favorable demographic trends. According to the U.S. Census Bureau, individuals aged 65 and older in the United States comprise the fastest growing segment of the population, and that segment is expected to grow to approximately 40 million by 2010. As a result, over time the number of patients and the volume of hospital admissions are expected to grow. The aging population and increasing life expectancy are increasing demand for health care services. |

| | • | | Increase in obesity.The U.S. population is getting heavier with 42 states now having obesity prevalence rates over 20%, compared to zero states with such rates in 1991 (Source: CDC Obesity Trends 2004). Therefore, health care facilities must be prepared for the needs of obese and morbidly obese patients. |

| | • | | Increased capital and operating expense pressures. As hospitals continue to experience tight capital and operating budgets, and while the cost and complexity of medical equipment increases, we expect that hospitals will increasingly look to us to source these capital equipment needs and manage medical equipment to achieve capital operating expense savings and efficiencies. |

| | • | | Nursing and professional staffing satisfaction. As hospitals continue to experience staffing pressures, we expect that they will increasingly turn to our programs to alleviate medical equipment management duties for nurses and professional staff to increase their overall job satisfaction levels. |

Strong value proposition.With our focus and expertise in medical equipment lifecycle management, we are able to create a strong value proposition for our customers. We provide our customers with the ability to improve their performance with respect to equipment acquisition, efficiency, utilization, management, maintenance, repair and disposal. We also can help our customers improve employee satisfaction, patient safety and regulatory compliance.

No direct reimbursement risk.Many health care providers rely on payment from patients or reimbursement from governmental or other third party payors. Our fees are

12

paid directly by our acute care hospital, alternate site and manufacturer customers rather than through third party payors. Accordingly, our exposure to uncollectible patient or reimbursement receivables or governmental reimbursement changes is reduced, as evidenced by our bad debt expense of approximately 0.4% of total revenues for the year ended December 31, 2005.

GROWTH STRATEGY

Historically, we have experienced significant and sustained organic and strategic growth. Our overall growth strategy is to continue to grow both organically and through strategic acquisitions.

Organic Growth

We believe that the following external and market factors will provide us significant growth opportunities:

| | • | | increasing life expectancy; |

| | • | | increasing patient acuity; |

| | • | | continued increase in the number and sophistication of medical technologies; |

| | • | | increasing cost and staffing pressures in hospitals; and |

| | • | | continuing growth of outsourcing of non-core functions by hospitals, alternate site providers and manufacturers. |

Our organic growth will be driven internally by the following factors:

| | • | | converting transactional rental and biomedical service customers to fully outsourced resident-based programs; |

| | • | | aggressively growing our less capital intensive technical and professional services and equipment sales and remarketing businesses; |

| | • | | increasing the number of hospitals, alternative care facilities and manufacturers to which we provide services; |

| | • | | expanding our relationships with GPOs and other national account customers; and |

| | • | | leveraging our broad range of service offerings to give us opportunities to serve new customers, and to provide new services to existing customers. |

Acquisitions

In recent years, we have made and successfully integrated several strategic acquisitions that have helped us expand our business by increasing our market share in existing markets, adding additional service offerings, and enabling us to penetrate new geographic regions. We intend to continue to pursue a disciplined course of growing our business with complementary acquisitions, and we regularly evaluate potential acquisitions.

COMPETITION

An analysis of our competition as it relates to our three business segments follows:

13

Medical Equipment Outsourcing Segment

We believe that the strongest competition to our outsourcing programs is the traditional purchase and lease alternatives for obtaining movable medical equipment. Currently, many acute care hospitals and alternate site providers view outsourcing primarily as a means of meeting short-term or peak supplemental needs, rather than as a long-term alternative to purchasing or leasing equipment and managing that equipment through its full lifecycle. Although we believe that we can demonstrate the cost-effectiveness of outsourcing patient-ready movable medical equipment and its management in the healthcare setting, we believe that many health care providers will continue to purchase or lease and manage internally a substantial portion of their movable medical equipment until they are educated in the advantages and efficiencies of outsourcing.

We compete with a limited number of national companies. Our largest, national competitor is Hill-Rom, a subsidiary of Hillenbrand Industries. Our other competition consists of regional or local companies and some movable medical equipment manufacturers and dealers that provide equipment outsourcing to augment their movable medical equipment sales. Local and regional companies often have difficulty maintaining equipment fleets with the latest technology available due to capital constraints and are frequently challenged with the lack of a full product offering. Therefore, most of our competitors tend to compete on price. In addition, local and regional companies often do not have the national infrastructure to service the large GPO and IDN systems.

Technical and Professional Services Segment

We face significant and direct competition in the technical and professional services area from many national, regional and local service providers, as well as from manufacturers. In addition, many of our customers choose to perform these functions using their own personnel. We believe that through our nationwide network of highly trained technicians, strong customer relations and extensive equipment database, we offer customers an attractive alternative for performing biomedical repair services on their equipment.

Medical Equipment Sales and Remarketing Segment

In medical equipment sales, we face significant direct competition from a variety of manufacturers and distributors on a nationwide basis. As a result, we are selective in our pursuit of these opportunities. The equipment remarketing market is highly fragmented with low barriers to entry. In addition to manufacturers seeking to control the remarketing and disposal of their own products, we compete with a number of localized or more specialized providers of remarketing and disposal services.

14

EMPLOYEES

We had 1,139 employees as of December 31, 2005, including 1,032 full-time and 107 part-time employees. Of such employees, 119 were sales representatives, 678 were operations personnel, 133 were employed in corporate support functions, and 209 were hospital service personnel.

None of our employees are covered by a collective bargaining agreement, and we have experienced no work stoppages to date. We believe that our relations with our employees are good.

INTELLECTUAL PROPERTY

We use “UHS®”, the UHS logo and “CHAMP®” as service marks in connection with our services and have registered these marks with the United States Patent and Trademark Office. We use the “Equipment Lifecycle Services”sm, and the Equipment Lifecycle Services logo as service marks in connection with our services. We have applied for federal trademark registration of the Equipment Lifecycle Services logo with the United States Patent and Trademark Office. U.S. service mark registrations are generally for a term of 10 years, renewable every 10 years as the mark is used in the regular course of business.

We have a domain name registration for UHS.com, which serves as our main website, and my.UHS.com and myservice.UHS.com, which are web-based tools that provide 24 hour on-demand access to equipment reports for all equipment outsourced or maintained by us.

We have developed proprietary software programs including the Asset Information Management System for Central Services (“AIMS/CS”), Resource for Equipment Documentation System (“REDS”) and Operator Error Identification System (“OEIS”). AIMS/CS is a medical equipment inventory management system that allows customers to track the location and usage of their leased and owned medical equipment using barcodes and hand held laser scanners. Our proprietary REDS and OEIS programs are specifically designed to help customers meet medical equipment documentation and reporting needs under applicable regulations and standards, such as those promulgated by the FDA and JCAHO.

MARKETING

We market our programs primarily through our direct sales force, which consisted of 119 professional sales representatives as of December��31, 2005. In the third quarter of 2004, we separated sales and customer service in the field to provide focused responsibility for each function. During 2005 we reorganized the sales team from three geographic regions (East, Central and West) to two (East and West) and reduced the number of sales divisions from 13 to 12. These changes were made to increase efficiencies by eliminating unnecessary management positions, to balance the regions and divisions more evenly in terms of revenue and to improve customer coverage.

15

We also market through our website, www.uhs.com, participation in numerous national and regional conventions, and placement of articles and advertisements in industry-leading publications.

In our marketing efforts we primarily target key decision makers, such as administrators, chief executive officers and chief financial officers as well as materials managers, department heads and directors of purchasing, nursing and central supply. We also promote our programs and services to hospital, manufacturer and alternate care provider groups and associations.

SEASONALITY/BUSINESS INTERRUPTION

Quarterly operating results are typically affected by seasonal factors. Historically, our first and fourth quarters are the strongest, reflecting increased hospital census and patient acuity during the fall and winter months. Our business can also be impacted by natural disasters, such as hurricanes and earthquakes, which affect our ability to transfer equipment to and from our customers.

REGULATORY MATTERS

Sarbanes-Oxley.

During 2006 we anticipate that we will incur additional expenses related to the management’s report, auditor’s attestation report and other requirements under Section 404 of the Sarbanes-Oxley Act of 2002. We incurred third party costs related to Section 404 compliance totaling $0.2 million and $0.6 million in 2004 and 2005, respectively. On September 21, 2005, the Securities and Exchange Commission (“SEC”) announced that the compliance date for non-accelerated filers (such as UHS) was extended to the first fiscal year ending on or after July 15, 2007.

Regulation of Medical Equipment.

Our customers are subject to documentation and safety reporting regulations and standards with respect to the medical equipment they use, including those established by the FDA, JCAHO, and the NFPA. Some states and municipalities also have similar regulations.

Our REDS and OEIS programs (see description in “Intellectual Property” section of this Form 10-K) are specifically designed to help customers meet documentation and reporting needs under such regulations and standards. We also monitor changes in regulations and standards and work to accommodate the needs of customers by providing specific product and manufacturer information upon request. Manufacturers of medical equipment are subject to regulation by agencies and organizations such as the FDA, Underwriters Laboratories, and the NFPA. We believe that all movable medical equipment we outsource conforms to these regulations.

16

The Safe Medical Devices Act of 1990 (“SMDA”), which amended the Food, Drug and Cosmetic Act (“FDCA”), requires manufacturers, user facilities, and importers of medical devices to report deaths and serious injuries which a device has or may have caused or to which a device has or may have contributed. In addition, the SMDA requires the establishment and maintenance of adverse event files and various other FDA reports. Manufacturers and importers are also required to report certain device malfunctions. We work with our customers to assist them in meeting their reporting obligations under the FDCA, including those requirements added by the SMDA.

As a distributor of medical devices, we are required by the FDCA to maintain device complaint records containing any incident information regarding the identity, quality, durability, reliability, safety, effectiveness or performance of a device. We are required to retain copies of these records for a period of two years from the date of inclusion of the record in the file or for a period of time equivalent to the expected life of the device, whichever is greater, even if we cease to distribute the device. Finally, we are required to provide authorized FDA employees access to copy and verify these records upon their request. We have current compliance records regarding maintenance, repairs, modification, and user-error with respect to all of our equipment.

Besides the FDA, a number of states regulate medical device distributors and wholesalers either through pharmacy or device distributor licensure. Currently, we hold licenses in 12 states. Some licensure regulations and statutes in additional states may apply to our activities. Although our failure to possess such licenses in these states for our existing operations may subject us to certain monetary fines, we do not believe the extent of such fines, in the aggregate, would be material to our liquidity, financial condition or results of operation.

In addition, we are required to provide information to the manufacturer regarding the permanent disposal or any change in ownership of certain categories of medical outsourcing equipment. We believe our medical equipment tracking systems are in material compliance with these regulations.

The Health Insurance Portability and Accountability Act of 1996, (“HIPAA”), applies to certain covered entities, including health plans, health care clearinghouses and health care providers. HIPAA regulations protect individually identifiable health information, including information in an electronic format, by, among other things, setting forth specific standards under which such information may be used and disclosed, furnishing patient rights to obtain and amend their health information, and establishing certain administrative requirements for covered entities.

Because of our self-insured health plans, we are a covered entity under the HIPAA regulations. Also, we may be obligated contractually to comply with certain HIPAA requirements as a business associate of various health care providers. In addition, various state legislatures may enact additional privacy legislation that is not preempted by the federal law, which may impose additional burdens on us. Accordingly, we have made and, as new standards go into effect, we expect to continue to make administrative, operational and information infrastructure changes in order to comply with these rules.

17

Third Party Reimbursement

Our fees are paid directly by our customers rather than through direct reimbursement from private insurers or governmental entities, such as Medicare or Medicaid. We do not bill the patient, the insurer or other third party payors directly for services provided for hospital inpatients or outpatients. Payment to health care providers by third party payors for our services depends substantially upon the reimbursement policies of these payors. Consequently, those policies have a direct effect on the ability of health care providers to pay for our services and an indirect effect on our level of charges. Also, in certain circumstances, third party payors may take regulatory or other action against service providers even though the service provider does not receive direct reimbursement from third party payors.

Hospitals and alternate site providers are facing increased cost containment pressures from public and private insurers and other managed care providers, such as health maintenance organizations, preferred provider organizations and managed fee-for-service plans, as these organizations attempt to reduce the cost and utilization of healthcare services. We believe that these payors have followed or will follow the federal government in limiting reimbursement through preferred provider contracts, discounted fee arrangements and capitated (fixed patient care reimbursement) managed care arrangements. In addition to promoting managed care plans, employers are increasingly self funding their benefit programs and shifting costs to employees through increased deductibles, co-payments and employee contributions. We believe that these cost reduction efforts will place additional pressures on health care providers’ operating margins and will encourage efficient equipment management practices, such as use of our outsourcing and AMPP services.

Liability and Insurance

Although we do not manufacture any medical equipment, our business entails the risk of claims related to the outsourcing, sale and service of medical equipment. In addition, our instruction of hospital employees with respect to the equipment’s use and our professional consulting services are sources of potential claims. We have not suffered a material loss due to a claim; however, any such claim, if made, could have a material adverse effect on our business. We maintain a number of insurance policies including commercial general liability coverage (product and premises liability insurance), automobile liability insurance, worker’s compensation insurance and professional liability insurance. We also maintain excess liability coverage. Our policies are subject to annual renewal. We believe that our current insurance coverage is adequate. Claims exceeding such coverage may be made and we may not be able to continue to obtain liability insurance at acceptable levels of cost and coverage.

18

ITEM 1A: Risk Factors

Our business faces many risks. Any of the risks discussed below, or elsewhere in this Form 10-K or our other filings with the SEC, could have a material impact on our business, financial condition or results of operations. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may also impair our business operations.

If the patient census of our customers decreases, the revenues generated by our business could decrease.

Our operating results are dependent in part upon the amount and types of equipment necessary to service our customers’ needs which are heavily influenced by the total number of patients our customers are serving at any time (which we refer to as “patient census”). At times of lower patient census, our customers have a decreased need for our services on a supplemental or peak needs basis. Our operating results can vary depending on, for example, the timing and severity of the cold and flu season, local, regional or national epidemics, and the impact of national catastrophes, as well as other factors affecting patient census.

If we are unable to fund our significant cash needs, we may be unable to expand our business as planned or to service our debt.

We require substantial cash to operate our Medical Equipment Outsourcing programs and service our debt. Our outsourcing programs require us to invest a significant amount of cash in movable medical equipment purchases. To the extent that such expenditures cannot be funded from our operating cash flow, borrowings under our senior secured credit facility or other financing sources, we may not be able to grow as currently planned. We currently expect that over the next 12 months we will invest approximately $45-50 million in new movable medical equipment and other capital expenditures. This estimate is subject to numerous assumptions, including revenue growth, the number of AMPP signings, and any significant changes in GPO contracts. In addition, a substantial portion of our cash flow from operations must be dedicated to servicing our debt and there are significant restrictions on our ability to incur additional indebtedness under the indenture governing our 10.125% senior notes due 2011 and our Amended Credit Agreement.

Primarily because of our debt service obligations and debt refinancing charges, we have had a history of net losses. If we continue to incur net losses, this could result in our inability to finance our business in the future. We had net losses of $19.5 million, $3.6 million and $1.6 million for the years ended 2003, 2004 and 2005, respectively.

19

If we are unable to meet certain financial and operating covenants contained in our Amended Credit Agreement or Senior Notes, our creditors could accelerate the debt or restrict further borrowing.

Our Amended Credit Agreement and our Senior Notes contain financial and operating covenants. (For a summary of the covenants under the Amended Credit Agreement, see “Covenants Under Our Amended Credit Agreement” in Item 7 of this Form 10-K). If we fail to meet these covenants or obtain appropriate waivers, our creditors have a number of remedies including, but not limited to, acceleration of our debt or placement of restrictions on further borrowing.

If we are unable to change the manner in which health care providers traditionally procure medical equipment, we may not be able to achieve significant revenue growth.

We believe that the strongest competition to our outsourcing programs is the traditional purchase or lease alternative for obtaining movable medical equipment. Currently, many acute care hospitals and alternate site providers view outsourcing primarily as a means of meeting short-term or peak supplemental needs, rather than as a long-term, effective and cost efficient alternative to purchasing or leasing equipment. Many health care providers may continue to purchase or lease a substantial portion of their movable medical equipment.

Our competitors may engage in significant price competition or liquidate significant amounts of surplus equipment, thereby decreasing the demand for outsourcing services and possibly causing us to reduce the rates we charge for our services.

In a number of our geographic and product markets, we compete with one principal competitor and various smaller equipment outsourcing companies that compete primarily on the basis of price. These competitors may offer certain customers lower prices depending on utilization levels and other factors. Our largest, national competitor is Hill-Rom, a subsidiary of Hillenbrand Industries. Our competition may engage in competitive practices that may undercut our pricing. In addition, a competitor may liquidate significant amounts of surplus equipment, thereby decreasing the demand for outsourcing services and possibly causing us to reduce the rates we may charge for our services.

We have relationships with certain key suppliers, and adverse developments concerning these suppliers could delay our ability to procure equipment or increase our cost of purchasing equipment.

We purchased movable medical equipment from over 150 manufacturers in 2005. Our ten largest manufacturers of movable medical equipment accounted for approximately 56% of our direct movable medical equipment purchases in 2005. Adverse developments concerning key suppliers or our relationships with them could force us to seek alternative sources for our movable medical equipment or to purchase such equipment on unfavorable terms. A delay in procuring equipment or an increase in the cost to purchase equipment could limit our ability to provide equipment to our customers on a timely and cost-effective basis. If we are unable to have access to parts or if manufacturers do not provide access to equipment manuals or training, we may not be able to provide certain technical and professional services.

20

A substantial portion of our revenues come from customers with whom we do not have long-term commitments and cancellations by or disputes with customers could decrease the amount of revenues we generate, thereby reducing our ability to operate and expand our business.

We derived approximately 67% of our outsourcing revenues for the year ended December 31, 2005, from customers with which we do not have any formal long-term commitment to use our programs. Our customers are generally not obligated to outsource our equipment under long-term commitments. In addition, many of our customers do not sign written agreements with us fixing the rights and obligations of the parties regarding matters such as billing, liability, warranty or use. Therefore, we face risks such as fluctuations in usage, inaccurate or false reporting of usage by customers and disputes over liabilities related to equipment use. We do not have written agreements with some of our AMPP customers for which we provide a substantial portion of the movable medical equipment that they use and provide substantial staffing resources. These arrangements could be terminated by the healthcare provider without notice or payment of any termination fee. A large number of such terminations may adversely affect our ability to generate revenue growth and sufficient cash flows to support our growth plans.

If we are unable to renew our contracts with GPOs or IDNs, we may lose existing customers, thereby reducing the amount of revenues we generate.

Our past revenue growth and our strategy for future growth depends, in part, on access to the new customers granted by our major contracts with GPOs and IDNs. In the past, we have been able to renew such contracts when they are up for renewal. If we are unable to renew our current GPO contracts, we may lose a portion of existing business with the customers who are members of such GPOs.

Although we do not manufacture any medical equipment, our business entails the risk of claims related to the medical equipment that we outsource and service. We may not have adequate insurance to cover a claim, and it may be more expensive or difficult for us to obtain adequate insurance in the future.

We may be liable for claims related to the use of our movable medical equipment or to our maintenance or repair of a customer’s movable medical equipment. Any such claims, if made and upheld, could make our business more expensive to operate and therefore less profitable. We may be subject to claims exceeding our insurance coverage or we may not be able to continue to obtain liability insurance at acceptable levels of cost and coverage. In addition, litigation relating to a claim could adversely affect our existing and potential customer relationships, create adverse public relations and divert management’s time and resources from the operation of the business.

21

Our growth strategy depends in part on our ability to successfully identify and manage our acquisitions and a failure to do so could impede our future revenue growth, thereby weakening our position in the industry with respect to our competitors.

As part of our growth strategy, we intend to pursue acquisitions or other strategic relationships within the health care industry that we believe will enable us to generate revenue growth and enhance our competitive position. During 2005, we acquired substantially all the assets of one business for the purchase price of $1.1 million. Future acquisitions may involve significant cash expenditures that could impede our future revenue growth. In addition, our efforts to execute our acquisition strategy may be affected by our ability to identify suitable candidates and negotiate and close acquisitions. We regularly evaluate potential acquisitions. We may not be successful in acquiring other businesses, and the businesses we do acquire in the future may not ultimately produce returns that justify our related investment.

Acquisitions may involve numerous risks, including:

| | • | | difficulties assimilating personnel and integrating distinct business cultures; |

| | • | | diversion of management’s time and resources from existing operations; |

| | • | | potential loss of key employees or customers of acquired companies; and |

| | • | | exposure to unforeseen liabilities of acquired companies. |

If we are unable to continue to grow through acquisitions, our ability to generate revenue growth and enhance our competitive position may be impaired.

We depend on our sales professionals and service specialists and may lose customers when any of our sales professionals and service specialists leave us.

Our revenue growth has been supported by hiring and developing new sales professionals and service specialists and adding, through acquisitions, established sales professionals and service specialists whose existing customers generally have become our customers. We have experienced and will continue to experience intense competition for these resources. The success of our programs depends on the relationships developed between our sales professionals and service specialists and our customers.

Our cash flow fluctuates during the year because operating income as a percentage of revenue fluctuates with our quarterly operating results and we make semi-annual debt service payments.

Our results of operations have been and can be expected to be subject to quarterly fluctuations. We may experience increased revenues in the first and fourth quarters of the year, depending upon the timing and severity of the cold and flu season and the related increased hospital census and movable medical equipment usage during that season. Because a significant portion of our expenses are relatively fixed over these periods, our operating income as a percentage of revenue tends to increase during the first and fourth quarter of each year. If the cold and flu season is delayed by as little as one month, or is less severe than in prior periods, our quarterly operating results for a current period can vary significantly from prior periods. Our quarterly results can also fluctuate as a result of other factors such as the timing of acquisitions, new AMPP agreements or new office openings. In addition, semi-annual interest payments on our 10.125% senior notes are paid in the second and fourth quarters, thus leading to significant fluctuations in cash flow from operations.

22

Changes in reimbursement rates and policies by third-party payors for medical equipment costs may reduce the rates that providers can pay for our services, thereby requiring us to reduce our rates or putting our ability to collect payments at risk.

Our health care provider customers that pay us directly for the services we provide to them rely on reimbursement from third party payors for a substantial portion of their operating revenue. These third party payors include both governmental payors such as Medicare and Medicaid and private payors such as insurance companies and managed care organizations. There are widespread efforts to control health care costs in the United States by all of these payor groups. These cost containment initiatives have resulted in reimbursement policies based on fixed rates for a particular patient treatment that are unrelated to the providers’ actual costs or require health care providers to provide services on a discounted basis. Consequently, these reimbursement policies have a direct effect on health care providers’ ability to pay us for our services and an indirect effect on our level of charges. Ongoing concerns about rising health care costs may cause more restrictive reimbursement policies to be implemented in the future. Restrictions on the amounts or manner of reimbursements to health care providers may affect the financial strength of our customers and amount our customers are able to pay for our services.

In periods when significant health care reform initiatives were under consideration and uncertainty remained as to their likely outcome, our profits decreased as the cost of doing business increased. If other significant health care reform initiatives occur, they may have a similar, negative effect.

Because the regulatory and political environment for health care significantly influences the capital equipment procurement decisions of health care providers, our ability to generate profits has historically been adversely affected in periods when significant health care reform initiatives were under consideration and uncertainty remained as to their likely outcome.

A portion of our revenues are derived from home care providers and nursing homes, and these health care providers may pose additional credit risks.

Our nursing home and home care customers, may pose additional credit risks since they are generally less financially sound than hospitals. Nursing homes in particular have experienced significant financial problems since the implementation of the Balanced Budget Act of 1997. We may incur losses in the future due to the credit risks, including potential bankruptcy filings, associated with any of these customers.

23

The interests of our major stockholders may conflict with your interests, and these stockholders could cause us to take action that would be against your interests.

J.W. Childs Equity Partners, L.P. (JWC Fund I), J.W. Childs Equity Partners III, L.P. (JWC Fund III), JWC UHS Co-Invest LLC, JWC Fund III Co-Invest LLC, and Halifax Capital Partners, L.P., (Halifax), and their respective affiliates beneficially own shares representing over 90% of our outstanding common equity. Accordingly, these stockholders have the power to elect our board of directors, appoint new management and approve any action requiring a stockholder vote, including amendments to our certificate of incorporation and approving mergers or sales of substantially all of our assets. Such concentration of voting power could have the effect of deterring and preventing a change of control of our company that might otherwise be beneficial to our security holders. The directors so elected will have the authority to make decisions affecting our capital structure, including the issuance of additional indebtedness and the declaration of dividends. Circumstances may occur in which the interests of these equity holders could be in conflict with your interests.

Consolidation in the health care industry may lead to a reduction in the outsourcing rates we charge, thereby decreasing our revenues.

In recent years, many acute care hospitals and alternate site providers have consolidated to create larger health care organizations. We believe that this consolidation trend may continue. Any resulting consolidated health care organization may have greater bargaining power over us, which could lead to a reduction in the outsourcing rates that we are able to charge. A reduction in our outsourcing rates may decrease our revenues.

Our competitors may bundle products and services offered to customers, some of which we do not offer.

If competitors offer their products and services to customers on a combined basis with reduced prices, and we do not offer some of these products or cannot offer them on comparable terms, we may have a competitive disadvantage that will lower the demand for our services.

Our customers operate in a highly regulated environment and the regulations affecting them could lead to additional expenses associated with compliance and licensing, along with penalties resulting from possible violations, thereby increasing our costs and reducing income.

The healthcare industry is required to comply with extensive and complex laws and regulations at the federal, state and local government levels. While the majority of these regulations do not directly apply to us, there are some that do, including the FDCA and certain state pharmaceutical licensing requirements. Although we believe we are in compliance with the FDCA, if the FDA expands the reporting requirements under the FDCA, we may be required to comply with the expanded requirements and may incur substantial additional expenses in doing so. With respect to state licensing requirements, we are currently licensed in 12 states and may be required to be licensed in additional states. Our failure to possess such licenses for our existing operations may subject us to certain additional expenses.

24

Given that our industry is heavily regulated, we may be subject to additional regulatory requirements. If our operations are found to be in violation of any governmental regulations to which we or our customers are subject, we may be subject to the applicable penalty associated with the violation. Any penalties, damages, fines or curtailment of our operations would significantly increase our costs of doing business, thereby leading to difficulty generating sufficient income to support our business. Also, if we are found to have violated certain federal or state laws or regulations regarding Medicare, Medicaid or other governmental funding sources, we could be subject to fines and possible exclusion from participation in federal and state health care programs.

Although we do not manufacture any medical equipment, we own a large fleet of movable medical equipment which may be subject to equipment recalls or obsolescence.

We are required to incur significant expenditures of resources in order to maintain a large and modern equipment fleet. Our equipment may be subject to recalls that could be expensive to implement. We may be required to incur additional costs to repair or replace the equipment at our own expense or we may choose to purchase incremental new equipment from a supplier not affected by the recall. Additionally, our relationship with our customers may be damaged if we cannot promptly replace the equipment that has been recalled.

Our success is dependent, in part, on our ability to respond effectively to changes in technology. Since we maintain a large fleet of equipment, we are subject to the risk of equipment obsolescence. If advancements in technology render a substantial portion of our equipment fleet obsolete, we may experience a decrease in demand for our products which could adversely affect our operating results and cause us to invest in new technology to maintain our market share and operating margins.

We may incur increased vendor costs that we cannot pass through to our customers.

Our customer agreements may include limitations on our ability to increase prices over the term of the agreement. On the other hand, we rely on subcontractors to provide some of the services and we do not always have fixed pricing agreements with these subcontractors. Therefore, we are at risk of incurring increased costs that we are unable to pass through to our customer.

ITEM 1B: Unresolved Staff Comments

None.

ITEM 2: Properties

As of December 31, 2005, we operated 75 full service district offices and six technical service Centers of Excellence. We own our Minneapolis, Minnesota district office facility, consisting of approximately 24,000 square feet of office, warehouse, processing

25

and technical repair space. We lease our other district offices, averaging approximately 5,900 square feet, and our regional service centers. None of our offices is dedicated to a single business segment. Our corporate offices are located at a 41,000 square foot leased facility in Edina, Minnesota.

ITEM 3: Legal Proceedings

From time to time, we may become involved in litigation arising out of operations in the normal course of business. As of December 31, 2005, we were not a party to any pending legal proceedings the adverse outcome of which could reasonably be expected to have a material adverse effect on our operating results, financial position, or cash flows.

ITEM 4: Submission of Matters to a Vote of Security Holders

None.

PART II

ITEM 5: Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

As of March 26, 2006, there were 53 holders of our common stock, par value $.01 per share. There is no established public trading market for our common stock and during 2004 and 2005 we did not declare or pay a cash dividend on any class of our common stock. We intend to retain earnings for use in the operation and expansion of our business and therefore do not anticipate paying any cash dividends in the foreseeable future. Our debt instruments contain certain restrictions on our ability to pay cash dividends on our common stock (See Note 6, “Long Term Debt”, in the audited financial statements included in Item 15 of this Form 10-K, and the information regarding our revolving credit facility contained under the caption “Liquidity and Capital Resources” in Item 7 of this Form 10-K).

Pursuant to the exercise of outstanding options, on November 10, 2005, we sold 416 shares of common stock to a departing employee for the aggregate purchase price of $499.20. Such sale was completed pursuant to the exemption from registration provided under Section 4(2) of the Securities Act of 1933, as amended. The proceeds from the sale of such shares were added to our general funds and used for general corporate purposes.

We did not repurchase any of our equity securities during the fourth quarter of 2005.

ITEM 6: Selected Financial Data

The selected financial data presented below under the captions “Statement of Operations Data,” “Other Financial Data,” “Other Operating Data” and “Balance Sheet Data” for and as of each of the years in the five-year period ended December 31, 2005, are derived from our audited financial statements. The selected financial data presented below is qualified

26

in its entirety by, and should be read in conjunction with, the financial statements and notes thereto and other financial and statistical information included elsewhere in this Form 10-K, including the information contained under the caption “Management’s Discussion and Analysis of Financial Condition and Results of Operations”.

| | | | | | | | | | | | | | | | | | | | |

| | | Years Ended December 31, | |

| | | 2001 | | | 2002 | | | 2003 | | | 2004 | | | 2005 | |

| | | (dollars in thousands) | |

| Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total revenues | | $ | 125,635 | | | $ | 153,766 | | | $ | 171,005 | | | $ | 199,600 | | | $ | 215,904 | |

Cost of medical equipment outsourcing, sales and service | | | 67,872 | | | | 82,609 | | | | 95,398 | | | | 113,783 | | | | 127,049 | |

Gross Margin | | | 57,763 | | | | 71,157 | | | | 75,607 | | | | 85,817 | | | | 88,855 | |

| | | | | | | | | | | | | | | | | | | | |

Selling, general and administrative: | | | | | | | | | | | | | | | | | | | | |

Recapitalization, stock compensation and severance | | | 1,553 | | | | 10,099 | | | | 14,385 | | | | — | | | | — | |

Terminated initial public offering expenses | | | 1,241 | | | | — | | | | — | | | | — | | | | — | |

Other selling, general and administrative. | | | 38,837 | | | | 43,053 | | | | 46,956 | | | | 57,713 | | | | 58,455 | |

| | | | | | | | | | | | | | | | | | | | |

Total selling, general and administrative | | | 41,631 | | | | 53,152 | | | | 61,341 | | | | 57,713 | | | | 58,455 | |

| | | | | | | | | | | | | | | | | | | | |

Operating income | | | 16,132 | | | | 18,005 | | | | 14,266 | | | | 28,104 | | | | 30,400 | |

Interest expense | | | 19,635 | | | | 18,126 | | | | 20,245 | | | | 30,508 | | | | 31,127 | |

Loss on early retirement of debt | | | — | | | | — | | | | 13,272 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Loss before income taxes | | | (3,503 | ) | | | (121 | ) | | | (19,251 | ) | | | (2,404 | ) | | | (727 | ) |

Income tax expense | | | 56 | | | | 97 | | | | 275 | | | | 1,188 | | | | 842 | |

| | | | | | | | | | | | | | | | | | | | |

Net loss(4) | | $ | (3,559 | ) | | $ | (218 | ) | | $ | (19,526 | ) | | $ | (3,592 | ) | | $ | (1,569 | ) |

| | | | | | | | | | | | | | | | | | | | |

| |

| | | Years Ended December 31, | |

| | | 2001 | | | 2002 | | | 2003 | | | 2004 | | | 2005 | |

| | | (dollars in thousands) | |

| Other Financial Data: | | | | | | | | | | | | | | | | | | | | |

Net cash provided by operating activities | | $ | 31,696 | | | $ | 40,186 | | | $ | 15,957 | | | $ | 37,966 | | | $ | 43,963 | |

Net cash used in investing activities | | | (41,511 | ) | | | (38,956 | ) | | | (36,770 | ) | | | (65,150 | ) | | | (40,631 | ) |

Net cash provided by (used in) financing activities | | | 9,815 | | | | (1,230 | ) | | | 20,813 | | | | 27,184 | | | | (3,332 | ) |

| Other Operating Data: | | | | | | | | | | | | | | | | | | | | |

Movable medical equipment (approximate number of units at end of period) | | | 127,000 | | | | 138,000 | | | | 144,000 | | | | 150,000 | | | | 161,000 | |

Offices (at end of period) | | | 62 | | | | 65 | | | | 69 | | | | 75 | | | | 75 | |

Number of total customers (at end of period) | | | 5,570 | | | | 5,880 | | | | 5,950 | | | | 6,250 | | | | 6,300 | |

| | | | | |

Depreciation and amortization | | $ | 31,978 | | | $ | 32,775 | | | $ | 35,532 | | | $ | 42,097 | | | $ | 46,327 | |

EBITDA(1)(2) | | | 48,110 | | | | 50,781 | | | | 36,525 | | | | 68,459 | | | | 74,984 | |

27

| | | | | | | | | | | | | | | | | | | | |

| | | As of December 31, | |

| | | 2001 | | | 2002 | | | 2003 | | | 2004 | | | 2005 | |

| | | (dollars in thousands) | |

| Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | |

Working capital (3) | | $ | 8,416 | | | $ | 10,043 | | | $ | 8,575 | | | $ | 17,198 | | | $ | 19,379 | |

Total assets | | | 196,214 | | | | 202,136 | | | | 220,219 | | | | 246,407 | | | | 249,185 | |

Total debt | | | 204,441 | | | | 200,806 | | | | 271,082 | | | | 297,302 | | | | 300,480 | |

Shareholders’ deficiency | | | (54,297 | ) | | | (55,358 | ) | | | (89,903 | ) | | | (93,058 | ) | | | (96,799 | ) |

| (1) | EBITDA is defined as earnings before interest expense, income taxes, depreciation and amortization. Management understands that some industry analysts and investors consider EBITDA as a supplementary non-GAAP financial measure useful in analyzing a company’s ability to service debt. EBITDA, however, is not a measure of financial performance under GAAP and should not be considered as an alternative to, or more meaningful than, net income as a measure of operating performance or to cash flows from operating, investing or financing activities or as a measure of liquidity. Since EBITDA is not a measure determined in accordance with GAAP and is thus susceptible to varying interpretations and calculations, EBITDA, as presented, may not be comparable to other similarly titled measures of other companies. EBITDA does not represent an amount of funds that is available for management’s discretionary use. See note 2 for a reconciliation of net cash provided by operating activities to EBITDA. |

| (2) | The following is a reconciliation of net cash provided by operating activities to EBITDA: |

| | | | | | | | | | | | | | | | | | | | |

| | | Years Ended December 31, (dollars in thousands) | |

| | | 2001 | | | 2002 | | | 2003 | | | 2004 | | | 2005 | |

Net cash provided by operating activities | | $ | 31,696 | | | $ | 40,186 | | | $ | 15,957 | | | $ | 37,966 | | | $ | 43,963 | |

Changes in operating assets and liabilities | | | 434 | | | | 4,122 | | | | 7,916 | | | | 2,245 | | | | 2,327 | |

Other non-cash expenses | | | (3,711 | ) | | | (11,750 | ) | | | (7,867 | ) | | | (3,448 | ) | | | (3,275 | ) |

Income tax expense | | | 56 | | | | 97 | | | | 275 | | | | 1,188 | | | | 842 | |

Interest expense | | | 19,635 | | | | 18,126 | | | | 20,244 | | | | 30,508 | | | | 31,127 | |

| | | | | | | | | | | | | | | | | | | | |

EBITDA | | $ | 48,110 | | | $ | 50,781 | | | $ | 36,525 | | | $ | 68,459 | | | $ | 74,984 | |

| (3) | Represents total current assets (excluding cash and cash equivalents) less total current liabilities, excluding current portion of long-term debt. |

| (4) | Effective January 1, 2002, we adopted Statement of Financial Accounting Standard No. 142, “Goodwill and Other Intangible Assets.” This standard discontinued the amortization of goodwill and indefinite lived intangible assets effective January 1, 2002. The pro forma amounts shown below reflect the effect of retroactive application of the non-amortization of goodwill as if this method of accounting had been in effect in the periods prior to adoption (2002), in thousands as follows: |

| | | | |

| | | 2001 | |

Net loss as reported | | $ | (3,559 | ) |

Effect of goodwill amortization | | | 2,731 | |

Net loss as adjusted | | $ | (828 | ) |

28

Segment Information

| | | | | | | | | | | | | | | |

| | | Year Ended December 31, 2005 (dollars in thousands) |

| | | Medical Equipment Outsourcing | | Technical and Professional Services | | Medical Equipment Sales & Remarketing | | Corporate and Unallocated | | Total |

Revenues | | $ | 167,687 | | $ | 29,654 | | $ | 18,563 | | $ | — | | $ | 215,904 |

Cost of Revenue | | | 52,499 | | | 21,878 | | | 14,706 | | | — | | | 89,083 |

Movable Medical Equipment Depreciation | | | 37,966 | | | — | | | — | | | — | | | 37,966 |

| | | | | | | | | | | | | | | |

Gross Margin | | $ | 77,222 | | $ | 7,776 | | $ | 3,857 | | $ | — | | $ | 88,855 |

| | | | | | | | | | | | | | | |

Total Assets | | $ | 40,467 | | $ | 2,496 | | $ | 3,850 | | $ | 202,372 | | $ | 249,185 |

| |

| | | Year Ended December 31, 2004 (dollars in thousands) |

| | | Medical Equipment Outsourcing | | Technical and Professional Services | | Medical Equipment Sales & Remarketing | | Corporate and Unallocated | | Total |

Revenues | | $ | 156,490 | | $ | 25,491 | | $ | 17,619 | | $ | — | | $ | 199,600 |

Cost of Revenue | | | 47,178 | | | 17,295 | | | 13,307 | | | — | | | 77,780 |

Movable Medical Equipment Depreciation | | | 36,003 | | | — | | | — | | | — | | | 36,003 |

| | | | | | | | | | | | | | | |

Gross Margin | | | 73,309 | | $ | 8,196 | | $ | 4,312 | | $ | — | | $ | 85,817 |

| | | | | | | | | | | | | | | |

Total Assets | | $ | 41,070 | | $ | 3,199 | | $ | 3,858 | | $ | 198,280 | | $ | 246,407 |

| |

| | | Year Ended December 31, 2003 (dollars in thousands) |

| | | Medical Equipment Outsourcing | | Technical and Professional Services | | Medical Equipment Sales & Remarketing | | Corporate and Unallocated | | Total |

Revenues | | $ | 140,233 | | $ | 14,662 | | $ | 16,110 | | $ | — | | $ | 171,005 |

Cost of Revenue | | | 42,427 | | | 9,306 | | | 11,554 | | | — | | | 63,287 |

Movable Medical Equipment Depreciation | | | 32,111 | | | — | | | — | | | — | | | 32,111 |

| | | | | | | | | | | | | | | |

Gross Margin | | $ | 65,695 | | $ | 5,356 | | $ | 4,556 | | $ | — | | $ | 75,607 |

| | | | | | | | | | | | | | | |