As filed with the Securities and Exchange Commission on October 4, 2002

Registration No. 333-92018

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

-----------------------------------------

AMENDMENT NO. 2 TO FORM SB-2

REGISTRATION STATEMENT

Under

THE SECURITIES ACT OF 1933

BEARTOOTH PLATINUM CORPORATION

(formerly IDAHO CONSOLIDATED METALS CORP.)

(Name of small business issuer in its charter)

Yukon Territory, Canada 1041

(State or jurisdiction of (Primary Standard Industrial

incorporation or organization) Classification Code Number)

82-0465571

(I.R.S. Employer Identification Number)

3rd Floor, 10190 - 152A Street

Surrey, British Columbia

Canada V3R 1J7, (604) 580-5907

(Address, including zip code, and telephone number,

including area code of registrant's

principal executive offices)

-------------------------------------------

JOHN ANDREWS

President and Chief Executive Officer

Beartooth Platinum Corporation

(formerly Idaho Consolidated Metals Corp.)

3rd Floor, 10190 - 152A Street

Surrey, British Columbia

Canada V3R 1J7, (604) 580-5907

(Name, address, including zip code and telephone number,

including area code, of agent for service)

Copies of communications to:

Jonathan C. Guest, Esq. Gareth Howells

PERKINS, SMITH & COHEN, LLP CAMPION & MACDONALD

One Beacon Street Suite 200 Financial Plaza,

204 Lambert Street

Boston, MA 02108 Whitehorse, YT, Canada Y1A 3T2

(617) 854-4000 (867) 667-7885

Approximate date of proposed sale of to the public: As soon as practicable after

this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a

delayed or continuous basis pursuant to Rule 415 under the Securities Act of

1933, check the following box. |X|

If this Form is filed to register additional securities for an offering pursuant

to Rule 462(b) under the Securities Act, please check the following box and list

the Securities Act registration statement number of the earlier effective

registration statement for the same offering. |_|

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under

the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement

for the same offering. |_|

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under

the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement

for the same offering. |_|

If delivery of the prospectus is expected to be made pursuant to Rule 434,

please check the following box. |_|

CALCULATION OF REGISTRATION FEE

================================================================================

Title of Proposed Maximum Proposed Maximum

Each Class of Amount to be Offering Aggregate

Securities to Registered Price Offering Amount of

be Registered (1) Per Unit Price (4) Registration Fee

================================================================================

Common Shares 27,961,797 C $0.515 (2) $9,434,794 $868.00

- --------------------------------------------------------------------------------

Common Shares 16,519,931 C $0.648 (3) $7,013,638 $645.25

- --------------------------------------------------------------------------------

Totals 44,481,728 $16,591,812 $1,513.25 *

================================================================================

* Previously submitted.

(1) Total represents up to 27,961,797 already issued common shares of the

Registrant to be offered by selling security holders of the Registrant,

9,718,502 shares which may be issued to the selling security holders of

the Registrant under existing stock option and stock warrant agreements

and 6,801,429 shares which may be issued to a certain selling security

holder of the Registrant upon the conversion of an outstanding debenture

including the related stock purchase warrants. In the event of a stock

split, stock dividend or similar transaction involving the Common Stock

of the Registrant, in order to prevent dilution, the number of shares

registered shall be automatically increased to cover additional shares

in accordance with Rule 416(a) under the Securities Act.

(2) Estimated solely for the purpose of calculating the amount of the

registration fee pursuant to Rule 457(c) under the Securities Act, on

the basis of the average high and low prices as reported by the TSX

Venture Exchange on July 2, 2002.

(3) Estimated solely for the purpose of calculating the amount of the

registration fee pursuant to Rule 457(h) under the Securities Act, on

the basis of the actual prices at which the options and warrants may be

exercised.

(4) The US $ amounts are based on the exchange rate of US $1.00 to C$1.5263,

the noon buying rate as reported by the Federal Reserve Bank of New York

on July 2, 2002 for all transfers in foreign currencies as certified for

customs purposes.

- --------------------------------------------------------------------------------

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES

AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE

A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT

SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE

SECURITIES ACT OF 1933,AS AMENDED, OR UNTIL THE REGISTRATION STATEMENT SHALL

BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION

8(A), MAY DETERMINE.

- --------------------------------------------------------------------------------

THE INFORMATION CONTAINED IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE

CHANGED. THE SELLING SECURITY HOLDERS MAY NOT SELL THESE SECURITIES UNTIL THE

REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS

EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS

NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR

SALE IS NOT PERMITTED.

SUBJECT TO COMPLETION, DATED OCTOBER 4, 2002

BEARTOOTH PLATINUM CORPORATION

(formerly IDAHO CONSOLIDATED METALS CORP.)

44,481,728 Shares of Common Stock, no par value

This Prospectus covers the resale from time to time, by the selling

security holders identified in this prospectus, of up to 44,481,728 of our

common shares. The shares were issued by us in private placement transactions or

represent shares which may be issued to our selling security holders upon the

exercise of stock options and warrants and upon the conversion of convertible

securities. The selling security holders may sell all or a portion of their

shares through public or private transactions at prevailing market prices or at

privately negotiated prices. We will not receive any of the proceeds from the

sale of shares by the selling security holders.

Our shares are listed and quoted in the United States on the Pink Sheets

under the trading symbol BTPUF since July 24, 2002 (formerly IOCMF). Our shares

are listed and quoted in Canada on the TSX Venture Exchange under the trading

symbol BTP since July 24, 2002 (formerly IDO). See Market for Our Common Shares

beginning at page 7.

INVESTING IN OUR COMMON SHARES INVOLVES A HIGH DEGREE OF RISK. SEE "RISK

FACTORS" BEGINNING ON PAGE 3 TO READ ABOUT CERTAIN RISKS YOU SHOULD CONSIDER

BEFORE BUYING OUR COMMON SHARES.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES

COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE

ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A

CRIMINAL OFFENSE.

THE DATE OF THIS PROSPECTUS IS ____________________, 2002

TABLE OF CONTENTS

GLOSSARY.................................................................... iii

PROSPECTUS SUMMARY.......................................................... 1

THE OFFERING................................................................ 3

RISK FACTORS................................................................ 3

We are a mineral exploration company without operating history

We have incurred net losses to date and depend upon outside capital

We may not discover ore in commercial quantities

There may not be a ready market for the sale of platinum and palladium.

Mining is dangerous and we could face claims for personal injury or property

damage.

Our potential profitability is subject in part to matters over which we have no

control.

We may face substantial costs for compliance with existing and future

legislation, government controls and environmental controls.

Our properties may be subject to title disputes.

If we do not comply with applicable regulatory requirements, we may lose rights

to unpatented mining claims.

We depend on key technical personnel and may unable to hire or retain such

personnel or general labor.

We have no significant assets except our mining claims.

We may not remain in business without obtaining additional financing.

U.S. Investors may face potential tax risks due to our status as a Canadian

Corporation.

We are incorporated in a foreign country, which may affect the enforceability of

civil liabilities.

FORWARD-LOOKING STATEMENTS.................................................. 10

USE OF PROCEEDS............................................................. 10

MARKET FOR OUR COMMON SHARES................................................ 10

PLAN OF OPERATION........................................................... 11

CAPITALIZATION.............................................................. 13

SELECTED FINANCIAL DATA..................................................... 14

DESCRIPTION OF BUSINESS..................................................... 15

LEGAL PROCEEDINGS........................................................... 42

MANAGEMENT.................................................................. 42

EXECUTIVE COMPENSATION...................................................... 44

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT.............. 47

SELLING SECURITY HOLDERS.................................................... 48

PLAN OF DISTRIBUTION........................................................ 58

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS.............................. 60

DESCRIPTION OF SHARES....................................................... 62

ADDITIONAL INFORMATION...................................................... 63

LEGAL MATTERS............................................................... 67

EXPERTS 67

WHERE YOU CAN FIND MORE INFORMATION......................................... 68

Financial Statements........................................................ F-1

GLOSSARY

Adit An opening driven horizontally into the side of a

mountain or hill for providing access to a mineral

deposit.

Alteration Any physical or chemical change in a rock or

mineral subsequent to its formation. Milder and

more localized than metamorphism.

Anomalous

enrichment or

mineralization Minerals or elements in soils or rocks in greater

concentration than is normally encountered in those

specific rock types.

Assay A chemical test performed on a sample of ores or

minerals to determine the amount of valuable metals

contained.

Base Metal Any non-precious metal (e.g. copper, lead, zinc,

nickel, etc.).

Breccia A rock in which angular fragments are surrounded by

a mass of fine-grained minerals.

Conduits Zones that are more permeable than the surrounding

rock and allow the flow of water or solutions.

Country rocks Non-mineralized rock adjacent to rocks containing

mineralization.

Cretaceous-Tertiary

granitic rocks Rocks of granitic composition that are Cretaceous

or Tertiary in age.

Development Work carried out for the purpose of opening up a

mineral deposit and making the extraction of ore

possible.

Dip The angle at which a vein, structure or rock bed is

inclined from the horizontal as measured at right

angles to the strike.

Disseminated Ore Ore carrying small particles of valuable

minerals spread more or less uniformly through the

host rock.

Drill-Indicated

Reserves The size and quality of a potential ore-body as

suggested by widely spaced drill holes; more work

is required before reserves can be classified as

probable or proven.

Dykes A tabular body of igneous rock that cuts across the

structure of adjacent rocks or cuts massive rocks.

Exploration Work involved in searching for ore, usually by

drilling or driving a drift.

Ferromagnesian Containing iron and magnesium.

- - iii -

Gneisses A coarse-grained rock in which bands rich in

granular materials alternate with bands in which

schistose minerals predominate.

Grade The average assay of a ton of ore, reflecting metal

content.

Hematite An oxide mineral rich in iron.

Host Rock The rock surrounding an ore deposit.

Intrusive A body of igneous rock formed by the consolidation

of magma intruded into other rocks, in contrast to

lava, which is extruded upon the surface.

Igneous Formed by solidification from a molten or partially

molten state.

Lens Generally used to describe a body of ore that is

thick in the middle and tapers towards the ends.

Limontitic A group of brown amorphous naturally occurring

hydrous iron rich oxides.

Lode A mineral deposit in solid rock.

Mafic rocks Rocks rich in Iron or magnesium silicates.

Metamorphic rocks Rocks, which have undergone a change in

texture or composition as the result of heat and/or

pressure.

Mill A processing plant that produces a concentrate of

the valuable minerals or metals contained in an

ore. The concentrate must then be treated in some

other type of plant, such as a smelter, to affect

recovery of the pure metal.

Mineable Reserves Ore reserves that are known to be

extractable using a given mining plan.

Mineral A naturally occurring homogeneous substance having

definite physical properties and chemical

composition and, if formed under favourable

conditions, a definite crystal form.

Mineralized Material

or Deposit A mineralized body which has been delineated by

appropriate drilling and/or underground sampling to

support a sufficient tonnage and average grade of

metal(s). Under SEC standards, such a deposit does

not qualify as a reserve until a comprehensive

evaluation, based upon unit cost, grade,

recoveries, and other factors, conclude economic

feasibility.

Net Profit Interest A portion of the profit remaining

after all charges, including taxes and bookkeeping

charges (such as depreciation) have been deducted.

Net Smelter Return A share of the net revenues generated from the sale

of metal produced by a mine.

- iv -

Ore Material that can be mined and processed at a profit.

Participating

Interest An interest in a mine, which entitles the holder to

a certain percentage of profits in return for

putting up an equal percentage of the capital cost

of the project.

Patent The ultimate stage of holding a mineral claim in

the United States, after which no more assessment

work or claim rental fees are necessary because all

mineral rights have been earned.

Patented

Mining Claim A parcel of land originally located on

federal lands as an unpatented mining claim under

the General Mining Law, the title of which has been

conveyed from the federal government to a private

party pursuant to the patenting requirements of the

General Mining Law.

Porphyry Any igneous rock in which relatively large

crystals, called phenocrysts, are set in a

fine-grained groundmass.

Precambrian The oldest, most stable regions of the Earth's

crust, the largest of which is the Canadian Shield.

Prospect A mining property, the value of which has not been

determined by exploration.

Probable Reserves Reserves for which quantity and grade and/or

quality are computed from information similar to

that used for proven (measured) reserves, but the

sites for inspection, sampling and measurement are

farther apart or are otherwise less adequately

spaced. The degree of assurance, although lower

than that for proven (measured) reserves, is high

enough to assume continuity between points of

observation.

Proven (Measured)

Reserves Reserves for which, quantity and grade are computed

from dimensions revealed in trenched outcrops,

workings or drill holes; and sampling and

measurement are spaced so closely and the geologic

character is so well defined that size, shape,

depth and mineral content of reserves are well

established.

Reclamation The restoration of a site after mining or

exploration activity is completed.

Reserves That part of a mineral deposit, which could be

economically and legally extracted or produced at

the time of the reserve determination.

Royalty An amount of money paid at regular intervals by the

lessee or operator of an exploration or mining

property to the owner of the ground. Generally

based on a certain amount per ton or a percentage

of the total production or profits. Also, the fee

paid for the right to use a patented process.

- v -

Sample A small portion of rock or a mineral deposit, taken

so that the metal content can be determined by

assaying.

Schists A medium or coarse-grained metamorphic rock with

sub-parallel orientation of the micaceous minerals,

which dominate its composition.

Sericite A fine-grained variety of mica occurring in small

scales, especially in schists.

Shear or Shearing The deformation of rocks by lateral

movement along innumerable parallel planes,

generally resulting from pressure and producing

such metamorphic structures as cleavage and

schistosity.

Siliceous Containing abundant quartz or silica.

Silicate A compound whose crystal structure contains Si-O

tetrahedral either isolated or joined together

through one or more of the oxygen atoms.

Sills An intrusive body of approximately uniform

thickness and relatively thin compared to its

lateral extent, which has been emplaced parallel to

the bedding or schistosity of intruded rocks.

Stratigraphy The description of bedded rock sequences; used

loosely, the sequence of bedded rocks in a

particular area.

Strike The direction, or bearing from true north, of a

vein or rock formation measured on a horizontal

surface.

Sulfide A compound of sulfur and some other element.

Trend The direction, in the horizontal plane, of a linear

geological feature (for example, an ore zone),

measured from true north.

Ultramafic rocks Igneous rocks containing less than 45% silica

and composed of ferromagnesian silicates, metallic

oxides and sulfides.

Unpatented Mining

Claim A parcel of property located on federal lands

pursuant to the General Mining Law and the

requirements of the state in which the unpatented

claim is located, the paramount title of which

remains with the federal government. The holder of

a valid, unpatented lode-mining claim is granted

certain rights including the right to explore and

mine such claim under the General Mining Law.

Vein A mineralized zone having a more or less regular

development in length, width and depth, which

clearly separates it from neighbouring rock.

Waste Barren rock in a mine, or mineralized material that

is too low in grade to be mined and milled at a

profit.

- vi -

PROSPECTUS SUMMARY

About This Prospectus

This prospectus is part of a registration statement we filed with the

U.S. Securities and Exchange Commission. You should rely only on the information

provided in this prospectus. Neither we, nor the selling security holders listed

in this prospectus, have authorized anyone to provide you with information

different from that contained in this prospectus. The selling security holders

are offering to sell, and seeking offers to buy, common shares only in

jurisdictions where offers and sales are permitted. The information contained in

this prospectus is accurate only as of the date of this prospectus, regardless

of the time of delivery of this prospectus or of any sale of common shares.

Applicable SEC rules may require us to update this prospectus in the future.

This preliminary prospectus is subject to completion prior to this offering.

The information found on our Website at www.montanaplatinum.com is not

part of this Prospectus.

About Beartooth Platinum Corporation (formerly Idaho Consolidated Metals Corp.)

We are a mineral exploration company and are primarily engaged in the

acquisition, and exploration of precious metals properties. We are an

exploration stage company and there is no assurance that a commercially viable

mineral deposit or reserve exists in any of our properties until further

geological work is done and a final evaluation based upon the results obtained

conclude economic and legal feasibility. The principal precious metals targeted

by us are platinum group metals. From 1988 to 1996, we purchased, staked and

leased gold claims in Idaho. Beginning in 1998, we shifted our focus to claim

acquisitions and exploration for platinum group metals on the Stillwater Complex

located in the Park, Sweetgrass and Stillwater Counties, Montana, by staking

unpatented claims, and by obtaining leasehold interests in and/or options to

purchase, explore and develop certain patented and unpatented claims located

therein.

Subsequent to December 31, 2001 we sold all of our gold properties,

subject to regulatory approval currently being sought by the acquirer. We are

actively exploring our platinum group claims in Park County, Sweetgrass County

and Stillwater County, Montana. Accordingly, our current principal business does

not include further acquisition or exploration of our gold claims. (See Gold

Properties Description below).

At the end of 2001, we had no proven or probable reserves in any of our

claims. However, the area consisting of our Montana claims indicate anomalous

enrichment in the platinum group elements and we will conduct drilling,

sampling, trenching, assaying, geological and geophysical programs during the

year 2002. We will follow-up on results obtained during the 2001 exploration

program during the 2002 exploration field season.

Our basic strategy will be to concentrate our efforts on the claims,

which are wholly-owned by us and specifically on areas identified in the 2001

exploration program. Based on the 2001 results, we have prioritized our targets

and our 2002 and subsequent programs will concentrate on the higher priority

areas. We will seek through option, joint venture or other forms of exploration

agreements with third parties the lower priority areas in order to allow us to

concentrate our funds on the higher priority targets. Lower priority claims,

which cannot be optioned-out or joint-ventured may be dropped.

- 1 -

There is no assurance that the areas considered as favorable mineralized

targets within our claims, which have been selected based upon preliminary

geophysical results, contain commercially viable mineral deposits until close

systematic drilling and/or sampling and in depth results are evaluated and

conclude economic feasibility.

We face many risks and difficulties in the course of achieving our

strategy including the access to sufficient capital to complete our future

exploration plans and to fund general and administrative costs. We also have not

generated any revenues from operations to date and do not expect any revenues in

the foreseeable future.

Our December 31, 2001 financial statements contain in Note 1 the

following description related to our ability to continue as a going concern:

"These consolidated financial statements have been prepared assuming the Company

will continue as a going concern and be able to realize assets and liquidate

liabilities in the normal course of business. Since its inception, the Company

has incurred significant losses during the exploration stage and at December 31,

2001 has a net working capital deficiency of approximately $624,000. These

factors, along with the uncertainties regarding the Company's ability to obtain

necessary financing to develop its properties and to successfully develop

economic ore reserves on these properties and realize profitable production

levels or proceeds from their disposition, raise substantial doubt about the

Company's ability to continue as a going concern. These consolidated financial

statements do not include any adjustments that might result from the outcome of

these uncertainties. Management of the Company continues to seek additional

sources of financing to fund its ongoing capital needs and mitigate its working

capital deficiency. The Company is presently considering additional funding

sources including the sale of its common stock. Additionally, the Company is

seeking additional joint venture partners to assist in the exploration and

development of certain of its other properties. There can be no assurance that

the Company will be successful in obtaining additional funds or in locating

suitable joint venture partners to assist in the exploration and development of

its mineral properties."

Further our auditors in their opinion dated February 22, 2002 added the

following comments for U.S. Readers on Canada - U.S. Reporting Conflict: "In the

United States, reporting standards for auditors require the addition of an

explanatory paragraph (following the opinion paragraph) when the financial

statements are affected by significant conditions and events that cast

substantial doubt on the company's ability to continue as a going concern, such

as those described in Note 1 to the consolidated financial statements. Our

report to the shareholders dated February 22, 2002 (except for note 11, which is

at March 7, 2002) is expressed in accordance with Canadian reporting standards

which do not permit a reference to such events and conditions in the auditors'

report when these are adequately disclosed in the financial statements."

For a further discussion of the risks associated with our business,

please see "Risk Factors" below.

Our selling shareholders received their shares through various private

placements, a short form prospectus filed under Canadian securities regulations,

a debt settlement, the conversion of convertible debt and related warrants, the

exercise of share purchase warrants and the exercise of share purchase options.

All funds are reported in U.S. dollars unless otherwise specified.

Canadian funds are designated by "C$".

- 2 -

Corporate Information

We were incorporated by registration of our memorandum and articles

under the laws of the Province of British Columbia on September 15, 1988 under

the name "Consolidated Idaho Platinum Resources Inc.". Subsequently we changed

our name from "Consolidated Idaho Platinum Resources Inc." to "Idaho

Consolidated Metals Corp." effective as of June 30, 1989. On August 17, 2001, we

were continued to the Yukon Territory under the Yukon Business Corporations Act.

On July 24, 2002, we changed our name to Beartooth Platinum Corporation. Our

head and principal office is located at 3rd Floor, 10190 - 152A Street, Surrey

B.C., Canada V3R 1J7 and its exploration office is located at 102 - Two Willow

Lane, Red Lodge, MT 59068, USA.

We have a wholly owned subsidiary, Idaho Consolidated Metals

International, Ltd., incorporated under the laws of the British Virgin Islands

on July 17, 1996. Its registered and records office is located at Craigmuir

Chambers, P.O. Box 71 Road Town, Tortola, British Virgin Islands and its

business address is located at Suite 225 - 4299 Canada Way, Burnaby, B.C.,

Canada V5G 1H3. Idaho Consolidated Metals International, Ltd. has never operated

any business.

THE OFFERING

Common shares offered by us: None

Common stock offered by the selling security holders: 44,481,728

Common shares currently outstanding (as of June 30, 2002): 44,021,930

Common shares currently outstanding, on a fully

diluted basis (as of June 30, 2002) 60,994,361 (1)

Use of Proceeds: We will not receive any proceeds from the

sale of shares by the selling security

holders.

(1) Includes 5,857,458 shares, which may be issued to the holders on

exercise of options outstanding at June 30, 2002. Includes 4,313,544

shares, which may be issued to the holders on exercise of share purchase

warrants outstanding at June 30, 2002. Includes 4,534,286 shares, which

may be issued to the holder on conversion of a convertible debenture.

Includes 2,267,143 shares, which may be issued on exercise of warrants

related to the convertible debenture. Does not include 2,376,928 shares,

which have been reserved for issuance upon the issuance of options not

yet granted under our stock option plan.

The proceeds from the initial sales of common shares to the selling

shareholders have been used to fund the exploration activities on the Montana

claims, the holding costs of the gold claims and our general and administrative

costs to date. The remaining proceeds from our early 2002 private placements and

the proceeds of the convertible debenture will be used to fund the balance of

exploration and general and administrative costs for the remainder of 2002.

RISK FACTORS

An investment in our common shares involves a high degree of risk. You

should carefully consider the risks described below and the other information

contained in this prospectus before deciding to invest in our common shares. The

risks described below are not the only ones facing us. Additional risks not

presently known to us, or which we currently consider immaterial may also

adversely affect our business. We have attempted to identify the major factors

under the heading "Risk Factors" that could cause differences between actual and

planned or expected results, but we cannot assure you that we have identified

all of those factors. If any of the following risks actually happen, our

business, financial condition and operating results could be materially

adversely affected.

- 3 -

We are a mineral exploration company without operating history.

We are in the business of exploring natural resource properties: a

highly speculative endeavor. Only persons who can afford the total loss of their

investment should make an investment in our securities. We have not had revenues

from operations to date, nor the provision of return on investment and there is

no assurance that we will produce revenue, operate profitably or provide a

return on investment in the future. All of our properties are in the

exploration-stage without a known body of ore. There is no guarantee that ore

will be found or that if it is found that it will be found in commercially

mineable quantities. Few properties, which are explored, are ultimately

developed into producing mines.

We have incurred net losses to date and depend upon outside capital.

Our financial statements are prepared using Canadian generally accepted

accounting principles ("GAAP") and so much of the disclosures and discussion

herein is based upon these accounting principles. Our December 31, 2001

financial statements contain a reconciliation of the significant differences

between Canadian GAAP and U.S. GAAP at Note 12.

As at December 31, 2001, under U.S. GAAP our accumulated deficit was

$16,941,273 (Canadian GAAP $12,808,244) and we had a working capital deficiency

of approximately $624,000. At June 30, 2002 our accumulated deficit was

$17,507,482 (Canadian GAAP $13,745,143) and we had working capital of

approximately $316,000.

We believe that we will require $1,000,000 for the 2002 exploration

season and approximately a cumulative $5,000,000 for the 2003 to 2005

exploration seasons to gain a sufficient level of understanding of our current

exploration targets. These estimates are based upon obtaining positive results,

which indicate that additional work is warranted. Subsequent to December 31,

2001 we raised approximately $866,500 in two private placements of our

securities and entered into a convertible debenture agreement for an additional

$1,000,000 to be drawn upon as funds are required for the 2002 exploration

program. Accordingly, we have sufficient funds available to complete our current

exploration plans for the 2002 season but will require additional funds for the

2003 through 2005 seasons. Our Montana property is very large and to adequately

explore the entire area is beyond our capability. Our plan is to concentrate on

the targets, which our aerial geophysics has identified and to look for other

parties to explore the other areas of the property through option agreements,

joint ventures or other exploration agreements. Claims, which cannot be

optioned-out or joint-ventured to other parties or claims, which are less

prospective may be dropped to reduce future holding costs.

Additional funds will have to be raised in order to finance further

exploration of our properties. We may be unable to raise this additional

financing other than through the sale of additional equity capital. If

additional financing is raised through the sale of equity capital, investors may

suffer a further dilution of their investment. The only alternative for the

financing of further exploration would be the offering by us of an interest in

the properties to be earned by another party or parties carrying out further

exploration thereof. This could result in a substantial dilution of our interest

in such property. There are no assurances that such sources of financing will be

available or, if available, that the terms thereof will be acceptable to us.

- 4 -

We may not discover ore in commercial quantities.

Exploration for minerals is a speculative venture necessarily involving

substantial risk. There is no certainty that the expenditures to be made by us

in the exploration of the interests described herein will result in discoveries

of commercial quantities of ore. We currently have no reserves on our

properties.

Our claims in Montana were acquired mainly through a staking program.

Most of these claims were previously owned by the Stillwater Mining Company, a

company in platinum and palladium production. In October of 1993, Stillwater

Mining Company elected not to pay the claim rental fees for certain of its

staked claims and abandoned in excess of 1,346 claims. As a result, those claims

for which Stillwater Mining Company elected not to pay the required claim rental

fee were adjudicated by the BLM as relinquished.

There may not be a ready market for the sale of platinum and palladium.

There is no assurance that even if commercial quantities of ore are

discovered, a ready market will exist for its sale. Factors beyond our control

may affect the marketability of any platinum and palladium discovered.

In the event that the Company's exploration program is successful, the

profitability of any future operations, which may be brought into production on

claims owned or under the control of the Company, could be significantly

affected by changes in the market prices of platinum group metals (PGM). Prices

fluctuate widely and are influenced by numerous factors beyond the Company's

control, including such factors as expectations for inflation, currency exchange

fluctuations, particularly between the South African Rand and the US Dollar,

global and regional demand for PGM, consumption patterns, speculative

activities, international economic trends, political and economic conditions,

and production quantities and costs in the other PGM producing countries,

including the Republic of South Africa and Russia. Since some of the world

supply of platinum and palladium is a by-product of the mining of nickel and

copper, a portion of the worldwide production of platinum and palladium is

unrelated to the demand for such metals. Accordingly, ordinary market balancing

mechanisms may be less effective.

Approximately 50 percent of current world platinum demand is for

industrial and manufacturing processes, more than one-half of which is used by

the global auto industry in the manufacture of catalytic converters for emission

control on automobiles. Autocatalyst demand is dependent upon growth in new

vehicle sales in countries where legislation requires specific exhaust emission

standards; new vehicle sales are in turn dependent upon general economic

conditions. In addition to the United States, legislation requiring emission

control on automobiles has been enacted in many countries including Japan and

Europe and emission standards have become more stringent and comprehensive over

time. If a substitute material, which is more cost effective than PGM, can be

developed, tested and accepted by the regulatory authorities, the automobile

industry and the public then the demand for platinum could be significantly and

negatively impacted.

Approximately 50 percent of current world platinum demand is for the

production of jewelry, such as gem settings for rings and for investment /

collector coins. Historically, jewelry demand has been most significant in Japan

and China and, since 1998, in North America. A change in the attitude of

consumers in any of these markets could negatively impact the demand for and the

price of platinum.

- 5 -

Palladium, like platinum, has numerous industrial applications. In 2000,

approximately 60 percent of palladium consumption was in autocatalysts.

Approximately 25 percent of consumption was in the electronics industry. Dental,

chemical and jewelry consumption are also significant.

To some extent, platinum and palladium can be substituted for one

another in the autocatalysis application. The ability to substitute one metal

for the other should serve to keep the price of the two metals in equilibrium

over the medium term. However, if a substitute material, which is more cost

effective than PGM, can be developed, tested and accepted by the regulatory

authorities, the automobile industry and the public then the demand for

palladium could be significantly and negatively impacted.

In the electronics sector, the consumption of palladium particularly as

the conductive element in multi-layer ceramic capacitors peaked at about 2.6

million ounces in 1997. In 2000, consumption of palladium in the electronics

sector amounted to about 25 percent of demand. The intensity of use of palladium

in this sector has declined significantly during the last five years. However,

the number of capacitors required to support the expanding demand in electronic

applications has sustained the demand in the range 2 to 2.2 million ounces in

the years 1998 thru 2000. In low-end electronic applications, such as children's

toys, palladium is being substituted by base metals, copper and nickel. However,

in high-end applications, where reliability is a concern such as in automobile

and personal comupters, palladium is the metal of choice. If a substitute

material which is more cost effective than PGM can be developed, tested and

accepted by the electronics industry particularly for high-end applications,

then the demand for palladium could be significantly and negatively impacted.

The exact effect of these factors cannot be accurately predicted, but

the combination of these factors may result in us not receiving an adequate

return on invested capital.

Mining is dangerous and we could face claims for personal injury or property

damage.

Mining activities involve significant physical and environmental risk.

There are continuous hazards to mine workers arising from poor ventilation,

slides, cave-ins, the operation of heavy equipment below ground, and the use of

explosives and toxic chemicals in mining, processing and refining operations. We

are required to contribute to state industrial insurance and workman's

compensation plans. Our general liability insurance against claims for personal

injury or property damage is limited to $5,000,000(US) per person and

$5,000,000(US) per occurrence. We could be held liable for personal injury or

property damage claims substantially in excess of our coverage.

We could also face claims by individuals and government agencies arising

from our use and potential discharge of toxic chemicals. We do not have

environmental liability insurance now, and we may not be able to obtain such

insurance in the future at a reasonable cost. Insurance companies have, in some

cases, successfully asserted that harm caused by the intentional use of toxic

substances is not covered by their policies regardless of the precautions that

were taken by the insured. If we incur liability for environmental harm while

uninsured, the resulting cost could seriously weaken our financial condition.

Our potential profitability is subject in part to matters over which we have no

control.

Potential profitability of mining ventures and mineral properties

depends upon factors beyond our control. For instance, world prices of, and

markets for, platinum and palladium are unpredictable, highly volatile,

potentially subject to government fixing, pegging and controls, and respond to

changes in domestic, international, political, social and economic environments.

Since January 2001, the world price for platinum, as published by Kitco.com, has

ranged from a low of approximately $400 per ounce to a high of approximately

$650 and has recently been in the $520 to $560 per ounce range. Over the same

period, the world price for palladium, as published by Kitco.com, has ranged

from a low of approximately $300 per ounce to a high of approximately $1,100 and

has recently been in the $320 to $340 per ounce range. Our future profitability,

should economic reserves of platinum and palladium be discovered, will be

directly linked to the volatile world prices of platinum and palladium.

- 6 -

Additionally, in the current period of world-wide economic uncertainty,

the availability and costs of funds for exploration and other costs have become

increasingly difficult, if not impossible, to project. These changes and events

could materially affect our financial condition.

We may face substantial costs for compliance with existing and future

legislation, government controls and environmental controls.

Our business is subject to extensive federal, state and local

governmental controls and regulations, including regulation of mining and

exploration operations, discharge of materials into the environment, disturbance

of land, reclamation of disturbed lands, threatened or endangered species and

other environmental matters. Compliance with existing and future laws and

regulations may require additional control measures and expenditures which

cannot be estimated at this time.

We must seek governmental permits for exploration activities at our

properties. Obtaining the necessary govemmental permits is a complex and

time-consuming process involving numerous federal, state and local agencies. The

duration and success of the permitting efforts are contingent upon many

variables not within our control. All our future exploration and development

projects require or will require a variety of permits. The failure to obtain

certain permits could have a material adverse effect on our business, operations

and prospects. Presently, we have our drill sites for the 2002 season fully

permitted. However, we will require additional drill sites to be permitted as we

continue to explore our current targets over the 2003 to 2005 seasons or for new

drill sites should the results of the current drilling program so dictate.

Compliance requirements for any mines and mills may require substantial

additional control measures that could materially affect proposed permitting and

construction schedules for such facilities. Under certain circumstances,

facility construction may be delayed pending regulatory approval. The cost of

complying with existing and future laws and regulations may render existing and

any future properties unprofitable and could adversely affect the value of our

mineralized material, if any.

Our business is subject to extensive environmental regulations including

Environmental Protection Laws, Clean Air Act, Clean Water Act, Endangered

Species Act, National Environmental Policy Act and State Environmental

Protection Laws. In the context of environmental protection permitting,

including the approval of reclamation plans, we must comply with the known

standards and existing laws and regulations which may entail greater or lesser

costs and delays depending on the nature of the activity to be permitted and the

interpretation of the regulations implemented by the permitting authority.

Compliance with existing and future laws and regulations may require additional

control measures and expenditures which cannot be estimated at this time. The

cost of complying with existing and future laws and regulations may render

existing and any future properties unprofitable and could adversely affect the

value of our mineralized material, if any.

A more detailed discussion of the environmental regulations, which

affect our business can be found in "Compliance Costs and Effects of

Environmental and other Laws".

- 7 -

Our properties may be subject to title disputes.

We have not performed formal title searches on all the claims, which we

hold and we do not perform formal title searches on an ongoing basis. Our

properties may be subject to prior unregistered agreements or transfers of

native land claims, and title may be affected by undetected defects. In

addition, certain of our boundaries have not been surveyed and, therefore, their

precise location and area may be in doubt. Should a title dispute arise and

should our title not stand we could lose the related claim or claims, which

could have a material adverse effect on our business, operations and prospects.

If we do not comply with applicable regulatory requirements, we may lose rights

to unpatented mining claims.

In order to establish rights to mining claims in the United States,

certain criteria must be met, including the erection of a monument, and the

posting of a location notice marking the boundaries of the "unpatented" mining

claim, together with filing a Notice of location within the county in which the

unpatented claim is located. If the statutes and regulations for the location of

an unpatented mining claim are complied with, the claimant obtains a valid

possessory right to the contained minerals. To preserve an otherwise valid

unpatented mining claim, a claimant also must make certain additional filings

with the county and the US Bureau of Land Management and annually pay a fee

required by the US regulatory authorities. Failure to pay the fee or make the

required filings may render the unpatented mining claim void or voidable.

Because unpatented mining claims are self-initiated and self-maintained, they

possess some unique vulnerabilities not associated with other types of property

interests. It is impossible to ascertain the validity of unpatented mining

claims from public real property records, and therefore it can be difficult or

impossible to confirm that all of the requisite steps have been followed for

location and maintenance of an unpatented mining claim.

We depend on key technical personnel and may unable to hire or retain such

personnel or general labor.

For us to succeed, we may be required to hire and retain additional

geologists and mining engineers. In any case, if we develop our claims we must

hire supervisors, heavy-equipment operators, experienced hard-rock miners and

general laborers. We will compete for these personnel in Montana with other

mining and exploration companies in addition to other heavy equipment users. In

periods of high employment in the mining industry we may be unable to attract

and retain sufficient competent employees to fulfill our business plans

efficiently and meet our budgets. Failure to retain such key employees or

consultants or to attract and retain additional key employees or consultants

with the necessary skills could have a materially adverse impact upon our growth

and profitability. As of the date hereof, key person life insurance has not been

established for any director or officer.

We have no significant assets except our mining claims.

Our assets are comprised of our mining claims and modest amounts of

cash. Our claims have no value apart from the economically recoverable metals,

if any, they contain. We do not have the financial or technical resources to

acquire other assets or engage in other businesses if our claims prove to be

unproductive. Should our claims not contain any economically recoverable metals,

we may not be able to continue as a going concern. See also Note 1 to our

consolidated financial statements for the year ended December 31, 2001 where the

going concern issue is further addressed.

- 8 -

We may not remain in business without obtaining additional financing.

Our December 31, 2001 financial statements contain in Note 1 the

following description related to our ability to continue as a going concern:

"These consolidated financial statements have been prepared assuming the Company

will continue as a going concern and be able to realize assets and liquidate

liabilities in the normal course of business. Since its inception, the Company

has incurred significant losses during the exploration stage and at December 31,

2001 has a net working capital deficiency of approximately $624,000. These

factors, along with the uncertainties regarding the Company's ability to obtain

necessary financing to develop its properties and to successfully develop

economic ore reserves on these properties and realize profitable production

levels or proceeds from their disposition, raise substantial doubt about the

Company's ability to continue as a going concern. These consolidated financial

statements do not include any adjustments that might result from the outcome of

these uncertainties. Management of the Company continues to seek additional

sources of financing to fund its ongoing capital needs and mitigate its working

capital deficiency. The Company is presently considering additional funding

sources including the sale of its common stock. Additionally, the Company is

seeking additional joint venture partners to assist in the exploration and

development of certain of its other properties. There can be no assurance that

the Company will be successful in obtaining additional funds or in locating

suitable joint venture partners to assist in the exploration and development of

its mineral properties."

Further our auditors in their opinion dated February 22, 2002 added the

following comments for U.S. Readers on Canada - U.S. Reporting Conflict: "In the

United States, reporting standards for auditors require the addition of an

explanatory paragraph (following the opinion paragraph) when the financial

statements are affected by significant conditions and events that cast

substantial doubt on the company's ability to continue as a going concern, such

as those described in Note 1 to the consolidated financial statements. Our

report to the shareholders dated February 22, 2002 (except for note 11, which is

at March 7, 2002) is expressed in accordance with Canadian reporting standards

which do not permit a reference to such events and conditions in the auditors'

report when these are adequately disclosed in the financial statements."

Should we not remain a going concern then the effect could have a material

adverse effect on our business, operations and prospects.

U.S. investors may face potential tax risks due to our status as a Canadian

Corporation.

U.S. Holders of shares of the Registrant should note that the Registrant

believes that it is a Passive Foreign Investment Corporation ("PFIC") as that

term is defined for U.S. income tax purposes. As a result, a U.S. Holder may be

subject to adverse income tax consequences resulting form their investment in

the Registrant and we urge U.S. holders to consult with competent U.S. tax

advice concerning the impact of the PFIC rules on their investment in the

Registrant.

A more detailed discussion of the potential tax risks, which our U.S. investors

may face can be found in "Additional Information - Taxation".

We are incorporated in a foreign country, which may affect the enforceability of

civil liabilities.

We are incorporated under the laws of a foreign country, some of our

officers and directors are residents of a foreign country and a substantial

portion of our assets and such persons' assets are located outside the United

States. As a result, it may be difficult for holders of our common shares, with

respect us or any of our non-U.S. resident executive officers, directors, or

experts we have named in this registration statement to (i) effect service of

process within the United States; (ii) enforce judgments obtained in the U.S.

courts based on the civil liability provisions of the U.S. federal securities

laws; (iii) enforce judgments of U.S. courts based on the civil liability

provisions of the U.S. federal securities laws in a Canadian court; and (iv)

bring an original action in a Canadian court to enforce liabilities based on the

U.S. federal securities laws.

- 9 -

FORWARD-LOOKING STATEMENTS

This prospectus contains "forward-looking" statements that involve risks

and uncertainties. Forward-looking statements include statements about our

expectations concerning future exploration activities, statements about future

business plans and strategies, and most other statements that are not historical

in nature. Because forward-looking statements involve risks and uncertainties,

there are factors, including those discussed in the section of this prospectus

titled "Risk Factors", that could cause actual results to be materially

different from any future results, performance or achievements expressed or

implied. Accordingly, readers should not place undue reliance on forward-looking

statements. We undertake no obligation to publicly release the result of any

revision of these forward-looking statements to reflect events or circumstances

after the date they are made or to reflect the occurrence of unanticipated

events.

USE OF PROCEEDS

We will not receive any of the proceeds from the resale of the shares

covered by this prospectus. The proceeds from the initial sales of common shares

to the selling shareholders have been used to fund the exploration activities on

the Montana claims, the holding costs of the gold claims and our general and

administrative costs to date.

MARKET FOR OUR COMMON SHARES

Our shares are listed and quoted in the United States by the Pink Sheets

under the trading symbol BTPUF since July 24, 2002 (formerly IOCMF). Our shares

are traded on the TSX Venture Exchange under the trading symbol BTP since July

24, 2002 (formerly "IDO").

For the period from January 1, 2000 through June 30, 2002 the high and

low sales prices (in U.S. dollars) for the shares for each quarter, as reported

by the Pink Sheets, were:

2002 High Low

First Quarter $0.42 $0.23

Second Quarter $0.47 $0.28

2001 High Low

First Quarter $1.12 $0.57

Second Quarter $1.14 $0.64

Third Quarter $0.88 $0.19

Fourth Quarter $0.29 $0.20

2000 High Low

First Quarter $1.79 $0.28

Second Quarter $1.07 $0.61

Third Quarter $0.99 $0.50

Fourth Quarter $0.56 $0.28

- 10 -

For the period from January 1, 2000 through June 30, 2002 the high and

low sales prices (in Canadian dollars) for the shares for each quarter, as

reported by the TSX Venture Exchange and its predecessors, the CDNX and the

Vancouver Stock Exchange, were:

2002 High Low

First Quarter C$0.67 C$0.38

Second Quarter C$0.75 C$0.38

2001 High Low

First Quarter C$1.90 C$0.50

Second Quarter C$1.80 C$0.88

Third Quarter C$1.31 C$0.28

Fourth Quarter C$0.60 C$0.26

2000 High Low

First Quarter C$2.55 C$0.30

Second Quarter C$1.60 C$0.80

Third Quarter C$1.49 C$0.76

Fourth Quarter C$0.84 C$0.45

Holders

As of December 31, 2001, we had approximately 213 shareholders of

record.

Dividends

We have never paid dividends. We do not expect to have cash flow from

which we could pay dividends in the foreseeable future.

PLAN OF OPERATION

Liquidity and Capital Resources

We were incorporated on September 15, 1988 and since that time have

raised our capital resources through an Initial Public Offering completed in

Canada on April 12, 1991, the proceeds of a series of private placements, the

proceeds of a Short Form Prospectus offering, the proceeds from stock option

exercises and the proceeds from the issuance of convertible securities.

Our financial statements are prepared in accordance with Canadian

generally accepted accounting principles ("GAAP") and the analysis of liquidity

and capital resources herein is based upon these statements. Our financial

statements contained in this prospectus include a reconciliation of Canadian

GAAP to U.S. GAAP at Note 12 for the December 31, 2001 financial statements, at

Note 6 for the March 31, 2002 interim financial statements and at Note 7 for the

June 30, 2002 interim financial statements.

- 11 -

We have had negative cash flows from operating activities since

inception, and expect that such negative cash flows will continue. For the

period ended June 30, 2002 and the years ended December 31, 2001, 2000, and

1999, the negative cash flows from operating activities, on a U.S. GAAP basis,

were ($1,035,962), ($1,888,443), ($1,640,629) and ($889,371), respectively. Our

negative cash flows from investing activities, on a U.S. GAAP basis, totaled

($13,693), ($305,639), ($537,931) and ($196,423) for the period ended June 30,

2002 and the years ended December 31, 2001, 2000, and 1999, respectively. Our

cash flows from financing activities, on the basis of both the Canadian and U.S.

GAAP, totaled $1,201,178, $2,255,494, $2,173,118 and $1,117,337 for the period

ended June 30, 2002 and the years ended December 31, 2001, 2000, and 1999,

respectively. As of December 31, 2001, we had a working capital deficiency of

$624,250 and as at June 30, 2002 our position had improved such that our working

capital was $315,861.

Subsequent to December 31, 2001, we raised a total of $1,554,625 through

June 30, 2002. Further, as part of the February 2002 private placement, we

issued a convertible debenture payable in the amount of $1,000,000. We will draw

down the proceeds of this debenture as required over the course of the 2002

exploration season. The debenture is convertible into units of our common stock

at the rate of one unit per C$0.35 of debt converted at the option of the

holder. Each unit will consist of one common share and one-half of one common

share purchase warrant, which allow the holder to acquire an additional common

share for two one-half common share purchase warrants and C$0.70 for two years

to December 19, 2003. However, we will require additional funding to continue

our operations during the next twelve months. We will be dependent on the

proceeds of debt and equity financing such as private placements, the issuance

of convertible securities, the exercise of stock options and warrants, and

optioning or selling our properties or other assets to fund our mineral

exploration expenditures and our general and administrative costs. Without such

proceeds, we may not continue as a going concern. There can be no assurance that

such funding will be available. We do not expect to purchase or sell significant

equipment, and we do not expect significant changes in the number of employees

over the next twelve months. As at December 31, 2001 we have two full-time and

two part-time employees employed in our exploration and administration areas.

For the ensuing twelve-month period, we anticipate that we will expend

approximately $1,000,000 on drilling, exploration programs and claim rental fees

related to our Montana claims and approximately $30,000 maintaining our Idaho

claims. The reduced maintenance costs for the Idaho claims is based upon the

goal of management to locate a new partner for the gold properties in order to

allow management to concentrate its efforts and resources on the Montana claims.

Subsequent to December 31, 2001, we entered into an agreement with Canden

Capital Corporation to sell them all of our gold interests in Idaho. The

transaction remains subject to TSX Venture Exchange approval.

At present, our plan for completing exploration of our Montana property

is to begin with a four-year staged program. We have divided the property into

various areas and have prioritized these targets. In the 2002 exploration season

we intend to expend approximately $1,000,000 exploring our highest priority

targets. Based on the results of the 2002 programs and dependent upon funding,

we intend to expend an additional $5,000,000 over the 2003 to 2005 exploration

seasons to further investigate the highest priority targets. We are currently

utilizing the results and interpretations of the 2000 exploration season

airborne geophysical program and the recently completed ground geophysical

program in an effort to locate the most favorable targets for our current

systematic surface and drill sampling programs. The approach has identified

several geophysical anomalies, which on a priority basis will be the subject of

the remainder of the 2002 season exploration program and future programs. This

systematic approach will be employed to assist us in determining the location,

size and average grade of mineralization within our property.

- 12 -

We believe that we will require approximately $460,000 for general and

administrative expenses for the 2002 fiscal year. The budget includes

approximately $265,000 for wages, consulting fees and benefits, $92,000 for

professional fees, $42,000 for office costs and rent, $38,000 for corporate

travel and board meetings and $24,000 for shareholder information. The amount

has decreased from the amount reported for this item in our Annual Report on

Form 10-KSB for the year ended December 31, 2001, as a result of closing

administrative offices in Vancouver, British Columbia and Lewiston, Idaho and

decreased professional fees to comply with Canadian and U.S. regulations as a

result of more of these tasks being performed with in-house staff. Management

will also be employing cost cutting measures on all areas of the general and

administrative expenses in an effort to expend as high a proportion of our funds

as possible on exploration activities.

Should we discover economic reserves on our property, our current plans

would be to look for a take-over by a larger company experienced in the

development of a producing mine or a joint venture or similar agreement to

advance the project through the development of a mine.

We are also investigating the possibility of a listing on the

Alternative Investment Market, operated by the London Stock Exchange, in the

coming months and have established a preliminary budget of $300,000 to

accomplish this task.

CAPITALIZATION

The following table sets forth our capitalization as of June 30, 2002,

as adjusted for our anticipated proceeds from draws upon the convertible

debenture agreement.

June 30, 2002

---------------------------

Actual As Adjusted

----------- -----------

Common voting shares, no par value, 100,000,000

shares authorized and 44,021,930 shares

outstanding actual and 48,556,216 shares

outstanding pro forma as adjusted (1) $16,259,161 $17,259,161

Deficit accumulated during exploration stage (13,745,143) (13,745,143)

----------- -----------

$2,514,018 $3,514,018

- --------------------------------------------------------------------------------

(1) As part of the private placement, which closed on February 7, 2002 was

the issuance of a convertible debenture in the amount of $1,000,000. The

debenture is convertible at the option of the holder. To date, we have

not drawn down any of the funds related to this debenture, although we

expect to call upon these funds as we proceed with the 2002 exploration

season. The debenture is convertible into units of our stock at C$0.35

per share. Each unit consists of one common share and one half common

share purchase warrant. Each full warrant entitles the holder to acquire

one common share at C$0.70 for two years expiring December 19, 2003.

Using an exchange rate of 0.6301 we expect to issue 4,534,286 shares on

conversion of the debenture. We have not adjusted for the potential

exercise of the related warrants, as the warrants are not currently in

the money.

- 13 -

SELECTED FINANCIAL DATA

The income statement data for the years ended December 31, 1999 through

2001, and balance sheet data at December 31, 1999 through 2001, are derived from

our financial statements that have been audited by PricewaterhouseCoopers, LLP,

independent accountants, and are qualified by reference to those audited

financial statements and related notes to the statements, which are included

elsewhere in this prospectus. The audited financial statements for the year

ended December 31, 2001 and 2000, included herein, include Note 12, which

provides a reconciliation from Canadian to U.S. generally accepted accounting

principles. The income statement data for the six months ended June 30, 2002,

and balance sheet data at June 30, 2002, are derived from unaudited interim

consolidated financial statements, which are included elsewhere in this

prospectus. The unaudited interim consolidated financial statements include all

adjustments, consisting of normal recurring accruals, which our management

considers necessary for a fair presentation of the information set forth in

those statements. Operating results for the six months ended June 30, 2002, are

not necessarily indicative of the results that may be expected for the year

ending December 31, 2002. You should read the data set forth below in

conjunction with "Plan of Operation," above, and the financial statements and

notes included in this prospectus. Further the data set forth below is based

upon U.S. generally accepted accounting principles based upon Note 12 to the

December 31, 2001 consolidated financial statements and Note 7 to the June 30,

2002 interim consolidated financial statements.

Six

Months

Years Ended 31 December Ended

------------------------------------------- 30 June

Income Statement Data 2001 2000 1999 2002

- -------------------------------------------------------------------------------------

Revenue $ -- $ -- $ -- $ --

Net loss for the period $ (4,580,618) $ (2,153,262 $ (1,195,978) $ (984,412)

Net loss per share

- Basic and diluted $ (0.13) $ (0.07) $ (0.07) $ (0.02)

Weighted average Shares

- Basic and diluted 36,181,875 29,868,903 16,692,843 43,102,569

- -------------------------------------------------------------------------------------

Years Ended As At 31 December As At

------------------------------------------- 30 June

Income Statement Data 2001 2000 1999 2002

- -------------------------------------------------------------------------------------

Balance Sheet Data 2001 2000 1999 2002

Total assets $ 353,253 $ 1,493,234 $ 1,236,662 $ 1,420,848

Working capital $ (624,250) $ (234,490) $ (610,609) $ 315,861

Long-term debt $ 390,785 $ -- $ 3,590 $ --

Shareholders'

equity (deficiency) $ (780,964) $ 1,220,276 $ 741,885 $ 1,284,371

- 14 -

DESCRIPTION OF BUSINESS

Organization and corporate structure

We were incorporated in British Columbia, Canada on September 15, 1988.

Our original name was "Consolidated Idaho Platinum Resources Inc." We changed

our name to "Idaho Consolidated Metals Corp." as of June 30, 1989. We changed

our domicile in Canada from British Columbia to the Yukon as of August 2, 2001.

We changed our name to Beartooth Platinum Corporation on July 24, 2002.

We have one wholly owned subsidiary, Idaho Consolidated Metals

International, Ltd. It was incorporated in the British Virgin Islands on July

17, 1996. The subsidiary does not operate any business at the date of this

Prospectus.

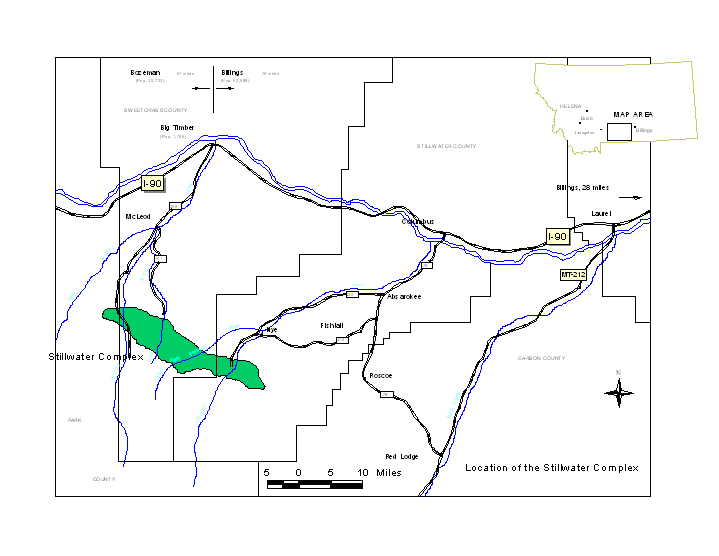

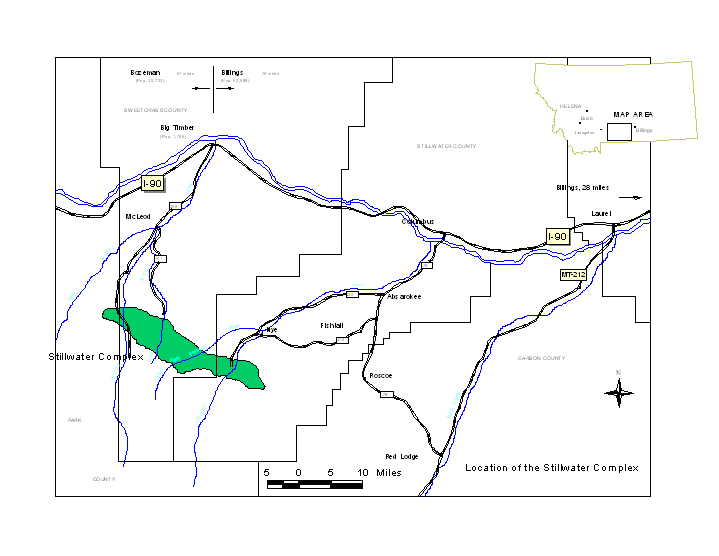

Map of the Location of our Montana Property

- 15 -

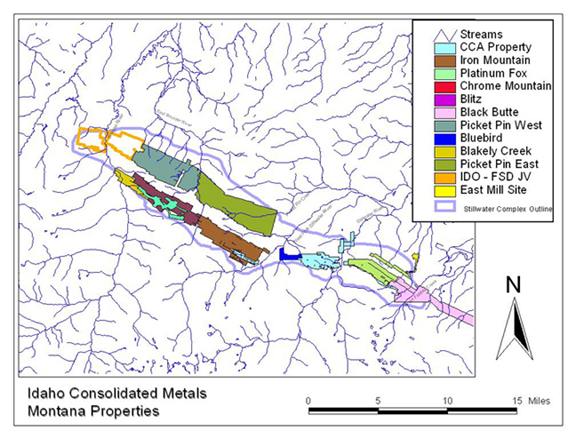

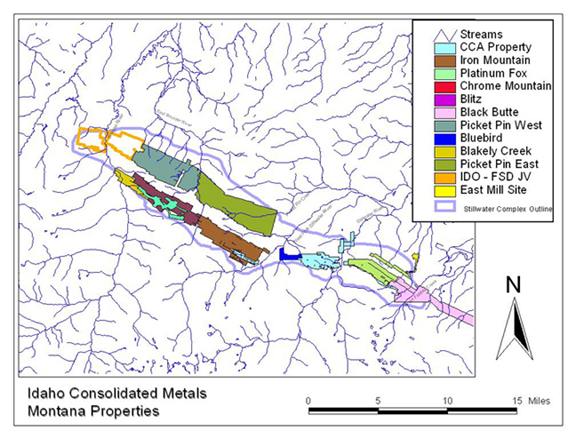

Map of our Montana Claims

- 15 -

Map of our Montana Claims

Assembly and exploration of our mining claims - 1988 to 2001

We are a mineral exploration company and are primarily engaged in the

acquisition, and exploration of precious metals properties. The principal

precious metals targeted by us are platinum group metals and gold. From 1988 to

1996 we purchased, staked and leased gold claims in Idaho. Beginning in 1998, we

shifted our focus to claim acquisitions and exploration for platinum group

metals on the Stillwater Complex located in the Park, Sweetgrass and Stillwater

Counties, Montana, by staking unpatented claims, and by obtaining leasehold

interests in and/or options to purchase, explore and develop certain patented

and unpatented claims located therein. (For a discussion of these terms, see

Risk Factor entiltled "If we do not comply with applicable regulatory

requirements, we may lose rights to unpatented mining claims.")

- 16 -

Subsequent to December 31, 2001 we have sold all of our gold properties,

subject to regulatory approval currently being sought by the acquirer. We are

actively exploring our platinum group claims in Park County, Sweetgrass County

and Stillwater County, Montana. Accordingly, our current principal business does

not include further acquisition or exploration of our gold claims. (See Gold

Properties Description below).

The Stillwater Complex contains five stratigraphic layers that appear to

host layers or reefs that contain anomalous platinum group metal values. Our

claims possess anomalous mineralization (platinum, palladium, nickel and copper)

hosted in horizons or layers, that are encountered and labeled from south to

north as follows: the Basal Series, the A and B Chromites (hosted in the

Ultramafic series), the Stillwater-Rose-Volatile Enrichment Zone (the "VEZ",

located at the contact between the Ultramafic Series and the Lower Member of the

Banded Series), the transverse faults (which cut across the Basal Zone and

Ultramafic Series), and the Picket Pin Zone (located at the contact between the

Middle and Upper Member's of the Banded Series)..

The significance of the Stillwater Complex can be found in the diverse

use of platinum group metals in industrial applications. Platinum group metals

are rare precious metals with unique physical properties. Platinum's largest use

is jewelry. However, the fastest growing use for platinum group metals is in the

automotive industry for the production of catalytic converters that reduce

harmful gases in automobile emissions. Industrial uses for platinum, in addition

to catalysts, include the production of data storage disks, glass, paints,

nitric acid, anti-cancer drugs, fiber optic cables, fertilizers, unleaded and

high-octane gasoline refining and fuel cells. Palladium is the conductive

element in multi-layer ceramic capacitors used in personal computers, cellular

phones, facsimile machines and other devices, as well as dental applications.

At the end of 2001, we have no proven or probable reserves in any of our

claims. However, the area consisting of our Montana claims, indicate anomalous

enrichment in the platinum group elements and we will conduct drilling,

sampling, trenching, assaying, geological and geophysical programs during the

year 2002. We will follow-up on results obtained during the 2001 exploration

program and are currently compiling the information and developing the

exploration plan for the 2002 exploration field season.

For a discussion of the risks associated with our business, please see

"Risk Factors", "Description of Properties" and "Plan of Operation".

Our Montana Claims for Platinum, Palladium and Rhodium

Our platinum group metals claims lie within or around the Stillwater

Complex. The Stillwater Complex is located in the Beartooth Mountains in south

central Montana. The Stillwater Complex is situated along the northern edge of

the Beartooth Plateau, which rises to elevations of over 10,000 feet. The

Beartooth Plateau is deeply incised by multiple rivers and their tributaries,

including the Stillwater River, which is located towards the eastern end of the

Complex and the Boulder River, which is near the western end of the Complex.

Both of these rivers eroded their valley floor, resulting in deep valleys that

cut into the gently undulating Beartooth Plateau.

- 17 -

The Stillwater Complex is a rare geological feature, composed of an

assemblage of mafic and ultramafic rocks derived from a single, large, buried

magma body emplaced an estimated 2.7 billion years ago. It is believed that as

the molten rock cooled individual minerals crystallized sequentially, with the

heavier, basic, darker minerals crystallizing first and sinking towards the

bottom of the magma chamber and the lighter, more siliceous light-colored

minerals crystallizing later to produce bands of norite, gabbro and anorthosite.

These layers formed in a generally horizontal position, but, through the years,

a portion of the original horizontal orientation of the Stillwater Complex was

moved due to shifts in the earth's crust, and it was tilted, dipping towards the

northeast at an angle of between 50 and 90 degrees to the horizontal. This

tilting exposed the rock of the Stillwater Complex at the surface as a series of

bands, which can be traced across most of the strike length of the Complex.