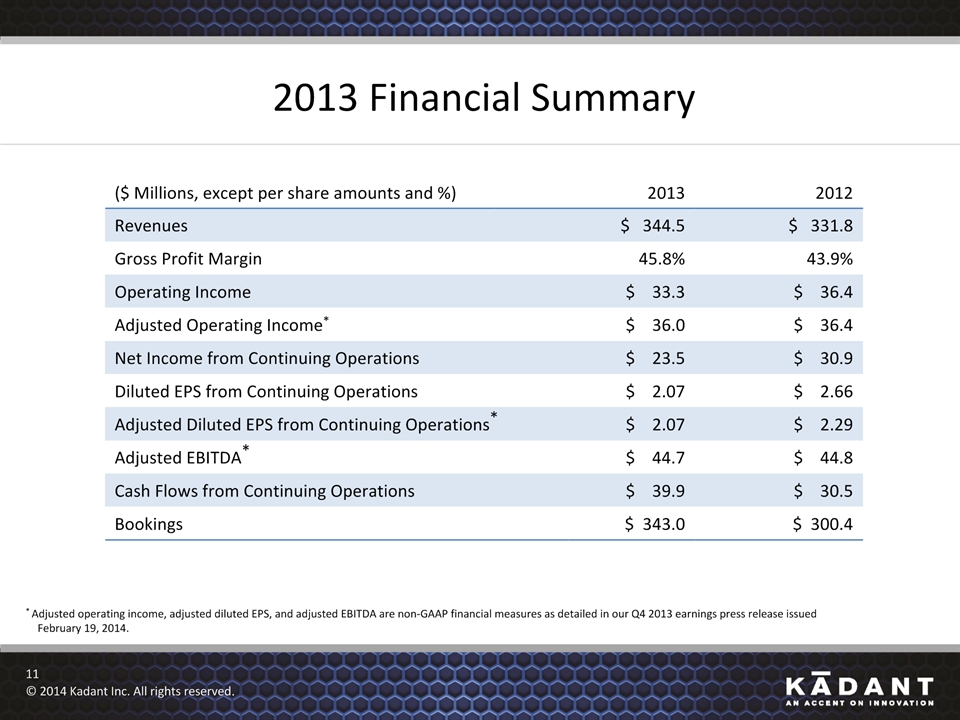

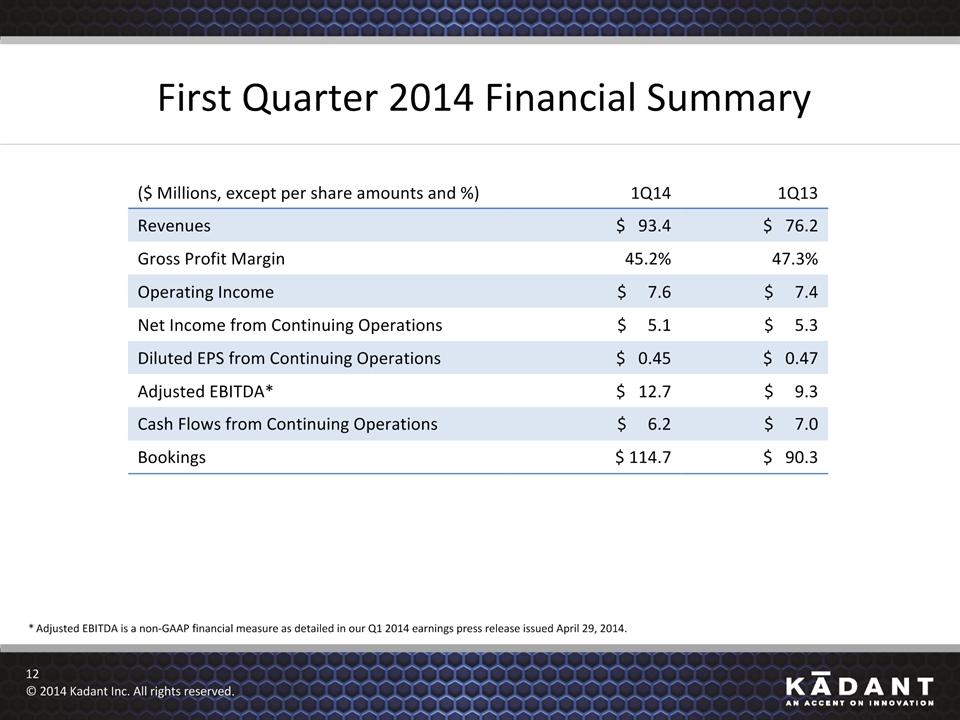

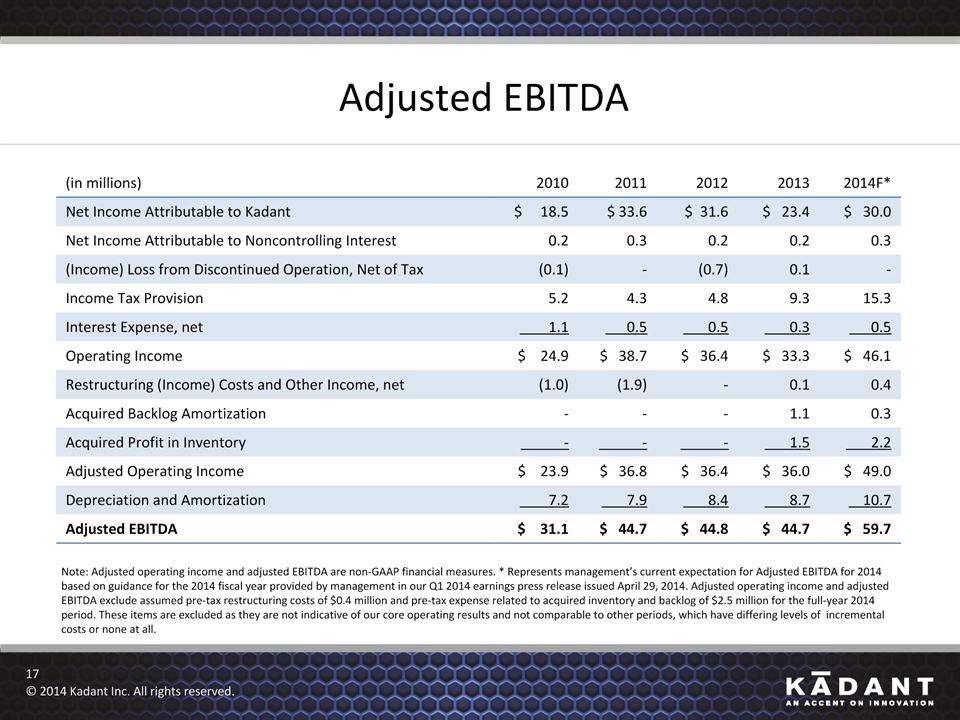

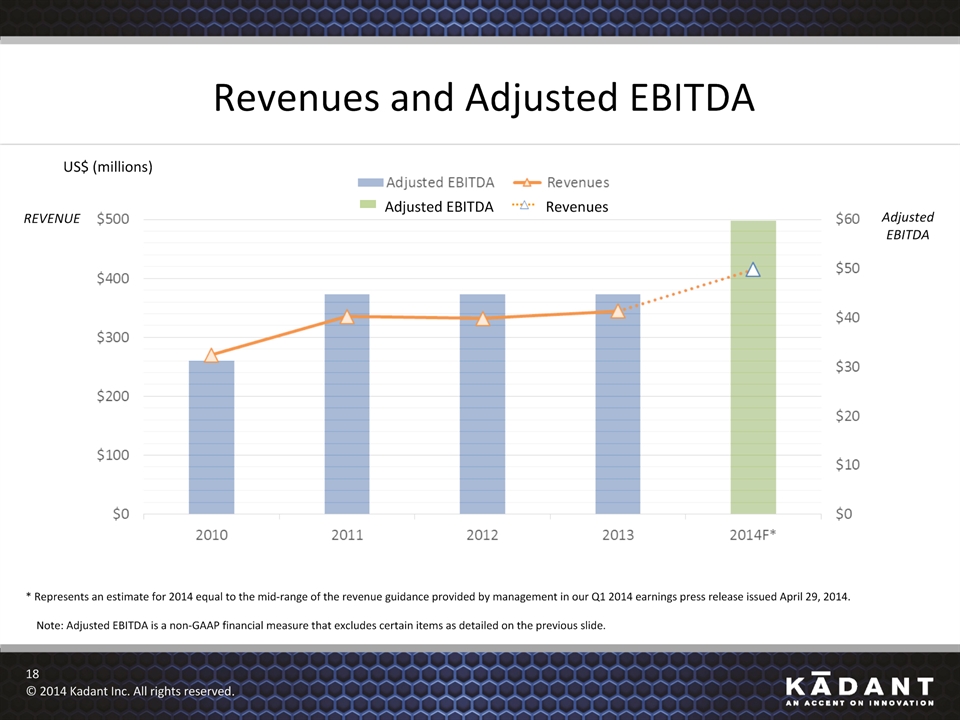

Use of Non-GAAP Financial Measures *© 2014 Kadant Inc. All rights reserved. Adjusted net income, adjusted diluted earnings per share (EPS), adjusted operating income, and adjusted EBITDA are non-GAAP financial measures. These non-GAAP financial measures exclude items that are not indicative of our normal operating results and are not comparable to other periods, which may have differing levels of acquired profit in inventory and backlog, restructuring costs, other expense (income), or discrete tax items or none at all. We provide these non-GAAP measures to give investors additional insight into our annual operating performance, especially when compared to periods in which such items had greater or lesser effect or no effect. Non-GAAP financial measures are not meant to be considered superior to or a substitute for the results of operations prepared in accordance with generally accepted accounting principles (GAAP). In addition, the non-GAAP financial measures have limitations associated with their use as compared to the most directly comparable GAAP measures, in that they may be different from, and therefore not comparable to, similar measures used by other companies. We believe that the inclusion of such measures helps investors to gain an understanding of our underlying operating performance and future prospects, consistent with how management measures and forecasts our performance, especially when comparing such results to previous periods or forecasts and to the performance of our competitors. Such measures are also used by us in our financial and operating decision-making and for compensation purposes. We also believe this information is responsive to investors’ requests and gives them an additional measure of our performance.