Fourth Quarter and FY 2022 Business Review February 16, 2023 Exhibit 99.2

Forward-Looking Statements The following constitutes a “Safe Harbor” statement under the Private Securities Litigation Reform Act of 1995: This presentation contains forward-looking statements that involve a number of risks and uncertainties, including forward-looking statements about our future financial and operating performance, demand for our products, and economic and industry outlook. These forward-looking statements represent our expectations as of February 15, 2023. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events, or otherwise. These forward-looking statements are subject to known and unknown risks and uncertainties that may cause our actual results to differ materially from these forward-looking statements as a result of various important factors, including those set forth under the heading "Risk Factors" in Kadant’s annual report on Form 10-K for the fiscal year ended January 1, 2022 and subsequent filings with the Securities and Exchange Commission. These include risks and uncertainties relating to adverse changes in global and local economic conditions; the variability and difficulty in accurately predicting revenues from large capital equipment and systems projects; health epidemics; our acquisition strategy; levels of residential construction activity; reductions by our wood processing customers of their capital spending or production of oriented strand board; changes to the global timber supply; development and use of digital media; cyclical economic conditions affecting the global mining industry; demand for coal, including economic and environmental risks associated with coal; failure of our information systems or breaches of data security and cybertheft; implementation of our internal growth strategy; supply chain constraints, inflationary pressure, price increases and shortages in raw materials; competition; changes in our tax provision or exposure to additional tax liabilities; our ability to successfully manage our manufacturing operations; disruption in production; future restructurings; loss of key personnel and effective succession planning; protection of intellectual property; climate change; adequacy of our insurance coverage; global operations; policies of the Chinese government; the variability and uncertainties in sales of capital equipment in China; currency fluctuations; economic conditions and regulatory changes caused by the United Kingdom’s exit from the European Union; changes to government regulations and policies around the world; compliance with government regulations and policies and compliance with laws; environmental laws and regulations; environmental, health and safety laws and regulations impacting the mining industry; our debt obligations; restrictions in our credit agreement and note purchase agreement; substitution of an alternative index for LIBOR; soundness of financial institutions; fluctuations in our share price; and anti-takeover provisions. 2KAI 4Q22 BUSINESS REVIEW–FEBRUARY 2023 | © 2023 KADANT INC. ALL RIGHTS RESERVED.

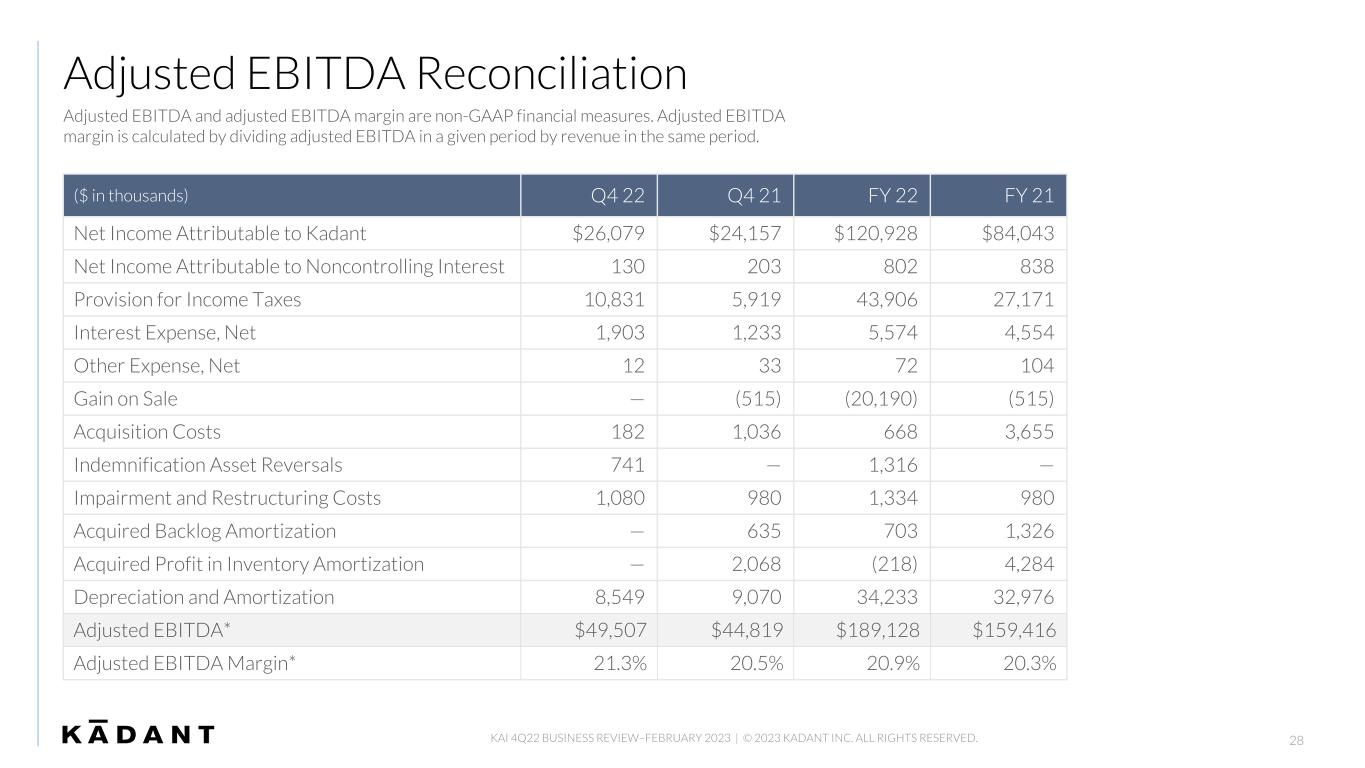

Use of Non-GAAP Financial Measures In addition to the financial measures prepared in accordance with U.S. generally accepted accounting principles (GAAP), we use certain non-GAAP financial measures, including increases or decreases in revenue excluding the effect of acquisitions and foreign currency translation (organic revenue), adjusted diluted EPS (earnings per share), adjusted earnings before interest, taxes, depreciation, and amortization (adjusted EBITDA), adjusted EBITDA margin, adjusted operating income, and free cash flow. Specific non-GAAP financial measures have been marked with an * (asterisk) within this presentation. A reconciliation of those numbers to the most directly comparable GAAP financial measures is shown in the Appendix and in our fourth quarter and fiscal year 2022 earnings press release issued February 15, 2023, which is available in the Investors section of our website at investor.kadant.com under the heading News Releases. We believe these non-GAAP financial measures, when taken together with the corresponding GAAP financial measures, provide meaningful supplemental information regarding our performance by excluding certain items that may not be indicative of our core business, operating results, or future outlook. We believe the inclusion of such measures helps investors gain an understanding of our underlying operating performance and future prospects, consistent with how management measures and forecasts our performance, especially when comparing such results to previous periods or forecasts and to the performance of our competitors. Such measures are also used by us in our financial and operating decision-making and for compensation purposes. We also believe this information is responsive to investors' requests and gives them an additional measure of our performance. The non-GAAP financial measures included in this presentation are not meant to be considered superior to or a substitute for the results of operations prepared in accordance with GAAP. In addition, the non-GAAP financial measures included in this presentation have limitations associated with their use as compared to the most directly comparable GAAP measures, in that they may be different from, and therefore not comparable to, similar measures used by other companies. 3 KAI 4Q22 BUSINESS REVIEW–FEBRUARY 2023 | © 2023 KADANT INC. ALL RIGHTS RESERVED.

BUSINESS REVIEW Jeffrey L. Powell, President & CEO 4 KAI 4Q22 BUSINESS REVIEW–FEBRUARY 2023 | © 2023 KADANT INC. ALL RIGHTS RESERVED.

Operational Highlights • Excellent execution by our businesses led to strong financial performance and record adjusted EBITDA* in Q4 and FY 2022 • Internal initiatives driving margin improvement • Named by Newsweek as one of America's Most Responsible Companies for the third consecutive year KAI 4Q22 BUSINESS REVIEW–FEBRUARY 2023 | © 2023 KADANT INC. ALL RIGHTS RESERVED. . 5

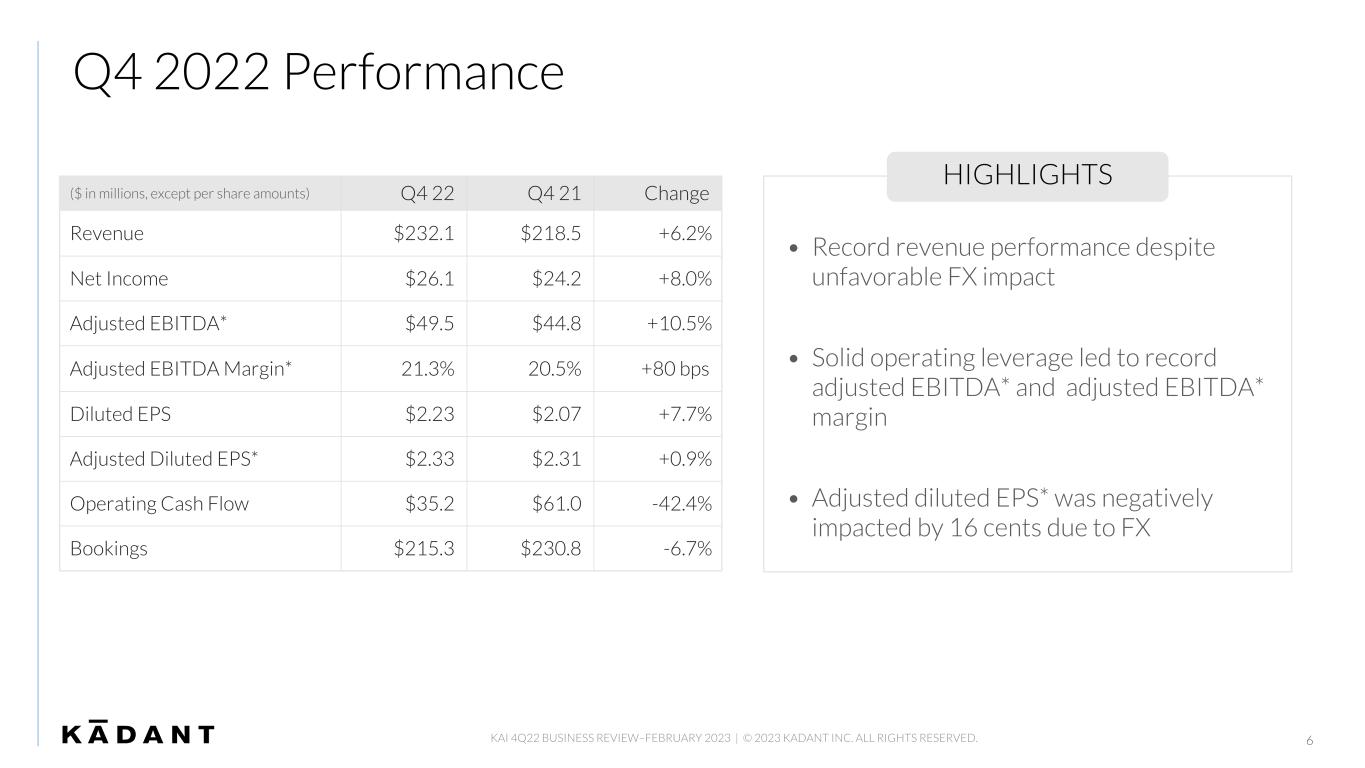

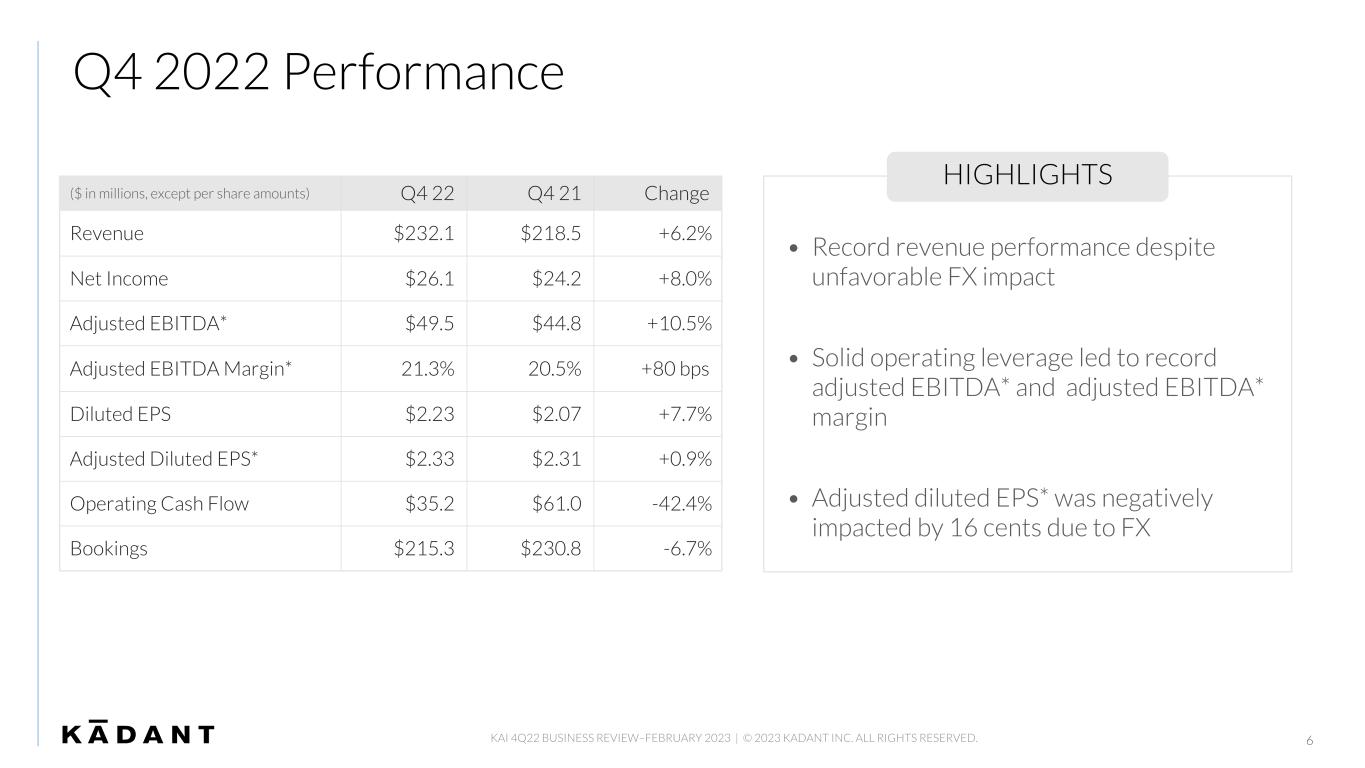

Q4 2022 Performance 6 ($ in millions, except per share amounts) Q4 22 Q4 21 Change Revenue $232.1 $218.5 +6.2% Net Income $26.1 $24.2 +8.0% Adjusted EBITDA* $49.5 $44.8 +10.5% Adjusted EBITDA Margin* 21.3% 20.5% +80 bps Diluted EPS $2.23 $2.07 +7.7% Adjusted Diluted EPS* $2.33 $2.31 +0.9% Operating Cash Flow $35.2 $61.0 -42.4% Bookings $215.3 $230.8 -6.7% HIGHLIGHTS • Record revenue performance despite unfavorable FX impact • Solid operating leverage led to record adjusted EBITDA* and adjusted EBITDA* margin • Adjusted diluted EPS* was negatively impacted by 16 cents due to FX KAI 4Q22 BUSINESS REVIEW–FEBRUARY 2023 | © 2023 KADANT INC. ALL RIGHTS RESERVED.

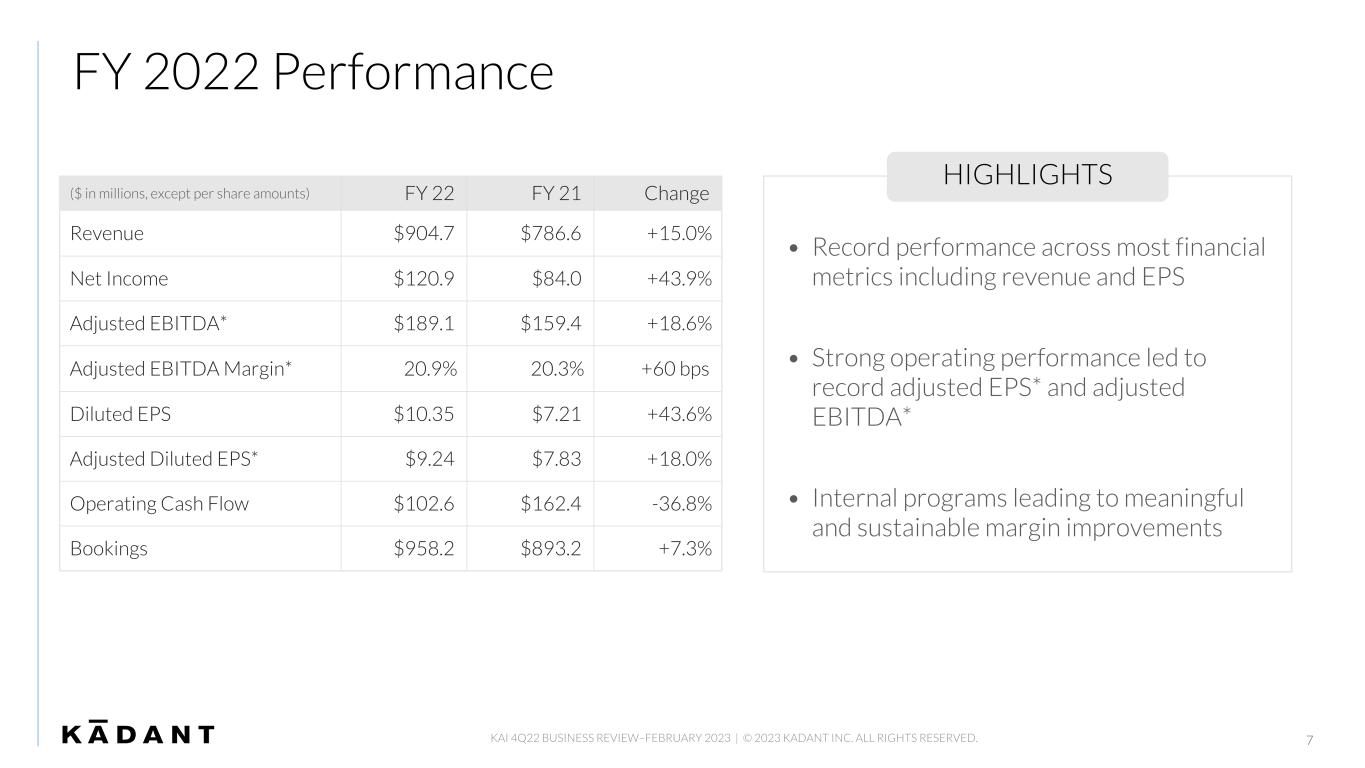

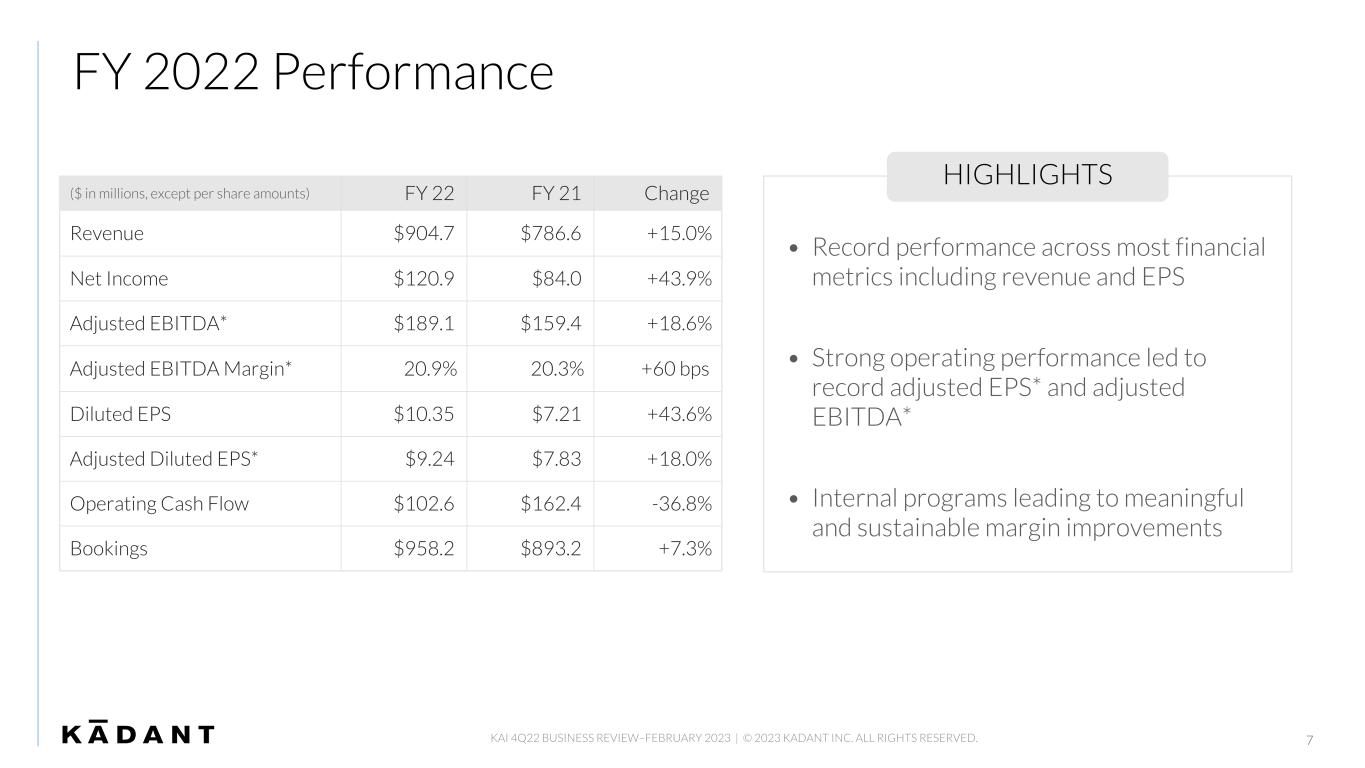

FY 2022 Performance 7 ($ in millions, except per share amounts) FY 22 FY 21 Change Revenue $904.7 $786.6 +15.0% Net Income $120.9 $84.0 +43.9% Adjusted EBITDA* $189.1 $159.4 +18.6% Adjusted EBITDA Margin* 20.9 % 20.3 % +60 bps Diluted EPS $10.35 $7.21 +43.6% Adjusted Diluted EPS* $9.24 $7.83 +18.0% Operating Cash Flow $102.6 $162.4 -36.8% Bookings $958.2 $893.2 +7.3% HIGHLIGHTS • Record performance across most financial metrics including revenue and EPS • Strong operating performance led to record adjusted EPS* and adjusted EBITDA* • Internal programs leading to meaningful and sustainable margin improvements KAI 4Q22 BUSINESS REVIEW–FEBRUARY 2023 | © 2023 KADANT INC. ALL RIGHTS RESERVED.

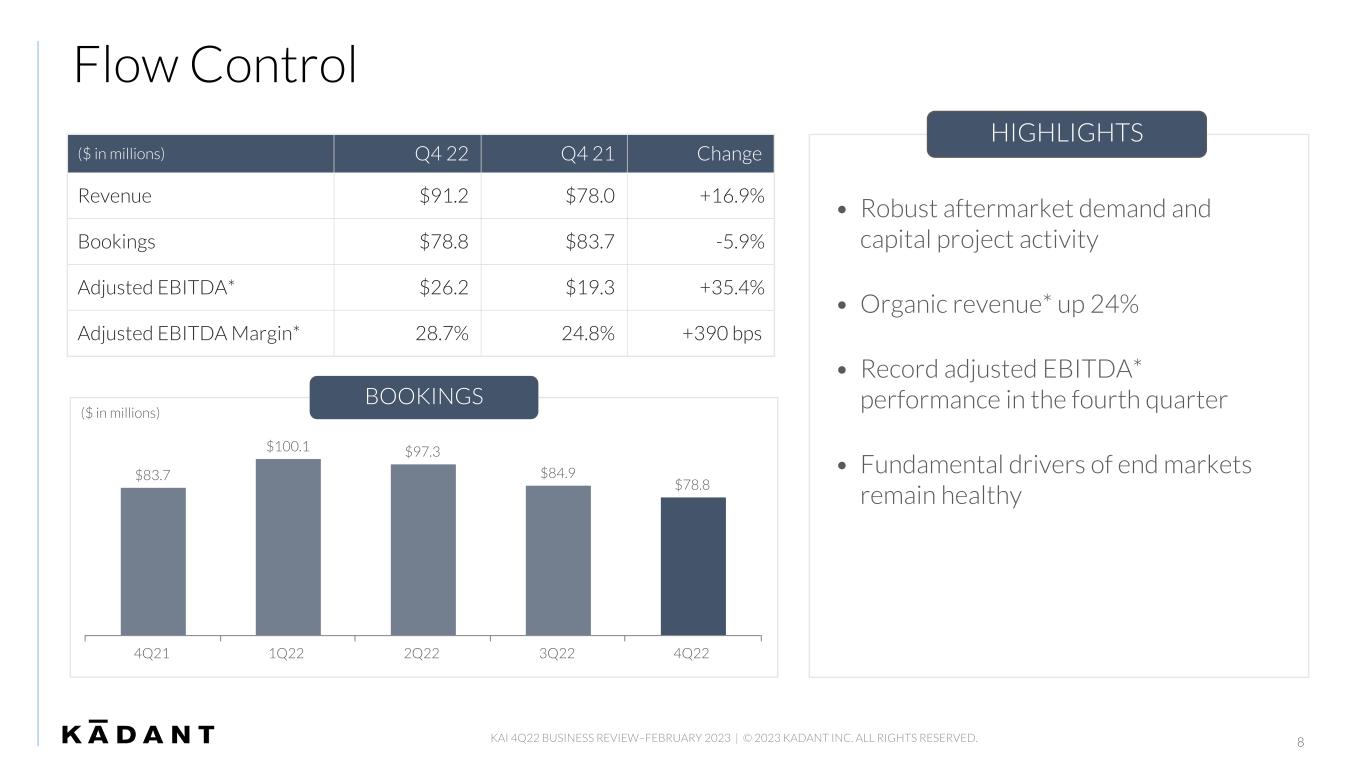

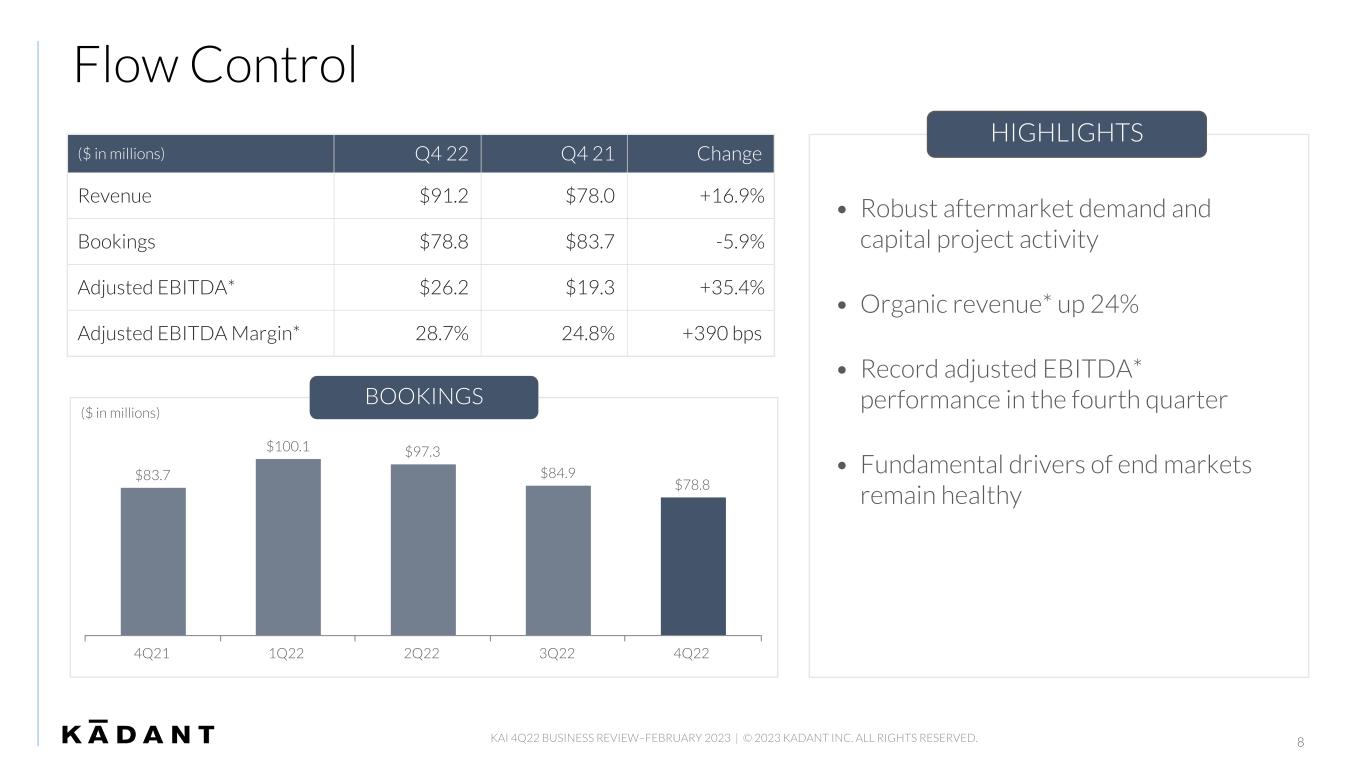

$83.7 $100.1 $97.3 $84.9 $78.8 4Q21 1Q22 2Q22 3Q22 4Q22 8 ($ in millions) Q4 22 Q4 21 Change Revenue $91.2 $78.0 +16.9% Bookings $78.8 $83.7 -5.9% Adjusted EBITDA* $26.2 $19.3 +35.4% Adjusted EBITDA Margin* 28.7% 24.8% +390 bps HIGHLIGHTS • Robust aftermarket demand and capital project activity • Organic revenue* up 24% • Record adjusted EBITDA* performance in the fourth quarter • Fundamental drivers of end markets remain healthy ($ in millions) KAI 4Q22 BUSINESS REVIEW–FEBRUARY 2023 | © 2023 KADANT INC. ALL RIGHTS RESERVED. BOOKINGS Flow Control

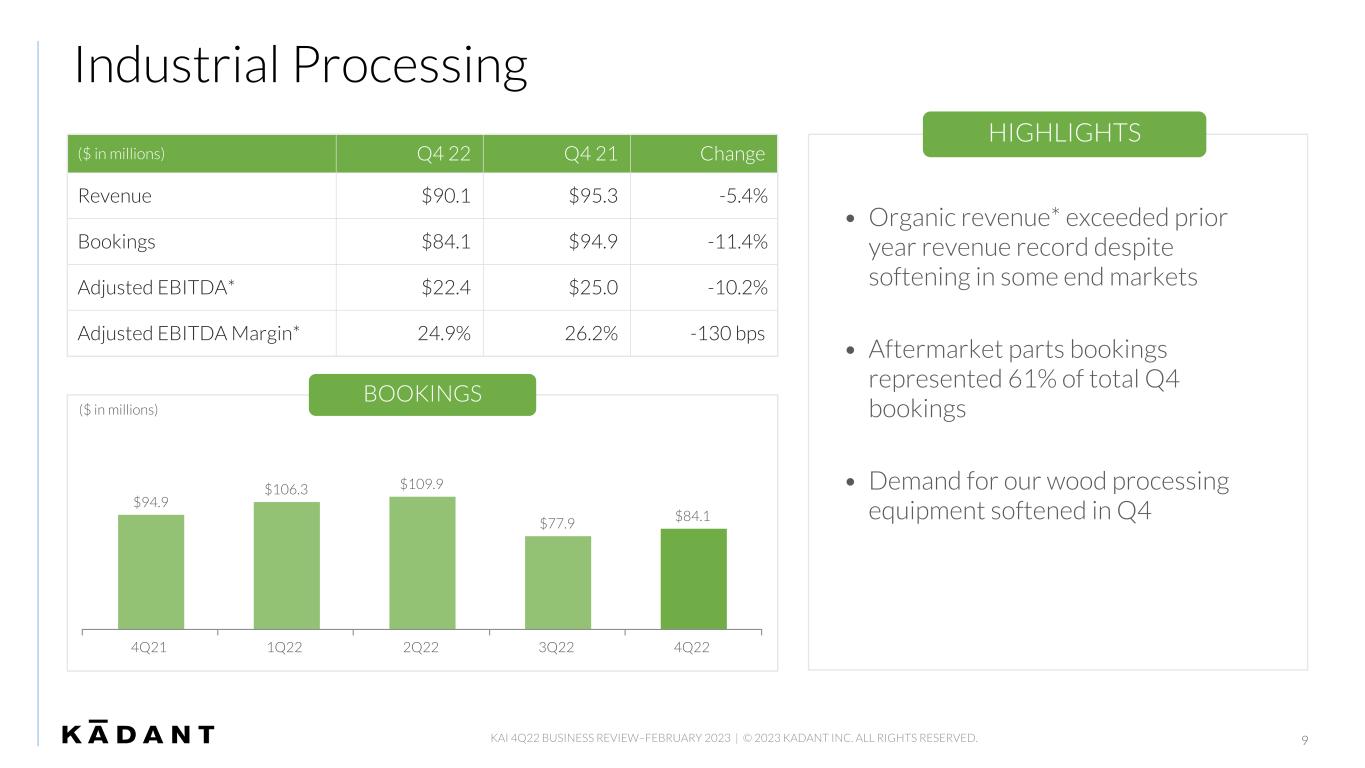

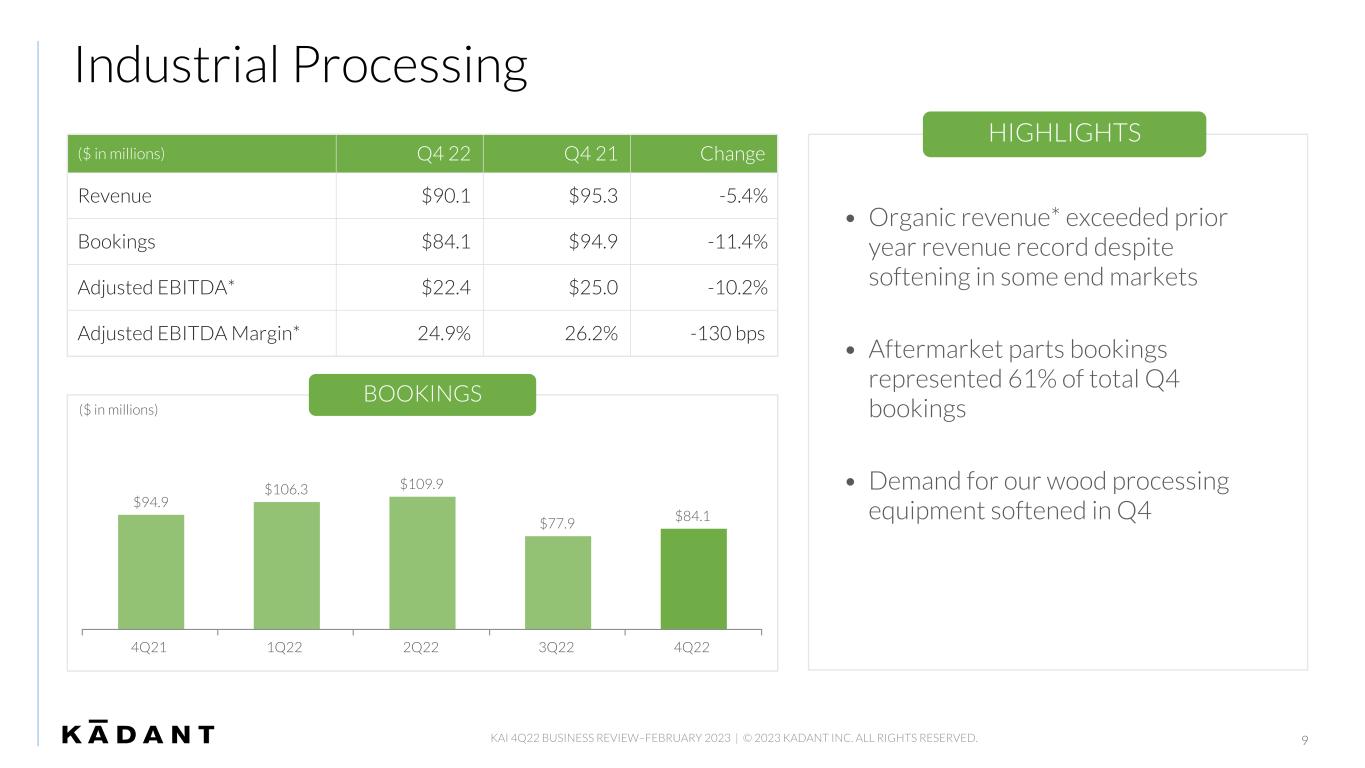

9 ($ in millions) Q4 22 Q4 21 Change Revenue $90.1 $95.3 -5.4% Bookings $84.1 $94.9 -11.4% Adjusted EBITDA* $22.4 $25.0 -10.2% Adjusted EBITDA Margin* 24.9% 26.2% -130 bps HIGHLIGHTS • Organic revenue* exceeded prior year revenue record despite softening in some end markets • Aftermarket parts bookings represented 61% of total Q4 bookings • Demand for our wood processing equipment softened in Q4 KAI 4Q22 BUSINESS REVIEW–FEBRUARY 2023 | © 2023 KADANT INC. ALL RIGHTS RESERVED. Industrial Processing $94.9 $106.3 $109.9 $77.9 $84.1 4Q21 1Q22 2Q22 3Q22 4Q22 BOOKINGS ($ in millions)

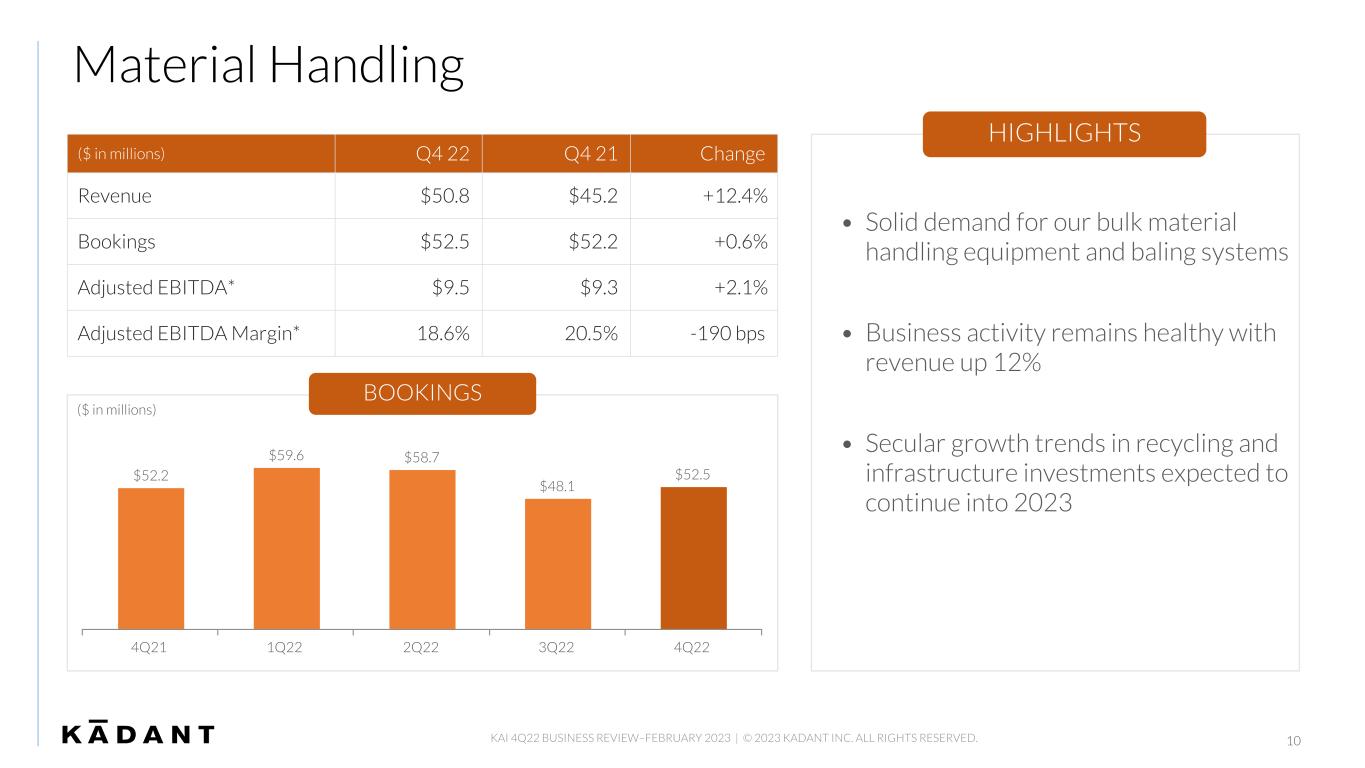

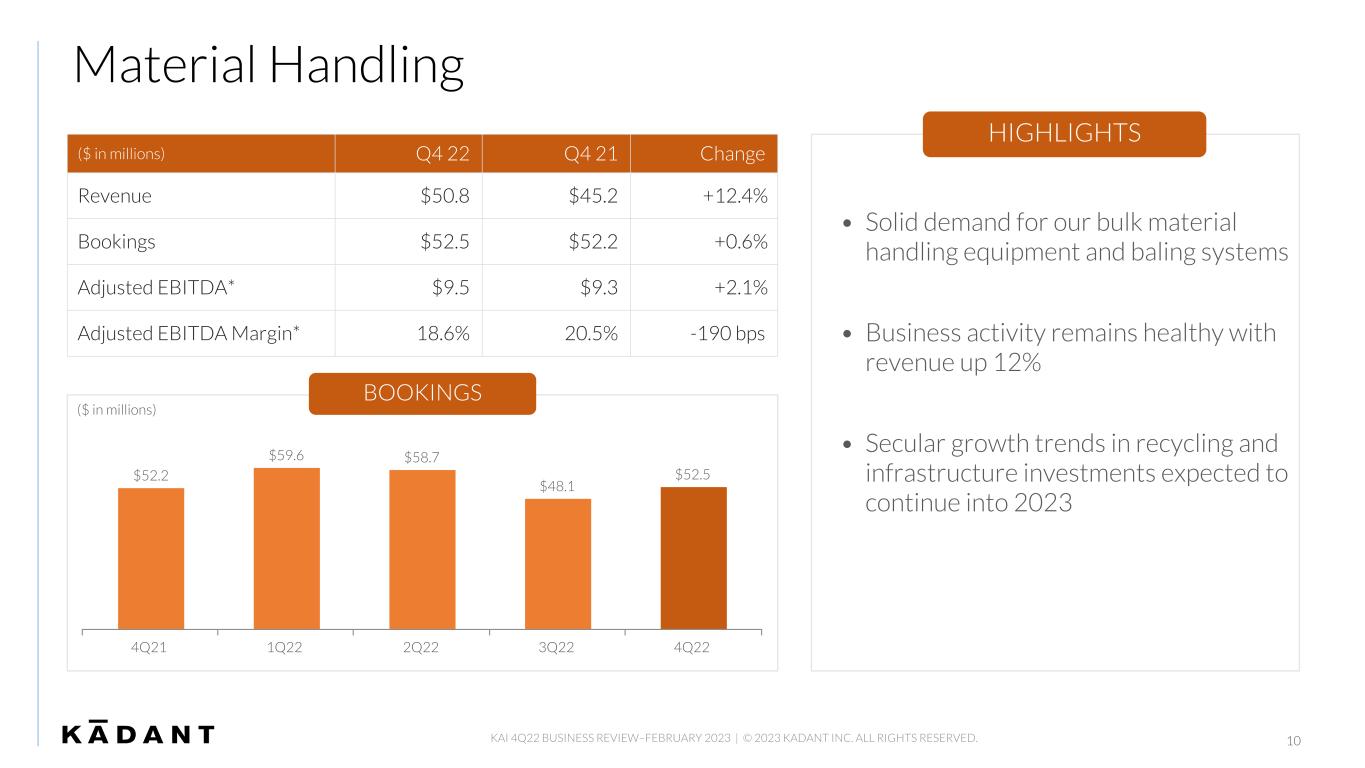

10 ($ in millions) Q4 22 Q4 21 Change Revenue $50.8 $45.2 +12.4% Bookings $52.5 $52.2 +0.6% Adjusted EBITDA* $9.5 $9.3 +2.1% Adjusted EBITDA Margin* 18.6% 20.5% -190 bps HIGHLIGHTS • Solid demand for our bulk material handling equipment and baling systems • Business activity remains healthy with revenue up 12% • Secular growth trends in recycling and infrastructure investments expected to continue into 2023 KAI 4Q22 BUSINESS REVIEW–FEBRUARY 2023 | © 2023 KADANT INC. ALL RIGHTS RESERVED. Material Handling $52.2 $59.6 $58.7 $48.1 $52.5 4Q21 1Q22 2Q22 3Q22 4Q22 BOOKINGS ($ in millions)

Business Outlook • Good level of project activity going into 2023 • Industrial demand expected to be relatively strong in the first half of the year; less visibility and certainty in the second half • Economic headwinds are expected to strengthen as the year progresses 11KAI 4Q22 BUSINESS REVIEW–FEBRUARY 2023 | © 2023 KADANT INC. ALL RIGHTS RESERVED.

FINANCIAL REVIEW Michael J. McKenney, EVP & CFO KAI 4Q22 BUSINESS REVIEW–FEBRUARY 2023 | © 2023 KADANT INC. ALL RIGHTS RESERVED. 12

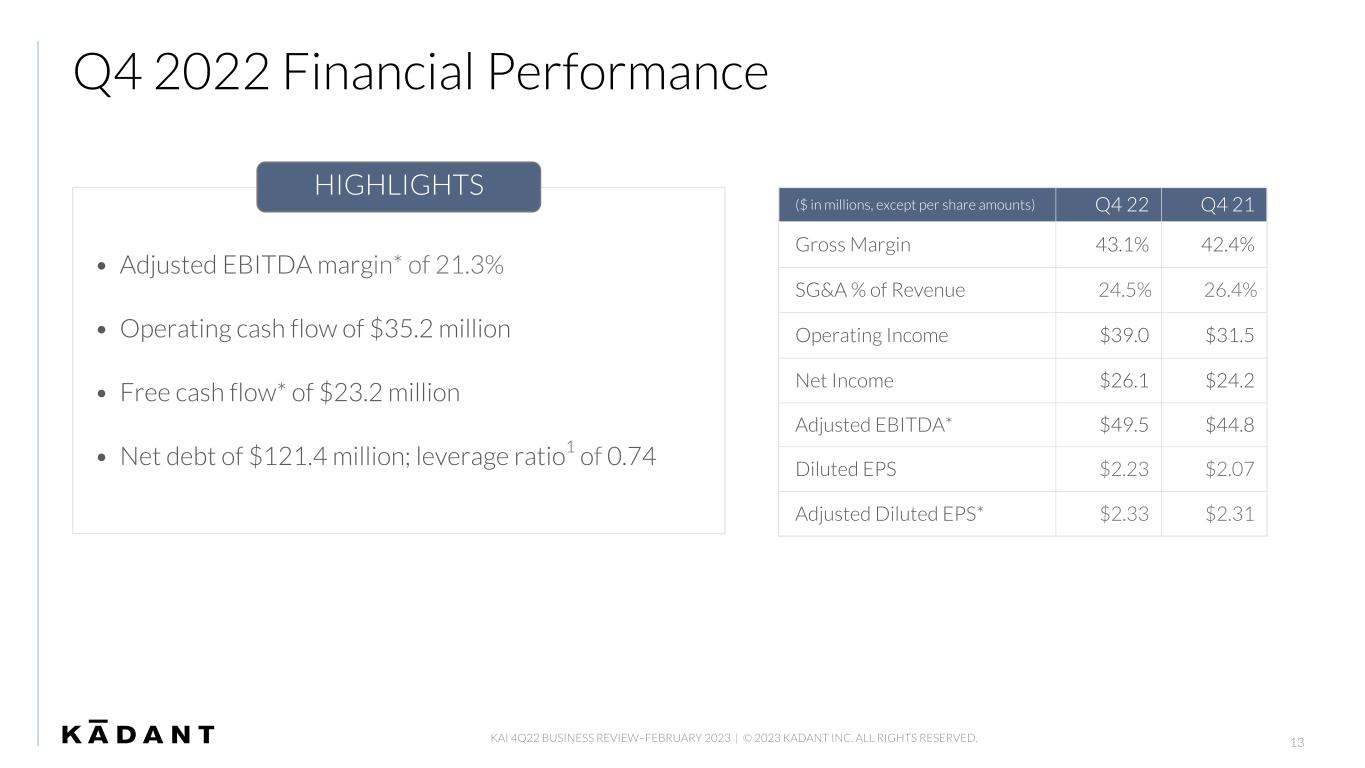

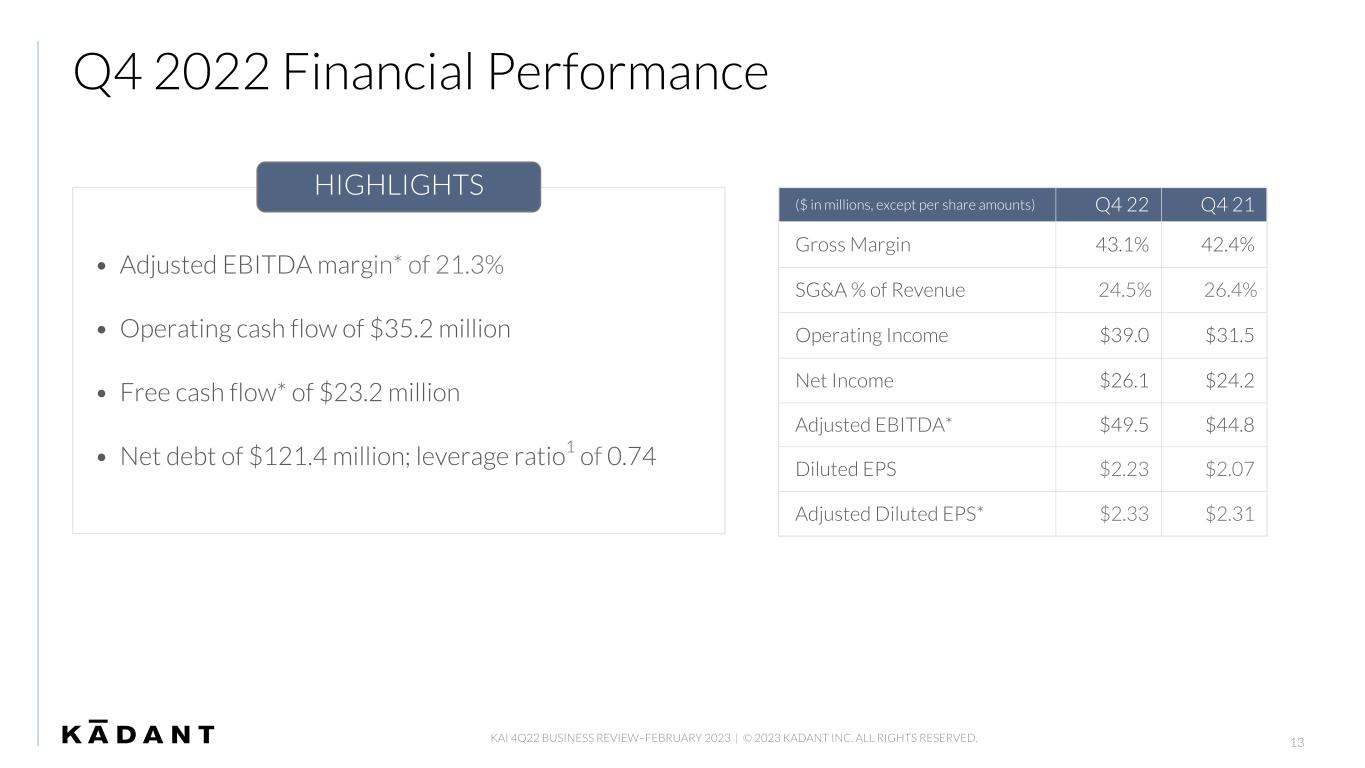

Q4 2022 Financial Performance ($ in millions, except per share amounts) Q4 22 Q4 21 Gross Margin 43.1% 42.4% SG&A % of Revenue 24.5% 26.4% Operating Income $39.0 $31.5 Net Income $26.1 $24.2 Adjusted EBITDA* $49.5 $44.8 Diluted EPS $2.23 $2.07 Adjusted Diluted EPS* $2.33 $2.31 HIGHLIGHTS • Adjusted EBITDA margin* of 21.3% • Operating cash flow of $35.2 million • Free cash flow* of $23.2 million • Net debt of $121.4 million; leverage ratio1 of 0.74 KAI 4Q22 BUSINESS REVIEW–FEBRUARY 2023 | © 2023 KADANT INC. ALL RIGHTS RESERVED. 13

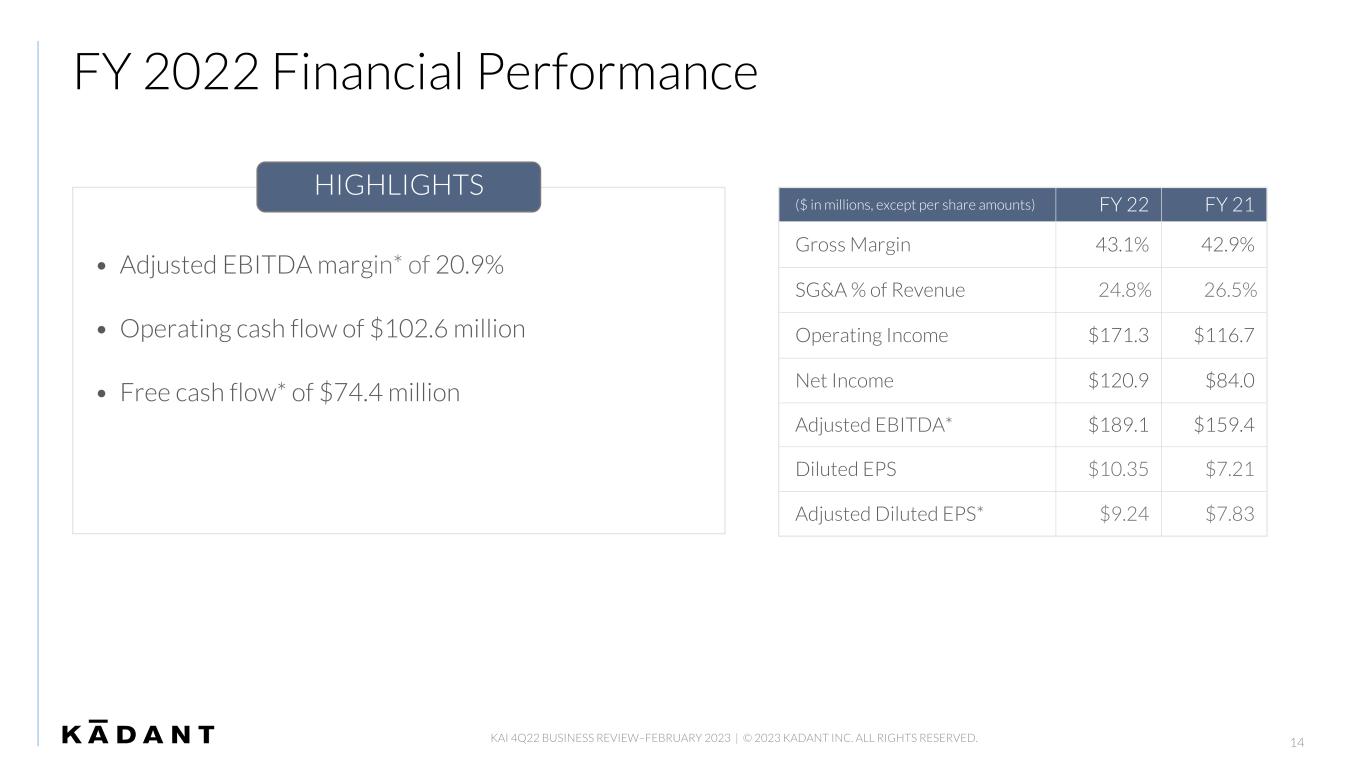

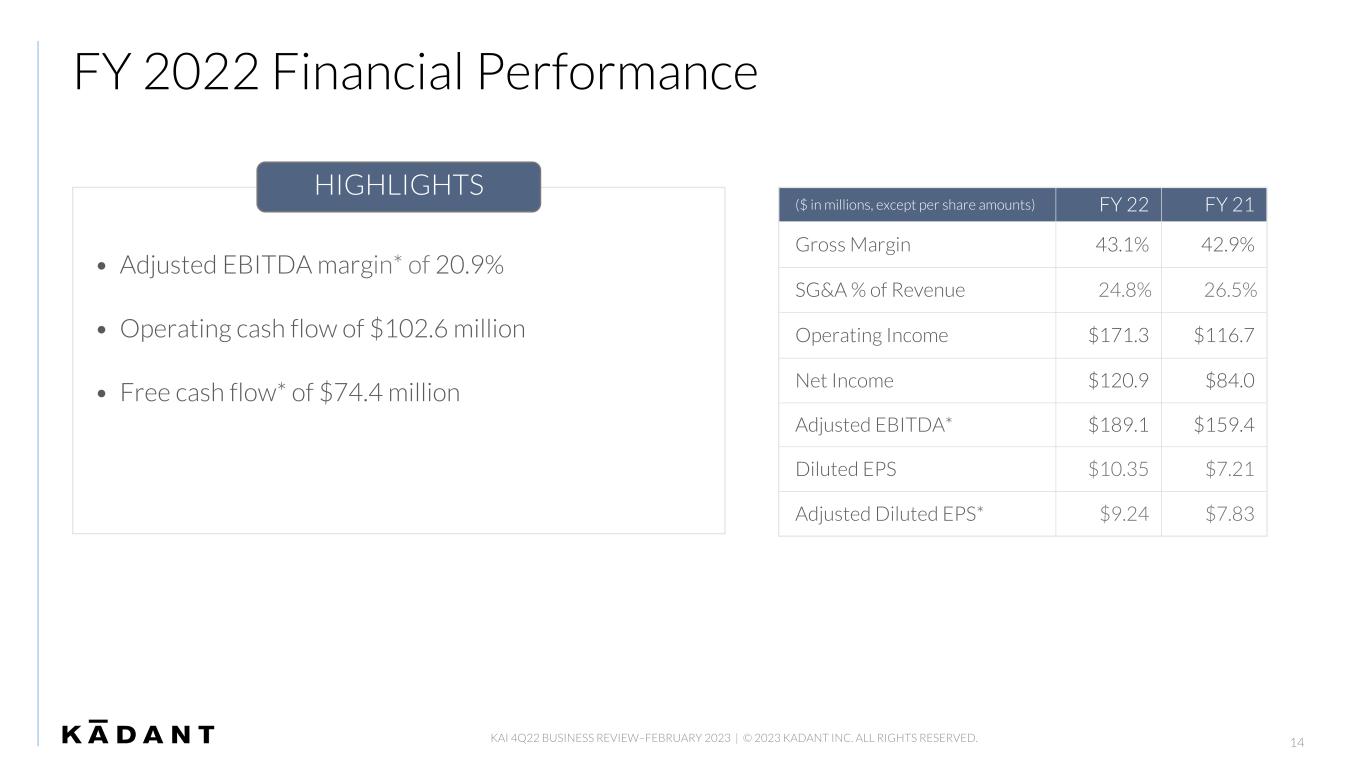

FY 2022 Financial Performance ($ in millions, except per share amounts) FY 22 FY 21 Gross Margin 43.1% 42.9% SG&A % of Revenue 24.8% 26.5% Operating Income $171.3 $116.7 Net Income $120.9 $84.0 Adjusted EBITDA* $189.1 $159.4 Diluted EPS $10.35 $7.21 Adjusted Diluted EPS* $9.24 $7.83 HIGHLIGHTS • Adjusted EBITDA margin* of 20.9% • Operating cash flow of $102.6 million • Free cash flow* of $74.4 million KAI 4Q22 BUSINESS REVIEW–FEBRUARY 2023 | © 2023 KADANT INC. ALL RIGHTS RESERVED. 14

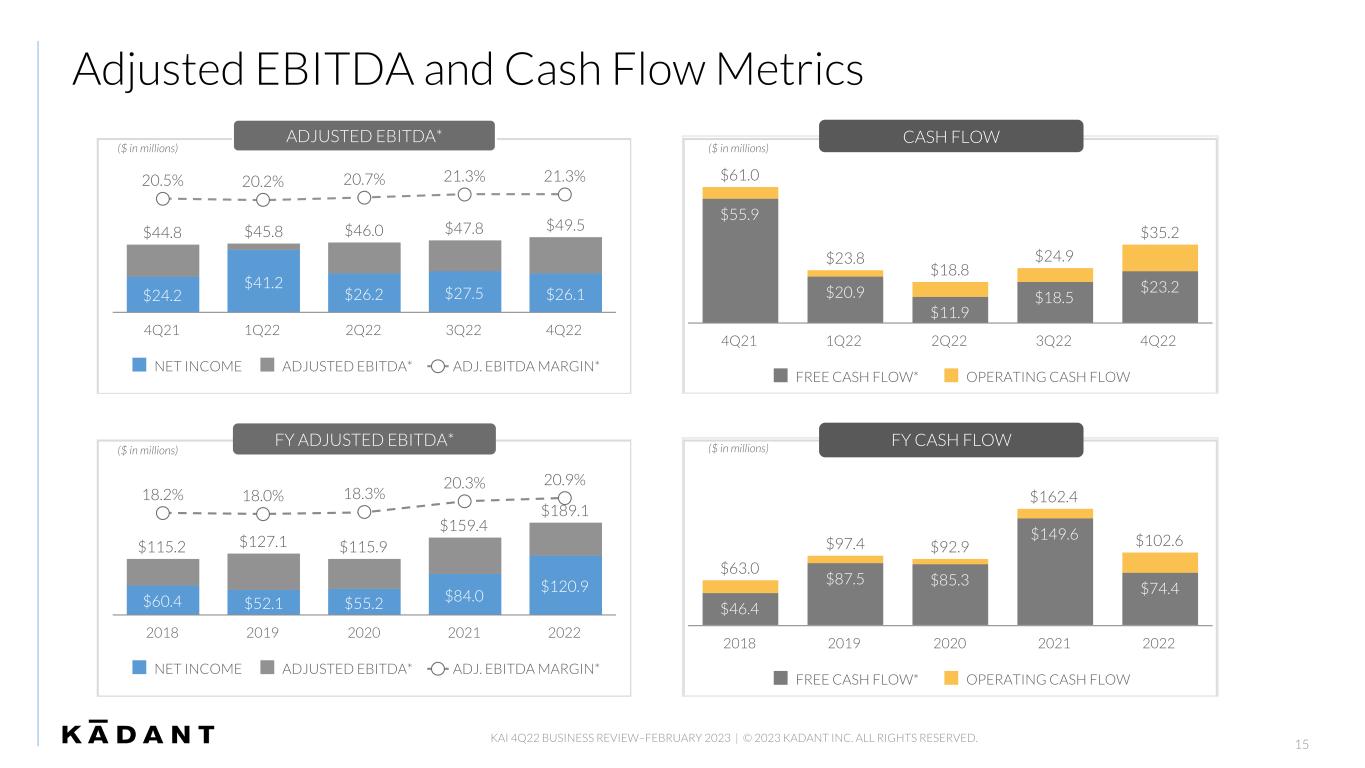

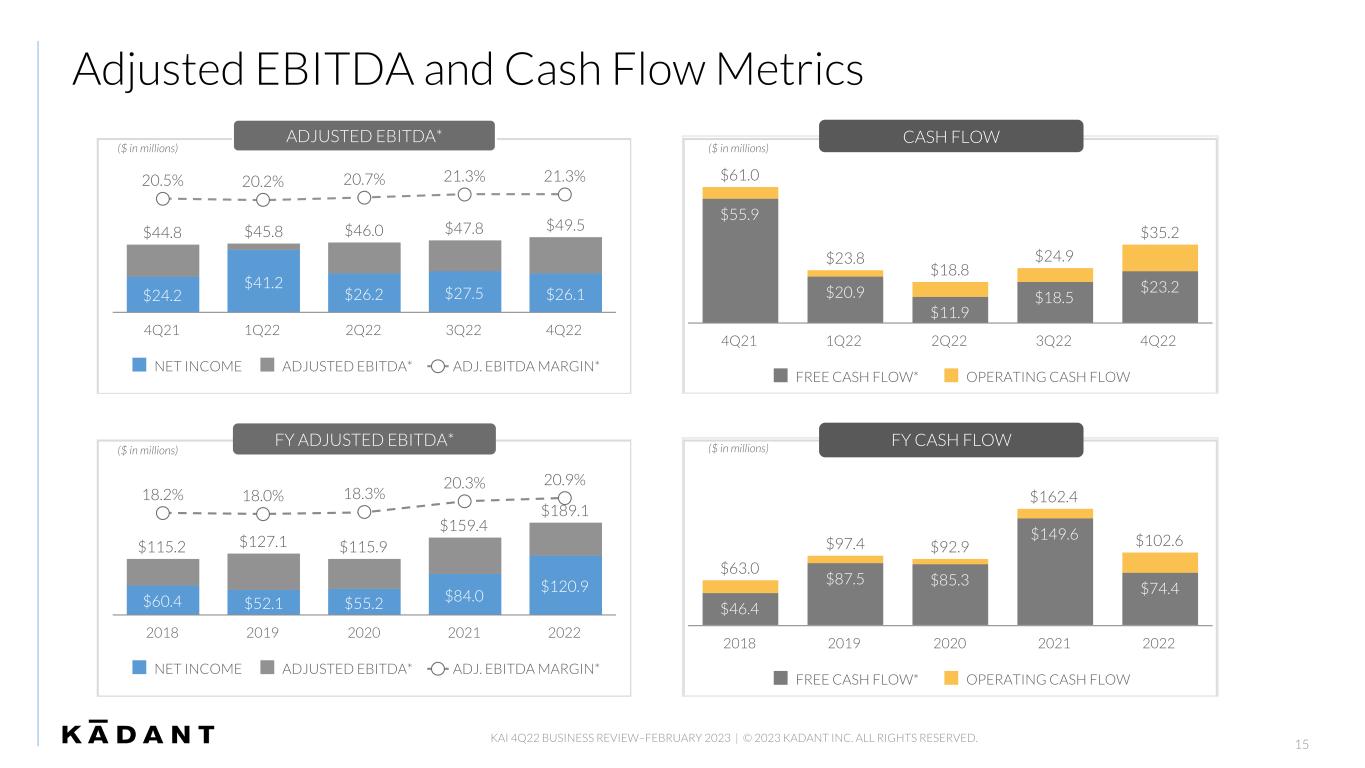

$115.2 $127.1 $115.9 $159.4 $189.1 $60.4 $52.1 $55.2 $84.0 $120.9 18.2% 18.0% 18.3% 20.3% 20.9% NET INCOME ADJUSTED EBITDA* ADJ. EBITDA MARGIN* 2018 2019 2020 2021 2022 Adjusted EBITDA and Cash Flow Metrics KAI 4Q22 BUSINESS REVIEW–FEBRUARY 2023 | © 2023 KADANT INC. ALL RIGHTS RESERVED. 15 FY ADJUSTED EBITDA* ($ in millions) $61.0 $23.8 $18.8 $24.9 $35.2 $55.9 $20.9 $11.9 $18.5 $23.2 FREE CASH FLOW* OPERATING CASH FLOW 4Q21 1Q22 2Q22 3Q22 4Q22 CASH FLOW ($ in millions) $63.0 $97.4 $92.9 $162.4 $102.6 $46.4 $87.5 $85.3 $149.6 $74.4 FREE CASH FLOW* OPERATING CASH FLOW 2018 2019 2020 2021 2022 FY CASH FLOW ($ in millions)($ in millions) $44.8 $45.8 $46.0 $47.8 $49.5 $24.2 $41.2 $26.2 $27.5 $26.1 20.5% 20.2% 20.7% 21.3% 21.3% NET INCOME ADJUSTED EBITDA* ADJ. EBITDA MARGIN* 4Q21 1Q22 2Q22 3Q22 4Q22 ADJUSTED EBITDA* ($ in millions)

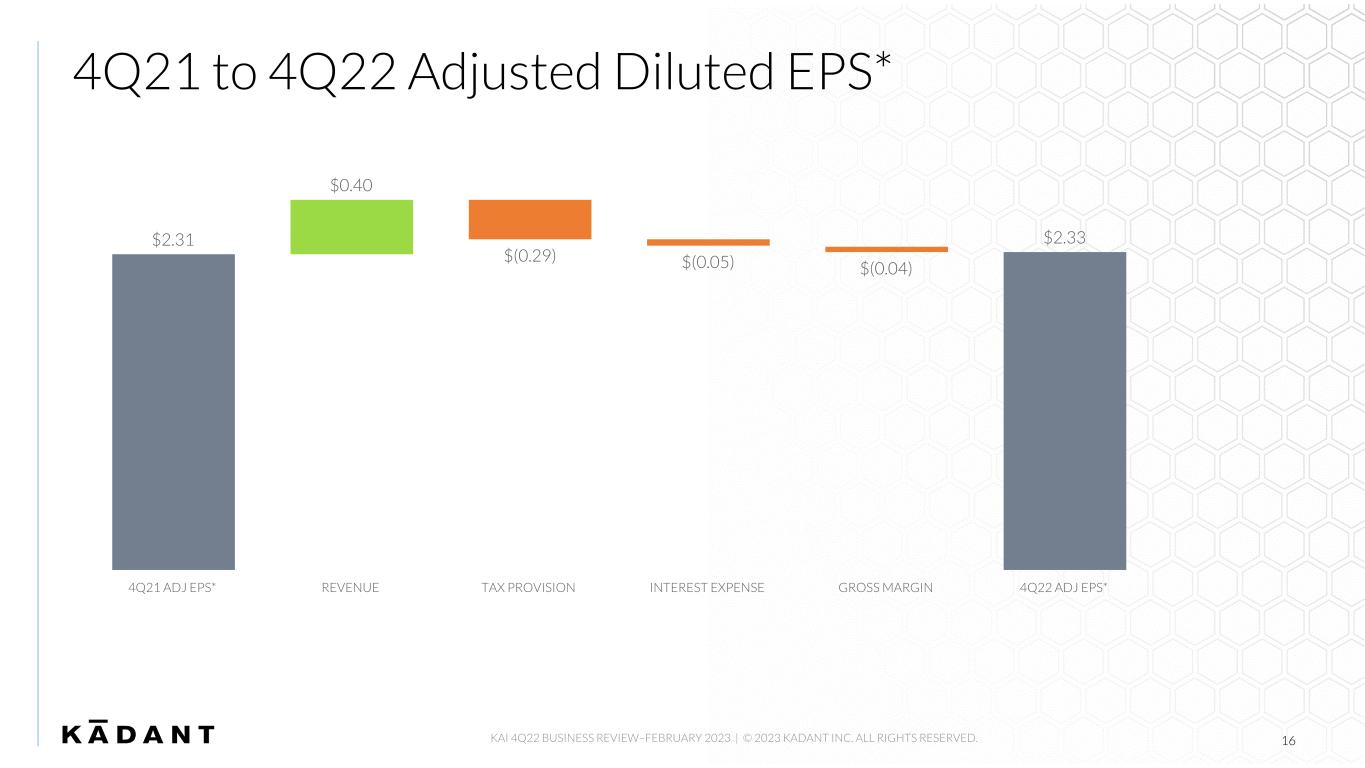

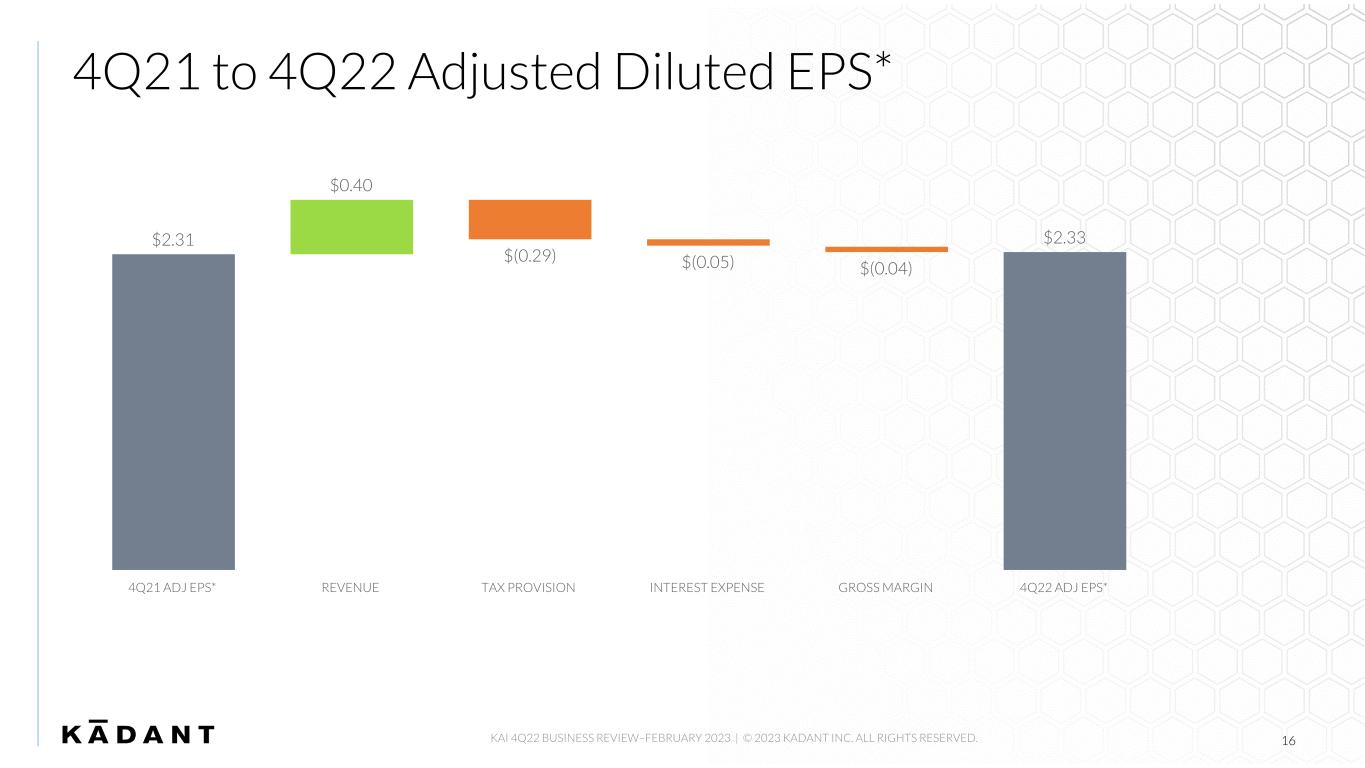

2Q21 ADJ EPS* 2Q22 ADJ EPS* KAI 4Q22 BUSINESS REVIEW–FEBRUARY 2023 | © 2023 KADANT INC. ALL RIGHTS RESERVED. 4Q21 to 4Q22 Adjusted Diluted EPS* 16 $2.31 $0.40 $(0.29) $(0.05) $(0.04) $2.33 4Q21 ADJ EPS* REVENUE TAX PROVISION INTEREST EXPENSE GROSS MARGIN 4Q22 ADJ EPS*

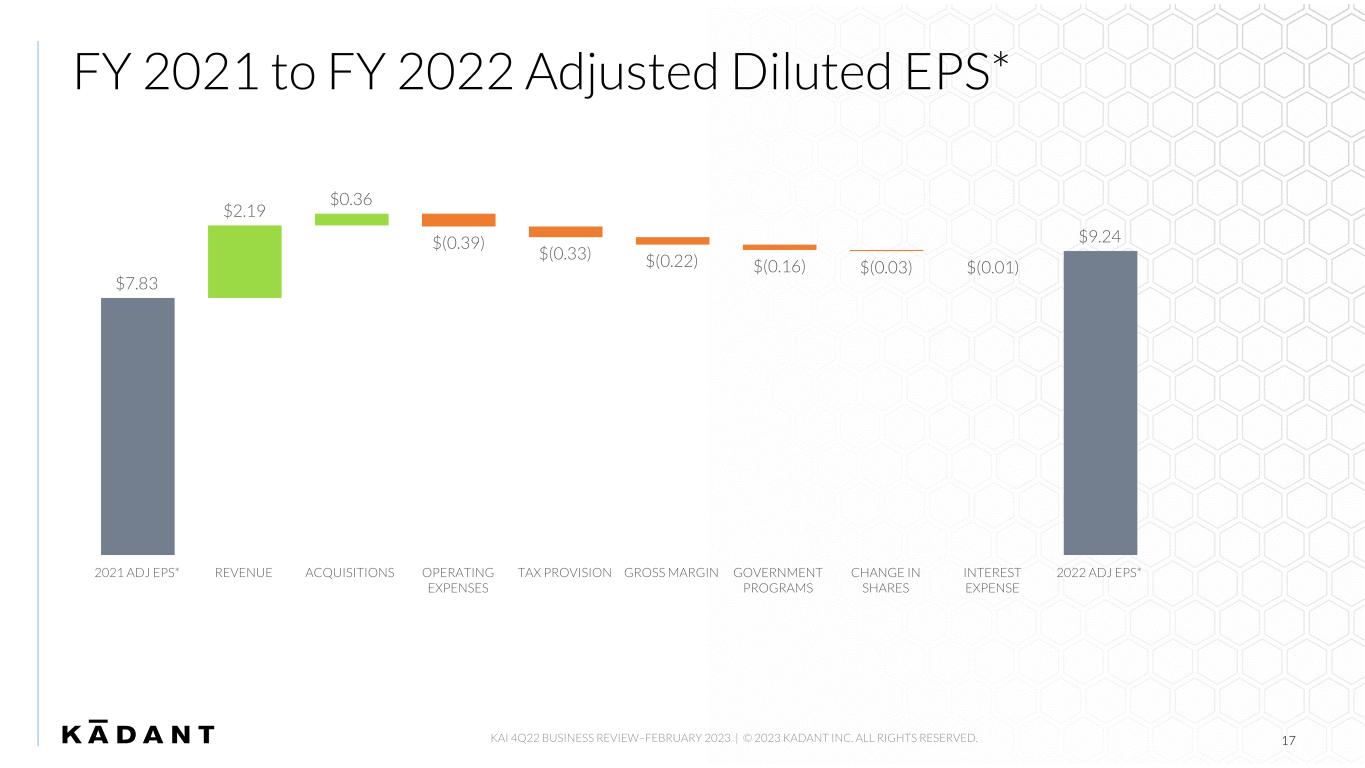

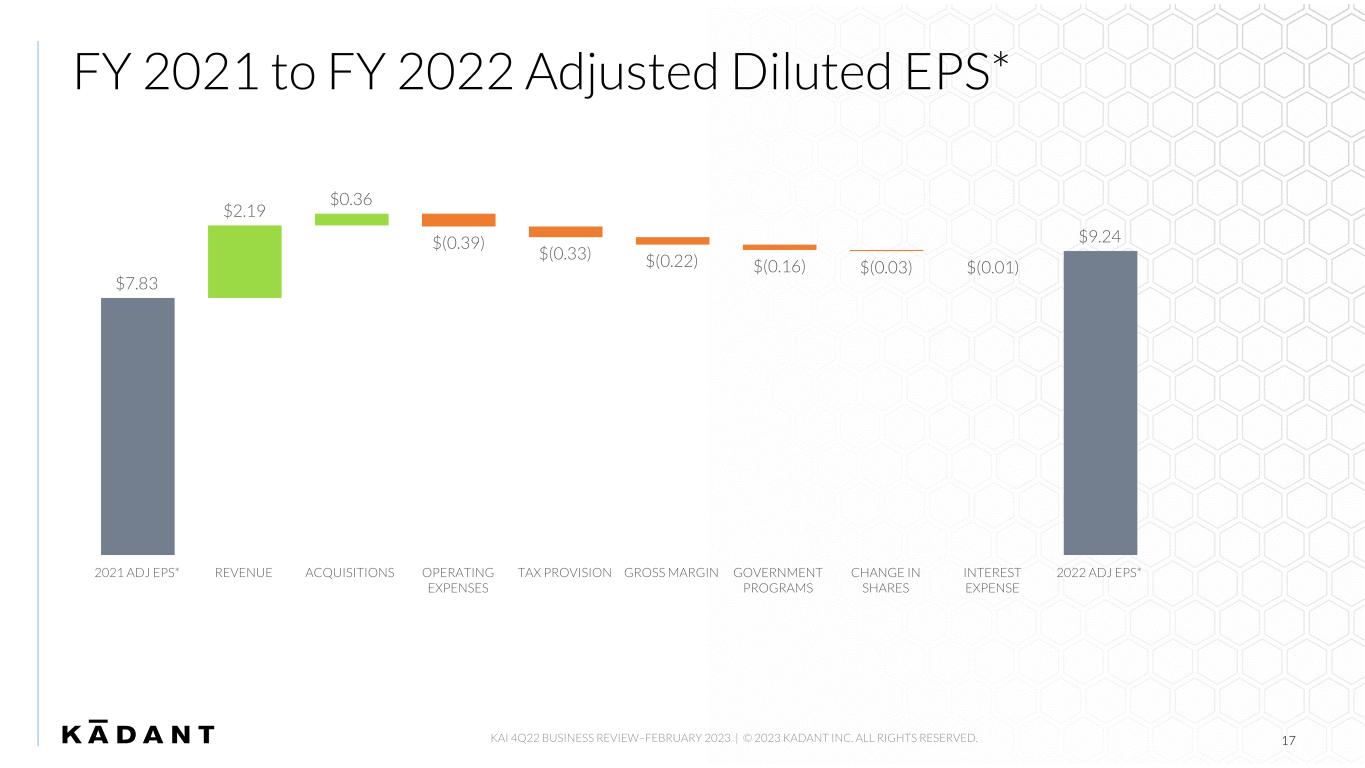

2Q21 ADJ EPS* 2Q22 ADJ EPS* KAI 4Q22 BUSINESS REVIEW–FEBRUARY 2023 | © 2023 KADANT INC. ALL RIGHTS RESERVED. FY 2021 to FY 2022 Adjusted Diluted EPS* 17 $7.83 $2.19 $0.36 $(0.39) $(0.33) $(0.22) $(0.16) $(0.03) $(0.01) $9.24 2021 ADJ EPS* REVENUE ACQUISITIONS OPERATING EXPENSES TAX PROVISION GROSS MARGIN GOVERNMENT PROGRAMS CHANGE IN SHARES INTEREST EXPENSE 2022 ADJ EPS*

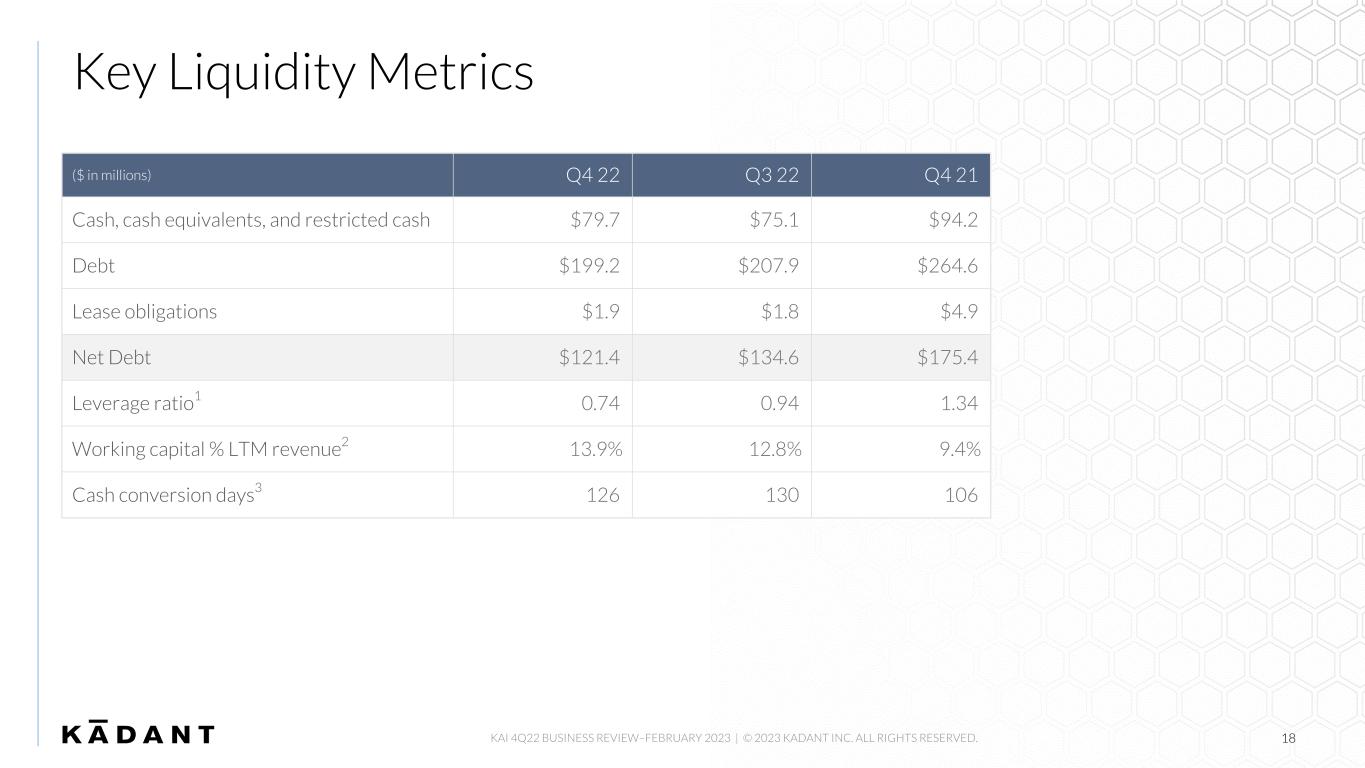

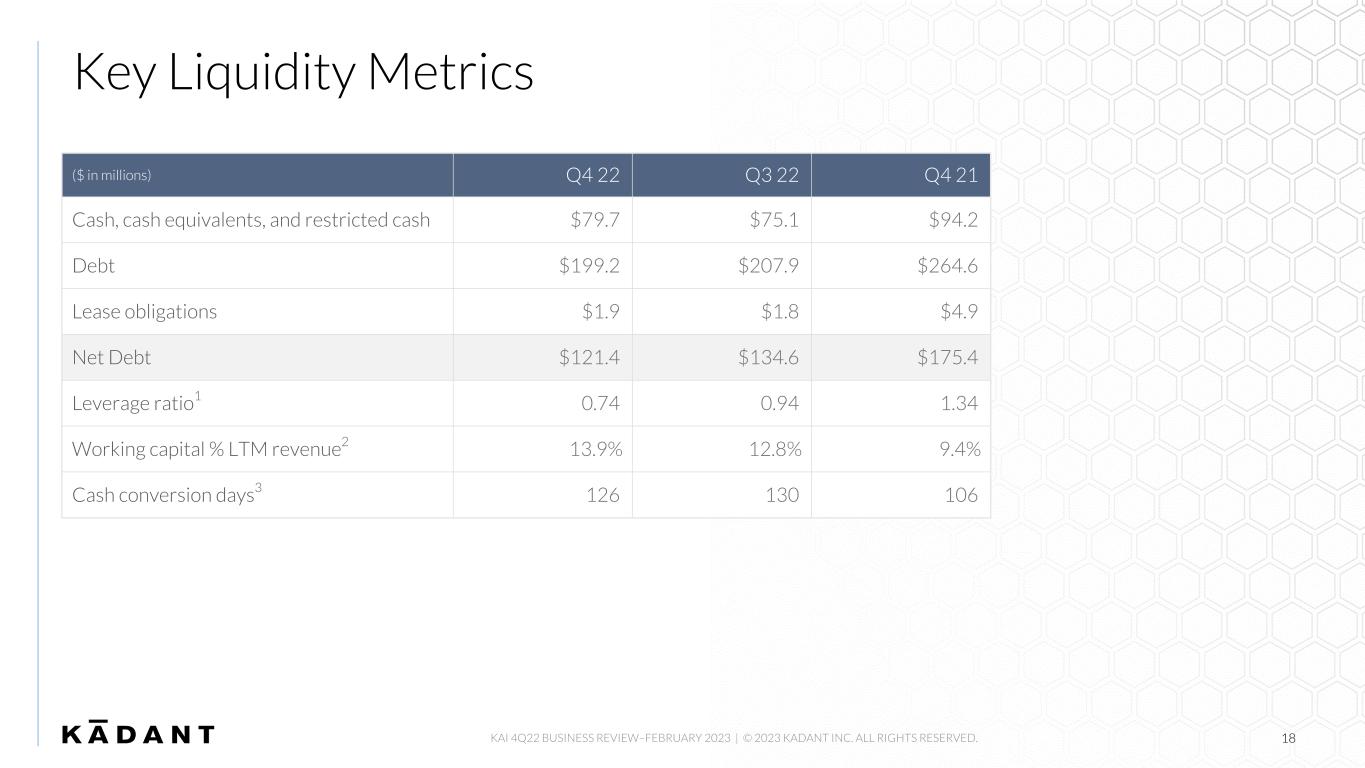

Key Liquidity Metrics KAI 4Q22 BUSINESS REVIEW–FEBRUARY 2023 | © 2023 KADANT INC. ALL RIGHTS RESERVED. 18 ($ in millions) Q4 22 Q3 22 Q4 21 Cash, cash equivalents, and restricted cash $79.7 $75.1 $94.2 Debt $199.2 $207.9 $264.6 Lease obligations $1.9 $1.8 $4.9 Net Debt $121.4 $134.6 $175.4 Leverage ratio1 0.74 0.94 1.34 Working capital % LTM revenue2 13.9% 12.8 % 9.4 % Cash conversion days3 126 130 106

Guidance for 2023 KAI 4Q22 BUSINESS REVIEW–FEBRUARY 2023 | © 2023 KADANT INC. ALL RIGHTS RESERVED. 19 • Q1 2023 revenue of $217 to $223 million • Q1 2023 adjusted diluted EPS* of $2.08 to $2.20 • FY 2023 revenue of $900 to $925 million • FY 2023 adjusted diluted EPS* of $8.80 to $9.05 • Gross margin 42% to 43% • SG&A approximately 24% to 25% of revenue • Net interest expense of approximately $9 million • Recurring tax rate of 27% to 28% • Capex spending of $32 to $34 million, including $8 to $9 million for China facility project • Depreciation & amortization expense of $34 to $35 million

Questions & Answers To participate in the live Q&A session, please go to investor.kadant.com and click on the Q&A session link to receive a dial-in number and unique PIN. Please mute the audio on your computer. KAI 4Q22 BUSINESS REVIEW–FEBRUARY 2023 | © 2023 KADANT INC. ALL RIGHTS RESERVED. 20

2023 Key Priorities 21 ENABLE SUSTAINABLE INDUSTRIAL PROCESSING DELIVER EXCEPTIONAL STAKEHOLDER VALUE PROVIDE STRONG CASH FLOW CAPITALIZE ON NEW OPPORTUNITIES KAI 4Q22 BUSINESS REVIEW–FEBRUARY 2023 | © 2023 KADANT INC. ALL RIGHTS RESERVED.

INVESTOR RELATIONS CONTACT Michael McKenney, 978-776-2000 IR@kadant.com MEDIA RELATIONS CONTACT Wes Martz, 269-278-1715 media@kadant.com February 16, 2023

APPENDIX Fourth Quarter and FY 2022 Business Review KAI 4Q22 BUSINESS REVIEW–FEBRUARY 2023 | © 2023 KADANT INC. ALL RIGHTS RESERVED. 23

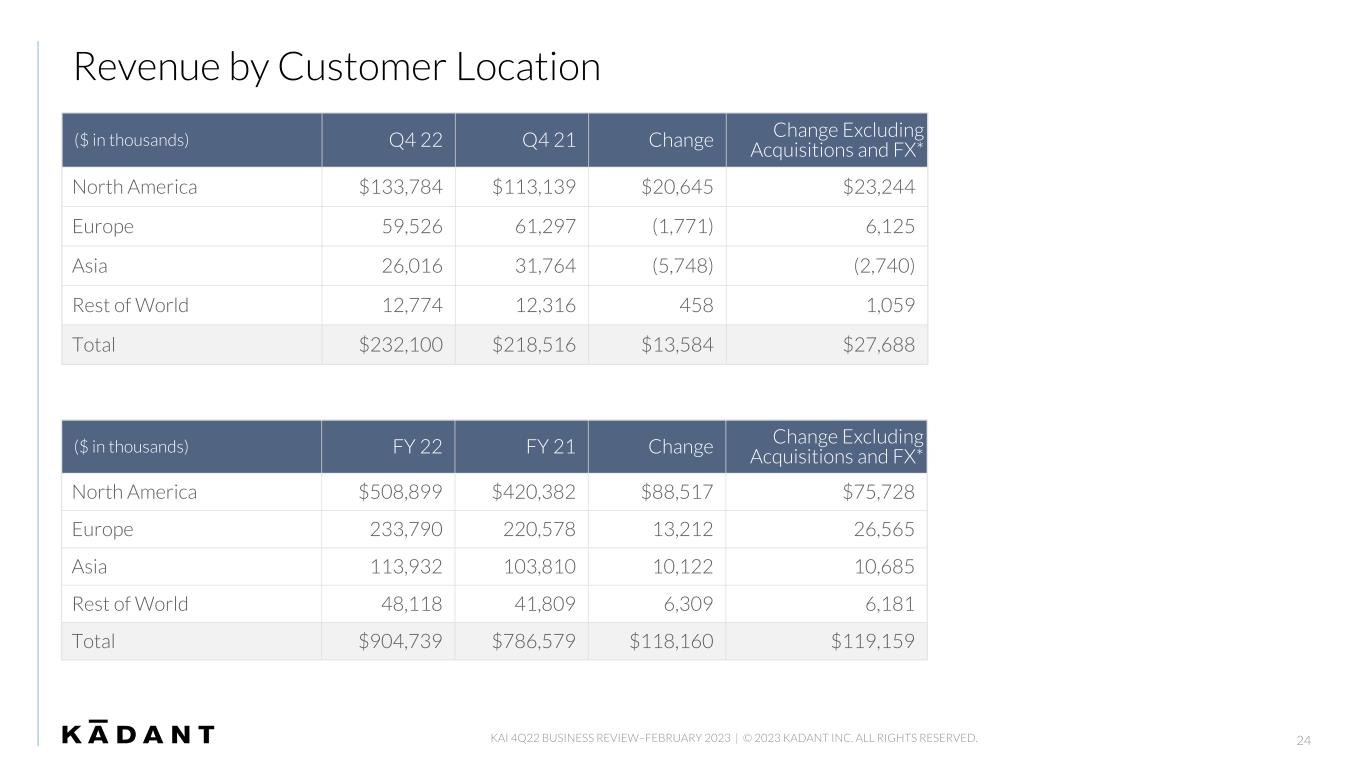

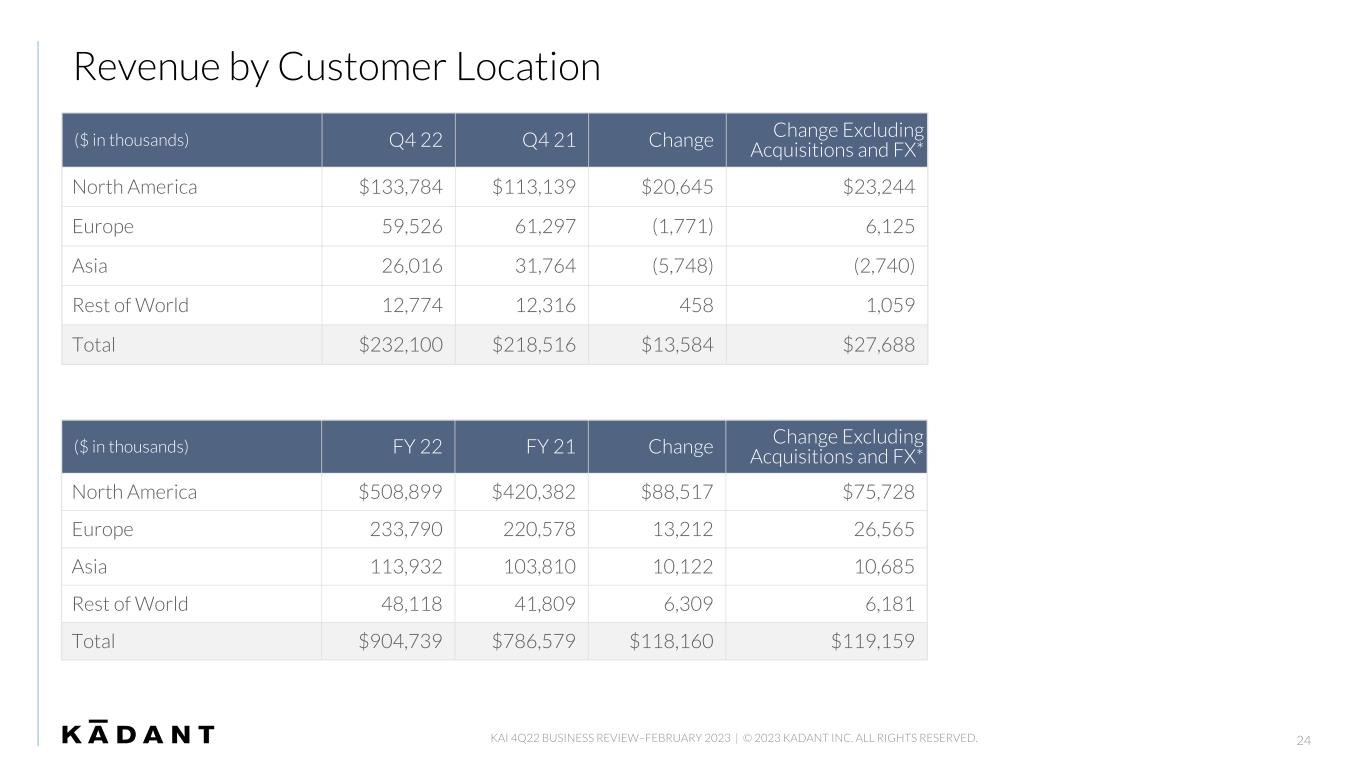

Revenue by Customer Location ($ in thousands) Q4 22 Q4 21 Change Change Excluding Acquisitions and FX* North America $133,784 $113,139 $20,645 $23,244 Europe 59,526 61,297 (1,771) 6,125 Asia 26,016 31,764 (5,748) (2,740) Rest of World 12,774 12,316 458 1,059 Total $232,100 $218,516 $13,584 $27,688 KAI 4Q22 BUSINESS REVIEW–FEBRUARY 2023 | © 2023 KADANT INC. ALL RIGHTS RESERVED. 24 ($ in thousands) FY 22 FY 21 Change Change Excluding Acquisitions and FX* North America $508,899 $420,382 $88,517 $75,728 Europe 233,790 220,578 13,212 26,565 Asia 113,932 103,810 10,122 10,685 Rest of World 48,118 41,809 6,309 6,181 Total $904,739 $786,579 $118,160 $119,159

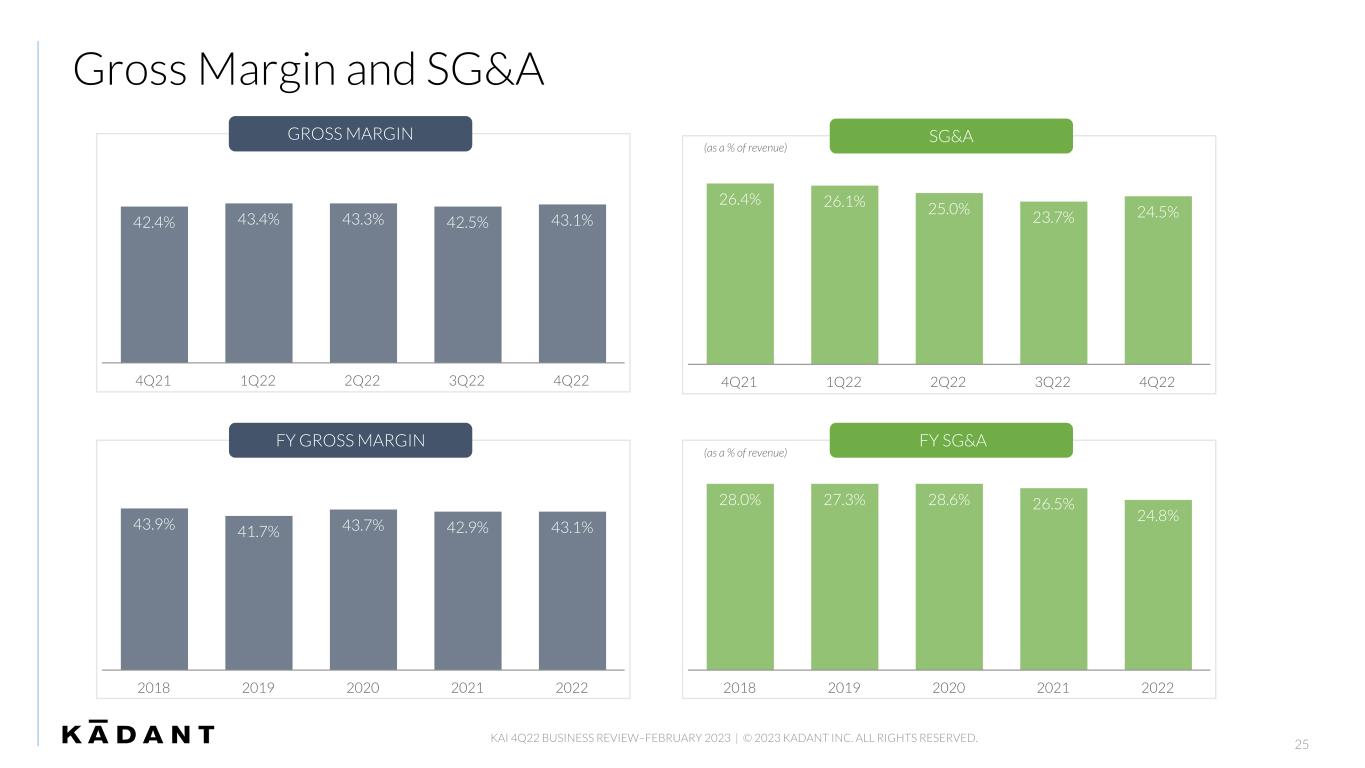

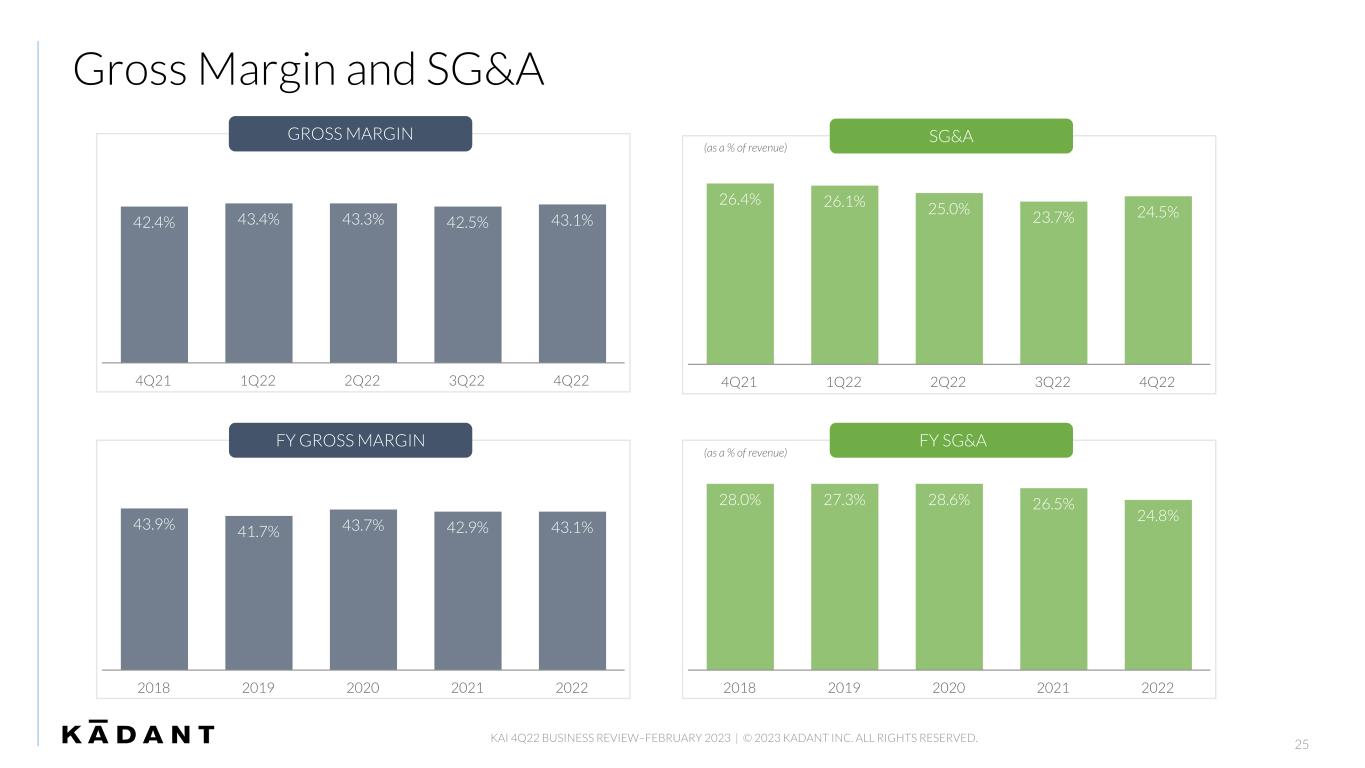

Gross Margin and SG&A KAI 4Q22 BUSINESS REVIEW–FEBRUARY 2023 | © 2023 KADANT INC. ALL RIGHTS RESERVED. 25 26.4% 26.1% 25.0% 23.7% 24.5% 4Q21 1Q22 2Q22 3Q22 4Q22 42.4% 43.4% 43.3% 42.5% 43.1% 4Q21 1Q22 2Q22 3Q22 4Q22 SG&A (as a % of revenue) GROSS MARGIN 43.9% 41.7% 43.7% 42.9% 43.1% 2018 2019 2020 2021 2022 28.0% 27.3% 28.6% 26.5% 24.8% 2018 2019 2020 2021 2022 FY GROSS MARGIN FY SG&A (as a % of revenue)

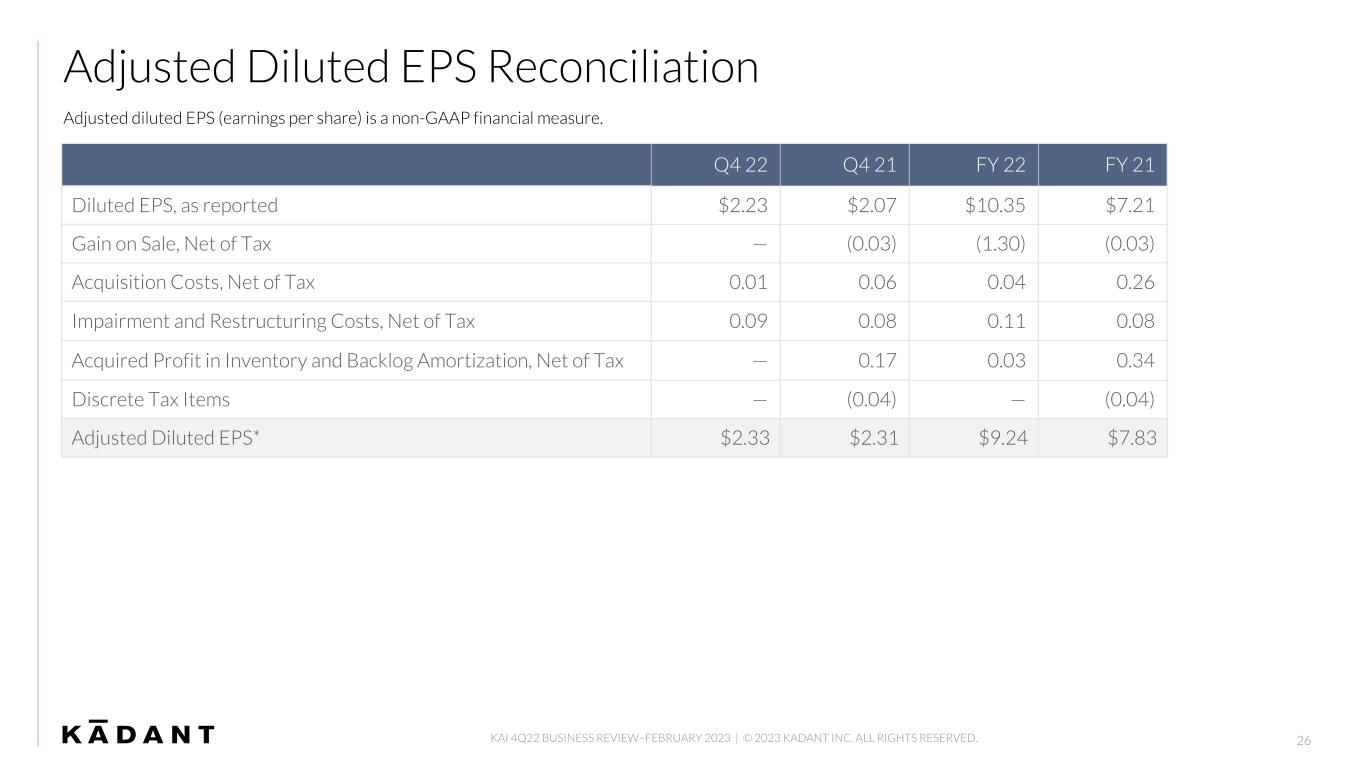

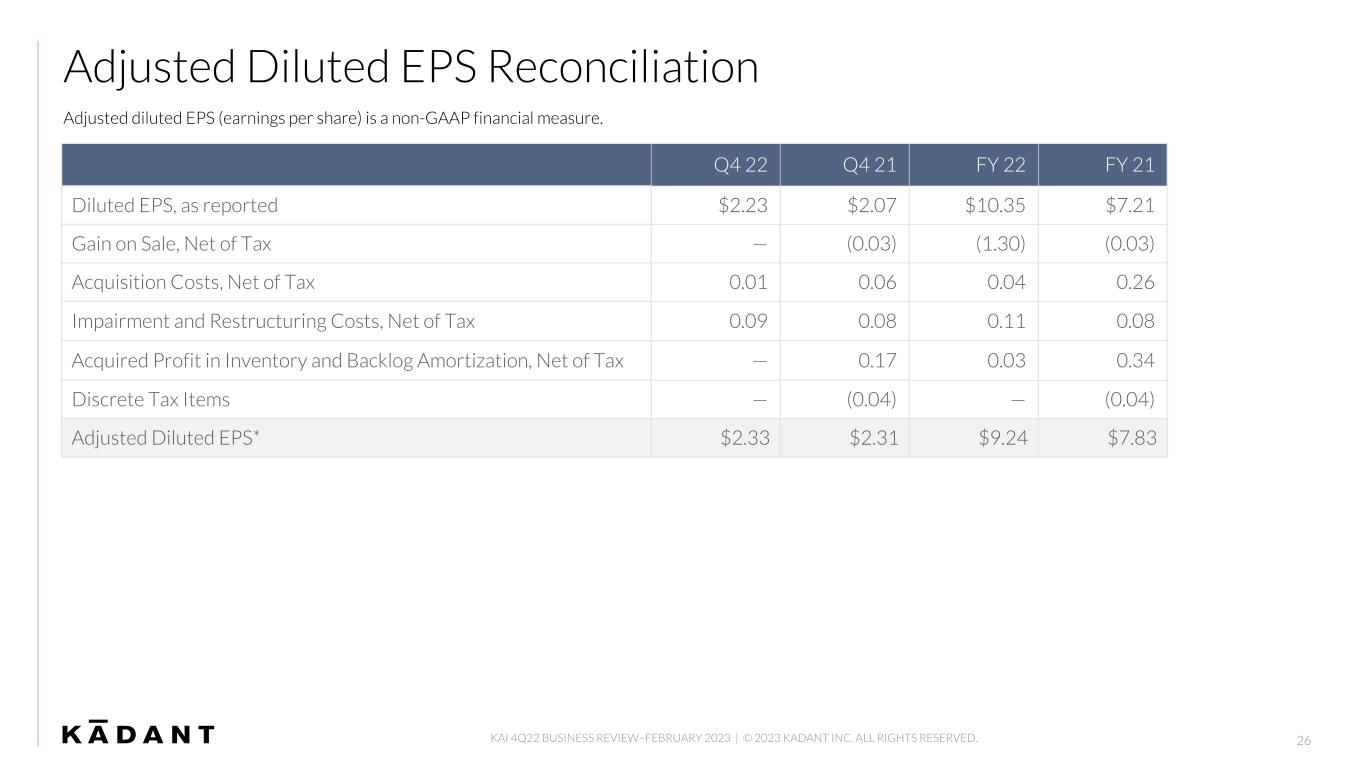

Adjusted Diluted EPS Reconciliation Q4 22 Q4 21 FY 22 FY 21 Diluted EPS, as reported $2.23 $2.07 $10.35 $7.21 Gain on Sale, Net of Tax — (0.03) (1.30) (0.03) Acquisition Costs, Net of Tax 0.01 0.06 0.04 0.26 Impairment and Restructuring Costs, Net of Tax 0.09 0.08 0.11 0.08 Acquired Profit in Inventory and Backlog Amortization, Net of Tax — 0.17 0.03 0.34 Discrete Tax Items — (0.04) — (0.04) Adjusted Diluted EPS* $2.33 $2.31 $9.24 $7.83 Adjusted diluted EPS (earnings per share) is a non-GAAP financial measure. KAI 4Q22 BUSINESS REVIEW–FEBRUARY 2023 | © 2023 KADANT INC. ALL RIGHTS RESERVED. 26

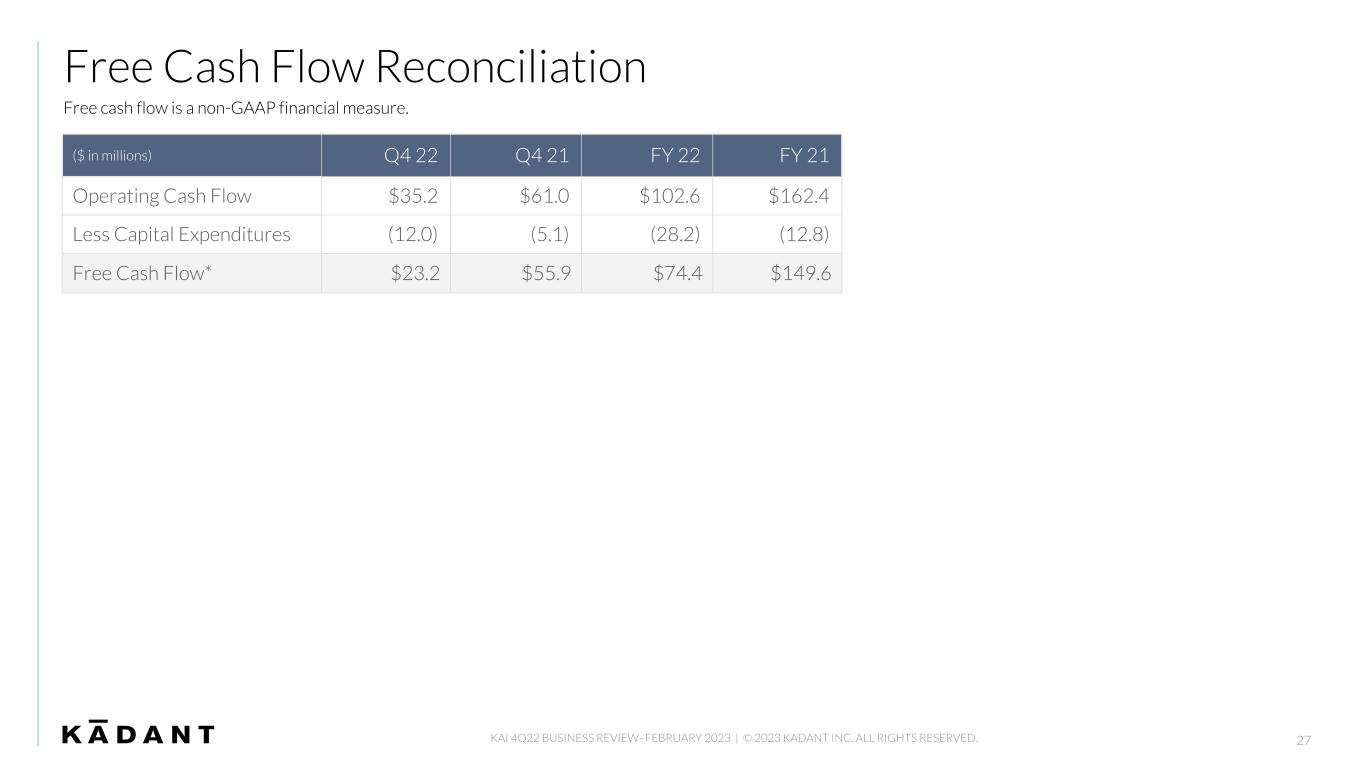

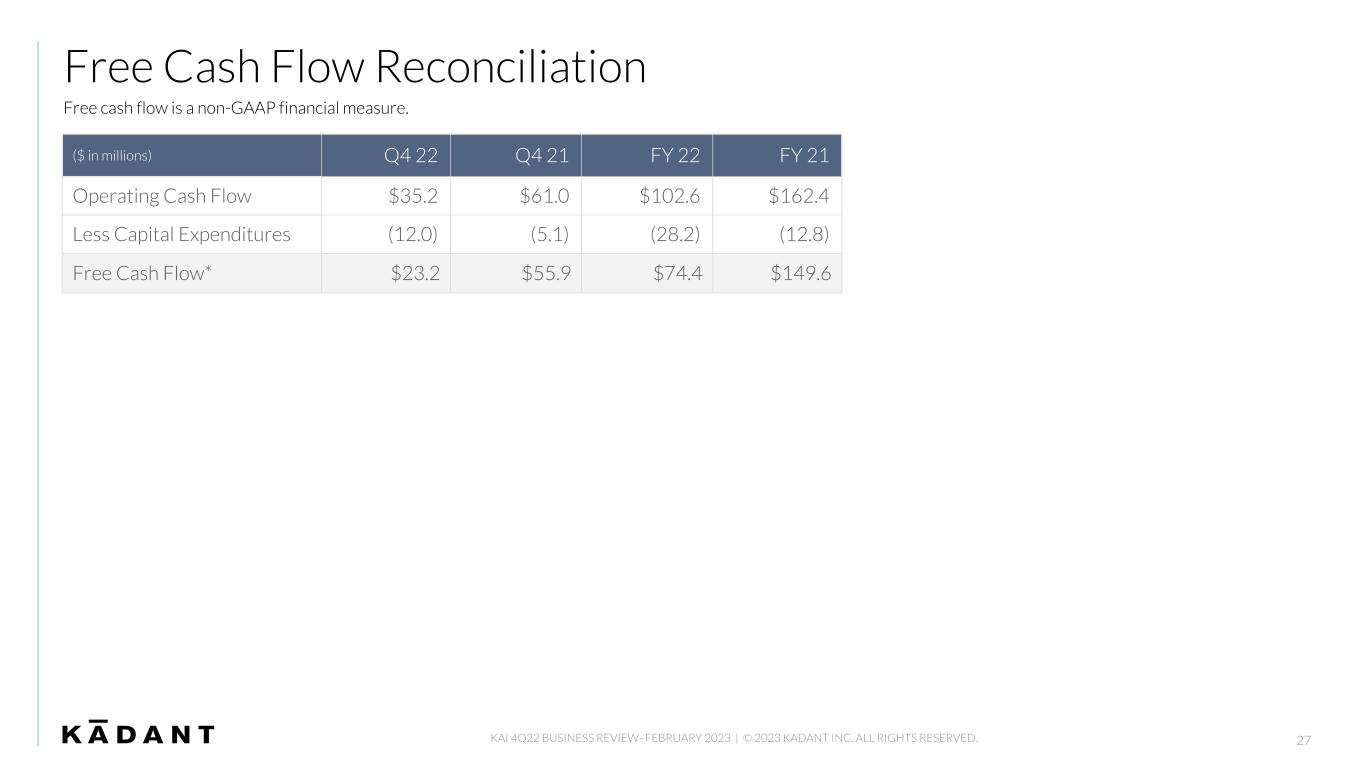

Free Cash Flow Reconciliation ($ in millions) Q4 22 Q4 21 FY 22 FY 21 Operating Cash Flow $35.2 $61.0 $102.6 $162.4 Less Capital Expenditures (12.0) (5.1) (28.2) (12.8) Free Cash Flow* $23.2 $55.9 $74.4 $149.6 Free cash flow is a non-GAAP financial measure. KAI 4Q22 BUSINESS REVIEW–FEBRUARY 2023 | © 2023 KADANT INC. ALL RIGHTS RESERVED. 27

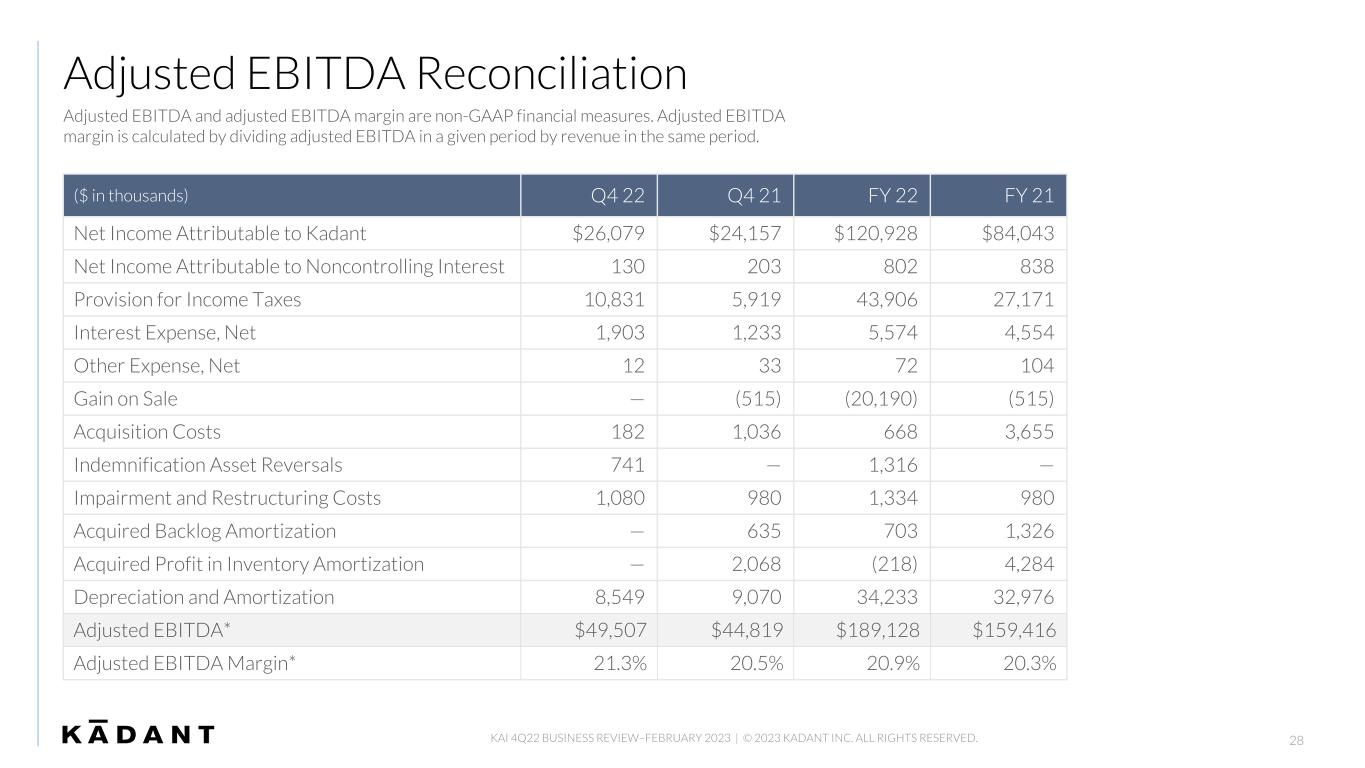

Adjusted EBITDA Reconciliation Adjusted EBITDA and adjusted EBITDA margin are non-GAAP financial measures. Adjusted EBITDA margin is calculated by dividing adjusted EBITDA in a given period by revenue in the same period. ($ in thousands) Q4 22 Q4 21 FY 22 FY 21 Net Income Attributable to Kadant $26,079 $24,157 $120,928 $84,043 Net Income Attributable to Noncontrolling Interest 130 203 802 838 Provision for Income Taxes 10,831 5,919 43,906 27,171 Interest Expense, Net 1,903 1,233 5,574 4,554 Other Expense, Net 12 33 72 104 Gain on Sale — (515) (20,190) (515) Acquisition Costs 182 1,036 668 3,655 Indemnification Asset Reversals 741 — 1,316 — Impairment and Restructuring Costs 1,080 980 1,334 980 Acquired Backlog Amortization — 635 703 1,326 Acquired Profit in Inventory Amortization — 2,068 (218) 4,284 Depreciation and Amortization 8,549 9,070 34,233 32,976 Adjusted EBITDA* $49,507 $44,819 $189,128 $159,416 Adjusted EBITDA Margin* 21.3% 20.5% 20.9% 20.3% KAI 4Q22 BUSINESS REVIEW–FEBRUARY 2023 | © 2023 KADANT INC. ALL RIGHTS RESERVED. 28

Notes PRESENTATION NOTES • All references to EPS (earnings per share) are to our EPS as calculated on a diluted basis. • Percent change in slides 6-10 is calculated using actual numbers reported in our press release dated February 15, 2023. FOOTNOTES 1) Leverage ratio is calculated by dividing total debt by EBITDA. For purposes of this calculation, EBITDA is calculated by adding or subtracting certain items from Adjusted EBITDA, as required by our amended and restated credit facility (“Credit Facility”). Our Credit Facility defines total debt as debt less worldwide cash of up to $50 million. 2) Working capital is defined as current assets less current liabilities, excluding cash and debt. LTM is defined as last 12 months. 3) Cash conversion days is based on days in receivables plus days in inventory less days in accounts payable. KAI 4Q22 BUSINESS REVIEW–FEBRUARY 2023 | © 2023 KADANT INC. ALL RIGHTS RESERVED. 29