Fourth Quarter 2024 and FY 2024 Business Review February 13, 2025 Exhibit 99.2

Forward-Looking Statements The following constitutes a “Safe Harbor” statement under the Private Securities Litigation Reform Act of 1995: This presentation contains forward-looking statements that involve a number of risks and uncertainties, including forward-looking statements about our future financial and operating performance, demand for our products, and economic and industry outlook. These forward-looking statements represent our expectations as of February 12, 2025. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events, or otherwise. These forward-looking statements are subject to known and unknown risks and uncertainties that may cause our actual results to differ materially from these forward-looking statements as a result of various important factors, including those set forth under the heading "Risk Factors" in Kadant’s Annual Report on Form 10-K for the fiscal year ended December 30, 2023 and subsequent filings with the Securities and Exchange Commission. These include risks and uncertainties relating to adverse changes in global and local economic conditions; the variability and difficulty in accurately predicting revenues from large capital equipment and systems projects; our acquisition strategy; levels of residential construction activity; reductions by our wood processing customers of their capital spending or production of oriented strand board; changes to the global timber supply; development and use of digital media; cyclical economic conditions affecting the global mining industry; demand for coal, including economic and environmental risks associated with coal; failure of our information systems or breaches of data security and cybertheft; implementation of our internal growth strategy; supply chain constraints, inflationary pressure, price increases and shortages in raw materials; competition; changes to tax laws and regulations; our ability to successfully manage our manufacturing operations; disruption in production; future restructurings; loss of key personnel and effective succession planning; protection of intellectual property; climate change; adequacy of our insurance coverage; global operations; policies of the Chinese government; the variability and uncertainties in sales of capital equipment in China; currency fluctuations; changes to government regulations and policies around the world; compliance with government regulations and policies and compliance with laws; environmental laws and regulations; environmental, health and safety laws and regulations impacting the mining industry; our debt obligations; restrictions in our credit agreement and note purchase agreement; soundness of financial institutions; fluctuations in our share price; and anti-takeover provisions. 2KAI 4Q24 BUSINESS REVIEW– FEBRUARY 2025 | © 2025 KADANT INC. ALL RIGHTS RESERVED.

Use of Non-GAAP Financial Measures In addition to the financial measures prepared in accordance with U.S. generally accepted accounting principles (GAAP), we use certain non-GAAP financial measures, including increases or decreases in revenue excluding the effect of acquisitions and foreign currency translation (organic revenue), adjusted EPS, adjusted earnings before interest, taxes, depreciation, and amortization (adjusted EBITDA), adjusted EBITDA margin, adjusted operating income, and free cash flow. All references to EPS (earnings per share) are to our EPS as calculated on a diluted basis. Specific non-GAAP financial measures have been marked with an * (asterisk) within this presentation. A reconciliation of those numbers to the most directly comparable GAAP financial measures is shown in the Appendix and in our fourth quarter and fiscal year 2024 earnings press release issued February 12, 2025, which is available in the Investors section of our website at investor.kadant.com under the heading News Releases. We believe these non-GAAP financial measures, when taken together with the corresponding GAAP financial measures, provide meaningful supplemental information regarding our performance by excluding certain items that may not be indicative of our core business, operating results, or future outlook. We believe the inclusion of such measures helps investors gain an understanding of our underlying operating performance and future prospects, consistent with how management measures and forecasts our performance, especially when comparing such results to previous periods or forecasts and to the performance of our competitors. Such measures are also used by us in our financial and operating decision-making and for compensation purposes. We also believe this information is responsive to investors' requests and gives them additional measures of our performance. The non-GAAP financial measures included in this presentation are not meant to be considered superior to or a substitute for the results of operations or cash flows prepared in accordance with GAAP. In addition, the non-GAAP financial measures included in this presentation have limitations associated with their use as compared to the most directly comparable GAAP measures, in that they may be different from, and therefore not comparable to, similar measures used by other companies. 3 KAI 4Q24 BUSINESS REVIEW– FEBRUARY 2025 | © 2025 KADANT INC. ALL RIGHTS RESERVED.

Business Review Jeffrey L. Powell, President & CEO 4

Operational Highlights 5 KAI 4Q24 BUSINESS REVIEW– FEBRUARY 2025 | © 2025 KADANT INC. ALL RIGHTS RESERVED. • Stable demand led to a solid finish to a record-setting year • Solid margin performance and strong cash flow • Named by Newsweek as one of America's Most Responsible Companies for the fifth consecutive year

Q4 2024 Performance 6 ($ in millions, except per share amounts) Q4 24 Q4 23 Change Revenue $258.0 $238.7 +8.1% Net Income $24.0 $27.4 -12.3% Adjusted EBITDA* $52.4 $48.5 +8.1% Adjusted EBITDA Margin* 20.3 % 20.3% — bps EPS $2.04 $2.33 -12.4% Adjusted EPS* $2.25 $2.41 -6.6% Operating Cash Flow $51.9 $59.2 -12.4% Free Cash Flow* $46.3 $49.5 -6.4% Bookings $240.6 $218.0 +10.4% HIGHLIGHTS • Revenue growth led by contributions from recent acquisitions • Solid demand for aftermarket parts continued while capital activity softened in the fourth quarter • Industrial demand, particularly in Europe and Asia, continues to be impacted by economic headwinds KAI 4Q24 BUSINESS REVIEW– FEBRUARY 2025 | © 2025 KADANT INC. ALL RIGHTS RESERVED.

FY 2024 Performance 7 ($ in millions, except per share amounts) FY 24 FY 23 Change Revenue $1,053.4 $957.7 +10.0% Net Income $111.6 $116.1 -3.9% Adjusted EBITDA* $229.7 $201.3 +14.1% Adjusted EBITDA Margin* 21.8 % 21.0 % +80 bps EPS $9.48 $9.90 -4.2% Adjusted EPS* $10.28 $10.04 +2.4% Operating Cash Flow $155.3 $165.5 -6.2% Free Cash Flow* $134.3 $133.7 +0.4% Bookings $981.1 $917.4 +6.9% HIGHLIGHTS • Record performance across many financial metrics including revenue and bookings • Strong operating performance led to record adjusted EPS* and adjusted EBITDA* • Internal initiatives and customer-focused innovations delivered solid gains KAI 4Q24 BUSINESS REVIEW– FEBRUARY 2025 | © 2025 KADANT INC. ALL RIGHTS RESERVED.

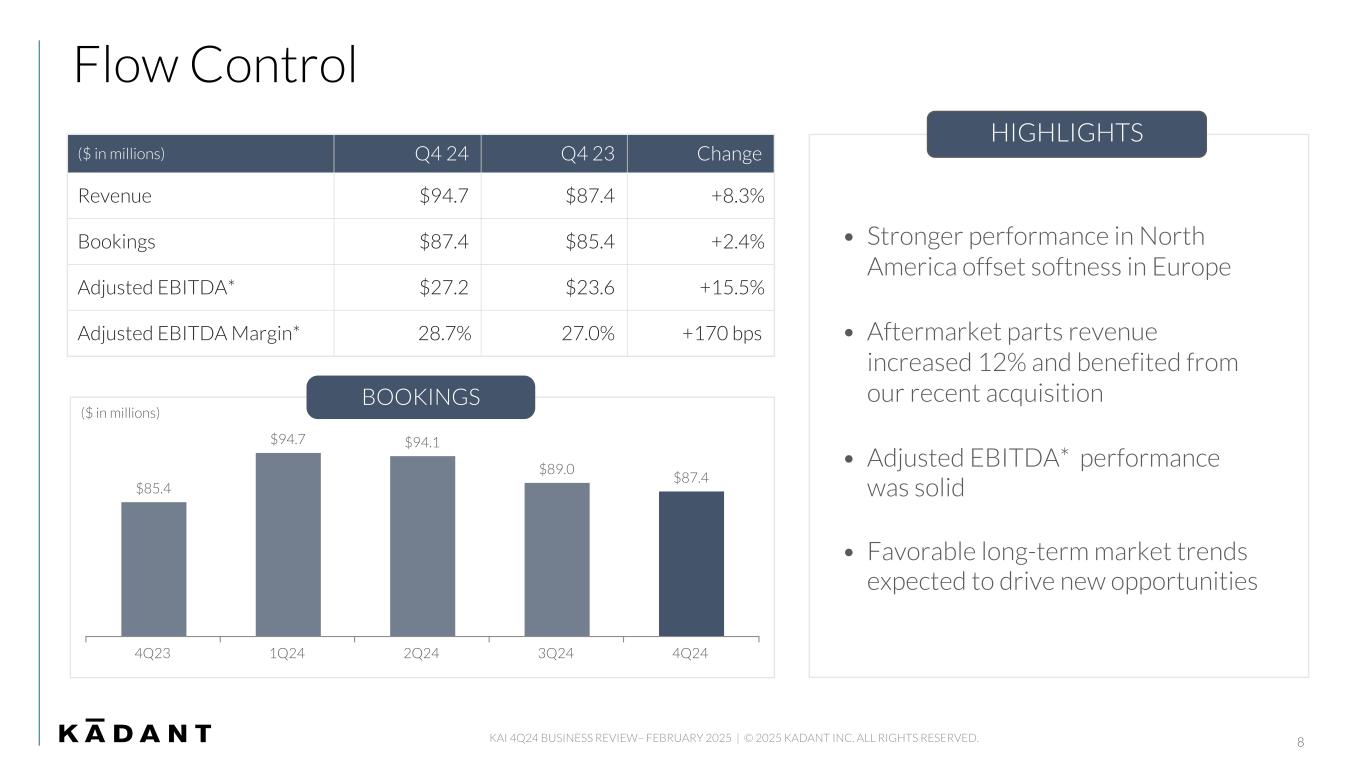

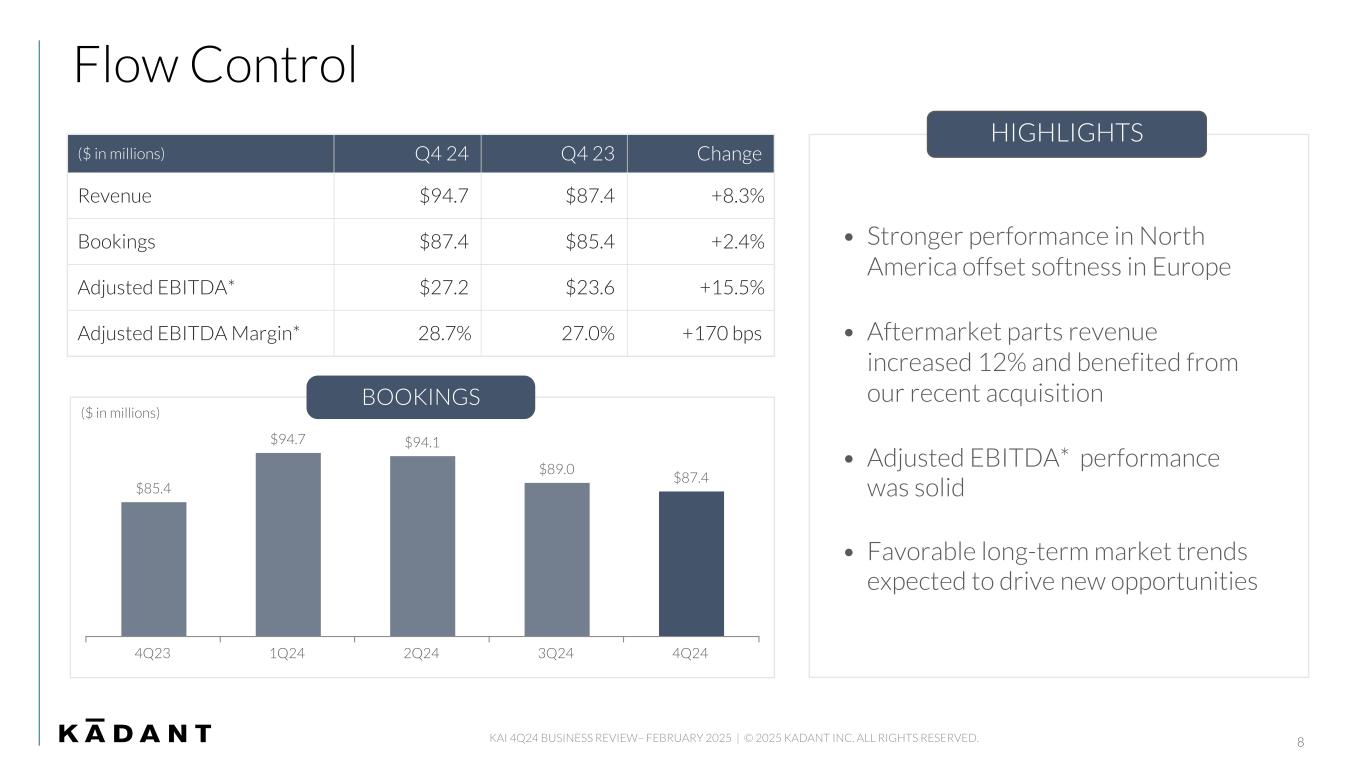

$85.4 $94.7 $94.1 $89.0 $87.4 4Q23 1Q24 2Q24 3Q24 4Q24 8 ($ in millions) Q4 24 Q4 23 Change Revenue $94.7 $87.4 +8.3% Bookings $87.4 $85.4 +2.4% Adjusted EBITDA* $27.2 $23.6 +15.5% Adjusted EBITDA Margin* 28.7 % 27.0% +170 bps HIGHLIGHTS • Stronger performance in North America offset softness in Europe • Aftermarket parts revenue increased 12% and benefited from our recent acquisition • Adjusted EBITDA* performance was solid • Favorable long-term market trends expected to drive new opportunities ($ in millions) KAI 4Q24 BUSINESS REVIEW– FEBRUARY 2025 | © 2025 KADANT INC. ALL RIGHTS RESERVED. BOOKINGS Flow Control

9 ($ in millions) Q4 24 Q4 23 Change Revenue $101.4 $87.0 +16.6% Bookings $103.6 $84.1 +23.2% Adjusted EBITDA* $22.6 $20.7 +9.1% Adjusted EBITDA Margin* 22.3 % 23.8% -150 bps HIGHLIGHTS • Strong demand for aftermarket parts in Q4 fueled bookings increase • Aftermarket parts revenue represented 67% of total revenue • Capital project activity remains healthy although project timing can be uncertain KAI 4Q24 BUSINESS REVIEW– FEBRUARY 2025 | © 2025 KADANT INC. ALL RIGHTS RESERVED. Industrial Processing $84.1 $89.9 $96.7 $89.3 $103.6 4Q23 1Q24 2Q24 3Q24 4Q24 BOOKINGS ($ in millions)

10 ($ in millions) Q4 24 Q4 23 Change Revenue $61.9 $64.3 -3.7% Bookings $49.6 $48.5 +2.2% Adjusted EBITDA* $12.9 $14.2 -9.0% Adjusted EBITDA Margin* 20.8 % 22.1% -130 bps HIGHLIGHTS • Aftermarket parts revenue was strong and represented 61% of total revenue in Q4 • Lower capital revenue resulted in a decrease in operating leverage • Capital project activity expected to strengthen as the year progresses KAI 4Q24 BUSINESS REVIEW– FEBRUARY 2025 | © 2025 KADANT INC. ALL RIGHTS RESERVED. Material Handling $48.5 $63.9 $60.9 $62.0 $49.6 4Q23 1Q24 2Q24 3Q24 4Q24 BOOKINGS ($ in millions)

Business Outlook • Project activity expected to be more favorable although timing remains uncertain • Foreign currency translation likely to temper financial results • Our strong cash flow and healthy balance sheet position us well to capitalize on new opportunities 11 KAI 4Q24 BUSINESS REVIEW– FEBRUARY 2025 | © 2025 KADANT INC. ALL RIGHTS RESERVED.

12 Financial Review Michael J. McKenney, EVP & CFO

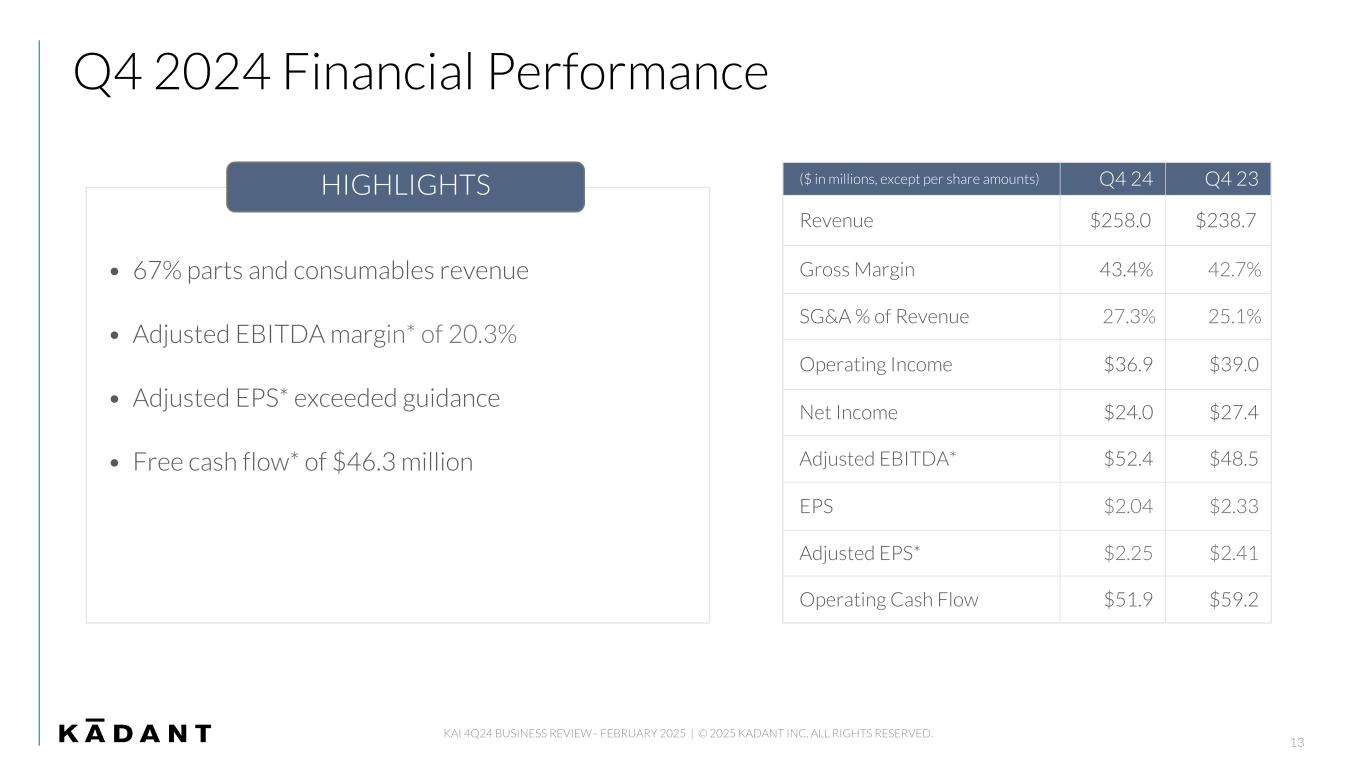

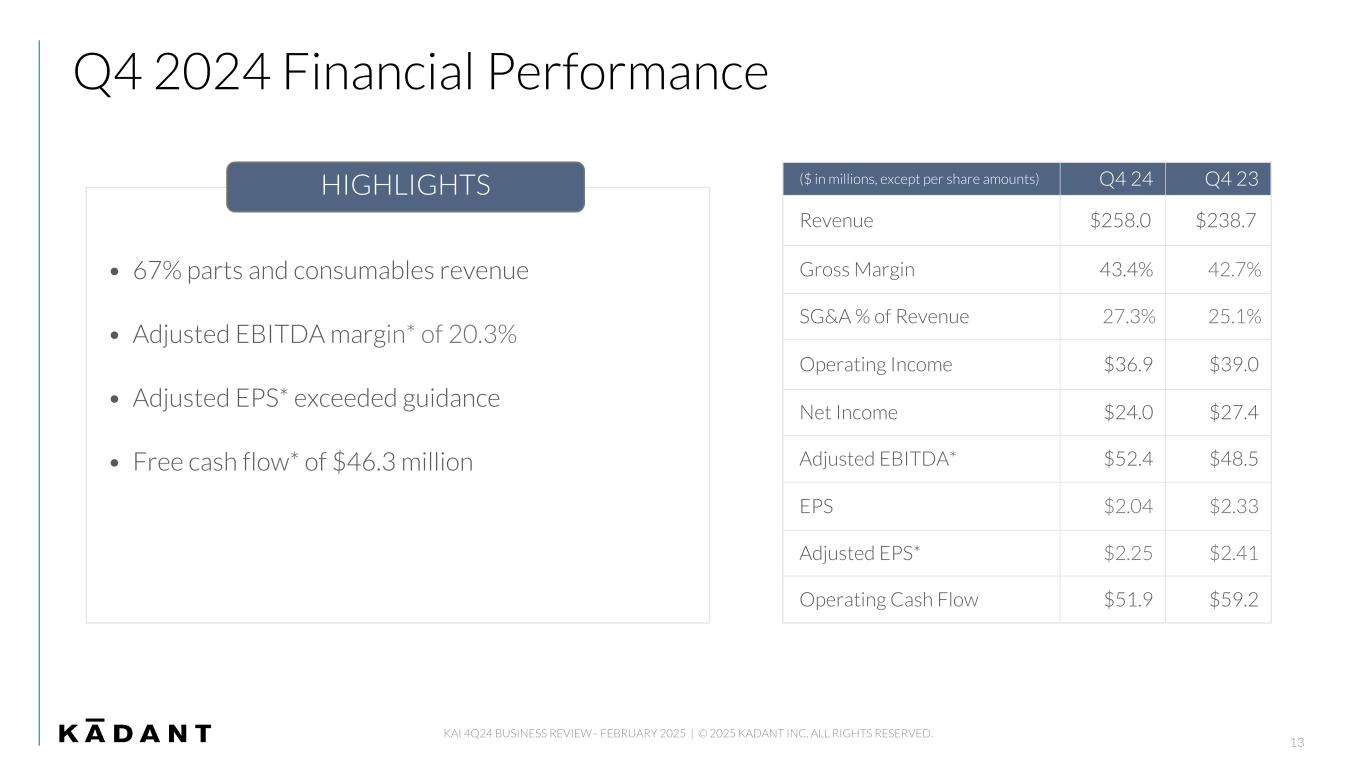

Q4 2024 Financial Performance ($ in millions, except per share amounts) Q4 24 Q4 23 Revenue $258.0 $238.7 Gross Margin 43.4% 42.7% SG&A % of Revenue 27.3% 25.1% Operating Income $36.9 $39.0 Net Income $24.0 $27.4 Adjusted EBITDA* $52.4 $48.5 EPS $2.04 $2.33 Adjusted EPS* $2.25 $2.41 Operating Cash Flow $51.9 $59.2 HIGHLIGHTS • 67% parts and consumables revenue • Adjusted EBITDA margin* of 20.3% • Adjusted EPS* exceeded guidance • Free cash flow* of $46.3 million KAI 4Q24 BUSINESS REVIEW– FEBRUARY 2025 | © 2025 KADANT INC. ALL RIGHTS RESERVED. 13

FY 2024 Financial Performance ($ in millions, except per share amounts) FY 24 FY 23 Revenue $1,053.4 $957.7 Gross Margin 44.3% 43.5% SG&A % of Revenue 26.6% 24.7% Operating Income $171.3 $165.8 Net Income $111.6 $116.1 Adjusted EBITDA* $229.7 $201.3 EPS $9.48 $9.90 Adjusted EPS* $10.28 $10.04 Operating Cash Flow $155.3 $165.5 HIGHLIGHTS • Record revenue • Record adjusted EBITDA* and adjusted EBITDA margin* • Adjusted EPS* was a record and exceeded guidance • Free cash flow* of $134.3 million KAI 4Q24 BUSINESS REVIEW– FEBRUARY 2025 | © 2025 KADANT INC. ALL RIGHTS RESERVED. 14

$115.9 $159.4 $189.1 $201.3 $229.7 $55.2 $84.0 $120.9 $116.1 $111.6 18.3% 20.3% 20.9% 21.0% 21.8% NET INCOME ADJUSTED EBITDA* ADJ. EBITDA MARGIN* 2020 2021 2022 2023 2024 Adjusted EBITDA* and Cash Flow Metrics KAI 4Q24 BUSINESS REVIEW– FEBRUARY 2025 | © 2025 KADANT INC. ALL RIGHTS RESERVED. 15 FY ADJUSTED EBITDA* ($ in millions) $59.2 $22.8 $28.1 $52.5 $51.9 $49.5 $16.6 $23.1 $48.3 $46.3 FREE CASH FLOW* OPERATING CASH FLOW 4Q23 1Q24 2Q24 3Q24 4Q24 CASH FLOW ($ in millions) $92.9 $162.4 $102.6 $165.5 $155.3 $85.3 $149.6 $74.4 $133.7 $134.3 FREE CASH FLOW* OPERATING CASH FLOW 2020 2021 2022 2023 2024 FY CASH FLOW ($ in millions)($ in millions) $48.5 $52.2 $61.8 $63.3 $52.4 $27.4 $24.7 $31.3 $31.6 $24.0 20.3% 21.0% 22.5% 23.3% 20.3% NET INCOME ADJUSTED EBITDA* ADJ. EBITDA MARGIN* 4Q23 1Q24 2Q24 3Q24 4Q24 ADJUSTED EBITDA* ($ in millions)

2Q21 ADJ EPS* 2Q22 ADJ EPS* KAI 4Q24 BUSINESS REVIEW– FEBRUARY 2025 | © 2025 KADANT INC. ALL RIGHTS RESERVED. 4Q23 to 4Q24 Adjusted EPS* 16 $2.41 $0.26 $0.17 $(0.36) $(0.20) $(0.02) $(0.01) $2.25 4Q23 ADJ EPS* ACQUISITIONS GROSS MARGIN REVENUE INTEREST EXPENSE OPERATING EXPENSES TAX PROVISION 4Q24 ADJ EPS*

2Q21 ADJ EPS* 2Q22 ADJ EPS* KAI 4Q24 BUSINESS REVIEW– FEBRUARY 2025 | © 2025 KADANT INC. ALL RIGHTS RESERVED. FY 2023 to FY 2024 Adjusted EPS* 17 $10.04 $0.88 $0.87 $0.02 $(0.72) $(0.54) $(0.24) $(0.03) $10.28 2023 ADJ EPS* GROSS MARGIN ACQUISITIONS TAX PROVISION INTEREST EXPENSE REVENUE OPERATING EXPENSES CHANGE IN SHARES 2024 ADJ EPS*

Key Liquidity Metrics KAI 4Q24 BUSINESS REVIEW– FEBRUARY 2025 | © 2025 KADANT INC. ALL RIGHTS RESERVED. 18 ($ in millions) Q4 24 Q3 24 Q4 23 Cash, cash equivalents, and restricted cash $95.9 $89.7 $106.5 Debt $286.5 $324.5 $109.1 Lease obligations $2.0 $1.9 $1.8 Net Debt $192.6 $236.7 $4.4 Leverage ratio1 0.99 1.13 0.27 Working capital % LTM revenue2 15.0% 17.2% 12.8% Cash conversion days3 122 129 130

Guidance KAI 4Q24 BUSINESS REVIEW– FEBRUARY 2025 | © 2025 KADANT INC. ALL RIGHTS RESERVED. 19 • FY 2025 revenue of $1.040 to $1.065 billion • FY 2025 GAAP EPS of $9.63 to $9.98 • FY 2025 adjusted EPS* of $9.70 to $10.05 • Q1 2025 revenue of $235 to $242 million • Q1 2025 GAAP EPS of $1.81 to $2.01 • Q1 2025 adjusted EPS* of $1.85 to $2.05

Questions & Answers To participate in the live Q&A session, please go to investor.kadant.com and click on the Q&A session link to receive a dial-in number and unique PIN. Please mute the audio on your computer. 20

2025 Key Priorities 21 ENABLE SUSTAINABLE INDUSTRIAL PROCESSING® DELIVER EXCEPTIONAL STAKEHOLDER VALUE PROVIDE STRONG CASH FLOW CAPITALIZE ON NEW OPPORTUNITIES KAI 4Q24 BUSINESS REVIEW– FEBRUARY 2025 | © 2025 KADANT INC. ALL RIGHTS RESERVED.

INVESTOR RELATIONS CONTACT Michael McKenney, 978-776-2000 IR@kadant.com MEDIA RELATIONS CONTACT Wes Martz, 269-278-1715 media@kadant.com 22

Fourth Quarter and FY 2024 Business Review 23 Appendix February 13, 2025

Revenue by Customer Location ($ in thousands) Q4 24 Q4 23 Change Change Excluding Acquisitions and FX* North America $159,796 $137,040 $22,756 $(6,560) Europe 53,852 63,881 (10,029) (11,227) Asia 27,466 25,481 1,985 1,611 Rest of World 16,916 12,277 4,639 4,604 Total $258,030 $238,679 $19,351 $(11,572) KAI 4Q24 BUSINESS REVIEW– FEBRUARY 2025 | © 2025 KADANT INC. ALL RIGHTS RESERVED. 24 ($ in thousands) FY 24 FY 23 Change Change Excluding Acquisitions and FX* North America $661,016 $538,658 $122,358 $15,538 Europe 230,141 245,154 (15,013) (19,179) Asia 101,714 113,511 (11,797) (11,487) Rest of World 60,513 60,349 164 25 Total $1,053,384 $957,672 $95,712 $(15,103)

Percentage of Parts and Consumables Revenue Q4 24 Q4 23 FY 24 FY 23 Flow Control 71 % 68 % 72 % 69 % Industrial Processing 67 % 64 % 65 % 62 % Material Handling 61 % 45 % 58 % 53 % Consolidated 67 % 60 % 66 % 62 % KAI 4Q24 BUSINESS REVIEW– FEBRUARY 2025 | © 2025 KADANT INC. ALL RIGHTS RESERVED. 25

Gross Margin and SG&A KAI 4Q24 BUSINESS REVIEW– FEBRUARY 2025 | © 2025 KADANT INC. ALL RIGHTS RESERVED. 26 25.1% 28.2% 25.5% 25.4% 27.3% 4Q23 1Q24 2Q24 3Q24 4Q24 42.7% 44.6% 44.4% 44.7% 43.4% 4Q23 1Q24 2Q24 3Q24 4Q24 SG&A (as a % of revenue) GROSS MARGIN 43.7% 42.9% 43.1% 43.5% 44.3% 2020 2021 2022 2023 2024 28.6% 26.5% 24.8% 24.7% 26.6% 2020 2021 2022 2023 2024 FY GROSS MARGIN FY SG&A (as a % of revenue)

Adjusted EPS* Reconciliation Q4 24 Q4 23 FY 24 FY 23 EPS, as Reported $2.04 $2.33 $9.48 $9.90 Adjustments, Net of Tax Acquired Profit in Inventory and Backlog Amortization 0.14 — 0.54 — Acquisition Costs 0.02 0.10 0.20 0.10 Restructuring and Impairment Costs — 0.02 — 0.04 Other Costs (Income) 0.06 (0.04) 0.06 — Adjusted EPS* $2.25 $2.41 $10.28 $10.04 KAI 4Q24 BUSINESS REVIEW– FEBRUARY 2025 | © 2025 KADANT INC. ALL RIGHTS RESERVED. 27 ($ in thousands) Q4 24 Q4 23 FY 24 FY 23 Operating Cash Flow $51,890 $59,234 $155,265 $165,545 Capital Expenditures (5,575) (9,756) (21,005) (31,850) Free Cash Flow* $46,315 $49,478 $134,260 $133,695 Free Cash Flow* Reconciliation

Adjusted EBITDA* Reconciliation ($ in thousands) Q4 24 Q4 23 FY 24 FY 23 Net Income Attributable to Kadant $24,032 $27,396 $111,598 $116,069 Net Income Attributable to Noncontrolling Interests 65 166 956 737 Provision for Income Taxes 8,706 10,449 40,516 42,210 Interest Expense, Net 4,113 971 18,113 6,640 Other Expense, Net 21 39 69 101 Acquired Profit in Inventory Amortization 1,124 — 5,189 — Acquired Backlog Amortization 1,071 — 3,252 — Acquisition Costs 339 1,442 2,872 1,442 Indemnification Asset Reversal (Provision), Net 309 (25) 158 102 Restructuring and Impairment Costs — 332 — 766 Other Costs (Income) 658 (652) 658 (43) Depreciation and Amortization 12,011 8,380 46,335 33,297 Adjusted EBITDA* $52,449 $48,498 $229,716 $201,321 Adjusted EBITDA Margin* 20.3% 20.3% 21.8% 21.0% KAI 4Q24 BUSINESS REVIEW– FEBRUARY 2025 | © 2025 KADANT INC. ALL RIGHTS RESERVED. 28

Notes PRESENTATION NOTES • All references to EPS (earnings per share) are to our EPS as calculated on a diluted basis. • Percent change in slides 6-10 is calculated using actual numbers reported in our press release dated February 12, 2025. FOOTNOTES 1) Leverage ratio is calculated by dividing total debt by EBITDA. For purposes of this calculation, EBITDA is calculated by adding or subtracting certain items from Adjusted EBITDA, as required by our amended and restated credit facility (“Credit Facility”). Our Credit Facility defines total debt as debt less worldwide cash of up to $50 million. 2) Working capital is defined as current assets less current liabilities, excluding cash and debt. LTM is defined as last 12 months. 3) Cash conversion days is based on days in receivables plus days in inventory less days in accounts payable. KAI 4Q24 BUSINESS REVIEW– FEBRUARY 2025 | © 2025 KADANT INC. ALL RIGHTS RESERVED. 29