UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2024

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to .

Commission File Number: 000-20859

GERON CORPORATION

(Exact name of registrant as specified in its charter)

| |

Delaware

(State or other jurisdiction of incorporation or organization) | 75-2287752

(I.R.S. Employer Identification No.) |

919 East Hillsdale Blvd., Suite 250, Foster City, CA

(Address of principal executive offices) | 94404

(Zip Code) |

Registrant’s telephone number, including area code: (650) 473-7700

| | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class: | Trading symbol(s): | Name of each exchange on which registered: |

Common Stock, $0.001 par value | GERN | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well‑known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S‑T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non‑accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b‑2 of the Exchange Act.

| | | | | | |

Large accelerated filer |

| ☒ |

| Accelerated filer |

| ☐ |

Non-accelerated filer |

| ☐ |

| Smaller reporting company |

| ☐ |

| | | | Emerging growth company |

| ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b‑2 of the Act). Yes ☐ No ☒

The aggregate market value of voting and non‑voting common equity held by non‑affiliates of the registrant was approximately $2,430,700,000 based upon the closing price of the registrant’s common stock on June 30, 2024 on the Nasdaq Global Select Market. The calculation of the aggregate market value of voting and non‑voting common equity held by non‑affiliates of the registrant excludes shares of common stock held by each officer, director and stockholder that the registrant concluded were affiliates on that date. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of February 21, 2025, there were 636,904,470 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

| | |

Document | | Form 10‑K

Parts |

Portions of the Registrant’s definitive proxy statement for the 2025 annual meeting of stockholders to be filed pursuant to Regulation 14A within 120 days of the Registrant’s fiscal year ended December 31, 2024. | | III |

TABLE OF CONTENTS

RYTELO® and other trademarks or service marks of Geron Corporation appearing in this Annual Report on Form 10-K (this "Report") are the property of Geron Corporation. This Report contains additional trade names, trademarks and service marks of others, which are the property of their respective owners. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, these other companies.

In this Report, unless otherwise indicated or the context otherwise requires, “Geron,” “the registrant,” “we,” “us,” and “our” refer to Geron Corporation, a Delaware corporation, and its wholly owned subsidiaries, Geron UK Limited, a United Kingdom company, and Geron Netherlands, B.V., a Dutch company.

Forward‑Looking Statements

This Report, including “Business” in Part I, Item 1 of this Report and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7 of this Report, contains forward‑looking statements that involve risks and uncertainties, as well as assumptions that, if they never materialize or prove incorrect, could cause the results of Geron Corporation, or Geron or the Company, to differ materially from those expressed or implied by such forward‑looking statements. All statements other than statements of historical fact are statements that could be deemed forward‑looking statements. In some cases, forward‑looking statements can be identified by the use of terminology such as “may,” “expects,” “plans,” “intends,” “will,” “should,” “could,” “projects,” “believes,” “predicts,” “anticipates,” “estimates,” “potential,” “seek,” or “continue” or the negative thereof or other comparable terminology. The risks and uncertainties referred to above include, without limitation, risks and uncertainties related to: (a) whether we are successful in commercializing RYTELO (imetelstat) for the treatment of certain patients with lower-risk myelodysplastic syndromes, or lower-risk MDS, with transfusion dependent anemia; (b) whether the European Commission, or EC, approves RYTELO for the treatment of patients with lower-risk MDS with transfusion dependent anemia and whether the FDA and EC will approve imetelstat for other indications on the timelines expected, or at all; (c) our plans to commercialize RYTELO in the European Union, or EU; (d) whether we overcome potential delays and other adverse impacts caused by enrollment, clinical, safety, efficacy, technical, scientific, intellectual property, manufacturing and regulatory challenges in order to have the financial resources for and meet expected timelines and planned milestones; (e) whether regulatory authorities permit the further development of imetelstat on a timely basis, or at all, without any clinical holds; (f) whether RYTELO (imetelstat) may cause, or have attributed to it, adverse events that could delay or prevent the commencement and/or completion of clinical trials, impact its regulatory approval, or limit its commercial potential; (g) whether the IMpactMF Phase 3 trial for relapsed/refractory myelofibrosis, or R/R MF, has a positive outcome and demonstrates safety and effectiveness to the satisfaction of the FDA and international regulatory authorities, and whether our projected rates for enrollment and death events differ from actual rates, which may cause the interim and final analyses to occur later than anticipated; (h) whether any future safety or efficacy results of RYTELO treatment cause its benefit-risk profile to become unacceptable; (i) whether imetelstat actually demonstrates disease-modifying activity in patients and the ability to target the malignant stem and progenitor cells of the underlying disease; (j) whether we meet our post-marketing requirements and commitments for RYTELO; (k) whether there are failures or delays in manufacturing or supplying sufficient quantities of RYTELO (imetelstat) or other clinical trial materials that impact commercialization of RYTELO or the continuation of the IMpactMF trial and other clinical trials; (l) whether we are able to establish and maintain effective sales, marketing and distribution capabilities, obtain adequate coverage and third-party payor reimbursement, and achieve adequate acceptance in the marketplace; (m) whether we are able to obtain and maintain the exclusivity terms and scopes provided by patent and patent term extensions, regulatory exclusivity, and have freedom to operate; (n) that we may be unable to successfully commercialize RYTELO due to competitive products, or otherwise; (o) that we may decide to partner and not to commercialize RYTELO independently in the United States, or U.S., or in Europe and other international markets; (p) whether we stay in compliance with and satisfy our obligations under our debt and synthetic royalty agreements; and (q) the impact of general economic, industry or political climate in the U.S. or internationally and the effects of macroeconomic conditions on our business and business prospects, financial condition and results of operations; as well as other risks that are described herein and that are otherwise described from time to time in our Securities and Exchange Commission reports including, but not limited to, the factors described in “Risk Factors,” in Part I, Item 1A of this Report. Geron assumes no obligation for and except as required by law, disclaims any obligation to update these forward‑looking statements to reflect future information, events or circumstances.

Risk Factor Summary

Below is a summary of material factors that make an investment in our common stock speculative or risky. Importantly, this summary does not address all of the risks and uncertainties that we face. You should understand that it is not possible to predict or identify all such factors. Consequently, you should not consider this summary to be a complete discussion of all potential risks or uncertainties that may substantially impact our business. Additional discussion of the risks and uncertainties summarized in this risk factor summary, as well as other risks and uncertainties that we face, can be found under “Risk Factors” in Part I, Item 1A of this Report. The summary below is qualified in its entirety by that more complete discussion of such risks and uncertainties. Moreover, we operate in a competitive and rapidly changing environment. New factors emerge from time to time and it is not possible to predict the impact of all of these factors on our business, financial condition or results of operations. You should consider carefully the risks and uncertainties described under “Risk Factors” in Part I, Item 1A of this Report as part of your evaluation of an investment in our common stock.

Risks Related to the Commercialization of RYTELO® (Imetelstat)

•Our near-term prospects are wholly dependent on RYTELO. We have limited experience with the commercialization of RYTELO, and if we are unable to successfully commercialize RYTELO in the U.S. for lower-risk MDS, or to expand its indication of use, our ability to generate meaningful revenue or achieve profitability will be materially and adversely affected.

•We have limited experience as a commercial company and our sales, marketing, and distribution of RYTELO may be unsuccessful or less successful than anticipated.

•If we are unable to continue to execute on our sales, marketing and distribution plans to commercialize RYTELO, we may be unable to generate meaningful product revenue.

•If we do not obtain acceptable prices or adequate reimbursement for RYTELO, the use of RYTELO could be severely limited.

•To be commercially successful, RYTELO must be accepted by the healthcare community, which can be slow to adopt or unreceptive to new technologies and products.

•If the market opportunities for RYTELO are smaller than we believe, our revenue may be adversely affected and our business may suffer.

•If competitors develop products, product candidates or technologies that are superior to or more cost-effective than RYTELO, it would significantly impact the development and commercial viability of RYTELO, which would severely and adversely affect our financial results, business and business prospects, and the future of RYTELO, and might cause us to cease operations.

•We rely on a select network of third party distributors, specialty pharmacies and other vendors to distribute RYTELO, and any failure by such distributors, specialty pharmacies and vendors could adversely affect our revenues, financial condition, or results of operations.

•We are seeking regulatory approval to commercialize RYTELO in the EU, and any such approval, if received, will be subject to pricing, drug marketing and reimbursement regulations in the EU, which may materially affect our ability to commercialize and receive reimbursement coverage for RYTELO in the EU.

Risks Related to Regulatory Approval of RYTELO

•We may be unable to maintain regulatory approval for RYTELO in the U.S. for lower-risk MDS, which would severely and adversely affect our business and business prospects, and might cause us to cease operations.

•Our regulatory approval for RYTELO in the U.S. for lower-risk MDS is subject to certain post-marketing requirements and commitments, and we may be subject to penalties or product withdrawal if we fail to comply with such regulatory requirements or commitments, or if we experience unanticipated problems with RYTELO.

•We may be unable to obtain regulatory approval to commercialize RYTELO in any other jurisdictions or for any new indications, or may experience significant delays in doing so, any of which could severely and adversely affect our business and business prospects, and might cause us to cease operations.

Risks Related to Compliance with Healthcare Laws

•The FDA, the Department of Justice, or DOJ, and other regulatory authorities actively enforce regulations related to the promotion and advertisement of pharmaceutical products, and if we were found to have violated the Food, Drug and Cosmetic Act, we could be subject to significant penalties, including civil, criminal and administrative penalties.

Risks Related to the Further Development of RYTELO (Imetelstat)

•We cannot be certain that we will be able to continue to develop RYTELO or advance it in clinical trials, or that we will be able to receive regulatory approval for RYTELO in any other indications in the U.S., the EU, or any other region, on a timely basis or at all.

•RYTELO may cause, or have attributed to it, undesirable or unintended side effects or other adverse events that could halt or limit its further commercialization, delay or prevent its regulatory approval in any other jurisdiction or indication, or cause us to delay or terminate our clinical trials.

•Results and data we disclosed from prior non-clinical studies and clinical trials may not predict success in later clinical trials, and we cannot assure you that any ongoing or future clinical trials of imetelstat, including IMpactMF, will lead to similar results and data that could potentially enable us to obtain any further regulatory approvals.

Risks Related to Manufacturing RYTELO (Imetelstat)

•Failure by us to maintain a manufacturing supply chain to appropriately and adequately supply RYTELO for commercial and future clinical uses would adversely affect our ability to commercialize RYTELO and result in a further delay in or cessation of clinical trials, and our business and business prospects could be severely harmed.

•If third parties that manufacture RYTELO fail to perform as needed, the commercial and clinical supply of RYTELO could be interrupted or limited, and we may be unable to successfully commercialize RYTELO or conduct or complete current or potential future clinical trials.

Risks Related to Our Operating Results, Financial Position and Need for Additional Capital

•We have a history of net losses and may not achieve consistent future profitability for some time, if ever.

•Our operating results are unpredictable and may fluctuate. If our operating results are below the expectations of securities analysts or investors, the trading price of our common stock could decline.

•Our failure to obtain additional capital if and when needed would force us to further delay, reduce or eliminate the further development of imetelstat, or to halt the commercialization of RYTELO, any of which would severely and adversely affect our financial results, business and business prospects, and might cause us to cease operations.

Risks Related to Our Indebtedness and Liabilities

•Our level of indebtedness and debt service obligations could adversely affect our financial condition, and may make it more difficult for us to fund our operations.

Risks Related to Protecting Our Intellectual Property

•If we are unable to obtain and maintain sufficient intellectual property protection and relevant regulatory exclusivities for RYTELO, our competitors could develop and commercialize products similar or identical to RYTELO, and our ability to successfully commercialize RYTELO may be adversely affected.

•Obtaining and maintaining our patent rights depends on compliance with various procedural, document submission, fee payment and other requirements imposed by governmental patent agencies, and our patent protection could be reduced or eliminated for noncompliance with these requirements.

•Patent terms may be inadequate to protect our competitive position on RYTELO for an adequate amount of time.

•The validity, scope and enforceability of any patents listed in the Orange Book that cover RYTELO or its methods of use can be challenged by third parties and may not protect us from generic or innovator competition.

Risks Related to Our Common Stock and Financial Reporting

•Historically, our stock price has been extremely volatile, and your investment may suffer a decline in value.

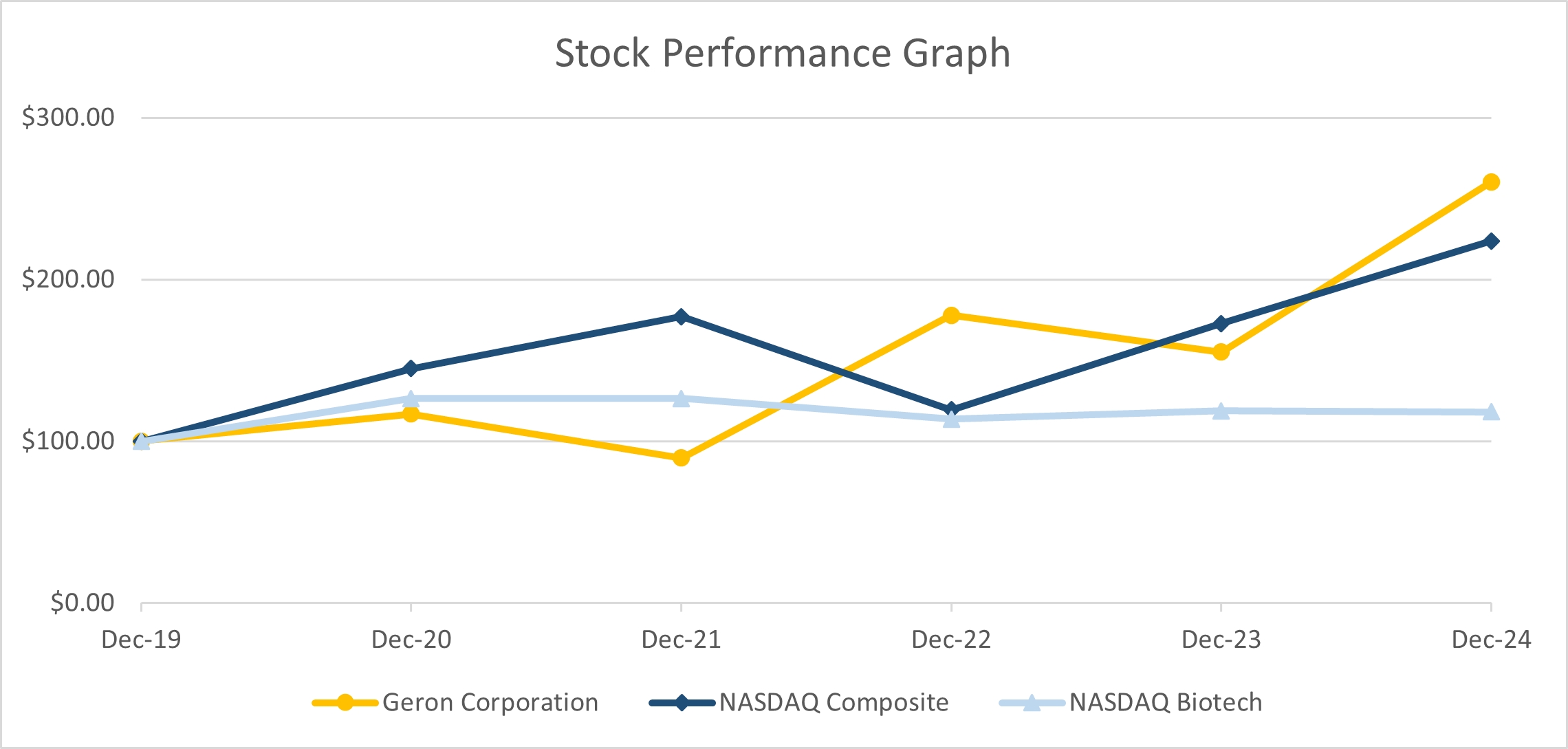

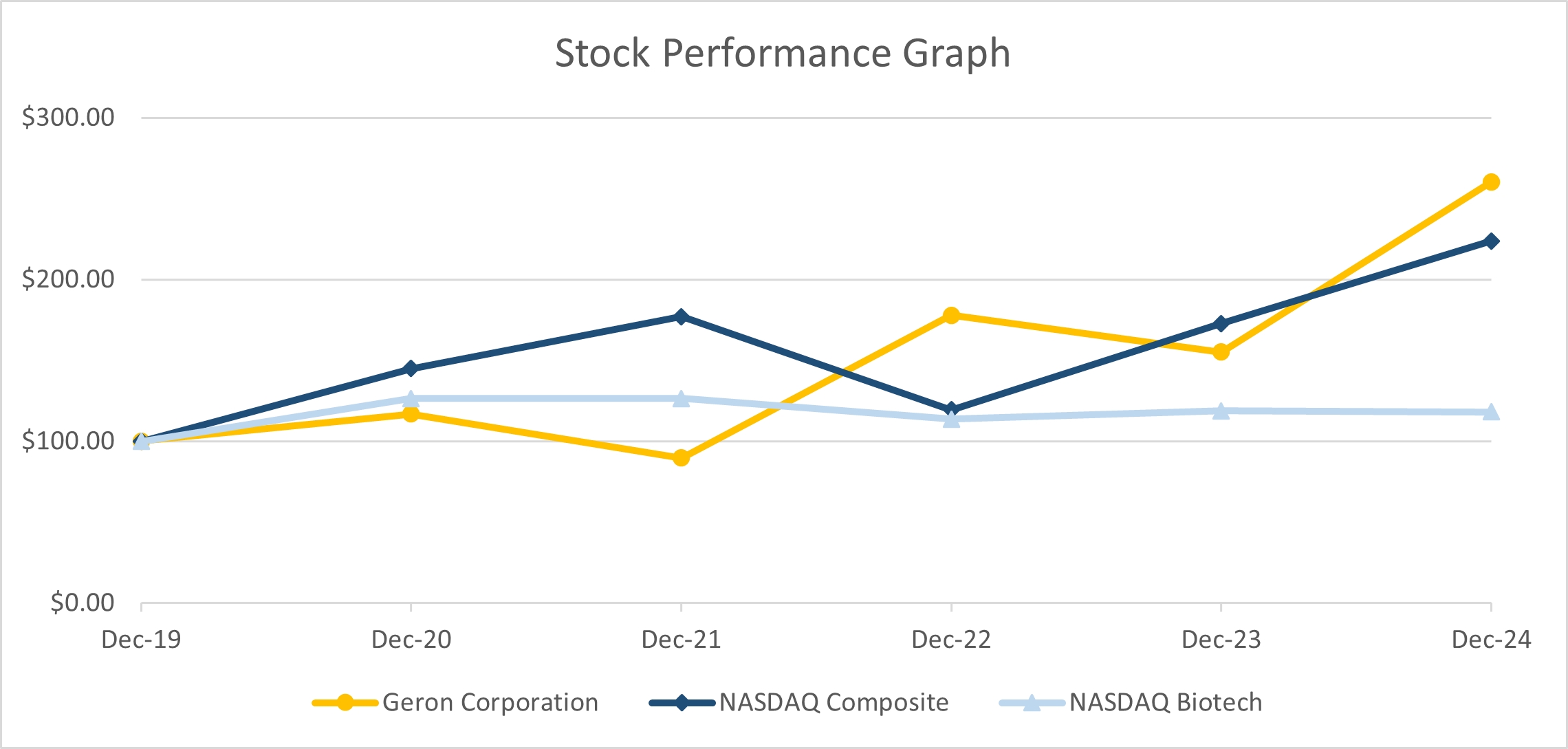

Calculation of Aggregate Market Value of Non‑Affiliate Shares

For purposes of calculating the aggregate market value of shares of our common stock held by non‑affiliates as set forth on the cover page of this Report, we have assumed that all outstanding shares are held by non‑affiliates, except for shares held directly or indirectly by each of our executive officers and directors. In the case of 5% or greater stockholders, we have not deemed any such stockholders to be affiliates given the lack of facts and circumstances that would indicate that any such stockholders exercise, or have the ability to exercise, any control over Geron. These assumptions should not be deemed to constitute an admission that all executive officers and directors are, in fact, affiliates of Geron, or that there are no other persons who may be deemed to be affiliates of Geron. Further information concerning shareholdings of our executive officers, directors and principal stockholders is incorporated by reference in Part III, Item 12 of this Report.

PART I

ITEM 1. BUSINESS

Company Overview

We are a commercial-stage biopharmaceutical company aiming to change lives by changing the course of blood cancer. Our first-in-class telomerase inhibitor, RYTELO® (imetelstat), harnesses Nobel Prize winning science in a treatment that scientific evidence suggests reduces proliferation of malignant cells, allowing production of new healthy cells, which we believe drives differentiated clinical benefits, potentially altering the underlying course and modifying the disease of these hematologic malignancies.

We commercially launched RYTELO in the U.S. in June 2024 following its approval by the U.S. Food and Drug Administration, or FDA, on June 6, 2024 for the treatment of adult patients with low- to intermediate-1 risk myelodysplastic syndromes, or lower-risk MDS, with transfusion-dependent, or TD, anemia requiring four or more red blood cell units over eight weeks who have not responded to or have lost response to or are ineligible for erythropoiesis-stimulating agents, or ESAs. Lower-risk MDS is a progressive blood cancer with high unmet need, where many patients with anemia become dependent on red blood cell transfusions, which can be associated with clinical consequences and decreased quality of life. We believe that the uptake of RYTELO since launch is supported by the high unmet need in lower-risk MDS and significant product differentiation, including observed benefit of RYTELO in difficult-to-treat sub-populations such as patients with high transfusion burden and ring sideroblast negative, or RS- patients. We believe that the favorable FDA label and National Comprehensive Cancer Network, or NCCN®, Clinical Practice Guidelines in Oncology, or NCCN Guidelines®, position RYTELO as a potential blockbuster treatment that can compete for significant market segments in lower-risk MDS, including first-line ESA ineligible patients and second-line patients regardless of prior treatment or RS status.

In September 2023, we submitted a marketing authorization application, or MAA, in the European Union, or EU, that was validated for review by the European Medicines Agency, or EMA, for RYTELO for the same proposed indication as in the U.S., and in December 2024, the Committee for Medicinal Products for Human Use, or CHMP, of the EMA adopted a positive opinion recommending the approval of RYTELO for the treatment of adult patients with TD anemia due to very low, low or intermediate risk myelodysplastic syndromes without an isolated deletion 5q cytogenetic, or non-del 5q, abnormality and who had an unsatisfactory response to or are ineligible for erythropoietin-based therapy. The European Commission, or EC, is reviewing the CHMP's recommendation, and we expect a potential approval decision by the EC in the first half of 2025. We are preparing for the potential commercialization of RYTELO in select EU countries in 2026, subject to regulatory approval, which could include working with experienced third parties who can provide contracted services, including essential critical path activities such as reimbursement, Health Technology Assessment, or HTA, submissions, market access and distribution.

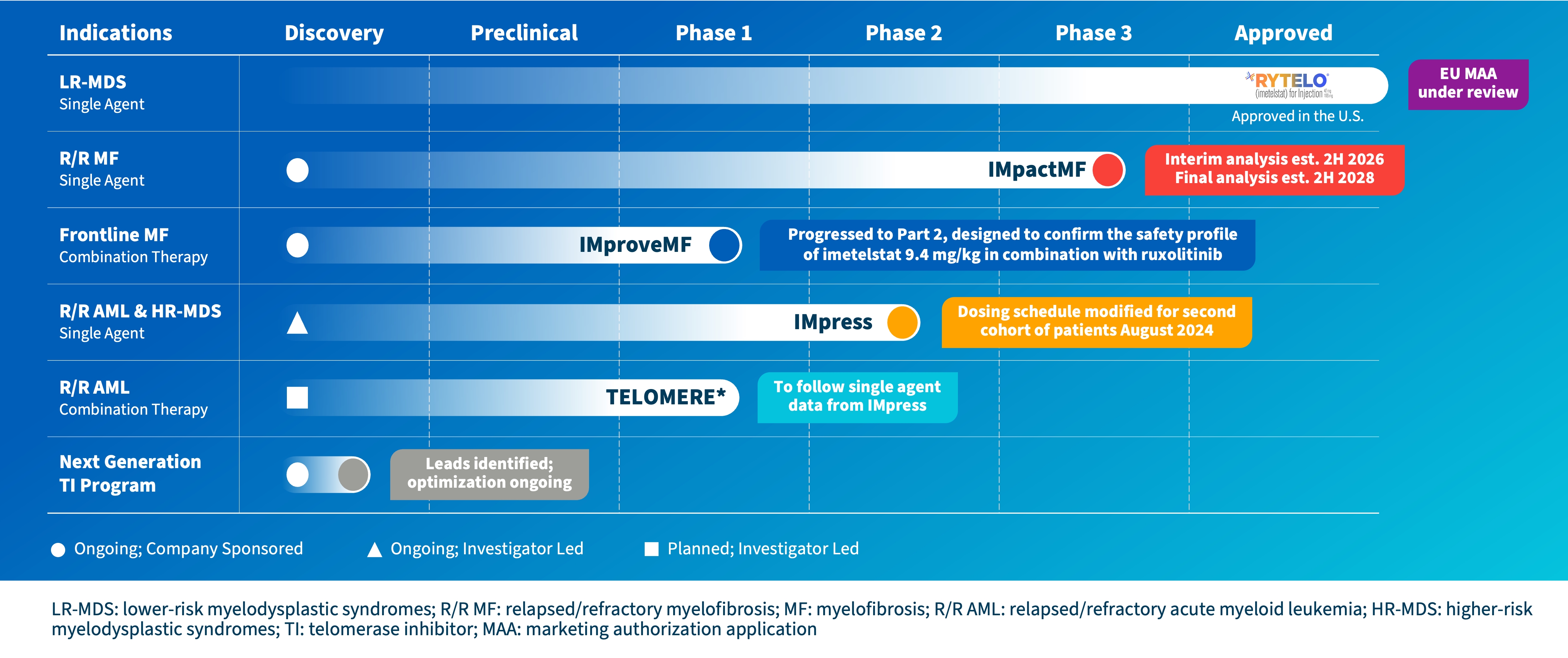

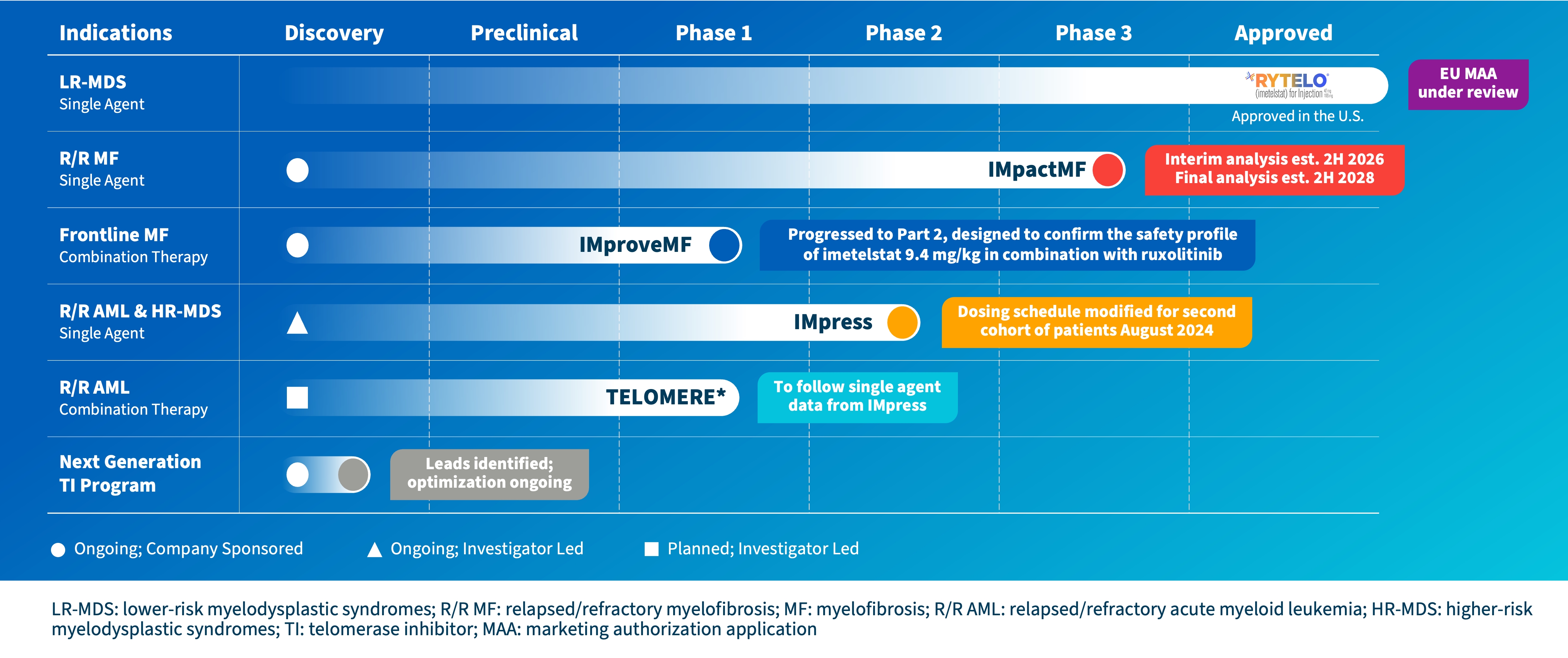

In addition to lower-risk MDS, we are developing imetelstat for the treatment of other myeloid hematologic malignancies. Our Phase 3 IMpactMF clinical trial is evaluating imetelstat in patients with intermediate-2 or high-risk myelofibrosis, or MF, who have relapsed after or are refractory to treatment with a janus associate kinase inhibitor, or JAK inhibitor, or relapsed/refractory MF, or R/R MF, with overall survival, or OS, as the primary endpoint. As of February 2025, the trial reached approximately 80% enrollment. Based on our current planning assumptions for enrollment and event (death) rates in the trial, we expect the interim analysis for OS in IMpactMF may occur in the second half of 2026 and the final analysis may occur in the second half of 2028.

We believe that telomerase inhibition with imetelstat represents a novel mechanism of action with unique benefits in hematologic malignancies and potentially in other tumor types.

Our Strategy

Our strategy is to maximize the value of our first-in-class telomerase inhibitor, RYTELO (imetelstat). This includes maximizing the commercial opportunity for RYTELO in lower-risk MDS by investing in and executing on our U.S. commercial launch. We expect to deliver steady growth by executing across several key imperatives, including driving new patient starts across all eligible lower-risk MDS population segments, particularly in second-line lower-risk MDS; reinforcing with health care providers, or HCPs, the value of duration of treatment we have

observed with RYTELO; educating HCPs on appropriate management of patient safety with RYTELO; and leveraging strong payor access for RYTELO.

We also plan to progress our development programs that could help identify potential additional indications for imetelstat. This includes continuing to enroll the Phase 3 IMpactMF trial, which, if positive and approved in label expansion, could significantly increase the RYTELO commercial opportunity. Additionally, we plan to execute on our pipeline programs and assess the data to understand the potential to develop imetelstat in additional hematologic malignancies and as a potential combination therapy.

U.S. Commercialization of RYTELO

RYTELO is the first and only FDA approved telomerase inhibitor. The FDA label indicates that RYTELO is approved for certain ESA ineligible or ESA relapsed/refractory lower-risk MDS patients, regardless of RS status. In August 2024, the MDS NCCN Guidelines® were updated to include imetelstat as a Category 1 treatment in second-line RS+/RS- patients regardless of prior treatment and as a Category 2A treatment for first-line ESA-ineligible RS+/RS- patients.

We believe that lower-risk MDS represents a significant market opportunity with blockbuster potential for RYTELO in this indication. We estimate there are approximately 15,400 treatment-eligible lower-risk MDS patients consistent with the FDA label in 2025, based on IQVIA projected claims and Clarivate/Decision Resources Group, or DRG, incidence data. This is comprised of approximately 3,400 first-line ESA ineligible patients, approximately 7,600 second-line ESA relapsed/refractory patients (approximately 5,700 RS- and 1,900 RS+, respectively), and approximately 4,400 third-line plus ESA relapsed/refractory patients (approximately 3,300 RS- and 1,100 RS+, respectively). We estimate that approximately 45% of first-line patients will progress to second-line treatment and approximately 59% of second-line patients will progress to third-line treatment in 2025.

To support this significant market opportunity, our commercial team includes 50 key account managers, oncology clinical educators, and field reimbursement and national account teams, along with our medical affairs field team. We offer a wide range of resources to support access and affordability for eligible RYTELO patients, including our Reach for RYTELO™ patient support program, which provides a range of resources which are designed to support access and affordability to eligible patients prescribed RYTELO.

Commercialization Plans for RYTELO in the EU

Subject to receiving regulatory approval, our goal in the EU is to optimize patient access and revenues for RYTELO in prioritized countries. We are preparing to commercialize RYTELO in select EU countries in 2026, which could include working with experienced third parties who can provide contracted services, including essential critical path activities such as reimbursement, HTA submissions, market access and distribution.

Background of Telomerase Inhibition in Hematologic Malignancies and Imetelstat Development

In the human body, normal growth and maintenance of tissues occurs by cell division. However, most cells are only able to divide a limited number of times, and this number of divisions is regulated by telomere length. Telomeres are repetitions of a deoxyribonucleic acid, or DNA, sequence located at the ends of chromosomes. They act as protective caps to maintain stability and integrity of the chromosomes, which contain the cell’s genetic material. Normally, every time a cell divides, the telomeres shorten. Eventually, they shrink to a critically short length, and as a result, the cell either dies by apoptosis or stops dividing and senesces.

Telomerase is a naturally occurring enzyme that maintains telomeres and prevents them from shortening during cell division, such as stem cells that must remain immortalized to support normal health. Telomerase consists of at least two essential components: a ribonucleic acid, or RNA, template, which binds to the telomere, and a catalytic subunit with reverse transcriptase activity, which adds a specific DNA sequence to the chromosome ends. The 2009 Nobel Prize for Physiology or Medicine was awarded to Drs. Elizabeth H. Blackburn, Carol W. Greider and Jack Szostak, former Geron collaborators, for the discovery of how chromosomes are protected by both telomeres and telomerase.

Telomerase is upregulated in many tumor cells and malignant stem and progenitor cells, enabling the continued and uncontrolled proliferation of the malignant cells that drive tumor growth and progression. We believe that inhibiting telomerase may be an attractive approach to treating cancer because it may limit the proliferative capacity of malignant stem and progenitor cells, which are believed to be important drivers of tumor growth and progression. We and others have observed in various in vitro, ex vivo and rodent tumor models that inhibiting telomerase: (a) results in telomere shortening and (b) arrests uncontrolled malignant cell proliferation and tumor growth.

Many myeloid hematologic malignancies, such as essential thrombocythemia, or ET, MF and MDS, have been shown to arise from malignant stem and progenitor cells that express higher telomerase activity and have shorter telomeres when compared to normal healthy cells. In vitro studies have suggested that tumor cells with short telomeres may be especially sensitive to the anti‑proliferative effects of inhibiting telomerase.

Imetelstat, our proprietary telomerase inhibitor which was discovered and developed at Geron, was designed to inhibit telomerase in malignant cells with continuously upregulated telomerase.

Imetelstat is a lipid conjugated 13‑mer oligonucleotide that we designed to be complementary to and bind with high affinity to the RNA template of telomerase, thereby directly inhibiting telomerase activity. Imetelstat does not act as an antisense inhibitor of protein translation. The compound has a proprietary thio‑phosphoramidate backbone, which is designed to provide resistance to the effect of cellular nucleases, thus conferring improved stability in plasma and tissues, as well as improved binding affinity to its target. To improve the ability of imetelstat to penetrate cellular membranes, we conjugated the oligonucleotide to a lipid group. Imetelstat’s IC50, or half maximal inhibitory concentration, is 3 – 9 nM in cell free assays.

We believe that imetelstat may have the potential to suppress the proliferation of malignant stem and progenitor cells while transiently affecting normal cells. Early clinical data from a Phase 2 trial of imetelstat in patients with ET, or the ET Trial, and a pilot study of imetelstat in patients with MF conducted at Mayo Clinic, or the Pilot Study, suggested that imetelstat inhibits the progenitor cells of the malignant clones believed to be responsible for the underlying diseases in a relatively select manner, indicating potential disease-modifying activity. These data were published in two separate articles in a September 2015 issue of The New England Journal of Medicine. In the Phase 2 IMbark study, an association of survival improvement and reduction in variant allele frequency, or VAF, was observed for high-risk imetelstat-treated MF patients, results which were published in Journal of Clinical Oncology in 2021. Additionally, in the Phase 2/3 IMerge study, SF3B1 VAF reduction was associated with longest transfusion independence, or TI, and with 8-week, 24-week and 1-year TI duration in imetelstat-treated lower-risk MDS patients. These results were published in The Lancet and at the European Hematology Association, or EHA, annual meeting in 2023.

Pipeline Chart

Lower-Risk Myelodysplastic Syndromes (MDS)

MDS is a group of blood disorders in which the proliferation of malignant progenitor cells produces multiple malignant cell clones in the bone marrow resulting in disordered and ineffective production of the myeloid lineage, which includes red blood cells, white blood cells and platelets. In MDS, bone marrow and peripheral blood cells may have abnormal, or dysplastic, cell morphology. MDS is frequently characterized clinically by severe anemia, or low red blood cell counts, and low hemoglobin. In addition, other peripheral cytopenias, or low numbers of white blood cells and platelets, may cause life‑threatening infections and bleeding. Transformation to acute myeloid leukemia, or AML, is reported to occur in up to 30% of MDS cases and results in poorer overall survival.

MDS is the most common of the myeloid malignancies. There are approximately 60,000 people in the U.S. living with the disease and approximately 16,000 reported new cases of MDS in the U.S. every year, according to Clarivate/DRG MDS Syndicated Report 2020, 2021, 2022. We believe that there are approximately 15,400 lower-risk MDS patients in the U.S. in 2025 that are eligible for treatment with RYTELO based on its approved FDA label, based on IQVIA projected claims and Clarivate/DRG incidence data. MDS is primarily a disease of the elderly, with median age at diagnosis around 70 years. The majority of patients, approximately 70%, fall into what are considered to be the lower-risk groups at diagnosis, according to the International Prognostic Scoring System, or IPSS, which assigns relative risk of progression to AML and overall survival by taking into account the presence of a number of disease factors, such as cytopenias and cytogenetics.

Chronic anemia is the predominant clinical problem in patients who have lower-risk MDS. Typically, these patients are treated with ESAs, such as erythropoietin, or EPO. Although ESAs provide an improvement in anemia in approximately 50% of patients, the effect is transient with a median duration of response of approximately two years. Once ESAs fail for patients, HMAs and lenalidomide have been used to improve anemia, but with limited success, such as reported ≥ 8-week red blood cell, or RBC, transfusion independence, or RBC-TI, rates of 17% for azacitidine, an HMA, and 27% for lenalidomide in non-del 5q lower-risk MDS patients. In August 2023, Reblozyl, or luspatercept, was approved for the treatment of anemia in adult patients with very low-to-intermediate-risk MDS without previous erythropoiesis stimulating agent use, or ESA-naive, who may require regular RBC transfusions. In April 2020, luspatercept was approved for use in ESA-failed lower-risk MDS patients with ringed sideroblasts. Such patients comprise approximately 15% to 30% of all lower-risk MDS patients. The majority of patients who do not have ringed sideroblasts or who no longer respond to ESAs or other available drug therapies become dependent on red blood cell transfusions due to low hemoglobin. Serial red blood cell transfusions can lead to elevated levels of iron in the blood and other tissues, which the body has no normal way to eliminate. Iron overload is a potentially dangerous condition. Published studies in patients with MDS have shown that iron overload resulting from regular red blood cell transfusions is associated with a poorer overall survival and a higher risk of developing AML.

Phase 3 IMerge Trial in Lower-Risk MDS

Our regulatory approval in the U.S. for certain patients with lower-risk MDS and our EMA submission are each based on positive data from the IMerge Phase 3 clinical trial. The trial met its primary endpoint of ≥ 8-week red blood cell transfusion independence rate and a key secondary endpoint of ≥ 24-week red blood cell transfusion independence rate, demonstrating highly statistically significant (i.e., p<0.001 for both) and clinically meaningful benefits with imetelstat treatment versus placebo. Furthermore, statistically significant and clinically meaningful efficacy results were observed in the trial across key MDS patient subtypes, including patients who were ringed sideroblast positive, or RS positive, and ringed sideroblast negative, or RS negative; patients with high (4-6 RBC units/8 weeks) and very high baseline transfusion burden (>6 RBC units/8 weeks); and patients classified as Low or Intermediate-1 risk according to the IPSS. The most common Grade 3/4 adverse reactions were neutropenia (72%) and thrombocytopenia (65%), which lasted a median duration of less than two weeks, and in more than 80% of patients were resolved to Grade <2 in under four weeks.

Myelofibrosis (MF)

MF, a type of myeloproliferative neoplasm, is a chronic blood cancer in which abnormal or malignant precursor cells in the bone marrow proliferate rapidly, causing scar tissue, or fibrosis, to form. As a result, normal blood production in the bone marrow is impaired and may shift to other organs, such as the spleen and liver, which can cause them to enlarge substantially. People with MF may have abnormally low or high numbers of circulating RBCs, white blood cells or platelets, and abnormally high numbers of immature cells in the blood or bone marrow. MF patients can also suffer from debilitating constitutional symptoms, such as drenching night sweats, fatigue, severe itching, or pruritus, abdominal pain, fever and bone pain. There are estimated to be approximately 12,000 patients living with MF in the U.S., of which an estimated approximately 10,000 patients are expected to be

relapsed/refractory to JAK inhibitors in 2028 and potentially eligible for treatment with imetelstat if it is approved in that indication, according to IQVIA claims data and a DRG 2022 report.

Approximately 70% of MF patients are classified as having Intermediate‑2 or High-risk disease, as defined by the Dynamic International Prognostic Scoring System Plus described in a 2011 Journal of Clinical Oncology article. Drug therapies currently approved by the FDA and other regulatory authorities for treating these MF patients include JAK inhibitors, ruxolitinib, fedratinib and momelotinib, as well as pacritinib, a kinase inhibitor. Currently, no drug therapy is approved for those patients who fail or no longer respond to JAK inhibitor treatment, and median survival for MF patients after discontinuation from ruxolitinib is only approximately 14–16 months, representing a significant unmet medical need.

Ongoing Phase 3 IMpactMF Trial in Relapsed/Refractory MF

Trial Design

IMpactMF, our Phase 3 clinical trial in relapsed/refractory MF, is an open label, 2:1 randomized, controlled clinical trial designed to evaluate imetelstat (9.4 mg/kg administered by intravenous infusion over two hours every three weeks) in approximately 320 patients. Patients relapsed after or refractory to a JAK inhibitor are defined as having an inadequate spleen response or symptom response after treatment with a JAK inhibitor for at least six months, including an optimal dose of a JAK inhibitor for at least two months. The best available therapy, or BAT, control arm of IMpactMF excludes the use of JAK inhibitors. With respect to the trial design for IMpactMF, the FDA urged us to consider adding a third dosing arm to assess a lower dose and/or a more frequent dosing schedule that might improve the planned trial’s chance of success by identifying a less toxic regimen and/or more effective spleen response, one of the trial’s secondary endpoints. Based on data from IMbark, we believe that testing a lower dose regimen would likely result in a lower median OS, which is the trial’s primary endpoint, in the imetelstat treatment arm. We believe existing data also suggest that lowering the dose would not result in a clinically meaningful reduction in toxicity. For these reasons, we therefore determined not to add a third dosing arm to the trial design, and the FDA did not object to our proposed imetelstat dose and schedule of 9.4 mg/kg every three weeks. Our belief may ultimately be incorrect. Therefore, our failure to add a third dosing arm could result in a failure to maintain regulatory clearance from the FDA and similar international regulatory authorities, could result in the trial’s failure, or could otherwise delay, limit or prevent marketing approval of imetelstat for relapsed/refractory MF by the FDA or similar international regulatory authorities.

The primary efficacy endpoint for IMpactMF is OS. Key secondary endpoints include symptom response; spleen response; progression free survival; complete remission, partial remission or clinical improvement, as defined by the International Working Group for Myeloproliferative Neoplasms Research and Treatment criteria; duration of response; safety; pharmacokinetics; and patient reported outcomes. There are IMpactMF sites across North America, South America, Europe, Australia and Asia.

IMpactMF is designed with >85% power to detect a 40% reduction in the risk of death (hazard ratio=0.60; one-sided alpha=0.025). The final analysis for OS is planned to be conducted after more than 50% of the patients planned to be enrolled in the trial have died (referred to as an event). An interim analysis of OS, in which the alpha spend is expected to be approximately 0.01, is planned to be conducted after approximately 70% of the total projected number of events (deaths) for the final analysis have occurred.

Current Status of IMpactMF

IMpactMF opened for patient screening and enrollment in December 2020. As of February 2025, the trial was approximately 80% enrolled. Based on our planning assumptions for enrollment and event (death) rates in the trial, we expect the interim analysis for OS in IMpactMF may occur in the second half of 2026 and the final analysis may occur in the second half of 2028. Because these analyses are event-driven and it is uncertain whether actual rates for enrollment and events will reflect current planning assumptions, the results may be available at different times than currently expected. At the interim analysis, if the pre-specified statistical OS criterion is met, then we expect such data may potentially support the registration of imetelstat in relapsed/refractory MF. Subject to protocol-specified stopping rules for futility, if the pre-specified OS criterion is not met at the interim analysis, the trial will continue to the final analysis, which is expected to occur approximately one year later.

The timing and achievement of either or both of the planned analyses depend on numerous factors, including enrollment rates and blinded death rates, which have in the past been, and may continue to be, lower than our projections. In addition, our ability to enroll, conduct and complete IMpactMF depends on whether we can obtain and maintain the relevant clearances from regulatory authorities and other institutions to enroll, conduct and complete the trial.

Improvement in Overall Survival and Potential Disease-Modifying Activity Observed in IMbark Phase 2

The IMbark Phase 2 clinical trial was designed to evaluate two dosing regimens of imetelstat (either 4.7 mg/kg or 9.4 mg/kg administered by intravenous infusion every three weeks) in patients with relapsed/refractory MF.

We previously reported efficacy and safety results from the IMbark Phase 2 clinical trial, including median OS of 28.1 months for patients on the high dose arm of the study, which is almost twice the reported median OS of 14–16 months in medical literature. To evaluate this potential benefit, we conducted a post-hoc analysis of OS for patients treated with imetelstat 9.4 mg/kg in IMbark compared to OS calculated from real world data, or RWD, collected at the Moffitt Cancer Center for patients who had discontinued treatment with ruxolitinib, a JAK inhibitor, and who were subsequently treated with BAT. To make a comparison between the IMbark data and RWD, a cohort from the real-world dataset was identified that closely matched the IMbark patients, using guidelines for inclusion and exclusion criteria as defined in the IMbark clinical protocol, such as platelet count and spleen size. Calculations from two propensity score analysis approaches resulted in a median OS of 30.7 months for the imetelstat-treated patients from IMbark, which is more than double the median OS of 12.0 months using RWD for patients treated with BAT. These analyses also showed a 65% – 67% lower risk of death for the imetelstat-treated patients vs. BAT-treated patients. We believe these analyses suggest potentially longer OS for imetelstat-treated relapsed/refractory MF patients in IMbark, compared to BAT in closely-matched patients from RWD. However, comparative analyses between RWD and our clinical trial data have several limitations. For instance, the analyses create a balance between treatment groups with respect to commonly available covariates, but do not take into account the unmeasured and unknown covariates that may affect the outcomes of the analyses. Potential biases are introduced by factors which include, for example, the selection of the patients included in the analyses, misclassification in the matching process, the small sample size, and estimates that may not represent the outcomes for the true treated patient population. For these and other reasons, such comparative analyses and any conclusions from such analyses should be considered carefully and with caution, and should not be relied upon as demonstrative or otherwise predictive or indicative of any current or potential future clinical trial results of imetelstat in relapsed/refractory MF, including IMpactMF.

In IMbark, patients also experienced other positive clinical outcomes, including symptom improvement, spleen reduction and bone marrow fibrosis improvement. In June 2020, we reported correlation analyses from IMbark that showed a trend of longer OS in patients who achieved symptom response, spleen volume reductions and improved bone marrow fibrosis, in a dose-dependent manner. Furthermore, the reductions in the variant allele frequency of key driver mutations in MF and the improvement in bone marrow fibrosis observed in IMbark have also been correlated to the improvement in OS. We believe the improvement in bone marrow fibrosis, potential survival benefit, molecular data and correlations from IMbark provide strong evidence of the potential for disease modification with imetelstat, which we believe would differentiate imetelstat from currently approved treatments for MF, if approved.

The safety results observed in IMbark were consistent with prior clinical trials of imetelstat in hematologic malignancies, and no new safety signals were identified. In the 9.4 mg/kg arm, reversible and manageable Grade 3/4 thrombocytopenia and neutropenia were reported in 24/59 patients (41%) and 19/59 patients (32%), respectively, without significant clinical consequences. 1/59 patients (2%) had Grade 3 febrile neutropenia. 3/59 patients (5%) had Grade 3/4 bleeding. 6/59 patients (10%) had Grade 3/4 infections. Furthermore, more than 70% of the observed Grade 3/4 cytopenias resolved to Grade 2 or lower by laboratory assessment within four weeks.

FDA Fast Track Designation

Fast Track designation provides opportunities for frequent interactions with FDA review staff, as well as eligibility for priority review, if relevant criteria are met, and rolling review. Fast Track designation is intended to facilitate and expedite development and review of an NDA to address unmet medical needs in the treatment of serious or life-threatening conditions. However, Fast Track designation does not accelerate conduct of clinical trials or mean that the regulatory requirements are less stringent, nor does it ensure that imetelstat will receive marketing approval or that approval will be granted within any particular timeframe. In addition, the FDA may withdraw Fast Track designation if it believes that the designation is no longer supported by data emerging from the imetelstat clinical development program.

In October 2017, the FDA granted Fast Track designation to imetelstat for the treatment of adult patients with TD anemia due to lower-risk MDS who do not have a non-del 5q abnormality and who are refractory or resistant to treatment with an ESA (i.e., the treatment population in IMerge Phase 3).

In September 2019, the FDA granted Fast Track designation to imetelstat for the treatment of adult patients with Intermediate-2 or High-Risk MF whose disease has relapsed after or is refractory to JAK inhibitor treatment (i.e., the treatment population in IMpactMF).

Potential Additional Indications

IMproveMF: Phase 1 Combination Clinical Trial in Frontline Myelofibrosis (Frontline MF)

We are also evaluating imetelstat as a combination therapy in the Phase 1 IMproveMF clinical trial as a first-line treatment for patients with Intermediate-1, Intermediate-2 or High-Risk myelofibrosis. Based on the dose escalation findings in Part 1 of the study, presented at the American Society of Hematology, or ASH, annual meeting in December 2024, imetelstat 9.4 mg/kg dosed every four weeks with ruxolitinib was the selected dose for the dose expansion Part 2 of the study, which is currently enrolling patients.

IMpress: Investigator-Led Phase 2 Clinical Trial in Higher Risk Myelodysplastic Syndromes (Higher Risk MDS) and Acute Myeloid Leukemia (AML)

Imetelstat is also being studied in an investigator-led IMpress Phase 2 clinical trial in Intermediate-2 or High-Risk myelodysplastic syndromes, or higher-risk MDS, and acute myeloid leukemia, or AML, patients that are relapsed or refractory to hypomethylating agent, or HMA, treatment. Based on observations from an interim analysis from the first cohort, presented at ASH in December 2024, the protocol was amended to a more frequent dosing schedule for a second cohort of patients being enrolled and treated with this modified schedule as of August 2024.

In addition, pending the results of IMpress, we plan to support a Phase 1/2 investigator-led study, called TELOMERE, in relapsed/refractory AML, using a combination approach of imetelstat and venetoclax or azacitidine.

Research Programs

Next Generation Telomerase Inhibitor Discovery

We have initiated a discovery program to identify lead compounds as a potential next generation oral telomerase inhibitor. If the leads we have identified are optimized, we may conduct preclinical experiments that may serve as a basis for potential future clinical testing. Discovery research is an uncertain and unpredictable process. As such, the timing and nature of any results from this discovery effort are difficult to forecast. If we optimize lead compounds from this discovery program, we expect to provide an update on our efforts at that time.

Preclinical Lymphoid Hematologic Malignancies

Academic research data suggests that certain lymphoid hematologic malignancies have higher telomerase activity and shorter telomeres when compared to normal healthy cells. Based on this scientific hypothesis, we conducted a preclinical research project with MD Anderson Cancer Center to determine the potential application of imetelstat in lymphoid hematologic malignancies. The project was completed, and preliminary results of the research project were published in Blood in November 2022. Exploring the utility of imetelstat in lymphoid hematologic malignancies remains an area of interest for us.

Intellectual Property and Regulatory Exclusivity

Intellectual property, including patent protection, is very important to our business. We file patent applications in the U.S. and other jurisdictions, and we also rely on trade secret protection and contractual arrangements to protect aspects of our business. An enforceable patent with appropriate claim coverage can provide an advantage over competitors who may seek to employ similar approaches to develop therapeutics, and so the future commercial success of RYTELO (imetelstat), and therefore our future success, will be in part dependent on our intellectual property strategy.

Our intellectual property strategy includes the early development of a technology, such as imetelstat, followed by rounds of increasingly focused innovation around a product opportunity, including identification and definition of a specific product candidate and uses thereof, manufacturing processes, product formulation and methods of treatment and administration. The result of this process is that products in development are often protected by several families of patent filings that are filed at different times during the development process and cover different aspects of the product. Consequently, earlier filed, broad technology patents will usually expire ahead of patents covering later developments, such as product formulations and methods of treatment and administration, so that

patent expirations on a product may span several years. Patent coverage may also vary from country to country based on the scope of available patent protection. There are also opportunities to obtain an extension of patent coverage for a product in certain countries, which adds further complexity to the determination of patent life.

From time to time, we may endeavor to monitor worldwide patent filings by third parties that are relevant to our business. Based on this monitoring, we may determine that an action is appropriate to protect our business interests. Such actions may include negotiating patent licenses where appropriate, filing oppositions against a patent, filing a request for post grant review against a patent or filing a request for the declaration of an interference with a patent application or issued patent.

The information provided in this section should be reviewed in the context of the section entitled “Risks Related to Protecting Our Intellectual Property” described in “Risk Factors” in Part I, Item 1A of this Report.

RYTELO (imetelstat)

Summary

RYTELO was developed internally by us, and we hold global commercial rights to it. We own issued patents related to RYTELO in the U.S., Europe and other countries. Although composition of matter patents generally provide the most comprehensive coverage of a therapeutic product such as RYTELO, subsequent patent filings directed to other aspects of RYTELO may also provide additional patent coverage with later expiration dates. In addition, it may be possible to obtain patent term extensions of some patents in some countries for claims covering RYTELO or relating to RYTELO, such as methods of treatment with RYTELO, which could further extend the patent term.

We have issued patents in the U.S., Europe and other countries that provide patent coverage into 2033 (not including any patent term extension) pertaining to the treatment of MDS and MF with RYTELO.

In the U.S., our method of treatment patent rights for MDS and MF expire in March 2033 (not including any patent term extension). We also hold an issued patent in the U.S. covering the composition of matter of RYTELO (imetelstat) that expires in December 2025. Now that we have received approval for RYTELO in the U.S., we have applied for patent term extensions under the provisions of the Drug Price Competition and Patent Term Restoration Act of 1984 (as amended), or the Hatch-Waxman Act, which, if granted, would extend the patent term of either our method of treatment patent for MDS and MF or our composition of matter patent by up to five years.

In Europe and other countries, our patent rights for use in MDS and MF expire in November 2033 (not including any patent term extension). Our composition of matter patent coverage expired in September 2024. Subject to receiving approval for RYTELO from the EC, we plan to seek patent term extension under a Supplementary Protection Certificate, or SPC, as permitted under European Council (EC) Regulation No. 469/2009, or the European SPC Regulation, of one of our use patents, such as our patent for use in MDS, in the European Economic Area, or the EEA, which could extend the patent term by up to five years.

In the U.S., Europe, and other countries, we are also pursuing other patent rights relating to RYTELO (imetelstat), such as methods of treatment of MDS in specific patient subpopulations, reagents useful in the manufacturing processes for the drug, and other methods of treatment and kit claims, certain of which are co‑owned with other entities.

Patent Term Extension

Although we are in the process of seeking patent term extension for some of our issued patents covering RYTELO, it is not possible to obtain patent term extension of any patents that expired prior to or are issued following regulatory approval. For the patents for which we are seeking a patent term extension, we may not be granted any such patent term extension and/or the applicable time period of such patent term extension could be less than we have projected. Moreover, in some countries, including the U.S., such patent term extensions, if any, are limited to those claims which encompass the product composition and treatment indications as approved by the relevant healthcare regulatory authority. During the life of the patent term extension, however, its scope of protection will expand to include any additional indications subsequently approved for the product and claimed by the patent. Furthermore, some jurisdictions, including the U.S., allow the filing of patent term extension applications on multiple patents, but ultimately the patent owner must select one patent to which the extension is applied.

In the U.S., now that we have received approval for RYTELO in certain patients with lower-risk MDS, we may potentially extend the term of our composition of matter patent in the U.S. for a maximum of five years until December 2030, subject to U.S. Patent and Trademark Office, or USPTO, approval. Alternatively, we may potentially extend the term of our method of treatment for MDS claims in the U.S. until August 2037, subject to USPTO approval. As we have previously disclosed, we expect to apply patent term extension, if granted, to our method of treatment patent, since doing so provides a longer patent term. However, if we do not receive a patent term extension for our U.S. method of treatment patent for MDS, it will expire in March 2033. Once our composition of matter patent expires in the U.S., we must rely on our method of treatment patent and other patents and regulatory exclusivity for RYTELO in the U.S.

Similarly, in Europe, subject to receiving approval from the EC for RYTELO in certain patients with lower-risk MDS, we plan to seek to potentially extend the term of our patents in the EEA for the use of RYTELO in MDS for a maximum of five years, from November 2033 until November 2038, subject to European Patent Office approval. Since our European composition of matter patents expired in September 2024, we must rely on our use and other patents and, subject to receiving approval from the EC, regulatory exclusivity for RYTELO in the EEA.

If we do not have sufficient patent life and regulatory exclusivity to protect RYTELO in the U.S. and EU, our financial results, business and business prospects, and future development of imetelstat could be materially and adversely affected, which might cause us to cease operations.

Orphan Drug Designation and Market Exclusivity

United States

For a drug to qualify for orphan drug designation by the FDA, both the drug and the disease or condition must meet certain criteria specified in the Orphan Drug Act, or ODA, and FDA’s implementing regulations. Orphan drug designation is granted by the FDA’s Office of Orphan Drug Products in order to support development of medicines for rare diseases or conditions, which generally are those that affect fewer than 200,000 people in the U.S. or, if the disease or condition affects more than 200,000 individuals annually in the U.S., if there is no reasonable expectation that the cost of developing and making the drug would be recovered from sales in the U.S. Orphan drug designation qualifies the sponsor of the drug for various development incentives under the ODA, including certain tax credits for qualified clinical testing and exemption from user fees. A drug granted approval for an orphan designated indication generally receives seven years of market exclusivity, during which time the FDA generally may not approve any other application for the same product for the same use, with certain limited exceptions, most notably when the later product is shown to be clinically superior to the product with exclusivity. Orphan drug exclusivity does not prevent the FDA from approving a different drug for the same disease or condition, or the same drug for a different disease or condition. The FDA can revoke a product’s orphan drug exclusivity under certain circumstances, including when the product sponsor is unable to assure the availability of sufficient quantities of the product to meet patient needs.

A marketing application for a prescription drug product that has received orphan drug designation is not subject to a prescription drug user fee unless the application includes an indication for a disease or condition other than the rare disease or condition for which the drug was granted orphan drug designation. The granting of orphan drug designation does not alter the standard regulatory requirements and process for obtaining marketing approval. The safety and effectiveness of a drug product must be established through adequate and well‑controlled studies. Orphan drug exclusivity does not prevent the FDA from approving a drug product containing a different active moiety for the same disease or condition, or a drug product containing the same active moiety for a different disease or condition , and also imposes certain requirements on manufacturers, such as the availability of drug supply, in order to maintain orphan drug exclusivity.

In June 2015 and December 2015, the FDA granted orphan drug designation to imetelstat for the treatment of MF and MDS, respectively, and following approval of RYTELO in June 2024, the FDA listed in its Approved Drug Products with Therapeutic Equivalence Evaluations, commonly known as the Orange Book, that RYTELO has orphan drug exclusivity, which is expected to provide orphan drug exclusivity until June 2031, subject to our continuing compliance with the requirements to maintain such orphan drug exclusivity.

In addition to orphan drug exclusivity, under the Hatch-Waxman Act, if a product is a “new chemical entity” or NCE, generally meaning that the active moiety has never before been approved in any drug, there is a period of five years from approval of the first indication during which the FDA may not accept for filing any abbreviated new drug application, or ANDA, under section 505(j) of the Federal Food, Drug, and Cosmetic Act, or an application under section 505(b)(2) of the statute for a drug with the same active moiety. An ANDA or 505(b)(2) application may be submitted after four years, however, if the sponsor of the application makes a Paragraph IV certification.

Our request for NCE exclusivity for RYTELO is pending review by the FDA. If the FDA were to grant NCE exclusivity for RYTELO, NCE exclusivity would continue until June 2029.

A product that is not an NCE may qualify for a three-year period of exclusivity if the NDA contains new clinical data, (other than bioavailability studies) derived from studies conducted by or for the sponsor, that were necessary for approval. In that instance, the exclusivity period does not preclude filing or review of an ANDA or 505(b)(2) application; rather, the FDA is precluded from granting final approval to the ANDA or 505(b)(2) application until three years after approval of the RLD. Additionally, the exclusivity applies only to the conditions of approval that required submission of the clinical data.

In the US, the exclusivity periods and patent-related protections described above also may be eligible for a six-month extension of regulatory exclusivity, or pediatric exclusivity, pursuant to section 505A of the Federal Food, Drug, and Cosmetic Act, if the sponsor submits pediatric data that “fairly respond” to a written request from FDA for such data; however, we do not expect to receive pediatric exclusivity for RYTELO in the U.S.

Europe

In the EEA, pursuant to the European Union Data Exclusivity Directive 2004/27/EC, upon drug product approval a new medicinal product is entitled to New Active Substance, or NAS, exclusivity in the form of eight years of data exclusivity and two years of market exclusivity, conferring a total of ten years of exclusivity for the first-approved indication. Thus, subject to receiving approval from the EC for RYTELO for the treatment of certain patients with lower-risk MDS, we expect to have a total of ten years of NAS exclusivity for this indication from the time of approval.

In addition to NAS exclusivity, orphan drug designation by the EC provides regulatory and financial incentives for companies to develop and market therapies that treat a life‑threatening or chronically debilitating condition affecting no more than five in 10,000 persons in the EU, and where no satisfactory treatment is available. Orphan drug designation also entitles a party to financial incentives such as reduction of fees or fee waivers, as well as protocol assistance from the EMA during the product development phase, and direct access to the centralized authorization procedure. In addition, ten years of market exclusivity is granted following receipt of drug product approval, meaning that another application for marketing authorization of a later similar medicinal product for the same therapeutic indication will generally not be approved by the EC. This period may be reduced to six years if the orphan drug designation criteria are no longer met, including where it is shown that the product is sufficiently profitable to not justify maintenance of market exclusivity.

In December 2015 and July 2020, the EC granted orphan drug designation to imetelstat for the treatment of MF and MDS, respectively. As part of its review of our MAA for RYTELO, the EMA reviewed the grant of orphan drug designation for the treatment of certain patients with MDS. If RYTELO is approved by the EC and we continue to maintain orphan drug designation for RYTELO for MDS, we anticipate that we will have the potential to retain market exclusivity in the EEA for RYTELO in the approved indication for ten years post-approval. However, if in the future the EC chooses not to maintain its grant of orphan designation for RYTELO for MDS, we will not be eligible for 10 years of orphan drug exclusivity, although we would still be eligible for up to 10 years of NAS exclusivity, as described above.

In addition, subject to RYTELO's approval by the EC, under the European Pediatric Regulation, if we fulfill our pediatric investigation plan agreed upon with the EMA, we would be eligible to receive an additional two years of exclusivity, which may enable us to maintain orphan drug exclusivity in the EEA for RYTELO in certain patients with lower-risk MDS for an additional two years.

Prior Collaboration with Janssen Biotech, Inc.

Upon the effective date of termination of the license and collaboration agreement, or the Prior Collaboration Agreement, with Janssen Biotech, Inc., or Janssen, on September 28, 2018, we regained global rights to imetelstat and are continuing the development, commercialization and marketing of imetelstat on our own. In accordance with the termination provisions of the Prior Collaboration Agreement, we have an exclusive worldwide license for intellectual property developed under the Prior Collaboration Agreement for the further development, commercialization and marketing of imetelstat, without any economic obligations to Janssen with respect to such license. Janssen has assigned to us certain intellectual property developed by it under the Prior Collaboration Agreement. We now are responsible for the costs of maintaining, prosecuting and litigating all imetelstat intellectual property that we own.

Licensing

We have no material license agreements. We have global rights to imetelstat, which was discovered and developed at Geron.

Manufacturing

A typical sequence of steps in the manufacture of imetelstat drug product includes the following key components:

•starting materials, which are well‑defined raw materials that are used to make bulk drug substance;

•bulk drug substance, which is the active pharmaceutical ingredient in a drug product that provides pharmacological activity or other direct effect in the treatment of disease; and

•final drug product, which is the finished dosage form that contains the drug substance that is shipped to the clinic for patient treatment.

Since September 2018, we have engaged third‑party contract manufacturers and have established our own manufacturing supply chain to manufacture and supply additional quantities of imetelstat that meet applicable regulatory standards for current and potential commercial uses and current and potential future clinical trials.

We do not have direct control over third‑party personnel or operations. These third‑party contract manufacturers, and/or any other third parties that we may rely upon for the manufacture and/or supply of imetelstat, typically complete their services on a proposal by proposal basis under master supply agreements and may need to make substantial investments to enable sufficient capacity increases and cost reductions, and to implement those regulatory and compliance standards necessary for commercial production and successful Phase 3 clinical trials. These third‑party contract manufacturers, and/or any other third parties that we may rely upon for the manufacture and/or supply of imetelstat, may not be able to achieve such capacity increases, cost reductions, or regulatory and compliance standards, and even if they do, such achievements may not be at a commercially reasonable cost. We are responsible for establishing any long‑term commitments or commercial supply agreements with any of the third‑party contract manufacturers for imetelstat. The information provided in this section should be reviewed in the context of the section entitled “Risks Related to Manufacturing RYTELO (Imetelstat)” under Part I, Item 1A, “Risk Factors” of this Report.

Competition

The pharmaceutical and biotechnology industries are characterized by intense and dynamic competition with rapidly advancing technologies and a strong emphasis on proprietary products. While we believe our proprietary oligonucleotide chemistry; experience with the biological mechanisms related to RYTELO, telomeres and telomerase; clinical data to date indicating potential disease-modifying activity with RYTELO treatment; and knowledge and expertise around the development of potential treatments for myeloid hematologic malignancies provide us with competitive advantages, we face competition from many different sources, including major pharmaceutical, specialty pharmaceutical and biotechnology companies, academic institutions, governmental agencies, and public and private research institutions. RYTELO is competing with other products and therapies that currently exist, are being developed or will in the future be developed, some of which we may not currently be aware of.

Competition in Lower-Risk MDS

The current standard of care for the treatment of lower-risk MDS is the use of ESAs to address the patient’s chronic anemia. Once ESAs are no longer effective, serial blood transfusions are often administered that can cause damaging effects to other organs due to iron overload, resulting in shorter survival. In addition, other best available therapies are used without durable effect for the patient.

In lower-risk MDS, data from IMerge Phase 3 resulted in FDA approval of RYTELO in June 2024 for the treatment of certain patients with lower-risk MDS. IMerge showed meaningful and durable transfusion independence, activity across MDS patient subtypes, and potential disease-modifying activity achievable with RYTELO treatment. We believe that these key features are differentiators compared to currently approved products as well as investigational drugs currently in clinical development.

In lower-risk MDS, RYTELO competes against a number of currently existing therapies, including ESAs and other hematopoietic growth factors that are indicated for anemia; immunomodulators, such as Revlimid (lenalidomide) by Celgene Corporation, or Celgene, a Bristol Myers Squibb Company, or BMS, company;

hypomethylating agents, such as Vidaza (azacitidine) by Celgene and manufacturers of generic azacitidine; Dacogen (decitabine) by Otsuka America Pharmaceutical, Inc. and other manufacturers in the U.S. and Janssen in the EU; Inqovi (oral combination of decitabine and cedazuridine) by Astex Pharmaceuticals, Inc., or Astex; Tibsovo (ivosidenib), an IDH1 inhibitor, by Servier Pharmaceuticals, LLC; and Reblozyl (luspatercept), a TGF-beta inhibitor, by BMS. In August 2023, luspatercept was also approved for the treatment of anemia in ESA-naive adult patients with very low-to intermediate-risk MDS who may require regular RBC transfusions.

Other therapies currently in Phase 3 development in lower-risk MDS include elritercept (KER-050), a TGF-beta inhibitor, by Keros Therapeutics, Inc.; and Reblozyl (luspatercept) in non-transfusion-dependent lower-risk MDS patients, by BMS.

In addition, there are multiple Phase 1 and Phase 2 clinical trials of other agents being developed for lower-risk MDS, including but not limited to: LB‐100, a PP2A inhibitor, by Lixte Biotechnology Holdings, Inc.; bemcentinib, an AXL inhibitor, by BerGenBio ASA; H3B‐8800, a spliceosome inhibitor, by H3 Biomedicine, Inc.; TP-0184, an inhibitor of ALK2 or ACVR1 kinase, by Sumitomo Dainippon Pharma Oncology, Inc; ilginatinib (NS-018), a JAK2 inhibitor, by NS Pharma, Inc., a U.S. subsidiary of Nippon Shinyaku Co., Ltd., or NS Pharma; a lower dose of ASTX727, an oral formulation of decitabine and cedazuridine, referred to as ASTX727 LD, by Astex; ASTX030, an oral formulation of azacitidine and cedazuridine, by Astex; JSP191, or briquilimab, an anti-C-kit antibody, by Jasper Therapeutics, Inc.; R289, an oral inhibitor of interleukin receptor-associated kinases 1 and 4, or IRAK1/4, by Rigel Pharmaceuticals, Inc.; a combination treatment regimen of luspatercept and lenalidomide by BMS; and HuMax-IL8 (BMS-986253), an anti-IL-8 monoclonal antibody, by BMS and etavopivat, an oral, small molecule activator of erythrocyte pyruvate kinase (PKR) by Forma Therapeutics, Inc., a Novo Nordisk Company; canakinumab, an interleukin antagonist, by Novartis AG; and AG946, a next-generation pyruvate kinase-R (PKR) activator, by Agios Pharmaceuticals, Inc.

Competition in Relapsed/Refractory MF

The current standard of care for the treatment of Intermediate-2 or High-risk MF is the use of JAK inhibitors, to address the patient’s symptoms. Once JAK inhibitors fail or are no longer effective, a variety of best available therapies are used since there are no approved treatments for this patient population and median OS is 14 to 16 months after discontinuation from the predominant JAK inhibitor being used today.

In Intermediate-2 or High-risk relapsed/refractory MF, data from IMbark suggest potential disease-modifying activity with RYTELO treatment and a potential meaningful improvement in OS, which is supported in a comparison to real-world data.

If approved for commercial sale for the treatment of relapsed/refractory MF, RYTELO would compete against currently approved JAK inhibitors: Jakafi (ruxolitinib) by Incyte Corporation, or Incyte, Inrebic (fedratinib) by Celgene, and OJJAARA (momelotinib), which was approved in September 2023 for the treatment of intermediate or high-risk MF, including primary MF or secondary MF (postpolycythemia vera and post-essential thrombocytopenia), in adults with anemia, by GlaxoSmithKline plc, or GSK, as well as a kinase inhibitor, Vonjo (pacritinib), by CTI Biopharma Corp., which was approved in February 2022 for the treatment of adults with Intermediate or High-Risk primary or secondary myelofibrosis with a platelet count below 50 × 109/L. Other treatment modalities for MF include hydroxyurea for the management of splenomegaly, leukocytosis, thrombocytosis and constitutional symptoms; splenectomy and splenic irradiation for the management of splenomegaly and co-existing cytopenias; chemotherapy; and pegylated interferon. Drugs for the treatment of MF-associated anemia include ESAs, androgens, danazol, corticosteroids, thalidomide and lenalidomide.

Other therapies currently in Phase 3 development in MF, some of which may obtain regulatory approval earlier than RYTELO for MF, include momelotinib plus AZD5153, a BET inhibitor by GSK; pelabresib (CPI-0610), a BET inhibitor, by MorphoSys AG (acquired by Novartis in 2024); and navtemadlin, an MDM2-inhibitor, by Kartos Therapeutics, Inc. Other approaches for MF currently under investigation that could compete with RYTELO in the future include luspatercept; zinpentraxin alfa (RG6354, formerly PRM-151), an anti-fibrosis antibody, by F. Hoffmann-La Roche, Ltd.; INCB160058, a JAK2 inhibitor, by Incyte; AJ1-11095, a JAK2 inhibitor, by Ajax Therapeutics, Inc.; SLT-5505, a pan-LOX inhibitor, by Syntara Limited; tasquinimod, an S100A9 inhibitor, by Active Biotech AB; XPOVIO (selinexor), a nuclear export inhibitor, by Karyopharm Therapeutics, Inc.; TL-895, an oral tyrosine kinase inhibitor, by Telios Pharma, Inc.; pelcitoclax (APG-1252), a dual BCL-2/BCL-XL inhibitor, by Ascentage Pharma; DISC-0974, a monoclonal antibody against hemojuvelin (HJV) by DISC Management Inc.; KER-050 in combination with ruxolitinib, by Keros Therapeutics; CK0804, an allogeneic T-regulatory cell agent, by Cellenkos, Inc. in collaboration with Incyte; TP-3654, PIM kinase inhibitor by Sumitomo Pharma Co., Ltd.; and a mutated-CALR vaccine, a peptide-based vaccine, from the Icahn School of Medicine at Mount Sinai.

Government Regulation