Exhibit 99.2 |

Please see our Press Release of February 19, 2009, for our cautionary statement regarding forward-looking comments made in today’s remarks. |

Andrea Jung Chairman and CEO Avon Products, Inc |

AVON Dawn Video |

Dawn is… |

One of 500,000 Avon Representatives in the US who have turned to Avon in a challenging economy… |

One of six million Representatives worldwide who have discovered the power of Avon to help them achieve their dreams… |

One of 2 billion women globally who are searching for solutions in a more and more complex world |

In this time of global economic uncertainty when the world is full of questions… |

Avon can be the answer |

These Are Unprecedented Times Consumer Contraction Global Recession Credit Squeeze Job Layoffs Currency Volatility |

We enter 2009 recognizing that we must navigate through challenging new realities |

Our Navigation Tools Flexibility Flexibility Four Point Turnaround Plan Four Point Turnaround Plan |

Our Navigation Tools Four Point Turnaround Plan Four Point Turnaround Plan |

The foundation of the business is far stronger as a result of three years of progress with our turnaround plan |

Four Point Turnaround Plan 1 Commit to Brand Competitiveness Win with Commercial Edge 2 Elevate Organization Effectiveness 3 Radically Transform the Cost Structure 4 |

1 Progress to Date Commit to Brand Competitiveness |

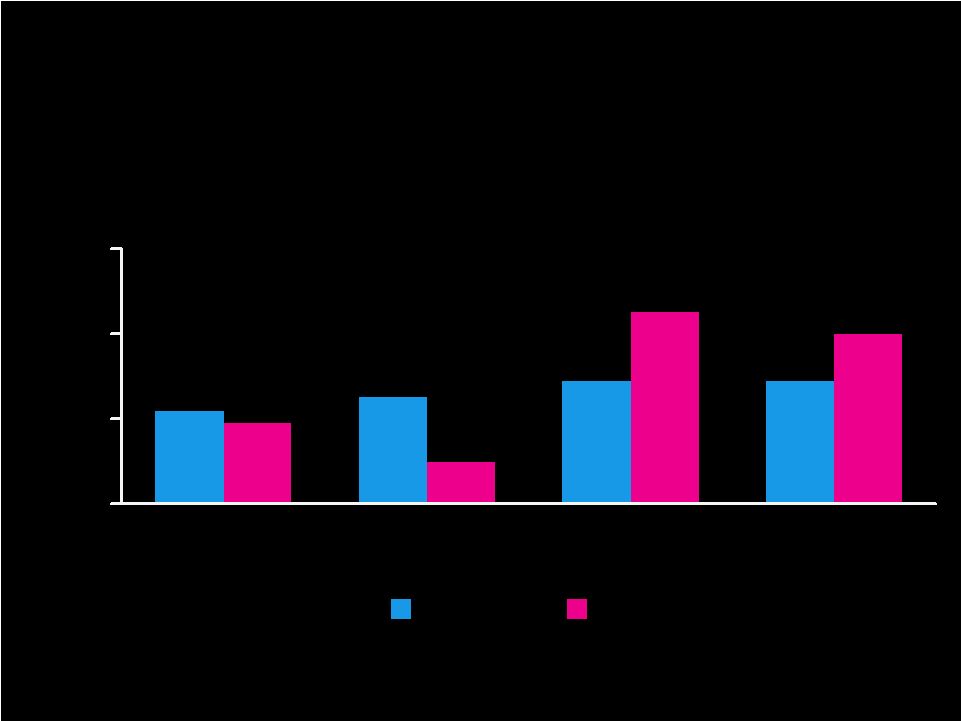

Beauty Growth Continued Strong in 2008 Avon Beauty Sales Growth (FY C$ %Change vs YAG) 3% 6% 7% 9% 2005 2006 2007 2008 Dollar growth rates were 6%, 8%, 15%, 10% respectively |

$136 $249 $368 $391 2005 2006 2007 2008 Advertising Investment $ M 3X Advertising Investment |

0% 4% 8% 12% '05 '06 '07 '08 Industry Avon Successful Turnaround in Color Note: 2008 Industry Growth Estimated Color Sales Growth (FY C$ %Change vs YAG) Avon dollar growth rates were 6%, 3%, 16%, 11% respectively |

Continued to Leverage the Power of Reese Plumping Lipstick Mistake-proof Mascara Pro-To-Go |

Sustained Growth in Fragrance on a High Base 9% 10% 13% 8% 2005 2006 2007 2008 Fragrance (FY C$ %Change vs YAG) Dollar growth rates were 12%, 12%, 20%, 9% respectively |

Fueled by a Strong Alliance Pipeline |

The Beginnings of a Skin Care Turnaround… -1.5% 4.9% 0.5% 5.1% 2005 2006 2007 2008 Skin Care (FY C$ %Change vs YAG) Dollar growth rates were 1%, 6%, 6%, 10% respectively |

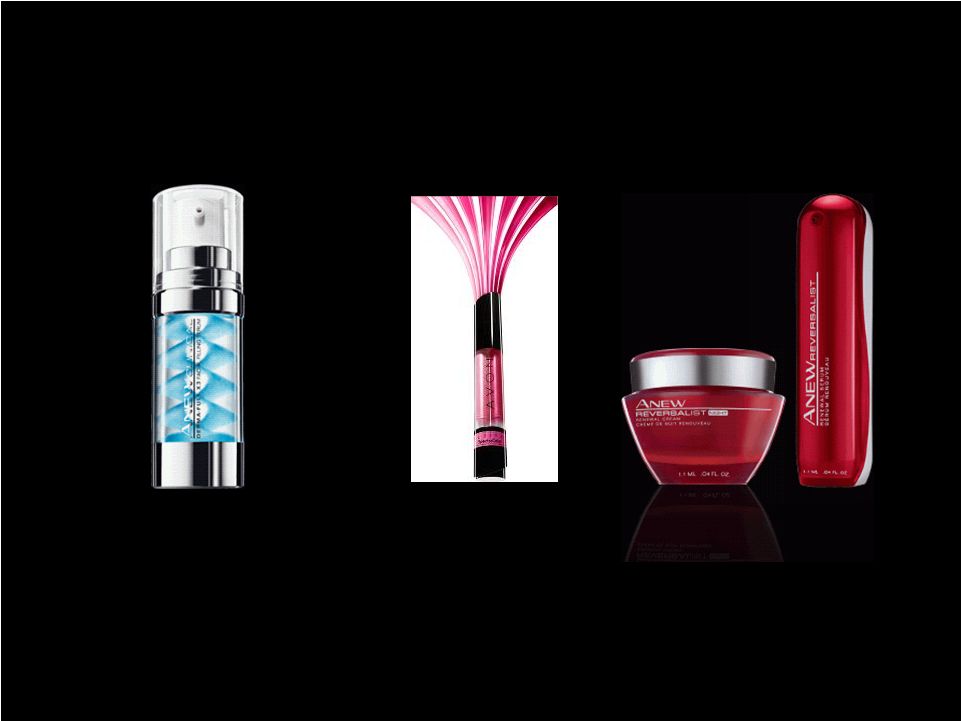

Flagship Anew Brand Performing Strongly 2008 Revenues • $900M • +20% vs. 2007 |

Innovation Concepts vs. Innovation Revenue ($K) More Productive Innovation 2,139 2,497 2,567 893 619 663 2008 2006 2009P 2007 Revenue per Concept # of Concepts |

2009 Product Pipeline Continues to Deliver Breakthrough Innovation The First EVER Injectable Grade Line Filler The First EVER Product with 7 Shades in 1 Q4 Launch 2009 5 Years of Scientific Research -- Breakthrough Technology |

Progress to Date 2 Win With Commercial Edge – The Representative |

Invested an incremental $200 Million in RVP over the past two years |

Sales Leadership Other 13% 87% 2005 Revenue Source 2008 Revenue Source % Revenue from Leadership Other 49% 51% 5 Leadership Markets 30+ Leadership Markets Sales Leadership Leadership Is Working |

Field Fundamentals Strengthened in Key Markets - Mexico -5 3 7 0 6 -6 Active Reps Revenue LC 2006 2007 2008 Active Reps and Local Currency Growth |

Revenue CAGR 30% Field Fundamentals Strengthened in Key Markets - China # of promoters $ Revenues 0 500 K 1M 2006 2007 2008 0 100 200 300 Sales Promoters $ Revenues |

Good Progress on Our Journey to Web Enablement… 25 Markets with more than 50% of orders online |

Progress to Date 2 Win With Commercial Edge – Merchandising |

Product Line Simplification Now Embedded SKUs Are Down 40% Since 2005 2006 2007 2008 -21% -11% -12% (YOY Change in SKUs) |

Demonstrated Pricing Power in Third Year of Turnaround -0.7 0.7 1.7 1.0 2008 Gross Margin Expansion, % +2.8 pts Cost / SC Other CTI / PLS 2008 Pricing / Mix 63.1 2007 60.3 |

85% 86% 2005 2008 39% 39% We Held the Line on Beauty Discounting Despite the Environment Percent of Discount Depth of Discount 2005 2008 |

Progress to Date 3 Elevate Organizational Effectiveness |

We Successfully Evolved Our Operating Model Business Support Functions From “Vertical” Geographies |

This is Driving Efficiencies of Scale “Horizontal” Functions Business Support Functions To “Vertical” Geographies Commercial Business Units Global Marketing Global Sales Global Supply Chain |

Entry Next Next Mid Mgmt 2 Mid Mgmt 1 Execs Sr. Execs 14 Layers reduced to 8 and holding The Organization Remains Flatter Post Delayering 14 13 12 11 10 9 8 7 6 5 4 3 2 1 2008 |

We Are Approaching Stage 5 on Our Analytics Journey Stages of Analytical Capability Stage 2 Stage 1 Used to help set priorities Center of Excellence and fully integrated Poor tools and capability Competitive Advantage Some functional or business unit usage Stage 5 Stage 3 Stage 4 |

Associate Engagement Score We Are Driving Associate Engagement to World Class Levels … 2008 2006 2007 60 65 67 World Class = 70 |

50% IT Fin HR Leg Com APAC SC GBM CEE Ch. LA NA WEM 2008 2006 76 59 71 59 70 66 66 76 63 68 57 71 54 65 53 60 56 58 58 68 59 59 82 72 72 75 61 61 74 60 60 62 … With Across the Board Gains |

Progress to Date 4 Radically Transform the Cost Structure |

Constant turnaround mentality has become a way of life |

3 Year Success Story • Exceeding transformation program targets • Achieving ZOG and NOG • Reinvesting to successfully fuel growth |

We therefore enter unprecedented headwinds with both the fundamentals and execution capabilities significantly improved |

Our Navigation Tools Flexibility Flexibility Four Point Turnaround Plan Four Point Turnaround Plan |

Flexibility to Leverage Avon’s Advantaged Model |

We Have an Updated Playbook for These Times |

Our broad product assortment at all price tiers allows us to rebalance our product mix as consumer needs shift |

Last Year We Strategically Focused on Net Per Unit to Drive Productivity 1% 4% Units Net Per Unit 2008 Net Per Unit and Units % Growth |

In Line With This We Flowed Fewer Value Concepts FY’08 > $10.00 Price Range +13% +3% -5% Top 14 Market Concept Share % $5.00-9.99 < $4.99 |

< $4.99 In 2009 We Will Flow More “Door Opener” Units While Not Backing Off Pricing Stay the Course on Strategic Pricing Increase Flow in Value Tier $5.00-9.99 > $10.00 |

UK “Mini” Brochures With Entry Price Point Offers… |

Featuring Attractive Beauty Bargains |

Reaching Budget Conscious Consumers with a Targeted Message Avon is the answer to the recession |

Strong Promotion of our Appealing Shopping Experience…. |

Clear Focus on Smart Value Message US |

Smart Value “Fashionomics” Deals US |

Door Openers to Activate New Customers Argentina |

Brochure “Bookmarks” to Call out Special Offers Russia |

In addition to promoting smart value, we will ramp up our focus on recruiting |

Avon is the largest engine of economic opportunity for women on earth…we are also the largest microlender to women |

We Are Shifting Advertising Investment to Representative Recruiting 34 18 Markets with Representative Advertising 20% 10% % Total Advertising To From |

And Making the Message More Impactful From To • Empowerment and Earnings • Hard-hitting call to action • More problem solution • “Be the Answer” in this moment |

From Affinity Focus “Everybody knows the Avon name” To Economy Focus “I can’t get fired…I can’t lose my job. This is my business” Generating 2X More Leads |

|

The Super Bowl |

• Ran a 30-second recruiting spot during the pre-game show • Spot ran after singing of the National Anthem by AVON spokesperson, Jennifer Hudson |

AVON RECRUITING AD |

Super Bowl ad generated over 130 million impressions in “media buzz” |

AVON SUPER BOWL NEWS CLIP |

Supporting National Advertising with Local Ads by Leadership Representatives |

Leveraging Many Different Venues to Promote Avon’s Economic Opportunity avon.com Career Fairs Internet |

From To Prominent Focus on Avon’s Home Page Online leads +92% vs PY US |

Sponsored Links on Internet Sites “At a time when jobs are scarce, Avon is the answer for you and your family” JOIN TODAY click here to go to avon.com US |

Participation in Career Fairs 140+ Opportunity Fairs in 1Q alone 140+ Opportunity Fairs in 1Q alone US |

Participation in Career Fairs Mobile Beauty Tours AVON Opportunity Fairs US |

In Development – AVON Infomercial • Success stories and roundtable discussions with AVON Representatives • Hosted by Deborah Norville • Highlight Avon R&D • Key product commercials • Special guest appearance by Suze Orman US |

Prominent Focus on Avon’s Home Page China |

Sponsored Links on Internet Sites (Six portals - Sohu, Sina, Onlylady, PClady, Baidu, MSN) 1,800 Leads Generated in First Three Weeks China |

Participation in Career Fairs and Recruiting Events Shanghai and Shantou China |

Strategic Alliances to Promote the Avon Opportunity Reaching 98%+ of all expectant and new mothers Partnership with online parenting forum UK |

Outrun consumer spending contraction and protect market share New Customers Active Representatives GROW + |

$0 $200 $400 $600 $800 '97 '98 '99 '00 '01 '02 '03 '04 '05 '06 '07 '08 1998 Russia Financial Crisis Avon Russia stays the course |

$0 $500 $1,000 $1,500 $2,000 '97 '98 '99 '00 '01 '02 '03 '04 '05 '06 '07 '08 1999 Brazil Financial Crisis Avon Brazil stays the course |

$0 $100 $200 $300 $400 '01 '02 '03 '04 '05 '06 '07 '08 2002 Argentina Financial Crisis Avon Argentina stays the course |

This is the strategy we have used in recessions in the past, and each time we have emerged stronger and better |

Flexibility to Resize Our Cost Base |

ZOG NOG All non-strategic spending has come to a halt |

Based on our success, we are launching a new restructuring program |

Chuck Cramb Vice Chairman, CFO and Chief Strategy Officer |

These Are Unprecedented Times Consumer Contraction Global Recession Credit Squeeze Job Layoffs Currency Volatility |

Major Rates Significantly Unfavorable to 2008 Brazil 1.82 2.31 - 21% Mexico 11.07 14.20 - 22% UK* 1.85 1.43 - 23% Russia 24.96 35.42 - 30% Euro* 1.47 1.32 - 10% Turkey 1.31 1.62 - 19% Poland 2.38 3.31 - 28% - 31% Ukraine 5.31 7.70 *Units of Foreign Currency per dollar January 31, 2009 spot rates 2008 Average Rates versus 2009 |

Can’t control Transaction Foreign Currency Impact Translation But can react over time |

Let’s Look at Translation Impact Transaction Foreign Currency Impact Translation |

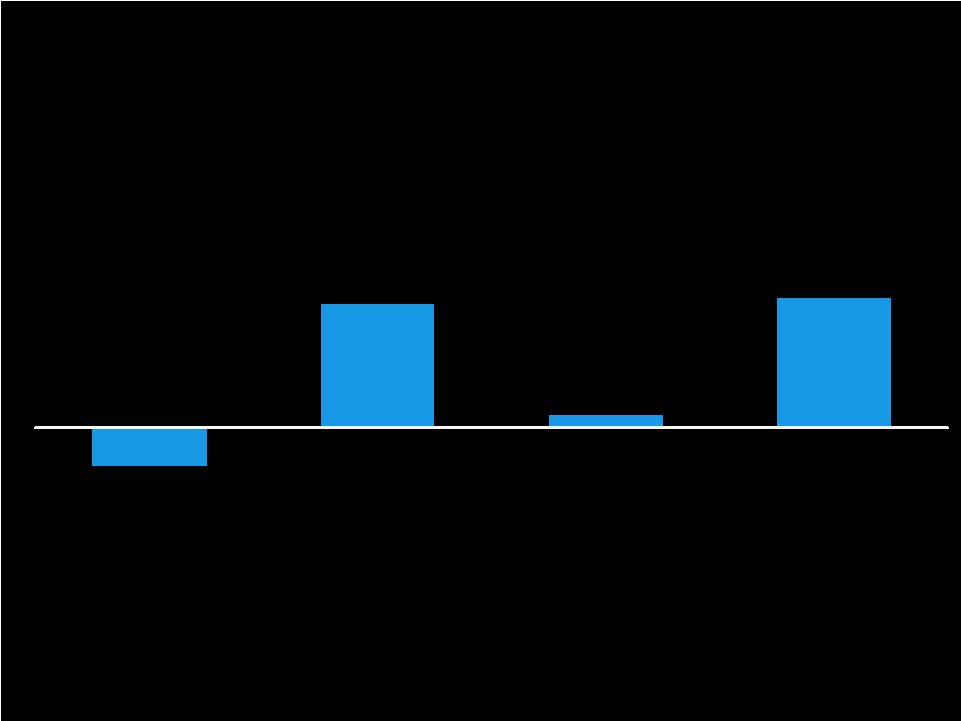

The Q4 2008 Shift in FX Rates Dramatically Impacted Revenue Growth Q4 7 -11 Q2 Q1 Q3 FX Impact on Revenue Growth 8 8 |

The Q4 2008 Shift in FX Rates Dramatically Impacted Revenue Growth FX Impact on Revenue Growth - 18 pt. swing! Q4 7 -11 Q2 Q1 Q3 8 8 |

... the impact is likely to worsen Q1 through Q3 2009 |

Translation Impact Even Greater at Operating Profit Larger scale of International business Translation reduces topline growth Higher margin international business Disproportionate $ - based expenses |

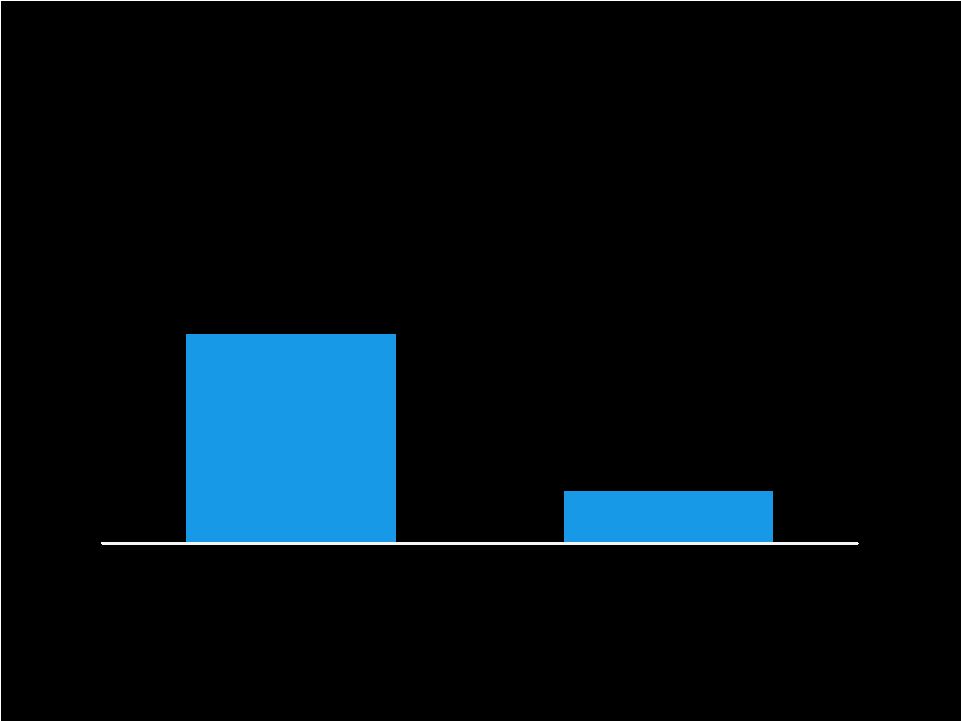

International Has Higher Operating Margins... 0 5 10 15 20 25 Latin Amer North Amer CEE WEMEA Asia Pacific China Avon 2008 Operating Margin |

...And Over Half the Revenue in the Two Highest Margin Regions CEE & LatAm 52% 25% 23% Rest of Int’l North America |

20% As a US Based Company, We Have Relatively Higher $ Costs than Revenues 30% Revenue $10.7 B 2008 SG&A $5.4 B |

Net Result of Currency Translation: • When dollar weakens we have positive leverage on operating profit and margin • When dollar strengthens we have negative leverage |

Now Let’s Look at Transaction Impact Transaction Foreign Currency Impact Translation |

What Causes Transaction Exchange Impact? • Global sourcing configuration • Small number of manufacturing facilities • Commodity pricing: $ or Euro-indexed • Sudden and significant currency devaluation |

Global Sourcing and Manufacturing Increases Transaction Exposure • Euro sourcing to U.K. and CEE, including Russia and Ukraine • Raw materials for Russia manufacturing indexed in $’s or Euro’s • China-sourced non-beauty products to Latin America • $-sourced beauty to Canada • China sourced non-beauty to Canada |

If we took no actions, transaction impact could cost 200 b.p. of gross margin in 2009... But we have the plans to mitigate it! |

Actions to Offset Currency Impacts • Price • Product mix • Volume • Cost containment / reduction Translation Impact Transaction Impact |

Actions to Offset Currency Impacts • SSI • Flexible cross-border sourcing • Product substitutions • Product mix • Raw material substitution Translation Impact Transaction Impact |

Impact of Actions on 2008 Gross Margin 2007 / 8 Gross Margin 60.3% Absence of PLS charges ++ Pricing/Mix ++ SSI ++ Mfg productivity + Commodity costs - Transaction FX - Gross Margin 63.1% |

As We Look At 2009 Gross Margin Impact • Holding strategic pricing • Strengthening manufacturing productivity • Delivering SSI ahead of targets • Managing product mix, including PLS • Pursuing favorable raw material and production sourcing |

Emphasis on Smart Value does NOT hurt Gross Margin |

Smart Value – What does it do? • Creates better opportunity to engage new Representatives • Easier start to build customer base • Improves “length of activation” by early success • Drives productivity growth (volume / revenue / trade-up) • Builds overall unit growth, thus top-line revenue growth • Builds market share as there is little cannibalization • Creates stronger Representative and Customer base • As consumer spending improves, this stronger base is an accelerator of future growth |

Negative GM Pressure Should Decline in Last Half of 2009 Q1’09 Q3’09 Q4’09 Q2’09 Better commodity pricing FX transaction exposure Pricing to devaluation LESS MORE MORE LESS LESS MORE |

Impact of Actions on Gross Margin 2007 / 8 2008 / 9 Gross Margin 60.3% 63.1% Absence of PLS charges ++ 0 Pricing/Mix ++ ++ SSI ++ ++ Mfg productivity + ++ Commodity costs - + Transaction FX - - - Gross Margin 63.1% Down slightly |

Addressing All Areas of SG&A Expenses in 2009 ZOG to NOG Period Overhead Driving efficiencies Advertising RVP flat to up slightly as % of revenue Selling Savings on logistics Distribution savings to come Distribution |

Initiatives for 2009 • Drive advertising and RVP efficiencies • More for same, same for less • Freeze number of positions • Freeze worldwide salaries (exceptions for labor agreements and high inflation markets) • Reduce costs beyond compensation • Travel & Entertainment reduced 35% • Challenge all other non-compensation costs |

2009 Cash Management Beyond the P&L • Capital Expenditures focus on major transformation initiatives • Supply Chain restructuring • Systems development • ERP • Finance • Representative enablement (web based) • Total investment below 2008 level ($380M) |

2009 Cash Management • Inventory progress to continue • Target 3-5 days reduction • Progress to be second half weighted • North America to work down 2008 excess • Safety stock for distribution center start-up |

2009 Cash Management • Pension plan funding will increase • 2008 equity market performance • Magnitude uncertain – guidelines expected • Dividend increase announced • Strong balance sheet and cash flow outlook • Share repurchase • Quarter by quarter approach • Strong liquidity is our priority in these uncertain times • Offshore cash of $1.1B is our “insurance policy” |

Progress to Date 4 Radically Transform the Cost Structure |

Restructuring Program is On Track • $270M of savings in 2008 • Will increase to $300M in 2009 • Primarily Supply Chain initiatives left • Requiring long-lead time infrastructure change Total Savings: $430M in 2011-12 |

Supply Chain Initiatives are Well Underway • North American Distribution • Brazilian Distribution • Have just broken ground |

SSI is Ahead of Plan • Strong success in chemicals, packaging and timing • In 2008, achieved benefits of $135M vs. $100M target • Benefits of approximately $200M in 2009 Total benefits now expected: $250M+ in 2010 |

PLS is On Track • Total SOL reduction – 12% vs. 2007 and 40% vs. 2005 • Achieved approx. $40M benefits – in line with 2008 target • Launched in all markets in 2008; full implementation by end of 2009 • Much higher sales growth (2-4x) in opportunity products • Expect $120M benefit in 2009 Total Benefits: $200M+ in 2010 |

PLS is On Track UK Brazil US Mexico Russia Ukraine Beauty Growth Opportunity Product Sales Growth Opportunity Product Sales Growth vs Beauty Growth |

Savings from Restructuring On Track ($M) $230 $270 $300 $350 $430 2007 2008 2009 2010 2011-12 Restructuring SSI PLS |

SSI Ahead of Target ($M) Total expected SSI benefits now $250+ $230 $270 $300 $350 $430 $135 $15 $250+ $250+ $200 2007 2008 2009 2010 2011-12 Restructuring SSI |

PLS Tracking to Targets $230 $270 $300 $350 $430 $40 $120 $135 $15 $250+ $250+ $200 $200+ $200+ 2007 2008 2009 2010 2011-12 Restructuring SSI PLS ($M) |

$230 $270 $300 $350 $430 $40 $120 $135 $15 $250+ $250+ $200 $200+ $200+ 2007 2008 2009 2010 2011-12 Restructuring SSI PLS Overachieving Targets in Total ($M) $245 $445 $620 $800+ $880M+ |

$230 $270 $300 $350 $430 $40 $120 $135 $15 $250+ $250+ $200 $200+ $200+ 2007 2008 2009 2010 2011-12 Restructuring SSI PLS Overachieving Targets in Total ($M) $245 $445 $620 $800+ $880M+ A Job Well Done! A Job Well Done! |

Why So Successful? • External experience brought into Avon (new talent, consultants) • Aggressive benchmarking • Relentless attack on all costs - with analytics • Encouraged risk taking - and it paid off • Perhaps a bit conservative on identifying the size of opportunities • Success breeds further success • We’ve reinvested for growth, as promised |

Flawless execution of current programs enables and encourages bold new initiatives |

Adding Another Restructuring On Top Restructuring November 2005 $300 M PLS October 2006 $200+ M Additional Restructuring January 2007 $130 M SSI October 2006 $200+ M SSI February 2009 $50 M $880M+ Next Restructuring February 2009 |

New Restructuring Program • Costs to implement $300-$400M • Impacting 2,500-3,000 positions globally including existing vacancies over next 4 years • Annual savings of approximately $200M by 2013 Fund Growth Opportunities Benefits Improve Profits ($ and Margin) |

New Restructuring Program • Captures and expands upon successful experiences to date • Benefits from global matrix structure • Manufacturing/Sourcing as a global not regional footprint • Shared services that go beyond local geographies • Ability and willingness to outsource processes • Constant Turnaround Mentality • Creates a sense of urgency and opportunity • Not about small cost refinements • Constantly challenging everything we do (what & how & where) |

Global Supply Chain New Restructuring Program Sales Structure and Support Leverage Matrix to Reduce Overheads |

• Factory rationalization • Manufacturing realignment • Outsourcing • Further distribution consolidation Global Supply Chain |

Sales Structure & Sales Support • Reduce sales zones and districts • Improve sales fundamentals – talent upgrades • Consolidate support structures Market – Cluster – Region – Global |

Leverage Matrix to Reduce Overhead • Consolidate marketing activities • Further Finance and Administrative shared service activities • Selective outsourcing Market – Cluster – Region – Global |

Delivering on Top of Our Original Targets Restructuring November 2005 $300 M PLS October 2006 $200+ M Additional Restructuring January 2007 $130 M SSI October 2006 $200+ M SSI February 2009 $50 M $880M+ $1080M+ New Restructuring February 2009 +$200M |

Summary We have proven • Ability to take costs out • Willingness to productively reinvest • Flexibility to react to changes in our cost structure We will • Continue our constant turnaround mentality • Deliver against current initiatives • Embark upon a bold new round of initiatives • Rationalizing the Supply Chain • Enhancing Sales & Sales Support Structures • Further leveraging the matrix |

And so the journey continues... And so the journey continues... |

Our Destination |

With the world on edge, fear can trump fundamentals... |

...but, Avon has proven that fundamentals can trump fear |

We have a proven track record |

We have the playbook for challenging times |

Our Playbook |

We have the proven and timely power of direct selling |

Our Competitive Advantage Being the solution for Dawn and six million other Avon Representatives who touch hundreds of millions of customers across the globe |

|