executive medical exam following employment because she did not receive an exam during 2017. The value of the repatriation benefits that she would receive is currently estimated to be $30,701.

Disability:Had Ms. McCoy experienced a termination of employment as of December 31, 2017 due to a qualifying disability, the estimated incremental payments and benefits that would be payable to her is $3,997,180. This amount includes the following: Assuming continuation of disability payments until age 65, the present value of her disability payments is $3,555,863, based on a discount rate of 2.42%. Assuming she commences her benefit immediately, the present value of the additional pension benefits earned under the PRA and BRP while on disability for up to 29 months is $441,317 for Ms. McCoy, assuming a discount rate and lump sum rate of 3.48% for the PRA and 3.53% for the BRP.

Retirement:Had Ms. McCoy experienced a retirement as of December 31, 2017, there would be no incremental payments and benefits that would be payable to her.

Death:Had Ms. McCoy experienced a termination of employment as of December 31, 2017 due to her death, the estimated incremental payments and benefits that would be payable is $100,000, which reflects death benefits that would be paid pursuant to our applicable group life and accident plans for U.S.-based employees.

Involuntary or Constructive Termination Following a Change of Control:Our change in control policy provides for payments to be made to covered executives upon a “double trigger” as described above. Had Ms. McCoy experienced an involuntary or constructive termination as of December 31, 2017 following a change of control, the estimated incremental payments and benefits that would be payable to her is $14,686,005. This amount includes the following: She would receive $9,000,000, which consists of 300% of the sum of the target annual cash bonus and base salary. Ms. McCoy would be entitled to continued coverage under our applicable group health plan(s) and applicable group life and accident plan(s), in each case for the three-year period following a double trigger change in control, the value of which is $60,186 and $334, respectively. The value of the repatriation benefits that she would receive is currently estimated to be $30,701. The value of the Performance RSUs granted under our long-term incentive program in 2016 and 2017 that would vest at target regardless of performance is $5,594,784. The Performance RSUs would be settled on the original settlement date, which is three years following the grant date (March 2019 and March 2020 for Performance RSUs granted in March 2016 and March 2017, respectively).

CEO PAY RATIO

As required by Section 953(b) of the Dodd-Frank Wall Street Reform and Consumer Protection Act, and Item 402(u) of RegulationS-K, we are providing the following information about the relationship of the annual total compensation of our employees and the annual total compensation of Ms. McCoy, Chief Executive Officer (the “CEO”) for 2017:

For 2017, our last completed fiscal year:

| | • | | the annual total compensation of the employee identified at median of our company (other than our CEO), was $32,635; and |

| | • | | the annual total compensation of the CEO was $9,887,594. |

Based on this information, for 2017, the ratio of the annual total compensation of Ms. McCoy, our Chief Executive Officer, to the median of the annual total compensation of all employees is estimated to be 303 to 1.

This pay ratio is a reasonable estimate calculated in a manner consistent with SEC rules based on our payroll and employment records and the methodology described below. The SEC rules for identifying the median compensated employee and calculating the pay ratio based on that employee’s annual total compensation allow companies to adopt a variety of methodologies, to apply certain exclusions, and to make reasonable estimates and assumptions that reflect their compensation practices. As such, other companies may have different employment and compensation practices and may utilize different methodologies, exclusions, estimates and assumptions in calculating their own pay ratios. Therefore, the estimated pay ratio reported above may not be comparable to the pay ratios reported by other companies and should not be used as a basis for comparison between companies.

To identify the “median employee,” the methodology and the material assumptions, adjustments, and estimates that we used were as follows: We determined that, as of October 1, 2017, our employee population consisted of approximately 25,921 individuals globally. We selected October 1, 2017, which is within the last three months of 2017, as the date upon which we would identify the “median employee”. To identify the “median employee” from our employee population, we used base salary paid during the12-month period ending December 31, 2017. In making the determination, however, this resulted in approximately 770 associates with the same base salary, so we then took the median of annual total compensation for this group of employees to determine the “median employee” for the purposes of the CEO pay ratio disclosure. For purposes of this disclosure, amounts were converted from local currency to U.S. dollars using the rate of exchange in effect on December 31, 2017.

| | | | |

| | AVON 2018 Proxy Statement | | 71 |

- Member

- Member

Comprehensive Clawback Policy

Comprehensive Clawback Policy No Excise TaxGross-Ups on Change in Control

No Excise TaxGross-Ups on Change in Control

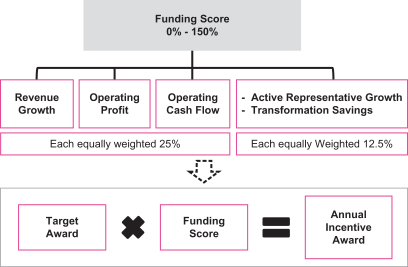

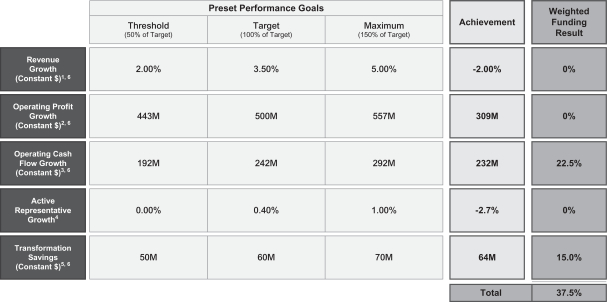

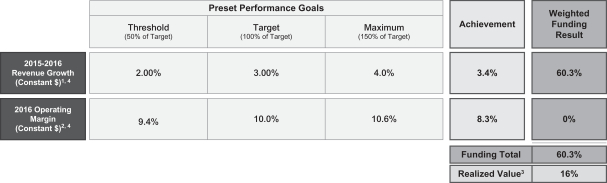

= Funding Achieved

= Funding Achieved  = Not Achieved

= Not Achieved