- Company Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Superior Energy Services DEF 14ADefinitive proxy

Filed: 12 Apr 17, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| ☒ | Definitive Proxy Statement | |||

| ☐ | Definitive Additional Materials | |||

| ☐ | Soliciting Material under §240.14a-12 | |||

| Superior Energy Services, Inc. | ||||

| (Name of registrant as specified in its charter) | ||||

| (Name of person(s) filing proxy statement, if other than the registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| ||||

| (2) | Aggregate number of securities to which transaction applies: | |||

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| ||||

| (4) | Proposed maximum aggregate value of transaction: | |||

| ||||

| (5) | Total fee paid: | |||

| ||||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| ||||

| (2) | Form, Schedule or Registration Statement No.: | |||

| ||||

| (3) | Filing Party: | |||

| ||||

| (4) | Date Filed: | |||

| ||||

Superior

ENERGY SERVICES

Proxy Statement 2017

Forged for recovery.

SPN

|

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

|

|

SUPERIOR ENERGY SERVICES, INC.

NOTICE OF ANNUAL MEETING

OF STOCKHOLDERS

Tuesday, May 23, 2017

9:00 a.m., Central Daylight Time

1001 Louisiana Street

Houston, Texas 77002 USA

The annual meeting of stockholders of Superior Energy Services, Inc. will be held at 9:00 a.m., Central Daylight Time, on Tuesday, May 23, 2017, at our headquarters located at 1001 Louisiana Street, Houston, Texas, 77002. At the annual meeting, our stockholders will be asked to vote on the following proposals:

1.the election of the eight director nominees named in this proxy statement (Proposal 1);

2.an advisory vote to approve our named executive officers’ 2016 compensation (Proposal 2);

3.an advisory vote on the frequency of future advisory votes on our named executive officers’ compensation (Proposal 3); and

4. the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for 2017 (Proposal 4).

The Board of Directors recommends that you vote “FOR” Proposals 1, 2 and 4, and “Every 1 Year” for Proposal 3. Only holders of record of shares of our common stock as of the close of business on April 3, 2017 are entitled to receive notice of, attend and vote at the meeting.

Your vote is important. Whether or not you plan to attend the meeting, please complete, sign and date the enclosed proxy or voting instruction card and return it promptly in the enclosed envelope, or submit your proxy and/or voting instructions by one of the other methods specified in this proxy statement. If you attend the annual meeting, you may vote your shares of our common stock in person, even if you have sent in your proxy.

By Order of the Board of Directors,

William B. Masters

Executive Vice President, General Counsel and Secretary

Houston, Texas

April 12, 2017

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON MAY 23, 2017.

This Notice of Meeting, Proxy Statement and the 2016 Annual Report on Form10-K are available without cost at https://materials.proxyvote.com/868157

2017 SPN Proxy Statement |

|

| i | |||

| viii | |||

| x | |||

Election of Directors (Proposal 1)

| 1 | |||

| 1 | ||||

| 5 | |||

| 5 | ||||

| 5 | ||||

| 6 | ||||

| 6 | ||||

| 7 | ||||

| 7 | ||||

| 8 | ||||

| 9 | ||||

| 9 | ||||

| 9 | ||||

| 9 | ||||

| 9 | ||||

| 10 | |||

| 12 | |||

| 12 | ||||

| 13 | ||||

| 14 | ||||

Advisory Vote to Approve Our Named Executive Officers’ 2016 Compensation (Proposal 2)

| 15 | |||

| 16 | |||

Ratification of the Appointment of Our Independent Registered Public Accounting Firm (Proposal 4)

| 17 | |||

| 18 | ||||

| 18 | ||||

| 19 | |||

| 21 | |||

| 23 | |||

| 23 | ||||

| 44 | ||||

| 45 | ||||

| 49 | ||||

| 52 | ||||

Questions and Answers about the 2017 Annual Meeting

| 59 | |||

| 63 | ||||

2017 SPN Proxy Statement |

|

This summary highlights selected information contained in this proxy statement. This summary provides only a brief outline of the contents of this proxy statement and does not provide a full and complete discussion of the information you should consider. Before voting on the proposals to be presented at the annual meeting of stockholders, please review the entire proxy statement carefully. For more complete information regarding our 2016 performance, please review our 2016 Annual Report on Form10-K.

The 2016 Annual Report to stockholders, including financial statements, is being mailed to stockholders together with the proxy statement and form of proxy on or about April 12, 2017.

2017 ANNUAL MEETING OF STOCKHOLDERS

| ||

Time and Date:

| Tuesday, May 23, 2017, 9:00 a.m. (Central Daylight Time)

| |

Place:

| 1001 Louisiana Street, Houston, Texas 77002

| |

Record Date:

| April 3, 2017

| |

Voting: | Stockholders as of the record date are entitled to vote. Each share of common stock is entitled to one vote for each director position and one vote for each of the other proposals to be voted on.

| |

2016 PERFORMANCE HIGHLIGHTS

Managing the Downturn

Superior Energy Services, Inc. (“Superior”) is a globally diversified oilfield services provider, with product and service lines deployed across the U.S. land, Gulf of Mexico and over 20 international markets. Responding to depressed commodity prices, our exploration and production customers have continued to cut spending and reduce capital expenditures since the fourth quarter of 2014, resulting in significant activity reductions, lower rig counts and pricing pressure on service providers. The two years that followed presented the most challenging market environment faced by our industry and our Company in several decades, both domestically and internationally.

On the domestic front, these challenges were particularly acute in the U.S. land market, where the average rig count in 2016 decreased 48% as compared to 2015. U.S. land revenues declined as supply overcapacity remained high throughout 2016, resulting in pricing pressure across all of our product and service lines. We are not unique in this respect. The entire competitive landscape has been similarly impacted by the downturn, but the revenue and cash flows generated in the Gulf of Mexico and international markets throughout the downturn demonstrate how important the execution of our core strategy of geographic diversity is throughout the cycles to which our industry is prone.

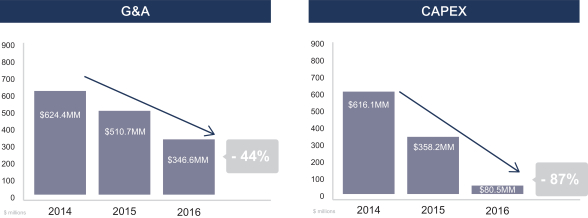

Reducing Costs

Responding to the depth and duration of the downturn, we took steps in 2016 to continue implementing company-wide cost reduction initiatives. We further reduced our cost structure by integrating product and service lines, reorganizing businesses, limiting capital expenditures to approximately $81 million and reducing our workforce by over 20% as compared to 2015 levels. We reduced our general and administrative (G&A) expenses by approximately 32% from $510.7 million in 2015 to $346.6 million during 2016. We believe our reduced cost structure and streamlined operations provide us a sustainable competitive advantage going forward.

Reduced Capital Expenditures by approximately $278 million (

| Reduced General & Administrative Expenses by approximately $164 million (

| $40 - $50 million in Annual Cost Savings from Restructuring our Businesses

|

|

| |||||

| 2017 SPN Proxy Statement |

i

| |||||

|

|

|

PROXY SUMMARY

|

|

|

Disciplined Cash Management

In addition to cost discipline, we have taken positive action regarding liquidity preservation to solidify our balance sheet. During this down-cycle, we have been able to sustain our worldwide days sales outstanding (DSO) at 74 days, marking only a modest increase from DSO of 71 days in both 2014 and 2015. Additionally, we extended the term of our revolving credit facility for an additional two years, so we have no current debt maturities until 2019. We also made payments totaling $325.0 million in 2016 on this credit facility, which extinguished the outstanding debt balance. Following these debt payments, we were able to preserve $188 million in cash on hand atyear-end 2016, providing us with liquidity on our balance sheet to execute our operational objectives.

Worldwide DSO at 74 days

|

Cash on Hand of $188 million

|

$300 million Revolving Credit Facility with $100 million Accordion

|

Positioned for the Upcycle

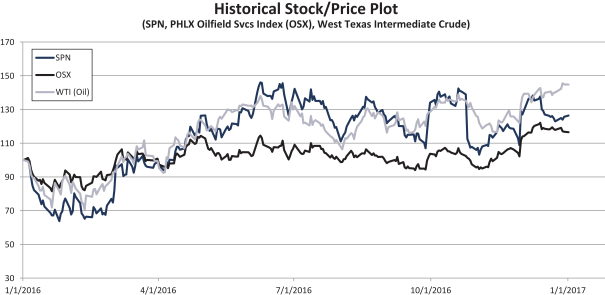

During the second half of 2016, West Texas Intermediate crude oil prices began to recover and find price stability, reversing some of the steep declines that began in 2014. Many of our customers, primarily in the U.S. land market, gradually increased their activity levels in the third and fourth quarters and began to project a bias towards spending growth in 2017. After two years of industry decline, we were able to generate an increase in revenue in the fourth quarter of 2016.

By taking steps to conserve cash, retire debt and reduce our cost structure throughout the downturn, we positioned ourselves to be an early responder to the market recovery and seize market share. Seeing indications of 2017 spending increases by our customers, we felt confident enough in the forward outlook to make the tactical decision to transition to a mode of cash deployment in the second half of 2016 and begin activating idle equipment and supply chain in our well fracturing and well services businesses, ahead of expected demand increases. During the second half of 2016, we spent $23.1 million reactivating pressure pumping capacity to prepare for a return to service and to increase our active hydraulic horsepower (HHP) by 28% to approximately 450,000 HHP.

While we are optimistic the industry is entering a sustainable recovery, recovery is never linear in nature. By taking the measured steps described above, we feel confident we have responded to the changing dynamics of the current market environment and remain well positioned for future growth, both domestically and internationally. Going forward, we continue to look for opportunities to expand our market share and diversify our sources of revenue in pursuit of long-term stakeholder value creation.

ii

| 2017 SPN Proxy Statement | |

|

PROXY SUMMARY

|

|

MEETING AGENDA AND VOTING RECOMMENDATIONS

Proposal

|

Board Vote | Page

| ||||

1 |

Election of eight director nominees named in this proxy statement |

FOR each nominee |

1 | |||

2 |

Advisory vote to approve our named executive officers’ 2016 compensation |

FOR |

15 | |||

3 |

Advisory vote on the frequency of future advisory votes on our named executive officers’ compensation |

FOR every 1 year |

16 | |||

4 |

Ratification of the appointment of KPMG LLP as our independent registered public accounting firm for 2017 |

FOR |

17 |

|

| |||||

| 2017 SPN Proxy Statement |

iii

| |||||

|

|

|

PROXY SUMMARY

|

|

PROPOSAL 1 HIGHLIGHTS

Director Nominees

Our Board is comprised of a strong team of current and former senior professionals with significant industry experience. In 2016, we“right-sized” our Board in this instance by decreasing from nine to eight members, so as to coincide with the efficiencies we have sought throughout the Company. Of our current eight directors, six are independent, including our Lead Director, with the other two being our current and former CEO. We believe this gives us the right blend ofin-depth legacy and strategic knowledge of our Company, as well as broader skills and perspectives on the wider industry and market.

Name

| Age

|

Director | Principal Occupation | Independent

| Board Committees

| |||||

Harold J. Bouillion |

73 |

2006 |

Managing Director Bouillion & Associates, LLC. |

✓ |

• Compensation • Audit (Chair) | |||||

David D. Dunlap |

55 |

2010 |

CEO & President SPN | |||||||

James F. Funk |

67 |

2005 |

President J.M. Funk & Associates |

✓ Lead Director |

• Compensation • Nominating and Corporate | |||||

Terence E. Hall |

71 |

1995 |

Founder & Chairman of the Board SPN | |||||||

Peter D. Kinnear |

70 |

2011 |

Retired Chairman, CEO & President FMC Technologies, Inc. |

✓ |

• Audit • Nominating and Corporate Governance | |||||

Janiece M. Longoria |

63 |

2015 |

Chairman Port of Houston Authority |

✓ |

• Audit • Nominating and Corporate | |||||

Michael M. McShane |

62 |

2012 |

Advisor Advent International |

✓ |

• Compensation • Audit | |||||

W. Matt Ralls |

67 |

2012 |

Retired Chairman, CEO & President Rowan Companies, plc |

✓ |

• Compensation • Nominating & Corporate | |||||

iv

| 2017 SPN Proxy Statement | |

|

PROXY SUMMARY

|

|

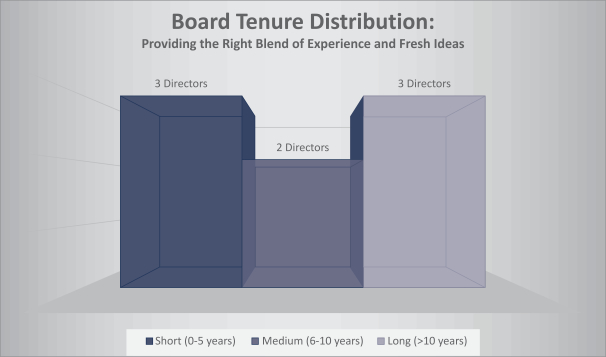

As a result of healthy refreshment over the past three years, our Board has an effective mix of experience and fresh ideas, as reflected by our balanced distribution of tenure. The Company appreciates the strong level of support of our Board in recent years.

Board Refreshment 1 New Director 2 Retirements In the Last Three Years

Each Board Member received 98.5% Support or Higher at our 2016 Annual Meeting of Stockholders

|

|

| |||||

| 2017 SPN Proxy Statement |

v

| |||||

|

|

|

PROXY SUMMARY

|

|

Corporate Governance

Our Approach: Our leadership structure and corporate policies are designed to strengthen board leadership, foster cohesive decision-making at the board level, solidify director collegiality, improve problem solving and enhance strategy formation and implementation. In establishing corporate policies, our Board examines the Company’s organizational needs, managing its growth, competitive challenges, the potential of senior leadership, future development and possible emergency situations to help provide strategic plans.

Our Actions:

Governance Best Practices

|

SPN

| |

CEO and Chairman Positions are Separate

| ✓

| |

Non-Management Lead Director

| ✓

| |

Annual Election of Directors

| ✓

| |

AnnualSay-on-Pay Votes

| ✓

| |

Robust Stock Ownership Guidelines for all Directors and Executive Officers

| ✓

| |

Annual Performance Evaluations for Board and Standing Committees

| ✓

| |

ISS Governance QualityScore of “1”*

| ✓

|

PROPOSAL 2 HIGHLIGHTS

Executive Compensation

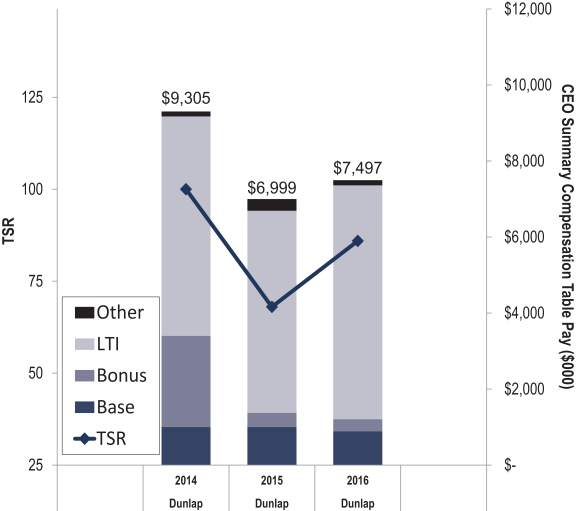

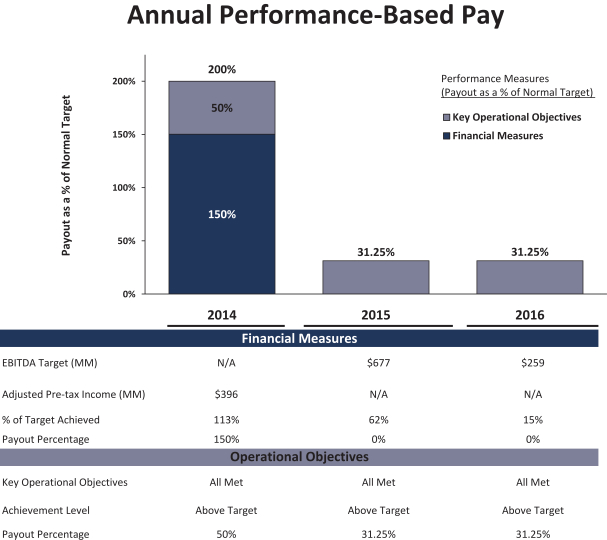

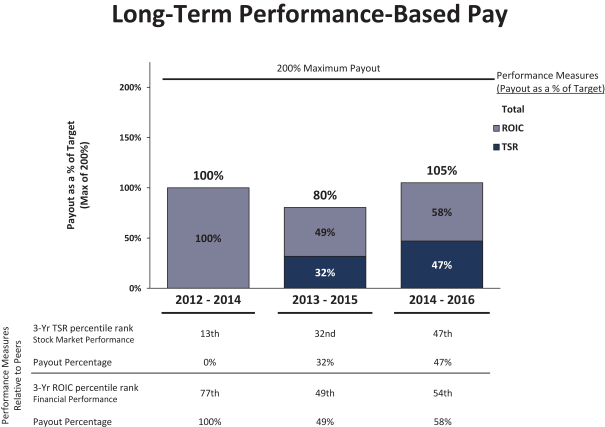

Our Approach: Our Compensation Committee has implemented and oversees a compensation program that strives to: (i) provide a balanced mix of performance-based compensation; (ii) motivate our executives to improve both our financial and stock-price performance; and (iii) maintain alignment of both short- and long-term objectives.

Our Actions:

| • | Reduced by 15% the base salaries of Named Executive Officers effective April 1, 2016. |

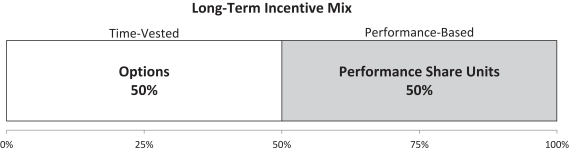

| • | Granted 50% of the awards under our LTI program in 2016 as Options (instead of 25% restricted stock units and 25% options) in order to better align the interests of our executives with those of our stockholders. |

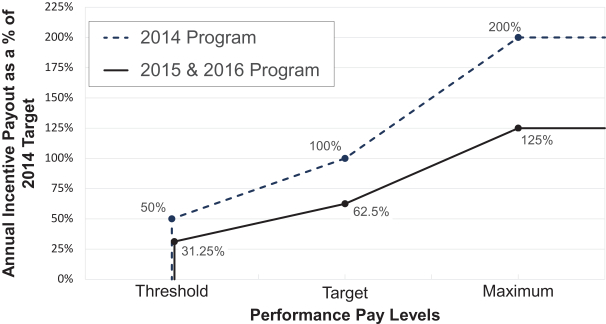

| • | Maintained the 37.5% reduced potential payout opportunities under our Annual Incentive Program. |

| • | No Restricted Stock Units or Strategic Performance Stock Units granted in 2016. |

| • | Continued our Shareholder Outreach program to sustain dialogue with and responsiveness to our stockholders. |

| * | A decile score of 1 indicates lowest governance risk. Score current as of April 1, 2017 |

vi

| 2017 SPN Proxy Statement | |

|

PROXY SUMMARY

|

|

PROPOSAL 3 HIGHLIGHTS

We understand the concerns of some investors that annualsay-on-pay votes lead to excessive focus on near-term, cyclical stock price movements and are redundant to annual votes on compensation committee members. However, at this time we continue to believe that annualsay-on-pay votes remain the market norm and allow our stockholders to express their views timely on our executive compensation program. As a result, we recommend that we continue to future holdsay-on-pay votes annually.

PROPOSAL 4 HIGHLIGHTS

Taking a number of factors into consideration, including past performance, expertise, industry knowledge, and the strong support of 99.5% of our stockholders at our 2016 annual meeting, the Audit Committee has selected KPMG as our independent auditor for the fiscal year ending December 31, 2017, which we submit to our stockholders for ratification. KPMG has audited the Company’s financial statements since 1995.

|

| |||||

| 2017 SPN Proxy Statement |

vii

| |||||

|

|

|

Our Shared Core Values

Since our founding, Superior has remained committed to conducting our business in a socially responsible and values-based manner, creating sustainable value for our stockholders, employees, customers and communities. In 2015 our President and CEO, Dave Dunlap, personally outlined Our Shared Core Values at Work, which we codified as our new code of conduct and mandate for how we do business:

| • | We conduct ourselves and our business affairs with honesty and integrity, and do not tolerate illegal or fraudulent activities. |

| • | We treat our employees with fairness, dignity and respect and do not tolerate any forms of discrimination. |

| • | We protect the safety and health of ourselves, our fellow employees and everyone that we work with and stop unsafe actions. |

| • | We deal fairly with customers, suppliers and other business relationships and always act in the best interests of the Company. |

| • | We conduct ourselves as good citizens in the communities where we operate, and we respect the environment. |

These core values capture what is unique about Superior and what sets us apart as a fair employer, a trusted business partner and a good corporate citizen, helping us to maintain our well-earned reputation for honesty and integrity. The complete code is available on our website:www.superiorenergy.com/about/corporate-governance/shared-core-values/. All of our other policies flow from Our Shared Core Values.

Health, Safety, Environment and Quality (HSEQ)

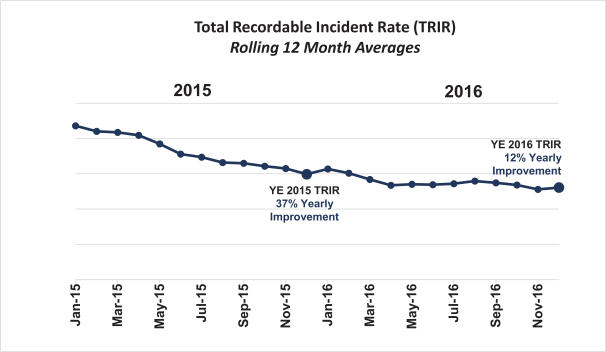

Superior’s focus on HSEQ, an approach we call “Target Zero”, is more than a priority; it is deeply rooted as one of the core values of Superior. Emphasizing our commitment to Target Zero, in 2016 we reviewed and updated our HSEQ Policy Statement to better align our message with Our Shared Core Values. Our HSEQ Policy Statement is a concise message stating our commitment to HSEQ and outlining our cornerstone principles essential for our future growth and success. Our new policy has been endorsed by our President and CEO and communicated throughout the Company. Our executive management is graded on an ongoing basis on Target Zero performance metrics, with our full Board receiving HSEQ updates and discussing progress at each Board meeting.

| Our unwavering commitment toWorking Safely, Living SafelyandProtecting the Environment is what makes our Company strong. |

viii

| 2017 SPN Proxy Statement | |

|

CORPORATE RESPONSIBILITY

|

|

Focusing on results, we strive to maintain a healthy reporting culture and promote proactive behavior in preventing incidents. In 2016 we improved our Total Recordable Incident Rate (TRIR) by 12%, and the total number of lost time injuries decreased by 40%. Four of our business units completed the year without any recordable injuries and six business units achieved improvements in their TRIR of more than 50%. Part of this operational success is due to the fact that all Superior personnel are empowered with “Stop Work Authority” and are trained to use this authority whenever they see something that could harm people or the environment. Our executives and operational leaders continued to demonstrate visible leadership throughout 2016 by participating in Target Zero training, as well as internal HSEQ audits/inspections, described as Target Zero Evaluations. In 2016 we completed week long Target Zero Evaluations at forty locations involvingtwenty-one different business units across our global operations. These evaluations were completed by a team of corporate level auditors who were tasked with ensuring compliance not only with health and safety standards, but also with environmental compliance. Superior is committed to minimizing any environmental impact through strict pollution prevention, waste management, water and energy efficiency, and effective use of raw materials. Additional information on our HSEQ efforts and a copy of our HSEQ Policy Statement is available on our website:www.superiorenergy.com/about/hseq/.

|

| |||||

| 2017 SPN Proxy Statement |

ix

| |||||

|

|

|

We have institutionalized a governance and compensation focused outreach program to sustain and improve dialogue with our stockholders. With the support of our Board, our outreach team consists of members of executive management, our investor relations, human resources and corporate secretarial teams, as well as the Chair of our Compensation Committee, who has participated in meetings with some of our long-term stockholders. Our annual engagement cycle consists of a primary stockholder outreach effort in the fourth quarter of each year, followed by internal analysis of the feedback, consideration of any necessary changes, communication of our efforts to the proxy advisory firms, and finally the reporting of any actions taken in our annual Proxy Statement. Our outreach is done primarily by holding conference calls with stockholders, but we also provide questionnaires, allowing our stockholders to provide written responses regarding any concerns. Our annual engagement cycle is summarized in the graph below.

Consistent with this approach, in our 2016 engagement campaign we invited ourtop-50 stockholders, representing approximately 82% of our outstanding shares, to discuss our compensation philosophy, executive compensation and any governance concerns. Topics discussed included our recent board refreshment efforts, as well as our improved ISS QualityScore, reflecting our best practices in corporate governance. The significant majority of stockholders who engaged with us indicated that, they did not have any concerns regarding the structure or philosophy of our executive compensation program, particularly after having seen how our program and our Board responded to the market conditions and stockholder feedback by reducing compensation to better align with total shareholder return (TSR) in 2015 and 2016. Overall, our stockholders continued to express confidence in our governance practices and our engagement program. Stockholders’ input received as a result of the outreach program was reported to the Compensation Committee and to our Board.

The feedback we receive from our stockholders is important to us. Through our outreach effort, we are able to hear any concerns from our stockholders, respond effectively and communicate this back to our stockholders. We expect to continue a strong level of engagement to ensure that we understand and remain able to address stockholder concerns and the issues on which they are focused.

x

| 2017 SPN Proxy Statement | |

ELECTION OF DIRECTORS (PROPOSAL 1)

|

All of our directors are elected annually. On March 30, 2017, the Nominating and Corporate Governance Committee (the Corporate Governance Committee) recommended, and our Board of Directors (the Board) nominated, each of our then-current directors to serve anotherone-year term of office.

Proxies cannot be used to vote a share more than one time for each of the eight nominees. Unless you specify otherwise in your proxy card, your shares will be voted by the proxy holder FOR the election of each of the eight director nominees named below to serve until the next annual meeting and until their successors are duly elected and qualified. If any director nominee should decline or be unable to serve for any reason, and you have returned a proxy card, the proxy holder will vote your shares for a substitute candidate nominated by our Board. Each of the director nominees has advised us that they will serve on our Board if elected.

Information about Director Nominees

The biographies below provide certain information as of the record date, April 3, 2017, for each director nominee. The information includes the person’s tenure as a director, business experience, director positions with other public companies held currently or at any time during the last five years, and the experiences, qualifications, attributes or skills that caused the Corporate Governance Committee and our Board to determine that the person should be nominated to serve as a director of the Company. Unless otherwise indicated, each person has been engaged in the principal occupation shown for the past five years.

Harold J. Bouillion, 73

Director since 2006

Mr. Bouillion is currently the Managing Director of Bouillion & Associates, LLC, which provides tax and financial planning services, a position he has held since 2002. From 1966 until 2002, Mr. Bouillion was with KPMG LLP (KPMG) where he served as Managing Partner of the New Orleans office from 1991 through 2002. Mr. Bouillion is a certified public accountant.

Mr. Bouillion’s tax and financial planning services experience and his36-year career in tax with a leading international accounting firm, where he served in various leadership positions, make him a valuable member of our Board and distinctively qualified to chair the Audit Committee and to serve on our Compensation Committee. His prior management experiences, as well as service with other private andnon-profit organizations, adds valuable perspectives to the challenges faced at the board level.

David D. Dunlap, 55

Director since 2010

Mr. Dunlap has served as CEO since 2010 and President since 2011. Prior to joining the Company, from 2007 to 2010 Mr. Dunlap served as Executive Vice President — Chief Operating Officer of BJ Services Company (BJ Services), a well services provider. He joined BJ Services in 1984 as a District Engineer. Prior to being promoted to Executive Vice President — Chief Operating Officer, Mr. Dunlap held the position of Vice President — International Division from 1995 to 2007. Prior to 1995, he served as Vice President — Sales for the Coastal Division of North America and U.S. Sales and Marketing Manager for BJ Services. Mr. Dunlap previously served as a director of Linn Energy, LLC from 2012 to 2017, and he currently serves as director and trustee on the boards of numerousnon-profit organizations.

Mr. Dunlap has worked and held leadership positions in the oil and gas industry for more than 30 years. Under his direction, BJ Services significantly expanded internationally and successfully transformed into a global leader in multiple well service product

| 1 | |||

|

ELECTION OF DIRECTORS (PROPOSAL 1)

|

|

lines, demonstrating his exceptional leadership abilities in developing and executing a global business strategy. His extensive knowledge, experience and expertise and his insight on global expansion in the oil and gas industry make him a valuable member of our Board and uniquely position him to assist our Board in the successful implementation of our business strategy.

James M. Funk, 67

Director since 2005

Dr. Funk is currently the President of J.M. Funk & Associates, an oil and gas business consulting firm, and has more 39 years of experience in the energy industry. Dr. Funk served as Senior Vice President of Equitable Resources (now EQT Corporation) and President of Equitable Production Co. from June 2000 to 2003. Previously, Dr. Funk worked for 23 years with Shell Oil Company and its affiliates. Dr. Funk previously served on the boards of Westport Resources (2000 to 2004), Matador Resources Company (2003 to 2008) and Sonde Resources Corp. (2009 to 2014). Dr. Funk currently serves as a director of Range Resources Corporation. Dr. Funk is a Certified Petroleum Geologist.

Dr. Funk’s extensive experience in the energy industry in similar areas as our operations, along with his strong technical experience, gives him a unique understanding of our business and the challenges and strategic opportunities facing us. His senior executive leadership in the energy industry qualifies him to serve as our Lead Director and provides each of the Compensation and Corporate Governance Committees with substantial personnel management experience. In addition, his current and past service on the board of directors of a number of public companies adds valuable perspective in connection with the role of the Board and positions him well to handle challenges faced at the Board level.

Terence E. Hall, 71

Director since 1995

Mr. Hall has served as the Chairman of the Board since 1995. Mr. Hall is the founder of the Company and served as CEO of the Company and its predecessors from 1980 until 2010. Mr. Hall also currently serves as a director of the Hancock Holding Company (Hancock).

As founder of the Company, Mr. Hall led the Company through tremendous growth through all industry cycles. His detailed knowledge of every aspect of our business and perspective regarding strategic and operational opportunities and challenges facing the Company and the oil and gas industry enable him to guide our business strategy and focus our Board on the most significant business issues.

Peter D. Kinnear, 70

Director since 2011

Mr. Kinnear held numerous management, operations, and marketing roles with FMC Technologies, Inc. (FTI) and FMC Corporation from 1971 until his retirement in 2011. Mr. Kinnear served as Chief Executive Officer from 2007 to 2011 of FTI, chairman of the board from 2008 to 2011, as President from 2006 to 2010 and as Chief Operating Officer from 2006 to 2007.

In addition to serving as trustee or director of variousnon-public entities, Mr. Kinnear previously served on the board of directors of Tronox Incorporated (from November 2005 to December 2010), FTI (from October 2008 through October 2011) and Stone Energy Corporation (from March 2009 to March 2017).

Mr. Kinnear’s experience in numerous roles of management, operations and marketing in the global energy industry brings extensive knowledge and leadership skills to our Board. His management and board experience gives him a thorough understanding of industry regulations and public policy applicable to the industry, experience and understanding of the different cultural, political and regulatory requirements from international operations and extensive oil service industry experience. This experience makes Mr. Kinnear highly qualified to serve on the Audit Committee and to chair the Corporate Governance Committee.

| 2 | | |||

|

ELECTION OF DIRECTORS (PROPOSAL 1)

|

|

Janiece M. Longoria, 63

Director since 2015

Ms. Longoria serves as the Chairman of the Port of Houston Authority. She has served on the board of directors of CenterPoint Energy, Inc. since 2005. She also currently serves as a Regent for the University of Texas System, and on the board of directors of the Texas Medical Center. Formerly, Ms. Longoria practiced law as a securities and commercial litigator for over 35 years. She was a named partner at the law firm of Ogden, Gibson, Broocks, Longoria & Hall, L.L.P. and previously at Andrews Kurth LLP.

Ms. Longoria’s legal experience, particularly with securities and regulatory matters, allows her to provide extensive guidance to our Board. She has received numerous honors and recognitions for her community and board service during her career, including the Sandra Day O’Connor Award for Board Excellence, as well as the Female Executive of the Year Award from the Houston Hispanic Chamber of Commerce. She brings a fresh and unique perspective to our Board based on her diverse business and legal experience, which makes Ms. Longoria highly qualified to serve on our Audit Committee and Corporate Governance Committee.

Michael M. McShane, 62

Director since 2012

Mr. McShane serves as an Advisor to Advent International, a global private equity fund. Mr. McShane served as a director and President and Chief Executive Officer of Grant Prideco, Inc. from 2002 until the completion of its merger with National Oilwell Varco, Inc. in 2008, having also served as the chairman of its board from 2003 to 2008. Prior to joining Grant Prideco, Mr. McShane was Senior Vice President — Finance and Chief Financial Officer and a director of BJ Services from 1990 to 2002, and Vice President — Finance from 1987 to 1990 when BJ Services was a division of Baker Hughes Incorporated. Mr. McShane also serves as a director of Enbridge, Inc., Oasis Petroleum Inc. and Forum Energy Technologies, Inc.

Mr. McShane’s knowledge of the global oil and gas industry provides insight to our Board. His experience and knowledge in the energy industry, including serving in a variety of executive management and financial leadership positions, provide our Board excellent perspective and experience. Mr. McShane’s experience and finance and accounting background make him highly qualified to serve on the Audit Committee and the Compensation Committee.

| 3 | |||

|

ELECTION OF DIRECTORS (PROPOSAL 1)

|

|

W. Matt Ralls, 67

Director since 2012

Mr. Ralls previously served as Executive Chairman of Rowan Companies, plc (Rowan) from 2014 to 2016, as the Chief Executive Officer from 2009 until 2014, and as President from 2009 to 2013.

Mr. Ralls served as Executive Vice President and Chief Operating Officer of GlobalSantaFe Corporation from 2005 until the completion of the merger of GlobalSantaFe with Transocean, Inc. in 2007, prior to which he had served as Senior Vice President and Chief Financial Officer from 2001 to 2005.

Mr. Ralls currently serves as a director of Cabot Oil and Gas Corporation and previously served as a director of El Paso Pipeline Partners L.P., Enterprise Partners G.P., the International Association of Drilling Contractors and the American Petroleum Institute.

Mr. Ralls’ extensive financial and senior executive management experience at companies focusing on the various phases of the drilling and production industry, provides insight to our Board. Our Board also benefits from his extensive leadership and financial knowledge in the global oil and gas drilling and production industry, making him highly qualified to chair the Compensation Committee and to serve on the Corporate Governance Committee.

Vote Required

The election of directors will be decided by plurality vote in compliance with our majority voting policy, which means that the eight director nominees receiving the highest number of affirmative votes cast will be elected to our Board provided no director nominee receives a greater number of “withhold” than “for” votes in an uncontested election. In the event a director nominee receives a greater number of “withhold” than “for” votes, the director will provide his or her resignation for consideration. See “Corporate Governance — Election of Directors.”

Our Board unanimously recommends that stockholders voteFOR each of the eight director nominees named in this proxy statement.

| ||||

| 4 | | |||

|

Our Board is responsible for our management and direction and for establishing broad corporate policies. Our Board regularly discusses the Company’s organizational needs, managing its growth, competitive challenges, the potential of senior leadership, future development and possible emergency situations to help provide strategic plans.

Our Corporate Governance Principles provide that in a director election where the only director nominees are those nominated by our Board (an uncontested election), if a director nominee receives a greater number of votes withheld from his or her election than for his or her election (a “majority withheld vote”) the nominee is required to tender his or her resignation, after certification of the stockholder vote, for consideration by the Corporate Governance Committee. The Corporate Governance Committee will consider the resignation and recommend to our Board whether to accept it or take other action, including rejecting the tendered resignation and addressing the apparent underlying cause of the majority withheld vote.

In making its recommendation, the Corporate Governance Committee will consider all factors deemed relevant by its members, including without limitation (i) the underlying cause of the majority withheld vote (if it can be determined), (ii) the length of service and qualifications of the director whose resignation has been tendered, (iii) the director’s contributions to the Company, (iv) the current mix of skills and attributes of directors on our Board, (v) whether, by accepting the resignation, the Company will no longer be in compliance with any applicable law, rule, regulation or governing document, and (vi) whether or not accepting the resignation is in the best interests of the Company and its stockholders.

Our Board will act on the Corporate Governance Committee’s recommendation at its first regularly scheduled meeting following certification of the stockholder vote, or within 120 days after the certification if a regular board meeting is not scheduled within that time. Our Board will consider the

same criteria as the Corporate Governance Committee, as well as any additional information and factors it believes are relevant. Our Board’s decision and process will then be disclosed in a periodic or current report filed with the Securities and Exchange Commission (SEC).

Director Independence; Board’s Leadership Structure

Our Board determined that the following directors are “independent” within the meaning of the New York Stock Exchange (NYSE) listing standards: Harold J. Bouillion, James M. Funk, Peter D. Kinnear, Janiece M. Longoria, Michael M. McShane and W. Matt Ralls. Our Board has also affirmatively determined that each member of our standing committees (the Audit Committee, Compensation Committee and Corporate Governance Committee) has no material relationship with the Company and satisfies the independence criteria (including the enhanced criteria applicable to audit and compensation committees) set forth in the NYSE listing standards and SEC rules.

Our Board takes a flexible approach to the issue of whether the offices of Chairman and CEO should be separate or combined, considering the tenure and experience of the CEO along with the broader economic and operating environment of the Company, allowing for regular evaluation as to which structure will best serve the Company. We previously separated the role of Chairman and CEO and maintain such separation at this time.

Our Board determined that the separation of the Chairman and CEO roles would maximize management’s efficiency by allowing our CEO to focus on ourday-to-day business, while allowing the Chairman to lead our Board in its fundamental role of providing guidance to and oversight of management.

As described above,six of our eight current directors are independent, and our Board believes that the independent directors provide effective oversight of management. Moreover, ournon-management directors meet regularly in executive session and provide feedback to the Board during the course of Board meetings.

| 5 | |||

|

CORPORATE GOVERNANCE

|

|

Our Board annually elects anon-management Lead Director who has been recommended by the Corporate Governance Committee. The Lead Director communicates any issues discussed by thenon-management directors back to the CEO and Chairman, confers with the CEO and Chairman at intervals between Board meetings, and assists in planning for Board and Board committee meetings. In addition, he acts as a liaison between our Board and the CEO and Chairman to ensure close communication and coordination between them and to promote a harmonious and effective relationship. Mr. Funk currently serves as our Lead Director.

Our Board believes that the foregoing leadership structure and polices strengthen board leadership,

foster cohesive decision-making at the board level, solidify director collegiality, improve problem solving and enhance strategy formulation and implementation.

Meetings of our Board; Meeting Attendance

Each of our directors attended 100% of the four Board meetings in 2016 and at least 75% of the meetings of any committees of which he or she was a member. On a combined basis, our directors attended 97.8% of all Board and committee meetings in 2016.

Additionally, our Board has adopted a policy that recommends that all directors personally attend each annual meeting of stockholders. All of our directors attended our 2016 annual meeting of stockholders.

Our Board has three standing committees: an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. These committees regularly report back to the full Board with specific findings and recommendations in their areas of oversight and liaise regularly with the Chairman and Lead Director. The current members and primary functions of each board committee are described below.

Director

| Audit*

| Compensation

| Nominating and Corporate Governance

| |||

H.J. Bouillion

|

CHAIR

|

✓

| ||||

J.M. Funk

|

✓

|

✓

| ||||

P.D. Kinnear

|

✓

|

CHAIR

| ||||

J.M. Longoria

|

✓

|

✓

| ||||

M.M. McShane

|

✓

|

✓

| ||||

W.M. Ralls

|

CHAIR

|

✓

|

| * | Messrs. Bouillion, Kinnear and McShane are each an “audit committee financial expert” as defined by the SEC |

Audit Committee

|

Number of Meetings in 2016: 5

|

| • | Retain, terminate, oversee, and evaluate the independent registered public accounting firm |

| • | Review and discuss annual and quarterly financial statements and earnings releases |

| • | Review critical accounting policies, accounting treatments and determine if there are any recommendations to improve controls or procedures |

| • | Discuss risk assessment, legal matters or any matters pertaining to the integrity of management |

| • | Please also see “Audit Committee Report” included in this Proxy Statement |

Compensation Committee

|

Number of Meetings in 2016: 4

|

| • | Evaluate and approve the Company’s executive officers’ compensation philosophy |

| • | Review and approve corporate goals and objectives for executive officers’ compensation |

| • | Review incentive compensation and other stock-based plans for the Company’s executive officers |

| • | Please also see “Executive Compensation—Compensation Discussion & Analysis” included in this Proxy Statement |

| 6 | | |||

|

CORPORATE GOVERNANCE

|

|

Nominating and Corporate Governance Committee

|

Number of Meetings in 2016: 4

|

| • | Lead search for director nominees and recommend director nominees to our Board |

| • | Review committee structure and committee appointments |

| • | Recommend to our Board an annual self-evaluation process |

| • | Review director compensation |

| • | Recommend to our Board and implement our Corporate Governance Principles |

Each of our Board’s standing committees has adopted a written charter that has been approved by our Board. Copies of these charters, as well as copies of our Corporate Governance Principles andOur Shared Core Values at Work (Code of Conduct), are available in the Corporate Governance section of our website at www.superiorenergy.com and are available in print upon request to our Secretary, Superior Energy Services, Inc., 1001 Louisiana Street, Suite 2900, Houston, Texas 77002.

Since May 2007, the Compensation Committee has engaged Pearl Meyer & Partners (PM&P), an independent compensation consultant, to advise the Compensation Committee on matters relating to executive compensation and assist it in maintaining and administering our executive compensation programs. The Compensation Committee annually requests PM&P to conduct an executive compensation review to evaluate the compensation of our senior executives relative to an industry peer group selected by the Compensation Committee with input from the compensation consultant and management and published market survey data. See “Executive Compensation — Compensation Discussion and Analysis — How We Make Compensation Decisions — Role of Compensation Consultants” herein for more information.

Our stock incentive plan permits the Compensation Committee to delegate to appropriate personnel its authority to make awards to employees other than those subject to Section 16 of the Securities Exchange Act of 1934 (Exchange Act) and other than with respect to awards intended to qualify as “performance-based compensation” under 162(m) of the Internal Revenue Code. The Compensation Committee has delegated authority to our CEO to make or alter awards under our long-term incentive plan to such participants, subject to the following conditions:

| • | the CEO may grant awards relating to no more than 100,000 shares of our common stock in any fiscal year, and awards relating to no more than 20,000 shares to any one participant; |

| • | the CEO may grant no more than 30,000 performance share units (PSUs) in any fiscal year, and no more than 5,000 PSUs to any one participant; |

| • | the CEO may cancel, modify, or waive rights under awards related to no more than 20,000 shares and 5,000 PSUs held by a participant; |

| • | the CEO must approve the grant in writing during an open window period, with the grant date being the date of the written approval or a future date; and |

| • | the CEO must report the grants, cancellations or alterations to the Compensation Committee at its next meeting. |

Director Nominee Qualifications

The Corporate Governance Committee is responsible for reviewing with our Board, on an annual basis, the appropriate skills and characteristics required of directors in accordance with our Corporate Governance Principles and evaluating whether the current members of our Board as a group possess those skills and characteristics. Our Corporate Governance Principles provide that our Board will nominate director candidates who represent a mix of backgrounds and experiences that enhance the quality of our Board’s deliberations and decisions. Our Board believes that a diverse membership with varying perspectives and breadth of experience is an important attribute of a well-functioning board. As a result, our Board will seek diversity of background, experience, gender, race and skills among its members.

When seeking new candidates for director, the Corporate Governance Committee will identify potential director nominees through business and other contacts. The Corporate Governance Committee will also consider new candidates for director recommended by stockholders in accordance with the procedures described in our Bylaws and may also choose to retain a professional search firm to identify

| 7 | |||

|

CORPORATE GOVERNANCE

|

|

potential director nominees. We did not pay any fee to any third party to identify or evaluate, or assist in identifying or evaluating, potential director nominees for election at the annual meeting.

When the Corporate Governance Committee selects candidates, it is looking for director nominees:

| • | with a mix of backgrounds and experiences to bring diversity and desired skills to our Board; |

| • | having substantial experience with one or more publicly-traded domestic or multinational companies; |

| • | having achieved high distinction or success in their respective fields; |

| • | displaying the personal attributes necessary to be an effective director, including having unquestioned integrity, sound judgment, independence in fact and mindset, and the ability to operate collaboratively; and |

| • | commitment to the Company and its stockholders. |

Our Board is particularly interested in maintaining a mix that includes, but is not necessarily limited to, active or retired chief executive officers and senior executives, particularly those with significant management experience in operations, international business, finance, accounting, law or significant targeted expansion areas for the Company. The committee evaluates a potential director nominee by considering whether the potential candidate meets the expectations described above, as well as considering the following factors:

| • | whether the potential director nominee has experience and expertise that is relevant to our business and/or industry, including any specialized business or legal experience, technical expertise, or other specialized skills, and whether the potential director nominee has knowledge regarding issues affecting us; |

| • | whether the potential director nominee is independent, whether he or she is free of any conflict of interest or the appearance of any conflict of interest with the best interests of the Company or of our stockholders, and whether he or she is willing and able to represent the interests of all of our stockholders; and |

| • | whether there are factors that could affect the ability or willingness of the potential director nominee to devote sufficient time to Board activities and to enhance his or her understanding of our business. |

There are no differences in the manner in which the Corporate Governance Committee evaluates a candidate for nomination as a director suggested by stockholders using the process set forth in our Bylaws. See “2018 Stockholder Nominations and Proposals” for information on a stockholder proposing a candidate for consideration for nomination as a director, in accordance with our Bylaws and Corporate Governance Principles. For the annual meeting, we did not receive notice of director nominations from any stockholder.

When reviewing an incumbent director for potentialre-election, the Corporate Governance Committee considers the incumbent director’s service to us during his or her term, including the number of meetings attended, level of participation, and overall contribution to our Board. As provided in our Corporate Governance Principles, a director is expected to retire at the annual meeting following his or her 75th birthday, unless asked by our Board to continue to serve.

Role of our Board in Stockholder Outreach

As discussed more fully in the “Stockholder Outreach” section below, our Board believes in the importance of the Company engaging with our stockholders to gain feedback regarding our compensation and governance practices, to answer questions about the Company and to respond as appropriate to stockholder concerns. Our Board receives reports from our engagement team, summarizing the responses and viewpoints of our stockholders. Further, while senior management routinely engage with stockholders, the Board reviews and considers the degree of engagement and stockholder requests in order to determine whether direct Board member participation would be appropriate and beneficial. To that end, the Chair of our Compensation Committee has participated directly in discussions with certain of our largest stockholders to ensure a direct line of communication. Our Board appreciates the time taken and responses provided by our stockholders and looks forward to continuing such outreach going forward.

| 8 | | |||

|

CORPORATE GOVERNANCE

|

|

Role of our Board in Succession Planning

Succession planning is a critical board function. Long-term succession planning involves assessing the Company’s business goals, determining the skills and experience necessary for future executives to help the Company achieve those goals, and an open dialogue between the Board and management to assess talent and prepare for transition. Reviewing the company’s leadership development and “bench strength” is a key component of analyzing internal potential for future executives. To that end, our Board is engaged in succession planning and management development activities, seeking input from members of our Board and senior management regarding candidates for potential successors to the CEO and other senior executives.

Role of our Board in Risk Oversight

Our Board is responsible for the oversight of risk, while assessing and managing risk is the responsibility of management. It is management’s responsibility to anticipate, identify and communicate risks to our Board and its committees, so that our Board can better understand the risks the Company faces, the steps management takes to manage these risks and the level of risk that is appropriate for the Company at any given time. Management performs an annual enterprise risk management exercise to gather empirical data on risks confronting the Company, monitor changes over time, and determine optimal approaches to address identified key risks. Additionally, management meets regularly to discuss our business strategies, challenges, identified risks and opportunities, and management reviews those items with our Board at each regularly scheduled meeting.

While our Board has primary responsibility for risk oversight, each of its standing committees support our Board by addressing various risks in their respective areas of oversight. For instance, the Audit Committee maintains responsibility related to our financial reporting, audit process, and internal control over financial reporting and disclosure controls and procedures. The Compensation Committee endeavors to develop a program of incentives that encourages an appropriate level of risk-taking behavior consistent

with our long-term business strategy and also reviews the leadership development of our employees. The Corporate Governance Committee conducts assessments of nominees to our Board and is charged with developing and recommending to our Board any policies, corporate governance principles and the structure, leadership and membership of our Board committees, including those policies and principles related to, affecting or concerning risk oversight of our Board and its committees.

Director Stock Ownership Guidelines

Within three years of joining the Board, eachnon-management director is expected to own shares of our common stock equal in value to five times the annual retainer paid to him or her. All of our directors with at least three years of tenure on our Board exceed the required ownership level. See “Ownership of Securities — Management and Director Stock Ownership.”

Stockholders and other interested parties may communicate directly with one or more members of our Board, or thenon-management directors as a group, by sending a letter by mail c/o Secretary, Superior Energy Services, Inc., 1001 Louisiana Street, Suite 2900, Houston, Texas 77002. The Secretary will forward the communication directly to the appropriate director or directors.

Compensation Committee Interlocks and Insider Participation

During 2016, none of Messrs. Bouillion, Funk, McShane or Ralls (Chair), who comprised the Compensation Committee, were officers or employees of the Company or any of our subsidiaries or had any relationships requiring disclosure in this proxy statement under “Certain Transactions,” and none of our executive officers served as a member of the compensation committee of another entity or as a director of another entity whose executive officers served on our Board or the Compensation Committee. No member of the Compensation Committee is a former officer of the Company.

| 9 | |||

|

In response to the market downturn and in order to align with compensation reductions of our management, our Board voted unanimously to reduce by 15% the annual retainer paid tonon-management directors effective April 1, 2016. As a result, during 2016 ournon-management directors received:

| • | an annual retainer of $85,000; |

| • | an additional annual fee of $20,000 for the chair of the Audit Committee; |

| • | an additional annual fee of $15,000 for the chair of the Compensation Committee; |

| • | an additional annual fee of $10,000 for the chair of the Corporate Governance Committee; |

| • | an additional annual fee of $25,000 for the Lead Director; and |

| • | an additional annual fee of $125,000 for thenon-executive chairman of the Board. |

Mr. Hall has served as Chairman of the Board since 1995, during which time he received no additional annual fee for serving as Chairman. In order to better align with market norms, the Board voted unanimously to fix the additional annualized fee for thenon-executive chairman of the Board at $125,000, effective April 1, 2016.

To better align thenon-management directors’ compensation with the financial interests of our stockholders, a significant portion of their compensation is paid in the form of restricted stock units (RSUs) with grant date fair values of approximately $200,000. The RSUs are granted on the day following each annual meeting of our

stockholders, with the number of RSUs granted determined by dividing $200,000 by the closing price of our common stock on the day of the annual meeting, and rounding up to the next whole RSU. In addition, if the director’s initial election or appointment does not occur at an annual meeting, then he or she will receive a pro rata number of RSUs based on the number of full calendar months between the date of election or appointment and the first anniversary of the previous annual meeting.

The RSUs vest and pay out in shares of our common stock on the date of the next year’s annual meeting, subject to the applicable director’s continued service through such date and further subject to each director’s ability to elect to defer receipt of the shares of our common stock under our Directors Deferred Compensation Plan.

Under our Directors Deferred Compensation Plan,non-management directors may elect to defer compensation received from the Company for service on our Board. Deferred cash compensation will earn a rate of return based on hypothetical investments in certain mutual funds from which the director may select, or may be converted to deferred stock units. Both the deferred stock units and any deferred restricted stock units will be paid out in shares of our common stock and will be credited with dividend equivalents for any dividends paid on our common stock. Director participants may elect the timing of the distributions of their deferred compensation, which may be made in a lump sum payment or installments, provided that all payments are made no later than 10 years following the director’s termination of service on our Board.

In 2016 our Board voluntarily determined to reduce their own annual retainers by 15% in a show of solidarity with stockholders and alignment with management.

|

| 10 | | |||

|

DIRECTOR COMPENSATION

|

|

The table below summarizes the compensation of ournon-management directors for 2016. As CEO and President, Mr. Dunlap does not receive any additional compensation for his service as a director. His compensation as an executive is reflected in the “2016 Summary Compensation Table” under “Executive Compensation.” Allnon-management directors are reimbursed for reasonable expenses incurred in attending Board and committee meetings.

2016 Director Compensation

| Name | Fees Earned Or Paid in Cash(1) | Stock

| All Other

| Total | ||||

Mr. Bouillion

| $108,750

| $200,015

| $3,003

| $311,767

| ||||

Mr. Funk

| $113,750

| $200,015

| $3,309

| $317,074

| ||||

Mr. Hall

| $182,500

| $200,015

| $1,181

| $383,696

| ||||

Mr. Kinnear

| $98,750

| $200,015

| $ 927

| $299,692

| ||||

Ms. Longoria

| $88,750

| $200,015

| $ 0

| $288,765

| ||||

Mr. McShane

| $88,750

| $200,015

| $835

| $289,600

| ||||

Mr. Ralls

| $111,250

| $200,015

| $835

| $312,100

| ||||

| (1) | Amounts shown reflect fees earned by the directors as retainers or fees for their service on our Board during 2016. Mr. Ralls elected to defer his cash retainer into deferred stock units. Mr. Ralls was inadvertently paid an excess annual retainer amount equal to $7,500 in 2016 which has been offset against his Q1 2017 retainer payment. |

| (2) | Amounts reflect the aggregate grant date fair value of the RSU awards calculated in accordance with FASB ASC Topic 718 at the closing sales price of our common stock on the date of grant. On May 25, 2016, eachnon-employee director received an award of 12,431 RSUs, with a grant date fair value of $16.09 per unit. The aggregate RSUs held by our directors as of December 31, 2016 were as follows: Mr. Bouillion – 49,964 RSUs; Mr. Funk – 71,741 RSUs; Mr. Hall – 27,194 RSUs; Mr. Kinnear – 24,021 RSUs; Ms. Longoria – 12,431 RSUs; and Mr. McShane – 22,868 RSUs; Mr. Ralls – 31,383 RSUs and 13,683 DSUs. |

| (3) | The amounts reflected in “All Other Compensation” include accrued dividend equivalents on outstanding RSUs that were granted prior to the Company’s commencement of paying dividends on its common stock (accordingly the payment of dividends was not part of the grant date valuation of these awards). |

| 11 | |||

|

The following table shows the number of shares of our common stock beneficially owned by holders as of March 31, 2017, known by us to beneficially own more than 5% of the outstanding shares of our common stock. The information in the table is based on our review of filings with the SEC.

Name and Address of Beneficial Owner

| Amount and Nature of Beneficial Ownership | Percent of Class(1)

| ||

BlackRock, Inc. 40 East 52nd Street New York, New York 10022 | 18,474,442(2) | 12.1% | ||

The Vanguard Group 100 Vanguard Boulevard Malvern, Pennsylvania 19355 | 12,005,962(3) | 7.9% | ||

Victory Capital Management Inc. 4900 Tiedeman Road, 4th Floor Brooklyn, Ohio 44144 | 9,082,128(4) | 5.9% | ||

FMR, LLC 245 Summer Street Boston, Massachusetts 02210 | 7,748,797(5) | 5.1% |

| (1) | Based on 152,831,563 shares of our common stock outstanding as of March 31, 2017. |

| (2) | In the Schedule 13G filed on January 17, 2017, BlackRock, Inc. reported that it has the sole power to dispose or direct the disposition of all the shares reported and the sole power to vote or direct the vote of 17,771,240 shares of our common stock. |

| (3) | In the Schedule 13G filed on February 10, 2017, the Vanguard Group reported that it has (i) the sole power to dispose or direct the disposition of 11,905,956 shares, (ii) the shared power to dispose or direct the disposition of 100,006 shares, (iii) the sole power to vote or direct the vote of 89,005 shares, and (iv) the shared power to vote or direct the vote of 18,001 shares of our common stock. |

| (4) | In the Schedule 13G filed on February 13, 2017, Victory Capital Management, Inc. reported that it has the sole power to dispose or direct the disposition of all the shares reported and the sole power to vote or direct the vote of 8,555,035 shares of our common stock. |

| (5) | In the Schedule 13G filed on February 14, 2017, FMR, LLC reported that it has the sole power to dispose or direct the disposition of all the shares reported and the sole power to vote or direct the vote of 723 shares of our common stock. |

| 12 | | |||

|

OWNERSHIP OF SECURITIES

|

|

Management and Director Stock Ownership

The following table shows the number of shares of our common stock beneficially owned as of March 31, 2017, by (i) our currentnon-management directors, (ii) our “named executive officers,” as defined below in “Executive Compensation — Compensation Discussion and Analysis,” and (iii) all of our current directors and executive officers as a group. The information in the table is based on our review of filings with the SEC. Each person listed below has sole voting and investment power with respect to the shares beneficially owned unless otherwise stated.

Name of Beneficial Owner

| Amount and Nature of Beneficial Ownership(1) |

Percent of

| ||

NON-MANAGEMENT DIRECTORS:(2)

| ||||

Harold J. Bouillion

| 81,666

| *

| ||

James M. Funk

| 80,969

| *

| ||

Terence E. Hall

| 1,055,160

| *

| ||

Peter D. Kinnear

| 56,197

| *

| ||

Janiece M. Longoria

| 22,619

| *

| ||

Michael M. McShane

| 85,212

| *

| ||

W. Matt Ralls

| 101,443

| *

| ||

NAMED EXECUTIVE OFFICERS

| ||||

David D. Dunlap

| 1,607,106

| 1.05

| ||

Robert S. Taylor

| 627,144

| *

| ||

Brian K. Moore

| 593,598

| *

| ||

A. Patrick Bernard

| 434,739

| *

| ||

William B. Masters

| 385,610

| *

| ||

All directors and executive officers as a group (13 persons)(4)

| 5,326,393

| 3.49%

| ||

| * | Less than 1%. |

| (1) | Includes the number of shares subject to options that are exercisable within 60 days, as follows: Mr. Hall (757,652); Mr. Dunlap (1,121,449); Mr. Taylor (440,824); Mr. Moore (324,074); Mr. Bernard (318,159); Mr. Masters (275,083); and all directors and executive officers as a group (3,237,241). |

| (2) | Includes the number of shares thenon-management director will receive upon vesting of RSUs or the payout of deferred stock units, as noted, within 60 days, as follows: Mr. Bouillon (49,964); Mr. Funk (48,442, plus 20,566 deferred RSUs); Mr. Hall (27,194); Mr. Kinnear (24,021); Ms. Longoria (12,431); Mr. McShane (22,868); and Mr. Ralls (22,868, plus 22,198 deferred RSUs). Each RSU granted to directors prior to 2013 vested immediately upon grant, but the shares of Company common stock payable upon vesting will not be delivered to the director until he ceases to serve on our Board. Beginning with the 2013 grants, the RSUs vest and pay out in shares of our common stock the year following the grant, subject to each director’s ability to elect to defer receipt of the shares. |

| (3) | Based on 152,831,563 shares of our common stock outstanding as of March 31, 2017. |

| (4) | One executive officer (not a named executive officer) had previously pledged 7,778 shares to secure a personal line of credit. This pledge was in place prior to the adoption of our anti-pledging policy in 2013. |

| 13 | |||

|

OWNERSHIP OF SECURITIES

|

|

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors and executive officers to file with the SEC reports of ownership and changes in ownership of our equity securities. Based solely upon our review of the Forms 3, 4 and 5 filed during 2016, and written representations from our directors and executive officers, we believe that all required reports were timely filed during 2016.

| 14 | | |||

ADVISORY VOTE ON OUR NAMED EXECUTIVE OFFICERS’ 2016 COMPENSATION (PROPOSAL 2)

|

In accordance with Section 14A of the Exchange Act and the related rules of the SEC, our stockholders have the opportunity to cast an advisory,non-binding vote to approve the compensation of our named executive officers as disclosed in this proxy statement (our“say-on-pay” proposal). This vote is not intended to address any specific item of compensation but rather the overall compensation of our named executive officers for 2016 and our compensation philosophy and practices. In considering how to vote on this proposal, we urge you to carefully consider the information in the “Executive Compensation” section of this proxy statement, namely the Compensation Discussion and Analysis, including its Executive Summary and the compensation tables and accompanying narrative disclosures.

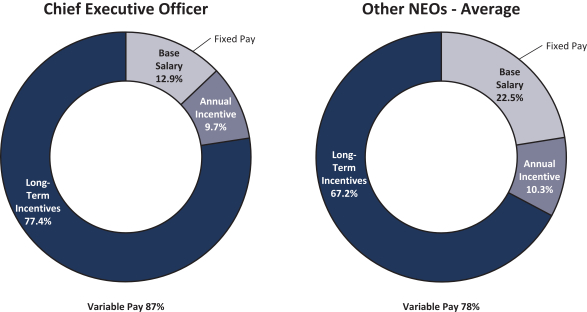

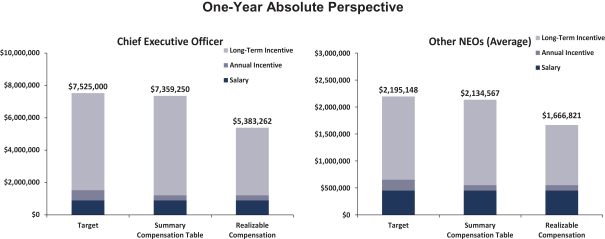

The Compensation Committee of the Board designs, implements and administers our compensation program for our executive officers, including our named executive officers. As noted in the Compensation Discussion and Analysis, the majority of our executives’ target direct compensation isat-risk, with a significant percentage of the target compensation (87% for our CEO and an average of nearly 78% for our other current named executive officers) based on annual and long-term performance measures. Our core executive compensation philosophy and practice continue to be based on pay for performance with an understanding of current market conditions, and we believe that our compensation program is strongly aligned with the long-term interests of our stockholders.

At last year’s annual meeting, we provided our stockholders with the opportunity to cast anon-binding advisory vote regarding the 2015 compensation of our named executive officers as disclosed in our proxy statement for the 2016 annual meeting of stockholders. Showing strong support for our efforts to align compensation with results and total shareholder return during the recent market downturn, our stockholders approved the 2016say-on-pay proposal

by an affirmative vote of 97% of the holders of shares of our common stock present and entitled to vote on the proposal.

We are again asking our stockholders to vote on the following resolution:

RESOLVED, that the stockholders of Superior Energy Services, Inc. (the Company) approve, on an advisory basis, the compensation of the Company’s named executive officers for 2016 as disclosed in the Company’s proxy statement for the 2017 annual meeting of stockholders pursuant to the rules of the Securities and Exchange Commission.

While thissay-on-pay vote is not binding, the Company, our Board and the Compensation Committee value the opinions of our stockholders and will consider the outcome of the vote when making future compensation decisions for our named executive officers. We invite stockholders who wish to communicate with our Board on executive compensation matters or any other matter to contact us as provided under “Corporate Governance — Communications with our Board.” Additionally, the Company engages our larger stockholders at least annually to discuss both compensation and governance matters as discussed more fully in the “Stockholder Outreach” section of this proxy.

Vote Required

The approval, by an advisory vote, of the compensation of our named executive officers requires the affirmative vote of the holders of a majority of the shares of our common stock present in person or by proxy at the annual meeting and entitled to vote on such proposal. It is expected that, unless the Board modifies its policy on the frequency of futuresay-on-pay advisory votes, we will hold our next“say-on-pay” vote at our 2018 annual meeting of stockholders.

Our Board unanimously recommends a voteFOR Proposal 2.

| ||||

| 15 | |||

ADVISORY VOTE ON THE FREQUENCY OF FUTURE ADVISORY VOTES ON OUR NAMED EXECUTIVE OFFICERS’ COMPENSATION (PROPOSAL 3)

|

Our stockholders have the opportunity to cast an advisory,non-binding vote on how often we should include asay-on-pay proposal in our proxy materials for future annual shareholder meetings or any special shareholder meeting for which we must include executive compensation information in the proxy statement for that meeting (our“say-on-frequency” proposal). Under thissay-on-frequency proposal, our stockholders may vote to have thesay-on-pay vote every year, every two years, or every three years. Our stockholders voted on a similar proposal in 2011 with the majority voting to hold asay-on-pay vote every year.

We share the concerns of some investors that annualsay-on-pay votes may (i) pressure compensation committees to try to adjust long-term compensation plans to mirror near-term, cyclical stock price movements, and (ii) be unnecessary, as investors can already express pay concerns through their annual votes on compensation committee members. However, at this time we continue to believe that annualsay-on-pay votes remain the market norm and allow our stockholders to express their views timely on our executive compensation program.

While thissay-on-frequency vote is not binding, the Company, our Board and the Compensation Committee value the opinions of our stockholders and will consider the outcome of the vote when making future decisions regarding the frequency of conducting asay-on-pay vote. Stockholders may cast their advisory vote to conduct advisory votes on executive compensation every “1 Year,” “2 Years,” “3 Years,” or “Abstain.” The Board recommends a vote on Proposal 3 to holdsay-on-pay votes every 1 Year.

Vote Required

The approval, by an advisory vote, of the frequency of votes on the compensation of our named executive officers requires the affirmative vote of the holders of a majority of the shares of our common stock present in person or by proxy at the annual meeting and entitled to vote on such proposal. Our“say-on-frequency” vote currently occurs once every six years. Accordingly, we expect to hold the next“say-on-frequency” vote at our 2023 annual meeting of stockholders.

Our Board unanimously recommends a vote on Proposal 3 to hold future“say-on-pay” votesEVERY 1 YEAR.

| ||||

| 16 | | |||

RATIFICATION OF THE APPOINTMENT OF OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM (PROPOSAL 4)

|

The Audit Committee has selected KPMG as our independent registered public accounting firm (independent auditor) for the fiscal year ending December 31, 2017, which, as a matter of good corporate practice, we submit to our stockholders for ratification. If the selection is not ratified by our stockholders, the Audit Committee will consider whether it is appropriate to select another independent auditor. Even if the selection is ratified, the Audit Committee in its discretion may select a different independent auditor at any time during the year if it determines that such a change would be in the best interests of the Company and our stockholders.

KPMG has audited the Company’s financial statements since 1995. The Audit Committee took a number of factors into consideration in determining whether to reappoint KPMG as the Company’s independent auditor, including KPMG’s historical and

recent performance of the Company’s audit, KPMG’s capabilities and expertise, its tenure as the Company’s independent auditor and its familiarity with our business and operations, the appropriateness of its professional fees and its independence.

Representatives of KPMG are expected to be present at the annual meeting and will have an opportunity to make a statement if they desire to do so. They will also be available to respond to appropriate questions from our stockholders.

Vote Required

The ratification of the appointment of KPMG as our independent auditor for 2017 requires the affirmative vote of the holders of a majority of the shares of our common stock present in person or by proxy at the annual meeting and entitled to vote on such proposal.

The Audit Committee and our Board unanimously recommend a voteFOR Proposal 4.

| ||||

| 17 | |||

|

RATIFICATION OF THE APPOINTMENT OF OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM (PROPOSAL 4)

|

|

Fees Paid to Independent Registered Public Accounting Firm

The following is a summary and description of fees billed to the Company for professional services rendered by KPMG in 2016 and 2015.

Fiscal Year Ended December 31,

| ||||||||

| 2016 | 2015 | |||||||

Audit Fees(1) | $ | 3,103,882 | $ | 3,146,945 | ||||

Audit-Related Fees | — | — | ||||||

Tax and StatutoryReporting | $ | 228,616 | $ | 166,892 | ||||

All Other Fees | — | — | ||||||