UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ¨

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-11(c) or § 240.14a-12 |

KRONOS INCORPORATED

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Notes:

Reg. § 240.14a-101.

SEC 1913 (3-99)

KRONOS INCORPORATED

297 Billerica Road

Chelmsford, Massachusetts 01824

December 31, 2003

Dear Stockholder:

We cordially invite you to attend our 2004 Annual Meeting of Stockholders, which will be held at 10:00 a.m. on Thursday, February 12, 2004 at the offices of the Company, 297 Billerica Road, Chelmsford, Massachusetts 01824.

At this meeting you are being asked to (i) elect two Class III Directors, (ii) approve an amendment to the Company’s 2002 Stock Incentive Plan to increase the number of shares of common stock available for issuance thereunder from 2,550,000 shares to 5,000,000 shares, and (iii) ratify the selection of Ernst & Young LLP as independent auditors for the Company for the 2004 fiscal year.

Please read the enclosed Proxy Statement, which describes the nominees for Director and presents other important information, and complete, sign and return your proxy promptly in the enclosed envelope.

We hope you will join us on February 12 for our Annual Meeting, but we know that every stockholder will not be able to do so. Whether or not you plan to attend, please return your signed proxy as soon as possible.

Sincerely,

MARK S. AIN

Chief Executive Officer and Chairman

KRONOS INCORPORATED

297 Billerica Road

Chelmsford, Massachusetts 01824

NOTICE OF 2004 ANNUAL MEETING OF STOCKHOLDERS

February 12, 2004

Notice is hereby given that the Annual Meeting of Stockholders of Kronos Incorporated (the “Company”) will be held at the offices of the Company, 297 Billerica Road, Chelmsford, Massachusetts 01824, on Thursday, February 12, 2004 at 10:00 a.m. for the following purposes:

1. To elect two Class III Directors for the ensuing three years.

2. To approve an amendment to the Company’s 2002 Stock Incentive Plan to increase the number of shares of common stock available for issuance thereunder from 2,550,000 shares to 5,000,000 shares.

3. To ratify the selection of Ernst & Young LLP as the Company’s independent auditors for the 2004 fiscal year.

4. To transact such other business as may properly come before the meeting and any and all adjourned sessions thereof.

Only stockholders of record at the close of business on December 17, 2003 will be entitled to notice of and to vote at the Annual Meeting and any and all adjourned sessions thereof. The stock transfer books of the Company will remain open.

By Order of the Board of Directors,

PAUL A. LACY,

Clerk

Chelmsford, Massachusetts

December 31, 2003

IT IS IMPORTANT THAT YOUR STOCK BE REPRESENTED AT THE ANNUAL MEETING. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING IN PERSON, PLEASE COMPLETE, DATE AND SIGN THE ENCLOSED PROXY AND MAIL IT PROMPTLY IN THE ENCLOSED ENVELOPE IN ORDER TO ASSURE REPRESENTATION OF YOUR SHARES. NO POSTAGE NEED BE AFFIXED IF THE PROXY IS MAILED IN THE UNITED STATES.

KRONOS INCORPORATED

297 Billerica Road

Chelmsford, Massachusetts 01824

Proxy Statement for the Annual Meeting of Stockholders

To Be Held on February 12, 2004

The enclosed proxy is being solicited on behalf of the Board of Directors (the “Board”) of Kronos Incorporated (“Kronos” or the “Company”) for use at the 2004 Annual Meeting of Stockholders (the “Annual Meeting”) to be held at the offices of the Company, 297 Billerica Road, Chelmsford, Massachusetts 01824, on Thursday, February 12, 2004 at 10:00 a.m. and at any and all adjourned sessions thereof.

A proxy may be revoked by a stockholder, at any time before it is voted, by (i) returning to the Company another properly signed proxy bearing a later date, (ii) otherwise delivering a written revocation to the Clerk of the Company, or (iii) attending the Annual Meeting or any adjourned session thereof and voting the shares covered by the proxy in person. Shares represented by the enclosed proxy properly executed and returned, and not revoked, will be voted at the Annual Meeting in accordance with the instructions contained therein.If no choice is specified, the proxies will be voted in favor of the matters set forth in the accompanying Notice of Meeting.

If you are a stockholder whose shares are registered in another name, for example in “street name,” you must follow the procedures required by the holder of record, which is usually a brokerage firm or bank, to revoke a proxy. You should contact the holder of record directly for more information on these procedures.

Stockholders that attend the Annual Meeting and wish to vote in person will be given a ballot at the meeting. If your shares are held in “street name” and you want to attend the Annual Meeting, you must bring an account statement or letter from the brokerage firm or bank holding your shares showing that you were the beneficial owner of the shares on the record date. If you want to vote shares that are held in “street name” or are otherwise not registered in your name, you will need to obtain a “legal proxy” from the holder of record and present it at the Annual Meeting.

The expense of soliciting proxies will be borne by the Company. In addition to solicitations by mail, officers and regular employees of the Company, without additional remuneration, may solicit proxies by telephone, telegram and personal interviews from brokerage houses and other stockholders. The Company has retained Morrow & Co., Inc. to assist in the solicitation of proxies and will pay the firm a fee of $7,500 plus expenses. The Company will also reimburse brokers and other persons for their reasonable charges and expenses incurred in forwarding soliciting materials to their principals.

The Annual Report of the Company for the fiscal year ended September 30, 2003, is being mailed to the Company’s stockholders with this Notice and Proxy Statement on or about December 31, 2003.

A copy of the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2003, as filed with the Securities and Exchange Commission, except for exhibits, will be furnished without charge to any stockholder upon written request to the Treasurer, Kronos Incorporated, 297 Billerica Road, Chelmsford, Massachusetts 01824.

1

Voting Securities and Votes Required

On December 17, 2003, the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting, there were outstanding and entitled to vote an aggregate of 30,805,572 shares of common stock of the Company, $.01 par value per share (“common stock”). Each share is entitled to one vote.

The holders of a majority of the number of shares of common stock issued, outstanding and entitled to vote on any matter shall constitute a quorum with respect to that matter at the Annual Meeting. Shares of common stock present in person or represented by proxy (including shares which abstain or do not vote with respect to one or more of the matters presented for stockholder approval) will be counted for purposes of determining whether a quorum is present.

The affirmative vote of the holders of a plurality of the votes cast by the stockholders entitled to vote at the Annual Meeting is required for the election of Directors. The affirmative vote of the holders of a majority of the shares of common stock present or represented and properly cast on a matter is required to approve the amendment to the 2002 Stock Incentive Plan (the “2002 Plan”), and the ratification of the selection of Ernst & Young LLP (“Ernst & Young”) as the Company’s independent auditors for the current fiscal year.

Shares that abstain from voting as to a particular matter, and shares held in “street name” by brokers or nominees who indicate on their proxies that they do not have discretionary authority to vote such shares as to a particular matter, will not be counted as votes in favor of such matter, and will also not be counted as votes cast or shares voting on such matter. Accordingly, abstentions and “broker non-votes” will have no effect on the voting on a matter that requires the affirmative vote of a certain percentage of the votes cast or shares voting on a matter.

2

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The table below sets forth certain information with respect to the beneficial ownership of the common stock as of September 30, 2003(except as otherwise indicated) by (i) each person known by the Company to own beneficially more than 5% of the outstanding shares of common stock; (ii) each Director and nominee for Director; (iii) each executive officer named in the Summary Compensation Table under the heading “Executive Compensation” below and (iv) all Directors and executive officers of the Company as a group.

The number of shares beneficially owned by each Director or executive officer is determined under rules of the Securities and Exchange Commission, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares as to which the individual has sole or shared voting power or investment power and also any shares, which the individual has the right to acquire within 60 days after September 30, 2003 through the exercise of any stock option or other right. Unless otherwise indicated, each person has sole investment and voting power (or shares such power with his or her spouse) with respect to the shares set forth in the following table. The inclusion herein of any shares deemed beneficially owned does not constitute an admission of beneficial ownership of those shares.

Name and Address | Shares of Common Stock | Percentage of Common Stock Outstanding# | ||||

T. Rowe Price Associates, Inc. 100 East Pratt Street Baltimore, MD 21202 | 3,653,850 | (1) | 12.0 | % | ||

Columbia Wanger Asset Management, L.P. 227 W. Monroe Street, Suite 3000 Chicago, Illinois 60606 | 3,210,375 | (2) | 10.5 | % | ||

Kayne Anderson Rudnick Investment Management, LLC 1800 Avenue of the Stars, 2nd Floor Los Angeles, CA 90067 | 1,608,513 | 5.3 | % | |||

Barclays Global Investors, N.A. and Barclays Global Fund Advisors 45 Fremont Street San Francisco, CA 94105 | 1,529,748 | (3) | 5.0 | % | ||

Mark S. Ain* | 592,761 | (4) | 1.9 | % | ||

W. Patrick Decker* | 55,830 | (4) | † | |||

Richard J. Dumler* | 21,655 | (4) | † | |||

David B. Kiser* | 1,500 | (4)(5) | † | |||

D. Bradley McWilliams* | 364,680 | (4) | 1.2 | % | ||

Lawrence Portner* | 21,750 | (4) | † | |||

Samuel Rubinovitz* | 23,437 | (4) | † | |||

Paul A. Lacy | 85,610 | (4) | † | |||

Aron J. Ain | 61,687 | (4) | † | |||

Peter George | 97,576 | (4) | † | |||

James Kizielewicz | 45,511 | (4) | † | |||

All Directors and executive officers as a group (14 persons) | 1,545,045 | (6) | 5.0 | % | ||

3

| # | Based upon 30,439,518 shares of common stock outstanding as of September 30, 2003. Common stock subject to options currently exercisable or exercisable within 60 days of September 30, 2003 are deemed outstanding for computing the percentage ownership of the person holding such options, but are not deemed outstanding for computing the percentage ownership of any other person. |

| * | Director of the Company |

| † | Less than 1% of the shares of common stock outstanding |

| (1) | The share number represents an aggregate of 3,653,850 shares of common stock owned by various individuals and institutional investors (including 1,575,000 shares owned by T. Rowe Price Small Cap Stock Fund, Inc.), as to which T. Rowe Price Associates, Inc. (‘Price Associates’) serves as investment advisor with power to direct investments and/or vote the securities. Price Associates has sole dispositive power for 3,653,850 shares and sole voting power for 599,850 shares. T. Rowe Price Small Cap Fund has sole voting power over 1,575,000 shares. For purposes of the reporting requirements of the Securities Exchange Act of 1934, Price Associates is deemed to be a beneficial owner of such securities; however, Price Associates expressly disclaims the beneficial ownership of such securities. |

| (2) | Consists of 1,770,000 shares held by Columbia Acorn Fund; 331,650 shares held by Columbia Acorn USA; 9,000 shares held by Banque du Louvre Multi Select; 52,500 held by New America Small Caps; 12,000 held by Northeastern University; 334,500 held by the State of Oregon; 3,450 held by Optimum Small Cap Growth Fund; 657,825 held by Wanger US Smaller Companies (Wanger Advisors Trust); and 39,450 held by Wanger US Smaller Companies (Wanger Investment Company PLC). Columbia Wanger Asset Management, L.P. acts as investment advisor to each of the foregoing entities and as a result has shared voting authority and dispositive power with respect to these shares of common stock. |

| (3) | Consists of 1,034,709 shares held by Barclays Global Investors, N.A. (“BGI”) and 495,039 shares held by Barclays Global Fund Advisors (“BGFA”). BGI and BGFA have sole voting and dispositive power over 921,576 and 495,039 of these shares respectively. |

| (4) | Includes the following shares of common stock issuable upon the exercise of outstanding stock options which may be exercised within 60 days after September 30, 2003: Mr. Mark Ain: 234,000; Mr. Decker: 22,500 Mr. Dumler: 10,125; Mr. McWilliams: 10,125; Mr. Portner: 6,750; Mr. Rubinovitz: 8,437; Mr. Aron Ain: 56,625; Mr. Lacy: 70,687; Mr. George: 86,625: Mr. Kizielewicz: 43,312. |

| (5) | Includes 450 shares held by Mr. Kiser’s wife and 150 shares held by Mr. Kiser’s son. |

| (6) | Includes 692,623 shares of common stock issuable upon the exercise of outstanding stock options held by executive officers and Directors of the Company that may be exercised within 60 days after September 30, 2003. |

EQUITY COMPENSATION PLAN INFORMATION

As of September 30, 2003

| (a) | (b) | (c) | |||||||

Plan category | Number of securities rights | Weighted-average of outstanding warrants, and | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | ||||||

Equity compensation plans approved by shareholders(1) | 3,639,549 | (2) | $ | 16.89 | 2,354,025 | (3) | |||

Equity compensation plans not approved by shareholders | — | — | — | ||||||

TOTAL | 3,639,549 | $ | 16.89 | 2,354,025 | (1) | ||||

4

| (1) | Consists of the following Company equity compensation plans: 1992 Equity Incentive Plan (“1992 Plan”), 2002 Plan and the 2003 Employee Stock Purchase Plan (“2003 ESPP”), each as amended and/or restated to date. Shares of common stock are available for issuance only under the 2002 Plan and 2003 ESPP. |

| (2) | Consists of 2,321,949 shares subject to outstanding options under the 1992 Plan, and 1,317,600 shares subject to outstanding options under the 2002 Plan. Excludes 1,125,000 shares issuable under the 2003 ESPP in connection with the current and future offering periods; such shares being included in column (c) of the table. Also excludes 2,450,000 shares under the 2002 Plan being submitted to the Company’s stockholders for approval at the Annual Meeting. |

| (3) | Includes 1,229,025 shares available for issuance under the 2002 Plan to the Company’s officers, directors, employees, consultants and advisors. Also includes 1,125,000 shares available for issuance under the 2003 ESPP in connection with the current and future offering periods. Excludes 2,450,000 shares under the 2002 Plan being submitted to the Company’s stockholders for approval at the Annual Meeting. |

5

PROPOSAL I

ELECTION OF DIRECTORS

The Company’s Restated Articles of Organization and Amended and Restated By-Laws provide for the classification of the Board into three classes, as nearly equal in number as possible. The Class I, Class II and Class III Directors are currently serving until the annual meeting of stockholders to be held in 2005, 2006 and 2004, respectively, and until their respective successors are duly elected and qualified. At each annual meeting of stockholders, Directors are elected for a full term of three years to succeed those whose terms are expiring.

The Board has fixed the number of Directors at seven and the number of Class III Directors at two. There are currently two Class I Directors, three Class II Directors and two Class III Directors.

Unless otherwise instructed, the enclosed proxy will be voted to elect the persons named below as Class III Directors for a term of three years expiring at the 2007 annual meeting of stockholders and until their respective successors are duly elected and qualified.

The nominees, as identified below, are currently serving as Directors of the Company, and both of them have indicated their willingness to serve, if elected. All the candidates were nominated for election by the Nominating Committee of the Board. If any of the nominees should become unavailable, the enclosed proxy may be voted for a substitute nominee designated by the Board, unless instructions are given to the contrary. The Board has no reason to believe that any of the nominees will become unavailable.

The following table sets forth the name, age, length of service as a Director of each member of the Board, including the nominees for Class III Directors, information given by each concerning all positions he holds with the Company, his principal occupation and business experience for at least the past five years and the names of other publicly-held companies of which he serves as a Director. Information with respect to the number of shares of common stock beneficially owned by each Director, directly or indirectly, as of September 30, 2003, appears above under the heading “Security Ownership of Certain Beneficial Owners and Management.”

Other than Mr. Mark Ain, our Chief Executive Officer and Chairman, and Mr. Aron Ain, our Executive Vice President and Chief Operating Officer, who are brothers, there are no family relationships among any of the directors, nominees for directors and executive officers of the Company.

Nominees for Class III Directors

Terms Expiring in 2007

Richard J. Dumler, 61

Director

Richard J. Dumlerhas served as a Director of the Company since 1982. Mr. Dumler joined Milestone Venture Partners II L.P., a venture capital partnership, as a general partner in January 2002. Mr. Dumler has also served as a general partner of Lambda Management, L.P., a venture capital investment company, since 1983 and as Vice President of Lambda Fund Management Inc., an investment management company, since 1990. He served as First Vice President of Drexel, Burnham, Lambert, Inc. from 1983 to 1990.

Samuel Rubinovitz, 73

Director

Samuel Rubinovitzhas served as a Director of the Company since 1985 and as lead Director since August 2002. From 1989 until April 1996, he was a director of PerkinElmer, Inc., a diversified manufacturer of scientific instruments and electronic, optical and mechanical equipment. In January 1994, Mr. Rubinovitz retired from his position as Executive Vice President of PerkinElmer, a position he had held since 1989. From 1986 to 1989, he was Senior Vice President of PerkinElmer. Mr. Rubinovitz is a director of the following two companies: Richardson Electronics, Inc., a manufacturer and distributor of electron tubes and semiconductors; and LTX Corporation.

6

Class II Directors

Term Expiring in 2006

Mark S. Ain, 60

Chief Executive Officer, Chairman of the Board and Director

Mark S. Ain, a founder of the Company, has served as Chief Executive Officer, Chairman of the Board and a Director of the Company since its organization in 1977. He also served as President from 1977 through September 1996. From 1974 to 1977, Mr. Ain operated his own consulting company, providing strategic planning, product development and market research services. From 1971 to 1974, he was associated with a consulting firm. From 1969 to 1971, Mr. Ain was employed by Digital Equipment Corporation both in product development and as Sales Training Director. He received a B.S. from the Massachusetts Institute of Technology and an M.B.A. from the University of Rochester. Mr. Ain is a director of KVH Industries, Inc., a manufacturer of navigation and satellite communications equipment, Park Electrochemical Corporation, a manufacturer of electronic materials used to fabricate printed circuit boards and semiconductor packages, and LTX Corporation, a manufacturer of instruments used to test semiconductor devices. Mr. Ain is the brother of Aron J. Ain, Executive Vice President and Chief Operating Officer of the Company.

W. Patrick Decker, 56

Director

W. Patrick Deckerhas served as a Director since 1997. From October 1996 until April 2002, Mr. Decker served as President and Chief Operating Officer of the Company. Previously, he served as Vice President, Marketing and Field Operations of the Company from 1982 until October 1996. From 1981 to 1982, Mr. Decker was General Manager at Commodore Business Machines, Inc.- New England Division, a personal computer manufacturer. From 1979 to 1980, Mr. Decker was a National Sales Manager for the General Distribution Division of Data General Corporation, a computer company. Mr. Decker is a director of MatrixOne, Inc., a provider of internet based product collaboration solutions.

David B. Kiser, 56

Director

David B. Kiser was appointed as a Director of the Company in October 2002. Mr. Kiser is an independent management consultant and investor. From 1992 until 1996, he served as Chairman of the Board and CEO of Gradient Corporation, an environmental consulting firm. From 1978 to 1984, he served as partner and director of Cambridge Research Institute, Inc., a general management and healthcare consulting firm. Mr. Kiser previously served as a Director of the Company from 1989 until January 1997.

7

Class I Directors

Terms Expiring in 2005

D. Bradley McWilliams, 61

Director

D. Bradley McWilliamshas served as a Director of the Company since 1993. From 1982 to 1995, Mr. McWilliams held the position of Vice President of Cooper Industries Ltd., a world-wide manufacturer of electrical products, tools and hardware. From 1995 to 2003, Mr. McWilliams served as Senior Vice President and Chief Financial Officer of Cooper Industries Ltd. Mr. McWilliams is a director of McDermott International, Inc., an energy services company.

Lawrence Portner, 67

Director

Lawrence Portnerhas served as a Director of the Company since 1993. Mr. Portner held the position of Vice President of Software Engineering for Data General Corporation from June 1992 to December 1994 and served as a consultant to Data General from 1988 to June 1992. Prior to that time, Mr. Portner held the position of Vice President and General Manager of Research and Development of Apollo Computer from 1983 to 1986. From 1963 to 1983, Mr. Portner served in various capacities at Digital Equipment Corporation, most recently as Vice President of Strategic Planning.

Director Compensation

Each Director who is not a full-time employee of the Company receives a quarterly retainer of $1,250 for his services as a Director, $2,750 for each Board meeting attended, and $1,000 for each committee meeting attended that is not held on the same day as a Board meeting. In addition, the chairman of the Audit Committee receives a quarterly retainer of $1,500 and each member of the Audit Committee receives $500 quarterly. All other Board Committee chairmen also receive a quarterly retainer of $500. The Company also reimburses expenses incurred by non-employee Directors to attend Board and committee meetings. Each non-employee Director generally receives an annual stock option grant to purchase 6,750 shares of common stock at a price equal to fair market value on the date of grant, so long as that Director owns a minimum of 6,750 shares of common stock of the Company. On February 11, 2003, each of Messrs. Decker, Dumler, Kiser, McWilliams, Portner and Rubinovitz was awarded a stock option to purchase 6,750 shares of common stock at an exercise price of $24.21 per share.

Board of Directors and Committees

The Board consists of seven Directors. Samuel Rubinovitz has served as lead Director since August 2002. During the Company’s fiscal year ended September 30, 2003, the Board of the Company held a total of five meetings. Each Director attended at least 75% of the total number of meetings of the Board and at least 75% of all committees on which he served.

The Company has a standing Audit Committee of the Board (the “Audit Committee”), which, among other things, recommends independent auditors, reviews with the independent auditors the scope and results of the audit, monitors the Company’s financial policies and internal control procedures and reviews and monitors the provision of non-audit services by the Company’s auditors. During the fiscal year ended September 30, 2003, the members of the Audit Committee were Messrs. McWilliams (chair), Dumler and Kiser. The Company’s Board of Directors has determined that Mr. McWilliams qualifies as an “audit committee financial expert” in accordance with the applicable rules and regulations of the SEC. The Board of Directors considered a number of factors in this determination, including that Mr. McWilliams, now retired, served as Chief Financial Officer of Cooper Industries, Ltd. a New York Stock Exchange listed company from 1995 to 2003. Mr. McWilliams is “independent” as defined in Rule 4200(a)(15) of the National Association of Securities Dealers, Inc. listing standards. The Audit Committee met eight times during the fiscal year ended September 30, 2003.

8

The Company has a standing Compensation and Stock Option Committee of the Board (the “Compensation Committee”), which reviews and recommends salaries, bonuses and other compensation for the Company’s officers. The Compensation Committee is also responsible for administering the Company’s equity incentive programs. During the fiscal year ended September 30, 2003, the members of the Compensation Committee were Messrs. Dumler (chair), Portner and Rubinovitz. The Compensation Committee met five times during the fiscal year ended September 30, 2003.

The Company has a standing Nominating Committee of the Board (the “Nominating Committee”), which nominates candidates for election to the Board and to fill vacancies in the Board. The Nominating Committee considers suggestions from stockholders regarding possible candidates for membership to the Company’s Board of Directors. Such suggestions must be submitted in accordance with the Company’s bylaws. (Please refer to “Deadline for Submission of Stockholder Proposals for the 2005 Annual Meeting” found elsewhere in this document.) The Nominating Committee met one time during the past calendar year. The members of the Nominating Committee are Messrs. Rubinovitz (chair), Kiser and McWilliams.

All of the members of the Audit Committee and the Compensation Committee are independent directors as defined by the SEC and NASDAQ®.

The Company has adopted a code of ethics that applies to all employees, including the chief executive officer and chief financial and accounting officer. The text of the code of ethics is posted on the Company’s website atwww.kronos.com. The Company intends to post on its website any information relating to any amendments to or waivers for any provision of its code of ethics that applies to the Company’s chief executive officer and chief financial and accounting officer. The Company’s website is included in this proxy statement as a textual reference only and the information in the website is not incorporated by reference into this proxy statement.

Compensation Committee Interlocks and Insider Participation

The Compensation Committee consists of Messrs. Dumler (chair), Portner and Rubinovitz. No member of the Compensation Committee was at any time during the past fiscal year, or prior to that time, an officer or employee of the Company or any subsidiary of the Company, nor has any member of the Compensation Committee had any relationship with the Company requiring disclosure under Item 404 of Regulation S-K under the Securities Exchange Act of 1934, as amended. No executive officer of the Company has served as a Director or member of the Compensation Committee (or other committee serving an equivalent function) of any other entity, one of whose executive officers served as a Director of or member of the Compensation Committee of the Company.

9

REPORT OF AUDIT COMMITTEE

The Audit Committee is composed of three independent Directors, Messrs. McWilliams, Dumler and Kiser, who meet the independence and financial literacy requirements as defined by applicable NASDAQ® and SEC rules. The Audit committee acts pursuant to a written charter initially adopted in May 2000, which was amended in July 2003. A copy of the Audit Committee Charter, as amended, is attached as “APPENDIX A”. The Audit Committee is responsible for assessing the information provided by the Company’s management and the independent auditors in accordance with its business judgment. Management is responsible for preparing the Company’s financial statements and the quality and integrity of the reporting process, including the system of internal controls. The Company’s independent auditors, Ernst & Young, are responsible for expressing an opinion on the conformity of the financial statements with generally accepted accounting principles.

In fulfilling its oversight responsibilities, the Audit Committee has reviewed and discussed the audited financial statements in the Annual Report on Form 10-K for the year ended September 30, 2003 with both management and the independent auditors. The Audit Committee’s review included a discussion of the quality and integrity of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements.

The Audit Committee discussed with the Company’s independent auditors the overall scope and plan of Ernst & Young’s audit. In addition, it met with the independent auditors, with and without management present, to discuss the results of Ernst & Young’s examination, the evaluation of the Company’s system of internal controls, the overall quality of the Company’s financial reporting and such other matters as are required to be discussed under generally accepted auditing standards.

The Audit Committee has discussed with Ernst & Young that firm’s independence from management and the Company, including the matters in the written disclosures and the letter required by the Independence Standards Board Standard No. 1. The Audit Committee has also considered the compatibility of nonaudit services with the auditors’ independence.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board, and the Board has approved, that the audited financial statements be included in the Annual Report on Form 10-K for the year ended September 30, 2003 for filing with the Securities and Exchange Commission. The Audit Committee and the Board have also recommended, subject to stockholder ratification, the reappointment of the Company’s independent auditors.

In addition, the Audit Committee reviews on a regular basis the Company’s compliance with the provisions of the Sarbanes-Oxley Act of 2002 and related proposed SEC and NASDAQ® rules.

By the Audit Committee of the Board of Directors:

D. Bradley McWilliams, Audit Committee Chair Richard J. Dumler, Audit Committee Member David B. Kiser, Audit Committee Member |

10

REPORT OF COMPENSATION COMMITTEE

Introduction

The Company’s compensation program for executive officers is administered by the Compensation Committee, which is composed of three non-employee, independent members of the Board, Messrs. Dumler, Portner and Rubinovitz. The Compensation Committee, which held five meetings during fiscal year 2003, is responsible for establishing and administering the policies that govern both annual compensation and equity ownership. It administers the Company’s stock option plans, approves stock option awards, recommends to the Board the annual salaries and bonuses of the Company’s executive officers and makes recommendations to the Board with regard to the adoption of any new employee stock benefit plans.

The Company’s executive compensation program reflects input from the Company’s Chief Executive Officer. The Compensation Committee reviews his proposals concerning executive compensation and makes a final determination concerning the scope and nature of compensation arrangements. The actions of the Compensation Committee are reported to the full Board of the Company.

Kronos believes it important that its stockholders understand the Company’s philosophy regarding executive compensation, and how this philosophy manifests itself in the Company’s various compensation plans.

Philosophy

All of Kronos’ compensation programs are designed to attract and retain key employees, motivating them to achieve and rewarding them for superior Company performance. Different programs are geared to short and longer term performance with the goal of increasing stockholder value over the long term.

Executive compensation programs impact all employees by setting general levels of compensation and helping to create an environment of goals, rewards and expectations. Because Kronos believes the performance of every employee is important to the success of the Company, it is mindful of the effect of its executive compensation and incentive programs on all employees.

The Compensation Committee believes that the compensation of Kronos’ executives should reflect their success in attaining key operating objectives, such as growth of sales, growth of operating earnings and earnings per share and growth or maintenance of market share and long-term competitive advantage, and ultimately, in attaining an increased market price for the Company’s stock. The Compensation Committee believes that the performance of Kronos’ executives in the management of the Company, considered in the light of general economic and specific company, industry and competitive conditions, should be the basis for the determination of executive compensation, bonuses and stock option awards. It believes executive compensation should not be based on the short-term performance of the Company’s stock, whether favorable or unfavorable, but rather that the price of the Company’s stock will, in the long-term, reflect the operating performance of the Company, and ultimately, the management of the Company by its executives. The Company seeks to have the long-term performance of the Company’s stock reflected in executive compensation through the Company’s stock option and other equity incentive programs.

Programs

Kronos currently has three major components to its executive compensation plans: salary, bonus and stock option and other equity incentive programs.

Salary

The Compensation Committee reviews each executive officer’s salary annually. In determining appropriate salary levels for executives, the Compensation Committee primarily takes into account salary compensation at

11

comparably sized companies in the electronics and software industries. To track this, the Compensation Committee relies on salary surveys conducted by third parties and its own knowledge of compensation at companies in the greater Boston metropolitan area.

The Compensation Committee’s goal is to establish base salary compensation in the upper half of the range of salaries for executive officers with comparable qualifications, experience and responsibilities at other companies in the same or similar businesses and of comparable size and success, but not at the highest levels. The Company believes this gives it the opportunity to attract and retain talented managerial employees both at the level of Vice President and below. At the same time, this level of salary allows the Company to have a bonus plan based on performance without raising executive compensation beyond levels which the Company believes are appropriate.

Bonus

Kronos’ cash bonus plan is designed to reward its executives for the achievement of shorter-term Company financial goals, principally increases in the Company’s pre-tax income. The Company’s philosophy is to reward its executives as a group if the Company’s goals are achieved. The bonus payable for fiscal 2003 ranged from 20% to 60% of base salary, depending on the achievement of financial goals, including the level of pre-tax income achieved by the Company. The Company believes this level of award strikes the right balance between incentive and reward, without offering undue incentives to management to make short-term decisions that could be harmful to the Company in the long run. Early in the Company’s fiscal year, the Compensation Committee sets guidelines for the awards based upon achievement of financial goals, including the level of pre-tax income, and based upon its own assessment of the ability of the Company to achieve the Company’s annual financial plan, in light of economic conditions and other factors. It is the general philosophy of the Compensation Committee that management be rewarded for their performance as a team in the attainment of these goals, rather than individually.

While the cash bonus plan is based on the attainment of certain financial goals, awards under the plan for any individual or the officers as a group are entirely at the discretion of the Compensation Committee, which may choose to award the bonus or not, in light of all relevant factors after completion of the Company’s fiscal year.

Stock Option and Equity Incentive Programs

The Company intends that its stock option program be its primary vehicle for offering long-term incentives and rewarding its executives and key employees. Kronos believes that the granting of stock options is the compensation mechanism that works most effectively to align the interests of the Company’s management and stockholders. The goal of the program has been to enable members of the program to participate in the success of the Company commensurate with their contributions. Kronos desires that its executives achieve a meaningful equity stake in the Company through their participation in the option program.

The Compensation Committee and the Board of Directors are mindful of well publicized abuses of such incentive plans at other companies. Thus, Kronos’ options vest in four equal annual installments. Also, Kronos generally awards options to key employees over an extended period of years rather than grant huge numbers of options at any one time. This gives optionees an interest in the longer term success of the Company rather than focusing them on the performance of Kronos for any particular period.

The Committee is also mindful of the cost of this program, as it serves to dilute the ownership interest of its shareholders. Accordingly, the duration of options granted are set at 4 1/2 years, somewhat shorter than normal. Further, the proceeds from the exercise of options are available for the Company’s stock repurchase program. Thus, for example, if options are exercised after the Company’s stock has doubled and these proceeds are used to repurchase Kronos stock, the dilution from granting the stock options is reduced by half.

12

Stock options are granted to key employees based upon prior performance, the importance of retaining their services for the Company and the potential for their performance to help the Company attain its long-term goals. However, there is no set formula for the award of options to individual executives or employees. Stock options are generally granted annually in conjunction with the Compensation Committee’s formal review of the individual performance of its key executives, including its Chief Executive Officer, and their contributions to the Company.

In each of the past three fiscal years, Kronos has granted on average options to purchase 4.3% of the Company’s outstanding shares on a fully-diluted basis. Of this amount, approximately half have been granted to the Company’s executive officers and key managers, and the balance to other key employees. During fiscal year 2003, 532 employees received stock option awards, including the named executive officers who received options to acquire 300,000 shares or 24.1% of the total options granted in fiscal 2003.

In connection with the Company’s stock option plans, participants may use shares to exercise their options or to pay taxes at the applicable statutory minimum rate on nonstatutory options. The purpose of this program is to encourage the officers to hold rather than sell their Kronos shares.

The Employee Stock Purchase Plan is designed to appeal primarily to non-executive Kronos employees and is not intended to be a meaningful element in executive compensation.

Summary of Compensation of Chief Executive Officer

In fiscal year 2003, Mark S. Ain, the Company’s Chief Executive Officer, received a salary of $472,812 and bonus compensation of $216,660. In deciding whether or not bonus compensation would be paid for fiscal year 2003, the Compensation Committee reviewed whether certain of the Company’s financial goals established at the beginning of fiscal year 2003 had been attained. On November 21, 2003, Mr. Ain was granted a nonstatutory option to purchase 88,500 shares of common stock at a price of $38.81 per share, the fair market value on the date of the grant, based on Mr. Ain’s performance in fiscal year 2003. This option vests and becomes exercisable at the rate of 22,125 shares per year, beginning on the first anniversary date of the grant and each one year anniversary thereafter for the ensuing three years. In determining the number of shares covered by the options granted to Mr. Ain, the Compensation Committee evaluated Mr. Ain’s prior performance, the importance of retaining his services for the Company, and his potential to help the Company attain its long-term goals.

Section 162(m) of the Code generally disallows a tax deduction to public companies for compensation in excess of $1 million paid to the corporation’s Chief Executive Officer and four other most highly paid executive officers. Qualifying performance-based compensation will not be subject to the deduction limitation if certain requirements are met. The Compensation Committee periodically reviews the potential consequences of Section 162(m) and may structure the performance-based portion of its executive compensation to comply with certain exemptions in Section 162(m). However, the Compensation Committee reserves the right to use its judgment to authorize compensation payments that do not comply with the exemptions in Section 162(m) when the Compensation Committee believes that such payments are appropriate and in the best interests of the stockholders, after taking into consideration changing business conditions or the officer’s performance.

By the Compensation Committee of the Board of Directors:

Richard J. Dumler, Compensation Committee Chair Lawrence Portner, Compensation Committee Member Samuel Rubinovitz, Compensation Committee Member |

13

Executive Compensation

Summary Compensation. The following table sets forth certain information with respect to the annual and long term compensation of the Company’s Chief Executive Officer and each of the four other most highly compensated executive officers during the three fiscal years ended September 30, 2001, 2002 and 2003 who were serving as executive officers on September 30, 2003 (the “Named Executive Officers”).

SUMMARY COMPENSATION TABLE

Name and Principal Position | Annual Compensation | Long-Term Compensation | |||||||||||||

| Year | Salary ($) | Bonus ($) | Other Annual Compensation ($)(1) | Awards Securities Underlying Options (#) | All Other Compensation ($)(2) | ||||||||||

Mark S. Ain CEO and Chairman | 2003 2002 2001 | $

| 472,812 456,750 428,000 | $

| 216,660 236,600 192,600 | — — — | 90,000 103,500 67,500 | $

| 2,000 2,000 2,000 | ||||||

Paul A. Lacy Exec. V.P. and Chief Financial and Administrative Officer | 2003 2002 2001 |

| 286,096 256,377 225,000 |

| 131,100 143,000 101,250 | — — | 60,000 67,500 49,500 |

| 2,000 2,000 2,000 | ||||||

Aron J. Ain Exec. V.P. and Chief | 2003 2002 2001 |

| 286,096 256,377 225,000 |

| 131,000 143,000 101,250 | — — — | 60,000 67,500 49,500 |

| 2,000 2,000 2,000 | ||||||

Peter C. George V.P., Engineering | 2003 2002 2001 |

| 254,977 241,147 225,000 |

| 116,840 127,400 101,250 | — — — | 45,000 54,000 33,750 |

| 2,000 2,000 2,000 | ||||||

James Kizielewicz V.P., Marketing | 2003 2002 2001 |

| 254,977 238,383 204,000 |

| 116,840 127,400 91,800 | — — — | 45,000 54,000 33,750 |

| 2,000 2,000 2,000 | ||||||

| (1) | In accordance with the rules and regulations of the SEC, other compensation in the form of perquisites and other personal benefits have been omitted in instances where such perquisites and other personal benefits constituted less than the lesser of $50,000 or 10% of the total annual salary and bonus for each Named Executive Officer. |

| (2) | Amounts shown represent matching contributions made by the Company to its 401(k) Savings Plan on behalf of the Named Executive Officers. |

14

Option Grants and Exercises

The following tables summarize option grants and exercises during the fiscal year ended September 30, 2003 to the Named Executive Officers and the value of the options held by such persons at the end of fiscal year 2003.

OPTION GRANTS IN LAST FISCAL YEAR

| Individual Grants | ||||||||||||||||

Name | Number of Options | Percent of Total Options Granted to Employees in Fiscal Year(2) | Exercise Price ($/Sh)(3) | Expiration Date | Potential Realizable Value at Assumed | |||||||||||

| 5% ($) | 10% ($) | |||||||||||||||

Mark S. Ain | 90,000 | 7.2 | % | $ | 16.57 | 04/07/07 | $ | 366,775 | $ | 801,444 | ||||||

Paul A. Lacy | 60,000 | 4.8 | % | 16.57 | 04/07/07 | 244,517 | 534,296 | |||||||||

Aron J. Ain | 60,000 | 4.8 | % | 16.57 | 04/07/07 | 244,517 | 534,296 | |||||||||

Peter C. George | 45,000 | 3.6 | % | 16.57 | 04/07/07 | 183,388 | 400,722 | |||||||||

James Kizielewicz | 45,000 | 3.6 | % | 16.57 | 04/07/07 | 183,388 | 400,722 | |||||||||

| (1) | Each option vests in four equal annual installments commencing one year from the date of grant. |

| (2) | Based on an aggregate of 1,242,600 shares subject to options granted to employees of the Company in fiscal 2003. |

| (3) | The exercise price of each option was equal to the fair market value of the Company’s common stock on the date of grant as reported by The NASDAQ National Market®. |

| (4) | Amounts represent hypothetical gains that could be achieved for the respective options if exercised at the end of the option term. These gains are based on assumed rates of stock appreciation of 5% and 10% compounded annually from the date the respective options were granted to their expiration date [and are shown net of the option exercise price, but do not include deductions for taxes or other expenses associated with the exercise of the options or the sale of the underlying shares.] Actual gains, if any, on stock option exercises will depend on the future performance of the common stock, the optionholder’s continued employment with the Company through the option vesting period and the date on which the options are exercised. |

15

The following table sets forth information with respect to options to purchase the Company’s common stock granted to Named Executive Officers, including (i) the number of shares of common stock purchased upon exercise of options during the fiscal year ended September 30, 2003; (ii) the net value realized upon such exercise; (iii) the number of unexercised options outstanding as of September 30, 2003; and (iv) the value of such unexercised options as of September 30, 2003:

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END OPTION VALUES

Name | Shares Acquired on Exercise (#) | Value Realized ($)(1) | Number of Securities Underlying Unexercised Options at Fiscal Year-End (#) | Value of Unexercised In- The-Money Options at Fiscal Year-End ($)(2) | ||||||

Exercisable/ Unexercisable | Exercisable/ Unexercisable | |||||||||

Mark S. Ain | 101,250 | $ | 1,890,675 | 144,000/229,500 | $ | 2,688,360/4,154,130 | ||||

Paul A. Lacy | 102,375 | 1,920,668 | 16,875/147,750 | 262,894/2,658,874 | ||||||

Aron J. Ain | 116,438 | 2,147,980 | 2,813/147,750 | 16,706/2,658,874 | ||||||

Peter C. George | 25,875 | 459,189 | 54,000/110,250 | 1,056,660/1,997,310 | ||||||

James Kizielewicz | 58,500 | 1,118,055 | 2,250/112,500 | 13,365/2,013,930 | ||||||

| (1) | Represents the difference between the exercise price and the fair market value of the common stock on the date of exercise. |

| (2) | Based on the fair market value of the common stock on September 30, 2003 ($35.27), the last day of the Company’s 2002 fiscal year, less the option exercise price. |

Employment Contracts and Retention Agreements

Kronos currently has no employment contracts with any of its employees, including those executives named in the Summary Compensation Table. In October 2000, Kronos adopted and entered into retention agreements with each of the executives named in the Summary Compensation Table, with the exception of Mr. George, with whom Kronos entered into a retention agreement in February 2002. Under these agreements, each executive is eligible to receive, if his or her employment with Kronos is terminated by the Company for reasons other than for cause (as defined in the retention agreement) or by the executive for good reason (as defined in the retention agreement), within 12 months following a change in control of Kronos, a cash payment equal to three times the sum of the executive’s highest base salary (or in the case of Mr. George, a cash payment equal to one times his highest base salary) and highest bonus, received in any year for the five-year period prior to such change in control. The executive has the option to receive this cash payment in one lump sum or in 36 equal monthly installments. Except with respect to Mr. George, in the event an executive’s termination occurs after 12 months following a change in control, the executive is eligible to receive a cash payment equal to two times the sum of the executive’s highest base salary and highest bonus, received in any year for the five-year period prior to the change in control. The retention agreements also provide that the Company will continue to provide benefits to the executives for a period of one year after the date of his or her termination.

16

COMPARATIVE STOCK PERFORMANCE

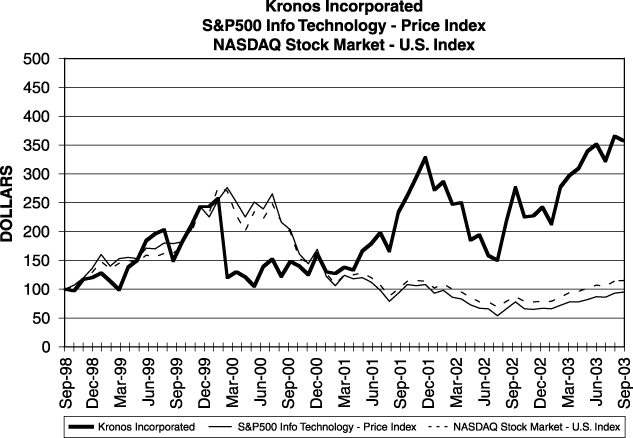

The following graph compares the cumulative total stockholder return on the Company’s common stock with the cumulative return of (i) the NASDAQ® Stock Market—U.S. Index (the “NASDAQ® Composite Index”), and (ii) the S&P500 Info Technology—Price Index during the five-year period ended September 30, 2003. The graph assumes the investment of $100 in the Company’s common stock, the NASDAQ® Composite Index and the S&P500 Info Technology—Price Index and assumes dividends are reinvested. Measurement points are the last days of the Company’s fiscal years ended September 30, 1999, 2000, 2001, 2002 and 2003 and the last trading days of each of the other months in the Company’s 1999, 2000, 2001, 2002 and 2003 fiscal years.

17

PROPOSAL II

APPROVAL OF AMENDMENT TO THE 2002 STOCK INCENTIVE PLAN

In the opinion of the Board of Directors, the future success of the Company depends, in large part, on its ability to attract, retain and motivate key employees with experience and ability in today’s intensely competitive market. Under the Company’s 2002 Plan, the Company is currently authorized to grant incentive stock options and non-statutory stock options to purchase up to an aggregate of 2,550,000 shares of Common Stock. As of December 12, 2003, 2,465,213 shares of Common Stock had been issued, or are reserved for issuance, pursuant to awards granted under the 2002 Plan to employees and Directors of the Company; the Company estimates that the remaining 84,787 shares available for issuance under the 2002 Plan will not be sufficient to meet the Company’s needs for the duration of the 2002 Plan, which expires by its terms in 2012. This is the only stock option plan under which the Company can currently issue any awards, other than the Company’s 2003 Employee Stock Purchase Plan. All awards granted under the 2002 Plan have been in the form of non-statutory stock options.

Accordingly, on October 31, 2003 the Board of Directors voted, subject to stockholder approval, to amend the 2002 Plan to increase from 2,550,000 to 5,000,000 the number of shares available for issuance under the 2002 Plan (subject to adjustment for certain changes in the Company’s capitalization). If the stockholders do not approve the proposed amendment, the Company’s ability to grant any further options or make any further awards of stock under the 2002 Plan will be significantly curtailed, which will adversely impact the Company’s ability to attract, retain and motivate current and prospective employees.

Description of the 2002 Plan

The following is a brief summary of the 2002 Plan and this summary is qualified in its entirety by reference to the 2002 Plan, a copy of which is attached to this Proxy Statement as Appendix B and to the electronic copy of this Proxy Statement filed with the SEC, which may be accessed from the SEC’s home page (www.sec.gov). In addition, a copy of the 2002 Plan may be obtained upon request by writing or calling the Company at 297 Billerica Road, Chelmsford, Massachusetts 01824, Attention: Investor Relations or by calling 978-250-9800.

Types of Options; Vesting

The 2002 Plan provides for the grant of incentive stock options intended to qualify under Section 422 of the Internal Revenue Code of 1986, as amended (the “Code”), and non-statutory stock options (collectively, “Options”). Participants (as defined below) receive the right to purchase a specified number of shares of Common Stock at a specified option price and subject to such other terms and conditions as are specified in connection with the Option grant. Options may be granted at an exercise price which may be equal to or greater than the fair market value of the Common Stock on the date of grant. Present law requires that incentive stock options and options intended to qualify as performance-based compensation under Section 162(m) of the Code be granted at an exercise price at least equal to 100% of the fair market value of the Common Stock on the date of grant (or at least equal to 110% of the fair market value in the case of incentive stock options granted to Participants holding more than 10% of the total combined voting power of the Company). Options may not be granted for a term in excess of ten years. The 2002 Plan permits the following forms of payment upon the exercise of Options:

| • | payment by cash, check or in connection with a “cashless exercise” through a broker, |

| • | surrender to the Company of shares of Common Stock owned by a Participant (as defined below) for at least six months; or |

| • | any combination of these forms of payment. |

18

The Board, in its sole discretion, may grant an option that becomes exercisable at such times and in such installments as may be determined by the Board.

Eligibility to Receive Options

Employees, officers, directors, consultants, advisors and other entities of the Company and its subsidiaries and of other business ventures in which the Company has a significant interest are eligible to be granted Options under the 2002 Plan (each a “Participant”). Under present law, however, incentive stock options may only be granted to employees of the Company. The maximum number of shares with respect to which Options may be granted to any Participant under the 2002 Plan may not exceed 337,500 shares per calendar year.

Plan Benefits

As of September 30, 2003, approximately 2,300 persons were eligible to receive Options under the 2002 Plan, including the Company’s eight executive officers and six non-employee directors. The granting of Options under the 2002 Plan is discretionary, and the Company cannot now determine the number or type of Options to be granted in the future to any particular person or group.

On December 12, 2003, the last reported sale price of the Company’s Common Stock on NASDAQ National Market® was $40.55.

Since adoption of the 2002 Plan in February 2002, the following options have been granted under the 2002 Plan to the following persons and groups:

Optionee(s) | No. of Options Granted | |

Named Executive Officers: Mark S. Ain, CEO and Chairman Paul A. Lacy, Exec. V.P., Chief Financial and Admin. Officer Aron J. Ain, Exec. V.P and Chief Operating Officer Peter C. George, V.P, Engineering and Chief Technology Officer James Kizielewicz, V.P., Marketing and Corporate Strategy | 103,500 71,250 71,250 54,000 54,000 | |

All Current Executive Officers as a Group | 489,000 | |

All Current Directors who are not Executive Officers as a Group | 47,250 | |

Each Director Nominee | ||

Richard J. Dumler | 6,750 | |

Samuel Rubinovitz | 6,750 | |

Each Associate of any of such Directors, Executive Officers or Nominees | — | |

Each Other Person who Received or is to Receive Five Percent of options under the 2002 Plan | — | |

All Employees, including all Current Officers who are not Executive Officers, as a Group | 820,575 | |

Administration

The 2002 Plan is administered by the Board of Directors. The Board of Directors has the authority to adopt, amend and repeal the administrative rules, guidelines and practices relating to the 2002 Plan and to interpret the provisions of the 2002 Plan. Pursuant to the terms of the 2002 Plan, the Board of Directors may delegate authority under the 2002 Plan to one or more committees or subcommittees of the Board of Directors consisting of not less than two members who shall be “outside directors” within the meaning of Section 162(m) of the Code and “non-employee directors” as defined under Rule 16-b3 promulgated under the Exchange Act. The Board of Directors has authorized the Compensation Committee to administer certain aspects of the 2002 Plan, including the granting of options to executive officers.

19

Subject to any applicable limitations contained in the 2002 Plan, the Board of Directors, the Compensation Committee, or any other committee to whom the Board of Directors delegates authority, as the case may be, selects the recipients of Options and determines:

| • | the number of shares of Common Stock covered by options and the dates upon which such options become exercisable; |

| • | the exercise price of options (which may not be less than 100% of fair market value of the Common Stock); and |

| • | the duration of options (which may not exceed 10 years). |

If any Option expires or is terminated or surrendered the unused shares of Common Stock covered by such Option will again be available for grant under the 2002 Plan, subject, however, in the case of incentive stock options, to any limitations under the Code.

Transferability of Options

Options generally may not be sold, assigned, transferred, pledged or otherwise encumbered by the Participant, except by will or the laws governing descent. However, with the approval of the Board, a Participant may transfer a nonstatutory stock option for no consideration to the Participant’s immediate family or a trust for the benefit of the Participant’s immediate family. In the event of any such transfer the transferee shall remain subject to all the terms and conditions applicable to the stock option agreement.

Forfeiture Provision

In the event that a Participant terminates his or her employment with the Company for any reason whatsoever and, within twenty-four months for Participants in the fields of research and development, engineering, testing, strategic planning or any phase of management or within twelve months for Participants in all other fields, such Participant:

| • | accepts employment with any competitor of, or otherwise engages in competition with, the Company; or |

| • | attempts to induce, directly or indirectly, any employee of the Company to accept employment elsewhere; |

the Board of Directors, in its sole discretion, may require the Participant to return, or (if not received) to forfeit, to the Company the economic value of an Option which is realized or obtained (measured at the date of exercise or vesting) by such Participant during the twelve months prior to the date of such Participant’s termination of employment with the Company.

Changes in Employment Status

In the event a Participant’s employment or service terminates by reason of death, the Participant’s legal representatives may exercise his or her Options for such number of shares that were vested on the date of death until the earlier of two years following the date of death or the expiration date of the applicable Options. If a Participant’s employment or service to the Company terminates by reason of disability, the Participant may exercise his or her Options for such number of shares as were vested on the date of termination until the earlier of one year following the date of termination or the expiration date of the applicable Options.

In the event a Participant’s employment or service to the Company terminates due to the Participant’s retirement, the Participant may exercise his or her Options for such number of shares as were vested on the date of termination until the earlier of three months following the date of termination or the expiration date of the

20

applicable Options, provided, that, if the retiring Participant is at least 60 years of age and has been continuously employed by the Company for at least 10 years, the Participant will be entitled to additional acceleration of vesting and an extended period in which to exercise his or her Options after the termination date as provided for in the 2002 Plan.

In the event a Participant’s employment or service to the Company terminates for Cause (as defined in the 2002 Plan) all Options then held by the Participant shall immediately terminate, provided, that, the Board may allow, in its discretion, the Participant to exercise his or her Options for such number of shares that were vested on the date of termination for a period of time as determined by the Board of Directors.

If a Participant’s employment or service to the Company is interrupted due to a leave of absence (whether paid or unpaid), all Options held by such Participant will cease to vest for the period of such leave of absence and will resume vesting upon return of the Participant to full employment or service to the Company.

In the event a Participant’s status with the Company terminates for reasons other than those outlined above, such Participant may exercise his or her Options for such number of shares that were vested on the date of such change in status until the earlier of three months after the date of such change in status or the expiration date of the applicable Options.

Adjustments for Changes in Common Stock and Other Events

Upon the occurrence of any stock split, reverse stock split, stock dividend, recapitalization, combination of shares, reclassification of shares, spin-off or other similar change in the Company’s capitalization, each Option under the 2002 Plan shall be appropriately adjusted to reflect any such event if the Board of Directors determines in good faith that an adjustment is necessary or appropriate.

In the event of a proposed liquidation or dissolution of the Company all unexercised Options shall become immediately exercisable in full at least 10 business days prior to the effective date of such proposed liquidation or dissolution and, upon the effectiveness of such an event, all remaining outstanding Options shall terminate if not exercised.

Reorganization Events and Change in Control Events

Upon the occurrence of a Reorganization Event (as defined in the 2002 Plan), or the signing of an agreement with respect to a Reorganization Event, all outstanding Options will be assumed or an equivalent option substituted by the successor corporation, provided that if such Reorganization Event also constitutes a Change in Control Event (as defined in the 2002 Plan) one-half of the unvested shares subject to each Option shall become immediately exercisable and the remaining one-half of such shares will continue to vest in accordance with each Option’s original vesting schedule. If on or prior to the one year anniversary of a Reorganization Event a Participant’s employment with the Company or its succeeding corporation is terminated by such Participant for Good Reason (as defined in the 2002 Plan) or is terminated by the Company for Cause (as defined in the 2002 Plan), all Options held by such Participant shall become immediately exercisable.

In the event the acquiring or succeeding corporation in a Reorganization Event does not agree to assume, or substitute for, outstanding Options, then the Board of Directors must either accelerate the Options to make them fully exercisable prior to consummation of the Reorganization Event or provide for a cash out of the value of any outstanding Options.

Upon the occurrence of a Change in Control Event that does not also qualify as a Reorganization Event, the vesting schedule of each outstanding Option shall be accelerated in part so that one-half of the unvested shares

21

subject to each Option shall become immediately exercisable and the remaining one-half of such shares will continue to vest in accordance with each Option’s original vesting schedule.

Amendment or Termination

No Option may be granted under the 2002 Plan after the completion of ten years from the date the 2002 Plan is approved by the Company’s stockholders, but Options previously granted may extend beyond that date. The Board of Directors may at any time amend, suspend or terminate the 2002 Plan, except that:

| • | no Option designated as subject to Section 162(m) of the Code by the Board of Directors after the date of such amendment shall become exercisable, realizable or vested (to the extent such amendment was required to grant such Option) unless and until such amendment shall have been approved by the Company’s stockholders; |

| • | no amendment may increase the limitations on the number of shares available for grant under the 2002 Plan or allow for below market price grants of Options without stockholder approval; |

| • | no amendment may amend the limitation on option repricing in the 2002 Plan without stockholder approval; and |

| • | no amendment may provide for awards under the 2002 Plan other than stock options without stockholder approval. |

Federal Income Tax Consequences of 2002 Plan

The following is a summary of the United States federal income tax consequences that generally will arise with respect to Options granted under the 2002 Plan. This summary is based on the federal tax laws in effect as of the date of this proxy statement. Changes to these laws could alter the tax consequences described below.

Incentive Stock Options

In general, a Participant will not recognize taxable income upon the grant or exercise of an incentive stock option. Instead, a Participant will recognize taxable income with respect to an incentive stock option only upon the sale of Common Stock acquired through the exercise of the option (“ISO Stock”). The exercise of an incentive stock option, however, may subject the Participant to the alternative minimum tax.

Generally, the tax consequences of selling ISO Stock will vary depending on the date on which it is sold. If the Participant sells ISO Stock more than two years from the date the Option was granted (the “Grant Date”) and more than one year from the date the Option was exercised (the “Exercise Date”), then the Participant will recognize long-term capital gain in an amount equal to the excess of the sale price of the ISO Stock over the exercise price.

If the Participant sells ISO Stock prior to satisfying the above waiting periods (a “Disqualifying Disposition”), then all or a portion of the gain recognized by the Participant will be ordinary compensation income and the remaining gain, if any, will be a capital gain. This capital gain will be a long-term capital gain if the Participant has held the ISO Stock for more than one year prior to the date of sale.

If a Participant sells ISO Stock for less than the exercise price, then the Participant will recognize capital loss in an amount equal to the excess of the exercise price over the sale price of the ISO Stock. This capital loss will be a long-term capital loss if the Participant has held the ISO Stock for more than one year prior to the date of sale.

Non-statutory Stock Options

As in the case of an incentive stock option, a Participant will not recognize taxable income upon the grant of a non-statutory stock option. Unlike the case of an incentive stock option, however, a Participant who exercises a

22

non-statutory stock option generally will recognize ordinary compensation income in an amount equal to the excess of the fair market value of the Common Stock acquired through the exercise of the option (“NSO Stock”) on the Exercise Date over the exercise price.

With respect to any NSO Stock, a Participant will have a tax basis equal to the exercise price plus any income recognized upon the exercise of the Option. Upon selling NSO Stock, a Participant generally will recognize capital gain or loss in an amount equal to the difference between the sale price of the NSO Stock and the Participant’s tax basis in the NSO Stock. This capital gain or loss will be a long-term gain or loss if the Participant has held the NSO Stock for more than one year prior to the date of the sale.

Tax Consequences to the Company

The grant of an Option under the 2002 Plan generally will have no tax consequences to the Company. Moreover, in general, neither the exercise of an incentive stock option nor the sale of any Common Stock acquired under the 2002 Plan will have any tax consequences to the Company. The Company or its parent or subsidiary, as the case may be, generally will be entitled to a business-expense deduction, however, with respect to any ordinary compensation income recognized by a Participant under the 2002 Plan, including as a result of the exercise of a non-statutory stock option or a Disqualifying Disposition. Any such deduction will be subject to the limitations of Section 162(m) of the Code.

23

PROPOSAL III

RELATIONSHIP WITH INDEPENDENT AUDITORS

Ernst & Young has served as the Company’s independent auditors since 1979. Although stockholder approval of the Board’s selection of Ernst & Young is not required by law, the Board believes that it is advisable to give stockholders an opportunity to ratify this selection. If this proposal is not approved at the Annual Meeting, the Board will reconsider its selection of Ernst & Young.

Representatives of Ernst & Young are expected to be present at the Annual Meeting. They will have the opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions from stockholders.

The Board recommends a vote “FOR” the approval of Ernst & Young as the Company’s independent auditors for the fiscal year ending September 30, 2004.

Audit Fees

The aggregate fees billed by Ernst & Young LLP for the annual audit, the reviews of financial statements included in the Company’s Quarterly Reports on Form 10-Q, and services provided by Ernst & Young LLP in connection with any statutory and regulatory filings or engagements for the fiscal years ended September 30, 2003 and 2002, were $619,000 and $442,000, respectively.

Audit-Related Fees

The aggregate fees billed by Ernst & Young LLP for assurance and related services by Ernst & Young LLP that are reasonably related to the performance of the audit or review of the Company’s financial statements and are not described above under “Audit Fees” for the fiscal years ended September 30, 2003 and 2002, were $37,000 and $53,000, respectively. These services included the implementation of new accounting standards, accounting for revenue transactions, services related to acquisition due diligence, and assistance with internal control reporting.

Tax Fees

The aggregate fees billed by Ernst & Young LLP for professional services related to tax compliance, tax advice, and tax planning for the fiscal years ended September 30, 2003 and 2002, were $431,000 and $148,000, respectively. These services included assistance with tax audits and appeals, review and signature of federal tax return filings and related disclosures, periodic research, consultation, and projects on matters that arose during the fiscal year regarding compliance and filings required under federal laws, assistance and review of international tax return filings and related disclosures, and periodic research, consultation, and projects on matters that arose during the fiscal year regarding compliance and filings required under international laws, as well as other tax advisory and planning services.

All Other Fees

In fiscal years 2003 and 2002, Ernst & Young LLP did not bill the Company for any products or services other than as described above. Ernst & Young LLP did not provide any internal audit services or financial information system design and implementation services to the Company during fiscal years 2003 and 2002.

During fiscal years 2003 and 2002, the Audit Committee approved all non-audit services provided to the Company by its independent auditor prior to management engaging the auditor for that purpose. The committee’s current practice is to consider for approval, at its regularly scheduled quarterly meetings, all audit and non-audit services proposed to be provided by its independent auditor. In situations where a matter cannot wait until the next regularly scheduled committee meeting, the chairman of the committee has been delegated authority to consider and, if appropriate, approve audit and non-audit services or, if in the chairman’s judgment it is considered appropriate, to call a special meeting of the committee for that purpose. The committee determined that Ernst & Young LLP’s provision of audit-related and tax services are compatible with maintaining Ernst & Young LLP’s independence.

24

COMPLIANCE WITH SECTION 16(a) OF THE SECURITIES EXCHANGE ACT OF 1934

Section 16(a) of the Securities and Exchange Act of 1934, as amended (“Section 16(a)”) requires the Company’s directors, executive officers and persons who own more than ten percent of any registered class of the Company’s equity securities (“reporting persons”), to file with the SEC initial reports of beneficial ownership and reports of changes in beneficial ownership of Common Stock and other equity securities of Kronos. Reporting persons are required by SEC regulations to furnish Kronos with copies of all Section 16(a) reports they file.

Based solely on its review of copies of reports filed by reporting persons of Kronos under Section 16(a), and written representations from such reporting persons, Kronos believes that, except as follows, all filings required to be made by reporting persons of Kronos were timely filed for the year ended September 30, 2003 in accordance with Section 16(a). On December 8, 2003, Mark S. Ain, Chief Executive Officer and Chairman of the Board of Directors of Kronos, filed a report on Form 4 that was due to be filed on a Form 5 by November 14, 2003, reporting five transactions of gifts to charitable organizations.

HOUSEHOLDING OF ANNUAL MEETING MATERIALS