- MEOH Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Methanex (MEOH) 6-KCurrent report (foreign)

Filed: 27 Mar 23, 11:51am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

FOR THE MONTH OF MARCH 2023

COMMISSION FILE NUMBER 000-20115

METHANEX CORPORATION

(Registrant’s name)

SUITE 1800, 200 BURRARD STREET, VANCOUVER, BC V6C 3M1 CANADA

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

| Introduction | Voting | Business of the Meeting | About the Directors | Corporate Governance | Compensation | Other Information | |||||||

Notice of annual general meeting of shareholders

Items of business

The Meeting is being held for the following purposes: | MEETING INFORMATION

The Annual General Meeting (the “Meeting”) of the shareholders of Methanex Corporation (the “Company”) will be held at the following time and place:

Date and Time Thursday, April 27, 2023 10:00 am (Pacific Time)

Place In Person: 1800-200 Burrard Street Vancouver, British Columbia

Online via live audio webcast: https://web.lumiagm.com/236824419 Password: methanex2023 Please refer to the instructions in the accompanying Information Circular | |||

1 | Receive the Consolidated Financial Statements of the Company for the financial year ended December 31, 2022 and the Auditors’ Report on such statements; | |||

2 | Elect directors; | |||

3 | Reappoint the auditors and authorize the Board of Directors to fix the remuneration of the auditors; and | |||

4 | Consider and approve, on an advisory basis, a resolution to accept the Company’s approach to executive compensation disclosed in the accompanying Information Circular. | |||

Shareholders will also transact such other business as may properly come before the Meeting. | ||||

If you hold common shares of the Company and do not expect to attend the Meeting in person or online via the live audio webcast, please complete the enclosed proxy form and either fax it to 1 416 368 2502 or toll-free in North America to 1 866 781 3111 or forward it to TSX Trust Company using the envelope provided with these materials. Proxies must be received no later than 48 hours (excluding Saturdays, Sundays and holidays) before the time fixed for commencement of the Meeting or any postponement or adjournment thereof.

DATED at the City of Vancouver, in the Province of British Columbia, this 9th day of March, 2023.

BY ORDER OF THE BOARD OF DIRECTORS

Kevin Price

Senior Vice President, General Counsel & Corporate Secretary

Methanex 2023 Information Circular

|

1

|

| �� | ||||||||||||||

| Introduction | Voting | Business of the Meeting | About the Directors | Corporate Governance | Compensation | Other Information | |||||||

| 1 | ||||||||

| 3 | ||||||||

| 8 | ||||||||

| 8 | ||||||||

| 8 | ||||||||

| 10 | ||||||||

4. Advisory “say on pay” vote on approach to executive compensation | 13 | |||||||

| 16 | ||||||||

| 16 | ||||||||

| 27 | ||||||||

| 28 | ||||||||

| 30 | ||||||||

| 31 | ||||||||

| 31 | ||||||||

| 32 | ||||||||

| 37 | ||||||||

| 41 | ||||||||

| 42 | ||||||||

| 50 | ||||||||

| 60 | ||||||||

| 60 | ||||||||

| 63 | ||||||||

| 63 | ||||||||

| 64 | ||||||||

| 74 | ||||||||

| 87 | ||||||||

| 87 | ||||||||

| 89 | ||||||||

| 91 | ||||||||

| 93 | ||||||||

| 96 | ||||||||

| 96 | ||||||||

| 96 | ||||||||

| 96 | ||||||||

| 96 | ||||||||

| 97 | ||||||||

Securities authorized for issuance under equity compensation plans | 97 | |||||||

| 101 | ||||||||

| 101 | ||||||||

| 102 | ||||||||

| 103 | ||||||||

| Methanex Corporation Board Mandate and Corporate Governance Principles | 103 | |||||||

About Methanex

Methanex Corporation is the world’s largest producer and supplier of methanol to major international markets in Asia Pacific, North America, Europe and South America.

Our methanol production sites are located in the United States, New Zealand, Trinidad, Chile, Egypt and Canada. Methanex is headquartered in Vancouver, Canada, and the Company’s common shares trade on the Toronto Stock Exchange under the symbol MX and on the NASDAQ Global Select Market under the symbol MEOH.

Our majority-owned subsidiary, Waterfront Shipping, is a global marine transportation company specializing in the safe, responsible and reliable transport of methanol and clean petroleum products to major international markets in Asia Pacific, North America, Europe and South America. We operate Waterfront Shipping’s fleet of 30 vessels mostly through long-term time charters, with 50 per cent ownership of five of the 30 vessels.

Explore Methanex

To read more about Methanex, including our 2022 Sustainability Report, visit our website at www.methanex.com.

2

|

Methanex 2023 Information Circular

|

| Introduction | Voting | Business of the Meeting | About the Directors | Corporate Governance | Compensation | Other Information | |||||||

Information Circular

Information contained in this Information Circular is given as at March 9, 2023 unless otherwise stated.

SOLICITATION OF PROXIES

This Information Circular is provided in connection with the solicitation of proxies by or on behalf of the management and Board of Directors (the “Board”) of Methanex Corporation (the “Company”, “we” or “our”, as applicable) for use at the Annual General Meeting (the “Meeting”) of the shareholders of the Company to be held at the time and place (including any adjournment or postponement thereof) and for the purposes described in the accompanying Notice of Annual General Meeting of Shareholders.

It is anticipated that this Information Circular and the accompanying proxy form will be mailed on or about March 23, 2023 to holders of common shares of the Company (“Common Shares”).

NOTICE-AND-ACCESS

We use notice-and-access to deliver this Information Circular (the “Circular”) to our registered and non-registered shareholders. While you will still receive a form of proxy or voting instruction form in the mail so you can vote your shares, instead of receiving a paper copy of the Circular, you will receive a notice outlining the matters to be addressed at the meeting and explaining how you can access the Circular electronically and how to request a paper copy. Notice-and-access is environmentally friendly and cost effective as it reduces paper, printing and postage costs.

You may request a paper copy of the Circular, at no cost, at any time prior to the Meeting and up to one year from the date the Circular was filed on SEDAR (www.sedar.com).

Registered shareholders, or shareholders without a control number, may request a paper copy by calling (English) 1-844-916-0609 or from outside North America 1-303-562-9305 or (French) 1-844-973-0593 or from outside North America 1-303-562-9306. Non-registered shareholders may request a paper copy by visiting http://www.proxyvote.com or by calling 1-877-907-7643 (toll free in Canada and the United States) and entering the control number located on the voting instruction form provided to you and following the instructions. If you are calling from outside Canada or the United States, you can call (English) 1-303-562-9305 or (French) 1-303-562-9306 to request a paper copy of the Circular. If you request a paper copy of the Circular, you will not receive a new proxy form or voting instruction form with it, so you should keep the original form sent to you in order to vote.

HOW DO I ACCESS THE MEETING ONLINE?

Please refer to “Voting Online” (below) for instructions on how to access the Meeting online.

WHAT WILL BE VOTED ON AT THE MEETING?

Shareholders will be voting on those matters that are described in the accompanying Notice of Annual General Meeting of Shareholders. The Notice includes all the matters to be presented at the Meeting that are presently known to management. A simple majority (that is, greater than 50%) of the votes cast, in person, online via the live audio webcast or by proxy, will constitute approval of these matters, other than the election of directors and the appointment of auditors.

Methanex 2023 Information Circular

|

3

|

| Introduction | Voting | Business of the Meeting | About the Directors | Corporate Governance | Compensation | Other Information | |||||||

WHO IS ENTITLED TO VOTE?

Only registered holders of Common Shares (“Registered Shareholders”) at the close of business on February 27, 2023 (the “Record Date”) are entitled to vote at the Meeting or at any adjournment or postponement thereof. Each Registered Shareholder will have one vote for each Common Share held at the close of business on the Record Date. As at the date of this Information Circular, March 9, 2023, there were 68,701,783 Common Shares outstanding. To the knowledge of the directors and senior officers of the Company, the only person who beneficially owns, directly or indirectly, or exercises control or direction over, Common Shares carrying 10% or more of the voting rights of the Company is M&G Investment Management Limited (“M&G”). Based on information filed by M&G, M&G owned 13,950,086 Common Shares1 which represent 20.3% of the Common Shares outstanding as at March 9, 2023.

CAN I VOTE COMMON SHARES THAT I ACQUIRED AFTER THE RECORD DATE (FEBRUARY 27, 2023)?

No. Only Common Shares that are held by a shareholder at the close of business on the Record Date are entitled to be voted at the Meeting.

REGISTERED SHAREHOLDERS - HOW DO I VOTE?

If you are a Registered Shareholder, there are four ways in which you can vote your Common Shares. You can (1) vote by returning the proxy form prior to the Meeting; (2) vote online during the live audio webcast; (3) vote by proxy (the proxyholder can vote either online during the Meeting or in person); or (4) vote in person at the Meeting.

VOTING ONLINE

You can vote during the Meeting by online ballot through the live audio webcast platform.

You will need the latest versions of Chrome, Safari, Edge or Firefox. Please ensure your browser is compatible by logging in early. Please do not use Internet Explorer.

It is your responsibility to ensure internet connectivity for the duration of the Meeting and you should allow ample time to log in to the Meeting online before it begins.

Caution: Internal network security protocols including firewalls and VPN connections may block access to the Lumi platform for the Meeting. If you are experiencing any difficulty connecting or watching the meeting, ensure your VPN setting is disabled or use a computer on a network not restricted to security settings of your organization.

Registered shareholders and duly appointed proxyholders (including non-registered shareholders who have duly appointed themselves as a proxyholder) that attend the Meeting online will be able to vote by completing a ballot online during the Meeting through the live audio webcast platform.

| a. | Step 1: Log in online |

at https://web.lumiagm.com/236824419 |

| b. | Step 2: Follow these instructions: |

Registered shareholders: Click “I have a control number” and then enter your control number and password methanex2023 (case sensitive). The control number located on the form of proxy or in the email notification you received from the transfer agent, TSX Trust Company (“TSX Trust”), is your control number. If you use your control number to log in to the Meeting, any vote you cast at the Meeting will revoke any proxy you previously submitted. If you do not wish to revoke a previously submitted proxy, you should not vote during the Meeting.

Duly appointed proxyholders: Click “I have a control number” and then enter your control number and password methanex2023 (case sensitive). Proxyholders who have been duly appointed and registered with TSX Trust will receive a control number by email from TSX Trust after the proxy voting deadline has passed. To become a duly appointed proxyholder, please see “Voting by proxy - online during the Meeting” below.

VOTING BY PROXY - ONLINE DURING THE MEETING

For a proxyholder to vote online during the Meeting they must obtain a control number. To do this you must complete the additional step of registering the proxyholder by either calling TSX Trust at 1-866-751-6315 (within North America) or 1-647-252-9650 (outside of North America) by no later than 10:00am (PT) on Tuesday, April 25, 2023, or by completing the electronic

| (1) | This information was obtained by the Company from a Schedule 13G filing dated January 20, 2023 available at www.sec.gov. Shares beneficially owned by M&G, or over which M&G exercises control or direction, may include Common Shares owned by certain of its affiliates and associates. |

4

|

Methanex 2023 Information Circular

|

| Introduction | Voting | Business of the Meeting | About the Directors | Corporate Governance | Compensation | Other Information | |||||||

form (in English) at https://www.tsxtrust.com/control-number-request by 10:00am PT on Tuesday, April 25, 2023. TSX Trust will then provide the proxyholder with a control number by email after the proxy voting deadline has passed. The control number is the proxyholder’s username for the purposes of logging into the Meeting. Failing to register your proxyholder online will result in the proxyholder not receiving a control number, which is required to vote at the Meeting. Non-registered shareholders who have not duly appointed themselves as proxyholder will not be able to vote at the Meeting but will be able to participate as a guest.

VOTING BY PROXY - IN PERSON AT THE MEETING

If you do not plan to come to the Meeting, you can have your vote counted by appointing someone who will attend the Meeting as your proxyholder. In the proxy, you can either direct your proxyholder as to how you want your Common Shares to be voted or let your proxyholder choose for you. You can always revoke your proxy if you decide to attend the Meeting and wish to vote your Common Shares at the Meeting.

VOTING IN PERSON

Registered Shareholders who will attend the Meeting and wish to vote their Common Shares in person should not complete a proxy form. Your vote will be taken and counted at the Meeting. Please register with the transfer agent, TSX Trust, when you arrive at the Meeting.

WHAT IF I AM NOT A REGISTERED SHAREHOLDER?

Many shareholders are “non-registered shareholders.” Non-registered shareholders are shareholders whose shares are registered in the name of an intermediary (such as a bank, trust company, securities broker, trustee or custodian). Unless you have previously informed your intermediary that you do not wish to receive materials relating to the Meeting, you should receive or have already received from your intermediary either a request for voting instructions or a proxy form.

Intermediaries have their own mailing procedures and provide their own instructions to shareholders. These procedures may allow you to provide your voting instructions by telephone, on the Internet, by mail or by fax. You should carefully follow the directions and instructions received from your intermediary to ensure that your Common Shares are voted at the Meeting.

If you wish to vote in person at the Meeting, you should follow the procedure in the directions and instructions provided by or on behalf of your intermediary. Please register with the transfer agent, TSX Trust, when you arrive at the Meeting.

Non-registered shareholders who wish to vote online at the Meeting need to duly appoint themselves as a proxyholder to obtain a control number. A control number is required to be able to log in and vote online at the Meeting. Please refer to “Voting by proxy - online during the Meeting” above, for instructions on how to obtain a control number. Once a control number is obtained you will be able to log in to the Meeting and vote by completing a ballot online during the Meeting through the live audio webcast platform. Please refer to “Voting online” above for instructions on how to log in as a duly appointed proxyholder.

Non-registered shareholders who have not duly appointed themselves as proxyholder and do not have a control number will not be able to vote at the Meeting but will be able to participate as a guest. Please refer to “What if I don’t have a control number” below for instructions on how to attend the Meeting as a guest.

WHAT IF I DON’T HAVE A CONTROL NUMBER?

If you do not have a control number you can attend the Meeting as a guest. Log in as outlined in ‘Voting Online” above. Click “Guest” and then complete the online form. Guests (including non-registered shareholders who have not duly appointed themselves as proxyholder) will be able to listen to the Meeting but will not be able to vote during the Meeting.

WHAT IS A PROXY?

A proxy is a document that authorizes someone else to attend the Meeting and cast your votes for you. Registered Shareholders may use the proxy form, or any other valid proxy form, to appoint a proxyholder. The proxy form authorizes the proxyholder to vote and otherwise act for you at the Meeting, including any continuation after the adjournment or postponement of the Meeting.

If you are a Registered Shareholder and you complete the proxy, your Common Shares will be voted as instructed. If you do not mark any boxes, your proxyholder can vote your shares at their discretion. See “How will my Common Shares be voted if I give my proxy?” below.

Methanex 2023 Information Circular

|

5

|

| Introduction | Voting | Business of the Meeting | About the Directors | Corporate Governance | Compensation | Other Information | |||||||

HOW DO I APPOINT A PROXYHOLDER?

Your proxyholder is the person you appoint and name on the proxy form to cast your votes for you. You can choose anyone you want to be your proxyholder. Your proxyholder does not have to be another shareholder. Just fill in the person’s name in the blank space provided on the enclosed proxy form or complete any other valid proxy form and deliver it to TSX Trust within the time specified below for receipt of proxies.

If you leave the space on the proxy form blank, either Doug Arnell or Rich Sumner, both of whom are named in the form, are appointed to act as your proxyholder. Mr. Arnell is the Chair of the Board and Mr. Sumner is the President and Chief Executive Officer of the Company.

For the proxy to be valid, it must be completed, dated and signed by the Registered Shareholder (or the Registered Shareholder’s attorney as authorized in writing) and then delivered to the Company’s transfer agent, TSX Trust, in the envelope provided or by fax to 1 416 368 2502 or toll-free in North America to 1 866 781 3111 and received no later than 48 hours (excluding Saturdays, Sundays and holidays) prior to the Meeting or any adjournment or postponement thereof.

HOW WILL MY COMMON SHARES BE VOTED IF I GIVE MY PROXY?

If you have properly filled out, signed and delivered your proxy, then your proxyholder can vote your shares for you at the Meeting. If you have specified on the proxy form how you want to vote on a particular issue (by marking FOR, AGAINST or WITHHOLD), then your proxyholder must vote your Common Shares accordingly.

If you have not specified how to vote on a particular issue, then your proxyholder will vote your Common Shares as they see fit. However, if you have not specified how to vote on a particular issue and Mr. Arnell or Mr. Sumner has been appointed as proxyholder, your Common Shares will be voted in favour of all resolutions proposed by management. For more information on these resolutions, see “Business of the Meeting.” The form of proxy confers discretionary authority upon the proxyholder you name with respect to amendments or variations to the matters identified in the accompanying Notice of Annual General Meeting of Shareholders and any other matters that may properly come before the

Meeting. If any such amendments or variations are proposed to the matters described in the Notice, or if any other matters properly come before the Meeting, your proxyholder may vote your Common Shares as he or she considers best.

HOW DO I REVOKE A PROXY?

Only Registered Shareholders have the right to revoke a proxy. Non-registered shareholders who wish to change their voting instructions must, in sufficient time in advance of the Meeting, arrange for their intermediaries to change their vote and if necessary revoke their proxy.

If you are a Registered Shareholder and you wish to revoke your proxy after you have delivered it, you can do so at any time before it is used. You or your authorized attorney may revoke a proxy by (i) clearly stating in writing that you want to revoke your proxy and delivering this revocation by mail to Proxy Department, TSX Trust Company, P.O. Box 721, Agincourt, ON M1S 0A1, Canada or by fax to 1 416 368 2502 or toll-free in North America to 1 866 781 3111, or by mail to the registered office of the Company, Suite 1800, 200 Burrard Street, Vancouver, BC V6C 3M1, Canada, Attention: Corporate Secretary, or by fax to the Company to 1 604 661 2602, at any time up to and including the last business day preceding the day of the Meeting or any adjournment or postponement thereof or (ii) any other manner permitted by law. Revocations may also be hand-delivered to the Chair of the Meeting on the day of the Meeting or any adjournment or postponement thereof. Such revocation will have effect only in respect of those matters upon which a vote has not already been cast pursuant to the authority confirmed by the proxy. If you revoke your proxy and do not replace it with another in the manner described in “How do I appoint a proxyholder?” above, you will be able to vote your Common Shares in person at the Meeting.

WHO PAYS FOR THIS SOLICITATION OF PROXIES?

The cost of this solicitation of proxies is paid by the Company. It is expected that the solicitation will be primarily by mail, but proxies may also be solicited personally or by telephone or other means of communication by directors and regular employees of the Company without special compensation. In addition, the Company may retain the services of agents to solicit proxies on behalf of its management. In that event, the Company will compensate any such agents for such services, including reimbursement for reasonable out-of-pocket expenses, and will indemnify them in respect of certain liabilities that may be incurred by them in performing their services. The Company may also reimburse brokers or other persons holding Common Shares in their names, or in the names of nominees, for their reasonable expenses in sending proxies and proxy material to beneficial owners and obtaining their proxies.

6

|

Methanex 2023 Information Circular

|

| Introduction | Voting | Business of the Meeting | About the Directors | Corporate Governance | Compensation | Other Information | |||||||

WHO COUNTS THE VOTES?

The Company’s transfer agent, TSX Trust, counts and tabulates the proxies. This is done independently of the Company. Proxies are referred to the Company only in cases where a shareholder clearly intends to communicate with management or when it is necessary to do so to meet legal requirements.

HOW DO I CONTACT THE TRANSFER AGENT?

If you have any inquiries, you can contact the Company’s principal registrar and transfer agent, TSX Trust Company, as follows:

Email:

shareholderinquiries@tmx.com

Toll-free:

1 800 387 0825

Telephone:

1 416 682 3860

Mail:

TSX Trust Company

PO Box 700

Station B

Montreal, Quebec H3B 3K3

The Company’s co-registrar and co-transfer agent in the United States is American Stock Transfer & Trust Company LLC; however, all shareholder inquiries should be directed to TSX Trust Company.

|

Corporate information

HEAD OFFICE METHANEX CORPORATION

1800 Waterfront Centre

200 Burrard Street

Vancouver, BC V6C 3M1

Tel 604 661 2600

Fax 604 661 2676

WEBSITE

www.methanex.com

TRANSFER AGENT

TSX Trust Company acts as transfer agent and registrar for Methanex stock and maintains all primary shareholder records. All inquiries regarding share transfer requirements, lost certificates, changes of address, or the elimination of duplicate mailings should be directed to TSX Trust Company at: 1 800 387 0825 Toll Free within North America

ANNUAL GENERAL MEETING

The Annual General Meeting will be held at the head office in Vancouver, British Columbia on Thursday, April 27, 2023 at 10:00 a.m. (Pacific Time) and will be available to attend virtually. For more information on how to attend and vote online, please refer to the section entitled “Voting” in this Information Circular.

INVESTOR RELATIONS INQUIRIES

Tel 604 661 2600

invest@methanex.com

SHARES LISTED

Toronto Stock Exchange – MX

NASDAQ Global Select Market – MEOH

ANNUAL INFORMATION FORM (AIF)

The Company’s AIF can be found online at www.sedar.com.

A copy of the AIF can also be obtained by contacting our head office.

|

Methanex 2023 Information Circular

|

7

|

| Introduction | Voting | Business of the Meeting | About the Directors | Corporate Governance | Compensation | Other Information | |||||||

| The Company’s consolidated financial statements for the year ended December 31, 2022 will be received by shareholders of the Company at the Meeting and are included in the Annual Report, which will be mailed to Registered Shareholders as required under the Canada Business Corporations Act (the “CBCA”) and to non-registered shareholders who have requested such financial statements. A copy of our Annual Report can also be found at www.methanex.com and at www.sedar.com. | ||||

The directors of the Company are elected each year at the annual general meeting of the Company and hold office until the close of the next annual general meeting or until their successors are elected or appointed in accordance with applicable law. The articles of the Company provide that the Company must have a minimum of 3 and a maximum of 15 directors. The by-laws of the Company state that, when the articles of the Company provide for a minimum and maximum number of directors, the number of directors within the range may be determined from time to time by resolution of the Board. The Board, on an annual basis, considers the size of the Board. On March 9, 2023, the directors resolved that the Board shall consist of 11 directors, such size being consistent with effective decision-making.

The Corporate Governance Committee recommends to the Board nominees for election as directors through a process described on page 46, under the heading “Nominating Committee and Nomination Process.” The persons listed below are being proposed for nomination for election at the Meeting. The persons named as proxyholders in the accompanying proxy, if not expressly directed otherwise, will vote the Common Shares for which they have been appointed proxyholder in favour of electing those persons listed below as nominees for directors. | ||||

The board

| ||||

Director nominees

Director Name Director Since Committee Memberships Age AFRC CGC HRC RCC Doug Arnell IND Chair of the Board 2016 56 Jim Bertram IND Former CEO, Keyera Corporation 2018 66 Paul Dobson IND Senior Vice President and Chief Financial Officer, Ballard Power Systems 2019 56 Maureen Howe IND Former Managing Director, RBC Capital Markets 2018 65 Robert Kostelnik IND Principal, GlenRock Recovery Partners, LLC 2008 71 Leslie O’Donoghue IND Former Executive Vice President and Advisor to the Chief Executive Officer, Nutrien Ltd. 2020 60 Kevin Rodgers IND Former Managing Director and Global Head of Foreign Exchange, Deutsche Bank 2019 60 Rich Sumner IND President and CEO, Methanex Corporation 2023 48 Margaret Walker IND Owner, MLRW Group, LLC 2015 70 Benita Warmbold IND Former Senior Managing Director & Chief Financial Officer, Canada Pension Plan Investment Board 2016 64 Xiaoping Yang IND Former Chair and President, BP China 2022 64 IND – Independent CGC – Corporate Governance Committee RCC – Responsible Care Committee AFRC – Audit, Finance and Risk Committee HRC – Human Resources Committee – Chair – Member

8

|

Methanex 2023 Information Circular

|

| Introduction | Voting | Business of the Meeting | About the Directors | Corporate Governance | Compensation | Other Information | |||||||

Board snapshot

Skills and experience - independent directors

Methanex 2023 Information Circular

|

9

|

| Introduction | Voting | Business of the Meeting | About the Directors | Corporate Governance | Compensation | Other Information | |||||||

|

The directors of the Company recommend the reappointment of KPMG LLP, Chartered Professional Accountants, Vancouver, as the auditors of the Company to hold office until the termination of the next annual meeting of the Company. KPMG LLP has served as the auditors of the Company for more than five years. As in past years, it is also recommended that the remuneration to be paid to the auditors be determined by the directors of the Company.

The persons named as proxyholders in the accompanying proxy, if not expressly directed to the contrary, will vote the Common Shares for which they have been appointed proxyholder to reappoint KPMG LLP as the auditors of the Company and to authorize the directors to determine the remuneration to be paid to the auditors. | |

The board unanimously recommends a vote FOR this proposal.

| ||

Auditor review

The Company’s Audit, Finance and Risk Committee (the “Audit Committee”) oversees and monitors the qualifications, independence, and performance of the Company’s external auditor. The Audit Committee recommends to the Board whether to propose the reappointment of the current independent auditors at the Company’s annual meeting of shareholders or to consider other audit firms. To inform their view, the Audit Committee conducts a formal review of the external auditor every year and a more comprehensive review every five years, and recommends to the Board whether to propose the reappointment of the current independent auditors or to consider other audit firms. These reviews are based on recommendations by the Chartered Professional Accountants of Canada and the Canadian Public Accountability Board (“CPAB”) to assist audit committees in their oversight duties. A comprehensive review covering the past 5 years was conducted in 2023 and focused on the following key factors affecting audit quality:

| • | Independence, objectivity and professional skepticism of the external auditor; |

| • | Quality of the external auditor’s engagement team; and |

| • | Quality of the communications and interactions between the Audit Committee and the external auditor. |

In addition, factors considered by the Audit Committee in deciding whether to recommend to the Board retaining KPMG LLP include:

| • | KPMG LLP’s global capabilities, specifically in regions which match the Company’s global operations; |

| • | The quality of the services provided by KPMG LLP, including input from management on KPMG LLP’s performance; |

| • | External data on audit quality and performance, including recent CPAB and Public Company Accounting Oversight Board reports on KPMG LLP and its peer firms; and |

| • | The appropriateness of KPMG LLP’s fees, KPMG LLP’s tenure as our independent auditor, and the controls and processes in place that help ensure KPMG LLP’s continued independence. |

The comprehensive review was completed and reported on in early 2023 and the Audit Committee determined that it was satisfied with the independence of, and the audit quality provided by, KPMG LLP. The Audit Committee will continue to closely monitor the factors listed to ensure audit quality.

10

|

Methanex 2023 Information Circular

|

| Introduction | Voting | Business of the Meeting | About the Directors | Corporate Governance | Compensation | Other Information | |||||||

How Methanex assures external auditor independence

Globally, different jurisdictions employ different regulatory controls to ensure external auditor independence. In the United Kingdom and in Europe, regulations heavily focus on audit firm rotation. In Canada and the United States, greater focus is placed on other controls. The Company adheres to the external auditor independence rules of both the US Securities and Exchange Commission and CPAB and employs the following controls:

• Services performed by KPMG LLP require pre-approval by the Audit Committee with approval of individual engagements by the Chief Financial Officer within the approved categories and fee amounts.

• Low quantum of non-audit fees (~5% of audit fees) with KPMG LLP and transparency of disclosure of such fees. The Company uses other accounting firms for most non-audit services.

• Audit partner rotation results in changes to the lead audit partner every five years with a five-year cooling-off period.

• Cooling-off periods for KPMG LLP audit staff if considered for employment by Methanex.

• In-camera meetings excluding management each time KPMG LLP meets with the Audit Committee.

|

Principal accountant fees and services

Pre-approval policies and procedures

The Audit Committee annually reviews and approves the terms and scope of the external auditors’ engagement. The Audit Committee oversees the Audit and Non-Audit Pre-Approval Policy, which sets forth the procedures and the conditions by which permissible non-audit services proposed to be performed by KPMG LLP are pre-approved in order to mitigate the risk of non-audit services impacting the auditor’s independence. The Audit Committee has delegated to the Chair of the Audit Committee pre-approval authority for any services not previously approved by the Audit Committee. All such services approved by the Chair of the Audit Committee are subsequently reviewed by the Audit Committee.

All non-audit service engagements, regardless of the cost estimate, must be coordinated and approved by the Chief Financial Officer of the Company to further ensure that adherence to this policy is monitored.

Audit and non-audit fees billed by the independent auditors

KPMG LLP’s global fees relating to the years ended December 31, 2022 and December 31, 2021 are as follows:

| US$000s | 2022 | 2021 | ||||||

| Audit Fees | 2,264 | 2,055 | ||||||

| Audit-Related Fees | 168 | 67 | ||||||

| Tax Fees | 66 | 14 | ||||||

| All Other Fees | — | — | ||||||

| Total | 2,498 | 2,136 | ||||||

Each fee category is described below.

Methanex 2023 Information Circular

|

11

|

| Introduction | Voting | Business of the Meeting | About the Directors | Corporate Governance | Compensation | Other Information | |||||||

Audit fees

Audit fees for professional services rendered by the external auditors for the audit of the Company’s consolidated financial statements; statutory audits of the financial statements of the Company’s subsidiaries; quarterly reviews of the Company’s financial statements; consultations as to the accounting or disclosure treatment of transactions reflected in the financial statements; and services associated with registration statements, prospectuses, periodic reports and other documents filed with securities regulators.

Audit fees for professional services rendered by the external auditors for the audit of the Company’s consolidated financial statements were in respect of an “integrated audit” performed by KPMG LLP globally. The integrated audit encompasses an opinion on the fairness of presentation of the Company’s financial statements as well as an opinion on the effectiveness of the Company’s internal controls over financial reporting.

Audit-related fees

Audit-related fees for professional services rendered by the auditors for financial audits of employee benefit plans; procedures and audit or attest services not required by statute or regulation; and financial statement preparation services relating to the statutory audits of certain of the Company’s subsidiaries, the fees for which represented less than 5% of total audit-related fees for fiscal 2022.

Tax fees

Tax fees for professional services rendered for tax compliance, including the review of tax returns; assistance in completing routine tax schedules and calculations; review of transfer pricing and indirect tax items.

All other fees

There were no other fees in 2022 and 2021.

12

|

Methanex 2023 Information Circular

|

| Introduction | Voting | Business of the Meeting | About the Directors | Corporate Governance | Compensation | Other Information | |||||||

Methanex 2023 Information Circular

|

13

|

| Introduction | Voting | Business of the Meeting | About the Directors | Corporate Governance | Compensation | Other Information | |||||||

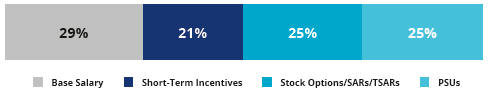

Elements of executive compensation

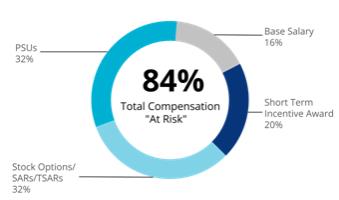

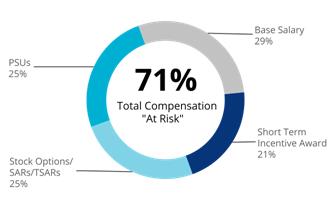

Executive compensation at the Company includes base salary, short-term incentives, long-term incentives and indirect compensation, including benefits, perquisites and pensions, as described in more detail in the table below.

CEO

| 84% Total Compensation “At Risk” |  |

All Other NEOs (average)

| 71% Total Compensation “At Risk” |  |

| “At Risk” | ||||||||||||

| “ | ||||||||||||

BASE SALARY

Fixed compensation intended to compensate executives competitively for leadership, specific skills, knowledge and experience required to perform their duties. | SHORT-TERM INCENTIVE AWARD

Variable compensation designed to recognize and reward the achievement of strategic performance goals with an annual cash reward. Amounts are based on an assessment of corporate financial performance – modified return on capital employed (“Modified ROCE”) – and individual performance over the year. | STOCK OPTIONS/ SARs/TSARs

Stock options/Share Appreciation Rights (“SARs”)/Tandem Share Appreciation Rights (“TSARs”) deliver value based on the Company’s share price performance over varying periods of time. | PSUs

Performance Share Units (“PSUs”) deliver value based on a combination of relative compounded total shareholder return and three-year average Modified ROCE. | |||||||||

14

|

Methanex 2023 Information Circular

|

| Introduction | Voting | Business of the Meeting | About the Directors | Corporate Governance | Compensation | Other Information | |||||||

Compensation best practices

|  | |||||||

| What we do | What we don’t do | |||||||

| The compensation of our executive officers is mainly performance-based |

| Our executive compensation does not entice our executive officers to take high risks | |||||

| We annually review the Company’s compensation policies and practices to confirm they align with the Company’s risk management principles, do not encourage inappropriate or excessive risk-taking and are not reasonably likely to have a material adverse effect on the Company |

| We do not practice tax gross-ups

Our Hedging Policy prohibits insiders, which include all of the Company’s executive officers and directors, from purchasing financial instruments designed to hedge or offset a decrease in the market value of the Common Shares or equity based incentive awards that they hold | |||||

| Our short-term incentive and PSU awards are not guaranteed and have maximum limits | |||||||

| We have significant share ownership requirements for all executive officers | |||||||

| Our Recoupment Policy applies to all employees, officers and directors | |||||||

| Double-trigger in place for employment agreements in the event of a change of control | |||||||

Actions taken in response to shareholder feedback

In response to recent shareholder feedback on our executive compensation and to more closely align with market practices, we made changes to some of the elements of our program:

• We reviewed the calculation methodology for the relative total shareholder return (“TSR”) measure in our Performance Share Units (PSUs) and, starting with the 2023 grant, the spread between the Company’s TSR and the TSR of the S&P Composite Chemicals 1500 Index will be calculated on a point-to-point basis using the 30-trading day average to determine starting and ending share price instead of taking the twelve-quarter average.

• We replaced the single trigger vesting of PSUs in the event of a change of control of the Company with double trigger vesting, where a change of control and the termination of employment would need to occur in order for PSUs to vest.

• We brought forward the regular independent review of our compensation comparator group and made changes to the composition of the group, while also confirming that the criteria the Board uses for selecting comparator companies remain appropriate. |

Methanex 2023 Information Circular

|

15

|

| Introduction | Voting | Business of the Meeting | About the Directors | Corporate Governance | Compensation | Other Information | |||||||

The following table sets out the names, ages and places of residence of all the persons to be nominated for election as directors of the Board, along with other relevant information, including the number and market value of Common Shares, Deferred Share Units (“DSUs”) and Restricted Share Units (“RSUs”) held by each of them and which standing committees (each a “Committee”) of the Board the nominees are members of, all as at the date of this Information Circular. The following table also sets out whether a nominee is independent or not independent. All amounts are in Canadian dollars.

DOUG ARNELL | • Chief Executive Officer of Cedar LNG LLC (“Cedar LNG”) since June 2021. Cedar LNG is developing an LNG export terminal in Northeastern British Columbia.

• President and Chief Executive Officer of Helm Energy Advisors Inc., a private company he founded in March 2015 that provides advisory services to the global energy sector.

• Chief Executive Officer of Golar LNG Ltd., from February 2011 to March 2015.

• Held various senior positions within BG Group plc from 2003 to 2010 and with other energy companies prior to that time.

• Has over 20 years of senior management experience in the global energy sector.

• Holds a Bachelor of Science from the University of Calgary.

| |||||||

Independent

West Vancouver,

British Columbia, Canada

Age: 56

Director since: October 2016

Other Current Board Memberships: None

Position / 2022 Committee Chair & Member of the Board(1) 6 of 6

Total 2022 Attendance at Board

6 of 6 (100%) |

Share and Share Equivalents Held as of March 9, 2023: | |||||||

Common Shares(2) (#)

|

5,555

| |||||||

Total DSUs and RSUs(3),(4) (#)

|

46,949

| |||||||

Total of Common Shares, DSUs and RSUs (#)

|

52,504

| |||||||

Total Market Value of Common Shares, DSUs and RSUs(5) ($)

|

3,231,621

| |||||||

Minimum Shareholding Requirements ($)

|

1,350,000

| |||||||

Meets Share Ownership Requirements?(6)

|

Yes

| |||||||

| ||||||||

16

|

Methanex 2023 Information Circular

|

| Introduction | Voting | Business of the Meeting | About the Directors | Corporate Governance | Compensation | Other Information | |||||||

JIM BERTRAM

Independent

Calgary, Alberta, Canada

Age: 66

Director since: October 2018

Committee memberships as at

Audit, Finance & Risk Committee Human Resources Committee (Chair)

Other Current Board Memberships:

Emera Inc. (since 2018) Keyera Corporation (since 2003)

Position / 2022 Committee Memberships & Attendance:

Member of the Board 6 of 6

Audit, Finance & Risk Committee 7 of 7

Human Resources Committee (Chair) 10 of 10

Total 2022 Attendance at Board and Committee Meetings:

23 of 23 (100%) | • A corporate director.

• Chief Executive Officer of Keyera Corporation (“Keyera”) from its inception in 1998 until his retirement at the end of 2014. Keyera is a publicly-traded, midstream oil and gas operator.

• Chair of the Board of Keyera since 2016.

• Has a wealth of senior management experience in the North American and global energy markets.

• Holds a Bachelor of Commerce from the University of Calgary and has been granted the ICD.D designation by the Institute of Corporate Directors.

|

| ||||||

Share and Share Equivalents Held as of March 9, 2023: | ||||||||

Common Shares(2) (#)

|

|

20,525

|

| |||||

Total DSUs and RSUs(3),(4) (#)

|

|

24,396

|

| |||||

Total of Common Shares, DSUs and RSUs (#)

|

|

44,921

|

| |||||

Total Market Value of Common Shares, DSUs and RSUs(5) ($)

|

|

2,764,888

|

| |||||

Minimum Shareholding Requirements ($)

|

|

780,000

|

| |||||

Meets Share Ownership Requirements?(6)

|

|

Yes

|

| |||||

| ||||||||

Methanex 2023 Information Circular

|

17

|

| Introduction | Voting | Business of the Meeting | About the Directors | Corporate Governance | Compensation | Other Information | |||||||

PAUL DOBSON

Independent

Naples, Florida, USA

Age: 56

Director since: April 2019

Committee memberships as at the date of the Information Circular:

Audit, Finance and Risk Committee Responsible Care Committee

Other Current Board

Position / 2022 Committee Memberships & Attendance:

Member of the Board (6 of 6)

Audit, Finance and Risk Committee (7 of 7)

Responsible Care Committee (3 of 3)

Total 2022 Attendance at Board and Committee Meetings:

16 of 16 (100%) | • Senior Vice President and Chief Financial Officer of Ballard Power Systems, a global provider of innovative clean energy and fuel cell solutions, since March 2021.

• Acting President and Chief Executive Officer of Hydro One Limited, a major transmission and distribution provider in Ontario, Canada, from July 2018 to May 2019 and prior to that was Chief Financial Officer from March 2018.

• Chief Financial Officer for Direct Energy Ltd. (“Direct Energy”) in Houston, Texas from January 2016 to February 2018.

• Chief Operating Officer of Direct Energy from May 2014 to December 2015.

• Held senior leadership positions in finance, operations, information technology and customer service across the Centrica Group, the parent company of Direct Energy, from 2003.

• Has considerable financial and energy-specific experience.

• Holds a Bachelor of Arts in Management Accounting (Honours) from the University of Waterloo as well as an MBA from the University of Western Ontario.

• A Chartered Professional Accountant and a Certified Management Accountant.

| |||||

Share and Share Equivalents Held as of March 9, 2023:

| ||||||

Common Shares(2) (#)

| 12,822

| |||||

Total DSUs and RSUs(3),(4) (#)

| 7,810

| |||||

Total of Common Shares, DSUs and RSUs (#)

| 20,632

| |||||

Total Market Value of Common Shares, DSUs and RSUs(5) ($)

| 1,269,900

| |||||

Minimum Shareholding Requirements ($)

| 780,000

| |||||

Meets Share Ownership Requirements?(6)

| Yes

| |||||

| ||||||

18

|

Methanex 2023 Information Circular

|

| Introduction | Voting | Business of the Meeting | About the Directors | Corporate Governance | Compensation | Other Information | |||||||

MAUREEN HOWE

Independent | • A corporate director.

• Managing Director at RBC Capital Markets, a global investment bank, in equity research from 1996 to 2008.

• Specialized in the area of energy infrastructure, which included power generation, transmission and distribution, oil and gas transmission and distribution, gas processing and alternative energy.

• Has substantial finance and capital market experience, as well as relevant public company experience.

• Holds a Bachelor of Commerce (Honours) from the University of Manitoba and a Ph.D. in Finance from the University of British Columbia. | |||||||

Vancouver, British Columbia,

Age: 65

Director since: June 2018

Committee memberships as

Audit, Finance and Risk Corporate Governance

Other Current Board

Memberships:

Freehold Royalties Ltd. (since 2022) Pembina Pipeline Corporation

Position / 2022 Committee Memberships & Attendance:

Member of the Board (6 of 6)

Audit, Finance and Risk (7 of 7)

Corporate Governance Committee (Chair) (3 of 3)

Total 2022 Attendance at

16 of 16 (100%) |

Share and Share Equivalents Held as of March 9, 2023:

| |||||||

Common Shares(2) (#)

| 26,250

| |||||||

Total DSUs and RSUs(3),(4) (#)

| 6,860

| |||||||

Total of Common Shares, DSUs and RSUs (#)

| 33,110

| |||||||

Total Market Value of Common Shares, DSUs and RSUs(5) ($)

| 2,037,921

| |||||||

Minimum Shareholding Requirements ($)

| 780,000

| |||||||

Meets Share Ownership Requirements?(6)

| Yes

| |||||||

Methanex 2023 Information Circular

|

19

|

| Introduction | Voting | Business of the Meeting | About the Directors | Corporate Governance | Compensation | Other Information | |||||||

ROBERT KOSTELNIK

Independent

Fulshear, Texas, USA

Age: 71

Director since: September 2008

Committee memberships as at the date of the Information Circular:

Human Resources Committee Responsible Care Committee (Chair)

Other Current Board Memberships:

| • Principal in GlenRock Recovery Partners, LLC since February 2012. GlenRock Recovery Partners facilitates the sale of non-fungible hydrocarbons in the United States.

• Prior to this, President & Chief Executive Officer of Cinatra Clean Technologies, Inc. from 2008 to May 2011.

• Held the position of Vice President of Refining for CITGO Petroleum Corporation (“CITGO”) from July 2006 until his retirement in 2007.

• Held a number of senior positions during his 16 years with CITGO.

• Has over 30 years’ experience in the petrochemical industry, with senior management experience in health, safety, security and environment.

• Holds a Bachelor of Science (Mechanical Engineering) from the Missouri University of Science and Technology (previously the University of Missouri) and is a Registered Professional Engineer.

| |||||||

Share and Share Equivalents Held as of March 9, 2023:

| ||||||||

Common Shares(2) (#)

| 27,000

| |||||||

Total DSUs and RSUs(3),(4) (#)

| 7,810

| |||||||

Total of Common Shares, DSUs and RSUs (#)

| 34,810

| |||||||

Total Market Value of Common Shares, DSUs and RSUs(5) ($)

| 2,142,556

| |||||||

Minimum Shareholding Requirements ($)

| 780,000

| |||||||

Meets Share Ownership Requirements?(6)

| Yes

| |||||||

HF Sinclair Corporation (previously HollyFrontier Corporation) (since 2011)

Position / 2022 Committee Memberships & Attendance:

Member of the Board (6 of 6)

Human Resources Committee (10 of 10)

Responsible Care Committee (Chair) (3 of 3)

Total 2022 Attendance at Board and Committee Meetings:

19 of 19 (100%) | ||||||||

20

|

Methanex 2023 Information Circular

|

| Introduction | Voting | Business of the Meeting | About the Directors | Corporate Governance | Compensation | Other Information | |||||||

LESLIE O’DONOGHUE Independent

Calgary, Alberta, Canada

Age: 60

Director since: April 2020

Committee memberships as at the Audit, Finance & Risk Committee Responsible Care Committee

Other Current Board Memberships: Dye & Durham (since 2022) Pembina Pipeline Corporation (since 2008)

Position / 2022 Committee | • A corporate director.

• Executive Vice President and Advisor to the Chief Executive Officer of Nutrien Ltd. (“Nutrien”) from June 2019 until her retirement in December 2019. Nutrien is a Canadian fertilizer company, and is the world’s largest provider of crop inputs, services and solutions.

• Executive Vice President, Chief Strategy and Business Development Officer of Nutrien from January 2018 to June 2019.

• Executive Vice President, Corporate Development and Strategy and Chief Risk Officer of Agrium Inc. (Nutrien’s predecessor company) from 2012 to 2017.

• Has extensive senior management experience with public companies and an in-depth knowledge of global commodity markets.

• Holds a Bachelor of Arts (Economics) degree from the University of Calgary and a LL.B., from Queen’s University.

| |||||

Share and Share Equivalents Held as of March 9, 2023:

| ||||||

Common Shares(2) (#)

| 11,000 | |||||

Total DSUs and RSUs(3),(4) (#)

| 7,812 | |||||

Total of Common Shares, DSUs and RSUs (#)

| 18,812 | |||||

Total Market Value of Common Shares, DSUs and RSUs(5) ($)

| 1,157,879 | |||||

Minimum Shareholding Requirements ($)

| 780,000 | |||||

Meets Share Ownership Requirements?(6)

| Yes | |||||

Memberships & Attendance: Member of the Board (6 of 6)

Audit, Finance and Risk Committee (7 of 7)

Responsible Care Committee (3 of 3)

Total 2022 Attendance at Board and Committee Meetings: 16 of 16 (100%) | ||||||

Methanex 2023 Information Circular

|

21

|

| Introduction | Voting | Business of the Meeting | About the Directors | Corporate Governance | Compensation | Other Information | |||||||

KEVIN RODGERS Independent

London, United Kingdom

Age: 60

| • A corporate director.

• Managing Director and Global Head of Foreign Exchange at Deutsche Bank in London (UK) from 2012 to June 2014. Deutsche Bank is a global multinational investment bank and financial services company.

• Held many other senior leadership roles within foreign exchange and commodities including Global Head of Foreign Exchange Trading and Global Head of Energy Trading after joining Deutsche Bank in 1999.

• Partner and Senior Advisor at Cumulus Asset Management from January 2018 until May 2019 following his retirement from Deutsche Bank.

• Has almost 30 years of financial and capital market experience.

• Holds a Master’s degree in Chemical Engineering from Imperial College in London (UK), an MBA from the London Business School and a Master’s Degree in Economic History from the London School of Economics (all with distinction). | |||||

Director since: July 2019

Committee memberships as at the Corporate Governance Committee Human Resources Committee

Other Current Board Memberships:

Arion Investment Management Limited (private) (since 2018)

Position / 2022 Committee |

Share and Share Equivalents Held as of March 9, 2023:

| |||||

Common Shares(2) (#)

| 6,000

| |||||

Total DSUs and RSUs(3),(4) (#)

| 11,415

| |||||

Total of Common Shares, DSUs and RSUs (#)

| 17,415

| |||||

Total Market Value of Common Shares, DSUs and RSUs(5) ($)

| 1,071,893

| |||||

Minimum Shareholding Requirements ($)

| 780,000

| |||||

Meets Share Ownership Requirements?(6)

| Yes

| |||||

Memberships & Attendance: Member of the Board (6 of 6)

Corporate Governance Committee (3 of 3)

Human Resources Committee (10 of 10)

Total 2022 Attendance at Board and Committee Meetings: 19 of 19 (100%) | ||||||

22

|

Methanex 2023 Information Circular

|

| Introduction | Voting | Business of the Meeting | About the Directors | Corporate Governance | Compensation | Other Information | |||||||

RICH SUMNER Non Independent

North Vancouver, British Columbia, Canada

Age: 48

Director since: January 2023

| • Appointed President & CEO of the Company effective January 1, 2023.

• Held a variety of progressively senior roles in North America and Asia in Finance, Supply Chain and Marketing and Logistics over a 19 year career with the Company.

• From October 2021 until his appointment as President & CEO, served as the Company’s Senior Vice President, Global Marketing & Logistics, overseeing the Marketing & Logistics function including Global Market Development and the jointly owned shipping subsidiary, Waterfront Shipping. Also had executive oversight for the Company’s North American manufacturing operations.

• Regional President, Marketing & Logistics, Asia Pacific of the Company based in Hong Kong, from February 2019 to October 2021.

• Vice President, Marketing & Logistics, North America of the Company based in Dallas, Texas from March 2015 to February 2019.

• Has a strong financial background and also held several senior finance leadership positions at the Company.

• Holds a Bachelor of Business Administration from Simon Fraser University and CPA, CA from the Chartered Professional Accountants of British Columbia.

| |||||

Other Current Board Memberships: None

Position / 2022 Committee Memberships & Attendance(7): N/A(8)

Total 2022 Attendance at Board and Committee Meetings: N/A(8) |

Share and Share Equivalents Held as of March 9, 2023:

| |||||

Common Shares(2) (#)

| 16,834

| |||||

Total DSUs and RSUs(3),(4) (#)

| —

| |||||

Total of Common Shares, DSUs and RSUs (#)

| 16,834

| |||||

Total Market Value of Common Shares, DSUs and RSUs(5) ($)

| 1,036,133

| |||||

Minimum Shareholding Requirements ($)

| 5,150,000

| |||||

Meets Share Ownership Requirements?(6)

| No(9)

| |||||

Methanex 2023 Information Circular

|

23

|

| Introduction | Voting | Business of the Meeting | About the Directors | Corporate Governance | Compensation | Other Information | |||||||

MARGARET WALKER

Independent

Austin, Texas, USA

Age: 70

Director since: April 2015

Committee memberships as at the Human Resources Committee Responsible Care Committee

Other Current Board Memberships: ioneer Ltd. (since 2021) Independent Project Analysis, Inc.

Position / 2022 Committee Memberships & Attendance: Member of the Board (6 of 6)

Human Resources Committee (10 of 10)

Responsible Care Committee (3 of 3)

Total 2022 Attendance at Board and Committee Meetings: 19 of 19 (100%)

| • Owner of MLRW Group, LLC since January 2011. MLRW Group is a consulting firm focusing on working with companies to improve capital investment outcomes and to improve overall safety performance.

• Vice President of Engineering & Technology for The Dow Chemical Company (“Dow Chemical”) from 2004 until her retirement in December 2010.

• Prior to this, held other senior positions with Dow Chemical including Senior Leader in Manufacturing & Engineering and Business Director of Contract Manufacturing.

• Dow Chemical provides chemical, plastic and agricultural products and services.

• Has over 30 years of experience in the petrochemical industry, including several senior management roles in operations and health and safety.

• Holds a Bachelor of Chemical Engineering from Texas Tech University, located in Lubbock, Texas.

• Became a Board Leadership Fellow of the National Association of Corporate Directors (“NACD”) in 2018 and in 2021 became NACD Directorship Certified. | |||||

Share and Share Equivalents Held as of March 9, 2023: | ||||||

Common Shares(2) (#)

| 9,500 | |||||

Total DSUs and RSUs(3),(4) (#)

| 7,810 | |||||

Total of Common Shares, DSUs and RSUs (#)

| 17,310 | |||||

Total Market Value of Common Shares, DSUs and RSUs(5) ($)

| 1,065,431 | |||||

Minimum Shareholding Requirements ($)

| 780,000 | |||||

Meets Share Ownership Requirements?(6)

| Yes | |||||

| ||||||

24

|

Methanex 2023 Information Circular

|

| Introduction | Voting | Business of the Meeting | About the Directors | Corporate Governance | Compensation | Other Information | |||||||

BENITA WARMBOLD Independent

Toronto, Ontario, Canada

Age: 64

Director since: February 2016

Committee memberships as at the date of the Information Circular: Audit, Finance & Risk Committee Corporate Governance Committee

Other Current Board Memberships: Bank of Nova Scotia (since 2018) SNC-Lavalin Group Inc. (since 2017) Canadian Public Accountability Board (since 2011)

Position / 2022 Committee Memberships & Attendance: Member of the Board (6 of 6)

Audit, Finance and Risk Committee (7 of 7)

Corporate Governance Committee (3 of 3)

Total 2022 Attendance at Board and Committee Meetings: 16 of 16 (100%) | • A corporate director.

• Senior Managing Director & Chief Financial Officer of the Canada Pension Plan Investment Board (“CPPIB”) from 2013 until her retirement in 2017. CPPIB is a professional investment management organization responsible for investing funds on behalf of the Canada Pension Plan.

• Senior Vice President & Chief Operations Officer of CPPIB from 2008 to 2013.

• Managing Director & Chief Financial Officer for Northwater Capital Management Inc from 1997 to 2008.

• Has over 30 years of experience in the finance industry as well as significant experience as a public company director.

• Holds a Bachelor of Commerce (Honours) degree from Queen’s University, is a Chartered Professional Accountant and is a Fellow of the Institute of Chartered Professional Accountants of Ontario. She is also a Fellow of the Institute of Corporate Directors and has been granted their ICD.D designation.

| |||||

Share and Share Equivalents Held as of March 9, 2023: | ||||||

Common Shares(2) (#)

| 6,000

| |||||

Total DSUs and RSUs(3),(4) (#)

| 19,530

| |||||

Total of Common Shares, DSUs and RSUs (#)

| 25,530

| |||||

Total Market Value of Common Shares, DSUs and RSUs(5) ($)

| 1,571,372

| |||||

Minimum Shareholding Requirements ($)

| 780,000

| |||||

Meets Share Ownership Requirements?(6)

| Yes | |||||

| ||||||

Methanex 2023 Information Circular

|

25

|

| Introduction | Voting | Business of the Meeting | About the Directors | Corporate Governance | Compensation | Other Information | |||||||

XIAOPING YANG Independent

Henderson, Nevada, USA | • A corporate director.

• Chair and President of BP China, a subsidiary of BP p.l.c. (“BP”) from 2016 until her retirement in 2020. BP is a multinational energy company.

• Held a variety of international executive roles at BP in both Asia and the USA within the downstream and new energy businesses including having accountability for its chemicals manufacturing operations and joint venture entities in Asia between 1990 and 2020.

• Has over 30 years of international energy and petrochemical business experience and brings a deep knowledge of doing business in China, manufacturing operations, commodity markets and health and safety.

• Holds a Bachelor of Science from Jiangnan University, China, a PhD in chemical engineering from Purdue University, USA and an MBA from the University of Chicago, USA.

| |||||

Age: 64

Director since: January 2022

Committee memberships as at the date of the Information Circular: Corporate Governance Committee Responsible Care Committee

Other Current Board Memberships: LONGi Green Energy Technology |

Share and Share Equivalents Held as of March 9, 2023: | |||||

Common Shares(2) (#)

| 700 | |||||

Total DSUs and RSUs(3),(4) (#)

| 4,738 | |||||

Total of Common Shares, DSUs and RSUs (#)

| 5,438 | |||||

Total Market Value of Common Shares, DSUs and RSUs(5) ($)

| 334,709 | |||||

Minimum Shareholding Requirements ($)

| 780,000 | |||||

Meets Share Ownership Requirements?(6)

| No(9) | |||||

Co. Ltd. (since 2022) IGO Limited (since 2020)

Position / 2022 Committee Memberships & Attendance: Member of the Board (6 of 6)

Corporate Governance Committee (3 of 3)

Responsible Care Committee (3 of 3)

Total 2022 Attendance at Board and Committee Meetings: 12 of 12 (100%) | ||||||

Footnotes

| (1) | Mr. Arnell is not a member of any Committee, but in his capacity as Chair of the Board, is considered an ex-officio. He attended all Committee meetings in 2021 on a non-voting basis. Mr. Arnell is an independent director. |

| (2) | The number of Common Shares held includes Common Shares directly or indirectly beneficially owned or under the control or direction of such nominee. |

| (3) | For information on Deferred Share Units, see “Share-Based Awards - Deferred Share Unit Plan (Director DSUs)”. |

| (4) | For information on Restricted Share Units, see “Share-Based Awards - Restricted Share Unit Plan for Directors”. |

| (5) | This value is calculated using $61.55, being the weighted average closing price of the Common Shares on the Toronto Stock Exchange for the 90-day period ending March 8, 2023. |

| (6) | See page 57 for more information on director share ownership requirements. See page 72 for more information on Mr. Sumner’s share ownership requirements as President & CEO of the Company. |

| (7) | Mr. Sumner is not a member of any Committee, but attends all Committee meetings on a non-voting basis by invitation in his capacity as President & CEO of the Company. |

| (8) | Mr. Sumner was appointed a director effective as of January 1, 2023 and therefore did not attend any Board or Committee meetings as a director in 2022. |

| (9) | Directors and executive officers have five years from the date of their appointment to meet their share ownership requirements. |

26

|

Methanex 2023 Information Circular

|

| Introduction | Voting | Business of the Meeting | About the Directors | Corporate Governance | Compensation | Other Information | |||||||

The Corporate Governance Committee is responsible for identifying new candidates to stand as nominees for election or appointment as directors to the Board. The Corporate Governance Committee uses a skills matrix to assist in this process. On an annual basis, the Corporate Governance Committee reviews a matrix that sets out the various skills and experience considered to be desirable for the Board to possess in the context of the Company’s strategic direction. The Corporate Governance Committee then assesses the skills and experience of each current Board member against this matrix. When completed, the matrix helps the Corporate Governance Committee identify any skills or experience gaps and provides the basis for a search to be conducted for new directors to fill any gaps. The skills matrix is reviewed annually by the Corporate Governance Committee to ensure alignment with the Company’s corporate strategy. Following is the current board skills matrix outlining the skills and experience of each non-management director nominee.

| Board Skills |  |  |  |  |  |  |  |  |  |  | ||||||||||

Leadership

Experience as a previous or current CEO of a mid to large cap ($500 M+) public company or equivalent size private company or group division. | · | · | · | · | · | · | ||||||||||||||

Industry Knowledge and Experience

Experience in either the global commodity or chemicals industry. | · | · | · | · | · | · | · | |||||||||||||

Operations

Experience with oversight of large-scale process plant operations. | · | · | · | |||||||||||||||||

Finance

CFO, senior retired Audit Partner, experience in capital markets, or “financial expert” under SEC Rules. | · | · | · | · | ||||||||||||||||

Health, Safety Environment & Sustainability

Managed organization or business unit with significant health, safety or environmental issues or knowledge and experience with ESG/sustainability initiatives. | · | · | · | · | · | · | · | |||||||||||||

International Perspective

High level of cultural fluency developed through managing or working in a major organization that has business in multiple international jurisdictions or as part of a global business leadership team. | · | · | · | · | · | · | · | · | ||||||||||||

Energy

Significant experience with an international energy or oil and gas company ideally with experience in upstream gas development, power generation or new energy markets. | · | · | · | · | · | · | ||||||||||||||

Understanding of Natural Gas Feedstock Issues

Strong understanding of business drivers in context of natural gas feedstock supply arrangements in multiple jurisdictions, including North America. | · | · | · | · | · | · | ||||||||||||||

Large Capital Projects Execution

Experience overseeing the delivery of large capital projects on time and on budget. | · | · | · | · | · | · | ||||||||||||||

Business Growth: Strategies and Risks

Understanding of implications of executing a plan for business growth including strategy, risks and people implications. | · | · | · | · | · | · | · | · | ||||||||||||

Government and Public Affairs

Broad experience with regulatory, political or public policy matters or engagement with governments internationally or domestically. | · | · | · | |||||||||||||||||

Board Experience

Board experience as a director of a large public company. | · | · | · | · | · | · | · | |||||||||||||

China

Experience successfully growing a foreign company’s presence in China and/ or with the Chinese government and State-Owned Enterprises. | · | |||||||||||||||||||

Methanex 2023 Information Circular

|

27

|

| Introduction | Voting | Business of the Meeting | About the Directors | Corporate Governance | Compensation | Other Information | |||||||

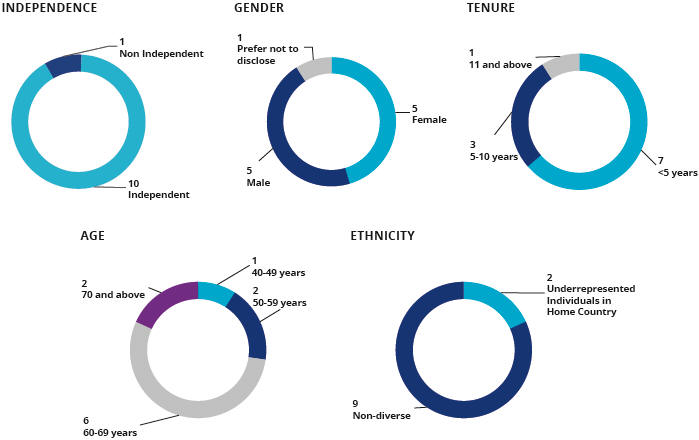

The Company has a Board Diversity Policy applicable to the directors of the Company. The full text of the Board Diversity Policy can be found on the Company’s website, and is summarized as follows:

The Company strives to create an inclusive culture in which diversity is valued and where differences are embraced; where everyone feels empowered and has the opportunity to contribute, develop, and advance. The Company is committed to demonstrating inclusive behaviours in all aspects of its business so that everyone is able to bring their authentic selves into the workplace.

The Company recognizes the importance of diversity, including gender diversity, at all levels of the Company, including the Board. Board diversity promotes the inclusion of different perspectives and ideas and ensures that the Company has the opportunity to benefit from all available talent. This enhances and improves decision making, which helps maintain a competitive advantage and makes for better corporate governance.

The Board believes that having diversity in the background and perspectives of its directors is essential for creating an appropriate balance of skills, experience, independence and knowledge required on the Board and enhancing board effectiveness. For the purposes of this Policy “diversity” encompasses characteristics or qualities that can be used to differentiate groups and people from one another and includes gender and gender identity, sexual orientation, visible minorities, Aboriginal peoples, persons with disabilities, age, education, business experience, professional expertise, personal character and interests, stakeholder perspectives, geographic background and other diverse attributes.

The Corporate Governance Committee considers these diversity attributes and the Board’s diversity target, described below, when identifying and nominating candidates for Board appointments and are factored into the recruitment and decision-making process when new Board appointments are made. The Board Diversity Policy stipulates that when engaging external search consultants to identify future candidates for Board or executive roles, such consultants are requested to take full account of all aspects of diversity in preparing their candidate list to provide a diverse and balanced slate. Ultimately, appointments are based on merit, measured against objective criteria.

In 2021, the Company added a target in the Board Diversity Policy that each gender comprises at least 30% of the directors on the Board and in 2022, the Board further revised the Policy to include a target that at least 40% of independent directors be individuals that are women, Aboriginal peoples, persons with disabilities, members of visible minorities1 and/or LGBTQ+, while maintaining a composition in which each gender comprises at least 30% of the independent directors. The Board currently meets each of its diversity targets.

In addition to promoting Board diversity, the Board monitors the initiatives undertaken by the Company to promote diversity within the organization. The Company is committed to fair and unbiased people practices that are transparent and consistently applied to mitigate barriers and enhance the diversity of our teams. Although no targets have been adopted, through our annual talent review and succession planning process, we review the diversity of both our executive team and the management teams of each business group. Following the establishment of a new management position, Director, Diversity & Inclusion (“D&I”), in 2021, management established a Global D&I Council made up of a diverse group of senior leaders from around the world to lead the development and implementation of a D&I strategy. The Company partnered with Ernst & Young to assess its current D&I culture and provide support with the development of a strategy and three-year roadmap to foster a more diverse and inclusive organization. More information on the D&I strategy and our Year 1 actions can be found in the 2022 Sustainability Report.

| (1) | Women, Aboriginal peoples, persons with disabilities and members of visible minorities have the meaning set out in the Equal Employment Act (Canada). |

28

|

Methanex 2023 Information Circular

|

| Introduction | Voting | Business of the Meeting | About the Directors | Corporate Governance | Compensation | Other Information | |||||||

As at the date of the Information Circular, the number and proportion (in percentage) of directors and senior management of the Company who identify as women, persons with disabilities, Aboriginal peoples or members of visible minorities is:

| Women2 | Persons with disabilities2 | Aboriginal peoples | Members of visible minorities | Total Number |

Number of individuals that are members of more than one designated group | |||||||||||||||||||||||||||||||||||||||

| Number | % | Number | % | Number | % | Number | % | ||||||||||||||||||||||||||||||||||||

Independent directors

| 5

| 50

| 0

| 0

| 0

| 0

| 2

| 20

| 10

| 1

| ||||||||||||||||||||||||||||||||||

Senior Management3

| 1

| 13

| 0

| 0

| 0

| 0

| 0

| 0

| 8

| 0

| ||||||||||||||||||||||||||||||||||

For the purposes of the Nasdaq’s Board Diversity Rule4, the Board’s Diversity Matrix as of March 9, 2023 is:

| Board Diversity Matrix | ||||||||

| Country of Principal Executive Offices | Canada | |||||||

| Foreign Private Issuer | Yes | |||||||

| Disclosure Prohibited Under Home Country Law | No | |||||||

| Total Number of Directors | 11 | |||||||

| Part I: Gender Identity | ||||||||

| Female | Male | Non-Binary | Did Not Disclose Gender | |||||

| Directors | 5 | 5 | 0 | 1 | ||||

| Part II: Demographic Background | ||||||||

| Underrepresented Individual in Home Country Jurisdiction | 2 | |||||||

| LGBTQ+ | 0 | |||||||

| Did Not Disclose Demographic Background | 1 | |||||||

For the purpose of the Board Diversity matrix above, “Underrepresented Individual in Home Country” includes persons with disabilities, Aboriginal peoples, and members of visible minorities. This is consistent with the Company’s reporting requirements in Canada.

| (2) | One director preferred not to disclose their gender and one director preferred not to disclose if they were a person with disabilities. |

| (3) | Senior management refers to the Company’s Executive Leadership Team (comprised of the Chief Executive Officer, Chief Financial Officer and Senior Vice Presidents) but does not include the Chair of the Board who is grouped with independent directors. |

| (4) | Nasdaq Rule 5605(f). |

Methanex 2023 Information Circular

|

29

|

| Introduction | Voting | Business of the Meeting | About the Directors | Corporate Governance | Compensation | Other Information | |||||||

Following are the voting results from the annual general meeting of shareholders held in 2022.

| Director | For | % | Withheld | % | ||||||||||||

Doug Arnell | 59,993,354 | 99.92 | 48,260 | 0.08 | ||||||||||||