- GS Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

The Goldman Sachs Group, Inc. (GS) DEF 14ADefinitive proxy

Filed: 24 Feb 05, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

x Definitive Additional Materials

¨ Soliciting Material Pursuant to Section 240.14a-12

The Goldman Sachs Group, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

| THE GOLDMAN SACHS GROUP, INC. 85 Broad Street New York, New York 10004 | February 24, 2005

|

Dear Shareholder:

You are cordially invited to attend the 2005 Annual Meeting of Shareholders of The Goldman Sachs Group, Inc. We will hold the meeting on Wednesday, April 6, 2005 at 9:30 a.m., New York City time, at our offices at 32 Old Slip, New York, New York 10005. We hope that you will be able to attend.

Enclosed you will find a notice setting forth the business expected to come before the meeting, the Proxy Statement, a form of proxy and a copy of our 2004 Annual Report.

Your vote is very important to us. Whether or not you plan to attend the meeting in person, your shares should be represented and voted.

Sincerely,

Henry M. Paulson, Jr.

Chairman and Chief Executive Officer

THE GOLDMAN SACHS GROUP, INC.

85 Broad Street

New York, New York 10004

Notice of 2005 Annual Meeting of Shareholders

February 24, 2005

The 2005 Annual Meeting of Shareholders of The Goldman Sachs Group, Inc. will be held at our offices at 32 Old Slip, New York, New York 10005, on Wednesday, April 6, 2005 at 9:30 a.m., New York City time, for the following purposes:

| 1. | To elect four directors to our Board of Directors for three-year terms (or one-year terms if the amendments referred to in Item 2 are approved); |

| 2. | To approve amendments to our Amended and Restated Certificate of Incorporation to provide for the annual election of all of our directors; |

| 3. | To ratify the appointment of PricewaterhouseCoopers LLP as our independent auditors for our fiscal year ending November 25, 2005; and |

| 4. | To transact such other business as may properly come before the Annual Meeting. |

The record date for the determination of the shareholders entitled to vote at the Annual Meeting, or any adjournments or postponements thereof, was the close of business on February 7, 2005. A list of the shareholders of record as of February 7, 2005 will be available for inspection during ordinary business hours at our offices, 85 Broad Street, New York, New York 10004, from March 25, 2005 to the date of our Annual Meeting. The list also will be available for inspection at the Annual Meeting. Additional information regarding the matters to be acted on at the Annual Meeting can be found in the accompanying Proxy Statement.

By Order of the Board of Directors,

Beverly L. O’Toole

Assistant Secretary

New York, New York

PLEASE SUBMIT YOUR PROXY THROUGH THE INTERNET OR BY PHONE

OR MARK, SIGN, DATE AND RETURN YOUR PROXY

IN THE ENCLOSED ENVELOPE

THE GOLDMAN SACHS GROUP, INC.

85 Broad Street

New York, New York 10004

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

April 6, 2005

INTRODUCTION

This Proxy Statement is furnished in connection with a solicitation of proxies by the Board of Directors of The Goldman Sachs Group, Inc., a Delaware corporation (“Goldman Sachs,” “firm,” “we” or “our”), to be used at our 2005 Annual Meeting of Shareholders on Wednesday, April 6, 2005 at 9:30 a.m., New York City time, and at any adjournments or postponements of the Annual Meeting. The approximate date on which this Proxy Statement and the accompanying form of proxy are first being sent to shareholders is February 24, 2005.

Holders of our common stock, par value $0.01 per share (the “Common Stock”), as of the close of business on February 7, 2005, will be entitled to vote at the Annual Meeting. On that date, there were 481,466,205 shares of Common Stock outstanding, each of which is entitled to one vote for each matter to be voted on at the Annual Meeting, held by 5,718 shareholders of record.

If you properly cast your vote, by either voting your proxy through the Internet or telephonically or by executing and returning the enclosed proxy card, and your vote is not subsequently revoked, your vote will be voted in accordance with your instructions. If you execute the enclosed proxy card but do not give instructions, your proxy will be voted as follows: FOR the election of the nominees for directors named below, FOR the approval of the amendments to our Amended and Restated Certificate of Incorporation to provide for the annual election of all of our directors, FOR the ratification of the appointment of PricewaterhouseCoopers LLP as our independent auditors for our fiscal year ending November 25, 2005 and otherwise in accordance with the judgment of the persons voting the proxy on any other matter properly brought before the Annual Meeting.

A vote through the Internet or by telephone may be revoked by executing a later-dated proxy card, by subsequently voting through the Internet or by telephone or by attending the Annual Meeting and voting in person. A shareholder executing a proxy card also may revoke it at any time before it is exercised by giving written notice revoking the proxy to our Secretary at One New York Plaza, 37th Floor, New York, New York 10004, by subsequently filing another proxy bearing a later date or by attending the Annual Meeting and voting in person. Attending the Annual Meeting will not automatically revoke your prior Internet or telephone vote or your proxy.

If you hold shares in “street name” (that is, through a bank, broker or other nominee) and would like to attend the Annual Meeting and vote in person, you will need to bring an account statement or other acceptable evidence of ownership of Common Stock as of the close of business on February 7, 2005, the record date for voting. Alternatively, in order to vote, you may contact the person in whose name your shares are registered, obtain a proxy from that person and bring it to the Annual Meeting.

Quorum Requirements

The holders of a majority of the outstanding shares of Common Stock on February 7, 2005 present in person or represented by proxy and entitled to vote will constitute a quorum for the transaction of business at the Annual Meeting. Abstentions are treated as “present” for quorum purposes.

Voting Requirements

Election of Directors.You may vote “for” or “withhold” with respect to any or all director nominees. The election of directors requires a plurality of the votes cast “for” the election of directors; accordingly, the directorships to be filled at the Annual Meeting will be filled by the nominees receiving the highest number of votes “for.” Votes that are “withheld” will be excluded entirely from the vote and will have no effect on the outcome of the vote.

Amendments to Our Amended and Restated Certificate of Incorporation to Provide for the Annual Election of All of Our Directors. You may vote “for,” “against” or “abstain” with respect to the amendments to our Amended and Restated Certificate of Incorporation to provide for the annual election of all of our directors. The affirmative vote of the holders of not less than 80% of all outstanding shares of Common Stock is required to approve the amendments. Only votes cast “for” a matter constitute affirmative votes. Thus, an abstention will not be treated as a vote cast “for” the proposal and will have the same effect as a vote “against” the proposal.

Ratification of the Appointment of Independent Auditors.You may vote “for,” “against” or “abstain” with respect to the ratification of the appointment of our independent auditors. The affirmative vote of a majority of the votes cast “for” or “against” the matter by shareholders entitled to vote at the Annual Meeting is required to ratify the appointment of our independent auditors. Because an abstention is not treated as a vote “for” or “against,” it will have no effect on the outcome of the vote for this proposal.

Broker Authority to Vote.Under the rules of the National Association of Securities Dealers, Inc., member brokers generally may not vote shares held by them in street name for customers unless they are permitted to do so under the rules of any national securities exchange of which they are a member. Under the rules of the New York Stock Exchange, Inc. (“NYSE”), a member broker who holds shares in street name for customers has the authority to vote on certain items if it has transmitted proxy soliciting materials to the beneficial owner but has not received instructions from that owner. NYSE rules permit member brokers (other than Goldman, Sachs & Co. and any of the other subsidiaries or affiliates of Goldman Sachs that are NYSE member brokers (collectively, “GS&Co.”)) that do not receive instructions from their customers to vote on all three of the proposals discussed above in their discretion. In the case of GS&Co., it is NYSE policy that, due to GS&Co.’s relationship with Goldman Sachs, if GS&Co. does not receive voting instructions regarding shares held by it in street name for its customers, it is entitled to vote these shares only in the same proportion as the shares represented by votes cast by all shareholders of record with respect to each proposal.

Employees’ Profit Sharing Retirement Income Plan. Pursuant to the terms of The Goldman Sachs Employees’ Profit Sharing Retirement Income Plan, any shares beneficially owned through the plan for which voting instructions are not received will be voted in the same proportion as the shares beneficially owned through the plan for which voting instructions are received.

Expenses of Solicitation

We will pay the expenses of the preparation of proxy materials and the solicitation of proxies for the Annual Meeting. In addition to the solicitation of proxies by mail, solicitation may be made by

2

certain directors, officers or employees of Goldman Sachs or its affiliates telephonically, electronically or by other means of communication and by Georgeson Shareholder Communications Inc., which we have hired to assist in the solicitation and distribution of proxies. Directors, officers and employees will receive no additional compensation for such solicitation, and Georgeson will receive a fee of $9,000 for its services. We will reimburse brokers, including GS&Co., and other nominees for costs incurred by them in mailing proxy materials to beneficial owners in accordance with applicable rules.

Availability of Certain Documents

A copy of our 2004 Annual Report to Shareholders is enclosed and a copy of our Policy Regarding Director Independence Determinations is attached as Annex A to this Proxy Statement.You also may obtain a copy of these documents, our 2004 Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (the “SEC”), our Corporate Governance Guidelines, our Code of Business Conduct and Ethics and the charters for our Audit, Compensation and Corporate Governance and Nominating Committees, without charge, by writing to: The Goldman Sachs Group, Inc., 85 Broad Street, 17th Floor, New York, New York 10004, Attn: Investor Relations. All of these documents also are available through our website athttp://www.gs.com/investor_relations.

Voting Arrangements

Shareholders’ Agreement.All employees of Goldman Sachs who participate in The Goldman Sachs Partner Compensation Plan (the “Partner Compensation Plan”) and The Goldman Sachs Restricted Partner Compensation Plan (the “Restricted Partner Compensation Plan”) are covered persons under our Shareholders’ Agreement. The Shareholders’ Agreement, among other things, restricts voting of the shares of Common Stock of which a party to the Shareholders’ Agreement is the sole beneficial owner (including for this purpose shares of Common Stock held in a joint account with the person’s spouse, but excluding any shares acquired pursuant to The Goldman Sachs Employees’ Profit Sharing Retirement Income Plan) (“Voting Shares”). The committee that administers the Shareholders’ Agreement (the “Shareholders’ Committee”) may, under certain circumstances, waive the voting provisions of the Shareholders’ Agreement.

Prior to any vote of the shareholders of Goldman Sachs, the Shareholders’ Agreement requires a separate, preliminary vote of the Voting Shares on each matter on which a vote of the shareholders is proposed to be taken. In elections of directors, each Voting Share will be voted in favor of the election of those persons, equal in number to the number of such positions to be filled, receiving the highest numbers of votes cast by the Voting Shares in the preliminary vote. In other matters, each Voting Share will be voted at the Annual Meeting in accordance with the majority of the votes cast by the Voting Shares in the preliminary vote.

If you are a party to the Shareholders’ Agreement, you previously gave an irrevocable proxy to the Shareholders’ Committee to vote your Voting Shares at the Annual Meeting, and you directed that the proxy be voted in accordance with the preliminary vote. You also authorized the holder of the proxy to vote on other matters that come before the Annual Meeting as the holder sees fit in his or her discretion in a manner that is not inconsistent with the preliminary vote or that does not frustrate the intent of the preliminary vote.

As of February 7, 2005, 41,718,738 of the outstanding shares of Common Stock are Voting Shares for purposes of the Shareholders’ Agreement (approximately 8.7% of the outstanding shares of Common Stock entitled to vote at the Annual Meeting). The preliminary vote with respect to the Voting Shares will be concluded on or about March 25, 2005.

The Shareholders’ Agreement will continue in effect until the earlier of January 1, 2050 and the time it is terminated by the vote of 66 2/3% of the covered shares (as defined in the Shareholders’ Agreement).

3

| Item 1. | Election of Directors |

Introduction

Our Board of Directors presently consists of ten members and is divided into three classes. Currently, at each Annual Meeting of Shareholders, a class of directors is elected generally for a term expiring at the Annual Meeting of Shareholders in the third year following the year of its election. If shareholders approve the amendments to our Amended and Restated Certificate of Incorporation, however, as described under Item 2 of this Proxy Statement, the terms of all of our directors, including the directors to be elected at the Annual Meeting, will expire at the 2006 Annual Meeting of Shareholders and the Board of Directors will consist of one class. In either case, each director will hold office until his or her successor has been elected and qualified or until the director’s earlier resignation or removal.

In January 2005, the Board of Directors, upon the recommendation of the Corporate Governance and Nominating Committee, nominated Stephen Friedman for election at the Annual Meeting, and approved an increase in the size of the Board of Directors to eleven members if Mr. Friedman is so elected.

The Board of Directors has determined, upon the recommendation of the Corporate Governance and Nominating Committee and in accordance with our Policy Regarding Director Independence Determinations, that the members of our Board of Directors who are not also officers of Goldman Sachs or any of its affiliates (the “Non-Management Directors”) and Mr. Friedman are “independent” within the meaning of the rules of the NYSE. All of our directors other than Henry M. Paulson, Jr. and Lloyd C. Blankfein are Non-Management Directors. Moreover, the Board of Directors has determined, upon the recommendation of the Corporate Governance and Nominating Committee, that each member of the Audit Committee (each of whom is a Non-Management Director) is both “independent” and an “audit committee financial expert” within the meaning of the rules of the SEC. Further, the Board of Directors has determined, upon the recommendation of the Corporate Governance and Nominating Committee, that neither any member of the Compensation Committee or the Corporate Governance and Nominating Committee nor Mr. Friedman receives, directly or indirectly, any consulting, advisory or other compensatory fees that would be prohibited under the SEC’s audit committee independence standards. All committees of the Board of Directors are comprised solely of independent directors.

Annual Meeting

At the Annual Meeting, our shareholders will be asked to elect as directors John H. Bryan, Mr. Friedman, William W. George and Mr. Paulson to hold office for terms ending at the 2008 Annual Meeting of Shareholders. The remaining seven directors named below will continue in office. However, if our shareholders approve the amendments to our Amended and Restated Certificate of Incorporation, as described under Item 2 of this Proxy Statement, the terms of all of our directors, including the directors to be elected at the Annual Meeting, will expire at the 2006 Annual Meeting of Shareholders.

While the Board of Directors does not anticipate that any of the nominees will be unable to stand for election as a director at the Annual Meeting, if that is the case, proxies will be voted in favor of such other person or persons as may be recommended by our Corporate Governance and Nominating Committee and designated by the Board of Directors.

Messrs. Bryan, George and Paulson currently are members of the Board of Directors, and all of the nominees have been recommended for election or re-election to the Board of Directors by our Corporate Governance and Nominating Committee and approved and nominated for election or re-election by the Board of Directors. Set forth below is information as of February 1, 2005 regarding the nominees and the directors continuing in office, which was confirmed by them for inclusion in this Proxy Statement.

We encourage our directors to attend Annual Meetings of Shareholders and believe that attendance at Annual Meetings is just as important as attendance at meetings of the Board of Directors and its committees. In fact, we typically schedule Board of Directors and committee meetings to coincide with the dates of our Annual Meetings. All of our directors attended last year’s Annual Meeting held on March 31, 2004.

4

Nominees for Election to the Board of Directors for a Three-Year Term Expiring in 2008

| John H. Bryan | Director since November 1999 |

Mr. Bryan, age 68, is the retired Chairman and Chief Executive Officer of, and currently serves as a consultant to, Sara Lee Corporation. He served as its Chief Executive Officer from 1975 to June 2000 and its Chairman of the Board from 1976 until his retirement in October 2001. He is on the boards of the following public companies in addition to Goldman Sachs: BP p.l.c. and General Motors Corporation. Mr. Bryan is the past Chairman of the Grocery Manufacturers of America, Inc. and the past Vice Chairman and a current member of The Business Council. He also served as Co-Chairman of the World Economic Forum’s annual meetings in 1994, 1997 and 2000. In addition, Mr. Bryan is affiliated with certain non-profit organizations, including as a trustee of the University of Chicago, Chairman of the Board of Trustees of The Art Institute of Chicago, Chairman of the Board of Directors of Millennium Park, Inc. and the past Chairman and a current member of The Chicago Council on Foreign Relations; he is also the past Chairman of Catalyst.

| Stephen Friedman |

Mr. Friedman, age 67, served as Assistant to the President for Economic Policy and Director of the National Economic Council from December 2002 until December 2004. From 1998 until December 2002, Mr. Friedman was a senior principal of Marsh & McLennan Capital Corp. He retired as Senior Partner and Chairman of the Management Committee of The Goldman Sachs Group, L.P., our predecessor, in 1994, having joined the firm in 1966. Mr. Friedman is not on the board of any public company. Mr. Friedman is known to certain members of our Corporate Governance and Nominating Committee because he served on our Board of Directors from May until December 2002.

| William W. George | Director since December 2002 |

Mr. George, age 62, was Chief Executive Officer of Medtronic, Inc. from May 1991 to May 2001 and its Chairman of the Board from April 1996 until his retirement in April 2002. He joined Medtronic in 1989 as President and Chief Operating Officer. Mr. George is currently a Professor of Management Practice at the Harvard Business School and was formerly Professor of Leadership and Governance at the International Institute for Management Development from January 2002 until May 2003, Visiting Professor of Technology Management at the Ecole Polytechnique Fédérale de Lausanne from January 2002 until May 2003 and an Executive-in-Residence at the Yale School of Management from September 2003 through December 2003. Mr. George is on the boards of the following public companies in addition to Goldman Sachs: Target Corporation and Novartis AG. He is also Chairman of the Board of Minnesota Thunder Professional Soccer. In addition, he is affiliated with certain non-profit organizations, including as Chairman of the Global Center for Leadership and Business Ethics and as a member of the Carnegie Endowment for International Peace.

| Henry M. Paulson, Jr. | Director since August 1998 |

Mr. Paulson, age 58, has been our Chairman and Chief Executive Officer since May 1999, and a director since August 1998. He was Co-Chairman and Chief Executive Officer or Co-Chief Executive Officer of The Goldman Sachs Group, L.P. from June 1998 to May 1999, and served as Chief Operating Officer from December 1994 to June 1998. Mr. Paulson is not on the board of any public company other than Goldman Sachs. He is affiliated with certain non-profit organizations, including as a member of the Board of Directors of Catalyst. He also serves on the Advisory Board of the J.L. Kellogg Graduate School of Management at Northwestern University and is a member of the Board of the Dean’s Advisors of the Harvard Business School. Mr. Paulson is a member of the Advisory Board of the Tsinghua University School of Economics and Management and a member of the Governing Board of the Indian School of Business. He is also Chairman of the Board of Governors of The Nature Conservancy, Co-Chairman of the Asia/Pacific Council of The Nature Conservancy and Chairman Emeritus of The Peregrine Fund, Inc.

5

Directors’ Recommendation

The Board of Directors unanimously recommends a vote FOR the election of Messrs. Bryan, Friedman, George and Paulson to the Board of Directors.

Directors Continuing in Office — Term Expiring in 2006

| Lloyd C. Blankfein | Director since April 2003 |

Mr. Blankfein, age 50, has been our President and Chief Operating Officer since January 2004, and a director since April 2003. Prior to that, from April 2002 until January 2004, he was a Vice Chairman of Goldman Sachs, with management responsibility for the Fixed Income, Currency and Commodities Division (“FICC”) and the Equities Division. Prior to becoming a Vice Chairman, he had been Co-Head of FICC since its formation in 1997. From 1994 until then, he headed or co-headed the J. Aron Currency and Commodities Division. Mr. Blankfein is not on the board of any public company other than Goldman Sachs. He is affiliated with certain non-profit organizations, including as Co-Chair of the Harvard University Financial Aid Task Force and as a member of the Executive Committee of the Harvard University Committee on University Resources, the Board of Trustees of the New York Historical Society, the Board of Overseers of the Weill Medical College of Cornell University and the Board of Directors of the Partnership for New York City and The Robin Hood Foundation.

| Edward M. Liddy | Director since June 2003 |

Mr. Liddy, age 59, has been Chairman, President and Chief Executive Officer of The Allstate Corporation, the parent of the Allstate Insurance Company, since January 1999. He served as President and Chief Operating Officer of The Allstate Corporation from January 1995 until January 1999. Prior to then, Mr. Liddy was Senior Vice President and Chief Financial Officer of Sears, Roebuck and Co., where he held a variety of senior operating and financial positions since 1988. Mr. Liddy is on the boards of the following public companies in addition to Goldman Sachs: 3M Company and The Kroger Co. He is also affiliated with certain non-profit organizations, including as Chairman of Northwestern Memorial Hospital and as a director of Catalyst and the Boys & Girls Clubs of America.

| Ruth J. Simmons | Director since January 2000 |

Dr. Simmons, age 59, has been President of Brown University since July 2001. She was President of Smith College from 1995 to June 2001 and Vice Provost of Princeton University from 1992 to 1995. Dr. Simmons is on the boards of the following public companies in addition to Goldman Sachs: Pfizer Inc. and Texas Instruments Inc. She also serves on the Directors’ Advisory Council of MetLife, Inc. In addition, Dr. Simmons is affiliated with certain non-profit organizations, including as a member of the American Academy of Arts and Sciences, the American Philosophical Society, the Business-Higher Education Forum, the Council on Foreign Relations, and the Board of Directors of the Alliance for Lupus Research.

Directors Continuing in Office — Term Expiring in 2007

| Lord Browne of Madingley | Director since May 1999 |

Lord Browne, age 56, was appointed an executive director in 1991 and Group Chief Executive of BP p.l.c. (under its former name, The British Petroleum Company p.l.c.) in 1995. He is on the board of one public company in addition to Goldman Sachs and BP p.l.c.: Intel Corporation. Lord Browne is also a trustee of the British Museum, a non-profit organization.

6

| Claes Dahlbäck | Director since June 2003 |

Mr. Dahlbäck, age 57, has been the nonexecutive Chairman of Investor AB, a Swedish-based investment company, since April 2002 and is also the Executive Vice Chairman of W Capital Management, an investment company owned by the Wallenberg Foundations. He served as Vice Chairman of Investor AB from April 1999 until April 2002 and from 1978 until April 1999 was its President and Chief Executive Officer. He also served as an international advisor to Goldman Sachs from May 1999 until February 2002. Mr. Dahlbäck is on the board of one public company in addition to Goldman Sachs: Stora Enso Oyj.

| James A. Johnson | Director since May 1999 |

Mr. Johnson, age 61, has been a Vice Chairman of Perseus, L.L.C., a merchant banking and private equity firm, since April 2001. From January 2000 to March 2001, he served as Chairman and Chief Executive Officer of Johnson Capital Partners, a private investment company. From January through December 1999, he was Chairman of the Executive Committee of Fannie Mae, from February 1991 through December 1998, he was Chairman and Chief Executive Officer of Fannie Mae and from 1990 through February 1991, he was Vice Chairman of Fannie Mae. Mr. Johnson is on the boards of the following public companies in addition to Goldman Sachs: Gannett Co., Inc., KB Home, Target Corporation, Temple-Inland, Inc. and UnitedHealth Group Inc. In addition, he is affiliated with certain non-profit organizations, including as Chairman Emeritus of the John F. Kennedy Center for the Performing Arts, as a member of the American Academy of Arts and Sciences, the American Friends of Bilderberg, the Council on Foreign Relations and The Trilateral Commission and as an honorary trustee of The Brookings Institution.

| Lois D. Juliber | Director since March 2004 |

Ms. Juliber, age 56, has been a Vice Chairman of the Colgate-Palmolive Company since July 2004. She served as Chief Operating Officer of the Colgate-Palmolive Company from March 2000 to July 2004, Executive Vice President — North America and Europe of the Colgate-Palmolive Company from 1997 until March 2000 and President of Colgate North America from 1994 to 1997. Ms. Juliber is on the board of one public company in addition to Goldman Sachs: E. I. Du Pont De Nemours and Company. She is affiliated with certain non-profit organizations, including Girls Incorporated, and is also a trustee of Wellesley College.

There are no family relationships among any directors, nominees or executive officers of Goldman Sachs.

Board of Directors’ Meetings and Committees

Our Board of Directors held seven meetings during our fiscal year ended November 26, 2004. Each of our directors attended at least 75% of the meetings of the Board of Directors and the committees of the Board of Directors on which he or she served during fiscal 2004 (in each case, which were held during the period for which he or she was a director). Attendance at Board of Directors and committee meetings during fiscal 2004 averaged 97.3% for our directors as a group. Our Board of Directors has three standing committees, each of which is described below.

Audit Committee

Lord Browne is the Chair, and Ms. Juliber and Messrs. Bryan, Dahlbäck, George, Johnson and Liddy are the other members, of our Audit Committee. The primary purposes of our Audit Committee are to: (a) assist the Board of Directors in its oversight of (i) the integrity of our financial statements; (ii) our compliance with legal and regulatory requirements; (iii) our independent auditors’ qualifications and independence; (iv) the performance of our internal audit function and independent auditors; and (v) our management of market, credit, liquidity and other financial and operational risks; (b) decide whether to appoint, retain or terminate our independent auditors and to pre-approve all audit, audit-related and other services, if any, to be provided by the independent auditors; and (c) prepare the report required

7

to be prepared by the Audit Committee pursuant to the rules of the SEC for inclusion in our annual proxy statement. Among its other duties and responsibilities set forth in its charter, the Audit Committee also reviews and monitors the adequacy of structures, policies and procedures that we have developed to assure the integrity of research by our investment research professionals.

During fiscal 2004, our Audit Committee met eleven times, including six executive sessions, five private sessions with management and five private sessions with each of the independent auditors and the Director of Internal Audit. In fiscal 2004, the Chair of the Audit Committee also had six meetings with our Director of Internal Audit, seven meetings with each of our Chief Financial Officer and Controller, four meetings with our General Counsel and three meetings with our Global Head of Compliance. The Audit Committee and our Board of Directors have established a procedure whereby complaints or concerns with respect to accounting, internal controls and auditing matters may be submitted to the Audit Committee, which is described under “Other Matters — Policies on Reporting of Concerns Regarding Accounting and Other Matters and on Communicating with Non-Management Directors.” Our Board of Directors and the Corporate Governance and Nominating Committee have determined that each member of the Audit Committee is “independent” within the meaning of the rules of both the NYSE and the SEC. Our Board of Directors has also determined that each member of the Audit Committee is financially literate and has accounting or related financial management expertise, as such qualifications are defined under the rules of the NYSE, and is an “audit committee financial expert” within the meaning of the rules of the SEC. In that connection, in addition to the information set forth above regarding the background of each director, Lord Browne currently serves on the Audit Committee of Intel Corporation; Mr. Bryan currently serves on the Audit Committee of BP p.l.c., and was previously a member of the Audit Committee of General Motors Corporation and the Audit and Risk Management Committee of Bank One Corporation; Mr. Dahlbäck currently serves on the Audit Committees of Investor AB and Gambro AB; Mr. George currently serves on the Audit Committee of Target Corporation; Mr. Johnson was previously a member of the Audit Committee of UnitedHealth Group Inc.; and Mr. Liddy is currently the Chair of the Audit Committee of 3M Company. The report of the Audit Committee is included in this Proxy Statement under “Report of the Audit Committee.”

Compensation Committee

Mr. Johnson is the Chair, and Lord Browne, Messrs. Bryan, Dahlbäck, George and Liddy, Ms. Juliber and Dr. Simmons are the other members, of our Compensation Committee. Each member of our Compensation Committee is “independent” within the meaning of the rules of the NYSE, and, as required by the Compensation Committee Charter, no member receives, directly or indirectly, any consulting, advisory or other compensatory fees that would be prohibited under the SEC’s audit committee independence standards. The primary purposes of our Compensation Committee are to: (a) determine and approve the compensation of our Chief Executive Officer; (b) make recommendations to the Board of Directors with respect to executive compensation (including compensation of non-Chief Executive Officer executive officers) and our incentive-compensation and equity-based plans that are subject to the approval of the Board of Directors; (c) assist the Board of Directors in its oversight of the development, implementation and effectiveness of our policies and strategies relating to our human capital management function, including but not limited to those policies and strategies regarding recruiting, retention, career development and progression, management succession (other than within the purview of the Corporate Governance and Nominating Committee), diversity and employment practices; and (d) prepare any report on executive officer compensation required by the rules and regulations of the SEC. The Compensation Committee also administers The Goldman Sachs Amended and Restated Stock Incentive Plan (the “Stock Incentive Plan”) and the Restricted Partner Compensation Plan, and oversees the committee appointed by the Board of Directors to administer the Partner Compensation Plan.

During fiscal 2004, our Compensation Committee met five times. In addition, Mr. Johnson met with the chairs of our internal compensation policy committee five times. The report of the Compensation Committee is included in this Proxy Statement under “Report of the Compensation Committee on Executive Compensation.”

8

Corporate Governance and Nominating Committee

Mr. Bryan is the Chair, and Lord Browne, Messrs. Dahlbäck, George, Johnson and Liddy, Ms. Juliber and Dr. Simmons are the other members, of our Corporate Governance and Nominating Committee. Each member of our Corporate Governance and Nominating Committee is “independent” within the meaning of the rules of the NYSE, and, as required by the Corporate Governance and Nominating Committee Charter, no member receives, directly or indirectly, any consulting, advisory or other compensatory fees that would be prohibited under the SEC’s audit committee independence standards.

The primary purposes of the Corporate Governance and Nominating Committee are to: (a) recommend individuals to the Board of Directors for nomination, election or appointment as members of the Board of Directors and its committees, consistent with the criteria included in our Corporate Governance Guidelines; (b) oversee the evaluation of the performance of the Board of Directors and our Chief Executive Officer; (c) review and concur in the Chief Executive Officer’s and other senior management’s succession plans; and (d) take a leadership role in shaping our corporate governance, including developing, recommending to the Board of Directors and reviewing on an ongoing basis the corporate governance principles and practices that should apply to Goldman Sachs. In identifying and recommending nominees for positions on the Board of Directors, the Corporate Governance and Nominating Committee places primary emphasis on the criteria set forth under “Selection of Directors — Nominations and Appointments” in our Corporate Governance Guidelines, namely: (a) judgment, character, expertise, skills and knowledge useful to the oversight of our business; (b) diversity of viewpoints, backgrounds, experiences and other demographics; (c) business or other relevant experience; and (d) the extent to which the interplay of the nominee’s expertise, skills, knowledge and experience with that of other members of the Board of Directors will build a board that is effective, collegial and responsive to the needs of Goldman Sachs.

The Corporate Governance and Nominating Committee does not set specific, minimum qualifications that nominees must meet in order for the Committee to recommend them to the Board of Directors, but rather believes that each nominee should be evaluated based on his or her individual merits, taking into account the needs of Goldman Sachs and the composition of the Board of Directors. Members of the Corporate Governance and Nominating Committee discuss and evaluate possible candidates in detail, and suggest individuals to explore in more depth. Outside consultants also have been employed to help in identifying candidates. Once a candidate is identified whom the Committee wants to seriously consider and move toward nomination, the Chair of the Corporate Governance and Nominating Committee enters into a discussion with that candidate. The Corporate Governance and Nominating Committee will consider candidates recommended by shareholders. The policy adopted by the Corporate Governance and Nominating Committee provides that candidates recommended by shareholders are given appropriate consideration in the same manner as other candidates. Shareholders who wish to submit candidates for director for consideration by the Corporate Governance and Nominating Committee for election at our 2006 Annual Meeting of Shareholders may do so by submitting in writing such candidates’ names, in compliance with the procedures and along with the other information required by our By-laws, to John F. W. Rogers, the Secretary of our Board of Directors, at The Goldman Sachs Group, Inc., 85 Broad Street, 30th Floor, New York, New York 10004 between December 7, 2005 and January 6, 2006.

During fiscal 2004, our Corporate Governance and Nominating Committee met five times. The report of the Corporate Governance and Nominating Committee is included in this Proxy Statement under “Report of the Corporate Governance and Nominating Committee.”

Non-Management Directors Meetings

In addition to the meetings of the committees of the Board of Directors described above, in connection with the Board of Directors meetings, our Non-Management Directors met five times in executive session during fiscal 2004. Mr. Bryan, Chair of our Corporate Governance and Nominating Committee, presided at these executive sessions.

9

Employment Contracts and Change of Control Arrangements

We have entered into employment agreements with, among others, our directors who are employees and our executive officers. Each of these employment agreements requires (unless waived by Goldman Sachs) that the employee devote his or her entire working time to the business and affairs of Goldman Sachs and its affiliates and subsidiaries; each agreement generally may be terminated at any time for any reason by either the employee or Goldman Sachs on 90 days’ prior notice.

The restricted stock units (“RSUs”) and stock options (“Options”) granted to our executive officers as described under “Executive Compensation” provide that if a change in control occursandwithin 18 months thereafter the grantee’s employment is terminated other than for “cause” (as defined in the applicable award agreement and/or the Stock Incentive Plan) or the grantee terminates employment for “good reason” (as defined in the applicable award agreement and/or the Stock Incentive Plan):

| Ÿ | any unvested outstanding RSUs and Options will become vested; |

| Ÿ | all outstanding Options will become exercisable; and |

| Ÿ | the Common Stock underlying any outstanding RSUs will be delivered. |

“Change in control” means the consummation of a business combination involving Goldman Sachs, unless immediately following the business combination, either:

| Ÿ | at least 50% of the total voting power of the surviving entity or its parent entity, if applicable, is represented by securities of Goldman Sachs that were outstanding immediately prior to the transaction (or by shares into which the securities of Goldman Sachs are converted in the transaction); or |

| Ÿ | at least 50% of the members of the board of directors of the surviving entity, or its parent entity, if applicable, following the transaction were, at the time of the Board of Directors’ approval of the execution of the initial agreement providing for the transaction, directors of Goldman Sachs on the date of grant of the RSUs and Options (including directors whose election or nomination was approved by two-thirds of the incumbent directors). |

Director Compensation

For fiscal 2004, non-employee director compensation consisted of a $75,000 annual retainer and a $25,000 committee chair fee, which were paid in fully vested RSUs on December 14, 2004. The number of RSUs awarded (720 RSUs in respect of the annual retainer, other than in the case of Ms. Juliber, who joined the Board of Directors after the start of the 2004 fiscal year and received a prorated annual retainer, and 240 RSUs in respect of the committee chair fee, if applicable) was determined by dividing the dollar amount by the average closing price-per-share of the Common Stock on the NYSE over the ten trading-day period up to and including the last day of fiscal 2004 ($104.27).

For fiscal 2004, non-employee directors also received, at their election, an annual equity grant on December 17, 2003 consisting of one of the following: 3,000 fully vested RSUs; 1,500 fully vested RSUs and 4,500 fully vested Options; or 9,000 fully vested Options. Each of Lord Browne, Mr. Liddy and Dr. Simmons received all RSUs, each of Messrs. Bryan, Dahlbäck and George received 1,500 RSUs and 4,500 Options, and Mr. Johnson received all Options. Ms. Juliber received a prorated amount of the annual equity grant (2,000 fully vested RSUs) on April 5, 2004 and a prorated amount of the annual retainer ($50,000) in fully vested RSUs (480 RSUs), in each case, based on the starting date of her directorship. RSUs granted to non-employee directors provide for delivery of the underlying shares of Common Stock on the last business day in May in the year following the year of the non-employee director’s retirement from the Board of Directors. Options granted to non-employee directors generally become exercisable on the earlier of: (a) the first trading day in January three years after the grant; and (b) the date on which the non-employee director ceases to be a member of the Board of Directors.

10

Non-employee directors will receive the annual retainer and committee chair fees for fiscal 2005 either in cash or through a grant of fully vested RSUs. With respect to the fiscal 2005 annual equity grant, which was made as of December 14, 2004, each of the non-employee directors received 3,000 fully vested RSUs.

In January 2004, the Board of Directors adopted, upon the recommendation of the Corporate Governance and Nominating Committee, a policy on stock ownership retention by Goldman Sachs’ non-employee directors. In general, this policy requires non-employee directors to beneficially own at least 5,000 shares of Common Stock or fully vested RSUs within two years of becoming a director.

Non-employee directors receive no compensation from Goldman Sachs other than directors’ fees.

Directors who are also employees of Goldman Sachs or an affiliate receive no compensation for serving as directors.

Executive Compensation

The following table sets forth for fiscal 2004, fiscal 2003 and fiscal 2002 the compensation for our Chief Executive Officer and for each of our four most highly compensated executive officers during fiscal 2004, other than the Chief Executive Officer, serving as executive officers at the end of fiscal 2004. These five persons are referred to collectively as the “Named Executive Officers.”

SUMMARY COMPENSATION TABLE

| Annual Cash Compensation | Long-Term Compensation Awards | ||||||||||||||

Named Executive Officer | Year | Salary | Bonus | Restricted Stock Unit Awards (a) | Securities Underlying Options (b) | All Other Compensation (c) | |||||||||

Henry M. Paulson, Jr. Chairman of the Board | 2004 2003 2002 | $ $ $ | 600,000 600,000 600,000 | $ $ $ | 0 0 6,253,500 | $ $ $ | 29,150,028 20,754,337 2,603,735 | 0 0 99,039 | $39,331 $46,242 $54,649 | ||||||

Lloyd C. Blankfein | 2004 | $ | 600,000 | $ | 14,995,500 | $ | 13,882,598 | 0 | $51,244 | ||||||

President and Chief Operating Officer | 2003 2002 | $ $ | 600,000 600,000 | $ $ | 10,244,500 8,253,500 | $ $ | 9,291,128 3,619,344 | 0 137,670 | $63,997 $84,686 | ||||||

David A. Viniar Executive Vice President and | 2004 2003 2002 | $ $ $ | 600,000 600,000 600,000 | $ $ $ | 9,745,500 6,224,500 3,753,500 | $ $ $ | 8,632,526 5,221,660 1,334,244 | 0 0 50,751 | $51,244 $63,997 $84,686 | ||||||

Robert S. Kaplan Vice Chairman | 2004 2003 2002 | $ $ $ | 600,000 600,000 600,000 | $ $ $ | 8,995,500 6,494,500 4,003,500 | $ $ $ | 7,882,500 5,475,984 1,461,224 | 0 0 55,581 | $33,314 $37,275 $39,479 | ||||||

Suzanne Nora Johnson Vice Chairman | 2004 2003 2002 | $ $ $ | 600,000 600,000 600,000 | $ $ $ | 9,017,500 4,767,500 2,772,500 | $ $ $ | 7,882,500 3,695,621 826,479 | 0 0 31,437 | $17,331 $23,242 $35,649 | ||||||

| (a) | The values of the RSUs shown in the table (which were granted for fiscal 2004, fiscal 2003 and fiscal 2002) were determined, respectively, by multiplying the number of RSUs awarded to each Named Executive Officer by the closing price-per-share of Common Stock on the NYSE on November 26, 2004 ($104.84), our 2004 fiscal year-end, for RSUs granted on December 14, 2004, on November 28, 2003 ($96.08), our 2003 fiscal year-end, for RSUs granted on December 17, 2003 (on November 28, 2003 for Ms. Nora Johnson), and on November 29, 2002 ($78.87), our 2002 fiscal year-end, for RSUs granted on December 13, 2002 (on November 29, 2002 for Ms. Nora Johnson). The number of RSUs awarded to each Named Executive Officer for fiscal 2004 was determined by dividing the dollar amount to be granted as an equity-based award by |

11

$104.84 (the closing price-per-share of the Common Stock on the NYSE on November 26, 2004, our 2004 fiscal year-end). In general, 40% of the RSUs granted for fiscal 2004 were vested on the grant date, with the remainder vesting on November 30, 2007. In general, 25% of the RSUs granted for fiscal 2003 were vested on the grant date, with the remainder vesting on November 24, 2006. In general, 25% of the RSUs granted for fiscal 2002 were vested on the grant date, with the remainder vesting on November 25, 2005. RSUs granted for fiscal 2004, fiscal 2003 and fiscal 2002 generally provide for delivery of the underlying shares of Common Stock in January 2008, January 2007 and January 2006, respectively. |

| In general, non-vested RSUs are forfeited on termination of employment, except in limited cases such as “retirement,” and RSUs, whether or not vested, may be forfeited in certain circumstances, such as if the holder’s employment is terminated for “cause.” Each Named Executive Officer currently meets the requirements under the RSUs for “retirement.” Each RSU includes a “dividend equivalent right,” pursuant to which the holder of the RSU is entitled to receive an amount equal to any ordinary cash dividends paid to the holder of a share of Common Stock approximately when those dividends are paid to shareholders. |

| The aggregate value of all Common Stock underlying all RSUs awarded to and held by each of the Named Executive Officers at the end of fiscal 2004 (including the RSUs granted for fiscal 2004), determined based on the closing price-per-share of the Common Stock on the NYSE on November 26, 2004 ($104.84), and the number of outstanding RSUs awarded to each of the Named Executive Officers in the aggregate since our initial public offering and for each of fiscal 2004, fiscal 2003 and fiscal 2002, respectively, were: Mr. Paulson — $55,257,704, 527,067, 278,043, 216,011 and 33,013; Mr. Blankfein — $28,831,944, 275,009, 132,417, 96,702 and 45,890; Mr. Viniar— $16,103,843, 153,604, 82,340, 54,347 and 16,917; Mr. Kaplan — $15,800,122, 150,707, 75,186, 56,994 and 18,527; and Ms. Nora Johnson — $13,013,684, 124,129, 75,186, 38,464 and 10,479. |

| (b) | For fiscal 2002, each Named Executive Officer received a grant of Options on December 13, 2002 (on November 29, 2002 for Ms. Nora Johnson) with an exercise price of $78.87, the closing price-per-share of Common Stock on the NYSE on November 29, 2002, our 2002 fiscal year-end. One-quarter of these Options were vested on the grant date, with the remainder generally vesting on November 25, 2005. These Options generally become exercisable in January 2006 and expire on November 30, 2012. |

| (c) | Fiscal 2004 includes Money Purchase Pension Plan contribution, Term Life Insurance premium, Goldman Sachs Employees’ Profit Sharing Retirement Income Plan contribution and executive medical and dental plan premium payments of: Mr. Paulson — $22,000, $162, $5,000 and $12,169; Mr. Blankfein — $22,000, $162, $5,000 and $24,082; Mr. Viniar — $22,000, $162, $5,000 and $24,082; Mr. Kaplan — $22,000, $162, $5,000 and $6,152; and Ms. Nora Johnson — $0, $162, $5,000 and $12,169. |

Fiscal 2003 includes Money Purchase Pension Plan contribution, Term Life Insurance premium, Goldman Sachs Employees’ Profit Sharing Retirement Income Plan contribution and executive medical and dental plan premium payments of: Mr. Paulson — $23,000, $176, $5,000 and $18,066; Mr. Blankfein — $23,000, $176, $5,000 and $35,821; Mr. Viniar — $23,000, $176, $5,000 and $35,821; Mr. Kaplan — $23,000, $176, $5,000 and $9,098; and Ms. Nora Johnson — $0 , $176, $5,000 and $18,066.

Fiscal 2002 includes Money Purchase Pension Plan contribution, Term Life Insurance premium, Goldman Sachs Employees’ Profit Sharing Retirement Income Plan contribution and executive medical and dental plan premium payments of: Mr. Paulson — $19,000, $185, $5,000 and $30,464; Mr. Blankfein — $19,000, $185, $5,000 and $60,501; Mr. Viniar — $19,000, $185, $5,000 and $60,501; Mr. Kaplan — $19,000, $185, $5,000 and $15,294; and Ms. Nora Johnson — $0, $185, $5,000 and $30,464.

12

In addition to the amounts disclosed in the table, each of Messrs. Paulson, Blankfein, Viniar and Kaplan and Ms. Nora Johnson has accrued benefits under The Goldman Sachs Employees’ Pension Plan (the “Pension Plan”), entitling them to receive annual benefits upon retirement at age 65 of $10,533, $3,401, $6,906, $3,526 and $15,706, respectively. Other than Ms. Nora Johnson, none of the Named Executive Officers has accrued any benefits under the Pension Plan since November 1992. Ms. Nora Johnson continued to accrue benefits under the Pension Plan through 2004. Effective as of November 27, 2004, the Pension Plan was frozen, and no participant will accrue any additional benefit thereunder.

We currently provide certain of our Named Executive Officers with the use of a car and trained security driver. In addition, we make available for business use to certain of our Named Executive Officers private aircraft in which Goldman Sachs owns a fractional interest. Our general policy is not to permit employees, including Named Executive Officers, to use such aircraft for personal use. During fiscal 2004, there were limited instances in which certain of our Named Executive Officers brought personal guests as passengers on business-related flights. In such cases, the Named Executive Officers paid Goldman Sachs an amount equal to the greater of: (a) the incremental cost to Goldman Sachs of the usage by such guests; or (b) the price of a first-class commercial airline ticket for the same trip.

During fiscal 2004, Goldman Sachs made available financial counseling services to approximately 185 of our senior executives, including our Named Executive Officers. In each such case, the incremental cost to Goldman Sachs was less than $50,000.

Fiscal Year-End Option Holdings

None of the Named Executive Officers was granted Options for fiscal 2004. The following table provides information about unexercised Options held by each Named Executive Officer as of November 26, 2004, our 2004 fiscal year-end. None of the Named Executive Officers had exercised any Options as of November 26, 2004.

FISCAL YEAR-END OPTION VALUES

| Number of Securities Underlying Unexercised Options at Fiscal Year-End | Value of Unexercised In-The- at Fiscal Year-End (a) | |||||||||

Named Executive Officer | Exercisable | Unexercisable (b) | Exercisable | Unexercisable | ||||||

Henry M. Paulson, Jr. | 139,965 | 320,117 | $ | 3,074,331 | $ | 5,496,905 | ||||

Lloyd C. Blankfein | 90,681 | 318,346 | $ | 1,991,808 | $ | 5,965,633 | ||||

David A. Viniar | 67,326 | 150,623 | $ | 1,478,816 | $ | 2,639,310 | ||||

Robert S. Kaplan | 87,144 | 155,453 | $ | 1,914,118 | $ | 2,764,745 | ||||

Suzanne Nora Johnson | 45,258 | 109,554 | $ | 994,092 | $ | 1,849,907 | ||||

| (a) | “Value of Unexercised In-The-Money Options” is the aggregate, calculated on a grant-by-grant basis, of the product of the number of unexercised Options at our 2004 fiscal year-end multiplied by the difference between the exercise price for the grant and the closing price-per-share of Common Stock on the NYSE on November 26, 2004 ($104.84), our 2004 fiscal year-end. The actual value, if any, that will be realized upon the exercise of an Option will depend upon the difference between the exercise price of the Option and the market price of the Common Stock on the NYSE on the date that the Option is exercised. |

| (b) | The portion of these Options granted for fiscal 2001 that became exercisable in January 2005 at an exercise price of $91.61 was as follows for each Named Executive Officer: Mr. Paulson — 221,078; Mr. Blankfein —180,676; Mr. Viniar — 99,872; Mr. Kaplan — 99,872; and Ms. Nora Johnson — 78,117. |

13

Stock Price Performance

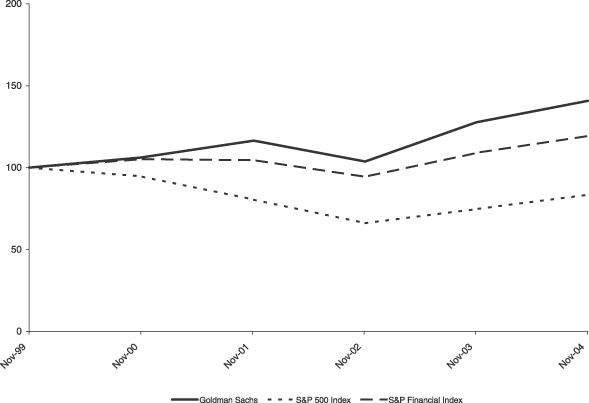

The following graph compares the performance of an investment in Common Stock from November 26, 1999 through November 26, 2004, with the S&P 500 Index and the S&P Financial Index. The graph assumes $100 was invested on November 26, 1999 in each of the Common Stock, the S&P 500 Index and the S&P Financial Index and the reinvestment of dividends on the date of payment without payment of any commissions. Dollar amounts in the graph are rounded to the nearest whole dollar. The performance shown in the graph represents past performance and should not be considered an indication of future performance.

The table below shows the cumulative total returns in dollars of the Common Stock, the S&P 500 Index and the S&P Financial Index for Goldman Sachs’ last five fiscal year ends, assuming $100 was invested on November 26, 1999 in each of the Common Stock, the S&P 500 Index and the S&P Financial Index and the reinvestment of dividends on the date of payment without payment of any commissions. The performance shown in the table represents past performance and should not be considered an indication of future performance.

| Cumulative Total Return (in dollars) | ||||||||||||

| 11/26/99 | 11/24/00 | 11/30/01 | 11/29/02 | 11/28/03 | 11/26/04 | |||||||

The Goldman Sachs Group, Inc. | 100.00 | 106.13 | 116.51 | 103.72 | 127.70 | 140.78 | ||||||

S&P 500 Index | 100.00 | 94.72 | 80.43 | 66.09 | 74.70 | 83.48 | ||||||

S&P Financial Index | 100.00 | �� | 105.15 | 104.60 | 94.42 | 108.98 | 119.32 | |||||

14

Report of the Compensation Committee on Executive Compensation

The Compensation Committee is comprised of all eight of our Non-Management Directors and operates pursuant to a written charter that was amended and restated in January 2005, and is available on our website athttp://www.gs.com/investor_relations. During fiscal 2004, the Compensation Committee held five meetings and the Chair of the Compensation Committee also met with the chairs of our internal compensation policy committee five times. The Board of Directors has determined, upon the recommendation of the Corporate Governance and Nominating Committee, that each member of the Compensation Committee is “independent” within the meaning of the rules of the NYSE. In addition, as required by its charter, no member of the Compensation Committee receives, directly or indirectly, any consulting, advisory or other compensatory fees that would be prohibited under the SEC’s audit committee independence standards. The Compensation Committee’s primary purposes are to: (a) determine and approve the compensation of Goldman Sachs’ Chief Executive Officer; (b) make recommendations to the Board of Directors with respect to executive compensation (including compensation of non-Chief Executive Officer executive officers) and our incentive-compensation and equity-based plans that are subject to the approval of the Board of Directors; (c) assist the Board of Directors in its oversight of the development, implementation and effectiveness of Goldman Sachs’ policies and strategies relating to our human capital management function, including but not limited to those policies and strategies regarding recruiting, retention, career development and progression, management succession (other than that within the purview of the Corporate Governance and Nominating Committee), diversity and employment practices; and (d) prepare this Report. As part of this responsibility, the Compensation Committee administers the Stock Incentive Plan and the Restricted Partner Compensation Plan, and oversees the committee appointed by the Board of Directors to administer the Partner Compensation Plan. For fiscal 2004, the Board of Directors appointed a committee consisting of Messrs. Paulson, Blankfein and Kaplan (who replaced John Thain, effective January 15, 2004) (with Mr. Paulson as Chair) as the administrative committee of the Partner Compensation Plan, and the Compensation Committee delegated to a committee consisting of these same three individuals certain responsibilities under the Stock Incentive Plan with respect to non-executive officers.

The Compensation Committee engaged three outside compensation consulting firms to assist it with benchmarking and compensation analyses, as well as to provide consulting on executive and non-executive compensation practices and determinations, including information on equity-based award design. The Compensation Committee specifically asked two of these firms to provide insight on our compensation practices relative to industry best practices. On conclusion of this assessment, the firms informed the Chair of the Compensation Committee that our executive pay practices “are consistent with competitive best practices and generally accepted compensation standards” and that our “‘pay for performance’ orientation drives Goldman Sachs’ consistently superior results.”

The discussion below constitutes the Report of the Compensation Committee.

Compensation Policies

To perpetuate the sense of partnership and teamwork that exists among our senior professionals, to reinforce the alignment of senior executive and shareholder interests, to help Goldman Sachs attract and retain senior executives whose efforts and judgments are vital to the continued success of the firm, and to permit certain bonus compensation paid to our covered employees to be considered qualified “performance-based compensation” within the meaning of Section 162(m) of the Internal Revenue Code, the Restricted Partner Compensation Plan was adopted by the Board of Directors and approved by our shareholders. The Restricted Partner Compensation Plan is the primary program through which Mr. Paulson, each of the other Named Executive Officers, each of our other executive officers and each member of the firm’s Management Committee (26 individuals in the aggregate for fiscal 2004) is compensated. Our other senior executives are compensated under the Partner Compensation Plan.

15

Participants in the Restricted Partner Compensation Plan receive a significant portion of their compensation in the form of equity-based awards under the Stock Incentive Plan. These equity-based awards are designed to align the interests of Restricted Partner Compensation Plan participants with the interests of our other shareholders.

For 2004, the Compensation Committee adopted a new program for participants in the Partner Compensation Plan and the Restricted Partner Compensation Plan called the PMD Discount Stock Program, which is designed to encourage the acquisition and long-term holding of our Common Stock by senior executives, and is described more fully below. In addition, effective with respect to our 2005 fiscal year, in order to encourage eligible employees to remain in the employ of Goldman Sachs by providing them with the ability to defer receipt of a portion of their eligible compensation, the Compensation Committee recommended for adoption, and the Board of Directors adopted, new non-qualified deferred compensation plans for eligible employees in the United States and the United Kingdom (including participants in the Partner Compensation Plan and the Restricted Partner Compensation Plan). In general, under these plans, participants will be able to defer payment of a portion of their cash end-of-year bonus for varying periods of time, but in no event for longer than the later of: (a) ten years; or (b) six months after termination of employment. During the deferral period, participants will be able to notionally invest their deferrals in certain alternatives available under their plan. Our obligations under the non-qualified deferred compensation plans will not be funded or secured in any manner, and the participants will be general unsecured creditors of Goldman Sachs.

The Restricted Partner Compensation Plan

General.Participants in the Restricted Partner Compensation Plan receive a base salary, which is paid in cash and is determined at the beginning of a fiscal year by the Compensation Committee, and a bonus, which is paid in cash and/or an equity-based award under the Stock Incentive Plan. The Restricted Partner Compensation Plan was approved by our shareholders at our Annual Meeting on April 1, 2003 and was applicable to fiscal 2004.

Each fiscal year, the Compensation Committee selects individuals to participate in the Restricted Partner Compensation Plan from among the firm’s executive officers and Management Committee members. No individual who participates in the Restricted Partner Compensation Plan can at the same time participate in the firm’s Partner Compensation Plan.

Under the Restricted Partner Compensation Plan, each participant may be paid a formula bonus (not in excess of $35 million), which is determined based on Goldman Sachs’ “Pre-Tax Pre-PCP Earnings” (as defined in the Restricted Partner Compensation Plan) for the fiscal year (the “Formula Bonus”). The Compensation Committee, in its discretion, may reduce any participant’s bonus to an amount below the Formula Bonus. The Formula Bonus for each participant in the Restricted Partner Compensation Plan for fiscal 2004 was $35 million. In light of the factors discussed more fully below, the Compensation Committee reduced each Named Executive Officer’s bonus to an amount below the Formula Bonus.

Formula Bonuses under the Restricted Partner Compensation Plan are payable, as determined by the Compensation Committee, in cash and/or an equity-based award of equivalent value granted under the Stock Incentive Plan. For purposes of the Formula Bonus, RSUs, restricted shares of Common Stock and unrestricted shares of Common Stock are valued at the average of the closing prices of Common Stock over the ten trading-day period up to and including the last day of fiscal 2004. However, in exercising its discretion to reduce a participant’s actual bonus below the Formula Bonus, the Compensation Committee may take into account the value of Common Stock over another period of time or as of any date it selects.

16

The following portions of this Report provide more detail regarding the manner in which the compensation payable to participants in the Restricted Partner Compensation Plan for fiscal 2004 was determined.

Base Salary.At the time individuals were selected to participate in the Restricted Partner Compensation Plan for fiscal 2004, the Compensation Committee determined to pay each participant a base salary for fiscal 2004 at the annual rate of $600,000 (the same base salary as was paid to participants in the Restricted Partner Compensation Plan for fiscal 2003, and the same base salary as was paid to participants in the Partner Compensation Plan since our initial public offering in 1999).

Bonus.In general, in determining participants’ actual bonuses under the Restricted Partner Compensation Plan, the Compensation Committee sought to assure that participants’ total compensation amounts were linked to Goldman Sachs’ results of operations as a whole, and also approximated the bonus amounts that would have resulted had the Restricted Partner Compensation Plan participants participated in the Partner Compensation Plan. In this way, the Compensation Committee sought to assure a continued spirit of collaboration among our senior executives. Ultimately, the Compensation Committee determined that, in light of the firm’s return on average tangible shareholders’ equity of 25.2%, pre-tax earnings of $6.68 billion and net earnings of $4.55 billion, the aggregate amount to be allocated as bonus compensation under both the Restricted Partner Compensation Plan and the Partner Compensation Plan should result in a ratio of total compensation and benefits for all Goldman Sachs employees (including Restricted Partner Compensation Plan and Partner Compensation Plan participants) to net revenues for the firm equal to 46.7%. The Compensation Committee concluded that this ratio of total compensation and benefits to net revenues was appropriate for the firm in light of information provided by the outside compensation consultants engaged by the Compensation Committee, the Compensation Committee’s understanding of general industry practice derived from prior years’ experience, and Goldman Sachs’ financial performance in fiscal 2004.

In determining the actual bonuses payable to each participant in the Restricted Partner Compensation Plan, in addition to Goldman Sachs’ performance, the Compensation Committee focused on each individual’s contribution to the firm (including as reflected in the individual’s performance evaluations, which are described more fully below), business unit and divisional performance and compensation recommendations of the individuals to whom participants report. In the case of the Named Executive Officers, the Compensation Committee also considered the closing price of Common Stock on November 26, 2004, the last day of the 2004 fiscal year. Finally, the Compensation Committee paid careful attention to competitive compensation practices (in light of certain objective performance criteria, including return on shareholders’ equity and diluted earnings-per-share), as more fully described below.

Performance Considerations.The individual, business unit and divisional performance considerations for determining total compensation are derived through a number of internal objective and discretionary processes, including Goldman Sachs’ performance evaluation program. This program is a “360 degree” feedback process that reflects input regarding each individual on an array of categories from a number of professionals in the organization, including peers, employees senior to the individual and employees junior to the individual. The performance review feedback is combined with a subjective determination of individual performance, business unit and divisional performance and individual contributions to hiring, mentoring, training and diversity, to determine a proposed amount of total compensation.

Competitive Compensation Considerations.The proposed amount of total compensation determined as described above then is considered in light of competitive compensation levels. In this regard, for participants in the Restricted Partner Compensation Plan, the Compensation Committee

17

used as a benchmark an independently prepared survey regarding compensation levels in 2003 for certain of the most highly compensated employees at The Bear Stearns Companies Inc., Citigroup Inc., Credit Suisse First Boston LLC, Lehman Brothers Holdings Inc., Merrill Lynch & Co., Inc. and Morgan Stanley.* With respect to the Named Executive Officers, the Compensation Committee paid particular attention to an internally prepared analysis based on publicly available data regarding the compensation paid in 2003 at The Bear Stearns Companies Inc., Citigroup Inc., J.P. Morgan Chase & Co., Lehman Brothers Holdings Inc., Merrill Lynch & Co., Inc. and Morgan Stanley.

Year-End Equity-Based Awards.The Compensation Committee believes that the portion of annual total compensation awarded in the form of equity-based compensation for Restricted Partner Compensation Plan participants (including each of the Named Executive Officers), without taking into account participation in the PMD Discount Stock Program, generally should be comparable to that of our other senior executives and our other employees. Accordingly, except for Mr. Paulson, who, as described below, received all of his bonus in the form of an equity-based award, the portion of each Restricted Partner Compensation Plan participant’s compensation to be paid in cash versus the portion required to be granted as an equity-based award was determined pursuant to a progressive compensation-based formula under which as the participant’s total compensation increased, a greater percentage of his or her total compensation was comprised of an equity-based award.

Each of the Named Executive Officers received a portion of his or her bonus in cash (other than Mr. Paulson, as discussed below) and a portion in the form of a year-end equity-based award under the Stock Incentive Plan as follows:

Named Executive Officer | % of Bonus Paid in Cash | % of Bonus Paid in the Form of Equity-Based Award | ||

Henry M. Paulson, Jr. | 0 | 100 | ||

Lloyd C. Blankfein | 52 | 48 | ||

David A. Viniar | 53 | 47 | ||

Robert S. Kaplan | 53 | 47 | ||

Suzanne Nora Johnson | 53 | 47 |

Each participant in the Restricted Partner Compensation Plan received his or her year-end equity-based award in the form of RSUs.** As described above, for purposes of determining each Restricted Partner Compensation Plan participant’s Formula Bonus under the Restricted Partner Compensation Plan, the number of year-end RSUs was determined by dividing the dollar amount to be granted as year-end RSUs by the average closing price-per-share of the Common Stock on the NYSE for the ten trading-day period up to and including the last day of the 2004 fiscal year ($104.27). In the case of each of the Named Executive Officers, the Compensation Committee decided to exercise its discretion to reduce the Formula Bonus so that the sum of each Named Executive Officer’s cash bonus (if any), plus the value of his or her RSU award, determined based on the closing price of Common Stock on November 26, 2004, the last day of the 2004 fiscal year ($104.84), rather than the ten-day average price, would equal the amount reflected on the Summary Compensation Table.

| * | Of these competitor companies, only Credit Suisse First Boston LLC is not included in the S&P Financial Index. |

| ** | An RSU constitutes an unfunded, unsecured promise to deliver a share of Common Stock on a predetermined date. In general, 40% percent of these year-end RSUs were “vested” when they were granted and the remaining 60% will become “vested” at the end of the 2007 fiscal year. The RSUs provide for accelerated vesting on a recipient’s “retirement,” and each Named Executive Officer currently meets the requirements for “retirement.” In general, shares underlying all of these year-end RSUs granted for fiscal 2004 will be delivered in January 2008. |

18

The Compensation Committee determined that it was appropriate to grant year-end equity-based awards in the form of RSUs in light of a number of factors, including input from the Compensation Committee’s outside compensation consultants, competitive compensation practices, maximization of shareholder value and alignment of the long-term interests of our shareholders and our senior executives. Each individual who receives an RSU becomes, economically, a long-term shareholder of Goldman Sachs, with the same interests as our other shareholders. This economic interest results because the amount a recipient ultimately realizes from an RSU depends on the value of Common Stock when actual shares are delivered in January 2008. The Compensation Committee also believes that these RSU awards should provide a strong incentive for Restricted Partner Compensation Plan participants to continue to analyze management issues in terms of the effect those issues will have on Goldman Sachs as a whole as opposed to the effect they might have on any particular Goldman Sachs business unit.

PMD Discount Stock Program

As noted above, in 2004, the Compensation Committee, with input from its outside compensation consultants, adopted the PMD Discount Stock Program under the Stock Incentive Plan. None of the Named Executive Officers was eligible to participate in the PMD Discount Stock Program for fiscal 2004.

The purpose of the PMD Discount Stock Program is to encourage the acquisition and long-term holding of Common Stock by senior executives. Subject to an overall limit determined by the Compensation Committee, the PMD Discount Stock Program gave participants in the Partner Compensation Plan and the Restricted Partner Compensation Plan an opportunity to request that they use all or part of the cash portion of their year-end bonuses to acquire RSUs under the Stock Incentive Plan at an effective 25% discount from the closing price of Common Stock on December 14, 2004 ($109.88). The 25% discount was accomplished by a grant of RSUs (the “Discount RSUs”) equal to one-third of the number of RSUs (the “Base RSUs”) each participant acquired based on the closing price of common stock on December 14, 2004. The Base RSUs were 100% vested when granted. In general, shares underlying Base RSUs granted in 2004 either were delivered in January 2005 or will be delivered in January 2008 (depending on whether participation was on a pre- or after-tax basis), but in either case the shares underlying the Base RSUs generally will not be transferable (other than to satisfy certain tax obligations) prior to January 2008. One-half of the Discount RSUs will vest in each of November 2006 and November 2007; shares underlying vested Discount RSUs generally will be delivered in January 2008, at which time they will be freely transferable. As with other RSUs that have been granted under the Stock Incentive Plan, RSUs granted under the PMD Discount Stock Program include a “dividend equivalent right,” pursuant to which the holder of the RSU is entitled to receive an amount equal to any ordinary cash dividends paid to the holder of a share of Common Stock approximately when those dividends are paid to shareholders. While the Base RSUs (and their underlying shares) are not forfeitable, the Discount RSUs are subject to forfeiture for termination of employment prior to vesting and for failing to comply with certain terms and conditions including certain restrictive covenants. Unlike year-end RSUs granted to employees described above, Discount RSUs do not have accelerated vesting on a participant’s “retirement.”

19

Compensation of the Chief Executive Officer