- GS Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

The Goldman Sachs Group, Inc. (GS) DEF 14ADefinitive proxy

Filed: 17 Mar 17, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant☑ Filed by a Party other than the Registrant☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☑ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to Section 240.14a-12 |

The Goldman Sachs Group, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☑ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

The Goldman Sachs Group, Inc.

| ||

ANNUAL MEETING OF SHAREHOLDERS PROXY STATEMENT

2017

|

The Goldman Sachs Group, Inc.

The Goldman Sachs Group, Inc.

Notice of 2017 Annual Meeting of Shareholders

TIME AND DATE

|

8:30 a.m., local time, on Friday, April 28, 2017

| |||

PLACE

|

Goldman Sachs offices located at: 30 Hudson Street, Jersey City, New Jersey 07302

| |||

ITEMS OF BUSINESS |

∎ Election to our Board of Directors of the 11 director nominees named in the attached Proxy Statement for aone-year term

∎ An advisory vote to approve executive compensation (Say on Pay)

∎ An advisory vote on the frequency of Say on Pay votes

∎ Ratification of the appointment of PwC as our independent registered public accounting firm for 2017

∎ Transaction of such other business as may properly come before our 2017 Annual Meeting of Shareholders

| |||

RECORD DATE |

The record date for the determination of the shareholders entitled to vote at our 2017 Annual Meeting of Shareholders, or any adjournments or postponements thereof, was the close of business on February 27, 2017.

| |||

Important Notice Regarding the Availability of Proxy Materials for our Annual Meeting to be held on April 28, 2017. Our Proxy Statement, 2016 Annual Report to Shareholders and other materials are available on our website atwww.gs.com/proxymaterials. | ||||

By Order of the Board of Directors,

Beverly L. O’Toole

Assistant Secretary

March 17, 2017

Your vote is important to us. Please exercise your shareholder right to vote.By March 17, 2017, we will have sent to certain of our shareholders a Notice of Internet Availability of Proxy Materials (Notice). The Notice includes instructions on how to access our Proxy Statement and 2016 Annual Report to Shareholders and vote online. Shareholders who do not receive the Notice will continue to receive either a paper or an electronic copy of our proxy materials, which will be sent on or about March 21, 2017. For more information, seeFrequently Asked Questions.

|

Table of Contents

| Letter from our Chairman and CEO | ii | |||

| Letter from our Lead Director | iii | |||

| Executive Summary | 1 | |||

| 1 | ||||

| 1 |

| 2 |

| 5 |

| 8 |

| 11 |

| Corporate Governance | 13 | |||

| 13 | ||||

| 13 | ||||

| 22 | ||||

| 23 |

| 23 | ||||

| 25 | ||||

| 26 | ||||

| 28 | ||||

| 29 | ||||

| 29 |

| 29 | ||||

| 31 | ||||

| Compensation Matters | 33 | |||

| 33 | ||||

| 33 | ||||

| 42 | ||||

| 43 | ||||

| 46 | ||||

| 48 | ||||

| 50 | ||||

| 53 | ||||

| 54 | ||||

| 55 | ||||

| 58 | ||||

| 59 | ||||

| 59 | ||||

| 60 | ||||

| 61 | ||||

| 63 | ||||

| 66 | ||||

Item 2. An Advisory Vote to Approve Executive | 67 | |||

Item 3. An Advisory Vote on the Frequency | 68 | |||

| 69 | ||||

| Audit Matters | 72 | |||

| 72 | ||||

Item 4. Ratification of Appointment of Independent | 72 |

| Certain Relationships and Related Transactions | 74 | |||

| Beneficial Ownership | 77 | |||

| Additional Information | 80 | |||

| Frequently Asked Questions | 82 | |||

| Annex A: Additional Details on Director Independence | A-1 | |||

| Directions to our 2017 Annual Meeting of Shareholders | B-1 | |||

| Proxy Statement for the 2017 Annual Meeting of Shareholders | Goldman Sachs i |

Letter from our Chairman and CEO

| Letter from our Chairman and CEO |

March 17, 2017 |

Fellow Shareholders:

You are cordially invited to attend the 2017 Annual Meeting of Shareholders of The Goldman Sachs Group, Inc. We will hold the meeting on Friday, April 28, 2017 at 8:30 a.m., local time, at our offices in Jersey City, New Jersey. Enclosed you will find a notice setting forth the items we expect to address during the meeting, a letter from our Lead Director, our proxy statement, a form of proxy and a copy of our 2016 annual report to our shareholders.

In our 2016 letter to our shareholders, which is included in the annual report, we discuss the firm’s performance, strategy and outlook for the future. We hope that you will find the letter informative and the themes emblematic of our commitment to providing our shareholders with long-term value.

I would like to personally thank you for your continued investment in Goldman Sachs. We look forward to welcoming many of you to our annual meeting. Your vote is important to us – even if you do not plan to attend the meeting in person, we hope your votes will be represented.

Lloyd C. Blankfein

Chairman and Chief Executive Officer

| Proxy Statement for the 2017 Annual Meeting of Shareholders | Goldman Sachs ii |

Letter from our Lead Director

| Letter from our Lead Director |

March 17, 2017 |

To my fellow shareholders,

In numerous ways, 2016 was an eventful year both for Goldman Sachs and for the broader operating environment. It included a challenging first half of the year for the financial services industry and the capital markets, the “Brexit” vote and the U.S. presidential election. Within the firm, 2016 included the launch of a new consumer lending business, Marcus by Goldman Sachs, as well as several senior executive changes. In times of challenge and change, a board’s role in setting the “tone at the top” – providing oversight and advising on management’s strategic plans – becomes even more critical, and I am pleased to report that our Board responded in kind.

In addition to undertaking the actions I describe below, throughout the year we remained focused on our oversight of the firm’s risk management and engaged with management on its firmwide, regional and divisional strategies for growth across our businesses. Despite a challenging start to 2016, we believe that the firm’s senior management responded effectively and swiftly. As a result of their focus on operating expense discipline, the firm remains well-positioned to capitalize on opportunities as they unfold and to continue to drive long-term shareholder value.

Last year there were a number of executive succession events, which is a topic I know from my own direct engagement is of critical importance to our shareholders. At the end of 2016, we bid farewell to three distinguished executives from around the globe – Gary Cohn, Michael Sherwood and Mark Schwartz – each of whom added significant value to the firm over the course of their long-tenured careers. In addition to his many other contributions to the firm over the course of his over 25-year career, Gary’s perspective was greatly valued by the Board during his tenure as a fellow director. In light of Gary’s commencement as Director of the National Economic Council, as a Board we needed to determine how to appropriately address Gary’s historical, vested compensation arrangements in order to avoid any actual or perceived conflicts of interest given his new responsibilities in the public sector. Details regarding these determinations are summarized in the enclosed proxy statement.

These departures resulted in the elevation of several of our senior leaders to executive positions, consistent with our executive succession plan. Each year and throughout 2016, our Governance Committee met with our CEO, Lloyd Blankfein, and met separately in closed and executive sessions to review, provide input on and refine the firm’s long-term and emergency executive succession plans. Our thorough consideration of and deliberations on executive succession, coupled with the firm’s commitment to developing leaders in every area of its businesses, enabled us to act quickly and efficiently in promoting David Solomon and Harvey Schwartz to the roles of President andCo-Chief Operating Officers of the firm, as well as Richard Gnodde and Pablo Salame to the role of Vice Chairman. Further, Marty Chavez was appointed to the position of Chief Financial Officer, which he will assume in May. We look forward to working with all of these talented individuals in their new roles. These leaders have distinguished themselves throughout their careers at the firm and are representative of the firm’s deep bench of talent. We are confident in their continued success in these new positions.

In addition to executive succession planning, ensuring that the firm has an executive compensation program that appropriately incentivizes our management is one of the most important responsibilities we have as directors. To this end, during 2016 our Compensation Committee undertook a robust process to review the firm’s executive compensation structure, taking into account input from key stakeholders, including specific feedback that I received during my own engagement. As a result, our Board adopted several changes to the structure of our compensation program that are described in the proxy statement, among them, streamlining the structure and discontinuing future Long-Term Performance Incentive Plan awards.

| Proxy Statement for the 2017 Annual Meeting of Shareholders | Goldman Sachs iii |

Letter from our Lead Director

With respect to our Board, as I have communicated to you in the past, we remain focused on ensuring that we have the right mix of skills and experiences and the appropriate balance of institutional knowledge as well as fresh perspectives to carry out our duties on behalf of shareholders. We accomplish this through a variety of means, including our annual board and director evaluation process, comprehensivere-nomination process and ongoing review of the Board’s composition and potential candidates.

As a result of these processes, we identified Ellen Kullman, who we believe brings strategic and risk-focused expertise among other attributes, which is important for our Board. Ellen is a talented business leader, having held a variety of senior roles at E.I. du Pont de Nemours and Company, including as chair and chief executive officer. She is also an experienced board member in both the public andnot-for-profit sectors. Ellen joined our Board on December 21, 2016, and we are confident that the Board and firm will continue to benefit from her insight and counsel.

I would also like to take this opportunity to thank our colleagues, Debora Spar and Mark Tucker, who will each be retiring from our Board at our Annual Meeting and embarking on new professional endeavors. Debora, previously the president of Barnard College, has become the president and chief executive officer of the Lincoln Center for the Performing Arts, and Mark, who will be retiring from his role leading AIA Group Limited will become non-executive chair of HSBC in the fall.

During her nearly six years of service on our Board, we have benefited in particular from Debora’s insights relating to the firm’s people, including through her commitment to diversity and her informed advice on recruiting and retention efforts. Mark drew upon his global financial industry expertise to provide us over the course of his nearly five-year tenure on our Board with sound advice on, among other things, the firm’s strategy and risk management.

I join my fellow directors in thanking each of them for their commitment to our Board and wishing them success in their new roles.

Finally, as your Lead Director, I had an active year of engagement: in addition to the 58 Board and standing committee meetings and 21 sessions our directors held without management present as described herein, I had over 90 additional meetings, calls and engagements with the firm and its people, our shareholders, regulators and other constituents.

With that, let me conclude by reiterating that I am grateful for your support of our Board and the firm. We hope that you find this Proxy Statement informative and look forward to continuing our dialogue with you in the year to come.

Adebayo O. Ogunlesi

Lead Director

| iv Goldman Sachs | Proxy Statement for the 2017 Annual Meeting of Shareholders |

Executive Summary | 2017 Annual Meeting Information

This summary highlights certain information from our Proxy Statement for the 2017 Annual Meeting. You should read the entire Proxy Statement carefully before voting. Please refer to our glossary inFrequently Asked Questions on page 82 for definitions of certain capitalized terms.

2017 Annual Meeting Information

DATE AND TIME

| PLACE

| RECORD DATE

| ADMISSION

| |||||||||

8:30 a.m., local time Friday, April 28, 2017 | Goldman Sachs offices located at: 30 Hudson Street, Jersey City, New Jersey | February 27, 2017 | Photo identification and proof of ownership as of the record date are required to attend the Annual Meeting

| |||||||||

For additional information about our Annual Meeting, including how to access the audio webcast, seeFrequently Asked Questions.

Matters to be Voted on at our 2017 Annual Meeting

BOARD RECOMMENDATION

| PAGE | |||

Item 1. Election of Directors

| FOR each director

| 13

| ||

Other Management Proposals

| ||||

Item 2. Advisory Vote to Approve Executive Compensation (Say on Pay)

| FOR

| 67

| ||

Item 3. Advisory Vote on the Frequency of Say on Pay

| EVERY YEAR

| 68

| ||

Item 4. Ratification of PwC as our Independent Registered Public Accounting Firm for 2017

| FOR

| 72

| ||

| Proxy Statement for the 2017 Annual Meeting of Shareholders | Goldman Sachs 1 |

Executive Summary | Performance Highlights

We encourage you to read the following Performance Highlights as background to this Proxy Statement.

After a challenging first half of 2016, the firm performed well for the remainder of the year as the operating environment improved. We continued to manage our expenses carefully and ended the year with industry leading positions across our businesses, as well as strong capital and liquidity.

|

RETURN OUTPERFORMANCE VS. PEERS

|

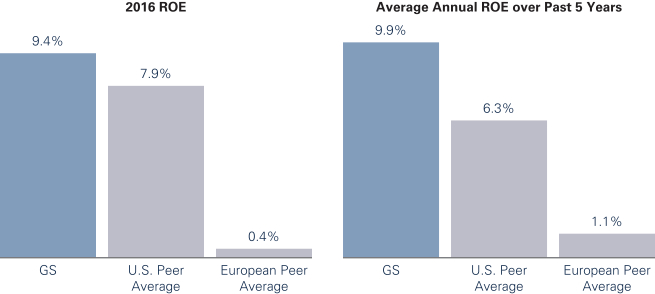

While net revenues were down in 2016 due to the challenging operating environment early in the year, the firm continued to post strong relative performance against its global peer group (i.e., its U.S. Peers and European Peers).

∎ In fact, our full year ROE of 9.4% was approximately 150 basis points higher than the U.S. Peer average and approximately 900 basis points higher than the European Peer average.

| 2 Goldman Sachs | Proxy Statement for the 2017 Annual Meeting of Shareholders |

2016 ROE Average Annual ROE over Past 5 Years 9.9% 9.4% 7.9% 6.3% 1.1% 0.4% GS U.S. Peer Average European Peer Average GS U.S. Peer Average European Peer Average

Executive Summary | Performance Highlights

CONTINUED EXPENSE DISCIPLINE

|

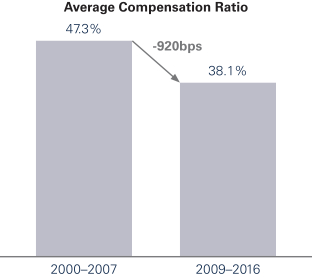

We maintained a disciplined approach to expense management throughout 2016. For example:

∎ We recorded ourlowestnon-compensation expense since 2007

∎ Compensation and benefits expense declined 8% year-over-year reflecting expense discipline and tracking the decline in our net revenues (down 9% year-over-year)

∎ We have demonstrated a continuous commitment over time to prudently managing our expense base

» In 2011-2012, we undertook an expense savings initiativethat reduced ourrun-rate by approximately $1.9 billion

» In 2016, we undertook a new savings initiative resulting in a reduction of approximately$900 millionin run-rate compensation |  |

TRACK RECORD OF CAPITAL RETURN

|

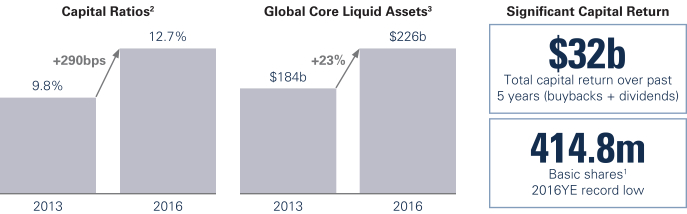

Through our continued focus on improving the firm’s financial positioning, we have been able to maintain a leading track record of returning capital to our shareholders.

∎ We finished 2016 withrecord low basic shares1of 414.8 million

∎ We also closed the year withstrong capital ratios and liquidity levels

∎ We havereduced gross leverageby 24% from 2011YE and by 62% from 2007YE

∎ Wereturned $7.2 billion of capitalin 2016 through repurchases and dividends

| 1 | Includes Common Stock outstanding and RSUs granted to employees with no future service requirements |

| 2 | Basel III Common Equity Tier 1 ratio computed on a fullyphased-in basis under the advanced approach |

| 3 | As of period end. Comprised of cash, high quality and narrowly defined unencumbered assets, including U.S. Treasuries and German, French, Japanese and United Kingdom government obligations |

Average Compensation Ratio 47.3% -920bps 38.1% 2000-2007 2009-2016

Capital Ratios2 9.8% +290bps 12.7% 2013 2016 Global Core Liquid Assets3 $184b +23% $226b 2013 2016 Significant Capital Return $32b Total capital return over past 5 years (buybacks + dividends) 414.8m Basic shares1 2016YE record low

| Proxy Statement for the 2017 Annual Meeting of Shareholders | Goldman Sachs 3 |

Executive Summary | Performance Highlights

SHAREHOLDER VALUE CREATION

|

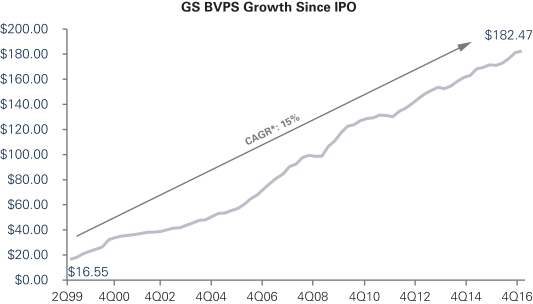

We haveconsistently grown book value per share since becoming a public company.

| * | Compound Annual Growth Rate |

STRONG FRANCHISE POSITION – OPPORTUNITIES FOR GROWTH

|

During 2016, we maintained strong franchise positions across our businesses and explored opportunities for growth.

INVESTMENT BANKING

|

INVESTMENT MANAGEMENT

| |

∎ #1 in announced and completed M&A

∎ Record annual debt underwriting revenues and improved league table positioning |

∎ Assets under supervision up 10% year-over-year to record $1.38 trillion

∎ Positive long-term inflows vs. outflows for most

| |

INSTITUTIONAL CLIENT SERVICES

|

INVESTING & LENDING

| |

∎ Leading FICC and Equities franchises with comprehensive suite of capabilities

∎ Significant investment in technology to strengthen our product offering, manage risk and allocate capital |

∎ Contributor to book value growth

∎ Continued support for our clients through loan growth and capital commitment

∎ Development and launch of a new consumer lending platform (Marcus by Goldman Sachs)

|

| 4 Goldman Sachs | Proxy Statement for the 2017 Annual Meeting of Shareholders |

GS BVPS Growth Since IPO $200.00 $180.00 $160.00 $140.00 $120.00 $100.00 $80.00 $60.00 $40.00 $20.00 $0.00 2Q99 4Q00 4Q02 4Q04 4Q06 4Q0B 4Q10 4Q12 4Q14 4Q16 $16.55 CAGR*: 15% $182.47

Executive Summary | Compensation Highlights

(see Compensation Matters beginning on page 33)

We provide highlights of our compensation program below. It is important that you review our CD&A and compensation-related tables in this Proxy Statement for a complete understanding of our compensation program.

2016 NEO COMPENSATION DETERMINATIONS

|

The following table summarizes our Compensation Committee’s 2016 annual compensation decisions for our NEOs (dollar amounts shown in millions).

NAME AND PRINCIPAL POSITION | SALARY/FIXED ALLOWANCE ($) | ANNUAL VARIABLE COMPENSATION ($)

| TOTAL ($) | |||||||

CASH

|

RSUS |

PSUS (redesigned for 2016)

| ||||||||

Lloyd C. Blankfein Chairman and CEO

| 2.0 | 4.0 | — | 16.0 | 22.0 | |||||

Gary D. Cohn(retired) Former President and COO

| 1.85 | 5.45 | 12.71 | — | 20.0 | |||||

Harvey M. Schwartz Executive Vice President and CFO

| 1.85 | 5.45 | — | 12.71 | 20.0 | |||||

Michael S. Sherwood(retired) Former Vice Chairman

| 1.85/11.15* | — | 7.0 | — | 20.0 | |||||

Mark Schwartz(retired) Former Vice Chairman

| 1.85 | 4.55 | 10.61 | — | 17.0 | |||||

Note: Messrs. Cohn, Sherwood and Mark Schwartz retired from the firm as of December 31, 2016. (For more information regarding arrangements in connection with Mr. Cohn’s departure, see pages 50-52; for more information regarding arrangements in connection with Messrs. Sherwood’s and Mark Schwartz’s departures, see page 64.) As of January 1, 2017, Mr. Harvey Schwartz was named the firm’s President andCo-COO; he remains our CFO through April 2017, after which time he will assume the full responsibilities of his new role.

| * | For 2016, Mr. Sherwood, who was based in the U.K., received a cash salary of $1.85 million and a fixed allowance of $11.15 million, payable approximately 51% in equity-based awards, with the remainder in cash. Mr. Sherwood received a higher level of fixed compensation than our U.S.-based NEOs in connection with applicable U.K. regulatory guidance. See page 46 for more details. |

| Compensation Committee Rationale for 2016 NEO Compensation Amounts | ||||

Our Compensation Committee determined thateach NEO’s total annual 2016 compensation should be reducedby approximately4-6%compared to 2015. The Committee determined a reduction for 2016 was appropriate in light of, among other factors, the firm’s decrease in net revenues compared to 2015, primarily due to the challenging operating environment during the first half of 2016, particularly during the first quarter. However, the Committee also took into consideration the following factors in determining the amount of the reduction:

∎ The firm’s financial results, which reflected strong performance in the second half of 2016 and relative to the firm’s U.S. Peers and European Peers;

∎ The firm’s disciplined expense management, including the lowest annualnon-compensation expenses since 2007 and the completion of a savings initiative resulting in a reduction of approximately $900 million inrun-rate compensation;

∎ Our strong financial position with respect toyear-end capital ratios and liquidity levels;

∎ The firm’s strong capital return to shareholders, including the prudent use of share repurchases, which resulted in the firm’s lowest ever basic share count;

∎ Our continued #1 position in announced and completed M&A league tables, our top 3 ranking in equity underwriting and improved positioning in debt underwriting league tables;

∎ The strength in our Investment Management business, where the firm achieved record assets under supervision;

∎ Each NEO’s individual performance, including continued strength in establishing a “tone at the top” which focused on, among other items, the firm’s culture of adaptability, client service, risk management (including reputational risk) and emphasis on the importance and performance of the firm’s “control side”; and

∎ The strategic vision of our senior leadership, including the launch of a new consumer lending platform (Marcus by Goldman Sachs).

| ||||

| Proxy Statement for the 2017 Annual Meeting of Shareholders | Goldman Sachs 5 |

Executive Summary | Compensation Highlights

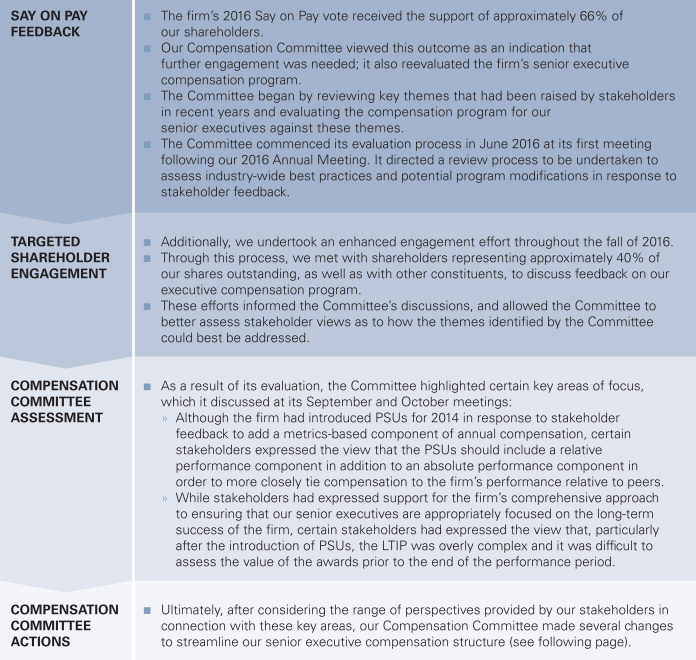

SAY ON PAY

|

Our 2016 advisory vote to approve NEO compensation received the support of approximately 66% of our shareholders, and our Compensation Committee viewed this outcome as an indication that further engagement was needed. At the Committee’s request, we engaged in extensive shareholder outreach during the fall of 2016, meeting with shareholders representing approximately 40% of our shares outstanding, as well as other constituents, to discuss feedback on our executive compensation program.

|

∎ Our Compensation Committee Responded.Taking into account this feedback, our Compensation Committee reevaluated the firm’s senior executive compensation program and made several changes to streamline its structure. For more information, please see page 34.

STAKEHOLDER FEEDBACK

|

OUR COMPENSATION COMMITTEE’S RESPONSE

| |||

∎ Overly complex compensation program for senior executives (e.g., grant of LTIP awards in addition to annual compensation program, complexity in LTIP calculation mechanics, overlapping performance thresholds for LTIP and PSU awards)

∎ Metrics for performance-based pay measured only on absolute basis; no incentive tied to performance relative to peers

∎ Desire for a higher proportion of performance- based compensation |

✓ Compensation structurestreamlined; overlapping performance metrics eliminated

✓ LTIP grantsdiscontinued

✓ PSUsredesignedto addrelative ROE componentthat more closely ties compensation to performance relative to peers over a three-year performance period usingas reported financial results

✓ For CEO and CFO, equity-based annual compensation paidentirely in PSUs, resulting insignificant increasein percentage of variable compensation tied to ongoing performance metrics

✓ 80%of CEO’s 2016 annual variable compensation tied to ongoing performance metrics (compared to 35% for 2015)

| |||

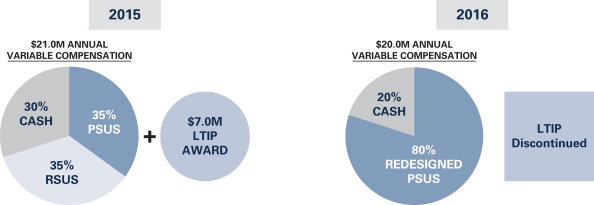

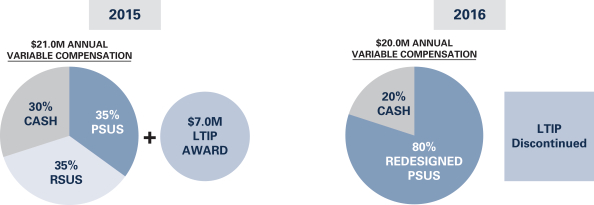

CEOYear-End Compensation Decisions: 2015 vs. 2016

∎ Of particular note, our Compensation Committee streamlined our CEO’s compensation structure to eliminate overlapping performance metrics, with all long-term performance-based pay now awarded in PSUs:

2015 $21.0M ANNUAL VARIABLE COMPENSATION 30% CASH 35% PSUS 35% RSUS + $7.0M LTIP AWARD 2016 $20.0M ANNUAL VARIABLE COMPENSATION 20% CASH 80% REDESIGNED PSUS LTIP Discontinued 2016 ANNUAL MEETING OUTREACH AND SAY ON PAY VOTE TARGETED SHAREHOLDER OUTREACH COMPENSATION COMMITTEE ASSESSMENT COMPENSATION COMMITTEE ACTIONS

| 6 Goldman Sachs | Proxy Statement for the 2017 Annual Meeting of Shareholders |

Executive Summary | Compensation Highlights

DETERMINATIONS REGARDING MR. GARY COHN

|

∎ Mr. Cohn resigned as our President and COO effective December 31, 2016, and has since become Director of the National Economic Council (NEC).

∎ In connection with his departure and consistent with applicable U.S. federal ethics laws, our Compensation Committee made a number of determinations regarding Mr. Cohn’s compensation arrangements, including settling his then-outstanding RSUs, PSUs and LTIP awards, in order to permit him to sever his financial interests relating to Goldman Sachs.

» All of Mr. Cohn’s RSUs, PSUs and LTIP awards were already fully vested at the time these determinations were made. In the event that Mr. Cohn had simply retired from the firm, the awards would have remained outstanding and been settled in due course on their existing terms.

∎ These determinations were previously described in our Form8-K filed on January 24, 2017, and are also described on pages50-52.

|

| Proxy Statement for the 2017 Annual Meeting of Shareholders | Goldman Sachs 7 |

Executive Summary | Corporate Governance Highlights

Corporate Governance Highlights

(see Corporate Governance beginning on page 13)

KEY FACTS ABOUT OUR BOARD

|

We strive to maintain a well-rounded and diverse Board that balances financial industry expertise with independence and the institutional knowledge of longer-tenured directors with the fresh perspectives brought by newer directors. As summarized below, our directors bring to our Board a variety of skills and experiences developed across a broad range of industries, both in established and growth markets, and in each of the public, private andnot-for-profit sectors.

NOMINEE SKILLS & EXPERIENCES

| ||||||||||||||

6

|

5

|

8

|

7

|

4

|

8

|

3

|

9

| |||||||

FINANCIAL SERVICES INDUSTRY | OTHER COMPLEX / REGULATED INDUSTRIES

| RISK MANAGEMENT | TALENT DEVELOPMENT | TECHNOLOGY

| PUBLIC COMPANY GOVERNANCE

| AUDIT / TAX / ACCOUNTING | GLOBAL | |||||||

KEY BOARD STATISTICS

| ||||

DIRECTOR NOMINEES

|

INDEPENDENCE OF NOMINEES

| |||

Board

| 11

| 9 of 11

| ||

Audit

| 3

| All

| ||

Compensation

| 5

| All

| ||

Governance

| 9

| All

| ||

Risk

| 6

| 5 of 6

| ||

Public Responsibilities

| 3

| All

| ||

14

|

44 |

21 |

~ 200 | |||||||||

BOARD MEETINGS IN 2016 | STANDING COMMITTEE MEETINGS IN 2016 | DIRECTOR SESSIONS IN 2016 WITHOUT MANAGEMENT PRESENT

| MEETINGS OF LEAD DIRECTOR / CHAIRS OUTSIDE OF BOARD MEETINGS

|

DIVERSITY OF NOMINEES ENHANCES BOARD PERFORMANCE

| ||||||||

54%

|

7YEARS |

64 |

44% |

33% | ||||

JOINED IN THE LAST 5 YEARS | AVERAGE TENURE | AVERAGE AGE | INDEPENDENT

| INDEPENDENT

| ||||

| 8 Goldman Sachs | Proxy Statement for the 2017 Annual Meeting of Shareholders |

Executive Summary | Corporate Governance Highlights

DIRECTOR NOMINEES

|

| NAME/AGE | INDEPENDENT | DIRECTOR SINCE | OCCUPATION/CAREER HIGHLIGHTS | COMMITTEE MEMBERSHIP | OTHER CURRENT

| |||||||||||

| Lloyd Blankfein, 62 Chairman

| No

| April 2003

| Chairman & CEO, The Goldman Sachs Group, Inc.

| None

| 0

| ||||||||||

| Adebayo Ogunlesi, 63 Lead Director

| Yes

| October 2012

| Chairman & Managing Partner, Global Infrastructure Partners

| Governance (Chair) Ex-Officio Member all other Committees

| 2

| ||||||||||

| Michele Burns, 59

| Yes

| October 2011

| Retired, Chairman & CEO, Mercer LLC; Retired, CFO of each of: Marsh & McLennan Companies, Inc., Mirant Corp. and Delta Air Lines, Inc.

| Compensation Governance Risk (Chair)

| 4

| ||||||||||

| Mark Flaherty, 57

| Yes

| December 2014

| Retired, Vice Chairman, Wellington Management Company

| Audit Governance Risk

| 0

| ||||||||||

| William George, 74

| Yes

| December 2002

| Senior Fellow, Harvard Business School; Retired, Chairman & CEO, Medtronic, Inc.

| Compensation Governance Public Responsibilities (Chair)

| 0

| ||||||||||

| James Johnson, 73

| Yes

| May 1999

| Chairman, Johnson Capital Partners

| Compensation (Chair) Governance Public Responsibilities

| 0

| ||||||||||

| Ellen Kullman, 61 New Director

| Yes

| December 2016

| Retired, Chairman & CEO E.I. du Pont de Nemours and Company

| Compensation Governance Risk

| 3

| ||||||||||

| Lakshmi Mittal, 66

| Yes

| June 2008

| Chairman & CEO, ArcelorMittal S.A.

| Compensation Governance Public Responsibilities

| 1

| ||||||||||

| Peter Oppenheimer, 54

| Yes

| March 2014

| Retired, Senior Vice President and CFO, Apple, Inc.

| Audit (Chair) Governance Risk

| 0

| ||||||||||

| David Viniar, 61

| No

| January 2013

| Retired, CFO, The Goldman Sachs Group, Inc.

| Risk

| 1

| ||||||||||

| Mark Winkelman, 70

| Yes

| December 2014

| Private investor

| Audit Governance Risk

| 0

| ||||||||||

* As per SEC rules

| Proxy Statement for the 2017 Annual Meeting of Shareholders | Goldman Sachs 9 |

Executive Summary | Corporate Governance Highlights

FOUNDATION IN SOUND GOVERNANCE PRACTICES AND SHAREHOLDER ENGAGEMENT

|

| ∎ | Independent Lead Directorwith expansive duties |

| ∎ | Regularexecutive sessionsof independent andnon-employee directors |

| ∎ | Focus of our independent directors onexecutivesuccession planning |

| ∎ | CEO evaluation processconducted by our Lead Director with our Governance Committee |

| ∎ | Comprehensive process forBoard refreshment, including a focus on diversity and on succession for Board leadership positions |

| ∎ | Annual Board and Committee evaluations, which incorporate feedback onindividual directorperformance(see page 25 for more details) |

| ∎ | Candid,one-on-one discussionsbetween the Lead Director and eachnon-employee director supplementing formal evaluations |

| ∎ | After engagement with shareholders, proactiveadoption of a proxy access rightfor shareholders. In addition, shareholders are welcome to continue torecommend director candidatesfor consideration by our Governance Committee |

| ∎ | Active, year-round shareholder engagementprocess, whereby we, including our Lead Director, meet and speak with our shareholders and other key constituents |

| ∎ | Board and committee oversight ofenvironmental,social and governance (ESG) matters |

| ∎ | Directors maycontact any employeeof our firm directly, and the Board and its committees mayengage independent advisorsat their sole discretion |

| ∎ | Annual electionsof directors (i.e., no staggered board) |

| ∎ | Majority voting with resignation policy for directors in uncontested elections |

| ∎ | Shareholders holding at least 25% of our outstanding shares of Common Stock cancall a special meetingof shareholders |

| ∎ | No supermajority vote requirementsin our charter orBy-laws |

| ∎ | Executive retention and share ownershiprequirementsrequire significant long-term share holdings by our NEOs (see page 48 for more detail) |

| ∎ | Director share ownership requirementof 5,000 shares or RSUs, with a transition period for new directors |

| » | All RSUs granted as director compensation must be held until the year after he or she retires from our Board. Directors are not permitted to hedge, pledge or transfer these RSUs |

| 10 Goldman Sachs | Proxy Statement for the 2017 Annual Meeting of Shareholders |

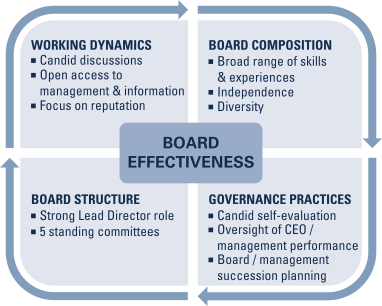

WORKING DYNAMICS Candid discussions Open access to management & information Focus on reputation BOARD COMPOSITION Broad range of skills & experiences Independence Diversity BOARD EFFECTIVENESS BOARD STRUCTURE Strong Lead Director role 5 standing committees GOVERNANCE PRACTICES Candid self-evaluation Oversight of CEO / management performance Board / management succession planning

Executive Summary | Shareholder Engagement

| Commitment to Active Engagement with our Shareholders | ||||

| Constituents’ views regarding matters affecting our firm are important to the Board. We employ a year-round approach to engagement that includes proactive outreach as well as responsiveness to targeted areas of focus.

| ||||

OUR APPROACH

|

WHO

|

WHEN

|

HOW

| ||||

∎ Shareholders

∎ ESG Rating Firms

∎ Fixed-Income Investors

∎ Proxy Advisory Firms

∎ Thought Leaders

∎ Prospective Investors |

∎ Year-round

∎ Additional targeted outreach ahead of annual meetings and as needed |

Firm Engagement

∎ Led by Investor Relations (IR), including targeted outreach and open lines of communication for inbound inquiries

∎ Feedback provided to Board throughout the year from these interactions and on other key areas of focus

|

Board Engagement

∎ Led by our Lead Director who meets regularly with stakeholders

∎ Lead Director provides feedback to fellow directors about engagements | |||

DEPTH OF ENGAGEMENT

|

We conducted approximately 150 meetings focused on corporate governance with 77 shareholders during 2016:

∎ Targeted outreach to top 150 shareholders ahead of 2016 annual meeting

∎ IR met with 38 shareholders during the fall across the U.S. and Europe, representing 40% of shares outstanding, to discuss executive compensation

∎ Lead Director met with 26 shareholders in 2016, representing approximately 26% of shares outstanding |

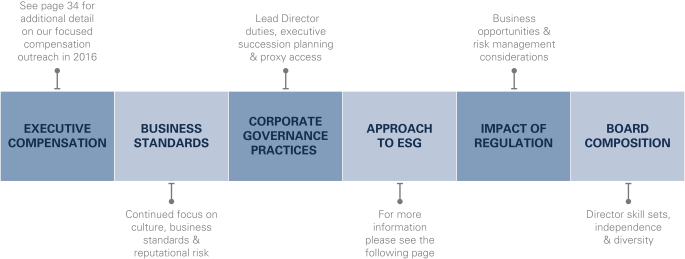

The diverse views of our shareholders were relayed to the Board on topics including:

See page 34 for additional detail on our focused compensation outreach In 2016 Lead Director duties, executive succession planning & proxy access Business opportunities & risk management considerations EXECUTIVE COMPENSATION BUSINESS STANDARDS CORPORATE GOVERNANCE PRACTICES APPROACH TO ESG IMPACT OF REGULATION BOARD COMPOSITION Continued focus on culture, business standards & reputational risk For more information please see the following page Director skill sets, independence & diversity

| Proxy Statement for the 2017 Annual Meeting of Shareholders | Goldman Sachs 11 |

Executive Summary | Shareholder Engagement

APPROACH TO ESG

|

Over the past year, our investors have continued to express interest in our approach to environmental, social and governance (ESG) issues.

We take an integrated approach to ESG, focusing on both opportunities and risks.

| ∎ | Our ESG-related policies and procedures are outlined in detail in the “Environmental, Social and Governance” reporting section on our website at www.gs.com/corpgov. |

| ∎ | In addition, we report annually in our online ESG Report the areas in which we have demonstrated a commitment to finding effective ways to tackle economic, social and environmental challenges. |

| ∎ | Our Board’s Public Responsibilities Committee has primary oversight of the firm’s approach to ESG, which includes reviewing keyESG-related policies such as our Environmental Policy Framework and our annual ESG Report. |

| » | Other ESG matters are also reviewed by the full Board or its other committees as part of their respective mandates. |

| 12 Goldman Sachs | Proxy Statement for the 2017 Annual Meeting of Shareholders |

KEY ESG TOPICS DISCUSSED IN 2016 BUSINESS STANDARDS AND CULTURE ESG INTEGRATION, INCLUDING GROWTH OF ESG AND IMPACT INVESTING IN INVESTMENT MANAGEMENT CLEAN ENERGY AND OUR FOCUS ON HELPING TO MITIGATE CLIMATE CHANGE ESG RISK MANAGEMENT IN TRANSACTIONS APPROACH TO DIVERSITY AND INCLUSION OF ALL EMPLOYEES SUSTAINABILITY OF OUR OPERATIONS BOARD OVERSIGHT OF ESG

Corporate Governance | Item 1. Election of Directors

| Proposal Snapshot — Item 1. Election of Directors | ||||

| What is being voted on . Election to our Board of 11 director nominees.

Board recommendation. After a review of the individual qualifications and experience of each of our director nominees and his or her contributions to our Board, our Board determined unanimously to recommend that shareholders vote FOR all of our director nominees.

| ||||

|

Recent Changes to our Board

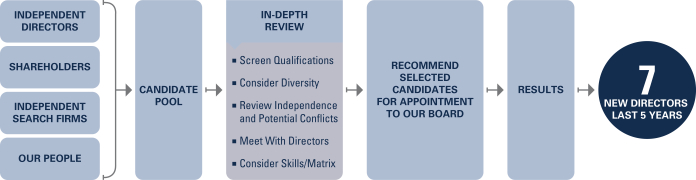

We were pleased to welcome Ms. Kullman to our Board in December 2016. Ms. Kullman was recommended to our Lead Director and to our Governance Committee by our independent director search firm. As described in her biography below, Ms. Kullman brings to the Board and its Committees experience honed through her leadership of a highly-regulated and complex global company and her service on several public company andnot-for-profit boards.

We also thank Mr. Cohn, who retired from the Board in December 2016, for his over ten years of dedicated service and his many contributions to our Board. In addition, we are grateful to both Debora Spar and Mark Tucker, who will not be standing for re-election and will be retiring from our Board at the Annual Meeting after many years of providing our Board with their informed counsel and judgment.

For more information on our process for board refreshment, see —Structure of our Board and Governance Practices—Year-Round Review of Board Composition.

Board of Directors’ Qualifications and Experience

Our 11 director nominees have a great diversity of experience and bring to our Board a wide variety of skills, qualifications and viewpoints that strengthen their ability to carry out their oversight role on behalf of shareholders.

CORE QUALIFICATIONS AND EXPERIENCES

|

DIVERSITY OF SKILLS AND EXPERIENCES

| |||

✓ Integrity, business judgment and commitment

✓ Demonstrated management ability

✓ Extensive experience in the public, privateor not-for-profit sectors

✓ Leadership and expertise in their respective fields

✓ Financial literacy

✓ Involvement in educational, charitable and community organizations

✓ Strategic thinking

✓ Reputational focus |

+ Financial services industry

+ Complex & regulated industries

+ Risk management

+ Public company / corporate governance

+ Global experience

+ Technology

+ Audit, tax, accounting & preparation of financial statements

+ Compliance

+ Operations

+ Established & growth markets

+ Credit evaluation

+ Environmental, social & governance

+ Talent development

+ Academia

+ Business ethics

+ Government, public policy & regulatory affairs

| |||

| Proxy Statement for the 2017 Annual Meeting of Shareholders | Goldman Sachs 13 |

Corporate Governance | Item 1. Election of Directors

Given the nature of our business, our Governance Committee continues to believe that directors with current and prior financial industry experience, among other skills, are critical to our Board’s effectiveness. We take very seriously, however, any actual or perceived conflicts of interest that may arise, and have taken various steps to address this.

For example, in addition to our policies on director independence and related person transactions, we maintain a policy with respect to outside director involvement with financial firms, such as private equity firms or hedge funds. Under this policy, in determining whether to approve any current or proposed affiliation of anon-employee director with a financial firm, our Board will consider, among other things, the legal, reputational, operational and business issues presented, and the nature, feasibility and scope of any restrictions, procedures or other steps that would be necessary or appropriate to ameliorate any perceived or potential future conflicts or other issues.

Diversity is an important factor in our consideration

| ||||

| Our Governance Committee considers a number of demographics including race, gender, ethnicity, sexual orientation, culture and nationality, seeking to develop a board that, as a whole, reflects diverse viewpoints, backgrounds, skills, experiences and expertise.

Among the factors the Governance Committee considers in identifying and evaluating a potential director candidate is the extent to which the candidate would add to the diversity of our Board. The Committee considers the same factors in determining whether tore-nominate an incumbent director.

Diversity is also considered as part of the annual Board evaluation.

| ||||

Director Tenure: A Balance of Experiences

Our nominees have an average tenure of 7 years and a median tenure of approximately 4.5 years. This balances the institutional knowledge of our longer-tenured directors with the fresh perspectives brought by our newer directors.

|

|

| 14 Goldman Sachs | Proxy Statement for the 2017 Annual Meeting of Shareholders |

<3 YEARS 3 DIRECTORS 3-5 YEARS 3 DIRECTORS 5-10 YEARS 2 DIRECTORS 10+ YEARS 3 DIRECTORS

Corporate Governance | Item 1. Election of Directors

| Comprehensive Re-Nomination Process | ||||

We appreciate the importance of critically evaluating individual directors and their contributions to our Board in connection withre-nomination decisions.

In considering whether to recommendre-nomination of a director for election at our Annual Meeting, the Governance Committee conducts a detailed review, considering factors such as:

∎ The extent to which the director’sskills, qualifications and experiencecontinue to contribute to the success of our Board;

∎ Feedback from the annual board evaluation and individual discussionsbetween eachnon-employee director and our Lead Director;

∎ Attendanceandparticipationat, andpreparationfor, Board and Committee meetings;

∎ Independence;

∎ Shareholder feedback, including the support received by director nominees elected at our 2016 Annual Meeting of Shareholders;

∎ Outside board and other affiliations,including any actual or perceived conflicts of interest; and

∎ The extent to which the director continues to contribute to thediversityof our Board.

| ||||

Each of our director nominees has been recommended for election by our Governance Committee and approved andre-nominated for election by our Board.

If elected by our shareholders, our director nominees, all of whom are currently members of our Board, will serve for aone-year term expiring at our 2018 Annual Meeting of Shareholders. Each director will hold office until his or her successor has been elected and qualified or until the director’s earlier resignation or removal.

All of our directors must be elected by majority vote of our shareholders.

∎ A director who fails to receive a majority of FOR votes will be required to tender his or her resignation to our Board.

∎ Our Governance Committee will then assess whether there is a significant reason for the director to remain on our Board, and will make a recommendation to our Board regarding the resignation.

For detailed information on the vote required for the election of directors and the choices available for casting your vote, please seeFrequently Asked Questions.

Biographical information about our director nominees follows. This information is current as of March 1, 2017 and has been confirmed by each of our director nominees for inclusion in our Proxy Statement. There are no family relationships between any of our directors or executive officers.

| Proxy Statement for the 2017 Annual Meeting of Shareholders | Goldman Sachs 15 |

Corporate Governance | Item 1. Election of Directors

Lloyd C. Blankfein, 62

Chairman and CEO

Director Since:April 2003

Other U.S.-Listed Company Directorships

∎ Current: None

∎ Former (Past 5 Years): None | KEY EXPERIENCE AND QUALIFICATIONS | |||||||||||

∎ Committed and deeply engaged leader with strong communication skills: Over 30 years of experience in various positions across our firm. Mr. Blankfein utilizes thisfirm-specific knowledge and experience in his role as Chairman and CEO to, among other things, lead the firm and its people, help protect and enhance our culture and articulate a vision of the firm’s strategy. Mr. Blankfein also uses strong communication skills to guide Board discussions and keeps our Board apprised of significant developments in our business and industry

∎ Extensive market and industry knowledge: Leverages extensive familiarity with all aspects of the firm’s industry and business, including our risk management practices and strategy

∎ Face of our firm: Drawing from extensive interaction with our clients, investors and other constituents, provides additional perspective to the Board

| ||||||||||||

CAREER HIGHLIGHTS

∎ Goldman Sachs

» Chairman and Chief Executive Officer (June 2006 – Present)

» President and Chief Operating Officer (January 2004 – June 2006)

» Vice Chairman with management responsibility for FICC and Equities Divisions (April 2002 – January 2004)

» Co-head of FICC (1997 – April 2002)

» Head and/orCo-head of the Currency and Commodities Division (1994 – 1997)

OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT

∎ Member, Dean’s Advisory Board, Harvard Law School

∎ Member, Board of Dean’s Advisors, Harvard Business School

∎ Member, Dean’s Council, Harvard University

∎ Member, Advisory Board, Tsinghua University School of Economics and Management

∎ Member, Board of Overseers, Weill Cornell Medical College

∎ Member, Board of Directors, Partnership for New York City

EDUCATION

∎ Graduate of Harvard College and Harvard Law School

| ||||||||||||

| 16 Goldman Sachs | Proxy Statement for the 2017 Annual Meeting of Shareholders |

Corporate Governance | Item 1. Election of Directors

Adebayo O. Ogunlesi, 63

Lead Director

Director Since:October 2012

GS Committees

∎ Governance (Chair)

∎ Ex-officio member:

» Audit

» Compensation

» Public Responsibilities

» Risk

Other U.S.-Listed Company Directorships

∎ Current: Callaway Golf Company; Kosmos Energy Ltd.

∎ Former (Past 5 Years): None | KEY EXPERIENCE AND QUALIFICATIONS | |||||||||||

∎ Strong leader, including leadership experience in the financial services industry: Founder, Chairman and Managing Partner of Global Infrastructure Partners and a former executive of Credit Suisse with over 20 years of experience in the financial services industry, including investment banking and private equity

∎ International business and global capital markets experience, including emerging markets: Advised and executed transactions and provided capital markets strategy advice globally

∎ Expertise regarding governance and compensation: Service on the boards of directors and board committees of other public companies andnot-for-profit entities, and in particular as chair or former chair of the nominating and corporate governance committees at each of Callaway Golf and Kosmos Energy, provides additional governance perspective

| ||||||||||||

CAREER HIGHLIGHTS

∎ Chairman and Managing Partner, Global Infrastructure Partners, a private equity firm that invests worldwide in infrastructure assets in the energy, transport, water and waste industry sectors (July 2006 – Present)

∎ Credit Suisse, a financial services company

» Executive Vice Chairman and Chief Client Officer (2004 – 2006)

» Member of Executive Board and Management Committee (2002 – 2006)

» Head of Global Investment Banking Department (2002 – 2004)

» Head of Global Energy Group (1997 – 2002)

∎ Law Clerk to the Honorable Thurgood Marshall, Associate Justice of the U.S. Supreme Court (1980-1981)

OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT

∎ Member, President’s Strategic and Policy Forum

∎ Member, National Board of Directors, The NAACP Legal Defense and Educational Fund, Inc.

∎ Member, Board of Directors, Partnership for New York City Fund

∎ Member, Harvard University Global Advisory Council and Harvard Law School Leadership Council of New York

∎ Member, Board of Dean’s Advisors, Harvard Business School

EDUCATION

∎ Graduate of Oxford University, Harvard Business School and Harvard Law School

| ||||||||||||

| Proxy Statement for the 2017 Annual Meeting of Shareholders | Goldman Sachs 17 |

Corporate Governance | Item 1. Election of Directors

M. Michele Burns, 59

Director Since:October 2011

GS Committees

∎ Risk (Chair)

∎ Compensation

∎ Governance

Other U.S.-Listed Company Directorships

∎ Current: Alexion Pharmaceuticals, Inc.; Anheuser-Busch InBev; Cisco Systems, Inc.;

∎ Former (Past 5 Years):

| KEY EXPERIENCE AND QUALIFICATIONS | |||||||||||

∎ Leadership, governance and risk expertise: Leverages service on the boards of directors and board committees of other public companies and not-for-profit entities

∎ Accounting and the review and preparation of financial statements: Garnered expertise as former CFO of several global public companies

∎ Human capital management and strategic consulting: Background gained as former CEO of Mercer LLC | ||||||||||||

CAREER HIGHLIGHTS

∎ Chief Executive Officer, Retirement Policy Center, sponsored by Marsh & McLennan Companies, Inc. (MMC); Center focuses on retirement public policy issues (October 2011 – February 2014)

∎ Chairman and Chief Executive Officer, Mercer LLC, a subsidiary of MMC and a global leader in human resource consulting, outsourcing and investment services (September 2006 – early October 2011)

∎ Chief Financial Officer, MMC, a global professional services and consulting firm (March 2006 – September 2006)

∎ Chief Financial Officer, Chief Restructuring Officer and Executive Vice President, Mirant Corporation, an energy company (May 2004 – January 2006)

∎ Executive Vice President and Chief Financial Officer, Delta Air Lines, Inc., an air carrier (including various other positions, 1999 – April 2004)

∎ Senior Partner and Leader, Southern Regional Federal Tax Practice, Arthur Andersen LLP, an accounting firm (including various other positions, 1981 – 1999)

OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT

∎ Center Fellow and Strategic Advisor, Stanford University Center on Longevity

∎ Board Member and Treasurer, Elton John AIDS Foundation

EDUCATION

∎ Graduate of University of Georgia (including for Masters)

| ||||||||||||

Mark A. Flaherty, 57

Director Since:December 2014

GS Committees

∎ Audit

∎ Governance

∎ Risk

Other U.S.-Listed Company Directorships

∎ Current: None

∎ Former (Past 5 Years): None | KEY EXPERIENCE AND QUALIFICATIONS | |||||||||||

∎ Investment management: Leverages over 20 years of experience in the investment management industry, including at Wellington Management Company

∎ Background at Wellington and Standish, Ayer and Wood providesperspective on institutional investors’ approach to company performance and corporate governance

∎ Risk expertise: Draws upon years of experience in the financial industry

| ||||||||||||

CAREER HIGHLIGHTS

∎ Wellington Management Company, an investment management company

» Vice Chairman (2011 – 2012)

» Director of Global Investment Services (2002 – 2012)

» Partner, Senior Vice President (2001 – 2012)

∎ Standish, Ayer and Wood, an investment management company

» Executive Committee Member (1997 – 1999)

» Partner (1994 – 1999)

» Director, Global Equity Trading (1991 – 1999)

∎ Director, Global Equity Trading, Aetna, a diversified healthcare benefit company (1987 – 1991)

OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT

∎ Member, Board of Trustees, The Newman School

∎ Former Member, Board of Trustees, Providence College

EDUCATION

∎ Graduate of Providence College

| ||||||||||||

| 18 Goldman Sachs | Proxy Statement for the 2017 Annual Meeting of Shareholders |

Corporate Governance | Item 1. Election of Directors

William W. George, 74

Director Since:December 2002

GS Committees

∎ Public Responsibilities (Chair)

∎ Compensation

∎ Governance

Other U.S.-Listed Company Directorships

∎ Current: None

∎ Former (Past 5 Years): Exxon Mobil Corporation | KEY EXPERIENCE AND QUALIFICATIONS | |||||||||||

∎ Focus on reputation and environmental, social and governance matters: Utilizes current and prior service on the boards of directors and board committees of several other public companies and not-for-profit entities, particularly as Chair of our Public Responsibilities Committee

∎ Leadership: Served as Chief Executive Officer and Chairman of Medtronic, Inc. and as a senior executive at Honeywell International Inc.

∎ Organizational behavior and management: A senior fellow and former professor of leadership and management practice at Harvard Business School and an author of several books on leadership, which provide academic expertise in business management and corporate governance

| ||||||||||||

CAREER HIGHLIGHTS

∎ Harvard Business School

» Senior Fellow (July 2014 – present)

» Professor of Management Practice (January 2004 – July 2014)

∎ Medtronic, Inc., a medical technology company

» Chairman (April 1996 – April 2002)

» Chief Executive Officer (May 1991 – May 2001)

» President and Chief Operating Officer (1989 – 1991)

∎ Executive Vice President, Honeywell International Inc., a diversified technology and manufacturing company (1978 – 1989)

OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT

∎ Board Member, World Economic Forum USA

∎ Trustee, Mayo Clinic

∎ Member, National Academy of Engineering

EDUCATION

∎ Graduate of Georgia Institute of Technology and Harvard Business School

| ||||||||||||

James A. Johnson, 73

Director Since:May 1999

GS Committees

∎ Compensation (Chair)

∎ Governance

∎ Public Responsibilities

Other U.S.-Listed Company Directorships

∎ Current: None

∎ Former (Past 5 Years): Forestar Group, Inc.; | KEY EXPERIENCE AND QUALIFICATIONS | |||||||||||

∎ Financial services, including investment management industry: Leverages professional experience in financial services

∎ Government affairs and the regulatory process: Experience developed through, among other things, his tenure at Fannie Mae and his work with Vice President Walter F. Mondale

∎ Leadership, compensation and governance: Current and prior service on the boards of directors of public companies andnot-for-profit entities, including in lead director and committee chair roles, provides additional perspective

| ||||||||||||

CAREER HIGHLIGHTS

∎ Chairman, Johnson Capital Partners, a private consulting company (Present)

∎ Vice Chairman, Perseus L.L.C., a merchant banking and private equity firm (April 2001 – June 2012)

∎ Fannie Mae

» Chairman of the Executive Committee (1999)

» Chairman and Chief Executive Officer (February 1991 – 1998)

» Vice Chairman (1990 – February 1991)

OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT

∎ Chairman Emeritus, John F. Kennedy Center for the Performing Arts

∎ Chairman Emeritus and Honorary Trustee, The Brookings Institution

∎ Council Member, Smithsonian Museum of African American History and Culture

∎ Chair, Advisory Council, Stanford University Center on Longevity

∎ Member, Council on Foreign Relations

∎ Member, American Academy of Arts and Sciences

EDUCATION

∎ Graduate of University of Minnesota and the Woodrow Wilson School of Public and International Affairs, Princeton University

| ||||||||||||

| Proxy Statement for the 2017 Annual Meeting of Shareholders | Goldman Sachs 19 |

Corporate Governance | Item 1. Election of Directors

Ellen J. Kullman, 61

Director Since:December 2016

GS Committees

∎ Compensation

∎ Governance

∎ Risk

Other U.S.-Listed Company Directorships

∎ Current: Amgen Inc., Dell Technologies Inc., United Technologies Corporation

∎ Former (Past 5 Years): E.I. du Pont de Nemours and Company | KEY EXPERIENCE AND QUALIFICATIONS | |||||||||||

∎ Leadership and strategy:During her tenure as Chair and CEO of DuPont, a highly-regulated science and technology-based company with global operations, led the company through a period of strategic transformation and growth

∎ Corporate governance and compensation: Leverages service on the boards of directors and board committees (including in leadership roles) of other public companies and not-for-profit entities

∎ Risk management experience:Draws upon experiences gained from DuPont and other board roles to provide our Risk Committee with diverse viewpoints

| ||||||||||||

CAREER HIGHLIGHTS

∎ E.I. du Pont de Nemours and Company, a provider of basic materials and innovative products and services for diverse industries

» Chairman and Chief Executive Officer (2009 - 2015)

» President (Oct. 2008 - Dec. 2008)

» Executive Vice President, DuPont Coatings and Color Technologies, DuPont Electronic and Communication Technologies; DuPont Performance Materials, DuPont Safety and Protection, Marketing and Sales, Pharmaceuticals, Risk Management, and Safety and Sustainability (2006 - 2008)

» Various positions, including Group Vice President, DuPont Safety and Protection (1988 - 2006)

OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT

∎ Member, Board of Overseers, Tufts University School of Engineering

∎ Trustee, Northwestern University

∎ Member, National Academy of Engineering

∎ Member, The Business Council

EDUCATION

∎ Graduate of Tufts University and Kellogg School of Management, Northwestern University

| ||||||||||||

Lakshmi N. Mittal, 66

Director Since:June 2008

GS Committees

∎ Compensation

∎ Governance

∎ Public Responsibilities

Other U.S.-Listed Company Directorships

∎ Current: ArcelorMittal S.A.

∎ Former (Past 5 Years): None | KEY EXPERIENCE AND QUALIFICATIONS | |||||||||||

∎ Leadership, business development and operations: Founder of Mittal Steel Company and Chairman and Chief Executive Officer of ArcelorMittal S.A., the world’s leading integrated steel and mining company

∎ International business and growth markets:Leading company with operations in over 20 countries on four continents provides global business expertise and perspective on public responsibilities

∎ Corporate governance and international governance: Current and prior service on the boards of directors of other international public companies and not-for-profit entities assists in committee responsibilities

| ||||||||||||

CAREER HIGHLIGHTS

∎ ArcelorMittal S.A., a steel and mining company

» Chairman and Chief Executive Officer (May 2008 – Present)

» President and Chief Executive Officer (November 2006 – May 2008)

∎ Chief Executive Officer, Mittal Steel Company N.V. (1976 – November 2006)

OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT

∎ Member, International Business Council of the World Economic Forum

∎ Trustee, Cleveland Clinic

∎ Member, Executive Committee, World Steel Association

∎ Member, Executive Board, Indian School of Business

∎ Member, The Business Council

EDUCATION

∎ Graduate of St. Xavier’s College in India

| ||||||||||||

| 20 Goldman Sachs | Proxy Statement for the 2017 Annual Meeting of Shareholders |

Corporate Governance | Item 1. Election of Directors

Peter Oppenheimer, 54

Director Since:March 2014

GS Committees

∎ Audit (Chair)

∎ Governance

∎ Risk

Other U.S.-Listed Company Directorships

∎ Current: None

∎ Former (Past 5 Years): None

| KEY EXPERIENCE AND QUALIFICATIONS | |||||||||||

∎ Capital and risk management: Garnered experience as CFO and Controller at Apple and Divisional CFO at ADP

∎ Review and preparation of financial statements: Over 20 years as a CFO or controller provides valuable experience and perspective as Audit Committee Chair

∎ Oversight of technology and technology risks: Leverages prior experience in overseeing information systems at Apple

| ||||||||||||

CAREER HIGHLIGHTS

∎ Apple, Inc., a designer and manufacturer of electronic devices and related software and services

» Senior Vice President (retired September 2014)

» Senior Vice President and Chief Financial Officer (2004 – June 2014)

» Senior Vice President and Corporate Controller (2002 – 2004)

» Vice President and Corporate Controller (1998 – 2002)

» Vice President and Controller, Worldwide Sales (1997 – 1998)

» Senior Director, Finance and Controller, Americas (1996 – 1997)

∎ Divisional Chief Financial Officer, Finance, MIS, Administration, and Equipment Leasing Portfolio at Automatic Data Processing, Inc. (ADP), a leading provider of human capital management and integrated computing solutions (1992 – 1996)

∎ Consultant, Information Technology Practice at Coopers & Lybrand, LLP (1988 – 1992)

OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT

∎ Vice Chairman, Foundation Board of Directors, California Polytechnic State University

∎ Board Member, French Hospital

EDUCATION

∎ Graduate of California Polytechnic State University and the Leavey School of Business, University of Santa Clara | ||||||||||||

David A. Viniar, 61

Director Since:January 2013

GS Committees

∎ Risk

Other U.S.-Listed Company Directorships

∎ Current: Square, Inc.

∎ Former (Past 5 Years): None

| KEY EXPERIENCE AND QUALIFICATIONS | |||||||||||

∎ Financial industry, in particular risk management and regulatory affairs: Over 30 years of experience in various roles at Goldman Sachs, as well as service as chair of the audit and risk committee of Square, Inc., provides valuable perspective to our Board

∎ Unique insight into our firm’s financial reporting, controls and risk management: As our former CFO, able to provide unique insight about our risks to our Risk Committee

∎ Capital management processes and assessments: Experience gained through serving as the Goldman Sachs CFO for over 10 years

| ||||||||||||

CAREER HIGHLIGHTS

∎ Goldman Sachs

» Executive Vice President and Chief Financial Officer (May 1999 – January 2013)

» Head of Operations, Technology, Finance and Services Division (December 2002 – January 2013)

» Head of the Finance Division and Co-head of Credit Risk Management and Advisory and Firmwide Risk (December 2001 – December 2002)

» Co-head of Operations, Finance and Resources (March 1999 – December 2001)

OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT

∎ Trustee, Garden of Dreams Foundation

∎ Former Trustee, Union College

EDUCATION

∎ Graduate of Union College and Harvard Business School

| ||||||||||||

| Proxy Statement for the 2017 Annual Meeting of Shareholders | Goldman Sachs 21 |

Corporate Governance | Item 1. Election of Directors

Mark O. Winkelman, 70

Director Since:December 2014

GS Committees

∎ Audit

∎ Governance

∎ Risk

Other U.S.-Listed Company Directorships

∎ Current: None

∎ Former (Past 5 Years): Anheuser-Busch InBev

| KEY EXPERIENCE AND QUALIFICATIONS | |||||||||||

∎ Audit and financial expertise, corporate governance and leadership: Leverages prior service on the board of directors and the audit and finance committees of Anheuser-Busch InBev and service on the boards of directors and audit, finance and other committees ofnot-for-profit entities

∎ Financial services industry: Experience gained through his role as operating partner at J.C. Flowers and through other industry experience

∎ Knowledgeaboutourfirm,includingourfixedincomebusiness,andanunderstandingoftherisksweface: Utilizes his previous tenure at Goldman Sachs

| ||||||||||||

CAREER HIGHLIGHTS

∎ Private investor (Present)

∎ Operating Partner, J.C. Flowers & Co., a private investment firm focusing on the financial services industry (2006 – 2008)

∎ Goldman Sachs

» Retired Limited Partner (1994 – 1999)

» Management Committee Member and Co-Head of Fixed Income Division (1987 – 1994)

» Various positions at the firm, including Head of J. Aron Division (1978 – 1987)

∎ Senior Investment Officer, The World Bank (1974 – 1978)

OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT

∎ Director, Goldman Sachs International

∎ Trustee Emeritus, University of Pennsylvania

∎ Trustee Emeritus, Penn Medicine

EDUCATION

∎ Graduate of Erasmus University in the Netherlands and The Wharton School, University of Pennsylvania

| ||||||||||||

|

| 9 of our 11 director nominees are independent | ||||

| Our Board determined, upon the recommendation of our Governance Committee, that Ms. Burns, Mr. Flaherty, Mr. George, Mr. Johnson, Ms. Kullman, Mr. Mittal, Mr. Ogunlesi, Mr. Oppenheimer and Mr. Winkelman, as well as Dr. Spar and Mr. Tucker, who are retiring in April 2017, are “independent” within the meaning of NYSE rules and our Director Independence Policy. Furthermore, our Board has determined that all of our independent directors satisfy the heightened audit committee independence standards under SEC and NYSE rules, and Compensation Committee members also satisfy the relevant heightened standards under NYSE rules.

| ||||

Process for Independence Assessment

A director is considered independent under NYSE rules if our Board determines that the director does not have any direct or indirect material relationship with Goldman Sachs. Our Board has established a Policy Regarding Director Independence (Director Independence Policy) that provides standards to assist our Board in determining which relationships and transactions might constitute a material relationship that would cause a director not to be independent.

To assess independence, our Governance Committee and our Board review detailed information regarding our independent directors, including employment and public company andnot-for-profit directorships as well as information regarding immediate family members and affiliated entities.

Through the course of this review, the Governance Committee and the Board consider relationships between the independent directors (and their immediate family members and affiliated entities) on the one hand, and Goldman Sachs and its affiliates on the other in accordance with the Director Independence Policy. This includes a review of revenues to the firm from, and payments or donations to, relevant entities affiliated with our directors (or their immediate family members) as a result of ordinary course transactions or contributions tonot-for-profit organizations.

For more information on the categories of transactions that our Governance Committee and our Board reviewed, considered and determined to be immaterial under our Director Independence Policy, seeAdditional Details onDirector Independencein Annex A.

| 22 Goldman Sachs | Proxy Statement for the 2017 Annual Meeting of Shareholders |

Corporate Governance | Structure of our Board and Governance Practices

Structure of our Board and Governance Practices

|

Our Board has five standing committees: Audit, Compensation, Governance, Public Responsibilities and Risk. The specific membership of each committee allows us to take advantage of our directors’ diverse skill sets, which enables deep focus on committee matters.

Each of our committees:

∎ Operates pursuant to a written charter (available on our website atwww.gs.com/charters)

∎ Evaluates its performance annually

∎ Reviews its charter annually |

The firm’sreputation is of critical importance. In fulfilling their duties and responsibilities, each of our standing committees and our Board consider the potential effect of any matter on our reputation.

|

AUDIT

| ||||

| ALL INDEPENDENT | KEY SKILLS & EXPERIENCES

| KEY RESPONSIBILITIES | ||

Peter Oppenheimer* Mark Flaherty Mark Tucker** Mark Winkelman

Adebayo Ogunlesi (ex-officio) |

∎ Audit/Tax/Accounting

∎ Preparation or oversight of financial statements

∎ Compliance |

∎ Assist our Board in its oversight of our financial statements, legal and regulatory compliance, independent auditors’ qualification, independence and performance, internal audit function performance and internal controls over financial reporting

∎ Decide whether to appoint, retain or terminate our independent auditors

∎ Pre-approve all audit, audit-related, tax and other services, if any, to be provided by the independent auditors

∎ Appoint and oversee the work of our Director of Internal Audit and annually assess her performance and administrative reporting line

∎ Prepare the Audit Committee Report

| ||

COMPENSATION

| ||||

ALL INDEPENDENT |

KEY SKILLS & EXPERIENCES

|

KEY RESPONSIBILITIES | ||

James Johnson Michele Burns William George Ellen Kullman Lakshmi Mittal Debora Spar**

Adebayo Ogunlesi (ex-officio) | ∎ Setting executive compensation

∎ Evaluating executive and firmwide compensation programs

∎ Human capital | ∎ Determine and approve the compensation of our CEO and other executive officers

∎ Approve, or make recommendations to our Board for it to approve, our incentive, equity-based and other compensation plans

∎ Assist our Board in its oversight of the development, implementation and effectiveness of our policies and strategies relating to our human capital management function, including:

» recruiting;

» retention;

» career development and progression;

» management succession (other than that within the purview of the Governance Committee); and

» diversity and employment practices.

∎ Prepare the Compensation Committee Report

|

* A majority of the members of our Audit Committee, including the Chair, have been determined to be “audit committee financial experts”

** Retiring at the Annual Meeting

| Proxy Statement for the 2017 Annual Meeting of Shareholders | Goldman Sachs 23 |

Corporate Governance | Structure of our Board and Governance Practices

GOVERNANCE

| ||||

ALL INDEPENDENT |

KEY SKILLS & EXPERIENCES

|

KEY RESPONSIBILITIES | ||

Adebayo Ogunlesi Michele Burns Mark Flaherty William George James Johnson Ellen Kullman Lakshmi Mittal Peter Oppenheimer Debora Spar** Mark Tucker** Mark Winkelman |

∎ Corporate governance

∎ Talent development and succession planning

∎ Current and prior public company board service |

∎ Recommend individuals to our Board for nomination, election or appointment as members of our Board and its committees

∎ Oversee the evaluation of the performance of our Board and our CEO

∎ Review and concur with the succession plans for our CEO and other members of senior management

∎ Take a leadership role in shaping our corporate governance, including developing, recommending to the Board and reviewing on an ongoing basis the corporate governance principles and practices that apply to us

∎ Review periodically the form and amount ofnon-employee director compensation and make recommendations to the Board with respect thereto

| ||

PUBLIC RESPONSIBILITIES

| ||||

ALL INDEPENDENT |

KEY SKILLS & EXPERIENCES

|

KEY RESPONSIBILITIES | ||

William George James Johnson Lakshmi Mittal Debora Spar**

Adebayo Ogunlesi (ex-officio)

|

∎ Government and regulatory affairs

∎ ESG

∎ Philanthropy

∎ Reputational risk |

∎ Assist our Board in its oversight of our firm’s relationships with major external constituencies and our reputation

∎ Oversee the development, implementation and effectiveness of our policies and strategies relating to citizenship, corporate engagement and relevant significant public policy issues | ||

RISK

| ||||

MAJORITY |

KEY SKILLS & EXPERIENCES

|

KEY RESPONSIBILITIES | ||

Michele Burns Mark Flaherty Ellen Kullman Peter Oppenheimer Mark Tucker** Mark Winkelman

Adebayo Ogunlesi (ex-officio)

Non-independent David Viniar | ∎ Understanding of how risk is undertaken, mitigated and controlled in complex industries

∎ Technology

∎ Understanding of financial products

∎ Expertise in capital adequacy and deployment |

∎ Assist our Board in its oversight of our firm’s overall risk-taking tolerance and management of financial and operational risks, such as market, credit and liquidity risk, including reviewing and discussing with management:

» our firm’s capital plan, regulatory capital ratios, capital management policy and internal capital adequacy assessment process and the effectiveness of our financial and operational risk management policies and controls

» our liquidity risk metrics, management, funding strategies and controls, and the contingency funding plan

» our market, credit, operational and model risk management strategies, policies and controls | ||

** Retiring at the Annual Meeting

| 24 Goldman Sachs | Proxy Statement for the 2017 Annual Meeting of Shareholders |

Corporate Governance | Structure of our Board and Governance Practices

BOARD AND COMMITTEE EVALUATIONS

|

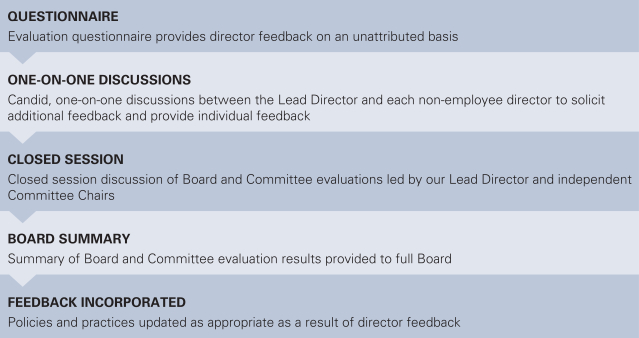

We recognize the critical role that Board and committee evaluations play in ensuring the effective functioning of our Board. It is important to take stock of Board, committee and director performance and to solicit and act upon feedback received from each member of our Board. To this end, under the leadership of our Lead Director, our Governance Committee is responsible for evaluating the performance of our Board annually, and each of our Board’s committees also annually conducts a self-evaluation.

2016 Evaluations — A Multi-Step Process

The Governance Committee periodically reviews the format of the Board and Committee evaluation process to ensure that actionable feedback is solicited on the operation of the Board and director performance.