UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 6, 2020

The Goldman Sachs Group, Inc.

(Exact name of registrant as specified in its charter)

| | | | |

Delaware | | No. 001-14965 | | No. 13-4019460 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | |

200 West Street, New York, N.Y. | | 10282 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (212) 902-1000

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of each class | | Trading

Symbol | | Exchange on which registered |

Common stock, par value $.01 per share | | GS | | NYSE |

Depositary Shares, Each Representing 1/1,000th Interest in a Share of Floating Rate Non-Cumulative Preferred Stock, Series A | | GS PrA | | NYSE |

Depositary Shares, Each Representing 1/1,000th Interest in a Share of Floating Rate Non-Cumulative Preferred Stock, Series C | | GS PrC | | NYSE |

Depositary Shares, Each Representing 1/1,000th Interest in a Share of Floating Rate Non-Cumulative Preferred Stock, Series D | | GS PrD | | NYSE |

Depositary Shares, Each Representing 1/1,000th Interest in a Share of 5.50% Fixed-to-Floating Rate Non-Cumulative Preferred Stock, Series J | | GS PrJ | | NYSE |

Depositary Shares, Each Representing 1/1,000th Interest in a Share of 6.375% Fixed-to-Floating Rate Non-Cumulative Preferred Stock, Series K | | GS PrK | | NYSE |

Depositary Shares, Each Representing 1/1,000th Interest in a Share of 6.30% Non-Cumulative Preferred Stock, Series N | | GS PrN | | NYSE |

5.793% Fixed-to-Floating Rate Normal Automatic Preferred Enhanced Capital Securities of Goldman Sachs Capital II | | GS/43PE | | NYSE |

Floating Rate Normal Automatic Preferred Enhanced Capital Securities of Goldman Sachs Capital III | | GS/43PF | | NYSE |

Medium-Term Notes, Series A, Index-Linked Notes due 2037 of GS Finance Corp. | | GCE | | NYSE Arca |

Medium-Term Notes, Series B, Index-Linked Notes due 2037 | | GSC | | NYSE Arca |

Medium-Term Notes, Series E, Index-Linked Notes due 2028 of GS Finance Corp. | | FRLG | | NYSE Arca |

| |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 under the Securities Act (17 CFR 230.405) or Rule 12b-2 under the Exchange Act (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

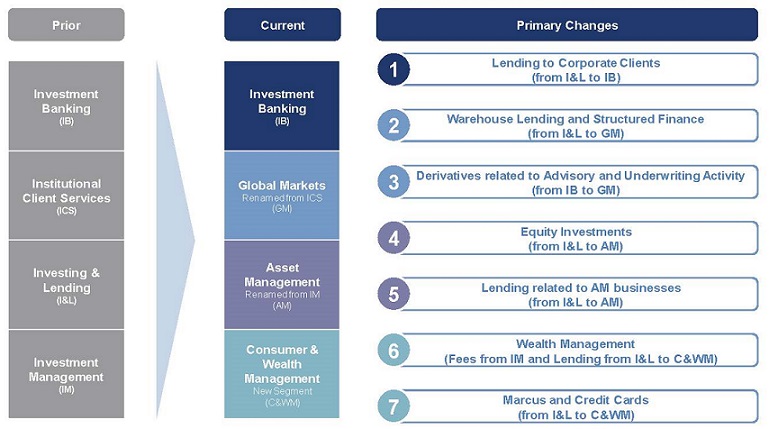

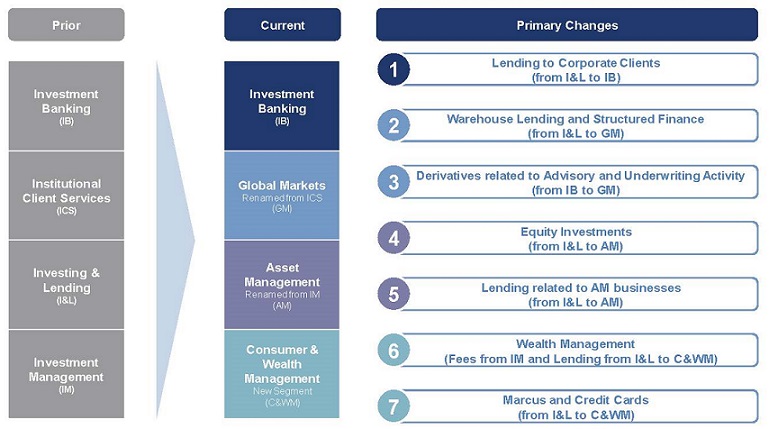

The Goldman Sachs Group, Inc. (together with its consolidated subsidiaries, the firm) has made certain changes to its business segments, commencing with the fourth quarter of 2019.

Prior to the fourth quarter of 2019, the firm had the following four business segments: Investment Banking, Institutional Client Services, Investing & Lending, and Investment Management.

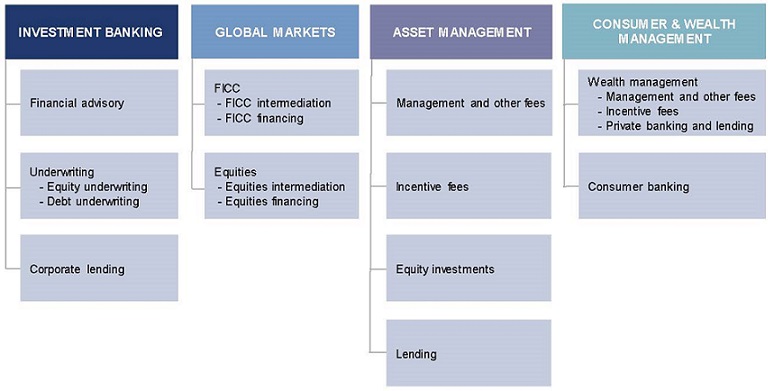

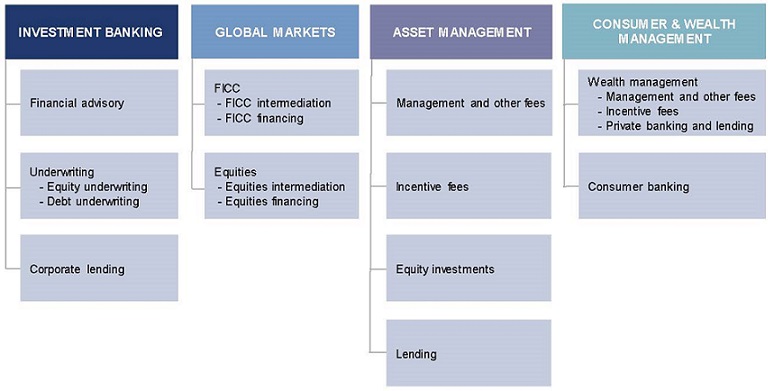

Beginning with the fourth quarter of 2019, the firm will report its results in the following four business segments: Investment Banking, Global Markets, Asset Management, and Consumer & Wealth Management. The business segments and their revenue sources are presented below:

Prior results beginning with the firm’s 2017 fiscal year are presented on a comparable basis in the tables on pages 4 - 5.

The primary changes made were as follows:

| • | Investing & Lending results are now included across the four segments as described below. |

| • | Investment Banking additionally includes the results from lending to corporate clients, including middle-market lending, relationship lending and acquisition financing, previously reported in Investing & Lending. These results are included within Corporate lending. |

| • | Institutional Client Services has been renamed Global Markets and additionally includes the results from providing warehouse lending and structured financing to institutional clients, previously reported in Investing & Lending, and the results from transactions in derivatives related to client advisory and underwriting assignments, previously reported in Investment Banking. |

| • | Investment Management has been renamed Asset Management and additionally includes the results from investments in equity securities and lending activities related to the firm’s asset management businesses, including investments in debt securities and loans backed by real estate, both previously reported in Investing & Lending. |

| • | Consumer & Wealth Management is a new segment that includes management and other fees, incentive fees and results from deposit-taking activities related to the firm’s wealth management business, all previously reported in Investment Management. It also includes the results from providing loans through the firm’s private bank, providing unsecured loans and accepting deposits through the firm’s digital platform, Marcus: by Goldman Sachs, and providing credit cards, all previously reported in Investing & Lending. |

The firm’s four business segments are now as follows:

Investment Banking, which is comprised of:

| • | Financial advisory, which includes strategic advisory assignments with respect to mergers and acquisitions, divestitures, corporate defense activities, restructurings and spin-offs. |

| • | Underwriting, which includes: |

| | • | Equity underwriting, which includes public offerings and private placements of common and preferred stock and convertible and exchangeable securities. |

| | • | Debt underwriting, which includes investment-grade and high-yield debt offerings, bank and bridge loans, and the structuring of asset-backed securities. |

| • | Corporate lending, which includes lending to corporate clients, including middle-market lending, relationship lending and acquisition financing. |

Global Markets, which is comprised of:

| • | Fixed Income, Currency and Commodities (FICC), which includes: |

| | • | Market intermediation, which includes client execution activities related to making markets in interest rate products, credit products, mortgages, currencies and commodities. |

| | • | Financing, which includes providing financing to clients through repurchase agreements, as well as through structured credit, warehouse and asset-backed lending. |

| • | Equities, which includes: |

| | • | Market intermediation, which includes client execution activities related to making markets in equity products, as well as commissions and fees from executing and clearing institutional client transactions. |

| | • | Financing, which includes prime brokerage and other equities financing activities, including securities lending, margin lending and swaps. |

Asset Management, which is comprised of:

| • | Activities related to managing institutional and third party distribution assets across traditional and alternative asset classes, which generate: |

| | • | Management and other fees |

| • | Equity investments, which includes alternative investing activities related to public and private equity investments in corporate, real estate and infrastructure entities, as well as making investments through consolidated investment entities, substantially all of which are engaged in real estate investment activities. |

| • | Lending, which includes lending activities related to the firm’s asset management businesses, including investments in debt securities and loans backed by real estate. |

Consumer & Wealth Management, which is comprised of:

| • | Wealth management, which includes: |

| | • | Management and other fees related to managing assets, providing investing and wealth advisory solutions, providing financial planning and counseling, and executing brokerage transactions for wealth management clients. |

| | • | Incentive fees related to managing assets for wealth management clients. |

| | • | Private banking and lending, which includes lending and deposit-taking activities for wealth management clients. |

| • | Consumer banking, which includes lending and deposit-taking activities through Marcus: by Goldman Sachs, as well as providing credit cards. |

These changes to the firm’s business segments have no effect on the firm’s historical total net revenues, total provision for credit losses, total operating expenses and total pre-tax earnings in the consolidated statements of earnings. Prior period segment results have been conformed to the new business segments.

The Goldman Sachs Group, Inc. and Subsidiaries

Operating Results by Segment (unaudited)

$ in millions

| | | | | | | | | | | | | | | | |

| | THREE MONTHS ENDED | |

| | | | | | | | | | | | |

| | SEPTEMBER 30,

2019 | | | JUNE 30,

2019 | | | MARCH 31,

2019 | | | DECEMBER 31,

2018 | |

INVESTMENT BANKING | |

Financial advisory | | | $ 697 | | | | $ 771 | | | | $ 874 | | | | $ 1,198 | |

| | | | | | | | | | | | | | | | |

Equity underwriting | | | 366 | | | | 476 | | | | 262 | | | | 307 | |

Debt underwriting | | | 524 | | | | 514 | | | | 482 | | | | 437 | |

Underwriting | | | 890 | | | | 990 | | | | 744 | | | | 744 | |

| | | | | | | | | | | | | | | | |

Corporate lending | | | 254 | | | | 187 | | | | 128 | | | | 251 | |

Net revenues | | | 1,841 | | | | 1,948 | | | | 1,746 | | | | 2,193 | |

Provision for credit losses | | | 91 | | | | 81 | | | | 86 | | | | 36 | |

Operating expenses | | | 972 | | | | 1,050 | | | | 1,005 | | | | 1,104 | |

Pre-tax earnings | | | $ 778 | | | | $ 817 | | | | $ 655 | | | | $ 1,053 | |

| | | | | | | | | | | | | | | | |

GLOBAL MARKETS | | | | | | | | | | | | | | | | |

FICC intermediation | | | $ 1,315 | | | | $ 1,440 | | | | $ 1,872 | | | | $ 757 | |

FICC financing | | | 364 | | | | 262 | | | | 366 | | | | 330 | |

FICC | | | 1,679 | | | | 1,702 | | | | 2,238 | | | | 1,087 | |

| | | | | | | | | | | | | | | | |

Equities intermediation | | | 1,080 | | | | 1,154 | | | | 1,161 | | | | 897 | |

Equities financing | | | 784 | | | | 860 | | | | 641 | | | | 625 | |

Equities | | | 1,864 | | | | 2,014 | | | | 1,802 | | | | 1,522 | |

Net revenues | | | 3,543 | | | | 3,716 | | | | 4,040 | | | | 2,609 | |

Provision for credit losses | | | 16 | | | | (4) | | | | 3 | | | | 7 | |

Operating expenses | | | 2,377 | | | | 2,685 | | | | 2,748 | | | | 2,340 | |

Pre-tax earnings | | | $ 1,150 | | | | $ 1,035 | | | | $ 1,289 | | | | $ 262 | |

| | | | | | | | | | | | | | | | |

ASSET MANAGEMENT | | | | | | | | | | | | | | | | |

Management and other fees | | | $ 660 | | | | $ 667 | | | | $ 607 | | | | $ 629 | |

Incentive fees | | | 24 | | | | 31 | | | | 30 | | | | 67 | |

Equity investments | | | 596 | | | | 1,499 | | | | 805 | | | | 951 | |

Lending | | | 341 | | | | 351 | | | | 351 | | | | 327 | |

Net revenues | | | 1,621 | | | | 2,548 | | | | 1,793 | | | | 1,974 | |

Provision for credit losses | | | 81 | | | | 60 | | | | 13 | | | | 47 | |

Operating expenses | | | 1,176 | | | | 1,247 | | | | 1,103 | | | | 818 | |

Pre-tax earnings | | | $ 364 | | | | $ 1,241 | | | | $ 677 | | | | $ 1,109 | |

| | | | | | | | | | | | | | | | |

CONSUMER & WEALTH MANAGEMENT | | | | | | | | | | | | | | | | |

Management and other fees | | | $ 881 | | | | $ 833 | | | | $ 794 | | | | $ 830 | |

Incentive fees | | | 21 | | | | 13 | | | | 28 | | | | 86 | |

Private banking and lending | | | 199 | | | | 187 | | | | 203 | | | | 202 | |

Wealth management | | | 1,101 | | | | 1,033 | | | | 1,025 | | | | 1,118 | |

| | | | | | | | | | | | | | | | |

Consumer banking | | | 217 | | | | 216 | | | | 203 | | | | 186 | |

Net revenues | | | 1,318 | | | | 1,249 | | | | 1,228 | | | | 1,304 | |

Provision for credit losses | | | 103 | | | | 77 | | | | 122 | | | | 132 | |

Operating expenses | | | 1,091 | | | | 1,138 | | | | 1,008 | | | | 888 | |

Pre-tax earnings | | | $ 124 | | | | $ 34 | | | | $ 98 | | | | $ 284 | |

| | | | | | | | | | | | | | | | |

TOTAL | | | | | | | | | | | | | | | | |

Net revenues | | | $ 8,323 | | | | $ 9,461 | | | | $ 8,807 | | | | $ 8,080 | |

Provision for credit losses | | | 291 | | | | 214 | | | | 224 | | | | 222 | |

Operating expenses | | | 5,616 | | | | 6,120 | | | | 5,864 | | | | 5,150 | |

Pre-tax earnings | | | $ 2,416 | | | | $ 3,127 | | | | $ 2,719 | | | | $ 2,708 | |

The Goldman Sachs Group, Inc. and Subsidiaries

Operating Results by Segment (unaudited)

$ in millions

| | | | | | | | | | | | | | | | |

| | NINE MONTHS ENDED | | | | | | YEAR ENDED | |

| | | | | | | | |

| | SEPTEMBER 30, 2019 | | | | | | DECEMBER 31,

2018 | | | DECEMBER 31,

2017 | |

INVESTMENT BANKING | | | | | | | | | | | | | | | | |

Financial advisory | | | $ 2,342 | | | | | | | | $ 3,444 | | | | $ 3,161 | |

Equity underwriting | | | 1,104 | | | | | | | | 1,628 | | | | 1,235 | |

Debt underwriting | | | 1,520 | | | | | | | | 2,358 | | | | 2,680 | |

Underwriting | | | 2,624 | | | | | | | | 3,986 | | | | 3,915 | |

Corporate lending | | | 569 | | | | | | | | 748 | | | | 383 | |

Net revenues | | | 5,535 | | | | | | | | 8,178 | | | | 7,459 | |

Provision for credit losses | | | 258 | | | | | | | | 124 | | | | 34 | |

Operating expenses | | | 3,027 | | | | | | | | 4,473 | | | | 3,613 | |

Pre-tax earnings | | | $ 2,250 | | | | | | | | $ 3,581 | | | | $ 3,812 | |

| | | | | | | | | | | | | | | | |

GLOBAL MARKETS | | | | | | | | | | | | | | | | |

FICC intermediation | | | $ 4,627 | | | | | | | | $ 5,737 | | | | $ 5,067 | |

FICC financing | | | 992 | | | | | | | | 1,248 | | | | 1,151 | |

FICC | | | 5,619 | | | | | | | | 6,985 | | | | 6,218 | |

Equities intermediation | | | 3,395 | | | | | | | | 4,681 | | | | 4,000 | |

Equities financing | | | 2,285 | | | | | | | | 2,772 | | | | 2,077 | |

Equities | | | 5,680 | | | | | | | | 7,453 | | | | 6,077 | |

Net revenues | | | 11,299 | | | | | | | | 14,438 | | | | 12,295 | |

Provision for credit losses | | | 15 | | | | | | | | 52 | | | | 178 | |

Operating expenses | | | 7,810 | | | | | | | | 10,585 | | | | 9,981 | |

Pre-tax earnings | | | $ 3,474 | | | | | | | | $ 3,801 | | | | $ 2,136 | |

| | | | | | | | | | | | | | | | |

ASSET MANAGEMENT | | | | | | | | | | | | | | | | |

Management and other fees | | | $ 1,934 | | | | | | | | $ 2,612 | | | | $ 2,329 | |

Incentive fees | | | 85 | | | | | | | | 384 | | | | 296 | |

Equity investments | | | 2,900 | | | | | | | | 4,207 | | | | 4,405 | |

Lending | | | 1,043 | | | | | | | | 1,632 | | | | 1,500 | |

Net revenues | | | 5,962 | | | | | | | | 8,835 | | | | 8,530 | |

Provision for credit losses | | | 154 | | | | | | | | 160 | | | | 322 | |

Operating expenses | | | 3,526 | | | | | | | | 4,179 | | | | 3,773 | |

Pre-tax earnings | | | $ 2,282 | | | | | | | | $ 4,496 | | | | $ 4,435 | |

| | | | | | | | | | | | | | | | |

CONSUMER & WEALTH MANAGEMENT | | | | | | | | | | | | | | | | |

Management and other fees | | | $ 2,508 | | | | | | | | $ 3,282 | | | | $ 3,156 | |

Incentive fees | | | 62 | | | | | | | | 446 | | | | 121 | |

Private banking and lending | | | 589 | | | | | | | | 826 | | | | 790 | |

Wealth management | | | 3,159 | | | | | | | | 4,554 | | | | 4,067 | |

Consumer banking | | | 636 | | | | | | | | 611 | | | | 379 | |

Net revenues | | | 3,795 | | | | | | | | 5,165 | | | | 4,446 | |

Provision for credit losses | | | 302 | | | | | | | | 338 | | | | 123 | |

Operating expenses | | | 3,237 | | | | | | | | 4,224 | | | | 3,574 | |

Pre-tax earnings | | | $ 256 | | | | | | | | $ 603 | | | | $ 749 | |

| | | | | | | | | | | | | | | | |

TOTAL | | | | | | | | | | | | | | | | |

Net revenues | | | $ 26,591 | | | | | | | | $ 36,616 | | | | $ 32,730 | |

Provision for credit losses | | | 729 | | | | | | | | 674 | | | | 657 | |

Operating expenses | | | 17,600 | | | | | | | | 23,461 | | | | 20,941 | |

Pre-tax earnings | | | $ 8,262 | | | | | | | | $ 12,481 | | | | $ 11,132 | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | THE GOLDMAN SACHS GROUP, INC. | | |

| | | | | | (Registrant) | | |

| | | | | | | |

Date: January 6, 2020 | | By: | | /s/ Stephen M. Scherr | | |

| | | | Name: Stephen M. Scherr | | |

| | | | Title: Chief Financial Officer | | |