Exhibit 99.2 Second Quarter 2022 Earnings Results Presentation July 18, 2022

Results Snapshot Net Revenues Net Earnings EPS 2Q22 $11.86 billion 2Q22 $2.93 billion 2Q22 $7.73 2Q22 YTD $24.80 billion 2Q22 YTD $6.87 billion 2Q22 YTD $18.47 1 1 Annualized ROE Annualized ROTE Book Value Per Share 2Q22 10.6% 2Q22 11.4% BVPS $301.88 2Q22 YTD 12.8% 2Q22 YTD 13.6% YTD Growth 6.2% Highlights Resilient first half performance Record Consumer & Wealth Management net revenues, up 25% YoY amid an evolving macroeconomic environment 3,4 Record AUS of $2.50 trillion 2 #1 in M&A and Equity and equity-related offerings Record Management and other fees of $2.23 billion, up 22% YoY Strong Global Markets performance Increased quarterly dividend by 25% to Record FICC financing and strong Equities financing net revenues $2.50 per common share in 3Q22 1

Financial Overview Financial Results Financial Overview Highlights vs. n 2Q22 results included EPS of $7.73 and ROE of 10.6% vs. vs. 2Q22 2Q21 $ in millions, except per share amounts 2Q22 1Q22 2Q21 YTD YTD — 2Q22 net revenues were significantly lower compared with a strong prior year period o Significantly lower net revenues in Asset Management and Investment Banking $ Investment Banking 2,137 (11)% (41)% $ 4,548 (38)% o Partially offset by significantly higher net revenues in Global Markets and Consumer Global Markets 6,467 (18)% 32% 14,339 15% & Wealth Management — 2Q22 provision for credit losses was $667 million, reflecting portfolio growth (primarily in Asset Management 1,084 99% (79)% 1,630 (83)% credit cards) and the impact of broad macroeconomic concerns — 2Q22 operating expenses were lower YoY, reflecting significantly lower compensation and Consumer & Wealth Management 2,176 3% 25% 4,280 23% benefits expenses, partially offset by higher non-compensation expenses Net revenues 11,864 (8)% (23)% 24,797 (25)% Provision for credit losses 667 19% N.M. 1,228 N.M. Net Revenues by Segment ($ in millions) Operating expenses 7,653 (1)% (11)% 15,369 (15)% $15,388 Pre-tax earnings $ 3,544 (24)% (48)% $ 8,200 (46)% $1,747 $12,933 $11,864 Net earnings $ 2,927 (26)% (47)% $ 6,866 (44)% $2,104 $5,132 $2,176 $546 Net earnings to common $ 2,786 (27)% (48)% $ 6,617 (45)% $1,084 $7,872 Diluted EPS $ 7.73 (28)% (49)% $ 18.47 (45)% $4,900 $6,467 1 ROE 10.6% (4.4)pp (13.1)pp 12.8% (14.5)pp $3,609 $2,411 $2,137 1 ROTE 11.4% (4.4)pp (13.7)pp 13.6% (15.3)pp 2Q21 1Q22 2Q22 3 Efficiency Ratio 64.5% 4.8pp 8.4pp 62.0% 7.4pp Investment Banking Global Markets Asset Management Consumer & Wealth Management 2

Investment Banking Financial Results Investment Banking Highlights vs. n 2Q22 net revenues were significantly lower compared with a strong prior year period vs. vs. 2Q22 2Q21 $ in millions 2Q22 1Q22 2Q21 YTD YTD — Financial advisory net revenues reflected a decrease in industry-wide completed mergers and acquisitions transactions Financial advisory $ 1,197 6% (5)% $ 2,324 (2)% — Equity underwriting and Debt underwriting net revenues reflected a significant decline in industry-wide volumes Equity underwriting 131 (50)% (89)% 392 (86)% — Corporate lending net revenues primarily reflected net gains from hedges related to relationship lending activities and higher net revenues in transaction banking, partially offset Debt underwriting 457 (38)% (52)% 1,200 (34)% by net mark-downs on acquisition financing activities 3 n Overall backlog decreased vs. 1Q22, reflecting a significant decrease in debt underwriting and Underwriting 588 (41)% (73)% 1,592 (66)% a decrease in equity underwriting, partially offset by an increase in financial advisory Corporate lending 352 26% 121% 632 74% Investment Banking Net Revenues ($ in millions) Net revenues 2,137 (11)% (41)% 4,548 (38)% $3,609 $159 Provision for credit losses 83 (49)% N.M. 247 N.M. $950 Operating expenses 1,105 (11)% (43)% 2,353 (38)% $2,411 $2,137 $280 Pre-tax earnings $ 949 (5)% (46)% $ 1,948 (49)% $352 $1,243 $743 $457 Net earnings $ 786 (7)% (44)% $ 1,631 (48)% $261 $131 Net earnings to common $ 766 (8)% (45)% $ 1,595 (48)% $1,257 $1,197 $1,127 Average common equity $ 10,454 (11)% 7% $ 11,028 9% 2Q21 1Q22 2Q22 Return on average common equity 29.3% 1.0pp (27.6)pp 28.9% (32.1)pp Financial advisory Equity underwriting Debt underwriting Corporate lending 3

Global Markets Financial Results Global Markets Highlights vs. n 2Q22 net revenues were significantly higher YoY vs. vs. 2Q22 2Q21 $ in millions 2Q22 1Q22 2Q21 YTD YTD — FICC net revenues reflected significantly higher net revenues in both intermediation and financing FICC $ 3,607 (24)% 55% $ 8,330 34% — Equities net revenues were higher, reflecting significantly higher net revenues in financing, partially offset by slightly lower net revenues in intermediation Equities 2,860 (9)% 11% 6,009 (4)% n 2Q22 operating environment was characterized by solid client activity and increased volatility amid an evolving macroeconomic backdrop Net revenues 6,467 (18)% 32% 14,339 15% Provision for credit losses 131 28% 836% 233 N.M. Operating expenses 3,366 (11)% – 7,127 (6)% $ Pre-tax earnings 2,970 (26)% 96% $ 6,979 42% Global Markets Net Revenues ($ in millions) $7,872 $ Net earnings 2,452 (28)% 104% $ 5,844 46% $6,467 Net earnings to common $ 2,367 (29)% 111% $ 5,694 48% $3,149 Average common equity $ 55,595 6% 25% $ 54,078 27% $4,900 $2,860 Return on average common equity 17.0% (8.4)pp 6.9pp 21.1% 3.1pp $2,580 $4,723 $3,607 $2,320 2Q21 1Q22 2Q22 FICC Equities 4

Global Markets – FICC & Equities FICC Net Revenues Equities Net Revenues vs. vs. vs. vs. 2Q22 2Q21 vs. vs. 2Q22 2Q21 $ in millions $ in millions 2Q22 1Q22 2Q21 YTD YTD 2Q22 1Q22 2Q21 YTD YTD $ $ FICC intermediation 2,839 (30)% 50% $ 6,877 29% Equities intermediation 1,734 (20)% (2)% $ 3,895 (10)% FICC financing Equities financing 768 12% 82% 1,453 68% 1,126 14% 38% 2,114 10% FICC $ 3,607 (24)% 55% $ 8,330 34% Equities $ 2,860 (9)% 11% $ 6,009 (4)% FICC Highlights Equities Highlights n 2Q22 net revenues were significantly higher YoY n 2Q22 net revenues were higher YoY — FICC intermediation net revenues reflected significantly higher net revenues in interest rate — Equities intermediation net revenues reflected significantly lower net revenues in cash products, commodities and currencies, partially offset by significantly lower net revenues in products, partially offset by higher net revenues in derivatives mortgages and credit products — Equities financing net revenues primarily reflected increased activity — FICC financing net revenues were a record, primarily driven by mortgage lending and repurchase agreements 5

Asset Management Financial Results Asset Management Highlights vs. n 2Q22 net revenues were significantly lower YoY as macroeconomic concerns and the vs. vs. 2Q22 2Q21 prolonged war in Ukraine continued to contribute to volatility in global equity prices and wider $ in millions 2Q22 1Q22 2Q21 YTD YTD credit spreads Management and other fees $ 5 1,008 31% 39% $ 1,780 25% — Management and other fees reflected the inclusion of NN Investment Partners (NNIP) and the impact of fee waivers on money market funds in the prior year period — Incentive fees were driven by harvesting Incentive fees 160 208% 105% 212 77% — Equity investments net losses reflected significant mark-to-market net losses from investments in public equities and significantly lower net gains from investments in private Equity investments (221) N.M. N.M. (588) N.M. equities, compared with a strong prior year period o Private: 2Q22 ~$440 million, compared to 2Q21 ~$2,815 million Lending and debt investments 137 54% (78)% 226 (83)% o Public: 2Q22 ~$(660) million, compared to 2Q21 ~$900 million — Lending and debt investments net revenues primarily reflected mark-downs on debt Net revenues 1,084 99% (79)% 1,630 (83)% securities and loans compared with net gains in the prior year period Asset Management Net Revenues ($ in millions) Provision for credit losses 59 44% N.M. 100 N.M. $5,132 $610 Operating expenses 1,461 33% (25)% 2,556 (33)% $1,084 $137 Pre-tax earnings/(loss) $ $160 (436) N.M. N.M. $ (1,026) N.M. $546 $89 $3,717 $52 $ Net earnings/(loss) (360) N.M. N.M. $ (859) N.M. $1,008 $772 $ $78 Net earnings/(loss) to common (382) N.M. N.M. $ (898) N.M. $727 $(221) Average common equity $ 24,310 1% (4)% $ 24,132 (4)% $(367) 2Q21 1Q22 2Q22 Return on average common equity (6.3)% 2.3pp (47.1)pp (7.4)% (45.3)pp 6

Asset Management – Asset Mix 4 4 Equity Investments of $16 billion Lending and Debt Investments of $26 billion ~$13 billion Private, ~$3 billion Public 4% 5% 16% By Vintage By Region 7% 27% 40% 62% 10% 2019-thereafter Americas By Industry Loan Portfolio $13 billion 29% 20% Loans 2016-2018 Asia 11% 31% 18% $13 billion 2015 or earlier EMEA 25% 84% 11% Debt investments Real Estate: Mixed Use 8%, Other 6%, Multifamily 6%, Office 5% 6 4 Consolidated Investment Entities of $13 billion 6 Funded with liabilities of ~$7 billion 3% 3% 3% 4% By Vintage By Region 7% By Accounting By Region 7% 23% Classification 31% 50% 67% 11% 47% 12% 11% 2019-thereafter Americas Loans at FV/Held for sale Americas By Industry 46% 10% By Asset Class 41% 20% 2016-2018 Asia Loans at amortized cost Asia 11% 14% 48% 33% 4% 23% 22% 2015 or earlier EMEA Debt investments at FV EMEA 20% 13% 16% 7

Asset Management – Harvesting Progress of Balance Sheet Equity Portfolio Significant progress in asset sales over the past 10 quarters, offset by mark-ups Rollforward ($ in billions) ~$7 ~$(20) ~$7 $22 $16 Net Dispositions: ~$(13) 7 YE19 Equity Investments Mark-Ups/(Mark-Downs) Additions Dispositions 2Q22 Equity Investments 2Q22: ~$(1) ~$ – ~$(1) 8

Consumer & Wealth Management Financial Results Consumer & Wealth Management Highlights vs. n 2Q22 net revenues were a record and significantly higher YoY vs. vs. 2Q22 2Q21 $ in millions 2Q22 1Q22 2Q21 YTD YTD — Wealth management net revenues were higher, reflecting higher placement fees, the impact of higher average AUS and higher loan and deposit balances Management and other fees $ 1,224 (2)% 10% $ 2,479 13% — Consumer banking net revenues were significantly higher, primarily reflecting significantly higher credit card balances and higher deposit balances Incentive fees 24 (11)% 60% 51 24% n 2Q22 provision for credit losses primarily reflected growth in credit cards Private banking and lending 320 (6)% 23% 659 26% Wealth management 1,568 (3)% 13% 3,189 16% Consumer banking 608 26% 67% 1,091 49% Consumer & Wealth Management Net Revenues ($ in millions) Net revenues 2,176 3% 25% 4,280 23% Provision for credit losses 394 55% 497% 648 414% $2,176 $2,104 Operating expenses 1,721 7% 26% 3,333 16% $1,747 $483 $608 $363 $339 $ $320 Pre-tax earnings 61 (74)% (80)% $ 299 (39)% $27 $260 $24 $15 Net earnings $ 49 (76)% (81)% $ 250 (37)% $1,255 $1,224 $1,109 Net earnings to common $ 35 (82)% (85)% $ 226 (40)% Average common equity $ 15,167 11% 45% $ 14,345 39% 2Q21 1Q22 2Q22 Return on average common equity 0.9% (4.7)pp (8.3)pp 3.2% (4.1)pp Management and other fees Incentive fees Private banking and lending Consumer banking 9

Asset Management and Consumer & Wealth Management Details 3,4 3,4 Firmwide Assets Under Supervision Highlights n Firmwide AUS increased $101 billion during the quarter, as Asset Management AUS increased $ in billions 2Q22 1Q22 2Q21 $168 billion and Consumer & Wealth Management AUS decreased $67 billion Asset Management $ 1,824 $ 1,656 $ 1,633 — Long-term net inflows of $293 billion and liquidity products net inflows of $7 billion, both 5 driven by the acquisition of NNIP Consumer & Wealth Management 671 738 672 — Net market depreciation of $199 billion, primarily in equity and fixed income assets Firmwide AUS $ $ $ 2,495 2,394 2,305 n Firmwide Management and other fees increased 22% YoY Firmwide Management and Other Fees/Incentive Fees 3,4 2Q22 AUS Mix vs. vs. vs. 2Q22 2Q21 10% $ in millions 2Q22 1Q22 2Q21 YTD YTD 27% 37% Asset Management $ 1,008 31% 39% $ 1,780 25% 41% 22% Asset Distribution Consumer & Wealth Management 1,224 (2)% 10% 2,479 13% Class Channel Total Management and other fees $ 2,232 10% 22% $ 4,259 18% 36% 27% Asset Management $ 160 208% 105% $ 212 77% Consumer & Wealth Management 24 (11)% 60% 51 24% 7% 12% Total Incentive fees $ 184 133% 98% $ 263 63% 22% Vehicle Region 55% 33% 71% 10

Net Interest Income and Loans 4 Loans Net Interest Income by Segment ($ in millions) Metrics $ in billions 2Q22 1Q22 2Q21 Corporate $ 62 $ 58 $ 48 $1,827 2.8% $1,734 $1,629 ALLL to Total Wealth management 48 45 40 Gross Loans, at Amortized Cost Commercial real estate 28 29 20 $845 $645 $974 Residential real estate 17 15 12 1.7% ALLL to Gross $118 $147 Installment 5 4 3 Wholesale Loans, at $118 Amortized Cost Credit cards 12 11 5 $742 $730 $487 12.8% Other 9 8 6 ALLL to Gross $155 $124 $105 Consumer Loans, at Allowance for loan losses (5) (4) (3) Amortized Cost 2Q21 1Q22 2Q22 Total Loans $ $ $ 176 166 131 Investment Banking Global Markets Asset Management Consumer & Wealth Management Lending Highlights Net Interest Income Highlights n Total loans increased $10 billion, up 6% QoQ, primarily reflecting growth in corporate, wealth n 2Q22 net interest income increased $105 million YoY management and residential real estate loans n The YoY increase in net interest income primarily reflected higher loan balances, partially n Total allowance was $5.27 billion (including $4.56 billion for funded loans), up ~$0.52 billion QoQ offset by higher funding costs — $3.16 billion for wholesale loans, $2.11 billion for consumer loans n Provision for credit losses of $667 million in 2Q22, compared with a net benefit of $92 million in 2Q21 n 2Q22 net charge-offs of $149 million for an annualized net charge-off rate of 0.4%, unchanged QoQ — Wholesale annualized net charge-off rate of 0.2%, down 10bps QoQ — Consumer annualized net charge-off rate of 2.3%, up 20bps QoQ 11

Expenses Expense Highlights Financial Results vs. n 2Q22 total operating expenses decreased YoY vs. vs. 2Q22 2Q21 — Compensation and benefits expenses were significantly lower 2Q22 1Q22 2Q21 YTD YTD $ in millions — Partially offset by higher non-compensation expenses, reflecting: Compensation and benefits $ 3,695 (10)% (30)% $ 7,778 (31)% o Higher expenses related to growth initiatives (including acquisitions) o Higher business activity 1,317 6% 17% 2,561 8% Transaction based o Lower net provisions for litigation and regulatory proceedings 235 45% 104% 397 104% Market development n 2Q22 YTD effective income tax rate was 16.3%, up from 15.4% in 1Q22, primarily due to a decrease in the impact of tax benefits on the settlement of employee share-based awards, partially offset by permanent tax benefits, in the first half of 2022 compared with the first quarter Communications and technology 444 5% 20% 868 16% of 2022 Depreciation and amortization 570 16% 10% 1,062 4% 3 Efficiency Ratio Occupancy 259 3% 7% 510 5% 62.0% 54.6% Professional fees 490 12% 42% 927 32% Other expenses 643 3% (3)% 1,266 2% Total operating expenses $ 7,653 (1)% (11)% $ 15,369 (15)% Provision for taxes $ 617 (14)% (54)% $ 1,334 (53)% Effective Tax Rate 16.3% (2.5)pp 12 2Q21 YTD 2Q22 YTD

Capital and Balance Sheet 3,4 Capital Capital and Balance Sheet Highlights n Both Standardized and Advanced CET1 capital ratios decreased QoQ $ in billions 2Q22 1Q22 2Q21 — Increase in market RWAs driven by increased exposures and market volatility Common Equity Tier 1 (CET1) capital $ 98.3 $ 98.3 $ 89.4 — CET1 capital was unchanged as net earnings was offset by the impact of the NNIP acquisition, share repurchases and dividends 8 Standardized RWAs $ 692 $ 682 $ 621 n Returned $1.22 billion of capital to common shareholders during the quarter 8 3 — Repurchased 1.5 million common shares for a total cost of $500 million Standardized CET1 capital ratio 14.2% 14.4% 14.4% — Paid $719 million of common stock dividends Advanced RWAs $ 686 $ 674 $ 667 n Increased the quarterly dividend from $2.00 to $2.50 per common share in 3Q22 n BVPS increased 2.9% QoQ, driven by net earnings Advanced CET1 capital ratio 14.3% 14.6% 13.4% Supplementary leverage ratio (SLR) 5.6% 5.6% 5.5% 4 Selected Balance Sheet Data Book Value $ in billions 2Q22 1Q22 2Q21 In millions, except per share amounts 2Q22 1Q22 2Q21 $ 1,601 $ 1,589 $ 1,388 Total assets 3 Basic shares 355.0 356.4 349.9 $ 391 $ 387 $ 306 Deposits Book value per common share $ 301.88 $ 293.31 $ 264.90 Unsecured long-term borrowings $ 251 $ 258 $ 239 1 Tangible book value per common share $ 278.75 $ 275.13 $ 251.02 Shareholders’ equity $ 118 $ 115 $ 102 3 Average GCLA $ 391 $ 375 $ 329 13

Cautionary Note Regarding Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are not historical facts or statements of current conditions, but instead represent only the firm’s beliefs regarding future events, many of which, by their nature, are inherently uncertain and outside of the firm’s control. It is possible that the firm’s actual results, financial condition and liquidity may differ, possibly materially, from the anticipated results, financial condition and liquidity in these forward-looking statements. For information about some of the risks and important factors that could affect the firm’s future results, financial condition and liquidity and the forward-looking statements below, see “Risk Factors” in Part I, Item 1A of the firm’s Annual Report on Form 10-K for the year ended December 31, 2021. Information regarding the firm’s assets under supervision, capital ratios, risk-weighted assets, supplementary leverage ratio, balance sheet data and global core liquid assets (GCLA) consists of preliminary estimates. These estimates are forward-looking statements and are subject to change, possibly materially, as the firm completes its financial statements. Statements regarding (i) estimated GDP growth and interest rate and inflation trends, (ii) the impact of the COVID-19 pandemic on the firm’s business, results, financial position and liquidity, (iii) the timing, profitability, benefits and other prospective aspects of business initiatives and the achievability of medium- and long-term targets and goals, (iv) the future state of the firm’s liquidity and regulatory capital ratios (including the firm’s stress capital buffer and G-SIB buffer), (v) the firm’s prospective capital distributions (including dividends and repurchases), (vi) the firm’s future effective income tax rate, (vii) the firm’s investment banking transaction backlog and future results, (viii) the firm’s planned 2022 debt benchmark issuances, and (ix) the impact of Russia’s invasion of Ukraine and related sanctions and other developments on the firm’s business, results and financial position, are forward-looking statements. Statements regarding estimated GDP growth and interest rate and inflation trends are subject to the risk that actual GDP growth and interest rate and inflation trends may differ, possibly materially, due to, among other things, changes in general economic conditions and monetary and fiscal policy. Statements about the effects of the COVID-19 pandemic on the firm’s business, results, financial position and liquidity are subject to the risk that the actual impact may differ, possibly materially, from what is currently expected. Statements about the timing, profitability, benefits and other prospective aspects of business initiatives and the achievability of medium and long-term targets and goals are based on the firm’s current expectations regarding the firm’s ability to implement these initiatives and achieve these targets and goals and may change, possibly materially, from what is currently expected. Statements about the future state of the firm’s liquidity and regulatory capital ratios (including the firm’s stress capital buffer and G-SIB buffer), as well as its prospective capital distributions, are subject to the risk that the firm’s actual liquidity, regulatory capital ratios and capital distributions may differ, possibly materially, from what is currently expected. Statements about the firm’s future effective income tax rate are subject to the risk that the firm’s future effective income tax rate may differ from the anticipated rate indicated, possibly materially, due to, among other things, changes in the tax rates applicable to the firm, the firm’s earnings mix or profitability, the entities in which the firm generates profits and the assumptions made in forecasting the firm’s expected tax rate, and potential future guidance from the U.S. IRS. Statements about the firm’s investment banking transaction backlog and future results are subject to the risk that transactions may be modified or may not be completed at all and related net revenues may not be realized or may be materially less than expected. Important factors that could have such a result include, for underwriting transactions, a decline or weakness in general economic conditions, an outbreak or worsening of hostilities, including the escalation or continuation of the war between Russia and Ukraine, continuing volatility in the securities markets or an adverse development with respect to the issuer of the securities and, for financial advisory transactions, a decline in the securities markets, an inability to obtain adequate financing, an adverse development with respect to a party to the transaction or a failure to obtain a required regulatory approval. Statements regarding the firm’s planned 2022 debt benchmark issuances are subject to the risk that actual issuances may differ, possibly materially, due to changes in market conditions, business opportunities or the firm’s funding needs. Statements about the impact of Russia’s invasion of Ukraine and related sanctions and other developments on the firm’s business, results and financial position are subject to the risks that hostilities may escalate and expand, that sanctions may increase and that the actual impact may differ, possibly materially, from what is currently expected. 14

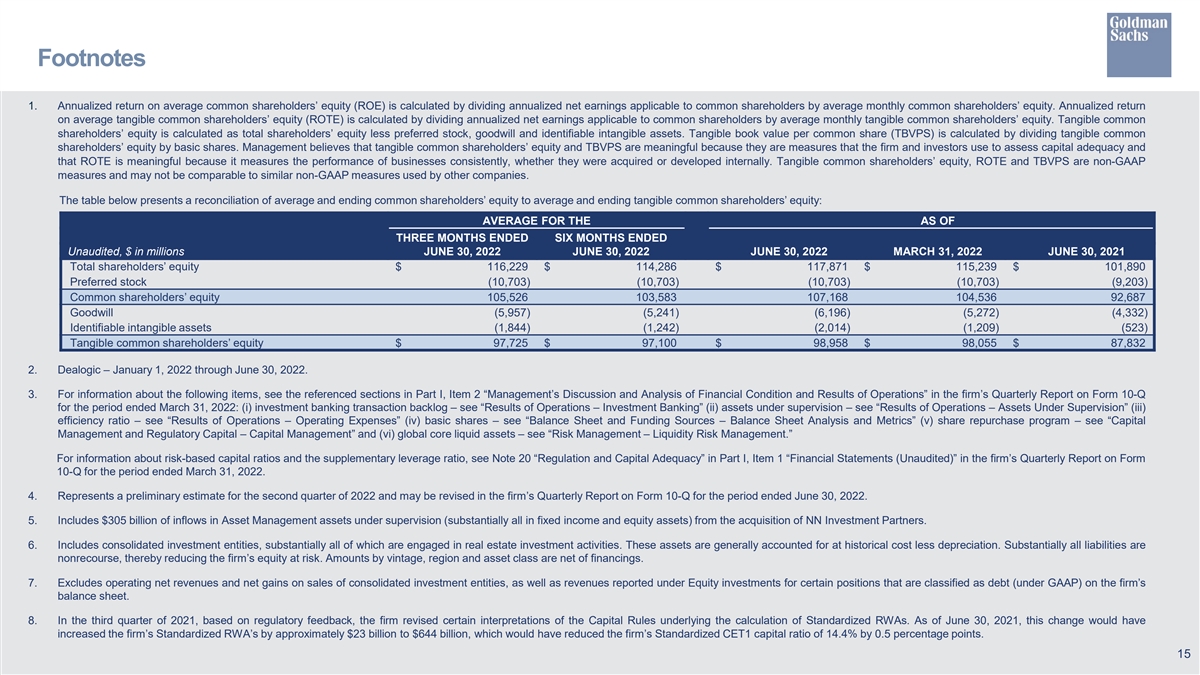

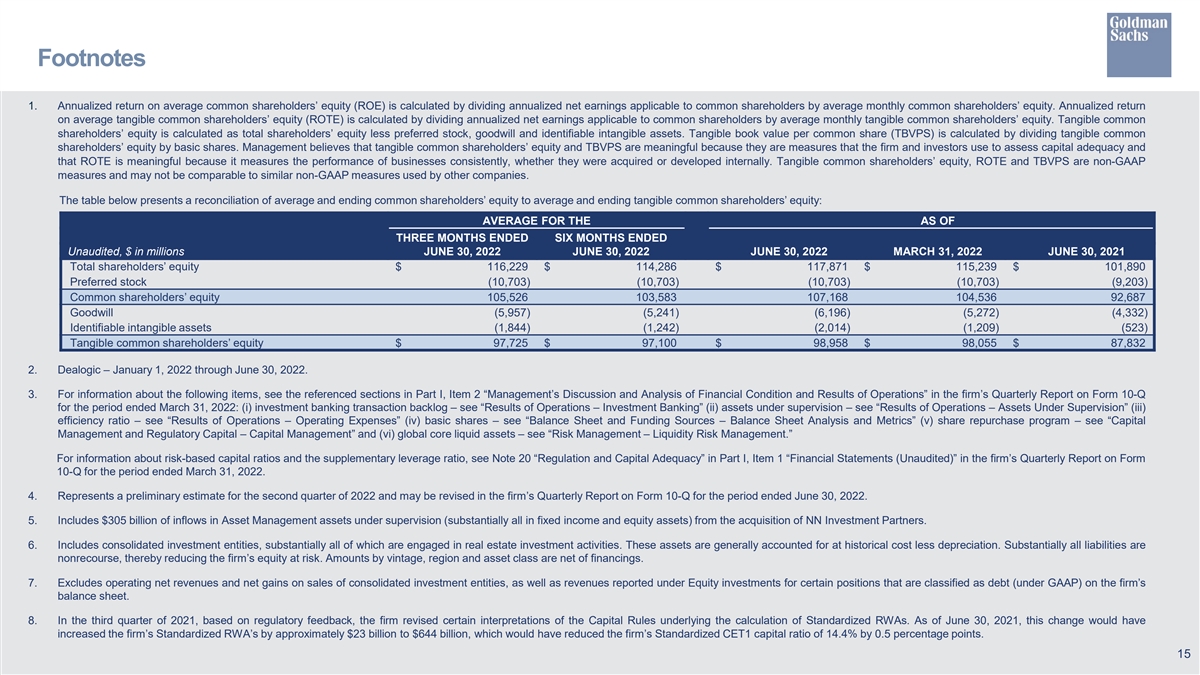

Footnotes 1. Annualized return on average common shareholders’ equity (ROE) is calculated by dividing annualized net earnings applicable to common shareholders by average monthly common shareholders’ equity. Annualized return on average tangible common shareholders’ equity (ROTE) is calculated by dividing annualized net earnings applicable to common shareholders by average monthly tangible common shareholders’ equity. Tangible common shareholders’ equity is calculated as total shareholders’ equity less preferred stock, goodwill and identifiable intangible assets. Tangible book value per common share (TBVPS) is calculated by dividing tangible common shareholders’ equity by basic shares. Management believes that tangible common shareholders’ equity and TBVPS are meaningful because they are measures that the firm and investors use to assess capital adequacy and that ROTE is meaningful because it measures the performance of businesses consistently, whether they were acquired or developed internally. Tangible common shareholders’ equity, ROTE and TBVPS are non-GAAP measures and may not be comparable to similar non-GAAP measures used by other companies. The table below presents a reconciliation of average and ending common shareholders’ equity to average and ending tangible common shareholders’ equity: AVERAGE FOR THE AS OF THREE MONTHS ENDED SIX MONTHS ENDED Unaudited, $ in millions JUNE 30, 2022 JUNE 30, 2022 JUNE 30, 2022 MARCH 31, 2022 JUNE 30, 2021 Total shareholders’ equity $ 116,229 $ 114,286 $ 117,871 $ 115,239 $ 101,890 Preferred stock (10,703) (10,703) (10,703) (10,703) (9,203) Common shareholders’ equity 105,526 103,583 107,168 104,536 92,687 Goodwill (5,957) (5,241) (6,196) (5,272) (4,332) Identifiable intangible assets (1,844) (1,242) (2,014) (1,209) (523) Tangible common shareholders’ equity $ 97,725 $ 97,100 $ 98,958 $ 98,055 $ 87,832 2. Dealogic – January 1, 2022 through June 30, 2022. 3. For information about the following items, see the referenced sections in Part I, Item 2 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the firm’s Quarterly Report on Form 10-Q for the period ended March 31, 2022: (i) investment banking transaction backlog – see “Results of Operations – Investment Banking” (ii) assets under supervision – see “Results of Operations – Assets Under Supervision” (iii) efficiency ratio – see “Results of Operations – Operating Expenses” (iv) basic shares – see “Balance Sheet and Funding Sources – Balance Sheet Analysis and Metrics” (v) share repurchase program – see “Capital Management and Regulatory Capital – Capital Management” and (vi) global core liquid assets – see “Risk Management – Liquidity Risk Management.” For information about risk-based capital ratios and the supplementary leverage ratio, see Note 20 “Regulation and Capital Adequacy” in Part I, Item 1 “Financial Statements (Unaudited)” in the firm’s Quarterly Report on Form 10-Q for the period ended March 31, 2022. 4. Represents a preliminary estimate for the second quarter of 2022 and may be revised in the firm’s Quarterly Report on Form 10-Q for the period ended June 30, 2022. 5. Includes $305 billion of inflows in Asset Management assets under supervision (substantially all in fixed income and equity assets) from the acquisition of NN Investment Partners. 6. Includes consolidated investment entities, substantially all of which are engaged in real estate investment activities. These assets are generally accounted for at historical cost less depreciation. Substantially all liabilities are nonrecourse, thereby reducing the firm’s equity at risk. Amounts by vintage, region and asset class are net of financings. 7. Excludes operating net revenues and net gains on sales of consolidated investment entities, as well as revenues reported under Equity investments for certain positions that are classified as debt (under GAAP) on the firm’s balance sheet. 8. In the third quarter of 2021, based on regulatory feedback, the firm revised certain interpretations of the Capital Rules underlying the calculation of Standardized RWAs. As of June 30, 2021, this change would have increased the firm’s Standardized RWA’s by approximately $23 billion to $644 billion, which would have reduced the firm’s Standardized CET1 capital ratio of 14.4% by 0.5 percentage points. 15