Exhibit 99.3

Management’s Discussion and Analysis

February 21, 2023

1

Teck 2022 Management’s Discussion and Analysis

Management’s Discussion and Analysis

Our business is exploring for, acquiring, developing and producing natural resources. We are organized into business units focused on copper, zinc and steelmaking coal, with increasing focus on the development of an industry-leading portfolio of copper and zinc development projects. These are supported by our corporate offices, which manage our corporate growth initiatives and provide marketing, administrative, technical, health, safety, environment, community, financial and other services.

Through our interests in mining and processing operations in Canada, the United States (U.S.), Chile and Peru, we are an important producer of copper, one of the world’s largest producers of mined zinc and the world’s second-largest seaborne exporter of steelmaking coal. We also produce lead, silver, molybdenum and various specialty and other metals, chemicals and fertilizers. We actively explore for copper, zinc, nickel and gold.

This Management’s Discussion and Analysis of our results of operations is prepared as at February 21, 2023 and should be read in conjunction with our audited annual consolidated financial statements for the year ended December 31, 2022. Unless the context otherwise dictates, a reference to Teck, Teck Resources, the Company, us, we or our refers to Teck Resources Limited and its subsidiaries, including Teck Metals Ltd. and Teck Coal Partnership. All dollar amounts are in Canadian dollars, unless otherwise stated, and are based on our 2022 audited annual consolidated financial statements that are prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB). In addition, we use certain financial measures, which are identified throughout the Management’s Discussion and Analysis in this report, that are not measures recognized under IFRS and do not have a standardized meaning prescribed by IFRS. See “Use of Non-GAAP Financial Measures and Ratios” on page 64 for an explanation of these financial measures and reconciliation to the most directly comparable financial measures under IFRS.

This Management’s Discussion and Analysis contains certain forward-looking information and forward-looking statements. You should review the cautionary statement on forward-looking statements under the heading “Cautionary Statement on Forward-Looking Statements” on page 75, which forms part of this Management’s Discussion and Analysis, as well as the risk factors discussed in our most recent Annual Information Form.

Additional information about us, including our most recent Annual Information Form, is available on our website at www.teck.com, under Teck’s profile at www.sedar.com (SEDAR), and on the EDGAR section of the United States Securities and Exchange Commission (SEC) website at www.sec.gov.

2

Teck 2022 Management’s Discussion and Analysis

Business Unit Results

The following table shows a summary of our production of our major commodities for the last five years and estimated production for 2023.

Five-Year Production Record and Our Estimated Production in 2023

| | | | | | | | | | | | | | | | | | | | | | | |

| Principal Products | | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 estimate2 |

| | | | | |

|

|

Copper1 | thousand tonnes | 294 | | 297 | | 276 | | 287 | | 270 | | 418 |

| | | | | |

|

|

| Zinc | | | | | |

|

|

Contained in concentrate1 | thousand tonnes | 705 | | 640 | | 587 | | 607 | | 650 | | 665 |

| Refined | thousand tonnes | 303 | | 287 | | 305 | | 279 | | 249 | | 280 |

| | | | | |

|

|

| Steelmaking coal | million tonnes | 26.2 | | 25.7 | | 21.1 | | 24.6 | | 21.5 | | 25.0 |

| | | | | |

| |

Notes:

1.We include 100% of production and sales from our Quebrada Blanca and Carmen de Andacollo mines in our production and sales volumes, even though we do not own 100% of these operations, because we fully consolidate their results in our financial statements. We include 22.5% of production and sales from Antamina, representing our proportionate ownership interest in this operation. Zinc contained in concentrate production includes co-product zinc production from our 22.5% interest in Antamina.

2.Production estimates for 2023 represent the midpoint of our production guidance range. The 2023 copper production guidance includes Quebrada Blanca concentrate production.

3

Teck 2022 Management’s Discussion and Analysis

Average commodity prices and exchange rates for the past three years, which are key drivers of our profit, are summarized in the following table.

| | | | | | | | | | | | | | | | | |

| US$ |

| 2022 | % chg | 2021 | % chg | 2020 |

| Copper (LME cash — $/pound) | $ | 3.99 | | -6% | $ | 4.23 | | +51% | $ | 2.80 | |

| Zinc (LME cash — $/pound) | 1.58 | +16% | 1.36 | | +32% | 1.03 | |

| Steelmaking coal (realized — $/tonne) | 355 | +70% | 209 | +85% | 113 |

| Exchange rate (Bank of Canada) | | | | | |

| US$1 = CAD$ | 1.30 | +4% | 1.25 | | -7% | 1.34 | |

| CAD$1 = US$ | 0.77 | -4% | 0.80 | | +7% | 0.75 | |

Our revenue, gross profit and gross profit before depreciation and amortization, by business unit, for the past three years are summarized in the following table.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenue | Gross Profit (Loss) | Gross Profit (Loss) Before Depreciation and Amortization1 |

| ($ in millions) | 2022 | 2021 | 2020 | 2022 | 2021 | 2020 | 2022 | 2021 | 2020 |

| Copper | $ | 3,381 | | $ | 3,452 | | $ | 2,419 | | $ | 1,399 | | $ | 1,741 | | $ | 859 | | $ | 1,837 | | $ | 2,126 | | $ | 1,242 | |

| Zinc | 3,526 | | 3,063 | | 2,700 | | 771 | | 688 | | 523 | | 1,044 | | 918 | | 815 | |

| Steelmaking coal | 10,409 | | 6,251 | | 3,375 | | 6,401 | | 2,785 | | 277 | | 7,364 | | 3,657 | | 1,009 | |

Energy2 | — | | — | | 454 | | — | | — | | (326) | | — | | — | | (223) | |

| Total | $ | 17,316 | | $ | 12,766 | | $ | 8,948 | | $ | 8,571 | | $ | 5,214 | | $ | 1,333 | | $ | 10,245 | | $ | 6,701 | | $ | 2,843 | |

Note:

1.This is a non-GAAP financial measure or ratio. See “Use of Non-GAAP Financial Measures and Ratios” section for further information.

2.Comparative figures for 2021 for the Energy Business Unit have been represented for the classification of Fort Hills as a discontinued operation. 2020 figures have not been represented.

4

Teck 2022 Management’s Discussion and Analysis

Copper

In 2022, we produced 270,500 tonnes of copper from our Highland Valley Copper Operations in B.C., our 22.5% interest in Antamina in Peru, and our Carmen de Andacollo and Quebrada Blanca operations in Chile.

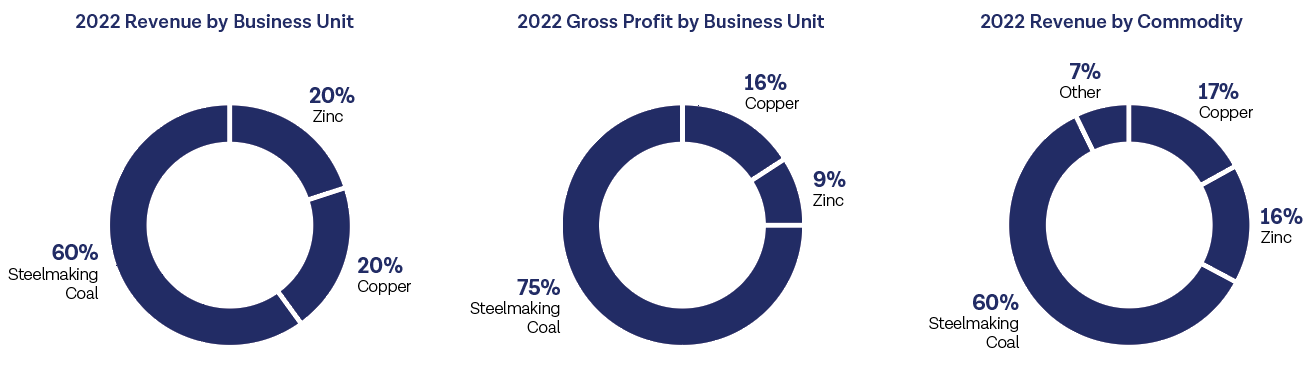

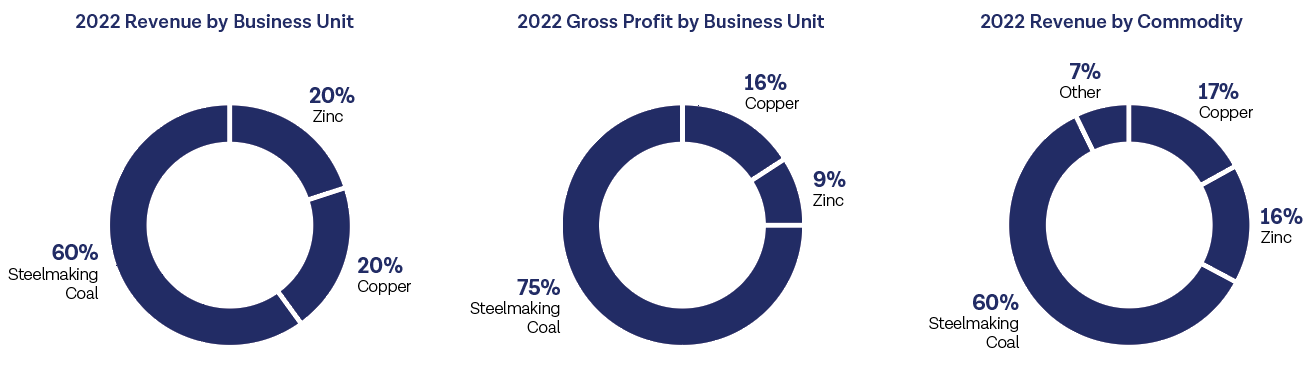

In 2022, our copper business unit accounted for 20% of our revenue and 16% of our gross profit.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenue | Gross Profit (Loss) | Gross Profit (Loss) Before Depreciation and Amortization1 |

| ($ in millions) | 2022 | 2021 | 2020 | 2022 | 2021 | 2020 | 2022 | 2021 | 2020 |

| Highland Valley Copper | $ | 1,454 | | $ | 1,440 | | $ | 993 | | $ | 580 | | $ | 721 | | $ | 331 | | $ | 738 | | $ | 883 | | $ | 476 | |

| Antamina | 1,423 | | 1,383 | | 868 | 818 | | 828 | 414 | | 1,021 | | 992 | 566 |

| Carmen de Andacollo | 399 | | 493 | 442 | 2 | | 153 | 95 | | 73 | | 209 | 170 |

| Quebrada Blanca | 105 | | 136 | 116 | 2 | | 39 | 19 | 8 | | 42 | | 30 |

| Other | — | | — | | — | | (3) | | — | | — | | (3) | | — | | — | |

| Total | $ | 3,381 | | $ | 3,452 | | $ | 2,419 | | $ | 1,399 | | $ | 1,741 | | $ | 859 | | $ | 1,837 | | $ | 2,126 | | $ | 1,242 | |

Note:

1.This is a non-GAAP financial measure or ratio. See “Use of Non-GAAP Financial Measures and Ratios” section for further information.

| | | | | | | | | | | | | | | | | | | | |

| Production1 | Sales1 |

| (thousand tonnes) | 2022 | 2021 | 2020 | 2022 | 2021 | 2020 |

| Highland Valley Copper | 119 | 131 | 119 | 127 | 124 | 119 |

| Antamina | 102 | 100 | 86 | 101 | 99 | 85 |

| Carmen de Andacollo | 39 | 45 | 58 | 39 | 45 | 59 |

| Quebrada Blanca | 10 | 11 | 13 | 9 | 12 | 14 |

| Total | 270 | 287 | 276 | 276 | 280 | 277 |

Note:

1.We include 100% of production and sales from our Quebrada Blanca and Carmen de Andacollo mines in our production and sales volumes, even though we do not own 100% of these operations, because we fully consolidate their results in our financial statements. We include 22.5% of production and sales from Antamina, representing our proportionate ownership interest in the operation.

Operations

Highland Valley Copper

Highland Valley Copper Operations is located in south-central B.C. Gross profit was $580 million in 2022, compared with $721 million in 2021 and $331 million in 2020. The decrease from 2021 was primarily the result of lower copper prices and production, and higher operating costs driven by inflationary pressures.

Highland Valley Copper’s 2022 copper production was 119,100 tonnes, compared to 130,800 tonnes in 2021. The decrease in 2022 production was primarily a result of lower copper grades, coupled with a decrease in mill throughput driven by processing harder ore, as expected in the mine plan. This was partially offset by an increase in mill recoveries. Production during the fourth quarter of 2022 was impacted by a temporary pit closure as a result of a localized geotechnical instability event that has since been stabilized. Molybdenum

5

Teck 2022 Management’s Discussion and Analysis

production was 10% lower in 2022 at 1.0 million pounds compared to 2021, primarily due to lower grades, as expected in the mine plan.

Copper production in 2023 is anticipated to be between 110,000 and 118,000 tonnes, with a relatively even distribution throughout the year. Copper production from 2024 to 2026 is expected to be between 120,000 and 165,000 tonnes per year. Molybdenum production in 2023 is expected to be between 0.8 million and 1.2 million pounds, with production expected to be between 2.0 million and 6.0 million pounds per year from 2024 to 2026.

Antamina

We have a 22.5% share interest in Antamina, a copper-zinc mine in Peru. The other shareholders are BHP (33.75%), Glencore (33.75%) and Mitsubishi Corporation (10%). Our share of gross profit in 2022 was $818 million, compared with $828 million in 2021 and $414 million in 2020. Gross profit in 2022 was similar to 2021, as higher zinc prices partly offset reduced zinc production, lower copper prices and higher operating costs due to significant inflationary increases on consumables such as diesel and explosives in 2022.

On a 100% basis, Antamina’s copper production in 2022 was 454,800 tonnes, compared to 445,300 tonnes in 2021. Zinc production was 433,000 tonnes in 2022, a decrease from 462,200 tonnes of production in 2021. Copper production rose and zinc production declined in 2022 primarily due to treating more copper-only ore, per the mine plan. In 2022, 100% molybdenum production was 6.9 million pounds, which was 40% higher than in 2021.

In 2022, Antamina submitted a MEIA (Modification of Environmental Impact Assessment) to Peruvian regulators to extend its mine life from 2028 to 2036. The regulatory review process is progressing as scheduled, with approval anticipated in the second half of 2023.

Pursuant to a long-term streaming agreement made in 2015, Teck delivers an equivalent to 22.5% of payable silver sold by Compañía Minera Antamina S.A. to a subsidiary of Franco-Nevada Corporation (FNC). FNC pays a cash price of 5% of the spot price at the time of each delivery, in addition to an upfront acquisition price previously paid. In 2022, approximately 3.1 million ounces of silver were delivered under the agreement. After 86 million ounces of silver have been delivered under the agreement, the stream will be reduced by one-third. A total of 24.9 million ounces of silver have been delivered under the agreement from the effective date in 2015 to December 31, 2022.

Our 22.5% share of 2023 production at Antamina is expected to be in the range of 90,000 to 97,000 tonnes of copper, 95,000 to 105,000 tonnes of zinc and 2.2 to 2.6 million pounds of molybdenum. Our share of annual copper production is expected to be between 90,000 and 100,000 tonnes from 2024 to 2026. Our share of zinc production is expected to average between 55,000 and 95,000 tonnes per year during 2024 to 2026, with annual production fluctuating due to feed grades and the amount of copper-zinc ore available to process. Our share of annual molybdenum production is expected to be between 2.0 and 4.0 million pounds between 2024 and 2026.

6

Teck 2022 Management’s Discussion and Analysis

Carmen de Andacollo

We have a 90% interest in the Carmen de Andacollo mine, which is located in the Coquimbo Region of central Chile. The remaining 10% is owned by Empresa Nacional de Minería (ENAMI), a state-owned Chilean mining company. Gross profit decreased to $2 million in 2022 from $153 million in 2021 and $95 million in 2020. Gross profit decreased in 2022 primarily due to lower copper prices, along with higher unit operating costs driven by high inflation in 2022 on consumables, and lower production and sales volumes as a result of processing lower copper grade material.

Carmen de Andacollo produced 38,600 tonnes of copper contained in concentrate in 2022, compared to 43,500 tonnes in 2021, driven by lower copper grades due to weather events that decreased access to fresh ore feed, resulting in the processing of stockpiled ore with a lower copper grade. Copper cathode production was 900 tonnes in 2022 compared with 1,300 tonnes in 2021. Gold production of 25,900 ounces in 2022 was lower than the 35,800 ounces produced in 2021, with 100% of the gold produced for the account of RGLD Gold AG, a wholly owned subsidiary of Royal Gold, Inc. In effect, 100% of gold production from the mine has been sold to Royal Gold, Inc., who pays a cash price of 15% of the monthly average gold price at the time of each delivery, in addition to an upfront acquisition price previously paid.

Carmen de Andacollo’s production in 2023 is expected to be in the range of 40,000 to 50,000 tonnes of copper. Annual copper in concentrate production is expected to be between 50,000 and 60,000 tonnes for 2024 to 2026.

Quebrada Blanca

Quebrada Blanca is located in the Tarapacá Region of northern Chile. We have a 60% indirect interest in Compañía Minera Quebrada Blanca S.A. (QBSA). A 30% interest is owned indirectly by Sumitomo Metal Mining Co., Ltd. and Sumitomo Corporation (together referred to as SMM/SC), and 10% is owned by ENAMI. ENAMI’s 10% preference share interest in QBSA does not require ENAMI to fund capital spending.

Quebrada Blanca Operations

Quebrada Blanca’s gross profit in 2022 was $2 million compared with $39 million in 2021 and $19 million in 2020. The decreased gross profit in 2022 compared with 2021 is primarily a result of lower copper prices, higher unit operating costs driven by inflationary pressures on consumables, and lower production and sales volumes, as expected.

Quebrada Blanca produced 9,600 tonnes of copper cathode in 2022, compared to 11,500 tonnes in 2021, with the decrease due to the continued decline of cathode production, as the operation ceased mining in 2018. Copper cathode production is now expected to continue through 2023 using existing leach piles, and we expect 2023 to be the final year of cathode production.

7

Teck 2022 Management’s Discussion and Analysis

Quebrada Blanca Phase 2

The Quebrada Blanca hypogene deposit is one of the world’s largest unexploited copper resources. The operation is expected to have low operating costs, an initial mine life of 27 years and significant potential for further growth. Teck approved the QB2 project for full construction in December 2018 and the project continued to advance construction, pre-operational testing and commissioning through 2022, with first production expected in the first quarter of 2023. The final construction completion and commissioning will support ramp-up to full capacity, which is expected before the end of 2023.

Construction of associated port facilities is ongoing, with the ship loader expected to be in service in the fourth quarter of 2023. Any timing gap between available concentrate and shiploading will be managed through a combination of deliveries to alternate ports and domestic sales.

Construction capital cost guidance remains unchanged from our prior disclosure of US$7.4 to US$7.75 billion. Project development expenditures in 2022 were approximately $3.1 billion. We expect to spend approximately US$900 million to US$1.3 billion of QB2 development capital in 2023. A portion of this capital is related to items outside of the critical path for first copper, including the ship loader and the molybdenum plant.

As noted above, the QB2 project is expected to ramp up to full production capacity before the end of 2023. We expect copper in concentrate production to be between 285,000 and 315,000 tonnes per year for 2024 to 2026, with molybdenum production between 10.0 and 14.0 million pounds per year.

Copper Growth Projects

We continue to actively advance our industry-leading Copper Growth portfolio. The approach is driven by balancing growth and return of capital, value-focused asset de-risking, optimization of funding sources, and prioritization and sequencing of capital investments. As part of our Copper Growth strategy, Teck, together with our partners, continues to advance eight significant copper-dominant base metals assets. We are meeting project, permitting and commercial milestones in order to position Teck with various high-quality development options to maximize value from copper demand well beyond the ramp-up of QB2 and the continued operation of our core copper-producing operations. The Copper Growth portfolio comprises eight assets, namely Highland Valley Copper 2040, Zafranal, San Nicolás, NewRange Copper Nickel (formerly Mesaba and NorthMet), the Quebrada Blanca Mill Expansion (QBME), Galore Creek, Schaft Creek and NuevaUnión. All assets are located in the Americas in jurisdictions that we are familiar with and where we have experience conducting detailed studies, advancing permitting activities, developing strong community and stakeholder relationships, and operating mines in a productive, sustainable and safe manner.

We continue to advance the Highland Valley Copper 2040 (HVC 2040) project to extend the life of the operation to at least 2040, through an extension of the existing site infrastructure to access and liberate substantial copper-molybdenum mineral resources. HVC 2040 is undergoing a feasibility study, which is

8

Teck 2022 Management’s Discussion and Analysis

targeted for completion in the second half of 2023, and a concurrent environmental assessment application is in progress under the B.C. Environmental Assessment Act, with submission planned in the second half of 2023.

Work in 2023 on the Zafranal copper-gold project located in the Arequipa Region of Peru will be focused on completing a regulator-led review of the project’s Social and Environmental Impact Assessment (SEIA) permit application, as well as on meeting the project’s community commitments and key stakeholder engagement activities in the areas of health, capacity building, cultural heritage resource management and water. We expect to potentially receive the SEIA permit for Zafranal in the first half of 2023 and will then focus our attention on updating feasibility study capital and operating cost estimates, as well as initiating detailed engineering study work in support of a potential project sanction decision in 2024, targeting potential first production in 2027.

The San Nicolás copper-zinc project located in Zacatecas State, Mexico, initiated a feasibility study in the first quarter of 2022, with completion targeted in early 2024. In addition, work in 2023 will include the submission of an Environmental Impact Assessment (MIA-R), continuing social and environmental baseline studies, and completing additional socio-economic studies in support of advancing through permitting and the next investment decision milestone. The proposed partnering transaction with Agnico Eagle in San Nicolás, announced in the third quarter of 2022, is expected to close in the second quarter of 2023, after which the partners will work together to complete ongoing study and permitting work, targeting potential first production for 2027.

In the third quarter of 2022, we announced an agreement with PolyMet Mining Corp. to form a 50:50 joint venture to advance the NorthMet project and our Mesaba mineral deposit. This transaction closed on February 15, 2023. The 50:50 joint venture is held and operated through a new entity called NewRange Copper Nickel LLC. Planned work activities in 2023 will be to update the NorthMet feasibility study, including capital and operating cost estimates, advance salvage and demolition work on this expansive brownfield site, and secure the development permits for NorthMet, which are currently being contested in the courts. Baseline social and environmental studies, along with select technical studies on Mesaba, will continue in 2023. To support the initiation of a prefeasibility study at Mesaba in 2024, we will focus on capturing necessary information, which will include input from communities of interest, local and regional Indigenous Peoples, and interest groups.

The QBME project progressed in 2022, with a focus on trade-off studies and the commencement of a feasibility study. Engineering studies commenced in the fourth quarter of 2021 to evaluate the addition of a third grinding line for a 50% capacity increase to the Quebrada Blanca concentrator currently under construction. This configuration is expected to make use of excess capacity in the supporting infrastructure, reducing capital costs and minimizing the project footprint. A permit application was submitted to the Chilean regulator in early 2023. QBME will be a significant contributor to our near-term Copper Growth portfolio, with potential first production as early as 2026. Resource and geotechnical drilling will continue in 2023 to support the evaluation of further opportunities to develop the vast Quebrada Blanca resource.

9

Teck 2022 Management’s Discussion and Analysis

At the Galore Creek copper-gold-silver project located in Tahltan Territory within the Golden Triangle of northwest B.C., we and our partner, Newmont Corporation, are targeting completion of a prefeasibility study in the second half of 2023, after which the partners plan to submit an Initial Project Description for Galore Creek, which is the first step in re-permitting this world-class copper-gold resource. Work in 2023 will finalize the prefeasibility field, continue baseline social and environmental field programs, and initiate permitting activities.

At Schaft Creek, located in northwest B.C., we are investing additional resources to progress environmental and social baseline field studies and focused design and engineering data collection fieldwork. This includes resource modelling, geometallurgical and geotechnical studies, mining and mineral processing studies, siting studies, and capital and operating cost estimations, in support of advancing Schaft Creek into prefeasibility studies.

Teck and Newmont each have a 50% interest in Compañía Minera NuevaUnión S.A., which owns the Relincho and La Fortuna deposits. Work in 2023 will be focused on establishing a cost-effective path forward for the development of this world-class copper-molybdenum and copper-gold resource in a manner acceptable to communities of interest, key stakeholders and the regulator.

Markets

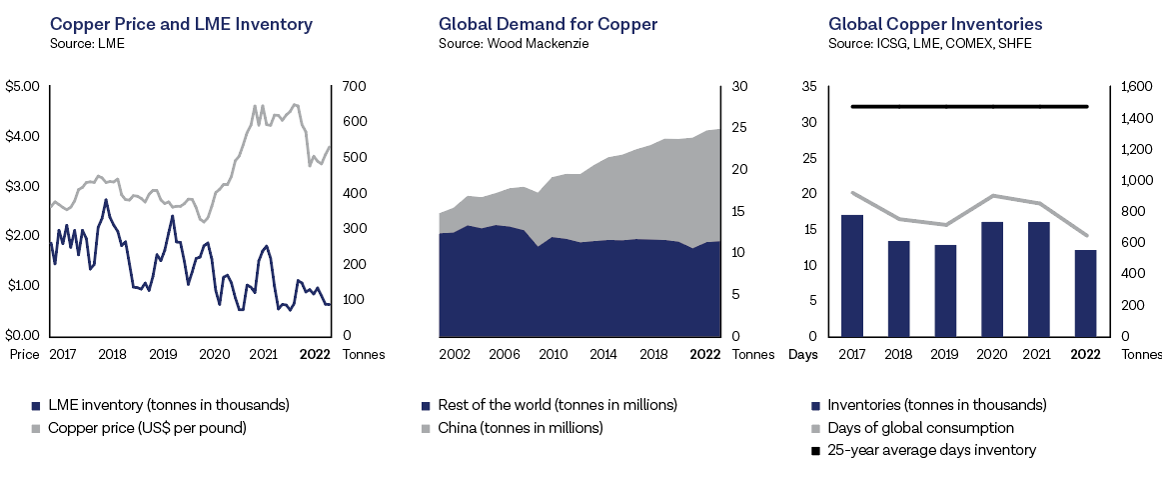

Copper prices on the London Metal Exchange (LME) averaged US$3.99 per pound in, 2022, down from an average of US$4.23 per pound in 2021.

Copper stocks on the LME were flat in the year falling only 25 tonnes to 88,925 tonnes in 2022. Copper stocks on the Shanghai Futures Exchange (SHFE) rose by 81.4% from an extremely low level to 54,569 tonnes, while COMEX warehouse stocks fell 40.1% to 30,855 tonnes. Commercial stocks in bonded warehouses in China fell the most in 2022, falling 73.5% to 49,600 tonnes. Combined stocks increased 5.8% or 10,392 tonnes during 2022 and ended the year at 238,468 tonnes. Exchange stocks ended the year at 13-year lows for the second straight year, ending at levels not seen since 2008. Total reported global stocks, including producer, consumer, merchant and terminal stocks, stood at an estimated 3.5 days of global consumption, versus the 25-year average of 15 days.

In 2022, global copper mine production increased 2.6%, according to Wood Mackenzie, a commodity research consultancy, with total production estimated at 22.0 million tonnes. Global mine production has increased at an average of 1.4% annually since 2016. Wood Mackenzie is forecasting a 4.6% increase in global mine production in 2023 to 23.0 million tonnes. This is 1.0 million tonnes lower than their forecast of 24.0 million tonnes at this time last year, due to higher-than-normal production disruptions at global copper mines. Chinese imports of copper concentrates increased by 9% in 2022 to reach over 6.1 million tonnes of contained copper.

Copper scrap availability increased in 2022 due to stronger prices in the first half of the year. Scrap and unrefined copper imports into China, including blister and anode, were up 13% year over year in 2022

10

Teck 2022 Management’s Discussion and Analysis

following a 30% increase in 2021. Refined cathode imports in 2022 increased by 8.4% to 3.4 million tonnes. Despite reports of weak copper demand in China, net contained copper unit imports were up 9.1% or 1.0 million tonnes from 2021 levels to 12.6 million tonnes, while reported cathode stocks in China fell by 0.1 million tonnes.

Wood Mackenzie estimates that global refined copper production grew 0.5% in 2022, below the 0.8% increase in global copper cathode demand. Wood Mackenzie are projecting that refined production will increase by 3.0% in 2023, reaching 25.7 million tonnes, with demand increasing only 2.1% to 25.5 million tonnes. The projected surplus in 2023 is 0.2 million tonnes, which is 0.3 million tonnes lower than Wood Mackenzie's forecast a year ago for the 2023 surplus, due mostly to weaker-than-forecast mine production. Demand continues to increase as governments and corporations expand decarbonization efforts, which require additional copper units for renewable energy generation and distribution. Consumer demand is forecast to come under pressure in 2023 in Europe and North America, while stimulus spending and consumer demand is now forecast to improve in China following a relaxation of COVID-related lockdowns in the country.

Outlook

Our 2023 annual guidance outlined below is unchanged from our previously disclosed guidance.

Copper production in 2023 is expected to be in the range of 390,000 to 445,000 tonnes. QB2 is expected to add substantially to overall copper production compared to 2022 as we ramp up to full capacity before the end of 2023. The increase is partially offset by lower expected production at Highland Valley Copper due to harder ore and lower copper grades as part of an update to the mine plan, and lower copper grades at Antamina as expected in the mine plan.

11

Teck 2022 Management’s Discussion and Analysis

Excluding QB2, we expect 2023 copper net cash unit costs in the range of US$1.60 to US$1.80 per pound after cash margins for by-products. Guidance reflects continued inflationary pressures on diesel, explosives, tires and reagents, as well as increased unit operating costs at Highland Valley Copper due to lower expected production, as outlined above.

We continue to expect QB2 to reach full capacity by end of 2023. As a result of recent changes to IFRS, we are required to recognize sales proceeds and related costs associated with products sold during the ramp-up and commissioning phase of QB2 through earnings, rather than capitalizing these amounts. We expect this to increase our unit operating costs for QB2 during ramp-up. Once QB2 is running at full production rates, we expect the average net cash unit costs will be between US$1.40 per pound and US$1.60 per pound.

Copper production from 2024 to 2026 is expected to be between 545,000 and 640,000 tonnes per year, including QB2.

12

Teck 2022 Management’s Discussion and Analysis

Zinc

We are one of the world’s largest producers of mined zinc, primarily from our Red Dog Operations in Alaska, and the Antamina copper mine in northern Peru, which has significant zinc co-product production. Our metallurgical complex in Trail, B.C. is one of the world’s largest integrated zinc and lead smelting and refining operations. In 2022, we produced 650,500 tonnes of zinc in concentrate, while our Trail Operations produced 248,900 tonnes of refined zinc.

In 2022, our zinc business unit accounted for 20% of revenue and 9% of our gross profit.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenue | Gross Profit (Loss) | Gross Profit (Loss) Before Depreciation and Amortization1 |

| ($ in millions) | 2022 | 2021 | 2020 | 2022 | 2021 | 2020 | 2022 | 2021 | 2020 |

| Red Dog | $ | 2,111 | | $ | 1,567 | | $ | 1,394 | | $ | 862 | | $ | 678 | | $ | 513 | | $ | 1,060 | | $ | 822 | | $ | 717 | |

| Trail Operations | 2,059 | | 1,997 | | 1,761 | | (93) | | (2) | | (23) | | (18) | | 84 | | 65 | |

| Other | 11 | | 10 | 9 | 2 | | 12 | | 33 | | 2 | | 12 | | 33 | |

| Intra-segment | (655) | | (511) | | (464) | | — | | — | | — | | — | | — | | — | |

| Total | $ | 3,526 | | $ 3,063 | $2,700 | $ | 771 | | $ | 688 | | $ | 523 | | $ | 1,044 | | $ | 918 | | $ | 815 | |

Note:

1.This is a non-GAAP financial measure or ratio. See “Use of Non-GAAP Financial Measures and Ratios” section for further information.

| | | | | | | | | | | | | | | | | | | | |

| Production | Sales |

| (thousand tonnes) | 2022 | 2021 | 2020 | 2022 | 2021 | 2020 |

| Refined zinc | | | | | | |

| Trail Operations | 249 | 279 | 305 | 257 | 281 | 307 |

| | | | | | |

| Contained in concentrate | | | | | | |

| Red Dog | 553 | 503 | 491 | 578 | 446 | 551 |

Antamina1 | 97 | 104 | 96 | 97 | 103 | 95 |

| Total | 650 | 607 | 587 | 675 | 549 | 646 |

Note:

1.Co-product zinc production from our 22.5% interest in Antamina.

Operations

Red Dog

Our Red Dog Operations, located in northwest Alaska, is one of the world’s largest zinc mines. Gross profit in 2022 was $862 million compared with $678 million in 2021 and $513 million in 2020. The increase in gross profit in 2022 compared with 2021 was primarily due to higher zinc prices and higher production volumes offset by increased operating costs and increased royalty costs, which are tied to increased profitability at Red Dog.

13

Teck 2022 Management’s Discussion and Analysis

In 2022, zinc production at Red Dog increased to 553,100 tonnes, compared to 503,400 tonnes produced in 2021, primarily due to higher ore grade, as expected in the mine plan, and slightly better recovery. Lead production in 2022 of 79,500 tonnes was lower than 2021 production of 97,400 tonnes as a result of lower grade ore, as expected in the mine plan.

Red Dog’s location exposes the operation to severe weather and winter ice conditions, which can significantly affect production, sales volumes and operating costs. In addition, the mine’s bulk supply deliveries and all concentrate shipments occur during a short ocean shipping season that normally runs from early July to late October. This short shipping season means that Red Dog’s sales volumes are usually higher in the last six months of the year, resulting in significant variability in its quarterly profit, depending on metal prices. As a result of the shipping season, inflationary impact on the cost of consumables only impacted Red Dog Operations in the fourth quarter. We expect to see the full impact of inflation in 2023.

The 2022 Red Dog concentrate shipping season commenced on schedule on July 4, 2022, and completed on October 26, 2022. A total of 1.31 million wet metric tonnes of zinc and lead concentrate, or 100% of planned volumes, was safely transloaded from our proprietary coastal barges onto 23 ships for delivery to our global customers.

In accordance with the operating agreement governing the Red Dog mine between Teck and NANA Regional Corporation, Inc. (NANA), we pay a royalty on net proceeds of production to NANA, which increased from 35% to 40% in October 2022. This royalty increases by 5% every fifth year to a maximum of 50%, with the next adjustment to 45% anticipated to occur in October 2027. The NANA royalty expense in 2022 was US$353 million, compared with US$255 million in 2021. NANA has advised us that it ultimately shares approximately 60% of the royalty, net of allowable costs, with other Regional Alaska Native Corporations pursuant to section 7(i) of the Alaska Native Claims Settlement Act.

Red Dog’s production of contained metal in 2023 is anticipated to be in the range of 550,000 to 580,000 tonnes of zinc and 110,000 to 125,000 tonnes of lead. From 2024 to 2026, zinc production is expected to be in the range of 500,000 to 550,000 tonnes of contained zinc per year, while lead production is expected to be between 85,000 and 95,000 tonnes of contained lead per year.

14

Teck 2022 Management’s Discussion and Analysis

Trail Operations

Our Trail Operations in southern B.C. produces refined zinc and lead, as well as a variety of precious and specialty metals, chemicals and fertilizer products.

Trail Operations incurred a gross loss of $93 million in 2022, in comparison to a gross loss of $2 million in 2021 and a gross loss of $23 million in 2020. The higher gross loss in 2022 is primarily due to an extended major maintenance shutdown and higher operating costs driven by inflation, offset slightly by higher zinc prices and premiums.

Refined zinc production in 2022 was 248,900 tonnes, lower than 279,000 tonnes in 2021. Refined zinc production in 2022 was impacted in the second half of the year by a planned major maintenance shutdown of the KIVCET furnace to have its hearth replaced, as well as the replacement of a dome on a zinc roaster. Production was also impacted by weather events resulting from extreme cold temperatures, as well as unplanned maintenance and operational challenges. Refined lead production in 2022 was 56,400 tonnes, compared with 81,400 tonnes in 2021. Silver production was 9.7 million ounces in 2022, compared to 11.7 million ounces in 2021. The decrease in both lead and silver production between 2022 and 2021 is also attributable to the KIVCET Furnace maintenance activities mentioned above.

Our recycling process treated 19,200 tonnes of material during the year, and we plan to treat about 28,200 tonnes in 2023. Our focus remains on treating lead acid batteries and cathode ray tube glass, plus small quantities of zinc alkaline batteries and other post-consumer waste.

In 2023, we expect Trail Operations to produce between 270,000 and 290,000 tonnes of refined zinc. Refined zinc production from 2024 to 2026 is expected to be between 280,000 and 310,000 tonnes per year. Refined lead and silver production at Trail is expected to be similar to prior years, excluding major maintenance years, but will fluctuate as a result of concentrate feed source optimization.

Zinc Growth

In the second quarter of 2022, we launched a zinc initiative focused on surfacing value from our high-quality portfolio of zinc projects. Similar to our approach on Copper Growth, we will methodically advance one significant growth project and several potential growth options with prudent investments to improve our understanding of each asset's potential, and define development options and paths to value for each of the assets.

Our principal zinc growth project is located in the Red Dog District in Alaska, where we have several high-quality opportunities located between 10 and 20 kilometres from the existing Red Dog Operations. Our primary focus is on Aktigiruq, a significant mineralized system with an exploration target of 80–150 million tonnes at grades of 16%–18% zinc plus lead. Scoping-level studies will continue in 2023 and 2024 on an underground mine, leveraging the existing mill and supporting facilities at Red Dog Operations.

15

Teck 2022 Management’s Discussion and Analysis

Within the zinc growth portfolio, there are two primary opportunities. Teena is a significant high-grade zinc-lead discovery made by Teck in 2013 that is located approximately 8 kilometres from Glencore’s McArthur River operation in Northern Territory, Australia. We are advancing early-stage conceptual studies at Teena to assess the stand-alone development opportunity represented by this high-quality discovery, which is located in a world-class zinc district with access to established infrastructure.

In central B.C., Teck has a 50% interest in the Cirque deposit, which is located in a long-established mineral district with recently improved road and rail infrastructure. This can provide ready access to market for the concentrate, including to our Trail smelting and refining operations. Our work at Cirque is focused on permitting and program definition, with potential drilling to start later in 2023.

Markets

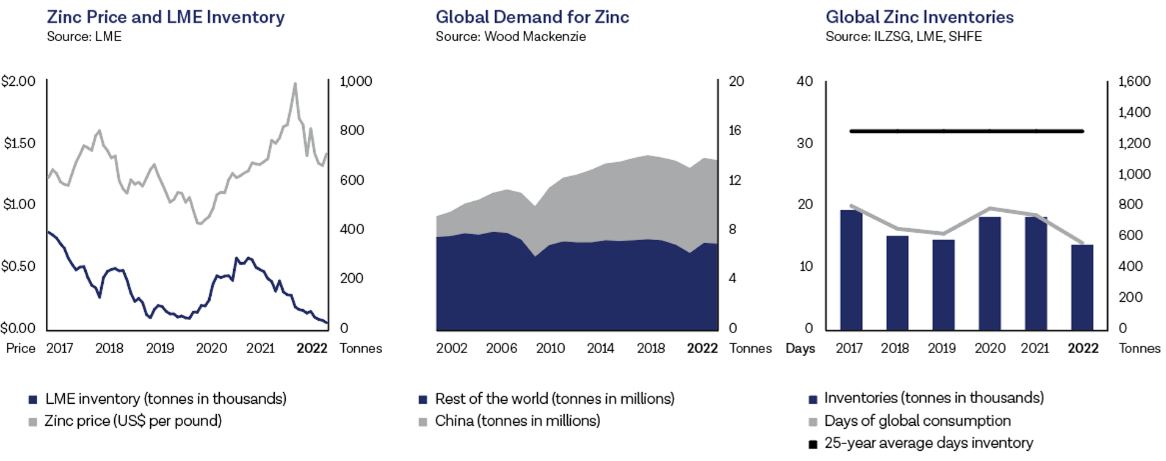

Zinc prices on the London Metal Exchange (LME) averaged US$1.58 per pound during 2022, higher than US$1.36 per pound in 2021, and the highest annual average ever recorded.

Zinc stocks on the LME fell by 167,550 tonnes in 2022, an 84.0% decrease from 2021 levels, finishing the year at 32,025 tonnes, the lowest level of LME stocks since 1989, which was just after the LME SHG zinc contract started trading. Stocks held on the Shanghai Futures Exchange (SHFE) fell 37,464 tonnes in 2022, a 64.7% decrease from 2021 levels, finishing the year at 20,453 tonnes, which was the lowest level since 2018. Total global exchange stocks remained well below historical levels, ending the year at 1.4 days of global consumption, compared to the 25-year average of 17.2 days. We estimate that total reported global stocks, which include producer, consumer, merchant and terminal stocks, fell by approximately 217,500 tonnes in 2022 to less than 60,000 tonnes at year-end, representing an estimated 1.4 days of global demand, compared to the 25-year average of 18.2 days.

In 2022, global zinc mine production increased 0.2% according to Wood Mackenzie, with total mine production reaching 12.9 million tonnes. This was significantly below Wood Mackenzie’s forecast a year ago for 2022 of 13.3 million tonnes. Global zinc mine production in 2022 continued to be impacted by COVID-related restrictions and labour shortages. According to Wood Mackenzie, global zinc mine production has not grown since 2013. Mine production in 2022 at 12.9 million tonnes was the same as it was in 2013. Wood Mackenzie expects global zinc mine production to only grow 2.5% in 2023 to reach 13.2 million tonnes, which is 0.6 million tonnes lower than its forecast a year ago for 2023 of 13.8 million tonnes.

Wood Mackenzie estimates that the global zinc metal market remained in deficit in 2022, recording a shortfall of 0.5 million tonnes of available material. Global refined zinc demand fell 1.4% in 2022 over 2021 to 13.8 million tonnes. Demand in China fell by 1.8%, and demand in Europe fell 3.1% on higher energy prices. North America was the only demand-growth region in 2022, according to Wood Mackenzie. In 2023, they expect demand for zinc to grow globally by 1.3% to 14.0 million tonnes, with growth coming primarily from Asia and South America, while demand in Europe and North America is expected to weaken.

16

Teck 2022 Management’s Discussion and Analysis

Wood Mackenzie estimates that global refined zinc production fell 4.0% in 2022 to 13.3 million tonnes, as European zinc smelters were forced to cut production due to higher energy costs, and North American and Asian smelters suffered from a variety of production problems throughout the year. Wood Mackenzie estimates that refined zinc production will see a 3.8% increase in 2023 over 2022 levels, back to 13.9 million tonnes as European power prices stabilize and North American and Asian smelters return to normal production levels. The estimate for the total increase in supply in 2023 will still be below the total global metal demand, suggesting that the refined metal market will be in a 0.2-million-tonne deficit in 2023.

Outlook

Our 2023 annual guidance outlined below is unchanged from our previously disclosed guidance.

We expect 2023 zinc in concentrate production, including co-product zinc production from Antamina (22.5%), to be in the range of 645,000 to 685,000 tonnes. This increase from 2022 production levels is driven by higher zinc grades at both Red Dog and Antamina, as expected in the mine plan.

In 2023, we expect our zinc net cash unit costs to be in the range of US$0.50 to US$0.60 per pound after cash margins for by-products. The increase over 2022 reflects a full year of inflation impact in 2023 on the cost of major consumables such as diesel. In 2022, the inflationary impacts were primarily in the fourth quarter of 2022.

Zinc in concentrate production from 2024 to 2026 is expected to be in the range of 555,000 to 645,000 tonnes per year. Guidance reflects Antamina's 2024 zinc production being at the lower end of the 2024-2026 guidance provided, and at the higher end for 2025-2026.

17

Teck 2022 Management’s Discussion and Analysis

In 2023, we expect refined zinc production to be between 270,000 and 290,000 tonnes, reflecting the residual impact of weather-related events on our Trail Operations at the end of 2022 that continued into January. Operations are expected to return to normal in the first quarter of 2023.

Refined zinc production from 2024 to 2026 is expected to be between 280,000 and 310,000 tonnes per year.

18

Teck 2022 Management’s Discussion and Analysis

Steelmaking Coal

In 2022, our steelmaking coal operations in Western Canada produced 21.5 million tonnes, with sales of 22.2 million tonnes. The majority of our steelmaking coal sales are to the Asia-Pacific region, with the remaining amounts sold primarily to Europe and the Americas. Our production capacity is 26 to 27 million tonnes, and we have total proven and probable reserves of 806 million tonnes of steelmaking coal.

In 2022, our steelmaking coal business unit accounted for 60% of revenue and 75% of gross profit.

| | | | | | | | | | | |

| ($ in millions) | 2022 | 2021 | 2020 |

| Revenue | $ | 10,409 | | $ | 6,251 | | $ | 3,375 | |

| Gross profit | $ | 6,401 | | $ | 2,785 | | $ | 277 | |

Gross profit before depreciation and amortization1 | $ | 7,364 | | $ | 3,657 | | $ | 1,009 | |

| Production (million tonnes) | 21.5 | | 24.6 | | 21.1 | |

| Sales (million tonnes) | 22.2 | | 23.4 | | 21.9 | |

Note:

1.This is a non-GAAP financial measure or ratio. See “Use of Non-GAAP Financial Measures and Ratios” section for further information.

Operations

During the year, we continued to advance our high-quality development projects, including development of the Elkview Administration and Maintenance Complex (AMC) Project (previously, the Harmer Project). Site preparation early works were completed in 2022, and detailed engineering and early procurement is over 50% complete. Construction will start in the first half of 2023. Once the Elkview workforce has relocated from the existing Harmer facilities to the new AMC complex, the area will be decommissioned and rehabilitated to prepare for mining operations in 2025. The AMC Project takes advantage of existing infrastructure and is expected to provide high-quality steelmaking coal that will support a long-term run rate of 9 million tonnes per year at Elkview.

We continue to advance the Fording River Extension Project to extend the lifespan of our existing Fording River Operations. A draft decision issued by the Province of British Columbia in December 2022 contemplates continued discussions with Indigenous communities and the development of a revised project description.

Gross profit for our steelmaking coal business unit was $6.4 billion in 2022, up from $2.8 billion in 2021 and $277 million in 2020. Substantially higher steelmaking coal prices contributed to exceptional financial performance in 2022 compared to 2021, despite lower production and sales volumes.

Our average realized steelmaking coal selling price in 2022 increased to US$355 per tonne, compared with US$209 per tonne in 2021 and US$113 per tonne in 2020.

19

Teck 2022 Management’s Discussion and Analysis

Sales volumes were 22.2 million tonnes in 2022, compared with 23.4 million tonnes sold in 2021. Strong logistics chain performance early in the year resulted in the drawdown of record-high opening inventories due to weather-related disruptions in late 2021 and into early 2022. Inventories were reduced to low levels by the end of the second quarter to capitalize on higher steelmaking coal prices. In the second half of the year, the Elkview plant was non-operational for two months, due to the failure of the plant feed conveyor, limiting sales volumes. Extreme cold during the final weeks of the year hampered our logistic chain while production rates recovered, resulting in increased inventories at year-end. These inventories will be drawn down in the first half of 2023.

Our 2022 production of 21.5 million tonnes was 3.1 million tonnes lower than 2021, primarily due to plant availability challenges throughout the year, particularly the two-month plant outage at Elkview to repair the raw coal conveyor. In addition, production was impacted by ongoing labour constraints and the extreme weather events at the end of both 2021 and 2022.

Adjusted site cash cost of sales1 in 2022 was $89 per tonne, significantly higher than $65 per tonne in 2021. The increase in the cost of sales was driven primarily by lower production and continued inflationary pressures, most notably diesel prices, as well as higher profit-based compensation.

Capital spending in 2022 included $520 million for sustaining capital, including water projects and Neptune Bulk Terminals (Neptune), and $30 million for RACE growth capital.

Elk Valley Water Quality Management Update

We continue to implement the water quality management measures required by the Elk Valley Water Quality Plan (the Plan). The Plan establishes short-, medium- and long-term water quality targets for selenium, nitrate, sulphate and cadmium to protect the environment and human health.

The majority of our 2022 capital spending for water projects was associated with building additional Saturated Rock Fill (SRF) treatment capacity across the Elk Valley. Capital spending in 2022 on water projects was $184 million. Our existing SRFs and Active Water Treatment Facilities (AWTFs) are operating as designed and, with the recent construction of the Fording River North SRF, there is currently 77.5 million litres per day of constructed water treatment capacity, which we expect to be operating as designed by the end of 2023. This is a fourfold increase in our treatment capacity from 2020.

With this additional capacity, we expect to achieve one of the primary objectives of the Plan: stabilizing and reducing the selenium trend in the Elk Valley.

In 2023, sustaining capital investment in water treatment facilities, water management (source control, calcite management and tributary management) and the incremental measures required under the October 2020 Direction issued by Environment and Climate Change Canada (the Direction) is expected to be

1 This is a non-GAAP financial measure or ratio. See “Use of Non-GAAP Financial Measures and Ratios” section for further information.

20

Teck 2022 Management’s Discussion and Analysis

approximately $220 million. Key projects include the North Line Creek Phase 1 and the Fording River North 1 Phase 3 SRFs.

Unchanged from our previously issued guidance, we plan to invest between $450 and $550 million of capital in 2023 and 2024 on water management and water treatment, including the capital attributable to incremental measures required under the Direction. This also includes the advancement of the Fording River North 2 Phase 1 SRF, which will increase treatment capacity in the north Elk Valley earlier than previously planned. The continued investment in water treatment during this time frame will further increase our constructed water treatment capacity to 120 million litres per day by the end of 2026.

Operating costs associated with water treatment were approximately $1.50 per tonne in 2022 and are projected to increase gradually over the long term to approximately $3 to $5 per tonne as additional water treatment becomes operational. Long-term capital costs for construction of additional treatment facilities are expected to average approximately $2 per tonne annually.

Final costs of implementing the Plan and other water quality initiatives will depend in part on the technologies applied, on regulatory developments, and on the results of ongoing environmental monitoring and modelling. The timing of expenditures will depend on resolution of technical issues, permitting timelines and other factors. Certain cost estimates to date are based on limited engineering. Implementation of the Plan also requires additional operating permits. We expect that, in order to maintain water quality, some form of water treatment will continue for an indefinite period after mining operations end. The Plan contemplates ongoing monitoring to ensure that the water quality targets set out in the Plan are protective of the environment and human health, and provides for adjustments if warranted by monitoring results. Proposed amendments to the Plan are under discussion with provincial regulators and Indigenous communities. The state of Montana's water quality standard for the Koocanusa Reservoir downstream of our mining operations has been set aside on procedural grounds. We continue to engage with U.S. regulators to work towards the establishment of appropriate science-based standards for the reservoir. Ongoing monitoring, as well as our continued research into treatment technologies, could reveal unexpected environmental impacts, technical issues or advances associated with potential treatment technologies. This could substantially increase or decrease both capital and operating costs associated with water quality management, or could materially affect our ability to permit mine life extensions in new mining areas.

Rail

Rail transportation of product westbound from our four steelmaking coal mines in southeast B.C. to Vancouver terminals is currently provided by Canadian Pacific Railway Company (CPR) and by Canadian National Railway Company (CN Rail). CPR transports a portion of these westbound shipments to Kamloops, B.C., and interchanges the trains with CN Rail for further transportation to the west coast. The remaining westbound shipments are transported by CPR from the mines to the terminals in Vancouver. Our current westbound shipments with CPR are under a tariff that expires in April 2023. Negotiations with CPR for a new westbound contract are underway.

21

Teck 2022 Management’s Discussion and Analysis

We have a long-term agreement with CN Rail until December 2026 for shipping steelmaking coal from our four B.C. operations via Kamloops to Neptune and other west coast ports, including Trigon Pacific Terminals (formerly Ridley Terminals).

Ports

We export our seaborne steelmaking coal primarily through three west coast terminals: Neptune, Westshore Terminals (Westshore) and Trigon. We have a 46% ownership interest in Neptune, which provides shiploading services on a cost-of-service basis at North Vancouver, B.C. Neptune, which became our primary terminal in 2021, continues to handle most of our production volumes (72% in 2022). Coal capacity at Neptune is exclusive to Teck. Neptune is well positioned to deliver strong throughput in 2023 and beyond, with significantly increased terminal-loading capacity to meet delivery commitments to our customers while further lowering our port costs.

In 2021, we entered into an agreement with Westshore for the shipment of between 5 and 7 million tonnes of steelmaking coal per year at fixed loading charges, for a total of 33 million tonnes over a period of approximately five years.

We also have a long-term agreement with Trigon, located in Prince Rupert, for shipments of up to 6 million tonnes of steelmaking coal per year through to December 2027.

Through our capacity at Neptune and complementary commercial agreements with Westshore and Trigon Terminals, our annual port capacity exceeds production. This incremental capacity provides flexibility and improved reliability in the case of weather and corridor disruptions or terminal outages.

Sales

Our steelmaking coal marketing strategy is focused on maintaining and building relationships with our traditional customers while establishing new customers in markets where we anticipate long-term growth in steel production and demand for seaborne steelmaking coal. In 2022, our sales strategy focused on capitalizing on the record pricing environment by optimizing sales to the seaborne market.

Markets

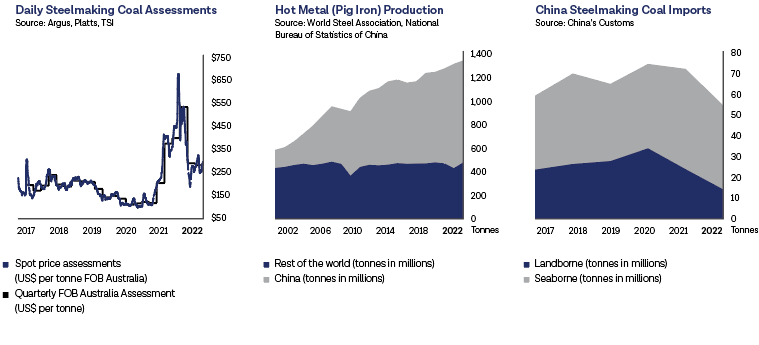

Global steel production diminished through the year as global inflationary pressures, monetary tightening and high energy prices weighed on manufacturing activity.

Premium hard coking coal prices FOB Australia reached an all-time high of US$670 per tonne in March 2022, triggered by the Russian invasion of Ukraine and supported by concerns over weather disruptions in Australia. In the second half of 2022, the global economic environment weakened as the war in Ukraine continued and the Chinese government extended COVID restrictions. Inflationary pressures, including high

22

Teck 2022 Management’s Discussion and Analysis

energy prices, lower consumer demand and falling steel prices, forced several European steel mills to reduce production in the second half. As a result, premium hard coking coal prices FOB Australia averaged US$365 per tonne in 2022, a historic high.

Coal shipments from Australia to China remained restricted through 2022. The average CFR China steelmaking coal price was US$371 per tonne in 2022, also a record high. Trade relations between China and Australia are improving, which is likely to result in the restart of Australian coal exports to China in 2023. We do not expect increased coal trade between China and Australia to have a material impact on the price of steelmaking coal, as the global demand and supply balance will remain unchanged.

The following graphs show key metrics affecting steelmaking coal sales: spot price assessments and quarterly pricing, hot metal production (each tonne of hot metal, or pig iron, produced requires approximately 650–700 kilograms of steelmaking coal), and China’s steelmaking coal imports by source.

Outlook

In December 2022, we announced the sale of our Quintette steelmaking coal mine to Conuma Resources Limited (Conuma) for $120 million in cash in staged payments over 36 months and an ongoing 25% net profits interest royalty, first payable after Conuma recovers its investment in Quintette. The transaction closed on February 16, 2023.

Our 2023 annual guidance outlined below is unchanged from our previously disclosed guidance.

Driven by all-time high steelmaking coal prices, the coal business unit delivered record financial results in 2022, and is in a solid position to deliver strong financial performance again in 2023. As noted above, we entered 2023 with higher-than-normal steelmaking coal inventories. We expect the 2022 fourth quarter

23

Teck 2022 Management’s Discussion and Analysis

deferred sales will be largely recovered in the first half of 2023, and inventories will return to low levels. We expect sales to be between 6.0 and 6.4 million tonnes for the first quarter of 2023 as we ramp back up to planned logistics operating rates.

We expect 2023 annual steelmaking coal production in the range of 24 to 26 million tonnes. Labour constraints are expected to continue to negatively impact equipment operating hours despite improved workforce attraction and retention as a result of initiatives implemented in 2022. We updated 2024 to 2026 steelmaking coal guidance to 24 to 26 million tonnes per year to reflect uncertainties related to ongoing labour impacts and the increasing frequency of adverse weather events.

We expect 2023 adjusted site cash cost of sales in the range of $88 to $96 per tonne. Relative to 2022, we anticipate favourable mining drivers, lower profit-based costs and an increased rate of capitalization of stripping in 2023 that will be offset by continued inflationary pressures. Major plant maintenance is scheduled to take place in the second and third quarters, resulting in expected adjusted site cash cost of sales2 to be at or above the upper end of the guidance range in those quarters, offset with lower costs in the first and fourth quarters. Inflationary pressures remain the primary driver of unit cost increases over historical periods, which are expected to be more than offset by the strong steelmaking coal prices supported by global supply constraints.

Transportation unit costs2 for 2023 are expected to be between $45 and $48 per tonne, including costs at or above the high end of our annual guidance range in the first quarter of 2023 due to the impact of logistics disruptions late in 2022. Savings associated with higher sales volumes through our expanded Neptune terminal are expected to be partially offset by inflationary pressures that are expected to continue through 2023.

Capital expenditures for 2023 are expected to be approximately $790 million, including $220 million related to water treatment. Total capital also includes $30 million of growth investment focused on improvement initiatives and supply chain optimization, and $540 million of sustaining capital supporting operations and the development of mining areas such as the Elkview AMC project. Capital is expected to remain in this range for the next couple of years as we develop further water treatment facilities, bring the Elkview AMC project online and continue to invest in future mine development.

Capitalized stripping costs are expected to be approximately $750 million in 2023. This is an increase from 2022 due to continued inflationary pressures, largely in mine and maintenance costs, and a notable peak period of capitalized stripping to advance the development of mine pits to support future production, partly as a result of the additional Indigenous engagement required in connection with the Fording River Extension permitting process.

2 This is a non-GAAP financial measure or ratio. See “Non-GAAP Financial Measures and Ratios” for further information.

24

Teck 2022 Management’s Discussion and Analysis

Exploration & Geoscience

Throughout 2022, we conducted exploration around our existing operations and globally in seven countries through our six regional offices, as our exploration activities returned to pre-pandemic levels. Expenditures for the year of $90 million, which were focused on copper, zinc, nickel and gold, were higher than expenditures in 2021 of $65 million, primarily due to the recommencement of drilling programs across our portfolio.

Exploration & Geoscience plays three critical roles at Teck: discovery of new orebodies through early-stage exploration and acquisition; pursuit, evaluation and acquisition of development opportunities; and delivery of geoscience solutions and services to create value at our existing mines and development projects.

Work continues on resource expansion at Quebrada Blanca, where we commenced a large-scale drill program in 2022 to continue to investigate and confirm the extensions of the orebody, which remains open in multiple directions.

Early-stage copper exploration in 2022 focused primarily on advancing projects targeting porphyry-style mineralization in Canada, Chile, Peru and the United States. In 2023, we plan to drill a number of early-stage copper projects in Chile, Peru and the United States.

Zinc exploration in 2022 was concentrated on early-stage programs in Australia, Canada, Ireland and Turkey, and on an advanced-stage project in the Red Dog district in Alaska. In Alaska, Australia and Canada, the targets are large sediment-hosted deposits; in Ireland, we are targeting large carbonate-hosted deposits. In 2023, we plan to drill test early-stage targets on our properties in Australia, Ireland and Turkey, and to continue drilling advanced-stage projects in the Red Dog mine district in Alaska.

In 2022, we initiated early-stage exploration for nickel, with an initial focus on Canada and the United States. A key element of this program is the complete digitalization of Teck’s historical exploration records – this digitization program will use advanced machine learning tools to drive and inform our evaluation of high-quality nickel prospects, plus copper and zinc prospects, globally.

We have ongoing exploration for gold, both on 100% Teck-owned properties and through partnerships. Our current exploration efforts and drill testing for gold are focused in Peru and Turkey.

In 2022, we also drilled 68 kilometres across four steelmaking coal operations in the Elk Valley to support our existing operations and extension projects.

Teck’s exploration strategy is underpinned by an agile commercial mindset whereby we manage and refresh a portfolio of commercial opportunities, such as retained project royalties and equity in junior exploration companies, to create value for Teck. In 2022, investments were made in exploration companies with copper portfolios in Canada, Kazakhstan and Peru and zinc portfolios in Canada and the United States.

25

Teck 2022 Management’s Discussion and Analysis

Financial Overview

Financial Summary

| | | | | | | | | | | |

| ($ in millions, except per share data) | 2022 | 20212 | 20202 |

| Revenue and profit | | | |

| Revenue | $ | 17,316 | | $ | 12,766 | | $ | 8,948 | |

| Gross profit | $ | 8,571 | | $ | 5,214 | | $ | 1,333 | |

Gross profit before depreciation and amortization1 | $ | 10,245 | | $ | 6,701 | | $ | 2,843 | |

| Profit (loss) from continuing operations before taxes | $ | 6,565 | | $ | 4,688 | | $ | (1,136) | |

Adjusted EBITDA1 | $ | 9,568 | | $ | 6,573 | | $ | 2,570 | |

| Profit (loss) attributable to shareholders | $ | 3,317 | | $ | 2,868 | | $ | (864) | |

Profit (loss) from continuing operations attributable to

shareholders | $ | 4,089 | | $ | 3,123 | | $ | (864) | |

| | | |

| Cash flow | | | |

| Cash flow from operations | $ | 7,983 | | $ | 4,738 | | $ | 1,563 | |

| Property, plant and equipment expenditures | $ | 4,423 | | $ | 3,966 | | $ | 3,129 | |

| Capitalized stripping costs | $ | 1,042 | | $ | 667 | | $ | 499 | |

| Investments | $ | 199 | | $ | 160 | | $ | 190 | |

| | | |

| Balance sheet | | | |

| Cash balances | $ | 1,883 | | $ | 1,427 | | $ | 450 | |

| Total assets | $ | 52,359 | | $ | 47,368 | | $ | 41,278 | |

| Debt and lease liabilities, including current portion | $ | 7,738 | | $ | 8,068 | | $ | 6,947 | |

| | | |

| Per share amounts | | | |

| Basic earnings (loss) per share | $ | 6.30 | | $ | 5.39 | | $ | (1.62) | |

| Diluted earnings (loss) per share | $ | 6.19 | | $ | 5.31 | | $ | (1.62) | |

| Basic earnings (loss) per share from continuing operations | $ | 7.77 | | $ | 5.87 | | $ | (1.62) | |

| Diluted earnings (loss) per share from continuing operations | $ | 7.63 | | $ | 5.78 | | $ | (1.62) | |

| Dividends declared per share | $ | 1.00 | | $ | 0.20 | | $ | 0.20 | |

Note:

1.This is a non-GAAP financial measure or ratio. See “Use of Non-GAAP Financial Measures and Ratios” section for further information.

2.Comparative figures for 2021 for the Energy Business Unit have been represented for the classification of Fort Hills as a discontinued operation. 2020 figures have not been represented.

Our revenue and profit depend on the prices for the commodities we produce, sell and use in our production processes. Commodity prices are determined by the supply of and demand for those commodities, which are influenced by global economic conditions. We normally sell the products that we produce at prevailing market prices or, in the case of steelmaking coal, through an index-linked pricing mechanism or on a spot basis. Prices for our products can fluctuate significantly, and that volatility can have a material effect on our financial results.

Foreign exchange rate movements can also have a significant effect on our results and cash flows, as substantial portions of our operating costs are incurred in Canadian dollars and other currencies, and most of our revenue and debt is denominated in U.S. dollars. We determine our financial results in local currency and report those results in Canadian dollars; accordingly, our reported operating results and cash flows are

26

Teck 2022 Management’s Discussion and Analysis

affected by changes in the Canadian dollar exchange rate relative to the U.S. dollar, as well as the Peruvian sol and Chilean peso.

In 2022, our profit attributable to shareholders was a record $3.3 billion, or $6.30 per share. This compares with a profit attributable to shareholders of $2.9 billion or $5.39 per share in 2021, and a loss attributable to shareholders of $864 million or $1.62 per share in 2020. The significant increase in profit in 2022 was due to substantially higher steelmaking coal prices, partly offset by slightly lower steelmaking coal sales volumes and increased operating costs across our operations reflecting inflationary pressures, particularly for diesel. Profit attributable to shareholders in 2021 improved from 2020 due to higher prices for all of our principal products, as well as an increase in sales volumes of steelmaking coal. In 2020, COVID-19 had a significant negative effect on the price and demand for our products, reducing our profit attributable to shareholders.

Our profit and loss over the past three years has included items that we segregate for additional disclosure to investors so that the underlying profit of the Company may be more clearly understood. Our adjusted EBITDA3, which takes these items into account, was $9.6 billion in 2022, $6.6 billion in 2021 and $2.6 billion in 2020. Our adjusted profit attributable to shareholders3, which takes these items into account, was a record $4.9 billion in 2022, $3.1 billion in 2021 and $561 million in 2020, or $9.25, $5.74 and $1.05 per share, respectively. These items are described below and summarized in the table that follows.

In October 2022, we announced an agreement to sell our 21.3% interest in Fort Hills Energy Limited Partnership (Fort Hills) and certain associated downstream assets to Suncor Energy Inc. Subsequently, TotalEnergies EP Canada Ltd. exercised its right of first refusal to purchase a proportional share of our interest in Fort Hills. On February 2, 2023, we completed the sale to Suncor and TotalEnergies for aggregate gross proceeds of approximately $1 billion in cash and we do not anticipate any tax payable on the disposal. Based on the consideration of $1 billion in cash and other contractual adjustments, we recorded a non-cash, pre-tax impairment of $1.2 billion in 2022 as a result of the sale of our interest in Fort Hills.

In 2021, we recorded a non-cash pre-tax asset impairment reversal on our Carmen de Andacollo Operations of $215 million as a result of an increase in market expectations for long-term copper prices. This was partially offset by a $141 million charge associated with the QB2 variable consideration.

In 2020, as outlined below, COVID-19 had a significant effect on our financial results, with decreases in commodity prices, most significantly for steelmaking coal, the temporary suspension of construction on our QB2 project and temporary reductions in production at our operations in the second quarter. As a result, we expensed $434 million of costs associated with COVID-19, primarily relating to the suspension of our QB2 project, including $103 million of interest that would otherwise have been capitalized if construction on QB2 had not been suspended. We also recorded inventory write-downs of $134 million as a result of lower commodity prices. During 2020, we recorded non-cash pre-tax asset impairments on our interest in Fort Hills of $1.2 billion. We also recorded environmental costs of $270 million, primarily relating to a decrease in the rates used to discount our decommissioning and restoration provisions, and increased expected remediation costs.

3 This is a non-GAAP financial measure or ratio. See “Use of Non-GAAP Financial Measures and Ratios” section for further information.

27

Teck 2022 Management’s Discussion and Analysis

The following table shows the effect of these items on our profit and loss.

| | | | | | | | | | | |

| ($ in millions, except per share data) | 20221 | 20212 | 2020 |

Profit (loss) attributable to shareholders3 | $ | 4,089 | | $ | 2,868 | | $ | (864) | |

| | | |

| Add (deduct) on an after-tax basis: | | | |

| Asset impairments (impairment reversal) | 952 | | (150) | | 912 | |

| COVID-19 costs | — | | — | | 233 | |

| Loss on debt purchase | 42 | | — | | 8 | |

| QB2 variable consideration to IMSA and ENAMI | 115 | | 124 | | (34) | |

| Environmental costs | 99 | | 79 | | 210 | |

| Inventory write-downs (reversals) | 36 | | 2 | | 91 | |

| Share-based compensation | 181 | | 94 | | 34 | |

| Commodity derivatives | (25) | | 15 | | (46) | |

Loss from discontinued operations for the nine months ended September 30, 20224 | (791) | | — | | — | |

| Other | 175 | | 25 | | 17 | |

Adjusted profit attributable to shareholders5 | $ | 4,873 | | $ | 3,057 | | $ | 561 | |

Basic earnings (loss) per share3 | $ | 7.77 | | $ | 5.39 | | $ | (1.62) | |

Diluted earnings (loss) per share3 | $ | 7.63 | | $ | 5.31 | | $ | (1.62) | |

Adjusted basic earnings per share5 | $ | 9.25 | | $ | 5.74 | | $ | 1.05 | |

Adjusted diluted earnings per share5 | $ | 9.09 | | $ | 5.66 | | $ | 1.04 | |

Note:

1.Adjustments for the year ended December 31, 2022 are the nine months ended September 30, 2022 as previously reported plus the three months ended December 31, 2022 for continuing operations.

2.Amounts for the year ended December 31, 2021 are as previously reported.

3.Amount for the year ended December 31, 2022 is for continuing operations only.

4.Adjustment required to remove the effect of discontinued operations for the nine months ended September 30, 2022.

5.This is a non-GAAP financial measure or ratio. See “Use of Non-GAAP Financial Measures and Ratios” section for further information.

Cash flow from operations in 2022 was $8.0 billion, compared with $4.7 billion in 2021 and $1.6 billion in 2020. The changes in cash flow from operations are mainly due to varying commodity prices, especially for steelmaking coal, and sales volumes of our principal products, offset to some extent by changes in foreign exchange rates.

At December 31, 2022, our cash balance was $1.9 billion. Total debt was $7.7 billion and our net-debt to net-debt-plus-equity ratio4 was 19% at December 31, 2022, compared with 22% at December 31, 2021 and 24% at the end of 2020.

COVID-19 Financial Impact

COVID-19 operating protocols remain in place across our business, with a continued focus on preventive measures, controls and compliance processes, and the integration of these actions into our operations and business planning. Operating our mines at full production in a COVID-19 environment increases certain costs, such as medical testing, safety equipment, safety supplies, additional transportation costs, accommodation costs for social distancing, and increased absenteeism, among other things. These costs and certain costs related to inefficiencies would not have occurred absent COVID-19 and are incremental

4 This is a non-GAAP financial measure or ratio. See “Use of Non-GAAP Financial Measures and Ratios” section for further information.

28

Teck 2022 Management’s Discussion and Analysis

costs. However, they are considered a cost of operating in this environment and are not adjusted for in our adjusted profit calculation.

During 2020, the COVID-19 pandemic had a significant negative effect on prices and demand for our products and on our financial results. As a result of the pandemic, during the second quarter of 2020, we had to temporarily reduce production at a number of our operations, and we suspended active construction on our QB2 project. We incurred idle labour and other non-productive costs while production was temporarily reduced and these costs were adjusted for in our adjusted profit calculation, noted above.

During 2020, we expensed $272 million in costs associated with the temporary suspension of our QB2 project and the remobilization of the project. We also expensed $103 million of interest that would otherwise have been capitalized if construction on our QB2 project had not been suspended. Consistent with the return to active construction on the QB2 project in the third quarter of 2020, we recommenced capitalization of borrowing costs and we did not expense further costs associated with the remobilization of the project in the fourth quarter of 2020. For the year ended December 31, 2020, we expensed pre-tax COVID-19 costs of $434 million (after-tax $233 million).

Gross Profit

Our gross profit is made up of our revenue less the operating expenses at our producing operations, including depreciation and amortization. Income and expenses from our business activities that do not produce commodities for sale are included in our other operating income and expenses or in our non-operating income and expenses.

Our principal commodities are copper, zinc and steelmaking coal, which accounted for 17%, 16% and 60% of revenue, respectively, in 2022. Silver and lead are significant by-products of our zinc operations, accounting for 4% of our 2022 revenue. We also produce a number of other by-products, including molybdenum, various specialty metals, and chemicals and fertilizers, which in total accounted for 3% of our revenue in 2022.

Our revenue is affected by sales volumes, which are determined by our production levels and by demand for the commodities we produce, commodity prices and currency exchange rates.

Our revenue was a record $17.3 billion in 2022, compared with $12.8 billion in 2021 and $8.9 billion in 2020. The increase in 2022 was primarily due to substantially higher steelmaking coal prices. The increase in 2021 revenue from 2020 was primarily due to substantially higher prices for our principal products and increased sales volumes of steelmaking coal, partly offset by Fort Hills revenue represented as discontinued operations.

Average prices for zinc (LME) and steelmaking coal were 16% and 70% higher in 2022 than in 2021, while average copper prices (LME) declined by 6% in 2022 compared with 2021.

29

Teck 2022 Management’s Discussion and Analysis

Our cost of sales includes all of the expenses required to produce our products, such as labour, energy, operating supplies, concentrates purchased for our Trail Operations’ refining and smelting activities, royalties, and marketing and distribution costs required to sell and transport our products to various delivery points. Our cost of sales also includes depreciation and amortization expense. Due to the geographic locations of many of our operations, we are highly dependent on third parties for the provision of rail, port, and other distribution services. In certain circumstances, we negotiate prices and other terms for the provision of these services where we may not have viable alternatives to using specific providers or may not have access to regulated rate-setting mechanisms or appropriate remedies for service failures. Contractual disputes, demurrage charges, availability of vessels and railcars, weather problems and other factors, as well as rail and port capacity issues can have a material effect on our ability to transport materials from our suppliers and to our customers in accordance with schedules and contractual commitments.

Our costs are dictated mainly by our production volumes; by the costs for labour, operating supplies and concentrate purchases; by strip ratios, haul distances and ore grades; by distribution costs, commodity prices, foreign exchange rates and costs related to non-routine maintenance projects; and by our ability to manage these costs. Production volumes mainly affect our variable operating and distribution costs. In addition, production affects our sales volumes; when combined with commodity prices, this affects profitability and our royalty expenses.

Our cost of sales was $8.7 billion in 2022, compared with $7.6 billion in 2021 and $7.6 billion in 2020. The increase in cost of sales in 2022 compared to 2021 was primarily due to inflationary pressures we experienced across our business units, and to higher profit-based compensation and royalties. The increases in the cost of certain key supplies, including diesel, mining equipment, tires and explosives, are largely being driven by price increases for underlying commodities such as steel, crude oil and natural gas. This contrasts with our underlying key mining drivers such as strip ratios and haul distances, which remained relatively stable in 2022 as compared to 2021.

30

Teck 2022 Management’s Discussion and Analysis

Other Expenses

| | | | | | | | | | | |

| ($ in millions) | 2022 | 2021 | 2020 |

| General and administration | $ | 236 | | $ | 172 | | $ | 132 | |

| Exploration | 90 | | 65 | | 45 | |