EXHIBIT 99.3

Management’s Discussion and Analysis

The management’s discussion and analysis of our results of operations is prepared as at March 5, 2010 and should be read in conjunction with our audited consolidated financial statements and the notes thereto as at and for the year ended December 31, 2009. Unless the context otherwise dictates, a reference to Teck, Teck Resources, the Company, us, we or our, refers to Teck Resources Limited and its subsidiaries including Teck Metals Ltd.; a reference to TML refers to Teck Metals Ltd. and its subsidiaries; and a reference to Aur or Aur Resources refers to Aur Resources Inc. and its subsidiaries. All dollar amounts are in Canadian dollars, unless otherwise specified, and are based on our consolidated financial statements that are prepared in accordance with Canadian generally accepted accounting principles (GAAP). The effect of significant diff erences between Canadian and US GAAP are disclosed in note 25 to our consolidated financial statements. Certain comparative amounts have been reclassified to conform to the presentation adopted for 2009. In addition, in May 2007 our Class A common and Class B subordinate voting shares were split on a two-for-one basis. All comparative figures related to outstanding shares and per share amounts have been adjusted to reflect the share split.

This management’s discussion and analysis contains certain forward-looking information and forward-looking statements. You should review the cautionary statement on forward-looking information under the caption “Caution on Forward-Looking Information”, which forms part of this management’s discussion and analysis.

Business Unit Results

The table below shows our share of production of our major commodities for the last five years and expected production for 2010.

Five-year production record and 2010 plan (our proportionate share)

| | Units (000’s) | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 Plan |

| |

| | | | | | | | |

| Principal Products | | | | | | | |

| Copper contained in concentrate | tonnes | 268 | 258 | 218 | 209 | 203 | 245 |

| Copper cathodes | tonnes | – | – | 37 | 107 | 105 | 95 |

| | | 268 | 258 | 255 | 316 | 308 | 340 |

| Metallurgical coal | | | | | | | |

| Direct share | tonnes | 9,948 | 8,657 | 9,024 | 11,282 | 18,930 | 24,000 |

| Indirect share | tonnes | 1,376 | 1,147 | 1,552 | 2,345 | – | – |

| | | 11,324 | 9,804 | 10,576 | 13,627 | 18,930 | 24,000 |

| | | | | | | | |

| Refined zinc | tonnes | 223 | 296 | 292 | 270 | 240 | 290 |

| Zinc contained in concentrate | tonnes | 657 | 627 | 699 | 663 | 711 | 650 |

| | | | | | | | |

| Other Products | | | | | | | |

| Molybdenum contained in concentrate | pounds | 9,640 | 8,032 | 7,235 | 7,224 | 7,798 | 7,500 |

| Refined lead | tonnes | 69 | 90 | 76 | 85 | 73 | 80 |

| Lead contained in concentrate | tonnes | 110 | 129 | 146 | 133 | 132 | 95 |

Notes to five-year production record and 2010 plan:

(1) In August 2007, we acquired the Quebrada Blanca, Andacollo and Duck Pond mines as a result of our acquisition of Aur Resources Inc. Quebrada Blanca and Andacollo produce cathode copper. Duck Pond produces copper and zinc concentrates. We report 100% of the production of Quebrada Blanca and Andacollo, even though we own 76.5% and 90%, respectively of these operations because we fully consolidate their results in our financial statements.

(2) The direct share of coal production includes our proportionate share of production from the Teck Coal Partnership (formerly Elk Valley Coal Partnership), which was 35% on February 28, 2003 and increased in various increments to 40% on April 1, 2006. Fording Canadian Coal Trust (Fording) owned the remaining interest in the Teck Coal Partnership. The indirect share of coal production was from our investment in units of Fording. We owned approximately 9% of Fording from February 28, 2003 to September 27, 2007 and on September 27, 2007 increased our interest in Fording to 19.95%. In October 2008, we acquired all of the assets of Fording, which consisted primarily of its 60% interest in the Teck Coal Partnership.

(3) Our Lennard Shelf zinc mine produced from April 2007 to August 2008 when it was permanently closed. Our Pend Oreille zinc mine has been on a temporary shutdown since February 2009.

(4) In 2005, refined zinc and lead production was affected by a three-month strike at our Trail metallurgical operation.

Our business is the exploration for and development and production of natural resources. Through our interests in mining and processing operations in Canada, the United States and South America we are an important producer of copper and one of the world’s largest zinc miners. We hold a 100% direct ownership in Teck Coal, the world’s second largest exporter of seaborne high quality coking coal. Our principal products are copper, metallurgical coal, and zinc. Lead, molybdenum, various specialty and other metals, chemicals and fertilizers are by-products produced at our operations. We also own a 20% interest in the Fort Hills oil sands project and a 50% interest in other oil sands leases in the Athabasca region of Alberta, Canada. In 2009 we sold our gold mines and results from those operations have been classified as discontinued operatio ns.

We manage our activities along commodity lines and are organized into business units as follows:

• Copper • Coal • Zinc • Energy • Corporate

Our energy business unit consists of our investments in our oil sands projects, which are in various stages of exploration and development. Our corporate business unit includes all of our activities in other commodities, our corporate growth initiatives and groups that provide administrative, technical, financial and other support to all of our business units.

Teck 2009 Management’s Discussion and Analysis 1

The comparability of business unit results between 2009 and 2008 was affected by two significant events. The first was the rapid deterioration in global economic conditions in the latter part of 2008 followed by a subsequent improvement throughout 2009. The deterioration that occurred in late 2008 contributed to a steep decline in the demand and selling prices for the commodities we produce. As a result, significant negative pricing adjustments reduced our revenues from base metals in the fourth quarter of 2008. With the improvement in the global economy in 2009, commodity prices improved significantly and this resulted in substantial positive pricing adjustments on our base metal revenues in 2009. The second event was our acquisition of Fording’s 60% interest in the coal assets in October, 2008. Our operating profit for the coal business uni t included 40% of Teck Coal’s operating profit for 10 months and 100% for two months in 2008 and 100% for the entire year in 2009. In addition, the acquisition of the coal assets resulted in a significant increase in the depreciation charge against the coal assets as the historical cost bases of the acquired assets were adjusted to reflect the acquisition cost. As a result of the US dollar denominated debt incurred to finance the Fording acquisition, and the favourable movement in the Canadian/US dollar exchange rate, our 2009 earnings included a significant non-cash foreign exchange translation gain.

Average commodity prices and exchange rates for the past three years, which are a key driver of our earnings, are summarized in the following table.

| | | | US$ | | | | | CDN$ | | |

| | 2009 | % chg | 2008 | % chg | 2007 | 2009 | % chg | 2008 | % chg | 2007 |

| | | | | | | | | | | |

| Copper (LME Cash – $/pound) | 2.34 | -26% | 3.17 | -2% | 3.23 | 2.67 | -21% | 3.37 | -3% | 3.46 |

| Coal (realized – $/tonne) | 157 | -23% | 205 | +109% | 98 | 177 | -20% | 220 | +110% | 105 |

| Zinc (LME Cash – $/pound) | 0.75 | -12% | 0.85 | -42% | 1.47 | 0.86 | -6% | 0.91 | -42% | 1.57 |

| Molybdenum (Platts* – $/pound) | 11 | -62% | 29 | -3% | 30 | 13 | -58% | 31 | -3% | 32 |

| Lead (LME Cash – $/pound) | 0.78 | -18% | 0.95 | -19% | 1.17 | 0.89 | -12% | 1.01 | -19% | 1.25 |

| Exchange rate (Bank of Canada) | | | | | | | | | | |

| US$1 = CDN$ | 1.14 | +7% | 1.07 | –% | 1.07 | | | | | |

| CDN$1 = US$ | 0.88 | -7% | 0.93 | –% | 0.93 | | | | | |

*Published major supplier selling price in Platts Metals Week.

Our revenue and operating profit before depreciation and amortization by business unit is summarized in the following table.

| | | Revenues | | | | | | Operating Profit Before Depreciation and Amortization* | |

| ($ in millions) | | 2009 | | | 2008 | | | 2007 | | | 2009 | | | 2008 | | | 2007 | |

| | | | | | | | | | | | | | | | | | | |

| Copper | | $ | 2,161 | | | $ | 2,156 | | | $ | 2,186 | | | $ | 1,284 | | | $ | 1,146 | | | $ | 1,459 | |

| Coal | | | 3,507 | | | | 2,428 | | | | 951 | | | | 1,795 | | | | 1,226 | | | | 249 | |

| Zinc | | | 2,006 | | | | 2,071 | | | | 3,052 | | | | 583 | | | | 439 | | | | 1,328 | |

| Total | | $ | 7,674 | | | $ | 6,655 | | | $ | 6,189 | | | $ | 3,662 | | | $ | 2,811 | | | $ | 3,036 | |

*Operating profit before depreciation and amortization is a non-GAAP financial measure. See use of non-GAAP Financial Measures section for further information.

Teck 2009 Management’s Discussion and Analysis 2

Copper

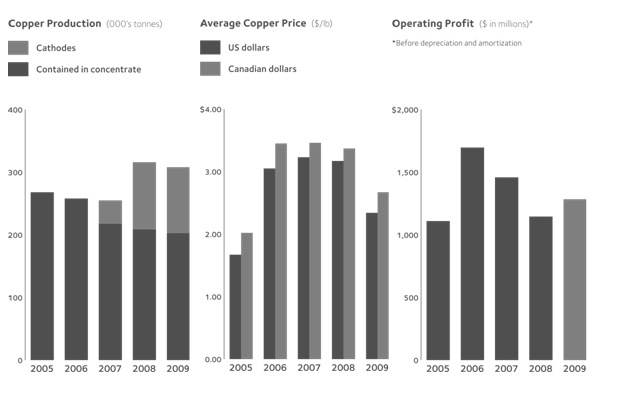

2009 Production: 308,000 tonnes

In 2009, we produced copper concentrates at Highland Valley Copper, Duck Pond and Antamina, in which we have a joint venture interest. Our Quebrada Blanca and Carmen de Andacollo mines in Chile produce cathode copper, with Andacollo transitioning to a concentrate producer in 2010. Significant amounts of zinc were produced in concentrates at both Antamina and Duck Pond, and Highland Valley Copper and Antamina produced significant amounts of molybdenum in concentrate.

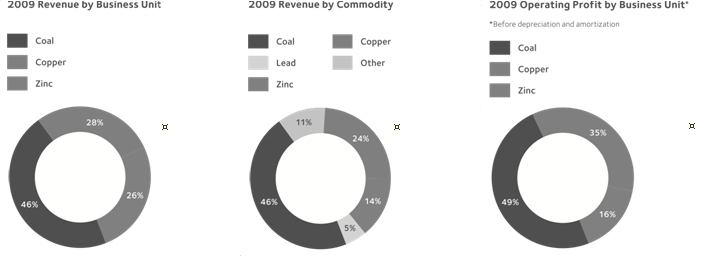

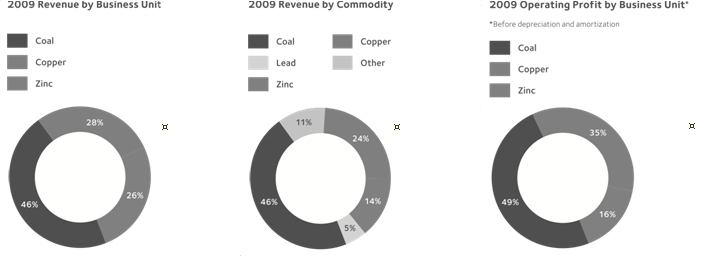

In 2009, our copper operations accounted for 28% of our revenue and 35% of our operating profit before depreciation and amortization.

| | | | | | Revenues | | | | | | Operating Profit Before Depreciation and Amortization |

| ($ in millions) | | 2009 | | | 2008 | | | 2007 | | | 2009 | | | 2008 | | | 2007 | |

| | | | | | | | | | | | | | | | | | | |

| Highland Valley Copper | | $ | 838 | | | $ | 789 | | | $ | 1,115 | | | $ | 473 | | | $ | 426 | | | $ | 776 | |

| Antamina | | | 634 | | | | 569 | | | | 775 | | | | 450 | | | | 368 | | | | 597 | |

| Quebrada Blanca | | | 484 | | | | 574 | | | | 215 | | | | 265 | | | | 267 | | | | 71 | |

| Andacollo | | | 101 | | | | 142 | | | | 46 | | | | 47 | | | | 72 | | | | 9 | |

| Duck Pond | | | 104 | | | | 82 | | | | 35 | | | | 49 | | | | 13 | | | | 6 | |

| Total | | $ | 2,161 | | | $ | 2,156 | | | $ | 2,186 | | | $ | 1,284 | | | $ | 1,146 | | | $ | 1,459 | |

| | | Production | | | Sales | |

| (000’s tonnes) | 2009 | 2008 | 2007 | 2009 | 2008 | 2007 |

| | | | | | | |

| Highland Valley Copper | 118 | 119 | 139 | 118 | 122 | 140 |

| Antamina | 71 | 77 | 74 | 73 | 76 | 74 |

| Quebrada Blanca | 87 | 86 | 30 | 83 | 85 | 32 |

| Andacollo | 18 | 21 | 7 | 17 | 21 | 7 |

| Duck Pond | 14 | 13 | 5 | 14 | 13 | 5 |

| Total | 308 | 316 | 255 | 305 | 317 | 258 |

Teck 2009 Management’s Discussion and Analysis 3

Markets

Copper

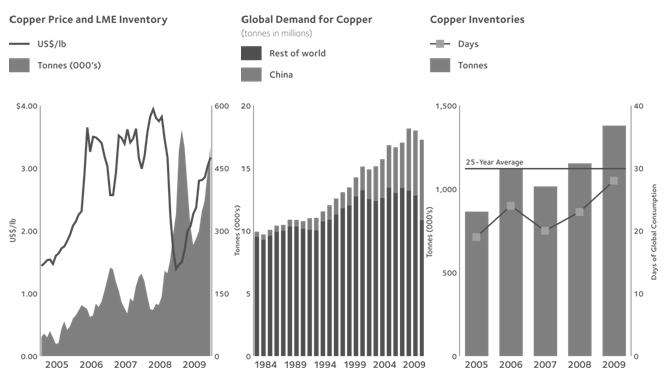

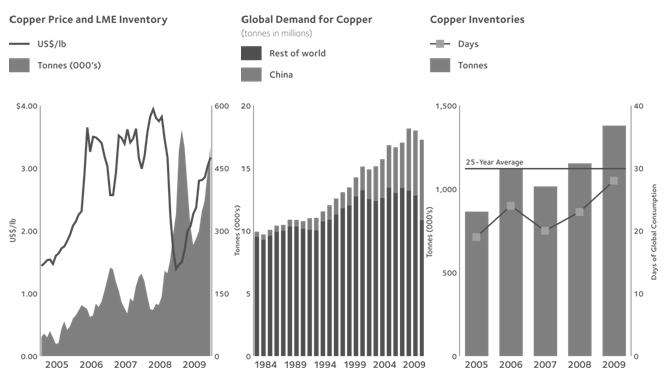

Copper prices recorded their largest yearly increase on record in 2009. London Metal Exchange (LME) copper prices ended 2008 at US$1.32 per pound, a level not seen since 2004, but by December 2009 LME copper prices had increased 153% to end the year at US$3.33 per pound. Copper prices per pound averaged US$2.34 in 2009, down US$0.83 from the 2008 average of US$3.17. Global refined copper consumption fell by 1.3% in 2009. Most of the decline took place in the developed world. In North America, demand was down 9%. In Europe, demand was down 12% in Germany and 9% in France. In China, apparent consumption as reported by the International Copper Study Group (ICSG) was up 42% in 2009. This increase was due in large part to the rapid deployment of stimulus spending and infrastructure spending by the Chinese government as well as the restocking of strategic stockpiles and a certain amount of speculative buying. Chinese imports of copper concentrates rose 18% to 1.8 million tonnes of contained copper in 2009. Chinese imports of scrap copper fell 28% to 1.2 million tonnes of contained copper in 2009 and imports of refined copper increased 129% to 3.1 million tonnes. In 2009, China’s copper smelting capacity increased by 290,000 tonnes, while global capacity outside of China increased by 340,000 tonnes, keeping the global copper concentrate market in a structural deficit. Although a surplus of copper metal occurred in the global marketplace in 2009, a continuation of the mine production disruptions could again push the metal market into deficit in 2010. | | Total mine production including solvent extraction and electrowinning (SX-EW) was little changed over 2008, but was down over 600,000 tonnes from what had been projected at the beginning of the year. Several of the economic production cutbacks made at the beginning of the year were rescinded by the end of the year as prices improved. When combined with an increase in production from Chile, this resulted in flat production globally. Despite record high copper prices over the past four years, copper concentrate production globally has shown little change from where it was in 2005. This lack of growth has been due to pit stability issues, mill failures, weather, labour unrest and lower overall grades at many of the largest copper mines in the world. The copper industry is projecting a 7% increase in global concentrate production in 2010, barring any u nforeseen events. However, even this increase is expected to be insufficient to meet demand from the smelting industry. Copper stocks on the LME rose in the first quarter of 2009 by 60% as producers and consumers tried to monetize surplus inventories. By the end of the first half, those stocks had been removed and shipped to Asia, hence LME stocks in June 2009 were down by 20%. As the differential between the domestic Chinese copper price and the LME price began to decline, stocks started reappearing on the LME so that by the end of December 2009, LME stocks were up 163,000 tonnes to 502,000 tonnes. Copper stocks on the Shanghai Futures Exchange (“SHFE”) were up 77,000 tonnes or over 400% from the beginning of the year, albeit from a very low base of only 18,000 tonnes. At the end of 2009 total global stocks were up 233,000 tonnes compared with the end of 2008. Total global stocks (producer, consumer, merchant and terminal stocks) stood at 28 days of global consumption while 25-year average levels are estimated at 30 days of global consumption. |

Teck 2009 Management’s Discussion and Analysis 4

Molybdenum Molybdenum oxide prices averaged US$11 per pound in 2009, 62% lower than the 2008 price of US$30 per pound. Prices started the year at US$9.60 per pound, and fell to their lowest level since 2004 in April to US$7.90 per pound. Prices made a short recovery in September to just over US$18 per pound on speculation of improving demand and tight supply, however this was short-lived and prices retreated to US$11 per pound where they have remained since October 2009. China’s net imports of molybdenum containing materials, increased to 26,000 tonnes of contained molybdenum in 2009. By comparison, net exports in 2008 were 230,000 tonnes, a net change of over 49,000 tonnes or 108 million pounds of molybdenum that were unavailable to the western world. Due to these price considerations, global mine production in 2009 was cut significantly with several primary and by-product mines curtailing production in the first half of the year. Several of these cutbacks remain in place and will continue into 2010. We are projecting mine production in 2010 will increase between 7% and 9% due to the restart and resumption of full production at a number of by-product mines and primary western mines. However, this will still not bring us back to 2007 production levels. Going forward, major primary projects that had been slated for production in 2011/12 have likely been delayed due to the lower prices and could impact the global balance when market demand returns. Global steel production has improved from the low levels of the first quarter of 2009, when many US mills were running below 40% of capacity. While capacity utilization outside China did improve in 2009, the industry as a whole is still running below levels seen in 2008. Demand for molybdenum from the steel mills should be better in 2010 than in 2009, but may not reach 2007 levels for several years. Operations Highland Valley Copper Mine We have a 97.5% interest in Highland Valley Copper, located in south central British Columbia. Operating profit before depreciation and amortization was $473 million in 2009 compared with $426 million in 2008 and $776 million in 2007. Highland Valley’s 2009 copper production was 118,200 tonnes, which was within 1% of production for 2008. Molybdenum production was higher than 2008 levels at 6.6 million pounds due to higher ore grades. Highland Valley Copper is executing a two-phase mine life extension that requires push backs of the east and west walls of the Valley pit to facilitate mining until 2020. Stripping of the west wall began in mid-2009 after we successfully obtained the required permits. The work will continue through to 2013. Redesign of the east and southeast Valley pit walls was required to address slope stability concerns. This included additional waste stripping in the upper soil layers, further dewatering efforts and the placement of stabilization buttresses to ensure long-term stability. These efforts will be ongoing in 2010 and 2011. To handle this activity more mining equipment has been added to the mine’s fleet. Costs for both the additional east wall stripping and the west wall push back are being capitalized. The redesign of the Valley pit will result in continued low-grade feed to the ore processing circuit in 2010 and 2011. Highland Valley’s production in 2010 is estimated at 105,000 tonnes of copper and 5.8 million pounds of molybdenum. | | Antamina Mine We have a 22.5% interest in the Antamina mine, a large copper and zinc mine at high elevation in Peru. Our partners are BHP Billiton (33.75%), Xstrata plc (33.75%) and Mitsubishi Corporation (10%). In 2009, our share of operating profit before depreciation and amortization was $450 million compared with $368 million in 2008 and $597 million in 2007. Production figures at Antamina reflected a different distribution between available copper ores and copper-zinc ore than in previous years. Consequently, copper production was 316,100 tonnes in 2009, 8% lower than in 2008. This was due to the lower ore tonnage and copper grades available from the pit. By contrast, zinc production increased by 31% to 456,300 tonnes in 2009 as a result of higher ore grades and the processing of greater proportions of copper-zinc ores in the year. Molybdenum production totalled 5.5 million pounds, lower than in 2008, due to lower head grades. Antamina engaged in several major projects during 2009, including further raising of the tailings dam and ore-feed systems allowing direct feed to the ball mills. Antamina completed the study and design of a significant expansion of milling and flotation capacity that was approved in early January 2010. The expansion, with an estimated cost of US$1.3 billion, is expected to increase ore throughput by approximately 38% to 130,000 tonnes per day, and annual production of copper and zinc by approximately 30% on completion in late 2011. Antamina’s production in 2010 is expected to be 305,000 tonnes of copper, 344,000 tonnes of zinc and 7.7 million pounds of molybdenum. Quebrada Blanca Mine Quebrada Blanca is located in northern Chile, 240 kilometres southeast of the city of Iquique, at 4,400 metres elevation. We own 76.5% of Quebrada Blanca. Our partners are Inversiones Mineras S.A. (“IMSA”) 13.5% and Empresa Nacional de Minera (“ENAMI”) 10%. The operation mines ore from an open pit and leaches the ore to produce copper cathodes via a conventional SX-EW process. Operating profit before depreciation and amortization was $265 million in 2009 compared with $267 million in 2008 and $71 million in 2007. Operating results for 2007 reflect that we took ownership in late August that year. Quebrada Blanca’s supergene ore body is expected to be mined out by 2014, but copper cathode production is expected to continue until about 2016. Production from Quebrada Blanca in 2009 was 87,400 tonnes, representing a new production record. Production of 85,000 tonnes of copper cathode is anticipated in 2010. At the start of the third quarter of 2009, scoping study work on the Quebrada Blanca hypogene project was initiated. This phase of the hypogene project encompasses infill drilling to improve the confidence level associated with the resource, enabling us to update our resource model accordingly. Metallurgical test work was also undertaken to confirm the process flow sheet (the process design needed to extract the resource) in a series of trade-off studies to confirm plant location and the estimation of projected capital and operating costs. By the end of 2009 approximately 19,000 metres of infill drilling had been completed. At present, there are five drill rigs on-site continuing with the infill drilling. |

Teck 2009 Management’s Discussion and Analysis 5

Carmen de Andacollo Mine We have a 90% interest in the Carmen de Andacollo mine in Chile, which is located 350 kilometres north of Santiago. The remaining 10% is owned by ENAMI. Operating profit before depreciation and amortization was $47 million in 2009 compared with $72 million in 2008 and $9 million in 2007. Operating results for 2007 reflect that we took ownership in late August that year. Carmen de Andacollo produced 17,900 tonnes of copper cathode in 2009, lower than in 2008 due to the lower ore grades available in the remaining supergene resource. Carmen de Andacollo’s copper cathode production for 2010 is estimated at only 10,000 tonnes as the supergene resource is nearing depletion and is expected to be exhausted in 2011. Development of the mine’s 55,000 tonnes per day copper concentrator project continued throughout 2009, with issues associated with process water supply being resolved in December. Mechanical completion occurred at the end of 2009 with the first ore sent to the crusher on December 6, 2009 and fed to the concentrator grinding circuit on January 19, 2010. Design capacity is expected to be reached during the first half of 2010 and if successful, we expect to produce 55,000 tonnes of copper contained in concentrate in the year. The new plant is expected to produce 80,000 tonnes of copper and 55,000 ounces of gold in concentrate annually over the first 10 years of the operation. The initial project is on track to be completed for the forecasted cost of US$435 million, of which US$423 million had been spent by December 31, 2009. Two additional projects associated with the hypogene project have been approved. The Elqui River water supply project has an estimated cost of US$40 million and will provide a long-term supply of process water for the concentrator. In addition, a cover to minimize the generation of dust will be constructed for the coarse ore stockpile at a cost of US$8 million. In January 2010, Andacollo completed the previously announced sale of an interest in future gold production to Royal Gold, Inc. (“Royal Gold”). Proceeds to Andacollo, on a 100% basis, were US$218 million and 1.2 million common shares of Royal Gold, valued at US$56 million. Royal Gold’s production entitlement is equivalent to 75% of the payable gold produced until total cumulative production reaches 910,000 ounces of gold, and 50% thereafter. | | Duck Pond Mine The Duck Pond copper-zinc mine is located in central Newfoundland and achieved commercial production in April 2007. Duck Pond’s operating profit before depreciation and amortization was $49 million in 2009, compared with $13 million in 2008 and $6 million in 2007. Operating results for 2007 reflect that we took ownership in late August that year. Copper production was 13,900 tonnes while zinc production was 21,000 tonnes. Development of the lower ore zones was completed in 2009, allowing access to new production areas. Duck Pond’s production in 2010 is projected to be 15,000 tonnes of copper and 25,000 tonnes of zinc in concentrate. |

Teck 2009 Management’s Discussion and Analysis 6

Coal

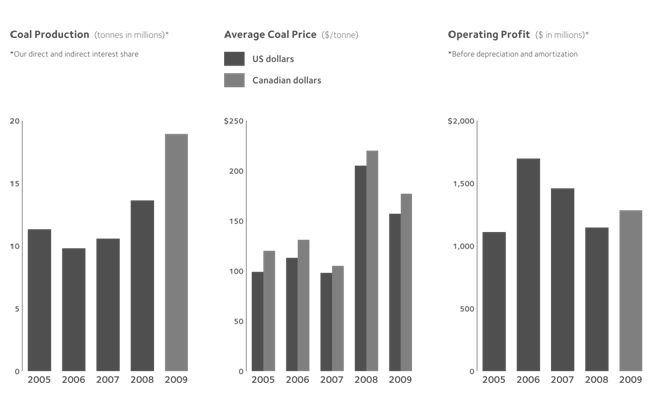

2009 Production: 19 million tonnes

Through October 29, 2008, our coal business included a 52% direct and indirect interest in Teck Coal Partnership (formerly Elk Valley Coal Partnership). We increased our ownership to 100%, effective October 30, 2008, with the purchase of the assets of Fording Canadian Coal Trust.

Teck Coal operates five metallurgical coal mines in British Columbia and one in Alberta. Together, these mines represent the world’s second largest exporter of seaborne hard coking coal, substantially all of which is used in the production of steel.

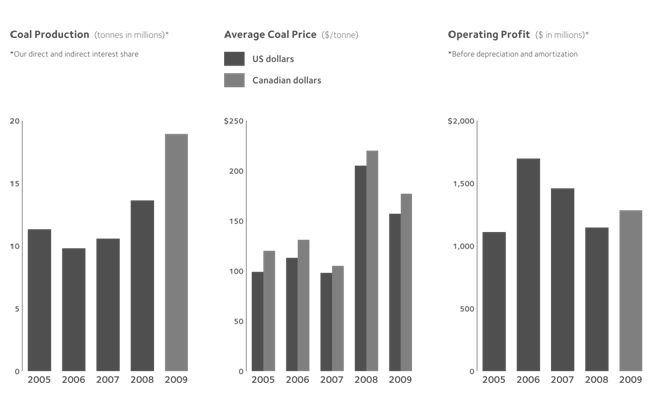

In 2009, our coal operations accounted for 46% of revenue and 49% of operating profit before depreciation and amortization.

| ($ in millions) | | 2009 | | | 2008 | | | 2007 | |

| | | | | | | | | | |

| Revenues | | $ | 3,507 | | | $ | 2,428 | | | $ | 951 | |

| Operating profit before depreciation and amortization | | $ | 1,795 | | | $ | 1,226 | | | $ | 249 | |

| | | | | | | | | | | | | |

| Production volumes – 100% basis (000’s tonnes) | | | 18,930 | | | | 23,009 | | | | 22,561 | |

| Sales volumes – 100% basis (000’s tonnes) | | | 19,767 | | | | 22,978 | | | | 22,677 | |

Markets

Coal

The extraordinary volatility in the global steel and metallurgical coal industries continued in 2009, with the first half of the year marked by sudden and severe reductions in steel production and commensurate falls in the demand for metallurgical coal. This period of decline was followed by a recovery in the second half of the year. Prior to 2009, China had not been a major importer of seaborne coking coal, but the country began to import significant quantities in 2009. Market expectations are that China will import even greater quantities in 2010. These sales to China represent a significant and increasing share of the total seaborne coking coal market. In addition, most steel producers outside China moderately increased their production levels from the early 2009 lows in response to higher steel prices and the global economic recovery. We have t aken steps to increase our production levels to meet the additional demand created by this market upturn. We now project our coal production in 2010 to be 23.5 to 25 million tonnes and are actively planning for further production increases in 2011 and 2012.

Teck 2009 Management’s Discussion and Analysis 7

Mine and infrastructure capacity constraints continue to limit the global supply of seaborne coking coal. Relatively few new resources of high quality hard coking coal have been developed in recent years. Increasing demand and constrained supply have resulted in a tight market and upward pressure on prices ahead of the next round of negotiations for the 2010 coal year. Current market sentiment suggests that coal prices will increase when compared to the 2009 coal year. We also expect that a portion of our sales volumes in 2010 will be priced on a shorter pricing cycle as opposed to the traditional coal year. A shorter pricing cycle would create more frequent adjustments to coal prices during the year. The near-term outlook for seaborne coking coal is positive and has largely been driven by developments in China. Any substantial disruption in China’s economic growth or an increased supply of hard coking coal from domestic Chinese suppliers could alter the demand and supply dynamics. On the supply side, developments of new resources of high quality hard coking coal and infrastructure improvements in Australia and Mozambique appear to have accelerated in response to the current market. Operations Coal sales volumes of 19.8 million tonnes were down 14% from 2008 due to very weak demand and production cutbacks in early 2009. The markets recovered later in the year, but our sales were then constrained by our clean coal production levels and severe weather. Significant reductions in deliveries to our traditional contract customers were partially mitigated by increased sales to new markets, primarily in China. During the 2009 calendar year, we sold approximately 4 million tonnes of coal to new markets. Customers in Asia accounted for over two-thirds of our 2009 sales volume. Historically, Asia represented about half of our sales volume. Our realized coal price was C$177 (US$157) per tonne in 2009 compared with C$220 (US$205) per tonne in 2008. The lower average US dollar selling price in 2009 primarily reflects the lower contract price settlements for the 2009 coal year that commenced April 1. During 2009, approximately 5 million tonnes were delivered at higher 2008 contract prices. In addition, we agreed to settle the unfulfilled 2008 carryover obligations of several customers in exchange for lump sum cash payments totalling $55 million, recording this as other non-operating income. At year’s end, we had approximately 0.8 million tonnes of carryover remaining from the 2008 coal year. For the 2009 coal year, we reduced annual contract tonnages in response to lower intake by our traditional customers. This allowed us to develop new markets and should result in lower levels of carryover tonnage from the 2009 coal year into the next contract period. | | Operating profit before depreciation and amortization reflects our 100% interest in Teck Coal for all of 2009 compared with only two months at the 100% level in 2008. Operating profit before depreciation and amortization was $1.8 billion in 2009 compared with $1.2 billion in 2008, as our increased ownership interest was partially offset by the lower coal price and reduced sales volumes in 2009. Operating profit also reflects higher unit production costs and lower unit transportation costs. Strip ratios were higher in 2009 and the lower production levels increased our fixed costs per tonne of coal produced. These cost increases were partially mitigated by lower diesel fuel prices. Unit transportation costs decreased due primarily to lower rail rates with Canadian Pacific Railway for the westbound transportation of coal from our five British Columbia minesites as well as lower port loading costs at Westshore Terminals, which were variable in part with average Canadian dollar selling prices. The current westbound arrangements with Canadian Pacific Railway expire in April. Negotiations regarding a replacement contract are underway. In February 2010, we agreed with Westshore Terminals on terms for the shipment of 3 million tonnes of coal per year from our Elkview, Cardinal River and Line Creek mines over the next two years at fixed rates. Under the prior Elkview agreement, which expires on March 31, 2010, port rates varied with the price of coal. The agreement under which Westshore Terminals handles coal for our Fording River, Greenhills and Coal Mountain mines was also amended. Commencing April 1, 2011 to the end of the term of the new contract on February 29, 2012, none of our port charges will be linked to the price of coal. In addition to our ongoing use of the Westshore Terminals facility, we expect to ship additional coal through Neptune Terminals, in which we hold a 46% interest. |

Teck 2009 Management’s Discussion and Analysis 8

Zinc

| 2009 Production: | 711,000 tonnes of zinc in concentrate 240,000 tonnes of refined zinc |

Our zinc business unit includes our Trail refining and smelting complex and the Red Dog mine. Our Lennard Shelf mine in Western Australia was permanently closed in August 2008, and Pend Oreille was placed on care and maintenance in February 2009.

In 2009, our zinc operations accounted for 26% of revenue and 16% of operating profit before depreciation and amortization.

| | | Revenues | Operating Profit (Loss) Before

Depreciation and Amortization |

| ($ in millions) | | 2009 | | | 2008 | | | 2007 | | | 2009 | | | 2008 | | | 2007 | |

| | | | | | | | | | | | | | | | | | | |

| Trail | | $ | 1,190 | | | $ | 1,442 | | | $ | 1,839 | | | $ | 122 | | | $ | 208 | | | $ | 396 | |

| Red Dog | | | 986 | | | | 703 | | | | 1,434 | | | | 473 | | | | 240 | | | | 885 | |

| Other | | | 50 | | | | 117 | | | | 166 | | | | 7 | | | | (26 | ) | | | 31 | |

| Inter-Division Sales | | | (220 | ) | | | (191 | ) | | | (387 | ) | | | (19 | ) | | | 17 | | | | 16 | |

| Total | | $ | 2,006 | | | $ | 2,071 | | | $ | 3,052 | | | $ | 583 | | | $ | 439 | | | $ | 1,328 | |

| | Production | Sales |

| (000’s tonnes) | 2009 | 2008 | 2007 | 2009 | 2008 | 2007 |

| | | | | | | |

| Refined zinc | | | | | | |

| Trail | 240 | 270 | 292 | 243 | 266 | 292 |

| | | | | | | |

| Contained in concentrate | | | | | | |

| Red Dog | 583 | 515 | 575 | 556 | 529 | 576 |

| Pend Oreille and | | | | | | |

| Lennard Shelf | 5 | 51 | 50 | 5 | 53 | 47 |

| Other business units | 123 | 97 | 74 | 120 | 96 | 73 |

| Total | 711 | 663 | 699 | 681 | 678 | 696 |

Teck 2009 Management’s Discussion and Analysis 9

Markets Zinc Global zinc consumption is estimated to have declined by more than 5% in 2009. In late 2008 as the economic crisis took hold, most consumers stopped purchasing metal and instead started to destock their own inventories. Faced with reduced demand, refined metal producers curtailed production and closed their operations rather than build up inventories. By the end of 2009 global demand started to pick up as the global economic crisis faded, destocking came to an end and in some countries government stimulus packages started to buoy demand from low levels. Refined production cutbacks already in place came to an end and producers started producing at normal levels again. In 2009, London Metal Exchange stocks rose by 235,000 tonnes or 92% to 488,000 tonnes. We estimate that total reported refined inventories (LME, SHFE, Producer, Consumer and Merchant) at the end of 2009 were 1,115,000 tonnes or 38 days of global consumption, just below the 25-year average of 39 days of global consumption. Prices started the year at US$0.55 per pound and rose throughout the year to finish the year at US$1.17 per pound. In 2009, the average price was US$0.75 per pound, down from the 2008 average of US$0.85 per pound. In 2009 China imported 61% more zinc concentrates than in 2008. This was a result of continuing growth in refined production and capacity, while domestic mine production was reported to have declined from 2008 levels. China was a net importer of 640,000 tonnes of refined zinc in 2009, compared to 112,000 tonnes in 2008. | | The zinc concentrate market in 2009 was a balanced market. As the price of zinc rose steadily throughout 2009, some mines restarted production. According to the International Lead and Zinc Study Group (ILZSG), global mine production fell over 300,000 tonnes of contained zinc in 2009 versus 2008. In 2010, we believe that global zinc metal demand will grow at above trend growth as a restocking of inventories will occur. This restocking will add to growth from positive industrial production forecasts. We also believe the global zinc concentrate market will move into a structural deficit as smelters return to full production rates and smelting capacity grows at a greater rate than mine production. In spite of the cuts in metal production from planned levels, mine production and ultimately refined production should increase at a greater rate than refined demand so we believe the global refined market will be well supplied in 2010. Historically, surpluses in metal have resulted in high exchange stocks and have put downward pressure on prices. However, since March 2009 the price of zinc more than doubled by the end of the year at a time when LME stocks increased by 42%. Prices have been moving up buoyed by the renewed interest of investment funds in commodities as an asset class and weakness in the US dollar. |

Teck 2009 Management’s Discussion and Analysis 10

Lead The global market for refined lead was in surplus in 2009 after four consecutive years of deficit and one balanced year. The LME cash price started 2009 at US$0.47 per pound and finished the year at US$1.09 per pound. The price averaged US$0.78 per pound in 2009, down from the 2008 average of US$0.95 per pound. LME stocks rose 101,000 tonnes in 2009 and finished the year at 146,500 tonnes. As a result of the global economic crisis, global refined lead consumption fell for the first year since 2001, down by 1% from the 2008 level. The recession prompted the largest contraction in lead demand since a 5.4% year-on-year fall in 1980 as a result of the US-led recession that started that year. In 2009, lead demand contracted in all the major regions and economies, with the notable exception being China. We believe growth in refined lead consumption will rebound in 2010. Supply will grow at a greater rate due to increased secondary production of batteries, which is lead’s number one end use. We expect a modest surplus of refined lead in 2010. Reported refined lead stocks (LME, Producer, Consumer & Merchant) at the end of 2009 stood at 375,000 tonnes which represented 16 days of global consumption, well below the 25-year average of 26 days. These low stocks do not provide a significant cushion for higher than expected demand growth. | | |

Teck 2009 Management’s Discussion and Analysis 11

Operations Trail Metallurgical Operations Our Trail Operations, located in British Columbia, include one of the world’s largest fully integrated zinc and lead smelting and refining complexes and the Waneta hydroelectric dam and transmission system. The metallurgical operations produce refined zinc and lead and a variety of precious and specialty metals, chemicals and fertilizer products. The Waneta Dam provides power to the metallurgical operations. Historically, power that was surplus to our requirements has been sold through the transmission system to customers in British Columbia and the United States. In 2009 we entered into an agreement to sell a one-third interest in the Waneta Dam, representing substantially all of our previous surplus power generation, to BC Hydro for $825 million. Trail metal operations contributed $82 million to operating profits before depreciation and amortization in 2009 compared with $146 million in 2008, with the reduction due primarily to lower prices for zinc, lead, specialty metals and sulphur products and lower sales volumes that reflected the downturn in the economy. Refined zinc production totalled 240,000 tonnes in 2009 compared with 270,000 tonnes the previous year. Trail Operations curtailed zinc production from a monthly capacity of 25,000 tonnes to approximately 20,000 tonnes during the first eight months of the year in response to decreased customer demand. As demand for product increased in the third and fourth quarters, we returned to full zinc production capacity, but were constrained by some operational issues in the zinc electrolytic plant. These issues are being resolved at the time of writing. Refined lead production of 72,600 tonnes was 12,400 tonnes less than that of 2008. Operational issues in the drossing plant, where the lead is purified, continued into 2009 and culminated in maintenance work being moved into the fourth quarter of 2009. This necessitated a 20-day shutdown of the lead smelter to complete repairs. By the end of 2009, the lead smelter had returned to full production. In 2010, we expect to produce 290,000 tonnes of zinc, 80,000 tonnes of lead and 21 million ounces of silver. The Waneta Dam is one of several hydroelectric generating plants in the region operated through contractual arrangements under which we currently receive approximately 2,800 gigawatt hours of energy entitlement per year, regardless of the water flow available for power generation. Lower average power sales prices and an increasing Canadian/US dollar exchange rate reduced operating profit from surplus power sales before depreciation and amortization to $40 million in 2009, down $22 million from the previous year. Surplus power sales volumes were slightly higher than the previous year as a result of the zinc production curtailment. In June 2009, we agreed to sell a one-third interest in the Waneta Dam to BC Hydro for $825 million, with provision for firm supply of power until January 1, 2036. This transaction closed on March 5, 2010. Capital expenditures for the year totalled $25 million, related to projects required to sustain operations, with each totalling less than $3 million. | | Our electronic waste recycling program reached a milestone in October, having processed 25,000 tonnes of material since the program began in 2006. Our goal is to treat 11,500 tonnes in 2010 as a result of an expansion in the types of electronic waste that will be accepted at collection sites effective this July. In conjunction with the British Columbia Ministry of Environment, we are also conducting tests related to the recycling of zinc alkaline batteries and fluorescent bulbs. Red Dog Mine Red Dog’s location in northwest Alaska exposes the operation to severe weather and winter ice conditions, which can significantly impact production, sales volumes and operating costs. In addition, the mine’s bulk supply deliveries and all concentrate shipments occur during a short ocean shipping window that normally runs from early July to late October. This short ocean shipping window means that Red Dog’s sales volumes are normally higher in the last six months of the year, resulting in significant volatility in its quarterly earnings, depending on metal prices. In 2009, both zinc and lead production were higher than in 2008 due to increased mill operating rates and online time resulting from a number of site-driven performance improvement initiatives. A new annual production record was set for metal in concentrate in 2009, breaking the prior record set in 2007. Red Dog’s 2009 shipping season began on June 30 and was completed on October 18. Final tonnages shipped for 2009 were 1,020,000 tonnes of zinc concentrate and 220,000 tonnes of lead concentrate. Metal available for sale from January 1, 2010 to the beginning of next year’s shipping season is 227,000 tonnes of contained zinc in concentrate and 3,000 tonnes of contained lead in concentrate. In accordance with the operating agreement governing the Red Dog mine, the royalty to NANA Regional Corporation Inc. (“NANA”), our Regional Alaskan Native Corporation partner, is at 25% of net proceeds of production. The NANA royalty charge in 2009 was US$128 million compared with US$92 million in 2008. The net proceeds royalty will increase by 5% every fifth year to a maximum of 50%. The increase to 30% of net proceeds of production will occur in 2012. NANA has advised us that it ultimately shares approximately 62% of the royalty with other Regional Alaskan Native Corporations pursuant to section 7(i) of the Alaskan Native Claims Settlement Act. Red Dog’s operating profit before depreciation and amortization was $473 million compared with $240 million in 2008. The higher 2009 operating profit was mainly due to higher metal prices, lower fuel costs and higher production levels achieved as a result of a number of site-wide performance improvement initiatives. Major capital projects in 2009 included US$15 million for tailings dams and US$14 million on other sustaining capital projects. The dewatering of our five-hole shallow shale-gas exploration wells was completed at year end. Additional drilling and capital expenditure decisions are pending completion of the reservoir calculations by a third-party engineering firm. The results of this analysis are anticipated in the second quarter of 2010. We expect 2010 production to be approximately 550,000 tonnes of zinc in concentrate and 95,000 tonnes of lead contained in concentrate. 2010 production is forecast to be lower than 2009 due to the lower ore grades expected in the bottom of the main pit. |

Teck 2009 Management’s Discussion and Analysis 12

Aqqaluk Permitting On receipt of Supplemental Environmental Impact Statement (“SEIS”) and new National Pollutant Discharge Elimination System (NPDES) and other required permits, we expect to start pre-stripping of the Aqqaluk deposit in 2010. It is anticipated that the Aqqaluk deposit will be the main ore supply for the next 20 years, from 2011 onwards. On December 15, 2009, the State of Alaska issued a certification of the NPDES Permit to be issued by the US Environmental Protection Agency (“EPA”) under Section 401 of the US Clean Water Act. On January 15, 2010, local tribal and environmental groups filed an appeal of the certification asserting that certain provisions do not comply with the Clean Water Act. If successful, the appeal could result in revisions to the NPDES Permit. The certification will remain in effect pending resolution of the appeal and will not affect the development of the Aqqaluk deposit. On January 8, 2010, the EPA approved the Aqqaluk SEIS and, simultaneously, issued the new NPDES Permit. On February 16, 2010, the same groups that appealed the 401 Certification filed a petition for review of the NPDES Permit. On February 26, 2010, the EPA notified us that, as a result of the appeal, the conditions of the new permit governing effluent limitations for lead, selenium, zinc, cyanide and total dissolved solids (TDS) are stayed pending a resolution of the appeal by the Environmental Appeal Board. Until then, the corresponding provisions of our existing permit will remain in effect. The existing permit contains an effluent limitation for TDS that the mine cannot meet. We will be discussing that issue with EPA and awaiting the issuance of a wetlands permit before proceeding with a decision on the development of Aqqaluk. Other State and local permits required for the development of Aqqaluk were received in December. The appeal period for those permits has expired. The wetlands permit from the Army Corps of Engineers is the only outstanding agency authorization and is undergoing final agency review. There is no specific period established for an appeal of this permit. An appeal of the SEIS or wetlands permit could also delay access to the Aqqaluk deposit. Our current operating plan is to continue to mine the main pit until mid-2011, but to maintain efficient production rates, this ore will eventually need to be supplemented with ore from Aqqaluk. Permit appeals that delay access to Aqqaluk could affect our transition plan and production at Red Dog could be curtailed in October, 2010. We and our partner, NANA, have been working with the public agencies involved and have held discussions with some of the appellants. While we believe that the regulatory process has been appropriate and robust and will be sustained on appeal, there can be no assurance that appeals will not delay the development of Aqqaluk. We are developing contingency plans to minimize the potential disruption to the operation from an appeal. | | Other Zinc Operations Our Pend Oreille mine, located in northeastern Washington State, produced zinc and lead concentrates that were delivered to our Trail smelter 80 kilometres to the northwest, in British Columbia. The mine was shut down and placed on care and maintenance in February 2009 due to reduced metal demand and weak zinc prices. A core group of employees are working to keep the site ready in anticipation of a restart in the future. All regulatory and environmental requirements are being met. The mine produced 4,800 tonnes of zinc and 900 tonnes of lead in 2009 before it was placed on care and maintenance compared with 35,000 tonnes of zinc and 5,700 tonnes of lead in 2008. |

Teck 2009 Management’s Discussion and Analysis 13

Energy Our energy business unit has recoverable contingent bitumen resources of approximately 1.6 billion barrels, which includes our 20% interest in the Fort Hills oil sands project and our 50% interest in the Frontier and Equinox oil sands projects that we jointly own with UTS Energy Corporation (“UTS”). We also have a 50% interest in various other oil sands leases, including the Lease 421 Area, which are in the exploration phase. All of these properties are located in the Athabasca region of northeastern Alberta, Canada. The disclosure below includes references to contingent bitumen resource estimates. Further information on these estimates, and the risks and uncertainties relating thereto, is set out in our most recent Annual Information Form filed on SEDAR and under cover of Form 40F on EDGAR. There is no certainty that it will be commerc ially viable to produce any portion of the contingent resources. Our oil sands projects are expected to be long-life assets, located in a politically stable jurisdiction with limited exploration risk, employing conventional technologies that build upon our core skills of developing large-scale truck and shovel mining operations. Fort Hills Oil Sands Project The Fort Hills oil sands project is located approximately 90 kilometres north of Fort McMurray in Northern Alberta. We hold a 20% interest in the Fort Hills Energy Limited Partnership (the “Fort Hills Partnership”), which owns the Fort Hills oil sands project with 20% being held by UTS and the remaining 60% held by the operator of the project, Suncor Energy Inc. (“Suncor”), which became operator and a partner by way of a merger with Petro-Canada in August 2009. At December 31, 2009, our best estimate of our 20% share of the recoverable bitumen at Fort Hills is 678 million barrels. To the end of 2009, approximately $2.9 billion has been spent on the Fort Hills project. Our share was $901 million, of which $271 million was spent in 2009. In connection with our ownership interest, our future commitment is to fund 27.5% of the next $4.6 billion of project spending and our 20% pro rata share thereafter. During 2009 the Fort Hills project: •reached an agreement with the Government of Alberta to extend the term of its oil sand leases until July 31, 2019, in exchange for a commitment to upgrade the bitumen produced from the second phase of the Fort Hills oil sands project in Alberta. If the project is not producing bitumen by 2019, it is possible that the Fort Hills leases could be forfeited to the government, and •received conditional approval from the Energy Resources Conservation Board (“ERCB”) for most aspects of proposed amendments to the mine, which include revisions to its footprint to enable construction to proceed for the first phase of the mine and extraction portion of the project. The ERCB requested a revised assessment of the cumulative effects and mine plan by December 31, 2010 to facilitate the request to increase the total recoverable resource. The timing of a final investment decision on the Fort Hills oil sands project depends both on improvements in commodity prices and financial markets and on the results of a project review currently being undertaken by Suncor. Spending on the project has been significantly reduced and the workforce downsized to allow the project review to be completed. Suncor has provided a forecast project spending estimate of $33 million for 2010, of which our share would be $9 million, including our earn-in commitments, compared with our $271 million share in 2009, assuming the planned regulatory work is completed during 2010. | | Recent economic conditions and the project review being undertaken by Suncor have increased the uncertainty around the probability of realizing future benefits from certain costs incurred to advance the mine and bitumen production facilities and the engineering of the upgrading portions of the project. Accordingly, asset impairment charges have been recorded against various project related costs, materials and contracts, including related contract cancellation charges. In 2009, we recorded an equity loss of $119 million from our Fort Hills oil sands investment as a result of the deferral of the upgrader portion and the delay of the mine and bitumen production portion of the project. Teck/UTS Joint Venture We have jointly acquired, with UTS, oil sands leases located near the Fort Hills project totalling approximately 124,000 hectares. To date, we have spent $348 million for our 50% share of the acquisition, exploration and engineering costs of these leases of which $59 million was spent in 2009. We expect to spend approximately $25 million for our share of studies and exploration drilling planned for 2010. Frontier and Equinox Projects The Equinox oil sands project is located immediately west of the Fort Hills project and the Frontier oil sands project, which includes Lease 311, is approximately 10 kilometres north of the Equinox project. The Equinox oil sands project consists of approximately 2,890 hectares of oil sands lease and our best estimate is that our 50% interest represents 166 million barrels of recoverable bitumen. The Frontier oil sands project consists of approximately 26,112 hectares of oil sands leases and our best estimate is that our 50% interest in the Frontier project represents approximately 725 million barrels of recoverable bitumen. In February 2009, we received the final terms of reference for the Environmental Impact Assessment for both the Frontier and Equinox projects. This establishes the terms to complete the Environmental Impact Assessment for submission to Alberta Environment. Pilot plant testing on ore recovered from Frontier and Equinox leases was conducted during 2009. The operational phase of the pilot plant test work, to support the design assumptions used for both projects, was completed during the third quarter and data analysis is expected to be finalized in 2010. Engineering studies have started on the Frontier Project, which will include an option of developing Equinox as a satellite operation. Various development options for a stand-alone mine/extraction operation of up to 240,000 barrels of bitumen per day from Frontier and either an additional 30,000 to 50,000 barrels of bitumen per day from Equinox or using Equinox bitumen to extend the life of the Frontier project will be considered. The results of this work are expected in by early 2011 and will be compared to the draft Design Basis Memorandum study for Equinox as a stand-alone project. The joint venture continues to advance the projects through the regulatory permitting process and has ongoing consultations with stakeholders including project update meetings with key stakeholder groups. A field exploration program on the Frontier project consisting of approximately 80 core holes is planned for the winter of 2010. We expect to spend approximately $22 million for our share of the exploration, engineering, regulatory and stakeholder activities for Frontier and Equinox projects during 2010. |

Teck 2009 Management’s Discussion and Analysis 14

Exploration – Lease 421 Area During the 2009 winter exploration season we drilled 54 core holes in the Lease 421 Area (oil sands leases 421, 022 and 023, in which we have a 50% interest), bringing the total core holes completed to 59. Analytical testing was completed during the fourth quarter. The results indicate 49 of the core holes contain prospective oil sands that range in thickness from 10 to 40 metres (averaging 19 metres) with oil sands grades ranging from 9 to 18% by weight and overburden thicknesses ranging from 10 to 68 metres (averaging 39 metres). These results indicate the potential for a mineable resource, however further core hole drilling will be required to establish the quantity and quality of any potential resources. We currently have no exploration work planned during 2010 on these leases. Regulatory Developments In January of 2008, the Government of Alberta announced a plan to reduce carbon emissions intensity to 50% below 1990 levels by 2020. Major emitters (those over 100,000 tonnes per year) are required to reduce their emissions intensity by 12% as compared to their established baseline. For new construction projects, the plan is applicable three years after start-up. In early 2010, the Canadian Federal Government announced new national targets for greenhouse gas emission reductions as part of the Copenhagen Accord. However, details of how these new targets would be achieved and how they might apply to individual facilities, companies, and industries has not yet been announced. Previously, in June 2009, details of the proposed federal offset system for greenhouse gas emissions were published. We will continue to review the effect of these regulatory developments on our oil sands projects. Gold During 2009, we sold our 50% interest in the Hemlo mines, our 40% interest in the Pogo mine, our 60% interest in the Lobo-Marte project in Chile, and our 78.8% interest in the Morelos project in Mexico. In January 2010 we closed the sale of the Agi Dagi and Kirazli projects in Turkey and a royalty on the future gold production from our Andacollo copper mine in Chile. We received consideration totalling $940 million in cash and equity securities in the various purchasers valued at $103 million on closing of the transactions. These sales resulted in gains totalling $479 million ($382 million after-tax) of which $429 million (pre-tax) was recorded in 2009. The cash proceeds, net of taxes and costs were used to repay the debt we incurred to finance our acquisition of the coal assets from Fording in late 2008. The gains on these sales and the results of operations from the Hemlo and Pogo mines prior to the closings of the sales are included in our earnings from discontinued operations. We remain committed to the gold business, but are not necessarily committed to being a producer. Our strategy will be to find and identify gold resources and then add value through further definition drilling and engineering studies. We will then sell those resources at a point in the development cycle where we believe we can maximize the return on our investment, which may be well before a production decision. | | |

Teck 2009 Management’s Discussion and Analysis 15

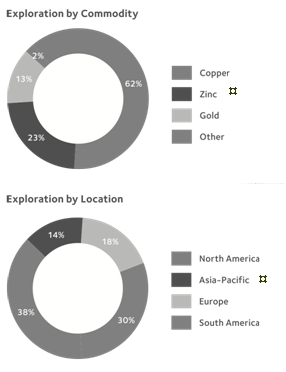

Corporate Our corporate business unit includes all of our activities in other commodities, our corporate development and growth initiatives, and groups that provide administrative, technical, financial and other support to all of our business units. Development Projects Galore Creek In August 2007, we formed a 50/50 partnership with NovaGold Resources Inc. to develop the Galore Creek copper-gold deposit in northwest British Columbia. After suspending construction activities in November 2007 due to escalating cost estimates and reduced operating margins, studies were initiated in 2008 aimed at re-evaluating and optimizing the project by defining a more realistic and lower risk development alternative, including alternative plant site and tailings locations. Further engineering and evaluation work is expected in 2010. In February 2009, we amended certain provisions of the partnership agreement relating to the Galore Creek project. Under the amended agreement, our remaining committed funding on Galore Creek has been reduced to approximately $36 million, which must be contributed by December 31, 2012. To December 31, 2009, we have spent $11 million of the $36 million commitment. While we are making these committed contributions, which will represent 100% of project funding, we will have a casting vote on the Galore Creek management committee with respect to the timing and nature of expenses to be funded. The Galore Creek project remained on care and maintenance during 2009. While the project site will remain on care and maintenance for 2010, we plan to begin the preparation of a pre-feasibility study so that updated capital and operating cost estimates can be prepared for the project. Relincho Project The Relincho copper project, located in central Chile, was acquired from Global Copper Corp. in August 2008. A total of 49,000 metres of infill drilling was completed on the property in 2008. There was no drilling and only minimal site activity on the Relincho project in 2009. Further mine engineering optimization studies were started in late 2009 based on a revised block model that included 2008 drilling. This work is being done to analyze various cut-off grades, throughput rates and stockpiling strategies. The next phase of work will be a pre-feasibility study that is currently planned to commence in the second quarter of 2010. Mesaba Project A variety of work was carried out on the Mesaba copper-nickel project in northern Minnesota in 2008. A total of 13,900 metres of resource definition drilling was completed in 2008. Drilling was also carried out to provide material for a bulk sample. In 2009, this sample was treated at a research facility in Minnesota to produce nine tonnes of copper-nickel concentrate, which was delivered to our CESL test facility in Richmond, British Columbia. This sample is being processed through the hydrometallurgical pilot plant at CESL to assess the feasibility of treatment for the production of copper and nickel. Carrapateena Project A preliminary scoping study was carried out to assess the potential development of an underground copper-gold mine at the Carrapateena property in South Australia in 2008. No exploration work was undertaken on the project in 2009. We have the right to acquire 100% of the project by making a payment to the vendor equal to 66% of its fair market value with credit for our expenditures on the project to date. We are reviewing with the vendor strategic alternatives in connection with the project. | | Exploration Exploration expenditures were $33 million in 2009 compared with $133 million in 2008. We closed seven exploration offices in early 2009 and reduced our exploration staff by approximately 250 positions. Copper, zinc and gold were our main commodities of interest. We decided not to continue with exploration for diamonds, nickel, and seafloor massive sulphides in 2009. Copper Copper exploration was focused in Chile, Peru, Mexico, Turkey and Canada. Several new porphyry copper targets were defined in the Pelambres North project in central Chile. Outcropping copper mineralization and extensive geophysical and geochemical targets will be drilled in 2010. Encouraging drill results were returned from the 60% owned Halilaga copper/gold project in Turkey. Drilling programs are planned for 2010 on copper projects in Chile, Mexico, Turkey, and Namibia. During the year we optioned out several 100% owned copper projects located in Chile, Peru, Brazil, Namibia, and Mexico. All are expected to be drilled by other parties in 2010 and we retain back-in rights to majority interests in all of the projects. Zinc Zinc exploration was primarily focused in Alaska, Ireland, and Australia. Additional surface surveys were undertaken on the 100% owned Noatak project in the Red Dog district in Alaska where drilling is planned for 2010. Drilling was undertaken on zinc projects in Ireland and Australia, both of which returned multiple drill holes with sulphide mineralization warranting additional drilling in 2010. We entered into an agreement with Nonfemet, a Chinese mining and smelting entity, which will solely fund the next phases of drilling to earn a 40% interest in our 100% owned Ballinalack project in Ireland. The partners are planning a 30,000 metre drill program in 2010. Gold Gold exploration was primarily focused in western Turkey. We undertook drilling on our 100% owned Demir property in the fourth quarter and test results from this work are currently pending. We elected to farm out several of our gold projects in Australia, Mexico, Canada and South America. We expect to be significantly more active in the gold sector in 2010. |

Teck 2009 Management’s Discussion and Analysis 16

Technology Our Technology Group works closely with our business units to create value through the development and application of innovative technologies. Three separate centres provide expertise in process development for internal and external growth opportunities, technical improvement and environmental treatment for operations, and product development to support metal sales. CESL Limited (“CESL”) oversees the development of our proprietary hydrometallurgical technology, which offers an environmentally superior method for treating copper, copper-gold, nickel-copper, and nickel concentrates, especially those with complex challenges related to mineralogy and deleterious elements that inhibit conventional production and sale of concentrates. Our Applied Research and Technology (“ART”) group works with our business units to characterize ore bodies, develop and test processing options, evaluate and implement technologies to improve performance and decrease unit costs, and to design and test innovative solutions to potential environmental impacts. Our Product Technology Centre (“PTC”) supports metal sales for the Zinc Business Unit by working with zinc customers to develop new alloys and bath management technologies for continuous and general galvanizing. PTC’s battery technology group develops and sells new technologies to improve the use and efficiency of lead acid batteries. PTC also works with the Trail operation to understand emerging technical uses and markets for specialty metals produced at Trail. The Technology Group also works with all of our business units to evaluate and implement technologies, and with external companies, contractors and researchers to develop and assess new technologies. We support external research and development through industry associations, companies and universities. In many cases, our funds are levered through collaboration with other companies and government programs. We are active participants in university-based educational programs, research groups, industry-government initiatives, and industry-university advisory committees. We use contacts with these groups to identify prospective employees and to develop training programs for our technical employees. In addition to seeking growth and continuous improvement, we work to foster sustainability through more efficient processes, better control of waste products , and the long-term stewardship of metals. | | | |

Teck 2009 Management’s Discussion and Analysis 17

Financial Overview

Financial Summary

| | | 2009 | | | 2008 | | | 2007 | |

| | | | | | | | | | |

| Revenue and earnings | | | | | | | | | |

| Revenues | | $ | 7,674 | | | $ | 6,655 | | | $ | 6,189 | |

| Operating profit before depreciation and amortization | | $ | 3,662 | | | $ | 2,811 | | | $ | 3,036 | |

| EBITDA | | $ | 4,109 | | | $ | 1,961 | | | $ | 2,799 | |

| Net earnings from continuing operations | | $ | 1,750 | | | $ | 668 | | | $ | 1,681 | |

| Net earnings | | $ | 1,831 | | | $ | 659 | | | $ | 1,615 | |

| Cash flow | | | | | | | | | | | | |

| Cash flow from operations | | $ | 2,983 | | | $ | 2,109 | | | $ | 1,742 | |

| Capital expenditures | | $ | 590 | | | $ | 928 | | | $ | 555 | |

| Investments | | $ | 372 | | | $ | 12,298 | | | $ | 3,911 | |

| Balance sheet | | | | | | | | | | | | |

| Cash balances, including restricted cash | | $ | 1,420 | | | $ | 850 | | | $ | 1,408 | |

| Total assets | | $ | 29,873 | | | $ | 31,533 | | | $ | 13,573 | |

| Debt, including current portion | | $ | 8,004 | | | $ | 12,874 | | | $ | 1,523 | |

| Per share amounts | | | | | | | | | | | | |

| Net earnings from continuing operations | | | | | | | | | | | | |

| Basic | | $ | 3.28 | | | $ | 1.48 | | | $ | 3.89 | |

| Diluted | | $ | 3.27 | | | $ | 1.47 | | | $ | 3.87 | |

| Net earnings | | | | | | | | | | | | |

| Basic | | $ | 3.43 | | | $ | 1.46 | | | $ | 3.74 | |

| Diluted | | $ | 3.42 | | | $ | 1.45 | | | $ | 3.72 | |

| Dividends declared per share | | $ | – | | | $ | 0.50 | | | $ | 1.00 | |

Our revenues and earnings depend on prices for the commodities we produce, sell and use in our production processes. Commodity prices are determined by the supply of and demand for raw materials, which are influenced by global economic growth. We normally sell the products that we produce at prevailing market prices or at prices negotiated on annual contracts, particularly metallurgical coal. Prices for these products, particularly for exchange-traded commodities, can fluctuate widely and that volatility can have a material effect on our financial results. We record our financial results using the Canadian dollar and accordingly, our operating results and cash flows are affected by changes in the Canadian dollar exchange rate relative to the currencies of other countries. Exchange rate movements, particularly as they affect the US dollar, can have a significant impact on our results as a significant portion of our operating costs are incurred in Canadian and other currencies and most of our debt and revenues are denominated in US dollars. Our net earnings for 2009 were $1.831 billion, which included $881 million of after-tax foreign exchange gains and gains on the sale of assets, or $3.43 per share compared with $659 million or $1.46 per share in 2008, which included $856 million of after-tax asset impairment losses. Net earnings were $1.6 billion or $3.74 per share in 2007. Our earnings were higher in 2009 due to increased operating profits from each of our business units, significant foreign exchange gains on our debt and asset sale gains. Our coal business unit benefitted from our acquisition of Fording’s 60% interest in Teck Coal in October, 2008. This was partially offset by significantly lower coal prices in 2009 and significantly higher interest expense on the debt incurred to acquire Fording’s coal assets. Our copper and zinc business units contributed higher earnings in the year due mainly to significant positive pricing adjustments, which offset the lower average base metal prices. In 2009, we had positive after-tax final price adjustments of $207 million as a result of the improved global economy and rising metal prices. In 2008, we incurred negative after-tax final price adjustments of $329 mill ion as a result of the rapid deterioration of the global markets and subsequent sharp decline in metal prices that occurred in the latter part of the year. | | Our earnings in 2009 included $561 million of after-tax non-cash foreign exchange gains on our net debt and $320 million of after-tax gains on the sale of various assets that were undertaken as part of our debt reduction plan. Partially offsetting these favourable items were $117 million of unamortized discounts and issues costs related to our Fording acquisition debt that we wrote off as we repaid and refinanced that debt and $139 million of impairment losses related to our oil sands assets, the majority of which relates to the delay of the mine and bitumen production portion of the Fort Hills project. Our earnings in 2008 were negatively affected by non-cash after-tax asset and goodwill impairment charges totalling $856 million taken against (i) the goodwill related to the three copper mines we acquired from Aur in 2007 ($345 million), (ii) the deferral of the upgrader portion of our Fort Hills oil sands project ($90 million) (iii) our Lennard Shelf, Pend Oreille and Duck Pond mines ($116 million), (iv) our Petaquilla copper project in Panama, Santa Fe nickel project in Brazil and other exploration properties ($60 million) and (v) $245 million in respect of marketable securities that we own in various development stage companies, whose decline in value was considered other-than-temporary. |

Teck 2009 Management’s Discussion and Analysis 18

Our earnings in 2007 were affected by a $33 million equity loss ($50 million pre-tax) related to our investment in the Galore Creek project where mine construction was suspended due to escalating capital costs and by a number of asset write-downs totalling $51 million after taxes. The equity loss represented our after-tax share of the Galore Creek partnership’s estimated demobilization costs. The asset write-downs related to our investment in Tahera Diamond Corporation, which was due to the severe financial difficulties it faced. Due to difficult mining conditions and low ore grades that impacted their ongoing profitability, we also wrote down the property, plant and equipment at our Pend Oreille and Lennard Shelf zinc mines. We also had a $59 million cumulative foreign exchange loss related to the repatriation of US dollars to Canada to provide funds for our acquisition of Aur. We also had a $46 million loss on our contingent receivable related to the sale of our Cajamarquilla refinery compared with a $36 million gain in 2006.

The table below shows the impact of these items on our earnings.

| | | 2009 | | | 2008 | | | 2007 | |

| | | | | | | | | | |

| Net earnings as reported | | $ | 1,831 | | | $ | 659 | | | $ | 1,615 | |

| Add (deduct) the after-tax effect of: | | | | | | | | | | | | |

| (Earnings) loss from discontinued operations | | | (81 | ) | | | 9 | | | | 66 | |

| Derivative (gains) losses | | | 36 | | | | (202 | ) | | | 32 | |

| Asset impairment and equity losses | | | 119 | | | | 266 | | | | 84 | |

| Impairment of goodwill and marketable securities | | | 20 | | | | 590 | | | | – | |

| Asset sales and other | | | (320 | ) | | | 73 | | | | (36 | ) |

| Foreign exchange gains on net debt | | | (561 | ) | | | – | | | | – | |

| Realization of cumulative translation adjustment loss | | | – | | | | – | | | | 59 | |

| Financing items | | | 117 | | | | – | | | | – | |

| Tax items | | | (30 | ) | | | (50 | ) | | | (80 | ) |

| | | | (700 | ) | | | 686 | | | | 125 | |

| Adjusted net earnings* | | | 1,131 | | | | 1,345 | | | | 1,740 | |

| Negative (positive) pricing adjustments | | | (207 | ) | | | 329 | | | | 66 | |

Comparative net earnings* | | $ | 924 | | | $ | 1,674 | | | $ | 1,806 | |

*Adjusted net earnings and comparative net earnings are non-GAAP financial measures. See Use of Non-GAAP Financial Measures section for further information.

Pricing adjustments generally increase earnings in a rising commodity price environment and decrease earnings in a declining price environment. They are a normal part of our business but we exclude them from comparative earnings in the table above to provide a better understanding of how our company performed. In the latter part of 2008 general conditions in credit markets deteriorated substantially, which had a serious impact on the global economy and contributed to a significant and rapid decline in the demand for and selling price of our products. Average base metal prices were down significantly in the fourth quarter of 2008, with two of our major products, copper and zinc, dropping significantly from prices at the end of September 2008, resulting in negative pricing adjustments of $474 million ($270 million after tax) in the fourth quarter alone. Economic conditions improved in 2009 contributing to a significant improvement in base metal prices, which resulted in positive pricing adjustments of $325 million ($207 million after tax) in 2009. | | Cash flow from operations in 2009, before changes in non-cash working capital items, was $2.3 billion compared with $3.6 billion in 2008 and $2.0 billion in 2007. The changes in cash flow from operations are due mainly to the volatility in commodity prices and changes in the Canadian/US dollar exchange rate. In 2008, our earnings included a $1.5 billion non-cash future tax provision, $856 million of non-cash asset impairment charges and a provision against our marketable securities. Cash flow from operations, after changes in non-cash working capital items, less scheduled debt repayments, dividends and sustaining capital expenditures, was $2.6 billion in 2009 compared with $1.3 billion in 2008 and $1.1 billion in 2007. At December 31, 2009, our cash balance, including restricted cash, was $1.4 billion. Total debt was $8.0 billion and our net debt to net debt-plus-equity ratio was 31% compared with 52% at December 31, 2008. |

Teck 2009 Management’s Discussion and Analysis 19

Operating Profit

Our operating profit is made up of our revenues less the operating, depreciation and amortization expenses at our producing operations. Income and expenses from our business activities that do not produce commodities for sale are included in our other income and expenses.

Our principal commodities are copper, metallurgical coal and zinc, which accounted for 24%, 46% and 14% of revenues respectively in 2009. Molybdenum is a significant product of our copper operations, and lead is a significant product of our zinc operations, respectively accounting for 1% and 5% of our 2009 revenues. In addition, our Antamina copper mine produces a significant volume of zinc concentrate. Other products produced at various operations include silver, various specialty metals, chemicals and fertilizers, and electricity, and in total accounted for 10% of our revenue in 2009.

Our acquisitions of the Fording coal assets in October 2008 and Aur in August 2007 has had a significant impact on our revenues, operating expenses and operating profits. Our results for 2008 included a full year of results from the three mines we acquired from Aur compared with just over four months in 2007. In addition, our 2008 operating profit includes our 40% share of the results of Teck Coal until the end of October 2008 and 100% thereafter compared with only our 40% direct interest for all of 2007. Accordingly, these two acquisitions accounted for a portion of the increase in revenues, operating expenses, and depreciation and amortization in 2008 and the acquisition of the Teck Coal assets accounted for a significant portion of the increase in revenues, operating expenses, and depreciation and amortization when comparing 2009 with 2008.