Management’s Discussion and Analysis

Our business is exploring for, acquiring, developing and producing natural resources. We are organized into business units focused on copper, steelmaking coal, zinc and energy. These are supported by our corporate business unit, which manages our corporate growth initiatives and provides administrative, technical, financial and other functions.

Through our interests in mining and processing operations in Canada, the United States, Chile and Peru, we are the world’s second-largest exporter of seaborne high-quality steelmaking coal, an important producer of copper and one of the world’s largest zinc producers. We also produce lead, molybdenum, silver, and various specialty and other metals, chemicals and fertilizers. In addition, we own a 20% interest in the Fort Hills oil sands project, a 100% interest in the Frontier oil sands project and a 50% interest in Lease 421 in the Athabasca region of Alberta. We also actively explore for copper, zinc and gold.

This Management’s Discussion and Analysis of our results of operations is prepared as at February 20, 2013 and should be read in conjunction with our audited consolidated financial statements as at and for the year ended December 31, 2012. Unless the context otherwise dictates, a reference to Teck, Teck Resources, the Company, us, we, or our refers to Teck Resources Limited and its subsidiaries including Teck Metals Limited and Teck Coal Partnership. All dollar amounts are in Canadian dollars, unless otherwise specified, and are based on our consolidated financial statements that are prepared in accordance with International Financial Reporting Standards (IFRS). In addition, we use certain non-GAAP financial measures, which are explained and reconciled throughout the Management’s Discussion and Analysis in this report. Certain comparative amounts have been reclassified to conform to the presentation adopted for 2012.

This Management’s Discussion and Analysis contains certain forward-looking information and forward-looking statements. You should review the cautionary statement on forward-looking information under the caption “Caution on Forward-Looking Information” on page 42, which forms part of this Management’s Discussion and Analysis.

Additional information about us, including our most recent Annual Information Form, is available on the Canadian Securities Administrators website at www.sedar.com (SEDAR) and on the EDGAR section of the United States Securities and Exchange Commission (SEC) website at www.sec.gov.

| Teck 2012 Management’s Discussion and Analysis | 2 |

Business Unit Results

The table below shows our share of production of our major commodities for the last five years and expected production for 2013.

Five-Year Production Record and Our Expected Share of Production in 2013

| | | Units | | | | | | | | | | | | | | | | | | (Note 4) | |

| | | | (000’s) | | | | 2008 | | | | 2009 | | | | 2010 | | | | 2011 | | | | 2012 | | | 2013 estimate | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Principal Products | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Copper (Notes 1 and 3) | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Contained in concentrate | | tonnes | | | | 209 | | | | 203 | | | | 216 | | | | 251 | | | | 307 | | | | 290 | |

| Cathodes | | tonnes | | | | 107 | | | | 105 | | | | 97 | | | | 70 | | | | 66 | | | | 60 | |

| | | | | | | | 316 | | | | 308 | | | | 313 | | | | 321 | | | | 373 | | | | 350 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Steelmaking coal (Note 2) | | tonnes | | | | 13,627 | | | | 18,930 | | | | 23,109 | | | | 22,785 | | | | 24,652 | | | | 24,500 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Zinc | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Contained in concentrate | | tonnes | | | | 663 | | | | 711 | | | | 645 | | | | 646 | | | | 598 | | | | 575 | |

| Refined | | tonnes | | | | 270 | | | | 240 | | | | 278 | | | | 291 | | | | 284 | | | | 285 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Other Products | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Lead | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Contained in concentrate | | tonnes | | | | 133 | | | | 132 | | | | 110 | | | | 84 | | | | 95 | | | | 85 | |

| Refined | | tonnes | | | | 85 | | | | 73 | | | | 72 | | | | 86 | | | | 88 | | | | 85 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Molybdenum contained in concentrate | | pounds | | | | 7,224 | | | | 7,798 | | | | 8,557 | | | | 10,983 | | | | 12,692 | | | | 8,000 | |

Notes to five-year production record and 2013 estimate:

| (1) | We include 100% of the production and sales from our Highland Valley Copper, Quebrada Blanca and Carmen de Andacollo mines in our production and sales volumes, even though we own 97.5%, 76.5% and 90%, respectively, of these operations, because we fully consolidate their results in our financial statements. We include 22.5% of production and sales from Antamina, representing our proportionate equity interest in Antamina. |

| (2) | Coal production in 2008 includes our 40% share of production from the Teck Coal Partnership and 2.345 million tonnes being our indirect share of production from our 19.95% investment in units of Fording. |

| (3) | Includes pre-commercial production from Carmen de Andacollo prior to September 30, 2010. Production of copper contained in concentrate during the pre-commercial start-up period in the nine months ended September 30, 2010 was 20,700 tonnes. |

| (4) | Production estimate for 2013 represents the mid-range of our production plan. |

Average commodity prices and exchange rates for the past three years, which are key drivers of our profit, are summarized in the following table.

| | | US$ | | | Cdn$ | |

| | | 2012 | | | % chg | | | 2011 | | | % chg | | | 2010 | | | 2012 | | | % chg | | | 2011 | | | % chg | | | 2010 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Copper (LME cash – $/pound) | | | 3.61 | | | | -10 | % | | | 4.00 | | | | +17 | % | | | 3.42 | | | | 3.61 | | | | -9 | % | | | 3.96 | | | | +13 | % | | | 3.52 | |

| Coal (realized – $/tonne) | | | 193 | | | | -25 | % | | | 257 | | | | +42 | % | | | 181 | | | | 194 | | | | -24 | % | | | 254 | | | | +35 | % | | | 188 | |

| Zinc (LME cash – $/pound) | | | 0.88 | | | | -11 | % | | | 0.99 | | | | +1 | % | | | 0.98 | | | | 0.88 | | | | -10 | % | | | 0.98 | | | | -3 | % | | | 1.01 | |

| Molybdenum (Platts* – $/pound) | | | 13 | | | | -13 | % | | | 15 | | | | -6 | % | | | 16 | | | | 13 | | | | -13 | % | | | 15 | | | | -6 | % | | | 16 | |

| Lead (LME cash – $/pound) | | | 0.94 | | | | -14 | % | | | 1.09 | | | | +12 | % | | | 0.97 | | | | 0.94 | | | | -13 | % | | | 1.08 | | | | +8 | % | | | 1.00 | |

| Exchange rate (Bank of Canada) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

US$1 = Cdn$ | | | 1.00 | | | | +1 | % | | | 0.99 | | | | -4 | % | | | 1.03 | | | | | | | | | | | | | | | | | | | | | |

Cdn$1 = US$ | | | 1.00 | | | | -1 | % | | | 1.01 | | | | +4 | % | | | 0.97 | | | | | | | | | | | | | | | | | | | | | |

*Published major supplier selling price in Platts Metals Week.

| Teck 2012 Management’s Discussion and Analysis | 3 |

Our revenue and gross profit before depreciation and amortization by business unit are summarized in the following table.

| | | Revenues | | | Gross Profit Before Depreciation and Amortization* | |

| ($ in millions) | | 2012 | | | 2011 | | | 2010 | | | 2012 | | | 2011 | | | 2010 | |

| | | | | | | | | | | | | | | | | | | |

| Copper | | $ | 3,142 | | | $ | 3,108 | | | $ | 2,509 | | | $ | 1,500 | | | $ | 1,674 | | | $ | 1,462 | |

| Coal | | | 4,647 | | | | 5,641 | | | | 4,351 | | | | 2,033 | | | | 3,306 | | | | 2,261 | |

| Zinc | | | 2,550 | | | | 2,765 | | | | 2,363 | | | | 480 | | | | 808 | | | | 715 | |

| Energy | | | 4 | | | | – | | | | – | | | | 4 | | | | – | | | | – | |

| Total | | $ | 10,343 | | | $ | 11,514 | | | $ | 9,223 | | | $ | 4,017 | | | $ | 5,788 | | | $ | 4,438 | |

*Gross profit before depreciation and amortization is a non-GAAP financial measure. See “Use of Non-GAAP Financial Measures” section for further information.

| Teck 2012 Management’s Discussion and Analysis | 4 |

Copper

In 2012, we produced a record 373,100 tonnes of copper from Antamina in Peru, Quebrada Blanca and Carmen de Andacollo in Chile, Highland Valley Copper in British Columbia (B.C.) and Duck Pond in Newfoundland. We achieved a key milestone in 2012 with the completion of the Antamina mine expansion. The mill modernization project at Highland Valley Copper also progressed, with concrete work well advanced, and steel erection and major equipment installation started. New collective labour agreements were achieved at Carmen de Andacollo, Quebrada Blanca and Antamina. We also completed a feasibility study on our Quebrada Blanca Phase 2 hypogene project and are actively working towards re-filing the Social Environmental Impact Assessment (SEIA). We estimate copper production will be in the range of 340,000 to 360,000 tonnes in 2013. Production is expected to be lower than 2012 due mainly to declining production from Quebrada Blanca’s leach operations as it nears the end of its productive life and lower head grades at Highland Valley Copper.

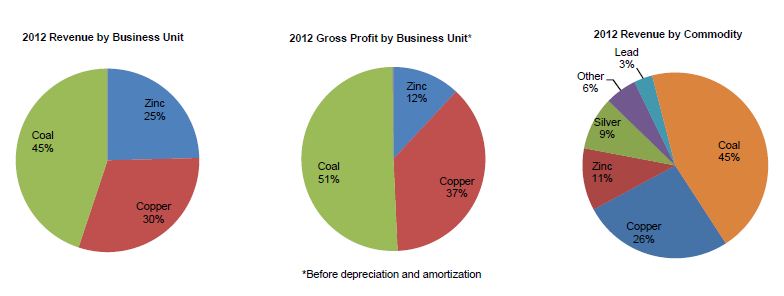

In 2012, our copper operations accounted for 30% of our revenue and 37% of our gross profit before depreciation and amortization.

| | | Revenues | | | Gross Profit Before Depreciation and Amortization | |

| ($ in millions) | | 2012 | | | 2011 | | | 2010 | | | 2012 | | | 2011 | | | 2010 | |

| | | | | | | | | | | | | | | | | | | |

| Highland Valley Copper | | $ | 1,012 | | | $ | 997 | | | $ | 828 | | | $ | 513 | | | $ | 486 | | | $ | 487 | |

| Antamina | | | 897 | | | | 799 | | | | 641 | | | | 633 | | | | 588 | | | | 420 | |

| Quebrada Blanca | | | 499 | | | | 562 | | | | 697 | | | | 82 | | | | 255 | | | | 406 | |

| Carmen de Andacollo | | | 597 | | | | 608 | | | | 208 | | | | 225 | | | | 288 | | | | 91 | |

| Duck Pond | | | 130 | | | | 142 | | | | 135 | | | | 42 | | | | 57 | | | | 58 | |

| Other | | | 7 | | | | – | | | | – | | | | 5 | | | | – | | | | – | |

| Total | | $ | 3,142 | | | $ | 3,108 | | | $ | 2,509 | | | $ | 1,500 | | | $ | 1,674 | | | $ | 1,462 | |

| | | Production | | | Sales | |

| (000’s tonnes) | | 2012 | | | 2011 | | | 2010 | | | 2012 | | | 2011 | | | 2010 | |

| | | | | | | | | | | | | | | | | | | |

| Highland Valley Copper | | | 116 | | | | 97 | | | | 99 | | | | 117 | | | | 104 | | | | 98 | |

| Antamina | | | 101 | | | | 75 | | | | 68 | | | | 101 | | | | 76 | | | | 65 | |

| Quebrada Blanca | | | 62 | | | | 64 | | | | 86 | | | | 62 | | | | 64 | | | | 90 | |

| Carmen de Andacollo | | | 80 | | | | 72 | | | | 45 | | | | 74 | | | | 69 | | | | 42 | |

| Duck Pond | | | 14 | | | | 13 | | | | 15 | | | | 15 | | | | 13 | | | | 15 | |

| Total | | | 373 | | | | 321 | | | | 313 | | | | 369 | | | | 326 | | | | 310 | |

Operations

Highland Valley Copper

We have a 97.5% interest in Highland Valley Copper, located in south-central B.C. Gross profit before depreciation and amortization was $513 million in 2012, compared to $486 million in 2011 and $487 million in 2010. Gross profit increased in 2012 due to a 20% increase in production and the resulting 13% increase in sales volumes, partially offset by lower copper prices. Highland Valley Copper’s 2012 copper production was 116,300 tonnes of copper in concentrate, significantly higher than last year, primarily due to higher mill throughput and higher grades. Molybdenum production was 27% higher than 2011 levels at 10.0 million pounds, due to improved throughput and higher feed grades.

| Teck 2012 Management’s Discussion and Analysis | 5 |

Ore is mined from the Valley, Lornex and Highmont pits. The waste stripping and buttress placement project completed in 2011 on the east wall of the Valley pit enabled higher grade ore to be mined. Mine activities in 2013 are focused on production from the Valley pit and continuing the pre-stripping program for the Lornex pit extension.

The mill modernization project progressed in 2012. The project includes the construction of new flotation and pebble-crushing capacity adjacent to the existing circuits, which should increase plant availability and increase copper recovery by 2%, molybdenum recovery by 3% and annual mill throughput by 10% over the remaining life of the mine. The project is scheduled for completion in the fourth quarter of 2013. The mill modernization project is not based on a technical report filed under National Instrument 43-101.

The continued growth of the mineral resource base at Highland Valley reflects the longer term development potential of the deposits. During the last year, measured and indicated resources increased by 48% to 907 million tonnes and inferred resources increased 63% to 519 million tonnes as of December 31, 2012. Additional drilling and engineering studies are planned in 2013, including a major 90,000-metre drill program focused on the Valley and previously active Bethlehem pits.

Highland Valley Copper’s production in 2013 is expected to be in the range of 100,000 to 110,000 tonnes of copper. Molybdenum production in 2013 is expected to be 5.0 million pounds contained in concentrate.

After completion of the mill modernization project, Highland Valley Copper is expected to produce between 100,000 and 150,000 tonnes of copper per year, depending on ore grades and hardness, for an average of 125,000 tonnes per year, over the current mine life through 2027.

Antamina

We have a 22.5% share interest in Antamina, a copper and zinc mine in Peru. The other shareholders are BHP Billiton (33.75%), Xstrata plc (33.75%) and Mitsubishi Corporation (10%). In 2012, our share of gross profit before depreciation and amortization was $633 million, compared with $588 million in 2011 and $420 million in 2010. A mill expansion project completed in 2012 increased ore throughput to 130,000 tonnes per day. Further optimization efforts are underway to fully utilize the installed SAG mill capacity. Increased gross profit in 2012 was due to significantly higher copper production and sales volumes, as the benefits of the expansion project were realized, partially offset by lower copper and zinc prices.

Copper production in 2012 was 446,800 tonnes, 34% higher than in 2011. This was primarily due to the benefits of the expansion project and record mill throughput of 46.5 million tonnes in 2012, a 24% increase from the previous year. Zinc production decreased by 7% to 219,000 tonnes in 2012, primarily due to lower zinc grades. Molybdenum production totalled 12.1 million pounds, which was lower than in 2011, due to lower molybdenum grades and recoveries.

Our 22.5% share of Antamina’s 2013 production is expected to be in the range of 90,000 to 100,000 tonnes of copper, 45,000 to 50,000 tonnes of zinc and 2.8 million pounds of molybdenum in concentrate.

Quebrada Blanca

Quebrada Blanca is located in northern Chile, 240 kilometres southeast of the city of Iquique. We own a 76.5% share interest of Quebrada Blanca; the other shareholders are Inversiones Mineras S.A. (13.5%) and Empresa Nacional de Minería (ENAMI) (10%). The operation mines ore from an open pit and leaches the ore to produce copper cathodes via a conventional solvent extraction and electrowinning (SX-EW) process. Gross profit before depreciation and amortization was $82 million in 2012, compared with $255 million in

| Teck 2012 Management’s Discussion and Analysis | 6 |

2011 and $406 million in 2010. Gross profit was lower in 2012, due to substantially higher operating costs and lower copper prices.

In 2012, Quebrada Blanca produced 62,400 tonnes of copper cathode, compared to 63,400 tonnes in 2011. The operation continued to experience operating difficulties due to severe weather conditions, maintenance requirements for aging plant equipment and the transition towards more dump leach production.

A restructuring plan was announced in the fourth quarter of 2012 in response to increasing operating costs — the result of lower copper grades and reduced reserves of the supergene, as well as other operational-related challenges. The restructuring plan is expected to reduce operating costs in an effort to sustain the operation while the Quebrada Blanca Phase 2 project is developed.

Production of approximately 50,000 to 60,000 tonnes of copper cathode is expected in 2013.

Quebrada Blanca’s supergene orebody is expected to be mined out by 2017, but residual copper cathode production is expected to continue, at declining production rates, through 2018.

In 2012, we completed the feasibility study for the Quebrada Blanca Phase 2 project. The study estimates a capital cost for the development of the project of US$5.6 billion on a 100% basis (in January 2012 dollars, not including working capital or interest during construction), of which our funding share would be $4.8 billion. The study contemplates the construction of a 135,000-tonne-per-day concentrator and related facilities connected to a new port facility by 165-kilometre concentrate and desalinated water pipelines.

As part of the project work plan for 2012, the Social Environmental Impact Assessment (SEIA) for the project was submitted to the Chilean regulatory authorities during the second quarter. This was subsequently voluntarily withdrawn in order to prepare responses to the comments and questions from the Chilean authorities, and to collect and analyze some additional baseline environmental data. It is anticipated that the SEIA will be re-filed by the end of the second quarter of 2013.

Discussions are ongoing with the other shareholders of Quebrada Blanca concerning financing options for the project, which may include limited recourse project financing and, possibly, bringing in a new funding partner.

Carmen de Andacollo

We have a 90% share interest in the Carmen de Andacollo mine in Chile, which is located 350 kilometres north of Santiago. The remaining 10% is owned by ENAMI. Copper and gold in concentrate and copper cathode are produced from the mine. Gross profit before depreciation and amortization was $225 million in 2012, compared with $288 million in 2011, and $91 million in 2010. Gross profit was lower in 2012, due to lower copper prices and higher operating costs, partially offset by higher copper production.

Carmen de Andacollo produced 75,800 tonnes of copper contained in concentrate in 2012, compared with 66,100 tonnes in 2011. Copper cathode production was 4,000 tonnes in 2012, compared with 6,300 tonnes in 2011.

A 20,000 tonnes per day pre-crushing plant that was commissioned during the third quarter of 2012 was primarily responsible for the increase in concentrator throughput.

We expect 2013 production to be 70,000 to 80,000 tonnes of copper in concentrate as well as 5,000 tonnes

| Teck 2012 Management’s Discussion and Analysis | 7 |

of copper cathode.

Duck Pond

We own 100% of the Duck Pond underground copper-zinc mine located in central Newfoundland. Duck Pond’s gross profit before depreciation and amortization was $42 million in 2012, compared to $57 million in 2011 and $58 million in 2010. Gross profit declined in 2012, primarily due to lower metal prices.

Copper production in 2012 was 14,100 tonnes and zinc production was 19,500 tonnes. This compares with copper production of 13,200 tonnes and 21,300 tonnes of zinc production in 2011.

The Boundary open pit is currently in development and will provide a supplemental feed source starting in the second half of 2013 as underground reserves become depleted. The current mine life extends to early 2015 and we are working to extend the life of the mine. Duck Pond’s production in 2013 is expected to be approximately 14,000 to 16,000 tonnes of copper and between 12,000 and 16,000 tonnes of zinc.

Relincho (100% owned)

Relincho, a major greenfields copper project, is located in central Chile, approximately 110 kilometres east of the port city of Huasco at an altitude of 2,200 metres above sea level. Permitting delays have affected the progress of third-party port and power supply facilities that we had expected to use for Relincho and will delay the completion of the feasibility study, which is now expected to be complete at the end of the fourth quarter of 2013. Exploration and geotechnical drilling are ongoing, and a new resource and reserve estimate is expected at the completion of the feasibility study. Based on the prefeasibility study, copper production would average 195,000 tonnes per year in the first five years of full production and 180,000 tonnes per year over the initial 22-year mine life. In addition, 6,000 tonnes per year of molybdenum could be produced as a byproduct over the life of the mine.

Galore Creek (50% owned)

The Galore Creek project is located in northwest B.C. In 2012, a work program including approximately 25,000 metres of infill and geotechnical drilling was completed. An additional 10,000- to 12,000-metre exploration drill program is planned in 2013.

Mesaba (100% owned)

Work on an advanced scoping study at the Mesaba copper-nickel project in northern Minnesota was completed in 2012. Further optimization studies will be conducted in 2013, including some metallurgical and infill drilling.

CESL Limited (CESL)

Located in Richmond, B.C., CESL focuses on advancing and commercializing our proprietary hydrometallurgical technology. We have a well-tested suite of technologies suitable for treating complex copper, copper-gold, copper-nickel and nickel concentrates, particularly those with deleterious elements such as arsenic or magnesium, which inhibit the sale of concentrates to conventional smelters. In 2013, the CESL team will continue to pursue opportunities to unlock metallurgically challenged resources to create additional value by employing the CESL process.

Markets

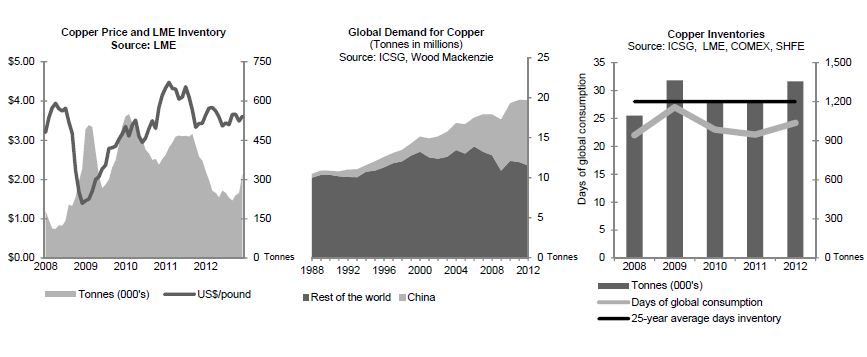

Copper prices on the London Metal Exchange (LME) averaged US$3.61 per pound in 2012, down US$0.39 per pound from the 2011 average.

| Teck 2012 Management’s Discussion and Analysis | 8 |

Demand for copper metal grew by 2.1% in 2012 to reach an estimated 19.7 million tonnes globally. Growth outside of China remained relatively subdued, with improved growth in North America offset by continued weakness in Europe. Growth in real demand in China, estimated at between 5% and 6%, was also weaker than in prior years, despite an increase in refined copper imports into China.

In 2012, global copper production increased 2.2% to reach just over 20 million tonnes for the year. Copper scrap availability remained tight for most of 2012, with Chinese imports up 3.8% over the previous year. We expect that scrap will again play an important part of the supply picture in 2013.

Copper stocks in the LME, Shanghai and COMEX warehouses increased 8% or 45,000 tonnes during the year. Total reported global stocks (which include producer, consumer, merchant and terminal stocks) stood at an estimated 24 days of global consumption versus the 25-year average of 28 days of global consumption.

Production disruptions continued to affect the market in 2012, with estimates of close to 0.9 million tonnes of planned production lost during the year. Total copper mine production increased by only 3.8% in 2012, which was well below the estimated 10.1% increase projected at the beginning of the year. Wood Mackenzie, a commodity research consultancy, is expecting a 12% increase in global mine production in 2013 as new mining projects begin to ramp up; at the same time, Wood Mackenzie is also expecting an 11% increase in smelter production. Based on a history of industry production shortfalls over the past eight years combined with the continuing difficulties in bringing new production to market on time, we continue to expect unplanned production disruptions through 2013. We therefore expect smelter capacity utilization to remain under pressure in 2013, with the concentrate market remaining in deficit.

With global copper metal demand projected by Wood Mackenzie to increase by 5.0% in 2013, projected supply is expected to exceed demand slightly, moving the refined market into balance. If mine production continues to disappoint in 2013 from current projections, the refined market could again slip into deficit in 2013.

| Teck 2012 Management’s Discussion and Analysis | 9 |

Coal

In 2012, we produced 24.7 million tonnes of steelmaking coal, the majority of which was shipped to the Asia-Pacific region. Our proven and probable reserves of more than 1 billion tonnes of coal position us to continue to meet global demand. In addition, our measured and indicated resources now total over 3.6 billion tonnes and our inferred resources over 2 billion tonnes of raw coal.

Our current production capacity is approximately 27 million tonnes and is expected to grow to 28 million tonnes by the end of 2013. However, to align production rates with anticipated demand and to effectively manage inventories, we plan to produce 24.0 to 25.0 million tonnes of coal in 2013.

With current expansion plans underway at our six producing mines and the potential restart of our Quintette mine, we expect to reach an annualized production rate above 30 million tonnes of coal per year by the end of 2014, subject to permitting and customer demand.

In 2012, our coal business unit accounted for 45% of revenue and 51% of gross profit before depreciation and amortization.

| ($ in millions) | | 2012 | | | 2011 | | | 2010 | |

| | | | | | | | | | |

| Revenues | | $ | 4,647 | | | $ | 5,641 | | | $ | 4,351 | |

| Gross profit before depreciation and amortization | | $ | 2,033 | | | $ | 3,306 | | | $ | 2,261 | |

| | | | | | | | | | | | | |

| Production (000’s tonnes) | | | 24,652 | | | | 22,785 | | | | 23,109 | |

| Sales (000’s tonnes) | | | 23,989 | | | | 22,207 | | | | 23,167 | |

Operations

Decreased gross profit before depreciation and amortization primarily reflects significantly lower coal prices, partially offset by higher production and sales volumes. The average realized selling price in 2012 decreased to US$193 per tonne, compared with US$257 per tonne in 2011 and US$181 per tonne in 2010.

Gross profit declined in 2012, due primarily to lower coal prices and higher transportation costs. Transportation unit cost increases resulted from lower than planned shipping volumes, the use of additional terminals to supplement capacity during outages resulting from expansion programs or incidents at our traditional terminals, as well as from inflation and annual contractual rate adjustments with our rail and port service providers and higher than normal proportion of coal sold inclusive of ocean freight. These costs were partially offset by higher sales volumes and lower mine operating unit costs, which resulted from a successful cost reduction program initiated at all coal mines in August 2012.

Coal sales volumes of 24.0 million tonnes increased 8% from 2011.

Our 2012 production of 24.7 million tonnes increased from 2011 and was at the low end of our 2012 guidance. This was due largely to weak market conditions during the year, which led to our decision in mid-August to reduce production in response to declining demand. The labour disruption at Canadian Pacific Railway (CP Rail) in 2012 also affected production.

| Teck 2012 Management’s Discussion and Analysis | 10 |

Our investments in mobile equipment, plant capacity and staffing have significantly increased our capacity to move waste, and to mine and process raw coal. During 2012, we increased our haul truck fleet size by nine units and our shovel fleet by one unit. In addition, we replaced 30 existing haul trucks and one existing shovel. All of this new equipment is state-of-the-art and large capacity, which increases the overall productivity and efficiency of our mobile equipment fleets. The expansion of the processing plant at Elkview was completed, and the Greenhills plant reached its full upgrade capacity after the 2011 expansion.

Capital spending in 2012 of $641 million included additional equipment, processing plant upgrades and new pit developments, as well as approximately $120 million for the Quintette project.

Selenium Management

Work is ongoing to develop and implement a plan for the management of selenium at all of our operating coal mines in the Elk Valley. In the course of mining, we deposit large quantities of waste rock in the valley. Water flows through that waste rock and over rock exposed during the mining process, releasing small quantities of selenium, a naturally occurring element found in the native rocks in the Elk Valley. While it is necessary for good health in humans, selenium is detrimental to fish populations at relatively low concentrations. We have commissioned extensive studies into the environmental effects of selenium. These studies have not identified population level effects on fish in the Elk Valley, but they have identified a trend of increasing selenium concentrations in the valley which is expected, in the absence of mitigation measures, to increase further as future mine expansions increase the footprint of our operations. As a result, we have devoted substantial resources to developing and implementing mitigation measures, which include water diversion works to keep clean water clean, as well as treatment facilities to remove selenium from waters affected by contact with waste rock.

Because of the scale of our operations, the substantial quantities of water involved, and the very low concentrations of selenium, identifying and implementing appropriate treatment technology is a challenge. We filed with regulatory authorities a draft valley-wide selenium management plan in the first quarter of 2013. This plan sets out an integrated approach to the construction of water diversion and treatment facilities intended to achieve acceptable selenium concentrations downstream from our mining operations. Although the plan is not yet finalized, we believe that the costs associated with installing these facilities will be substantial. Our draft plan contemplates total capital spending over the next five years of up to $600 million on the installation of water diversion and treatment facilities, much of which would be covered within our long-term average sustaining capital budget. Annual operating costs by the end of the five years are expected to be approximately $40 million per year, or less than $1.50 per tonne of coal produced. Water treatment costs are expected to increase further in future periods, as additional treatment facilities are required to manage runoff from new mining areas. While the amount of those costs will depend on the technology applied to control selenium, our current estimate, assuming no substantive changes in technology, is that by 2025 treatment costs could ultimately reach $140 million per year, or approximately $6 per tonne of coal produced. We expect that water treatment will need to continue for an indefinite period after mining operations end in order to maintain water quality.

These cost estimates assume the application of biological treatment technology, which is currently being installed in the water treatment plant under construction at our Line Creek mine. We are actively investigating alternative treatment technologies with the potential to substantially reduce treatment costs. Our draft valley-wide selenium management plan also assumes that relevant regulators will agree to site-specific downstream selenium concentrations in certain aquatic environments already affected by selenium discharges from our coal mining operations in excess of those in provincial water quality guidelines. The modelling on which our valley-wide selenium management plan is based indicates that the selenium levels

| Teck 2012 Management’s Discussion and Analysis | 11 |

we are proposing for the upper Elk and Fording rivers will result in selenium levels further downstream, including at Lake Koocanusa at the U.S. border, that comply with provincial water quality guidelines and applicable limits on selenium concentrations prescribed by the U.S. Environmental Protection Agency (EPA).

While we believe that there is good scientific evidence that the measures that we will propose are protective of the environment and of fish populations in the affected water bodies, and that these measures will meet our previously stated objective of reversing the trend of increasing selenium concentrations in the Elk Valley, there can be no assurance that regulatory authorities will not ultimately impose more stringent limits on selenium discharges, which could substantially increase both capital and operating costs associated with selenium management.

We expect that permitting for current and future projects may be delayed until regulatory authorities have accepted the valley-wide selenium management plan and are able to assess the cumulative effects of new projects in the context of the selenium management plan for the valley as a whole. There can be no assurance that delays in obtaining approval of our valley-wide selenium management plan will not result in consequential delays in permitting new mining areas, which would limit our ability to maintain or increase coal production in accordance with our long-term plans. The potential shortfall in production may be material.

We are continuing with research and development aimed at identifying new and more cost-effective treatment technologies and are reviewing mining plans with a view to reducing the water treatment capacity required to manage selenium and the associated costs.

Quintette Project

Our Quintette mine in northeast B.C. is progressing towards a potential start-up in 2014. In the third quarter of 2012 we completed the feasibility study for reopening the Quintette mine, which has been closed since 2000. The feasibility study estimates the capital cost to reopen Quintette at $858 million, not including escalation or interest during construction. The study contemplates an average clean coal production rate of 3.5 million tonnes per year over the estimated 12-year life of Quintette. A Mines Act Permit Amendment application was submitted in 2012 and we expect to receive the permit approval in the first half of 2013. First coal production is now expected in the first half of 2014 and by the end of 2014 Quintette is expected to be producing at an annualized rate of 3 million tonnes.

Rail

Rail transportation from our five mines in southeast B.C. for seaborne export is now provided under a 10-year agreement with CP Rail that commenced in April 2011. This agreement provides us with access to increased rail capacity to support our ongoing coal expansion and includes a commitment by CP Rail to invest capital to increase its capacity to transport coal. CP Rail’s investment in its network resulted in added capacity throughout 2012, with siding and loadout extensions carried out so that all Teck trains are now running at 152 cars in length, compared with an average of 126 cars in length prior to the investment, allowing more coal to be transported with fewer trains.

Port

A number of key initiatives have been undertaken to ensure that we have access to terminal loading capacity in excess of our planned shipments. Neptune Bulk Terminals, in which we have a 46% ownership interest, is expanding its annual coal throughput capacity from 9 million tonnes to 12.5 million tonnes in the spring of 2013 with the addition of a new stacker reclaimer. The feasibility study for the next expansion phase, to increase capacity from 12.5 million tonnes to 18.5 million tonnes, was completed in the fourth quarter of 2012 and detailed engineering will be carried out in 2013.

| Teck 2012 Management’s Discussion and Analysis | 12 |

In addition, in the fourth quarter of 2012 Westshore Terminals (Westshore) completed the installation of a second double railcar dumper, which completes the majority of the work required for the planned expansion of their capacity to 33 million tonnes per year. Teck’s contract with Westshore, which was extended by five years in 2012, increases to 19 million tonnes annually from April 2014 where it remains over its nine-year term through March 2021. Finally, in November of 2012, Ridley Terminals took possession of a new stacker reclaimer that is part of its plan to double capacity to 24 million tonnes per year by 2015. We have reached agreement with Ridley Terminals for sufficient annual capacity to meet our shipping needs for planned exports from Quintette through 2024.

In December 2012, an incident at Westshore resulted in damage to one of its two coal berths. We took measures to secure additional loading capacity at other coal terminals while repairs were carried out. Those repairs were completed in early February 2013 and port operations returned to normal.

Sales

A major focus of our coal marketing strategy has been to maintain and enhance relationships with our traditional customers while establishing new customers in markets where long-term growth in steel production and demand for seaborne steelmaking coal will support our expansion efforts over the long term. We are continuing to build our existing business position and to establish important new customer relationships in both China and India to assist in achieving our growth objectives. In 2012, we exceeded previously established record sales into both China and India and, for the first time, China became our largest market for coal sales. In 2013, we are expecting China to continue to be our largest market, but the ratio of Chinese sales to total sales will likely decline compared to the fourth quarter of 2012 and be more reflective of the level experienced in the first three quarters of 2012.

Markets

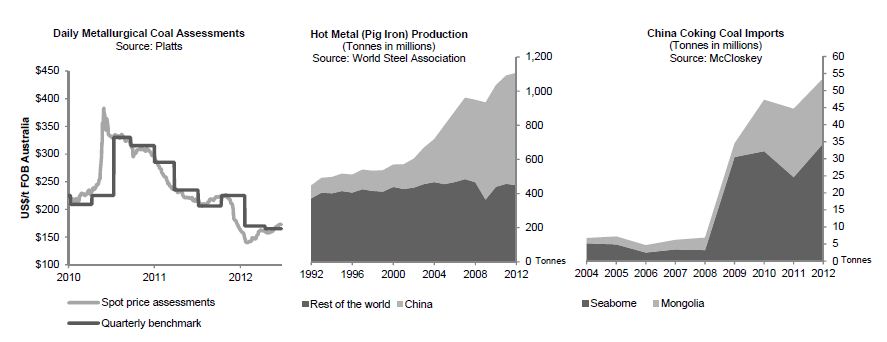

Sufficient supply of high-quality seaborne steelmaking coal and a large drop in pricing levels characterized 2012. Recovery from weather- and labour-related production shortfalls in Australia, production ramp-up in China and new supply areas contributed to increased availability of steelmaking coal. Economic uncertainty across most market areas affected steel demand. Weaker demand and better availability of coal caused the benchmark price for our highest-quality products to decrease from US$235 per tonne earlier in the year to US$165 per tonne for the first quarter of 2013. The lower pricing environment forced production cuts by a number of suppliers, with total reduction estimates ranging up to 30 million tonnes. The below graphs show key metrics affecting steelmaking coal sales: spot price assessments and quarterly benchmark pricing, hot metal production (each tonne of hot metal, or pig iron, produced requires approximately 650-700 kilograms of steelmaking coal), and China’s steelmaking coal imports by source.

| Teck 2012 Management’s Discussion and Analysis | 13 |

| Teck 2012 Management’s Discussion and Analysis | 14 |

Zinc

We are one of the world’s largest producers of zinc, primarily from our Red Dog mine in Alaska and Antamina mine in northern Peru. Our metallurgical complex in Trail, B.C. is also one of the world’s largest integrated zinc and lead smelting and refining operations. In total we produced 597,900 tonnes of zinc contained in concentrate while our Trail Operations produced 284,200 tonnes of refined zinc in 2012. In 2013, we estimate production of zinc in concentrate to be in the range of 560,000 to 590,000 tonnes and production of refined zinc to be in the range of 280,000 to 290,000 tonnes.

As an integrated metal producer, we also provide recycling solutions for metal-bearing scrap and residue, also known as electronic waste (e-waste). In 2012, we processed 12,000 tonnes of e-waste at our Trail Operations.

In 2012, our zinc business unit accounted for 25% of revenue and 12% of gross profit before depreciation and amortization.

| | | Revenues | | | Gross Profit Before Depreciation and Amortization | |

| ($ in millions) | | 2012 | | | 2011 | | | 2010 | | | 2012 | | | 2011 | | | 2010 | |

| | | | | | | | | | | | | | | | | | | |

| Red Dog | | $ | 892 | | | $ | 1,008 | | | $ | 1,106 | | | $ | 418 | | | $ | 547 | | | $ | 571 | |

| Trail | | | 1,865 | | | | 1,989 | | | | 1,447 | | | | 64 | | | | 256 | | | | 155 | |

| Other | | | 7 | | | | 18 | | | | 40 | | | | (2 | ) | | | 2 | | | | 9 | |

| Inter-segment sales | | | (214 | ) | | | (250 | ) | | | (230 | ) | | | – | | | | 3 | | | | (20 | ) |

| Total | | $ | 2,550 | | | $ | 2,765 | | | $ | 2,363 | | | $ | 480 | | | $ | 808 | | | $ | 715 | |

| | | Production | | | Sales | |

| (000’s tonnes) | | 2012 | | | 2011 | | | 2010 | | | 2012 | | | 2011 | | | 2010 | |

| | | | | | | | | | | | | | | | | | | |

| Refined zinc | | | | | | | | | | | | | | | | | | |

Trail | | | 284 | | | | 291 | | | | 278 | | | | 287 | | | | 289 | | | | 274 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Contained in concentrate | | | | | | | | | | | | | | | | | | | | | | | | |

Red Dog | | | 529 | | | | 572 | | | | 538 | | | | 510 | | | | 556 | | | | 585 | |

Other business

units | | | 69 | | | | 74 | | | | 107 | | | | 68 | | | | 75 | | | | 111 | |

| Total | | | 598 | | | | 646 | | | | 645 | | | | 578 | | | | 631 | | | | 696 | |

Operations

Red Dog

Red Dog, which is located in northwest Alaska, is one of the world’s largest zinc mines. Red Dog’s gross profit before depreciation and amortization was $418 million, compared with $547 million in 2011 and $571 million in 2010. The lower 2012 gross profit was mainly due to lower metal prices and lower zinc sales volumes.

In 2012, zinc production at Red Dog was 529,100 tonnes compared to 572,200 tonnes in 2011. This was due to milling rates being lowered to reduce silica in the zinc concentrate and due to lower ore grades. Lead production in 2012 was 95,400 tonnes compared to 84,000 in 2011, due to improved recoveries as

| Teck 2012 Management’s Discussion and Analysis | 15 |

significantly less near-surface weathered ore from the Aqqaluk pit was processed.

Red Dog’s location exposes the operation to severe weather and winter ice conditions, which can significantly affect production, sales volumes and operating costs. In addition, the mine’s bulk supply deliveries and all concentrate shipments occur during a short ocean shipping season that normally runs from early July to late October. This short shipping season means that Red Dog’s sales volumes are higher in the last six months of the year, resulting in significant variability in its quarterly profit, depending on metal prices.

In accordance with the operating agreement governing the Red Dog mine between Teck and NANA Regional Corporation Inc. (NANA), the royalty we pay NANA increased in the fourth quarter of 2012 to 30% of net proceeds of production from the previous 25%. This royalty increases by 5% every fifth year to a maximum of 50%. The NANA royalty charge in 2012 was US$137 million, compared with US$129 million in 2011. NANA has advised us that it ultimately shares approximately 62% of the royalty, net of allowable costs, with other Regional Alaskan Native Corporations pursuant to section 7(i) of the Alaska Native Claims Settlement Act.

In February 2013, the State of Alaska issued a renewal of Red Dog’s main water discharge permit. The water discharge permit was previously renewed in 2010 by the United States Environmental Protection Agency (EPA), but was stayed following a third-party appeal. As a result of the appeal, the conditions of the 2010 permit governing effluent limitations for lead, selenium, zinc, cyanide and total dissolved solids (TDS) were withdrawn and the limitations in the mine’s 1998 water discharge permit remained in effect. The limitations in the 1998 permit included an effluent limitation for TDS that the mine could not meet. That appeal was favourably resolved (although a related court decision is the subject of further appeal to the Ninth Circuit Court of Appeals) and jurisdiction over the permit passed to the State of Alaska. The 2013 permit issued by the State of Alaska reinstated the 2010 permit effluent limitations for TDS. Despite the issuance of this new permit, there can be no assurance that further appeals or permit uncertainty will not give rise to liability or impede mining activities, or that permit conditions that are ultimately issued will not impose significant costs on the Red Dog operation.

We expect 2013 production to be approximately 500,000 to 525,000 tonnes of zinc contained in concentrate and approximately 85,000 to 90,000 tonnes of lead contained in concentrate.

Trail Operations

Our Trail Operations in B.C. is one of the world’s largest fully integrated zinc and lead smelting and refining complexes. It also produces a variety of precious and specialty metals, chemicals and fertilizer products. Trail Operations has a two-thirds interest in the Waneta hydroelectric dam as well as ownership of the related transmission system. The Waneta Dam provides low-cost, clean, renewable power to the metallurgical operations.

Trail Operations contributed $64 million to gross profits before depreciation and amortization in 2012, compared with $256 million in 2011 and $155 million in 2010. Gross profit in 2012 decreased due primarily to a combination of lower metal prices and a one-time labour settlement charge of $59 million for a five-year labour agreement.

Refined zinc production totalled 284,200 tonnes in 2012, compared with 291,200 tonnes the previous year, as production was affected by poor operating performance in the zinc electrolytic cell house near the end of the fourth quarter.

Refined lead production of 87,900 tonnes was higher than the 85,600 tonnes produced in 2011, mainly due

| Teck 2012 Management’s Discussion and Analysis | 16 |

to higher feed rates to the KIVCET furnace.

Record silver production of 22.9 million ounces resulted from increased treatment of silver-bearing concentrate and an increased capacity to refine silver.

Operating costs in 2012, before the one-time labour settlement charge of $59 million, rose by $24 million. This was partly due to higher workforce levels to allow for succession planning, higher wages, increased consumable costs, the use of additional operating supplies and increased maintenance activity.

Our e-waste recycling process treated 12,000 tonnes of material during the year, and we plan to treat about 13,500 tonnes in 2013. We continue to process zinc alkaline batteries and fluorescent light bulbs as part of our expanded efforts in recycling post-consumer waste.

Construction continued on the new $125 million acid plant, which will replace two existing plants and is expected to deliver enhanced operating reliability and flexibility as well as improved environmental performance. The new plant is expected to go into service in the first quarter of 2014. As part of the capital deferrals announced in October 2012, work on the $210 million No. 4 Furnace Project was deferred as major excavation and construction had not commenced and detailed engineering had yet to be completed.

In 2013, we expect to produce in the range of 280,000 to 290,000 tonnes of refined zinc, approximately 87,000 tonnes of refined lead and approximately 23.5 million ounces of silver.

Other Zinc Operations

Our Pend Oreille mine, located in Washington State, has been on care and maintenance since February 2009. A core group of employees is working to keep the site ready in the event of a future restart. All regulatory and environmental requirements are being met.

Markets

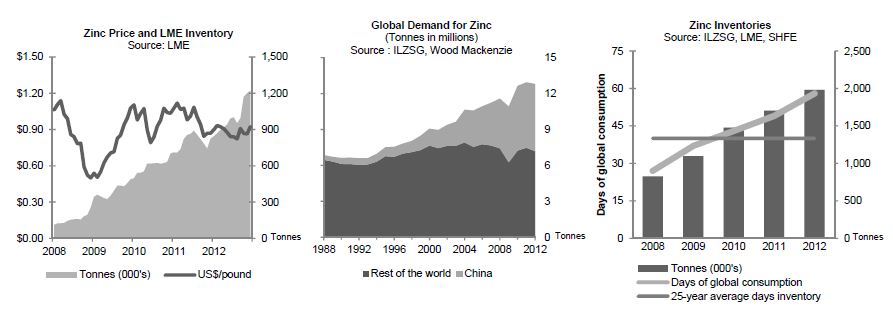

Zinc prices on the LME averaged US$0.88 per pound for the year, down US$0.11 per pound from the 2011 average.

In 2012, global zinc metal consumption was 12.8 million tonnes, which was an increase of 0.5% over 2011 levels. Metal premiums increased in North America, while premiums in Asia and in Europe remained stable. Metal supply grew at a greater rate than demand in 2012, leading to a surplus metal market in 2012 of approximately 200,000 tonnes. LME stocks increased by 399,000 tonnes, or 49%, over 2011 levels and finished the year at 1,220,750 tonnes. We estimate that total reported global stocks (which include producer, consumer, merchant and terminal stocks) increased by 279,000 tonnes in 2012 and at year-end represented an estimated 58 days of global consumption compared to the 25-year average of an estimated 40 days.

In 2012, global mine production grew by 2%, or 230,000 tonnes of contained zinc, while global refined production fell by 100,000 tonnes or 1.0%. This was a result of China increasing mine production by 14% and dropping refined production by 8%. As a result of this, the global concentrate market recorded a modest surplus in 2012, representing less than 1% of global mine production.

In 2013, we believe that the global zinc concentrate market will record a further modest surplus representing less than 2% of global mine production. We further believe that global refined production will grow at a greater rate than refined demand, leading to a global zinc metal surplus.

| Teck 2012 Management’s Discussion and Analysis | 17 |

| Teck 2012 Management’s Discussion and Analysis | 18 |

Energy

Located in the Athabasca oil sands region of northeastern Alberta, our energy assets include a 20% interest in the Fort Hills oil sands project and a 100% interest in the Frontier oil sands project. In addition, we hold a 50% interest in various other oil sands leases in the exploration phase, including the Lease 421 Area. Our recoverable contingent bitumen resources totalled 3.5 billion barrels at the end of 2012. These valuable long-term assets are located in a politically stable jurisdiction and will be mined using conventional technologies that build upon our core skills in large-scale truck and shovel operations.

We recognize that there are concerns over the potential environmental effects of developing oil sands projects. As such, we are researching methods to improve extraction and processing to enhance the sustainability of our projects. We are proud to be one of the founding members of the Canadian Oil Sands Innovation Alliance (COSIA) and are encouraged by the progress of the industry towards improving technology and production processes, reducing water consumption, improving tailings management, and increasing land reclamation and revegetation.

We are also developing renewable energy projects. We have a 30% interest in the Wintering Hills Wind Power Facility, which completed its first full year of operation in 2012.

The disclosure that follows includes references to contingent bitumen resource estimates. Further information on these estimates, and the related risks and uncertainties, is set out in our most recent Annual Information Form, which is available on our website at www.teck.com, or on the Canadian Securities Administrators website at www.sedar.com (SEDAR) and under cover of Form 40-F on the EDGAR section of the Securities Exchange Commission (SEC) website at www.sec.gov. There is no certainty that it will be commercially viable to produce any portion of the contingent resources.

Fort Hills Oil Sands Project

The Fort Hills oil sands project is located approximately 90 kilometres north of Fort McMurray in northern Alberta. We hold a 20% interest in the Fort Hills Energy Limited Partnership (Fort Hills Partnership), which owns the Fort Hills oil sands project, with 39.2% held by Total E&P Canada Ltd. (Total) and the remaining 40.8% held by the operator of the project, Suncor Energy Inc. (Suncor).

At December 31, 2012, our best estimate of our 20% share of the recoverable bitumen at Fort Hills is 662 million barrels. To the end of 2012, approximately $3.3 billion has been spent on the Fort Hills project. Our share was $1.1 billion, of which $122 million was spent in 2012. In connection with our ownership interest, we are committed to fund 27.5% of the next $4.2 billion of project spending and our 20% pro rata share thereafter.

Suncor has provided a forecast project spending estimate of approximately $1.05 billion for 2013, of which our share should be $290 million, including our earn-in commitments.

Engineering studies are ongoing to update the design basis for the project and improve the accuracy of the cost estimates in anticipation of a project sanction decision by the partners in 2013. Should the partners sanction Fort Hills (Phase 1), production is not expected to start before 2017, ramping up to approximately 160,000 barrels per day of bitumen production. Potential exists to double production with Phase 2, up to

| Teck 2012 Management’s Discussion and Analysis | 19 |

320,000 barrels per day.

Teck/SilverBirch Agreement

In April 2012, we completed the purchase of SilverBirch Energy Corporation. The transaction gave us full ownership of the Frontier project, including the Equinox property. SilverBirch assets, other than its interest in Frontier, Equinox and Twin Lakes were transferred to a new company owned by SilverBirch’s shareholders. Completion of this transaction created a simplified ownership structure for Frontier, provided an opportunity to explore new partnerships and other alternatives to move the project towards development, and reduced our exposure to oil sands leases not amenable to mining.

Frontier Project

The Frontier project is located immediately northwest of the Fort Hills project in northern Alberta. We hold a 100% interest in the Frontier project. In November 2011, the Frontier project application was submitted to regulators. In 2012, provincial and federal regulatory agencies completed their initial review of the Frontier project application and provided supplemental information requests. We prepared and submitted responses to all of these information requests in January 2013. The Canadian Environmental Assessment Agency has provided estimates of the federal review schedule for the Frontier project application. The cumulative federal review period is estimated to be approximately two years. When time to respond to information requests is included, 2015 is the earliest an approval decision and receipt of required permits are expected.

The Frontier project consists of approximately 28,960 hectares of oil sands leases and as at December 31, 2012, our best estimate is that our 100% interest in the Frontier project represents approximately 2.8 billion barrels of contingent bitumen resources. The project has been designed for up to four production lines with a total capacity of approximately 277,000 barrels per day of bitumen; the first two production lines are planned to have a production capacity of 159,000 barrels per day. The Frontier project includes an option of developing Equinox, 10 kilometres south of Frontier, as a satellite operation.

In 2012, no field exploration activities were undertaken — the focus was on supporting the regulatory application review, consultations with stakeholders and ongoing engineering studies. A field exploration program is planned for 2013 to acquire additional geotechnical information to assist in future engineering studies.

Lease 421 Area

We hold a 50% interest in the Lease 421 Area, which is located east of the Fort Hills project in northern Alberta. Imperial Oil and ExxonMobil jointly own the remaining 50%. During the first quarter of 2012, we acquired a 50% working interest in Lease 899, which is immediately southwest of and adjacent to the Lease 421 Area. This increases the contiguous land area of the Lease 421 Area project by 34%. To date, a total of 89 core holes have been completed in the Lease 421 Area, including 30 core holes previously completed on Lease 899.

Wintering Hills Wind Power Facility

Wintering Hills is located near Drumheller, Alberta. We hold a 30% interest in Wintering Hills with Suncor Energy Products Inc., a wholly owned subsidiary of Suncor Inc., the project operator. In 2012, the first full year of operation, our share of power generation from Wintering Hills was 88 GWh, enough power to provide 57,000 tonnes of CO2-equivalent credits. Our share of expected power generation in 2013 is 85 to 90 GWh, which is dependent on weather conditions.

| Teck 2012 Management’s Discussion and Analysis | 20 |

Exploration

Throughout 2012, exploration efforts were carried out around the world by our nine regional offices. Expenditures of $102 million in 2012 were focused on copper, zinc and gold opportunities.

Exploration plays three critical roles at Teck: discovery of new orebodies through early stage exploration and acquisition; pursuit, evaluation and acquisition of development opportunities; and delivery of geoscience solutions and services to create value at our existing mines.

Our copper exploration is focused on porphyry copper deposits and, during 2012, we drilled several porphyry copper projects in Canada, Chile, Mexico, Peru, Turkey and Namibia. In addition to our 100% owned projects, several resource stage joint venture projects advanced in 2012, including Zafranal in Peru, Haib in Namibia and La Verde in Mexico. Significant exploration work was focused in and around our existing operations and advanced projects in 2012. At our Highland Valley Copper Operations in Canada we successfully completed ground geophysical surveys and target definition drilling adjacent to the historical Bethlehem pits, outlining some near-surface and copper mineralization. At our Quebrada Blanca Operations in Chile, we drilled high-quality targets within 10 kilometres of the existing mine and at our Relincho project in Chile we made new discoveries within 2 kilometres of the current pit design. In 2013, we plan to drill copper projects in Canada, Peru, Chile, Namibia and Turkey and aggressively explore around our existing operations.

Zinc exploration remains focused on three areas: the Red Dog mine district in Alaska, northeastern Australia, and Ireland. In both Alaska and Australia, the target type is a large, high-grade, sediment-hosted deposit similar to major world-class deposits such as Red Dog in Alaska and Century or McArthur River in Australia. In 2012, we undertook approximately 4,000 metres of exploration drilling on the Noatak project, where we have identified multiple high-quality targets near our existing Red Dog mine. We also conducted exploration drilling for zinc in northeastern Australia and in Ireland, where the target is a large high-grade deposit similar to the producing Navan mine. Drill programs will continue in all three regions in 2013.

In addition to exploring for copper and zinc, we are exploring for, and looking to partner in, new gold opportunities. Our plan is to explore, find and advance gold resources through targeted exploration activity in select jurisdictions. Once an opportunity has been recognized, the strategy is to optimize that opportunity or asset through further definition drilling and engineering studies, then capture value through periodic divestitures. Our current exploration efforts and drill testing for gold are primarily focused in Turkey, Canada, Chile, Peru and Colombia. In 2012, we had encouraging results from TV Tower in Turkey, which is a joint venture with Pilot Gold, and we expect this to progress towards a resource estimate in 2013. Our 100% Demir and 60% Halilaga gold projects, also in Turkey, moved towards the resource estimate stage in 2012.

| Teck 2012 Management’s Discussion and Analysis | 21 |

Financial Overview

Financial Summary

| ($ in millions, except per share data) | | 2012 | | | 2011 | | | 2010 | |

| | | | | | | | | | |

| Revenue and profit | | | | | | | | | |

Revenues | | $ | 10,343 | | | $ | 11,514 | | | $ | 9,223 | |

Gross profit before depreciation and amortization | | $ | 4,017 | | | $ | 5,788 | | | $ | 4,438 | |

EBITDA* | | $ | 2,819 | | | $ | 5,459 | | | $ | 4,326 | |

Profit attributable to shareholders | | $ | 811 | | | $ | 2,668 | | | $ | 1,820 | |

| | | | | | | | | | | | | |

| Cash flow | | | | | | | | | | | | |

Cash flow from operations | | $ | 2,795 | | | $ | 3,957 | | | $ | 3,274 | |

Capital expenditures | | $ | 1,809 | | | $ | 1,236 | | | $ | 810 | |

Investments | | $ | 758 | | | $ | 463 | | | $ | 46 | |

| | | | | | | | | | | | | |

| Balance sheet | | | | | | | | | | | | |

Cash balances | | $ | 3,267 | | | $ | 4,405 | | | $ | 832 | |

Total assets | | $ | 34,617 | | | $ | 34,219 | | | $ | 29,055 | |

Debt, including current portion | | $ | 7,195 | | | $ | 7,035 | | | $ | 4,948 | |

| | | | | | | | | | | | | |

| Per share amounts | | | | | | | | | | | | |

Profit attributable to shareholders | | | | | | | | | | | | |

Basic | | $ | 1.39 | | | $ | 4.52 | | | $ | 3.09 | |

Diluted | | $ | 1.38 | | | $ | 4.50 | | | $ | 3.08 | |

Dividends declared per share | | $ | 0.85 | | | $ | 0.70 | | | $ | 0.50 | |

*EBITDA is a non-GAAP financial measure. See “Use of Non-GAAP Financial Measures” section for further information.

Our revenue and profit depend on prices for the commodities we produce, sell and use in our production processes. Commodity prices are determined by the supply of and demand for those commodities, which are influenced by global economic conditions. We normally sell the products that we produce at prevailing market prices or, in the case of steelmaking coal, at negotiated prices on term contracts or on a spot basis. Prices for these products, particularly for exchange-traded commodities, can fluctuate significantly and that volatility can have a material effect on our financial results.

We record our financial results using the Canadian dollar and, accordingly, our operating results and cash flows are affected by changes in the Canadian dollar exchange rate relative to the currencies of other countries where we operate and relative to the United States (U.S.) dollar. Exchange rate movements can have a significant effect on our results, as a significant portion of our operating costs are incurred in Canadian and other currencies, and most of our revenues and debt are denominated in U.S. dollars.

Profit attributable to shareholders for 2012 was $811 million, or $1.39 per share, which included $784 million of after-tax debt refinancing charges. This compares with $2.7 billion or $4.52 per share in 2011, and $1.8 billion, or $3.09 per share in 2010.

Our profit over the past three years has included items that we segregate for presentation to investors so that the ongoing profit of the company may be more clearly understood. These are described below and summarized in the table that follows. Excluding these items, our profit for 2012 was negatively affected by lower prices for our major commodities.

| Teck 2012 Management’s Discussion and Analysis | 22 |

Our profit in 2012 included $784 million of after-tax refinancing charges related to debt refinancing transactions completed during the year, $70 million of collective agreement charges, $39 million of gains on asset sales and $98 million of gains on various derivatives.

Our profit in 2011 included $146 million of after-tax gains on the sale of various assets that were undertaken as part of our debt reduction plan and $128 million of gains on various derivatives.

Our profit in 2010 included $65 million of after-tax non-cash foreign exchange gains and $768 million of after-tax gains on the sale of various assets that were undertaken as part of our debt reduction plan. Partially offsetting these favourable items was $658 million of after-tax unamortized discounts and issues costs related to our Fording acquisition debt that we wrote off as we repaid and refinanced that debt.

The table below shows the effect of these items on our profit.

| | | 2012 | | | 2011 | | | 2010 | |

| | | | | | | | | | |

| Profit attributable to shareholders | | $ | 811 | | | $ | 2,668 | | | $ | 1,820 | |

| | | | | | | | | | | | | |

| Add (deduct) the after-tax effect of: | | | | | | | | | | | | |

Gains on sale of assets | | | (39 | ) | | | (146 | ) | | | (768 | ) |

Foreign exchange (gains) losses | | | 20 | | | | (4 | ) | | | (65 | ) |

Derivative gains | | | (98 | ) | | | (128 | ) | | | (153 | ) |

Financing items | | | 784 | | | | – | | | | 658 | |

Collective agreement charges | | | 70 | | | | 55 | | | | – | |

Asset write-downs | | | – | | | | 23 | | | | – | |

Tax items | | | (29 | ) | | | – | | | | 11 | |

| | | | | | | | | | | | | |

| Adjusted profit * | | $ | 1,519 | | | $ | 2,468 | | | $ | 1,503 | |

| | | | | | | | | | | | | |

| Adjusted earnings per share * | | $ | 2.60 | | | $ | 4.18 | | | $ | 2.55 | |

*Adjusted profit and adjusted earnings per share are all non-GAAP measures. See “Use of Non-GAAP Financial Measures” section for further information.

Cash flow from operations in 2012 was $2.8 billion, compared with $4.0 billion in 2011 and $3.3 billion in 2010. The changes in cash flow from operations are due mainly to the volatility in commodity prices.

At December 31, 2012, our cash balance was $3.3 billion. Total debt was $7.2 billion and our net debt to net debt-plus-equity ratio was 18% compared with 13% at December 31, 2011 and 21% at the end of 2010.

Gross Profit

Our gross profit is made up of our revenues less the operating, depreciation and amortization expenses at our producing operations. Income and expenses from our business activities that do not produce commodities for sale are included in our other operating income and expenses or in our non-operating income and expenses.

Our principal commodities are copper, steelmaking coal and zinc, which accounted for 26%, 45% and 11% of revenues respectively in 2012. Silver and lead are significant byproducts of our zinc operations, accounting for 9% and 3% each, respectively, of our 2012 revenues. We also produce a number of other byproducts including molybdenum, various specialty metals, and chemicals and fertilizers, which in total accounted for 6% of our revenue in 2012.

| Teck 2012 Management’s Discussion and Analysis | 23 |

Our revenues are affected by sales volumes, which are determined by our production levels and by demand for the commodities we produce, commodity prices and currency exchange rates.

Our revenues were $10.3 billion in 2012 compared with the record $11.5 billion in 2011 and $9.2 billion in 2010. The reduction in 2012 was due mainly to a 25% reduction in the average realized coal price, lower metal prices and lower zinc sales volumes. The reduction was partially offset by higher sales volumes of copper and coal, which increased by 13% and 8%, respectively, compared with 2011. The increase in 2011 revenue over 2010 revenue was due to higher average prices for our main commodities and higher sales volumes for copper, partially offset by lower sales volumes of steelmaking coal and zinc.

Our cost of sales includes all of the expenses required to produce our products, such as labour, energy, operating supplies, concentrates purchased for our Trail Operations’ refining and smelting operation, royalties, and marketing and distribution costs required to sell and transport our products to various delivery points. Our cost of sales also includes depreciation and amortization expense. Due to the geographic locations of many of our operations, we are highly dependent on third parties for the provision of rail, port and other distribution services. In certain circumstances, we negotiate prices for the provision of these services where we may not have viable alternatives to using specific providers, or may not have access to regulated rate-setting mechanisms. Contractual disputes, demurrage charges, rail and port capacity issues, availability of vessels and railcars, weather problems and other factors can have a material effect on our ability to transport materials from our suppliers and to our customers in accordance with schedules and contractual commitments.

The magnitude of our costs is dictated mainly by our production volumes, the costs for labour, operating supplies and concentrate purchases and by strip ratios, haul distances, ore grades, distribution costs, commodity prices, foreign exchange rates and costs related to non-routine maintenance projects. Production volumes mainly affect our variable operating and our distribution costs. In addition, production may also affect our sales volumes and, when combined with commodity prices, affects profitability and ultimately our royalty expenses.

Our cost of sales was $7.3 billion in 2012, compared with $6.6 billion in 2011 and $5.7 billion in 2010. Costs of sales in 2012 increased from 2011 primarily due to higher production levels in our copper and coal business units, which increased 16% and 8% respectively, and accounted for approximately $380 million of the increase. Higher transportation unit costs in our coal business unit accounted for approximately $110 million of the increase in cost of sales in 2012. This was due to higher ocean freight, port and rail costs as

| Teck 2012 Management’s Discussion and Analysis | 24 |

well as to a higher proportion of coal being sold inclusive of freight charges. Although we achieved lower unit costs at most of our copper operations, unit costs increased significantly at our Quebrada Blanca Operations and accounted for approximately $100 million of the increase in cost of sales in 2012. This was due to significant increases for labour costs, reflecting new terms of the collective agreement ratified early in 2012, and higher contractor and consumable costs. We also incurred one-time labour settlement costs at various operations totalling $103 million in 2012 compared with $84 million in 2011.

Comparing 2011 with 2010, the higher costs were due mainly to the new copper concentrator at Carmen de Andacollo operating for a full year in 2011, compared with three months in 2010, as commercial production commenced October 1, 2010. This accounted for approximately $250 million of the increase in cost of sales in 2011. We also incurred one-time labour settlement costs at Highland Valley Copper and our coal operations totalling $84 million in 2011. The balance of our higher costs of sales was partly due to increased energy costs, consumables and the use of contractors to maximize production at our coal operations. In addition, the cost of concentrate purchases at our Trail Operations increased by approximately $400 million, due to higher metal prices, especially for silver, and as a result of our Trail Operations operating at higher production levels compared with 2010.

In 2012, our depreciation expense was $951 million compared with $911 million in 2011 and $916 million in 2010. Increased throughput and production levels at our coal and copper operations, the commencement of the amortization of Antamina’s major expansion project and Highland Valley’s two-year waste stripping campaign and buttress placement project were the main reasons for the higher depreciation expense in 2012. However, this was partially offset by the effect of an increase in our coal reserves, which reduced our per-unit amortization rate and our overall depreciation charge for coal. We expect that these increased reserves will have a more significant effect in reducing the depreciation charge in 2013.

Other Expenses

| ($ in millions) | | 2012 | | | 2011 | | | 2010 | |

| | | | | | | | | | |

| General and administrative | | $ | 136 | | | $ | 125 | | | $ | 137 | |

| Exploration | | | 102 | | | | 105 | | | | 56 | |

| Research and development | | | 19 | | | | 17 | | | | 20 | |

| Other operating expense (income) | | | 24 | | | | 174 | | | | (640 | ) |

| Finance income | | | (135 | ) | | | (113 | ) | | | (95 | ) |

| Finance expense | | | 577 | | | | 595 | | | | 691 | |

| Non-operating expense (income) | | | 848 | | | | (197 | ) | | | 418 | |

| Share of losses of associates | | | 10 | | | | 5 | | | | 5 | |

| | | $ | 1,581 | | | $ | 711 | | | $ | 592 | |

We must continually replace our reserves as they are depleted in order to maintain production levels over the long term. We try to do this through our exploration and development program and through acquisition of interests in new properties or in companies that own such properties. Exploration for minerals and oil is highly speculative and the projects involve many risks. The vast majority of exploration projects are unsuccessful and there are no assurances that current or future exploration programs will find deposits that are ultimately brought into production. We have expanded our exploration activities in 2012 and 2011, resulting in the costs being significantly higher than in 2010.

Our research and development expenditures are primarily focused on advancing our proprietary CESL hydrometallurgical technology, the development of internal and external growth opportunities, and the

| Teck 2012 Management’s Discussion and Analysis | 25 |

development and implementation of process and environmental technology improvements at operations.

Other operating income and expenses include items we consider to be related to the operation of our business, such as final pricing adjustments (which are further described in the next paragraph), share-based compensation, gains or losses on commodity derivatives, gains or losses on sale of operating or exploration assets, and provisions for various costs at our closed properties. Significant items in 2012 include $24 million from gains on the sale of assets, $45 million of positive pricing adjustments and a $34 million expense for share-based compensation. Significant items in 2011 include $130 million of gains on the sale of assets, $210 million of negative pricing adjustments, and a $21 million expense recovery for share-based compensation resulting from the decline in our share price. 2010 included $721 million of gains on the sale of assets, $116 million of positive pricing adjustments and a $124 million charge for share-based compensation.

Sales of metals in concentrate or copper cathodes are recognized in revenue on a provisional pricing basis when the rights, obligations, risks and benefits of ownership pass to the customer, which usually occurs upon shipment. However, final pricing is typically not determined until a subsequent date, often in the following quarter. Revenue in a quarter is based on prices at the date of sale. These pricing adjustments result in gains in a rising price environment, and losses in a declining price environment and are recorded as other operating income or expense. The extent of the pricing adjustments also takes into account the actual price participation terms as provided in certain concentrate sales agreements. It should be noted that these effects arise on the sale of concentrates, as well as on the purchase of concentrates at our Trail Operations.

The table below outlines our outstanding receivable positions, which were provisionally valued at December 31, 2011 and 2012, respectively.

| | Outstanding at | Outstanding at |

| | December 31, 2011 | December 31, 2012 |

| (pounds in millions) | Pounds | US$/lb | Pounds | US$/lb |

| | | | | |

| Copper | 164 | 3.43 | 179 | 3.59 |

| Zinc | 184 | 0.83 | 143 | 0.93 |

Our finance income includes the expected return on our pension plan assets in the form of interest and investment income. Our finance expense includes interest expense on our debt, financing fees and amortization, and the interest components of our pension obligations and our decommissioning and restoration provisions, less any interest that we capitalize against the cost of our development projects. The reduction in our finance expense relates primarily to lower average interest rates. Although our debt levels have increased since the end of 2010, the effect of the higher debt was offset by the reduction in interest rates arising from several refinancing transactions undertaken since the second half of 2010 in which we issued new lower-cost notes and used the proceeds and some cash to redeem high-yield notes issued in 2009 to refinance the Fording acquisition debt.

Non-operating income (expense) includes items that arise from financial and other matters and includes such items as foreign exchange, debt refinancing, realized gains or losses on marketable securities, and gains and losses on the revaluation of the call options on certain of our high-yield notes. In 2012, other non-operating income included $965 million of charges related to debt refinancing activities described in more detail below under the caption “Financing Activities”, $119 million of gains on the revaluation of the call options on our high-yield notes prior to their settlement and $29 million of gains on the sale of various investments. In 2011, other non-operating income consisted primarily of $146 million of gains on the revaluation of the call options on our high-yield notes and $44 million of gains on the sale of various

| Teck 2012 Management’s Discussion and Analysis | 26 |

investments. 2010 included debt repurchase and refinancing charges of $782 million related to our debt refinancing transactions, partly offset by $168 million of gains on the revaluation of our call options and $138 million from the sale of investments.

We account for our investment in the Fort Hills Energy Limited Partnership using the equity method. The majority of the activities on this project to date relate to capital projects, rather than expenditures that affect profit.